Departmental Accounts – CA Inter Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Departmental Accounts – CA Inter Accounts Study Material

Apportionment Of Expenses

Question 1.

State the basis on which the following common expenses, the benefit of which is shared by all the departments is distributed among the departments:

(i) Rent, rates and taxes, insurance of building;

(ii) Selling expenses such as discount, bad debts, selling commission and other such selling expenses;

(Hi) Carriage Inward;

(iv) Depreciation;

(v) Interest on loan;

(vi) Profit or loss on sale of investment;

(vii) Wages;

(viii) Lighting and Heating Expenses. (4 marks) (Nov. 2013)

Answer:

| S.No. | Expenses |

Basis of allocation |

| (i) | Rent, rates and taxes, repairs, insurance of building | Floor area occupied by each department (if given) otherwise on time basis |

| (ii) | Selling expenses, e.g., discount, bad debts, selling commission, and other such selling expenses | Sales of each department |

| (iii) | Carriage inward | Purchases of each department |

| (iv) | Depreciation | Value of assets of each department otherwise on time basis |

| (v) | Interest on loan | Utilization of loan amount in each department (if can be identified), otherwise in combined P&L A/c |

| (vi) | Profit & loss on sale of investment | Value of investments sold in each department (if value can be identified), otherwise in combined P&L A/c |

| (vii) | Wages | Time devoted to each department |

| (viii) | Lighting and Heating expenses (e.g. energy expenses) | Consumption of energy by each department |

Question 2.

Give the basis of allocation of the following common expenditure among different departments:

(i) Insurance of Building

(ii) Discount and bad debts

(iii) Discount received

(iv) Repairs and maintenance of capital assets

(v) Advertisement expenses

(vi) Labour welfare expenses

(vii) PF/ESI contributions

(viii) Carriage inward (4 marks) (May 2016)

Answer:

| S.No. | Expenses | Basis of allocation |

| (i) | Insurance of Building | Floor area occupied by each department (if given) otherwise on time basis |

| (ii) | Discount and Bad debts | Sales of each department |

| (iii) | Discount received | Purchases of each department |

| (iv) | Repairs and maintenance of capital assets | Value of assets of each department otherwise on time basis |

| (v) | Advertisement expenses | Sales of each department otherwise on time basis or equally among departments |

| (vi) | Labour welfare expenses | Number of employees in each department |

| (vii) | PF/ESI contributions | Wages and salaries of each department |

| (viii) | Carriage inward | Purchases of each department |

![]()

Basic Questions

Question 3.

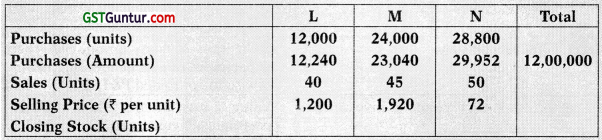

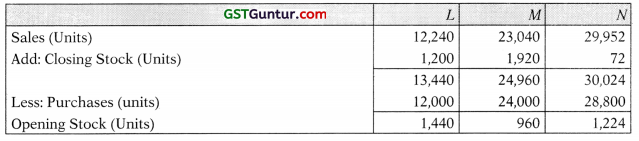

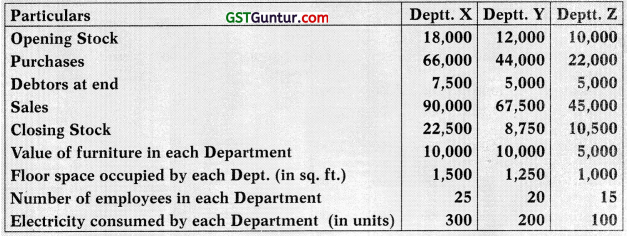

A Ltd. has three departments and submits the following information for the year ending on 31st March, 2014:

You are required to prepare departmental trading account of A Ltd., assuming that the rate of profit on sales is uniform in each case. (RTP)

Answer:

Departmental Trading Account for the year ended on 31st March, 2014

Working Notes:

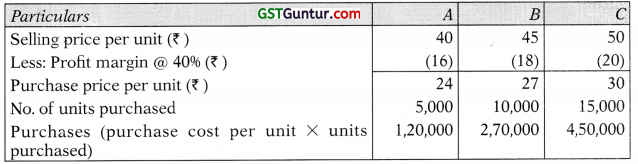

(2) Statement showing computation department-wise per unit Cost and Purchase Cost

(3) Statement showing computation of department-wise Opening Stock (in Units)

(4) Statement showing computation of department-wise cost of Opening Stock and Closing Stock

![]()

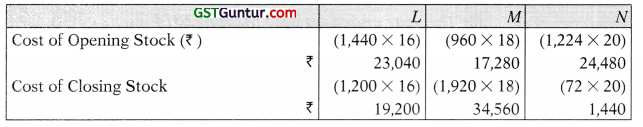

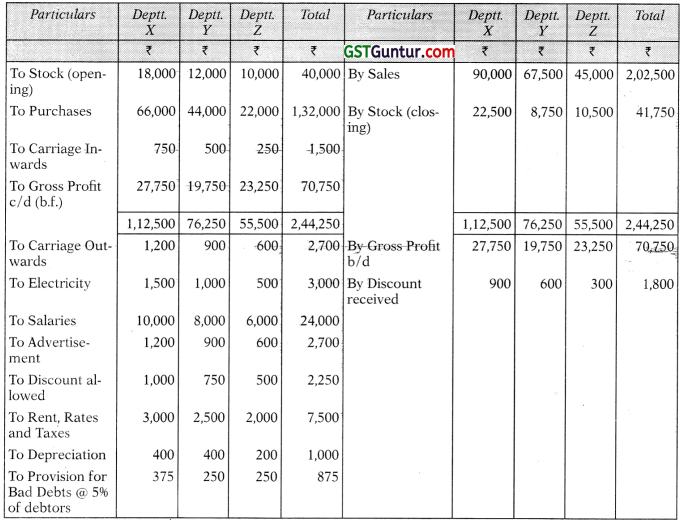

Question 4.

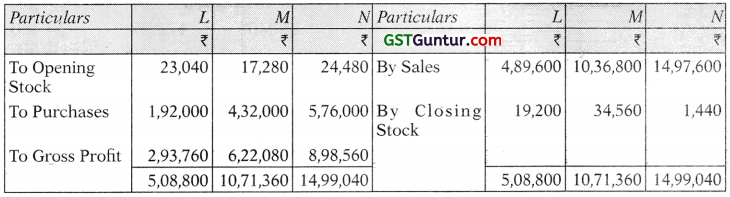

Brahma Limited has three departments and submits the following information for the year ending on 31st March, 2011:

You are required to prepare departmental trading account of Brahma Limited assuming that the rate of profit on sales is uniform in each case. (5 Marks) (May 2011)

Answer:

Departmental Trading Account for the year ended 31st March, 2011

Working Notes:

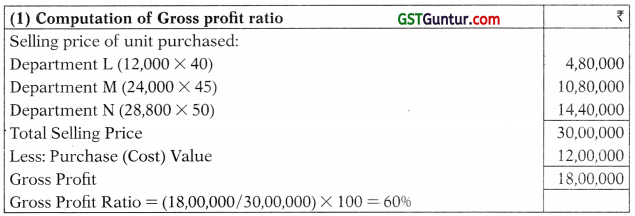

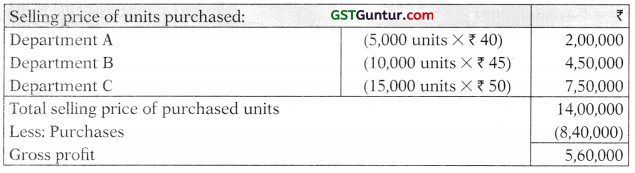

(1) Computation of Gross profit ratio

Gross Profit Ratio \(=\frac{\text { Gross profit }}{\text { Selling price }}\) × 100 = \(\frac{5,60,000}{14,00,000}\) × 100

(2) Statement showing computation of department-wise per unit cost arid purchase cost

(3) Statement showing computation of department-wise Opening Stock (in units)

(4) Statement showing computation of department-wise cost of Opening and Closing Stock

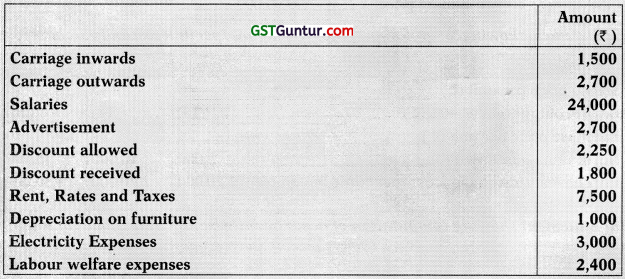

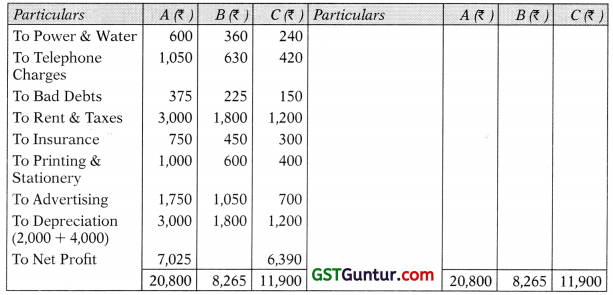

Question 5.

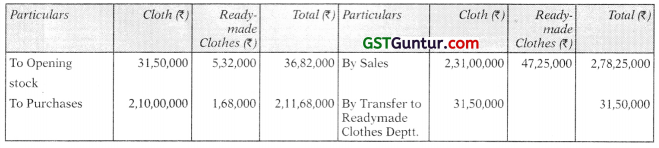

M/s. Delta is a Departmental Store having three departments X, Y and Z. The information regarding three departments for the year ended 31st March, 2018 are given below:

Additional Information:

Prepare Departmental Trading and Profit & Loss Account for the year ended 31st March, 2018 after providing provision for Bad Debts at 5%. (10 Marks) (May 2018)

Answer:

Departmental Trading and Profit and Loss Account for the year ended 31st March, 2018

![]()

Working Note:

| Basis of allocation of expenses | |

| Carriage inwards | Purchases (3:2:1) |

| Carriage outwards | Turnover (4:3:2) |

| Salaries | No. of Employees (5:4:3) |

| Advertisement | Turnover (4:3:2) |

| Discount allowed | Turnover (4:3:2) |

| Discount received | Purchases (3:2:1) |

| Rent, Rates and Taxes | Floor Space occupied (6:5:4) |

| Depreciation on furniture | Value of furniture (2:2:1) |

| Labour welfare expenses | No. of Employees (5:4:3) |

| Electricity expense | Units consumed (3:2:1) |

| Provision for bad debts | Debtors balances (3:2:2) |

Computation of Stock Reserve

Question 6.

Goods are transferred from Department P to Department 0 at a price 50% above cost.

If closing stock of Department Q is ₹ 27,000, compute the amount of stock reserve. (2 Marks) (Nov. 2009)

Answer:

Computation of Stock Reserve

| ₹ | |

| Closing stock of Department Q | 27,000 |

| Goods sent by Department P to Department Q at a price 50% above cost. Hence, profit of Department P included in the stock will be \( \left(\frac{\text { Rs. } 27,000 \times 50}{150}\right) \) | 9,000 |

| Amount of stock reserve will be ₹ 9,000 |

Question 7.

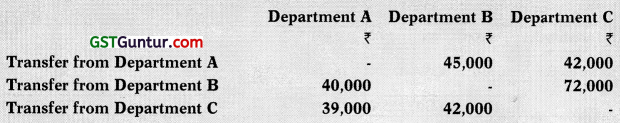

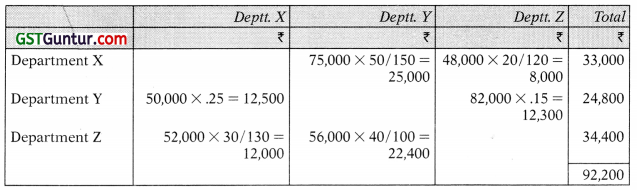

Department A sells goods to Department B at a profit of 50% on cost and to Department C at 20% on cost. Department B sells goods to A and C at a profit of 25% and 15% respectively on sales. Department C charges 30% and 40% profit on cost to Department A and B respectively.

Stock lying at different departments at the end of the year are as under:

Calculate the unrealized profit of each department and also total unrealized profit. (4 Marks) (May 2013)

Answer:

Computation of unrealized profit

[for each department and total unrealized profit]

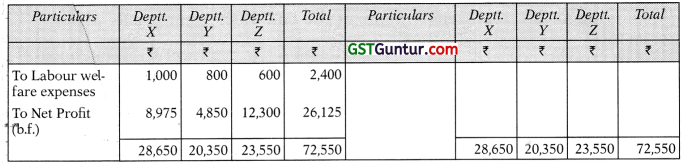

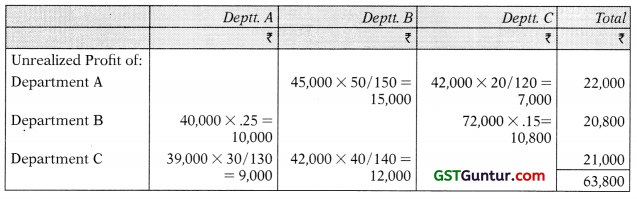

Question 8.

Department X sells goods to Department Y at a profit of 50% on cost and to Department Z at 20% on cost. Department Y sells goods to Department X and Z at a profit of 25% and 15% respectively on sales. Department Z charges 30% profit on cost to Department X and 40 profit on sale to Y.

Stocks lying at different departments at the end of the year are as under:

Calculate the unrealized profit of each department and also total unrealized profit. (4 Marks) (Nov. 2017)

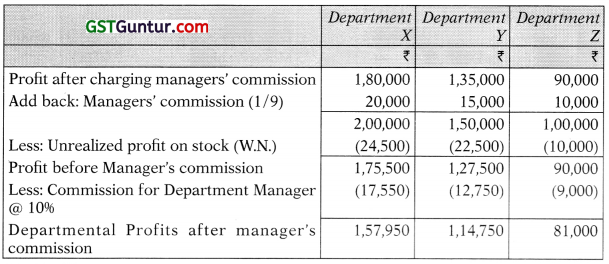

Answer:

Computation of unrealized profit

[For each department and total unrealized profit]

![]()

Inter departmental Transfers — Content Ratio and G.P. ratio both given

Question 9.

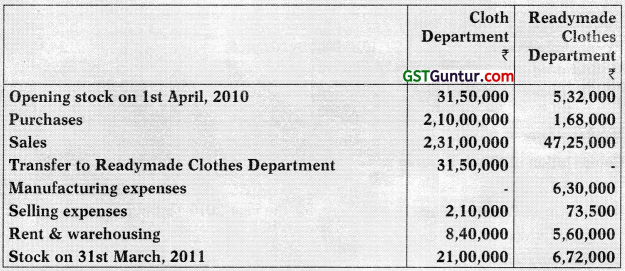

M/s. AM Enterprise had two departments, Cloth and Readymade Clothes. The readymade clothes were made by the firm itself out of the cloth supplied by the Cloth Department at its usual selling price. From the following figures, prepare Departmental Trading and Profit & Loss Account for the year ended 31st March, 2011:

In addition to the above, the following information is made available for necessary consideration:

The stock in the Readymade Clothes Department may be considered as consisting of 75% cloth and 25% other expenses. The Cloth Department earned a gross profit at the rate of 15% in 2009-10. General expenses of the business as a whole amount to ₹ 10,85,000. (8 Marks) (Nov. 2011)

Answer:

Departmental Trading and Profit and Loss Account for the year ended 31st March, 2011

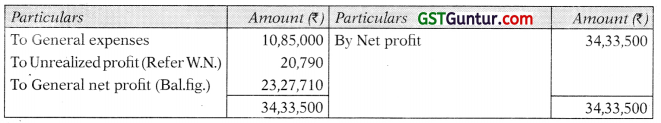

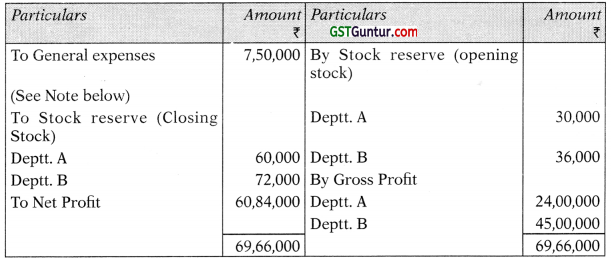

General Profit and Loss A/c

Working Note:

Computation of Stock Reserve

Rate of Gross Profit of Cloth Department, for the year 2010-11 \(=\frac{\text { Gross Profit }}{\text { Total Sales }}\) × 100

\(\frac{\text { Rs. } 42,00,000 \times 100}{\text { Rs. }(2,31,00,000+31,50,000}\) × 100 = 16%

Closing Stock of cloth in Readymade Clothes Department = 75%

i. e. ₹ 6,72,000 × 75% = ₹ 5,04,000

Stock Reserve required for unrealized profit @ 16% on closing stock

₹ 5,04,000 × 16% = ₹ 80,640

Stock reserve for unrealized profit included in opening stock of readymade clothes @ 15% i.e.

(₹ 5,32,000 × 75% × 15%) = ₹ 59,850

Additional Stock Reserve required during the year = ₹ 80,640 – ₹ 59,850 = ₹ 20,790.

![]()

Inter Departmental Transfers — Content Ratio Given But G.P. Ratio Missing

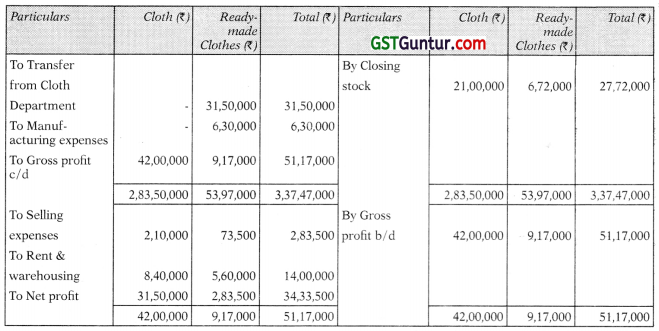

Question 10.

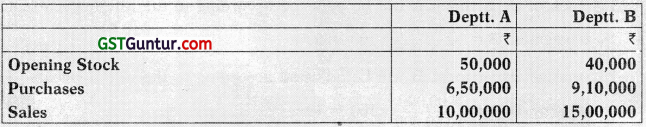

The following balances were extracted from the books of M/s ABC. You are required to prepare Departmental Trading Account and Profit and Loss account for the year ended 31st December, 2018 after adjusting the unrealized department profits if any.

General expenses incurred for both the departments were ₹ 1,25,000 and you are also supplied with the following information:

(a) Closing stock of Department A ₹ 1,00,000 including goods from Department B for ₹ 20,000 at cost of Department A.

(b) Closing stock of Department B ₹ 2,00,000 including goods from Department A for ₹ 30,000 at cost to Department B.

(c) Opening stock of Department A and Department B include goods of the value of ₹ 10,000 and ₹ 15,000 taken from Department B and Department A respectively at cost to transferee departments.

(d) The rate of gross profit is uniform from year to year. (RTP)

Answer:

Departmental Trading and Loss Account for the year ended 31st December, 2016

General Profit and Loss A/c

Working Notes:

- Stock of department A will be adjusted according to the rate applicable to department B = \(\frac{7,50,000}{15,00,000}\) × 100 = 50%

- Stock of department B will be adjusted according to the rate applicable to department A = \(\frac{4,00,000}{10,00,000}\) × 100 = 40%

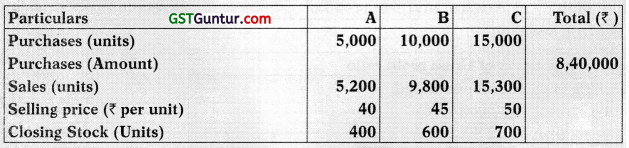

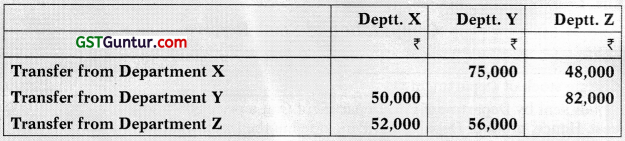

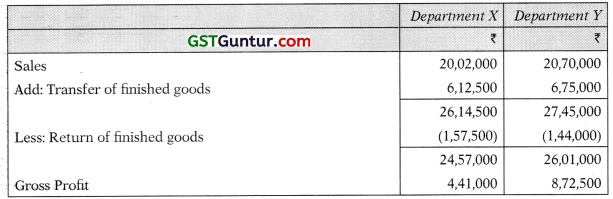

Question 11.

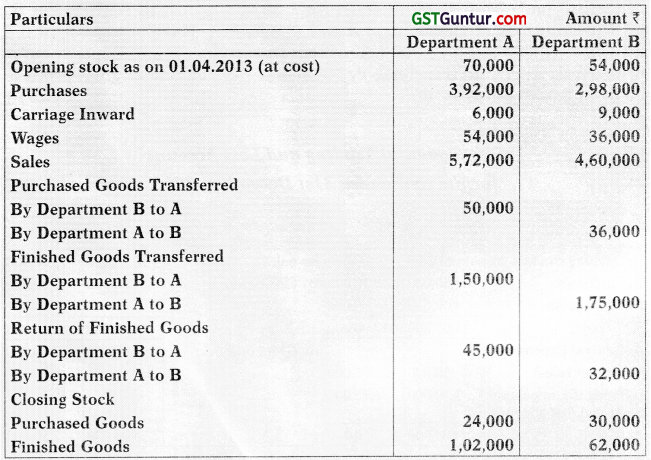

Mega Ltd. has two departments, A and B. From the following particulars, prepare departmental Trading A/c and General Profit & Loss Account for the year ended 31st March, 2014.

Purchased goods have been transferred mutually at their respective departmental purchase cost and finished goods at departmental market price and that 30% of the closing finished stock with each department represents finished goods received from the other department. (8 Marks) (Nov. 2014)

Answer:

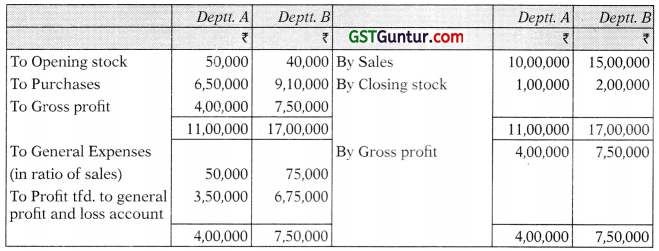

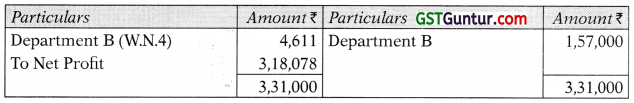

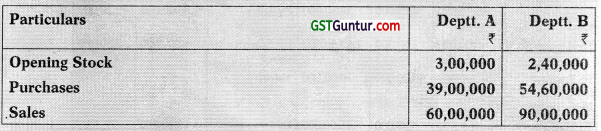

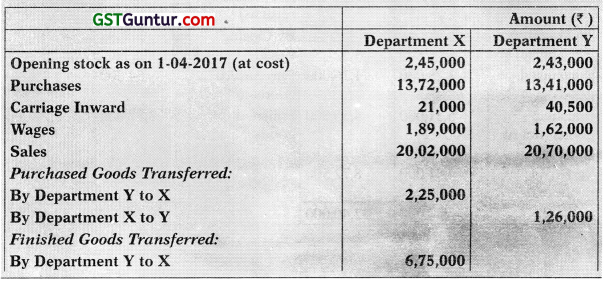

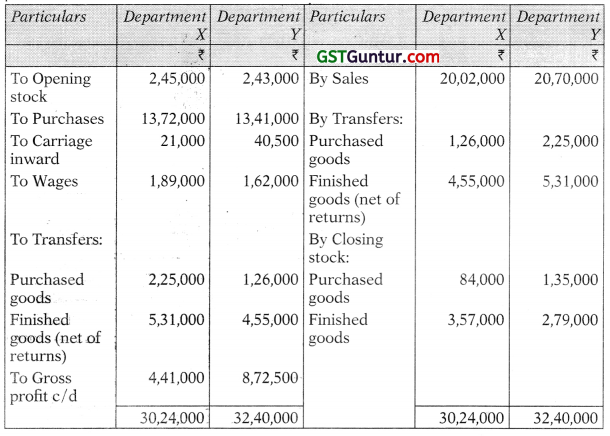

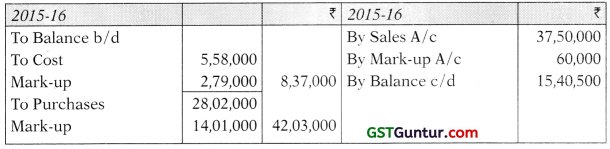

Department Trading Account for the year ended 31st March, 2014

![]()

Working Note:

1. Finished goods from other department included in closing stock

2. Net transfer of Finished Goods

By Department A to B = ₹ (1,75,000 – 45,000) = ₹ 1,30,000

By Department B to A = ₹ (1,50,000 – 32,000) = ₹ 1,18,000

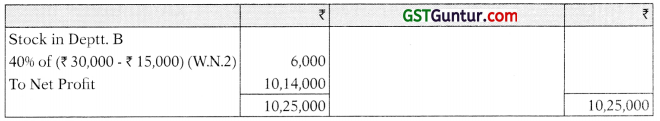

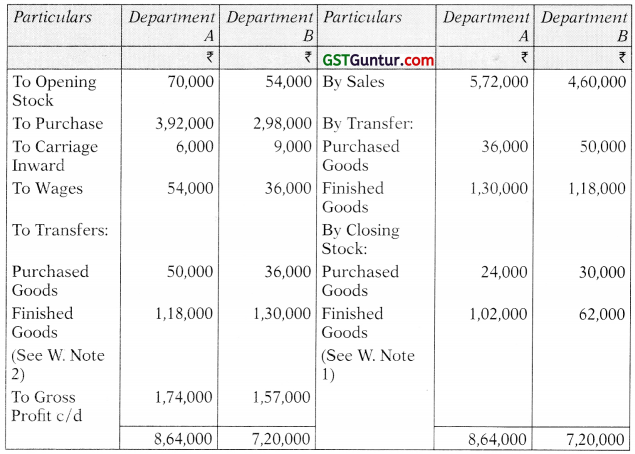

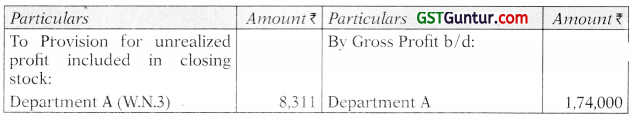

Profit and Loss A/c

For the year ended 31st March, 2014

Working Notes :

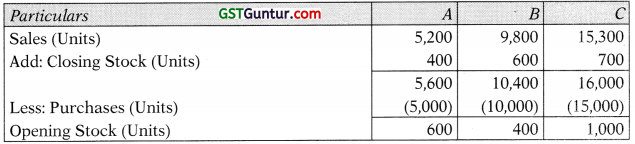

3. Computation of gross profit ratio

4. Unrealized profit included in the closing stock

Department A = 27.16% of ₹ 30,600 (30% of Stock of Finished Goods ₹ 1,02,000)

= ₹ 8311.00

Department B = 24.79% of ₹ 18,600 (30% of Stock of Finished Goods ₹ 62,000)

= ₹ 4611.00

![]()

Question 12.

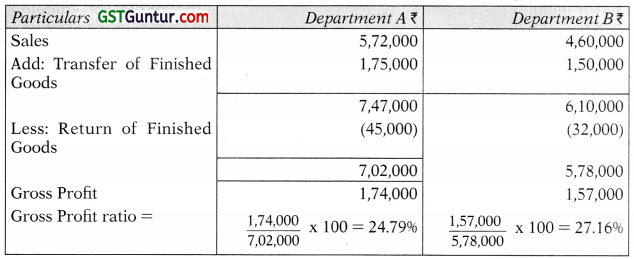

M/s. Suman Enterprises has two Departments, Finished Leather and Shoes. Shoes are made by the Firm itself out of leather supplied by Leather Department at its usual selling price. From the following figures, prepare Departmental Trading and Profit & Loss Account for the year ended 31st March, 2014:

The following further information are available for necessary consideration:

(i) The stock in Shoes Department may be considered as consisting of 75% of Leather and 25% of other expenses.

(ii) The Finished Leather Department earned a Gross Profit @ 15% in 2012-13.

(iii) General expenses of the business as a whole amount to t 8,50,000. (8 Marks) (May 2015)

Answer:

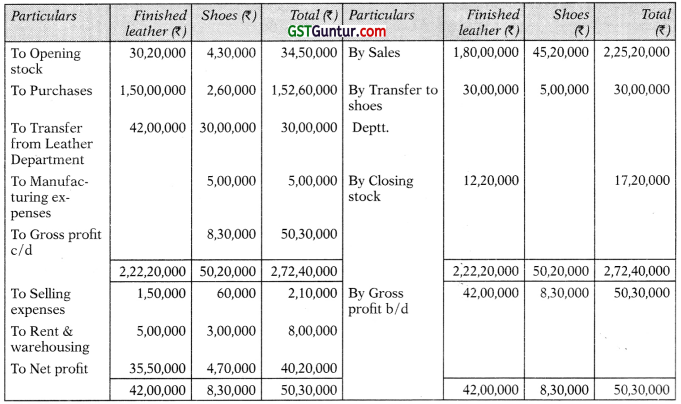

Departmental Trading and Profit and Loss Account for the year ended 31st March, 2014

General Profit and Loss A/c

Working Note:

Calculation of Stock Reserve

Rate of Gross Profit of Finished leather Department, for the ear 2013-14

\(=\frac{\text { Gross Profit }}{\text { Total Sales }}\) × 100 = [(42,00,000)/(1,80,000 + 30,00,000)] × 100 = 20%

Closing Stock of Finished leather in Shoes Department = 75% i.e. ₹ 5,00,000 × 75% = ₹ 3,75,000

Stock Reserve required for unrealized profit ‘ 20% on closing stock ₹ 3,75,000 × 20% = ₹ 75,000

Stock reserve for unrealized profit included in opening stock of Shoes deptt. ; 15% i.e.

(₹ 4,30,000 × 75% × 15%) = ₹ 48,375

Additional Stock Reserve required during the year = ₹ 75,000 – ₹ 48,375 = ₹ 26,625

![]()

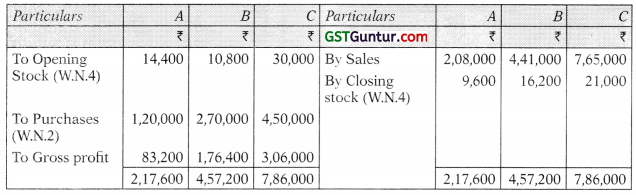

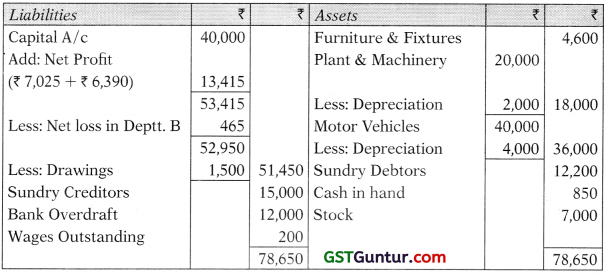

Question 13.

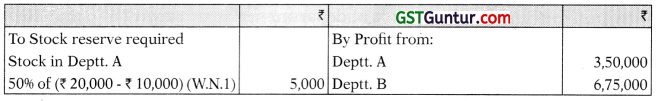

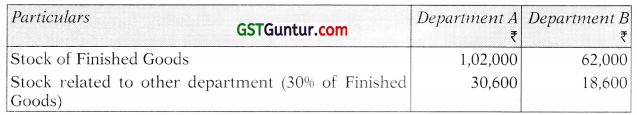

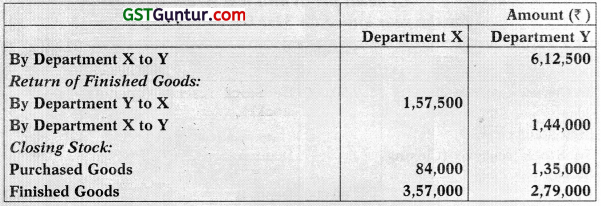

The following balances were extracted from the books of Beta. You are required to prepare Departmental Trading Account and general Profit & Loss Account for the year ended 31st December, 2016:

General expenses incurred for both the Departments were ₹ 7,50,000 and you are also supplied with the following information:

- Closing stock of Department, A ₹ 6,00,000 including goods from Department B for ₹ 1,20,000 at cost to Department A.

- Closing stock of Department B ₹ 12,00,000 including goods from Department A for ₹ 1,80,000 at cost to Department B.

- Opening stock of Department A and Department B include goods of the value of ₹ 60,000 and ₹ 90,000 taken from Department B and Department A respectively at cost to transferee departments.

- The gross profit is uniform from year to year. (8 Marks) (May 2017)

Answer:

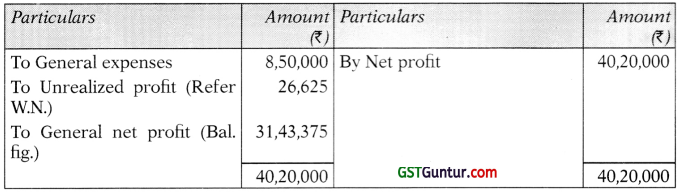

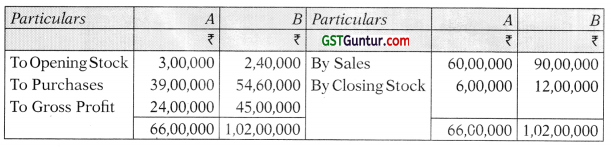

Departmental Trading Account for the year ended on 31st December, 2016

General profit and loss A/c for the year ended on 31st December, 2016

Note:

General expenses haven’t been allocated to individual department and is being therefore charged to General Profit and Loss A/c.

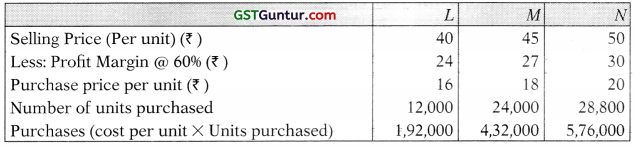

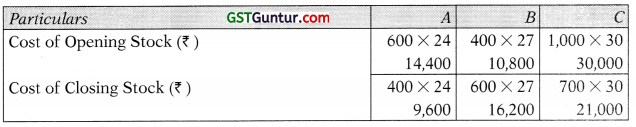

Working Notes:

![]()

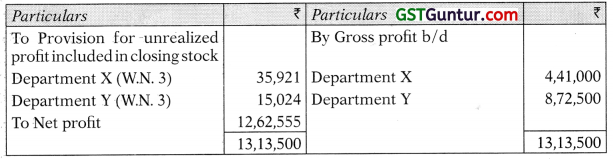

Question 14.

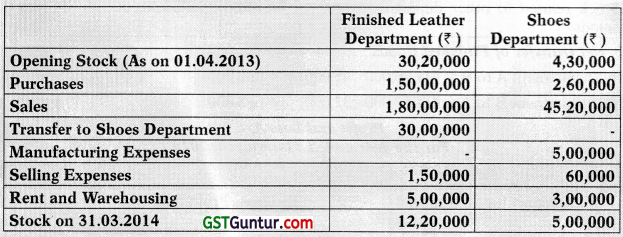

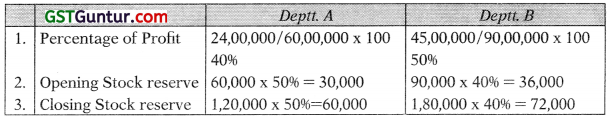

M/s. P have 2 Departments – X and Y. From the following information, prepare departmental Trading A/c and General Profit & Loss Account for the year ended on 31st March 2018.

Purchased goods have been transferred mutually at their respective departmental purchase cost and finished goodš at departmental market price and 30% of the closing finished stock with each department represents finished goods received from the other department. (8 Marks) (May 2018)

Answer:

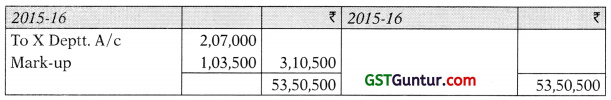

Departmental Trading Account for the year ended 31st March 2018

Genemi Profit and Loss A/c for the year ended 31st March, 2018

Working Notes:

1. Computation of gross profit

![]()

Final Accounts

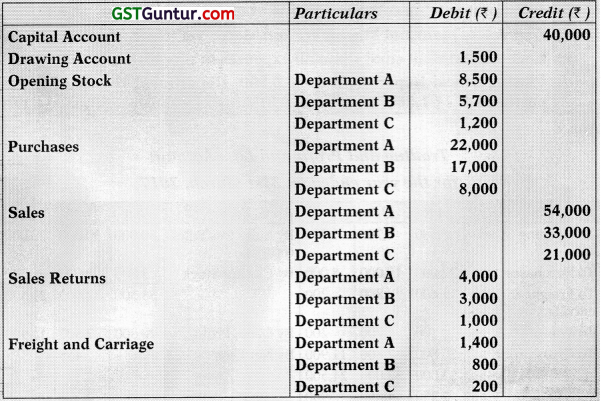

Question 15.

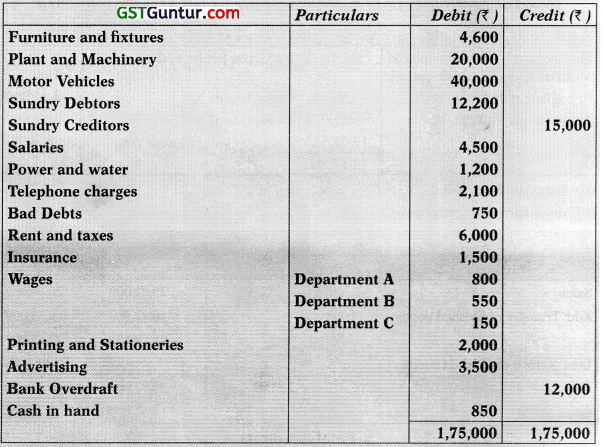

Following is the Trial Balance of Mr. A as on 31.03.2017:

You are required to prepare Department Trading, Profit and Loss Account and the Balance Sheet taking into account the following adjustments:

(а) Outstanding Wages: Department B – ₹ 150, Department C – ₹ 50.

(b) Depreciate Plant and Machinery and Motor Vehicles at the rate of 10%.

(c) Each Department shall share all expenses in proportion to their sales.

(d) Closing Stock: Department A – ₹ 3,500, Department B – ₹ 2,000, Department C – ₹ 1,500. (RTP)

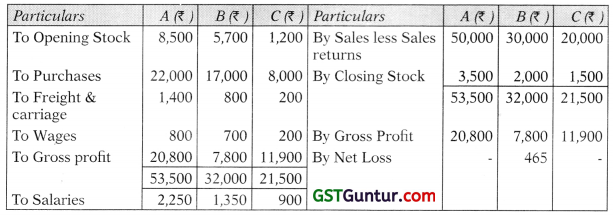

Answer:

Trading and Profit and Loss Account for the year ended on 31st March, 2017

Balance Sheet as at 31.03.2017

Note:

Allocation of expenses has been done in proportion of sales.

Managers Commission

Question 16.

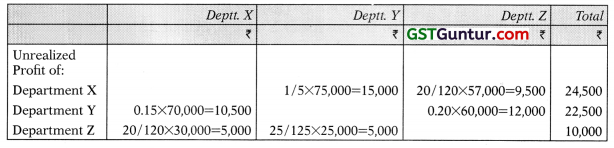

There is transfer/sale among the three departments as below:

Department X sells goods to Department Y at a profit of 25% on cost and to Department Z at 20% profit on cost.

Department Y sells goods to X and Z at a profit of 15% and 20% on sales respectively.

Department Z charges 20% and 25% profit on cost to Departments X and Y respectively.

Department Managers are entitled to 10% commission on net profit subject to unrealized profit on departmental sales being eliminated.

Departmental profits after charging Managers’ commission, but before adjustment of unrealized profit are as under:

Stocks lying at different Departments at the end of the year are as under:

Find out the correct departmental profits after charging Managers’ commission. (8 Marks) (May 2016)

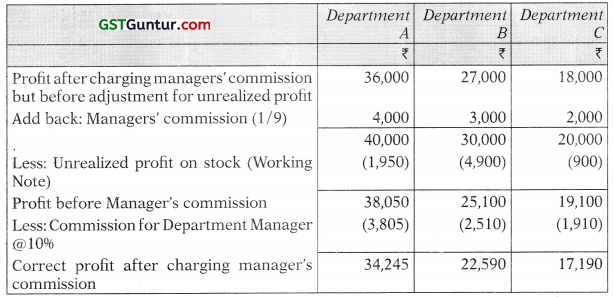

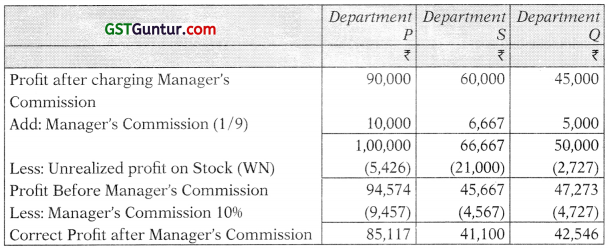

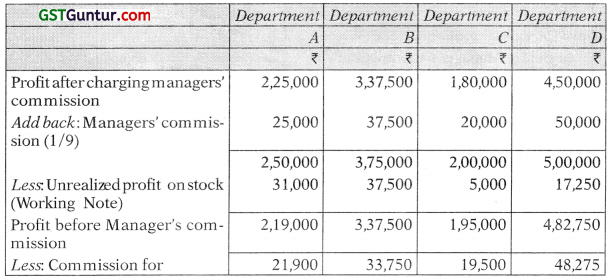

Answer:

Computation of Rectified Profit

Working Note:

computation of stock reserve on unsold stock

![]()

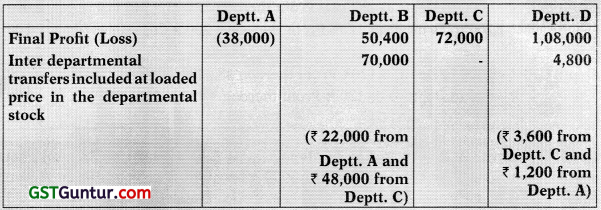

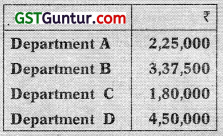

Question 17.

M/s. X and Co., had four departments A, B, C and D. Each department being managed by manager whose commission was 10% of the respective departmental profit, subject to a minimum of ₹ 6,000 in each case. Inter departmental transfers took place at a ‘loaded’ price as follows:

From Department A to Department B 10% abosre cost

From Department A to Department D 20% above cost

From Department C to Department D 20% above cost

From Department C to Department B 20% above cost

For the year ending on 31st March, 2014 the firm had already prepared and closed the departmental Trading and Profit and Loss Account. Subsequently, it was discovered that the closing stocks of departments had included inter departmentally transferred goods at loaded price instead of cost price. From the following information prepare a statement recomputing the departmental profit or loss:

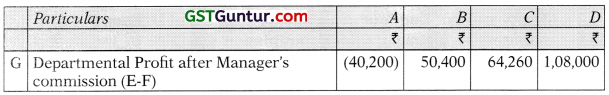

Answer:

Statement showing Computation of Rectified Profit

Working Note:

1. Computation of Manager ‘s Commission:

2. Computation of Unrealized Profit:

Question 18.

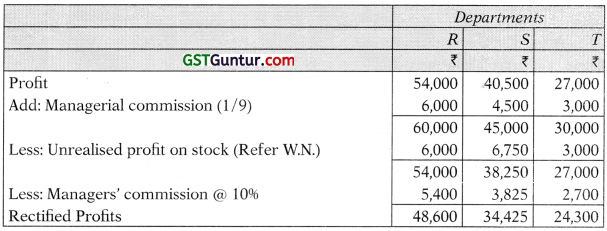

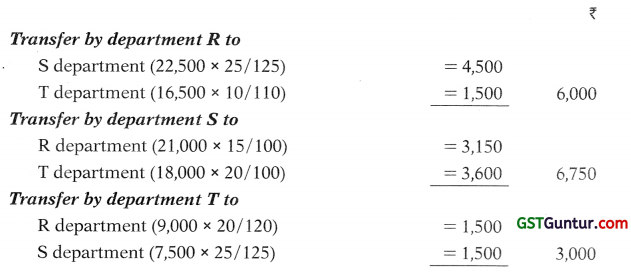

Department R sells goods to Department S at a profit of 25% on cost and Department T at 10% profit on cost. Department S sells goods to R and T at a profit of 15% and 20% on sales respectively. Department T charges 20% and 25% profit on cost to Department R and S respectively.

Department managers are entitled to 10% commission on net profit subject to unrealized profit on departmental sales being eliminated. Departmental profits after charging manager’s commission, but before adjustment of unrealized

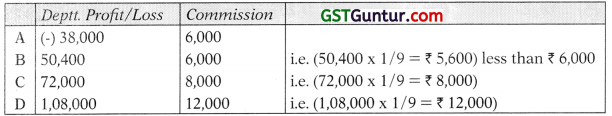

Stock lying at different departments at the end of the year are as under:

Find out the correct departmental profits after charging manager’s commission. (8 Marks) (Nov. 2010)

Answer:

Computation of Rectified Profit

Working Notes:

Computation of unrealised profit

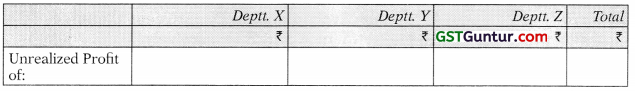

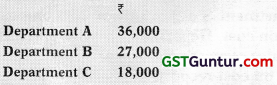

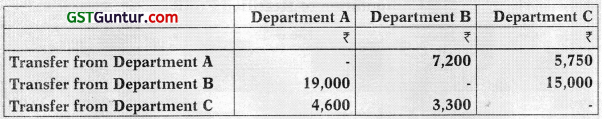

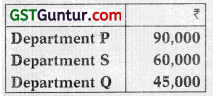

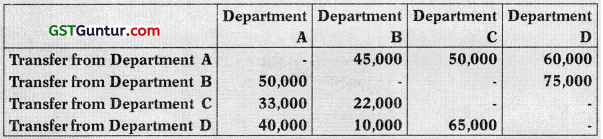

Question 19.

Department A sells goods to Department B at a profit of 20% on cost and Department C at 15% profit on cost. Department B sells goods to A and C at a profit of 10% and 20% on sales respectively. Department C sells goods to A and B at 15% and 10% profit on cost respectively.

Departmental managers are entitled to 10% commission on net profit subject to unrealized profit on departmental sales being eliminated. Departmental profits after charging manager’s commission, but before adjustment of unrealized profit are as under:

Stock lying at different departments at the end of the year are as below:

Find out correct departmental profits after charging manager’s commission. (8 Marks) (Nov. 2012)

Answer:

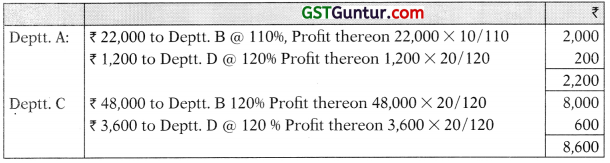

Computation of Rectified Profit

Working Note:

![]()

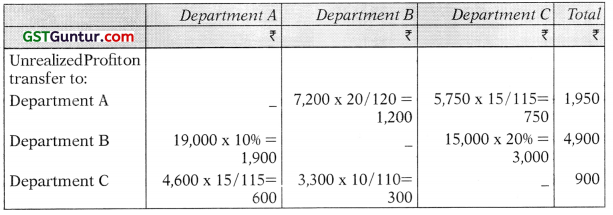

Question 20.

Department P sells goods to Department S at a profit of 25% on cost and to Department Q at a profit of 15% on cost. Department S sells goods to P and 0 at a profit of 20% and 30% on sales respectively. Department 0 sells goods to P and S at 20% and 10% profit on cost respectively.

Departmental Managers are entitled to 10% commission on net profit subject to unrealized profit on departmental sales being eliminated. Departmental profits after charging Manager’s commission, but before adjustment of unrealized profits are as below:

Stock lying at different Departments at the end of the year are as below:

Find out correct Departmental Profits after charging Managers’ Commission. (8 Marks) (May 2014)

Answer:

Computation of rectified profits

Working Notes:

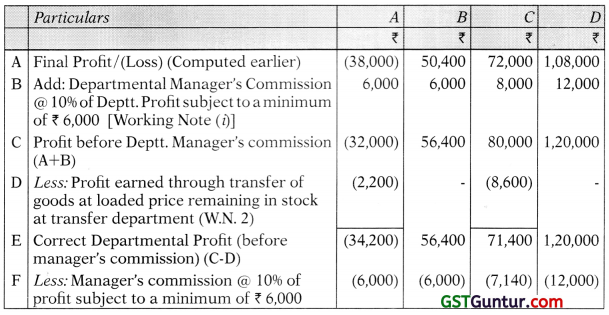

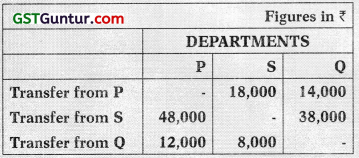

Question 21.

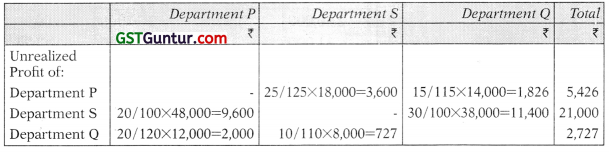

Axe Limited has four departments, A, B, C and D. Department A sells goods to other departments at a profit of 25% on cost. Department B sells goods to other department at a profit of 30% on sales. Department C sells goods to other departments at a profit of 10% on cost. Department D sells goods to other departments at a profit of 15% on sales.

Stock lying at different departments at the year-end was as follows:

Departmental managers are entitled to 10% commission on net profit subject to unrealized profit on departmental sales being eliminated.

Departmental profits after charging manager’s commission, but before adjustment of unrealized profit are as under:

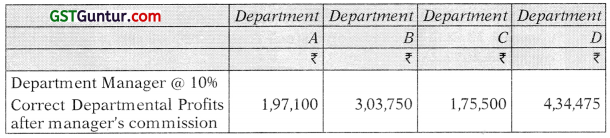

Calculate the correct departmental profits after charging Manager’s commission. (5 Marks) (Nov. 2018)

Answer:

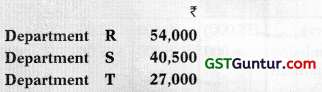

Computation of Rectified Profits

Working Note:

Stock Reserve on stock lying unsold

![]()

Memorandum Accounts

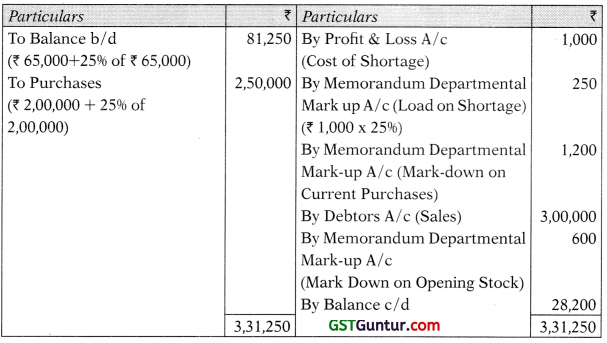

Question 22.

Martis Ltd. has several departments. Goods supplied to each department are debited to a Memorandum Departmental Stock Account at cost, plus a fixed percentage (mark-up) to give the normal selling price. The mark-up is credited to a memorandum departmental Mark-up account’, any reduction in selling prices (mark-down) will require adjustment in the stock account and in mark-up account. The mark-up for Department A for the last three years has been 25%. Figures relevant to Department A for the year ended 31st March, 2013 were as follows:

Opening stock as on 1st April, 2012, at cost ₹ 65,000

Purchase at cost ₹ 2,00,000

Sales ₹ 3,00,000

It is further ascertained that:

- Shortage of stock found in the year ending 31.03.2013, costing ₹ 1,000 were written off.

- Opening stock on 01.04.2012 IncludIng goods costing ₹ 6,000 had been sold during the year and had been marked down in the selling price by ₹ 600. The remaining stock had been sold during the year.

- Goods purchased during the year were marked down by ₹ 1,200 from a cost of ₹ 15,000. Marked-down stock costing ₹ 5,000 remained unsold on 31.03.2013.

- The departmental closing stock is to be valued at cost subject to ad-justment for mark-up and mark-down.

You are required to prepare:

(i) A Departmental Trading Account for Department A for the year ended 31st March, 2013 in the books of Head Office.

(ii) A Memorandum Stock Account for the year.

(iii) A Memorandum Mark-up Account for the year. (12 Marks) (Nov. 2013)

Answer:

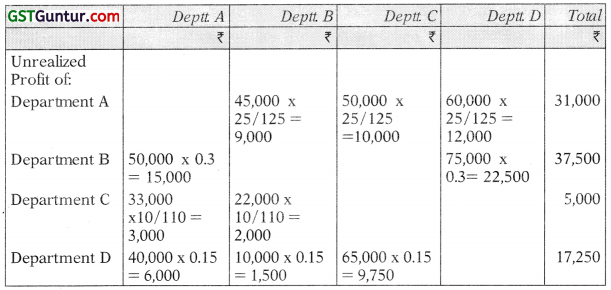

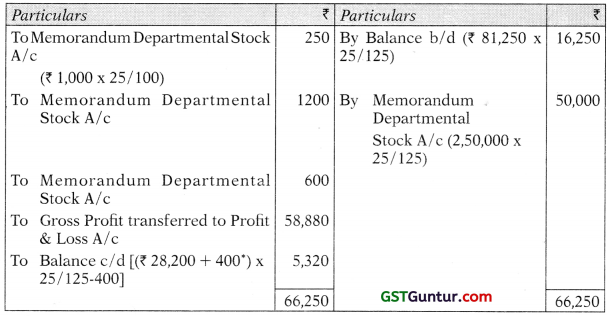

(i) Department Trading Account

For the year ending on 31.03.2013

(ii) Memorandum stock account

(for Department A – at selling price)

(iii) Memorandum Departmental Mark-up Account

* [₹ 1,200 × 5,000/15,000] = 400

Working Notes:

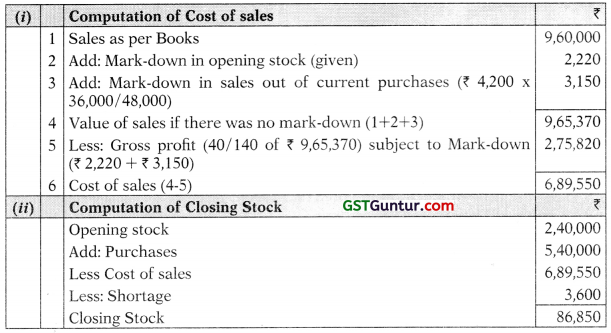

(i) Computation of Cost of Sales

(ii) Computation of Closing Stock

![]()

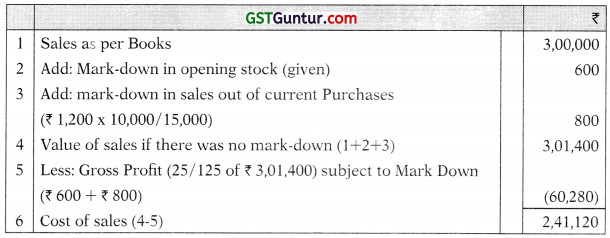

Question 23.

R Limited is a retail organization with several departments. Goods supplied to each department are debited to a Memorandum Departmental Stock Account at cost, plus fixed percentage (mark-up) to give the normal selling price. The mark up is credited to a Memorandum Departmental ‘Mark-up Account’. Any reduction in selling prices (mark-down) will require adjustment in the stock account and in mark-up account. The mark up for Department A for the last three years has been 40%. Figures relevant to Department A for the ended 31st March, 2016 were as follows:

Stock 1st April, 2015 at cost, ₹ 2,40,000, Purchases at cost ₹ 5,40,000, Sales ₹ 9,60,000. It is further ascertained that:

(a) Goods purchased in the period were marked-down by ₹ 4,200 from a cost of ₹ 48,000. Marked-down stock costing ₹ 12,000 remained unsold on 31st March, 2016.

(b) Stock shortages at the year end, which had cost ₹ 3,600 were to be written off.

(c) Stock at 1st April, 2015 including goods costing ₹ 24,600 had been sold during the year and has been mark-down in the selling price by ₹ 2,220. The remaining stock had been sold during the year.

(d) The departmental closing stock is to be valued at cost subject to adjustments for mark-up and mark-down.

Required: Prepare

(i) Departmental Trading Account

(ii) Memorandum Stock Account

(iii) Memorandum Mark-up Account for the year 2015-2016. (RTF)

Answer:

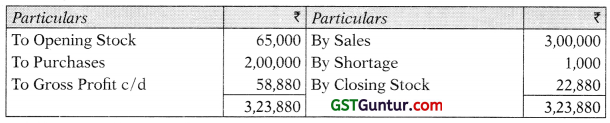

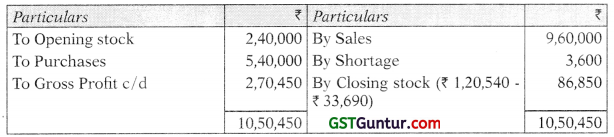

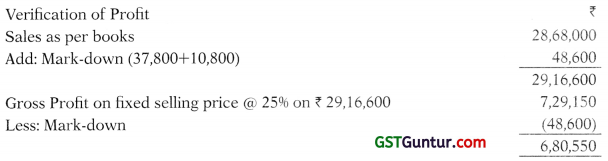

Departmental Trading Account for the year ending on 31st March, 2016

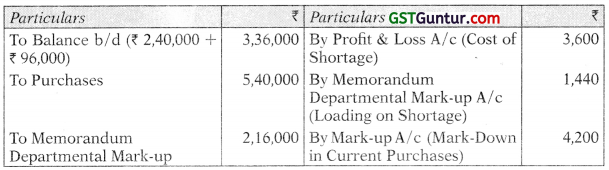

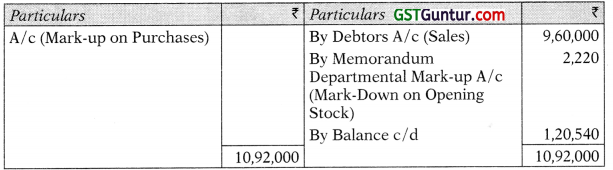

Memorandum Departmental Stock Account (At Selling Price)

Memorandum Departmental Mark-up Account

*[₹ 4200 × 12,000/48,000 = 1,050]

Working Notes:

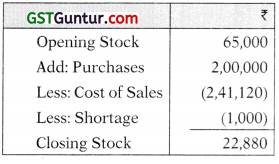

Question 24.

M/s. Sham Udyog, a retail store, has two departments, Department X and Department Y for each of which stock account and memorandum ‘mark-up’ account are kept. All the goods supplied to each department are debited to the stock account at cost plus a ‘mark-up’, which together make-up the selling price of the goods and in the account the sale proceeds of the goods are credited. The amount of ‘mark-up’ is credited to the Departmental Mark-up Account. If the selling price of any goods is reduced below its normal selling price, the reduction ‘marked-down’ is adjusted both in the Stock Account and the Departmental Mark-up Account. The rate of ‘Mark-up’ for X Department is 33-1/3% of the cost and for Y Department it is 50% of the cost.

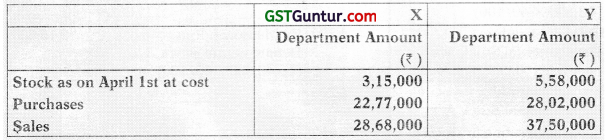

The following figures have been taken from the books for the year ended March, 2016:

- The stock of Department X on April 1, 2015 included goods the selling price of which had been marked-down by ₹ 37,800, These goods were sold during the year at the reduced prices.

- Certain stock of the value of ₹ 2,07,000 purchased from the Department X was later in the year transferred to the Department Y and sold for ₹ 31,05,000. As a result, though cost of the goods is included in the Department X the sale proceeds have been credited to the Department Y.

- During the year 2015-16 to promote the goods, they were marked-down as follows:

All the goods marked-down, w ere sold except of Department Y of the value of ₹ 1,50,000 marked-down by ₹ 30,000. - At the time of stock taking on 31st March, 2016, it was discovered that cloth of Department X of the cost of ₹ 11,700 was missing and it was decided that the amount be written-off.

You are required to prepare for both the departments for the year ended 31st March, 2016:

(a) The Memorandum Stock Account; and

(b) The Memorandum Mark-up Account. (8 Marks) (Nov. 2016)

Answer:

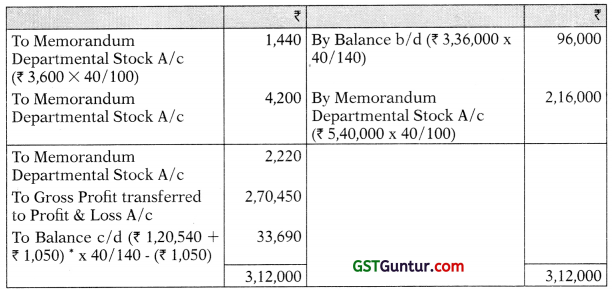

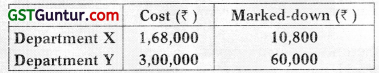

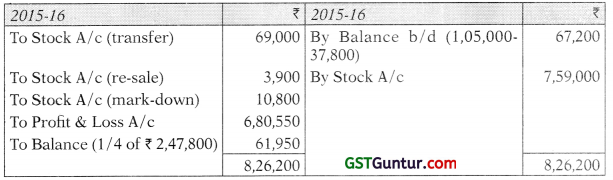

Department X Memorandum Stock A/c

Department X Memorandum Mark-up Account

Working Note:

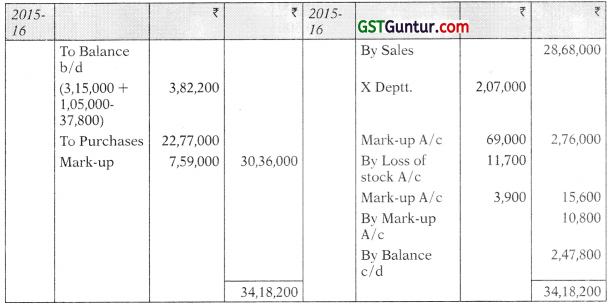

Department Y Memorandum Stock Account

Department Y Memorandum Mark-Up Account

Working Notes: