Dynamics of Competitive Strategy – CA Inter SM Notes is designed strictly as per the latest syllabus and exam pattern.

Dynamics of Competitive Strategy – CA Inter SM Study Material

Question 1.

Explain Competitive Landscape.

Answer:

- Competitive landscape is a business analysis which identifies competitors, either direct or indirect.

- Competitive landscape is about identifying and understanding the competitors and at the same time, it permits the comprehension of their vision, mission, core value, niche market, strengths and weaknesses.

- Understanding of competitive landscape requires an application of “competitive intelligence”.

- An in-depth investigation and analysis of a firm’s competition allows it to:

- assess the competitor’s strengths and weaknesses in the market-place and

- helps it to choose and implement effective strategies that will improve its competitive advantage.

Question 2.

What do you understand by ‘Competitive Landscape’? What are steps to understand the competitive landscape? (May 2019)

OR

Suresh Singhania is the owner of an agri-based private company in San- grur, Punjab. His unit is producing puree, ketchups and sauces. While its products have significant market share in the northern part of country, the sales are on decline in last couple of years. He seeks help of a management expert who advises him to first understand the competitive landscape.

Explain the steps to be followed by Suresh Singhania to understand competitive landscape. (RTP May 2018)

Answer:

Steps to understand the competitive landscape:

i. IDENTIFY THE COMPETITOR:

The first step to understand the competitive landscape is to identify the competitors in the firm’s industry and have actual data about their respective market share.

This answer the question:

- Who are the competitors?

ii. UNDERSTAND THE COMPETITORS:

Once the competitors have been identified, the strategist can use

market research report, interest, newspaper, social media, industry reports, and various other sources to understand the product and services offered by them in different markets.

This answer the question:

- What are their product and services?

iii. DETERMINE THE STRENGTHS OF THE COMPETITORS:

W’hat are the strength of the competitors? What do they do well? Do they offer great products? Do they utilize marketing in a way that comparatively reaches out to more consumers. Why do customers give them their business?

This answers the questions:

- What are their financial positions?

- What gives them cost and price advantage?

- What are they likely to do next?

- How strong is their distribution network?

- What are their human resources strength?

iv. DETERMINE THE WEAKNESSES OF THE COMPETITORS:

Weaknesses (and strengths) can be identified by going through consumer reports and reviews appearing in various media. After all, consumers are often willing to give their opinions, especially when the products or services are either great or very poor.

This answer the question

- Where are they lacking?

v. PUT ALL OF THE INFORMATION TOGETHER:

At this stage, the strategist should put together all information about competitors and draw inference about what they are not offering and what the firm can do to fill in the gaps.

The strategist can also know the areas which need to be strengthen by the firm.

This answers the questions:

- What will the business do with this information?

- What improvements does the firm need to make?

- How can the firm exploit the weaknesses of competitors?

![]()

Question 3.

Define “Industry”.

Answer:

Industries differ significantly in their basic character and structure. Industry and competitive analysis begins with an overview of the industry’s dominant economic features.

Industry is

- a group of firms

- whose products have same and similar attributes

- such that they compete for the same buyers.

Question 4.

Describe the factors to be considered in profiling an industry’s economic features.

OR

“Industry and competitive analysis begins with an overview of the industry’s dominant economic features.” Explain and also narrate the factors to be considered in profiling in industry’s economic features. (Nov. 2019; 5 Marks)

Answer:

Industry is “a group of firms whose products have same and similar attributes such that they compete for the same buyers.” Industries differ significantly in their basic character and structure. Industry and competi-tive analysis begins with an overview of the industry’s dominant economic features.

The factors to be considered in profiling an industry’s economic features are fairly standard and are given as follows:

- Size and nature of market.

- Scope of competitive rivalry (local, regional, national, international, or global).

- Market growth rate and position in the business life (early development, rapid growth and take off, early maturity, saturation and stagnation, decline).

- Number of rivals and their relative market share.

- The number of buyers and their relative size. Whether and to what extent industry rivals have integrated backward and/or forward.

- The types of distribution channels used to access consumer.

- The pace of technological change in the both production process innovation and new product introductions.

- Whether the products and services of rival firms are highly differentiated, weakly differentiated, or essentially identical?

- Whether organization can realize economies of scale in purchasing, manufacturing, transportation, marketing, or advertising?

- Whether key industry participants are clustered utilization are crucial to achieving low-cost production efficiency?

- Capital requirements and the ease of entry and exit.

- Whether industry profitability is above/below par?

Question 5.

Explain Driving forces in brief. Also Mention the most common Driving forces.

Answer:

- While it is important to judge what growth stage an industry is in, there’s more analytical value in identifying the specific causing fundamental industry and competitive adjustments, industry and competitive conditions change because forces are in motion that creates incentives or pressures for changes.

- The most dominant forces are called driving forces because they have the biggest influence on what kinds of changes will take place in the industry’s structure and competitive environment.

- Analyzing driving forces has two steps:

- Identifying what the driving forces are and

- assessing the impact they will have on the industry.

Question 6.

Shridhar who is running a medium size cloth manufacturing business in Panipat wishes to understand the driving forces that trigger change. He has sought advice from you and wishes to know’ common driving forces. (RTPNov. 2019)

Answer:

- Many events can affect an industry powerfully enough to quality as driving forces.

- Some are unique and specific to a particular industry situation, but many drivers of change fall into general category affecting different industries simultaneously.

- Some of the categories/example of drivers are follows:

- The internet and e-commerce opportunity and threats it breeds in the industry. m Increasing globalization.

- Product innovation.

- Marketing innovation.

- Entry or exit of major firms.

- Changes in the long-term industry growth rate.

- Diffusion of technical know-how across more companies and more countries.

- Changes in cost and efficiency.

Question 7.

What is a Strategic Group? Discuss the procedure for constructing a strategic group map. (RTP May 2019)

Answer:

[Step in examining the industry’s competitive structure is to study the market position of rival companies. One technique for reveling the competitive positions of industry participants is strategic group mapping.]

- Strategic Group Mapping is a useful analytical tool for comparing the market positions of each firm separately or for grouping them into like position when an industry has so many competitors that it is not practical to examine each one in-depth.

- A strategic group consists of those rival firms which have similar competitive approaches and positions in the market.

- Companies in the same strategic group can resemble one another in any of the several ways:

& they may have comparable product-line breadth,- sell in the same price/quality range,

- emphasize the same distribution channels,

- use essentially the same product attributes to appeal to similar types of buyers,

- depend on identical technological approaches, or

- offer buyers similar services and technical assistance.

- An industry contains only one strategic group when all sellers pursue essentially identical strategies and have comparable market positions. At the other extreme, there are as many strategic groups as there are competitors when each rival pursues a distinctively position in the marketplace.

- The procedure for constructing a strategic group map and deciding which firms belong in which strategic group is straight forward:

(a) IDENTIFY THE COMPETITIVE CHARACTERISTICS that differentiate firms in the industry typical variables are:

- price/quality range (high, medium, low);

- geographic coverage (local, regional, national, global);

- use of distribution channels (one, some, all);

- degree of service offered (no-frills, limited, full);

- degree of vertical integration (none, partial, full);

- product-line breadth (wide, narrow).

(b) PLOT THE FIRMS ON A TWO-VARIABLE MAP using pairs of these differentiating characteristics.

(c) ASSIGN FIRMS THAT FALL IN ABOUT THE SAME STRATEGY SPACE

to the same strategic group.

(d) DRAW CIRCLES AROUND EACH STRATEGIC GROUP making the circles proportional to the size of the group’s respective share of total industry sales revenues.

![]()

Question 8.

Explain Key Factors for Competitive Success. (Nov. 2018; 3 Marks)

Answer:

- An industry’s Key Success Factor (KSFs) are those things that most affect industry member’s ability to prosper in the marketplace –

- product attributes,

- resources,

- competencies, competitive capabilities,

- the particular strategy elements,

- and business outcomes that spell the different between profit and loss and, ultimately, between competitive success or failure.

- KSFs by their very nature are so important that all firms in the industry must pay close attention to them.

- They are the prerequisites for industry success or, to put it another way, KSFs are the rules that shape whether a company will be financially and competitively successful.

- The answer to three questions help identify an industry’s key success factors:

- On what basis do customers choose between the competing brands of seller?

- What product attributes are crucial?

- What resources and competitive capabilities does a seller need to have to be competitively successful?

- What does it take for seller to achieve a sustainable competitive advantage?

Question 9.

Explain Core Competencies in brief.

OR

What do you mean by core competencies? (May 2018; 2 Marks)

Answer:

- A core competence is a unique strength of an organization which may not be shared bv others.

- Core competencies are those capabilities that are critical to a business achieving competitive advantage. Core competencies are capabilities that serve as a source of competitive advantage for a firm over its rivals.

- In order to qualify as a core competence, the competency should i differentiate the business from any other similar businesses.

Question 10.

Rohit Patel is having a small chemist shop in the central part of Ahmadabad. What kind of competencies Rohit can build to gain competitive advantage over online medicine sellers? (RTP May 2019)

Answer:

Capabilities that are valuable, rare, costly to imitate, and non-substi-tutable are core competencies. A small chemist shop has a local presence and functions within a limited geographical area. Still it can build its own competencies to gain competitive advantage. Rohit Patel can build competencies in the areas of:

- Developing personal and cordial relations with the customers.

- Providing home delivery with no additional cost.

