Acceptance of Deposits By Companies – CA Inter Law Notes is designed strictly as per the latest syllabus and exam pattern.

Acceptance of Deposits By Companies – CA Inter Law Notes

What is Deposit?

Definition – Deposit – Section 2(31)

‘Deposit’ includes any receipt of money by way of deposit or loan or in any other form but does not include such categories of amount as may be prescribed in consultation with the Reserve Bank of India.

What is not De-posit?

As per Rule 2 of Companies (Acceptance of Deposits) Rules, 2014, ‘deposit’ does not include any amount received:

- from the Central Government or a State Government or any amount received from any other source, and whose repayment is guaranteed by the Central Government

- as a loan from any banking company or notified public financial institutions

- from foreign government, foreign bank or multilateral agency

- by a company from any other company

- from an employee of the company by way of security deposit (If it is as per contract of employment and non-interest bearing and not exceeding his annual salary)

- by way of security or as an advance from any purchasing agent, selling agent or as an advance

- by way of subscriptions money to any securities pending its allotment and any amount received by way of calls in advance on shares (Shares must be allotted within 60 days from receipt of application money, otherwise it is treated as deposit)

- from director of company

- from relative of director of the private company

- by the issue of bonds or debentures secured by the first charge or a charge ranking pari passu with the first charge on any assets referred to in Schedule III of the Act excluding intangible assets of the company or bonds or debentures compulsorily convertible into shares of the company within 10 years

- as non-interest bearing amount received and held in trust

- by non-convertible unsecured debentures, if listed on stock exchange

- brought in by the promoters by way of unsecured loans in pursuance of stipulations of financial institutions

- by Nidhi Company

- from Alternate Investment Funds, Domestic Venture Capital Funds, Infrastructure Investment Trusts and Mutual Funds registered with the SEBI as per its regulation

- by chit fund as subscription under Chit Funds Act

- under collective investment scheme as per SEBI regulations

- as an advance which is allowed by sectorial regulator or as per directions of Central Government or State Government

- as an advance for subscription towards publication

- as part of warranty or maintenance scheme (Period of service does not exceed 5 years or normally accepted period in industry, whichever is less)

- upto ₹ 25 lacs by a Start-up company by way of convertible note (Start Up Company means private company which is recognised under industrial policy)

Important Note:

- If the securities for which the application money was received, are not allotted within 60 days of receipt of application money, then, such application money shall be refunded within next 15 days, otherwise such amount shall be treated as deposit.

- Borrowings which were deposits as per 1956 Act but are not deposits under the 2013 Act.

![]()

Quantum of Deposit:

| Type of Company | Member | Public |

| Eligible Company | Eligible Company can accept deposits upto 10% of aggregate paid up capital, free reserve and securities premium account from member. | Eligible Company can accept deposits upto 25% of aggregate paid up capital, free reserve and securities premium account from public. |

| Company other than Eligible Company | Company other than Eligible Company can accept deposits upto 25% of aggregate paid up capital, free reserve and securities premium account from member | Company other than Eiigibie Company cannot accept deposits from public. |

| Government Company | Government Company can accept deposits upto 35% of the aggregate paid up capital, free reserve and securities premium account from public. |

Terms And Conditions For Acceptance Of Deposits From Members – Section 73

Which Company?

Following companies can accept deposits from its members:

- Private company

- Public company other than eligible company

Conditions for Acceptance of Deposits from Members as per Act-Section 73(2)

Resolution at GM

- A company may accept deposits from members by passing resolution at General Meeting :

- On such terms and coiiditions as may be agreed between company and the members: and

- Subject to rules, as may be prescribed by Central Government

Issue of Circular to Members

- The company shall issue a circular to the members inviting deposits from them.

- Circular is filed with ROC bef ore30 days from date of issue to members.

- Provisions regarding circular are explained later.

Deposit Repayment Reserve Account

- The company shall deposit in a Schedule Bank in a separate bank account a sum equal to 15% of the amount of deposits maturing during the financial year and next financial year.

- Such account is called as ‘Deposit repayment reserve account’.

- Amount deposited in Deposit repayment reserve account shall not be utilised for any other purpose except for repayment of deposits.

Deposit Insurance

- The company shall obtain deposit insurance in manner prescribed.

- Contract for insurance shall be entered at least 30 days before date of circular or advertisement.

- The insurance shall be for principal or interest.

- The insurance contract must indicate aggregate monetary ceiling.

- However, in any case, deposit and interest upto ₹ 20,000 must be paid to all depositors by insurance company, if company makes a default.

- The insurance premium is paid by company itself.

- If company fails to comply with conditions of insurance contract of fails to renew’ the insurance contract, company must pay amount of deposit within 15 days. If not re-paid, interest @ 15°6 is payable.

