CA Inter Accounts Question Paper Nov 2019 – CA Inter Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

CA Inter Nov 2019 Accounts Question Paper

Question 1.

Answer the following questions: (5 × 4 = 20)

(a) Prepare cash flow from investing activities as per AS 3 of M/s Subham Creative Limited for year ended 31.3.2019.

| Particulars | Amount (₹) |

| Machinery acquired by issue of shares at face value | 2,00,000 |

| Claim received for loss of machinery in earthquake | 55,000 |

| Unsecured loans given to associates | 5,00,000 |

| Interest on loan received from associate company | 70,000 |

| Pre-acquisition dividend received on investment made | 52,600 |

| Debenture interest paid | 1,45,200 |

| Term loan repaid | 4,50,000 |

| Interest received on investment (TDS of ₹ 8,200 was deducted on the above interest) | 73,800 |

| Purchased debentures of X Ltd., on 1st December, 2018 which are redeemable within 3 months | 3,00,000 |

| Book value of plant & machinery sold (loss incurred ₹ 9,600) | 90,000 |

Answer:

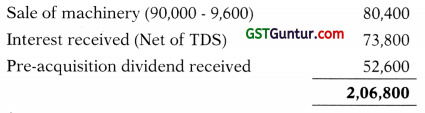

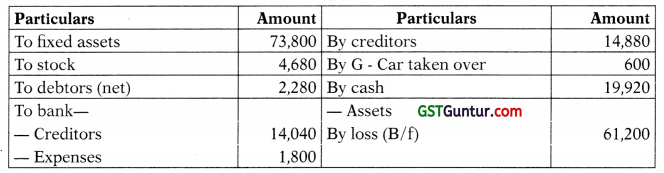

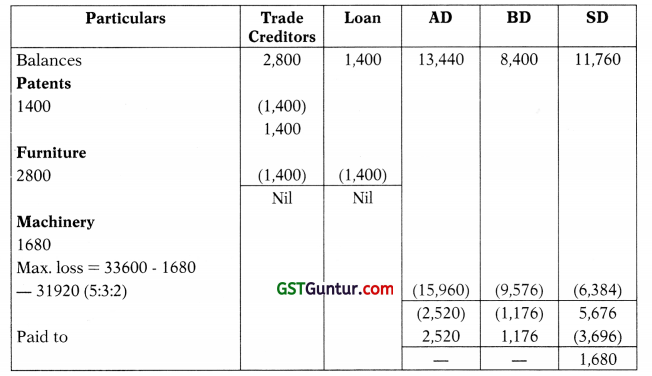

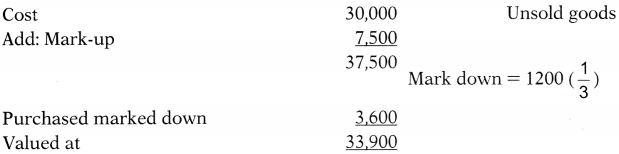

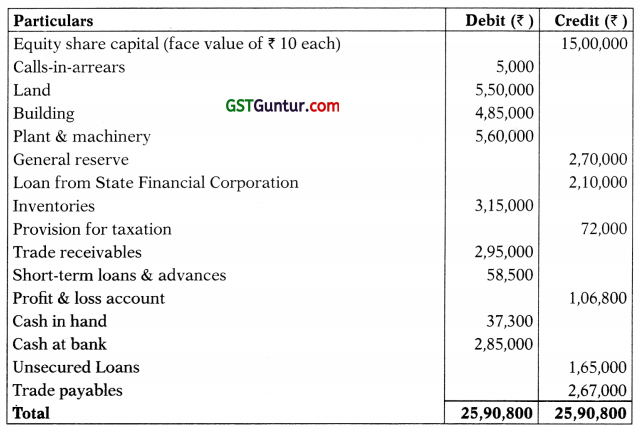

Cash Flows Investing Activities

![]()

(b) Karan Enterprises having its Head Office in Mangalore, Karnataka has a branch in Greenville, USA. Following is the trial balance of Branch as at 31-3-2019:

| Particulars | Amount ($) Dr. | Amount ($) Cr. |

| Fixed assets | 8,000 | |

| Opening inventory | 800 | |

| Cash | 700 | |

| Goods received from Head Office | 2,800 | |

| Sales | 24,050 | |

| Purchases | 11,800 | |

| Expenses | 1,800 | |

| Remittance to head office | 2,450 | |

| Head office account | 4,300 | |

| 28,350 | 28,350 |

- Fixed assets were purchased on 1st April, 2015.

- Depreciation at 10% p.a. is to be charged on fixed assets on straight line method.

- Closing inventory at branch is $ 700 as on 31-3-2019.

- Goods received from Head Office (HO) were recorded at ₹ 1,85,500 in HO books.

- Remittances to HO were recorded at ₹ 1,62,000 in HO books.

- HO account is recorded in HO books at ₹ 2,84,500.

- Exchange rates of US Dollar at different dates can be taken as:

1-4-2015 – ₹ 63;

1-4-2018 – ₹ 65 and

31-3-2019 – ₹ 67.

Prepare the trial balance after been converted into Indian rupees in accordance with AS-11.

Answer:

| Particulars | $ | Rate | ₹ |

| Fixed assets | 8000 | 63 | 5,04,000 |

| Opening Inventory | 800 | 65 | 52,000 |

| Cash | 70 | 67 | 46,900 |

| Goods received from HO | 2800 | HO Books | 1,85,500 |

| Sales | (24050) | 66 | (15,87,300) |

| Purchases | 11,800 | 66 | 7,78,800 |

| Expenses | 1800 | 66 | 1,18,800 |

| Remittances to HO | 2450 | HO Books | 1,62,000 |

| HO Ac | (4300) | HO Books | (2,84,500) |

| Exchange Gain | (23,800) |

![]()

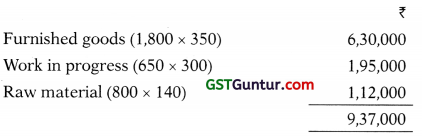

(c) Mr. Rakshit gives the following information relating to items forming part of inventory as on 31st March, 2019. His factory produces product X using raw material A.

- 800 units of raw material A (purchased @ ₹ 140 per unit). Replacement cost of raw material A as on 31st March, 2019 is ₹ 190 per unit.

- 650 units of partly finished goods in the process of producing X and cost incurred till date ₹ 310 per unit. These units can be finished next year by incurring additional cost of ₹ 50 per unit.

- 1,800 units of finished product X and total cost incurred ₹ 360 per unit. Expected selling price of product X is ₹ 350 per unit.

In the context of AS-2, determine how each item of inventory will be valued as on 31st March, 2019. Also, calculate the value of total inventory as on 31st March, 2019.

Answer:

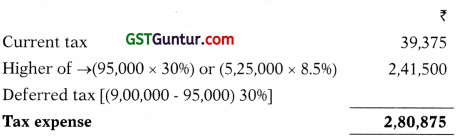

(d) Sheetal Ltd. has provided the following information for the year ended 31st March, 2019:

| Particulars | Amount (₹) |

| Accounting profit | 9,00,000 |

| Book profit as per MAT | 5,25,000 |

| Profit as per Income-tax Act | 95,000 |

| Tax rate | 30% |

| MAT rate | 7.5% |

You are required to calculate the deferred tax asset/liability as per AS-22 and amount of tax to be debited to the profit and loss account for the year.

Answer:

![]()

Question 2.

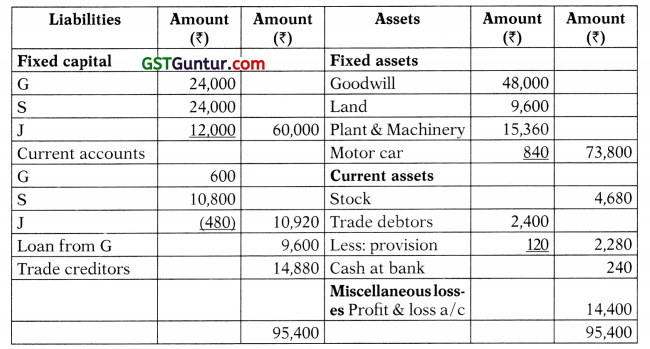

(a) G, S & J were partners sharing profits and losses in the ratio of 4:3:2, no partnership salary or interest on capital being allowed. Their Balance Sheet as on 31.3.2019 is as follows:

On 1st April, 2019, the partnership was dissolved. Motor car was taken over by G at a value of 600, but no cash passed specifically in respect of this trans action. Sale of other assets realized the following amounts:

| Particulars | ₹ |

| Goodwill | Nil |

| Land | 8,400 |

| Plant & machinery | 6,000 |

| Stock | 3,600 |

| Trade debtors | 1,920 |

Trade creditors were paid ₹ 14,040 in full settlement of their debts. The cost of dissolution amounted to ₹ 1,800. The loan from G was repaid; G and S were both fully solvent and able to bring in any cash required but J was forced into bankruptcy and was only able to bring 1/2 of the amount due.

You are required to prepare:

- Cash & Bank account

- Realization account, and

- Partner’s Fixed Capital Accounts (after transferring current accounts balances) Apply Garner vs. Murray rule. (15 Marks)

Answer:

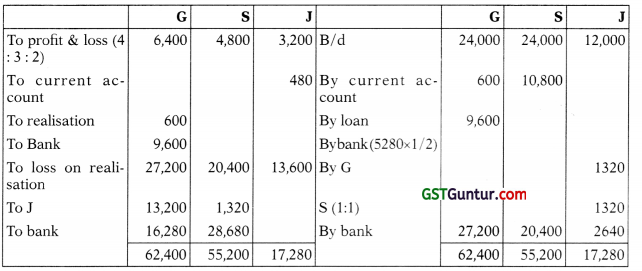

Realisation Account

Capital including current account

Cash at bank

![]()

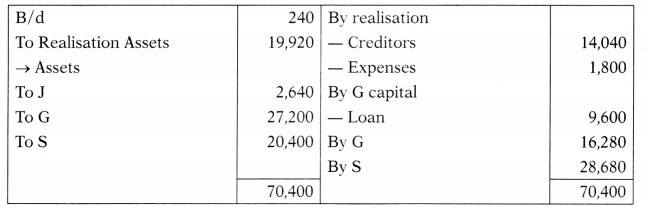

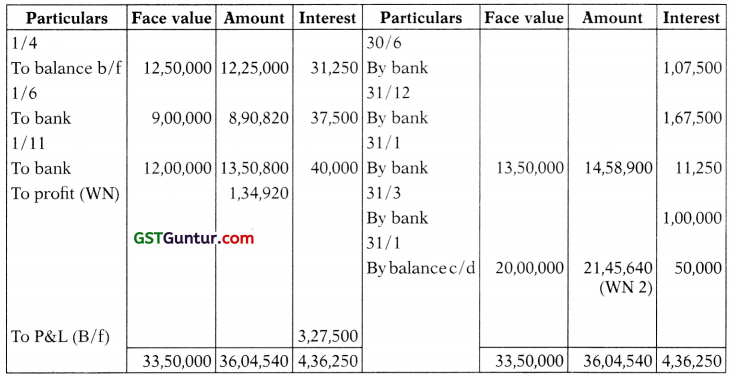

(b) AD, BD & SD are partners sharing profits and losses in the ratio of 5:3:2. There capitals were ₹ 13,440, ₹ 8,400, ₹ 11,760 respectively. Liabilities and assets of the firm are as under:

The assets realized in full in the order in which they are listed above. BD is insolvent.

You are required to prepare a statement showing the distribution of cash as and when available, applying maximum possible loss procedure. (5 Marks)

Answer:

| AD | BD | SD | |

| Outstanding Balances | 13,440 | 8,400 | 10,080 |

| Stock | |||

| 5600 | |||

| Max loss = 31,920 – 5,600 | |||

| → 26,320 | |||

| (5 : 3 : 2) | (13,160) | (7,896) | (5,264) |

| Paid to | 280 | 504 | 4,816 |

| Outstanding claims | 13,160 | 7,896 | 5,264 |

![]()

Question 3.

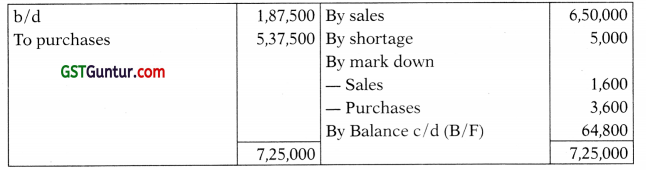

(a) Mr. Harsh provides the following details relating to his holding in 10% debentures (face value of ₹ 100 each) of Exe Ltd., held as current assets:

| 1.4.2018 | opening balance – 12,500 debentures, cost ₹ 12,25,000 |

| 1.6.2018 | purchased 9,000 debentures @ ₹ 98 each ex-interest |

| 1.11.2018 | purchased 12,000 debentures @ ₹ 115 each cum-interest |

| 31.1.2019 | sole 13,500 debentures @ ₹ 110 each cum-interest |

| 31.3.2019 | Market value of debentures @ ₹ 115 each |

Due dates of interest are 30th June and 31 st December.

Brokerage at 1 % is to be paid for each transaction. Mr. Harsh closes his books on 31.3.2019. Show investment account as it would appear in his books assuming FIFO method is followed. (10 Marks)

Answer:

Investment Account

Working Note 1

Profit / loss on sale

= 14,58,900 – [1225000 + \(\frac{890820}{900000}\) × 100000]

= 1,34,920

Working Note 2

23,00,000 or 21,45,640 whichever is less

(b) A fire occurred in the premises of M/s Kirti & Co. on 15th December, 2018. The working remained disturbed upto 15th March, 2019 as a result of which sales adversely affected. The firm had taken out an Insurance policy with an average clause against consequential losses for ₹ 2,50,000.

Following details are available from the quarterly sales tax return filed/GST return filed:

| Sales | 2015-16 (₹) |

2016-17 (₹) |

2017-18 (₹) |

2018-19 (₹) |

| From 1st April to 30th June | 3,80,000 | 3,15,000 | 4,11,900 | 3,24,000 |

| From 1st July to 30th September | 1,86,000 | 3,92,000 | 3,86,000 | 4,42,000 |

| From 1st October to 31st December | 3,86,000 | 4,00,000 | 4,62,000 | 3,50,000 |

| From 1st January to 31st March | 2,88,000 | 3,19,000 | 3,80,000 | 2,96,000 |

| Total | 12,40,000 | 14,26,000 | 16,39,900 | 14,12,000 |

A period of 3 months (i.e. from 16-12-2018 to 15-3-2019) has been agreed upon as indemnity period.

| Sales from 16-12-2017 to 31-12-2017 | 68,000 |

| Sales from 16-12-2018 to 31-12-2018 | Nil |

| Sales from 16-03-2018 to 31-03-2018 | 1,20,000 |

| Sales from 16-03-2019 to 31-03-2019 | 40,000 |

Net profit was ₹ 2,50,000 and standing charges (all insured) amounted to ₹ 77,980 for the year ending 31st March, 2018.

You are required to calculate the loss of profit claim amount. (10 Marks)

![]()

Question 4.

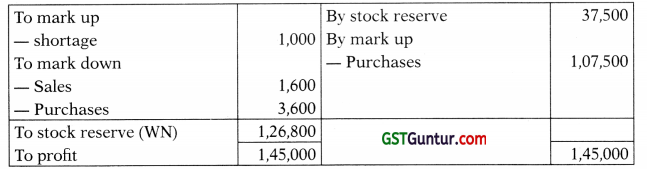

(a) ABC Ltd. has several departments. Goods supplied to each department are debited to a Memorandum Departmental Stock Account at cost plus a fixed percentage (mark-up) to give the normal selling price. The amount of mark-up is credited to a Memorandum Departmental Mark-up account. If the selling price of goods is reduced below its normal selling prices, the reduction (mark-down) will require adjustment both in the stock account and the markup account. The mark-up for department X for the last three years has been 20%. Figures relevant to department X for the year ended 31st March, 2019 were as follows:

Stock as on 1st April, 2018, at cost – ₹ 1,50,000

Purchases at cost – ₹ 4,30,000

Sales – ₹ 6,50,000

It is further ascertained that:

- Shortage of stock found in the year ending 31.3.2019, costing ₹ 4,000 were written off.

- Opening stock on 1.4.2015 including goods costing ₹ 12,000 had been sold during the year and had been marked-down in the selling price by ₹ 1,600. The remaining stock had been sold during the year.

- Goods purchased during the year were marked down by ₹ 3,600 from a cost of ₹ 30,000. Marked down stock costing ₹ 10,000 remained unsold on 31.3.2019.

- The departmental closing stock is to be valued at cost subject to adjustment for mark-up and mark-down.

You are required to prepare for the year ended 31st March, 2019:

- Departmental Trading Account for department X for the year ended 31st March, 2019 in the books of Head Office.

- Memorandum Stock Account for the year ended 31st March, 2019.

- Memorandum Mark-Up account for the year ended 31st March, 2019. (10 Marks)

Answer:

\(\frac{1}{5}\) on sales / \(\frac{1}{4}\) on cost

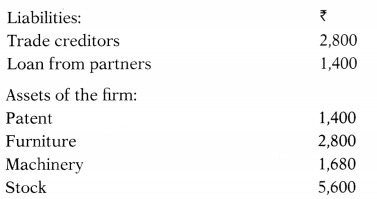

Memorandum Cost

Memorandum mark-up

Stock Reserve

Purchases marked down:

Stock reserve = (64800 + 1200) × \(\frac{1}{5}\)

= 1,200

= 12,000

![]()

Trading Account

(b) Archana Enterprises maintain their books of account under single entry system. The Balance Sheet as on 31st March, 2018 was as follows:

| Liabilities | Amount (₹) | Assets | Amount (₹) |

| Capital A/c | 6,75,000 | Furniture & fixtures | 1,50,000 |

| Trade creditors | 7,57,500 | Stock | 9,15,000 |

| Outstanding exp. | 67,500 | Trade debtors | 3,12,000 |

| Prepaid insurance | 3,000 | ||

| Cash in hand & at bank | 1,20,000 | ||

| 15,00,000 | 15,00,000 |

The following was the summary of cash and bank book for the year ended 31st March, 2019:

| Receipts | Amount (₹) | Payments | Amount (₹) |

| Cash in hand & at Bank on 1st April, 2018 | 1,20,000 | Payment to trade creditors | 1,24,83,000 |

| Cash sales | 1,10,70,000 | Sundry expenses paid | 9,31,050 |

| Receipts from trade debtors | 27,75,000 | Drawings | 3,60,000 |

| Cash in hand & at Bank on 31st March, 2019 | 1,90,950 | ||

| 1,39,65,000 | 1,39,65,000 |

Additional Information:

- Discount allowed to trade debtors and received from trade creditors amounted to ₹ 54,000 and ₹ 42,500 respectively (for the year ended 31st March, 2019)

- Annual fire insurance premium of ₹ 9,000 was paid every year on 1st August for the renewal of the policy.

- Furniture & fixtures were subject to depreciation @ 15% p.a. on diminishing balance method.

- The following are the balances as on 31st March, 2019:

Stock – ₹ 19,75,000

Trade debtors – ₹ 3,43,000

Outstanding expenses – ₹ 55,200 - Gross profit ratio of 10% on sales is maintained throughout the year. You are required to prepare Trading and Profit & Loss account for the year ended 31st March, 2019, and Balance Sheet as on that date. (10 Marks)

Answer:

Trading and Profit and Loss Account

Balance Sheet

![]()

Question 5.

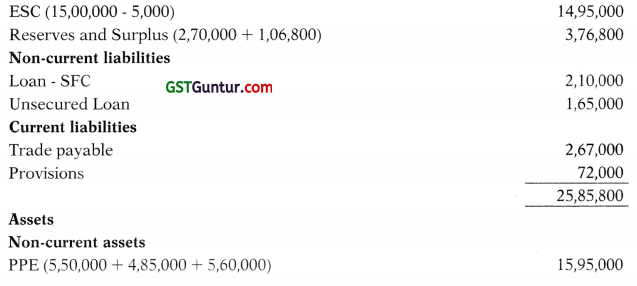

(a) From the following particulars furnished by the Prashant Ltd., prepare the Balance Sheet as at 31st March, 2019 as required by Schedule III of the Companies Act, 2013:

The following additional information is also provided:

- 10,000 equity shares were issued for consideration other than cash.

- Trade receivables of ₹ 55,000 are due for more than six months.

- The cost of building and plant & machinery is ₹ 5,50,000 and ₹ 6,25,000 respectively.

- The loan from State Financial Corporation is secured by hypothecation of plant & machinery. The balance of ₹ 2,10,000 in this account is inclusive of ₹ 10,000 for interest accrued but not due.

- Balance at Bank included ₹ 15,000 with Aakash Bank Ltd., which is not a scheduled bank. (10 Marks)

Answer:

Hint: Appropriate disclosures with be made as per schedule III

Balance Sheet

Equity and liabilities

Equity

Current assets

![]()

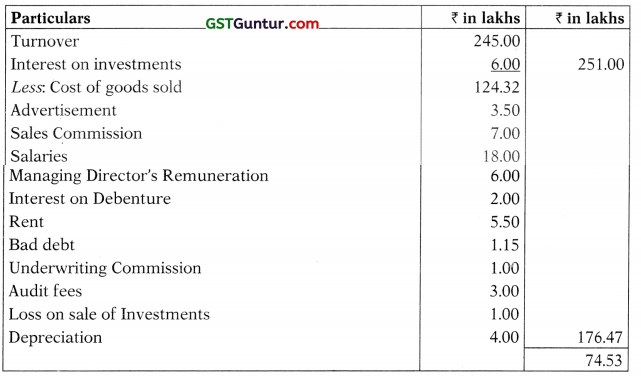

(b) The partners of C&G decided to convert their existing partnership business into a private limited called CG trading Pvt. Ltd. with effect from 1.7.2018.

The same books of account were continued by the company which closed its accounts for the first term on 31.3.2019.

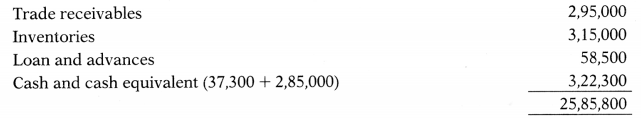

The summarized profit A loss account for the year ended 31.3.2019 is below:

The following additional information was provided:

- The average monthly sales doubled from 1.7.2018, GP ratio was constant.

- All investments were sold on 31.5.2018.

- Average monthly salaries doubled from 1.10.2018.

- The company occupied additional space from 1.7.2018 for which rent of ₹ 20,000 per month was incurred.

- Bad debts recovered amounting to ₹ 60,000 for a sale made in 2016-17 has been deducted from bad debts mentioned above.

- Audit fees pertains to the company.

Prepare a statement apportioning the expenses between pre and post Incorporation periods and calculate the profit/loss for such periods. (10 Marks)

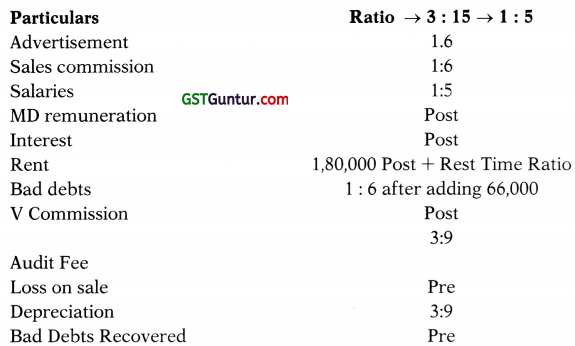

Answer:

Hint

(a) Time ratio = 3 : 9

(b) Sales ratio = 3 : 18 i.e. 1 : 6

Let monthly sales = x

Sales (April to June) = 3x

Sales (July to March) = 2x × 9

= 18x

(c) Salaries ratio = Pre : Post

= x × 3 : x × 3 + 2x × 6

![]()

Question 6.

Answer any four of the following: (4 × 5 = 20)

(a) The following extract of Balance Sheet of Prabhat Ltd. (Non-Investment Company) was obtained:

Balance Sheet (Extract) as on 31st March, 2019

| Liabilities | ₹ |

| Issued and subscribed capital: | |

| 30,000, 12% preference shares of ₹ 100 each (fully paid) | 30,00,000 |

| 24,00,000 equity shares of ₹ 10 each, ₹ 8 paid up | 1,92,00,000 |

| Share suspense account | 40,00,000 |

| Reserves and Surplus: | |

| Securities premium | 1,00,000 |

| Capital reserves (₹ 3,00,000 is revaluation reserve) | 3,90,000 |

| Secured loans: | |

| 12% debentures | 1,30,00,000 |

| Unsecured loans: | |

| Public deposits | 7,40,000 |

| Current liabilities: | |

| Trade payables | 6,90,000 |

| Cash credit from SBI (short term) | 9,30,000 |

| Assets | |

| Investments in shares, debentures etc. | 1,50,00,000 |

| Profit & loss account (Dr. balance) | 30,50,000 |

Share suspense account represents application money received on shares, the allotment of which is not yet made.

You are required to compute effective capital as per the provisions of Schedule V. Would your answer differ if Prabhat Ltd. is an investment company?

(b) Following is the extract of Balance Sheet of Prem Ltd. as at 31 st March, 2018:

| Authorized capital | ₹ |

| 3,00,000 equity shares of ₹ 10 each | 30,00,000 |

| 25,000, 10% preference shares of ₹ 10 each | 2,50,000 |

| 32,50,000 | |

| Issued and subscribed capital: | |

| 2,70,000 equity shares of ₹ 10 each fully paid up | 27,00,000 |

| 24,000, 10% preference shares of ₹ 10 each fully paid up | 2,40,000 |

| 29,40,000 | |

| Reserves and surplus: | |

| General reserve | 3,60,000 |

| Capital redemption reserve | 1,20,000 |

| Securities premium (in cash) | 75,000 |

| Profit and loss account | 6,00,000 |

| 11,55,000 |

On 1st April, 2018, the company decided to capitalize its reserves by way of bonus at the rate of two shares for every Five shares held. Show necessary journal entries in the books of the company and prepare the extract of the balance sheet after bonus issue.

Answer:

Hint

Bonus issue

= 2,70,000 × \(\frac{2}{5}\)

= 1,08,000 shares @10% each

Journal Entry

(c) Mac Ltd. gives the following data regarding to its six segments:

(₹ in lakhs)

| Particulars | A | B | C | D | E | F | Total |

| Segment assets | 80 | 160 | 60 | 40 | 40 | 20 | 400 |

| Segment results | 100 | (380) | 20 | 20 | (20) | 60 | (200) |

| Segment revenue | 600 | 1,240 | 160 | 120 | 160 | 120 | 2,400 |

The accountant contends that segments ‘A’ and ‘B’ alone are reportable segments. Is he justified in his view? Discuss in the context of AS-17 ‘Segment Reporting’,

Answer:

Hint

Accountant view is incorrect.

(d) Give an analytical statement of distinction between an ordinary partnership firm and a limited liability partnership.

![]()

(e) A company had issued 40,000, 12% debentures of ₹ 100 each on 1st April, 2015. The debentures are due for redemption on 1st March, 2019. The terms of issue of debentures provided that they were redeemable at a premium of 5% and also conferred option to the debenture holders to convert 20% of their holding into equity shares (nominal value ₹ 10) at a predetermined price of ₹ 15 per share and the payment in cash 50 debentures holders holding totally 5,000 debentures did not exercise the option. Calculate the number of equity shares to be allotted to the debenture holders and the amount to be paid in cash on redemption.

Answer:

No. or equity shares = \(\frac{(40000 \times 100 \times 20 \%) \times 1.05}{15}\) = 49,000 shares

Cash = (40,000 – 7,000) × 100 × 1.05 = 34,65,000