Non-Banking Financial Companies – CA Inter Advanced Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Non-Banking Financial Companies – CA Inter Advanced Accounting Study Material

Theory Questions

Question 1.

Write short note on earning value (equity share) in context of NBFC.

Answer:

Earning value means the value of an equity share computed by taking the average of profits after tax as reduced by the preference dividend and adjusted for extraordinary and non-recurring items, for the immediately preceding three years and further divided by the number of equity shares of the investee company and capitalized at the following rate:

(a) in case of predominantly manufacturing company, eight per cent;

(b) in case of predominantly trading company, ten per cent; and

(c) in case of any other company, including non-banking financial company, twelve per cent; Note: If an investee company is a loss making company the earning value will be taken at zero.

![]()

Question 2.

Explain ‘Non-Performing Assets’ as per NBFC Prudential Norms (RBI) directions.

Answer:

‘Non-performing asset’ means:

(a) an asset, in respect of which, interest has remained overdue for a period of six months or more;

(b) a term loan inclusive of unpaid interest, when the instalment is overdue for a period of six months or more or on which interest amount remained overdue for a period of six months or more;

(c) a demand or call loan, which remained overdue for a period of six months or more from the date of demand or call or on which interest amount remained overdue for a period of six months or more;

(d) a bill which remains overdue for a period of six months or more;

(e) the interest in respect of a debt or the income on receivables under the head ‘other current assets’ in the nature of short term loans/advances, which facility remained overdue for a period of six months or more;

(f) any dues on account of sale of assets or services rendered or reimbursement of expenses incurred, which remained overdue for a period of six months or more;

Note: As per Non-Banking Financial Company – Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016, the above six months criteria for the assets covered under (a) to (f) is 4 months for the financial year ending March 31, 2017; and from next year ending March 31, 2018 and thereafter it will be 3 months.

(g) the lease rental and hire purchase instalment, which has become overdue for a period of twelve months or more;

Note: The above twelve months criteria for the assets covered under (g) is 6 months for the financial year ending March 31, 2017 and from next year ending March 31, 2018 and thereafter it will be 3 months.

(h) in respect of loans, advances and other credit facilities (including bills purchased and discounted), the balance outstanding under the credit facilities (including accrued interest) made available to the same borrower/beneficiary when any of the above credit facilities becomes non-performing asset.

![]()

Net Owned Funds

Question 3.

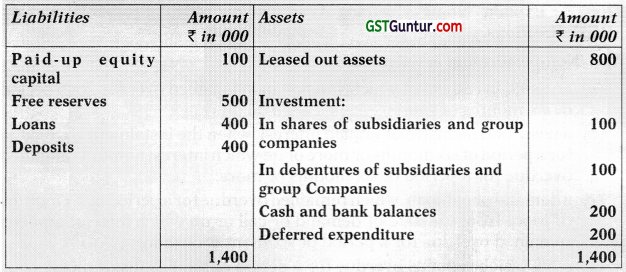

PQR Ltd. is a non-banking finance company. The extracts of its balance sheet are given below:

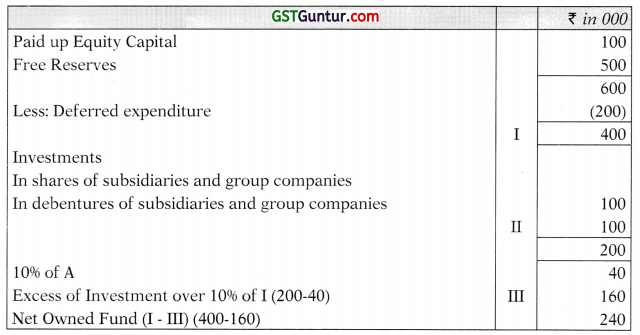

You are required to compute ‘Net owned Fund’ of Templeton Finance Ltd. as per Non-Banking Financial Company – Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016.

Answer:

Statement showing computation of ‘Net Owned Fund’

![]()

Classification of Assets

Question 4.

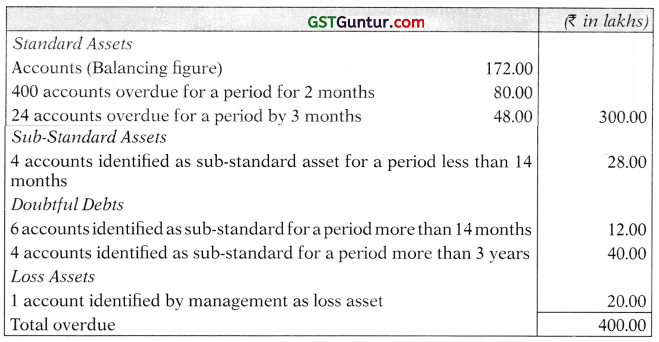

ABC Ltd. is a non-banking financial company. It provides you with the following information regarding its outstanding amount, ₹ 400 lakhs of which instalments are overdue on 400 accounts for last two months (amount overdue ₹ 80 lakhs), on 24 accounts for three months (amount overdue ₹ 48 lakhs), on 10 accounts for more than 30 months (amount overdue ₹ 40 lakhs) and on 4 accounts for more than three years (amount over due ₹ 40 lakhs-already identified as sub-standard assets) and one account of ₹ 20 lakhs which has been identified as non-recoverable by the management. Out of 10 accounts overdue for more than 30 months, 6 accounts are already identified as sub-standard (amount ₹ 12 lakhs) for more than fourteen months and other are identified as sub-standard asset for a period of less than fourteen months.

Classify the assets of the company in line with Non-Banking Financial Company -Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016.

Answer:

Statement showing classification of Assets

Provisioning

Question 5.

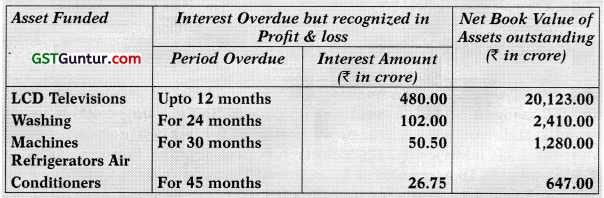

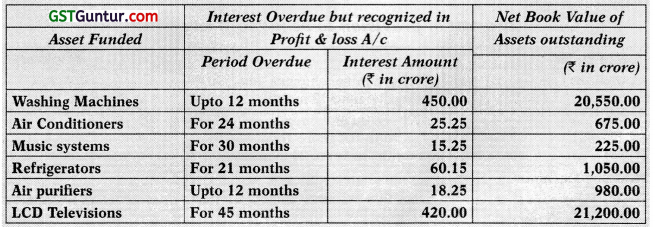

XYZ Ltd. is an NBFC providing Hire Purchase Solutions for acquiring consumer durables. The following information is extracted from its books for the year ended 31st March, 2017:

You are required to calculate the amount of provision to be made.

Answer:

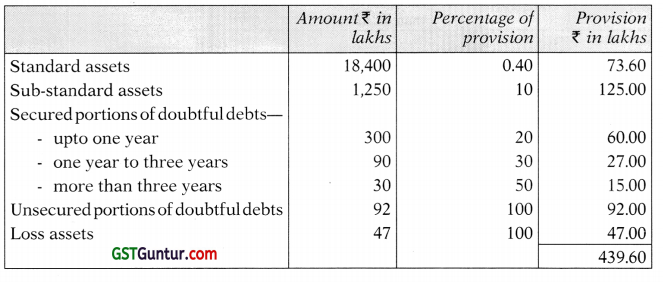

Computation showing additional provision

![]()

Question 6.

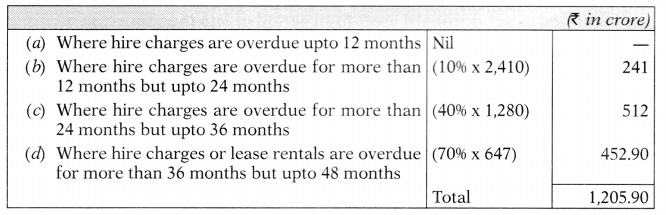

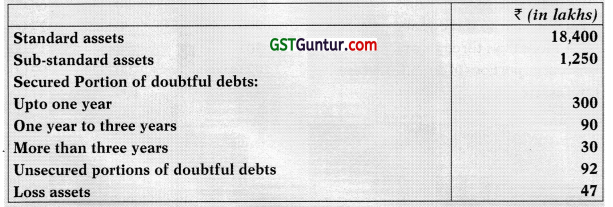

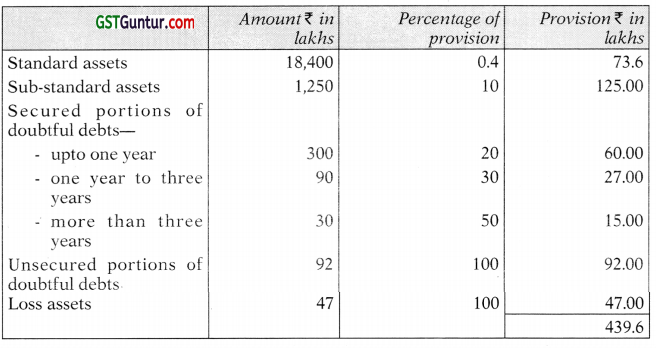

While closing its books of account on 31 st March, 2017 a Non-Banking Finance Company has its advances classified as follows:

Calculate the amount of provision, which must be made against the Advances as per the Non-Banking Financial Company – Non-Systemically Important Non-Deposit taking Company (Reserve Bank) Directions, 2016.

Answer:

Calculation of provision required on advances as on 31st March, 2017:

Question 7.

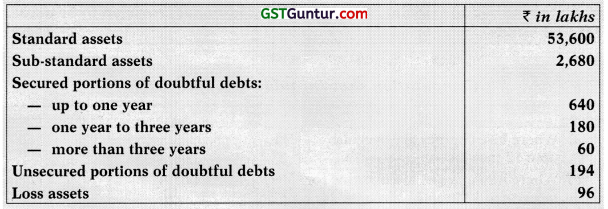

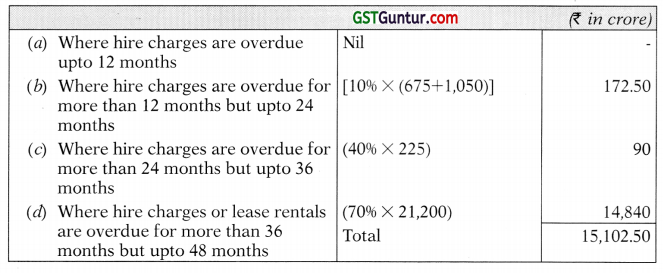

ABC Ltd. is an NBFC providing Hire Purchase Solutions for acquiring consumer durables. The following information is extracted from its books for the year ended 31st March, 2017:

You are required to calculate the amount of additional provision to be made. Mutual Funds

Answer:

Computation showing additional provision

![]()

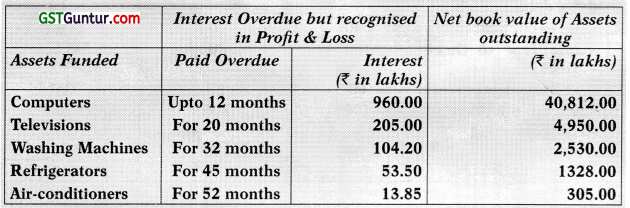

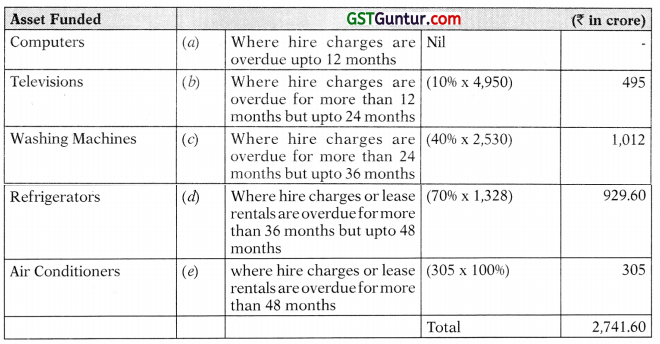

Question 8.

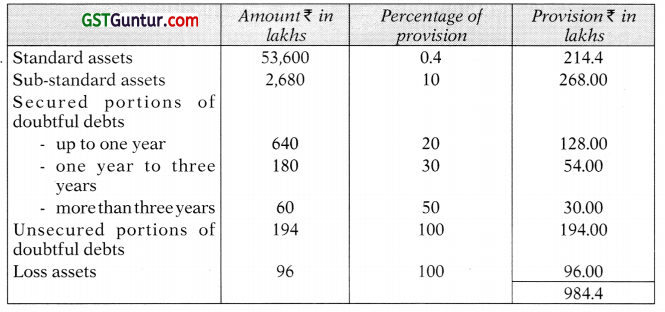

ABC Financiers Ltd. is an NBFC providing Hire Purchase Solutions for acquiring consumer durables. The following information is extracted from its books for the year ending 31st March, 2017:

You are required to calculate the amount of provision to be made. (May 2018 – New Course) (5 Marks)

Answer:

Amount of provision to be made is as under:

![]()

Question 9.

While closing its books of account on 31 st March 2018, a Non-Banking Finance Company has its advances classified as follows:

Calculate the amount of provision which must be made against the Advances as per-

- The Non-banking Financial Company – Non-systematically Important Non-Deposit taking Company (Reserve Bank) Directions, 2016; and

- Non-banking Financial Company – Systematically Important Won- Deposit taking Company (Reserve Bank) Directions, 2016. (November 2018 – New Course) (10 Marks)

Answer:

Calculation of provision required on advances as on 31st March, 2018

Computation of provision required on advances as on 31st March, 2018