Certificate of no default

The company shall certify that it has not defaulted in repayment of any deposits or interest thereon.

Security on deposits

- The company may provide security for repayment of deposits and interest payable thereon. For this purpose, company can create charge on its assets.

- Security is created in favour of trustees.

- Trustees should ensure about security of deposits.

- In case of unsecured deposit, every circular, advertisement or document through which deposits are accepted shall state ‘unsecured deposits’.

Repayment of deposits

- Company should repay deposits and interest thereon as per terms and conditions of deposits.

Conditions for Acceptance of Deposits from Members as per Rule – Rule 3 of Companies (Acceptance of Deposits) Rules, 2014 Maximum amount of deposits & Tenure - Company can accept deposits for period not less than 6 months and not more than 36 months.

- The amount of outstanding deposits together with the amount of deposits proposed to be accepted shall not exceed 25% of paid up capital, free reserves and securities premium account.

- However, company can accept deposits for period less than 6 months upto 10% of its paid up capital, free reserve and securities premium account but in any case it should not be less than 3 months.

- Company cannot accept deposits repayable on demand.

No right of alteration of terms

The company has no right to alter terms and conditions of deposits, deposit trust deed and deposit insurance contract which is disadvantageous to depositor after circular is issued and deposits are accepted.

Important Note:

- Private company and Specified IFSC public company can accept unsecured deposits from its members upto 100% of its paid up capital and free reserves, without complying requirements relating to:

- Issue of circular to the members

- Filing of circular

- Deposit insurance

- Providing security

- The details should be informed to Registrar in prescribed manner.

![]()

Acceptance Of Deposits From Public By Eligible Company – Sections 73 & 76

Restriction on Acceptance of Deposits from Public

- Company shall not accept or renew deposits from public except in accordance with the provisions of Chapter V. – Section 73(1)

- Such restriction is not applicable to:

- Banking company

- Non-Banking Financial Company

- Such other company as may be specified by Central Government.

Eligible Company

Eligible Company means public company which has a net worth of not less than ₹ 100 Crore or a turnover of not less than ₹ 500 Crore

Conditions for Acceptance of Deposits from Public

Comply with Section 73(2)

For accepting deposits from public, company shall comply with provisions of section 73(2). (Refer paragraph no.

Rating of deposit

- The company shall obtain rating with respect to its deposits.

- Rating shall be obtained from recognised rating agency.

- The rating shall be obtained every year during the tenure of deposits.

- The rating shall be sent to the ROC along with the return of deposits.

Conditions for Acceptance of Deposits from Members as per Rule – Rule 3 of Companies (Acceptance of Deposits) Rules, 2014

Maximum amount of deposits & Tenure

- Company can accept deposits for period not less than 6 months and not more than 36 months.

- Eligible Non -government Company shall not accept deposits in excess of:

- 25% of paid up capital, free reserve and securities premium account from public.

- 10% of paid up capital, free reserve and securities premium account from members.

- Government Company cannot accept deposits in excess of 35% of its paid up capital, free reserve and securities premium account.

To Register Charge

- In case of secured deposits from public, charge should be:

- created within 30 days in favour of depositors

- created on assets of company

- The value of charge shall not be less than the amount of deposits accepted.

Common Provisions Applicable For Acceptance of Deposits From Members And Deposits From Public

Following provisions are commonly applicable to deposits accepted from members and deposits accepted from public:

Circular or Circular in form of Advertisement

Registration of Circular

- Board shall prepare circular. It should be signed by majority of directors and filed with Registrar 30 days before such issue.

- Circular should be issued on the authority and in the name of the Board of directors of the company.

- It must also contain the date on which the text was approved by the Board of directors.

Issue to Members

- Circular shall be issued to its members by:

- Registered post with acknowledgement due; or

- Speed post; or

- Electronic means

- Circular shall be prepared in Form DPT- 1.

Advertisement of Circular

- A company inviting deposits from public advertisement in Form DPT-1 in English language and regional language newspaper.

- The advertisement shall be uploaded on website of company.

Validity of Circular

Circular shall remain valid for a period of 6 months from the closure of the financial year in which it is issued or until the date on which Annual General Meeting is held, whichever is earlier.

Return of Deposits

- Return of deposits shall be filed with Registrar on or before 30th June of every year stating position as on 31st March of that year.

- Return of deposits shall be certified by auditor of company.

- Return of deposits is filed in Form DPT-3.

- Company should obtain credit rating once in year and copy of rating shall be sent to Registrar with Return of Deposits.

Interest and Brokerage

- Interest and brokerage that can be paid shall not exceed interest or brokerage prescribed by RBI for acceptance of deposits by NBFC.

- Only persons authorised by company and through whom deposits are actually procured shall be eligible to get brokerage. – Rule 3

Premature Payment of Deposit

- Company shall not repay deposit within 3 months of its acceptance. Company can make premature payment of deposits after 6 months.

- If a company makes repayment of deposits before the date of maturity, the rate of interest payable on such deposit shall be less by 1% from the rate agreed.

- Company has discretionary power to repay premature deposits. Company may refuse to repay premature deposit.

Nomination

- Depositor may make nomination at any time.

- Provisions of nomination as prescribed under section 72 are applicable for nomination of deposit.

Deposit Receipt

Time limit

- Deposit receipt shall be furnished within period of 21 days from date of receipt of money or realisation of cheques.

- Deposit receipt shall be furnished by company on acceptance or renewal of deposit.

Sign

Deposit receipt shall be signed by an officer of the company duly authorized by the Board.

Registers of Deposits

- Every company accepting deposit shall maintain at its registered office, Register of deposit containing following particulars:

- Name, address and PAN of depositor

- Particulars of nominee

- Particulars of deposit receipt

- Date and amount of deposit

- Rate of interest and date on which interest will be paid

- Duration of deposit

- Details of deposit insurance

- Particulars of security or charge created

- Details shall be entered into 7 days.

- Entry shall be authorised by director or secretary or any other authorised person by Board.

- Register should be maintained for 8 years from date of last entry.

![]()

Disclosure in Financial Statements

- Every public company shall disclose in its financial statements, money received from directors and their relatives.

- A private company shall separately disclose in financial statements by way of notes, about money received from directors and their relatives – Rule 16A.

Failure to Repay the Deposit or Interest – Section 73(4)

Application to Tribunal

- Depositor may make an application to Tribunal, if company fails to repay deposit or interest as per terms and conditions of such deposit.

- Application shall be made in Form NCLT 11

Order of Tribunal

- The Tribunal may order the company to pay to the depositor:

- Any sum due to him; and

- Any loss or damage incurred by him.

- The Tribunal may make such other orders as it may deem fit.

Penal Interest – Rule 17

Every company shall pay penal interest at rate of 18% for overdue period in deposit.

Deposit Trustee – Rules 7-9 of Companies (Acceptance Of Deposits) Rules, 2014

Appointment of Trustee

- Written consent of trustee should be obtained before appointment.

- Company should execute trust deed 7 days before issue of circular in Form DPT-2.

- Statement that consent of deposit trustee is obtained shall be inserted in circular.

Who can be Appointed as Trustee?

Following person cannot be appointed as trustee:

- Director, KMP, employee of company, its holding company, its subsidiary company or its associate company

- Who is indebted to company?

- Who is depositor?

- Who has pecuniary relationship with company?

- Who has provided guarantee?

No Removal of Trustee

Deposit trustee cannot be removed after issue of advertisement and before expiry of his term without:

- Consent of all directors present at Board meeting

- Present of at least one Independent Director, if company require to appoint Independent Director.

Duties of Trustee

It shall be duty of every Deposit trustee to:

- Ensure that assets on which charge is created together with amount of deposit insurance are sufficient to cover principal amount and interest thereon

- Circular inviting deposits does not contain any information which is inconsistent with trust deed or provisions of Act

- Ensure that the company does not commit any breach of covenants and provisions of the trust deed

- Take steps to call a meeting of the deposit holders as and when required

- Supervise the implementation of the conditions regarding creation of security for deposits and the terms of deposit insurance

- Do such acts as are necessary in the event the security becomes enforceable

- Protect the interest of depositors and to resolve their grievances.

Meeting of Depositor through Trustee

The meeting of depositors shall be called by the deposit trustee on:

- requisition in writing signed by at least l/10th of the depositors in value for the time being outstanding; or

- the happening of any event, which constitutes a default or which in the opinion of the deposit trustee affects the interest of the depositors.

![]()

Practice Questions

Question 1.

A real estate company took advance money from its customer in the course of business on which no interest is supposed to be paid to the customers. At the end of financial year, company is in dilemma whether to treat this advance as ‘advance’ or ‘deposit’. Advise the company on how to treat this amount without interest.

Answer:

As per the Rule 2 of the Companies (Acceptance of Deposits) Rules, 2014, any amount received in the course of business as advance is exempted from the definition of the deposits if it is adjusted within 365 days from receipt.

Question 2.

The Board of Directors of Growmore Ltd. decides to invite deposits from public. You being the Company Secretary of the company have been asked to prepare and place before the Board, a detailed note on the conditions for inviting public deposits so that the legal requirements are duly complied with. Prepare a note advising the company.

Answer:

Question 3.

Discuss and decide with reference to the provisions of the Companies Act, 2013 and the rules made thereunder, whether the following shall be considered as ‘deposits’ accepted by a private company :

(i) A company has taken ₹ 50 lakh from a director of the company by way of loan.

(ii) A company has accepted ₹ 50 lakh by means of inter-corporate deposits.

(in) A company has taken ₹ 50 lakh as an advance from its customers towards the contracts for supply of certain products produced by the company.

(z’v) A company has taken ₹ 50 lakh from its promoters.

Answer:

(i) No (ii) No (iii) No (iv) No if it is by way of unsecured loan in accordance with stipulations of Financial Institution.

Question 4.

A depositor had deposited some money in a cumulative scheme of an eligible non-banking non-hnancial company, registered under the provision of Companies Act, 2013, but he did not receive the fixed deposit receipt until 42 days of the date of deposit. However, he got it on 47th day. State with reasons whether an infringement of law is involved in this case?

Answer:

Deposit receipt shall be furnished within period of 21 days from date of receipt of money or realisation of cheques. In this case, the receipt has been furnished within 47 days from the date of receipt of deposit. Company has violated provision.

Question 5.

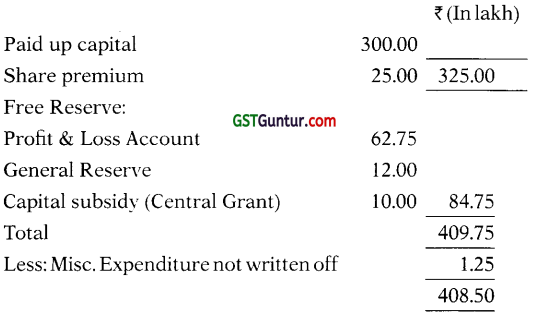

As per the audited balance sheet of Dowell Ltd. as at 31st March, 2014, the details of share capital, reserves and surplus are as under:

| ₹ In Lakhs | |

| Equity share capital Reserves and surplus |

300.00 |

| Profit and loss account | 62.75 |

| General reserves | 12.00 |

| Share premium | 25.00 |

| Capital subsidy (Central grant) | 10.00 |

| Revaluation reserve | 30.00 |

Miscellaneous expenditure to the extent not written off as at 31st March, 2014 is ₹ 1.25 lakh.

Break-up of unsecured loans as at 31st March, 2014 is given below:

| ₹ In Lakhs | |

| Deposits from public | 13.00 |

| Deposits from shareholder | 3.62 |

| Inter- corporate deposits | 15.00 |

| Deferred sales tax liability | 28.63 |

Compute the limits upto which Dowell Ltd. Can accept further deposits from the public and shareholders (Answer to the nearest Rupees in the thousands)

Answer:

Shareholders fund as on 31st March, 2014:

Revaluation reserve is not free reserve. Dowell Ltd. can accept deposits upto:

| From shareholders (₹ In Lakh) | From Public (₹ In Lakh) | |

| 10% of ₹ 408.50 | 40.85 | …. |

| 25% of ₹ 408.50 | 102.12 | |

| Deposit already accepted as at March 2004 | 3.62 | 13.00 |

| Maximum further deposits that can be accepted | 37.23 | 89.12 |

Question 6.

Certain companies are exempted from the provisions of deposits under Companies Act. Comment

Answer:

Statement is correct. Following companies are exempted:

- Banking company

- Non-banking finance company as defined in RBI Act

- Such classes of financial companies as Central Government specify.

Question 7.

Shine Well Ltd. has accepted deposits from the public under the Companies (Acceptance of Deposits) Rules, 2014. The company has now decided to repay some of its deposits before maturity. Can the company do so? If yes, what are the conditions attached thereto?

Answer:

Yes. Company may repay deposits before maturity.

Question 8.

Whether advance taken from customers by real estate company on which no interest has been paid will be treated as advance or deposit as per the Companies Act, 2013?

Answer:

As per the Rule 2 of the Companies (Acceptance of Deposits) Rules, 2014, any amount received in the course of business or against proposed sale of property as advance is exempted from the definition of the Deposits. But if such advance is not adjusted against the property in accordance with the terms of agreement or arrangement then it will be treated as deposit. Further, whether interest is charged or not is immaterial. Thus, advance taken from customers by real estate company shall not be considered as deposits. But if it is not adjusted against the property in accordance with the terms of agreement or arrangement, then it will be treated as deposit.

![]()

Past Examination Question

Question 1.

Atul Ltd. has passed a resolution in its General Meeting regarding accepting deposits from its members. Can this company accept deposits from its members under the Companies Act, 2013? If yes, state the conditions to be fulfilled regarding this. (CA May 2016)

Answer: