Framework for Preparation – CA Inter Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Framework for Preparation – CA Inter Accounts Study Material

Theory Questions

Question 1. What are the qualitative characteristics that improve the usefulness of information provided in the financial statements? (4 Marks) (Nov 2011)

Answer:

The following qualitative characteristics will help in improving the usefulness of the information provided in the financial statements:

1. Understandability:

Information in financial statements should be presented in a manner that the users with reasonable knowledge of business and economic activities and accounting, may readily understand it. All relevant information should be given therein.

2. Relevance :

The relevance of a piece of information should be judged by its materiality i.e. whether its omission or misstatement can influence economic decisions of users or not. No relevant information should be withheld on the grounds of complexity.

3. Reliability:

The information is said to be reliable when transactions and events reported are represented faithfully and also when they are reported in terms of their substance and economic reality. Prudence concept is also used whenever required.

4. Comparability:

The financial statements should permit both inter-firm and intra firm comparison. One essential feature or requirement of comparability is disclosure of financial effect of change in accounting policies.

![]()

Question 2.

What are the qualitative characteristics of the financial statements which improve the usefulness of the information furnished therein? (4 Marks) (May 2013)

Answer:

The following qualitative characteristics will help in improving the usefulness of the information provided in the financial statements:

1. Understandability:

Information in financial statements should be presented in a manner that the users with reasonable knowledge of business and economic activities and accounting, may readily understand it. All relevant information should be given therein.

2. Relevance :

The relevance of a piece of information should be judged by its materiality i.e. whether its omission or misstatement can influence economic decisions of users or not. No relevant information should be withheld on the grounds of complexity.

3. Reliability:

The information is said to be reliable when transactions and events reported are represented faithfully and also when they are reported in terms of their substance and economic reality. Prudence concept is also used whenever required.

4. Comparability:

The financial statements should permit both inter-firm and intra firm comparison. One essential feature or requirement of comparability is disclosure of financial effect of change in accounting policies.

![]()

Question 3.

Explain in brief, the alternative measurement bases, for determining the value at which an element can be recognized in the Balance Sheet or Statement of Profit and Loss. (4 Marks) (Nov 2016)

Answer:

The Framework for Recognition and Presentation of Financial statements recognizes four alternative measurement bases for the purpose of determining the value at which an element can be recognized in the balance sheet or statement of profit and loss.

These bases are:

- Historical Cost;

- Current cost

- Realisable (Settlement) Value and

- Present Value.

Let us elaborate each one of them.

1. Historical Cost:

Historical cost means acquisition price. According to this, assets are recorded at an amount of cash or cash equivalent paid or the fair value of the asset at the time of acquisition. Liabilities are recorded at the amount of proceeds received in exchange for the obligation.

2. Current Cost:

Current cost gives an alternative measurement basis. Assets are carried out at the amount of cash or cash equivalent that would have to be paid if the same or an equivalent asset was acquired currently. Liabilities are carried at the undiscounted amount of cash or cash equivalents that would be required to settle the obligation currently.

3. Realisable (Settlement) Value:

As per realisable value, assets are carried at the amount of cash or cash equivalents that could currently be obtained by selling the assets in an orderly disposal. Liabilities are carried at their settlement values; ie. the undiscounted amount of cash or cash equivalents paid to satisfy the liabilities in the normal course of business.

4. Present Value:

Under present value convention, assets are carried at present value of future net cash flows generated by the concerned assets in the normal course of business. Liabilities under this convention are carried at present value of future net cash flows that are expected to be required to settle the liability in the normal course of business.

![]()

Question 4.

(a) Write short note on main elements of Financial Statements.

(b) ABC Ltd. has entered into a binding agreement with XYZ Ltd. to buy a custom-made machine amounting to ₹ 4,00,000. As on 31st March, 2016 before delivery of the machine, ABC Ltd. had to change its method of production. The new method will not require the machine ordered and so it shall be scrapped after delivery. The expected scrap value is ‘NIL’.

Show’ the treatment of machine in the books of ABC Ltd. (4 × 2 = 8 Marks) (May 2017)

Answer:

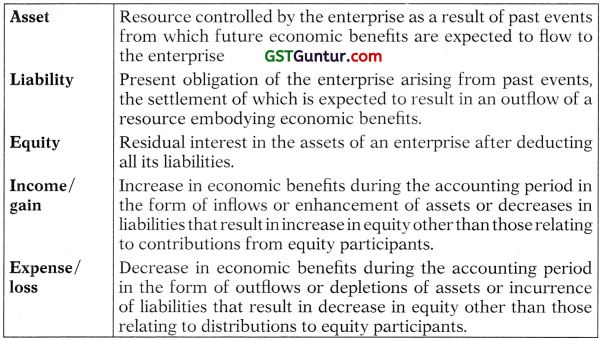

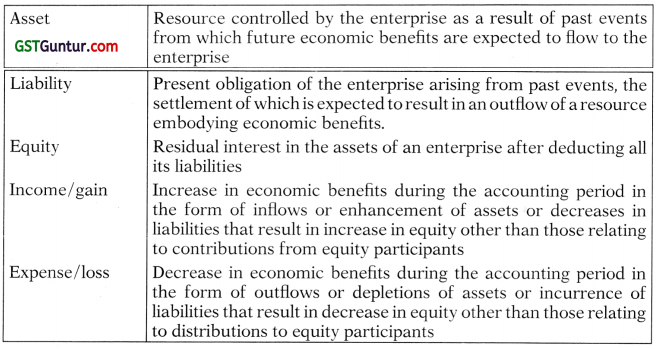

(a) Elements of Financial Statements

The framework classifies items of financial statements can be classified in five broad groups depending on their economic characteristics: Asset, Liability, Equity, Income/Gain and Expense/Loss.

(b) A liability is recognized when outflow of economic resources in settlement of a present obligation can be anticipated and the value of outflow can be reliably measured.

In the given case, ABC Ltd. should recognize a liability of ₹ 4,00,000 payable to XYZ Ltd.

When flow of economic benefit to the enterprise beyond the current accounting period is considered improbable, the expenditure incurred is recognized as an expense rather than as an asset. In the present case, flow of future economic benefit from the machine to the enterprise is improbable. The entire amount of purchase price of the machine should be recognized as an expense.

Hence ABC Ltd. should charge the amount of ₹ 4,00,000 (being loss due to change in production method) to Profit and loss statement and record the corresponding liability (amount payable to XYZ Ltd.) for the same amount in the books for the year ended 31st March, 2016.

![]()

Question 5.

With regard to financial statements name any four : (RTP)

- Users

- Qualitative characteristics

- Elements.

Answer:

- Users of financial statements:

Investors, Employees, Lenders, Supplies/Creditors, Customers, Government & Public - Qualitative Characteristics of Financial Statements:

Understandability, Relevance, Comparability, Reliability & Faithful Representation - Elements of Financial Statements:

Asset, Liability, Equity, Income/Gain and Expense/Loss

Question 6.

(a) Explain in brief, the alternative measurement bases, for determining the value at which an element can be recognized in the Balance Sheet or Statement of Profit and Loss.

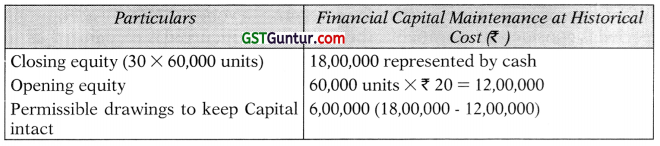

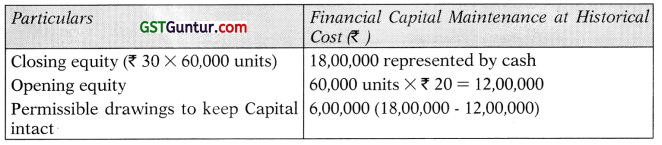

(b) Mohan started a business on 1st April 2017 with ₹ 12,00,000 represented by 60,000 units of ₹ 20 each. During the financial year ending on 31st March, 2018, he sold the entire stock for ₹ 30 each. In order to maintain the capital intact, calculate the maximum amount, which can be withdrawn by Mohan in the year 2017-18 if Financial Capital is maintained at historical cost. (RTP)

Answer:

(a) See similar question above.

(b)

Thus, in order to maintain the capital intact, Mohan can withdraw ₹ 6,00,000 as the maximum amount.

![]()

Question 7.

Briefly explain the elements of financial statements? (4 Marks) (May 2018)

Answer:

Elements of Financial Statements

Question 8.

‘One of the characteristics of the financial statement is neutrality.’ Do you agree with this statement? Explain in brief.

Answer:

Yes, one of the characteristics of financial statements is neutrality. To be reliable, the information contained in financial statement must be neutral, that is free from bias.

Financial Statements are not neutral if by the selection or presentation of information, the focus of analysis could shift from one area of business to another thereby arriving at a totally different conclusion based on the business results.

Information contained in the financial statements must be free from bias. It should reflect a balanced view of the financial position of the company without attempting to present them in biased manner. Financial statements cannot be prepared with the purpose to influence certain division, i.e. they must be neutral.

![]()

Practical Questions

Question 9.

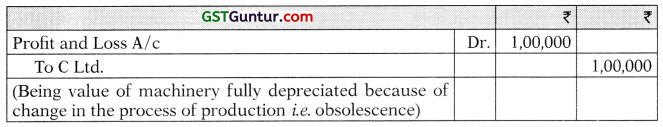

A Ltd. entered into a binding contract with C Ltd. to buy a machine for ₹ 1,00,000. The machine is to be delivered on 15th February, 2009. On 1st January, 2009, A Ltd. changed its process of production. The new process will not require the machine ordered and it shall have to be scrapped after delivery. The expected scrap value of the machine is nil.

Explain how A Ltd. should recognise the entire transaction in the books of account for the year ended 31st March, 2009. (2 Marks) (Nov 2009)

Answer:

A Ltd. entered into a binding contract with C Ltd. and therefore, it should recognise a liability of ₹ 1,00,000. The entire amount of purchase price of the machine should be recognised in the year ended 31st March, 2009 as loss because future economic benefit from the machine to the enterprise is improbable.

The accounting entry should be as follows:

Question 10.

ABC Ltd. has entered into a binding agreement with XYZ Ltd. to buy a custom-made machine amounting to ₹ 4,00,000. As on 31 st March, 2016 before delivery of the machine, ABC Ltd. had to change its method of production. The new method will not require the machine ordered and so it shall be scrapped after delivery. The expected scrap value is ‘NIL’.

Show the treatment of machine in the books of ABC Ltd. (4 Marks) (May 2017)

Answer:

A liability is recognized when outflow of economic resources in settlement of a present obligation can be anticipated and the value of outflow can be reliably measured. In the given case, ABC Ltd. should recognize a liability of ₹ 4,00,000 payable to XYZ Ltd.

When flow of economic benefit to the enterprise beyond the current accounting period is considered improbable, the expenditure incurred is recognized as an expense rather than as an asset. In the present case, flow of future economic benefit from the machine to the enterprise is improbable. The entire amount of purchase price of the machine should be recognized as an expense.

Hence ABC Ltd. should charge the amount of ₹ 4,00,000 (being loss due to change in production method) to Profit and loss statement and record the corresponding liability (amount payable to XYZ Ltd.) for the same amount in the books for the year ended 31st March, 2016.

![]()

Question 11.

Shankar started a business on 1 st April, 2017 with ₹ 12,00,000 represented by 60,000 units of ₹ 20 each. During the financial year ending on 31st March, 2018, he sold the entire stock for ₹ 30 each. In order to maintain the capital intact, calculate the maximum amount, which can be withdrawn by Shankar in the year 2017-18 if Financial Capital is maintained at Historical cost. (4 Marks) (May 2018)

Answer:

Therefore, ₹ 6,00,000 is the maximum amount which can be withdrawn by Shankar in the year 2017-18 if the Financial Capital Maintenance is maintained at Historical Cost.