- Developing a system of speedy delivery that can be difficult to match by online sellers. Being in central part of city, he can create a network to supply at wider locations in the city.

- Having extended working hours for convenience of buyers.

- Providing easy credit or a system of monthly payments to the patients consuming regular medicines.

Question 11.

‘Value for Money’ is a leading retail chain, on account of its ability to operate its business at low costs. The retail chain aims to further strengthen its top position in the retail industry. Marshal, the CEO of the retail chain is of the view that to achieve the goals they should focus on lowering the costs of procurement of products.

Highlight and explain the core competence of the ‘Value for Money’ retail chain. (RTP Nov. 2018)

OR

‘Speed’ is a leading retail chain, on account of its ability to operate its business at low costs. The retail chain aims to further strengthen its top position in the retail industry. The Chief executive of the retail chain is of the view that to achieve the goals they should focus on lowering the costs of procurement of products.

Highlight and explain the core competence of the retail chain. (RTP Nov. 2020)

Answer:

- A core competence is a unique strength of an organization which may not be shared by others.

- Core competencies are those capabilities that are critical to a business achieving competitive advantage. In order to qualify as a core competence, the competency should differentiate the business from any other similar businesses. A core competency for a firm is whatever it does is highly beneficial to the organisation.

- ‘Value for Money’ (or ‘SPEED’) is the leader on account of its ability to keep costs low.

- The cost advantage that ‘Value for Money’ (or ‘SPEED’) has created for itself has allowed the retailer to price goods lower than competitors.

- The core competency in this case is derived from the company’s ability to generate large sales volume, allowing the company to remain profitable with low profit margin.

Question 12.

Major core competencies are identified in three areas – competitor differentiation, customer value and application to other markets. Discuss. (RTP Nov. 2019)

Answer:

According to C.K. Prahalad and Gary Hamel, major core competencies are identified in three areas – competitor differentiation, customer value, and application to other markets.

- COMPETITOR DIFFERENTIATION:

- The company can consider having a core competence if the competence is unique and it is difficult for competitors to imitate.

- This can provide a company an edge compared to competitors. It allows the company to provide better products or services to market with no fear that competitors can copy it.

- The company has to keep on improving these skills in order to sustain its competitive position.

- CUSTOMER VALUE:

- When purchasing a product or service it has to deliver a fundamental benefit for the end customer in order to be a core competence.

- It will include all the skills needed to provide fundamental benefits.

- The service or the product has to have real impact on the customer as the reason to choose to purchase them.

- If customer has chosen the company without this impact, then competence is not a core competence.

- APPLICATION OF COMPETENCIES to other markets:.

- Core competence must be applicable to the whole organization; it cannot be only one particular skill or specified area of expertise.

- Therefore, although some special capability would be essential or g crucial for the success of business activity, it will not be considered

as core competence, if it is not fundamental from the whole organization’s point of view. - Thus, a core competence is a unique set of skills and expertise, which will be used through out the organization to open up potential markets to be exploited.

If the three above-mentioned conditions are met, then the company can regard it competence as core competency.

Question 13.

How to build core competencies (CC)?

OR

Describe Four specific criteria of sustainable competitive advantage that

firms can use to determine those capabilities that are core competencies. (RTP May 2020)

Answer:

Ans.

- There are tools that help the firm to identify and build its core competencies.

- Four specific criteria of sustainable competitive advantage that firms can use to determine those capabilities that are core competencies.

- Capabilities that are valuable, rare, costly to imitate, and non-substitutable are core compelencies.

i. VALUABLE:

- Valuable capabilities are that allows the firm to exploit opportunities or avert the threats in its external environment.

- A firm created value for customers by effectively using capabilities in financial services.

- In addition, to make such competencies as financial services highly successful require placing the right people in the right jobs.

- Human capital is important in creating value for customers.

ii. RARE:

- Core competencies are very rare capabilities and very few of the competitors posses this.

- Capabilities possessed by many rivals are unlikely to be sources of competitive advantage for any one of them.

- Competitive advantage results only when firms develop and exploit valuable capabilities that differ from those shared with competitors.

iii. COSTLY TO IMITATE:

- Costly to imitate means such capabilities that competing firms are unable to develop easily.

- For example: Intel has enjoyed a first-mover advantage more than once because of its rare fast R&D cycle time capability.

- The product could be imitated in due course of time, but it was much more difficult to imitate the R&D cycle time capability.

iv. NONT-SUBSTITUTABLE:

Capabilities that do not have strategic equivalents are called non-substitutable capabilities.

- This final criterion for a capability to be a source of competitive advantage is that there must be no strategically equivalent value resources that are themselves either not rare or imitable.

- For example: For years, firms tried to imitate Tata’s low -cost strategy but most have been unable to duplicate Tata’s success.

They did not realize that Tata has a unique culture and attracts some of the top talent in the industry.

