Redemption of Preference Shares – CA Inter Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Redemption of Preference Shares – CA Inter Accounts Study Material

Theory Questions

Question 1.

Explain the conditions when a company should issue new equity shares for redemption of the preference shares. Also discuss the advantages and disadvantages of redemption of preference shares by issue of equity shares. (4 Marks) (November 2018)

Answer:

A company may prefer issue of new equity shares in the following situations:

(a) When the company realizes that the capital is needed permanently and it makes more sense to issue Equity Shares in place of Redeemable Preference Shares which carry a fixed rate of dividend.

(b) When the balance of profit, which would otherwise be available for dividend, is insufficient.

(c) When the liquidity position of the company is not good enough.

Advantages of redemption of preference shares by issue of fresh equity shares

- No cash outflow of money is required – now or later.

- New equity shares may be valued at a premium.

- Shareholders retain their equity interest.

Disadvantages of redemption of preference shares by issue of fresh equity shares

- There will be dilution of future earnings;

- Shareholding in the company is changed.

Computation Of No. Of Shares To Be Issued For Redemption Of Preference Shares

Question 2.

The Board of Directors of a Company decide to issue minimum number of equity shares of ₹ 9 to redeem ₹ 5,00,000 preference shares. The maximum amount of divisible profits available for redemption is ₹ 3,00,000.

Calculate the number of shares to be issued by the company to ensure that provisions of Section 55 are not violated. Also determine the number of shares if the company decides to issue shares in multiples of ₹ 50 only.

Answer:

Nominal value of preference shares ₹ 5,00,000

Maximum possible redemption out of profits ₹ 3,00,000

Minimum proceeds of fresh issue ₹ 5,00,000 – 3,00,000 = ₹ 2,00,000

Proceed of one share = ₹ 9

Minimum number of shares = \(\frac{2,00,000}{9}\) = 22,222.22 shares

As fractional shares cannot be issued, the minimum number of shares to be issued is rounded off to higher side i.e. 22,223 shares.

Note:

If shares are to be issued in multiples of 50, then the next higher figure which is a multiple of 50 is 22,250.

![]()

Basic Questions

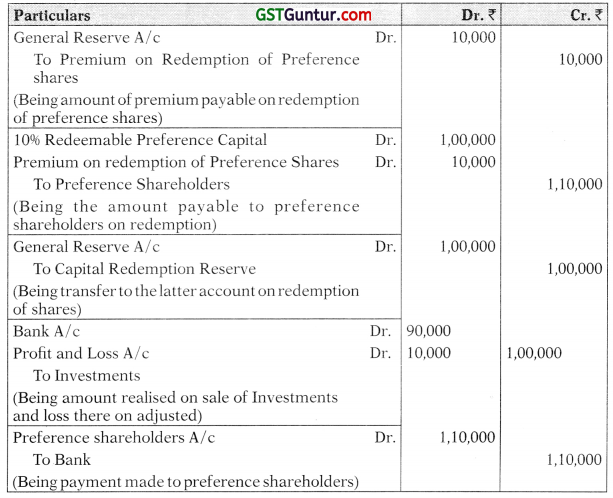

Question 3.

Dheeraj Limited had 5,000, 10% Redeemable Preference Shares of ₹ 100 each, fully paid up. The company had to redeem these shares at a premium of 10%.

It was decided by the company to issue the following:

- 40,000 Equity Shares of ₹ 10 each at par

- 2,000 12% Debentures of ₹ 700 each.

The issue was fully subscribed and all amounts were received in full. The payment was duly made. The company had sufficient profits. Show journal entries in the books of the company. (10 Marks) (May 2018)

Answer:

Journal Entries

Working Note:

Amount to be transferred to Capital Redemption Reserve Account

Question 4.

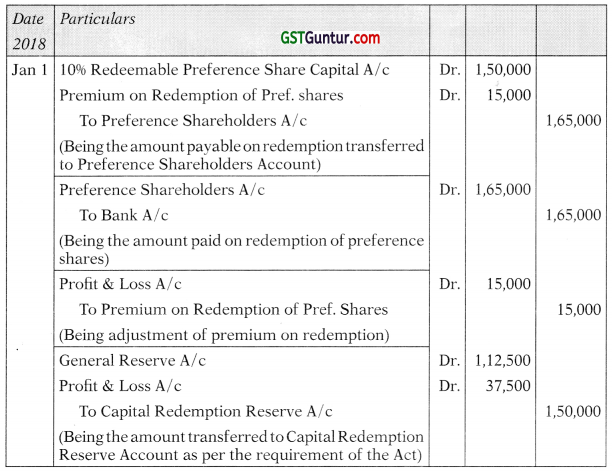

The following are the extracts from the Balance Sheet of Meera Ltd. as on 31st December, 2017.

