CA Inter Advanced Accounts Paper Nov 2020 – Advanced Accounts CA Inter Study Material is designed strictly as per the latest syllabus and exam pattern.

CA Inter Advanced Accounting Question Paper Nov 2020

Question 1.

(a) Rajendra undertook a contract for ₹ 20,00,000 on an arrangement that 80% of the value of work done as certified by the architech of the contractee, should be paid immediately and that the remaining 20% be retained until the contract was completed.

In year 1, the amounts expended were ₹ 8,60,000, the work was certified for ₹ 8,00,000 and 80% of this was paid as agreed. It was estimated that future expenditure to complete the contract would be ₹ 10,00,000.

In year 2, the amounts expended were ₹ 4,75,000. Three-fourths of the Contract was certified as done by December 31 st and 80% of this was received accordingly. It was estimated that future expenditure to complete the Contract would be ₹ 4,00,000.

In year 3, the amounts expended were ₹ 3,10,000 and on June 30th, the whole contract was completed.

Show how Contract revenue would be recognized in the P&L A/c of Mr. Rajendra each year.

Answer:

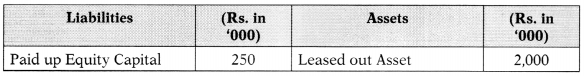

Computation of Expected Profit/Loss:

| Particulars | Year 1 | Year 2 | Year 3 |

| Contract Revenue (A) | 20,00,000 | 20,00,000 | 20,00,000 |

| Contract Cost: | |||

| Incurred | 8,60,000 | 13,35,000(8,60,000 + 4,75,000) | 16,45,000 (13,35,000 + 3,10,000) |

| Estimated further cost | 10,00,000 | 4,00,000 | Nil |

| Total Cost (B) | 18,60,000 | 17,35,000 | 16,65,000 |

| Contract Profit (A – B) | 1,40,000 | 2,65,000 | 3,35,000 |

| Particulars | Year 1 | Year 2 | Year 3 |

| Degree of completion Cost incurred as a % of total cost |

46.24% | 76.95% | 100% |

| Contract Revenue to be re-cognized for the given year | 9,24,800 (20 lacs × 46.24%) |

6,14,200 (20 lacs × 76.95% |

4,61,000 (20 lacs – 15,39,000) |

![]()

(b) Swift Limited acquired patent rights to manufactured Solar Roof Top Panels at a cost of ₹ 600 lacs. The Product life cycle has been estimated to be 5 years and the amortization was decided in the ratio of future cash flows which are estimated as under:

| Year | 1 | 2 | 3 | 4 | 5 |

| Cash Flows (₹ in lacs) | 300 | 300 | 300 | 150 | 150 |

After 3rd year, it was estimated that the patents would have an estimated balance future life of 3 year and Swift Ltd. expected the estimated cash flow after 5th year to be ₹ 75 Lacs. Determine the amortization cost of the patent for each of the above years as per Accounting Standard 26.

Answer:

Same as May 2018 Examination question (Figures X W) – Page 9.111 [Que. 15]

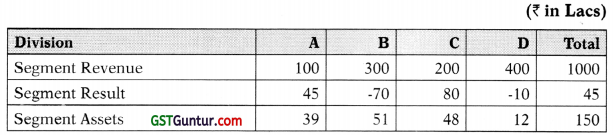

(c) The accountant of Parag Limited has furnished you with the following data related to its Business Divisions :

You are requested to indentify the reportable segment in accordance with the criteria laid down in AS 17.

Answer:

Quantitative thresholds Test:

| Segments | A | B | C | D |

| % segment revenue to total revenue % segment profit to total profits (See Working Note below) |

10% | 30% | 20% | 40% |

| % segment assets to total assets | 26% | 34% | 32% | 8% |

Based on:

(A) Revenue Test – All segments are reportable.

(B) Asset Test – A, B and C are reportable.

Working Note – Profit/Loss Test:

In compliance with AS 17, the segment profit/loss of respective segment will be compared with the greater of the following:

- All segments in profit, Le., A and C – Total profit ₹ 125 lacs.

- All segments in loss, Le., B and D – Total loss ₹ 80 lacs.

Greater of the above – ₹ 125 lacs.

Based on the above, reportable segments will be determined as follows:

| Segment | Profit/ (Loss) | Absolute Profit/Loss as a % of 125 | Reportable Segment |

| A | 45 | 36% | Yes |

| B | (70) | 56% | Yes |

| C | 80 | 64% | Yes |

| D | (10) | 8% | No |

| Total | 45 |

Final Conclusion:

All segments are reportable.

![]()

(d) From the following details of Aditya Limited for accounting year ended on 31st March, 2020 :

| Particulars | ₹ |

| Accounting profit | 15,00,000 |

| Book profit as per MAT | 7,50,000 |

| Profit as per Income tax Act | 2,50,000 |

| Tax Rate | 20% |

| MAT Rate | 7.5% |

Calculated has deferred tax asset/liability as per AS 22 and amount of tax to be debited to the profit and loss account for the year.

Question 2.

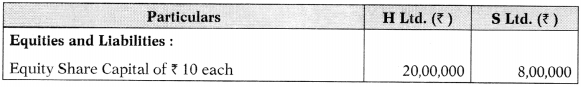

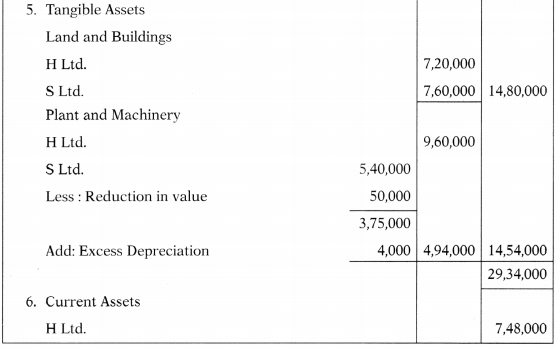

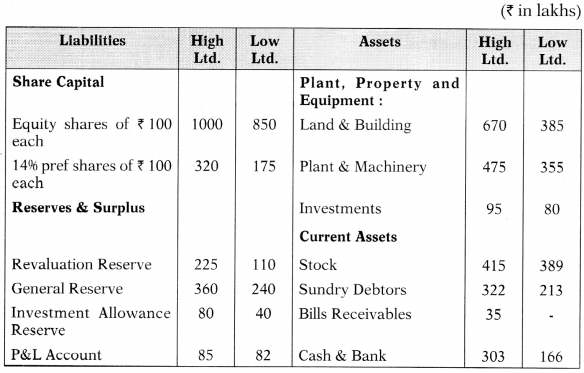

(a) H Limited acquired 64000 Equity Shares of ₹ 10 each in S Ltd. as on 1 st October, 2019. The Balance Sheets of the two companies as on 31 st March, 2020 were as under :

Additional Information

(1) The Profit & Loss Account of S Ltd. showed a balance of ₹ 1,20,000 on 1st April, 2019. S Ltd. paid a dividend of 10% out of the same on 1st November, 2019 for the year 2018-19. The dividend was correctly accounted for by H Ltd.

(2) The Plant & Machinery of S Ltd. which stood at ₹ 6,00,000 on 1st April, 2019 was considered worth ₹ 5,20,000 on the date of acquisition by H Ltd. S Ltd. charges depreciation @ 10% per annum on Plant & Machinery.

Prepare consolidated Balance Sheet of H Ltd. and its subsidiary S Ltd. as on 31st March, 2020 as per Schedule III of the Companies Act, 2013.

Answer:

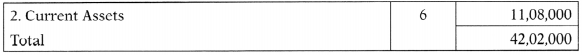

| Step 1:

Date of Acquisition: |

1st October, 2019

| Step 2:

% of Holding: |

| Step 3:

Analysis of Profit (AOP): |

| Particulars | Pre-acquisition profits Pre 1st October, 2019 | Post-Acquisition profits 1st October, 2019 to 31st March, 2020 |

| General Reserve | 4,20,000 Balance on 1st April, 2019 |

|

| Surplus in P&L | 40,000 Balance on 1st April, 2019 Still available (1,20,000 – 10% of 8 lacs) |

|

| Increase in Surplus in P&L Le. Profit for the year = 1,44,000 (3,28,000-40,000) In time ratio – 6 months : 6 months | 1,44,000 | 1,44,000 |

| Preliminary Expenses | (20,000) Balance on 1st April, 2019 | |

| Revaluation of P&M – Loss (See Working note below) [5,20,000 – 5,70,000] | (50,000) | |

| Excess Depreciation [5,20,000 × 10% × 6/12 vs 6,00,000 × 1096 × 6/12] |

4,000 | |

| Total | 5,34,000 | 1,48,000 |

| Holding company’s share (80%) | 4,27,200 | 1,18,400 |

| Minority’s share (20%) | 1,06,800 | 29,600 |

Working Note:

Let us calculate the Book Value on date of acquisition ie. 1st October, 2019: For this purpose, we need depreciation rate;

Book Value on 1st April, 2019 = 6,00,000.

Depreciation rate is 10%.

Thus, Book Value on 1 st October, 2019 = 6,00,000 -10% of 6,00,000 for 6 months = 5,70,000.

| Step 4:

Minority Interest: |

| Particulars | Amount |

| Paid up share capital (8,00,000 X 20%) | 1,60,000 |

| Pre-acquisition profits (Step 3) | 1,06,800 |

| Post-acquisition profits (Step 3) | 29,600 |

| Total | 2,96,400 |

| Step 5:

Cost of Control: |

| Particulars | Amount | Amount |

| Cost of shares | 12,27,200 | |

| Paid up share capital (8,00,000 × 80%) | 6,40,000 | |

| Pre-acquisition profits (Step 3) | 4.27.200 | 10,67,200 |

| Goodwill | 1,60,000 |

| Step 6:

Special Issues: |

1. Revaluation of P&M already taken care in AOR

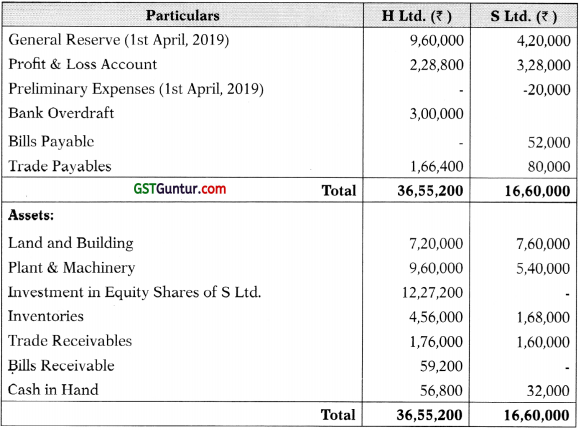

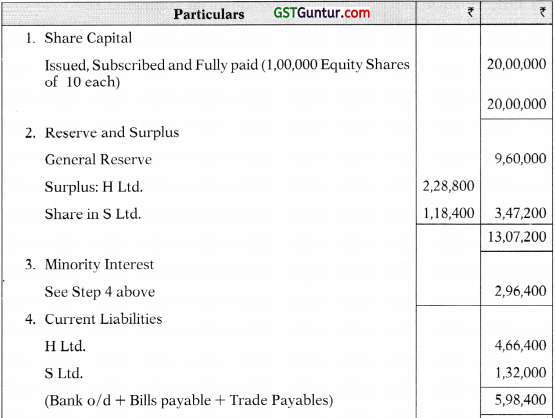

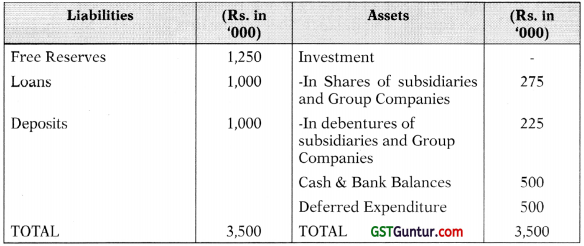

Consolidated Balance Sheet Of H Ltd. And Its Subsidiary S Ltd.

As at 31st March, 2020

![]()

Notes to Accounts

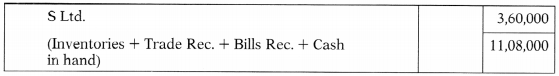

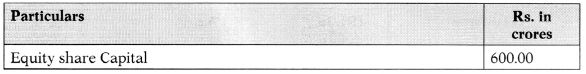

(b) PGL Finance Ltd. is a non-banking financial company. The following information is provided by the company regarding its outstanding amounts, ₹ 600 Lakhs, of which instalments are overdue on 300 accounts for last two months (amount overdue ₹ 150 Lakhs), on 48 accounts for three months (amount overdue ₹ 64 Lakhs), on 20 accounts for more than 30 months (amount overdue ₹ 120 Lakhs) and in 4 accounts for more than three years (amount overdue ₹ 60 Lakhs – already identified as sub-standard asset) and one account of ₹ 40 Lakhs which has been indentified as non-recoverablc by the management. Out of 20 accounts overdue for more than 30 months, 16 accounts are already indentified as sub-standard (amount ₹ 28 Lakhs) for more than fourteen months and others are identified as sub-standard asset for a period of less than fourteen months.

Classify the assets of the company in line with Non-Banking Financial Company – Systematically Important Non-Deposit Taking Company and Deposit taking Company (Reserve Bank) Directions, 2016.

![]()

Question 3.

(a) High Ltd. and Low Ltd. were amalgamated on and from 1st April, 2020. A new company little Ltd. was formed to take over the business of the existing Companies. The Balance sheets of High Ltd. and Low Ltd. as on 31st March, 2020 are as under :

Other information :

- 13% Debenture holders of High Ltd. & Low Ltd. are discharged by Little Ltd. by issuing such number of its 15% Debentures of ₹ 100 each so as to maintain the same amount of interest.

- Preference shareholders of the two companies are issued equivalent number of 15% Preference share of Little Ltd. at a price of ₹ 125 per share (Face Value ₹ 100)

- Little Ltd. will issue 4 Equity shares for each Equity share of High Ltd. & 3 equity shares for each Equity Share of Low Ltd. The share are to be issued ₹ 35 each having a face value of ₹ 10 per share.

- Investment Allowance Reserve is to be maintained for two more years. Prepare the Balance Sheet of Little Ltd. as on 1st April, 2020 after the amalgamation has been carried out in basis of in the nature of purchase.

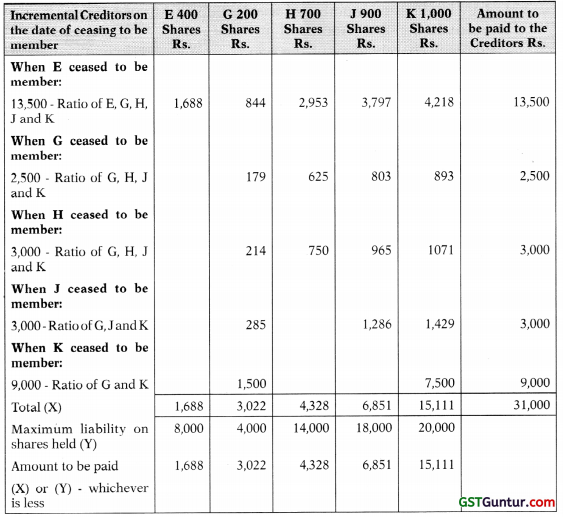

(b) In a winding up of a company creditors remain unpaid. The following persons has transferred their holdings before winding up.

The shares were of Rs. 100 each, Rs. 80 being called up and paid up on the date of transfers.

- A member G, who holds 200 shares died on 28th Feb., 2019 when the amount due to creditors was Rs. 16000. His shares were transmitted to his Son X.

- R was the transferee of shares held by J.R paid Rs. 20 per shares as calls in advance immediately on becoming a member.

- The liquidation of the company commenced on 1st February, 2020. When the liquidator made a call on the present and past contributories to pay the amount.

You are required to quantify the maximum liability of the transferors of shares mentioned in the above the table.

Answer:

Who is not part of List B contributories:

D will not be liable since he transferred his shares prior to one year preceding the date of winding up.

R since he paid calls in advance on becoming a member.

Computation of Liability of List B contributories:

Question 4.

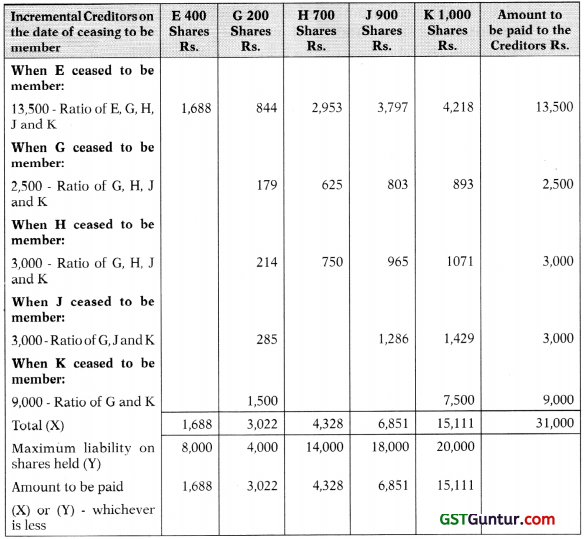

(a) Mohan and Sohan were carrying business in partnership, sharing profit and losses equally. The Balance Sheet of the firm as on 31st March, 2019 stood as under:

The business was carried on till 30th September, 2019. The partners withdrew the amounts equal to half the amount of profit made during the period of six months ended on 30th September, 2019 equally. The profit was calculated after charging depreciation @ 5% per annum on Leasehold premises and 10% per annum on Plant & Machinery.

In the half year, the amounts of Bank Overdraft and Trade Payables stood reduced by Rs. 18,000 and Rs. 12,000 respectively. On 30th September, 2019, the inventories were valued at Rs. 90,000 and Trade Receivables at Rs. 72,000. The Joint Life Policy had been surrendered for Rs. 10,800 before 30th September, 2019 and all other terms remained the same as at 31st March, 2019.

On 30th September, 2019, the firm sold off its business to PKR Limited. The value of Goodwill was fixed at Rs. 1,20,000 and the rest of the assets and liabilities were valued on the basis of their book values as at 30th September, 2019. PKR Ltd. paid the purchase consideration in equity shares of Rs. 10 each.

You are requested to prepare the following:

- Balance Sheet of the Firm as at 30th September, 2019;

- Realisation Account;

- Partners’ Capital Account showing the final settlement between them.

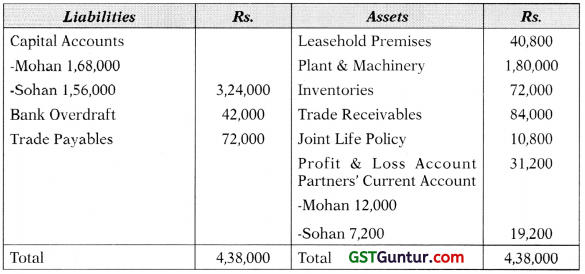

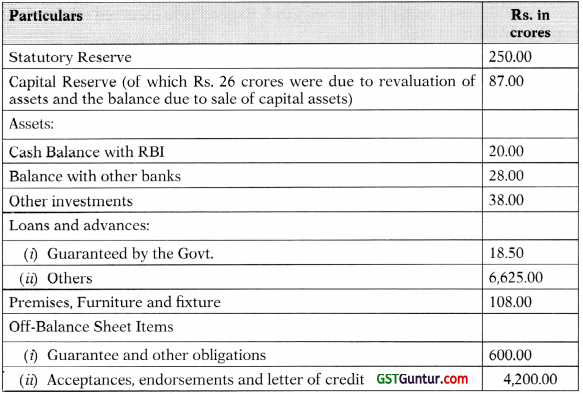

(b) Vikas Finance Ltd. is a Non-Banking Finance Company. The extract of its Balance Sheet are as under:

You are requested to compute the “Net Owned Funds” of Vikas Finance Ltd. as per Non-Banking Finance Company – Systematically Important Non-Deposit taking company and Deposit taking company (Reserve Bank) Direction, 2016.

![]()

Question 5.

(a) Sun Ltd. grants 100 stock options to each of its 1200 employees on 01-04-2016 for Rs. 30, depending upon the employees at the time of vesting of options. Options would be exercisable within a year it is vested. The market price of the share is Rs. 60 each. These options will vest at the end of the year 1 if the earning of Sun Ltd. is 16% or it will vest at end of year 2 if the average earning of two years in 13%, or lastly it will vest at the end of the third year, if the average earning of 3 years is 10%. 6000 unvested options lapsed on 31-3-2017, 5000 unvested options lapsed on 31-03-2018 and finally 4000 unvested options lapsed on 31-03-2019.

The earnings of Sun Ltd. for the three financial years ended on 31 st March, 2017,2018 and 2019 are 15%, 10% and 6%, respectively. 1000 employees exercised their vested options within a year and remaining options were unexercised at the end of the contractual life.

You are requested to give the necessary journal entries for the above and prepare the statement showing compensation expenses to be recognized at the end of the year.

(b) Vasu Commercial Bank has the following capital funds an assets. Segregate the capital funds into Tier I and Tire II capitals. Find out the risk adjusted asset and risk weighted assets ratio.

Question 6.

Answer any four of the following:

(a) Under what circumstances an LLP can be wound up by the tribunal?

(b) Beekey Limited is being wound up by the tribunal. All the assets of the company have been charged to the company’ bankers to whom the company owes Rs. 2.50 crores. The company owes following amounts to other:

| Dues to workers | – Rs. 62,50,000 |

| Taxes payable to Government | -Rs. 15,00,000 |

| Unsecured creditors | – Rs. 30,00,000 |

You are required to compute with reference to the provision of the Companies Act, 2013, the amount each kind of creditors is likely to get if the amount realized by the official liquidator from the secured assets and available for distribution among creditors is only Rs. 2,00,00,000.

(c) M/s. Pasa Ltd. is developing a new production process. During the financial year ended 31st March, 2019, the total expenditure incurred on the process was Rs. 80 lakhs. The production process met the criteria for recognition as an intangible asset on 1st November, 2018. Expenditure incurred till this date was Rs. 42 lakhs.

Further expenditure incurred on the process for the financial year ending 31 st March, 2020 was Rs. 90 lakhs. As on 31 -03-2020, the recoverable amount of know how embodied in the process is estimated to be Rs. 82 lakhs. This included estimates of future cash outflows and inflows.

You are required to work out:

- What is the expenditure to be charged to Profit and Loss Account for the year ended 31st March, 2019?

- What is the carrying amount of the intangible asset as on 31st March, 2019?

- What is the expenditure to be charged to Profit and Loss Account for the year ended 31st March, 2020?

What is the carrying amount of the intangible asset as on 31st March, 2020?

(d) A, B, C and D hold Equity Share Capital in the proportion of 40:30:20:10 and P, Q, R and S hold Preference Share Capital in the proportion of 30:40:20:10 in Alpha Ltd. If the paid up Equity Share Capital of Alpha Ltd. is Rs. 75 lacs and the Preference Share Capital is Rs. 25 lacs, find their voting rights in the case of resolution of winding up of the company.

(e) With reference to AS 29, how would you deal with the following in the Annual Accounts of the company at the Balance Sheet date:

(i) The company operates an offshore oilfield where its licensing agreement requires it to remove the oil rig at the end of production and restore the seabed. Eighty five per cent of the eventual costs relate to the removal of the oil rig and restoration of damage caused by building it, and fifteen per cent arise through the extraction of oil. At the balance sheet date, rig has been constructed but no oil has been extracted.

(ii) The Government introduces a number of changes to the taxation laws. As a result of these changes, the company will need to train a large proportion of its accounting and legal workforce in order to ensure continued compliances with tax law regulations. At the balance sheet date, no retraining of staff has taken place.

Answer:

Part (i)

Present obligation as a result of a past obligating event – The construction of the oil rig creates an obligation under the terms of the licence to remove the rig and restore the seabed and is thus an obligating event. At the balance sheet date, however, there is no obligation to rectify the damage that will be caused by extraction of the oil.

An outflow of resources embodying economic benefits in settlement – Probable.

Conclusion – A provision is recognised for the best estimate of 85% of the eventual costs that relate to the removal of the oil rig and restoration of damage caused by building it (see paragraph 14). These costs are included as part of the cost of the oil rig. The 15% of costs that arise through the extraction of oil are recognised as a liability when the oil is extracted.

Part (ii)

Present obligation as a result of a past obligating event – There is no obligation because no obligating event (retraining) has taken place.

Conclusion – No provision is recognised (see paragraphs 14 and 16-18)