AS 10: Property, Plant and Equipment – CA Inter Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

AS 10: Property, Plant and Equipment – CA Inter Accounts Study Material

Definitions And Recognition (Based On Para Nos. 6 To 10)

Question 1.

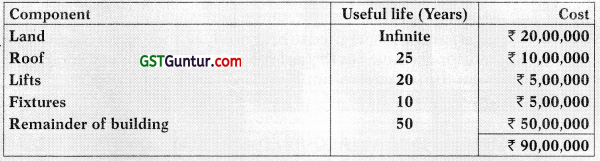

In the year 2016-17, an entity has acquired a new freehold building with a useful life of 50 years for ₹ 90,00,000. The entity desires to calculate the depreciation charge per annum using a straight-line method. It has identified the following components (with no residual value of lifts & fixtures at the end of their useful life) as follows:

Calculate depreciation for the year 2016-17 as per componentization method. (RTP)

Answer:

Computation of depreciation (Using Component approach)

![]()

Question 2.

Explain ‘Bearer Plant’ & ‘Biological Asset’ as per AS-10. (5 Marks) (May 2018)

Answer:

As per AS 10 Property, Plant and Equipment Bearer plant is a plant that—

(a) is used in the production or supply of agricultural produce;

(b) is expected to bear produce for more than a period of twelve months; and

(c) has a remote likelihood of being sold as agricultural produce, except for incidental scrap sales.

(d) The following are not bearer plants:

- plants cultivated to be harvested as agricultural produce (for example, trees grown for use as lumber);

- plants cultivated to produce agricultural produce when there is more than a remote likelihood that the entity will also harvest and sell the plant as agricultural produce, other than as incidental scrap sales (for example, trees that are cultivated both for their fruit and their lumber); and

- annual crops (for example, maize and wheat).

When bearer plants are no longer used to bear produce, they might be cut down and sold as scrap, for example, for use as firewood. Such incidental scrap sales would not prevent the plant from satisfying the definition of a bearer plant.

Biological Asset is a living animal or plant.

![]()

Measurement – Initial [Acquired And Self Constructed] (Based On Para Nos. 16 To 23)

Question 3.

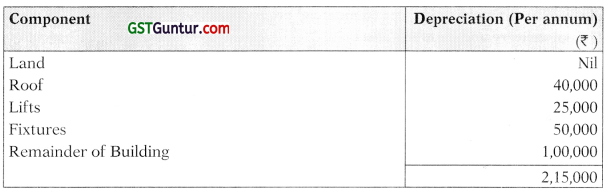

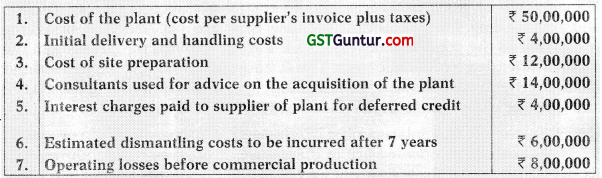

ABC Ltd. is installing a new plant at its production factory. It provides you the following information:

Please advise ABC Ltd. on the costs that can be capitalised for plant in accordance with AS 10: Property, Plant and Equipment. (5 Marks) (Nov. 2017)

Answer:

As per AS 10 on Property, Plant and Equipment, the costs which will be capitalized by ABC Ltd. are as follows:

Note: Operating losses before commercial production will not be capitalized as per AS 10. They should be written off to the Statement of Profit and Loss in the period they are incurred.

![]()

Question 4.

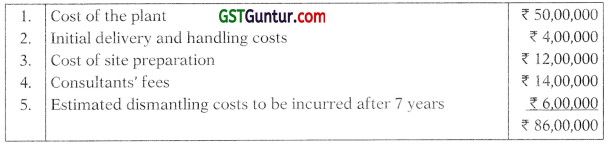

Y Ltd. is installing a new plant at its production facility. It has incurred these costs:

Please advise Y Ltd. on the costs that can be capitalised in accordance with AS 10 (Revised). (RTP)

Answer:

As per AS 10, the following costs can be capitalised:

Note : Interest charges paid on ‘Deferred credit terms’ are not regarded as directly attributable costs and thus cannot be capitalised. They should be written off to the Statement of Profit and Loss in the period they are incurred.

![]()

Question 5.

Neon Enterprise operates a major chain of restaurants located in different cities. The company has acquired a new restaurant located at Chandigarh. The new-restaurant requires significant renovation expenditure. Management expects that the renovations will last for 3 months during which the restaurant will be closed.

Management has prepared the following budget for this period—

Salaries of the staff engaged in preparation of restaurant before its ₹ 7,50,000 opening

Construction and remodelling cost of restaurant ₹ 30,00,000

Explain the treatment of these expenditures as per the provisions of AS 10 ‘Property, Plant and Equipment’. (5 Marks) (Nov. 2018)

Answer:

As per provisions of AS 10, any cost directly attributable to bring the assets to the location and conditions necessary for it to he capable of operating in the manner indicated by the management are called directly attributable costs and would be included in the costs of an item of PPE.

Analysis and conclusion:

Management of Neon Enterprise should capitalize the costs of construction and remodelling the restaurant, because they are necessary to bring the restaurant to the condition necessary for it to be capable of operating in the manner intended by management. The restaurant cannot be opened without incurring the construction and remodelling expenditure amounting ₹ 30,00,000 and thus the expenditure should be considered part of the asset.

However, the cost of salaries of staff engaged in preparation of restaurant ₹ 7,50,000 before its opening are in the nature of operating expenditure that would be incurred if the restaurant was open and these costs are not necessary to bring the restaurant to the conditions necessary for it to be capable of operating in the manner intended by management. Hence, ₹ 7,50,000 should be expensed.

![]()

Question 6.

G Ltd. has an existing freehold factory property, which it intends to knock down and redevelop. During the redevelopment period the company will move its production facilities to another (temporary) site.

The following incremental costs will be incurred:

Setup costs of ₹ 5,00,000 to install machinery in the new location.

Rent of ₹ 15,00,000

Removal costs of ₹ 3,00,000 to transport the machinery from the old location to the temporary location.

You are required to examine in line with AS 10 ‘Property, Plant and Equipment’ whether these costs can be capitalized into the cost of the new building.

Answer:

Constructing or acquiring a new asset may result in incremental costs that would have been avoided if the asset had not been constructed or acquired. These costs are not be included in the cost of the asset if they are not directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management.

Analysis and conclusion:

The costs to be incurred by the company are in the nature of costs of reducing or reorganizing the operations of the accompany. These costs do not meet that requirement of AS 10 ‘Property, Plant and Equipment’ and cannot, therefore, be capitalized.

![]()

Measurement – Initial (Deferred; Exchange Etc.) (Based On Para Nos. 25, 26 And 29 To 31)

Question 7.

Entity A exchanges surplus land with a book value of ₹ 10,00,000 for cash of ₹ 20,00,000 and plant and machinery valued at ₹ 25,00,000. What will be the measurement cost of the assets received?

Answer:

Since the transaction has commercial substance. The plant and machinery would be recorded at ₹ 25,00,000, which is equivalent to the fair value of the land of ₹ 45,00,000 less the cash received of ₹ 20,00,000.

Question 8.

Entity A exchanges car X with a book value of ₹ 13,00,000 and a fair value of ₹ 13,25,000 for cash of ₹ 15,000 and car Y which has a fair value of ₹ 13,10,000. The transaction lacks commercial substance as the company’s cash flows are not expected to change as a result of the exchange. It is in the same position as it was before the transaction. What will be the measurement cost of the assets received?

Answer:

The entity recognises the assets received at the book value of car X. Therefore, it recognises cash of ₹ 15,000 and car Y as PPE with a carrying value of ₹ 12,85,000.

Measurement – Subsequent (Based On Para Nos. 32 To 44)

Question 9.

Entity A is a large manufacturing group. It owns a number of industrial buildings, such as factories and warehouses and office buildings in several capital cities. The industrial buildings are located in industrial zones, whereas the office buildings are in central business districts of the cities. Entity A’s management want to apply the revaluation model as per AS 10 (Revised) to the subsequent measurement of the office buildings but continue to apply the historical cost model to the industrial buildings. State whether this is acceptable under AS 10 (Revised) or not with reasons?

Answer:

Entity A’s management can apply the revaluation model only to the office buildings. The office buildings can be clearly distinguished from the industrial buildings in terms of their function, their nature and their general location. AS 10 (Revised) permits assets to be revalued on a class by class basis.

The different characteristics of the buildings enable them to be classified as different PPE classes. The different measurement models can, therefore, be applied to these classes for subsequent measurement.

However, all properties within the class of office buildings must be carried at revalued amount.

![]()

Depreciation (Based On Para Nos. 45, 50, 53, 56, 57 And 62 To 65)

Question 10.

Entity A has a policy of not providing for depreciation on PPE capitalised in the year until the following year, but provides for a full year’s depreciation in the year of disposal of an asset is this acceptable?

Answer:

The depreciable amount of a tangible fixed asset should be allocated on a systematic basis over its useful life. The depreciation method should reflect the pattern in which the asset’s future economic benefits are expected to be consumed by the entity.

Analysis and conclusion:

Useful life means the period over which the asset is expected to be available for use by the entity. Depreciation should commence as soon as the asset is acquired and is available for use. Thus, the policy of Entity A is not acceptable.

Question 11.

Entity A purchased an asset on 1st January 2013 for ₹ 1,00,000 and the asset had an estimated useful life of 10 years and a residual value of nil.

On 1st January 2017, the directors review the estimated life and decide that the asset will probably be useful for a further 4 years.

Calculate the amount of depreciation for each year, if company charges depreciation on Straight Line basis.

Answer:

The entity has charged depreciation using the straight-line method at ₹ 10,000 per annum i.e. (1,00,000/10 years).

On 1st January 2017, the asset’s net book value is [1,00,000 – (10,000 × 4)] ₹ 60,000. The remaining useful life is 4 years.

The company should amend the annual provision for depreciation to charge the unamortised cost over the revised remaining life of four years. Consequently, it should charge depreciation for the next 4 years at ₹ 15,000 per annum i.e. (60,000/4 years).

![]()

Question 12.

A property costing ₹ 10,00,000 is bought in 2016. Its estimated total physical life is 50 years. However, the company considers it likely that it will sell the property after 20 years.

The estimated residual value in 20 years’ time, based on 2016 prices, is:

Case (a) ₹ 10,00,000

Case (b) ₹ 9,00,000

You are required to compute the amount of depreciation charged for the year 2016. (RTP)

Answer:

Case (a)

The company considers that the residual value, based on prices prevailing at the balance sheet date, will equal the cost.

There is, therefore, no depreciable amount and depreciation is zero.

Case (b)

The company considers that the residual value, based on prices prevailing at the balance sheet date, will be ₹ 9,00,000 and the depreciable amount is, therefore, ₹ 1,00,000.

Annual depreciation (on a straight-line basis) will be ₹ 5,000 [{10,00,000 – 9,00,000} ÷ 20].

![]()

Question 13.

Entity A, a supermarket chain, is renovating one of its major stores. The store will have more available space for in store promotion outlets after the renovation and will include a restaurant. Management is preparing the budgets for the year after the store reopens, which include the cost of remodelling and the expectation of a 15% increase in sales resulting from the store renovations, which will attract new customers.

Decide whether the remodelling cost will be capitalized or not. (RTP)

Answer:

The expenditure in remodelling the store will create future economic benefits (in the form of 15°6 of increase in sales). Moreover, the cost of remodelling can be measured reliably, therefore, it should be capitalized in line with AS 10 PPE.

Question 14.

M Ltd. purchased an asset on 1st January 2013 for ₹ 5,00,000 and the asset had an estimated useful life of 5 years and a residual value of nil. On 1st January 2017, the directors review the estimated life and decide that the asset will probably be useful for a further 4 years.

You are required to compute the amount of depreciation for each year, if company charges depreciation on Straight Line basis.

Answer:

The entity has charged depreciation using the straight-line method at ₹ 1,00,000 per annum i.e. (5,00,000/5 years). On 1st January 2017, the asset’s net book value is [5,00,000 – (1,00,000 × 4)] ₹ 1,00,000. The remaining useful life is 4 years.

The company should amend the annual provision for depreciation to charge the unamortized cost over the revised remaining life of four years. Consequently, it should charge depreciation for the next 4 years at ₹ 25,000 per annum i.e. (1,00,000/4 years).

![]()

Retirement And Derecognition (Based On Para Nos. 73, 74 And 79)

Question 15.

Entity A carried plant and machinery in its books at ? 2,00,000. These were destroyed in a fire. The assets were insured ‘New for old’ and were replaced by the insurance company with new machines that cost ₹ 20,00,000. The machines were acquired by the insurance company and the company did not receive the ₹ 20,00,000 as cash compensation. State, how Entity A should account for the same?

Answer:

Entity A should account for a loss in the Statement of Profit and Loss on de-recognition of the carrying value of plant and machinery in accordance with AS 10.

Entity A should separately recognise a receivable and a gain in the income statement resulting from the insurance proceeds under AS 29 once receipt is virtually certain. The receivable should be measured at the fair value of assets that will be provided by the insurer.