CA Inter FM ECO Question Paper 2 – CA Inter FM ECO Study Material is designed strictly as per the latest syllabus and exam pattern.

FM ECO CA Inter Question Paper 2

Time Allowed – 3 Hours

Maximum Marks – 100

Section A – Financial Management

Question 1.

Answer the following. (4 × 5 = 20 Marks)

(a) Following information relating to Jee Ltd. are given:

Profit after tax : ₹ 10,00,000

Dividend payout ratio : 50%

Number of Equity shares : 50,000

Cost of equity : 10%

Rate of return on investment : 12%

(1) What would be the market value per share as per Walter’s Model?

(2) What is the optimum dividend payout ratio according to Walter’s Model and market value of equity share at that payout ratio?

Answer:

(1) Market value (P) per share as per Walter’s Model:

P (Market value of share) = \(\frac{\mathrm{D}+(\mathrm{E}-\mathrm{D}) \times \frac{\mathrm{r}}{\mathrm{K}_{\mathrm{e}}}}{\mathrm{K}_{\mathrm{e}}}\)

= \(\frac{10+(20-10) \times \frac{0.12}{0.10}}{0.10}\) = ₹ 220.00

E (EPS) = ₹ 10,00,000 (PAT) ÷ 50,000 shares

= ₹ 20

![]()

(b) Tarus Ltd. has an estimated cash payments of ₹ 8,00,000 for a one month period and the payments are expected to steady over the period. The fixed cost per transaction is ₹ 250 and the interest rate on marketable securities is 12% p.a.

Calculate the optimal transaction size, average cash and number of transactions during one month.

Answer:

Optimal transaction size = \(\sqrt{\frac{2 \times 8,00,000 \times 12 \times 250}{0.12}}\) = ₹ 2,00,000

Number of transactions p.m. = Monthly cash requirement ÷ Transaction size

= ₹ 8,00,000 ÷ ₹ 2,00,000 = 4 transactions

![]()

(c) RES Ltd. is an all equity financed company with a market value of ₹ 25,00,000 and cost of equity Ke 21%. The company wants to buyback equity shares worth ₹ 5,00,000 by issuing and raising 15% perpetual amount (Debt).

Rate of tax may be taken as 30%. After the capital restructuring and applying

MM model with taxes.

You are required to calculate:

(a) Market value of RES Ltd.

(b) Cost of Equity Ke.

(c) Weighted average cost of capital and comment on it.

Answer:

(a) Market Value (MV) of RES Ltd:

MV before restructuring (VUL) = 25,00,000

MV after restructuring (VL) = VUL + Debt × Tax

= 25,00,000 + 5,00,000 × 30%

= 26,50,000

(b) Cost of Equity:

Ke = K0 + (K0 – Kd) × \(\frac{\mathrm{D}(1-\mathrm{t})}{\mathrm{E}}\)

= .21 + (.21 -.15) × \(\frac{5,00,000(1-.30)}{21,50,000}\) = 21.97%

Here,

Kd = before tax cost of debt

K0 = K0 of unlevered firm

K0 of unlevered firm = Ke of unlevered firm = 21%

E = Value of Equity

E = Value of firm – Value of Debt

= 26,50,000 – 5,00,000 = 21,50,000

(c) Weighted average cost of capital:

WACC = KeWe + KdWd

= 21.97% × \(\frac{21,50,000}{26,50,000}\) + 10.50% × \(\frac{5,00,000}{26,50,000}\) = 19.806%

Comment: WACC af ter restructuring is lower than before restructuring. Hence, company should restructure the firm.

![]()

(d) Door Ltd. is considering an investment of ₹ 4,00,000 this investments expected to generate substantial cash inflows over the next five years. Unfortunately the annual cash flows from this investment is uncertain, but the following probability distribution has been established:

| Annual Cash Flow (₹) | Probability |

| 50,000 | 0.3 |

| 1,00,000 | 0.3 |

| 1,50,000 | 0.4 |

At the end of its 5 years life, the investment is expected to have a residual value of ₹ 40,000. The cost of capital is 5%.

(1) Calculate NPV under the three different scenarios.

