Liquidation of Companies – CA Inter Advanced Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Liquidation of Companies – CA Inter Advanced Accounting Study Material

List B Contributories

Question 1.

M/s. ABC Limited has gone into liquidation on 25th June, 2011. Certain creditors could not receive payments out of realization of assets and contributions from A list contributories. The following are the details of certain transfers which took place in the year ended 31st March, 2011:

All the shares are of ₹ 10 each, ₹ 8 per share paid up. Show the amount to be realized from the persons listed above. Ignore remuneration to liquidator and other expenses. (Nov 2011) (8 Marks)

Answer:

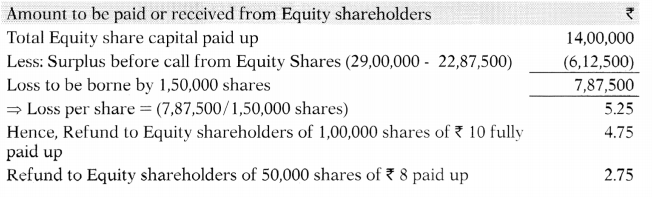

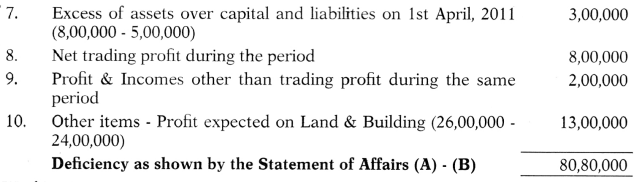

Statement showing Computation of Liabilities of B List Contributories

Notes:

- ‘P’ transferred shares before one year preceding the date of winding up, therefore, he cannot be held liable for any liability on liquidation.

- Liability of T has been restricted to the maximum allowable limit of ₹ 2,000. Therefore, amount payable by T on 09.03.2011 is ₹ 8 only.

- ‘Q’ will not be responsible for further debts incurred after 10th May, 2010 (from the date when he ceases to be a member). Similarly, ‘R’ & ‘S’ will not be liable for the debts incurred after the date of their transfer of shares.

Working Note:

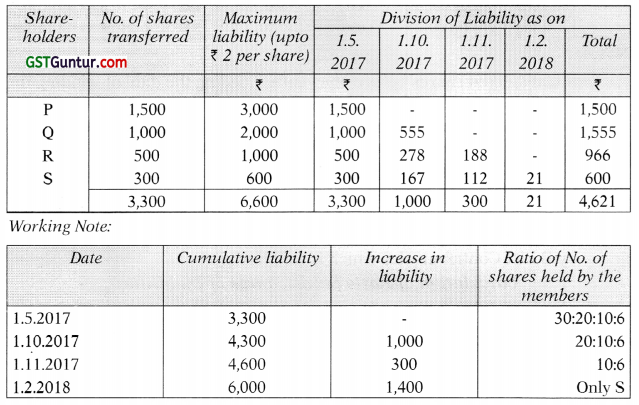

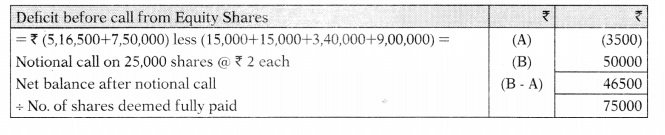

Calculation of Ratio for Discharge of Liabilities

![]()

Question 2.

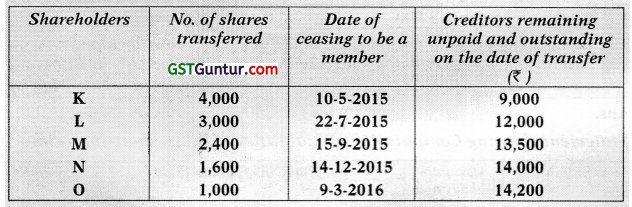

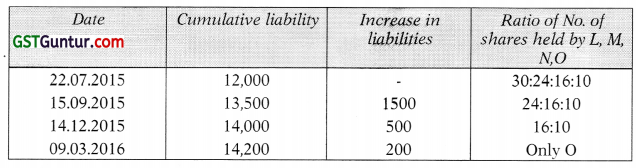

M/s. Cloud Limited has gone into liquidation on 25th June, 2016. Certain creditors could not receive payment out of realization of assets and contributions from ‘A list’ contributories. The following are the details of certain transfers which took place during the year ended 31st March, 2016:

All the shares are of ₹ 10 each and ₹ 8 per share paid up. Show the amount to be realized from the persons listed above. Ignore remuneration of liquidator and other expenses. (May 2017) (4 Marks)

Answer:

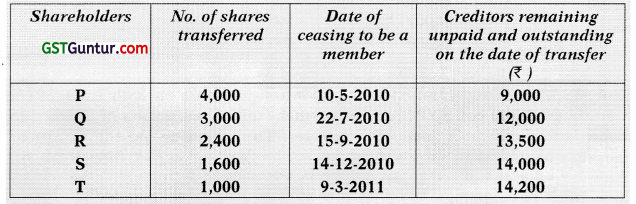

Statement showing Computation of Liabilities of B List Contributories

Notes:

- K transferred shares before one year preceding the date of winding up, therefore, he cannot be held liable for any liability on liquidation.

- Liability of O has been restricted to the maximum allowable limit of ₹ 2,000. Therefore, amount payable by O on 09.03.2016 is ₹ 8 only.

- L will not be responsible for further debts incurred after 22-7-2015 (from the date when he ceases to be a member). Similarly, M&N will not be liable for the debts incurred after the date of their transfer of shares.

- Ratio of discharge of liability will be in the ratio of No. of shares held by B List Contributories which is as follows:

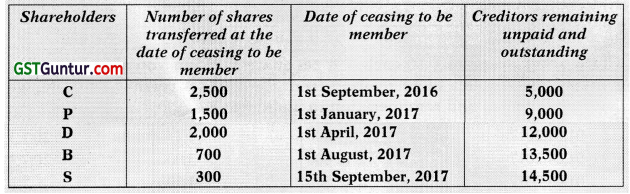

Calculation of Ratio for discharge of Liabilities

![]()

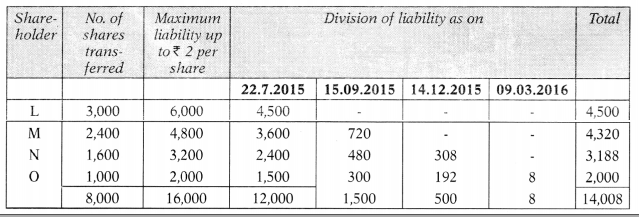

Question 3.

Liquidation of Y Ltd. commenced on 2nd April, 2018. Certain creditors could not receive payments out of the realisation of assets and out of the contributions from A list contributories. The following are the details of certain transfers which took place in 2017 and 2018:

All the shares were of ₹ 10 each, ₹ 8 per share paid up. You are required to compute the amount to be realized from the various persons listed above ignoring expenses and remuneration to liquidator etc.

Answer:

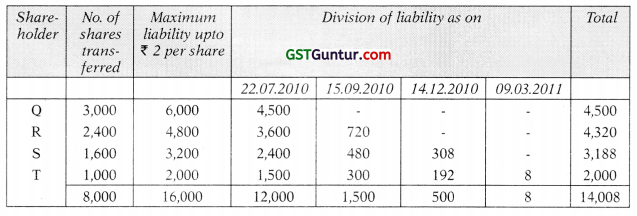

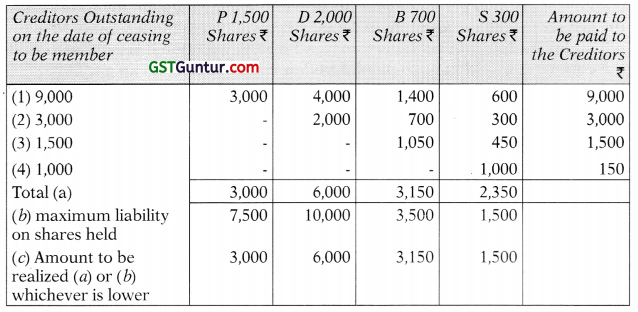

Statement showing computation of liabilities of B list contributories

Notes:

- Liability of S has been restricted to the maximum allowable limit of ₹ 600, therefore amount payable by S is restricted to ₹ 21 only, on 1.2.2018.

- A will not be liable to pay to the outstanding creditors since he transferred his shares prior to one year preceding the date of winding up.

- P will not be responsible for further debts incurred after 1st May, 2017 (from the date when he ceases to be member). Similarly, Q and R will not be responsible for the debts incurred after the date of their transfer of shares.

![]()

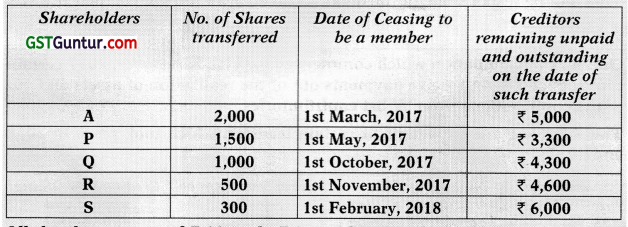

Question 4.

In a liquidation which commenced on 11th November, 2017 certain creditors could not receive payments out of the realization of assets and out of the contributions from ‘A’ list contributories.

The following are the details of certain transfer, which took place in 2016 and 2017:

All the shares were ₹ 10 each, ₹ 5 paid up.

Ignoring expenses of and remuneration to liquidators show the amount to be realised from various persons listed above. (May 2018 – New Course) (5 Marks)

Answer:

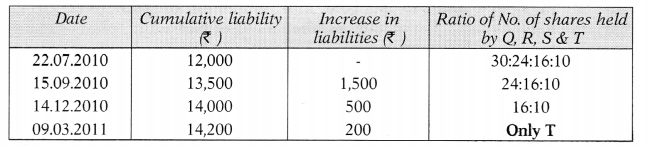

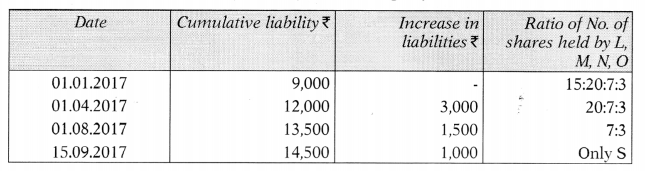

Statement of showing computation of Liabilities of B list contributors

Notes:

- C will not be liable since he transferred his shares prior to one year preceding the date of winding up.

- P will not be responsible for further debts incurred after 01.01.2017 (from the date when he ceases to be a member). Similarly, D & B will not be liable for the debts incurred after the date of their transfer of shares.

- The increase between 1 st August 2017 and 15th September 2017, is solely the responsibility of S. Liability of S has been restricted to the maximum allowable limit of ₹ 1,500. Therefore, amount payable by S on 15.09.2017 is ₹ 150 only.

- Ratio of discharge of liability will be in the ratio of No. of shares held by B List Contributories which is as follows:

Calculation of Ratio for discharge of Liabilities

![]()

Computation of Preferential Creditors

Question 5.

A company went into liquidation whose creditors are ₹ 36,000 includes ₹ 6,000 on account of wages of 15 men at ₹ 100 per month for 4 months immediately before the date of winding up; ₹ 9,000 being the salaries of 5 employees at ₹ 300 per month for the previous 6 months, Rent for godown for the last six months amounting to ₹ 3,000; Income-tax deducted out of salaries of employees ₹ 1,000 and Directors fees ₹ 500; in addition it is estimated that the company would have to pay ₹ 5,000 as compensation to an employee for injuries suffered by him, which was contingent liability not accepted by the company and not included in above said creditors figure.

Find the amount of Preferential Creditors. (Nov 2010) (4 Marks)

Answer:

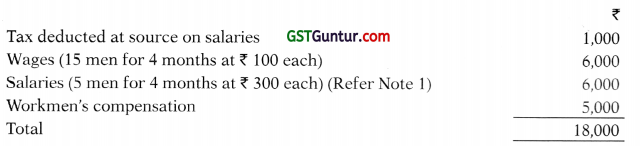

Calculation of Preferential Creditors

Note:

(i) Salaries payable to any employee due for the period not exceeding 4 months within the twelve months next before commencement of winding up subject to maximum ₹ 20,000 per person.

![]()

Question 6.

XYZ Limited is being would up by the tribunal. All the assets of the company have been charged to the company’s bankers to whom the company owes ₹ 5 crores. The company owes following amounts to others:

Dues to workers – ₹ 1,25,00,000

Taxes Payable to Government – ₹ 30,00,000

Unsecured Creditors – ₹ 60,00,000

You are required to compute with the reference to the provision of the Companies Act, 2013 the amount each kind of creditors is likely to get if the amount realized by the official liquidator from the secured assets and available for distribution among creditors is only ₹ 4,00,00,000.

Answer:

Section 326 of the Companies Act, 2013 talks about the overriding preferential payments to be made from the amount realized from the assets to be distributed to various kind of creditors. Proviso to section 326 the security of every secured creditor should be deemed to be subject to a pari passu change in favour of the workman to the extent of their portion.

Workman’s Share to Secured Assets = \(\frac{\text { Amount Realied x Workman’s Dues }}{\text { Workman’s Dues }+ \text { Secured Loan }}\)

= \(\frac{4,00,00,000 \times 1,25,00,000}{1,25,00,000+5,00,00,000}\)

4,00,00,000 × \(\frac{1}{5}\)

Workman’s Share to Secured Assets = 80,00,000

Amount available to secured creditor is ₹ 400 Lakhs – 80 Lakhs = 320 Lakhs

Hence, no amount is available for payment of government dues and unsecured creditors.

![]()

Liquidator’s Remuneration

Question 7.

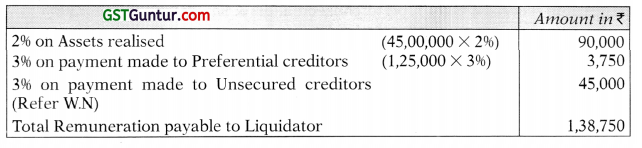

A liquidator is entitled to receive remuneration at 2% on the assets realized, 3% on the amount distributed to Preferential Creditors and 3% on the payment made to Unsecured Creditors. The assets were realized for ₹ 45,00,000 against which payment was made as follows:

Liquidation expenses – ₹ 50,000

Secured Creditors – ₹ 15,00,000

Preferential Creditors – ₹ 1,25,000

The amount due to Unsecured Creditors was € 15,00,000. You are asked to calculate the total remuneration payable to liquidator. Calculation shall be made to the nearest multiple of a rupee. (May 2015) (4 Marks)

Answer:

Calculation of Total Remuneration payable to Liquidator

Working Note:

Liquidator’s remuneration on payment to unsecured creditors =

Cash available for unsecured creditors after all payments including liquidation expenses, payment to secured creditors, preferential creditors & liquidator’s remuneration

= ₹ 45,00,000 – 50,000 – ₹ 15,00,000 – ₹ 1,25,000 – ₹ 90,000 – ₹ 3,750

= ₹ 27,31,250

Sufficient amount is available for unsecured creditors therefore Liquidator’s remuneration on payment to unsecured creditors = 3% × ₹ 15,00,000 = ₹ 45,000

![]()

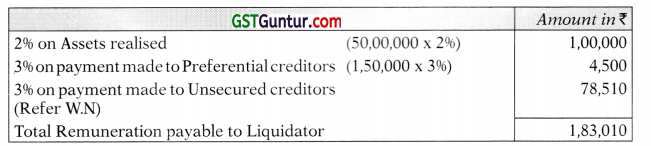

Question 8.

A liquidator is entitled to receive remuneration at 2% on the assets realized, 3% on the amount distributed to Preferential creditors and 3% on the payment made to unsecured creditors. The assets were realized for ₹ 50,00,000 against which payment was made as follows:

Liquidation – ₹ 50,000

Secured Creditors – ₹ 20,00,000

Preferential Creditors – ₹ 1,50,000

The amount due to Unsecured creditors was ₹ 30,00,000

You are asked to calculate the total Remuneration payable to Liquidator. Calculation shall be made to the nearest multiple of a rupee. (May 2018) (5 Marks)

Answer:

Calculation of Total Remuneration payable to Liquidator

Working Note:

Liquidator’s remuneration on payment to unsecured creditors =

Cash available for unsecured creditors after all payments including liquidation expenses, payment to secured creditors, preferential creditors & liquidator’s remuneration

= ₹ 50,00,000 – ₹ 50,000 – ₹ 20,00,000 – ₹ 1,50,000 – ₹ 1,00,000 – ₹ 4,500

= ₹ 26,95,500

Since cash balance is available for unsecured creditors, Liquidator’s remuneration on payment to unsecured creditors = ₹ 26,95,500 × 3/103 = ₹ 78,510 (rounded off)

![]()

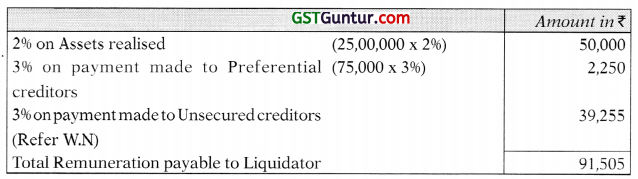

Question 9.

A Liquidator is entitled to receive remuneration at 2% on the assets realized, 3% on the amount distributed to Preferential Creditors and 3% on the payment made to Unsecured Creditors. The assets were realized for ₹ 25,00,000 against which payment was made as follows:

Liquidation expenses – ₹ 25,000

Secured Creditors – ₹ 10,00,000

Preferential Creditors – ₹ 75,000

The amount due to Unsecured Creditors was ₹ 15,00,000. You are asked to calculate the total Remuneration payable to Liquidator. Calculation shall be made to the nearest multiple of a rupee.

Answer:

Calculation of Total Remuneration payable to Liquidator

Working Note:

Liquidator’s remuneration on payment to unsecured creditors = Cash available for unsecured creditors after all payments including liquidation expenses, payment to secured creditors, preferential creditors & liquidator’s remuneration

= ₹ 25,00,000 – ₹ 25,000 – ₹ 10,00,000 – ₹ 75,000 – ₹ 50,000 – ₹ 2,250

= ₹ 13,47,750.

Liquidator’s remuneration on payment to unsecured creditors = 3/103 × ₹ 1347,750 = ₹ 39,255

Statement of Affairs Only

Question 10.

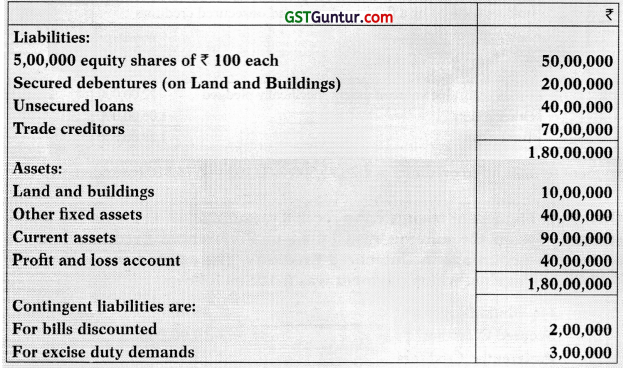

‘A’ Ltd. is to be liquidated. Their summarised Balance Sheet as at 30th September, 2016 appears as under:

On investigation, it is found that the contingent liabilities are certain to devolve and that the assets are likely to be realised as follows:

Answer:

Statement of Affairs of ‘A’ Ltd. as at 30th September, 2016

![]()

Statement off Affairs And Deficiency Account

Question 11.

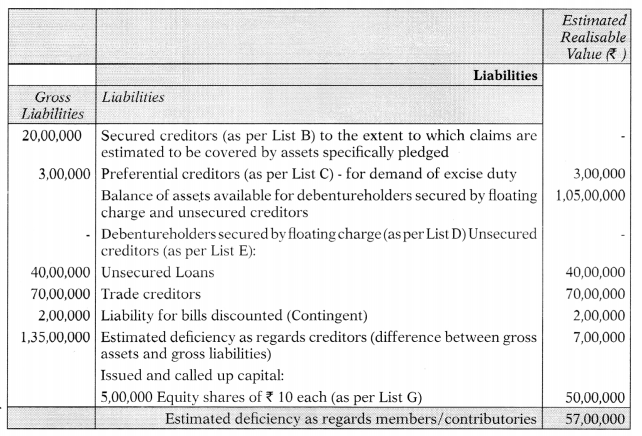

From the following particulars, prepare a Statement of Affairs and the Deficiency Account for submission to official liquidator of Sun City Development Ltd., which went into liquidation on 31st March, 2016:

On 31st March, 2011 the Balance Sheet of the Company showed a General Reserve of ₹ 8,00,000 accompanied by a debit balance of ₹ 5,00,000 in the Profit & Loss Account.

In 2012, the Company made a profit of ₹ 8,00,000 and declared a dividend of 10% on Equity Shares.

The Company suffered a total loss of ₹ 21,80,000 besides loss of stock due to fire to the tune of ₹ 8,00,000 during financial years ending March 2013, 2014 and 2015. For the financial year ended 31st March, 2016, accounts were not made.

The cost of winding-up is expected to be ₹ 3,00,000. (May 2016) (16 Marks)

Answer:

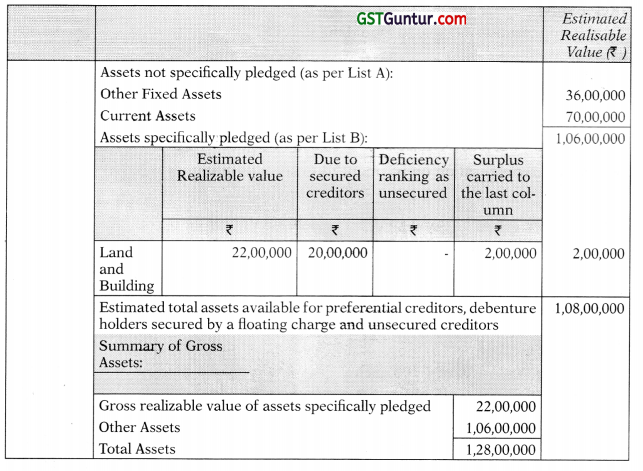

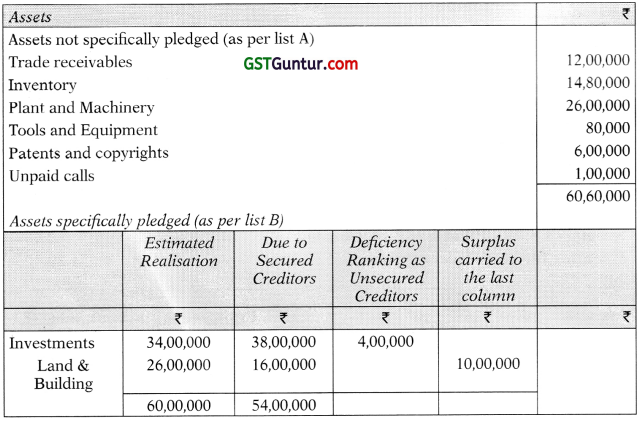

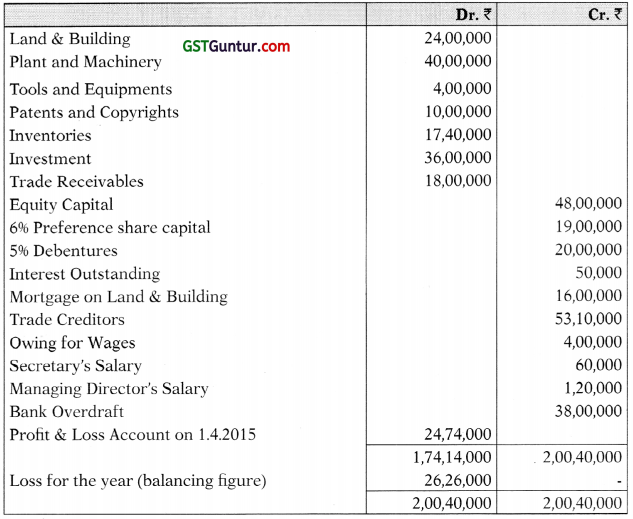

Statement of Affairs on 31st March, 2016, the date of winding up

Estimated realisable value

![]()

Notes:

(i) The Secretary of a Company, being an officer, is to be included within the definition of ‘employee’ for the purpose of computing preferential creditors. The preferential creditor for secretary’s salary has been restricted to 4 months salary but maximum pay shall not exceed ₹ 20,000 per claimant as per the requirement of the law.

List H – Deficiency Account

A. Item contributing to Deficiency

B. Items reducing Deficiency

Working Notes:

(1) Trial Balance to ascertain the amount of loss for the year ended 31st March, 2016

Let us now get the bifurcation of Reserve & surplus.

2. Reserve & Surplus Account

![]()

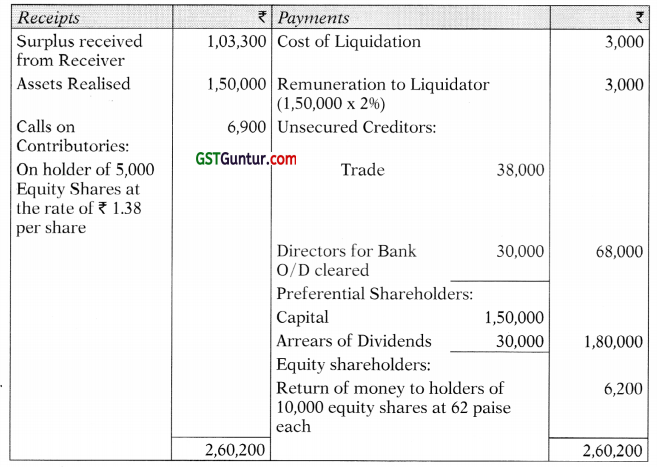

Liquidator’s Final Statement of Account – 1 Equity Share

Question 12.

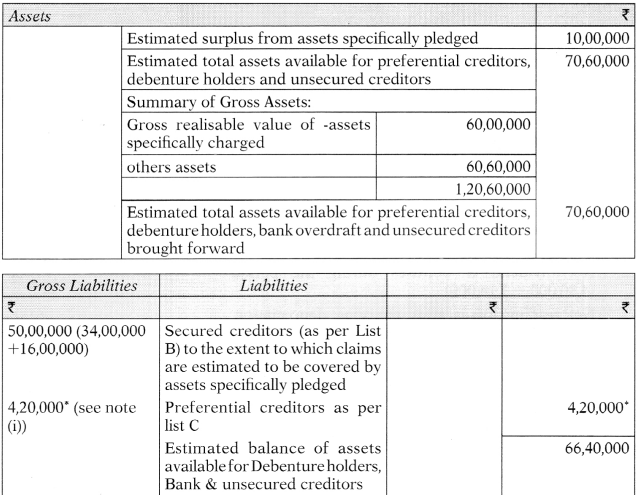

Given below is the Balance Sheet of A Limited as on 31.3.2016:

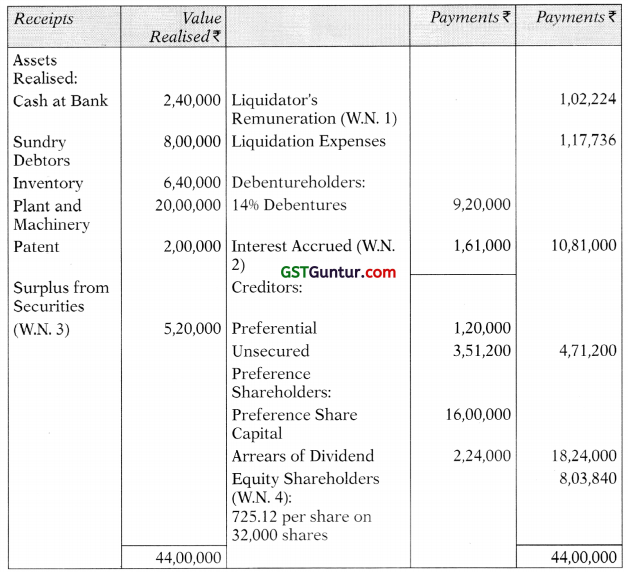

On 31.3.2016 the company went into voluntary liquidation. The dividend on 14% preference shares was in arrears for one year. Sundry creditors include preferential creditors amounting to ₹ 1,20,000.

The assets realized the following sums:

Land ₹ 3,20,000; Buildings ₹ 8,00,000; Plant and machinery ₹ 20,00,000; Patent ₹ 2,00,000; Inventory ₹ 6,40,000; Sundry debtors ₹ 8,00,000.

The expenses of liquidation amounted to ₹ 1,17,736. The liquidator is entitled to a commission of 2% on all assets realized (except cash at bank) and 2% on amounts among unsecured creditors other than preferential creditors. All payments were made on 30th June, 2016. Interest on mortgage loan shall be ignored at the time of payment.

Prepare the liquidator’s final statement of account. (RTP)

Answer:

A Ltd.

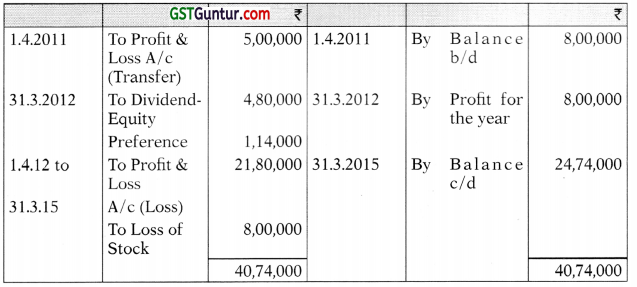

Liquidator’s Final Statement of Account

Working Notes:

![]()

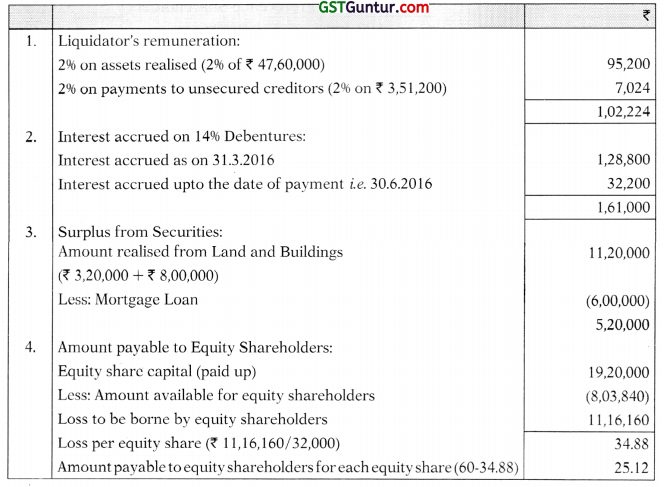

Question 13.

The position of C Ltd. on its liquidation is as under:

5.000, 10% Preference Shares of ₹ 100 each ₹ 60 paid up

2.000, Equity shares of ₹ 75 each, ₹ 50 paid up

Unsecured Creditors ₹ 99,000 Liquidation Expenses ₹ 1,000

Liquidator is entitled to a commission of 2% on the amount realized from calls made on contributories

You are required to prepare Liquidator’s Final Statement of Account if the total assets realized ₹ 3,80,400. (RTP)

Answer:

Liquidator’s Final Statement of Account

(ii) Calculation of funds required to meet shortage and commission payable on Calls to be made (to be called from equity shareholders)

Shortage of funds × \(\frac{100}{100 \text { – Rate of Commission }}\)

= ₹ 19600 × 100

= ₹ \(\frac{19600 \times 100}{98}\)

= ₹ 20,000

(iii) Uncalled Capital @ ₹ 25 on 2,000 shares = ₹ 50,000

(iv) Amount of Calls to be made (least of funds required and uncalled capital) i.e. ₹ 20,000 i.e. ₹ 10 per Share (20,000/20)

(v) Commission on Call = ₹ 20,000 × 2 /100 = ₹ 400

Liquidator’S Final Statement of Account – More Than 1 Equity Share

![]()

Question 14.

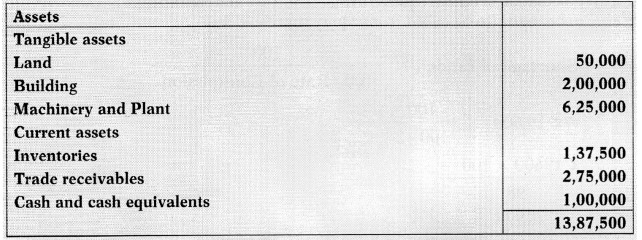

R Ltd. went into voluntary liquidation on 31st Ma their Balance Sheet read as follows:-

Other information:

- Bank overdraft is secured by deposit of title deed of land and building which realised ₹ 3,00,000.

- The assets realised as follows:

Machinery and Plant – ₹ 5,00,000;

Inventories – ₹ 1,50,000;

Trade receivables – ₹ 2,00,000 - Preference dividends were in arrears for 2 years.

- Expenses of liquidation amounted to ₹ 57,250.

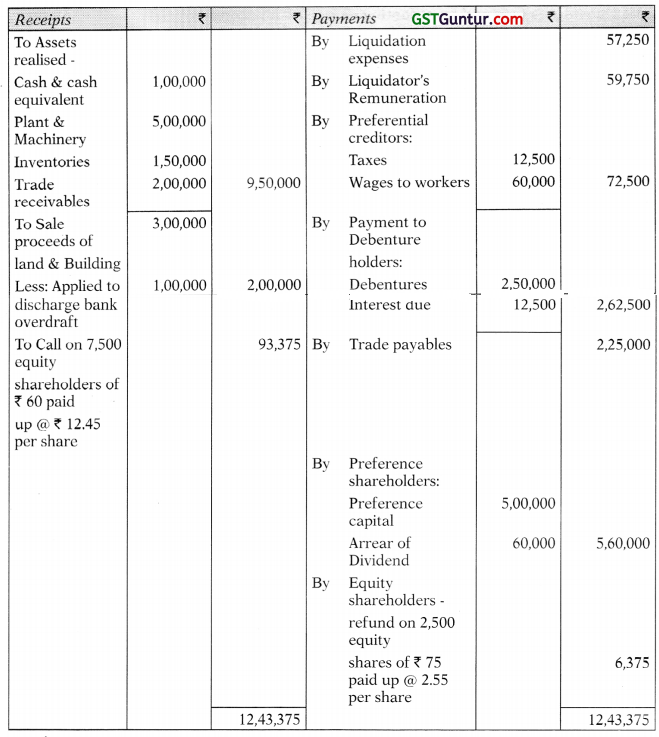

- The liquidator is entitled to a commission of 5% on all assets realised except cash and 1% on the amount distributed to Trade payables.

- Liquidator realised all assets on the above date and discharged his obligation on the same date.

Prepare liquidator’s Statement of Account.

Answer:

Liquidator’s Statement of Account

Working Notes:

![]()

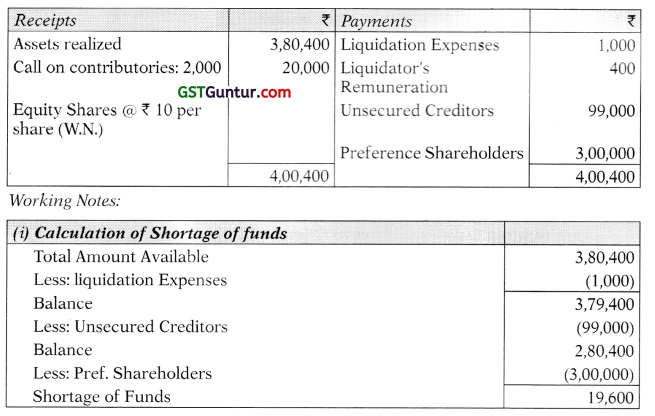

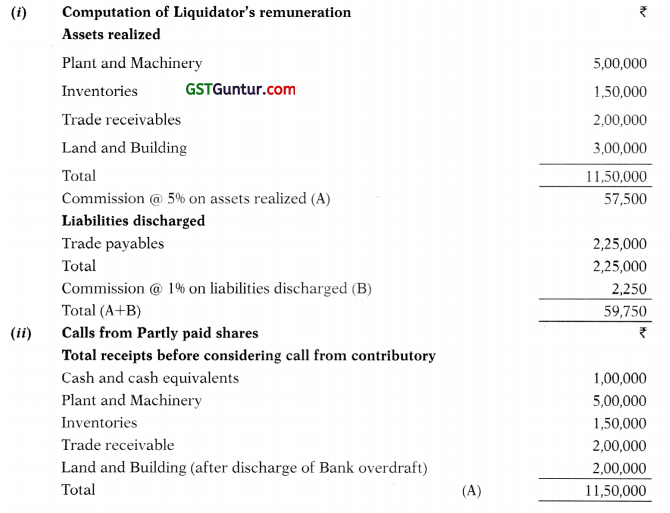

Question 15.

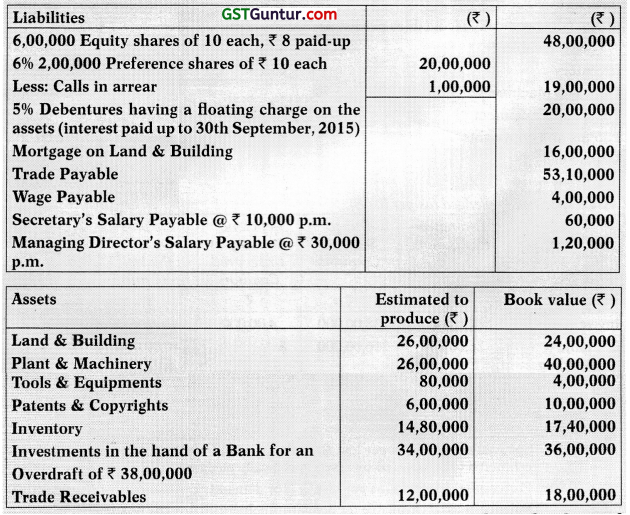

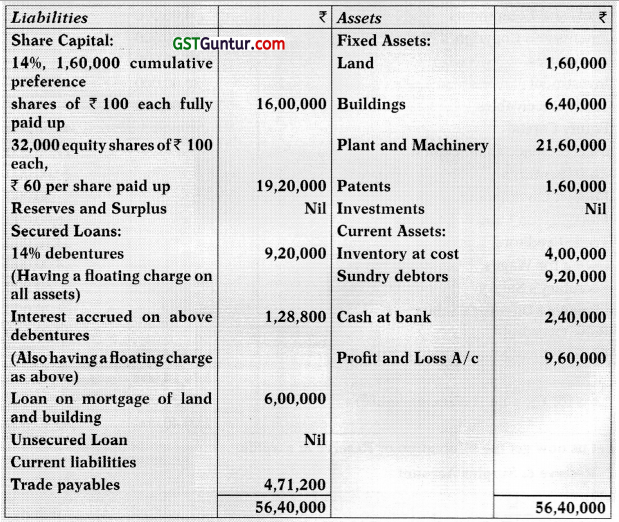

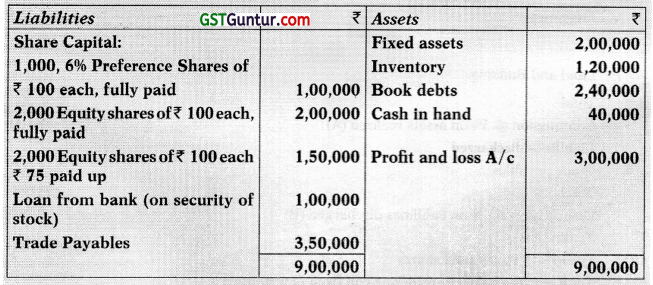

The following is the summarized Balance Sheet of S Ltd. C. which is in the hands of the liquidator:

Balance Sheet as at 31.3.2017

The assets realized the following amounts (after all costs of realization and liquidator’s commission amounting to ₹ 5,000 paid out of cash in hand).

Calls on partly paid shares were made but the amounts due on 200 shares were found to be irrecoverable.

You are required to prepare Liquidator’s Final Statement of Receipts and Payments.

Answer:

Liquidator’s Final Statement of Receipts and Payments A/c

Working Note:

Return per equity share

* Calls to be made @ ₹ 15 per share (₹ 90 -75) on 1,800 shares.

![]()

Question 16.

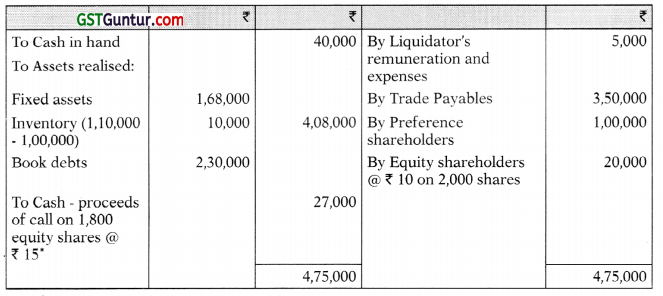

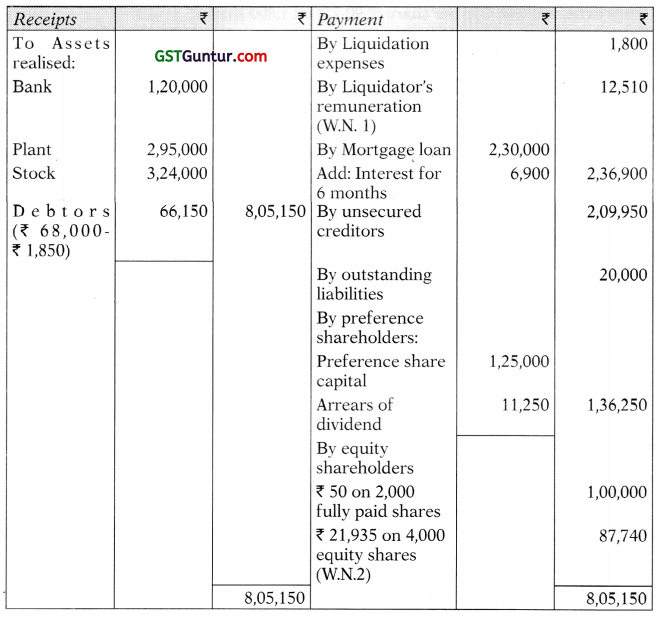

From the following Trial Balance of PQ Ltd. on 31.12.2009, prepare liquidators’ final statement of account:

Following points should be kept in mind:

- On 21st January, 2010 the liquidator of PQ Ltd. sold plant for ₹ 2,95,000 and stock in trade at 10% less than the book value. He realised 80% of Sundry debtors and incurred cost of collection of ₹ 1,850 (remaining debtors are to be treated as bad).

- The loan mortgage was discharged on 31st January, 2010 along with interest for 6 months. Creditors were discharged subject to 5% discount. Outstanding expenses paid at 20% less.

- Preference share dividend is due for one year and paid with final payment.

- Liquidation expenses incurred are ₹ 1,800 and liquidators remuneration is settled at 4% on disbursement to members (excluding preference dividend), subject to minimum of ₹ 10,000. (May 2010) (8 Marks)

Answer:

PQ Ltd.

Liquidator’s Final Statement of Account

Working Notes:

1. Liquidator’s remuneration

![]()

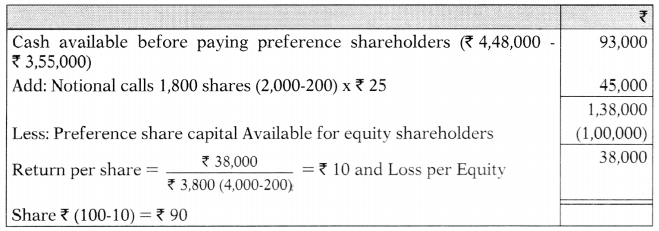

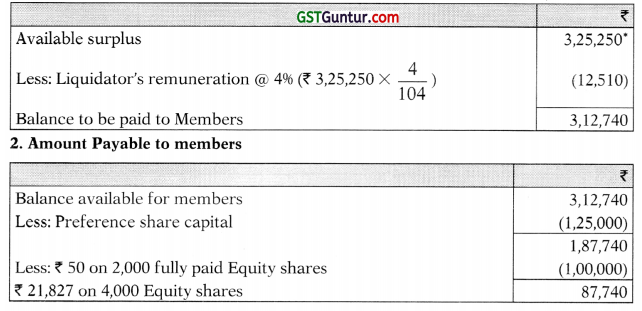

Question 17.

The summarized Balance Sheet of Full Stop Limited as on 31st March 2011, being the date of voluntary winding up is as under:

Preference dividend is in arrears for three years. By 31-3-2011, the assets realized were as follows:

Expenses of liquidation are ₹ 86,000. The remuneration of the liquidator is 2% of the realization of assets. Income tax payable on liquidation is ₹ 67,000. Assuming that the final payments were made on 31-3-2011, prepare the Liquidator’s Statement of Account. (May 2011) (8 Marks)

Answer:

Liquidator’s Statement of Account

Working Note:

![]()

Liquidators And Receivers Final Statement of Account

Question 18.

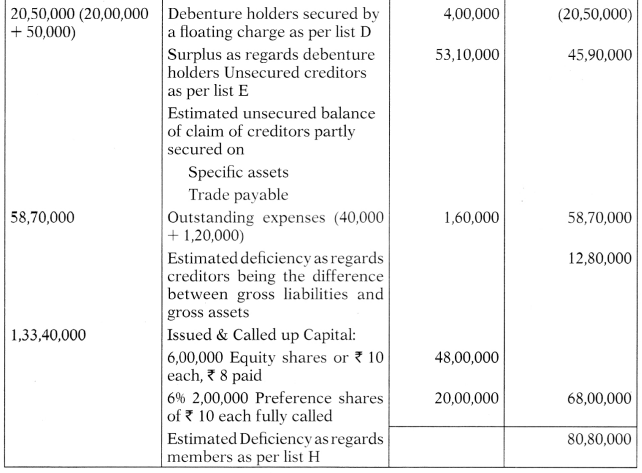

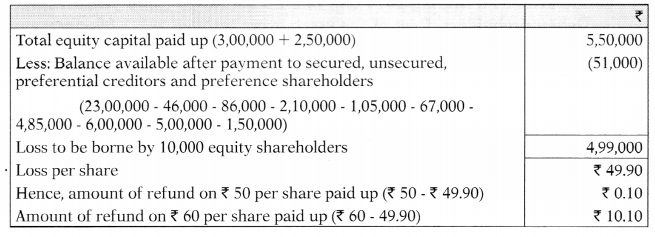

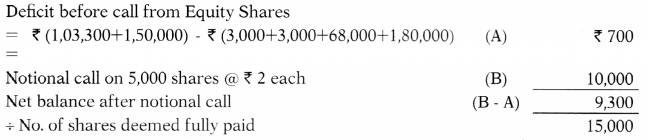

The sunimarized Balance Sheet of Vasant Ltd. as on 31st March, 2013, being the date of voluntary winding up is as under:

Mortgage loan was secured against Land & Building. Debentures were secured by a floating charge on all assets. The company was unable to meet the payments and therefore the debenture holders appointed a Receiver for the debentureholders. He brought the Land & Buildings to auction and realized ₹ 1,60,000. He also took charge of Sundry Assets of value of ₹ 2,36,000 and realized ₹ 2,00,000. The Bank overdraft was secured by personal guarantee of the directors of the company and on the Bank raising a demand, the Directors paid off the due from their personal resources. Costs incurred by the Receiver were ₹ 7,950 and by the Liquidator ₹ 3,000. The receiver was not entitled to any remuneration but the Liquidator was to receive 2% fee on the value of assets realized by him. Preference Shareholders have not been paid dividend for period after 31st March, 2011 and interest for the last half year was due to the Debentureholders. Rest of the assets were realized at ₹ 1,50,000.

Prepare the accounts to be submitted by the receiver and Liquidator. (Nov 2013) (16 Marks)

Answer:

Receiver’s Receipts and Payments Account

Liquidator’s Final Statement of Account

Working Note:

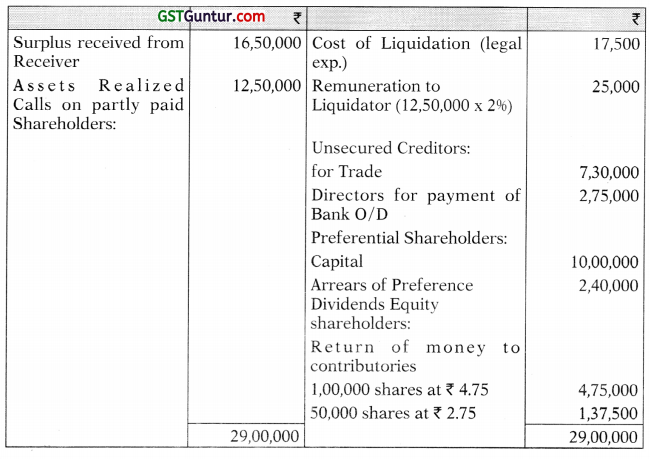

Call from partly paid shares

⇒ Refund on fully paid shares \(\frac{9,300}{15,000}\) = ₹ 0.62

Calls on partly paid share (₹ 2 – ₹ 0.62) = ₹ 1.38

![]()

Question 19.

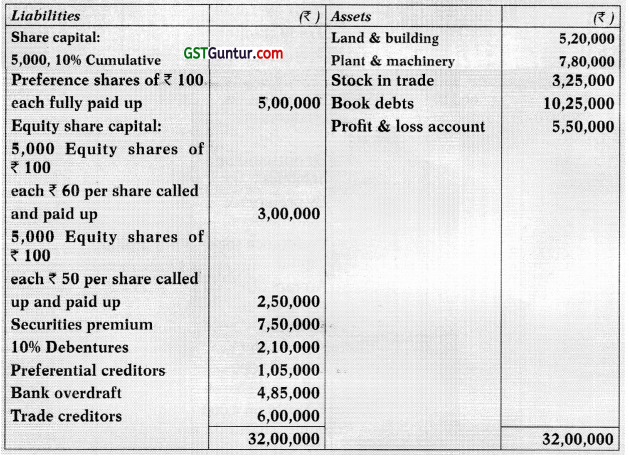

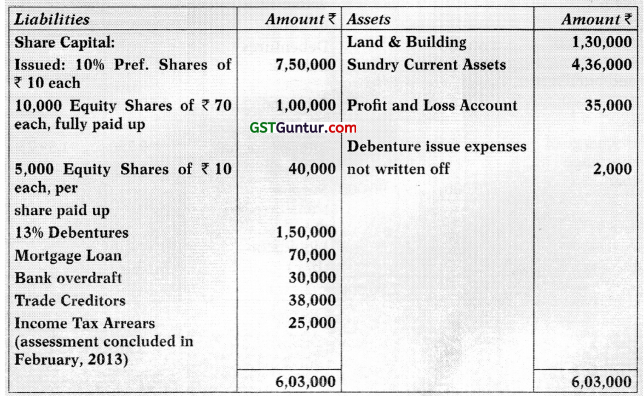

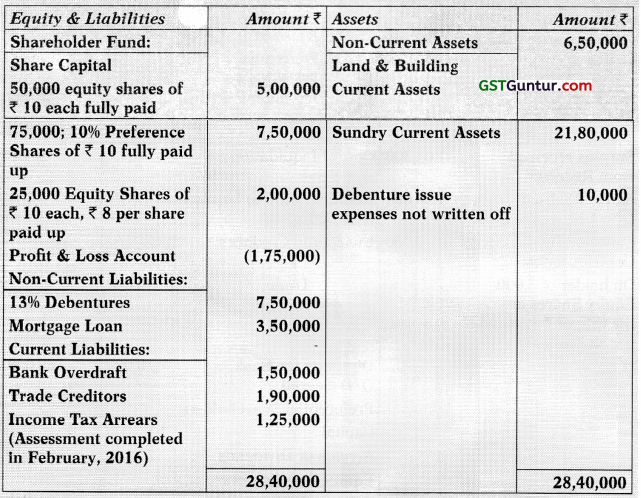

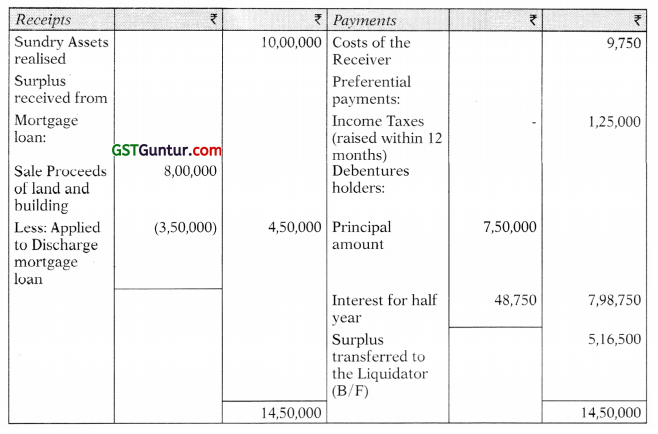

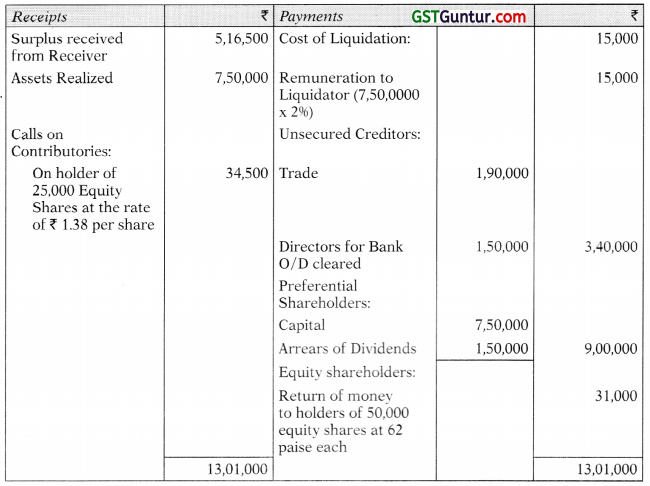

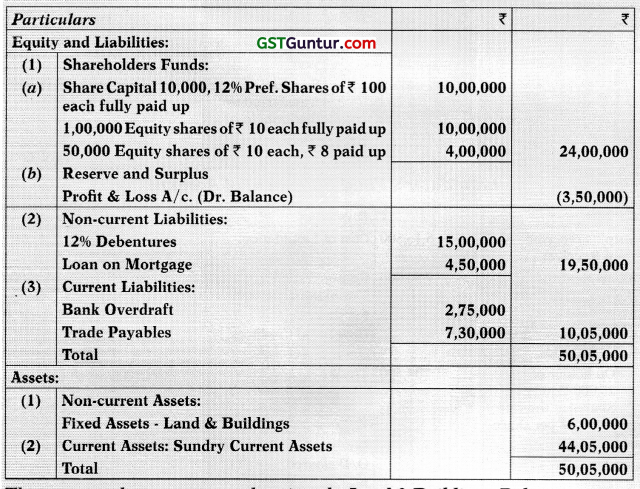

The summarized Balance Sheet of M/s. X Limited as at 31st March, 2016 are as follows:

Mortgage loan was secured against Land and Building. Debentures were secured by a floating charge on all assets. The company was unable to meet the payments and therefore the Debenture Holders appointed a Receiver for the Debenture Holders. He bought the Land & Building to auction and realized ₹ 8,00,000. He also took charge of Sundry Assets of value of ₹ 11,80,000 and realized ₹ 10,00,000. Bank overdraft was secured by personal guarantee of the Directors of the company and on the Bank raising a demand, the Directors paid off the due from their personal resources. Cost incurred by the receiver were ₹ 9,750 and by the Liquidator ₹ 15,000. The Receiver was not entitled to any remuneration but the Liquidator was to receive 2% fee on the value of assets realized by him. Preference Shareholders have not been paid Dividend for period after 31st March, 2014 and interest for the last half year was due to Debenture Holders. Rest of the Assets were realized at ₹ 7,50,000.

Prepare the Accounts to be submitted by the Receiver and Liquidator. (Nov 2016) (16 Marks)

Answer:

Receiver’s Receipts and Payments Account

Liquidator’s Final Statement of Account

Working Note:

Call from partly paid shares

⇒ Refund on fully paid shares 46,500/75,000 = ₹ 0.62

Call on partly paid share (2 – 0.62) = ₹ 1.38

![]()

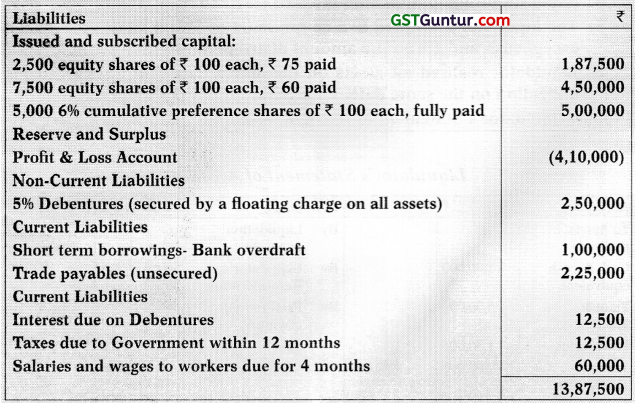

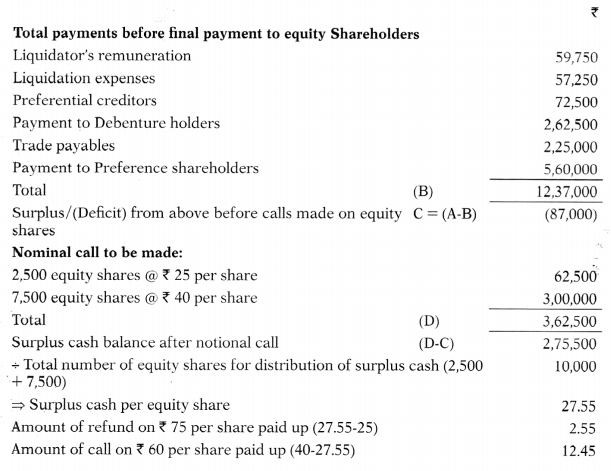

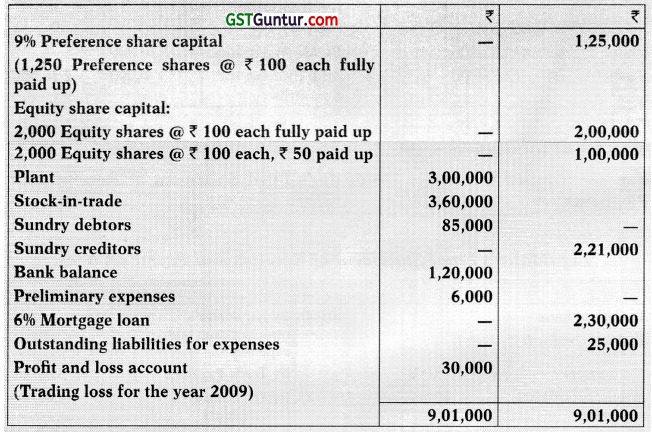

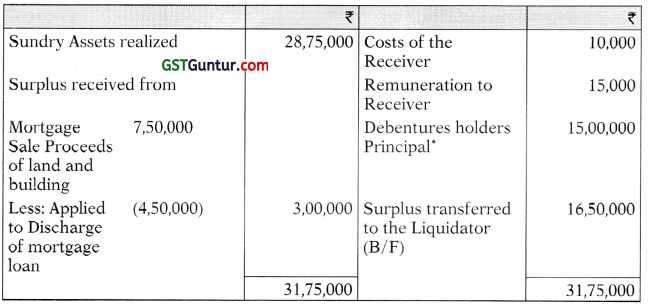

Question 20.

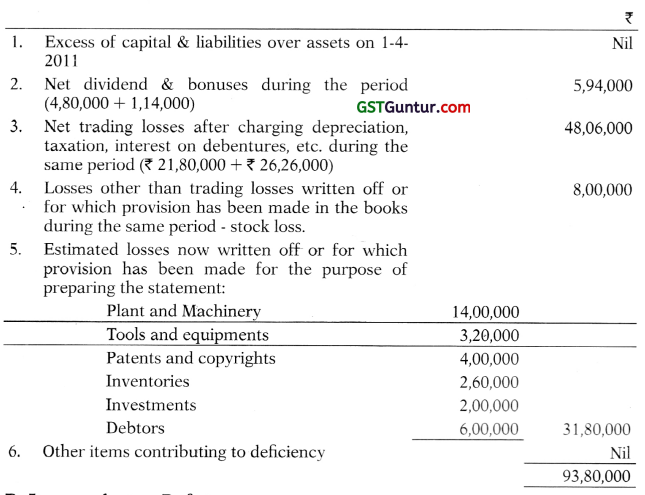

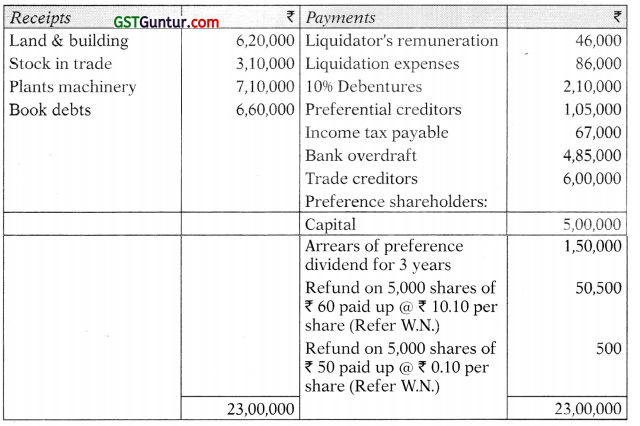

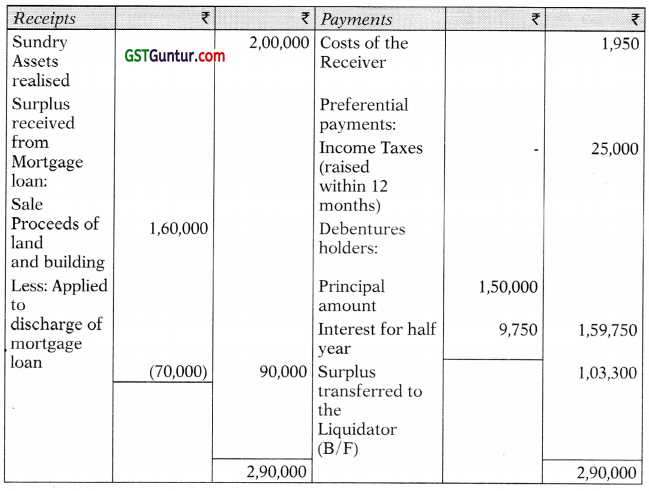

Virat Ltd. furnishes the following summarized Balance Sheet as at 31st March, 2018:

The mortgage loan was secured against the Land & Buildings. Debentures were secured by a floating charge on all the assets of the company. The debenture holders appointed a Receiver. The company being voluntarily wound up, a liquidator was also appointed. The Receiver was entrusted with the task of realising the Land & Buildings which fetched ₹ 7,50,000. Receiver also took charge of Sundry current assets of value ₹ 30,00,000 and sold them for ₹ 28,75,000. The Bank overdraft was secured by a personal guarantee of the directors who discharged their obligations in full from personal resources. The costs of the Receiver amounted to ₹ 10,000 and his remuneration ₹ 15,000.

The expenses of liquidator was ₹ 17,500 and his remuneration was decided at 2% on the value of the assets realised by him. The remaining assets were realised by liquidator for ₹ 12,50,000. Preference dividend was in arrear for 2 years. Articles of Association of the company provide for payment of preference dividend arrears in priority to return of equity capital.

Prepare the accounts to be submitted by the Receiver and the Liquidator. (November 2018 – New Course) (10 Marks)

Answer:

Receiver’s Receipts and Payments Account

Note:* Assumed that interest on debentures has already been paid before winding up proceedings.

Liquidator’s Final Statement of Account

![]()

Working Note: