Management of Working – CA Inter FM Notes is designed strictly as per the latest syllabus and exam pattern.

Management of Working – CA Inter FM Notes

1. Management of Cash:

Step 1: Prepare cash budget for coming period

Step 2: Take action for coming period on the basis of cash budget

| Situations | Planning |

| Budgeted Cash Balance < Desired Cash Balance (Deficit Cash) |

Plan to arrange cash to fulfil deficiency of cash (Like: Sell of marketable securities or arrangement of overdraft etc.) |

| Budgeted Cash Balance = Desired Cash Balance (Sufficient Cash) | No action |

| Budgeted Cash Balance > Desired Cash Balance (Surplus Cash) |

Plan to invest surplus cash (Like: Purchase of marketable securities or invest surplus cash elsewhere) |

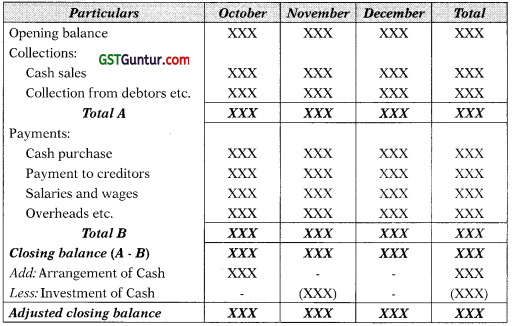

Proforma Cash Budget

2. Cash Cycle = F + D – C

3. Cash Turnover = 12 months (365 days) ÷ Cash Cycle Period

![]()

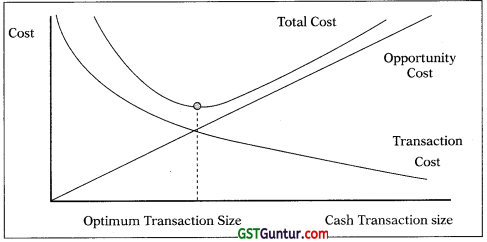

4. William J. BaumoVs Economic Order Quantity Model, (1952): According to this model, optimum cash level is that level of cash where the carrying costs and transactions costs are the minimum.

Optimum Cash Transaction (C) = \(\sqrt{\frac{2 \mathrm{U} \times \mathrm{P}}{\mathrm{S}}}\)

Where,

C = Optimum cash balance

U = Annual (or monthly) cash disbursement

P = Fixed cost per transaction

S = Opportunity cost of one rupee p.a. (or p.m.)

The model is based on the following assumptions:

- Cash needs of the firm are known with certainty.

- The cash is used uniformly over a period of time and it is also known with certainty.

- The holding cost is known and it is constant.

- The transaction cost also remains constant.

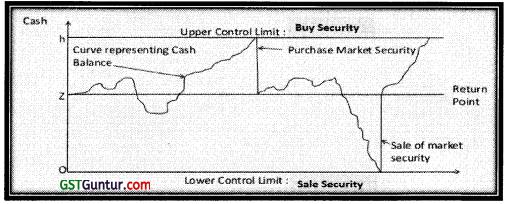

5. Miller-Orr Cash Management Model (1966): According to this model the net cash flow is completely stochastic. In this model control limits are set for cash balances. These limits may consist of h as upper limit, z as the return point; and zero as the lower limit.

- When the cash balance reaches the upper limit, the transfer of cash equal to h – z is invested in marketable securities account.

- When it touches the lower limit, a transfer from marketable securities account to cash account is made.

- During the period when cash balance stays between (h, z) and (z, 0) Le. high and low limits no transactions between cash and marketable securities account is made.

![]()

6. Management of Receivables: Management of receivables provides an answer to the following questions:

- Whether credit should be allowed or not?

- To whom credit should be allowed?

- How much amount of credit should be allowed?

- How much credit period should be allowed?

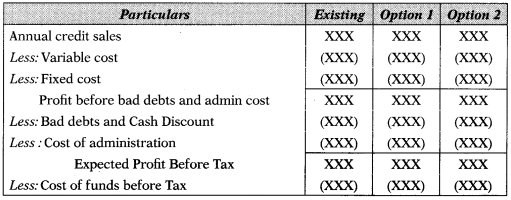

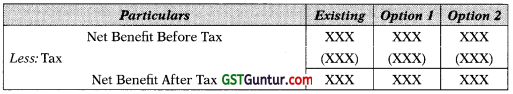

7. Evaluation of Credit Policies (Total Approach):

Select the option having higher net benefit.

Note:

If tax is given in the question and:

a. Cost of fund or Required return or Opportunity cost if before tax: It must be deducted before tax.

b. Cost of fund or Required return or Opportunity cost if after tax: It must be deducted after tax.

Cost of fund or Required return or Opportunity cost is calculated on the basis of total of Variable and Fixed cost related to credit sales and Bad debt, cash discount and credit admin cost are ignored.

Cost of fund or Required return or opportunity cost is calculated as given below:

Formula 1 = (Variable cost + Fixed cost) × \(\frac{\mathrm{ACP}}{365 / 52 / 12}\) × Rate

Formula 2 = (Variable cost + Fixed cost) × \(\frac{1}{\text { DTR }}\) × Rate

Formula 3 = Cost of Debtors X Rate

Average collection period is used to calculate Cost of fund when question provides both average collection period and credit period allowed to debtors.

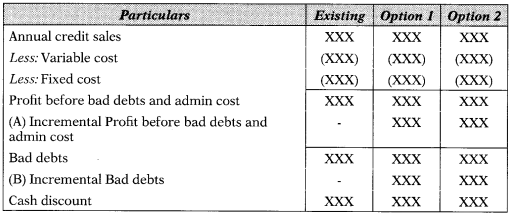

8. Evaluation of Credit Policies (Incremental Approach)

Statement of Evaluation of Credit Policies (Incremental Approach)

Select the option having higher Incremental net benefit

9. Meaning of Cash Discount with line:

‘x’/’y’, net ‘z’ days or 1 /10 net 45 days:

It means: if the bill is paid within 10 days, there is a 1% cash discount, other-wise, the total amount is due within 45 days.

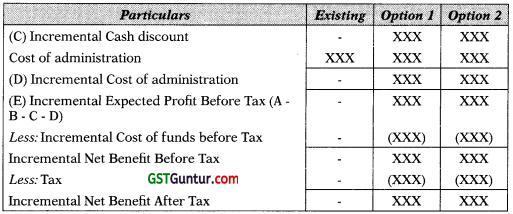

10. Factoring Service:

Factoring Service: Factoring is an agreement between factor and business firm. Factor provides various services to business firm as per the factoring agreement.

11. Types of Factoring Services:

(a) Collection service: Factor collect amount from debtors on behalf of business firm and charge commission on total bill amount.

(b) Advance service: Factor collect amount from debtors on behalf of business firm and charge commission and also give advance to business firm against bill amount and charge interest.

(c) Non-recourse factoring: Factor suffers loss of bad debts under such arrangement.

(d) Recourse factoring: Business firm suffers loss of bad debts under such arrangement.

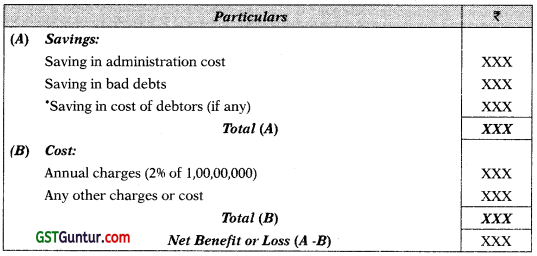

12. Steps in case of Collection Factoring Service:

Step 1: Calculate savings due to factoring proposal.

Step 2: Calculate cost due to factoring proposal.

Step 3: Calculate net benefit or loss and take decision accordingly.

Proforma Statement of Evaluation of Factoring Proposal

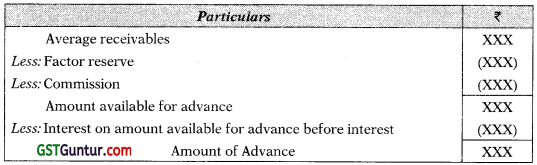

13. Steps in case of Advance Factoring Service:

Step 1: Calculate amount of advance:

Calculation of Amount of Advance

Step 2: Calculate Effective cost of Factoring (Annual):

Statement of Effective Cost of Factoring to the Firm (Annual)

Step 3: Compare Rate of Effective cost with Rate of Bank interest and take decision accordingly.

![]()

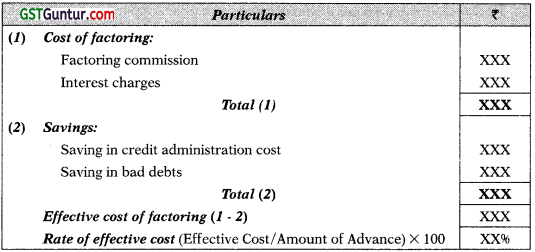

14. Forfaiting: Forfaiting is same as bill discounting with bank. In forfaiting a financial institution or bank buys the trade bills or trade receivables from ex-porters of goods or services and bank will receive amount due from importer instead of exporter.

Exporter receives immediate payment from financial institution on ‘without recourse’ basis in which risk and rewards related with the amount receivable is transferred to the financial institutions. It is a unique credit facility arrangement where an importer can open a “letter of credit” in favour of the exporter and can import goods and services on deferred payment terms.

15. Functions of Forfaiting:

- Exporter sells goods or services to an overseas buyer.

- The overseas buyers draws a letter of credit through its bank.

- The exporter on receiving the letter of credit approaches to its bank.

- The exporter’s bank buys the letter of credit ‘without recourse basis’ and provides the exporter the payment for the bill.

16. Features or Advantages of Forfaiting:

- Exporter can increase its business as payment is assured.

- Importer imports goods and services on deferred payment terms.

- Reduction in transaction costs and complexities in international trade transactions.

- The exporter can compete in the international market.

- Exporter can maintain sufficient working capital.

17. Working Capital: Working capital refers to funds invested in Stock of Raw Material, WIP, Finished Goods, Debtors, BR, and Prepaid etc. net of current liabilities.

- Gross Working Capital = Current Assets

- Net Working Capital = Current Assets – Current Liabilities

18. Permanent working capital: The minimum level of investment in the current assets that is carried by the entity at all times to carry its day to day activities.

19. Temporary working capital: It is used to finance the short term working capital requirements which arises due to fluctuation in sales volume. It is in additional of permanent working capital.

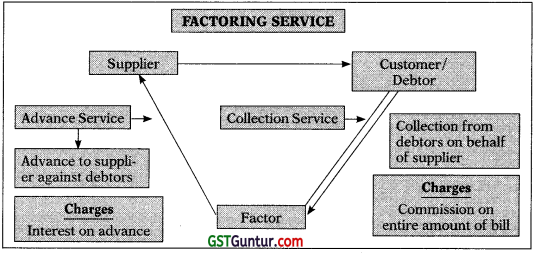

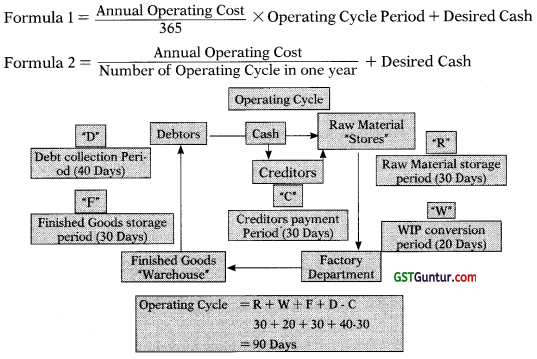

20. Estimation of Working Capital:

Method 1: Operating or Working Capital Cycle Method

Method 2: Component wise Estimation or Quantitative Estimation Method

![]()

21. Operating or Working Capital Cycle Method:

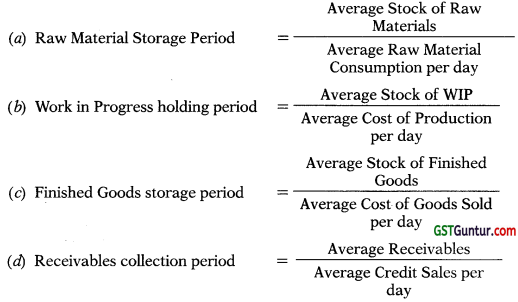

Step 1: Estimate Various Holding Period:

Step 2: Calculate Operating Cycle Period:

Operating Cycle Period = R + W + F + D – C

Step 3: Estimate Working Capital:

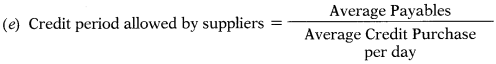

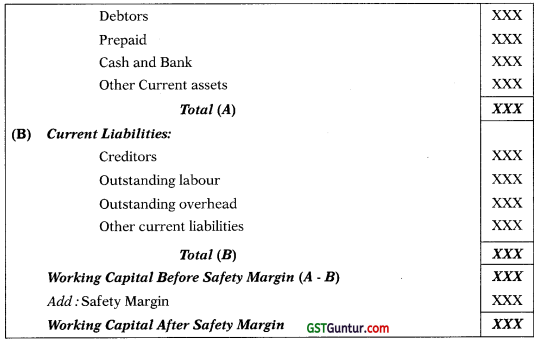

22. Component-wise Estimation Method:

Step 1: Prepare Projected Income Statement

Step 2: Prepare Statement of Estimated Working Capital

Proforma Statement of Working Capital Requirement

![]()

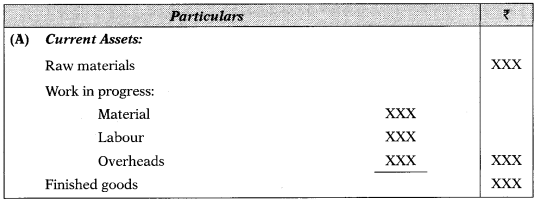

23. Valuation of Items Under Total and Cash Cost Approach

| Items | Total Approach | Cash Cost Approach |

| Current Assets | ||

| Raw Material Stock | Valued on the basis of Raw Material Consumed | Valued on the basis of Raw Material Consumed |

| WIP Stock: | ||

| Materials | Valued on the basis of Raw Material Consumed | Valued on the basis of Raw Material Consumed |

| Wages | On the basis of Wages Cost | On the basis of Wages Cost |

| Production OH | On the basis of Production OH (including Depreciation) | On the basis of Production OH (excluding Depreciation) |

| Finished Goods Stock | Valued on the basis of Cost of Production (including Depreciation) | Valued on the basis of Cost of Production (excluding Depreciation) |

| Debtors: | ||

| Alternative 1 | Valued on the basis of cost of credit sales (including Depreciation) | Valued on the basis of cost of credit sales (excluding Depreciation) |

| Alternative 2 | Valued on the basis of credit sales | N. A. |

| Prepaid Wages | On the basis of Wages Cost | On the basis of Wages Cost |

| Prepaid Overheads | On the basis of OH (excluding Depreciation) | On the basis of OH (excluding Depreciation) |

| Cash and Bank | As per given information | As per given information |

| Creditors | On the basis of credit purchases | On the basis of credit purchases |

| Outstanding Wages | On the basis of Wages Cost | On the basis of Wages Cost |

| Outstanding Overheads | On the basis of OH (excluding Depreciation) | On the basis of OH (excluding Depreciation) |

Note:

- Depreciation can never be outstanding or prepaid

- Debtors can be valued on cost of credit sales (preferred) or amount of credit sales under total approach

- Depreciation and profit are fully ignored under cash cost approach

- Assumption in respect of % of completion of WIP:

- Material cost 100%

- Labour cost 50%

- Production overheads 50%

- If nothing is specified, it is preferred to use total approach

![]()

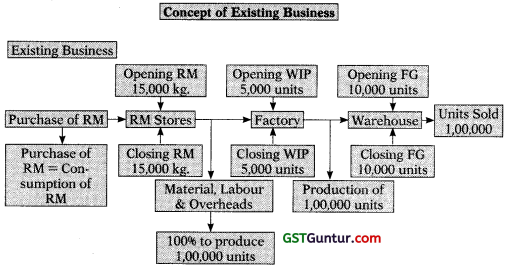

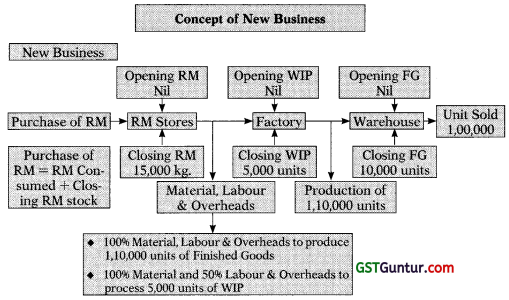

24. Working Capital Estimation Charts of Existing and New Business:

Note: In case of new company Purchase of RM = RM consumed + Closing RM stock

25. Methods of MPBF as Per Mr. P. L. Tandon’s Tandon Committee (1974):

| Methods | Maximum Permissible Bank Finance (MPBF) |

| Method I | 15% of (Current Assets Less Current Liabilities) ie. 15% of Net Working Capital |

| Method II | (15% of Current Assets) Less Current Liabilities |

| Method III | (15% of Soft Core Current Assets) Less Current Liabilities |

Note: During the computation of MPBF current liabilities must be excluding existing bank finance.

![]()

26. Impact of Double Shift:

| Items | Impact |

| Production and Sales | Double |

| Variable Cost | Double |

| Fixed Cost | No change |

| Raw Material Stock | Double in quantity and value subject to quantity discount |

| WIP stock | No change in units |

| Finished Goods Stock | Double in quantity, lower than double in value due to fixed cost |

| Debtors | Double |