(2) Calculate expected net present value

(3) Advise Door Ltd. on whether the investment is to be undertaken.

| Years | 1 | 2 | 3 | 4 | 5 |

| DF @ 5% | 0.952 | 0.907 | 0.864 | 0.823 | 0.784 |

Answer:

(1) NPV under different sccnarios:

NPV = PV of inflow – Initial Investment

Situation 1 = 50,000 × 4.33 + 40,000 × 0.784 – 4,00,000 = (1,52,140)

Situation 2 1,00,000 × 4.33 + 40,000 × 0.784 – 4,00,000 = 64,360

Situation 3 = 1,50,000 × 4.33 + 40,000 × 0.784 – 4,00,000 = 2,80,860

(2) Expected NPV:

Expected NPV = PV of expected inflow – Initial Investment

= 1,05,000 × 4.33 + 40,000 × 0.784 – 4,00,000

= 86,010

Expected Inflow = 50,000 × 0.3 + 1,00,000 × 0.3 + 1,50,000 × 0.4

= 1,05,000

(3) Advise: Door Ltd. should accept the proposal having positive expected NPV.

![]()

Question 2.

SRS Ltd has furnished the following ratios and information relating to the year ended 31st March, 2015.

Sales : ₹ 60,00,000

Return on Net Worth : 25%

Rate of Income Tax : 50%

Share Capital to Reserve : 7: 3

Current Ratio : 2

Net Profit to Sales (after tax) : 6.25%

Inventory Turnover : 12

(Based on cost of goods sold and closing stock)

Cost of Goods Sold : ₹ 18,00,000

Interest on Debenture @ 15% : ₹ 60,000

Sundry Debtors : ₹ 2,00,000

Sundry Creditors : ₹ 2,00,000

You are required to:

(i) Calculate the operating expenses for the year ended 31st March,2015.

(ii) Prepare Balance Sheet as on 31st March, 2015. (10 Marks)

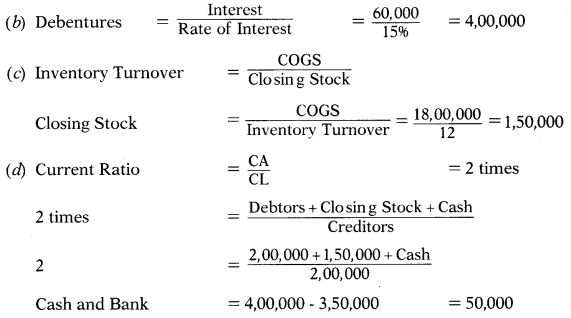

Answer:

(i) Operating Expenses = Gross Profit – EBIT

= ₹ 42,00,000 – ₹ 8,10,000 = ₹ 33,90,000

Working:

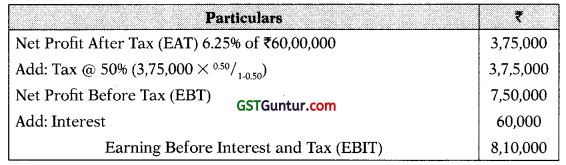

Calculation of EBIT

(ii) Balance Sheet (As on 31.03.2015)

![]()

Question 3.

ANP Ltd. Is providing the following information:

Annual cost of saving : ₹ 96,000

Useful life : 5 years

Salvage value : zero

Internal rate of return : 15%

Profitability index : 1.05

Table of discount factor:

| Discount | Years | |||||

| Factor | 1 | 2 | 3 | 4 | 5 | Total |

| 15% | 0.870 | 0.756 | 0.658 | 0.572 | 0.497 | 3.353 |

| 14% | 0.877 | 0.769 | 0.675 | 0.592 | 0.519 | 3.432 |

| 13% | 0.886 | 0.783 | 0.693 | 0.614 | 0.544 | 3.52 |

You are required to calculate:

(a) Cost of the project

(b) Payback period

(c) Net present value of cash inflow

(d) Cost of capital (10 Marks)

Answer:

(a) Cost of the project:

At IRR,

Present value of inflows = Present value of outflows

Present value of outflows = Annual cost of saving × Cumulative discount factor @ IRR for 5 years

= ₹ 96,000 × 3.353

= ₹ 3,21,888

Cost of project = ₹ 3,21,888

(b) Payback Period:

Payback period = \(\frac{\text { Initial Outflow }}{\text { Equal Annual Cash Inflows/ Saving }}\)

