AS 13: Accounting for Investments – CA Inter Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

AS 13: Accounting for Investments – CA Inter Accounts Study Material

Scope (Based On Para Nos. 1 And 2)

Question 1.

Z Bank has classified its total investment on 31 -3-2016 into three categories

(a) held to maturity (b) available for sale (c) held for trading as per the RBI Guidelines.

‘Held to maturity’ investments are carried at acquisition cost less amortised amount. ‘Available for sale’ investments are carried at marked to market. ‘Held for trading’ investments are valued at weekly intervals at market rates. Net depreciation, if any, is charged to revenue and net appreciation, if any, is ignored. Comment whether the policy of the bank is in accordance with AS 13? (RTP)

Answer:

AS 13 ‘Accounting for Investments’ is not applicable to Bank, Insurance Company, Mutual Funds.

In this case Z Bank is a bank, therefore, AS 13 does not apply to it.

Note:

For banks, the RBI has issued guidelines for classification and valuation of its investment and Z Bank should comply with those RBI Guidelines/Norms.

![]()

Cost Of Investment (Based On Para Nos. 9 To 11)

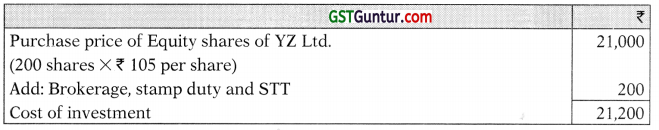

Question 2.

MY Ltd. had acquired 200 equity shares of YZ Ltd. at ₹ 105 per share on 01.01.2009 and paid ₹ 200 towards brokerage, stamp duty and STT. On 31st March, 2009, shares of YZ Ltd. were traded at ₹ 110 per share. At what value investment is to be shown in the Balance Sheet of MY Ltd. as at 31st March, 2009. (2 Marks) (Nov 2009)

Answer:

Case (i)

If the investment is a long-term investment than it will be shown at cost.

Thus, it will be shown at ₹ 21,200.

Case (ii)

If the investment is a current investment:

It will be shown at lower of cost (i.e. ₹ 21,200) or net realizable value (i.e. ₹ 200 × 110 = ₹ 22,000).

Thus, it will be valued at ₹ 21,200.

![]()

Interest And Dividend (Based On Para No. 12)

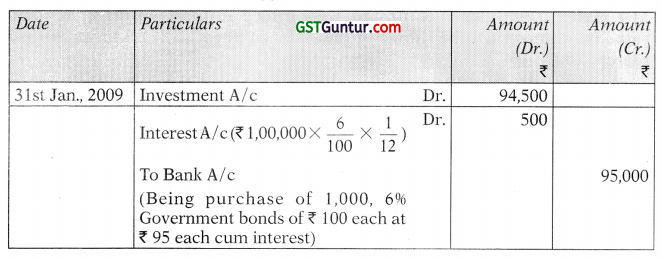

Question 3.

(i) Mr. X purchased 1,000, 6% Government Bonds of ₹ 100 each on 31st January, 2009 at ₹ 95 each. Interest is payable on 30th June and 31st December. The price quoted is cum interest. Journalise the transaction.

(ii) An unquoted long-term investment is carried in the books at cost of ₹ 2 lacs. The published accounts of unlisted company received in May, 2009 showed that the company has incurred cash losses with decline market share and the long-term investment may not fetch more than ₹ 20,000. How you will deal with it in the financial statement of investing company for the year ended 31.3.2009? (2 × 2 = 4 Marks) (May 2010)

Answer:

(i) Journal Entry

(ii) As per para 32 of AS 13 Accounting for Investments’, investment classified as long term investments should be carried in the financial statements at cost. However, provision for diminution shall be made to recognize a decline, other than temporary, in the value of the investments, such reduction being determined and made for each investment individually.

As per para 17 of the standard, indicators of the value of an investment are obtained by reference to its market value, the investee’s assets and results and the expected cash flows from the investment.

There is a clear-cut evidence of decline in the market share of the company and the investment will not fetch more than ₹ 20,000.

Thus, provision of ₹ 1,80,000 should be made to reduce the carrying amount of long-term investment to ₹ 20,000 in the financial statements for the year ended 31st March, 2009.

![]()

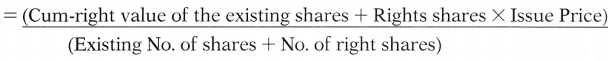

Right Issue (Based On Para No. 13)

Question 4.

A company offers new shares of ₹ 100 each at 25% premium to existing shareholders on the basis one for five shares. The cum-right market price of a share is ₹ 200.

You are required to calculate the (i) Ex-right value of a share; (ii) Value of a right share?

Answer:

Ex-right value of the shares

= (₹ 200 × 5 Shares + ₹ 125 × 1 Share)/(5 + 1) Shares

= ₹ 1,125/6 shares = ₹ 187.50 per share.

Value of right = Cum-right value of the share – Ex-right value of the share

= ₹ 200 – ₹ 187.50 = ₹ 12.50 per share.

Long Term Investments (Based On Para Nos. 17 To 19)

Question 5.

Rose Ltd. had made an investment of ₹ 500 lakhs in the equity shares of Nose Ltd. on 10.01.2009. The realisable value of such investment on 31.03.2009 became ₹ 200 lakhs as Nose Ltd. lost a case of patent rights. Rose Ltd. follows financial year as accounting year. How will you recognize this reduction in Financial statements for the year 2008-09? (4 Marks) (Nov 2009)

Answer:

As per provisions of AS 13, if the investments were acquired for long term and decline is temporary in nature, reduction in value will not be recognized and investments would be carried at cost.

If the decline is of permanent nature, it will be charged to profit and loss account. If the investments are current investments, then the reduction should be recognized and charged to Profit and Loss Account as the current investments are carried at cost or fair value, whichever is less.

![]()

Question 6.

M/s Innovative Garments Manufacturing Company Limited invested in the shares of another company on 1st October, 2011 at a cost of ₹ 2,50,000. It also earlier purchased Gold of ₹ 4,00,000 and Silver of ₹ 2,00,000 on 1st March, 2009. Market value as on 31st March, 2012 of above investments are as follows:

Shares – ₹ 2,25,000

Gold – ₹ 6,00,000

Silver – ₹ 3,50,000

How above investments will be shown in the books of account of M/s Innovative Garments Manufacturing Company Limited for the year ending 31 st March, 2012 as per the provisions of Accounting Standard 13 ‘Accounting for Investments’? (5 Marks) (May 2012)

Answer:

As per AS 13 ‘Accounting for Investments’:

Case (a)

For investment in shares – if the investment is purchased with an intention to hold for short-term period

It will be shown at the realizable value of ₹ 2,25,000 as on 31st March, 2012.

Case (b)

If equity shares are acquired with an intention to hold for long term period

It will continue to be shown at cost in the Balance Sheet of the company. However, provision for diminution shall be made to recognize a decline, if other than temporary, in the value of the investments.

Gold and silver are generally purchased with an intention to hold it for long term period until and unless given otherwise. Hence, the investment in Gold and Silver (purchased on 1st March, 2009) shall continue to be shown at cost as on 31st March, 2012 i.e., ₹ 4,00,000 and ₹ 2,00,000 respectively, though their realizable values have been increased.

![]()

Question 7.

M/s Active Builders Ltd. invested in the shares of another company on 31st October, 2015 at a cost of ₹ 4,50,000. It also earlier purchased Gold of ₹ 5,00,000 and Silver of ₹ 2,25,000 on 31st March, 2013.

Market values as on 31 st March, 2016 of the above investments are as follows: Shares ₹ 3,75,000; Gold ₹ 7,50,000 and Silver ₹ 4,35,000

How will the above investments be shown in the books of account of M/s Active Builders Ltd. for the year ending 31st March, 2016 as per the provision of AS-13? (5 Marks) (May 2016)

Answer:

As per AS 13 Accounting for Investments’, if the shares are purchased with an intention to hold for short-term period then investment will be shown at the realizable value.

If equity shares are acquired with an intention to hold for long term period then it will continue to be shown at cost in the Balance Sheet of the company. However, provision for diminution shall be made to recognize a decline, if other than temporary, in the value of the investments.

In the above case, shares purchased on 31st October, 2015, will be valued at ₹ 3,75,000 as on 31st March, 2016.

Gold and silver are generally purchased with an intention to hold it for long term period until and unless given otherwise. Hence, the investment in gold and silver (purchased on 31st March, 2013) shall continue to be shown at cost as on 31st March, 2016 i.e., 5,00,000 and 2,25,000 respectively, though their realizable values have been increased.

Therefore, the shares, gold and silver will be shown at 3,75,000, 5,00,000 and 2,25,000 respectively and hence, total investment will be valued at ₹ 11,00,000 in the books of account of M/s Active Builders for the year ending 31st March, 2016 as per provisions of AS 13.

![]()

Disposal Of Investment (Based On Para Nos. 21 And 22) & Reclassification Of Investment (Based On Para Nos. 23 And 24)

Question 8.

P Ltd. has current investment (X Ltd.’s shares) purchased for ₹ 5 lakhs, which the company want to reclassify as long-term investment on 31.3.2018. The market value of these investments as on date of Balance Sheet was ₹ 2.5 lakhs. How will you deal with this as on 31.3.18 with reference to AS-13? (RTP)

Answer:

As per AS 13 Accounting for Investments’, where investments are reclassified from current to long-term, transfers are made at the lower of cost or fair value at the date of transfer

Analysis:

The market value of the investment (X Ltd. shares) is ₹ 2.50 lakhs, which is lower than its cost i.e. ₹ 5 lakhs.

Conclusion:

Thus, the transfer to long term investments should be made at cost of ₹ 2.50 lakhs. The loss of ₹ 2.50 lakhs should be charged to profit and loss account.

Question 9.

Blue-chip Equity Investments Ltd., wants to re-classify its investments in accordance with AS 13.

(i) Long term investments in Company A, costing ₹ 8.5 lakhs are to be re-classified as current. The company had reduced the value of these investments to 6.5 lakhs to recognize a permanent decline in value. The fair value on date of transfer is ₹ 6.8 lakhs.

(ii) Long term investments in Company B, costing ₹ 7 lakhs are to be re-classified as current. The fair value on date of transfer is ₹ 8 lakhs and book value is ₹ 7 lakhs.

(iii) Current investment in Company C, costing ₹ 10 lakhs are to be re-classified as long term as the company wants to retain them. The market value on date of transfer is ₹ 12 lakhs.

(iv) Current investment in Company D, costing ₹ 15 lakhs are to be re-classified as long term. The market value on date of transfer is ₹ 14 Lakhs. (5 Marks) (Nov 2014)

Answer:

As per AS 13 Accounting for Investments’, where long-term investments are reclassified as current investments, transfers are made at the lower of cost and carrying amount at the date of transfer. And where investments are reclassified from current to long term, transfers are made at lower of cost and fair value on the date of transfer.

Accordingly, the re-classification will be done on the following basis:

- Carrying amount of investment on the date of transfer is less than the cost; hence this re-classified current investment should be carried at ₹ 6.5 lakhs in the books.

- Carrying/book value of the long-term investment is same as cost i.e. ₹ 7 lakhs. Hence this long-term investment will be reclassified as current investment at book value of ₹ 7 lakhs only.

- Reclassification of current investment into long-term investments will be made at ₹ 10 lakhs as cost is less than its market value of ₹ 12 lakhs.

- Market value is ₹ 14 lakhs which is lower than the cost of ₹ 15 lakhs. The reclassification of current investment as long-term investments will be made at ₹ 14 lakhs.

![]()

Question 10.

How you will deal with following in the financial statement of the Paridhi Electronics Ltd. as on 31.3.16 with reference to AS-13?

(i) Paridhi Electronics Ltd. invested in the shares of another unlisted company on 1st May 2012 at a cost of ₹ 3,00,000 with the intention of holding more than a year. The published accounts of unlisted company received in January, 2016 reveals that the company has incurred cash losses with decline market share and investment of Paridhi Electronics Ltd. may not fetch more than ₹ 45,000.

(ii) Also, Paridhi Electronics Ltd. has current investment (X Ltd.’s shares) purchased for ₹ 5 lakhs, which the company want to reclassify as long-term investment. The market value of these investments as on date of Balance Sheet was ₹ 2.5 lakhs. (5 Marks) (Nov 2016)

Answer:

(i) As per AS 13, Accounting for investments’ Investments classified as long i term investments should be carried in the financial statements at cost. However, provision for diminution shall be made to recognise a decline, other than temporary, in the value of the investments, such reduction being determined and made for each investment individually. The standard also states that indicators of the value of an investment are obtained by reference to its market, value, the investee’s assets and results and the expected cash flows from the investment.

Based on the facts of the case a provision for diminution should be made to reduce the carrying amount of shares to ₹45,000 in the financial statements for the year ended 31st March, 2016 and charge the difference of loss of ₹ 2,55,000 to Profit and Loss account.

(ii) As per AS 13 Accounting for Investments’, where investments are re-classified from current to long-term, transfers are made at the lower of cost or fair value at the date of transfer.

Market value of the investment (X Ltd. shares) is ₹ 2.50 lakhs, which is lower than its cost i.e. ₹ 5 lakhs. Therefore, the transfer to long term investments should be made at cost i.e. ₹ 2.50 lakhs. The loss of ₹ 2.50 lakhs should be charged to profit and loss account.

![]()

Question 11.

Sun Ltd. wants to re-classify its investments in accordance with AS-13. State the values at which the investments have to be re-classified as per AS-13 in the following cases:

(1) Current investments in Company Fine Ltd. costing ₹ 39,000 are to be re-classified as long term investments. The fair value on the date of transfer is ₹ 37,000.

(2) Long term investment in Company Bold Ltd., costing ₹ 16 lakhs are to be reclassified as current investments. The fair value on the date of transfer is ₹ 15 lakhs and book value are ₹ 16 lakhs. (4 Marks) (May 2018)

Answer:

Re-classification will be done on the following basis:

(i) As per AS 13, where investments are reclassified from current to long term, transfers are made at lower of cost and fair value on the date of transfer.

In this case, fair value is ₹ 37,000 which is lower than the cost of ₹ 39,000.

The reclassification of current investment as long-term investments will be made at ₹ 37,000.

(ii) As per AS 13 ‘Accounting for Investments ’ where long-term investments are reclassified as current investments, transfers are made at the lower of cost and carrying amount at the date of transfer.

The carrying/book value of the long-term investment is same as cost i.e. ₹ 16 lakhs. Hence this long-term investment will be reclassified as current investment at book value of ₹ 16 lakhs only.

![]()

Disclosures (Based On Para No. 25)

Question 12.

Briefly explain disclosure requirements for Investments as per AS-13.

Answer:

The disclosure requirements as per para 35 of AS 13 are as follows:

- Accounting policies followed for valuation of investments.

- Classification of investment into current and long term in addition to classification as per Schedule VI of Companies Act in case of company.

- The amount included in profit and loss statements for

(a) Interest, dividends and rentals for long term and current investments, disclosing therein gross income and tax deducted at source thereon;

(b) Profits and losses on disposal of current investment and changes in carrying amount of such investments;

(c) Profits and losses and disposal of long-term investments and changes in carrying amount of investments. - Aggregate amount of quoted and unquoted investments, giving the aggregate market value of quoted investments;

- Any significant restrictions on investments like minimum holding period for sale/disposal, utilisation of sale proceeds or non-remittance of sale proceeds of investment held outside India.

- Other disclosures required by the relevant statute governing the enterprises.

![]()

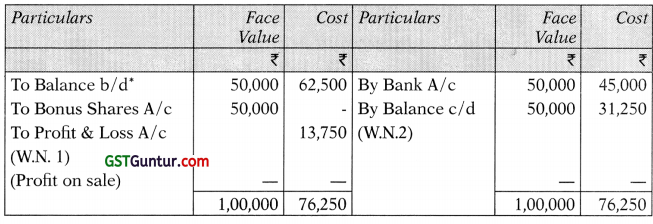

Ledger Accounts (Variable Return Securities)

Question 13.

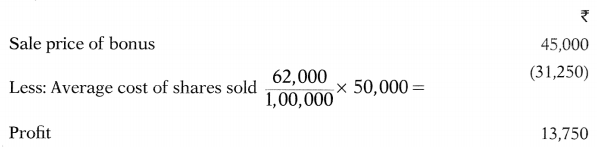

H purchased 500 equity shares of ₹ 100 each in the ABC Company Limited for ₹ 62,500 inclusive of brokerage and stamp duty. Some years later the company decided to capitalise its profit and to issue to the holders of equity shares one equity share as Bonus for every equity share held by them. Prior to capitalization, the shares of ABC Company Limited were quoted at ₹ 175 per share. After the capitalization, the shares were quoted at ₹ 92.50 per share. H sold the Bonus shares and received ₹ 90 per share. Show Investment A/c in H’s books on average cost basis as per AS 13. (5 Marks) (Nov. 2010)

Answer:

Investment A/c

(Equity Shares of ABC Co. Ltd.)

Working Notes:

1. Computation of profit on sale of bonus shares:

2. Closing Balance of investment:

Value of investment will be least of market value or average cost price, i.e. ₹ 31,250.

![]()

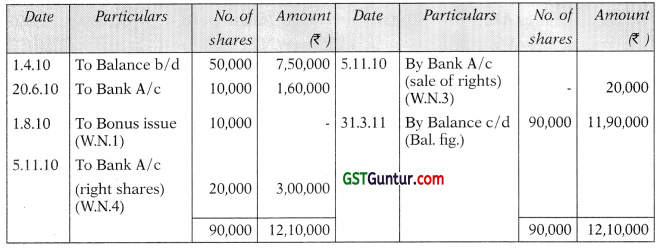

Question 14.

On 1st April, 2010, Rajat has 50,000 equity shares of P Ltd. at a book value of ₹ 15 per share (face value ₹ 10 each). He provides you the further information:

(1) On 20th June, 2010, he purchased another 10,000 shares of P Ltd. at ₹ 16 per share.

(2) On 1st August, 2010, P Ltd. issued one equity bonus share for every six shares held by the shareholders.

(3) On 31st October, 2010, the directors of P Ltd. announced a right issue which entitle the holders to subscribe three shares for every seven shares at ₹ 15 per share. Shareholders can transfer their rights in full or in part.

Rajat sold 1/3rd of entitlement to Umang for a consideration of ₹ 2 per share and subscribe the rest on 5th November, 2010.

You are required to prepare Investment A/c in the books of Rajat for the year ending 31st March, 2011. (5 Marks) (May 2011)

Answer:

Investment Account

(Equity shares in (P) Ltd.)

Working Notes:

- Bonus shares = \(\frac{50,000+10,000}{6}\) = 10,000 shares

- Right shares = \(\frac{50,000+10,000+10,000}{7}\) × 3 = 30,000 shares

- Sale of rights = 30,000 shares × \(\frac{1}{3}\) × ₹ 2 = ₹ 20,000

- Rights subscribed = 30,000 shares × \(\frac{2}{3}\) × ₹ 15 = ₹ 3,00,000

![]()

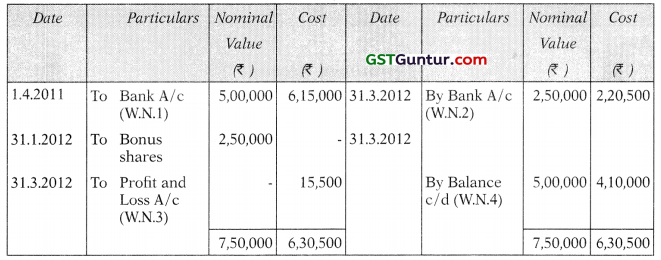

Question 15.

On 01 -04-2011, Mr. T. Shekharan purchased 5,000 equity shares of ₹ 100 each in V Ltd. @ ₹ 120 each from a broker, who charged 2% brokerage. He incurred 50 paisa per ₹ 100 as cost of shares transfer stamps. On 31-01-2012 bonus was declared in the ratio of 1 : 2. Before and after the record date of bonus shares, the shares were quoted at ₹ 175 per share and ₹ 90 per share respectively. On 31-03-2012, Mr. T. Shekharan sold bonus shares to a broker, who charged 2% brokerage.

Show the Investment Account in the books of T. Shekharan, who held the shares as Current Assets and closing value of investments shall be made at cost or market value whichever is lower. (8 Marks) (Nov. 2012)

Answer:

Investment Account for the year ended 31st March, 2012 (Equity Shares of V Ltd.)

Working Notes:

1. Cost of equity shares purchased on 1st April, 2011

= Cost + Brokerage + Cost of transfer stamps

= 5,000 × ₹ 120 + 2% of ₹ 6,00,000 + 112% of ₹ 6,00,000

= ₹ 6,15,000

2. Sale proceeds of equity shares sold on 31st March, 2012

= Sale price – Brokerage

= 2,500 × ₹ 90 – 2% of ₹ 2,25,000

= ₹ 2,20,500,

3. Profit on sale of bonus shares on 31st March, 2012

= Sales proceeds – Average cost

Sales proceeds = ₹ 2,20,500

Average cost = ₹ [6,15,000 × 2,50,000/7,50,000]

= ₹ 2,05,000

Profit = ₹ 2,20,500 – ₹ 2,05,000 = ₹ 15,500.

4. Valuation of equity shares on 31st March, 2012

Cost = ₹ [6,15,000 × 5,00,000/7,50,000] = ₹ 4,10,000 i.e. ₹ 82 per share

Market Value = 5,000 shares × ₹ 90 = ₹ 4,50,000

Note:

Closing stock of equity shares has been valued at ₹ 4,10,000 i.e. cost being lower than the market value.

![]()

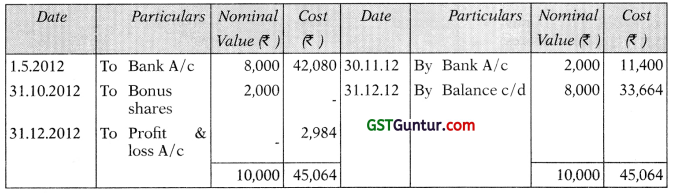

Question 16.

On 01-05-2012, Mr. Mishra purchased 800 equity shares of 10 each in Fillco Ltd. @ ₹ 50 each from a broker who charged 5%. He incurred 20 paisa per 100 as cost of shares transfer stamps. On 31-10-2012, bonus was declared in the ratio 1 : 4. The shares were quoted at ₹ 110 and ₹ 60 per share before and after the record date of bonus shares respectively. On 30-11-2012, Mr. Mishra sold the bonus shares to a broker who charged 5%. You are required to prepare Investment Account in the books of Mr. Mishra for the year ending 31-12-2012 and closing value of Investment shall be made at cost or market value whichever is lower. (4 Marks) (Nov. 2013)

Answer:

Investment Account for the year ended 31st December 2012 (Equity Shares of Fillco Ltd.)

Working Notes:

(i) Cost of equity shares purchased on 1.5.2012

= 800 × ₹ 50 + 596 of ₹ 40,000 + .002 of ₹ 40,000 = ₹ 42,080.

(ii) Sale proceeds of equity shares sold on 30.11.2012

= 200 × ₹ 60 – 596 of ₹ 12,000 = ₹ 11,400

(iii) Profit on sale of bonus shares on 30.11.12

= Sales proceeds – Average cost Sales proceeds

= ₹ 11,400

Average cost = ₹ \(\frac{42,080}{10,000}\) × 2,000

= ₹ 8,416

Profit = ₹ 11,400 – ₹ 8,416 = ₹ 2,984

(iv) Valuation of equity shares on 31st December, 2012 Cost

= (₹ 42,080/10,000 × 8,000) = ₹ 3.3,664

Market Value = 800 × ₹ 60 = 48,000

Note:

Closing balance has been valued at ₹ 33,664 being lower than the market value.

![]()

Ledger Accounts (Fixed Return Securities)

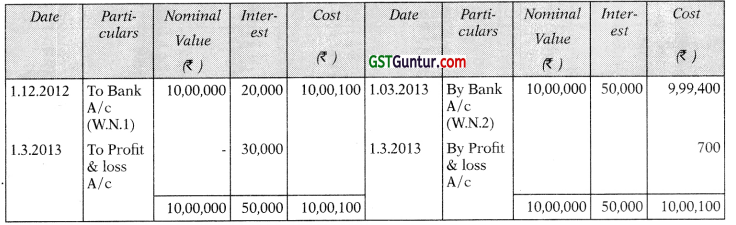

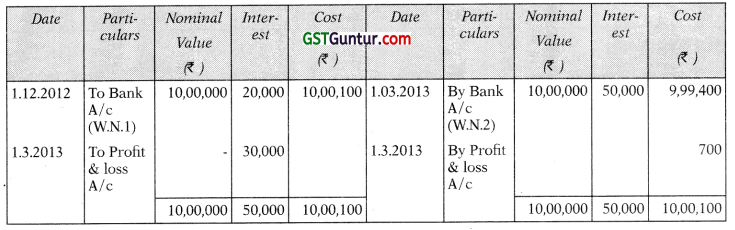

Question 17.

In 2011, M/s. Wye Ltd. issued 12% fully paid debentures of? 100 each, interest being payable half yearly on 30th September and 31st March of every accounting year.

On 1 st December, 2012, M/s. Bull & Bear purchased 10,000 of these debentures at ₹ 101 cum-interest price, also paying brokerage @ 1 % of cum-interest amount of the purchase. On 1st March, 2013 the firm sold all of these debentures at ₹ 106 cum-interest price, again paying brokerage @ 1% of cum-interest amount.

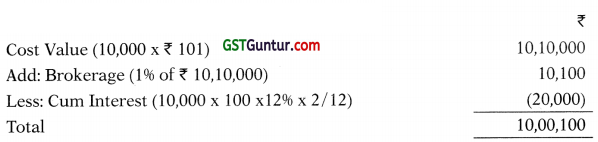

Prepare Investment Account in the books of M/s. Bull & Bear for the period 1st December, 2012 to 1st March, 2013. (5 Marks) (May 2013)

Answer:

Investment Account for the period from 1st December, 2012 to 1st March, 2013 (12% Debentures of M/s. Wye Ltd.)

Working Notes:

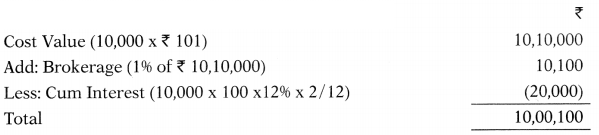

(i) Cost of 12% debentures purchased on 1.12.2012

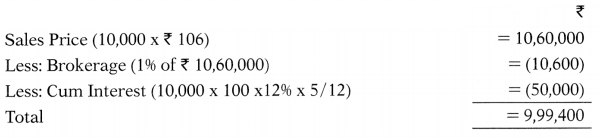

(ii) Sale proceeds of 12% debentures sold on 31st March, 2013

![]()

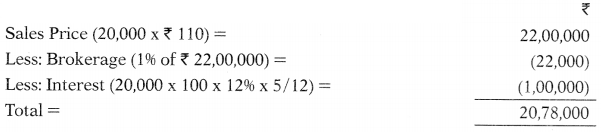

Question 18.

On 1st December, 2015, M/s Blue & Black purchased, 20,000 12% fully paid debentures of ₹ 100 each at ₹ 105 cum-interest price, also paying brokerage @ 1% of cum-interest amount of the purchase. On 1st March, 2016, the firm sold all these debentures at ₹ 110 cum-interest price, again paying brokerage @ 1% of cum interest amount. Prepare Investment Account in the books of M/s. Blue & Black for the period 1st December, 2015 to 1st March, 2016. Interest being payable half yearly on 30th September and 31st March of every accounting year.

On 1 st December, 2012, M /s. Bull & Bear purchased 10,000 of these debentures at ₹ 101 cum-interest price, also paying brokerage @ 1 % of cum-interest amount of the purchase. On 1st March, 2013 the firm sold all of these debentures at ₹ 106 cum-interest price, again paying brokerage @ 1 % of cum-interest amount.

Prepare Investment Account in the books of M/s. Bull & Bear for the period 1st December, 2012 to 1st March, 2013. (5 Marks) (.May 2013)

Answer:

Investment Account for the period from 1st December, 2012 to 1st March, 2013 (12% Debentures of M/s. Wye Ltd.)

Working Notes:

(i) Cost of 12% debentures purchased on 1.12.2012

(ii) Sale proceeds of 12% debentures sold on 31st March, 2013

![]()

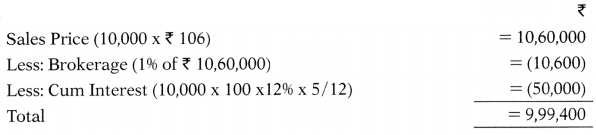

Question 18.

On 1st December, 2015, M/s Blue & Black purchased, 20,000 12% fully paid debentures of ₹ 100 each at ₹ 105 cum-interest price, also paying brokerage @ 1% of cum-interest amount of the purchase. On 1st March, 2016, the firm sold all these debentures at ₹ 110 cum-interest price, again paying brokerage @ 1% of cum interest amount. Prepare Investment Account in the books of M/s. Blue & Black for the period 1st December, 2015 to 1st March, 2016. Interest being payable half yearly on 30th September and 31st March of every accounting year. (4 Marks) (Nov. 2016)

Answer:

Investment Account for the period from 1st December, 2015 to 1st March, 2016

(12% fully paid Debentures)

Working Notes:

(i) Cost of 12% debentures purchased on 1.12.2015

(ii) Sale proceeds of 12% debentures sold on 1st March, 2016

![]()

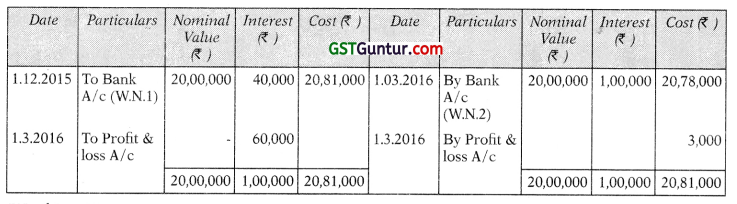

Question 19.

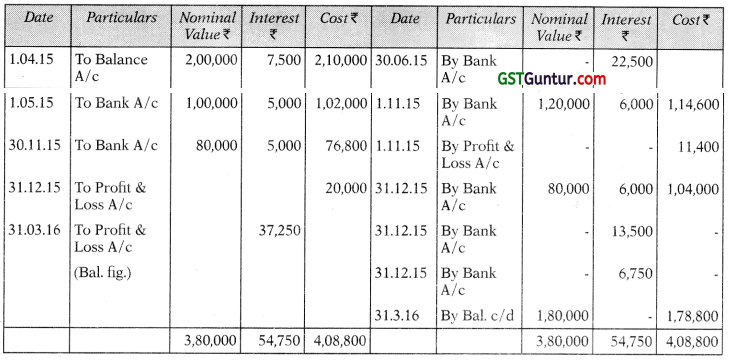

N holds 2,000, 15% Debentures of ₹ 100 each in R Ltd. as on April 1, 2015 at a cost of ₹ 2,10,000. Interest is payable on June, 30 and December, 31 each year. On May 1, 2015, 1,000 debentures are purchased cum-interest at ₹ 1,07,000. On November 1, 2015, 1,200 debentures are sold ex-interest at ₹ 1,14,600. On November 30, 2015, 800 debentures are purchased ex-interest at ₹ 76,800. On December 31, 2015, 800 debentures are sold cum-interest for ₹ 1,10,000. You are required to prepare the Investment Account showing value of holdings on March 31, 2016 at cost, using FIFO Method.

Answer:

Investment Account for the year ended 31.3.2016 (15% Debentures in R Ltd.)

Working Notes:

- Accrued Interest as on 1st April, 2015 = ₹ 2,00,000 × \(\frac{15}{100}\) × \(\frac{3}{12}\) = ₹ 7,500

- Accrued Interest as on 1.5.2015 = ₹ 1,00,000 × \(\frac{15}{100}\) × \(\frac{4}{12}\) = ₹ 5,000

- Cost of Investment for purchase on 1st May = ₹ 1,07,000 – ₹ 5,000 = ₹ 1,02,000

- Interest received as on 30.6.2015 = ₹ 3,00,000 × \(\frac{15}{100}\) × \(\frac{6}{12}\) = ₹ 22,500

- Accrued Interest on debentures sold on 1.11.2015 = ₹ 1,20,000 × \(\frac{15}{100}\) × \(\frac{6}{12}\) = ₹ 6,000

- Accrued Interest = ₹ 80,000 × \(\frac{15}{100}\) × \(\frac{5}{12}\) = ₹ 5 000

- Accrued Interest on sold debentures 31.12.2015 = ₹ 80,000 × \(\frac{15}{100}\) × \(\frac{6}{12}\) = ₹ 6,000

- Loss on Sale of Debenture on 1.1.2015

- Accrued interest as on 31.12.2015 = ₹ 1,80,000 × \(\frac{15}{100}\) × \(\frac{6}{12}\) = ₹ 13,500

- Accrued Interest = ₹ 1,80,000 × \(\frac{15}{100}\) × \(\frac{3}{12}\) = ₹ 6,750

- Cost of investment as on 31st March = ₹ 1,02,000 + ₹ 76,800 = ₹ 1,78,800

- Proht on debentures sold on 31st December

= ₹ 1,04,000 – (₹ 2,10,000 × 800/2,000) = ₹ 20,000

![]()

Ledger Accounts (Mix Questions)

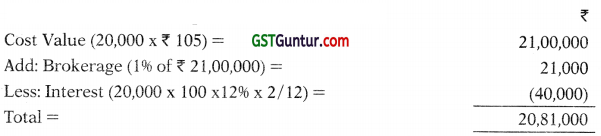

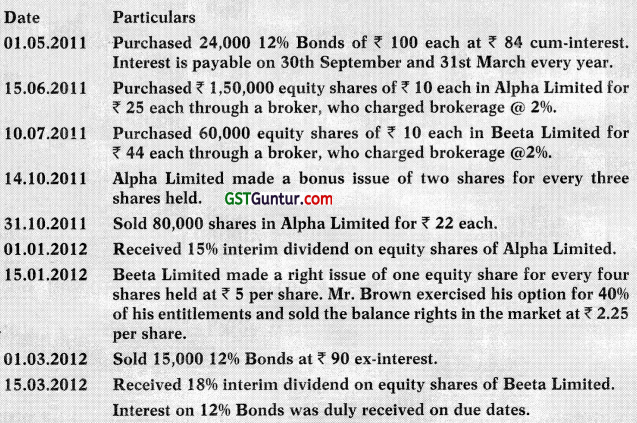

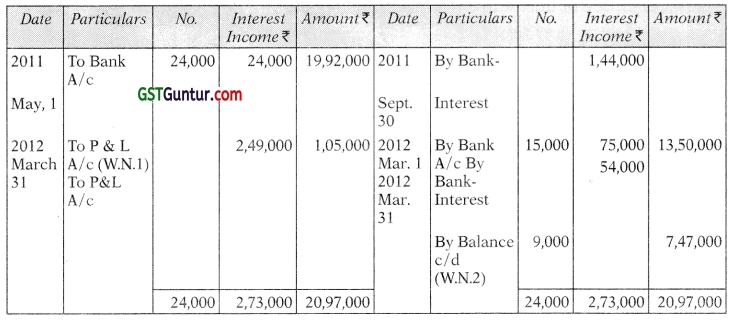

Question 20.

Mr. Brown has made following transactions during the financial year 2011-12:

Prepare separate investment account for 12% Bonds, Equity Shares of Alpha Limited and Equity Shares of Beeta Limited in the books of Mr. Brown for the year ended on 31st March, 2012. (8 Marks) (May 2012)

Answer:

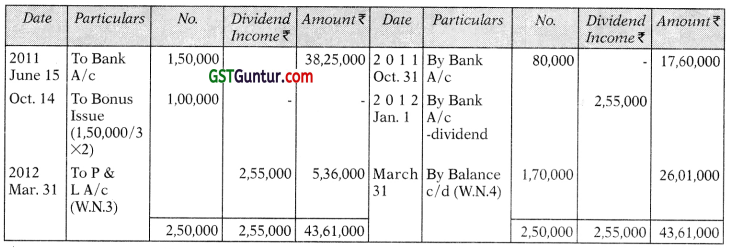

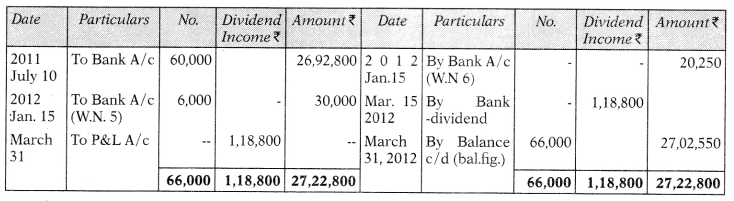

12% Bonds for the year ended 31st March, 2012

Investment in Equity shares of Alpha Ltd. for the year ended 31st March, 2012

Investment in Equity shares of Beeta Ltd. for the year ended 31st March, 2012

Working Notes:

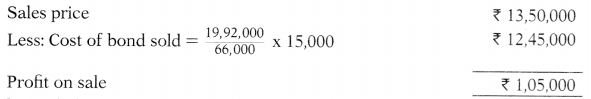

1. Profit on sale of 12% Bond

2. Closing balance as on 31.3.2012 of 12% Bond

\(\frac{19,92,000}{24,000}\) × 9.000 = ₹ 7,47,000

3. Profit on sale of equity shares of Alpha Ltd.

4. Closing balance as on 31.3.2012 of equity shares of Alpha Ltd.

\(\frac{38,25,000}{2,50,000}\) × 1,70,000 = ₹ 26,01,000

5. Calculation of right shares subscribed by Beeta Ltd.

Right Shares = \(\frac{60,000 \text { shares }}{4}\) × 1 = 15 000 shares

Shares subscribed by Mr. Brown = 15,000 × 40%= 6,000 shares

Value of right shares subscribed = 6,000 shares @ ₹ 5 per share = ₹ 30,000

![]()

6. Calculation of sale of right entitlement by Beeta Ltd.

No. of right shares sold = 15,000 – 6,000 = 9,000 shares

Sale value of right = 9,000 shares × ₹ 2.25 per share = ₹ 20,250