Share capital: 60,000 Equity shares of ₹ 10 each fully paid – ₹ 6,00,000; 1,500 10% Redeemable preference shares of ₹ 100 each fully paid – ₹ 1,50,000. Reserve & Surplus: Capital reserve – ₹ 75,000; Securities premium – ₹ 75,000; General reserve – ₹ 1,12,500; Profit and Loss Account – ₹ 62,500

On 1 st January, 2018, the Board of Directors decided to redeem the preference shares at premium of 10% by utilisation of reserve.

You are required to prepare necessary Journal Entries including cash transactions in the books of the company. (RTF)

Answer:

Journal Entries

![]()

Question 5.

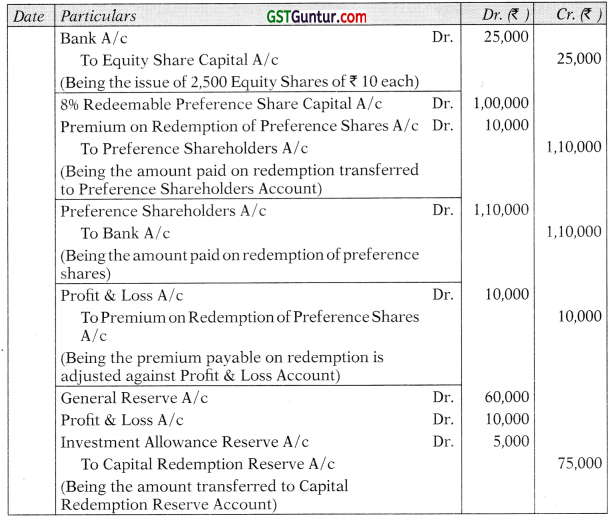

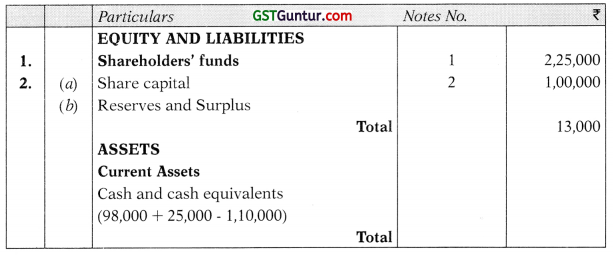

The capital structure of A Ltd. consists of 20,000 Equity Shares of ₹ 10 each fully paid up and 1,000 8% Redeemable Preference Shares of ₹ 100 each fully paid up (issued on 1.4.20X1).

Undistributed reserve and surplus stood as: General Reserve ₹ 80,000; Profit and Loss Account ₹ 20,000; Investment Allowance Reserve out of which ₹ 5,000, (not free for distribution as dividend) ₹ 10,000; Cash at bank amounted to ₹ 98,000. Preference shares are to be redeemed at a Premium of 10% and for the purpose of redemption, the directors are empowered to make fresh issue of Equity Shares at par after utilising the undistributed reserve and surplus, subject to the conditions that a sum of ₹ 20,000 shall be retained in general reserve and which should not be utilised.

Pass Journal Entries to give effect to the above arrangements and also show how the relevant items will appear in the Balance Sheet of the company after the redemption carried out. (RTP)

Answer:

Journal Entries

Balance Sheet [Extract]

Notes to accounts

1. Share Capital

22,500 Equity shares (20,000 + 2,500) of ₹ 10 each fully paid up 2,25,000

2. Reserves and Surplus

Working Note:

Therefore, No. of shares to be issued = 25,000/₹ 10 = 2,500 shares.

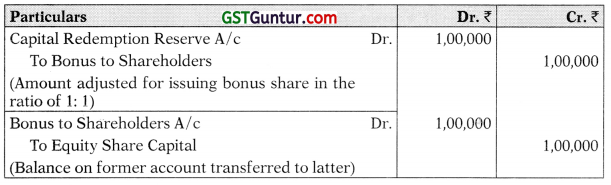

Question 6.

G India Ltd. had 9,000 10% redeemable Preference Shares of ₹ 10 each, fully paid up. The company decided to redeem these preference shares at par by the issue of sufficient number of equity shares of ₹ 9 each fully paid up.

You are required to prepare necessary Journal Entries including cash transactions in the books of the company.

Answer:

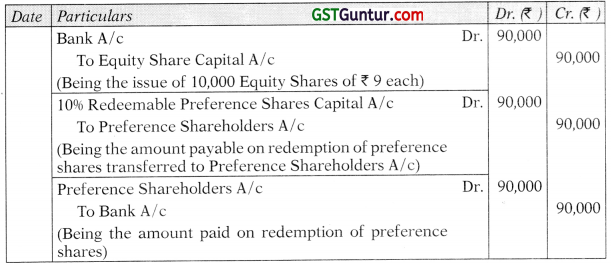

Journal Entries

![]()

Question 7.

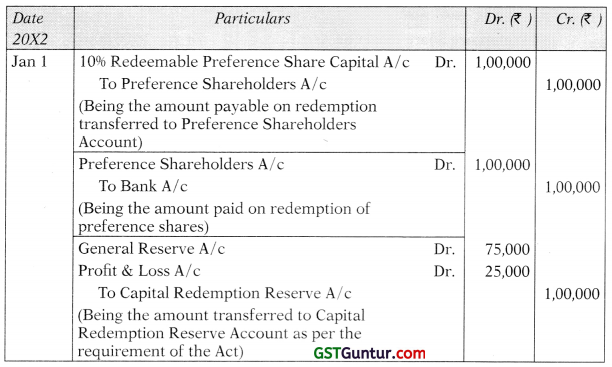

The following are the extracts from the Balance Sheet of ABC Ltd. as on 31st December, 20X1.

Share capital: 40,000 Equity shares of ₹ 10 each fully paid – ₹ 4,00,000; 1,000 10% Redeemable preference shares of ₹ 100 each fully paid – ₹ 1,00,000.

Reserve & Surplus: Capital reserve – ₹ 50,000; Securities premium – ₹ 50,000; General reserve – ₹ 75,000; Profit and Loss Account – ₹ 35,000

On 1st January, 20X2, the Board of Directors decided to redeem the preference shares at par by utilisation of reserve.

You are required to pass necessary Journal Entries including cash transactions in the books of the company.

Answer:

Journal Entries

Advanced Questions

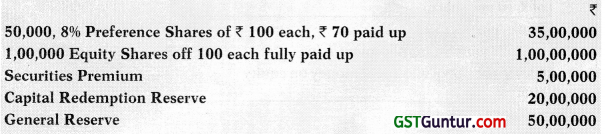

Question 8.

The Balance Sheet of XYZ as at 31st December, 20X1 Inter alia Includes the following:

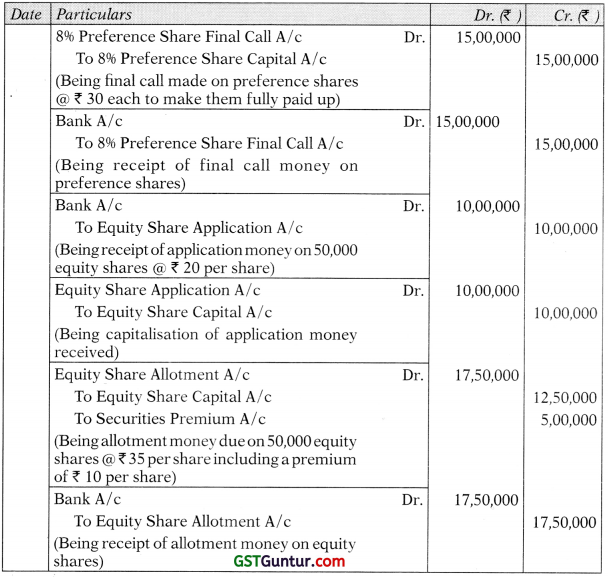

Under the terms of their issue, the preference shares are redeemable on 31st March, 20X2 at 5% premium. In order to finance the redemption, the company makes a rights issue of 50,000 equity shares of X 100 each at X 110 per share, X 20 being payable on application, X 35 (including premium) on allotment and the balance on 1st January, 20X3. The issue was fully subscribed and allotment made on 1st March, 20X2. The money due on allotment were received by 31st March, 20X2. The preference shares were redeemed after fulfilling the necessary conditions of section 55 of the Companies Act, 2013.

You are asked to pass the necessary Journal Entries and show the relevant extracts from the balance sheet as on 31 st March, 20X2 with the corresponding figures as on 31st December, 20X1.

Answer:

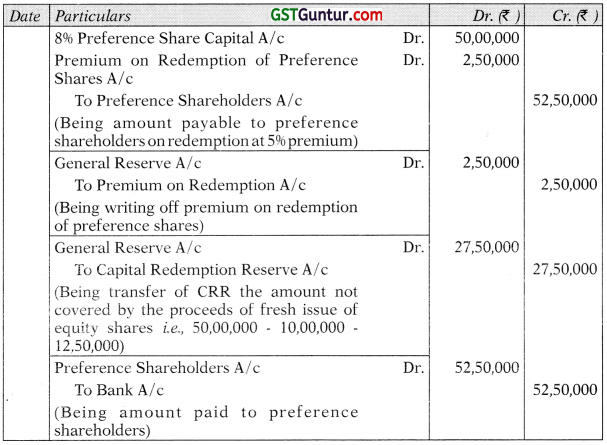

Journal Entries

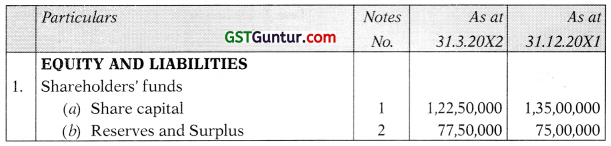

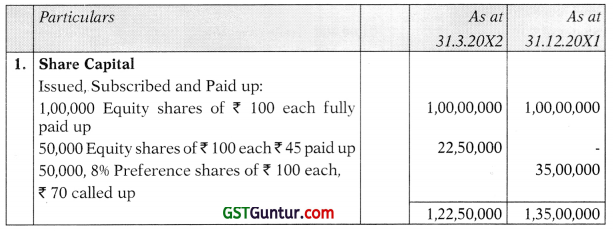

Balance Sheet (Extract)

Notes to accounts

Note:

It is important to keep in mind that only the amount received (excluding premium) on fresh issue of shares till the date of redemption should be considered for calculation of proceeds of fresh issue of shares.

Accordingly, we have considered proceeds of fresh issue of shares as ₹ 22,50,000 (₹ 10,00,000 application money plus ₹ 12,50,000 received on allotment towards share capital).

![]()

Mix Questions

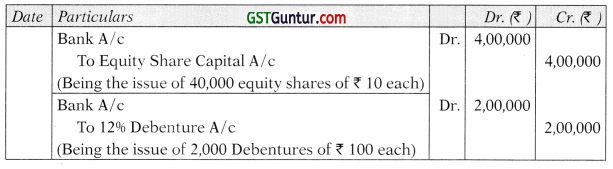

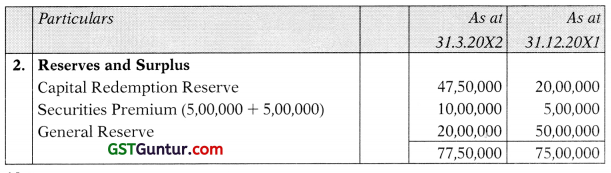

Question 9.

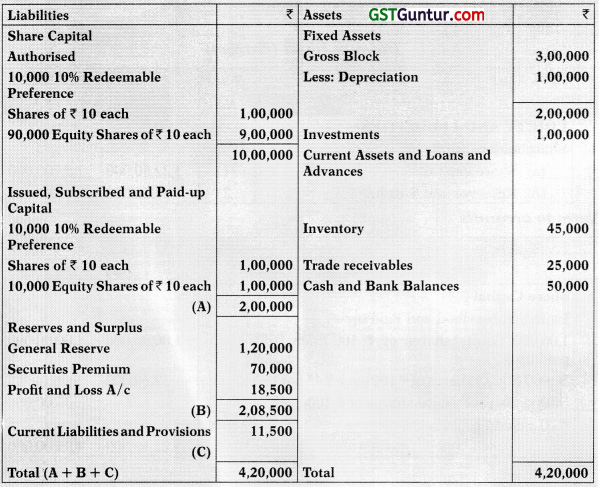

The following is the summarized Balance Sheet of Y Ltd. as at 31.3.20X1:

For the year ended 31.3.20X2, the company made a net profit of ₹ 35,000 after providing ₹ 20,000 depreciation.

The following additional information is available with regard to company’s operation:

- The preference dividend for the year ended 31.3.20X2 was paid.

- Except cash and bank balances other current assets and current liabilities as on 31.3.20X2, was the same as on 31.3.20X1.

- The company redeemed the preference shares at a premium of 10%.

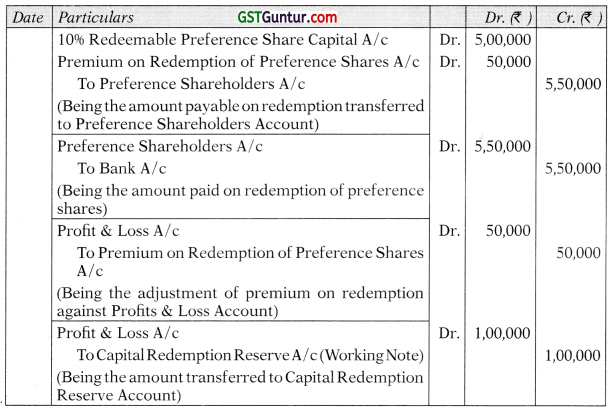

- The company issued bonus shares in the ratio of one share for every equity share held as on 31.3.20X2.

- To meet the cash requirements of redemption, the company sold investments.

- Investments were sold at 90% of cost on 31.3.20X2.

You are required to prepare necessary journal entries to record redemption and issue of bonus shares.

Answer:

Journal Entries