AS 12: Accounting for Governments Grants – CA Inter Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

AS 12: Accounting for Governments Grants – CA Inter Accounts Study Material

Grant Related To Specific Fixed Assets (Based On Para No. 8)

Question 1.

Weak Ltd. acquired the fixed assets of ₹ 100 lakhs on which it received the grant of ₹ 10 lakhs. What will be the cost of the fixed assets as per AS 12 and how it will be disclosed in the financial statements? (4 Marks) (May 2010)

Answer:

Paragraphs 8 and 14 of AS 12 ‘Accounting for Government Grants’ deal with the presentation of government grants related to specific fixed assets. It prescribes two different methods for recognition of a government grant. In the first method, Government grants related to specific fixed assets should be presented in the balance sheet by showing the grant as a deduction from the gross value of the assets concerned in arriving at their book value.

Under the second method, government grants related to depreciable fixed assets may be treated as deferred income which should be recognised in the profit and loss statement on a systematic and rational basis over the useful life of the asset, i.e., such grants should be allocated to income over the periods and in the proportions in which depreciation on those assets is charged.

Analysis and conclusion:

First Method:

Fixed assets should be presented at ₹ 90 lakhs (₹ 100 lakhs less ₹ 10 lakhs) in the balance sheet of Weak Ltd.

Second Method:

Fixed assets will be shown at ₹ 100 lakhs in the balance sheet of Weak Ltd. and the corresponding grant amounting ₹ 10 lakhs will be treated as deferred income to be recognized over useful life of the fixed asset.

![]()

Question 2.

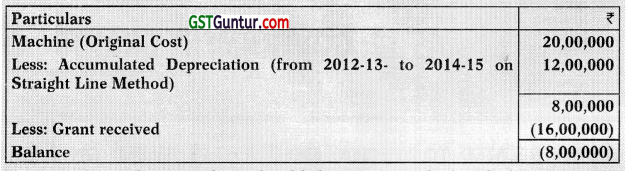

D Ltd. acquired a machine on 01-04-2012 for ₹ 20,00,000. The useful life is 5 years. The company had applied on 01-04-2012, for a subsidy to the tune of 80% of the cost. The sanction letter for subsidy was received in November 2015. The Company’s Fixed Assets Account for the financial year 2015-16 shows a credit balance as under:

You are required to state how should the company deal with this asset in its accounts for 2015-16? (RTP)

Answer:

It can be inferred from above, that the Company follows Reduction Method for accounting of Government Grants.

Accordingly, out of the ₹ 16,00,000 that has been received, ₹ 8,00,000 (being the balance in Machinery A/c) should be credited to the machinery A/c.

The balance ₹ 8,00,000 may be credited to P&L A/c, since already the cost of the asset to the tune of ₹ 12,00,000 had been debited to P&L A/c in the earlier years by way of depreciation charge, and ₹ 8,00,000 transferred to P&L A/c now would be partial recovery of that cost.

There is no need to provide depreciation for 2015-16 or 2016-17 as the depreciable amount is now Nil.

![]()

Question 3.

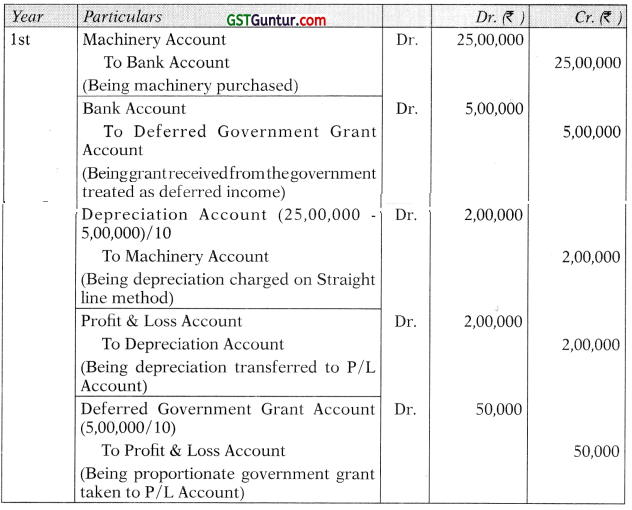

ABC Limited purchased a machinery for ₹ 25,00,000 which has estimated useful life of 10 years with the salvage value of ₹ 5,00,000. On purchase of the assets Central Government pays a grant for ₹ 5,00,000. Pass the journal entries with narrations in the books of the company for the first year, treating grant as deferred income. (5 Marks) (May 12)

Answer:

Journal Entries

Grant Related To Promoters Contribution (Based On Para No. 10)

Question 4.