= \(\frac{3,21,888}{96,000}\) = 3.353 years

(c) Net Present Value of cash inflows:

PI = \(\frac{\text { PV of Inflows }}{\text { PV of Outflows }}\)

1.05 = \(\frac{\text { PV of Inflows }}{3,21,888}\)

PV of Inflows = 3,21,888 × 1.05 = ₹ 3,37,982.4

NPV = PV of inflows – PV of outflows

= ₹ 3,37,982.40 – ₹ 3,2 1,888 = ₹ 16,094.40

(d) Cost of Capital:

Cum DF @ cost of capital for 5 years

= \(\frac{\text { Present Value of Inflows }}{\text { Annual Inflows }}\)

= \(\frac{3,37,982.40}{96,000}\) = 3.52065

Cost of capital = 13% (Given in table)

![]()

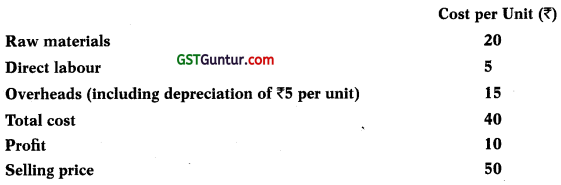

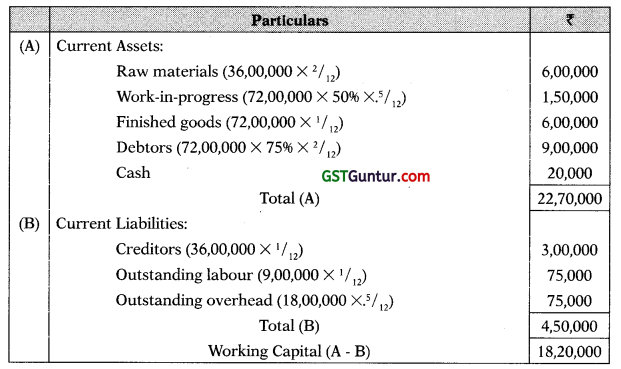

Question 4.

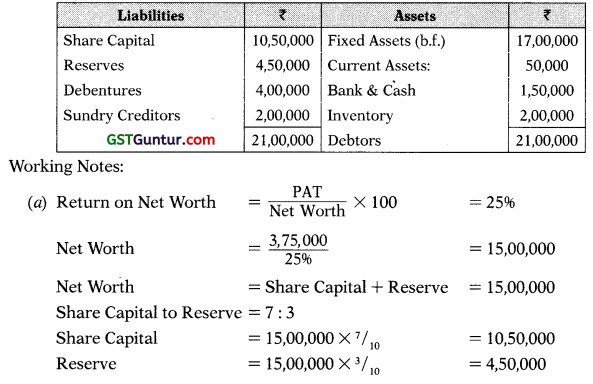

The management of Royal industries has called for a statement showing the working capital needs to finance a level of 1,80,000 units of output for the year. The cost structure for the company’s product for the above mentioned activity level is detailed below:

Additional Information:

(a) Minimum desired cash balance is ₹ 20,000.

(b) Raw materials are held in stock on an average for 2 months.

(c) Work-in-progress (assume 50% completion stage) will approximate to half month’s production.

(d) Finished goods remain in warehouse on an average for a month.

(e) Suppliers of materials extend a month’s credit and debtors are provided two month’s credit.

(f) Cash sales are 25% of total sales.

(g) There is a time lag in payment of wages of a month and half a month in case of overheads.

From the above data, you are required to:

(1) Prepare a statement showing working capital needs; and

(2) Determine the maximum working capital finance available under the first two methods suggested by Tandon Committee. (10 Marks)

Answer:

(1) Statement of Working Capital Requirement

(2) Calculation of Maximum Permissible Bank Finance under the suggestion of Tandon Committee:

Method 1 = 75% (CA – CL) = 75% of 18,20,000 = ₹ 13,65,000

Method 2 = (75% CA) – CL = (75% 22,70,000) – 4,50,000 = ₹ 12,52,500

Working Notes:

Projected Income Statement

![]()

