CA Inter FM Study Material PDF can be downloaded from this page. It contains a list of important questions from each chapter. Make use of this ICAI CA Inter Financial Management FM Study Material during the exam preparation. Here we have provided the direct links to download chapter-wise CA Intermediate FM Study Material.

CA Inter Financial Management Practice Manual is designed as per the latest syllabus as per the learning needs of the individuals. The conceptual way important questions are useful to identify the primary topics. Go through the FM Study Material, Chapter Wise Weightage, and Syllabus.

- CA Inter FM Study Material

- CA Inter FM ECO Question Papers

- Financial Management CA Inter Weightage

- CA Inter Financial Management Syllabus

- CA Inter FM Preparation Plan

- FAQs on ICAI CA Inter Financial Management & Economics for Finance Study Material

CA Inter FM Study Material – CA Inter Financial Management Study Material

People can grab this opportunity of learning CA Intermediate Course concepts easily with the free CA Inter FM Financial Management Practice Manual. By preparing your subject using CA Inter FM Study Material, you can move on to the correct track and get success in the exams. CA Inter FM Syllabus Chapter Wise Important Questions and Answers are covered here.

Just refer to the following sections and tap on the quick links to access the CA Inter Financial Management FM Notes Study Material. Along with the study material, we have also given the links to get CA Inter FM Question Papers for free. Use them during exam preparation.

CA Inter FM Study Material – CA Inter Financial Management Practice Manual

- Scope and Objectives of Financial Management

- Types of Financing

- Financial Analysis and Planning-Ratio Analysis

- Cost of Capital

- Financing Decisions-Capital Structure

- Financing Decisions-Leverages

- Investment Decisions

- Risk Analysis in Capital Budgeting

- Dividend Decisions

- Management of Working Capital

CA Inter FM ECO Question Papers

- CA Inter FM ECO Question Paper 1

- CA Inter FM ECO Question Paper 2

- CA Inter FM ECO Paper May 2022

- CA Inter FM ECO Paper Nov 2022

- CA Inter FM ECO Paper July 2021

- CA Inter FM ECO Paper Dec 2021

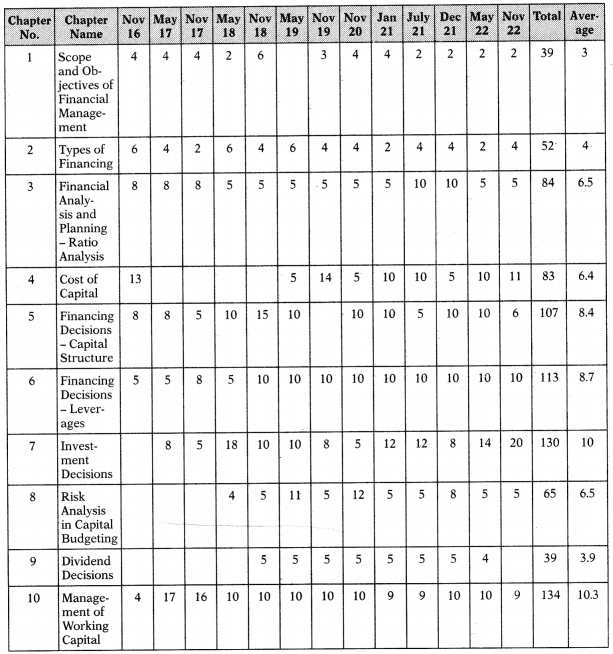

Financial Management CA Inter Weightage

We have listed the marking scheme for all the chapters of the Financial Management paper. Go through the CA Intermediate FM Weightage and prepare a list of topics that has high weightage. Begin your preparation with those high-weightage concepts. Later, prepare the remaining topics. In this manner, you can score the best marks in the Financial Management and Economics for Finance exam.

CA Inter Financial Management Syllabus – CA Inter FM Syllabus

By referring to our latest CA Inter Financial Management and Economics for Finance Syllabus, you can know the chapters and sub-topics involved. Financial Management Inter CA Syllabus even tell us the important concepts we have to focus on. Download the CA Inter Financial Management Exam Syllabus PDF and prepare all the concepts.

Financial Management CA Inter Syllabus

Paper 8: Financial Management and Economics for Finance

(One Paper – Three hours – 100 Marks)

Section A: Financial Management (Marks: 60)

Objective:

To develop an understanding of various aspects of Financial Management and acquire the ability to apply such knowledge in decision-making.

1. Financial Management and Financial Analysis

(i) Introduction to Financial Management Function

(a) Objective and scope of financial management (b) Role and purpose (c) Financial management environment (d) Functions of finance executives in an organization (e) Financial distress and insolvency.

(ii) Financial Analysis through Ratios

(a) Users of the financial analysis (b) Sources of financial data for analysis

(c) Calculation and Interpretation of ratios

Analysing liquidity, Analysing leverage, Analysing solvency, Analysing efficiency/activity, Analysing profitability

(d) Limitations of ratio analysis

2. Financing Decisions

(i) Sources of Finance

(a) Different Sources of Finance, Characteristics of different types of long-term debt and equity finance, Methods of raising long-term finance (b) Different Sources of short-term finance (c) Internal fund as a source of finance (d) International sources of finance (e) Other sources of finance- Lease Financing, Sale and leaseback, Convertible debt, Venture capital, Grants, etc.

(ii) Cost of Capital

(a) Significance of cost of capital (b) Factors of cost of capital (c) Measurement of costs of individual components of capital (d) Weighted average cost of capital (WACC) (e) Marginal cost of capital (f) Effective Interest rate.

(iii) Capital Structure Decisions

(a) Significance of capital structure (b) Determinants of capital structure (c) Capital structure planning and designing (d) Designing of optimum capital structure (e) Theories of Capital Structure and value of the firm-relevancy and Irrelevancy of capital structure (f) EBIT – EPS Analysis, Breakeven – EBIT Analysis (g) Under/Over Capitalisation.

(iv) Leverages

(a) Types of Leverages – Operating, Financial, and Combined (b) Analysis of leverages.

3. Capital Investment and Dividend Decisions

(i) Capital Investment Decisions

(a) Objective of capital investment decisions

(b) Methods of Investment appraisal:

Payback period, Discounted payback period, Accounting Rate of Return (ARR), Net Present Value (NPV) – The meaning of NPV, Strengths, and limitations of NPV method, The working capital adjustment in an NPV analysis, Capital rationing, Equivalent Annual Costs, Internal Rate of return (IRR) – Limitations of the IRR method, Multiple IRRs, Modified Internal Rate of Return (MIRR)- Definition and explanation of MIRR, The process for calculating MIRR, and Strengths of the MIRR approach, Profitability Index.

(ii) Adjustment of Risk and Uncertainty in Capital Budgeting Decision

(a) Probability Analysis (b) Certainty Equivalent Method (c) Risk-Adjusted Discount Rate (d) Scenario Analysis (e) Sensitivity Analysis.

(iii) Dividend Decisions

(a) Basics of Dividends (b) Forms of dividend (c) Determinants of dividend (d) Relevancy and Irrelevancy of Dividend Policies – Traditional Approach, Walter’s model, Gordon’s model, Modigliani, and Miller (MM) Hypothesis.

4. Management of Working Capital

(i) Management of Working Capital

(a) The management of working capital- Liquidity and Profitability (b) The Working capital financing decisions – Primary and Secondary Sources of Liquidity (c) The working Capital Cycle (operating Cycle), Effectiveness of Working Capital based on its operating and cash conversion cycles (d) Assessment of working capital requirement (e) Management of Accounts Receivables (Debtors) (f) Factoring and Forfaiting (g) Management of Accounts Payables (Creditors) (h) Management of Inventory (i) Management of Cash, Treasury management (j) Banking norms of working capital finance.

CA Inter Study Material has an important role to play during the test preparation. Individuals can find the important questions and answers to all concepts in this practice manual.

CA Inter FM Preparation Plan

The best and simple steps that are useful to clear the CA Inter FM Financial Management Paper are provided here. So, interested individuals can note down these steps and prepare well.

- CA preparing candidates must have a basic idea of the business topics and subjects.

- Check out the latest CA Inter Financial Management & Economics for Finance Syllabus to know the chapters and sub-topics.

- Also, check the weightage to know the importance of each chapter.

- For better preparation, you have to start the preparation with difficult concepts first and easy concepts later.

- Covet all the topics as early as possible.

- Refer to the CA Inter Previous Papers, and CA Inter FM notes.

- Take mock tests to test your knowledge.

FAQs on ICAI CA Inter Financial Management & Economics for Finance Study Material

1. Is study material enough for CA Inter?

Students need to have the syllabus, study material, notes, previous papers, and other references provided by ICAI to clear the CA Intermediate subjects.

2. How many attempts are allowed in CA Inter?

Students are allowed 8 times to clear the CA Inter exams successfully.

3. How to download CA Inter FM Study Material?

To download chapter-wise CA Inter Financial Management and Economics for Finance Study Material, visit our page and tap on the links provided above.

Conclusion

We thought that the information and links shared here about CA Inter FM Study Material can be helpful to some extent. Download the practice manual of CA Inter Financial Management PDF. Stay in touch with our site to know more related articles on CA Inter, Foundation, and Final Courses.