ICAI CA Inter Cost and Management Accounting Study Material Notes Pdf is widely used by candidates who are pursuing a CA Intermediate course. Candidates should practice using the CA Inter Costing Study Material. You can easily clear the exam by preparing the CA Inter Costing Theory Notes Formulas and Important Questions. Prepare well for the exam with the available references.

- CA Inter Costing Study Material

- CA Inter Costing Chapter Wise Weightage

- CA Inter Costing Syllabus

- How To Prepare for CA Inter Cost Accounting Exam 2023?

- FAQs on CA Inter Costing Study Material

CA Intermediate Costing Study Material – CA Inter Cost and Management Accounting Study Material

CA Inter Costing Study Material can be an extremely helpful resource for those people who need extra support. Chapter-wise CA Intermediate Cost and Management Accounting Notes Study Material is useful to know the important concepts.

All the topics and sub-topics of the CA Intermediate Costing Syllabus are taught on a deeper level with pictorial representation here. Just ta[ on the quick links available below to get the CA Inter Costing Study Material.

CA Inter Costing Study Material – CA Inter Costing Notes Pdf

- Introduction to Cost and Management Accounting

- Material Cost

- Employee Cost

- Overheads: Absorption Costing Method

- Activity Based Costing (ABC)

- Cost Sheet

- Cost Accounting System

- Unit and Batch Costing

- Job and Contract Costing

- Process and Operation Costing

- Joint Products and By Products

- Service Costing

- Standard Costing

- Marginal Costing

- Budget and Budgetary Control

- CA Inter Costing Question Paper May 2022

- CA Inter Costing Question Paper Nov 2022

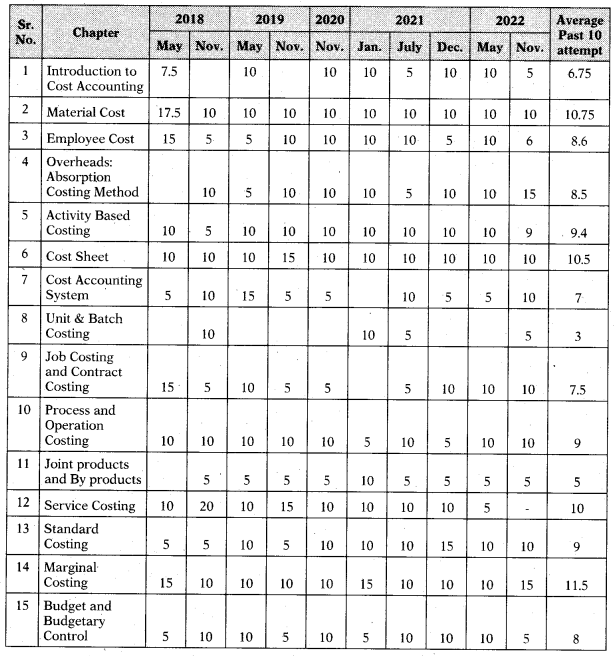

CA Inter Costing Chapter Wise Weightage

Chapter-wise CA Inter Cost Accounting Weightage contains the marks of every chapter in different previous papers. By looking at this, students can know the marking scheme of all topics. The ICAI provides 3 hours to complete the exam for 100 marks. Refer to the complete CA Inter Cost and Account Management Weightage and identify the important questions.

Weightage of Chapters in Costing CA Intermediate

CA Inter Costing Syllabus

Here we have given the CA Inter Cost Accounting Syllabus Important Questions and Answers. Interested aspirants can get the chapters, and sub-topics under every chapter here. Everyone must know the detailed CA Inter Cost Accounting Syllabus before starting their preparation. Therefore, have a look at the detailed syllabus below.

CA Inter Cost Accounting Syllabus

Paper 3: Cost and Management Accounting

(One Paper – Three hours – 100 Marks)

Objectives:

(a) To develop an understanding of the basic concepts and applications to establish the cost associated with the production of products and provision of services and apply the same to determine prices.

(b) To develop an understanding of cost accounting statements.

(c) To acquire the ability to apply information for cost ascertainment, planning, control, and decision-making.

Contents:

1. Overview of Cost and Management Accounting

(i) Introduction to Cost and Management Accounting

(a) Objectives and Scope of Cost and Management Accounting, (b) The users of Cost and Management accounting information, Functions of management accounting (c) Role of the cost accounting department in an organisation and its relation with other departments (d) Installation of Costing System (e) Relationship of Cost Accounting, Financial Accounting, Management Accounting, and Financial Management (f) Cost Terms and Concepts (g) Cost Reduction and Cost Control (h) Elements of Costs (i) Cost behavior pattern, Separating the components of fixed, variable, semi-variable, and step costs (j) Methods of Costing, Techniques of Costing (k) Cost Accounting with the use of Information Technology.

(ii) Elements of Cost and preparation of Cost Sheets

(a) Functional classification and ascertainment of cost (b) Preparation of Cost Sheets for the Manufacturing sector and for the Service sector.

2. Ascertainment of Cost and Cost Accounting System

(i) Material Cost

(a) Procurement procedures- Store procedures and documentation in respect of receipts and the issue of stock, Stock verification, (b) Valuation of material receipts,

(c) Inventory control-

- Techniques of fixing the level of stocks – minimum, maximum, reorder point, safety stock, determination of optimum stock level,

- Determination of Optimum Order quantity – Economic Order Quantity (EOQ),

- Techniques of Inventory control – ABC Analysis, Fast, Slow moving and Nonmoving (FSN), High, Medium, Low (HML), Vital, Essential, Desirable (VED), Just-in-Time (JIT) – Stock taking and

perpetual inventory system, use of control ratios,

(d) Inventory Accounting

(ii) Employee Cost

(a) Attendance and Payroll procedures- Elements of wages – Basic pay, Dearness Allowance, Overtime, Bonus, Holiday and leave wages, Allowances, and perquisites (b) Employee Cost Control (c) Employee Turnover – Methods of calculating employee turnover, causes of employee turnover, and effects of employee turnover (d) Utilisation of Human Resources, Direct, and indirect employee Costs, charging of employee cost, Identifying employee hours with work orders or batches or capital jobs (e) Remuneration systems and incentive schemes – Premium Bonus Method (Halsey Plan and Rowan Plan)

(iii) Overheads

(a) Functional analysis – Factory, Administration, Selling, Distribution, Research, and Development (b) Behavioral analysis – Fixed, Variable, and Semi- Variable (c) Allocation and Apportionment of overheads using the Absorption Costing Method (d) Factory Overheads – Primary and secondary distribution, (e) Administration Overheads – Method of allocation to cost centers or products, (f) Selling & Distribution Overheads – Analysis and absorption of the expenses in products/ customers, the impact of marketing strategies, and the cost-effectiveness of various methods of sales promotion (g) Treatment of Research and development cost in cost accounting.

(iv) Concepts of Activity-Based Costing (ABC)

(v) Recording and Accounting of Costs

(a) Non-integrated Cost Accounting system – Ledger under a nonintegral system (b) Integrated (Cost and Financial) Accounting system – Ledgers under the integral system (c) Difference between the Non-integrated and Integrated Accounting systems (d) Reconciliation of profit as per Cost and Financial Accounts (under a Non-Integrated Accounting System).

3. Methods of Costing

(i) Single Output/ Unit Costing

(ii) Job Costing: Job cost cards and databases, collecting direct costs of each job, attributing overheads to jobs, and Application of job costing.

(iii) Batch Costing: Determination of optimum batch quantity, Ascertainment of cost for a batch, Preparation of batch cost sheet, Treatment of spoiled and defective work.

(iv) Contract Costing

(a) Ascertainment of cost of a contract, Progress payment, Retention money, Escalation clause, Cost plus contract, Value of work certified, Cost of Work not certified. (b) Determination Value of work certified, Cost of work not certified, Notional or Estimated profit from a contact.

(v) Process/Operation Costing

(a) Process cost recording, Process loss, Abnormal gains and losses, Equivalent units of production, Inter-process profit, and Valuation of work in process (b) Joint Products – Apportionment of joint costs, Methods of apportioning joint cost over joint products, (c) By-Products – Methods of apportioning joint costs over byproducts, treatment of By-product cost.

(vi) Costing of Service Sectors

(a) Determination of Costs and Prices of services.

4. Cost Control and Analysis

(i) Standard Costing

(a) Setting up of Standards, Types of Standards, and Standard Costing as a method of performance measurement. (b) Calculation and Reconciliation of Cost Variances- Material Cost Variance, employee Cost Variance, Variable Overheads Variance, and Fixed Overhead Variance.

(ii) Marginal Costing

(a) Basic concepts of marginal costing, Contribution margin, Breakeven analysis, Break-even and profit volume charts, Contribution to sales ratio, Margin of Safety, Angle of Incidence, Cost-Volume-Profit Analysis (CVP), Multi-product break-even analysis, Consideration of Limiting factor (key factor), (b) Determination of Cost of a product/service under marginal costing method, determination of cost of finished goods, work-in-progress, (c) Comparison of Marginal costing with absorption costing method – Reconciliation of profit under both methods, (d) Short-term decision-making using the above concepts (basic/fundamental level).

(iii) Budget and Budgetary Control

(a) Meaning of Budget, Essentials of Budget, Budget Manual, Budget setting process, Preparation of Budget and monitoring procedures. (b) The use of budget in planning and control (c) Flexible budget, Preparation of Functional budget for operating and non-operating functions, Cash budget, Master budget, (d) Introduction to Principal/Key budget factor, Zero Based Budgeting (ZBB), Performance budget, Control ratios, and Budget variances.

CA Inter Study Material also plays a major role in the test preparation. It contains the quick links of all papers in one place. Refer this and prepare for the examination.

How To Prepare for CA Inter Cost Accounting Exam 2023?

Many individuals can have big questions about how to prepare for the CA Inter Exam. A proper preparation plan is not enough, individuals have to work hard as per the plan. The aspirants should make their plans according to their comfort and timings. To help you with this, we have given some key points.

- Prepare a best preparation plan before going to begin the subject preparation.

- Have a clear idea of the ICAI CA Inter Cost and Management Accounting Chapter Wise Weightage.

- Know the complete CA Intermediate Costing Syllabus.

- List out the topics that are challenging for you.

- Try to allot more time for preparing those important and difficult concepts.

- Refer to CA Inter Cost Accounting Notes Important Questions and Answers.

- Practice the previous question papers.

- Avoid last-minute pressure and revise the topics.

Do Refer

FAQs on CA Inter Costing Study Material

1. Does ICAI provide study material free of cost?

Yes, ICAI provides study material free of cost for CA Foundation Course, CA Intermediate Course, and CA Final Courses.

2. Is study material enough for CA Inter costing?

Along with the Ca Inter Costing Study Material, we need previous papers, and notes to prepare for the exams.

3. Which book is best for costing CA Inter?

Padhukas Students Handbook On Cost and Management Accounting is the best book for CA Intermediate Cost and Account Management paper.

4. Which study material is best for CA Inter?

Here we have given the best study material for the CA Inter Cost and Account Management subject free of cost.

Final Verdict

We wish the knowledge shared above in accordance with the CA Intermediate Cost Accounting Study Material has been helpful to you. Along with the study material, you can check the revised syllabus, notes, and previous papers. If you want to add any other info to the study material, reach us via the comment section. Keep in touch with our site GSTGuntur.co, to avail the latest updates on CA Intermediate Course.