CA Inter Advanced Accounts Paper Nov 2019 – Advanced Accounts CA Inter Study Material is designed strictly as per the latest syllabus and exam pattern.

CA Inter Advanced Accounting Question Paper Nov 2019

Question 1.

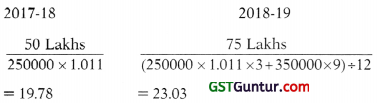

(a) A Ltd. provides after sales warranty for two years to its customers.

Based on past experience, the company has the following policy for making provision for warranties on the invoice amount, on the remaining balance warranty period.

Less than 1 year: 2% provision

More than 1 year: 3% provision The company has raised invoices as under:

Calculate the provision to be made for warranty under AS-29 as at 31st March, 2018 and 31st March, 2019. Also compute amount to be debited to P & L account for the year ended 31st March, 2019. [5 Marks]

Answer:

31st March, 2018 = 1,00,000 × 2% = 2,000

31st March, 2019 = 40,000 × 2% + 1,35,000 × 3% = 4,850

(b) As per provision of AS-26, how would you deal to the following situations:

(1) ₹ 23,00,000 paid by a manufacturing company to the legal advisor de-fending the patent of a product is treated as a capital expenditure.

(2) During the year 2018-19, a company spent ₹ 7,00,000 for publicity and research expenses on one of its new consumer product which was marketed in the same accounting year but proved to be a failure.

(3) A company spent ₹ 25,00,000 in the past three years to develop a product, these expenses were charged to profit and loss account since they did not meet AS-26 criteria for capitalization. In the current year approval of the concerned authority has been received. The company wishes to capitalize ₹ 25,00,000 by disclosing it as a prior period item.

(4) A company with a turnover of ₹ 200 crores and an annual advertising budget of ₹ 50,00,000 had taken up for the marketing of a new product by a company. It was estimated that the company would have a turnover of ₹ 20 crore from the new product. The company had debited to its Profit & Loss Account the total expenditure of ₹ 50,00,000 incurred on extensive special initial advertisement campaign for the new product. [5 Marks]

Answer:

(1) Revenue

(2) Revenue

(3) Incorrect

(4) Correct

![]()

(c) Indicate in each case whether revenue can be recognized and when it will be recognized as per AS-9.

(1) Trade discount and volume rebate received.

(2) Where goods are sold to distributor or others for resale.

(3) Where seller concurrently agrees to repurchase the same goods at a later date.

(4) Insurance agency commission for rendering services.

(5) On 11-3-2019 cloths worth ₹ 50,000 were sold to X mart, but due to re-furbishing of their showroom being underway, on their request cloths were delivered on 12-4-2019. [5 Marks]

Answer:

(1) Deducted from sales

(2) When ultimate sale is made (However depends upon terms of agreement)

(3) Not a sale (Financing arrangement)

(4) Policy is reversed

(5) Revenue for FY 2018-19

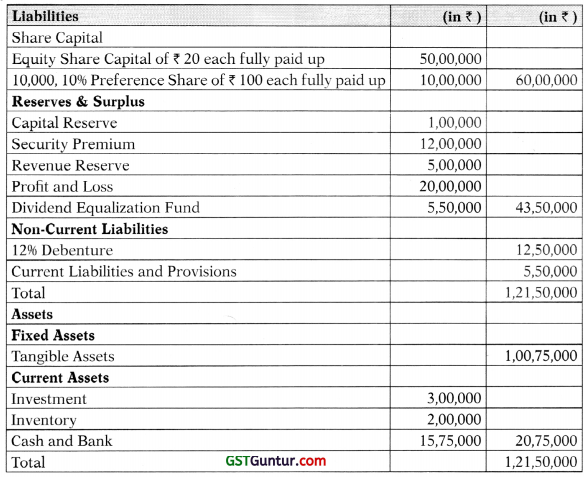

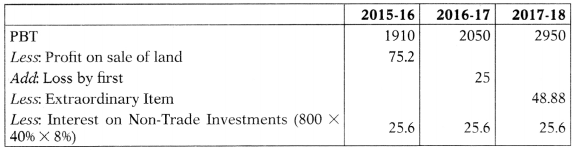

(d) Following information is supplied by K Ltd.

Number of shares outstanding prior to right issue – 2,50,000 shares.

Right issue – two new share for each 5 outstanding shares (i.e. 1,00,000 new shares)

Right issue price – ₹ 98

Last date of exercising rights – 30-6-2018.

Fair value of one equity share immediately prior to exercise of right on 30-6-2018 is ₹ 102.

Net Profit to equity shareholders:

2017- 18 – ₹ 50,00,000

2018- 19 – ₹ 75,00,000

You are required to calculate the basic earnings per share as per AS-20 Earning per Share. [5 Marks]

Answer:

Step 1: Theoretical Ex Right FV per share

= \(\frac{250000 \times 102+100000 \times 98}{350000}\)

= 100.86

Step 2: Adjustment Factor

= \(\frac{102}{100.86}\) = 1.011 100.86

Step 3: EPS Computation

![]()

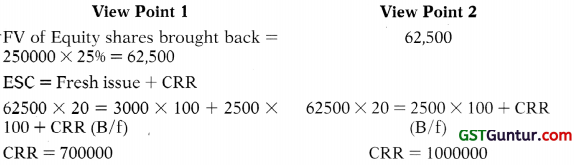

Question 2.

(a) X Ltd. furnishes the following summarized Balance Sheet as at 31-3-2018:

The shareholders adopted the resolution on the date of the abovementioned Balance Sheet to:

(1) Buy back 25% of the paid up capital and it was decided to offer a price of 20% over market price. The prevailing market value of the company’s share is ₹ 30 per share.

(2) To finance the buy back of share company:

(a) Issue 3000, 14% debenture of ₹ 100 each at a premium of 20%.

(b) Issue 2500, 10% preference share of ₹ 100 each

(3) Sell investment worth ₹ 1,00,000 for ₹ 1,50,000.

(4) Maintain a balance of ₹ 2,00,000 in Revenue Reserve.

(5) Later the company issue three fully paid up equity share of ₹ 20 each by way of bonus share for every 15 equity share held by the equity shareholder.

You are required to pass the necessary journal entries to record the above transactions and prepare Balance Sheet after buy back. [15 Marks]

Answer:

2 VIEW POINTS

Accordingly amount of journal entries will charge.

(b) On 1st April, 2018, XYZ Ltd., offered 150 shares to each of its 750 employees at ₹ 60 per share. The employees are given a year to accept the offer. The shares issued under the plan shall be subject to lock-in period on transfer for three years from the grant date. The market price of shares of the company on the grant date is ₹ 72 per share. Due to post-vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 67 per share.

On 31st March, 2019, 600 employees accepted the offer and paid ₹ 60 per share purchased. Nominal value of each share is ₹ 10.

You are required to record the issue of shares in the books of the XYZ Ltd., under the aforesaid plan. [5 Marks]

Answer:

![]()

Question 3.

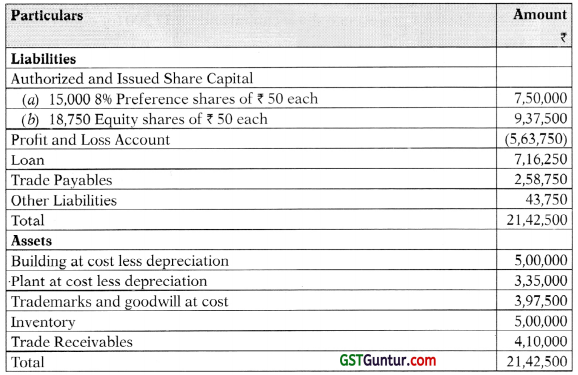

(a) Following is the summarized Balance Sheet of Fortunate Ltd. as on 31st March, 2019.

(Note: Preference shares dividend is in arrear for last five years).

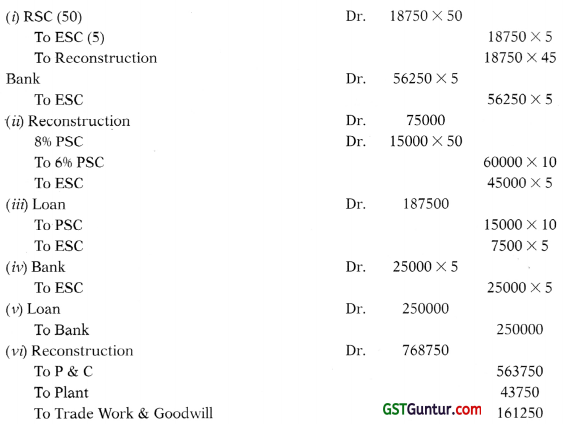

The Company is running with the shortage of working capital and not earn-ings profits. A scheme of reconstruction has been approved by both the classes of shareholders. The summarized scheme of reconstruction is as follows:

(i) The equity shareholders have agreed that their ₹ 50 shares should be reduced to ₹ 5 by cancellation of ₹ 45.00 per share. They have also agreed to subscribe for three new equity shares of ₹ 5.00 each for each equity share held.

(ii) The preference shareholders have agreed to forego the arrears of dividends and to accept for each ₹ 50 preference share, 4 new 6% preference shares of ₹ 10 each, plus 3 new equity shares of ₹ 5.00 each, all credited as fully paid.

(iii) Lenders to the company for ₹ 1,87,500 have agreed to convert their loan into shares and for this purpose they will be allotted 15,000 new preference shares of ₹ 10 each and 7,500 new equity shares of ₹ 5.00 each.

(iv) The directors have agreed to subscribe in cash for 25,000 new equity shares of ₹ 5.00 each in addition to any shares to be subscribed by them under (i) above.

(v) Of the cash received by the issue of new shares, ₹ 2,50,000 is to be used to reduce the loan due by the company.

(vi) The equity share capital cancelled is to be applied :

(a) To write off the debit balance in the Profit and Loss A/c, and

(b) To write off ₹ 43,750 from the value of plant.

Any balance remaining is to be used to write down the value of trade-marks and goodwill. The nominal capital as reduced is to be increased to ₹ 8,12,500 for preference share capital and t 9,37,500 for equity share capital.

You are required to pass journal entries to show the effect of above scheme and prepare the Balance Sheet of the Company after recon-struction. [15 Marks]

Answer:

Journal Entries

(b) A liquidator is entitled to receive remuneration at 5%, of the assets realised and 8% of the amount distributed among the unsecured creditors. The assets realised ₹ 13,75,000. Payment was made from realised amount as follows:

Liquidation expenses ₹ 13,000

Preferential creditors (treated as unsecured creditors) ₹ 88,500

Secured creditors ₹ 1,00,000

You are required to calculate remuneration payable to the liquidator. [5 Marks]

Answer:

5% of 1375000 + 8% of (1375000 – 13000 – 88500 – 100000) = 162630

![]()

Question 4.

(a) From the following information, you are required to prepare Profit and Loss Account of Simple Bank for the year ended as on 31st March, 2019:

| 2017-18 (₹ in ‘000) | Item | 2018-19 (₹ in ‘000) |

| 71,35 | Interest and Discount | 1,02,25 |

| 5,70 | Income from investment | 5,60 |

| 7,75 | Interest on Balances with RBI | 8,85 |

| 36,10 | Commission, Exchange and Brokerage | 35,60 |

| 60 | Profit on sale of investments | 6,10 |

| 30,60 | Interest on Deposits | 41,10 |

| 6,35 | Interest to RBI | 7,35 |

| 36,35 | Payment to and provision for employees | 42,75 |

| 7,90 | Rent, taxes and lighting | 8,95 |

| 7,35 | Printing and Stationery | 10,60 |

| 5,60 | Advertising and publicity | 4,90 |

| 4,90 | Depreciation | 4,90 |

| 7,40 | Director’s fees | 10,60 |

| 5,50 | Auditor’s fees | 5,50 |

| 2,50 | Law Charges | 7,60 |

| 2,40 | Postage, telegrams and telephones | 3,10 |

| 2,10 | Insurance | 2,60 |

| 2,85 | Repair and maintenance | 3,30 |

Other Information:

(i) The following items are alreadv adjusted with Interest and Discount (Cr.)

Tax Provision (₹ ‘000) 7,40

Provision for Doubtful Debts (₹ ‘000) 4,60

Loss on sale of investments (₹ ‘000) 60

Rebate on Bills discounted (₹ ‘000) 2,75

(ii) Appropriations:

25% of profit is transferred to Statutory Reserves.

5% of profit is transferred to Revenue Reserve

You are required to give necessary Schedules also.

(b) The investment portfolio of a mutual fund scheme includes 4,000 shares of P Ltd. and 3,200 shares of Q Ltd. acquired on 31-12-2017. The cost of P Ltd.’s share is ₹ 50 and Q Ltd.’s share is ₹ 75. The market value of these shares at the end of 2017-18 were ₹ 47 and ₹ 80 respectively. On 30th June, 2018 shares of both companies were disposed of realising:

P Ltd.’s share at ₹ 40 and

Q Ltd.’s share at ₹ 82

Show important accounting entries in the books of the fund for the accounting years 2017-18 and 2018-19. [5 Marks]

Answer:

Chapter deleted from course

(c) The following information is furnished by ALFA Bank Ltd.

| Margins held against letter of credit | ₹ in Lakhs 200 |

| Recurring accounts deposits | 100 |

| Current accounts deposits | 375 |

| Demand deposit | 125 |

| Unclaimed deposit | 75 |

| Gold deposit | 235 |

| Demand liabilities portion of saving bank deposit | 1325 |

| Time liabilities portion of saving bank deposit | 722 |

Explain CRR and you are required to calculate the amount of Cash Reserve Ratio (CRR) as per the direction of Reserve Bank of India. [5 Marks]

Question 5.

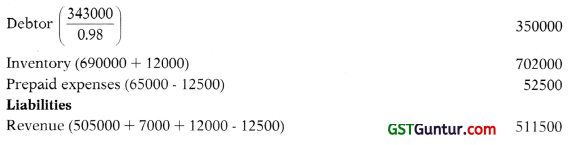

(a) Consider the following summarized Balance Sheets of subsidiary MNT Ltd.:

| Liabilities | 2017-18 Amount in ₹ | 2018-19 Amount in ₹ |

| Share Capital | ||

| Issued and subscribed 7500 Equity Shares of ₹ 100 each | 7,50,000 | 7,50,000 |

| Reserve and Surplus | ||

| Revenue Reserve | 2,14,000 | 5,05,000 |

| Securities Premium | 72,000 | 2,07,000 |

| Current Liabilities and Provisions | ||

| Trade Payables | 2,90,000 | 2,46,000 |

| Bank Overdraft | — | 1,70,000 |

| Provision for Taxation | 2,62,000 | 4,30,000 |

| 15,88,000 | 23,08,000 |

| Liabilities | 2017-18 Amount in ₹ | 2018-19 Amount in ₹ |

| Assets | ||

| Fixed Assets (Cost) | 9,20,000 | 9,20,000 |

| Less: Accumulated Depreciation | (1,70,000) | (2,82,500) |

| 7,50,000 | 6,37,500 | |

| Investment at Cost | — | 5,30,000 |

| Current Assets | ||

| Inventory | 4,12,300 | 6,90,000 |

| Trade Receivable | 2,95,000 | 3,43,000 |

| Prepaid expenses | 78,000 | 65,000 |

| Cash at Bank | 52,700 | 42,500 |

| 15,88,000 | 23,08,000 |

Other Information :

- MNT Ltd. is a subsidiary of LTC Ltd.

- LTC Ltd. values inventory on FIFO basis, while MNT Ltd. used LIFO basis. To bring MNT Ltd.’s inventories values in line with those of LTC Ltd., its value of inventory is required to be reduced by ₹ 5,000 at the end of 2017-2018 and increased by ₹ 12,000 at the end of 2018-2019. (Inventory of 2017-18 has been sold out during the year 2018-19)

- MNT Ltd. deducts 2% from Trade Receivables as a general provision against doubtful debts.

- Prepaid expenses in MNT Ltd. include Sales Promotion expenditure carried forward of ₹ 25,000 in 2017-18 and ₹ 12,500 in 2018-19 being part of initial Sales Promotion expenditure of ₹ 37,500 in 2017-18, which is being written off over three years. Similar nature of Sales Promotion expenditure of LTC Ltd. has been fully written off in 2017-18.

Restate the balance sheet of MNT Ltd. as on 31st March, 2019 after consider-ing the above information for the purpose of consolidation. Such restatement is necessary to make the accounting policies adopted by LTC Ltd. and MNT Ltd. uniform. [10 Marks]

Answer:

Balance Sheet (Extract)

[only changes have been reflected]

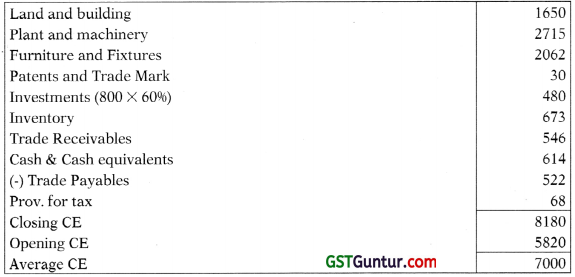

(b) On the basis of the following information, calculate the value of goodwill of Star Ltd. at, 5 years’ purchase of super profits, if any, earned by the com-pany in the previous three completed accounting years.

Summarised Balance Sheet of Star Ltd. as at 31st March, 2019

| ₹ in Lakhs | |

| Liabilities | |

| Share Capital | |

| Issued and subscribed | |

| 3 Crore Equity Shares of ₹ 10 each, fully paid up | 3,000 |

| Capital Reserve | 200 |

| General Reserve | 5,293 |

| Profit & Loss Account | 517 |

| Trade Payables | 522 |

| Provision for Taxation (net) | 68 |

| 9,600 | |

| Assets | |

| Goodwill | 510 |

| Land & Building | 1,650 |

| Plant & Machinery | 2,715 |

| Furniture & Fixtures | 2,062 |

| Patent and Trade Marks | 30 |

| Investments | 800 |

| Inventory | 673 |

| Trade Receivables | 546 |

| Cash and Cash equivalents | 614 |

| 9,600 |

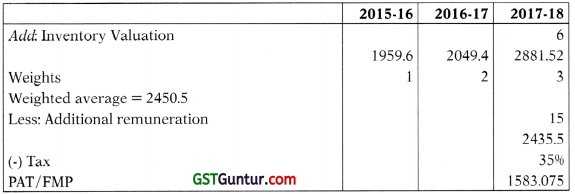

The profits before tax of three years are as follows:

| Year ended 31st March | Profit before tax in lakhs of (₹) | Weights |

| 2015-16 | 1,910 | 1 |

| 2016-17 | 2,050 | 3 |

| 2017-18 | 2,950 | 5 |

Other information:

- Assume that the rate of income tax for all the year is 35%,

- In the accounting year 2015-16 the company sold its land at a profit of ₹ 75.2 Lakhs, which is included in the profits of the same year.

- In December, 2016 there was a fire occurred in factory due to which the company lost property worth of ₹ 25 lakhs and the loss was not covered under the insurance policy.

- In November, 2017 the company earned an extraordinary income of ₹ 48.88 Lakhs due to a special contract.

- 40% of total investments were, 8% Non-trading investments (Purchased at par on 1st April, 2014).

- Company values inventory on FIFO basis. On 31 st March, 2018 inventory was undervalued by ₹ 6 Lakhs inventory of 2017-18 sold during the year 2018-19)

- Future maintainable profits to be ascertained considering weighted average.

- The normal rate of return for the industry in which company is engaged is 15%.

- Capital employed as on 31st March, 2018 was ₹ 5,820 Lakhs.

- In Shareholders’ general meeting a resolution was passed to sanction the directors additional remuneration of ₹ 15 lakhs every year beginning from the accounting year 2018-19. [10 Marks]

Answer:

Step 1: Average Capital Employed

Step 2:

Note:

Current year profits are missing. Thus, FMP has been computed on the basis of past 3 years profits.

Future Maintainable Profits

Step 3

NRR= 15%

Goodwill

= 1583.075 – 7000 × 15% × 5 = 2665.375

![]()

Question 6.

Answer any four of the following:

(a) X Ltd. is a group engaged in manufacture and sale of industrial and FMCG products. One of their division also deals in Leasing of proper-ties – Mobile Towers. The accountant showed the rent arising from the leasing of such properties as other income in the Statement of Profit and Loss.

Comment whether the classification of the rent income made by the accountant is correct or not in the light of Schedule III to the Companies Act, 2013. [5 Marks]

Answer:

Incorrect

(b) Darshan Ltd. incorporated on 1st January, 2018 issued a prospectus in-viting application for 40,000 Equity Shares of ₹ 10 each. The whole issue was fully underwritten by Arun, Babu and Chandran as follows:

Arun 20,000 shares

Babu 12,000 shares

Chandran 8,000 shares

Applications were received for 32,000 shares, of which marked applications were as follows:

Arun 16,000 shares

Babu 5,700 shares

Chandran 8,300 shares

You are required to find out the liabilities of individual underwriters viz. Arun, Babu & Chandran. [5 Marks]

Answer:

Statement Showing Net Liability of Underwriters

| A | B | C | |

| Gross Liability | 20000 | 12000 | 8000 |

| Marked Application | 16000 | 5700 | 8300 |

| Unmarked Application [2000] | 1000 | 600 | 400 |

| 3000 | 5700 | (700) | |

| Surplus Transferred (2012) | (438) | (262) | 700 |

| Net Liability | 2562 | 5438 | Nil |

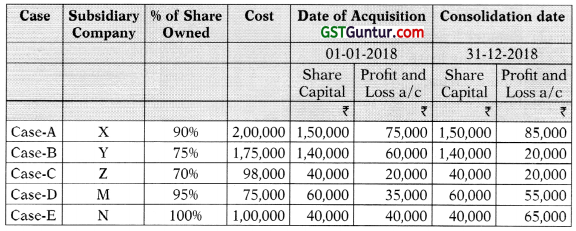

(c) From the following data determine in each case:

[5 Marks]

Answer:

Minority Interest

| Case | Subsidiary

Company |

% of Share Owned | Cost | Date of Acquisition

01-01-2018 |

Consolidation date

31-12-2018 |

||

| Share

Capital |

Profit and Loss a/c | Share

Capital |

Profit and Loss a/c | ||||

| 7 | 7 | 7 | 7 | ||||

| Case-A | X | 90% | 2,00,000 | 1,50,000 | 75,000 | 1,50,000 | 85,000 |

| Case-B | Y | 75% | 1,75,000 | 1,40,000 | 60,000 | 1,40,000 | 20,000 |

| Case-C | Z | 70% | 98,000 | 40,000 | 20,000 | 40,000 | 20,000 |

| Case-D | M | 95% | 75,000 | 60,000 | 35,000 | 60,000 | 55,000 |

| Case-E | N | 100% | 1,00,000 | 40,000 | 40,000 | 40,000 | 65,000 |

(d) Explain the criterion of income recognition in the case of Non Banking Financial Companies [5 Marks]

(e) Classify the following into either operating lease or finance lease with rea-son:

(1) Economic life of asset is 10 years, lease term is 9 years, but asset is not acquired at the end of lease term.

(2) Lessee has option to purchase the asset at lower than fair value at the end of lease term.

(3) Lease payments should be recognized as an expense in the statement of Profit & Loss of a lessee.

(4) Present Value (PV) of Minimum Lease Payment (MLP) = “X”. Fair value of the asset is “Y”. And X = Y.

(5) Economic life of the asset is 5 years, lease term is 2 years, but the asset is of special nature and has been procured only for use of the lessee. [5 Marks]

Answer:

(1) Finance lease

(2) Finance lease

(3) Operating lease

(4) Finance lease

(5) Finance lease