Partnership Accounts – CA Inter Advanced Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Partnership Accounts – CA Inter Advanced Accounting Study Material

Theory Questions

Question 1.

What is Piecemeal payments method under Partnership Dissolution? Briefly explain the two methods followed for determining the order in which the payments are made? (2 marks) (May 2010)

Answer:

Generally, the assets sold upon dissolution of partnership are realized only in small instalments over a period of time. In such circumstances the choice is either to distribute whatever is collected or to wait till whole amount is collected. Usually, the first course is adopted. In order to ensure that the distributed cash amongst the partners is in proportion to their interest in the partnership concern either of the two methods described below may be followed for determining the order in which the payment should be made.

(i) Maximum Loss Method: Each instalment realized is considered to be the final payment i.e. outstanding assets and claims are considered worthless and partners’ accounts are adjusted on that basis each time when a deposit is made following either Garner Vs. Murray rule or the profit-sharing ratio rule.

(ii) Highest Relative Capital Method: According to this method, the partner who has the higher relative capital, that is, whose capital is greater in proportion to his profit-sharing ratio is first paid off. This method is also called as proportionate capital method.

Question 2.

Explain Garner V/S Murray rule applicable in the case of partnership firms. State, when is this rule not applicable? (4 marks) (May 2013)

Answer:

Garner vs. Murray rule- Applicability

When a partner is unable to pay his debt due to the firm, he is said to be insolvent and the share of loss is to be borne by other solvent partners in accordance with the decision held in the English case of Garner vs. Murray. According to this decision, normal loss on realisation of assets is to be brought in cash by all partners (including insolvent partner) in the profit-sharing ratio but a loss due to insolvency of a partner has to be borne by the solvent partners in their capital ratio. In order to calculate the capital ratio, no adjustment will be made in case of fixed capitals. However, in case of fluctuating capitals, ratio should be calculated on the basis of adjusted capital before considering profit or loss on realization at the time of dissolution.

Non-Applicability of Garner vs Murray rule:

- When the solvent partner has a debit balance in the capital account. Only solvent partners will bear the loss of capital deficiency of insolvent partner in their capital ratio. If incidentally a solvent partner has a debit balance in his capital account, he will escape the liability to bear the loss due to insolvency of another partner.

- When the firm has only two partners.

- When there is an agreement between the partners to share the deficiency in capital account of insolvent partner.

- When all the partners of the firm are insolvent.

![]()

Question 3.

Explain the Limitations of Liability of Limited Liability Partnership (LLP) and its partners.

Answer:

Under section 27(3) of the LLP Act, 2008 an obligation of an LLP arising out of a contract or otherwise, shall be solely the obligation of the LLP;

- The Liabilities of an LLP shall be met out of the properties of the LLP;

- Under section 28(1) a partner is not personally liable, directly or indirectly, for an obligation referred to in Section 27(3) above, solely by reason of being a partner in the LLP;

- Section 27(1) states that an LLP is not bound by anything done by a partner in dealing with a person, if:

- The partner does not have the authority to act on behalf of the LLP in doing a particular act; and

- The other person knows that the partner has no authority or does not know or believe him to be a partner in the LLP

- Under section 30( 1) the liability of the LLP and the partners perpetrating fraudulent dealings shall be unlimited for all or any of the debts or other liabilities of the LLP.

Question 4.

Under what circumstances, an LLP can be wound up by the Tribunal. (4 marks) (May 2015)

Answer:

Under following circumstances, an LLP can be wound up by the Tribunal:

- If the LLP decides that it should be wound up by the Tribunal;

- If for a period of more than six months, the number of partners of the LLP is reduced below two;

- If the LLP is unable to pay its debts;

- If the LLP has acted against the interests of the integrity and sovereignty of India, the security of the state or public order;

- If the LLP has defaulted in the filing of the Statement of Account and Solvency with the Registrar for five consecutive financial years;

- If the Tribunal is of the opinion that it is just and equitable that the LLP be wound up.

Question 5.

What is the distinction between an Ordinary Partnership Firm and a Limited Liability Partnership (LLP)? (4 marks) (May 2016)

Answer:

Distinction between Partnership (LLP) an ordinary partnership firm and a Limited Liability

| Key Elements | Partnerships | LLPs | |

| 1 | Applicable Law | Indian Partnership Act, 1932 | Limited Liability Partnerships Act, 2008 |

| 2 | Registration | Optional | Compulsory with ROC |

| 3 | Creation | Created by an Agreement | Created by Law |

| 4 | Body Corporate | Not a body corporate | Yes, after registration with ROC, it becomes a body corporate |

| 5 | Separate Legal Identity | It has no separate legal identity | Yes, all body corporate is said to have a separate legal identity. |

| 6 | Perpetual Succession | Partnerships do not have perpetual succession | It has perpetual succession and individual partners may come and go |

| 7 | Number of Partners | Minimum 2 and Maximum 20 (subject to 10 for banks) | Minimum 2 but no maximum limit |

| 8 | Ownership of Assets | Firm cannot own any assets. The partners own the assets of the firm | The LLP as an independent entity can own assets |

| 9 | Liability of Partners/ Members | Liability of the partners is unlimited. Partners are severally and jointly liable for actions of other partners and the firm and their liability extends to personal assets | Liability of the partners is limited to the extent of their contribution towards LLP except in case of intentional fraud or wrongful act of omission or commission by a partner. |

| 10 | Principal Agent Relationship | Partners are the agents of the firm and of each other. | Partners are agents of the firm only and not of other partners |

Question 6.

Write short notes on Designated Partner in a Limited Liability Partnership and what are their liabilities. (4 marks) (Nov 2016)

Answer:

“Designated partner” means any partner designated as such pursuant to section 7 of the Limited Liability Partnerships (LLPs) Act, 2008.

As per section 7 of the LLP Act, every limited Liability Partnership shall have at least 2 designated Partners who are individuals and at least one of them shall be a resident in India:

Provided that in case of Limited Liability Partnership in which all the partners are bodies corporate or in which one or more partners are Individuals and bodies corporate, at least 2 individuals who are partners of such limited liability Partnership or Nominees of such Bodies corporate shall act as designated partners.

“Liabilities of designated partners”

As per Section 8 of LLP Act, unless expressly provided otherwise in this Act, a designated partner shall be-

(a) responsible for the doing of all acts, matters and things as are required to be done by the limited liability partnership in respect of compliance of the provisions of this Act including filling of any document, return, statement and the like report pursuant to the provisions of this Act and as may be specified in the limited liability partnership agreement; and

(b) liable to all penalties imposed on the limited liability partnership for any contravention of those provisions.

Question 7.

State the circumstances when LLP can be wound up by the Tribunal. (4 marks) (May 2017)

Answer:

Under section 64 of the LLP Act, 2008, an LLP may be wound up by the Tribunal:

- If the LLP decides that it should be wound up by the Tribunal;

- If for a period of more than six months, the number of partners of the LLP is reduced below two;

- If the LLP is unable to pay its debts;

- If the LLP has acted against the interests of the integrity and sovereignty of India, the security of the state or public order;

- If the LLP has defaulted in the filing of the Statement of Account and Solvency with the Registrar for five consecutive financial years;

- If the Tribunal is of the opinion that it is just and equitable that the LLP be wound up.

Question 8.

Explain the nature of Limited Liability Partnership. Who can be a designated partner in a Limited Liability Partnership? (4 marks) (Nov 2017)

Answer:

Nature of Limited Liability Partnership: A limited liability partnership is a body corporate formed and incorporated under the LLP Act, 2008 and is a legal entity separate from that of its partners. A limited liability partnership shall have perpetual succession and any change in the partners of a limited liability partnership shall not affect the existence, rights or liabilities of the limited liability partnership.

Designated partners: Every limited liability partnership shall have at least two designated partners who are individuals and at least one of them shall be a resident in India.

In case of a limited liability partnership in which all the partners are bodies corporate or in which one or more partners are individuals and bodies corporate, at least two individuals who are partners of such limited liability partnership or nominees of such bodies corporate shall act as designated partners.

![]()

Question 9.

Differentiate on ordinary partnership firm with an LLP (Limited Liability Partnership) in respect of the following:

(1) Applicable Law

(2) Number of Partners

(3) Ownership of Assets

(4) Liability of Partners/Members (4 Marks) (May 2018)

Answer:

Distinction between an ordinary partnership firm and an LLP

| Key Elements | Partnerships | LLPs |

| Applicable Law | Indian Partnership Act, 1932 | The Limited Liability Partnerships Act, 2008 |

| Number of Partners | Minimum 2 and Maximum 20 (subject to 10 for banks) | Minimum 2 but no maximum limit |

| Ownership of Assets | Firm cannot own any assets. The partners own the assets of the firm. | The LLP as an independent entity can own assets |

| Liability of

Partners/ Members |

Unlimited: Partners are severally and jointly liable for actions of other partners and the firm and their liability extends to personal assets. | Limited to the extent of their contribution towards LLP except in case of intentional fraud or wrongful act of omission or commission by a partner. |

Question 10.

Write short notes on extent of liability of LLP and its Partners. (5 Marks) (May 2018)

Answer:

Every partner of an LLP for the purpose of its business is an agent of the LLP but is not an agent of other partners. Obligations of LLP are solely its obligations and liabilities of LLP are to be met out of properties of LLP.

The partners of an LLP in the normal course of business are not liable for the debts of the LLP. The LLP is liable if a partner of LLP is liable to any person as a result of wrongful or omission on his part in the course of business of the LLP or with his authority. However, a partner will be liable for his own wrongful acts or commissions, but will not be liable for the wrongful acts or commissions of other partners of the LLP. Thus, a partner may be called to pay the liability of an LLP under exceptional circumstances.

If an LLP or any of its partners act with the intent to defraud creditors of the LLP or any other person or for any fraudulent purpose, then the liability of the LLP and the concerned partners is unlimited. However, where the fraudulent act is carried out by a partner, the LLP is not liable if it is established by the LLP that the act was without the knowledge or authority of the LLP. Where the business is carried out with fraudulent intent or for fraudulent purpose, every person who was knowingly a party is punishable with imprisonment and fine.

Question 11.

Can a partner be called upon to pay the liability of the LLP? If yes, under what circumstances?

Answer:

Under section 27(3) of the LLP Act, 2008, any obligation of the LLP arising out of a contract or otherwise will be the sole obligation of the LLP.

The partners of an LLP in the normal course of business are not liable for the debts of the LLP. However, under section 28(2) of the LLP Act, 2008, a partner will be liable for his own wrongful acts or commissions, but will not be liable for the wrongful acts or commissions of other partners of the LLP.

Thus, a partner may be called to pay the liability of an LLP under exceptional circumstances.

Question 12.

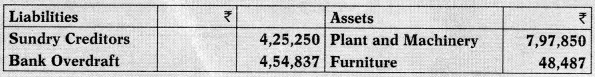

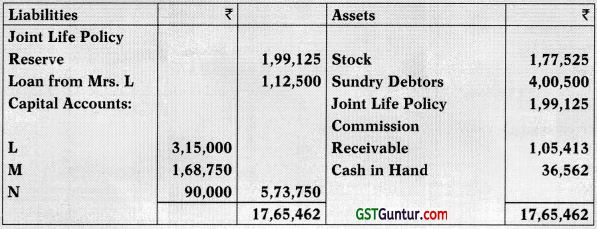

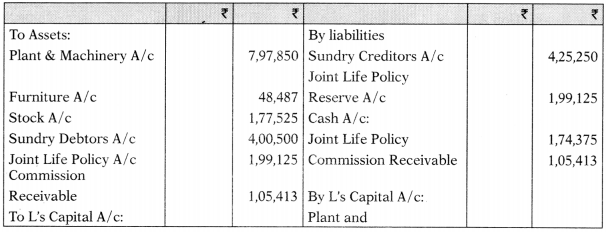

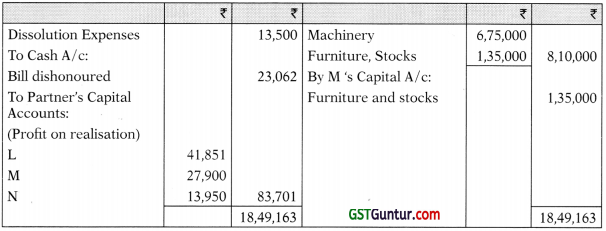

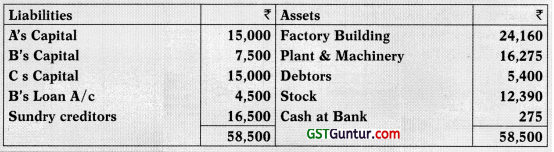

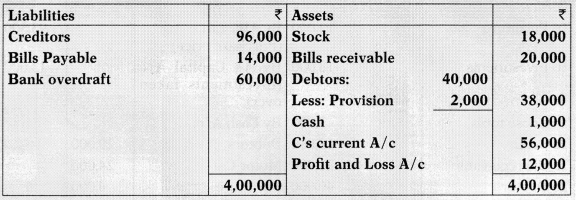

L, M and N were in partnership sharing profits and losses in the ratio of 3:2:1 respectively. They decided to dissolve the partnership firm on 31.3.2016, when the Balance Sheet of the firm appeared as under:

Balance Sheet of the firm as on 31.3.2016

The following details are relevant for dissolution:

- The joint life policy was surrendered for ₹ 1,74,375.

- L took over plant and machinery for ₹ 6,75,000.

- L also agreed to discharge bank overdraft and loan from Mrs. L.

- Furniture and stocks were divided equally between L and M at an agreed valuation of ₹ 2,70,000.

- Sundry debtors were assigned to firm’s creditors in full satisfaction of their claims.

- Commission receivable was received in time.

- A bill discounted was subsequently returned dishonoured and proved valueless ₹ 23,062 (including ₹ 375 noting charges).

- L paid the expenses of dissolution amounting to ₹ 13,500.

You are required to prepare:

(i) Realisation Account

(ii) Partners’ Capital Accounts and

(iii) Cash Account. (RTP)

Answer:

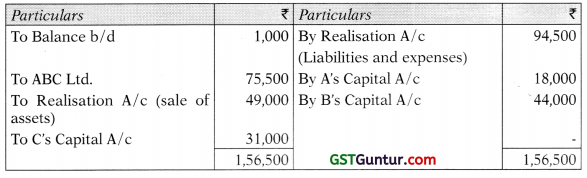

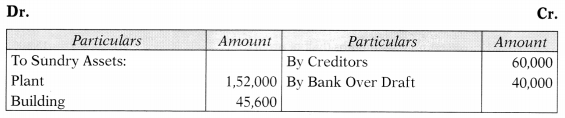

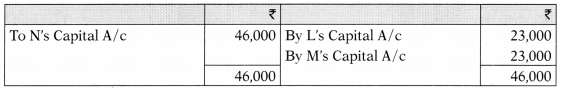

Realisation A/c

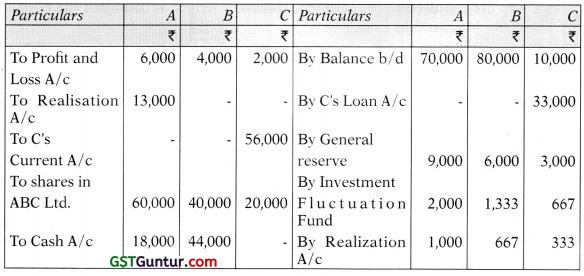

Partner’s Capital A/c’s

Cash A/c

Note:

There will be no entry for assignment of sundry debtors to sundry creditors in full satisfaction of their claims.

![]()

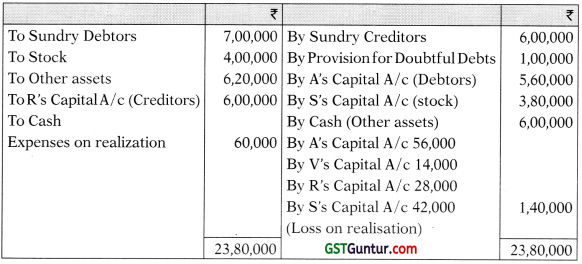

Question 13.

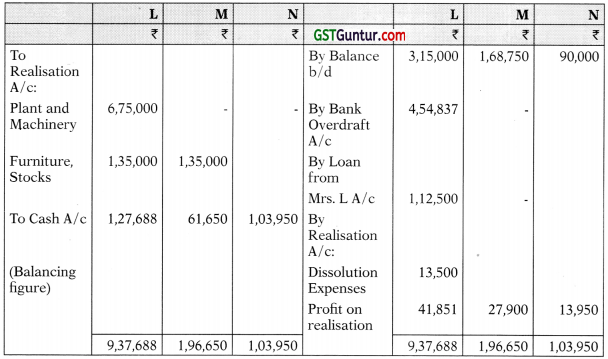

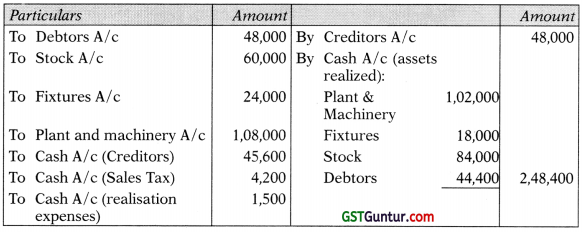

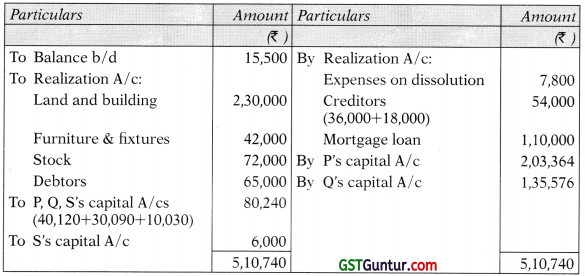

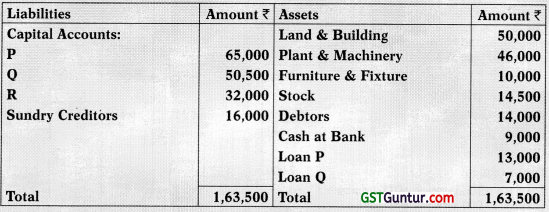

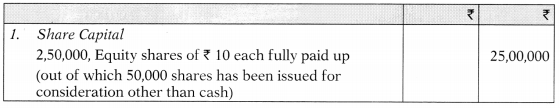

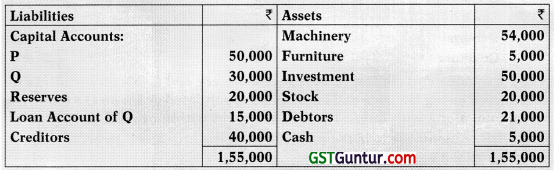

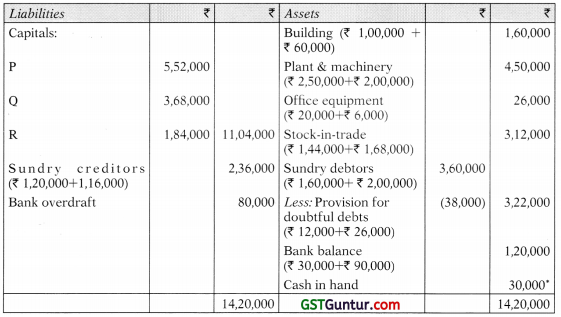

P, Q and R are partners sharing profits and losses in the ratio of 2: 2: 1. Their Balance Sheet as on 31st March, 2009 is as follows:

They decided to dissolve the firm. The following are the amounts realized from the assets:

Creditors allowed a discount of 5% and realization expenses amounted to ₹ 1,500. A bill for ₹ 4,200 due for sales tax was received during the course of realization and this was also paid.

