Insurance Claims for Loss of Stock and Loss of Profit – CA Inter Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Insurance Claims for Loss of Stock and Loss of Profit – CA Inter Accounts Study Material

Theory Questions

Question 1.

What is Consequential loss policy and what items are generally covered by such policy? (4 marks) (May 2017)

Answer:

Business enterprises get insured against the loss of stock on the happening of certain events such as fire, flood, theft, earthquake etc. Insurance being a contract of indemnity, the claim for loss is restricted to the actual loss of assets. Sometimes an enterprise also gets itself insured against consequential loss of profit due to decreased turnover, increased expenses etc.

If loss of profits consequent to the event or mis-happening (Fire, flood, theft etc.) is also insured, the policy is known as loss of profit or consequential loss policy.

The Loss of Profit Policy normally covers the following items:

- Loss of net profit

- Standing charges.

- Any increased cost of working e.g., renting of temporary premises.

Loss Of Stock — Simple Questions

Question 2.

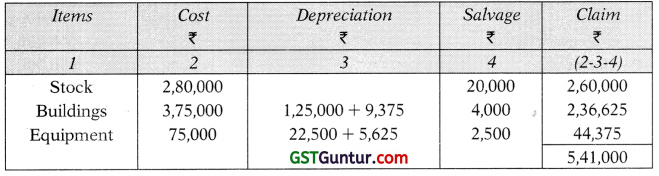

The premises of X Ltd. caught fire on 22nd January, 2013 and the stock was damaged. The value of goods salvaged was negligible. The firm made up accounts to 31st March each year. On 31st March, 2012 the stock at cost was ₹ 13,27,200 as against ₹ 9,62,200 on 31st March, 2011.

Purchases from 1st April, 2012 to the date of fire were ₹ 34,82,700 as against ₹ 45,25,000 for the full year 2011-12 and the corresponding sales figures were ₹ 49,17,000 and ₹ 52,00,000 respectively.

You are given the following further information:

- In July, 2012, goods costing ₹ 1,00,000 were given away for advertising purposes, no entries being made in the books.

- The rate of gross profit is constant.

X Ltd. had taken an insurance policy of ₹ 5,50,000 which was subject to the average clause. From the above information, you are required to make an estimate of the stock in hand on the date of fire and compute the amount of the claim to be lodged to the insurance company. (RTP)

Answer:

Memorandum Trading Account

[From 1st April, 2012 to 22nd January, 2013]

Computation showing Claim for loss of stock:

Since policy amount is less than claim amount, claim will be restricted to policy amount only. Therefore, claim of ₹ 5,50,000 should be lodged by X Ltd. to the insurance company.

Working Note 1:

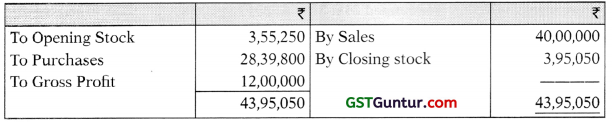

Trading Account for the year ended on 31st March, 2012

Rate of gross profit to sales = 10,40,000/52,00,000 × 100 = 20%.

![]()

Question 3.

The premises of A Ltd. caught fire on 22nd January, 2017, and the stock was damaged. The firm makes account up to 31st March each year. On 31st March, 2016 the stock at cost was ₹ 6,63,600 as against ₹ 4,81,100 on 31st March, 2015.

Purchases from 1st April, 2016 to the date of fire were ₹ 17,41,350 as against ₹ 22,62,500 for the full year 2015-16 and the corresponding sales figures were ₹ 24,58,500 and ₹ 26,00,000 respectively. You are given the following further information:

- In July, 2016, goods costing ₹ 50,000 were given away for advertising purposes, no entries being made in the books.

- During 2016-17, a clerk had misappropriated unrecorded cash sales. It is estimated that the defalcation averaged ₹ 1,000 per week from 1st April, 2016 until the clerk was dismissed on 18th August, 2016.

- The rate of gross profit is constant.

From the above information calculate the stock in hand on the date of fire. (RTP)

Answer:

Let us first of all ascertain the rate of gross profit for the year 2015-16;

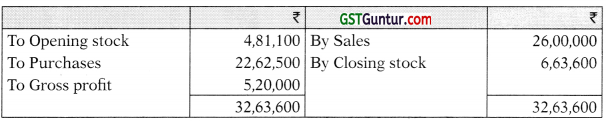

Trading A/c for the year ended 31-3-2016

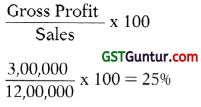

Rate of gross profit \(=\frac{\mathrm{GP}}{\text { Sales }}\) × 100

= \(\frac{5,20,000}{26,00,000}\) × 100 = 20%

Memorandum Trading A/c for the period from 1-4-2016 to 22-1-2017

Stock in hand on the date of fire was ₹ 3,72,150.

Working Note showing cash sales defalcated by the Accountant:

Defalcation period = 1-4-2016 to 18-8-2016 = 140 days

Since, 140 days/7 weeks = 20 weeks

Therefore, amount of defalcation = 20 weeks × ₹ 1,000 = ₹ 20,000.

Question 4.

A fire broke out in the godown of a business house on 8th July, 2009. Goods costing ₹ 2,03,000 in a small sub-godown remain unaffected by fire. The goods retrieved in a damaged condition from the main godown were valued at ₹ 1,97,000.

The following particulars were available from the books of account:

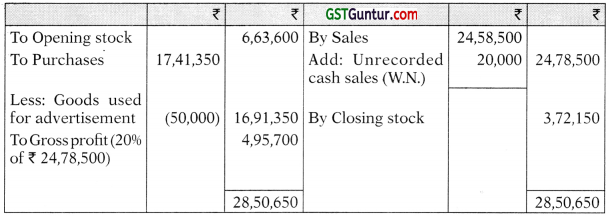

Stock on the last Balance Sheet date at 31st March, 2009 was ₹ 15,72,000. Purchases for the period from 1st April, 2009 to 8th July, 2009 were ₹ 37,10,000 and sales during the same period amounted to ₹ 52,60,000. The average gross profit margin was 30% on sales.

The business house has a fire insurance policy for ₹ 10,00,000 in respect of its entire stock. Assist the Accountant of the business house in computing the amount of claim of loss by fire. (8 marks) (Nov. 2009)

Answer:

Computation showing the amount of claim:

Application of average clause:

Amount of claim \(=\frac{\text { Amount of policy }}{\text { Stock on the date of fire }}\) × Loss of stock

= \(\frac{\text { Rs. } 10,00,000}{\text { Rs. } 16,00,000}\) × 12,00,000

= ₹ 7,50,000

Working Note:

Memorandum Trading Account for the period from 1st April, 2009 to 8th July, 2009

![]()

Question 5.

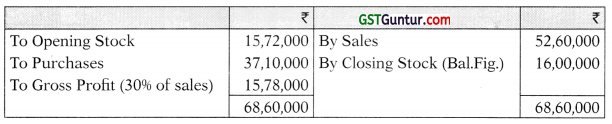

On 30th March, 2011 tire occurred in the premises of M/s Suraj Brothers. The concern had taken an insurance policy of ₹ 60,000 which was subject to the average clause. From the books of account, the following particulars are available relating to the period 1st January to 30th March, 2011.

- Stock as per Balance Sheet at 31st December, 2010, ₹ 95,600.

- Purchases (including purchase of machinery costing ₹ 30,000) ₹ 1,70,000

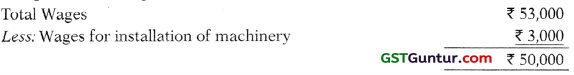

- Wages (including wages ₹ 3,000 for installation of machinery) ₹ 50,000.

- Sales (including goods sold on approval basis amounting to ₹ 49,500) ₹ 2,75,000. No approval has been received in respect of 2/3rd of the goods sold on approval.

- The average rate of gross profit is 20% of sales.

- The value of the salvaged goods was ₹ 12,300.

You are required to compute the amount of the claim to be lodged to the insurance company. (5 marks) (May 2011)

Answer:

Computation showing the claim for loss of stock

A claim of ₹ 48,211 should be lodged by M/s Suraj Brothers to the insurance company.

Working Notes:

I. Calculation of closing stock as on 30th March, 2011

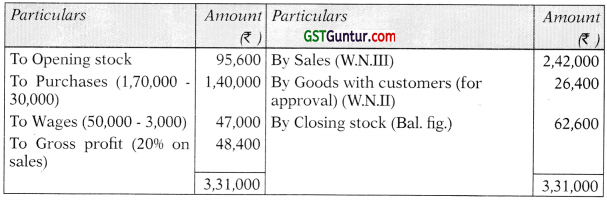

Memorandum Trading Account for (from 1st January, 2011 to 30th March, 2011)

II. Computation of goods with customers

Since no approval for sale has been received for the goods of ₹ 33,000 (ie. 2/3 of ₹ 49,500) hence, these should be valued at cost ie. ₹ 33,000 – 20% of ₹ 33,000 = ₹ 26,400.

III. Computation of actual sales

Total sales – Sale of goods on approval = ₹ 2,75,000 – ₹ 33,000 = ₹ 2,42,000.

Question 6.

On 29th August, 2012, the godown of a trader caught fire and a large part of the stock of goods was destroyed. However, goods costing ₹ 1,08,000 could be salvaged incurring firefighting expenses amounting to ₹ 4,700.

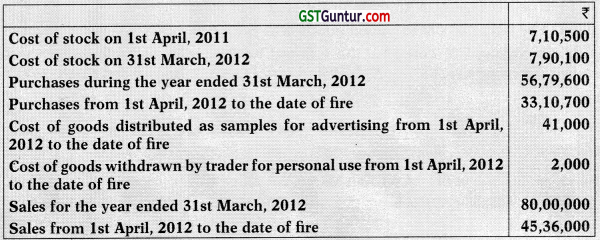

The trader provides you the following additional information:

The insurance company also admitted firefighting expenses. The trader had taken the fire insurance policy for ₹ 9,00,000 with an average clause.

Calculate the amount of the claim that will be admitted by the insurance company. (8 Marks) (Nov. 2012)

Answer:

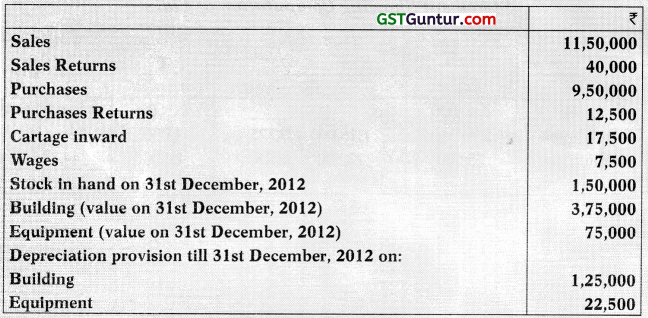

Memorandum Trading Account for the period 1st April, 2012 to 29th August, 2012

Statement showing computation of Insurance Claim

Note:

Since policy amount is more than claim amount, average clause will not apply. Therefore, claim amount of ₹ 7,79,300 will be admitted by the Insurance Company.

Working Note:

Trading Account for the year ended 31st March, 2012

Rate of Gross Profit in 2011 -12

![]()

Question 7.

On 15th December, 2012, a fire occurred in the premises of M/s. OM Exports. Most of the stocks were destroyed. Cost of stock salvaged being ₹ 1,40,000. From the books of account, the following particulars were available:

- Stock at the close of account on 31st March, 2012 was valued at ₹ 9,40,000.

- Purchases from 1-4-2012 to 15-12-2012 amounted to ₹ 13,20,000 and the sales during that period amounted to ₹ 20,25,000.

On the basis of his accounts for the past three years, it appears that average gross profit ratio is 20% on sales.

Compute the amount of the claim, if the stock were insured for ₹ 4,00,000. (5 marks) (May 2013)

Answer:

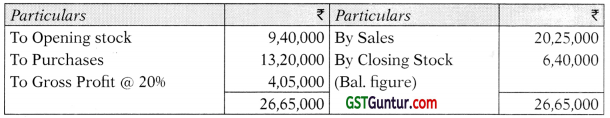

Memorandum Trading Account For the period 1-4-2012 to 15-12-2012

Statement showing computation of Claim

As the value of stock is more than insured value, amount of claim would be subject to average clause.

Amount of Claim \(=\frac{\text { Amount of Policy }}{\text { Value of Stock }}\) × Actual Loss of

Amount of Claim = \(\frac{4,00,000}{6,40,000}\) × 5 00,000 = ₹ 3,12,500

![]()

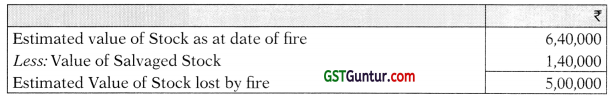

Question 8.

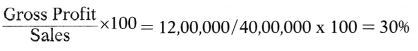

A fire occurred in the premises of M/s. Kailash & Cc. on 30th September, 2013. From the following particulars relating to the period from 1 st April, 2013 to 30th September, 2013, you are required to ascertain the amount of claim to be filed with the Insurance Company for the loss of Stock. The company has taken an Insurance policy for ₹ 75,000 which is subject to average clause. The value of goods salvaged was estimated at ₹ 27,000. The average rate of Gross Profit was 20% throughout the period.

(8 marks) (Nov. 2014)

Answer:

Memorandum Trading Account for the period 1st April, 2013 to 30th Sept., 2013

Statement showing computation of Insurance Claim

Note:

Since policy amount is less than claim amount, average clause will apply. Therefore, claim amount will be computed by applying the formula

Claim \(=\frac{\text { Insured value }}{\text { Total cost }}\) × Loss suffered

Claim amount = ₹ 60,689 (1,14,500 × 75,000/1,41,500)

Question 9.

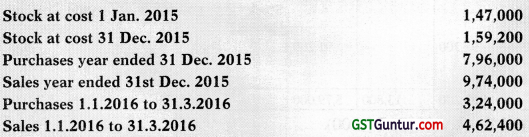

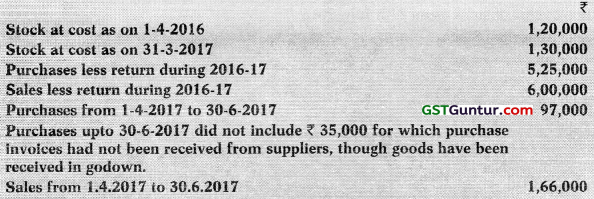

On 1st April, 2016 the stock of Mr. Hariprasad was destroyed by fire but sufficient records were saved from which following particulars w ere ascertained:

In valuing the stock for the Balance Sheet at 31st Dec. 2015 ₹ 4,600 had been written off on certain stock which was a poor selling line having the cost ₹ 13,800. A portion of these goods were sold in March, 2016 at a loss of ₹ 500 on original cost of ₹ 6,900. The remainder of this stock was now estimated to be worth its original cost. Subject to the above exception gross profit had remained at a uniform rate throughout the year.

The value of stock salvaged was ₹ 11,600. The policy was for ₹ 1,00,000 and was subject to average clause.

Work out the amount of the claim of loss by fire. (8 Marks) (Nov. 2016)

Answer:

Trading Account for year 2015

The (normal) rate of gross profit to sales is = \(\frac{1,94,800}{9,74,000}\) × 100 = 20%

Memorandum Trading Account upto March 31, 2016

* At cost. (Its Book value is ₹ 9,200).

Computation of Insurance Claim:

Claim subject to average clause:

\(=\frac{\text { Amount of policy }}{\text { Value of Stock }}\) × Actual Loss of Stock

= \(\frac{1,00,000}{1,16,100}\) × 1,04,500

= ₹ 90,009

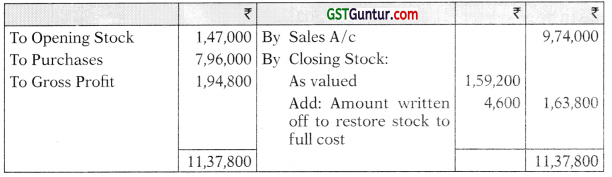

Question 10.

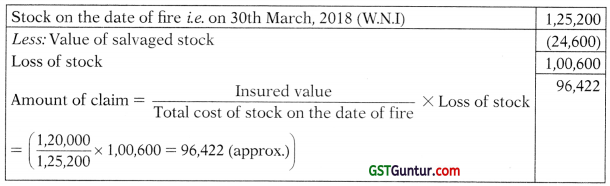

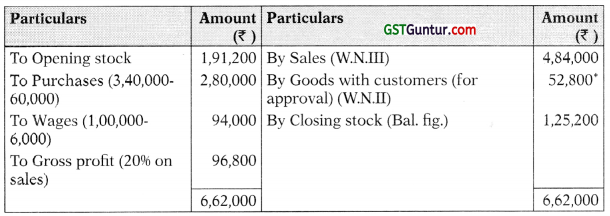

On 30th March, 2018 fire occurred in the premises of M/s Alok & Co. The concern had taken an insurance policy of ₹ 1,20,000 which was subject to the average clause. From the books of account, the following particulars are available relating to the period 1st January to 30th March, 2018:

No approval has been received in respect of 2/ 3rd of the goods sold on approval.

(v) The average rate of gross profit is 20% of sales.

(vi) The value of the salvaged goods was ₹ 24,600

You are required to compute the amount of the claim to be lodged to the Insurance Company. (May 2018) (10 Marks)

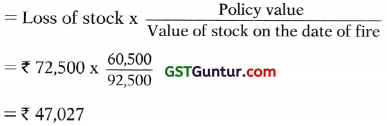

Answer:

Computation showing the claim for loss of stock

A claim of ₹ 96,422 should be lodged bv M/s Alok & Co. to the insurance company.

Working Notes:

I. Calculation of closing stock as on 30th March, 2018

Memorandum Trading Account for the period (from 1st January, 2018 to 30th March, 2018)

* This would form part of closing stock (since there has been no sale).

II. Calculation of goods with customers

Since no approval for sale has been received for the goods of ₹ 66,000 (ie. 2/3 of < 99,000) hence, these should be valued at cost ie. ₹ 66,000 – 20% of ₹ 66,000 = ₹ 52,800.

III. Calculation of actual sales

Total sales – Sale of goods on approval (2 /3rd) = ₹ 5,50,000 – ₹ 66,000 = ₹ 4,84,000.

![]()

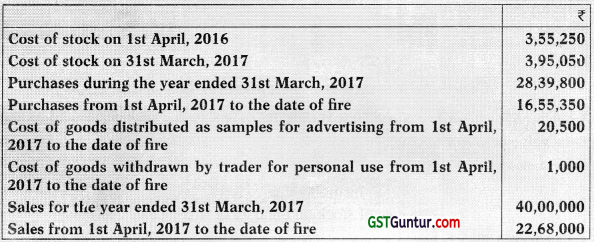

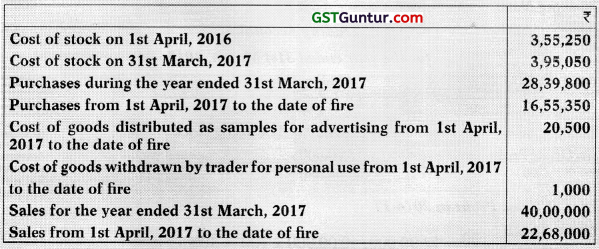

Question 11.

A trader’s godown caught fire on 29th August, 2017, and a large part of the stock of goods was destroyed. However, goods costing ₹ 54,000 could be salvaged incurring firefighting expenses amounting to ₹ 2,350.

The trader provides you the following additional information:

The insurance company also admitted firefighting expenses. The trader had taken the fire insurance policy for ₹ 4,50,000 with an average clause.

You are required to calculate the amount of the claim that will be admitted by the insurance company.

Answer:

Memorandum Trading Account for the period 1st April, 2017 to 29th August, 2017

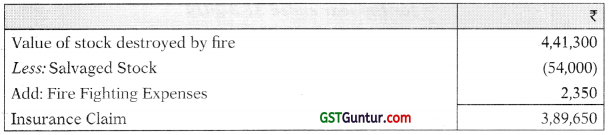

Statement Showing computation of Insurance Claim

Note:

Since policy amount is more than claim amount, average clause will not apply. Therefore, claim amount of ₹ 3,89,650 will be admitted by the Insurance Company.

Working Note:

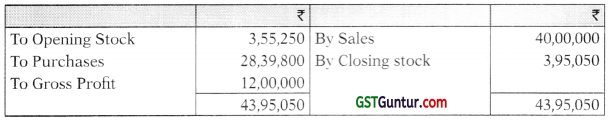

Trading Account for the year ended 31st March, 2017

Rate of Gross Profit in 2016-17

Gross profit/Sales × 100 = 12,00,000/40,00,000 × 100 = 30%

Question 12.

The premises of V Ltd. caught fire on 22nd January, 2015, and the stock was damaged. The firm makes account up to 31st March each year. On 31st March, 2014 the stock at cost was ₹ 13,27,200 as against ₹ 9,62,200 on 31st March, 2013.

Purchases from 1st April, 2014 to the date of fire were ₹ 34,82,700 as against ₹ 45,25,000 for the full year 2013-14 and the corresponding sales figures were ₹ 49,17,000 and ₹ 52,00,000 respectively. You are given the following further information:

- In July, 2014, goods costing ₹ 1,00,000 were given away for advertising purposes, no entries being made in the books.

- During 2014-15, a clerk had misappropriated unrecorded cash sales. It is estimated that the defalcation averaged ₹ 2,000 per w eek from 1st April, 2014 until the clerk was dismissed on 18th August, 2014.

- The rate of gross profit is constant.

From the above information calculate the stock in hand on the date of fire.

Answer:

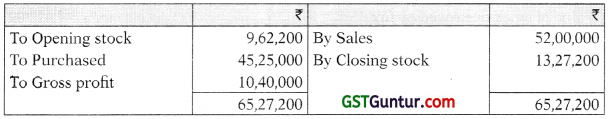

Let us first of all ascertain the rate of gross profit for the year 2013-14.

Trading A/c for the year ended 31-3-2014

Rate of gross profit \(=\frac{\mathrm{GP}}{\text { Sales }}\) × 100

\(\frac{10,40,000}{52,00,000}\) × 100 = 20%

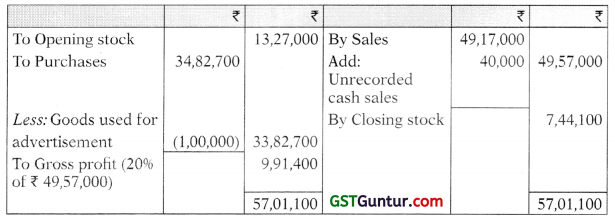

Memorandum Trading A/c for the period from 1-4-2014 to 22-1-2015

Estimated stock in hand on the date of fire = ₹ 7,44,100.

Working Note showing cash sales defalcated by the Accountant:

Defalcation period = 1.4.2014 to 18.8.2014 = 140 days

Since, 140 days/7 weeks = 20 weeks

Therefore, amount of defalcation = 20 weeks × ₹ 2,000 = ₹ 40,000.

Question 13.

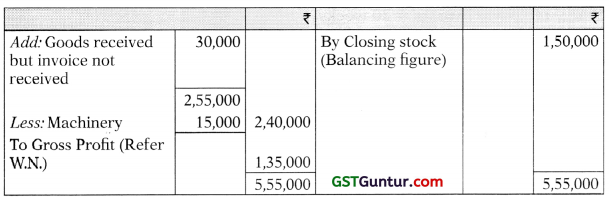

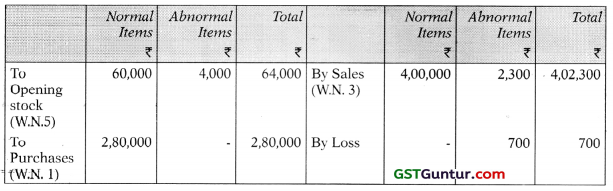

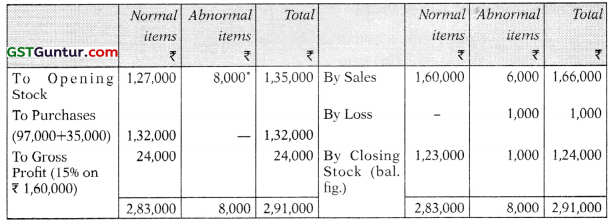

On 2.6.2018 the stock of Mr. B was destroyed by fire. However, following particulars were furnished from the records saved:

Sales upto 2.6.2018 includes ₹ 75,000 being the goods not dispatched to the customers. The sales invoice price is ₹ 75,000.

Purchases upto 2.6.2018 includes a machinery acquired for ₹ 15,000.

Purchases upto 2.6.2018 does not include goods worth ₹ 30,000 received from suppliers, as invoice not received upto the date of fire. These goods have remained in the godown at the time of fire. The insurance policy is for ₹ 1,20,000 and it is subject to average clause. Ascertain the amount of claim for loss of stock.

Answer:

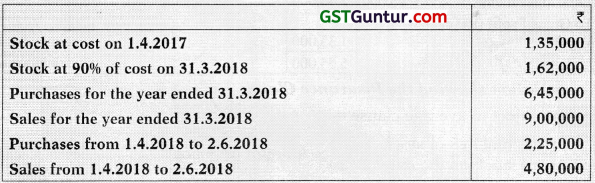

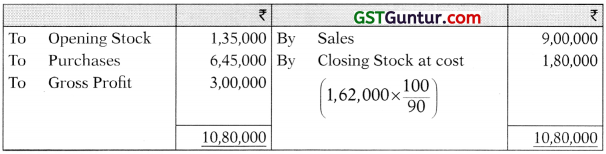

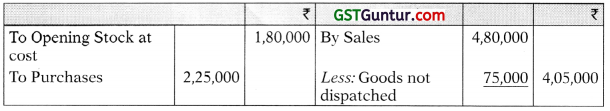

Trading Account for the year ended 31.3.2018

Memorandum Trading A/c for the period from 1.4.2018 to 2.6.2018

Computation showing the Insurance Claim:

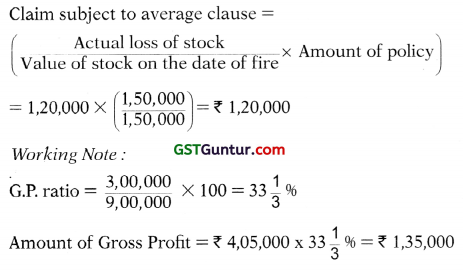

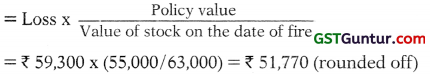

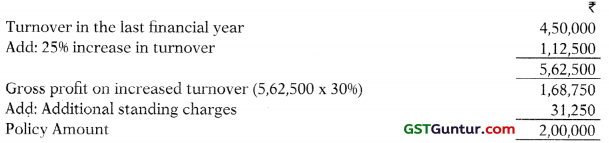

Claim subject to average clause =

![]()

Question 14.

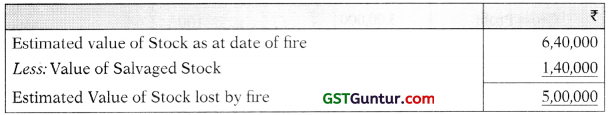

On 15th December, 2017, a fire occurred in the premises of M/s. XYZ. Most of the stocks were destroyed. Cost of stock salvaged being ₹ 1,40,000. Stock on 15 th December, 2017 was valued at ₹ 6,40,000. Compute the amount of the claim, if the stock were insured for ₹ 4,00,000.

Answer:

As the value of stock is more than insured value, amount of claim would be subject to average clause.

Amount of Claim \(=\frac{\text { Amount of Policy }}{\text { Value of Stock }}\) × Actual Loss of Stock

Amount of Claim = \(\frac{4,00,000}{6,40,000}\) × 5,00,000 = ₹ 3,12,500

Question 15.

A trader’s godown caught fire on 29th August, 2017, and a large part of the stock of goods was destroyed. However, goods costing ₹ 54,000 could be salvaged incurring firefighting expenses amounting to ₹ 2,350.

The trader provides you the following additional information:

The insurance company also admitted firefighting expenses. The trader had taken the fire insurance policy for ₹ 4,50,000 with an average clause.

You are required to calculate the amount of the claim that will be admitted by the insurance company.

Answer:

Memorandum Trading Account for the period 1st April, 2017 to 29th August, 2017

Statement Showing Computation of Insurance Claim

Note:

Since policy amount is more than claim amount, average clause will not apply. Therefore, claim amount of ₹ 3,89,650 will be admitted by the Insurance Company.

Working Note:

Trading Account for the year ended 31st March, 2017

Rate of Gross Profit in 2016-17

Loss Of Stock — Advanced

Question 16.

A fire occurred in the premises of M/s. Fireproof Co. on 31st August, 2010. From the following particulars relating to the period from 1st April, 2010 to 31st August, 2010, you are requested to ascertain the amount of claim to be filed with the insurance company for the loss of stock. The concern had taken an insurance policy for ₹ 60,000 which is subject to an average clause.

While valuing the stock at 31st March, 2010, ₹ 1,000 were written off in respect of a slow-moving item. The cost of which was ₹ 5,000. A portion of these goods were sold at a loss of ₹ 500 on the original cost of ₹ 2,500. The remainder of the stock is now estimated to be worth the original cost. The value of goods salvaged was estimated at ₹ 20,000. The average rate of gross profit was 20% throughout. (10 marks) (Nov. 2011)

Answer:

Memorandum Trading Account for the period 1st April, 2010 to 31st August, 2010

Statement showing computation of Claim for Loss of Stock

Amount of claim to be lodged with insurance company

Working Note:

Computation of Adjusted Purchases:

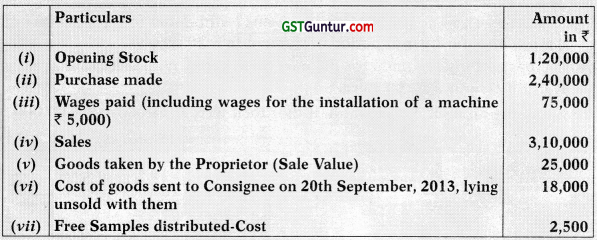

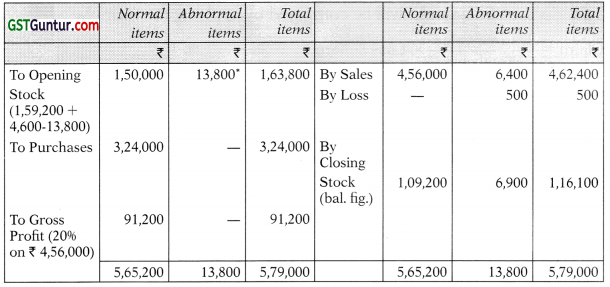

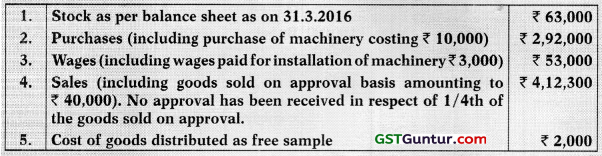

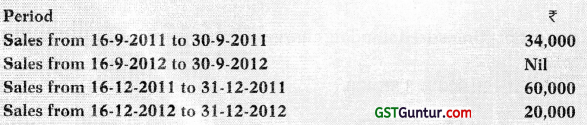

Question 17.

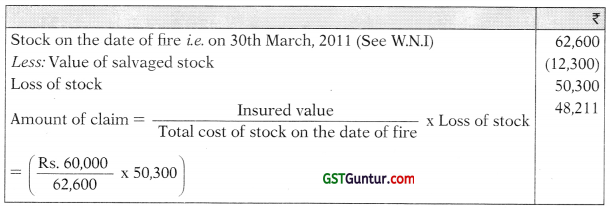

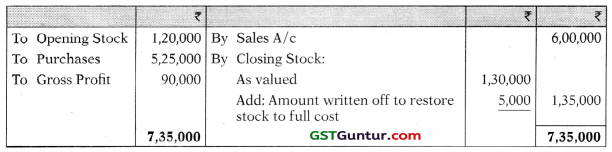

On 27th July, 2016, a fire occurred in the godown of M/s. Vijay Exports and most of the stocks were destroyed. However, goods costing ₹ 5,000 could be salvaged. Their firefighting expenses were amounting to ₹ 1,300.

From the salvaged accounting records, the following information is available relating to the period from 1.4.2016 to 27.7.2016:

Other Information:

- While valuing the stock on 31.1.2016, ₹ 1,000 had been written off in respect of certain slow-moving items costing ₹ 4,000. A portion of these goods were sold in June, 2016 at a loss of ₹ 700 on original cost of ₹ 3,000. The remainder of these stocks is now estimated to be worth its original cost.

- Past record shows the normal gross profit rate is 20%.

- The insurance company also admitted fire-fighting expenses. The Com-pany had taken the fire insurance policy of ₹ 55,000 with the average clause.

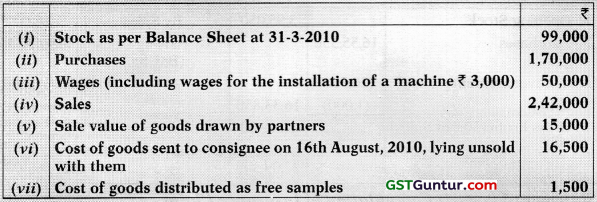

Compute the amount of claim of stock destroyed by fire, to be lodged to the Insurance Company. Also prepare Memorandum Trading Account for the period 1.4.2016 to 27.7.2016 for normal and abnormal items. (10 Marks) (Nov. 2017)

Answer:

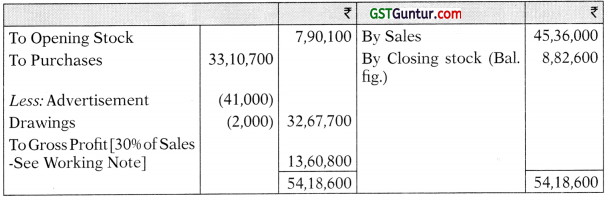

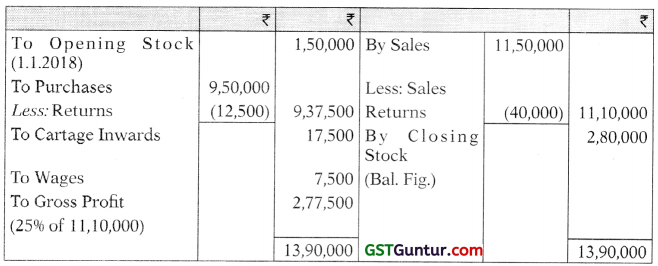

Memorandum Trading Account for the period 1st April, 2016 to 27th July, 2016

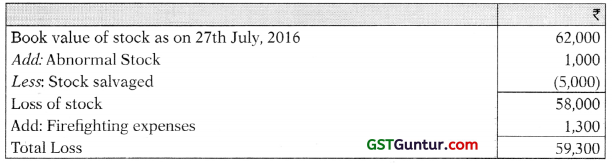

Statement Showing computation of Claim for Loss of Stock

Amount of claim to be lodged with insurance company

Working Notes:

1. Computation of Adjusted Purchases

2. Computation of Goods with Customers

Approval for sale has not been received = ₹ 40,000 × 1/4 = ₹ 10,000.

Hence, these should be valued at cost i.e. (₹ 10,000 – 20% of ₹ 10,000)

= ₹ 8,000

3. Computation of Actual Sales

4. Computation of Wages

5. Computation of Opening Stock

Original cost of stock as on 31st March, 2017

= ₹ 63,000 + ₹ 1,000 (Amount written off)

= ₹ 64,000.

![]()

Question 18.

A fire occurred in the premises of M/s. Raxby & Co. on 30-6-2017. From the salvaged accounting records, the following particulars were ascertained:

In valuing the slock for the Balance Sheet at 31st March, 2017, ₹ 5,000 had been written off on certain stock which was a poor selling line having the cost of ₹ 8,000. A portion of these goods were sold in. May, 2017 at a loss of ₹ 1,000 on original cost of ₹ 7,000. The remainder of the stock was now estimated to be worth its original cost. Subject to that exception, gross profit had remained at a uniform rate throughout the year.

The value of the salvaged stock was ₹ 10,000. M/s. Raxby & Co. had insured their stock for ₹ 1,00,000 subject to average clause.

Compute the amount of claim to be lodged to the insurance company. (8 Marks) (May 2018)

Answer:

M/s Raxby & Co. Trading Account for 2016-17

The normal rate of gross profit to sales is = \(\frac{90,000}{6,00,000}\) × 100 = 15%

Memorandum Trading Account up to June 30, 2017

* At cost.

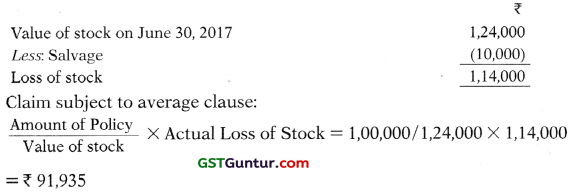

Computation showing amount of Insurance Claim:

Therefore, insurance claim will be limited to ₹ 91,935

Loss Of Profit — Simple Questions

Question 19.

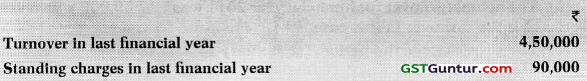

A trader intends to take a loss of profit policy with indemnity period of 6 months; however, he could not decide the policy amount. From the following details, suggest the policy amount:

Net profit earned in last year was 10% of turnover and the same trend expected in subsequent year.

Increase in turnover expected 25%.

To achieve additions! sales, trader has to incur additional expenditure of ₹ 31,250. (4 marks) (Nov. 2010)

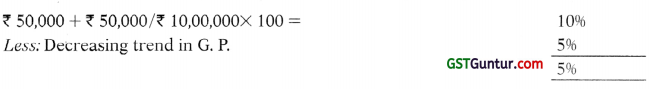

(a) Computation of Gross Profit

Gross Profit \(=\frac{\text { Gross Profit }+\text { Standing Charges }}{\text { Turnover }}\) × 100

= \(\frac{4,50,000+90,000}{4,50,000}\) × 100 = 30%

(b) Computation of policy amount to cover loss of profit

Therefore, the trader should go in for a loss of profit policy of ₹ 2,00,000.

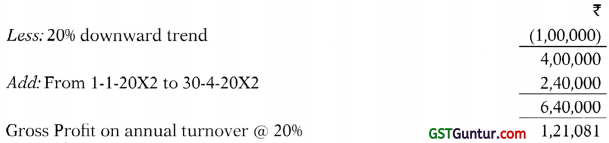

![]()

Loss Of Profit — Advanced Questions

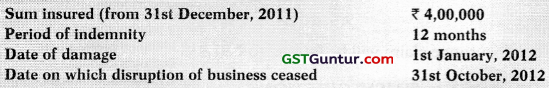

Question 20.

From the following particulars, you are required to calculate the amount of claim for B Ltd., whose business premises was partly destroyed by fire:

The subject matter of the policy was gross profit but only net profit and insured standing charges are included.

The books of account revealed:

(a) The gross profit for the financial year 2011 was ₹ 3,60,000.

(b) The actual turnover for financial year 2011 was ₹ 12,00,000 which was also the turnover in this case.

(c) The turnover for the period 1st January to 31st October, in the year preceding the loss, was ₹ 10,00,000.

During dislocation of the position, it was learnt that in November-December 2011, there has been an upward trend in business done (compared with the figure of the previous years) and it was stated that had the loss not occurred, the trading results for 2012 would have been better than those of the previous years.

The Insurance company official appointed to assess the loss accepted this view and adjustments were made to the pre-damaged figures to bring them up to the estimated amounts which would have resulted in 2012.

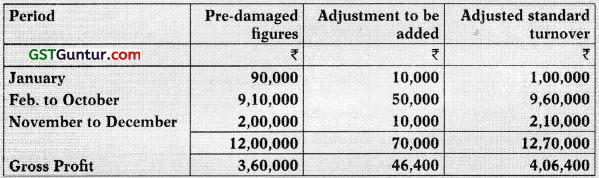

The pre-damaged figures together with agreed adjustments were:

Rate of Gross Profit 30% (actual for 2011), 32% (adjusted for 2012).

Increased cost of working amounted to ₹ 1,80,000.

There was a clause in the policy relating to savings in insured standard charges during the indemnity period and this amounted to ₹ 28,000.

Standing Charges not covered by insurance amounted to ₹ 20,000 p.a. The annual turnover for January was nil and for the period February to October 2012 ₹ 8,00,000. (RTP)

Answer:

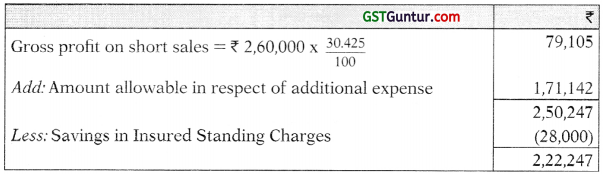

1. Computation of Short sales

2. Computation of Gross profit ratio

Gross profit – Insured Standing Charges – Uninsured standing charges = Net profit

Or

Gross profit – Uninsured standing charges = Net profit +Insured Standing Charges

= 4,06,400 – 20,000 = 3,86,400

3. Amount allowable in respect of additional expenses

Least of the following:

(i) Actual expenses = 1,80,000

(ii) Gross profit on sales during 10 months period = 8,00,000 × 30.42596 = 2,43,400

(iii)

4. Computation showing amount of Claim

On the amount of final claim, the average clause will not apply since the amount of the policy ₹ 4,00,000 is higher than gross profit on annual adjusted turnover ₹ 3,86,400.

Therefore, insurance claim will be ₹ 2,22,247.

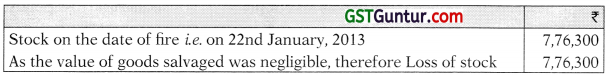

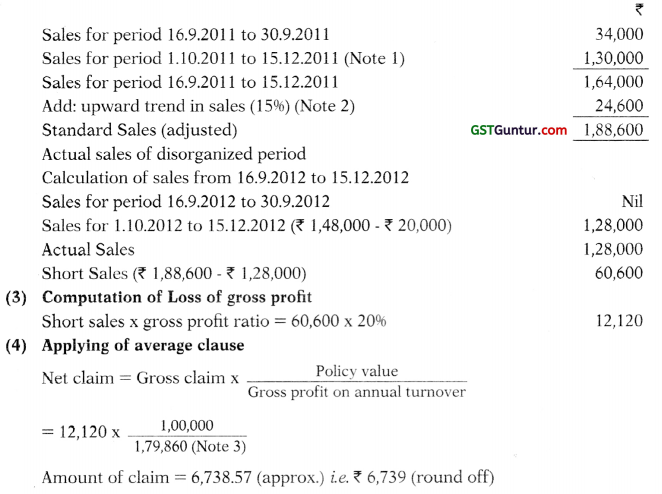

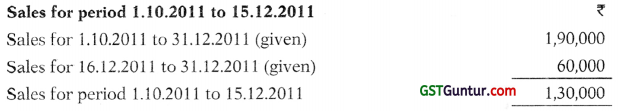

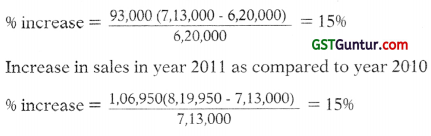

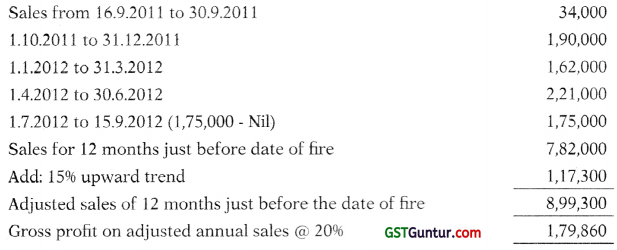

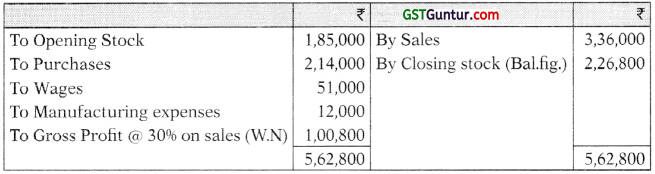

Question 21.

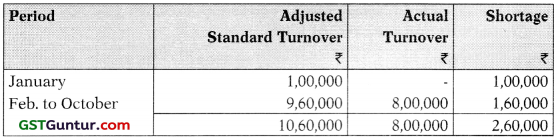

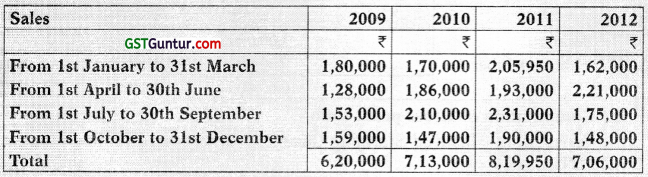

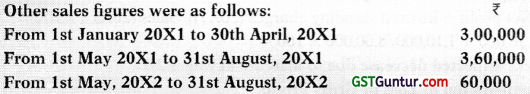

Monalisa & Co. runs plastic goods shop. Following details are available from quarterly sales tax return filed.

A loss of profit policy was taken for ₹ 1,00,000. Fire occurred on 15th September, 2012. Indemnity period was for 3 months. Net Profit was ₹ 1,20,000 and standing charges (all insured) amounted to ₹ 43,990 for year ending 2011.

Determine the Insurance Claim. (16 Marks) (Nov. 2013)

Answer:

(1)

(2)

Computation of Short sales

Indemnity period: 16.9.2012 to 15.12.2012

Standard sales to be calculated on basis of corresponding period of year 2011

![]()

Working Notes:

1.

2. Calculation of upward trend in sales

Total sales in year 2009 = 6,20,000

Increase in sales in year 2010 as compared to 2009 = 93,000

Thus, annual percentage increase trend is of 15%.

3. Computation of Gross profit on annual turnover

Computation Of Policy Amount

Question 22.

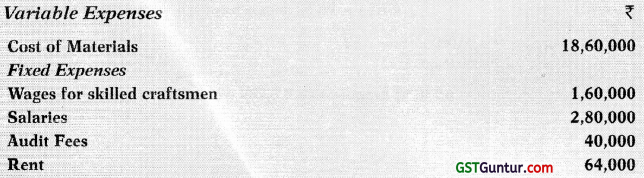

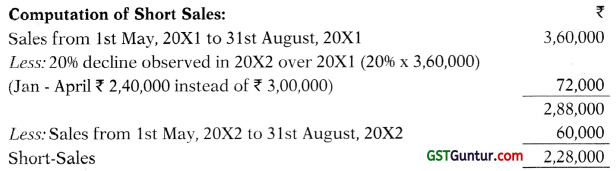

M/s. Platinum Jewellers wants to take up a ‘Loss of Profit Policy’ for the year 2015. The extract of the Profit and Loss Account of the previous year ended 31-12-2014 provided below:

Turnover is expected to grow by 25% next year.

To meet the growing working capital needs the partners have decided to avail overdraft facilities from their bankers @ 12% p.a. interest

The average daily overdraft balance will be around ₹ 2 lakhs.

The wages for the skilled craftsmen will increase by 20% and salaries by 10% in the current year. All other expenses will remain the same. Determine the amount of policy to be taken up for the current year by M/s. Platinum Jewellers. (6 Marks) (May 2015)

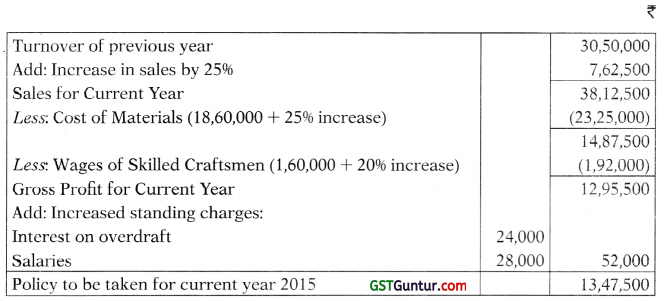

Answer:

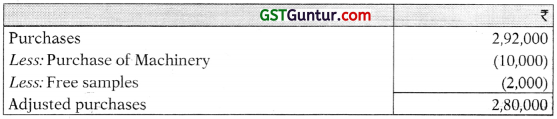

Statement showing computation of Amount of Insurance Policy to be taken

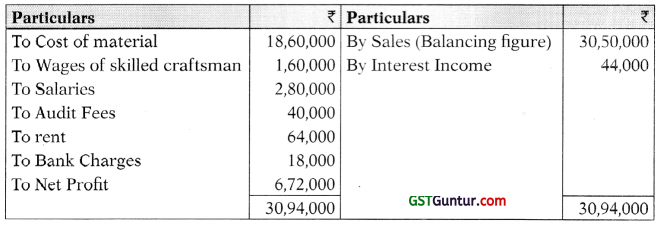

Working Note:

Trading and Profit and Loss account for the year ended 31.12.2014

![]()

Question 23.

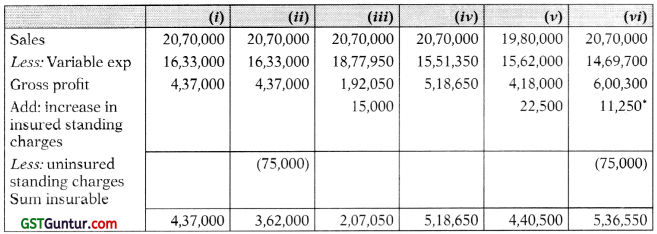

A firm has decided to take out a loss of profit policy for the year 2016 and given the following information for the last accounting year 2015.

Variable manufacturing expenses ₹ 14,20,000, Standing charges ₹ 1,50,000, Net Profits ₹ 80,000, Non-operating income ₹ 2,500, Sales ₹ 18,00,000.

Compute the sum to be insured in each of the following alternative cases showing the anticipation for the year 2016:

- If sales will increase by 15%.

- If sales will increase by 15% and only 50% of the present standing charges are to be insured.

- If sales and variable expenses will increase by 15% and standing charges will increase by 10%.

- If sales will increase by 15% and variable expenses will decrease by 5%.

- If sales will increase by 10% and standing charges will increase by 15%.

- If the turnover and standing charges will increase by 15% and variable expenses will decrease by 10%-but only 50% of the present standing charges are to be insured. (8 marks) (May 2016)

Answer:

Statement showing computation of sum insured

Notes:

1. It has been assumed that increase in sale is due to increase in volume of sales.

2. *In case (vi), it is given in the question that 50% of the present standing charges are to be insured. It is assumed that 50% of the increased standing charges are insured.

3. In case (iii), 15% increase in variable expenses has been calculated after considering proportionate increase in variable expenses due to increase in turnover.

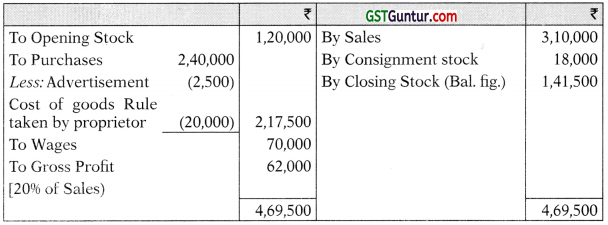

Loss Of Stock And Profit—Comprehensive Questions

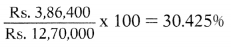

Question 24.

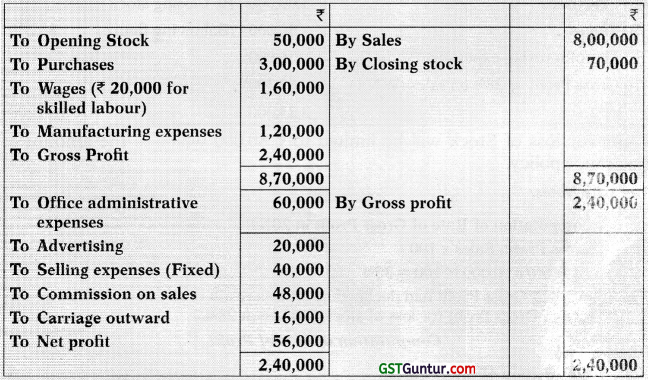

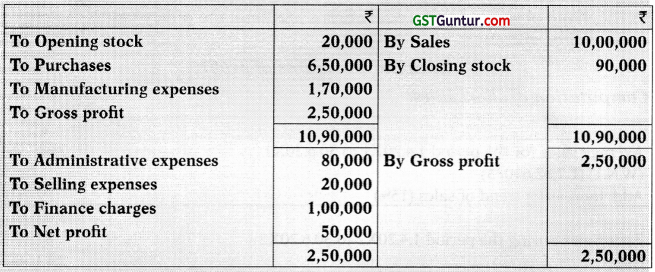

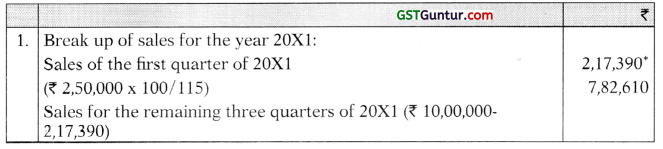

A Ltd. give the following Trading and Profit and Loss Account for year ended 31st December, 20X1:

Trading and Profit and Loss Account for the year ended 31st December, 20X1

The company had taken out policies both against loss of stock and against loss of profit, the amounts being ₹ 80,000 and ₹ 1,72,000. A fire occurred on 1st May, 20X2 and as a result of which sales were seriously affected for a period of 4 months. You are given the following further information:

(a) Purchases, wages and other manufacturing expenses for the first 4 months of 20X2 were ₹ 1,00,000, ₹ 50,000 and ₹ 36,000 respectively.

(b) Sales for the same period were ₹ 2,40,000.

(c)

(d) Due to rise in wages, gross profit during 20X2 was expected to decline by 2% on sales.

(e) Additional expenses incurred during the period after fire amounted to ₹ 1,40,000. The amount of the policy included ₹ 1,20,000 for expenses leaving ₹ 20,000 uncovered. Ascertain the claim for stock and for loss of profit.

All workings should form part of your answers.

Answer:

Memorandum Trading Account for the period 1st January to 1st May, 20X2

Claim for loss of Stock will be limited to ₹ 80,000 which is the amount of Insurance policy.

Working Notes:

(1) Computation of Rate of Gross Profit in 20X1

Gross Profit/Sales × 100

2,40,000/8,00,000 × 1oo = 30%

in 20X2, Gross Profit had declined by 2% as a result of rise in wages, hence the rate of Gross Profit for loss of stock is taken at 28%.

Computation of Loss of Profit

(a)

(b) Computation of Gross profit ratio

{[Net profit + Insured standing charges (20X1)]/Sales (20X1)} × 100

= 56,000 + 1,10,000/8,00,000 × 100 = 22%

Less: Expected decrease due to increase in wages 2% = 20%)

(c) Computation of Loss of Gross Profit:

20% on short sales ₹ 2,28,000 = ₹ 45,600

(d) Computation of Annual turnover (adjusted):

(12 months to 1st May, 20X2, ie., 1 May 20X1 to 30 Apr. 20X2):

(e) Amount allowable in respect of additional expenses

Least of the following:

(i) Actual expenses 1,40,000

(ii) Gross Profit on sales during indemnity period 20% of ₹ 60,000 12,000

(iii) Gross profit on annual (adjusted) turnover/Gross profit as above + Uninsured charges × Additional expenses

1,28,000/1,48,000 × 1,40,000 = 1,21,000

Least i.e. ₹ 12,000 is admissible.

Total claim for Loss of Profit: 45,600 + 12,000 = ₹ 57,600

Note:

On the amount of final claim, the average clause will not apply since the amount of the policy ₹ 1,72,000 is higher than Gross Profit on annual turnover ₹ 1,28,000.

![]()

Question 25.

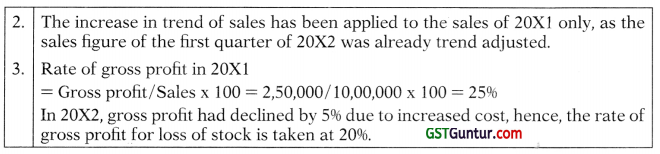

S Ltd.’s Trading and profit and loss account for the year ended 31st December, 20X1 were as follows:

Trading and Profit and Loss Account for the year ended 31st Dec., 20X1

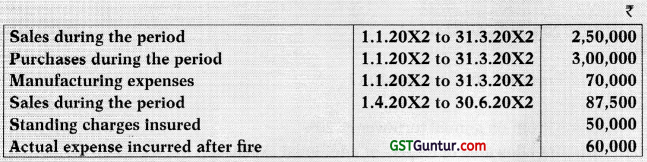

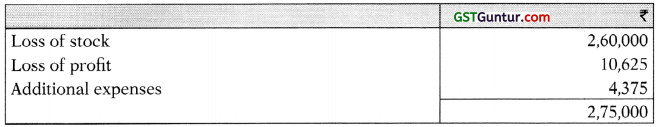

The company had taken out a fire policy for ₹ 3,00,000 and a loss of profits policy for ₹ 1,00,000 having an indemnity period of 6 months. A fire occurred on 1.4.20X2 at the premises and the entire stock were gutted with nil salvage value. The net quarter sales i.e. 1.4.20X2 to 30.6.20X2 was severely affected. The following are the other information:

The general trend of the industry shows an increase of sales by 15% and decrease in GP by 5% due to increased cost.

Ascertain the claim for stock and loss of profit.

Answer:

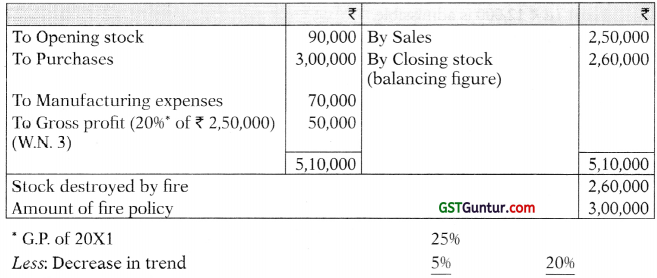

Trading A/c for the period 1.1.20X2 to 31.3.20X2

As the value of stock destroyed by fire is less than the policy value, the entire claim will be admitted.

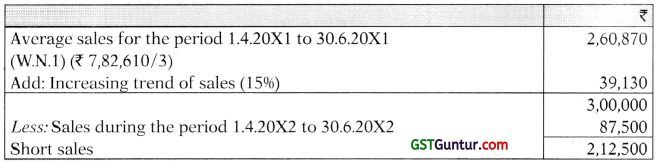

Computation of loss of profit:

Computation of short sales:

Computation of G.P. Ratio:

Gross profit ratio = Net profit + Insured standing charges/Sales × 100

Loss of profit = 596 of ₹ 2,12,500 = ₹ 10,625

Amount allowable in respect of additional expenses:

Least of the following:

(i) Actual expenditure ₹ 60,000

(ii) G.R on sales generated by additional expenses 5% of ₹ 87,500 ₹ 4,375

(assumed that entire sales during disturbed period is due to additional expenses)

(iii) Additional Exp. × G.R on Adjusted Annual Turnover/G.P. as above + Uninsured Standing Charges

₹ 60,000 × 57,500/57,500 + 1,30,000 = ₹ 18,400 (approx.)

least ie. ₹ 4,375 is admissible.

Gross Profit on annual turnover:

Adjusted annual turnover:

As the gross profit on annual turnover (₹ 57,500) is less than policy value (₹ 1,00,000), average clause is not applicable.

Computation of Insurance claim to be submitted:

Note:

According to the given information standing charges include administrative expenses (₹ 80,000) ahd finance charges (₹ 1,00,000). Insured standing charges being ₹ 50,000, uninsured standing charges would be ₹ 1,30,000.

Working Note:

* Sales for the first quarter of 20X1 is computed on the basis of sales of the first quarter of 20X2.

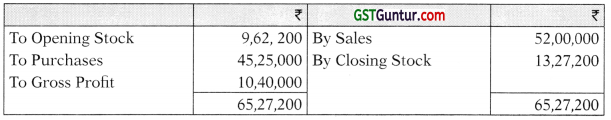

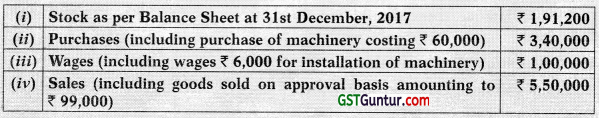

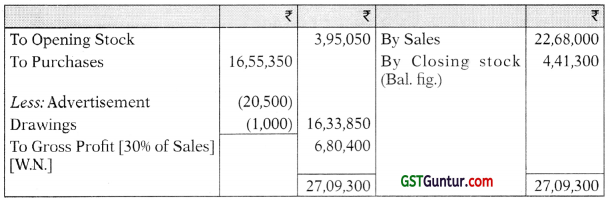

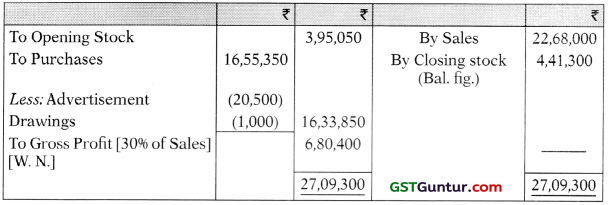

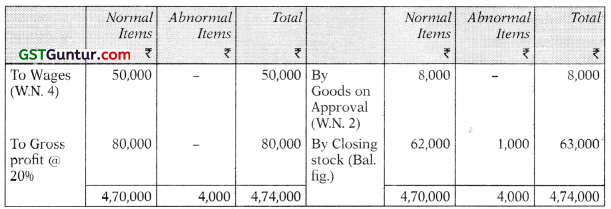

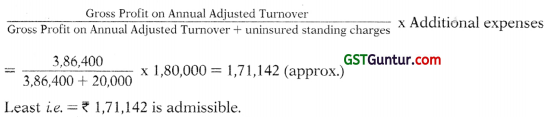

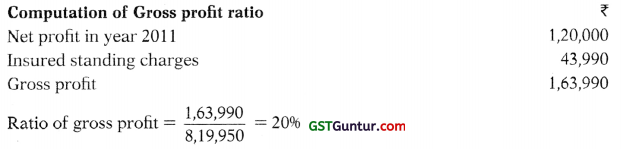

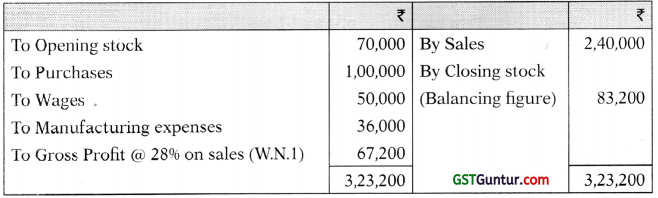

Question 26.

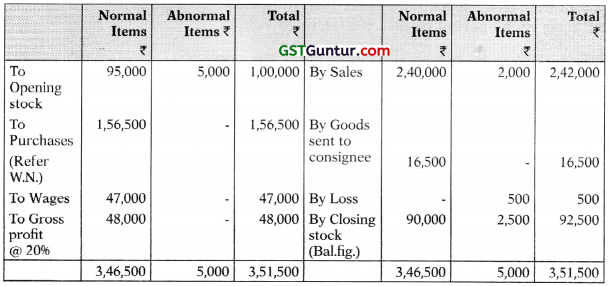

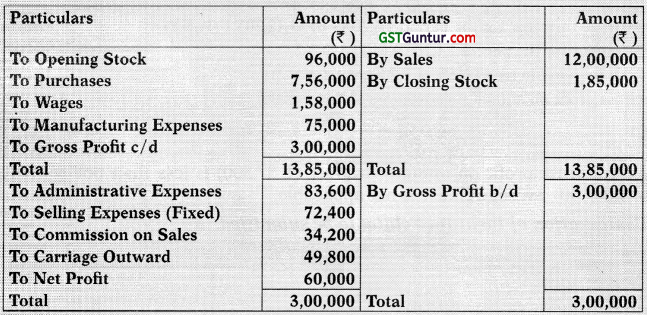

Ramda & Sons had taken out policies (without Average Clause) both against loss of stock and loss of profit, for ₹ 2,10,000 and ₹ 3,20,000 respectively. A fire occurred on 1st July, 2011 and as a result of which sales were seriously affected for a period of 3 months.

Trading and Profit & Loss A/c of Ramda & Sons for the year ended on 31st March, 2011 is given below:

Further detail provided is as below:

(a) Sales, Purchases, Wages and Manufacturing Expenses for the period 1.04.2011 to 30.6.2011 were ₹ 3,36,000, ₹ 2,14,000, ₹ 51,000 and ₹ 12,000 respectively.

(b) Other Sales figure were as follows:

(c) Due to decrease in the material cost, Gross Profit during 2011-12 was expected to increase by 5% on sales.

(d) ₹ 1,98,000 were additionally incurred during the period after fire. The amount of policy included ₹ 1,56,000 for expenses leaving ₹ 42,000 uncovered. Compute the claim for stock, loss of profit and additional expenses (16 Marks) (May 2012)

Answer:

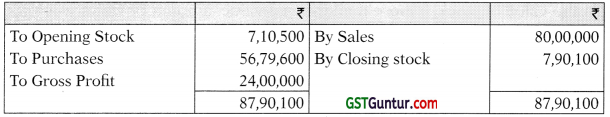

Memorandum Trading Account for the period 1st April to 1st July, 2011

Claim for loss of stock will be limited to ₹ 2,10,000 only which is the amount of Insurance policy and no average clause will be applied.

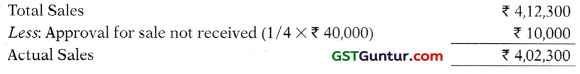

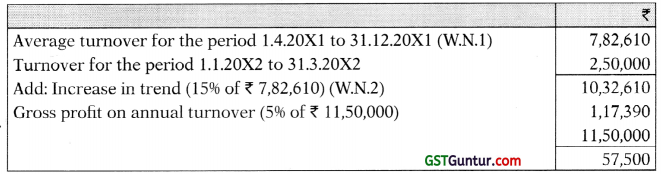

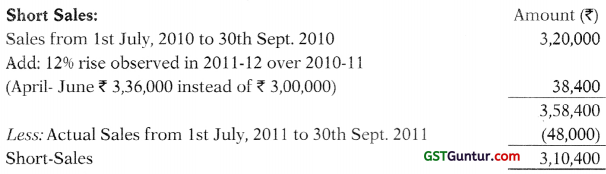

Computation of Loss of Profit

(a)

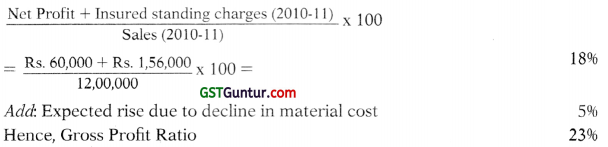

(b) Gross profit ratio

(c) Loss of Gross Profit

23% on short sales ₹ 3,10,400 = 71,392

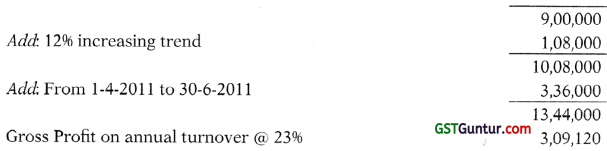

(d) Annual turnover (12 months to 1st July, 2011):

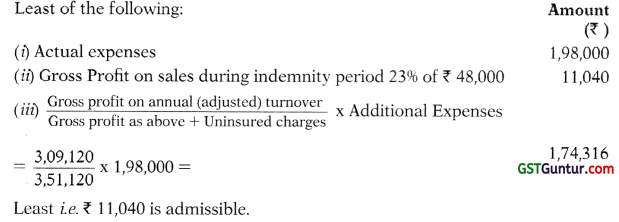

(e) Amount allowable In respect of additional expenses

Computation of Claim

Insurance claim for loss of profit will be of ₹ 82,432 only.

Working Note:

Rate of Gross Profit in 2010-11

In 2011-12, Gross Profit is expected to increase by 5 as a result of decline in material cost, hence the rate of Gross Profit for loss of stock is taken at 30%.

![]()

Miscellaneous

Question 27.

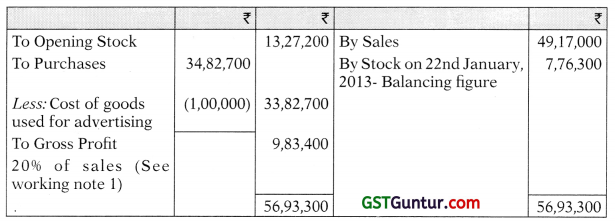

A fire engulfed the premises of a business of M/s Preet on the morning of 1st July, 2013. The building, equipment and stock were destroyed and the salvage recorded the following:

Building – ₹ 4,000; Equipment – ₹ 2,500; Stock – ₹ 20,000. The following other Information was obtained from the records saved for the period from 1st January to 30th June, 2013:

No depreciation has been provided since December 31, 2012. The latest rate of depreciation is 5% p.a. on building and 15% p.a. on equipment by straight line method.

Normally business makes a profit of 25% on net sales. You are required to prepare the statement of claim for submission to the Insurance Company. (RTP)

Answer:

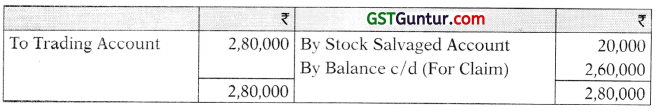

Memorandum Trading Account for the Period from 1.1.2018 to 30.6.2018

Stock Destroyed A/c

Statement Showing Computation of Claim