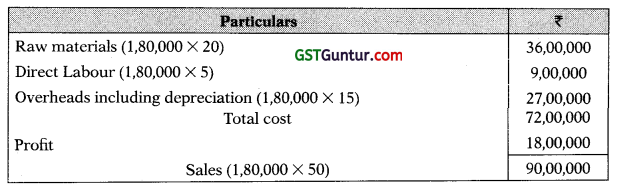

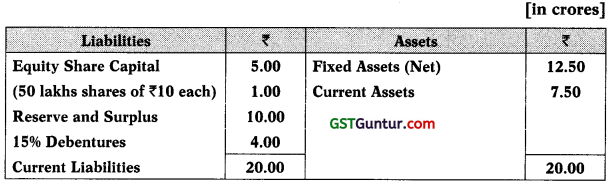

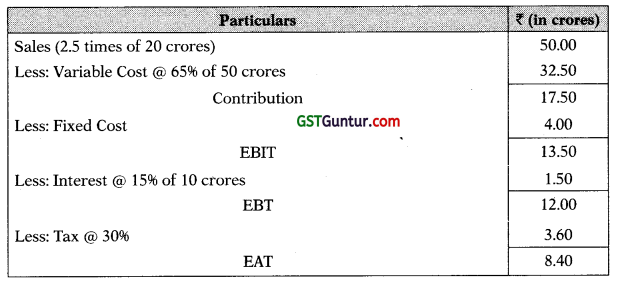

Question 5.

A company had the following Balance Sheet as on 31st March, 2014:

The additional information given is as under:

Fixed cost per annum (excluding interest) : 4 crores

Variable operating cost ratio : 65%

Total assets turnover ratio : 2.5

Income Tax rate : 30%

Required:

(i) Earnings Per Share

(ii) Operating Leverage

(iii) Financial Leverage

(iv) Combined Leverage (10 Marks)

Answer:

(i) Calculation of EPS:

EAT = \(\frac{\text { EAT }}{\text { No. of Shares }}\) = \(\frac{840 \text { Lakhs }}{50 \text { Lakhs }}\) = 16.80

(ii) Calculation of OL:

OL = \(\frac{\text { Contribution }}{\text { EBIT }}\) = \(\frac{17.50 \text { Crores }}{13.50 \text { Crores }}\) = 1.296 times

(iii) Calculation of FL:

FL = \(\frac{\text { EBIT }}{\text { EBT }}\) = \(\frac{13.50 \text { Crores }}{12.00 \text { Crores }}\) = 1.125 times

(iv) Calculation of CL:

CL = OL × FL = 1.296 × 1.125 = 1.458 times

Working Notes:

Income Statement

![]()

Question 6.

Answer the following:

(a) Explain in brief following Financial Instruments: (1 × 4 = 4 Marks)

- Euro Bonds

- Floating Rate Notes

- Euro Commercial paper

- Fully Hedged Bond

Answer:

- Euro bonds: Euro bonds are debt instruments which are not denominated in the currency of the country in which they are issued. E.g. a Yen note floated in Germany.

- Floating Rate Notes: Floating Rate Notes are issued up to seven years maturity. Interest rates are adjusted to reflect the prevailing exchange rates. They provide cheaper money than foreign loans.

- Euro Commercial Paper (ECP): ECPs are short term money market instruments. They are for maturities less than one year. They are usually designated in US Dollars.

- Fully Hedged Bond: In foreign bonds, the risk of currency fluctuations exists. Fully hedged bonds eliminate the risk by selling in forward markets the entire stream of principal and interest payments.

![]()

(b) Discuss the Advantages of Leasing. (4 Marks)

Answer:

(i) Lease may low cost alternative: Leasing is alternative to purchasing. As the lessee is to make a series of payments for using an asset, a lease arrangement is similar to a debt contract. The benefit of lease is based on a comparison between leasing and buying an asset. Many lessees find lease more attractive because of low cost.

(ii) Tax benefit: In certain cases tax benefit of depreciation available for owning an asset may be less than that available for lease payment

(iii) Working capital conservation: When a firm buy an equipment by bor-rowing from a bank (or financial institution), they never provide 10096 financing. But in case of lease one gets normally 10096 financing. This enables conservation of working capital.

(iv) Preservation of Debt Capacity: So, operating lease does not matter in computing debt equity ratio. This enables the lessee to go for debt financing more easily. The access to and ability of a firm to get debt financing is called debt capacity (also, reserve debt capacity).

