CA Inter FM ECO Question Paper 1 – CA Inter FM ECO Study Material is designed strictly as per the latest syllabus and exam pattern.

FM ECO CA Inter Question Paper 1

Time Allowed – 3 Hours

Maximum Marks – 100

Section A – Financial Management

Question 1.

Answer the followings:

(a) The Sale revenue of TM excellence Ltd. @ ₹ 20 per unit of output is ₹ 20 lakhs and Contribution is ₹ 10 lakhs. At the present level of output the DOL of the company is 2.5. The company does not have any Preference , Shares. The number of Equity Shares are 1 lakh. Applicable corporate income tax rate is 50% and the rate of interest on Debt Capital is 16% p.a.

What is the EPS (At sales revenue of ₹ 20 lakhs) and amount of Debt Capital of the company if a 25% decline in Sales will wipe out EPS.

Answer:

(A) Earnings Per Share = \(\frac{(\text { EBIT }-\mathrm{I})(1-\mathrm{t})}{\text { Equity shares }}\)

= \(\frac{(4,00,000-1,50,000)(1-0.50)}{1,00,000}\) = ₹ 1.25

(B) Amount of DEBT = Interest ÷ Rate of interest

= 1,50,000 ÷ 16% = ₹ 9,37,500

Working Note:

(1) Calculation of Fixed Cost:

DOL = \(\frac{\text { Contribution }}{\text { EBIT }}\) = \(\frac{10,00,000}{\text { EBIT }}\) = 2.5 times

EBIT = 10,00,000 ÷ 2.5 = ₹ 4,00,000

Fixed Cost = Contribution – EBIT

= 10,00,000 – 4,00,000 = ₹ 6,00,000

(2) Calculation of Degree of Combined Leverage:

Question says that 25% change in sales will wipe out EPS. Here wipe out means it will reduce EPS by 100%.

DCL = \(\frac{\% \text { Change in EPS }}{\% \text { Change in Sales }}=\frac{100 \%}{25 \%}\) = 4 times

(3) Calculation of EBT and Interest:

DCL = \(\frac{\text { Contribution }}{\text { EBT }}=\frac{10,00,000}{\text { EBT }}\) = 4 times

EBT = 10,00,000 ÷ 4 = ₹ 2,50,000

Interest = EBIT – EBT = 4,00,000 – 2,50,000

= ₹ 1,50,000

![]()

(b) The following figures are collected from the annual report of XYZ Ltd.:

| Net Profit | ₹ 30 lakhs |

| Outstanding 12% preference shares

No. of Equity shares Return on Investment Cost of capital i.e. (Ke) |

₹ 100 lakhs

3 lakhs 20% 16% |

What should be the approximate dividend payout ratio so as to keep the share price at ₹ 42 by using Walter model?

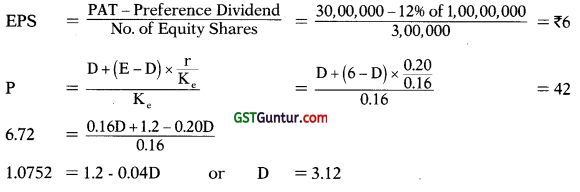

Answer:

Divided Payout ratio:

= \(\frac{\text { DPS }}{\text { EPS }}\) × 100 = \(\frac{3.12}{6}\) × 100 = 52%

![]()

(c) Alpha Ltd. requires funds amounting to ₹ 80,00,000 for its new project. To raise the funds, the company has following two alternatives:

(1) To issue Equity Shares of ₹ 100 each (at par) amounting to ₹ 60,00,000 and borrow the balance amount at the interest of 12% p.a.; or

(2) To issue Equity Shares of ₹ 100 each (at par) and 12% Debentures in equal proportion.

Find out the point of in difference between two modes of financing and state which option will be beneficial in different situations assuming tax rate 30%.

Answer:

Calculation of Indifference two modes of financing:

\(\frac{(\mathrm{EBIT}-\mathrm{I})(1-\mathrm{T})}{\mathrm{N}_1}\) = \(\frac{(\mathrm{EBIT}-\mathrm{I})(1-\mathrm{T})}{\mathrm{N}_2}\)

\(\frac{(\text { EBIT }-12 \% \text { of } 20 \text { lakhs) }(1-0.30)}{60,000}\) = \(\frac{(\text { EBIT }-12 \% \text { of } 20 \text { lakhs) }(1-0.30)}{40,000}\)

EBIT = ₹ 9,60,000

Course of action:

(a) If expected EBIT is less than ₹ 9,60,000 : Alternate 1

(b) if expected EBIT is equal to ₹ 9,60,000 : Alternate 1 or 2

(c) If expected EBIT is more than ₹ 9,60,000: Alternate 2

![]()

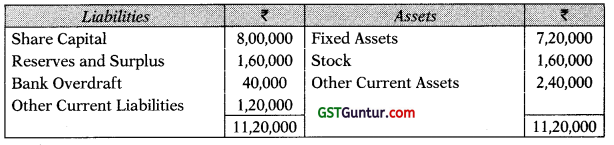

(d) From the following information, prepare a summarised Balance Sheet as at 31st March, 2002:

Working capital: ₹ 2,40,000

Bank overdraft : ₹ 40,000

Fixed assets to proprietary ratio : 0.75

Reserves and Surplus : ₹ 1,60,000

Current ratio : 2.5

Liquid ratio : 1.5

Answer:

Balance Sheet As at 31.03.2002

Working Notes:

1. Current assets and Current liabilities computation:

\(\frac{\mathrm{CA}}{\mathrm{CL}}\) = 2.5

CA = 2.5 CL

Working capital = CA – CL

2,40,000 = 2.5 CL – CL

CL = 1,60,000

CA = 1,60,000 × 2.5 = ₹ 4,00,000

2. Computation of stock:

Liquid ratio = \(\frac{\text { Liquid Assets }}{\text { Current Liabilities }}\)

1.5 = \(\frac{\text { Current Assets-Stock }}{1,60,000}\)

1.5 × 1,60,000 = 4,00,000 – Stock

Stock = 1,60,000

3. Computation of Proprietary fund. Fixed assets, Capital and Sundry Creditor

\(\frac{\text { Fixed Assets }}{\text { Proprietary Fund }}\) = 0.75

Fixed assets = 0.75 Proprietary fund

Net working capital = 0.25 Proprietary fund

2,40,000 = Proprietary fund

Proprietary fund = \(\frac{2,40,000}{0.25}\) = 9,60,000

Fixed assets = 0.75 Proprietary fund

= 0.75 × 9,60,000 = 7,20,000

Share Capital = Proprietary fund – R & S

= 9,60,000 – 1,60,000 = 8,00,000

Sundry creditors = CL – Bank overdraft

= 1,60,000 – 40,000 = 1,20,000

![]()

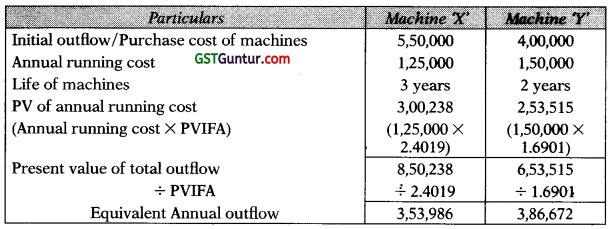

Question 2.

A company has to make a choice two machines ‘X’ and ‘Y’. The two machines have identical capacity, do exactly the same job, but designed differently.

Machine X costs ₹ 5,50,000 and will last for three years. It costs ₹ 1,25,000 per year to run. Machine Y is an economic model costing ₹ 4,00,000 will last for two years. It costs ₹ 1,50,000 per year to run.

The cash flows of machine ‘X’ and ‘Y’ are real cash flows. The costs are forecasted in rupees of constant purchasing power. Ignore taxes. The present value factors at 12% are:

| Years | t1 | t2 | t3 |

| PVIF0.12t | 0.8929 | 0.7972 | 0.7118 |

| PVIFA0.12.2 = 1.6901 | |||

| PVIFA0.12.3 = 2.4019 |

Which machine would you recommend the company to buy? (10 Marks)

Answer:

Statement Showing Evaluation of Two Machines

Select the Machine X having lower equivalent annualized outflow.

![]()

Question 3.

The R & G Company has following capital structure at 31st March, 2004, which is considered to be optimum:

13% debenture : ₹ 3,60,000

11% preference share capital : ₹ 1,20,000

Equity share capital (2,00,000 shares) : ₹ 19,20,000

The company’s share has a current market price of ₹ 27.75 per share. The expected dividend per share in next year is 50 per cent of the 2004 EPS. The EPS of last 10 years is as follows. The past trends are expected to continue:

The company can issue 14 per cent new debenture. The company’s debenture is currently selling at ₹ 98. The new preference issue can be sold at a net price of ₹ 9.80, paying a dividend of ₹ 1.20 per share. The company’s marginal tax rate is 50%.

(i) Calculate the after tax cost (a) of a new debts and new preference share capital, (b) of ordinary equity, assuming new equity comes from retained earnings.

(ii) Calculate the marginal cost of capital.

(iii) How much can be spent for capital investment before new ordinary share must be sold? Assuming that retained earning available for next year’s investment are 50% of 2004 earnings.

(iv) What will be marginal cost of capital [cost of fund raised in excess of the amount calculated in part (iii)] if the company can sell new ordinary shares to net ₹ 20 per share? The cost of debt and of preference capital is constant. (10 Marks)

Answer:

Assumption: The present capital structure is optimum. Hence, it will be followed in future.

Existing Capital Structure Analysis

| Name of source | Amount (₹) | Proportion |

| 13% debentures | 3,60,000 | 0.15 |

| 11% Preference | 1,20,000 | 0.05 |

| Equity share capital | 19,20,000 | 0.80 |

| Total | 24,00,000 | 1.00 |

(i) (a) After tax cost of new debt

Kd = \(\frac{I(1-t)}{N P}\) × 100 = \(\frac{14(1-.50)}{98}\) × 100 = 7.143%

After tax cost of new preference shares

Kp = \(\frac{\mathrm{PD}}{\mathrm{NP}}\) × 100 = \(\frac{1.20}{9.80}\) × 100 = 12.25%

(b) Cost of new equity (comes from retained earnings)

Ke = \(\frac{\mathrm{D}_1}{\mathrm{P}_0 \text { (old) }}\) + g = \(\frac{1.3865}{27.75}\) + 0.12 = 17%

(ii) MCC (K0) = KdWd + KpWp + KeWe

= 7.143% × .15 + 12.245% × .05 + 17% × .80 = 15.28%

(iii) The company can pay the following amount without selling the new shares:

Equity (retained earnings in this case) = 80% of the total capital

Therefore, investment before new issue = \(\frac{2,77,300}{80 \%}\) = ₹ 3,46,625

Retained earnings = ₹ 1.3865 × 2,00,000

= ₹ 2,77,300

(iv) MCC (K0)

= KdWd + KpWp + KeWe

= 7.14396 × .15 + 12.245% × .05 + 18.93% × .80 = 16.83%

If the company pay more than ₹ 3,46,625, it will have to issue new shares. The cost of new issue of ordinary share is:

Ke = \(\frac{D_1}{P_0(\text { new })}\) + g = \(\frac{1.3865}{20}\) + 0.12 = 18.93%

![]()

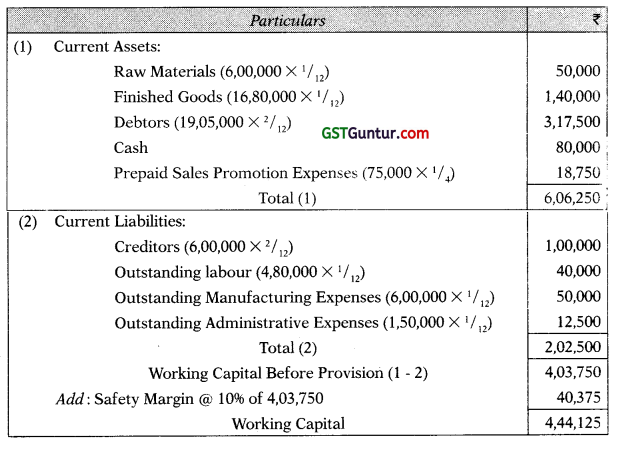

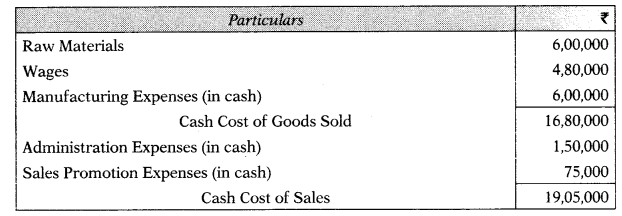

Question 4.

Q Ltd. sells goods at a uniform rate of gross profit of 20% on sales including depreciation as part of cost of production.

Its annual figures are as under:

Sales (at 2 months’ credit) : ₹ 24,00,000

Materials consumed (suppliers credit 2 months) : ₹ 6,00,000

Wages paid (monthly at the beginning of the subsequent month) : ₹ 4,80,000

Manufacturing expenses (cash expenses are paid one month in arrear) : ₹ 6,00,000

Administration expenses (cash expenses are paid one month in arrear) : ₹ 1,50,000

Sales promotion expenses (paid quarterly in advance) : ₹ 75,000

The company keeps one month stock each of raw materials and finished goods. A minimum cash balance of ₹ 80,000 is always kept. The company wants to adopt a 10% safety margin in the maintenance of working capital. The company has no work-in-progress.

Find out the requirements of working capital of the company on cash cost basis. (10 Marks)

Answer:

Statement of Working Capital Requirement (Cash Cost Basis)

Working Notes:

Projected Income Statement

![]()

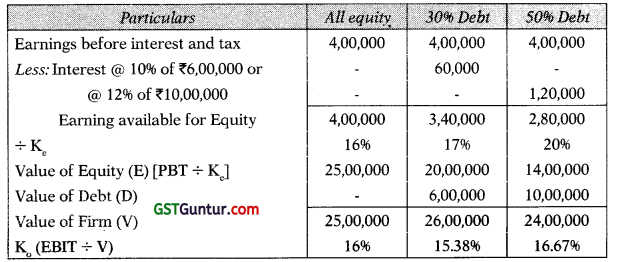

Question 5.

RST Ltd. is expecting an EBIT of ₹4,00,000 for F.Y. 2015-16. Presently the company is financed by equity share capital ₹ 20,00,000 with equity capitalization rate of 16%. The company is contemplating to redeem part of the capital by introducing debt financing. The company has two options to raise debt to the extent of 30% or 50% of the total fund. It is expected that for debt financing upto 30%, the rate of interest will be 10% and equity capitalization rate will increase to 17%. If the company opts for 50% debt, then the interest rate will be 12% and equity capitalization rate will be 20%.

You are required to compute value of the company; its overall cost of capital under different options and also state which is the best option. (10 Marks)

Answer:

Statement of Value of Firm and Cost of Capital

Decision: Company should opt for 30% debt finance having higher Value of firm and lower K0.

Question 6.

(a) Briefly explain the three finance function decisions. (3 Marks)

Answer:

The finance functions are divided into long term and short term functions/ decisions:

Long term Finance Function Decisions

(i) Investment decisions (I):

These decisions relate to the selection of assets in which funds will be invested by a firm. Funds procured from different sources have to be invested in various kinds of assets. Long term funds are used in a project for various fixed assets and also for current assets.

(ii) Financing decisions (F):

These decisions relate to acquiring the optimum finance to meet financial objectives and seeing that fixed and working capital are effectively managed. The financial manager needs to possess a good knowledge of the sources of available funds and their respective costs and needs to ensure that the company has a sound capital structure, i.e. a proper balance between equity capital and debt.

(iii) Dividend decisions (D):

These decisions relate to the determination as to how much and how frequently cash can be paid out of the profits of an organisation as income for its owners/shareholders. The owner of any profit-making organization looks for reward for his investment in two ways, the growth of the capital invested and the cash paid out as income; for a sole trader this income would be termed as drawings and for a limited liability company the term is dividends.

Short-term Finance Decisions/Function

Working capital Management (WCM): Generally short term decision is reduced to management of current asset and current liability (ie., working capital Management).

![]()

(b) Explain the steps while using the equivalent annualized criterion. (3 Marks)

Answer:

Equivalent Annualized Criterion: This method involves the following steps:

- Compute NPV using the WACC or discounting rate.

- Compute Present Value Annuity Factor (PVAF) of discounting factor used above for the period of each project.’

- Divide NPV computed under step (i) by PVAF as computed under step (ii) and compare the values.

(c) Explain the significance of Cost of Capital. (4 Marks)

OR

Briefly describe any four sources of short-term finance.

Answer:

ignificance of the Cost of Capital: The cost of capital is important to arrive at correct amount and helps the management or an investor to take an appropriate decision. The correct cost of capital helps in the following decision making:

(i) Evaluation of investment options:

The estimated benefits (future cash flows) from available investment opportunities (business or project) are converted into the present value of benefits by discounting them with the relevant cost of capital. Here it is pertinent to mention that every investment option may have different cost of capital hence it is very important to use the cost of capital which is relevant to the options available. Here Internal Rate of Return (IRR) is treated as cost of capital for evaluation of two options (projects).

(ii) Performance Appraisal:

Cost of capital is used to appraise the performance of a particulars project or business. The performance of a project or business in compared against the cost of capital which is known here as cut-off rate or hurdle rate.

(iii) Designing of optimum credit policy:

While appraising the credit period to be allowed to the customers, the cost of allowing credit period is compared against the benefit/profit earned by providing credit to customer of segment of customers. Here cost of capital is used to arrive at the present value of cost and benefits received.

![]()

OR

Sources of Short Term Finance: There are various sources available to meet short-term needs of finance. The different sources are discussed below-

(i) Trade Credit:

It represents credit granted by suppliers of goods, etc., as an incident of sale. The usual duration of such credit is 15 to 90 days. It generates automatically in the course of business and is common to almost all business operations. It can be in the form of an ‘open account’ or ‘bills payable’.

(ii) Accrued Expenses and Deferred Income:

Accrued expenses represent liabilities which a company has to pay for the services which it has already received like wages, taxes, interest and dividends. Such expenses arise out of the day-to-day activities of the company and hence represent a spontaneous source of finance.

Deferred Income:

These are the amounts received by a company in lieu of goods and services to be provided in the future. Since these receipts increases a company’s liquidity, they are also considered to be an important sources of short-term finance.

(iii) Advances from Customers:

Manufacturers and contractors engaged in producing or constructing costly goods involving considerable length of manufacturing or construction time usually demand advance money from their customers at the time of accepting their orders for executing their contracts or supplying the goods. This is a cost free source of finance and really useful.

(iv) Commercial Paper:

A Commercial Paper is an unsecured money market instrument issued in the form of a promissory note. The Reserve Bank of India introduced the commercial paper scheme in the year 1989 with a view to enabling highly rated corporate borrowers to diversify their sources of short-term borrowings and to provide an additional instrument to investors.

(v) Treasury Bills:

Treasury bills are a class of Central Government Securities. Treasury bills, commonly referred to as T-Bills are issued by Government of India to meet short term borrowing requirements with maturities ranging between 14 to 364 days.

(vi) Certificates of Deposit (CD):

A certificate of deposit (CD) is basically a savings certificate with a fixed maturity date of not less than 15 days up to a maximum of one year.

![]()

(vii) Bank Advances:

Banks receive deposits from public for different periods at varying rates of interest. These funds are invested and lent in such a manner that when required, they may be called back. Lending results in gross revenues out of which costs, such as interest on deposits, administrative costs, etc., are met and a reasonable profit is made. A bank’s lending policy is not merely profit motivated but has to also keep in mind the socio-economic development of the country. Some of the facilities provided by banks are Short Term Loans, Overdraft, Cash Credits, Advances against goods, Bills Purchased/Discounted.

(viii) Financing of Export Trade by Banks:

Exports play an important role in accelerating the economic growth of developing countries like India. Of the several factors influencing export growth, credit is a very important factor which enables exporters in efficiently executing their export orders. The commercial banks provide short-term export finance mainly by way of pre and post-shipment credit. Export finance is granted in Rupees as well as in foreign currency.

(ix) Inter Corporate Deposits:

The companies can borrow funds for a short period say 6 months from other companies which have surplus liquidity. The rate of interest on inter corporate deposits varies depending upon the amount involved and time period.

(x) Certificate of Deposit (CD):

The certificate of deposit is a document of title similar to a time deposit receipt issued by a bank except that there is no prescribed interest rate on such funds.

The main advantage of CD is that banker is not required to encash the deposit before maturity period and the investor is assured of liquidity because he can sell the CD in secondary market.

(xi) Public Deposits:

Public deposits are very important source of short-term and medium term finances particularly due to credit squeeze by the Reserve Bank of India. A company can accept public deposits subject to the stipulations of Reserve Bank of India from time to time maximum up to 35 per cent of its paid up capital and reserves, from the public and shareholders.

These deposits may be accepted for a period of six months to three years. Public deposits are unsecured loans; they should not be used for acquiring fixed assets since they are to be repaid within a period of 3 years. These are mainly used to finance working capital requirements.

Note: Student may write any six.

![]()

Section B – Economics For Finance

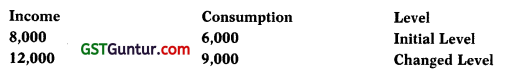

Question 7.

(a) Calculate Marginal Propensity to Consume (MPC) and Marginal Propensity to Save (MPS) from the following data: (2 Marks)

Answer:

(a) MPC (b) = ∆C/∆Y

= (9,000 – 6,000) ÷ (12,000 – 8,000) = 0.75

(b) MPS = 1 – b = 1 – 0.75 = 0.25

(b) Why is there a need for the government to resort to resource allocation? (3 Marks)

Answer:

Market failures provide the rationale for government’s allocative function. Market failures are situations in which a particular market, left to itself, is inefficient and leads to misallocation of society’s scarce resources. In the absence of appropriate government intervention in resource allocation, the resources are likely to be misallocated with too much production of certain goods or too little production of certain other goods. The allocation responsibility of the governments involves suitable corrective action when private markets fail to provide the right and desirable combination of goods and services to ensure optimal outcomes in terms of social welfare.

![]()

(c) Suppose in an economy:

Consumption Function = 150 + 0.75Yd

Investment spending = 100

Government spending = 115

Tax (Tx) = 20 + 0.20Y

Transfer Payments (Tr) = 40

Exports (X) = 35

Imports (M) = 15 + 0.1Y

Where, Y and Yd are National Income and Personal Disposable Income respectively. All figures are in rupees.

Find:

(a) The equilibrium level of National Income,

(b) Consumption at equilibrium level,

(c) Net Exports at equilibrium level (5 Marks)

Answer:

(a) The equilibrium level of National Income:

Y =C + I + G + (X – M)

= 165 + 0.6Y + 100 + 115 + [35 – (15 + 0.1Y)]

= 400 + 0.5Y

= 400 4- 0.5 = 800

(b) Consumption at equilibrium level:

C = 150 + 0.75Yd

Yd = Y – Tax + Transfer Payments,

= Y – (20 + 0.2Y) + 40 = 0.8Y + 20,

and C = 150 + 0.75Yd

= 150 + 0.75 (0.8Y + 20) (where Yd = 0.8Y + 20)

= 150 + (0.75 × 0.8Y) + (0.75 × 20)

C = 165 + 0.6Y

C = 165 + 0.6 × 800 = 645

(c) Net Exports at equilibrium level:

X – M = 35 – (15 + 0.1Y)

= 35 – (15 + 0.1 × 800) = – 60

There is adverse balance of trade

![]()

Question 8.

(a) Explain the leakages and Injections in the circular flow of Income. (2 Marks)

Answer:

Leakages:

A leakage is an outflow or withdrawal of income from the circular flow. Leakages are money leaving the circular flow and therefore, not available for spending on currently produced goods and services. Leakages reduce the flow of income.

Injections:

An injection is a non-consumption expenditure. It is an expenditure on goods and services produced within the domestic territory but not used by the domestic household for consumption purposes. Injections are exogenous additions to the circular flow and add to the total volume of the basic circular flow.

In the two-sector model with households and firms, household saving is the only leakage and investment is the only injection. In the three-sector model which includes the government, saving and taxes are the two leakages and investment and government purchases are the two injections. In the four-sector model which includes foreign sector also, saving, taxes, and imports are the three leakages; investment, government purchases, and exports are the three injections.

The state of equilibrium occurs when the total leakages are equal to the total injections that occur in the economy.

Savings + Taxes + Imports = Investment + Government Spending + Exports

![]()

(b) Define ‘Market power’. What Is Its disadvantage? (2 Marks)

Answer:

Market power is the ability of a price making firm to profitably raise the market price of a good or service over its marginal cost and thus earn supernormal profits or positive economic profits. Market power is an important cause of market failure. Market failure occurs when the free market outcomes do not maximize net benefits of an economic activity and therefore there is deadweight losses and inefficient allocation of resources.

Excess market power causes a single producer or a small number of producers to strategically reduce their supply and charge higher prices compared to competitive market. Market power can cause markets to be inefficient because it keeps price and output away from the equilibrium of supply and demand. Market power thus results in suboptimal outcomes such as deadweight loss, underproduction of goods and services, higher prices and loss of consumer surplus.

(c) The RBI published the following data as on 31st March, 2018. You are required to compute M4: (3 Marks)

(₹ in crores)

Currency with the public : ₹ 1,12,206.6

Demand Deposits with Banks : ₹ 1,93,300.4

Net Time Deposits with Banks : ₹ 2,67,310.2

Other Deposits of RBI : ₹ 614.8

Post Office Savings Deposits : ₹ 277.5

Post Office National Savings Certificates (NSCs) : ₹ 110.5

Answer:

M4 = Currency and coins with the people + demand deposits with the banks (Current and Saving accounts) + other deposits with the RBI + Net time deposits with the banking system + Total deposits with the Post Office Savings (excluding National Savings Certificate

| Components | ₹ in Crores |

| Currency with the public

Demand deposits with banks Other deposits with the RBI Net time deposits with the banking system |

1,12,206.6

1,93,300.4 2,67,310.2 614.8 |

| Post office saving deposits | 277.5 |

| Total | 5,73,709.5 |

![]()

(d) Explain the role of Monetary Policy Committee (MPC) In India. (3 Marks)

Answer:

Monetary Policy Committee (MPC) constituted by the Central Government is an empowered six-member committee with RBI Governor as the chairperson. Under the Monetary Policy Framework Agreement, the RBI will be responsible for price stability and for containing inflation targets at 496 (with a standard deviation of 296) in the medium term.

The committee is answerable to the Government of India if the inflation exceeds the range prescribed for three consecutive months. MPC has complete control over monetary policy decisions to ensure economic growth and price stability. The MPC decides the changes to be made to the policy rate (repo rate) so as to contain inflation within the target level specified to it by the central government.

Fixing of the benchmark policy interest rate (repo rate) is made in a more consultative and participative manner and on the basis of majority vote by this panel of experts. This has added lot of value and transparency to monetary policy decisions.

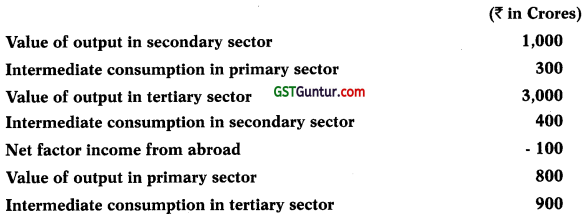

Question 9.

(a) From, the following data, compute the Gross National Product at Market Price using Value Added method: (3 Marks)

Answer:

Value Added Method:

GDPMP = (Value of output in primary sector – intermediate consumption of primary sector) + (value of output in secondary sector – intermediate consumption of secondary sector) + (value of output in tertiary sector – intermediate consumption of tertiary sector)

= 800 – 300 + 1,000 – 400 + 3,000 – 900 = 3,200 Crores

GNPMP = GDPMP + NFIA

= 3,200 – 100 = 3,100 Crores

![]()

(b) Describe the limitations of fiscal policy. (3 Marks)

Answer:

The following are the significant limitations in respect of choice and implementation of fiscal policy: ‘

1. One of the biggest problems with using discretionary fiscal policy to counteract fluctuations is the different types of lags involved in fiscal policy action. There are significant lags such as recognition lag, decision lag, implementation lag and impact lag.

2. Fiscal policy changes may at times be badly timed due to the various lags so that it is highly possible that an expansionary policy is initiated when the economy is already on a path of recovery and vice versa.

3. There are difficulties in instantaneously changing governments’ spending and taxiftion policies.

4. It is practically difficult to reduce government spending on various items such as defence and social security as well as on huge capital projects which are already midway.

5. Public works cannot be adjusted easily along with movements of the trade cycle because many huge projects such as highways and dams have long gestation period. Besides, some urgent public projects cannot be postponed for reasons of expenditure cut to correct fluctuations caused by business cycles.

![]()

6. Due to uncertainties, there are difficulties of forecasting when a period of inflation or deflation may set in and also promptly determining the accurate policy to be undertaken.

7. There are possible conflicts between different objectives of fiscal policy such that a policy designed to achieve one goal may adversely affect another. For example, an expansionary fiscal policy may worsen inflation in an economy.

8. Supply-side economists are of the opinion that certain fiscal measures will cause disincentives. For example, increase in profits tax may adversely affect the incentives of firms to invest and an increase in social security benefits may adversely affect incentives to work and save.

9. Deficit financing increases the purchasing power people. The production of goods and services, especially in under developed countries may not catch up simultaneously to meet the increased demand. This will result in prices spiraling beyond control.

10. Increase is government borrowing creates perpetual burden on even future generations as debts have to be repaid. If the economy lags behind in productive utilization of borrowed money, sufficient surpluses will not be generated for servicing debts. External debt burden has been a constant problem for India and many developing countries.

11. An increase in the size of government spending during recessions will ‘crowd out’ private spending in an economy and lead to reduction in an economy’s ability to self-correct from the recession, and possibly also reduce the economy’s prospects of long run economic growth.

12. If governments compete with the private sector to borrow money for spending, it is likely that interest rates will go up, and firms’ willingness to invest may be reduced. Individuals too may be reluctant to borrow and spend and the desired increase in aggregate demand may not be realized.

Note: Student may write any six.

![]()

(c) Explain the Monetary Policy Framework Agreement. (2 Marks)

Answer:

The Reserve Bank of India (RBI) Act, 1934 was amended in 2016, for giving a statutory backing to the Monetary Policy Framework Agreement. It is an agreement reached between the Government of India and the RBI on the maximum tolerable inflation rate that the RBI should target to achieve price stability.

The amended RBI Act (2016) provides for a statutory basis for the implementation of the ‘flexible inflation targeting framework’ by abandoning the ‘multiple indicator’ approach. The inflation target is to be set by the Government of India, in consultation with the Reserve Bank, once in every five years. Accordingly –

- The Central Government has notified 4 percent Consumer Price Index (CPI) inflation as the target for the period from August 5,2016 to March 31, 2021 with the upper tolerance limit of 6 percent and the lower tolerance limit of 2 percent.

- The RBI is mandated to publish a Monetary Policy Report every six months, explaining the sources of inflation and the forecasts of inflation for the coming period of six to eighteen months.

(d) Explain ‘depreciation’ and ‘appreciation’ of home currency under floating exchange rate. (2 Marks)

Answer:

Under a floating rate system, home currency depreciates when its value falls with respect to the value of another currency or a basket of other currencies i.e. there is an increase in the home currency price of the foreign currency. For example, if the Rupee dollar exchange rate in the month of January is $1 = ₹ 70 and ₹ 72 in June, then the Indian Rupee has depreciated in its value with respect to the US dollar and the value of US dollar has appreciated in terms of the Indian Rupee.

On the contrary, home currency appreciates when its value increases with respect to the value of another currency or a basket of other currencies i.e. there is a decrease in the home currency price of foreign currency. For example, if the Rupee dollar exchange rate in the month of January is $1 = ₹72 and ₹70 in June, then the Indian Rupee has appreciated in its value with respect to the US dollar and the value of US dollar has depreciated in terms of the Indian Rupee.

![]()

Question 10.

(a) What is meant by quasi public goods? (2 Marks)

Answer:

A quasi public good or near public good has many but not all the characteristics of a public good. These are goods which have an element of non-excludability and non rivalry.

Quasi public goods are:

(i) Not completely non rival. For example, public roads wi-fi networks and public parks do not get congested so as to reduce the space available for others when extra consumers use them only up to an optimal point. When more people use it beyond that, the amount others can benefit from these is reduced to some extent, because there will be increased congestion.

(ii) It is easy to keep people away from quasi public goods by charging a price or fee. For example, it is possible to exclude some users by building toll booths to charge for road usage on congested routes. Other examples are education, and health services. It is easy to keep people away from them by charging a price or fee.

However, it is undesirable to keep people away from such goods because the society would be better off if more people consume them. This particular characteristic namely, the combination of virtually infinite benefits and the ability to charge a price results in some quasi-public goods being sold through markets and others being provided by government.

![]()

(b) What is meant by expansionary fiscal policy? Under what circumstances does government pursue expansionary policy? (3 Marks)

Answer:

An expansionary fiscal policy is designed to stimulate the economy during the contractionary phase of a business cycle or when there is an anticipation of a business cycle contraction. This is accomplished by increasing aggregate expenditure and aggregate demand through an increase in all types of government spending and/or a decrease in taxes.

The objectives of expansionary fiscal policy are reduction in cyclical unemployment, increase in consumer demand and prevention of recession and possible depression. In other words, it aims to close a ‘recessionary gap’ or a contractionary gap wherein the aggregate demand is not sufficient to create conditions of full employment.

This is accomplished by increasing aggregate expenditure and aggregate demand through an increase in all types of government spending and/or a decrease in taxes. Government uses subsidies, transfer payments, welfare programmes, corporate and personal income tax cuts and increased spending on public works such as on infrastructure development to put more money into consumers’ hands to give them more purchasing power.

(c) Mention the general characteristics of Money. (2 Marks)

Answer:

There are some general characteristics that money should possess in order to make it serve its functions as money. Money should be:

- Generally acceptable

- Durable or long-lasting

- Effortlessly recognizable

- Difficult to counterfeit i.e. not easily reproducible by people

- Relatively scarce, but has elasticity of supply

- Portable or easily transported

- Possessing uniformity; and

- Divisible into smaller parts in usable quantities or fractions without losing value.

![]()

(d) Explain the classical theory of Comparative Advantage as given by David Ricardo. (3 Marks)

Answer:

The law of comparative advantage states that even if one nation is less efficient than (has an absolute disadvantage with respect to) the other nation in the production of both commodities, there is still scope for mutually beneficial trade.

The first nation should specialize in the production and export of the commodity in which its absolute disadvantage is smaller (this is the commodity of its comparative advantage) and import the commodity in which its absolute disadvantage is greater (this is the commodity of its comparative disadvantage). Labour differs in its productivity internationally and different goods have different labour requirements, so comparative labour productivity advantage was Ricardo’s predictor of trade.

The theory can be explained with a simple example Output per Hour of Labour

| Commodity | Country .4 | Country R |

| Wheat (bushels/hour) | 6 | 1 |

| Cloth (yards/hour) | 4 | 2 |

Country B has absolute disadvantage in the production of both wheat and cloth. However, since B’s labour is only half as productive in cloth but six times less productive in wheat compared to country A, country B has a comparative advantage in cloth. On the other hand, country A has an absolute advantage in both wheat and cloth with respect to the country B, but since its absolute advantage is greater in wheat (6:1) than in cloth (4:2), country A has a comparative advantage in wheat.

According to the law of comparative advantage, both nations can gain if country A specialises in the production of wheat and exports some of it in exchange for country B’s cloth. Simultaneously, country B should specialise in the production of cloth and export some of it in exchange for country A’s wheat.

If country A could exchange 6W for 6C with country B, then, country A would gain 2C (or save one-half bour of labour time) since the country A could only exchange 6W for 4C domestically. The 6W that the country B receives from the country A would require six hours of labour time to produce in country B. With trade, country B can instead use these six hours to produce 12C and give up only 6C for 6W from the country A. Thus, the country B would gain 6C or save three hours of labour time and country A would gain 2C. However, the gains of both countries are not equal.

![]()

Question 11.

(a) Explain the different mechanism of monetary policy which influences the price level and national income. (3 Marks)

Answer:

The process or channels through which the evolution of monetary aggregates affects the level of product and prices is known as ‘monetary transmission mechanism’. There are mainly four different mechanisms, namely, the interest rate channel, the exchange rate channel, the quantum channel, and the asset price channel.

The interest rate channel: A contractionary monetary policy-induced increase in interest rates increases the cost of capital and the real cost of borrowing for firms and households with the result that they cut back on their investment expenditures and durable goods consumption expenditures respectively.

A decline in aggregate demand results in a fall in aggregate output and employment. Conversely, an expansionary monetary policy induced decrease in interest rates will have the opposite effect through decreases in cost of capital for firms and cost of borrowing for households.

The exchange rate channel: The exchange rate channel works through expenditure switching between domestic and foreign goods. Appreciation of the domestic currency makes domestically produced goods more expensive compared to foreign-produced goods. This causes net exports to fall; correspondingly domestic output and employment also fall.

The quantum channel: (e.g., relating to money supply and credit) Two distinct credit channels: the bank lending channel and the balance sheet channel- also allow the effects of monetary policy actions to propagate through the real economy. Credit channel operates by altering access of firms and households to bank credit.

A direct effect of monetary policy on the firm’s balance sheet comes about when an increase in interest rates works to increase the payments that the firm must make to service its floating rate debts. An indirect effect sets in, when the same increase in interest rates works to reduce the capitalized value of the firm’s long-lived assets.

The asset price channel: Asset prices respond to monetary policy changes and consequently impact output, employment and inflation. A policy-induced increase in the short-term nominal interest rates makes debt instruments more attractive than equities in the eyes of investors leading to a fall in equity prices, erosion in household financial wealth, fall in consumption, output, and employment.

![]()

(b) How does international trade Increase economic efficiency? Explain. (3 Marks)

Answer:

International trade is a powerful stimulus to economic efficiency and contributes to economic growth and rising incomes.

(i) The wider market made possible owing to trade induces companies to reap the quantitative and qualitative benefits of extended division of labour. As a result, they would enlarge their manufacturing capabilities and benefit from economies of large scale production.

(ii) The gains from international trade are reinforced by the increased competition that domestic producers are confronted with on account of internationalization of production and marketing requiring businesses to invariably compete against global businesses. Competition from foreign goods compels manufacturers, especially in developing countries, to enhance competitiveness and profitability by adoption of cost reducing technology and business practices. Efficient deployment of productive resources to their best uses is a direct economic advantage of foreign trade. Greater efficiency in the use of natural, human, industrial and financial resources ensures productivity gains.

Since international trade also tends to decrease the likelihood of domestic monopolies, it is always beneficial to the community.

(iii) Trade provides access to new markets and new materials and enables sourcing of inputs and components internationally at competitive prices. Also, international trade enables consumers to have access to wider variety of goods and services that would not otherwise be available. It also enables nations to acquire foreign exchange reserves necessary for imports which are crucial for sustaining their economies.

![]()

(iv) International trade enhances the extent of market and augments the scope for Mechanization and specialisation.

(v) Exports stimulate economic growth by creating jobs, reducing poverty and augmenting factor incomes and in so doing raising standards of livelihood and overall demand for goods and services.

(vi) Employment generating investments, including foreign direct investment, inevitably follow trade.

(vii) Opening up of new markets results in broadening of productive base and facilitates export diversification.

(viii) Trade also contributes to human resource development, facilitates fundamental and applied research and exchange of know-how and best practices between trade partners

(ix) Trade strengthens bonds between nations by bringing citizens of different countries together in mutually beneficial exchanges and thus promotes harmony and cooperation among nations.

Note: Student may write any six.

(c) What is meant by ‘Mixed tariffs’? (2 Marks)

Answer:

Mixed tariffs are expressed either on the basis of the value of the imported goods (an ad valorem rate) or on the basis of a unit of measure of the imported goods (a specific duty) depending on which generates the most income (or least income at times) for the nation. For example, duty on cotton: 5 per cent ad valorem or ₹ 3,000 per tonne, whichever is higher.

![]()

(d) Distinguish between Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI). (2 Marks)

Answer:

Foreign direct investment takes place when the resident of one country (i.e. home country) acquires ownership of an asset in another country (i.e. the host country) and such movement of capital involves ownership, control as well as management of the asset in the host country. Foreign portfolio investment is the flow of what economists call ‘financial capital’ rather than ‘real capital’ and does not involve ownership or control on the part of the investor.

Foreign direct investment (FDI) VS Foreign portfolio investment (FPI)

| Foreign Direct Inwsttnenr (FDI) | Foreign Portfolio Investment (FPI) |

| Investment involves creation of physical assets | Investment is only in financial assets |

| Has a long term interest and therefore remain invested for long | Only short term interest and generally remain invested for short periods |

| Relatively difficult to withdraw | Relatively easy to withdraw |

| Not inclined to be speculative | Speculative in nature |

| Often accompanied by technology transfer | Not accompanied by technology transfer |

| Direct impact on employment of labour and wages | No direct impact on employment of labour and wages |

| Enduring interest in management and control | No abiding interest in management and control |

| Securities are held with significant degree of influence by the investor on the management of the enterprise | Securities are held purely as a financial investment and no significant degree of influence on the management of the enterprise |