Santosh Ltd. has received a grant of ₹ 8 crores from the Government for setting up a factory in a backward area. Out of this grant, the company distributed ₹ 2 crores as dividend. Also, Santosh Ltd. received land free of cost from the State Government but it has not recorded it at all in the books as no money has been spent. In the light of AS 12 examine, whether the treatment of both the grants is correct. (2 Marks) (May 2010)

Answer:

Analysis:

As per AS 12 ‘Accounting for Government Grants’, when government grant is received for a specific purpose, it should be utilised for the same.

Also, the grant received for setting up a factory is not available for distribution of dividend.

Even if the company has not spent money for the acquisition of land, land should be recorded in the books of account at a nominal value.

Conclusion:

The treatment of both the elements of the grant is incorrect as per AS 12.

![]()

Question 5.

M/s. A Ltd. has set up its business in a designated backward area with an investment of ₹ 200 Lakhs. The Company is eligible for 25% subsidy and has received ₹ 50 Lakhs from the Government.

Explain the treatment of the Capital Subsidy received from the Government in the Books of the Company. (4 Marks) (May 2015)

Answer:

As per para 10 of AS 12 ‘Accounting for Govt. Grants’, where the government grants are of the nature of promoters’ contribution, i.e., they are given with reference to the total investment in an undertaking or by way of contribution towards its total capital outlay (for example, central investment subsidy scheme) and no repayment is ordinarily expected in respect thereof, the grants are treated as capital reserve.

Analysis:

Subsidy received by A Ltd. is in the nature of promoter’s contribution, since this grant is given with reference to the total investment in an undertaking and by way of contribution towards its total capital outlay and no repayment is ordinarily expected in respect thereof.

Conclusion:

Therefore, this grant should be treated as capital reserve which can be neither distributed as dividend nor considered as deferred income.

Refund Of Government Grants (Based On Para No. 11)

Question 6.

S Ltd. received a grant of ₹ 2,500 lakhs during the accounting year 2010¬11 from government for welfare activities to be carried on by the company for its employees. The grant prescribed conditions for its utilization. However, during the year 2011-12, it was found that the conditions of grants were not complied with and the grant had to be refunded to the government in full. Elucidate the current accounting treatment, with reference to the provisions ofAS-12.

Answer:

As per para 11 of AS 12 Accounting for Government Grants \ Government grants sometimes become refundable because certain conditions are notfulfdled. A government grant that becomes refundable is treated as an extraordinary item as per AS 5.

Analysis:

The amount refundable in respect of a government grant related to revenue is applied first against any unamortized deferred credit remaining in respect of the grant. To the extent that the amount refundable exceeds any such deferred credit, or where no deferred credit exists, the amount is charged immediately to profit and loss statement.

Conclusion:

In the present case, the amount of refund of government grant should be shown in the profit & loss account of the company as an extraordinary item during the year 2011-12.

![]()

Question 7.

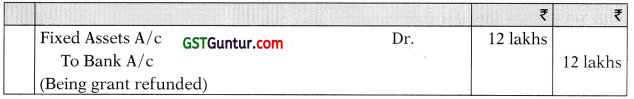

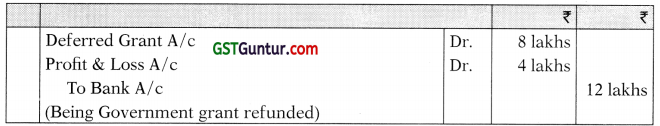

A Ltd. purchased a machinery for ₹ 40 lakhs. (Useful life 4 years and residual value ₹ 8 lakhs) Government grant received is ₹ 16 lakhs.

Show the Journal Entry to be passed at the time of refund of grant and the value of the fixed assets, if:

- the grant is credited to Fixed Assets A/c.

- the grant is credited to Deferred Grant A/c.

Answer:

Journal Entries

(1) If the grant was credited to Fixed Assets Account earlier:

Note: The balance of fixed assets after two years depreciation will be ₹ 16 lakhs (W.N.l) and now it will become (₹ 16 lakhs + ₹ 12 lakhs) = ₹ 28 lakhs on which depreciation will be charged for remaining two years.

Depreciation = (28-8)/2 = ₹ 10 lakhs p.a. will be charged for next two years.

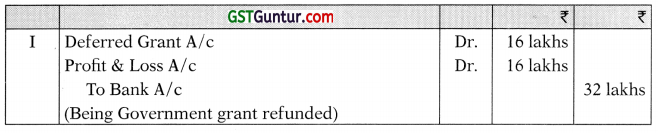

(2) If the grant was credited to Deferred Grant Account earlier:

In the first two years (₹ 16 lakhs/4 years) = ₹ 4 lakhs p.a. × 2 years = ₹ 8 lakhs were credited to Profit and Loss Account and ₹ 8 lakhs were the balance of Deferred Grant Account after two years.

Therefore, on refund in the 3rd year, following entry will be passed:

Note: Deferred grant account will become Nil. The fixed assets will continue to be shown in the books at ₹ 24 lakhs (W.N.2) and depreciation will continue to be charged at ₹ 8 lakhs per annum.

Working Notes:

1. Balance of Fixed Assets after two years but before refund (under 1st alternative)

Fixed assets initially recorded in the books = ₹ 40 lakhs – ₹ 16 lakhs = ₹ 24 lakhs Depreciation p.a. = ₹ 24 lakhs – ₹ 8 lakhs)/4 years = ₹ 4 lakhs per year

Value of fixed assets after two years but before refund of grant

= ₹ 24 lakhs – (₹ 4 lakhs × 2 years) = ₹ 16 lakhs

2. Balance of Fixed Assets after two years but before refund (under 2nd alternative)

Fixed assets initially recorded in the books = ₹ 40 lakhs

Depreciation p.a. = (₹ 40 lakhs – ₹ 8 lakhs)/4 years = ₹ 8 lakhs per year

Book value of hxed assets after two years = ₹ 40 lakhs – (₹ 8 lakhs × 2 years) = ₹ 24 lakh

![]()

Question 8.

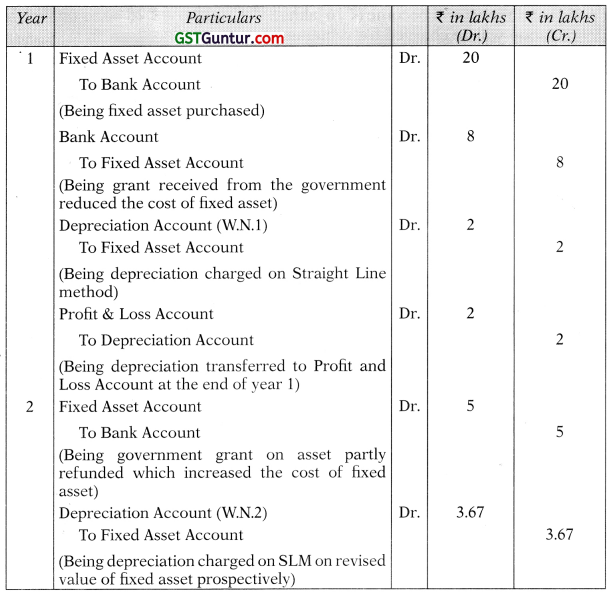

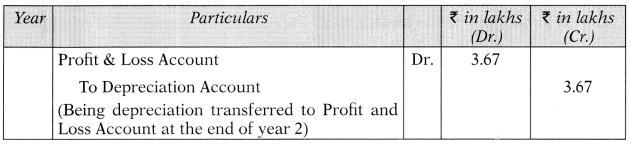

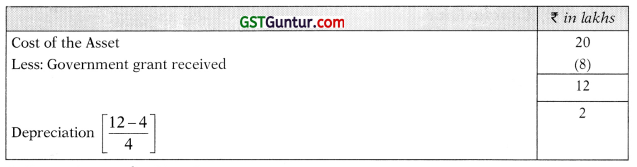

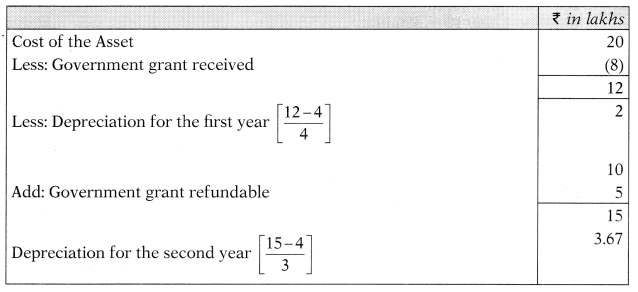

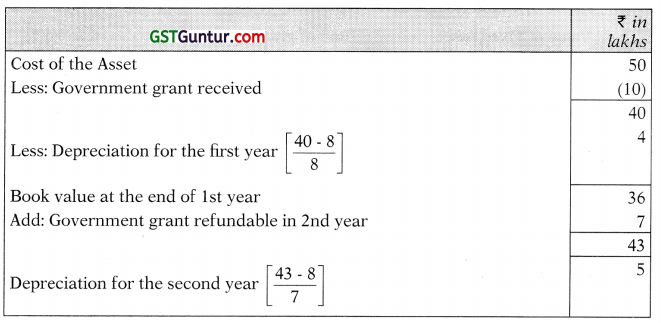

A fixed asset is purchased for ₹ 20 lakhs. Government grant received towards it is ₹ 8 lakhs. Residual Value is ₹ 4 lakhs and useful life is 4 years. Assume depreciation on the basis of Straight-Line method. Asset is shown in the balance sheet net of grant. After 1 year, grant becomes refundable to the extent of ₹ 5 lakhs due to non-compliance with certain conditions. Pass journal entries for first two years. (RTP)

Answer:

Journal Entries

Working Notes:

1. Depreciation for Year 1

2. Depreciation for Year 2

![]()

Question 9.

Y Ltd. received a specific grant of ₹ 300 lakhs for acquiring the plant of ₹ 1,500 lakhs during 2009-10 having useful life of 10 years. The grant received was credited to deferred income and shown in the balance sheet. During 2012-13, due to non-compliance of conditions laid down for the grant the company had to refund the grant to the Government. Balance in the deferred income on that date was ₹ 210 lakhs and written down value of plant was ₹ 1,050 lakhs.

(i) What should be the treatment for the refund of the grant and the effect on cost of the fixed asset and the amount of depreciation to be charged during the year 2012-13 in profit and loss account? Assume that depreciation is charged on assets as per straight line method.

(ii) What should be the treatment of the refund if grant was deducted from the cost of the plant during 2009-10? (RTP)

Answer:

As per para 21 of AS 12, Accounting for Government Grants’, amount refundable in respect of a grant related to revenue should be applied first against any unamortized deferred credit remaining in respect of the grant. To the extent the amount refundable exceeds any such deferred credit, the amount should be charged to the Statement of Profit and Loss.

Analysis of Conclusion :

(i) The grant refunded is ₹ 300 lakhs and balance in deferred income is ₹ 210 lakhs, therefore, ₹ 90 lakhs shall be charged to the Statement of Profit and Loss for the year 2012-13. There will be no effect on the cost of the fixed asset and depreciation charged will be same as charged in the earlier years.

(ii) The book value of the plant shall be increased by ₹ 300 lakhs. The increased cost of ₹ 300 lakhs of the plant should be amortised over 7 years (remaining useful life). Depreciation charged during the year 2012-13 shall be 1200/10 + 300/7= 162.86 lakhs.

![]()

Question 10.

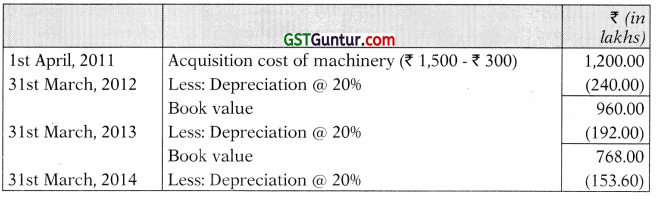

On 1.4.2011, A Ltd. received Government grant of ₹ 300 lakhs for acquisition of machinery costing ₹ 1,500 lakhs. The grant was credited to the cost of the asset. The life of the machinery is 5 years. The machinery is depreciated at 20% on WDV basis. The Company had to refund the grant in May 2014 due to non-fulfilment of certain conditions.

How you would deal with the refund of grant in the books of A Ltd.? (RTP)

Answer:

According to para 21 of AS 12 on Accounting for Government Grants, the amount refundable in respect of a grant related to a specific fixed asset should be recorded by increasing the book value of the asset or by reducing deferred income balance, as appropriate, by the amount refundable. Where the book value is increased, depreciation on the revised book value should be provided prospectively over the residual useful life of the asset.

Analysis of Conclusion :

Depreciation @ 20% on the revised book value amounting ₹ 914.40 lakhs is to be provided prospectively over the remaining useful life of the asset i.e. years ended 31st March, 2015 and 31st March, 2016.

![]()

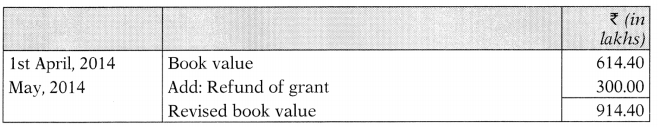

Question 11.

White Ltd. A fixed asset is purchased for ₹ 25 lakhs. Government grant received towards it is ₹ 10 lakhs. Residual Value is ₹ 5 lakhs and useful life is 5 years. Assume depreciation on the basis of Straight-Line method. Asset is shown in the balance sheet net of grant. After 1 year, grant becomes refundable to the extent of ₹ 6 lakhs due to non-compliance with certain conditions. Pass journal entries for first two years. (RTP)

Answer:

Journal Entries

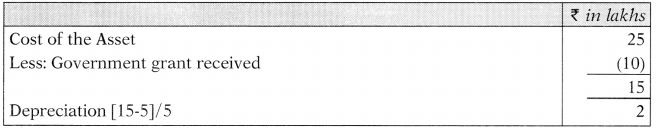

Working Notes:

1. Depreciation for Year 1

2. Depreciation for Year 2

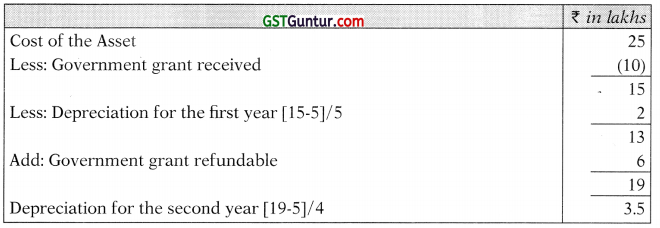

3. Computation of average accumulated expenses

![]()

Question 12.

X Ltd. received a revenue grant of ₹ 10 crores during 2006-07 from Government for welfare activities to be carried on by the company for its employees. The grant prescribed the conditions for utilization.

However, during the year 2008-09, it was found that the prescribed conditions were not fulfilled and the grant should be refunded to the Government.

State how this matter will have to be dealt with in the financial statements of X Ltd. for the year ended 2008-09. (2 Marks) (Nov. 2009)

Answer:

As per para 11 of AS 12 ‘Government Grants’, a grant that became refundable should be treated as an extra-ordinary item as per Accounting Standard 5 ‘Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies’.

The amount refundable in respect of a government grant related to revenue, is applied first against any unamortised deferred credit remaining in respect of the grant. To the extent that the amount refundable exceeds any such deferred credit, or where no deferred credit exists, the amount is charged immediately to profit and loss statement.

Analysis and conclusion:

Refund of grant of ₹ 10 crores should be shown in the profit and loss account of the company as an extraordinary item during the financial year 2008-09.

![]()

Question 13.

Siva Limited received a grant of ₹ 1,500 lakhs during the last accounting year (2009-10) from Government for welfare activities to be carried on by the company for its employees. The grant prescribed conditions for its utilization. However, during the year 2010-11, it w as found that the conditions of the grant were not complied with and the grant had to be refunded to the Government in full. Elucidate the current accounting treatment with reference to the provisions of AS-12. (4 Marks) (May 2011)

Answer:

As per para 11 of AS 12 ‘Accounting for Government Grants ’ Government Grant may, sometimes, become refundable if certain conditions are notfulfiled. A government grant that becomes refundable is treated as extraordinary item as per AS, 5 ‘Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies’.

The amount refundable in respect of a government grant related to revenue is applied first against any unamortized deferred credit remaining in respect of the grant. To the extent that the amount refundable exceeds any such deferred credit, or where no deferred credit exists, the amount is charged immediately to profit and loss statement.

Analysis and conclusion:

The amount of refund of grant of ₹ 1,500 lakhs should be charged to the profit and loss account in the year 2010-2011 as an extraordinary item.

![]()

Question 14.

Explain the treatment of refund of Government Grants as per Accounting Standard 12. (4 Marks) (Nov 2011)

Answer:

Para 11 of AS 12,‘Accounting for Government Grants’, explains treatment of government grants in following situations:

(i) When government grant is related to revenue

(a) When deferred credit account has a balance. The amount of government grant refundable will be adjusted against unamortized deferred credit balance remaining in respect of the grant. To the extent that the amount refundable exceeds any such deferred credit the amount is immediately charged to profit and loss account.

(b) Where no deferred credit account balance exists: The amount of government grant refundable will be charged to profit and Loss account.

(ii) When government grant is related to specific fixed assets

(a) Where at the time of receipt, the amount of government grant reduced the cost of asset The amount of government grant refundable will increase the book value of the asset.

(b) Where at the time of receipt, the amount of government grant was credited to ‘Deferred Grant Account’: The amount of government grant refundable will reduce the capital reserve or unamortized balance of deferred grant account as appropriate.

(iii) When government grant is in the nature of Promoter’s contribution The amount of government grants refundable in part or in full on non-fulfillment of specific conditions, the relevant amount recoverable by the government will be reduced from capital reserve.

A government grant that becomes refundable is treated as an extraordinary item.

![]()

Question 15.

Explain in brief the treatment of Refund of Government Grants in line with AS 12 in the following three situations: (4 Marks) (May 2014)

(i) When Government Grant is related to revenue,

(ii) When Government Grant is related to specific fixed assets,

(iii) When Government Grant is in the nature of Promoter’s contribution.

Answer:

Para 11 of AS 12,‘Accounting for Government Grants’, explains treatment of government grants in following situations:

(i) When government grant is related to revenue

(a) When deferred credit account has a balance. The amount of government grant refundable will be adjusted against unamortized deferred credit balance remaining in respect of the grant. To the extent that the amount refundable exceeds any such deferred credit the amount is immediately charged to profit and loss account.

(b) Where no deferred credit account balance exists: The amount of government grant refundable will be charged to profit and Loss account.

(ii) When government grant is related to specific fixed assets

(a) Where at the time of receipt, the amount of government grant reduced the cost of asset The amount of government grant refundable will increase the book value of the asset.

(b) Where at the time of receipt, the amount of government grant was credited to ‘Deferred Grant Account’: The amount of government grant refundable will reduce the capital reserve or unamortized balance of deferred grant account as appropriate.

(iii) When government grant is in the nature of Promoter’s contribution The amount of government grants refundable in part or in full on non-fulfillment of specific conditions, the relevant amount recoverable by the government will be reduced from capital reserve.

A government grant that becomes refundable is treated as an extraordinary item.

![]()

Question 16.

ABC Ltd. purchased fixed assets for ₹ 50,00,000. Government grant received towards it is 20%. Residual value is ₹ 8,00,000 and useful life is 8 years. Assumed depreciation is on the basis of Straight-Line Method, asset is shown in the Balance Sheet net of grant.

After one year, grant becomes refundable to the extent of ₹ 7,00,000 due to non-compliance of certain conditions.

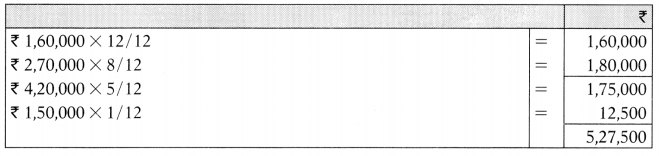

Pass Journal entries for 2nd year in the books of the company. (5 Marks) (May 2016)

Answer:

Journal Entries for 2nd year

Working Note:

Depreciation for year 2

Question 17.

Ram Ltd. purchased machinery for 80 lakhs, (useful life 4 years and residual value 8 lakhs). Government grant received is 32 lakhs. Show the Journal Entry to be passed at the time of refund of grant and the value of the fixed assets in the third year and the amount of depreciation for remaining two years, if : (5 Marks) (May 2017)

(i) the grant is credited to Fixed Assets A/c.

(ii) the grant is credited to Deferred Grant A/c.

Answer:

Journal Entries

(1) If the grant is credited to Fixed Assets Account earlier:

1. Journal Entry (at the time of refund of grant)

2. Value of Fixed Assets after two years but before refund of grant

Fixed assets initially recorded in the books = ₹ 80 lakhs – ₹ 32 lakhs

= ₹ 48 lakhs

Depreciation for each year = (48 lakhs – 8 lakhs)/4 years = ₹ 10 lakhs per year for first two years.

Value of the assets before refund of grant = 48 lakhs – 20 lakhs

= 28 lakhs

The difference between this figure and guaranteed residual value (₹ 50,000) is due to rounding off.

3. Value of Fixed Assets after refund of grant

Value of Fixed Assets before refund of grant – ₹ 28 lakhs

Add Refund of grant – ₹32 lakhs

₹ 60 lakhs

4. Amount of depreciation for remaining two years

Value of the fixed assets after refund of grant -residual value of the assets/No. of years

= ₹ 60 lakhs – ₹ 8 lakhs/2

= ₹ 26 lakhs per annum will be charged for next two years.

![]()

(2) If the grant is credited to Deferred Grant Account earlier:

As per AS 12 ‘Accounting for Government Grants,’ income from Deferred Grant Account is allocated to Profit and Loss account usually over the periods and in the proportions in which depreciation on related assets is charged.

Accordingly, in the first two years (₹ 32 lakhs/4 years) = ₹ 8 lakhs × 2 years = ₹ 16 lakhs will be credited to Profit and Loss Account and ₹ 16 lakhs will be the balance of Deferred Grant Account after two years.

Therefore, on refund of grant, following entry will be passed:

1. Value of Fixed Assets after two years but before refund of grant

Fixed assets initially recorded in the books = ₹ 80 lakhs

Depreciation for each year = (₹ 80 lakhs – ₹ 8 lakhs)/4 years = ₹ 18 lakhs per year

Book value of fixed assets after two years = ₹ 80 lakhs – (₹ 18 lakhs × 2 years) = ₹ 44 lakhs

2. Value of Fixed Assets after refund of grant

On refund of grant the balance of deferred grant account will become nil. The fixed assets will continue to be shown in the books at ₹ 44 lakhs.

3. Amount of depreciation for remaining two years

Depreciation will continue to be charged at ₹ 18 lakhs per annum for the remaining two years.

![]()

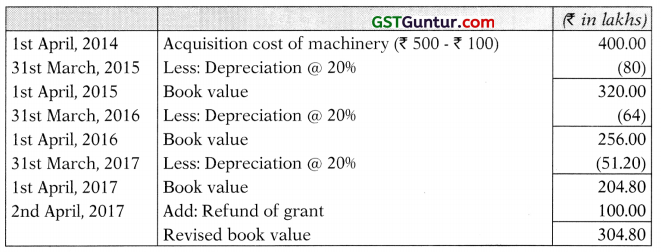

Question 18.

On 01.04.2014, XYZ Ltd. received Government grant of ₹ 100 Lakhs for an acquisition of new machinery costing ₹ 500 lakhs. The grant was received and credited to the cost of the assets. The life span of the machinery is 5 years. The machinery is depreciated at 20% on WDV method.

The company had to refund the entire grant in 2nd April, 2017 due to non-fulfilment of certain conditions which was imposed by the government at the time of approval of grant.

How do you deal with the refund of grant to the Government in the books of XYZ Ltd., as per AS 12? (5 Marks) (May 2018)

Answer:

According to AS 12 on Accounting for Government Grants, the amount refundable in respect of a grant related to a specific fixed asset (if the grant had been credited to the cost of fixed asset at the time of receipt of grant) should be recorded by increasing the book value of the asset, by the amount refundable. Where the book value is increased, depreciation on the revised book value should be provided prospectively over the residual useful life of the asset.

Depreciation @ 20% on the revised book value amounting ₹ 304.80 lakhs is to be provided prospectively over the residual useful life of the asset.