You are required to prepare:

(a) Realization account

(b) Partners’ capital accounts

(c) Cash account. (6 Marks) (Nov 2009)

Answer:

Realisation A/c

Partners’ Capital A/c

Cash A/c

![]()

Question 14.

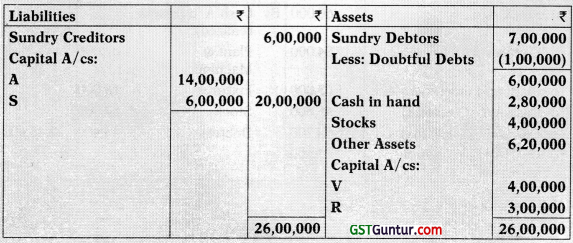

A, V, R and S are partners in a firm sharing profits and losses in the ratio of 4:1:2: 3. The following is their Balance Sheet as at 31st March, 2014:

On 31st March, 2014, the firm is dissolved and the following points are agreed upon:

(a) A is to takeover sundry debtors at 80% of book value.

(b) S is to take over the stocks at 95% of the value.

(c) R is to discharge sundry creditors.

(d) Other assets realise ₹ 6,00,000 and the expenses of realisation come to ₹ 60,000.

(e) V is found insolvent and ₹ 43,800 is realized from his estate.

You are required to prepare Realisation Account and Capital Accounts of the partners. Show also the Cash A/c. The loss arising out of capital deficiency may be distributed following the decision in Garner vs Murray. (RTP)

Answer:

Realisation A/c

Partners’ Capital A/c’s

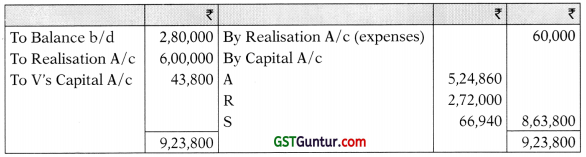

Cash A/c

Note:

V’s deficiency will be borne by A and S in the ratio of 7:3 i.e. on opening capitals of ₹ 14,00,000 and ₹ 6,00,000. R will not bear any portion of the loss since at the time of dissolution he had a debit balance in his capital account.

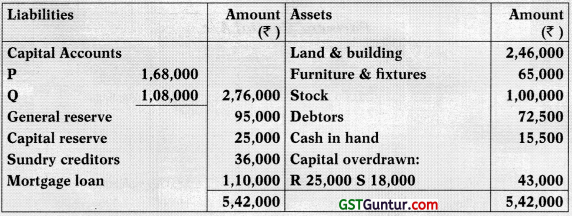

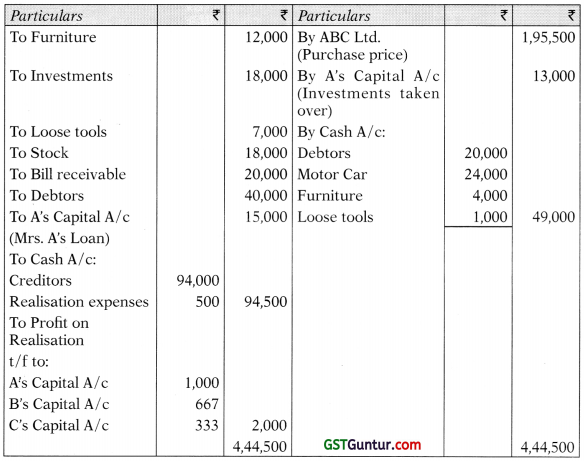

Question 15.

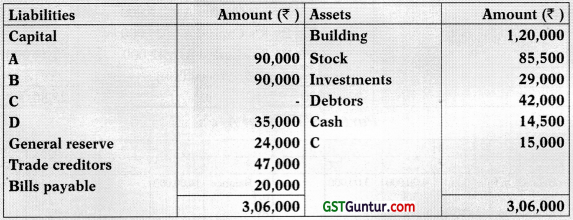

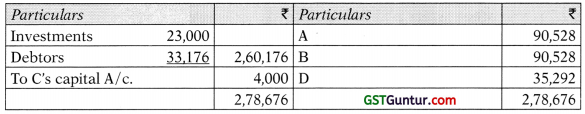

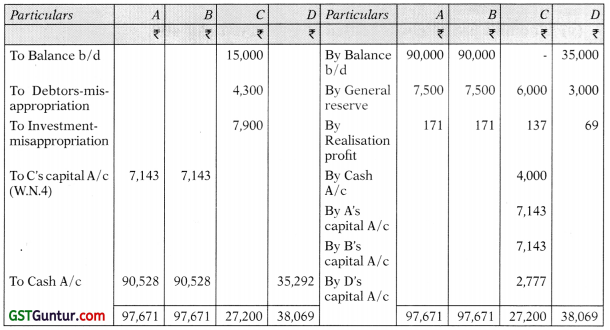

A, B, C and D are sharing profits and losses in the ratio 5: 5: 4: 2. Frauds committed by C during the year were found out and it was decided to dissolve the partnership on 31st March, 2010 when their Balance Sheet w as as under:

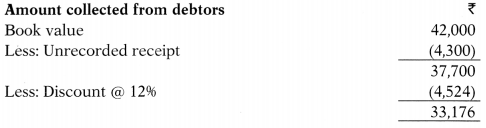

Following information is given to you:

- A cheque for ₹ 4,300 received from debtor was not recorded in the books and was misappropriated by C.

- Investments costing ₹ 5,400 were sold by C at ₹ 7,900 and the funds transferred to his personal account. This sale was omitted from the firm’s books.

- A creditor agreed to take over investments of the book value of ₹ 5,400 at ₹ 8,400. The rest of the creditors were paid off at a discount of 2%.

- The other assets realized as follows:

Building 105% of book value Stock ₹ 78,000

Investments The rest of investments were sold at a profit of ₹ 4,800

Debtors The rest of the debtors were realized at a discount of 12% - The bills payable was settled at a discount of ₹ 400.

- The expenses of dissolution amounted to ₹ 4,900

- It was found out that realization from C’s private assets would only be ₹ 4,000.

Prepare the necessary Ledger Accounts. (16 Marks) (Nov 2010)

Answer:

Realisation A/c

Cash A/c

Partner’s Capital A/c’s

Working Notes:

1.

2.

3.

4.

This deficiency of ₹ 17,063 in C’s capital account will he shared by other partners A, B and D in their capital ratio of 90: 90: 35

Thus,

A’s share of deficiency = [17,063 × (90/2 15)] = 7,143

B’s share of deficiency = [17,063 × (90/215)] = 7,143

D’s share oF deficiency = [17,063 × (35/215)] = 2,777

![]()

Question 16.

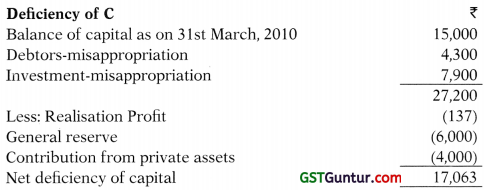

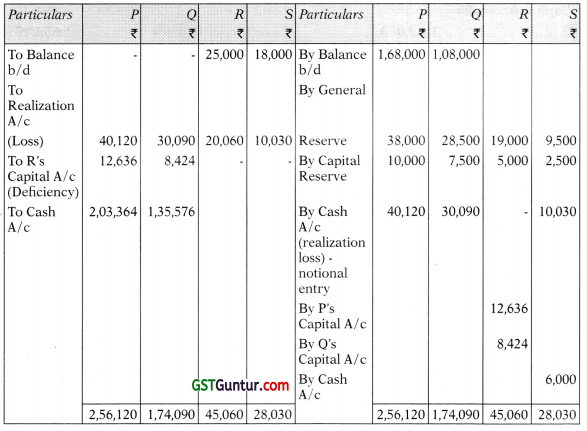

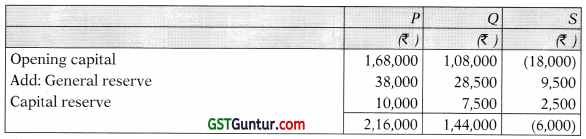

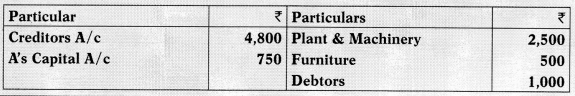

P, Q, R and S had been carrying on business In partnership sharing profits & losses in the ratio of 4:3:2:1. They decided to dissolve the partnership on the basis of following Balance Sheet as on 30th April, 2011:

- The assets were realized as under:

Land & building ₹ 2,30,000

Furniture & fixtures ₹ 42,000

Stock ₹ 72,000

Debtors ₹ 65,000 - Expenses of dissolution amounted to ₹ 7,800.

- Further creditors of ₹ 18,000 had to be met.

- R became Insolvent and nothing was realized from his private estate.

Applying the principles laid down in Garner Vs. Murray, prepare the Realisatlon Account, Partners’ Capital Accounts and Cash Account. (16 Marks) (Nov 2011)

Answer:

Realisation A/c

Partner’s Capital A/c

Cash A/c

Working Note:

As per Garner Vs. Murray rule, solvent partners have to bear loss of insolvent partner in their capital ratio.

Computation of Capital Ratio (of Solvent Partners)

Though S is a solvent partner yet he cannot be called upon to bear loss on account of insolvency of R because his capital account has a debit balance.

Therefore, capital ratio of P & Q = 216: 144 = 3: 2

Deficiency of R = ₹ {(25,000 + 20,060) – (19,000 + 5,000)} = ₹ 45,060 – ₹ 24,000 = ₹ 21,060. Deficiency of R will be shared by P & Q in the capital ratio of 3: 2 i.e.

P = ₹ 21,060 × 3/5 = ₹ 12,636

Q = ₹ 21,060 × 2/5 = ₹ 8,424

![]()

Question 17.

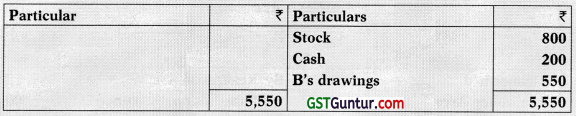

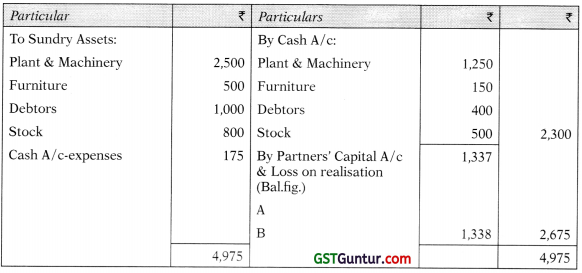

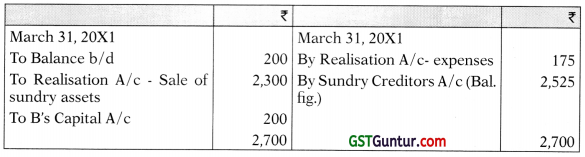

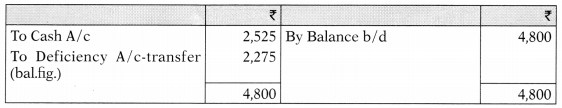

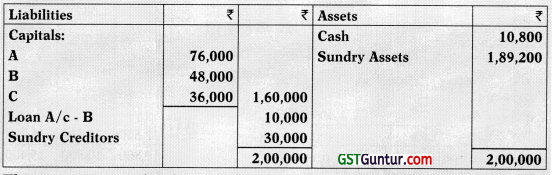

A and B are in equal partnership. Their Balance Sheet stood as under on 31st March, 20X1 when the firm was dissolved:

The assets realized as under:

The expenses of realisation amounted to ₹ 775. A’s private estate is not sufficient even to pay his private debts, whereas B’s private estate has a surplus of ₹ 200 only. Show necessary ledger accounts to close the books of the firm.

Answer:

Realisation A/c

Cash A/c

Sundry Creditors A/c

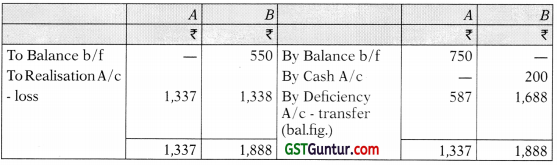

Partners’ Capital A/c’s

Deficiency Account

Question 18.

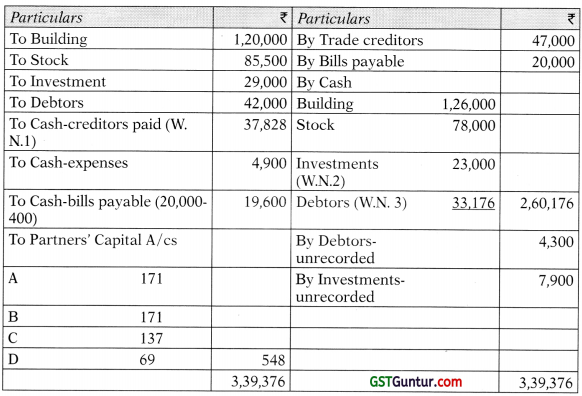

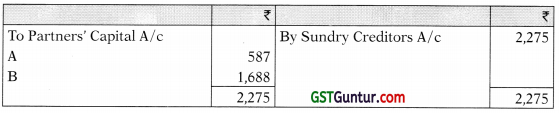

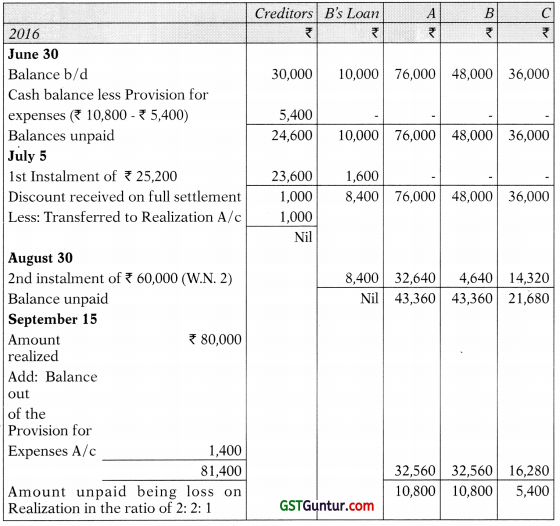

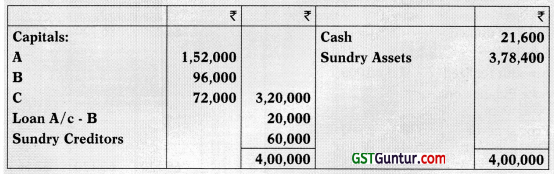

A partnership firm was dissolved on 30th June, 2016. Its Balance Sheet on the date of dissolution was as follows:

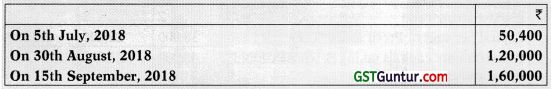

The assets were realized in instalments and the payments were made on the proportionate capital basis. Creditors were paid ₹ 29,000 in full settlement of their account. Expenses of realization were estimated to be ₹ 5,400 but actual amount spent was ₹ 4,000. This amount was paid on 15th September. Draw up a statement showing distribution of cash, which was realized as follows:

The partners shared profits and losses in the ratio of 2:2:1. Prepare a statement showing distribution of cash amongst the partners by ‘Highest Relative Capital’

method. (.RTP)

Answer:

Statement showing distribution of cash amongst the partners

Working Notes:

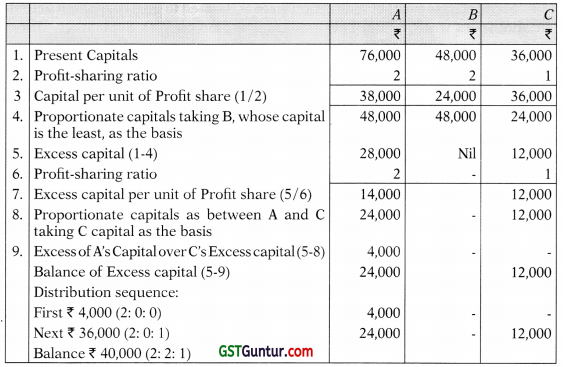

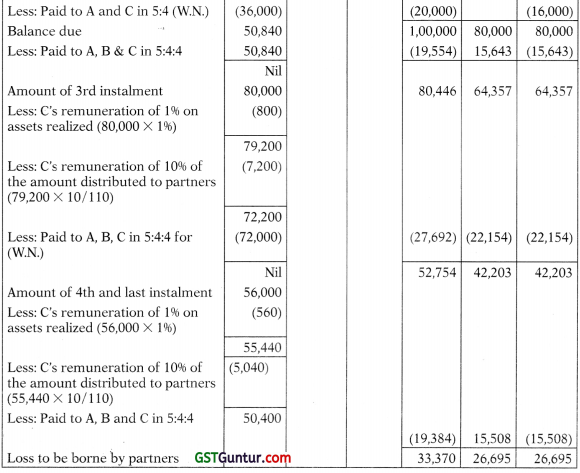

1. Scheme of Distribution

2. Distribution of IInd Instalment

![]()

Question 19.