The culture and excellent human capital worked together in implementing Tata’s strategy and are the basis for its competitive advantage.

- For example: Competitors are deeply aware about Apple’s operating system’s (iOS) successful model. However, to date, no competitors has been able to imitate Apple’s capabilities. These are also protected through copyrights.

To sum up, we can say that only when a capability is valuable, rare, costly to imitate, and non-substitutable, it is a core competence and a sources of competence advantage.

Question 14.

Describe Components of a Value Chain of an organisation.

Answer:

- Value chain refers to separate activities which are necessary to underpin an organization’s strategies and are linked together both inside and outside the organization.

- Organizations are much more than a random collection of machines, money and people.

- Value chain of a manufacturing organization comprises of primary and supportive activities.

- The primary ones are:

- inclusive of inbound logistics,

- operations,

- outbound logistics,

- marketing and sales, and

- services.

- The supportive activities relate to:

- procurement,

- human resource management,

- technology development and

- infrastructure.

- Value chain analysis helps in building and main taming the long-term competitive position of an organization to sustain value for-money in its products or service.

- It can be helpful in identifying those activities which the organization must undertake at a threshold level of competence and those which represent the core competences of the organization.

![]()

Question 15.

“Management of internal linkages in the value chain could create competitive advantage in a number of ways”. Briefly explain.

Answer:

This management of internal linkages in the value chain could create competitive advantage in a number of ways:

- There may be important linkages between the primary activities.

- For example, a decision to hold high levels of stock might ease production scheduling problems and provide for a faster response time to the customer. However, it will probably add to the overall cost of operations.

- It is easy to miss this issue of managing linkages between primary activities in an analysis if, for example, the organization’s competences in marketing activities and operations are assessed separately.

- The operations may look good because they are geared to high-volume, low-variety, low-unit-cost production.

- However, at the same time, the marketing team may be selling speed, flexibility and variety to the customers.

- The management of the linkages between a primary activity and a support activity may be the basis of a core competence.

- It may be key investments in systems or infrastructure which provides the basis on which the company outperforms competitors.

- Computer-based systems have been exploited in many different types of service organizations and have fundamentally transformed the customer experience (Ola and Uber).

- Travel booking and hotel reservation systems are examples which other services would do well to emulate.

- They have created within these organizations the competence to provide both a better service and a service at reduced cost.

- Linkages between different support activities may also be the basis of core competences.

- For example, the extent to which human resource development is in tune with new technologies has been a key feature in the implementation of new production and office technologies.

- Many companies have failed to become competent in managing this linkage properly and have lost out competitively.

Question 16.

Define Competitive Advantage. (May 18; 2 Marks)

Answer:

Competitive advantage is the position of a firm to maintain and sustain a favourable market position when compared to the competitors.

- Competitive advantage is ability to offer buyers something different and thereby providing more value for the money.

- It is the result of a successful strategy. This position gets translated into higher market share, higher profits when compared to those that are obtained by competitors operating in the same industry.

- Competitive advantage may also be in the form of low cost relationship in the industry or being unique in the industry along dimensions that are widely valued by the customers in particular and the society at large.

Question 17.

The sustainability of competitive advantage and a firm’s ability to earn profit from its competitive advantage depends upon four major characteristics of resources and capabilities. Explain.

Answer:

The sustainability of competitive advantage and a firm’s ability to earn profit from its competitive advantage depends upon four major characteristics of resources and capabilities:

- DURABILITY:

- The period over which a competitive advantage is sustainable depends in part on the rate at which a firm’s resources and capabilities deteriorate.

- In industries where the rate of product innovation is fast, product patent are quite likely to become obsolete.

- Similarly, capabilities which are the result of the management expertise of the CEO are also valuable to his or her retirement or departure.

- On the other hand, many consumer brand names have a highly durable appeal.

2. TRANSFERABILITY:

- Even if the resources and capabilities on which a competitive advantage is based are durable, it is likely to be eroded by competition from rivals.

- The ability of rivals to attack position of competitive advantage relies on their gaining access to the necessary resources and capabilities.

- The easier it is to transfer resources and capabilities between companies, the less sustainable will be the competitive advantage which is based on them.

3. IMITABILITY:

- If resources and capabilities cannot be purchased by a would be imitator, then they must be built from scratch.

- How easily and quickly can the competitor build the resources and capabilities on which a firm’s competitive advantage is based? This is the true test of imitability.

- For example: in financial services, innovations lack legal protection and are easily copied. Here again the complexity of many organizational capabilities can provide a degree of competitive defence.

- Where capabilities require networks of organizational routines, whose effectiveness depends on the corporate culture, imitation is difficult.

4. APPROPRIABILITY:

- Appropriability refers to the ability of the firm’s owner to appropriate the returns on its resources base.

- Even where resources and capabilities are capable of offering sustainable advantage, there is an issue as to who receives the returns on these resources.

Question 18.

Explain SBU. What are the characteristics of SBU?

Answer:

- Analysing portfolio may begin with identifying key businesses also

termed as strategic business unit (SBU). - SBU is a unit of the company that has:

- a separate mission and objectives and

- which can be run independently from other company businesses.

- The SBU can be a:

- company division,

- a product line within a division, or

- even a single product or brand.

- SBUs are common in organisations that are located in multiple countries with independent manufacturing and marketing setups.

- An SBU has the following characteristics:

- It has single business or collection of related businesses that can be planned for separately.

- It has its own sel of competitors.

- It has a manager who is responsible for strategic planning and profit.

- After identifying SBUs, the management will assess their respective attractiveness and decide how much support each deserves.

- There are a number of techniques that could be considered as corporate portfolio analysis techniques. The most popular is the Boston

Consulting Group (BCG) Matrix or product portfolio matrix. But there are several other techniques that should be understood in order to have a comprehensive view of how objective factors can help strategists in exercising strategic choice.

Question 19.

Explain the concept of Experience Curve and highlight its relevance

in strategic management. (RTP May 201S)

Answer:

- Experience curve is an important concept used for applying a portfolio approach.

- The concept is akin (similar) to a learning curve which explains the efficiency increase gained by workers through repetitive productive work.

- Experience curve is based on the commonly observed phenomenon that unit costs decline as a firm accumulates experience in terms of a cumulative volume of production.

- The implication is that larger firms in an industry would tend to have lower unit costs as compared to those for smaller companies, thereby gaining a competitive cost advantage.

- Experience curve results from a variety of factors such as learning effects, economies of scale, product redesign and technological improvements in production.

- The concept of experience curve is relevant for a number of areas in strategic management.

- For instance, experience curve is considered a barrier for new firms contemplating entry in an industry. It is also used to build market share and discourage competition.

Question 20.

In BCG matrix for what the metaphors like stars, cows and dogs are used?

In the light of BCG Growth Matrix, state the situations under which the following strategic options are suitable:

(a) Build

(b) Hold

(c) Harvest

(d) Divest

OR

Answer:

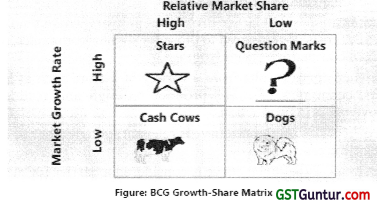

1. INTRODUCTION

The BCG growth-share matrix is the simplest way to portray a corporation’s portfolio of investments. Growth share matrix also known for its cow and dog metaphors is popularly used for resource allocation in a diversified company.

2. TWO-DIMENSIONAL GROWTH-SHARE MATRIX

Using the BCG approach, a company classifies its different businesses on a two-dimensional growth-share matrix. In the matrix:

- The vertical axis represents market growth rate and provides a measure of market attractiveness.

- The horizontal axis represents relative market share and serves as a measure of company strength in the market.

3. DIAGRAM

Relative Market Share

High Low

4. FOUR DIFFERENT SBUs/PRODUCTS

Using the matrix, organisations can identify four different types of products or SBU as follows:

- Stars are products or SBUs that are growing rapidly. They also need heavy investment to maintain their position and finance their rapid growth potential. They represent best opportunities for expansion.

- Cash Cows are low-growth, high market share businesses or products. They generate cash and have low costs. They are established, successful, and needless investment to maintain their market share. In long run when the growth rate slows down, stars become cash cows.

- Question Marks, sometimes called problem children or wildcats, are low market share business in high-growth markets. They require a lot of cash to hold their share. They need heavy investments with low potential to generate cash. Question marks if left unattended are capable of becoming cash traps. Since growth rate is high, increasing it should be relatively easier. It is for business organisations to turn them stars and then to cash cows when the growth rate reduces.

- Dogs are low-growth, low-share businesses and products. They may generate enough cash to maintain themselves, but do not have much future. Sometimes they may need cash to survive. Dogs should be minimised by means of divestment or liquidation.

5. FOUR STRATEGIES

After a firm, has classified its products or SBUs, it must determine what role each will play in the future. The four strategies that can be pursued are:

- Build: Here the objective is to increase market share, even by forgoing short-term earnings in favour of building a strong future with large market share.

- Hold: Here the objective is to preserve market share.

- Harvest: Here the objective is to increase short-term cash flow regardless of long-term effect.

- Divest: Here the objective is to sell or liquidate the business because resources can be better used elsewhere.

6. PROBLEMS & LIMITATIONS OF BCG MATRIX

- The growth-share matrix has done much to help strategic planning;

however, there are some problems and limitations with the technique, - BCG matrix can be:

- Difficult,

- Time-consuming, and

- Costly to implement.

- Provide little advice for future planning

- Management may find it difficult to define SBUs and measure market share and growth. They can lead the company to placing too much emphasis on market-share growth or growth through entry into attractive new markets. This can cause unwise expansion into hot, new, risky ventures or divesting established units too quickly.

![]()

Question 21.

Aurobindo, the pharmaceutical company wants to grow its business. Draw Ansoff’s Product Market Growth Matrix to advise them of the available options

Answer:

1. INTRODUCTION:

- The Ansoff s product market growth matrix (proposed by Igor Ansoff) is a useful tool that helps businesses decide their product and market growth strategy.

- With the use of this matrix a business can get a fair idea about how its growth depends upon it markets in new or existing products in both new and existing markets.

- Companies should always be looking to the future. One useful device for identifying growth opportunities for the future is the product/ market expansion grid.

2. DIAGRAM:

3. EXPLANATION:

The product/market growth matrix is a portfolio-planning tool for identifying growth opportunities for the company.

(I) MARKET PENETRATION:

- Market penetration refers to a growth strategy where the business focuses on selling existing products into existing markets.

- It is achieved by making more sales to present customers without changing products in any major way.

- Penetration might require greater spending on advertising or personal selling.

- Overcoming competition in a mature market requires an aggressive promotional campaign, supported by a pricing strategy designed to make the market unattractive for competitors.

- Penetration is also done by effort on increasing usage by existing customers.

(II) MARKET DEVELOPMENT:

- Market development refers to a growth strategy where the business seeks to sell its existing products into new markets.

- It is a strategy for company growth by identifying and developing new markets for current company products.

- This strategy may be achieved through new geographical markets, new product dimensions or packaging, new distribution channels or different pricing policies to attract different customers or create new market segments.

(III) PRODUCT DEVELOPMENT:

- Product development refers to a growth strategy where business aims to introduce new products into existing markets.

- It is a strategy for company growth by offering modified or new products to current markets.

- This strategy may require the development of new competencies and requires the business to develop modified products which can appeal to existing markets.

(IV) DIVERSIFICATION:

- Diversification refers to a growth strategy where a business markets new products in new markets.

- It is a strategy by starting up or acquiring businesses outside the company’s current products and markets.

- This strategy is risky because it does not rely on either the company’s successful product or its position in established markets.

- Typically the business is moving into markets in which it has little or no experience.

- As market conditions change overtime, a company may shift product-market growth strategies. For example, when its present market is fully saturated a company may have no choice other than to pursue new market.

Question 22.

In the context of Ansoff’s Product-Market Growth Matrix, identify with reasons, the type of growth strategies followed in the following cases:

(i) A leading producer of tooth paste, advises its customers to brush teeth twice a day to keep breath fresh.

(ii) A business giant in hotel industry decides to enter into dairy business.

(iii) One of India’s premier utility vehicles manufacturing company ventures to foray into foreign markets.

(iv) A renowned auto manufacturing company launches ungeared scooters in the market.

Answer:

The Ansoff’s product market growth matrix (proposed by Igor Ansoff) is an useful tool that helps businesses decide their product and market growth strategy. This matrix further helps to analyse different strategic directions.

According to Ansoff there are four strategies that organisation might follow.

(i) Market Penetration: A leading producer of toothpaste, advises its customers to brush teeth twice a day to keep breath fresh. It refers to a growth strategy where the business focuses on selling existing products into existing markets.

(ii) Diversification: A business giant in hotel industry decides to enter into dairy business. It refers to a growth strategy where a business markets new products in new markets.

(iii) Market Development: One of India’s premier utility vehicles manufacturing company ventures to foray into foreign markets. It refers to a growth strategy where the business seeks to sell its existing products into new markets.

(iv) Product Development: A renowned auto manufacturing company launches ungeared scooters in the market. It refers to a growth strategy where business aims to introduce new products into existing markets.

Question 23.

Explain in brief ADL Matrix.

OR

Write a short note on the role of ADL Matrix in assessing competitive position of a firm. (.RTP Nov. 2020)

Answer:

- The ADL matrix derived its name from Arthur D. Little

- It is a portfolio analysis technique that is based on product life cycle.

- The approach forms a two dimensional matrix based on:

- stage of industry maturity and

- the firms competitive position

- environmental assessment and business strength assessment.

- Stage of industry maturity is an environmental measure that represents a position in industry’s life cycle.

- Competitive position is a measure of business strengths that helps in categorization of products or SBU’s into one of five competitive positions: dominant, strong, favourable, tenable and weak. It is four by five matrix as follows:

The competitive position of a firm is based on an assessment of the following criteria:

Dominant: This is a comparatively rare position and in many cases is attributable either to a monopoly or a strong and protected technological leadership.

Strong: By virtue of this position, the firm has a considerable degree of freedom over its choice of strategies and is often able to act without its market position being unduly threatened by its competitions.

Favourable: This position, which generally comes about when the industry is fragmented and no one competitor stand out clearly, results in the market leaders a reasonable degree of freedom.

Tenable: Although the firms within this category are able to perform satisfactorily and can justify staying in the industry, they are generally vulnerable in the face of increased competition from stronger and more proactive companies in the market.

Weak: The performance of firms in this category is generally unsatisfactory although the opportunities for improvement do exist.

Question 24.

Write a short note on SWOT analysis. (May 2018; 3 Marks)

Answer:

- SWOT analysis is a tool used by organizations for evolving strategic options for the future.

- The term SWOT refers to the analysis of strengths, weaknesses, opportunities and threats facing a company.

- Strengths and weaknesses are identified in the internal environment, whereas opportunities and threats are located in the external environment.

- Strength: Strength is an inherent capability of the organization which it can use to gain strategic advantage over its competitors.

- Weakness: A weakness is an inherent limitation or constraint of the organization which creates strategic disadvantage to it.

- Opportunity: An opportunity is a favourable condition in the organisation’s environment which enables it to strengthen its position.

An example of an opportunity is growing demand for the products or services that a company provides. - Threat: A threat is an unfavourable condition in the organisation’s environment which causes a risk for, or damage to, the organisation’s position.

Question 25.

What is the purpose of SWOT analysis? Why is it necessary to do a SWOT analysis before selecting a particular strategy for a business organization? (RTP May 20)

Answer:

An important component of strategic thinking requires the generation of a series of strategic alternatives, or choices of future strategies to pursue, given the company’s internal strengths and weaknesses and its external opportunities and threats. The comparison of strengths, weaknesses, opportunities, and threats is normally referred to as SWOT analysis.

Strength: Strength is an inherent capability of the organization which it can use to gain strategic advantage over its competitors.

Weakness: A weakness is an inherent limitation or constraint of the organization which creates strategic disadvantage to it.

Opportunity: An opportunity is a favourable condition in the organisation’s environment which enables it to strengthen its position.

Threat: A threat is an unfavourable condition in the organisation’s environment which causes a risk for, or damage to, the organisation’s position.

SWOT analysis helps managers to craft a business model (or models) that will allow a company to gain a competitive advantage in its industry (or industries). Competitive advantage leads to increased profitability, and this maximizes a company’s chances of surviving in the fast-changing, competitive environment. Key reasons for SWOT analyses are:

- It provides a logical framework.

- It presents a comparative account.

- It guides the strategist in strategy identification.

![]()

Question 26.

To which industries the following developments offer opportunities and threats? “Increasing trend in India to organize IPL (Cricket) type of tournaments in other sports also.”

Answer:

An opportunity is a favourable condition in the organisation’s environment which enables it to strengthen its position. On the other hand a threat is an unfavourable condition in the organisation’s environment which causes a risk for, or damage to, the organisation’s position. An opportunity is also a threat in case internal weaknesses do not allow organization to take their advantage in a manner rivals can.

The IPL (Cricket) tournament is highly profit and entertainment driven. A number of entities and process are involved in this IPL type tournament. IPL (Cricket) type of tournament would offer opportunities/threats to the following industries:

Opportunities:

- Stadia (Stadium)

- Sports Industry.

- Media Industry – Sports channels/television, advertisers.

Threats:

- Entertainment industry like TV serials, cinema theatres, Entertainment theme parks as competitors will be fighting for the same viewers/ target customers.

- Tourism and hotel Industry.

- Event Management.

The organization’s performance in the marketplace is significantly influenced by the three factors:

- The organization’s correct market position.

- The nature of environmental opportunities and threat.

- The organization’s resource capability to capitalize the opportunities and to protect against the threats.

Question 27.

What are the significance of SWOT Analysis?

Answer:

The significance of SWOT analysis lies in the following points:

- IT PROVIDES A LOGICAL FRAMEWORK OF ANALYSIS:

- SWOT analysis provides us with a logical framework for systematic and sound thrashing of issues having bearing on the business situation, generation of alternative strategies and the choice of a strategy.

- Variation in managerial perceptions about organizational strengths and weaknesses and the environmental opportunities and threats lead to the approaches to specific strategies and finally the choice of strategy that takes place through an interactive process in dynamic backdrop.

- IT PRESENTS A COMPARATIVE ACCOUNT:

- SWOT analysis presents the information about both external and internal environment in a structured form where it is possible to compare external opportunities and threats with internal strengths and weaknesses.

- This helps in matching external and internal environments so that a strategist can come out with suitable strategy by developing certain patterns of relationship.

- The patterns are combinations say:

- high opportunities and high strengths,

- high opportunities and low strengths,

- high threats and high strengths,

- high threats and low strengths.

- IT GUIDES THE STRATEGIST IN STRATEGY IDENTIFICATION:

- It is natural that a strategist faces a problem when his organization cannot be matched in the four patterns.

- It is possible that the organization may have several opportunities and some serious threats.

- It is equally, true that the organization may have powerful strengths coupled with major weaknesses in the light of critical success factors.

- In such situation, SWOT analysis guides the strategist to think of overall position of the organization that helps to identify the major purpose of the strategy under focus.

Question 28.

How is TOWS Matrix an improvement over the SWOT Analysis? Describe the construction of TOWS Matrix?

Answer:

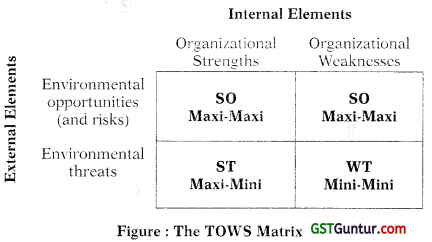

- Through SWOT analysis organisations identify their strengths, weaknesses, opportunities and threats.

- While conducting the SWOT Analysis managers are often not able to come to terms with the strategic choices that the outcomes demand.

- Heinz Weihrich developed a matrix called TOWS matrix by matching strengths and weaknesses of an organization with the external opportunities and threats.

- The incremental benefit of the TOWS matrix lies in systematically identifying relationships between these factors and selecting strategies on their basis.

- Thus TOWS matrix has a wider scope when compared to SWOT analysis. TOWS analysis is an action tool whereas SWOT analysis is a planning tool.

The TOWS Matrix is tool for generating strategic options. Through TOWS matrix four distinct alternative kinds of strategic choices can be identified.

SO(Maxi-Maxi): SO is a position that any firm would like to achieve. The strengths can be used to capitalize or build upon existing or emerging opportunities. Such firms can take lead from their strengths and utilize the resources to build up the competitive advantage.

ST(Maxi-Mini): ST is a position in which a firm strives to minimize existing or emerging threats through its strengths.

WO(Mini-Maxi): The firm needs to overcome internal weaknesses and make attempts to exploit opportunities to maximum.

WT(Mini-Mini) : WT is a position that any firm will try to avoid. A firm facing external threats and internal weaknesses may have to struggle for its survival. WT strategy is a strategy which is pursued to minimize or overcome weaknesses and as far as possible, cope with existing or emerging threats. The matrix is outlined below:

By using TOWS Matrix, a strategist can look intelligently at how he can best take advantage of the opportunities open to him, at the same time that he can minimize the impact of weaknesses and protect himself against threats.

Question 29.

What are the characteristics of a Global Company?

Answer:

A global company has three characteristics:

- It is a conglomerate of multiple units (located in different parts of the globe) but all linked by common ownership.

- Multiple units draw on a common pool of resources, such as money, credit, information, patents, trade names and control systems.

- The units respond to some common strategy. Besides, its managers and shareholders are also based in different nations.

Question 30.

Why do companies go global?

Answer:

There are several reasons why companies go global. These are discussed as follows:

- The first and foremost reason is need to grow. It is basic need of organisations. Often finding opportunities in the other parts of the globe organisation extend their businesses and globalise.

- There is rapid shrinking of time and distance across the globe thanks to faster communication, speedier transportation, growing financial flows and rapid technological changes.

- It is being realised that the domestic markets are no longer adequate and rich. Japanese have flooded the U.S. market with automobiles and electronics because the home market was not large enough to absorb whatever was produced.

- There can be varied other reasons such as need for reliable or cheaper source of raw-materials, cheap labour, etc.

For Example: Hyundai got competent engineers at lower cost, industry friendly Maharashtra Govt, which allowed them to setup a unit in India which supplies spare parts for all Hyundai Cars across the world. - Companies often set up overseas plants to reduce high transportation costs.

For Example: Making a car in Korea & exporting it in Europe & America is expensive & time consuming therefore India as a manufacturing hub for Hyundai proved to be better place. - When exporting organisations find foreign markets to open up or grow big, they may naturally look at overseas manufacturing plants and sales branches to generate higher sales and better cash flow.

For Example: Hyundai cars made by Korea, sold in India were highly demanded and Hyundai decided to setup a plant here. - The rise of services to constitute the largest single sector in the world economy; and regional economic integration, which has involved both the world’s largest economies as well as certain developing economies.

- The apparent and real collapse of international trade barriers redefines the roles of state and industry. The trend is towards increased privatization of manufacturing and services sectors, less government interference in business decisions and more dependence on the value-added sector to gain market place competitiveness. The trade tariffs and custom barriers are getting lowered, resulting in increased flow of business.

- Globalization has made companies in different countries to form strategic alliances to ward off (to prevent from) economic and technological threats and leverage their respective comparative and competitive advantages.