Process and Operation Costing – CA Inter Cost and Management Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Process and Operation Costing – CA Inter Costing Study Material

1. Treatment:

- Normal Process Loss: Loss of material which is inherent in the nature of work. The cost of normal process loss after considering sale of scrap is absorbed by good units.

- Abnormal Process Loss: It is the loss in excess of pre-determined normal loss. The cost of abnormal process loss is charged to costing profit and loss account.

- Abnormal Gain: It arises when the actual production exceeds the expected figures. It will be transferred to Costing Profit and Loss account.

2. Equivalent units: It is the conversion of incomplete production units into their equivalent completed units.

Equivalent completed units = Actual No. of units in process X % of work completed.

3. Process Costing Methods:

FIFO Method: Units completed and transferred are taken from both opening WIP and freshly introduced materials. Cost to complete the opening WIP and other completed units are calculated separately. Cost of opening WIP is added to cost incurred on completing the incomplete (WIP) units into complete one. The total cost of units completed and transferred is calculated by adding opening WIP cost to cost on freshly introduced inputs. Closing stock of WIP is valued at current cost.

Weighted Average Method: Cost of opening WIP and cost of current period are aggregated and the aggregate cost is divided by output in terms of completed units.

![]()

Theory Questions

Question 1.

Explain the “Equivalent Production.” [CA Inter Nov. 2013, 4 Marks]

Answer:

Equivalent Production:

When opening and closing stocks of work-in-process exist, unit costs cannot be computed by simply dividing the total cost by total number of units still in process. We can convert the work-in-process units into finished units called equivalent production units so that the unit cost of these uncompleted (WIP) units can be obtained. Equivalent Production units = Actual number of units in production × Percentage of work completed. It consists of balance of work done on opening work-in-process, current production done fully and part of work done on closing WIP with regard to different elements of costs viz., ma-terial, labour and overhead.

Question 2.

Explain briefly the procedure for the valuation of Work-in-process. [CA Inter Nov. 2002, 2 Marks]

Answer:

Valuation of Work-in process: The valuation of work-in-process can be made in the following three ways, depending upon the assumptions made regarding the flow of costs.

- First-in-first-out (FIFO) method

- Last-in-first-out (LIFO) method

- Average cost method

A brief account of the procedure followed for the valuation of work-in-process under the above three methods is as follows:

FIFO method: According to this method the units first entering the process are completed first. Thus the units completed during a period would consist partly of the units which were incomplete at the beginning of the period and partly of the units introduced during the period.

The cost of completed units is affected by the value of the opening inventory, which is based on the cost of the previous period. The closing inventory of work-in-process is valued at its current cost.

LIFO method: According to this method units last entering the process are to be completed first. The completed units will be shown at their current cost and the closing work-in-process will continue to appear at the cost of the opening inventory of work-in-progress along with current cost of work-in-progress if any.

Average cost method: According to this method opening inventory of work-inprocess and its costs are merged with the production and cost of the current period, respectively. An average cost per unit is determined by dividing the total cost by the total equivalent units, to ascertain the value of the units completed and units in process.

Question 3.

What is inter-process profit? State its advantages and disadvantages. [CA Inter Nov. 2012, 4 Marks]

Answer:

Definition of Inter-Process Profit and its advantages and disadvantages:

In some process industries, the output of one process is transferred to the next process not at cost but at market value or cost plus a percentage of profit. The difference between cost and the transfer price is known as inter-process profits.

The advantages and disadvantages of using inter-process profit, in the case of process type industries are as follows:

Advantages:

- Comparison between the cost of output and its market price at the stage of completion is facilitated.

- Each process is made to stand by itself as to the profitability.

Disadvantages:

- The use of inter-process profits involves complication.

- The system shows profits which are not realised because of stock not sold out.

![]()

Question 4.

“Operation costing is defined as refinement of Process costing.” Explain it. [CA Inter May 2007, 3 Marks]

Answer:

Operation costing is concerned with the determination of the cost of each operation rather than the process:

- In the industries where process consists of distinct operations, the operation costing method is applied.

- It offers better control and facilitates the computation of unit operation cost at the end of each operation.

Question 5.

What are the steps to be followed for preparing the production cost report which is prepared at the end of each accounting period? [ICAI Module]

Answer:

Step-1: Analysis of physical flow’ of production units The first step is to determine and analyse the number of physical units in the form of inputs (introduced fresh or transferred from previous process, beginning WIP) and outputs (completed and WIP).

Step-2: Calculation of equivalent units for each cost elements

The second step is to calculate equivalent units of production for each cost element i.e. for material, labour and overheads.

Step-3: Determination of total cost for each cost element

Total cost for each cost element is collected and accumulated for the period.

Step-4: Computation of cost per equivalent unit for each cost element In this step, the cost per equivalent unit for each cost element is calculated by dividing the total cost determined in Step-3 by the equivalent units as deter-mined in Step-2.

Step-5: Assignment of total costs to units completed and ending WIP In this step, the total cost for units completed, units transferred to next process, ending WIP, abnormal loss etc. are calculated and posted in the process account and production cost report.

Practical Questions

Normal Loss, Abnormal Loss & Abnormal Gain

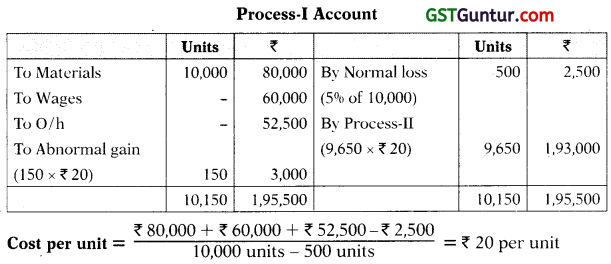

Question 1.

A product passes through Process-I and Process-II.

Particulars pertaining to the Process-I are:

Materials issued to Process-I amounted to ₹ 80,000, Wages ₹ 60,000 and manufacturing overheads were ₹ 52,500. Normal Loss anticipated was 5% of input, 9,650 units of output were produced and transferred out from Process-I to Process-II. Input raw materials issued to Process-I were 10,000 units.

There were no opening stocks.

Scrap has realizable value of ₹ 5 per unit.

You are required to prepare:

(i) Process-I Account

(ii) Abnormal Gain/Loss Account [CA Inter Dec. 2021, Nov. 2008, 5 Marks]

Answer:

(i)

(ii)

![]()

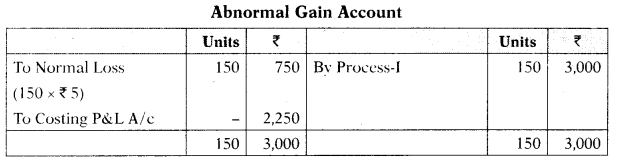

Question 2.

A product passes through two processes. The output of Process I becomes the input of Process II and the output of Process II is transferred to warehouse. The quantity of raw materials introduced into Process I is 20,000 kg at 10 per kg. The cost and output data for the month under review are as under:

| Process I | Process II | |

| Direct materials | ₹ 60,000 | ₹ 40,000 |

| Direct labour | ₹ 40,000 | ₹ 30,000 |

| Production overheads | ₹ 39,000 | ₹ 40,250 |

| Normal loss: | 8% | 5% |

| Output | 18,000 | 171400 |

| Loss realisation/Unit | 2.00 | 3.00 |

The company’s policy is to fix the Selling price of the end product in such a way as to yield a Profit of 20% on Selling price.

Required:

(i) Prepare the Process Accounts

(ii) Determine the Selling price per unit of the end product. [CA Inter Nov. 2002, 9 Marks]

Answer:

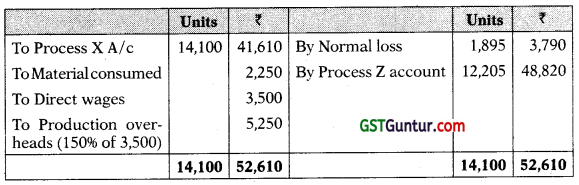

Process I Account

Process II Account

Working Notes:

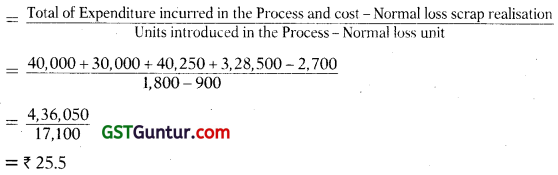

1. Valuation of abnormal loss & units finished & transfer to process II A/c:

Total Expenditure incurred in the Process – Scrap realisation of normal loss

= Units introduced in the Process – Normal loss unit

= \(\frac{2,00,000+60,000+40,000+39,000-3,200}{20,000-1,600}\)

= \(\frac{3,35,800}{18,400}\)

= ₹ 18.25

2. Valuation of Abnormal gain & units finished & transfer to warehouse:

3. Determination of selling price per Unit of the end Product:

Uet the S.P. be ₹ 100

Profit = 20% of 100 = ₹ 20

Cost = ₹ 100 – ₹ 20 = ₹ 80

It the cost price is 25.5, the selling price of the end product

= \(\frac{25.50}{80}\) × 100 = ₹ 31.875

![]()

Question 3.

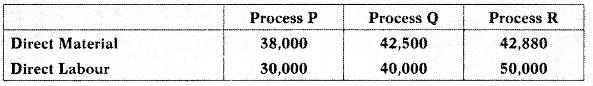

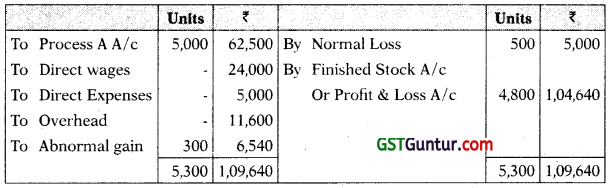

Alpha Ltd. is engaged in the production of a product A which passes through 3 different process – Process P, Process 0 and Process R. The following data relating to cost and output is obtained from the books of account for the month of April 2021:

Production overheads of ₹ 90,000 were recovered as percentage of direct labour. 10,000 kg. of raw material @ ₹ 5 per kg. was issued to Process P. There was no stock of materials or work-in-process. The entire output of each process passes directly to the next process and finally to warehouse. There is normal wastage, in processing, of 10%. The scrap value of wastage is ₹ 1 per kg. The output of each process transferred to next process and finally to warehouse are as under:

Process P = 9,000 kg.

Process 0 = 8,200 kg.

Process R = 7,300 kg.

The company fixes selling price of the end product in such a way so as to yield a profit of 25% selling price.

Prepare Process P, Q and R accounts. Also calculate selling price per unit of end product. [CA Inter May 2018, 10 Marks]

Answer:

Process P Account

Cost Per Unit:

= \(\frac{₹ 1,40,500-₹ 1,000}{10,000 \mathrm{kgs}-1,000 \mathrm{kgs}}\)

= \(\frac{₹ 1,39,500}{9,000 \mathrm{kgs}}\)

= ₹ 15.50

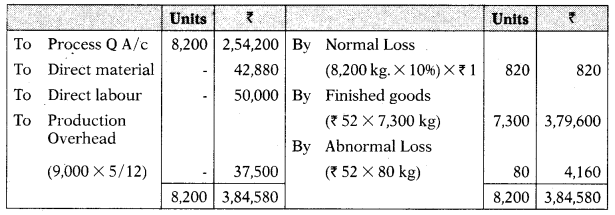

Process Q Account

Cost Per Unit:

= \(\frac{₹ 2,52,000-₹ 900}{9000 \mathrm{kgs}-900 \mathrm{kgs}}\)

= \(\frac{₹ 2,51,000}{8100 \mathrm{kgs}}\)

= ₹ 31

Process R Account

Cost per unit

= \(\frac{₹ 3,84,580 – ₹ 820}{8200 \mathrm{kgs}-820 \mathrm{kgs}}\)

= ₹ 52

Calculation of Selling Price:

| Cost per unit | ₹ 52 |

| Add: Profit 25% on selling price ie. 1/3rd of cost | ₹ 17.33 |

| Selling price per unit | ₹ 69.33 |

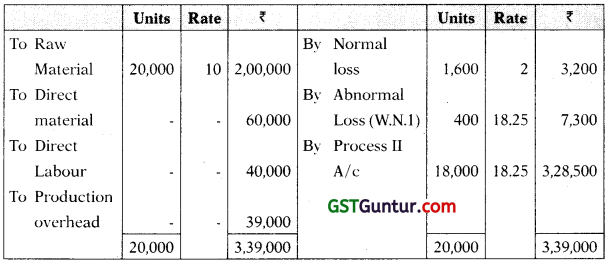

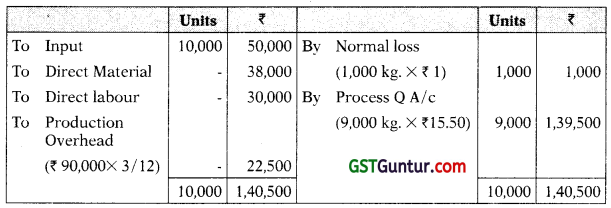

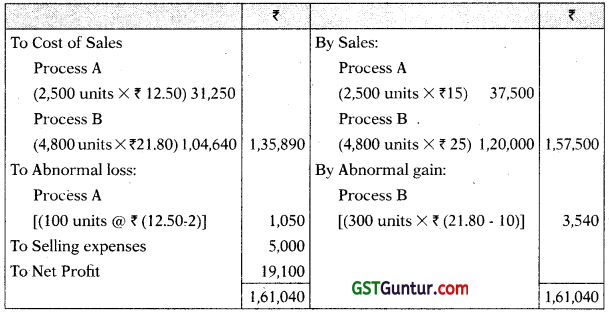

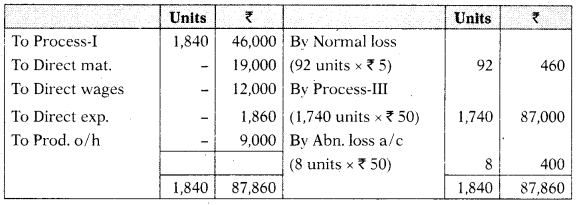

Question 4.

A product passes through two processes A and B. During the year 2021, the input to process A of basic raw material was 8,000 units @ ₹ 9 per unit. Other information for the year is as follows:

| Process A | Process B | |

| Output units | 7,500 | 4,800 |

| Normal loss (% to input) | 5% | 10% |

| Scrap value per unit (₹) | 2 | 10 |

| Direct wages (₹) | 12,000 | 24,000 |

| Direct expenses (₹) | 6,000 | 5,000 |

| Selling price per unit (₹) | 15 | 25 |

Total overheads ₹ 17,400 were recovered as percentage of direct wages. Selling expenses were ₹ 5,000. These are not allocated to the processes. 2/3rd of the output of Process A was passed on to the next process and the balance was sold. The entire output of Process B was sold.

Prepare Process A and B Accounts. [CA Inter May 2012, 8 Marks]

Answer:

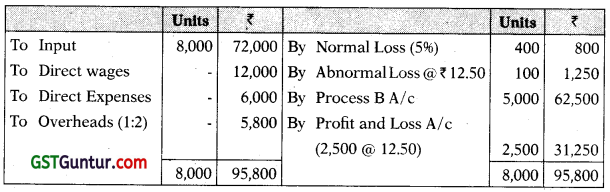

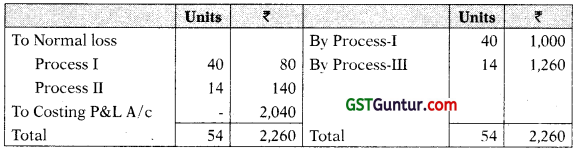

Process I Account

Cost of Abnormal Loss in Process A = \(\frac{95,800-800}{8,000-400}\) = \(\frac{95,000}{7,600}\) = ₹ 12.50 per unit

Process II Account

Cost of Abnormal gain = \(\frac{1,03,100-5,000}{5,000-500}\) = \(\frac{98,100}{4,500}\) = 21.80 per unit

Working Note:

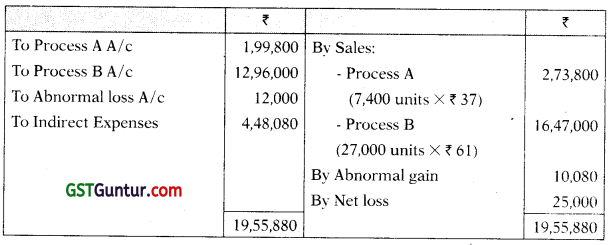

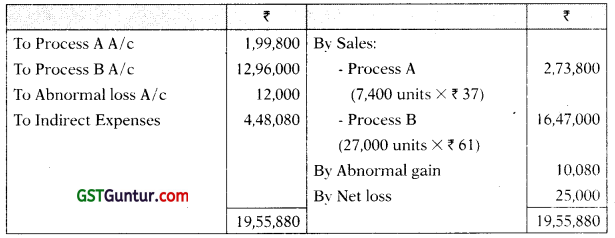

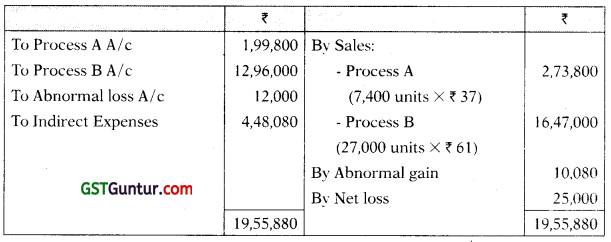

Profit & Loss Account

Note:

1. As mentioned selling expenses are not allocable to process which is debited directly to the Profit & Loss A/c.

2. It is assumed that Process A and Process B are not responsibility centres and hence, Process A and Process B have not been credited to direct sales. P/L A/c is prepared to arriving at profit/loss.

![]()

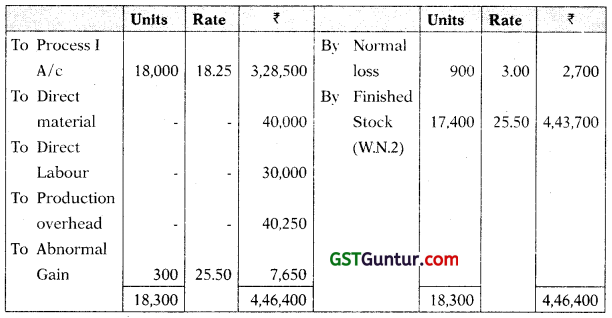

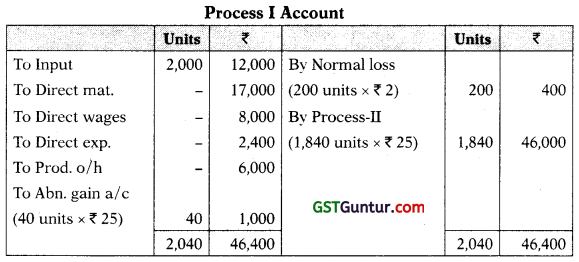

Question 5.

M J Pvt. Ltd, produces a product “SKY” which passes through two processes, viz. Process A and Process B. The details for the year ending 31st March, 2021 are as follows:

| Process A | Process B | |

| 40.000 Units introduced at a cost of | ₹ 3,60,000 | |

| Material Consumed | ₹ 2,42,000 | ₹ 2,25,000 |

| Direct Wages | ₹ 2,58,000 | ₹ 1,90,000 |

| Manufacturing Expenses | ₹ 196,000 | ₹ 1,23,720 |

| Output in Units | 37,000 | 27,000 |

| Normal Wastage of Inputs | 5% | 10% |

| Input Scrap Value(per unit) | ₹ 15 | ₹ 20 |

| Selling Price (per unit) | ₹ 37 | ₹ 61 |

Additional Information:

(a) 80% of the output of Process A, was passed on to the next process and the balance was sold. The entire output of Process B was sold.

(b) Indirect expenses for the year was ₹ 4,48,080.

(c) It is assumed that Process A and Process B are not responsibility centre.

Required:

(i) Prepare Process A and Process B Account.

(ii) Prepare Profit & Loss Account showing the net profit/net loss for the year. [CA Inter May 2014, 8 Marks]

Answer:

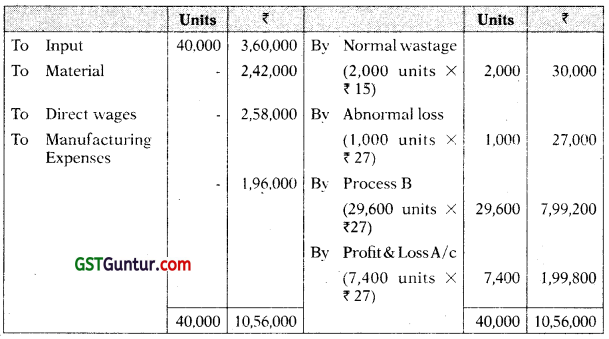

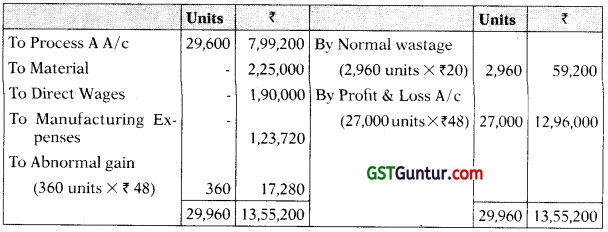

Process A A/c

Cost per unit = \(\frac{₹ 10,56,000-₹ 30,000}{₹ 40,000 \text { unit }-2,000 \text { units }}\) = ₹

Normal wastage = 40,000 units × 5% = 2,000 units

Abnormal loss = 40,0000 units – (37,000 units + 2,000 units)

= 1,000 units

Transfer to Process B = 37,000 units × 80%

= 29,600 units

Sale = 37,000 units × 20%

= 7,400 units

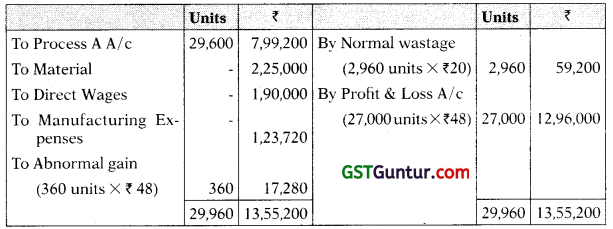

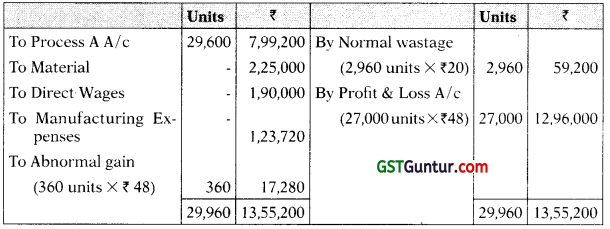

Process B Account

Cost per unit = \(\frac{₹ 13,37,920-₹ 59,200}{₹ 29,600 \text { units }-2,960 \text { units }}\) = ₹ 48 per unit

Normal wastage = 29,600 units × 10%

= 2,960 units

Abnormal gain = (27,000 units + 2,960 units) – 29,600 units

= 360 units

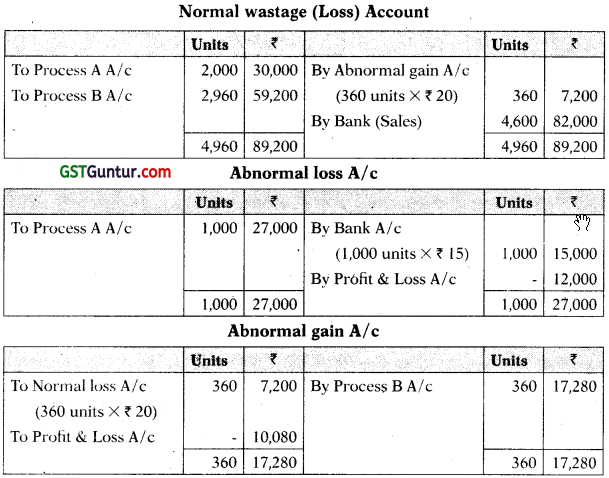

Profit & Loss Account

= 1,000 units

Transfer to Process B = 37,000 units × 80%

= 29,600 units

Sale = 37,000 units × 20%

= 7,400 units

Process B Account

Cost per unit = \(\frac{₹ 13,37,920-₹ 59,200}{₹ 29,600 \text { units }-2,960 \text { units }}\) = ₹ 48 per unit

Normal wastage = 29,600 units × 10%

= 2,960 units

Abnormal gain = (27,000 units + 2,960 units) – 29,600 units

= 360 units

Profit & Loss Account

= 1,000 units

Transfer to Process B = 37,000 units × 80%

= 29,600 units

Sale = 37,000 units × 20%

= 7,400 units

Process B Account

Cost per unit = \(\frac{₹ 13,37,920-₹ 59,200}{₹ 29,600 \text { units }-2,960 \text { units }}\) = ₹ 48 per unit

Normal wastage = 29,600 units × 10%

= 2,960 units

Abnormal gain = (27,000 units + 2,960 units) – 29,600 units

= – 360 units

Profit & Loss Account

Working notes:

![]()

Question 6.

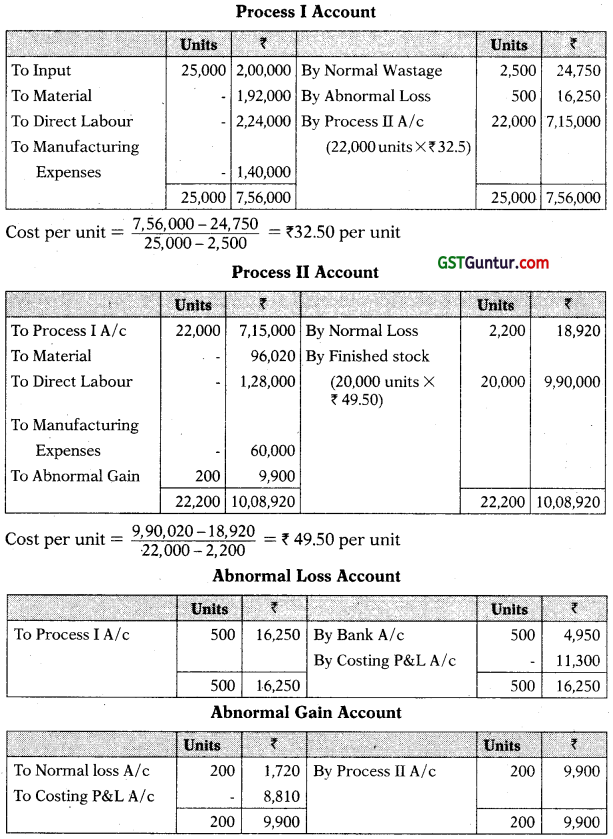

JK Ltd. produces a product “AZE”, which passes through two processes, viz., process I and process II. The output of each process is treated as the raw material of the next process to which it is transferred and output of the second process is transferred to finished stock. The following data related to December, 2020:

| Process I | Process II | |

| 25,000 units introduced at a cost of | ₹ 2,00,000 | – |

| Material consumed | ₹ 1,92,000 | ₹ 96,200 |

| Direct labour | ₹ 2,24,000 | ₹ 1,28,000 |

| Manufacturing expenses | ₹ 1,40,000 | ₹ 60,000 |

| Normal wastage of input | 10% | 10% |

| Scrap value of normal wastage (per unit) | ₹ 9.90 | 8.60 |

| Output in Units | 22,000 | 20,000 |

Required:

(i) Prepare Process I and Process II account.

(ii) Prepare Abnormal effective/wastage account as the case may be in each process. [CA Inter May 2008, 8 Marks]

Answer:

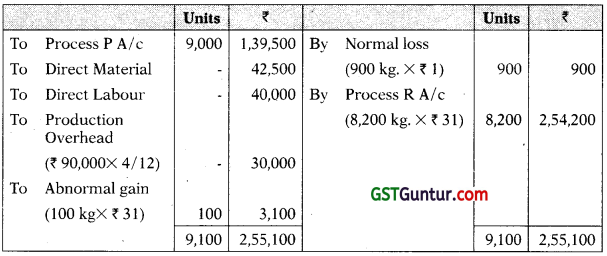

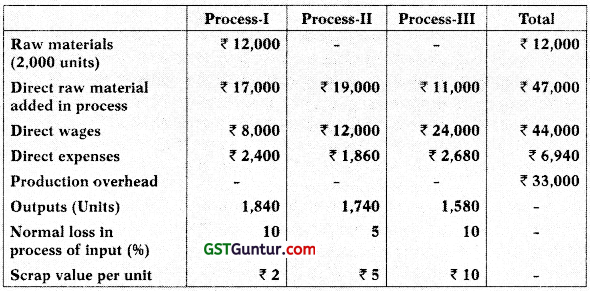

Question 7.

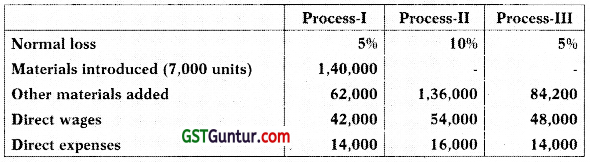

PQR Ltd. processes a range of product including a toy ‘Alpha’, which passes through three processes before completion and transfer to the finished goods warehouse. The information relating to the month of October 2021 are as follows:

The production overhead is absorbed as a percentage of direct wages. There was no opening and closing stock.

Prepare the following accounts:

(i) Process-I

(ii) Process-II

(iii) Process-Ill

(iv) Abnormal Loss

(v) Abnormal Gain [CA Inter Nov 2019, 8 Marks]

Answer:

(i)

Cost per unit = \(\frac{₹ 45,400-₹ 400}{2,000 \text { units – } 200 \text { units }}\) = ₹ 25 Per unit

(ii) Process II Account

Cost per unit = \(\frac{₹ 87,860-₹ 460}{1,840 \text { units – } 92 \text { units }}\) = ₹ 50 per unit

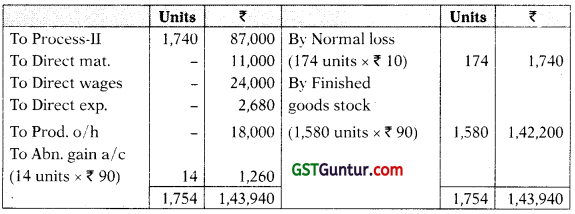

(iii) Process- III Account

Cost per unit = \(\frac{₹ 1,42,680-₹ 1,740}{1,740 \text { units – } 174 \text { units }}\) = ₹ 90 per unit

(iv) Abnormal Loss Account

(v) Abnormal Gain Account

![]()

Question 8.

A product passes through two distinct processes before completion. Following information are available in this respect:

| Process 1 | Process 2 | |

| Raw materials used | 10,000 units | – |

| Raw material cost (per unit) | ₹ 75 | |

| Transfer to next process/Finished good | 9,000 units | 8,200 units |

| Normal loss (on inputs) | 5% | 10% |

| Direct wages | ₹ 3,00,000 | ₹ 5,60,000 |

| Direct expenses | 50% of direct wages | 65% of direct |

| Manufacturing overheads | 25% of direct wages | 15% of direct wages |

| Realisable value of scrap (per unit) | ₹ 13.50 | ₹ 145 |

8,000 units of finished goods were sold at a profit of 15% on cost. There was no opening and closing stock of work-in-progress.

Prepare:

(i) Process 1 and Process 2 Account

(ii) Finished goods Account

(iii) Normal Loss Account

(iv) Abnormal Loss Account

(v) Abnormal Gain Account [CA Inter Nov. 2019, 10 Marks]

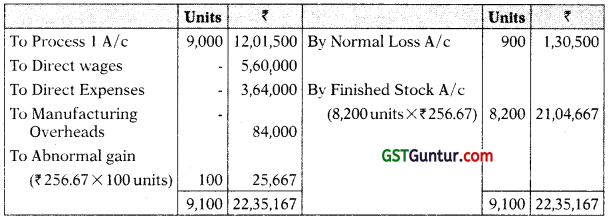

Answer:

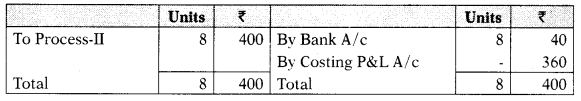

Process 1 Account

Cost per unit of Completed units and abnormal loss:

= \(\frac{₹ 12,75,000-₹ 6,750}{10,000 \text { units }-500 \text { units }}\)

= \(\frac{₹ 12,68,250}{9,500 \text { units }}\)

= ₹ 133.50

Process 2 Account

Cost per unit of Completed units and abnormal loss:

= \(\frac{22,09,500-₹ 1,30,500}{9,000 \text { units }-900 \text { units }}\)

= \(\frac{₹ 20,79,000}{8,100 \text { units }}\)

= ₹ 256.67

Finished Goods Account

![]()

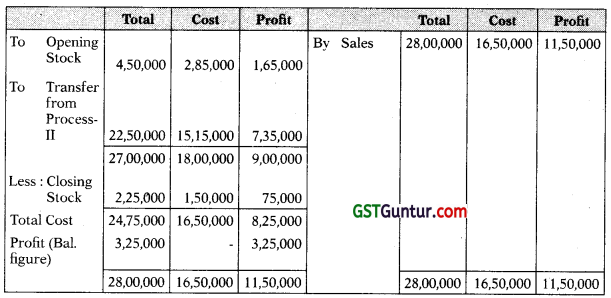

Equivalent Production: fifo Method

Question 9.

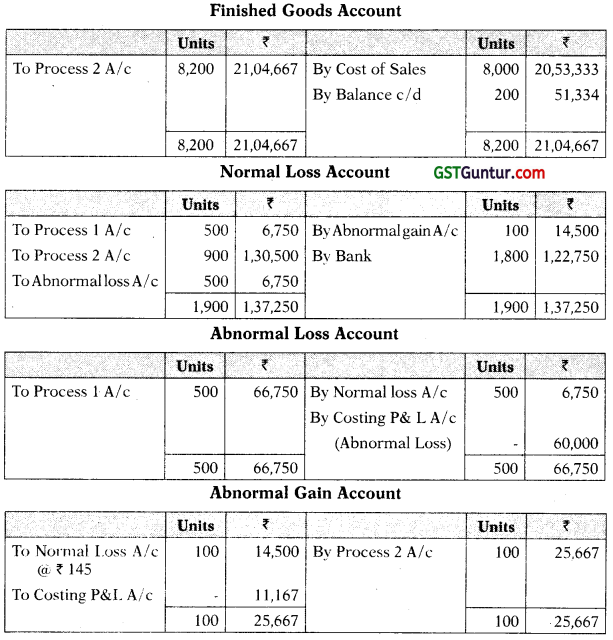

Following details have been provided by M/s AR Enterprises:

(i) Opening work-in-progress 3,000 units (70% complete)

(ii) Units introduced during the year 17,000 units

(in) Cost of the process (for the period) ₹ 33,12,720

(tv) Transferred to next process 15,000 units

(v) Closing work-in-progress 2,200 units (80% complete)

(vi) Normal loss is estimated at 12% of total input (including units in process in the beginning). Scraps realise ? 50 per unit. Scraps are 100% complete

Using FIFO method, compute:

(i) Equivalent production

(ii) Cost per equivalent unit [CA Inter Nov. 2018, 5 Marks]

Answer:

Computation of cost per equivalent production unit:

Cost of the Process (for the period) = ₹ 33,12,720

Less: Scrap value of normal loss (₹ 50 × 2,400 units) = ₹ 1,20,000

Total process cost = ₹ 31,92,720

Cost per Equivalent unit = \(\frac{₹ 31,92,720}{15,060 \text { units }}\)

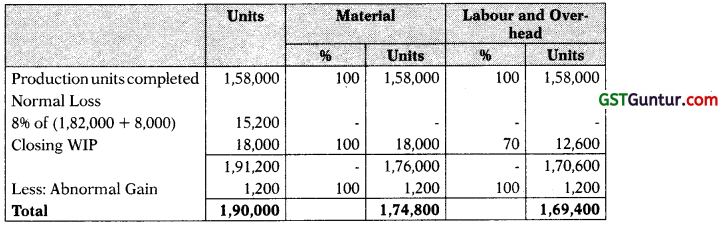

Question 10.

The following information relate to Process A:

(i) Opening WIP – 8,000 units at ₹ 75,000

(ii) Degree of Completion:

Material – 100%

Labour and Overhead – 60%

(iii) Input 1,82,000 units at – ₹ 7,37,500

(iv) Wages paid – ₹ 3,40,600

(v) Overheads paid – ₹ 1,70,300

Units scrapped – 14,000

Degree of Completion:

Material – 100%

Wages and Overheads – 80%

(vi) Closing WIP 18,000 units

Degree of Completion:

Material – 100%

Wages and Overheads – 70%

(vii) Units completed and transferred 1,58,000 to next Process

(viii) Normal loss 5% of total input including opening WIP.

(ix) Scrap value is ₹ 5 per unit to be adjusted out of direct material cost You are required to compute on the basis of FIFO basis:

(i) Equivalent Production

(ii) Cost Per Unit

(iii) Value of Units transferred to next process. [CA Inter Nov, 2014, 8 Marks]

Answer:

Statement of Equivalent Production

(FIFO Method)

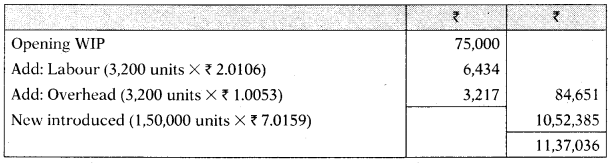

Total cost per unit = ₹ (4.00 + 2.0106 + 1.0053) = ₹ 7.0159

Value of units transferred to next process:

![]()

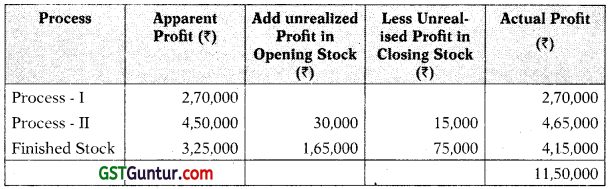

Question 11.

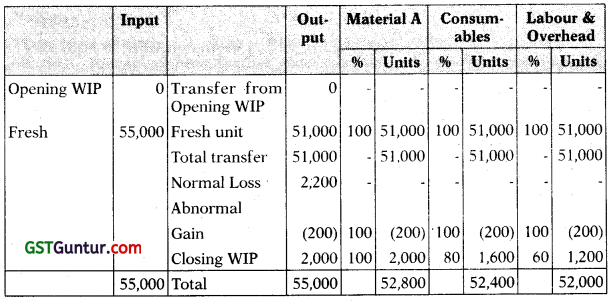

The following information is furnished by ABC Company for Process II of its manufacturing activity for the month of April 2021:

(i) Opening Work-in-Progress-Nil

(ii) Units transferred from Process I – 55,000

(iii) Expenditure debited to Process II

Consumables – ₹ 1,57,200

Labour – ₹ 1,04,000

Overhead – ₹ 52,000

(iv) Units transferred to Process III – 51,000 units

(v) Closing WIP- 2,000 units (Degree of completion)

Consumables – 80%

Labour – 60%

Overhead – 60%

(vi) Units scrapped – 2,000 units, scrapped units were sold at ₹ 5 per unit

(vii) Normal loss 4% of units introduced

You are required to:

(i) Prepare a Statement of Equivalent Production.

(ii) Determine the cost per unit.

(iii) Determine the value of Work-in-Process and units transferred to Process III. [CA Inter Nov. 2015, 8 Marks]

Answer:

(i) Statement of Equivalent Production

(ii) Determination of Cost per Unit

(iii) Determination of value of Work-In-Process and units transferred to Process-III

![]()

Question 12.

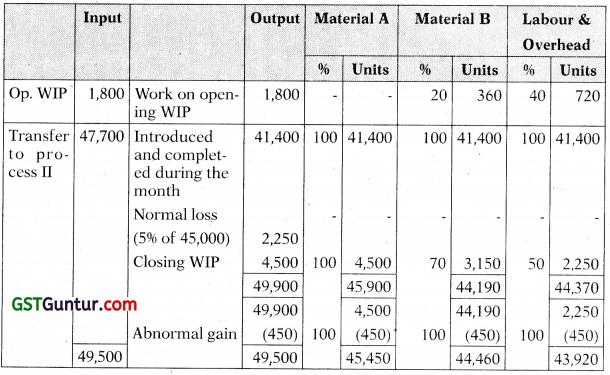

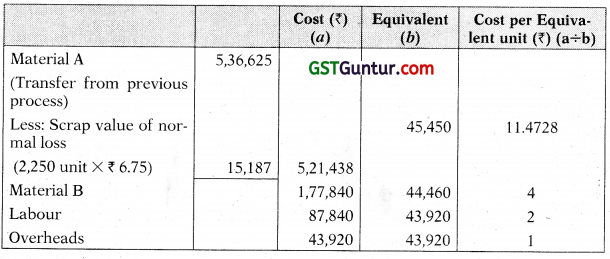

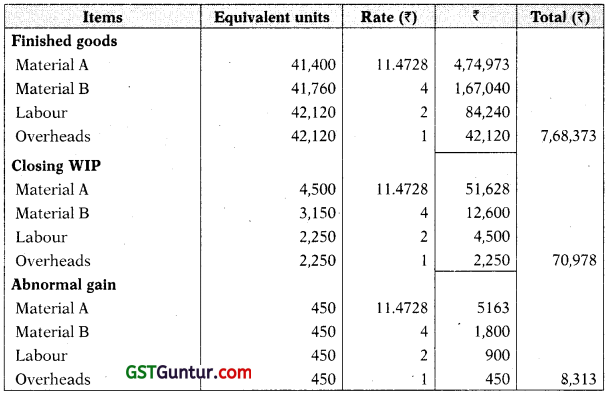

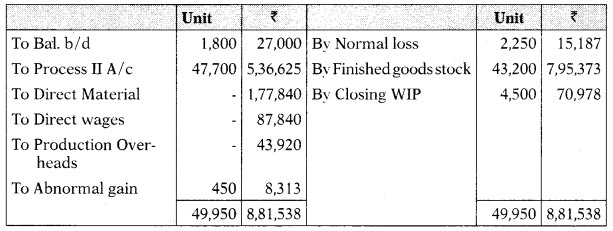

From the following Information for the month ending October, 2021. Prepare Process 111 Cost Accounts:

| Opening WIP In Process III | 1,800 units at ₹ 27,000 |

| Transfer from Process II | 47,700 units at ₹ 5,36,625 |

| Transferred to Warehouse | 43,200 units |

| Closing WIP of Process III | 4,500 units |

| Units scrapped | 1,800 units |

| Direct material added in Process III | ₹ 1,77,840 |

| Direct Wages | ₹ 87,840 |

| Production overheads | ₹ 43,920 |

| Degree of completion: | Opening Stock | Closing Stock | Scrap |

| Materials | 80% | 70% | 100% |

| Labour | 60% | 50% | 70% |

| Overheads | 60% | 50% | 70% |

The normal loss in the process was 5% of the production and scrap was sold @ ₹ 6.75 per unit. [CA Inter Nov. 2003, 10 Marks]

Answer:

Statement of Equivalent Production:

Statement of cost per unit

Statement of Evaluation

Process III Account

![]()

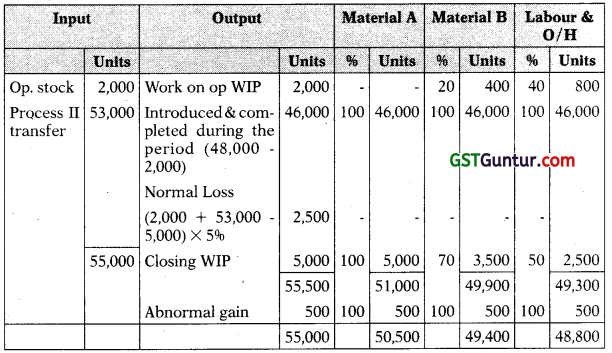

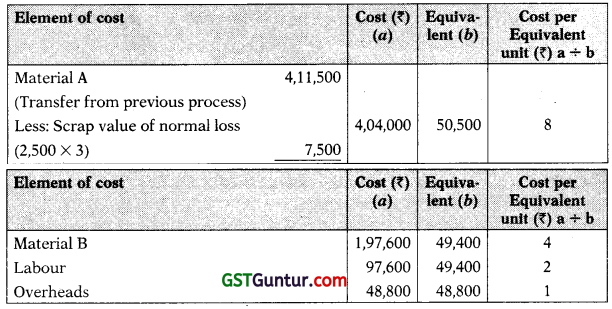

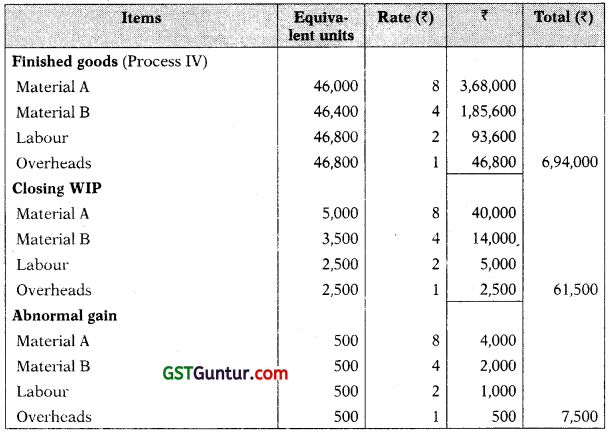

Question 13.

From the following Information for the month ending October, 2020, prepare Process Cost accounts for Process III. Use First-in-first-out (FIFO) method to value equivalent production.

Direct materials added in Process III (Opening WIP) – 2,000 units at ₹ 25,750

Transfer from Process II – 53,000 units at ₹ 4,11,500

Transferred to Process IV – 48,000 units

Closing stock of Process III – 5,000 units

Units scrapped – 2,000 units

Direct material added in Process III – ₹ 1,97,600

Direct wages – ₹ 97,600

Production Overheads – ₹ 48,800

Degree of completion:

| Opening Stock | Closing Stock | Scrap | |

| Materials | 80% | 70% | 100% |

| Labour | 60% | 50% | 70% |

| Overheads | 60% | 50% | 70% |

The normal loss in the process was 5% of production and scrap was sold at ₹ 3 per unit. [CA Inter Nov. 2005, 14 Marks]

Answer:

Process III Process Cost Sheet (FIFO Method) Period

Op. Stock: 2,000 units

Introduced: 53,000 units

Statement of Equivalent Production

Statement of Cost for each Element

Statement of Evaluation

Process III Account

![]()

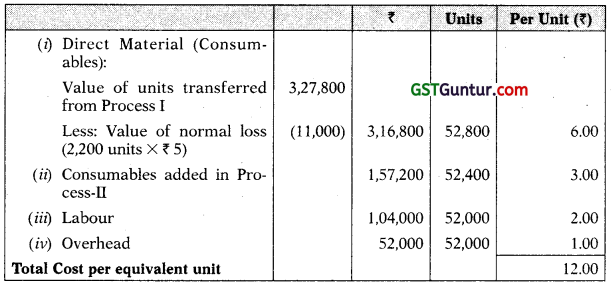

Question 14.

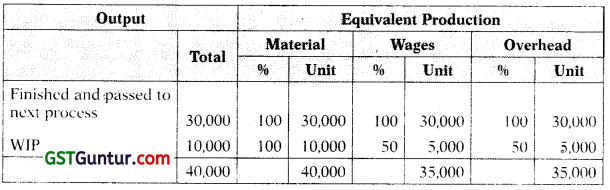

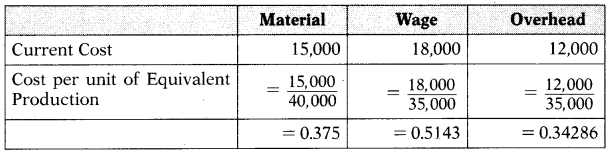

A Company produces a component, which passes through two processes. During the month of April, 2021, materials for 40,000 components were put into Process I of which 30,000 were completed and transferred to Process II. Those not transferred to Process II were 100% complete as to materials cost and 50% complete as to labour and overheads cost. The Process I costs incurred were as follows:

| Direct Materials | ₹ 15,000 |

| Direct Wages | ₹ 18,000 |

| Factory Overheads | ₹ 12,000 |

Of those transferred to Process II, 28,000units were completed and transferred to finished goods stores. There was a normal loss with no salvage value of 200 units in Process II. There were 1,800 units, remained unfinished in the process with 100% complete as to materials and 25% complete as regard to wages and overheads.

No further process material costs occur after introduction at the first process until the end of the second process, when protective packing is applied to the completed components. The process and packing costs incurred at the end of the Process II were:

| Direct Materials | ₹ 4,000 |

| Direct Wages | ₹ 3,500 |

| Factory Overheads | ₹ 4,500 |

Required:

(i) Prepare Statement of Equivalent Production, Cost per unit and Process I A/c.

(ii) Prepare statement of Equivalent Production, Cost per unit and Process II A/c. [CA Inter May 2006, 10 Marks]

Answer:

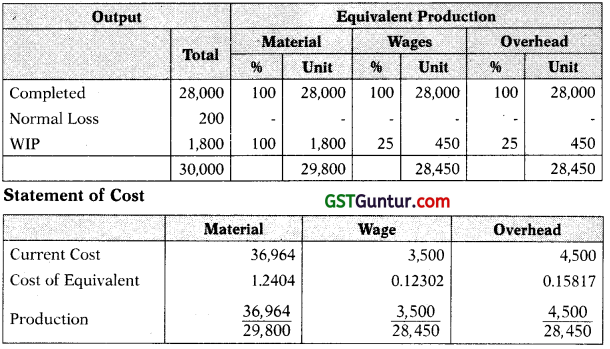

(i) Statement of Equivalent Production

Statement of Cost

Cost Analysis (Process I):

Finished and passed to next process

Process I Account

(ii) Statement of Equivalent Production

Total Cost per unit = 1.52159

Cost Analysis (Process II):

Process II Account:

![]()

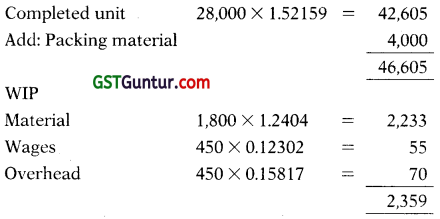

Question 15.

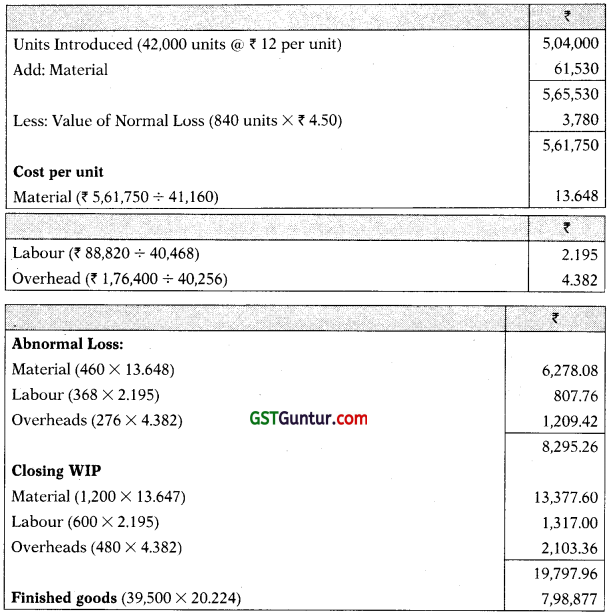

XP Ltd. furnishes you the following information relating to process II.

Opening work-in-progress – NIL

Units introduced 42,000 units @ ₹ 12

Expenses debited to the process:

(a) Direct material ₹ 61,530

(b) Labour ₹ 88,820

(c) Overhead ₹ 1,76,400

Normal loss in the process = 2%.of input

Closing work-in-progress – 1,200 units

Degree of completion:

Materials – 100%

Labour – 50%

Overhead – 40%

Finished output – 39,500 units

Degree of completion of abnormal loss:

Material – 100%

Labour – 80%

Overhead – 60%

Units scraped as normal loss were sold at ₹ 4.50 per unit.

All the units of abnormal loss were sold at ₹ 9 per unit.

Prepare:

(a) Statement of equivalent production;

(b) Statement showing the cost of finished goods, abnormal loss and closing WIP;

(c) Process II account and abnormal loss account.

[CA Inter Nov. 2009, 8 Marks]

Answer:

(a) Statement of Equivalent Production

(b) Statement of Cost

(c) Process II Account

![]()

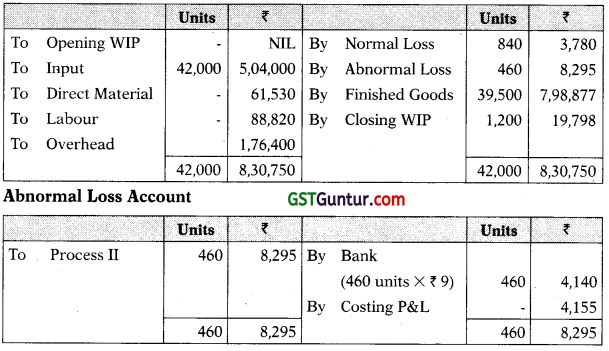

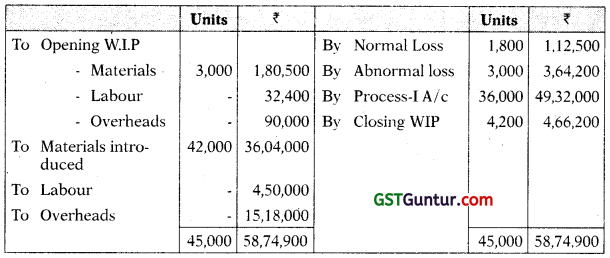

Question 16.

Following information is available regarding Process A for the month of October 2020:

Production Record:

| (i) Opening work-in progress | 40,000 Units |

| (ii) (Material: 100% complete, 25% complete for labour & overheads) | |

| (iii) Units Introduced | 1,80,000 Units |

| (iv) Units Completed | 1,50,000 Units |

| (v) Units in process on 31.10.2020 (Material: 100% complete, 50% complete for labour & overheads) |

70,000 Units |

Cost Records:

Opening Work-in-progress

| Material | ₹ 1,00,000 |

| Labour | ₹ 25,000 |

| Overheads | ₹ 45,000 |

Cost incurred during the month:

| Material | ₹ 6,60,000 |

| Labour | ₹ 5,55,000 |

| Overheads | ₹ 9,25,000 |

Assure that FIFO method is used for W.I.P. inventory valuation.

Required:

(i) Statement of Equivalent Production.

(ii) Statement showing Cost for each element

(iii) Statement of apportionment of Cost

(iv) Process A Account. [CA Inter Nov. 2010, 8 Marks]

Answer:

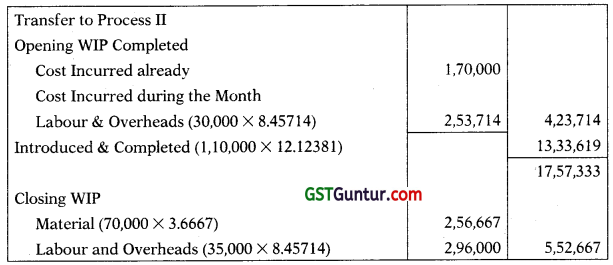

Statement of Equivalent Production

(FIFO Method)

Statement showing the Cost for each element

Statement of Evaluation

Process A A/c

![]()

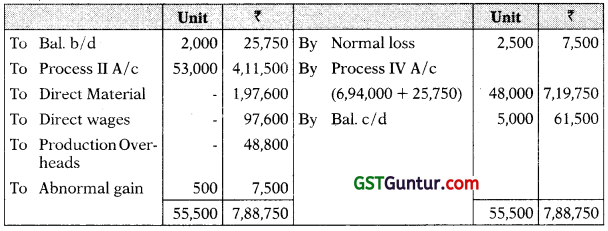

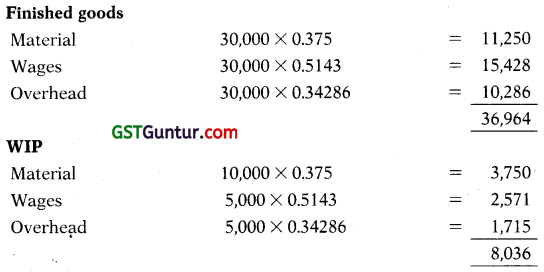

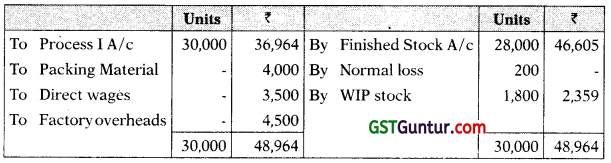

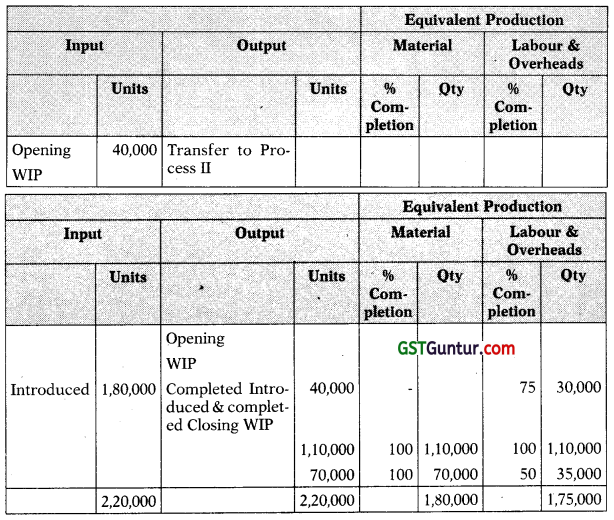

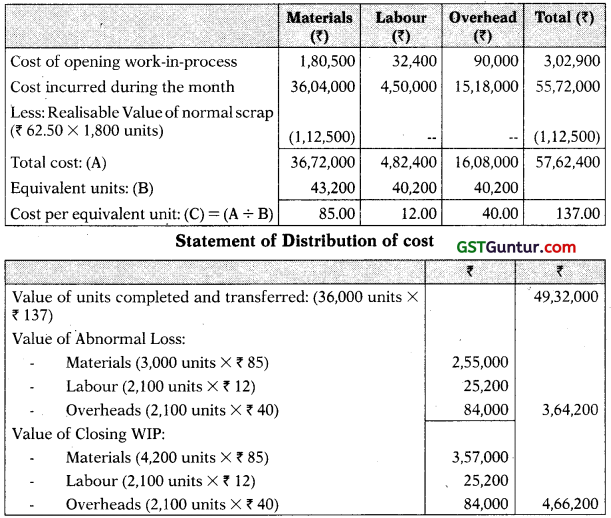

Question 17.

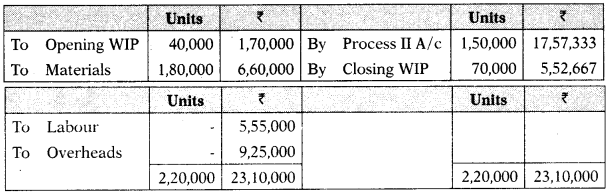

ABX Company Ltd. provides the following information relating to Process B:

(i) Opening Work-in-progress – NIL

(ii) Units Introduced – 45,000 units @ ₹ 10 per unit

(iii) Expenses debited to the process

Direct material – ₹ 65,500

Labour – ₹ 90,800

Overhead – ₹ 1,80,700

(iv) Normal loss in the process – 2% of Input

(v) Work-in progress – 1,800 units

Degree of completion

Materials – 100%

Labour – 50%

Overhead – 40%

(vi) Finished output – 42,000 units

(vii) Degree of completion of abnormal loss:

Direct material – 100%

Labour – 80%

Overhead – 60%

(viii) Units scrapped as normal loss were sold at ₹ 5 per unit.

(ix) All the units of abnormal loss were sold at ₹ 2 per unit.

You are required to prepare:

(a) Statement of equivalent production.

(b) Statement showing the cost of finished goods, abnormal loss and closing balance of work-in-progress.

(c) Process-B account and abnormal loss account. [CA Inter May 2013, 10 Marks]

Answer:

![]()

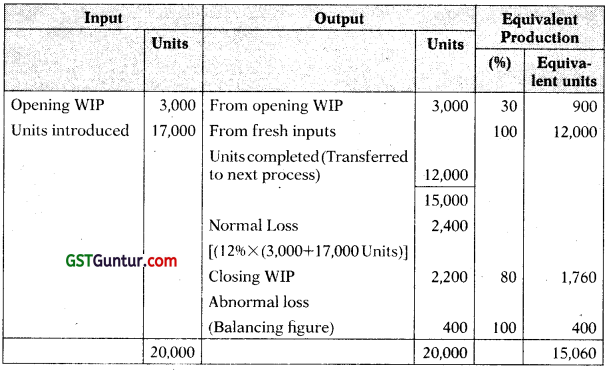

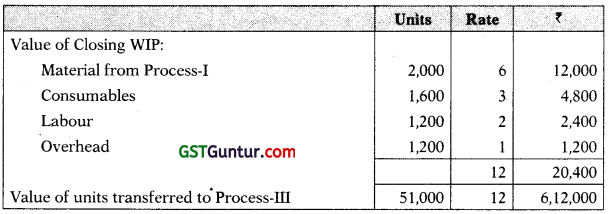

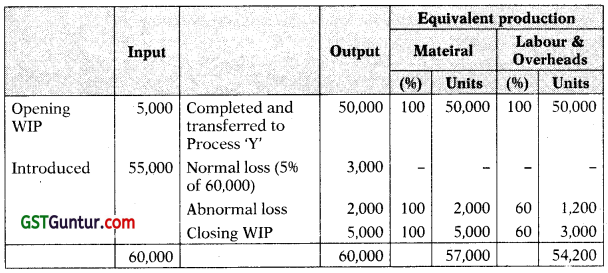

Question 18.

Answer the following:

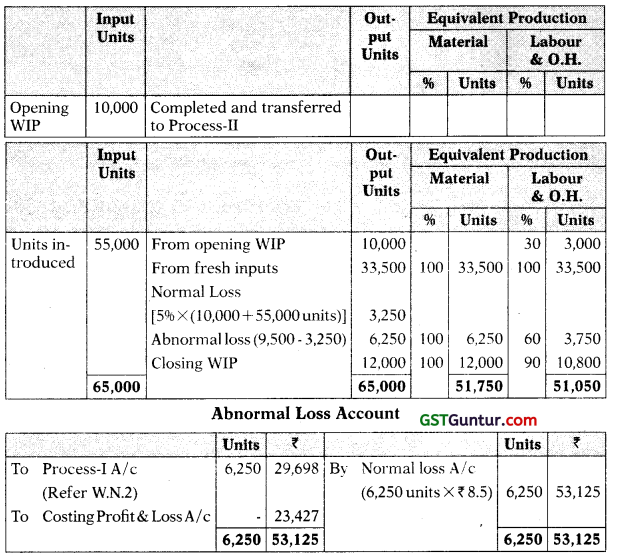

MNO Ltd. has provided following details:

- Opening work-in-progress is 10,000 units at ₹ 50,000 (Material 100%, Labour and overheads 70% complete).

- Input of materials is 55,000 units at ₹ 2,20,000. Amount spent on Labour and Overheads is ₹ 26,500 and ₹ 61,500 respectively.

- 9,500 units were scrapped; degree of completion for material 100% and for labour & overheads 60%.

- Closing work-in-progress is 12,000 units; degree of completion for material 100% and for labour & overheads 90%.

- Finished units transferred to next process are 43,500 units.

Normal loss is 5% of total input including opening work-in-progress. Scrapped units would fetch ₹ 8.50 per unit.

You are required to prepare using FIFO method:

(i) Statement of Equivalent production

(ii) Abnormal Loss Account [CA Inter January 2021, 5 Marks]

Answer:

Statement of Equivalent Production (Using FIFO method)

Working Notes:

Equivalent Production: Weighted Average Method

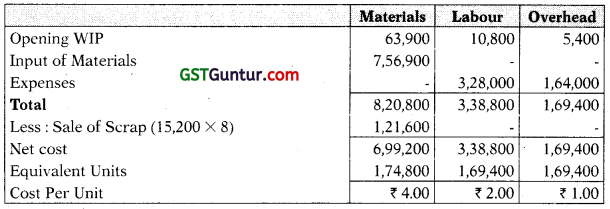

Question 19.

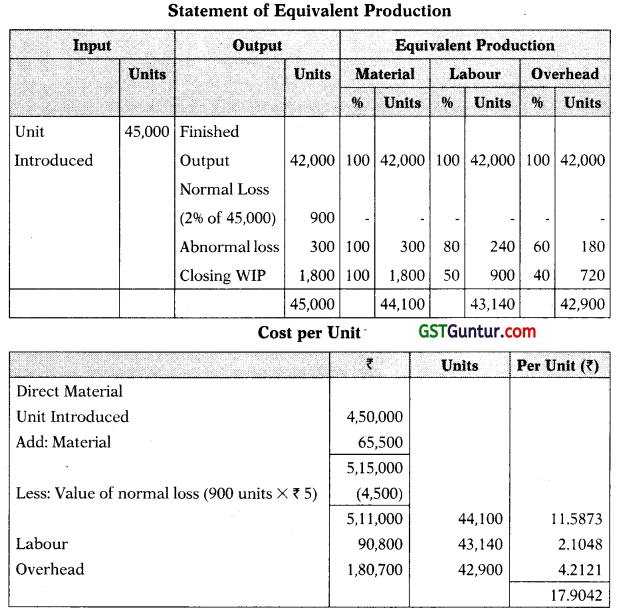

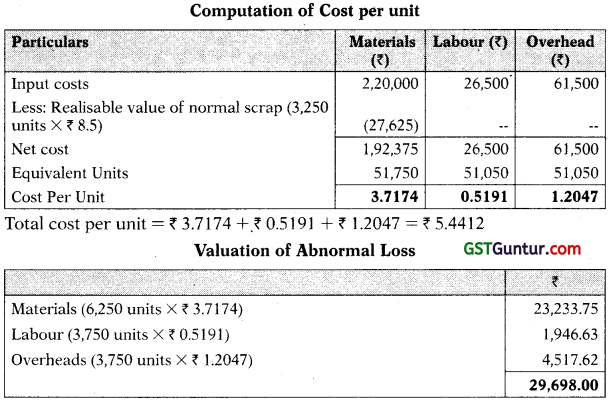

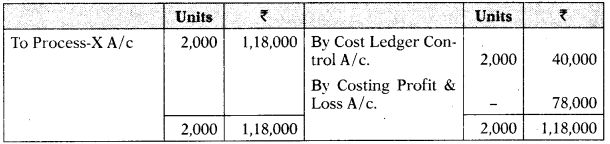

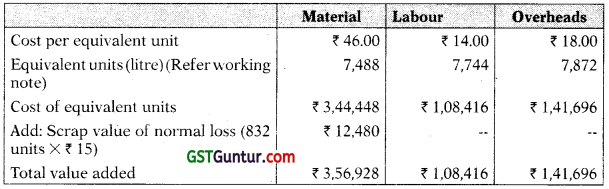

The following details are available of Process X for August 2020:

Opening work-in-progress 8,000 units

Degree of completion and cost:

| Material (100%) | ₹ 63,900 |

| Labour (60%) | ₹ 10,800 |

| Overheads (60%) | ₹ 5,400 |

| Input 1,82,000 units at | ₹ 7,56,900 |

| Labour paid | ₹ 3,28,000 |

| Over heads incurred | ₹ 1,64,000 |

| Units scrapped | 14,000 |

Degree of completion:

| Material | 100% |

| Labour and overhead | 80% |

| Closing work-in-process | 18,000 units |

Degree of completion

| Material | 100% |

| Labour and overhead | 70% |

1,58,000 units were completed and transferred to next process.

Normal loss is 8% of total input including opening work-in-process.

Scrap value is ₹ 8 per unit to be adjusted in direct material cost.

You are required to compute, assuming that average method of inventory is used:

(i) Equivalent production, and

(ii) Cost per unit [CA Inter Nov. 2011, 8 Marks]

Answer:

(i) Statement of Equivalent Production

(ii) Statement of cost

Total cost per unit = ₹ 4 + ₹ 2 + ₹ 1 = ₹ 7.00

![]()

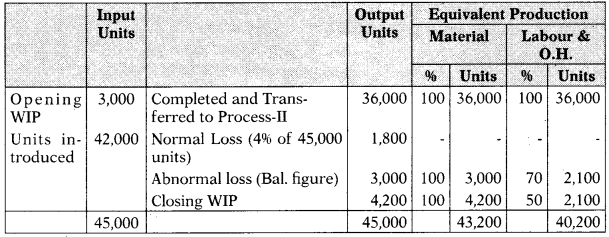

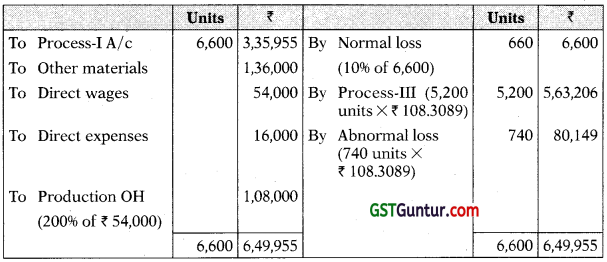

Question 20.

Following details are related to the work done in Process-I during the month of May 2021:

Opening work-in-process (3,000 units)

| Materials | ₹ 1,80,500 |

| Labour | ₹ 32,400 |

| Overheads | ₹ 90,000 |

| Materials introduced in Process-I (42,000 units) | ₹ 36,04,000 |

| Labour | ₹ 4,50,000 |

| Overheads | ₹ 15,18,000 |

| Units Scrapped | 4,800 units |

Degree of completion

| Materials | 100% |

| Labour & overhead | 70% |

| Closing Work-in-process | 4,200 units |

Degree of completion

| Materials | 100% |

| Labour & overhead | 50% |

Units finished and transferred to Process-II (36,000 units)

Normal loss:

4% of total input including opening work-in-process

Scrapped units fetch ₹ 62.50 per piece

Prepare:

(i) Statement of equivalent production.

(ii) Statement of cost per equivalent unit

(iii) Process-I A/c

(iv) Normal Loss Account and

(v) Abnormal Loss Account [CA Inter Nov. 2020, 10 Marks]

Answer:

(i) Statement of Equivalent Production (Weighted Average method)

(ii) Statement showing cost for each element

(iii) Process-I Account

(iv) Normal Loss account

(v) Abnormal Loss Account

![]()

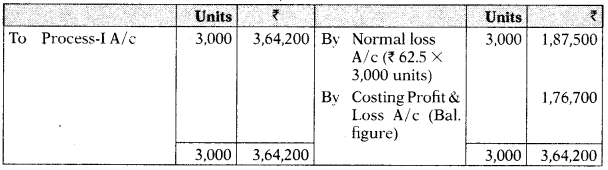

Question 21.

A product is manufactured in two sequential processes, namely Process-1 and Process-2. The following information relates to Process-1. At the beginning of June 2021, there were 1,000 WIP goods (60% completed in terms of conversion cost) in the inventory, which are valued at ₹ 2,86,020 (Material cost: ₹ 2,55,000 and Conversion cost: ₹ 31,020). Other information relating to Process-1 for the month of June 2021 is as follows:

| Cost of materials introduced-40,000 units (₹) | 96,80,000 |

| Conversion cost added (₹) | 18,42,000 |

| Transferred to Process 2 (Units) | 35,000 |

| Closing WIP (Units) (60% completed in terms of conversion cost) | 1,500 |

100% of materials are introduced to Process-1 at the beginning.

Normal loss is estimated at 10% of input materials (excluding opening WIP).

Required:

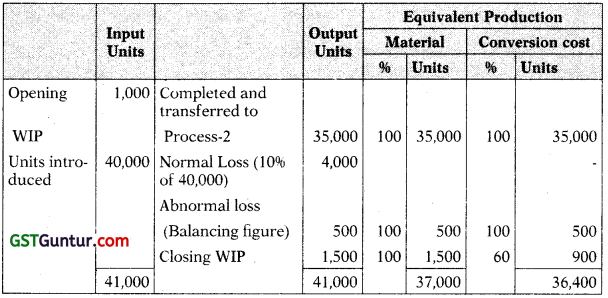

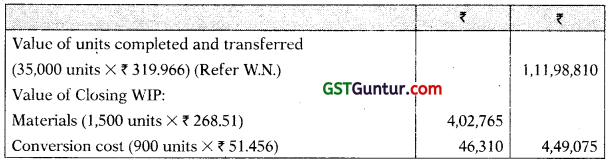

(i) Prepare a statement of equivalent units using the weighted average cost method and thereby calculate the following.

(ii) Calculate the value of output transferred to Process-2 and closing WIP. [CA Inter Nov. 2019 RTP]

Answer:

(i) Statement of Equivalent Production

(ii) Calculation of value of output transferred to Process-2 & Closing WIP

Working Note:

Cost for each element

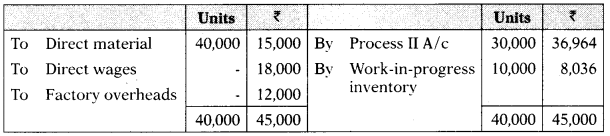

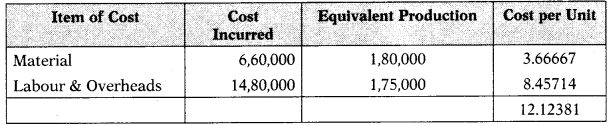

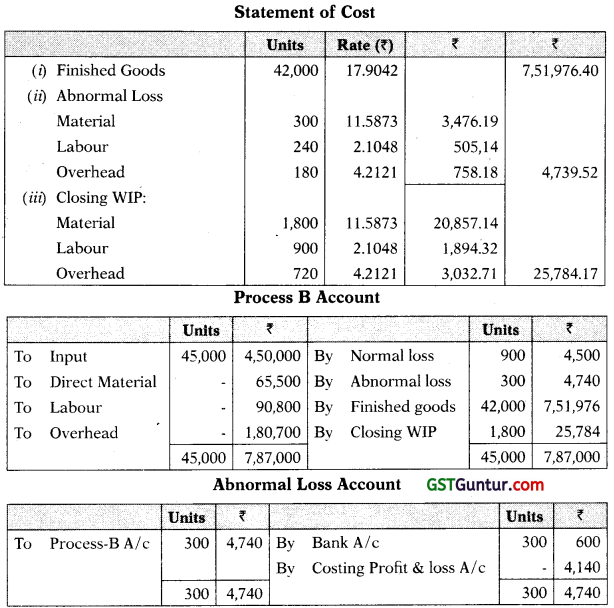

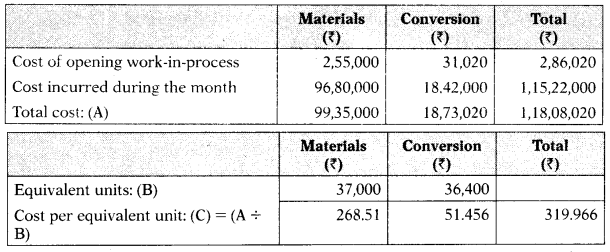

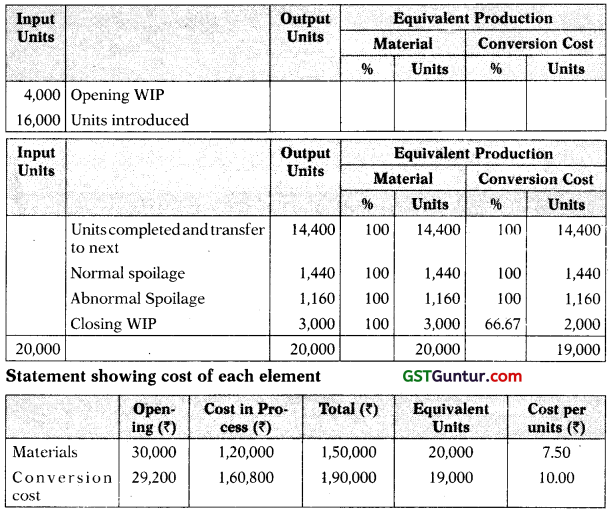

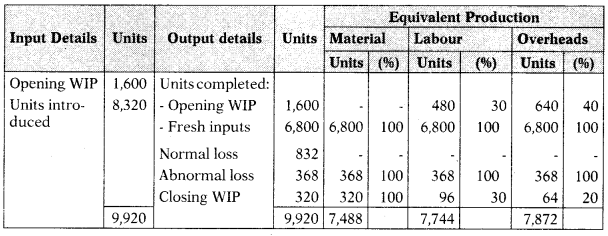

Question 22.

ABC Limited manufactures a product ‘ZX’ by using the process namely RT. For the month of May, 2021, the following data are available:

Work-in-process:

| Process RT | |

| Material introduced (units) | 16,000 |

| Transfer to next process (units) | 14,400 |

| Work-in-process: | |

| At the beginning of the month (units) (4/5 completed) | 4,000 |

| At the end of the month (units) (2/3 completed) | 3,000 |

| Cost records: | |

| Work-in-process at the beginning of the month | |

| Material | ₹ 30,000 |

| Conversion cost | ₹ 29,200 |

| Cost during the month: materials | ₹ 1,20,000 |

| Conversion cost | ₹ 1,60,800 |

Normal spoiled units are 10% of goods finished output transferred to next process.

Defects in these units are identified in their finished state. Material for the product is put in the process at the beginning of the cycle of operation, whereas labour and other indirect cost flow evenly over the year. It has no realizable value for spoiled units.

Required:

(i) Statement of equivalent production (Average cost method);

(ii) Statement of cost and distribution of cost;

(iii) Process accounts. [CA Inter Nov. 2007, 8 Marks]

Answer:

Statement of equivalent production of Process RT

Statement of apportionment of cost:

![]()

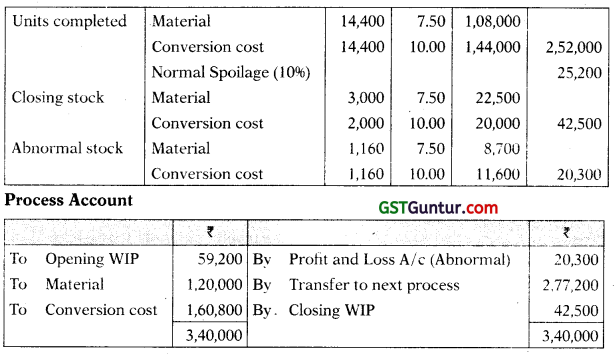

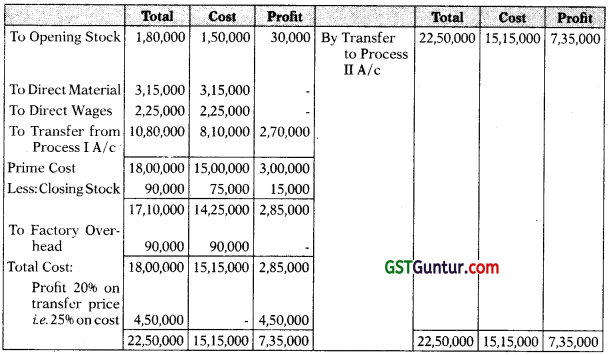

Inter Process Profits

Question 23.

Pharma Limited produces product ‘Glucodin’ which passes through two processes before it is completed and transferred to finished stock. Following data relates to March, 2021.

Output of process I is transferred to process II at 25% profit on the transfer price, whereas output of process II is transferred to finished stock at 20% on transfer price. Stock in processes are valued at prime cost. Finished stock is valued at the price at which it is received from process II. Sales for the month is ₹ 28,00,000.

You are required to prepare Proce$s*I a/c, Process-II a/c, and Finished Stock a/c showing the profit element at each stage. [CA Inter May 2019, May 2010, 10 Marks]

Answer:

Process I Account

Process II Account

Working Note:

Profit element in closing stock = \(\frac{3,00,000}{18,00,000}\) × 90,000 = ₹ 15,000

Finished Stock Account

Working Note:

Profit element in closing finished Stock = \(\frac{9,00,000}{27,00,000}\) × 2,25,000 = ₹ 75,000

Calculation of Profit on Sale:

![]()

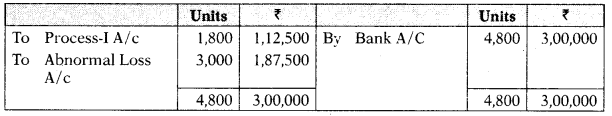

Question 24.

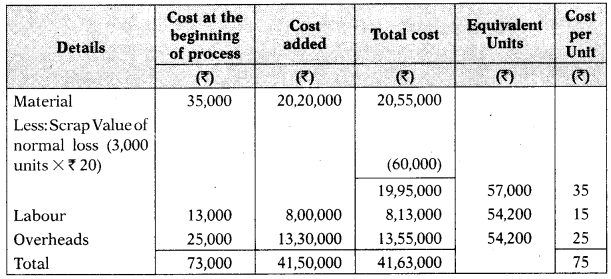

ABC Ltd. produces an item which is completed in three processes – X, Y and Z. The following information is furnished for process X for the month of March, 2021:

Opening work-in-progress (5,000 units):

| Materials | ₹ 35,000 |

| Labour | ₹ 13,000 |

| Overheads | ₹ 25,000 |

Units introduced into process X (55,000 units):

| Materials | ₹ 20,20,000 |

| Labour | ₹ 8,00,000 |

| Overheads | ₹ 13,30,000 |

Units scrapped: 5,000 units

Degree of completion:

| Materials | 100% |

| Labour & Overheads | 60% |

Closing work-in-progress (5,000 units):

Degree of completion:

| Materials | 100% |

| Labour & Overheads | 60% |

Units finished and transferred to Process Y: 50,000 units

Normal loss: 5% of total input (including opening works-in-progress). Scrapped units fetch ₹ 20 per unit.

Presuming that average method of inventory is used, prepare

(i) Statement of Equivalent production

(ii) Statement of Cost for each element

(iii) Statement of distribution of cost

(iv) Abnormal loss account [CA Inter May 2018, 8 Marks]

Answer:

(i) Statement of Equivalent Production

(ii) Statement of Cost for each element

(iii) Statement of Distribution of Cost

(iv) Abnormal Loss Account

![]()

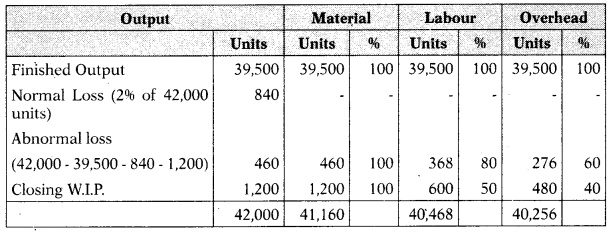

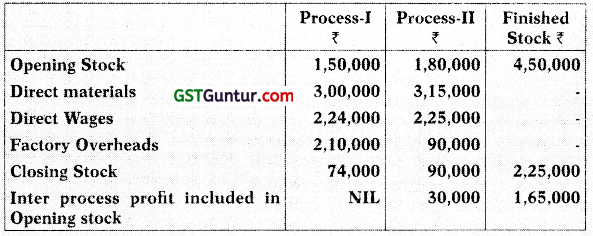

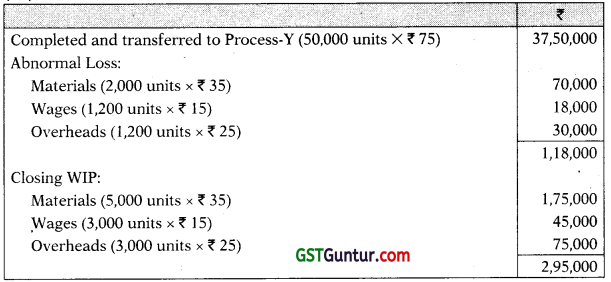

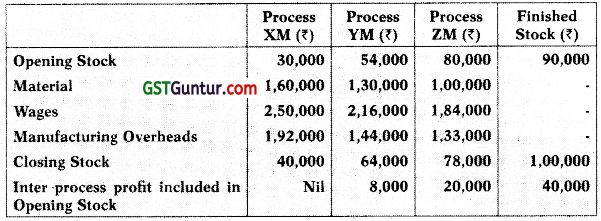

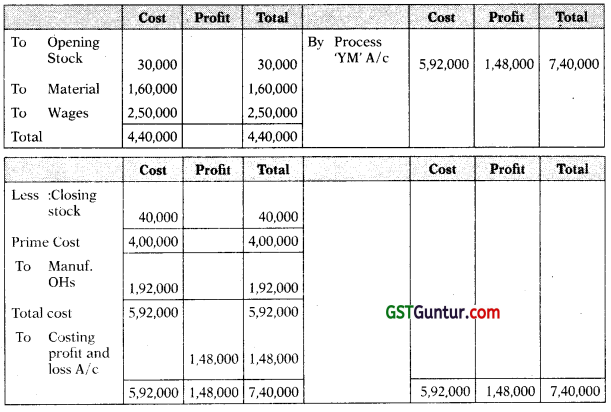

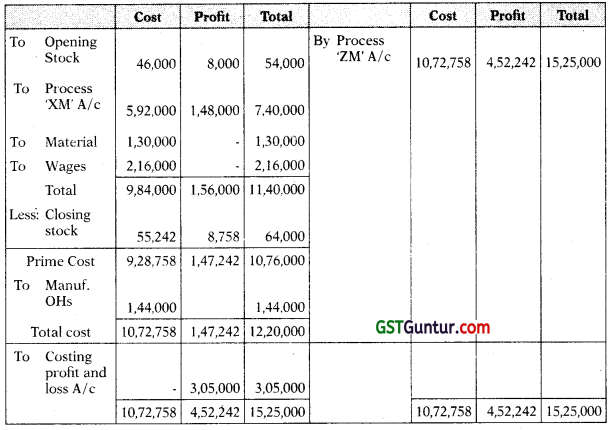

Question 25.

KMR Ltd. produces product AY, which passes through three processes ‘XM’, ‘YM’ and ‘ZM\ The output of process ‘XM’ and ‘YM’ Is transferred to next process at cost plus 20 per cent each on transfer price and the output of process ‘ZM’ is transferred to finished stock at a profit of 25 per cent on transfer price. The following information are available in respect of the year ending 31st March, 2021:

Stock in processes is valued at prime cost. The finished stock is valued at the price at which it is received from process ‘ZM*. Sales of the finished stock during the period was ₹ 28,00,000.

You are required to prepare:

(i) All process accounts and

(ii) Finished stock account showing profit element at each stage. [CA Inter May 2017, 8 Marks]

Answer:

Process ‘XM’ Account

Process ‘YM’ Account

Process ‘ZM’ Account

Miscellaneous

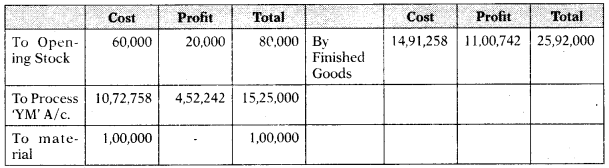

Question 26.

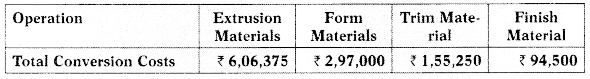

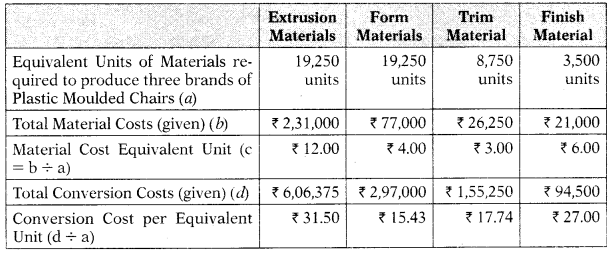

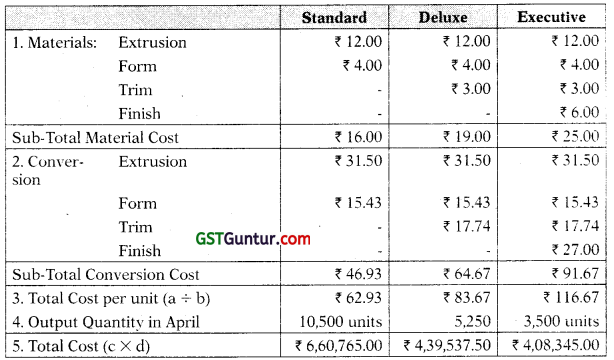

RST Ltd. manufactures Plastic moulded Chair. Three models of moulded chairs, all variation of the same design are Standard, Deluxe and Executive. The Company uses an Operation Costing system, RST Ltd. has Extrusion, Form, Trim and Finish Operations. Plastic Sheets are produced by the Extrusion Operation. During the Forming Operation, the Plastic Sheets are moulded into Chair Seats and the legs are added. The Standard Model is sold after this operation. During the Trim Operation, the arms are added to the Deluxe and Executive Models, and the chair edges are smoothed. Only the Executive Model enters the Finish Operation, in which padding is added. All of the units produced receive the same steps within each operation. In April, units of production and Direct Materials Cost incurred are as follows:

The total Conversion Costs for the month of April, are:

Required:

1. For each product produced by RST Ltd. during April, determine the Unit Cost and the Total Cost.

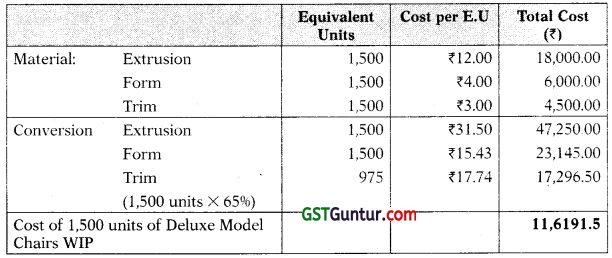

2. Now consider the following information for May. All unit costs in May

are identical to the April unit cost calculated as above in (1). At the end of May, 1,500 units of the Deluxe Model remain in Work-in-Progress. These units are 100% complete as to Materials and 65% complete in the Trim Operation. Determine the cost of the Deluxe Model Work-in Process inventory at the end of May. [CA Inter May 2003]

Answer:

1. Computation of Cost per Equivalent Unit for each Operation

2. Computation of Total and Unit Model

3. Valuation of WIP Inventory (1,500 units of Deluxe Model)

![]()

Question 27.

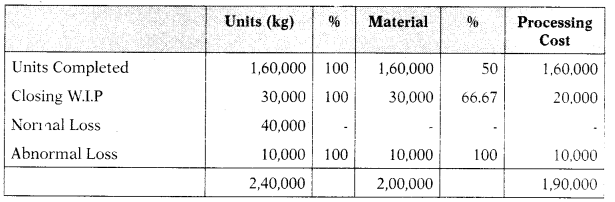

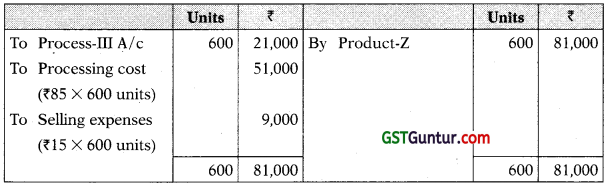

A Chemical Company carries on production operation in two processes. The material first pass through Process I, where Product ‘A’ is produced.

Following data are given for the month just ended:

| Material input quantity | 2,00,000 kgs |

| Opening work-in-progress quantity | |

| (Material 100% and conversion 50% complete) | 40,000 kgs |

| Work completed quantity- | 1,60,000 kgs |

| Closing work-in-progress quantity | |

| (Material 100% and conversion two-third complete) | 30,000 kgs |

| Material input cost | ₹ 75,000 |

| Processing cost | ₹ 1,02,000 |

| Opening work-in-progress cost | ₹ 20,000 |

| Material cost Processing cost | ₹ 12,000 |

Normal process loss in quantity may be assumed to be 20% of material input. It has no realisable value.

Any quantity of Product ‘A’ can be sold for ₹ 1.60 per kg.

Alternatively, it can be transferred to Process II for further processing and then sold as Product ‘AX’ for 12 per kg. Further materials are added in Process II, which yield two kgs. of Product ‘AX’ for every kg. of Product ‘A’ of Process I.

Of the 1,60,000 kgs. per month of work completed in Process I, 40,000 kgs are sold as Product ‘A’ and 1,20,000 kgs. are passed through Process II for sale as Product ‘AX’. Process II has facilities to handle upto 1,60,000 kgs. of Product ‘A’ per month, if required.

The monthly costs incurred in Process II (other than the cost of Product ‘A’) are:

| 1,20,000 kgs. of Product ‘A’ input | 1,60,000 kgs. of Product ‘A’ input | |

| Materials Cost | ₹ 1,32,000 | ₹ 1,76,000 |

| Processing Costs | ₹ 1,20,000 | ₹ 1,40,000 |

Required:

(i) Determine, using the weighted average cost method, the cost per kg. of Product ‘A’ in Process I and value of both work completed and closing work-in-progress for the month just ended.

(ii) Is it worthwhile processing 1,20,000 kgs. of Product ‘A’ further?

(iii) Calculate the minimum acceptable selling price per kg., if a potential buyer could be found for additional output of Product ‘AX’ that could be produced with the remaining Product ‘A’ quantity. [CA Inter Nov. 2006, 14 Marks]

Answer:

Statement of equivalent production:

(i) Calculation of cost of equivalent production

Cost per kg of product A (₹ 0.475 + ₹ 0.600) = ₹ 1.075 per unit

Value of work completed (1,60,000 × 1.075) = ₹ 1,72,000

Value of closing W.I.P (30,000 × 0.475) = 14,250

(20,000 × 0.600) = 12,000

14,250 + 12,000 = 26,250

(ii) Evaluation of further processing of 1,20,000 kg. of Product A:

| (2,40,000 kg. of product AX produced) | ₹ |

| Cost in process-I (1,20,000 × 1.60) | 1,92,000 |

| Material | 1,32,000 |

| Processing Cost | 1,20,000 |

| Cost of processing of product AX | 4,44,000 |

| Sales value (2,40,000 × 2) | 4,80,000 |

| Net gain | 36,000 |

(iii) Cost of processing of 40,000 kg. of Product A:

![]()

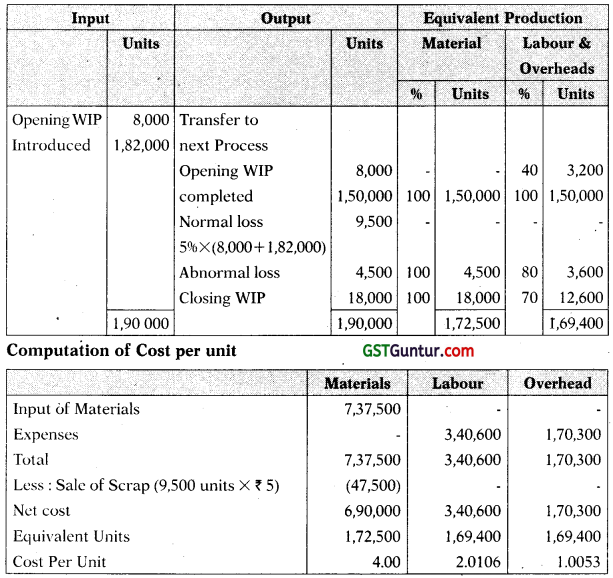

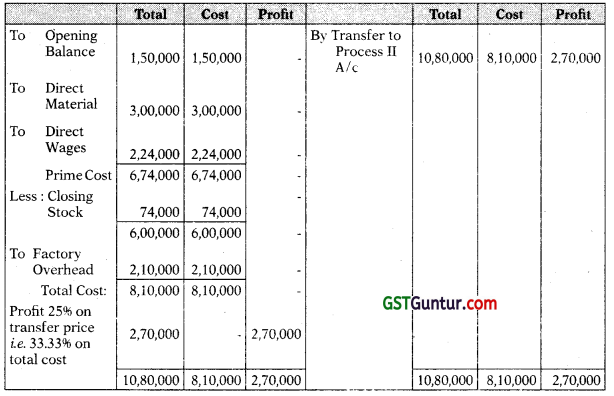

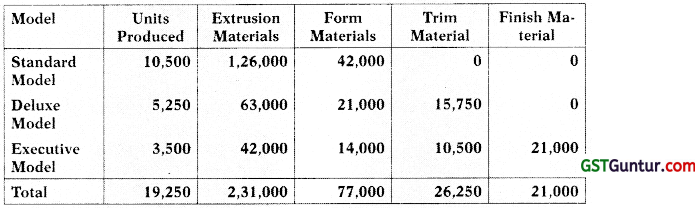

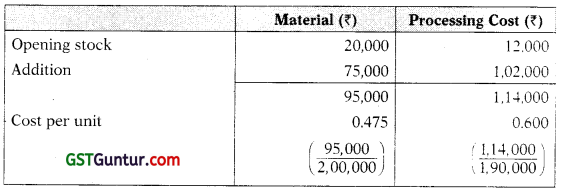

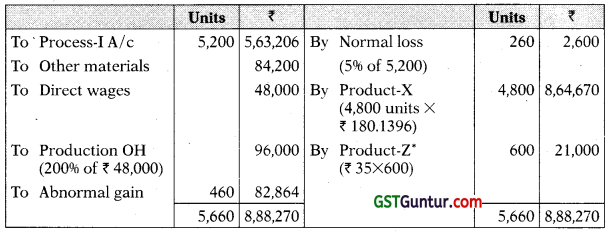

Question 28.

A Manufacturing unit manufactures a product ‘XYZ’ which passes through three distinct Processes-X, Y and Z. The following data is given:

| Process X | Process Y | Process Z | |

| Material consumed (in ₹) | 2,600 | 2,250 | 2,000 |

| Direct wages (in ₹) | 4,000 | 3500 | 3000 |

- The total Production Overhead of ₹ 15,750 was recovered @150% of direct wages.

- 15,000 units at ₹ 2 each were introduced to Process “X”.

- The output of each process passes to the next process and finally, 12,000 units were transferred to Finished Stock Account from Process “Z”.

- No stock of materials or work-in-progress was left at the end.

The following additional information is given:

| Process | % of wastage to normal input | Value of Scrapper unit(₹) |

| X | 6% | 1.10 |

| Y | ? | 2.00 |

| Z | 5% | 1.00 |

You are required to:

(i) Find out the percentage of wastage in process ‘Y’, given that the output of Process ‘Y’ is transferred to Process ‘Z’ at ₹ 4 per unit.

(ii) Prepare Process accounts for all the three processes X, Y and Z. [CA Inter July, 2021, 10 Marks]

Answer:

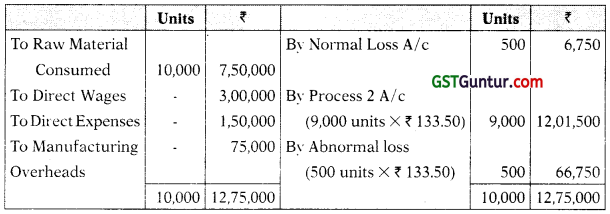

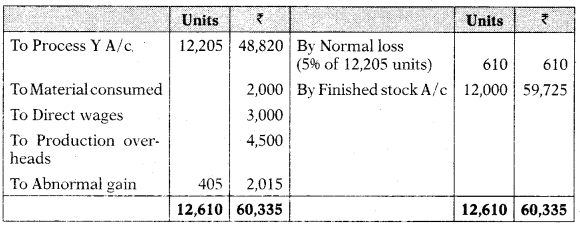

(i) Calculation of percentage of wastage in process Y

Let assume x be the unit of normal loss in process Y

Cost per unit in process Y = \(\frac{\text { Total cost }- \text { Sale of scrap }}{\text { Total units }- \text { Normal loss units }}\)

= \(\frac{₹ 52,610-2 x}{14,100-x}\)

Output of Process Y is transferred to Process Z at ₹ 4 per unit. Therefore, per unit cost in Process Y = ₹ 4.

4 = \(\frac{₹ 52,610-2 x}{14,100-x}\)

4(14,100 – x) = 52,610 – 2x

56,400 – 4x = 52,610 – 2x

3,790 = 2x

x = \(\frac{3,790}{2}\) = 1,895 units

Percentage of wastage = \(\frac{1,895 \text { units }}{14,100 \text { units }}\) units × 100 = 13.44%

(ii) Process X Account

Process Y Account

Process Z Account

Cost per unit = \(\frac{\text { Total cost }- \text { Sale of scrap }}{\text { Total units – Normal loss units }}\)

= \(\frac{₹ 58,320-₹ 610}{12,205-610}\)

= ₹ 4.977 per unit

![]()

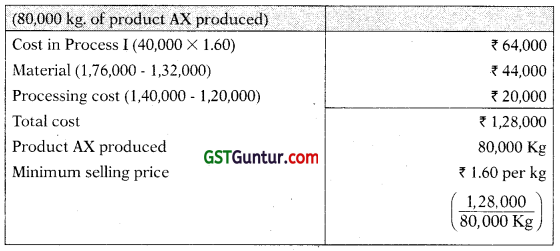

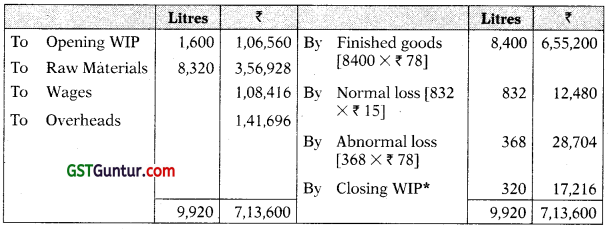

Question 29.

The following information is given in respect of Process No, 3 for the month of January, 2021,

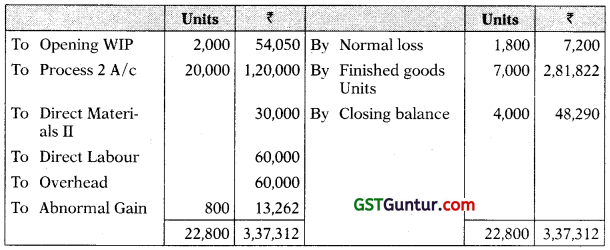

Opening stock – 2,000 units made-up of:

| Direct Materials-I | ₹ 12,350 |

| Direct Materials-II | ₹ 13,200 |

| Direct Labour | ₹ 17,500 |

| Overheads | ₹ 11,000 |

Transferred from Process No. 2: 20,000 units @6.00 per unit.

Transferred to Process No. 4:17,000 units.

Expenditure incurred in Process No. 3

| Direct Materials | ₹ 30,000 |

| Direct Labour | ₹ 60,000 |

| Overheads | ₹ 60,000 |

Scrap: 1,000 units-Direct Materials 100%, Direct Labour 60%, Overheads 40% Normal Loss 10% of production.

Scrapped units realised ₹ 4 per unit.

Closing Stock:4,000 units-Degree of completion: Direct Materials 80%, Direct Labour 60% and overheads 40%,

Prepare Process No. 3 Account using average price method, along with necessary supporting statements. [CA Inter May 2001,10 Marks]

Answer:

Process 3 Account

Working Note:

Statement of Equivalent Production

(Average cost method)

Working Note:

Normal loss given is 10% of production. Here production there fore means those units which come upto the state of inspection. In that case, opening stock plus receipts minus closing stock of WIP will represent units of production (2,000 units + 20,000 units-4,000 units). In such case, the units of production comes to 18,000 units and hence 1,800 units as normal loss units.

![]()

Question 30.

Star Ltd. manufactures chemical solutions for the food processing industry. The manufacturing takes place in a number of processes and the company uses FIFO method to value work-in-process and finished goods. At the end of the last month, a fire occurred in the factory and destroyed some of papers containing records of the process operations for the month.

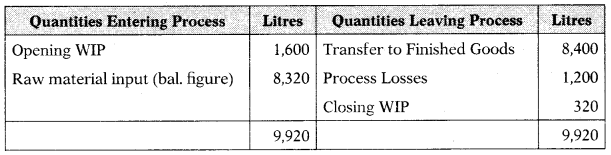

Star Ltd. needs your help to prepare the process accounts for the month during which the fire occurred. You have been able to gather some information about the month’s operating activities but some of the information could not be retrieved due to the damage. The following information was salvaged:

- Opening work-in-process at the beginning of the month was 1,600 litres, 70% complete for labour and 60% complete for overheads. Opening work-in-process was valued at ₹ 1,06,560.

- Closing work-in-process at the end of the month was 320 litres, 30% complete for labour and 20% complete for overheads.

- Normal loss is 10% of input and total losses during the month were 1,200 litres partly due to the fire damage.

- Output sent to finished goods warehouse was 8,400 litres.

- Losses have a scrap value of ₹ 15 per litre.

- All raw materials are added at the commencement of the process.

- The cost per equivalent unit (litre) is ₹ 78 for the month made up as follows:

| ₹ | |

| Raw Material | 46 |

| Labour | 14 |

| Overheads | 18 |

| 78 |

Required:

(i) CALCULATE the quantity (in litres) of raw material inputs during the month.

(ii) CALCULATE the quantity (in litres) of normal loss expected from the process and the quantity (in litres) of abnormal loss/ gain experienced in the month.

(iii) CALCULATE the values of raw material, labour and overheads added to the process during the month.

(iv) PREPARE the process account for the month. [CA Inter May 2020 RTP]

Answer:

(i) Calculation of Raw Material inputs during the month:

(ii) Calculation of Normal Loss and Abnormal Loss/Gain

| Litres | |

| Total process losses for month | 1,200 |

| Normal Loss (10% input) | 832 |

| Abnormal Loss (balancing figure) | 368 |

(iii) Calculation of values of Raw Material, Labour and Overheads added to the process

Workings:

Statement of Equivalent Units (litre)

(iv) Process Account for the month

[(320 × ₹ 46) + (320 × 0.30 × ₹ 14) + (320 × 0.20 × 18)] = 17,216

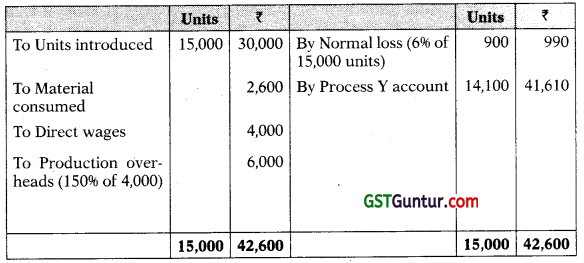

Question 31.

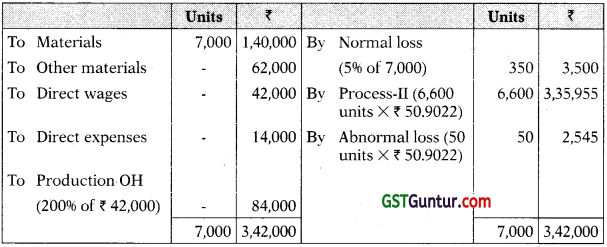

M Ltd. produces a product-X, which passes through three processes, I, II and III. In Process-Ill a by-product arises, which after further processing at a cost of 185 per unit, product Z is produced. The information related for the month of August 2020 is as follows:

Production overhead for the month is ₹ 2,88,000, which is absorbed as a percentage of direct wages.

The scraps are sold at ₹ 10 per unit.

Product-Z can be sold at ₹ 135 per unit with a selling cost of ₹ 15 per unit No. of units produced:

Process-I – 6,600; Process-II – 5,200, Process-III – 4,800 and Product-Z – 600

There is not stock at the beginning and end of the month

You are required to PREPARE accounts for:

(i) Processes-I, II and III

(ii) By-product process. [CA Inter Nov. 2020 RTP]

Answer:

Process-I Account

= \(\frac{3,42,000-3,500}{7,000-350}\) = ₹ 50.9022

Process-II Account

= \(\frac{₹ 6,49,955-6,600}{6,600-660 \text { units }}\) = ₹ 108.3089

Process-III Account

= \(\frac{(8,05,406-2,600-21,000)}{(5,200-260-600 \text { units })}\) = ₹ 180.1396

Realisable value = ₹ 135 – (85 + 15) = ₹ 35

By-Product Process Account

![]()

Question 32.

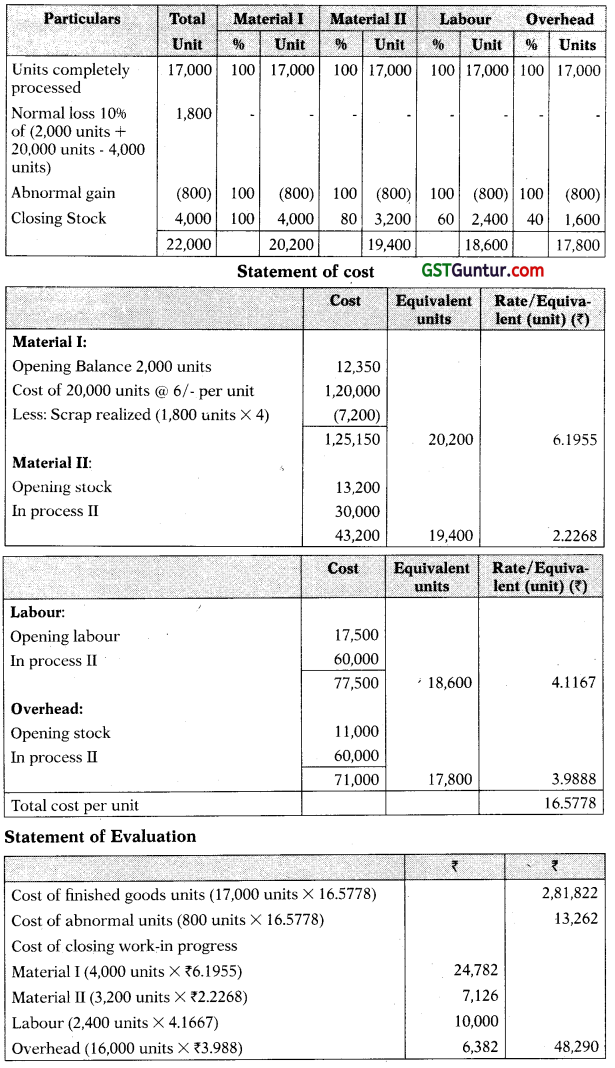

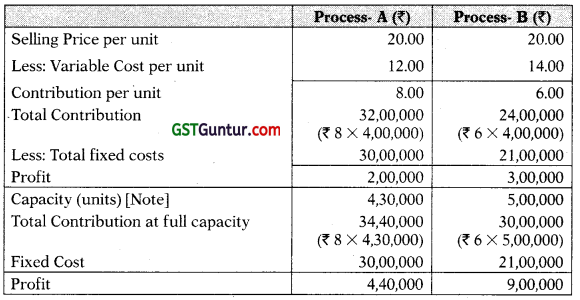

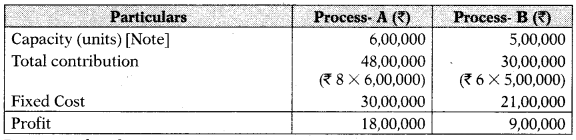

TheM-Tech Manufacturing Company is presently evaluating two possible processes for the manufacture of a toy. The following information is available:

| Process A (₹) | Process B (₹) | |

| Variable cost per unit | 12 | 14 |

| Sales price per unit | 20 | 20 |

| Total fixed costs per year | 30,00,000 | 21,00,000 |

| Capacity (in units) | 4,30,000 | 5,00,000 |

| Anticipated sales (Next year, in units) | 4,00,000 | 4,00,000 |

Suggest:

1. Which process should be chosen?

2. Would you change your answer as given above, if you were informed that the capacities of the two processes are as follows:

A – 6,00,000 units; B – 5,00,000 units? Why? [CA Inter May 2016, 4 Marks]

Answer:

(1) Comparative Profitability Statements

Process-B should be chosen as it gives more profit.

(2)

Process-A be chosen.

‘Note: It is assumed that capacity produced equals sales.