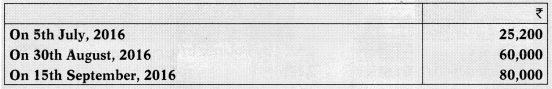

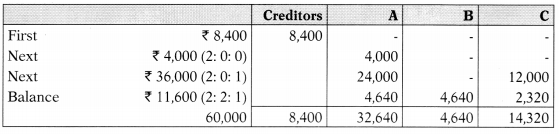

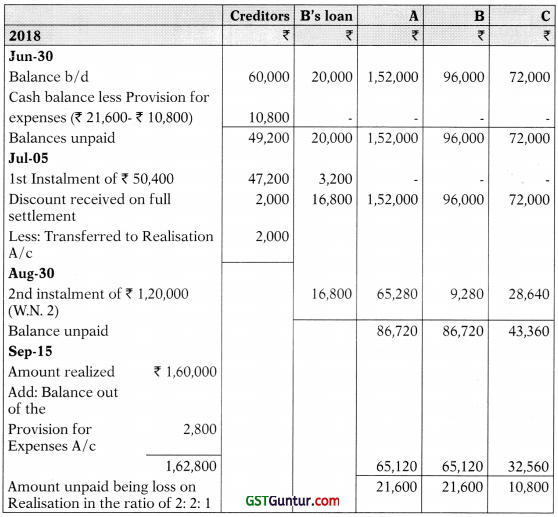

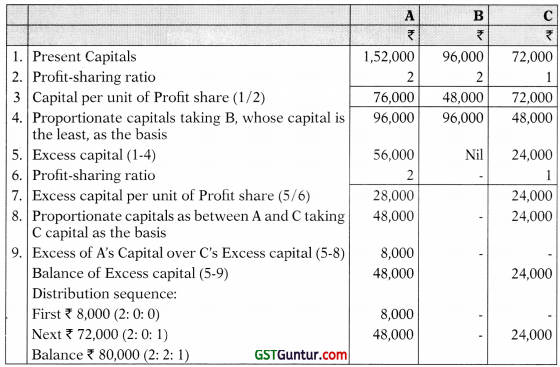

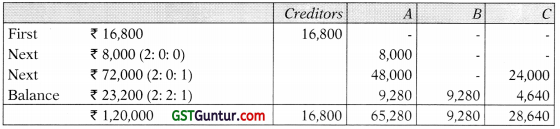

A partnership firm was dissolved on 30th June, 2018. Its Balance Sheet on the date of dissolution was as follows:

The assets were realized in instalments and the payments were made on the proportionate capital basis. Creditors were paid ₹ 58,000 in full settlement of their account. Expenses of realization were estimated to be ₹ 10,800 but actual amount spent was ₹ 8,000. This amount was paid on 15th September. Draw up a statement showing distribution of cash, which was realized as follows:

The partners shared profits and losses in the ratio of 2: 2: 1. Prepare a statement showing distribution of cash amongst the partners by ‘Highest Relative Capital’ method. (RTP)

Answer:

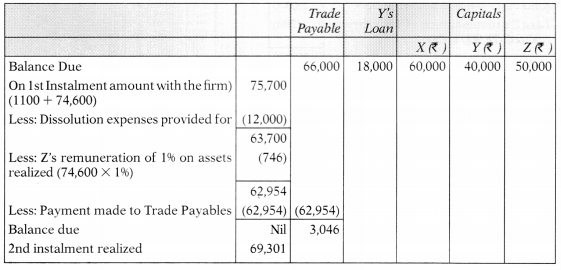

Statement showing distribution of cash amongst the partners

1. Scheme of Distribution

2. Distribution of IInd Instalment

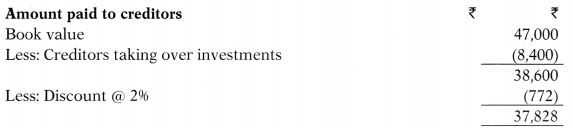

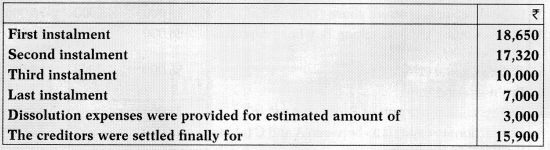

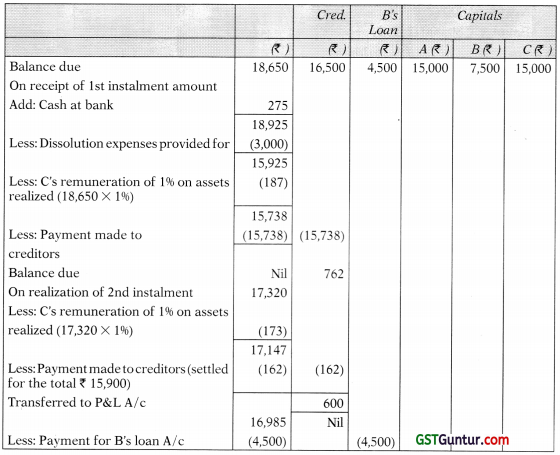

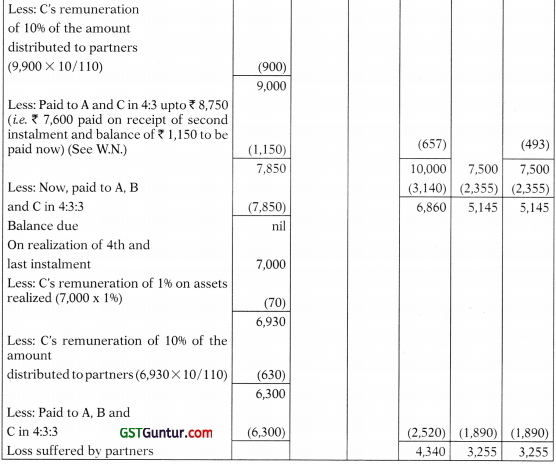

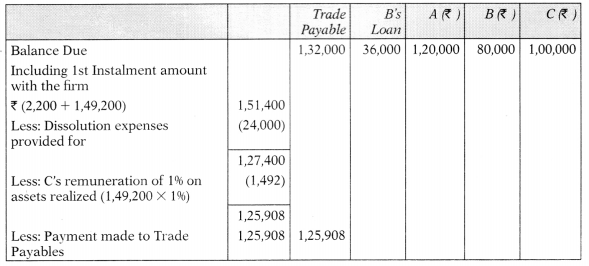

Question 20.

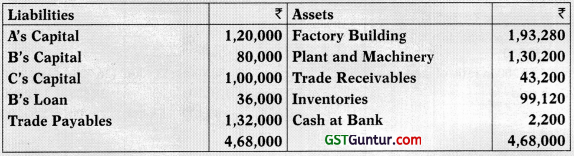

Ajay Enterprises, a Partnership firm in which A, B and C are three partners sharing profits and losses in the ratio of 4: 3: 3. the balance sheet of the firm as on 31st December, 2011 is as below:

On balance sheet date all the three partners have decided to dissolve their partnership. Since the realization of assets was protracted, they decided to distribute amounts as and when feasible and for this purpose they appoint C who was to get as his remunerations 1% of the value of the assets realized other than cash at Bank and 10% of the amount distributed to the partners.

Assets were realized piece-meal as under:

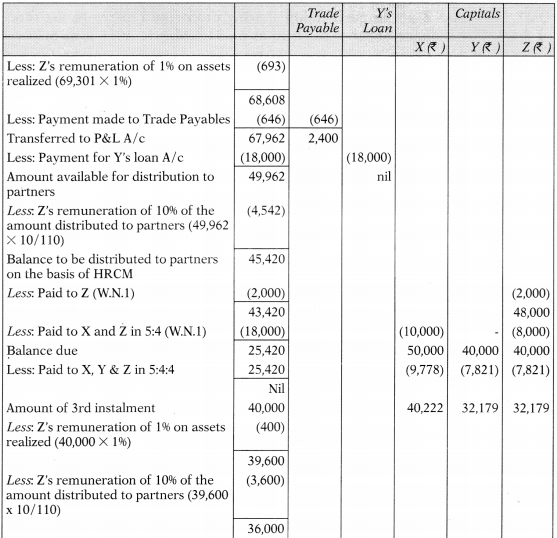

Prepare a statement showing distribution of cash amongst the partners by ‘Highest Relative capital method’. (16 Marks) (May 12)

Answer:

Statement showing distribution of cash amongst the partners

Working Note:

Scheme of distribution

Therefore, first ₹ 3,750 will be paid to C. Then A and C will receive in proportion of 4:3 upto ₹ 8,750 to bring the capital of all partners A, B and C in proportion to their profit-sharing ratio. Thereafter, balance available will be paid to all partners viz A, B and C in their profit-sharing ratio of 4:3:3.

![]()

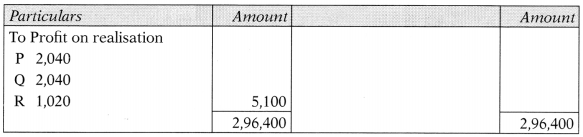

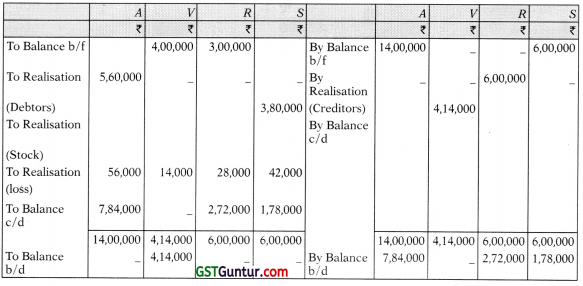

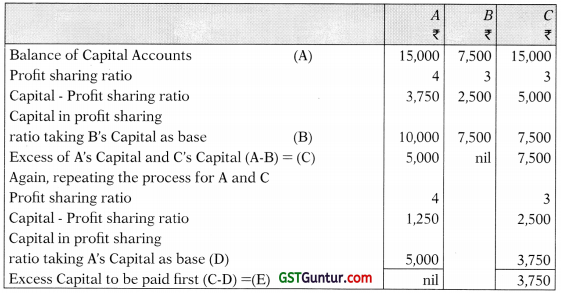

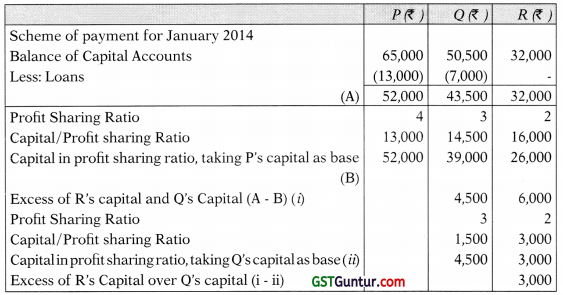

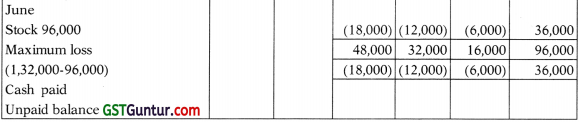

Question 21.

The partners P, Q & R have called you to assist them in winding up the affairs of their partnership on 31.12.2013. Their balance sheet as on that date is given below:

(а) The partners share profit and losses in the ratio of 4:3:2.

(b) Cash is distributed to the partners at the end of each month,

(c) A summary of liquidation transactions are as follows:

January 2014

- ₹ 9,000 – collected from debtors; balance is uncollectable.

- ₹ 8,000 – received from the sale of entire furniture

- ₹ 1,000 – Liquidation expenses paid.

- ₹ 6,000 – Cash retained in the business at the end of month February 2014

- ₹ 1,000 – Liquidation expenses paid.

- As part payment of his capital, R accepted a machinery for ₹ 9,000 (book value ₹ 3,500)

- ₹ 2,000 – Cash retained in the business at the end of month March 2014

- ₹ 38,000 – received on the sale of remaining plant and machinery.

- ₹ 10,000 – received from the sale of entire stock.

- ₹ 1,700 – Liquidation expenses paid.

- ₹ 41,000 – Received on sale of land & building.

- No Cash is retained in the business.

You are required to prepare a schedule of cash payments amongst the partners by “Higher Relative Capital Method”. (16 Marks) (May 2014)

Answer:

Working Note:

(i) Scheme of Distribution

(ii) Distribution of cash for March:

Question 22.

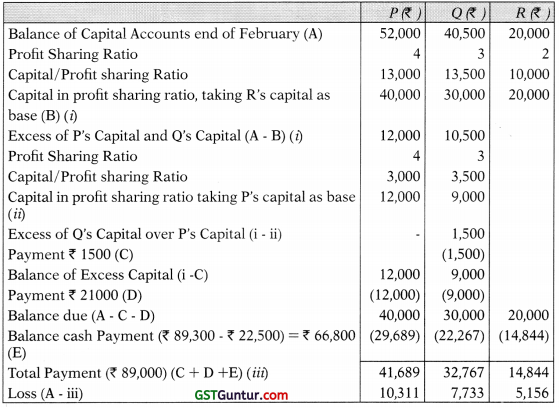

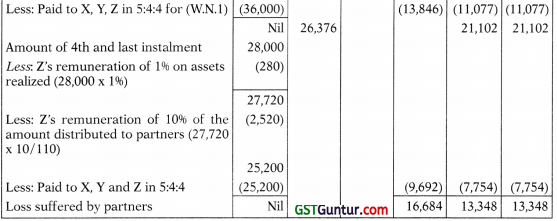

X, Y and Z are in partnership sharing profits and losses in the ratio of 5:4:4. The Balance Sheet of the firm as on 31st March, 2016 is as below:

On Balance Sheet date, all the three partners have decided to dissolve their partnership. Since the realisation of assets was protracted, they decided to distribute amounts as and when feasible and for this purpose they appoint Z who was to get as his remuneration 1% of the value of the assets realized other than cash at bank and 10% of the amount distributed to the partners.

Assets were realized piecemeal as under:

You are required to prepare a statement showing distribution of cash amongst the partners by “Highest Relative Capital Method”. (16 Marks) (Nov 2016)

Answer:

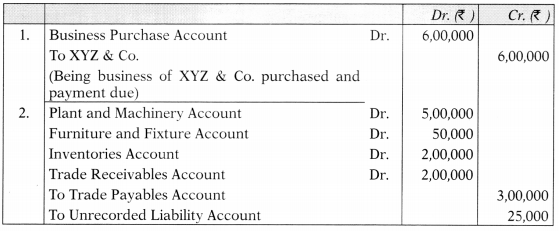

Statement showing distribution of cash amongst the partners

Working Note:

- ₹ 1100 added to the first instalment received on sale of assets represents the Cash in Bank

- The amount due to Creditors at the end of the utilization of First Instalment is ₹ 3046. However, since the creditors were settled for ₹ 63,600 only the balance 646 were paid and the balance ₹ 2400 was transferred to the Profit & Loss Account.

- Scheme of Distribution

Therefore, firstly ₹ 2,000 is to be paid to Z, then X and Z to be paid in proportion of 5:4 upto ₹ 18,000 to bring the capital of all partners X, Y and Z in proportion to their profit-sharing ratio. Thereafter, balance available will be paid in the profit-sharing ratio 5:4:4 to all partners viz X, Y and Z.

![]()

Question 23.

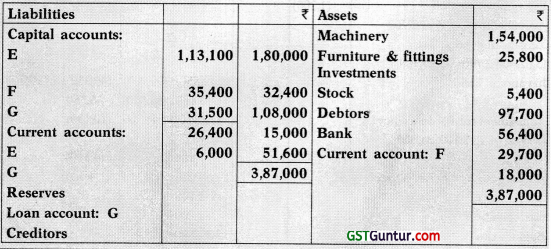

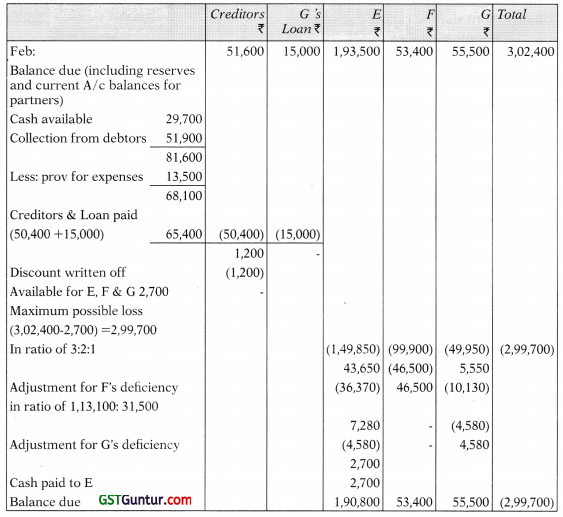

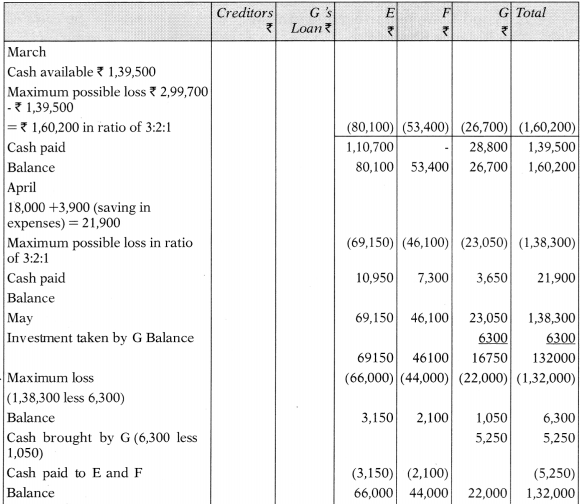

E, F and G were partners in a firm, sharing profits and losses in the ratio of 3:2:1, respectively. Due to extreme competition, it was decided to dissolve the partnership on 31st December, 2017. The balance sheet on that date was as follows:

The realization of assets is spread over the next few months as follows:

February, Debtors, ₹ 51,900; March, Machinery, ₹ 1,39,500; April, Furniture, etc. ₹ 18,000; May, G agreed to take over investment at ₹ 6,300; June, Stock, ₹96,000.

Dissolution expenses, originally provided, were ₹ 13,500, but actually amounted to ₹ 9,600 and were paid on 30th April. The partners decided that after creditors were settled for ₹ 50,400, all cash received should be distributed at the end of each month in the most equitable manner.

You are required to prepare a statement of actual cash distribution as received using “Maximum loss basis” method. (20 Marks) (November 2018)

Answer:

Statement Showing Distribution of Cash

Working Note:

Statement showing the cash available for distribution:

Feb. ₹ 29,700 + 51,900 – 13,500 = ₹ 68,100

March ₹ 1,39,500

April ₹ 18,000 + 3,900 = 21,900

May Nil

June ₹ 96,000

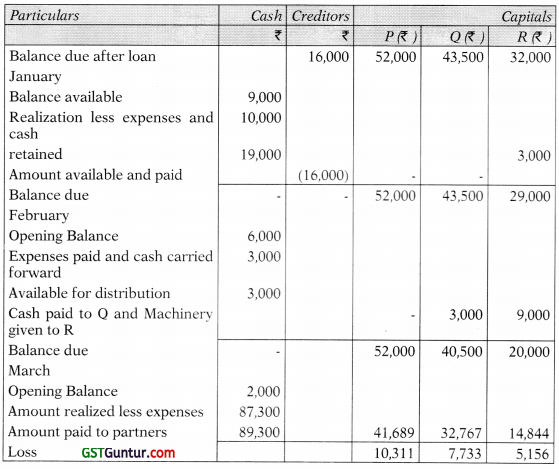

Question 24.

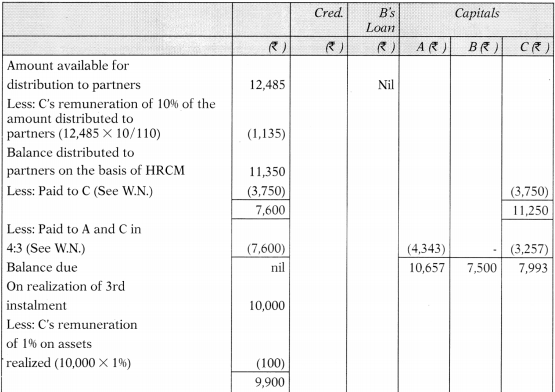

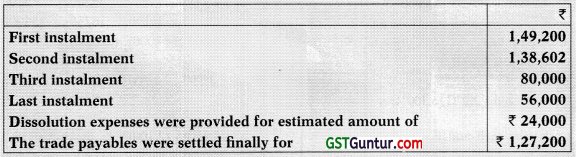

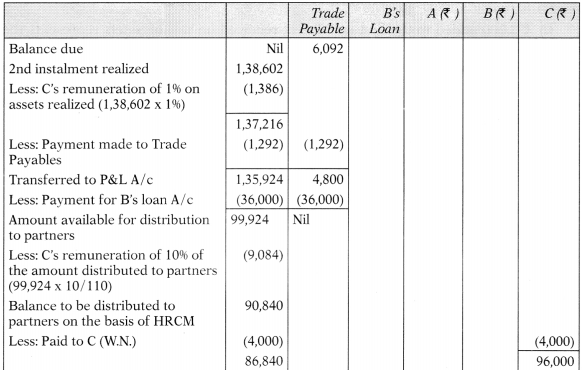

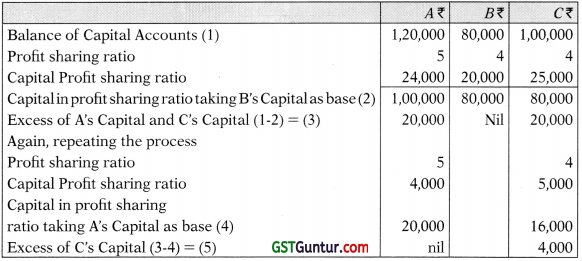

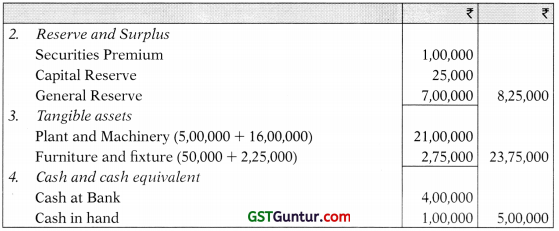

A, B and C are in partnership sharing profits and losses in the ratio of 5:4:4. The Balance Sheet of the firm as on 31st March, 2018 is as below:

On Balance Sheet date, all the three partners have decided to dissolve their partnership. The partners decided to distribute amounts as and when feasible and for this purpose they appoint C who was to get as his remuneration 1% of the value of the assets realized other than cash at bank and 10% of the amount distributed to the partners.

Assets were realized piecemeal as under:

You are required to prepare a statement showing distribution of cash amongst the partners by “Highest Relative Capital Method”. (RTP)

Answer:

Statement showing distribution of cash amongst the partners

Working Note:

- ₹ 2,200 added to the first instalment received on sale of assets represents the Cash in Bank

- The amount due to Creditors at the end of the utilization of First Instalment is ₹ 6,092. However, since the creditors were settled for ₹ 1,27,200 only the balance ₹ 1,292 were paid and the balance ₹ 4,800 was transferred to the Profit & Loss Account.

- Scheme of Distribution

Therefore, firstly 74,000 is to be paid to C, then A and C to be paid in proportion of 5:4 up to ₹ 36,000 to bring the capital of all partners A, B and C in proportion to their profit-sharing ratio. Thereafter, balance available will be paid in the profit-sharing ratio 5:4:4 to all partners viz A, B and C.

![]()

Sale To A Company

Question 25.

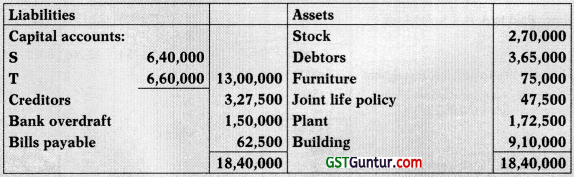

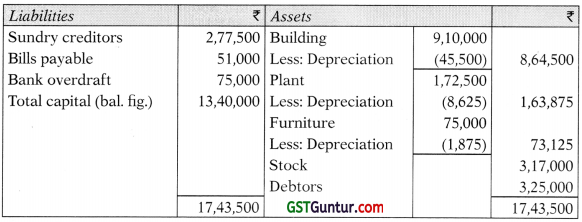

‘S’ and T were carrying on business as equal partner. Their Balance Sheet as on 31st March, 20X1 stood as follows:

The operations of the business were carried on till 30th September, 20X1. S and T both withdrew in equal amounts half the amount of profits made during the current period of 6 months after 10% per annum had been written off on building and plant and 5% per annum written off on furniture. During the current period of 6 months, creditors were reduced by ₹ 50,000, Bills payable by ₹ 11,500 and Bank overdraft by ₹ 75,000. The Joint Life policy was surrendered for ₹ 47,500 on 30th September, 20X1. Stock was valued at ₹ 3,17,000 and debtors at ₹ 3,25,000 on 30th September, 20X1. The other items remained the same as on 31st March, 20X1.

On 30th September, 20X1 the firm sold its business to ST Ltd. The value of goodwill was estimated at ₹ 5,40,000 and the remaining assets were valued on the basis of the Balance Sheet as on 30th September, 20X1. The ST Ltd. paid the purchase consideration in equity shares of ₹ 10 each. You are required to prepare a Realisation Account and Capital accounts of the partners.

Answer:

Realisation A/c

Partners ’ Capital A/c’s

Working Notes:

(1) Computation of total capital:

Balance Sheet as at 30th September, 20X1

(2) Profit earned for the period of six months till 30 September, 20X1

(3) Computation of Purchase consideration:

Question 26.

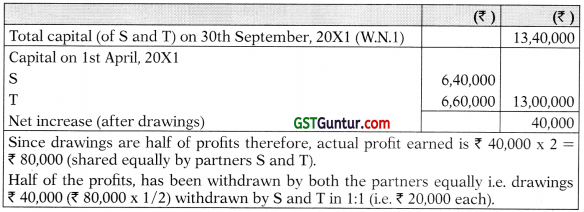

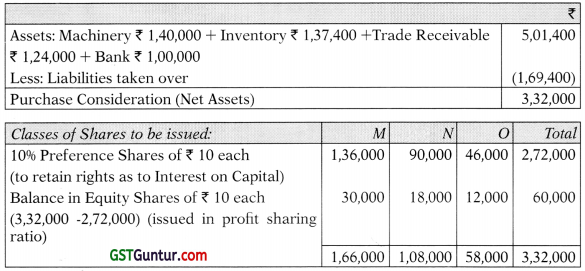

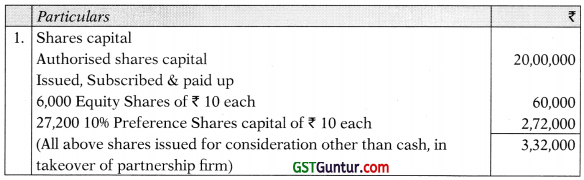

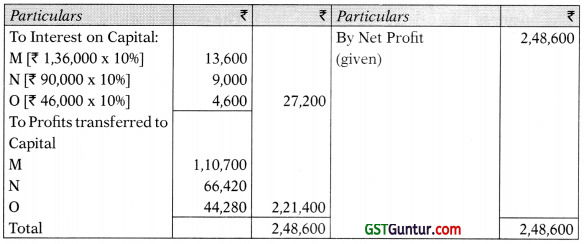

M, N and O were Partners sharing Profits and Losses in the ratio of 5:3:2 respectively. The Trial Balance of the Firm 31st March, 2014 was the following:

Interest on Capital Accounts at 10% p.a. on the amount standing to the credit of Partners’ Capital Account at the beginning of the year, was not provided before preparing the above Trial Balance. On the above date, they formed a MNO Private Limited Company with an Authorized Share Capital of 2,00,000 in shares of ₹ 10 each to be divided in different classes to take over the business of Partnership firm.

You are required as under:

1. Machinery is to be transferred at ₹ 1,40,000.

2. Shares in the Company are to be issued to the partners, at par, in such numbers, and in such classes as will give the partners, by reason of their shareholdings alone, the same rights as regards interest on capital and the sharing of profit and losses as they had in the partnership.

3. Before transferring the business, the partners wish to draw from the partnership profits to such an extent that the bank balance is reduced to ₹ 1,00,000. For this purpose, sufficient profits of the year are to be retained in profit-sharing ratio.

4. Assets and liabilities except Machinery and Bank, are to be transferred at their book value as on the above date.

You are required to prepare:

(а) Statement showing the workings of the Number of Shares of each class to be issued by the company, to each partner.

(b) Capital Accounts showing all adjustments required to dissolve the Partnership.

(c) Balance Sheet of the Company immediately after acquiring the business of the Partnership and Issuing of Shares. (RTP)

Answer:

(a) Number of Shares to be issued to Partners

(b) Partners’ Capital A/c

Note:

Gain on Transfer of Machinery = ₹ 1,40,000 – (₹ 2,00,000 – 80,000) = ₹ 20,000 in 5:3:2 ratio.

(c) Balance sheet of MNO Ltd. as on 31st March, 2014

(After Takeover)

Notes to Accounts

Working Note:

1. Profit & Loss Appropriation Account for the year ended 31st March

2. Statement showing Additional Drawings

(a) Funds available for Drawings

(b) Computation of Additional Drawings

![]()

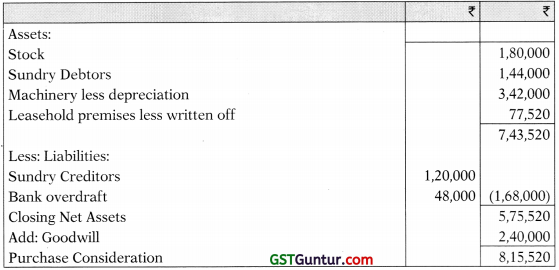

Question 27.

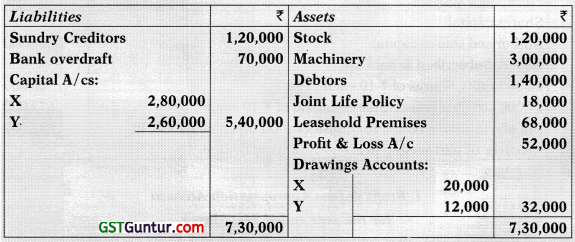

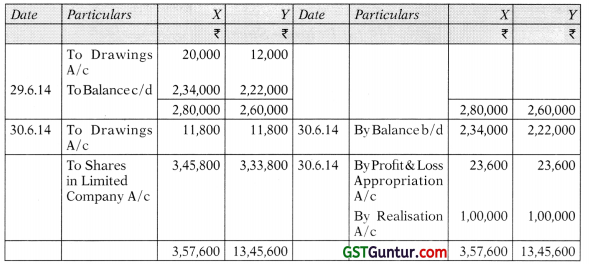

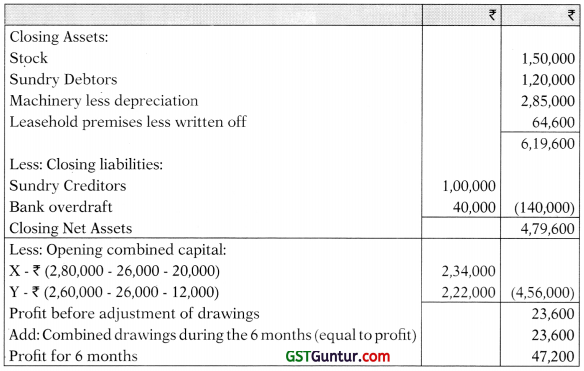

X and Y were carrying on business sharing profits and losses equally. The firm’s Balance Sheet as at 31.12.2013 was as follows:

The business was carried on till 30.6.2014. The partners withdrew in equal amounts half the amount of profits made during the period of six months after charging depreciation at 10% p.a. on machinery and after writing off 5% on leasehold premises. In the half year, sundry creditors were reduced by ₹ 20,000 and bank overdraft by ₹ 30,000.

On 30.6.2014, stock was valued at ₹ 1,50,000 and Debtors at ₹ 1,20,000; the Joint Life Policy had been surrendered for ₹ 18,000 before 30.6.2014 and other items remained the same as at 31.12.2013.

On 30.6.2014, the firm sold the business to a Limited Company. The value of goodwill was fixed at ₹ 2,00,000 and the rest of the assets were valued on the basis of the Balance Sheet as at 30.6.2014. The company paid the purchase consideration in Equity Shares of ₹ 10 each.

You are required to prepare:

(a) Balance Sheet of the firm as at 30.6.2014;

(b) Realisation Account;

(c) Partners’ Capital Accounts showing the final settlement between them. (RTP)

Answer:

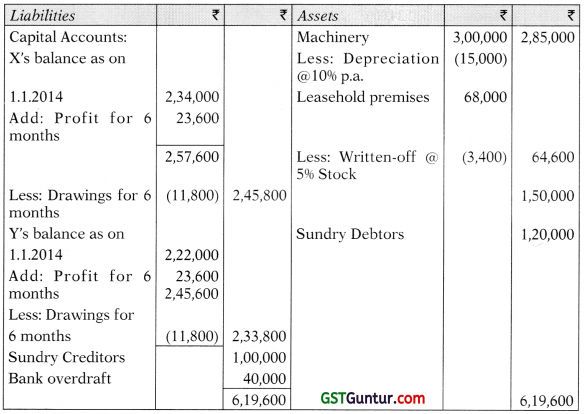

(a) Balance Sheet as on 30.6.2014

(b) Realisation A/c

(c) Partners’ Capital A/c’s

Working Notes:

(1) Ascertainment of profit for the period of 6 months ending 30th June, 2014

(2) Computation of purchase consideration:

Closing net assets (as above) ₹ 4,79,600 + Goodwill ₹ 2,00,000 = ₹ 6,79,600.

![]()

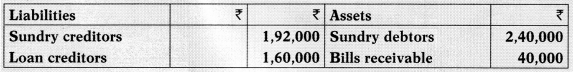

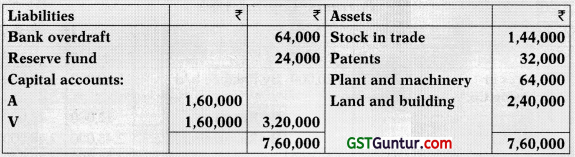

Question 28.

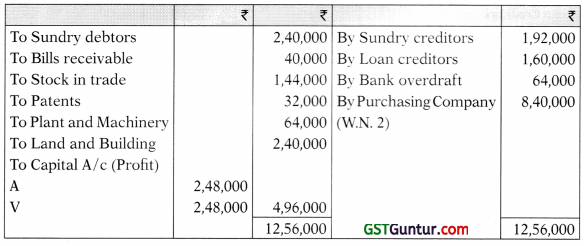

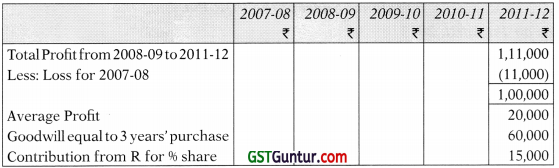

A and V, sharing profits and losses equally, desired to convert their business into a limited company on 31st December, 2016 when their balance sheet stood as follows:

(a) The goodwill of the firm was to be valued at two years’ purchase of the profits average of the previous three years.

(b) The loan creditor was agreed to accept 71/2% redeemable preference shares in settlement of his claim.

(c) Land and buildings and plant and machinery were to be valued at ₹ 4,00,000 and ₹ 96,000 respectively.

(d) The vendors (sundry creditors) were to be allotted equity shares of the value of ₹ 4,20,000.

(e) The past working results of the firm showed that they had made profits of ₹ 1,20,000 in 2014, ₹ 1,44,000 in 2015 and ₹ 1,68,000 in 2016 after setting aside ₹ 8,000 to reserve fund each year.

You are required to show realisation account and partners’ capital accounts in the books of the firm assuming that all the transactions are duly completed. (RTF)

Answer:

Realisation A/c

Partners’ Capital A/c’s

Working Notes:

- Goodwill = (1,20,000 + 1,44,000 + 1,68,000 + 24,000*)/3 × 2 Years = 3,04,000

* Profit transferred to reserve @ ₹ 8,000 for 3 years. - Computation of Purchase Consideration

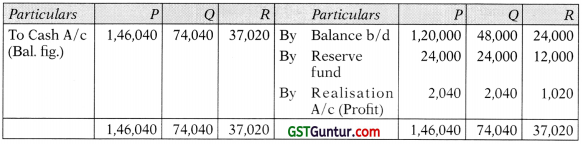

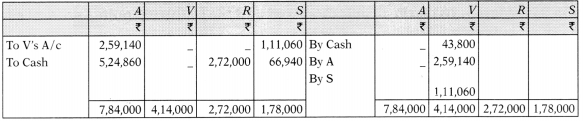

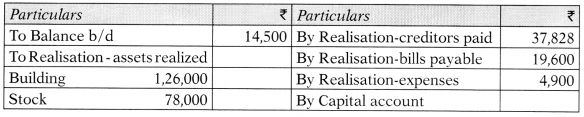

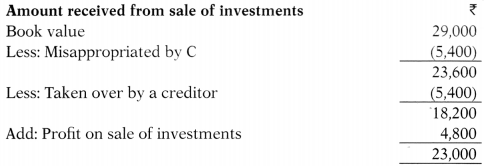

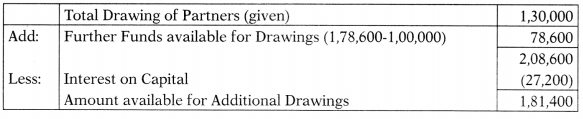

Question 29.

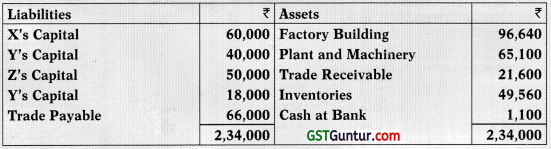

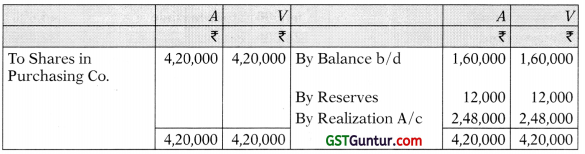

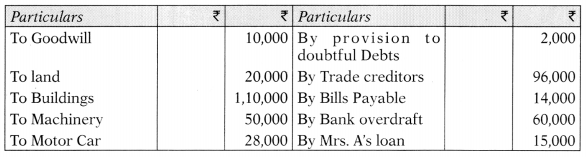

A, B and C share profits and losses of a business as to 3:2:1 respectively. Their balance sheet as at 31st March, 2017 was as follows:

The partners decide to convert their firm into a Joint Stock Company. For this purpose, ABC Ltd. was formed with an authorized capital of ₹ 10,00,000 divided into ₹ 100 equity Shares. The business of the firm was sold to the company as at the date of balance sheet given above on the following terms:

- Motor car, furniture, investments, loose tools, debtors and cash are not to be taken over by the company.

- Liabilities for bills payable and bank overdraft are to be taken over by the company.

- The purchase price is settled at ₹ 1,95,500 payable as to ₹ 75,500 in cash and the balance in company’s fully paid shares of ₹ 100 each.

- The remaining assets and liabilities of the firm are directly disposed of by the firm as per details given below:

Investments are taken over by A for ₹ 13,000; debtors realize in all ₹ 20,000; Motor Car, furniture and loose tools fetch ₹ 24,000, ₹ 4,000, and ₹ 1,000 respectively. A agrees to pay his wife’s loan. The creditors were paid ₹ 94,000 in final settlement of their claims. The realization expenses amount to ₹ 500. - The equity share received from the vendor company are to be divided among the partners in profit-sharing ratio.

You are required to prepare the necessary ledger accounts in the books of the partnership firm. (RTF)

Answer:

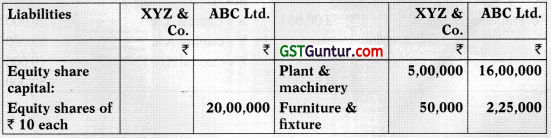

Realization A/c

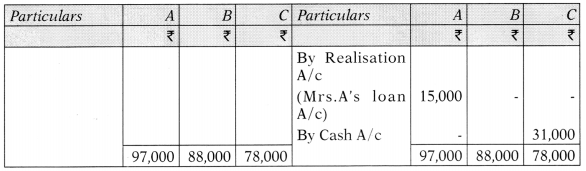

ABC Ltd. A/c

Partners’ Capital A/c’s

C’s Current A/c

Shares in ABC Ltd. A/c

Cash A/c

![]()

Question 30.

XYZ & Co. is a partnership firm consisting of Mr. X, Mr. Y and Mr. Z who share profits and losses in the ratio of 2:2:1 and ABC Ltd. is a company doing similar business.

Following is the summarized Balance Sheet of the firm and that of the company as at 31.3.2017:

It was decided that the firm XYZ & Co. be dissolved and all the assets (except cash in hand and cash at bank) and all the liabilities of the firm be taken over by ABC Ltd. by issuing 50,000 shares of ₹ 10 each at a premium of ₹ 2 per share.

Partners of XYZ & Co. agreed to divide the shares issued by ABC Ltd. in the profit-sharing ratio and bring necessary cash for settlement of their capital.

The trade payables of XYZ & Co. include ₹ 1,00,000 payable to ABC Ltd. An unrecorded liability of ₹ 25,000 of XYZ & Co. must also be taken over by ABC Ltd.

Prepare:

(i) Realisation account, Partners’ capital accounts and Cash in hand/Bank account in the books of XYZ & Co.

(ii) Pass journal entries in the books of ABC Ltd. for acquisition of XYZ & Co. and draw the Balance Sheet after the takeover. (RTP)

Answer:

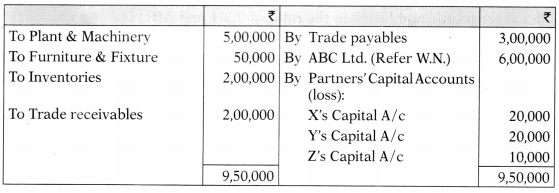

(i) In the books of XYZ & Co.

Realisation A/c

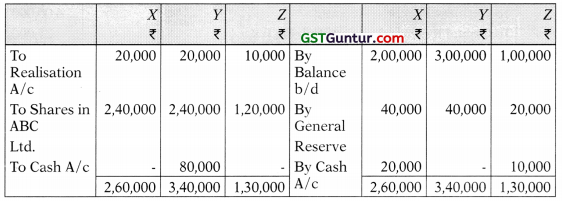

Partners’ Capital A/c’s

Cash and Bank A/c

Note:

It is assumed that cash at bank has been withdrawn to pay ₹ 80,000 to partner Y. However, payment to Y of ₹ 80,000 can also be made by cash ₹ 70,000 & by cheque ₹ 10,000.

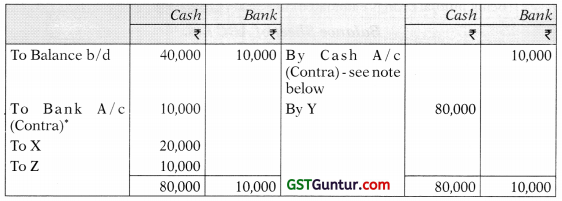

(ii) In the Books of ABC Ltd.

Journal Entries

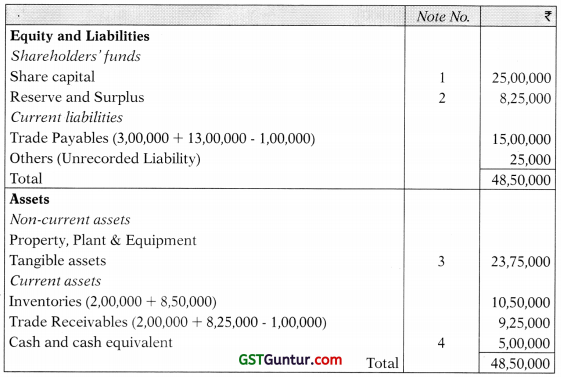

Balance Sheet of ABC Ltd. as at 31.3.2017 (After takeover of XYZ & Co.)

Notes to Accounts

Working Note:

Computation of purchase consideration:

50,000, Equity shares of 12 (10+2) each = ₹ 6,00,000

Equity shares distributed among partners:

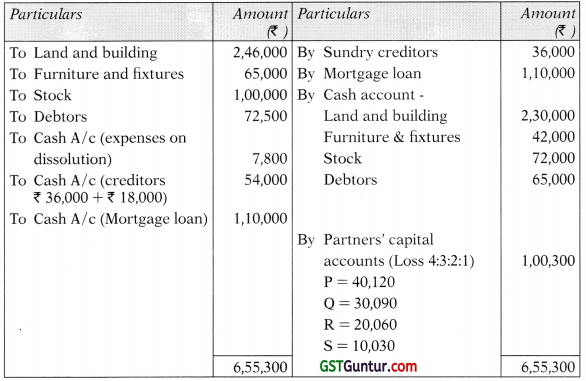

Question 31.

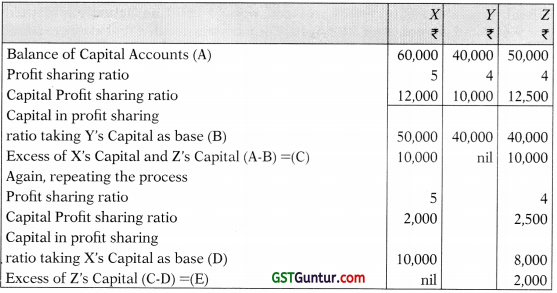

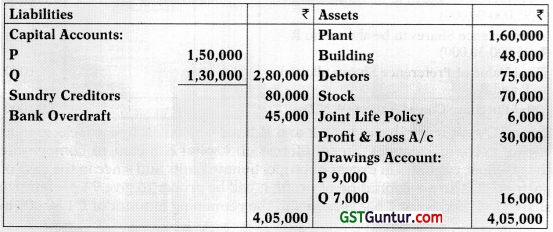

P, Q and Rare partners sharing profits and losses in the ratio 3: 2: 1 after allowing interest on capital @ 9% p.a. Their Balance Sheet as at 31st March, 2012 are as follows:

They applied for conversion of the firm into a Private Limited Company named PQR Pvt. Ltd. and the certificate was received on 01-04-2012. They decided to maintain same profit-sharing ratio and to preserve the priority in regard to repayment of capital as far as possible. For that purpose, they decided to insert a clause of Issuance of Preference shares in Memorandum of Association In addition to issuance of Equity shares of ₹ 10 each.

On 01-04-2012, the value of goodwill is to be determined on the basis of 2 years’ purchase of the average profit from the business of the last 5 years. The particulars of profits are as under:

The loss for the year ended 3 1-03-2009 was on account of loss by strike to the extent of ₹ 10,000.

It was agreed that rest of the assets are valued on the basis of the Balance Sheet as at 31-03-2012 except Plant & Machinery which is valued at ₹ 1,02,000.

You are required to prepare (a) the Balance Sheet of the Company as at 01-04-20 12,

(b) Partners’ Capital Accounts and

(c) Statement showing the final settlement between the partners taking Q’s capital as basis. (16 Marks) (Nov 2012)

Answer:

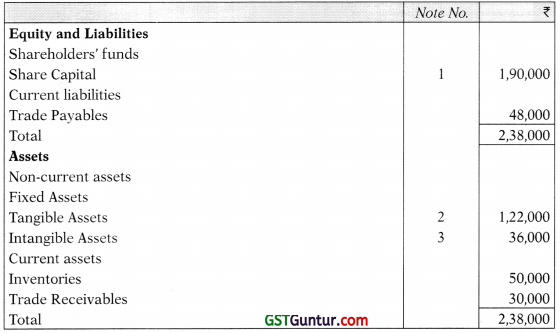

(a) Balance Sheet of the PQR Pvt Ltd. as on 1-4-2012

Notes to Accounts

(b) In the books of Partnership Firm

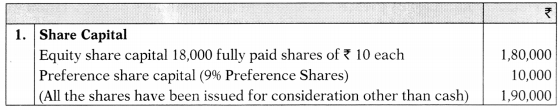

Partners’ Capital A/c’s

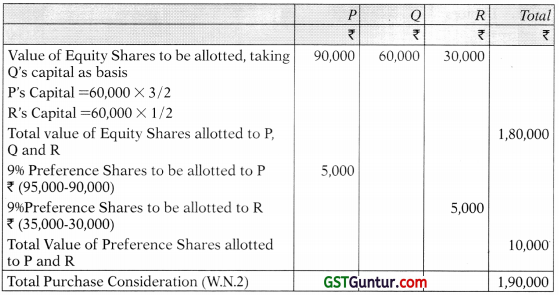

(c) Statement showing the final settlement between the Partners taking Q ‘s capital as basis

Taking Q’s capital as basis, both P and R have ₹ 5,000 each as excess in their capital account balances. Since interest on capital is meant to compensate those whose capital is in excess of proportionate limits and since in the case of partners it is an appropriation of profit, it will be proper to give 9% preference shares to P and R for ₹ 5,000 each and the remaining amount of ₹ 1,80,000 in the form of Equity Shares to he divided among P, Q and R in the ratio 3:2:1. They will then share the company’s profit in the ratio 3:2:1 after allowing preference dividend.

Working Notes:

1. Computation of goodwill

2. Computation of Purchase consideration

![]()

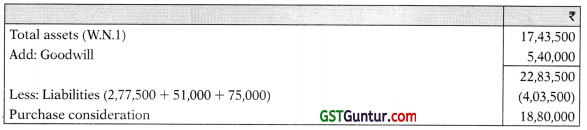

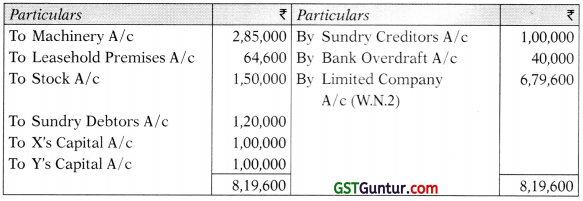

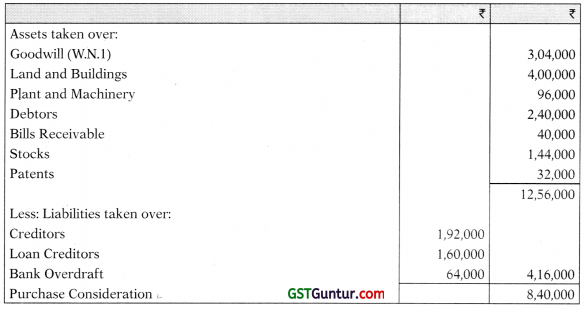

Question 32.

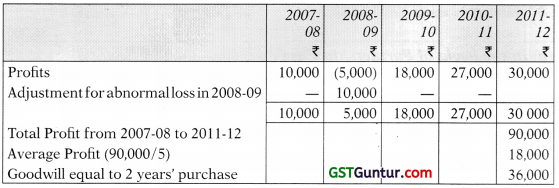

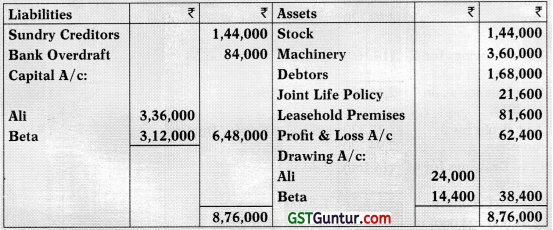

P and Q were carrying on business sharing profits and losses equally. The firm’s Balance Sheet as at 31.12.2013 was:

The operations of the business were carried on till 30.06.2014. P and 0 both withdrew in equal amount half the amount of profit made during the current period of six months after charging depreciation at 10% per annum on plant and after writing off 5% on building.

During the current period of six months, creditors were reduced by ₹ 20,000 and bank overdraft by ₹ 5,000.

The joint life policy was surrendered for ₹ 6,000 before 30th June 2014. Stock was valued at ₹ 84,000 and debtors at ₹ 68,000 on 30th June 2014. The other items remained the same as at 31.12.2013.

On 30.06.2014, the firm sold its business to PQ Ltd. The value of goodwill was estimated at ₹ 1,30,000 and the remaining assets were valued on the basis of the balance sheet as on 30.06.2014.

PQ Ltd. paid the purchase consideration in equity shares of ₹ 10 each. You are required to prepare:

(a) Balance sheet of the firm as at 30.06.2014,

(b) Realisation account,

(c) Partners’ Capital Accounts showing the final settlement between them. (16 Marks) (Nov 2014)

Answer:

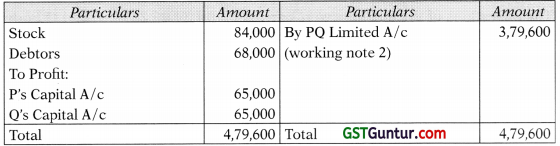

(a) Balance sheet of the firm as at 30.06.2014

(b) Realisation A/c

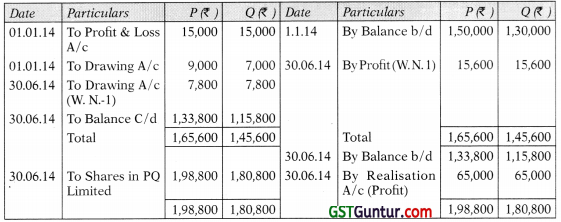

(c) Partner’s Capital A/c’s

Working Notes

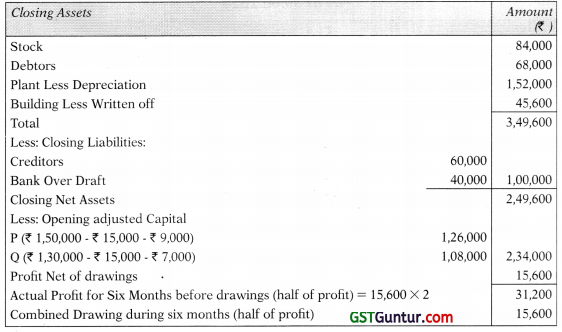

(1) Ascertainment of profit for the period of 6 Months ending 30.06.2014

(2) Computation of purchase consideration

Question 33.

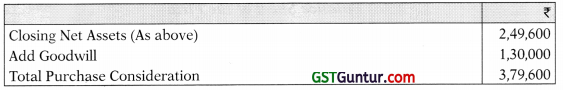

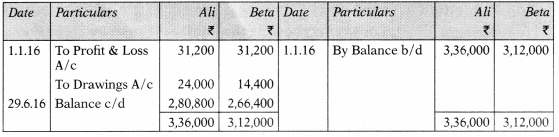

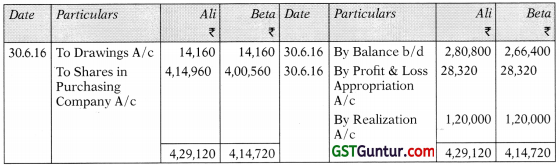

Ali and Beta were carrying on business, sharing profits and losses equally. The firm’s balance sheet as at 31-12-2015 was:

The business was carried on till 30-06-2016. The partners withdrew the amounts equal to half the amount of profit made during the period of six months ended on 30-06-2016, in equal proportion. The profit was calculated after charging depreciation at 10% p.a. on machinery and after writing off 5% on leasehold premises. In the half year, sundry creditors were reduced by ₹ 24,000 and bank overdraft by ₹ 36,000.

On 30-06-2016, stock was valued at ₹ 1,80,000 and debtors at ₹ 1,44,000; the Joint Life Policy had been surrendered for ₹ 21,600 before 30-06-2016 and other items remained the same as at 31-12-2015.

On 30-06-2016, the firm sold the business to a limited company. The value of goodwill was fixed at ₹ 2,40,000 and the rest of the assets were valued on the basis of the balance sheet as at 30-06-2016. The company paid the purchase consideration in equity shares of 10 each.

You are required to prepare:

(a) Balance Sheet of the firm as at 30-06-2016;

(b) Realisation Account; and

(c) Partners’ Capital Accounts showing the final settlement between them. (16 Marks) (May 2017)

Answer:

(a) Balance Sheet of the Firm as at 30.6.2016

(b) Realization A/c

(c) Partners’ Capital A/c

Working Notes:

(1) Computation of purchase consideration

(2) Ascertainment of profit for the period of 6 month ending 30th June, 2016

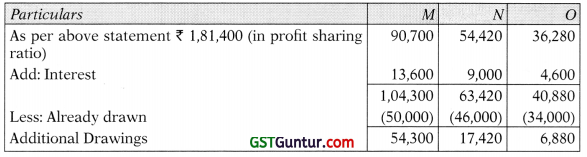

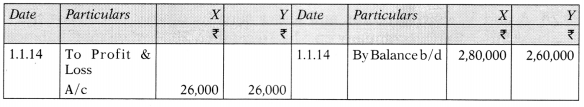

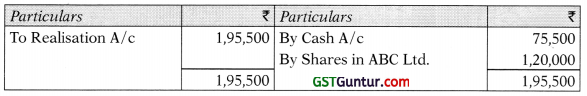

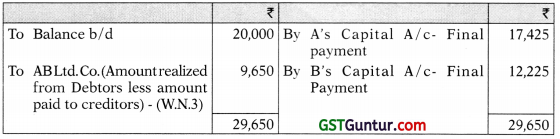

Question 34.

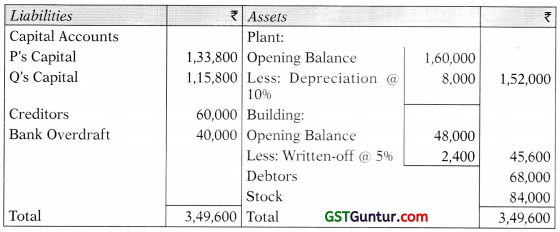

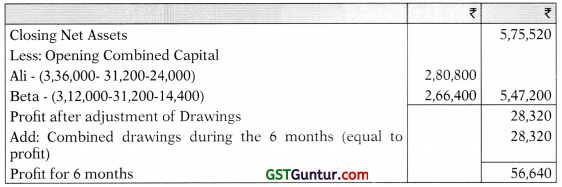

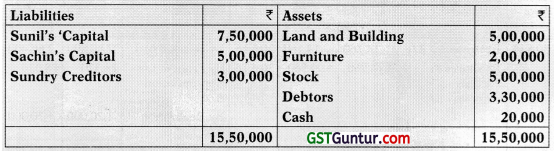

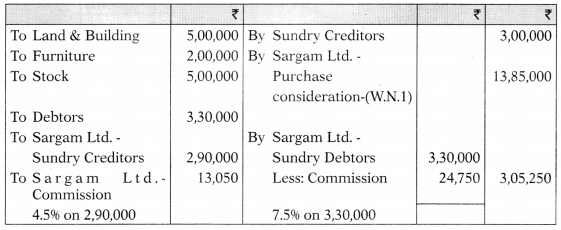

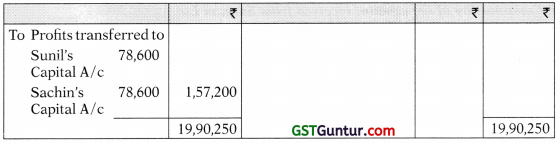

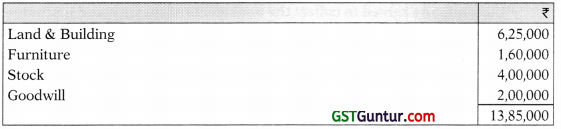

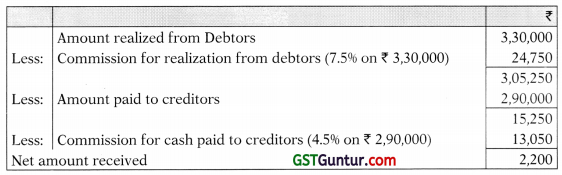

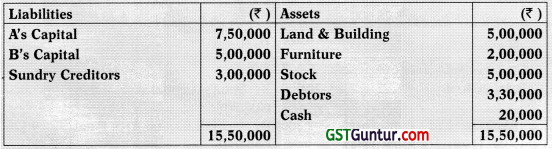

Sunil and Sachin carrying on business in partnership sharing profit and losses equally, wished to dissolve the firm and sell the business to Sargam Ltd. on 31-3-2018, when the firm’s position was as follows:

The arrangement with Sargam Ltd. was as follows:

- Land and Building was purchased at 25% more than the book value.

- Furniture and stock were purchased at book values less 20%.

- The goodwill of the firm was valued at ₹ 2,00,000.

- The firm’s debtors, cash and creditors were not to be taken over, but Sargam Ltd. agreed to collect the book debts of the firm and discharge the creditors of the firm as an agent, for which services, the company was to be paid 7.5% on all collections from the firm’s debtors and 4.5% on cash paid to firm’s creditors.

- The purchase price was to be discharged by the company in fully paid equity shares of ₹ 15 each at a premium of ₹ 5 per share.

- The partners distributed the company’s shares between themselves in their final claim ratio.

The company collected all the amounts from debtors. The creditors were paid off less by ₹ 10,000, allowed by them as discount. The company paid the balance due to the vendors in cash.

Prepare the Realisation account, the Capital Accounts of the partners and the cash account in the books of partnership firm. (16 Marks) (May 2018)

Answer:

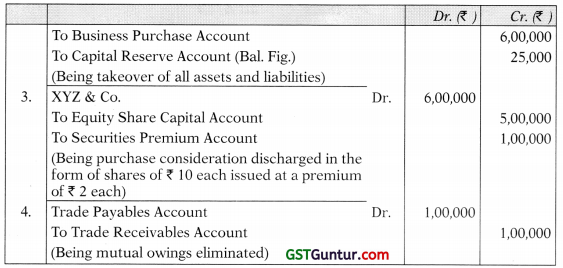

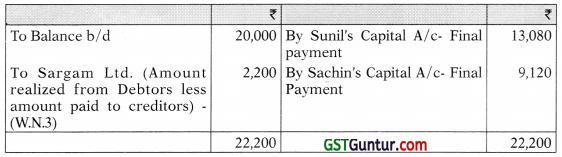

Realisation A/c

Partners’ Capital A/c’s

Cash A/c

Working Notes:

1. Computation of Purchase consideration

2. Shares received from Sargam Ltd.

The shares received from Sargam Ltd. have been distributed between the two partners Sunil & Sachin in the ratio of their final claims i.e., 8,28,600: 5,78,600.

No. of shares received from the company \(\frac{13,85,000}{20}\) = 69,250

Sunil gets \(\frac{69,250 \times 8,28,600}{14,07,200}\) = 40,776 shares valued at ₹ 20 = ₹ 8,15,520.

Sachin gets the remaining 28,474 shares, valued at ₹ 5,69,480 (28,474 × ₹ 20)

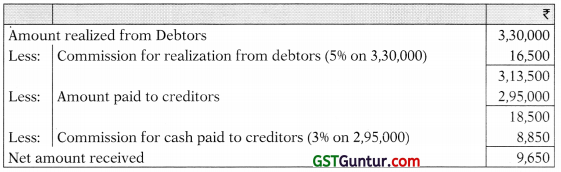

3 Computation of net amount received from Sargam Ltd.

![]()

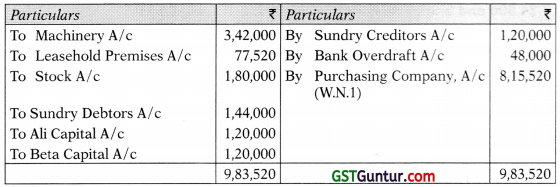

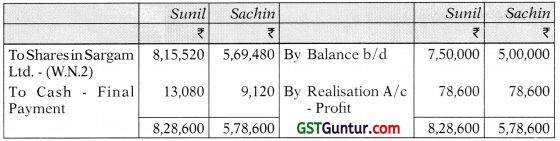

Question 35.

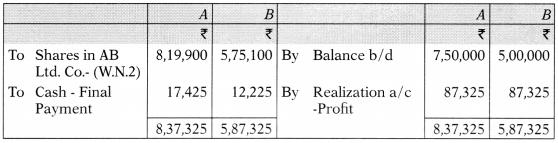

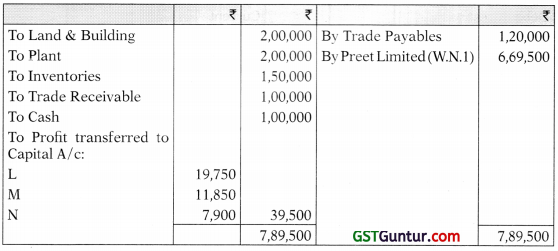

A and B carrying on business in partnership sharing profits and losses equally, wished to dissolve the firm and sell the business to AB Limited Company on 31.03.2018 when the firm’s position was as follows:

The arrangement with AB Limited Company was as follows:

- Land and Building was purchased at 20% more than the book value.

- Furniture and stock were purchased at book value less 15%.

- The Goodwill of the firm was valued at ₹ 2,00,000.

- The firm’s debtors, cash and creditors were not to be taken over, but the company agreed to collect the book debts of the firm and discharge the creditors of the firm as an agent, for which services the company was to be paid 5% on all collections from the firm’s debtors and 3% on cash paid to firm’s creditors.

- The purchase price was to be discharged by the company in fully paid equity shares of ₹ 10 each at a premium of ₹ 2 per share.

The company collected all the amounts from the debtors. The creditors were paid off less by ₹ 5,000 allowed as discount. The company paid the balance due to the vendors in cash.

Prepare the Realisation A/c, the Capital Accounts of the Partners and the Cash Account in the books of the Partnership firm. (15 Marks) (May 2018)

Answer:

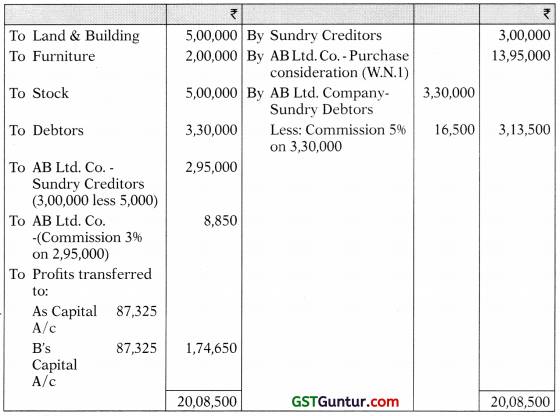

Realization A/c

Partner’s Capital A/c’s

Cash A/c

Working Notes:

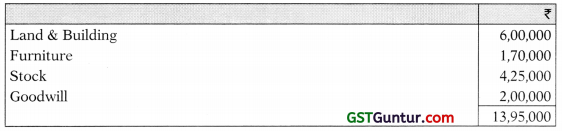

1. Computation of Purchase consideration:

2. Distribution of shares among partners

The shares received from the company have been distributed between the two partners A & B in the ratio of their final claims i.e., 8,37,325: 5,87,325*.

*No. of shares received from the company = 13,95,000/12 = 1,16,250

A gets [(1,16,250 × 8,37,325)/14,24,650] = 68,325 shares valued at 68,325 × 12 = ₹ 8,19,900. B gets the remaining 47,925 shares, valued at ₹ 5,75,100 (47,925 × 12)

3. Computation of net amount received from AB Ltd. on account of amount realized from debtors less amount paid to creditors.

Note:

Shares received from AB Ltd. Company have been distributed between two partners A and B in the ratio of their final claims.

![]()

Question 36.

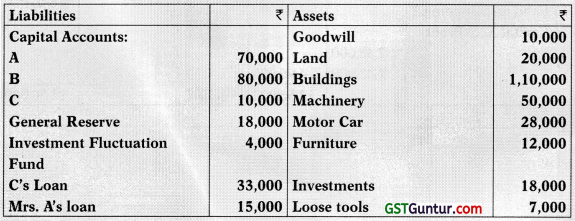

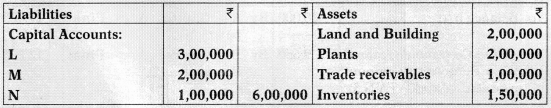

L, M and N share profits and losses in the ratio of 5:3:2. Their firm was dissolved due to misconduct of M and their balance sheet on that date was as under:

Balance Sheet as at 31-3-2016

The whole business of the firm was sold to Preet Limited, on that day on the following terms:

(i) Preet Limited will issue the following securities in consideration for transfer of business:

10,000 equity shares @ ₹ 15 each, 15,000 preference shares @ ₹ 15 each; and 20,000 debentures @ ₹ 14.725.

(ii) The agreed value of assets and liabilities of partnership firm are as follows:

Land & Building – ₹ 3,00,000, Plants – ₹ 1,50,000, Inventory – ₹ 1,40,000, Trade Receivable – ₹ 97,500, and Trade Payable – ₹ 1,18,000.

It was mutually decided that preference shares and debentures will be distributed in profit sharing ratio and cash brought in by the partner (if any) will be shared equally by the remaining partners before distribution of equity shares. Equity shares are distributed on residual basis at the end.

You are required to prepare Realization Account, Cash Account, Partners’ sij Current and Capital Accounts at the time of closing close the books of the firm.

Answer:

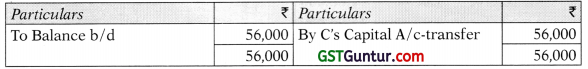

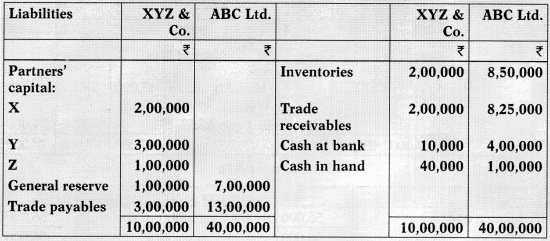

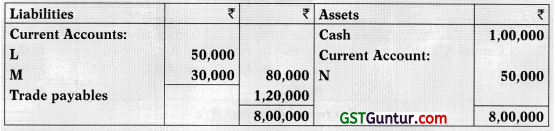

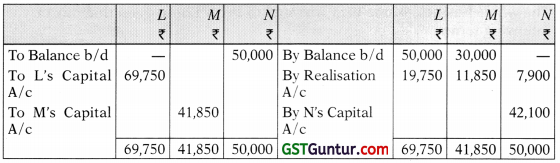

Realization A/c

Cash A/c

Partners’ Current A/c

Partners’ Capital A/c’s

Working Notes:

1. Computation of Purchase consideration

Net Payment Method

2. As whole business of the firm was sold to Preet Limited, cash balance of the firm ₹ 1,00,000 is also transferred to realization account. Cash brought in by N equal to Dr. balance appearing in his account, after distribution of preference shares and debentures in profit sharing ratio would be shared by L and M equally. The balance amount payable to L and M would be settled by transfer of equity shares in Preet Company.

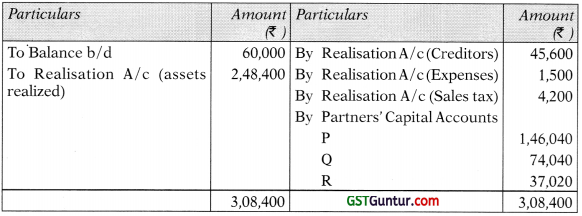

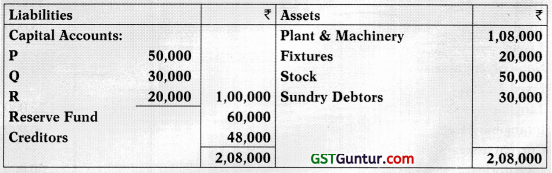

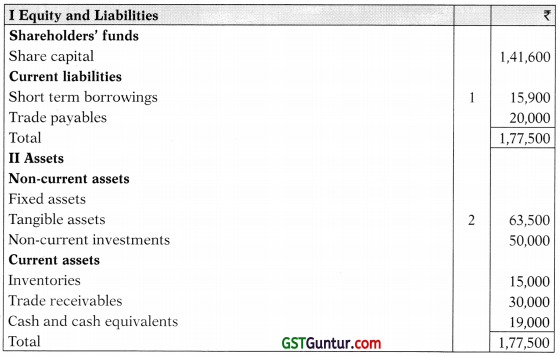

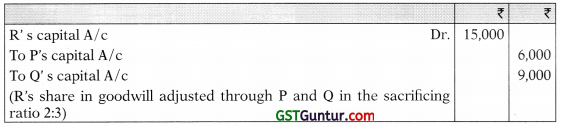

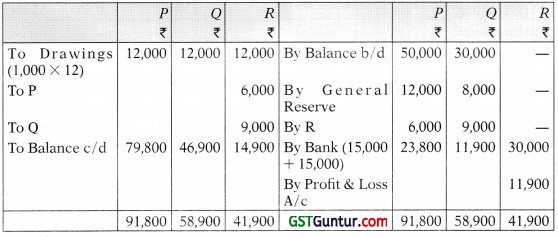

Question 37.

The following is the Balance Sheet of M/s. P and Q as on 31st March, 2012:

It was agreed that Mr. R is to be admitted for a fourth share in the future profits from 1st April, 2012. He is required to contribute cash towards goodwill and ₹ 15,000 towards capital.

The following further information is furnished:

(a) P & Q share the profits in the ratio 3: 2.

(b) P was receiving salary of ₹ 750 p.m. from the very inception of the firm in 2005 in addition to share of profit.

(c) The future profit ratio between P, Q & R will be 2:1:1. P will not get any salary after the admission of R.

(d) It was agreed that the value of goodwill of the firm shall appear in the books of the firm. The goodwill of the firm shall be determined on the basis of 3 years’ purchase of the average profits from business of the last 5 years. The particulars of the profits are as under:

The above Profits and Losses are after charging the Salary of P. The Profit of the year ended 31st March, 2008 included an extraneous profit of ₹ 40,000 and the loss for the year ended 31st March, 2010 was on account of less by strike to the extent of ₹ 20,000.

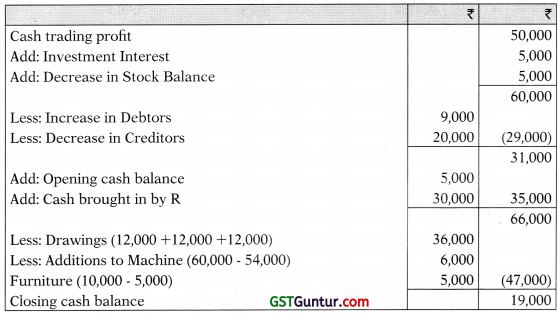

(e) The cash trading profit for the year ended 31st March, 2013 was ₹ 50,000 before depreciation.

(f) The partners had drawn each 1,000 p.m. as drawings.

(g) The value of other assets and liabilities as on 31st March, 2013 were as under:

Machinery (before depreciation) ₹ 60,000

Furniture (before depreciation) ₹ 10,000

Investment ₹ 50,000

Stock ₹ 15,000

Debtors ₹ 30,000

Creditors ₹ 20,000

(h) Provide depreciation @ 10% on Machinery and @ 5% on Furniture on the Closing Balance and interest is accumulated @ 6% on Q’s loan. The loan along with interest would be repaid within next 12 months.

(i) Investments are held from inception of the firm and interest is received @ 10% p.a.

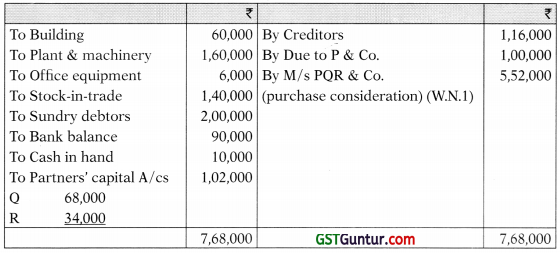

(j) The partners applied for conversion of the firm into a Private Limited Company. Certificate was received on 1st April, 2013. They decided to convert Capital A/cs of the partners into share capital in the ratio of 2:1:1 on the basis of a total Capital as on 31 st March, 2013. If necessary, partners have to subscribe to fresh capital or withdraw.

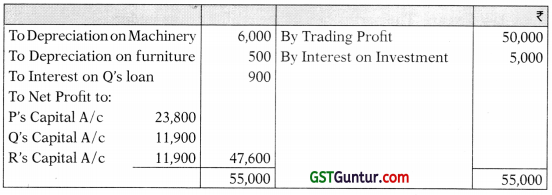

Prepare the Profit and Loss Account of the firm for the year ended 31 st March, 2013 and the Balance Sheet of the Company on 1st April, 2013. (16 Marks) (May 2013)

Answer:

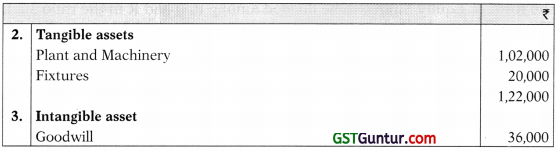

Profit and Loss Account for the year ending on 31st March, 2013

Balance Sheet of the PQR Pvt. Ltd. as on 1st April, 2013

Notes to Accounts

Working Notes:

1. Computation of goodwill

2. Computation of sacrificing ratio of Partners P and Q on admission of R

3. Goodwill entry

4. Partners’ Capital A/c’s

5. Balance Sheet of the firm as on 31st March, 2013

6. Cash balance (Closing)

7. Distribution of shares to partner’s

P and Q should withdraw capital of ₹ 9,000 (₹ 79,800 – ₹ 70,800) and ₹ 11,500 (₹ 46,900 – ₹ 35,400) respectively and R should subscribe shares of ₹ 20,500 (₹ 35,400 – ₹ 14,900).

![]()

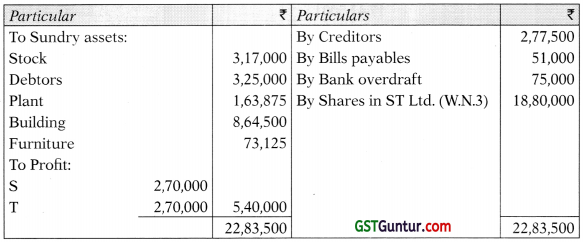

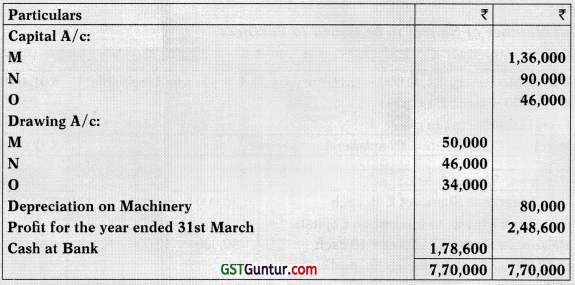

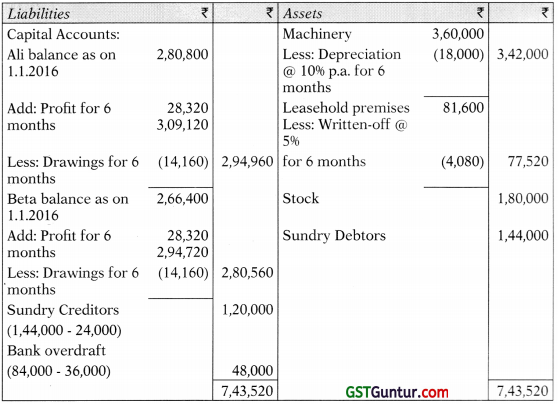

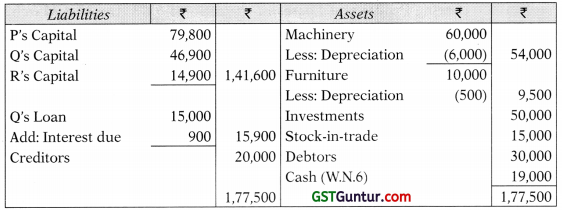

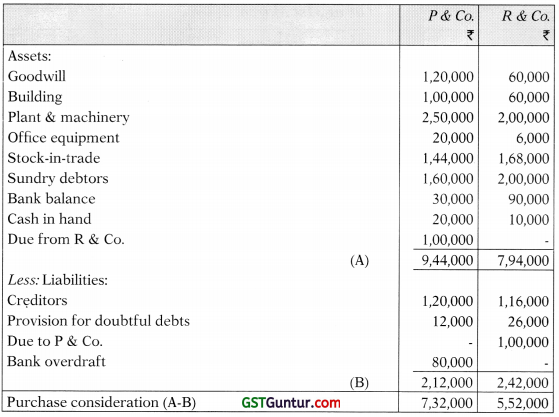

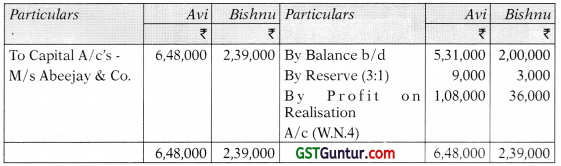

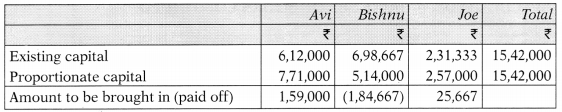

Question 38.

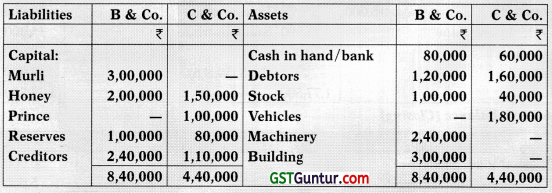

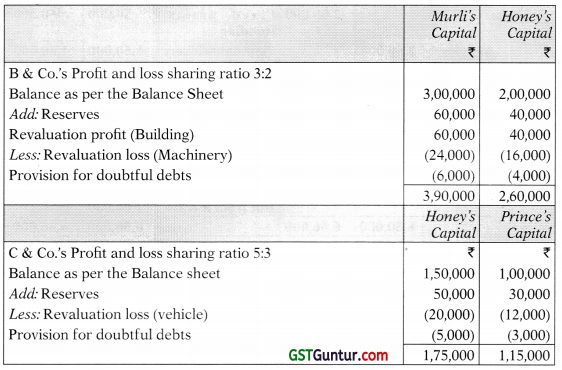

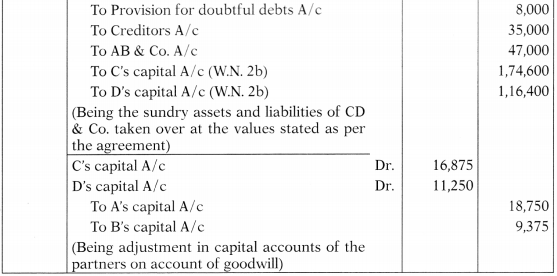

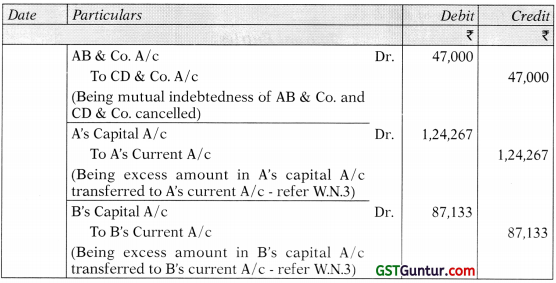

Firm B & Co. consists of partners Murli and Honey sharing Profits and Losses in the ratio of 3 : 2. The firm C & Co. consists of partners Honey and Prince sharing Profits and Losses in the ratio of 5 : 3. On 31st March, 2017 it was decided to amalgamate both the firms and form a new firm BC & Co., wherein Murli, Honey and Prince would be partners sharing Profits and Losses in the ratio of 4:5:1.

Balance Sheet as at 31.3.2017

The following were the terms of amalgamation:

- Goodwill of B & Co., was valued at ₹ 1,50,000. Goodwill of C & Co. was valued at ₹ 80,000. Goodwill account not to be opened in the books of the new firm but adjusted through the Capital accounts of the partners,

- Building, Machinery and Vehicles are to be taken over at ₹ 4,00,000, ₹ 2,00,000 and ₹ 1,48,000 respectively.

- Provision for doubtful debts ₹ 10,000 in respect of B & Co. and ₹ 8,000 in respect of C & Co. are to be provided.

You are required to:

(i) Show, how the value of Goodwill is to be adjusted amongst the partners,

(ii) Prepare the Balance Sheet of BC & Co. as at 31.3.2017 by keeping partners’ capital in their profit-sharing ratio by taking capital of ‘Honey’ as the basis. The excess or deficiency to be kept in the respective Partners’ Current accounts. (RTP)

Answer:

(i) Adjustment for goodwill (net impact)

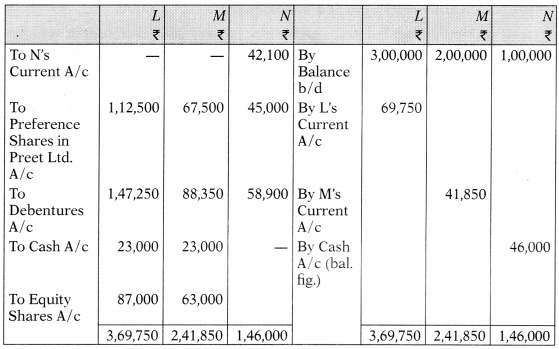

(ii) Balance Sheet of BC & Co. (New firm) as on 31.3.2017

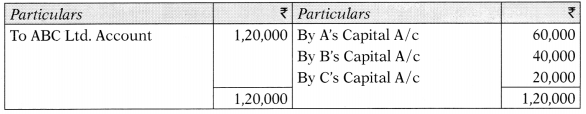

Working Notes:

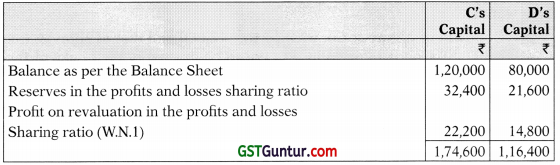

1. Balance of Capital Accounts at the time of amalgamation of firms

2. Balance of Capital Accounts in the balance sheet of the new firm as on 31.3.2017

![]()

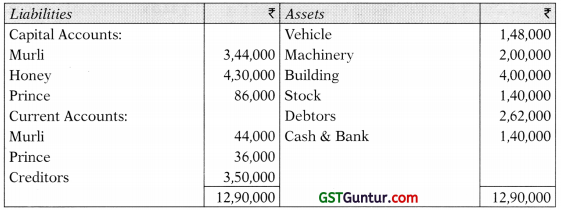

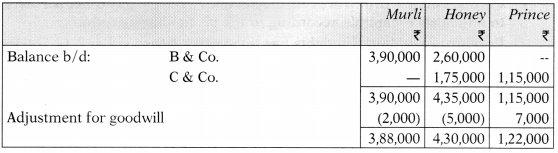

Question 39.

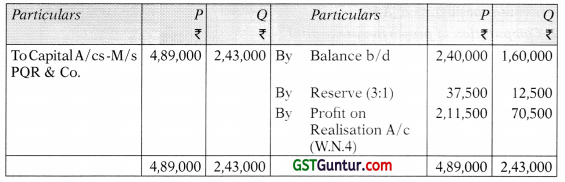

P and Q are partners of P & Co. sharing Profit and Losses in the ratio of 3:1 and Q and Rare partners of R & Co., sharing profits and losses in the ratio of 2:1. On 31st March, 2009, they decide to amalgamate and form a new firm M/s PQR & Co., wherein P, Q and R would be partners sharing profits and losses in the ratio of 3:2:1. The Balance Sheets of two firms on the above date are as under:

The amalgamated firm took over the business on the following terms:

(a) Building of P & Co. was valued at ₹ 1,00,000.

(b) Plant and machinery of P & Co. was valued at ₹ 2,50,000 and that of R & Co. at ₹ 2,00,000.

(c) All stock in trade is to be appreciated by 20%.

(d) Goodwill value of P & Co. at ₹ 1,20,000 and R & Co. at ₹ 60,000, but the same will not appear in the books of PQR & Co.

(e) Partners of new firm will bring the necessary cash to pay other partners to adjust their capitals according to the profit-sharing ratio.

(f) Provisions for doubtful debts has to be carried forward at ₹ 12,000 in respect of debtors of P & Co. and ₹ 26,000 in respect of debtors of R & Co.

You are required to prepare the Balance Sheet of new firm and capital accounts of the partners in the books of old firms. (16 Marks) (May 2010), (16 Marks) (May 2016)

Answer:

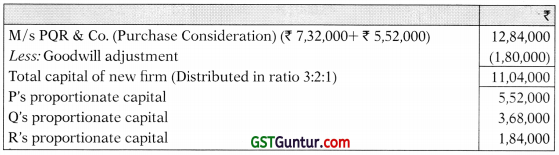

Balance Sheet of M/s PQR & Co. as at 31st March, 2009

₹ 20,000 + ₹ 10,000 + ₹ 1,53,000 + ₹ 30,000 – ₹ 1,83,000 = ₹ 30,000

In the books of P & Co. Partners’ Capital A/c’s

In the books of R & Co.

Partners’ Capital A/c’s

Working Notes:

1. Computation of purchase consideration

2. Computation of proportionate capital

3. Computation of Capital Adjustments

4. In the books of P & Co.

Realisation A/c

5. In the books of R & Co. Realisation A/c

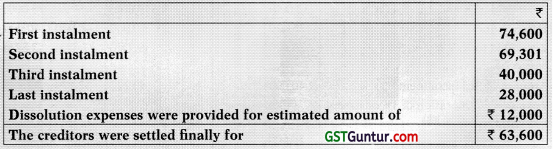

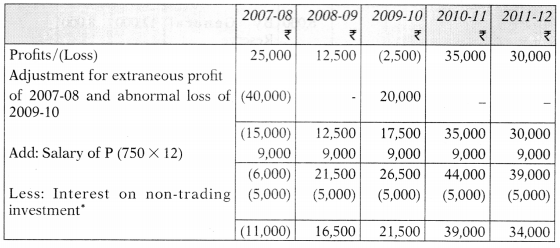

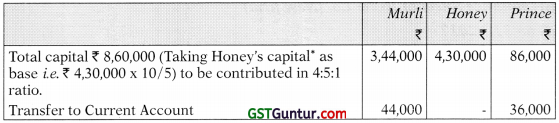

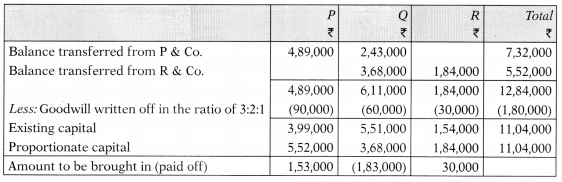

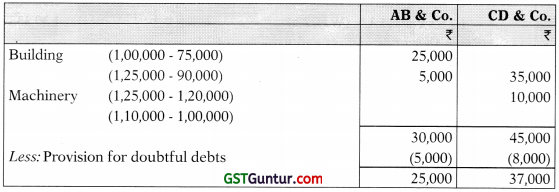

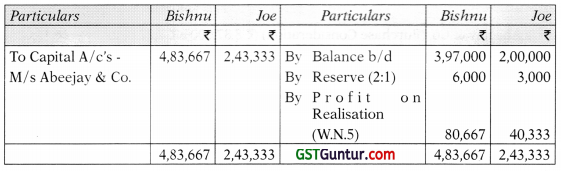

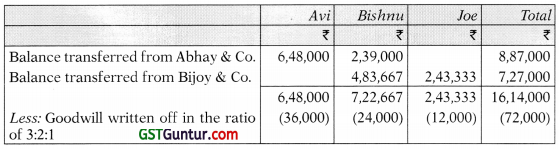

Question 40.

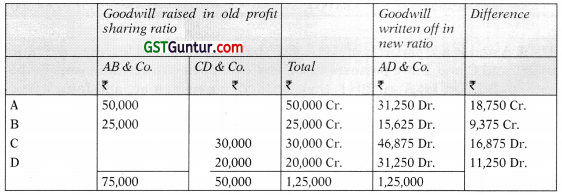

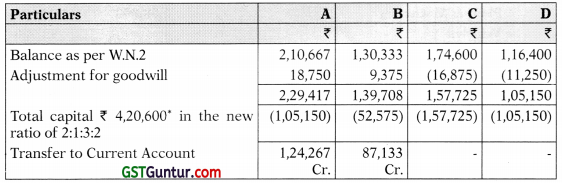

A and B are partners of AB & Co. sharing profits and losses in the ratio of 2:1 and C and D are partners of CD & Co. sharing profits and losses in the ratio of 3:2. On 1st April 2011, they decided to amalgamate and form a new firm M/s. AD & Co. wherein all the partners of both the firm would be partners sharing profits and losses in the ratio of 2:1:3:2 respectively to A,B,C and D.

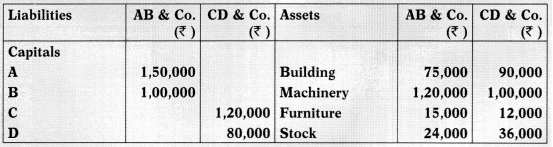

Their balance sheets on that date were as under:

The amalgamated firm took over the business on the following terms:

(a) Building was taken over at ₹ 1,00,000 and ₹ 1,25,000 of AB & Co. and CD & Co. respectively. And machinery was taken over at ₹ 1,25,000 and ₹ 1,10,000 of AB & Co. and CD & Co. respectively.

(b) Goodwill of AB & Co. was worth ₹ 75,000 and that of CD & Co. was worth ₹ 50,000. Goodwill account was not to be opened in the books of the new firm; the adjustments being recorded through capital accounts of the partners.

(c) Provision for doubtful debts has to be carried forward at ₹ 5,000 in respect of debtors of AB & Co. and ₹ 8,000 in respect of CD & Co.

You are required:

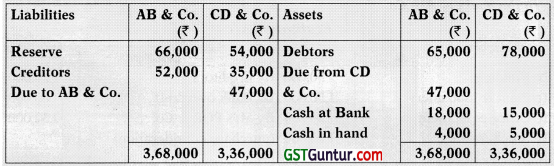

(i) Compute the adjustments necessary for goodwill.

(ii) Pass the Journal Entries in the books of AD & Co. assuming that excess/ deficit capital (taking D’s capital as base) with reference to share in profits are to be transferred to current accounts. (16 Marks) (May 2011)

Answer:

(i) Adjustment of goodwill (net impact)

(ii) In the books of AD & Co.

Journal Entries

Working Notes:

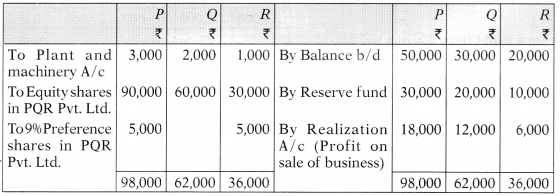

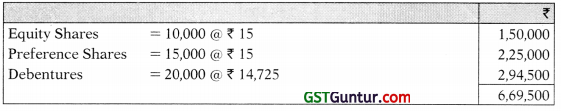

(1) Computation of Revaluation Profit

(2) Balance of capital accounts of partners on transfer of business to AD & Co.

(a) AB & Co.

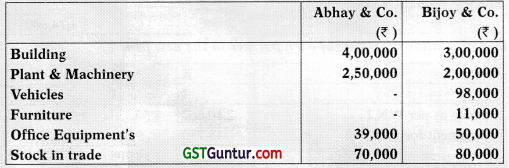

(b) CD & Co.

(3) Calculation of capital of each partner in the new firm

* Taking D’s capital as the base which is 2/8th of total capital; total capital will be 1,05,150× 8/2 ie. ₹ 4,20,600.

![]()

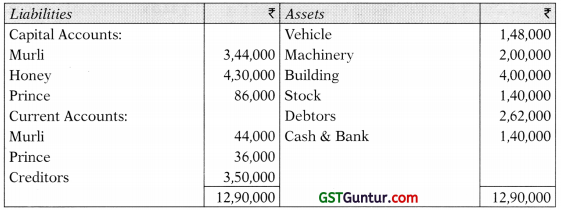

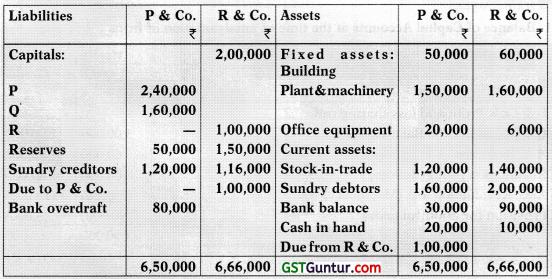

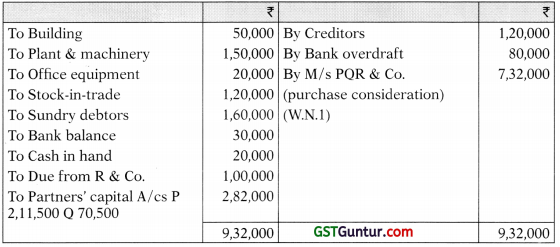

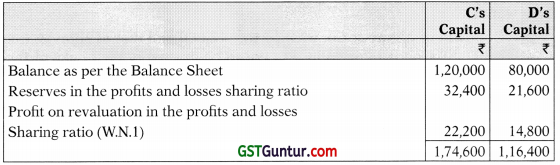

Question 41.

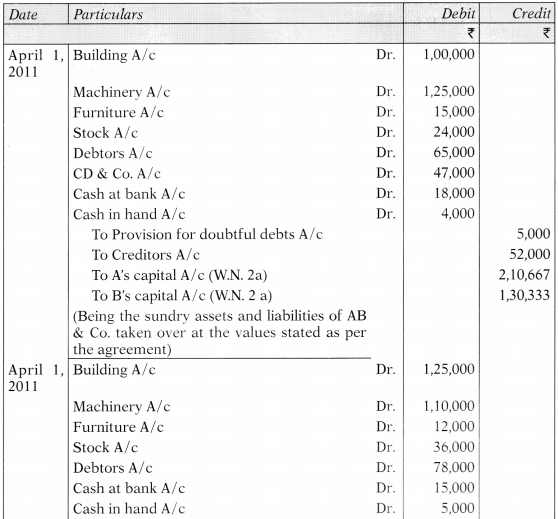

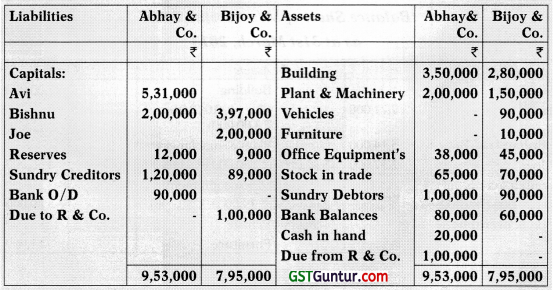

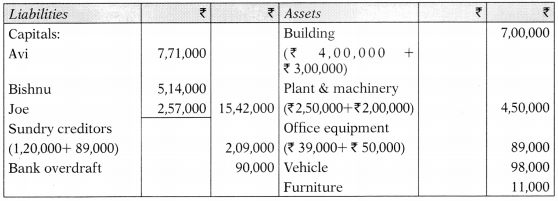

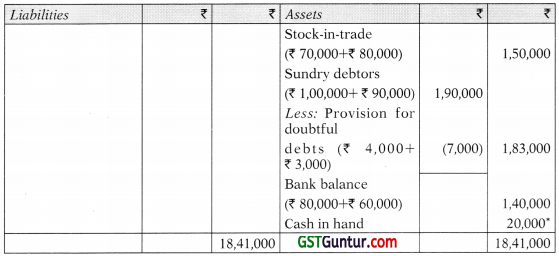

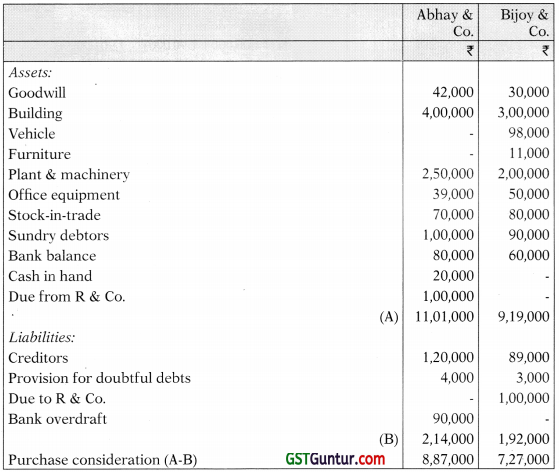

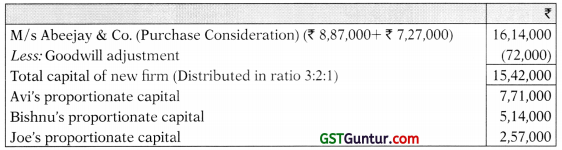

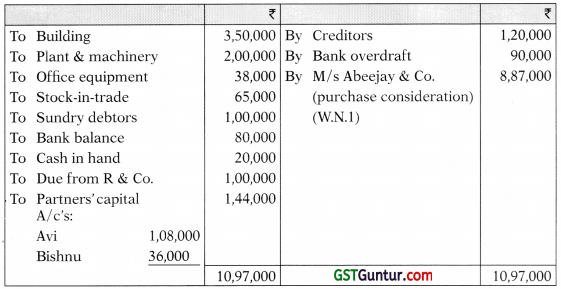

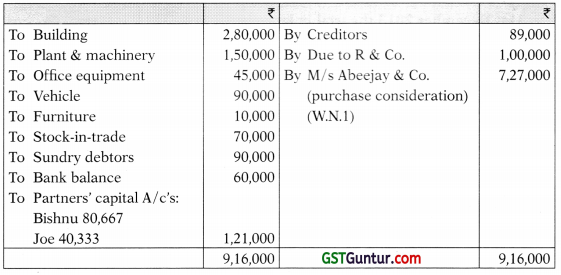

Avi and Bishnu are partners of Abhay & Co. sharing profit and losses in the ratio 3:1 and Bishnu and Joe are partners of Bijoy & Co. sharing profit and losses in the ratio 2:1. On 31st March, 2013, they decided to amalgamate and form a new firm M/s Abeejay & Co., wherein Avi, Bishnu and Joe would be partners sharing profit and losses in the ratio 3:2:1. The Balance Sheets of the two firms on 31st March, 2013 were as under:

The amalgamated firm M/s Abeejay & Co. took over the business on the following terms:

(a) Goodwill of Abhay & Co. was worth ₹ 42,000 and that of Bijoy & Co. ₹ 30,000. Goodwill account was not to be opened in the books of the new firm; the adjustments being recorded through capital accounts of the partners.

(b) The following assets were valued as below:

(c) Provision for doubtful debt was carried forward at 4,000 in respect of Debtors of Abhay & Co. and ₹ 3,000 in respect of Debtors of Bijoy & Co.

(d) Partners of new firm brought necessary cash to pay other partners to adjust their capitals according to the profit-sharing ratio.

You are required to:

(i) Prepare the Balance Sheet of the new firm as on 31st March, 2013.

(ii) Prepare Capital Accounts of the partners in the books of old firms. (16 Marks) (Nov. 2013)

Answer:

Balance Sheet of M/s Abeejay & Co. as at 31st March, 2013

* ₹ 20,000 + ₹ 1,59,000 + ₹ 25,667 – ₹ 184,667 = ₹ 20,000.

Partners’ Capital A/c’s (in the books of Abhay & Co.)

Partners ’ Capital A/c’s (in the books of Bijoy & Co.)

Working Notes:

1. Computation of purchase consideration

2. Computation of proportionate capitals

3. Computation of Capital Adjustments

4. Realisation A/c (in the books of Abhay & Co.)

5. Realisation Account (in the books of Bijoy & Co.)

![]()

Question 42.

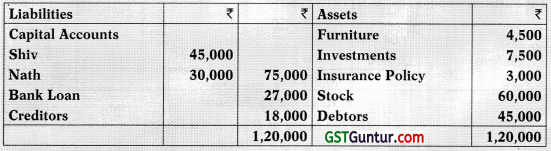

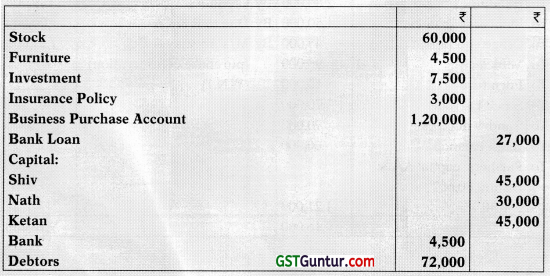

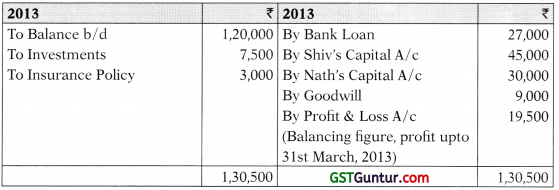

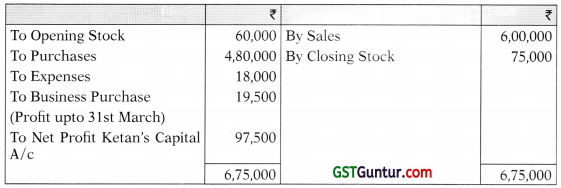

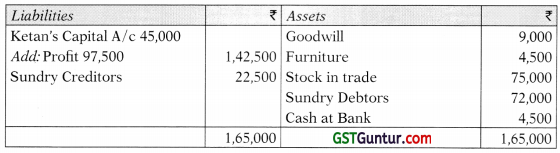

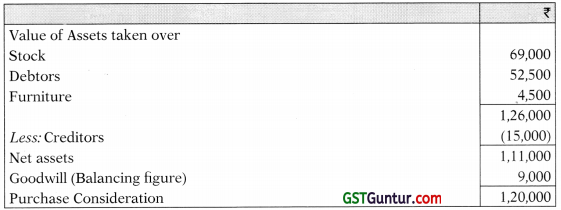

Ketan Kumar acquires the business of M/s Shiv and Nath on payment of ₹ 1,20,000 on 31st March 2013. The book value of assets and liabilities taken over by him as follows:

Debtors 52,500

Furniture 4,500

Stock 69,000

Creditors 15,000

There was no change between 1st January, 2013 and 31st March, 2013 in the book value of the assets and liabilities not taken over. The same set of books has been continued after the acquisition and no entries of the acquisition have been passed except for the payment of ₹ 1,20,000 made by Ketan Kumar.

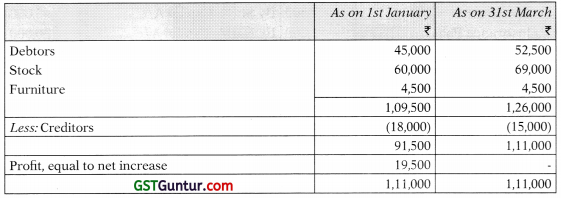

From the following balance sheet and trial balance prepare Business Purchase Account, Profit and Loss Account for the year ended 31st December, 2013 and Balance Sheet at that date.

Balance Sheet as at December, 2012

On 31st December 2013 the trial balance is:

(RTP)

(RTP)

Answer:

Business Purchase Account

Profit & Loss Account of Ketan for the year ended 31st December, 2013

Balance Sheet of Ketan as on 31st December, 2013

Working Notes:

(1) ComputatIon of Goodwill

(2) Increase in net assets upto 31st March 2013: