Risk Analysis in Capital Budgeting – CA Inter FM Notes is designed strictly as per the latest syllabus and exam pattern.

Risk Analysis in Capital Budgeting – CA Inter FM Notes

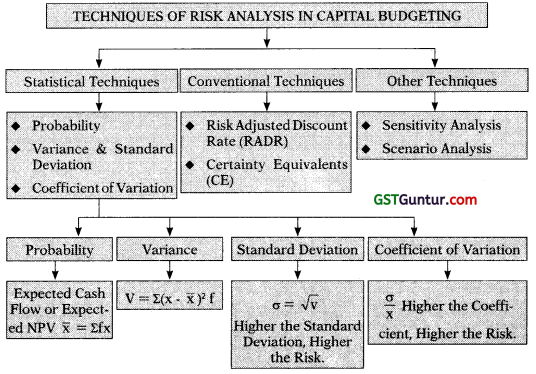

1. Techniques of Risk Analysis in Capital Budgeting:

![]()

2. Probability:

Situation 1: Cash Flow is given with its probability:

Step 1 : Calculate Expected Cash Flow \((\overline{\mathrm{X}})\) with the help of probability

Step 2 : Calculate Expected NPV on the basis of expected cash flow

Step 3 : Take decision on the basis of Expected NPV

Situation 2 : NPV is given with its probability:

Step 1 : Calculate Expected NPV \((\overline{\mathrm{X}})\) with the help of probability

Step 2 : Take decision on the basis of Expected NPV

Mean \((\overline{\mathrm{X}})\) = Σfx

3. Variance (V) or (σ2):

Variance (V) or (σ2) = Σ(X – \(\overline{\mathrm{X}}\))2f

Higher the Variance higher the Risk.

4. Standard Deviation (σ) :

Standard Deviation (σ) = \(\sqrt{V}\)

Higher the Standard Deviation higher the Risk.

5. Coefficient of Variation

Higher the Coefficient of Variation higher the Risk.

6. Risk Adjusted Discount Rate (RADR):

- The use of risk adjusted discount rate (RADR) is based on the concept that investors demands higher returns from the risky projects.

- In this technique management use discount rate as per the risk associated with the project.

7. Certainty Equivalent (CE):

Certainly Equivalent Coefficient (∝) \(=\frac{\text { Certain Cash Flow }}{\text { Risky or Expected Cash Flow }}\)

Step 1 : Calculate Certain Cash:

Certain Cash = Expected Cash Flow × C.E. Coefficient

Step 2 : Calculate NPY on the basis of certain cash flow and risk free discount rate.

![]()

8. Sensitivity Analysis:

- Sensitivity analysis is used to study the impact of changes in the variables on the outcome of the project.

- The project outcome is studied after taking into change in only one variable.

9. Scenario Analysis:

- This analysis brings in the probabilities of changes in key variables and also allows us to change more than one variable at a time.

- Scenario analysis examine the risk of investment, to analyse the impact of alternative combinations of variables, on the project’s NPV (or IRR).