(v) Obsolescence and Disposal: After purchase of leased asset there may be technological obsolescence of the asset. That means a technologically upgraded asset with better capacity may come into existence after purchase. To retain competitive advantage the lessee as user may have to go for the upgraded asset.

![]()

(c) Write two main objectives of Financial Management. (2 Marks)

Answer:

Two Main Objective of Financial Management are:’

- Profit Maximisation: It has traditionally been argued that the primary objective of a company is to earn profit; hence the objective of financial management is also profit maximisation.

- Wealth/Value Maximization: Shareholders wealth are the result of cost benefit analysis adjusted with their timing and risk i.e. time value of money. This is the real objective of Financial Management. So, Wealth = Present Value of benefits – Present Value of Costs.

Section B – Economics For Finance

Question 7.

(1) “World Trade Organisation (WTO) has a three-tier system of decision making.” Explain. (2 Marks)

Answer:

The World Trade Organization has a three-tier system of decision making. The WTO’s top level decision-making body is the Ministerial Conference which can take decisions on all matters under any of the multilateral trade agreements. The Ministerial Conference meets at least once every two years. The next level is the General Council which meets several times a year at the Geneva head-quarters.

The General Council also meets as the Trade Policy Review Body and the Dispute Settlement Body. At the next level, the Goods Council, Ser-vices Council and Intellectual Property (TRIPS) Council report to the General Council. These councils are responsible for overseeing the implementation of the WTO agreements in their respective areas of specialisation. The three also have subsidiary bodies. Numerous specialized committees, working groups and working parties deal with the individual agreements.

![]()

(2) In a two sector economy, the business sector produces 7,500 units at an average price of ₹ 7. (3 Marks)

(a) What is the money value of output?

(b) What is the money income of households?

(c) If households spend 75 percent of their income, what is the total con-sumer expenditure?

(d) What is the total money revenues received by the business sector?

(e) What should happen to the level of output? (5 Marks)

Answer:

(a) The money value of output equals total output times the average price per unit. The money value of output is:

= 7,500 × 7 = ₹ 52,500

(b) In a two sector economy, households receive an amount equal to the money value of output. Therefore, the money income of households is the same as the money value of output i.e ₹ 52,500.

(c) Total spending by households = ₹ 52,500 × 0.75 = ₹ 39,375

(d) The total money revenues received by the business sector is equal to aggregate spending by households i.e. ₹ 39,375.

(e) The business sector makes payments of ₹ 52,500 to produce output, whereas the households purchase only output worth ₹ 39,375 of what is produced. Therefore, the business sector has unsold inventories valued at ₹ 13,125. They should be expected to decrease output.

![]()

(3) Explain the objectives of Fiscal Policy. (3 Marks)

Answer:

Objectives of Fiscal Policy: Fiscal Policy refers to the policy of government related to public revenue and public expenditure. The objectives of fiscal policy are derived from the aspirations and goals of the society and vary from country to country. The most common objectives of fiscal policy are:

- Achievement and maintenance of full employment,

- Maintenance of price stability,

- Acceleration of the rate of economic development,

- Equitable distribution of income and wealth,

- Eradication of poverty, and

- Removal of regional imbalances in different parts of the country.

The importance as well as order of priority of these objectives may vary from country to country and from time to time. For instance, while stability and equality may be the priorities of developed nations, economic growth, employment and equity may get higher priority in developing countries. Also, these objectives are not always compatible; for instance the objective of achieving equitable distribution of income may conflict with the objective of economic growth and efficiency.

![]()

Question 8.

(1) Which types of Government interventions are applied for correcting information failure? (2 Marks)

Answer:

Government Interventions: For combating the problem of market failure due to information failure the following interventions are resorted to:

- Government makes it mandatory to have accurate labelling and content disclosures by producers.

- Public dissemination of information to improve knowledge and subsidizing of initiatives in that direction.

- Regulation of advertising and setting of advertising standards to make advertising more responsible, informative and less persuasive.

A few examples are: SEBI mandates on accurate information disclosure to prospective buyers of new stocks, mandatory statutory information, licensing of doctors practicing medicine, awareness campaigns and funding of organisations to influence public, media and government attitudes.

(2) Compute M1 supply of money from the data given below:

Currency with public : ₹ 2,13,279.8 Crores

Time deposits with bank : ₹ 3,45,000.7 Crores

Demand deposits with bank : ₹ 1,62,374.5 Crores

Post office savings deposit : ₹ 382.9 Crores

Other deposits of RBI : ₹ 765.1 Crores (3 Marks)

Answer:

Ml = Currency and coins with the people + demand deposits of banks (current and saving accounts) + other deposits of the RBI.

= ₹ 2,13,279.8 + ₹ 1,62,374.5 + ₹ 765.1 = ₹ 3,76,419.4 Crores

![]()

(3) Describe the determinants of demand for money as identified by Mil-ton Friedman in his restatement of Quantity Theory of demand for money. (3 Marks)

Answer:

According to Milton Friedman, Demand for money is affected by the same factors as demand for any other asset, namely:

- Permanent income.

- Relative returns on assets (which incorporate risk).

Friedman maintains that it is permanent income – and not current income as in the Keynesian theory – that determines the demand for money. Permanent income which is Friedman’s measure of wealth is the present expected value of all future income. To Friedman, money is a good as any other durable consumption good and its demand is a function of a great number of factors. Friedman identified the following four determinants of the demand for money. The nominal demand for money:

- is a function of total wealth, which is represented by permanent income divided by the discount rate, defined as the average return on the five asset classes in the monetarist theory world, namely money, bonds, equity, physical capital and human capital.

- is positively related to the price level, P. If the price level rises the demand for money increases and vice versa.

- rises, if the opportunity costs of money holdings (i.e. returns on bonds and stock) decline and vice versa.

- is influenced by inflation, a positive inflation rate reduces the real value of money balances, thereby increasing the opportunity costs of money holdings.

![]()

(4) The Nominal Exchange rate of India is ₹ 56/1$, Price Index in India is 116 and Price Index in USA is 112. What will be the Real Exchange Rate of India? (2 Marks)

Answer:

The ‘real exchange rate’ describes ‘how many’ of a good or service in one country can be traded for ‘one’ of that good or service in a foreign country. Thus it incorporates changes in prices

Real Exchange rate = Nominal exchange rate × (Domestic price index/Foreign price index)

= 56 × \(\frac{116}{112}\) = 58

Question 9.

(1) The table given below shows the number of labour hours required to produce Sugar and Rice in two countries X and Y:

| Commodity | Country X | Country Y |

| 1 Unit of Sugar | 2.0 | 5.0 |

| 1 unit of Rice | 4.0 | 2.5 |

(a) Compute the Productivity of labour in both countries in respect of both commodities.

(b) Which country has absolute advantage in production of Sugar?

(c) Which country has absolute advantage in production of Rice? (3 Marks)

Answer:

(a) Productivity of labour (output per labour hour = the volume of output produced per unit of labour input) = output/input of labour hours

| Output of commodity | Units in Country X | Units in Country Y |

| Sugar | 0.5 | 0.20 |

| Rice | 0.25 | 0.40 |

(b) A country has an absolute advantage in producing a good over another country if it requires fewer resources to produce that good. Since one hour of labour time produces 0.5 units of sugar in country X against

0. 20 units in country Y, Country X has absolute advantage in production of sugar.

(c) Since one hour of labour time produces 0.40 units of rice in country Y against 0.25 units in country X, Country Y has absolute advantage in production of rice.

![]()

(2) Calculate the Average Propensity to Consume (APC) and Average Propensity to Save (APS) from the following data:

Income : ₹ 4,000

Consumption : ₹ 3,000 (2 Marks)

Answer:

The average propensity to consume (APC) is the ratio of consumption expenditures (C) to disposable income (DI):

APC = C/DI = 3,000/4,000 = 0.75

The average propensity to save (APS) is the ratio of savings to disposable income:

APS = S/DI = 1,000/4,000 =0.25

(3) Explain with example how Ad Valorem Tariff is levied. (3 Marks)

Answer:

An ad valorem tariff is a duty or other charges levied on an import item on the basis of its value and not on the basis of its quantity, size, weight, or any other factor.

It is levied as a constant percentage of the monetary value of one unit of the imported good. For example, a 20% ad valorem tariff on a computer generates ₹ 2,000 government revenue from tariff on each imported computer priced at ₹ 10,000 in the world market. If the price of computer rises to ₹ 20,000, then it generates a tariff of ₹ 4,000.

![]()

(4) Describe features of public goods. (2 Marks)

Answer:

Features of public goods:

- Public goods yield utility and their consumption is essentially collective in nature.

- Public goods are non rival in consumption i.e. consumption of a public good by one individual does not reduce the quality or quantity available for all other individuals

- Public goods are non-excludable i.e. consumers cannot (at least at less than prohibitive cost) be excluded from consumption benefits

- Public goods are characterized by indivisibility, each individual may consume all of the good i.e. the total amount consumed is the same for each individual.

- Once a public good is provided, the additional resource cost of another person consuming the good is zero. No direct payment by the consumer is involved in the case of pure public goods and these goods are generally more vulnerable to issues such as externalities, inadequate property rights, and free rider problems

- Competitive private markets will fail to generate economically efficient outputs of public goods. E.g. national defence.

![]()

Question 10.

(1) Distinguish between Personal Income and Disposable Personal Income. (3 Marks)

Answer:

Personal Income: Personal Income is the income received by the household sector including Non-Profit Institutions Serving Households. Thus, while na-tional income is a measure of income earned and personal income is a measure of actual current income receipts of persons from all sources which may or may not be earned from productive activities during a given period of time.

In other words, it is the income ‘actually paid out’ to the household sector, but not necessarily earned. Examples of this include transfer payments such as social security benefits, unemployment compensation, welfare payments etc. Individuals also contribute income which they do not actually receive; for example, undistributed corporate profits and the contribution of employers to social security. Personal income forms the basis for consumption expenditures and is derived from national income as follows:

PI = NI + income received but not earned – income earned but not received

Disposable Personal Income (DI): Disposable personal income is a measure of amount of the money in the hands of the individuals that is available for their consumption or savings. Disposable personal income is derived from personal income by subtracting the direct taxes paid by individuals and other compulsory payments made to the government.

DI = PI – Personal Income Taxes

![]()

(2) Explain the role of Government in a market economy as stated by Richard Musgrave. (3 Marks)

Answer:

Richard Musgrave, in his classic treatise ‘The Theory of Public Finance’ (1959), introduced the three branch taxonomy of the role of government in a market economy. The objective of the economic system and the role of government is to improve the wellbeing of individuals or households. According to ‘Musgrave Three-Function Framework’, the functions of government are to be separated into three, namely, resource allocation, (efficiency), income redistribution (fairness) and macroeconomic stabilization.

The allocation and distribution functions are primarily microeconomic functions, while stabilization is a macroeconomic function. The allocation function aims to correct the sources of inefficiency in the economic system while the distribution role ensures that the distribution of wealth and income is fair. The stabilization branch is to ensure achievement of macroeconomic stability, maintenance of high levels of employment and price stability.

(3) Why is the central bank referred to as a “banker’s bank”? (2 Marks)

Answer:

A central bank of a country is called a ‘bankers’ bank because it acts as a banker to the community of commercial banks and provides them with financial services to facilitate their efficient functioning.

- The central bank acts as a custodian of cash reserves of commercial banks in the country.

- The central bank provides efficient means of funds transfer for all banks. All commercial banks maintain accounts with the central bank and it enables smooth and swift clearing and settlements of inter-bank transactions and interbank payments.

- The central bank acts as a lender of last resort. It provides liquidity to banks when the latter face shortage of liquidity. The scheduled commercial banks can borrow from the discount window against the collateral of securities like commercial bills, government securities, treasury bills, or other eligible papers.

![]()

(4) “World Trade Organisation (WTO) has a three-tier system of decision making.” Explain. (2 Marks)

Answer:

The World Trade Organization has a three-tier system of decision making. The WTO’s top level decision-making body is the Ministerial Conference which can take decisions on all matters under any of the multilateral trade agreements. The Ministerial Conference meets at least once every two years. The next level is the General Council which meets several times a year at the Geneva headquarters.

The General Council also meets as the Trade Policy Review Body and the Dispute Settlement Body. At the next level, the Goods Council, Services Council and Intellectual Property (TRIPS) Council report to the General Council. These councils are responsible for overseeing the implementation of the WTO agreements in their respective areas of specialisation. The three also have subsidiary bodies. Numerous specialized committees, working groups and working parties deal with the individual agreements.

Question 11.

(1) Describe the meaning and mechanism of ‘crowding out’ effect of public expenditure. (3 Marks)

Answer:

Crowding Out Meaning: ‘Crowding out’ effect is the negative effect fiscal policy may generate when spending by government in an economy substitutes private spending. For example, if government provides free computers to students, the demand from students for computers may not be forthcoming.

Crowding Out Mechanism:

The interest rates in an economy increase when:

- Government increases its spending by borrowing from the loanable funds from market and thus the demand for loans increases.

- Government increases the budget deficit by selling bonds or treasury bills and the amount of money with the private sector decreases.

Due to high interest, private investments, especially the ones which are inter-est – sensitive, will be reduced. Fiscal policy becomes ineffective as the decline in private spending partially or completely offset the expansion in demand resulting from an increase in government expenditure.

![]()

(2) “Money has four functions: a medium, a measure, a standard and a store.” Elucidate. (2 Marks)

Answer:

Money performs many important functions in an economy:

1. Money is a convenient medium of exchange or it is an instrument that

facilitates easy exchange of goods and services. Money, though not having any inherent power to directly satisfy human wants, by acting as a medium of exchange, it commands purchasing power and its possession enables us to purchase goods and services to satisfy our wants.

By acting as an intermediary, money increases the ease of trade and reduces the inefficiency and transaction costs involved in a barter exchange. By decomposing the single barter transaction into two separate transactions of sale and purchase, money eliminates the need for double coincidence of wants. Money also facilitates separation of transactions both in time and place and this in turn enables us to economize on time and efforts involved in transactions. ‘

2. Money is a ‘common measure of value’. The monetary unit is the unit of measurement in terms of which the value of all goods and services is measured and expressed. It is convenient to trade all commodities in exchange for a single commodity. So also, it is convenient to measure the prices of all commodities in terms of a single unit, rather than record the relative price of every good in terms of every other good.

A common unit of account facilitates a system of orderly pricing which is crucial for rational economic choices. Goods and services which are otherwise not comparable are made comparable through expressing the worth of each in terms of money.

3. Money serves as a unit or standard of deferred payment i.e money facilitates recording of deferred promises to pay. Money is the unit in terms of which future payments are contracted or stated. However, variations in the purchasing power of money due to inflation or deflation, reduces the efficacy of money in this function.

4. Like nearly all other assets, money is a store of value, .’eoplc prefer to hold it as an asset, that is, as part of their stock of wealth. The splitting of purchases and sale into two transactions involves a separation in both time and space. This separation is possible because money can be used as a store of value or store of means of payment during the intervening time.

Again, rather than spending one’s money at present, one can store it for use at some future time. Thus, money functions as a temporary abode of purchasing power in order to efficiently perform its medium of exchange function. Money also functions as a permanent store of value. Money is the only asset which has perfect liquiuity.

![]()

(3) What will be the total credit created by the commercial banking system for an initial deposit of ?3,000 at a Required Reserve Ratio (RRR) of 0.05 and 0.08 respectively? Also compute credit multiplier. (2 Marks)

Answer:

Credit Multiplier = 1/Required Reserve Ratio

For RRR 0.05 Credit Multiplier = 1/0.05 = 20

For RRR 0.08 Credit Multiplier = 1 / 0.08 = 12.5

Credit Creation = Initial Deposit × Credit Multiplier

For RRR 0.05 Credit creation = ₹ 3,000 × 20 = ₹ 60,000

For RRR 0.08 Credit creation = ₹ 3,000 × 12.5 = ₹ 37,500

(4) What are the modes of Foreign Direct Investment (FDI)? (3 Marks)

Answer:

Foreign direct investment is defined as the process whereby the resident of one country (i.e. home country) acquires more than 10 percent ownership of an asset in another country (i.e. the host country) and such movement of capital involves ownership, control as well as management of the asset in the host country. Various modes are:

![]()

- Opening of a subsidiary or associate company in a foreign country,

- Equity injection into an overseas company,”

- Acquiring a controlling interest in an existing foreign company,

- Mergers and acquisitions (M&A),

- Joint venture with a foreign company,

- Green field investment (establishment of a new overseas affiliate for freshly starting production by a parent company).