Accounts from Incomplete Records – CA Inter Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Accounts from Incomplete Records – CA Inter Accounts Study Material

Statement Of Affairs Method — Simple Problems

Question 1.

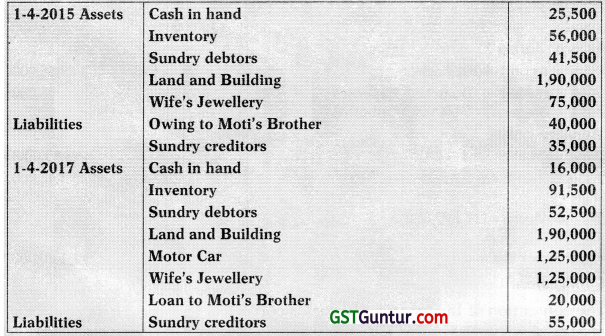

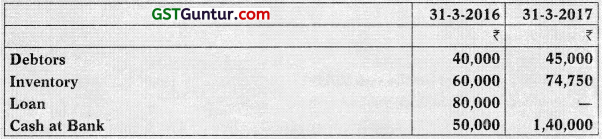

The Income Tax Officer, on assessing the income of Mr, X for the financial years 2015-2016 and 2016-17 feels that Mr. X has not disclosed the full income. He gives you the following particulars of assets and liabilities of Mr. X as on 1st April, 2015 and 1st April, 2017.

During the two years the domestic expenditure was ₹ 4,000 p.m. The declared income of the financial years was ₹ 1,05,000 for 2015-16 and ₹ 1,23,000 for 2016-17 respectively.

State whether the Income-tax Officer’s contention is correct. Explain by giving your workings.

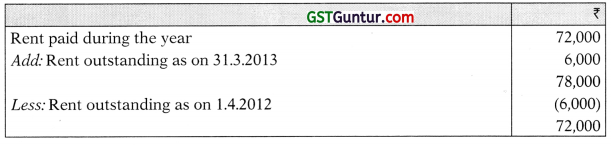

Answer:

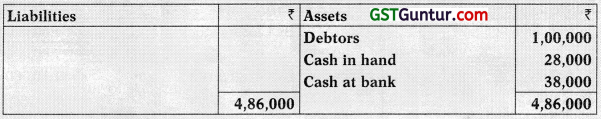

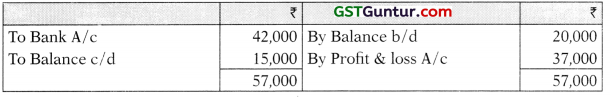

Computation of Capital Balance of Mr. X

Conclusion:

The contention of Income-tax officer’s is correct.

![]()

Question 2.

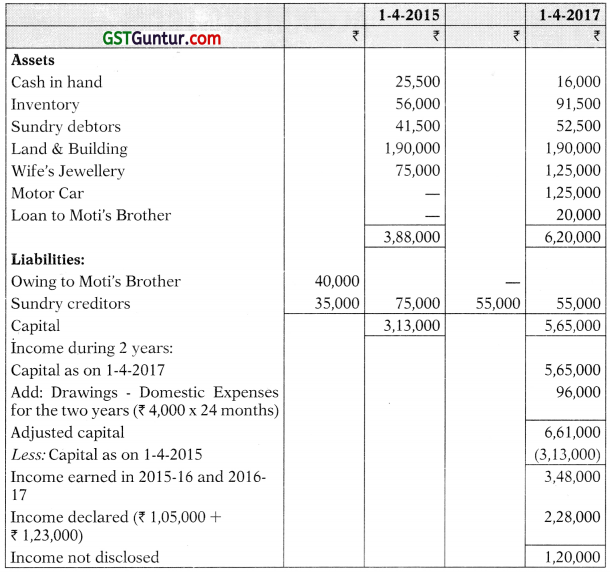

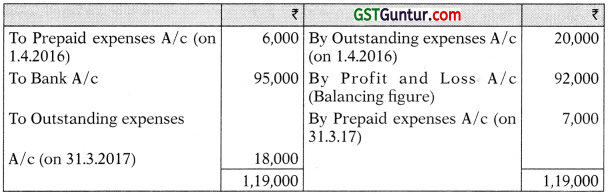

Mr. Aman is running a business of readymade garments. He does not maintain his books of account under double entry system. While assessing the income of Mr. Aman for the financial year 2016-17, Income Tax Officer feels that he has not disclosed the full income earned by him from his business. He provides you the following information:

During the year 2016-17, one life insurance policy of Mr. Aman was matured and amount received ₹ 50,000 was retained in the business.

State whether the Income Tax Officer’s contention is correct. Explain by giving your working. (4 Marks) (Nov. 2017)

Answer:

Computation of Capital balances of Mr. Aman

Computation of Profit

Conclusion:

The contention of Income-tax Officer’s is correct.

Statement Of Affairs Method — Advanced Problems

Question 3.

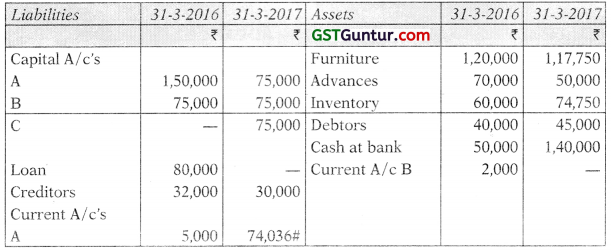

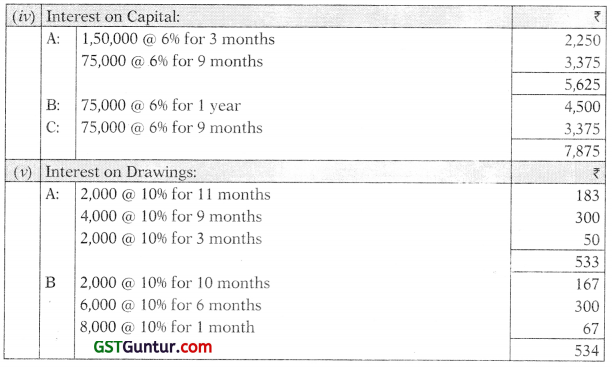

A and B are in Partnership having Profit sharing ratio 2:1. The following information is available about their assets and liabilities:

The partners are entitled to salary @ ₹ 2,000 p.m. They contributed proportionate capital. Interest is paid @ 6% on capital and charged @ 10% on drawings.

Drawings of A and B

On 30th June, they took C as 1 /3rd partner who contributed ₹ 75,000. C is entitled to share of 9 months’ profit. The new profit ratio becomes 1:1:1. A withdrew his proportionate share. Depreciate furniture @ 10% p a., new purchases ₹ 10,000 may be depreciated for l/4th of a year.

Current account balances as on 31-3-2016: A ₹ 5,000 (Cr.), B ₹ 2,000 (Dr.)

Prepare Statement of Profit, Current Accounts of partners and Statement of Affairs as on 31-3-2017. (Examination Ques.)

Answer:

Statement of Affairs as on 31-3-2016 and 31-3-2017

# See current. A/cs.

![]()

Notes:

This is after adding salary, interest on capital and deducting drawings and interest on drawings.

Current Accounts

Statement showing Computation of Profit

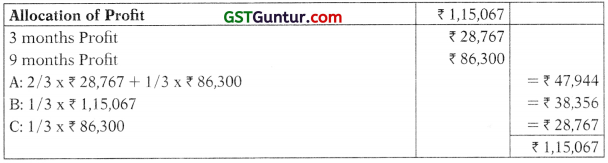

Final Accounts Method/Conversion Method — Simple Problems

Question 4.

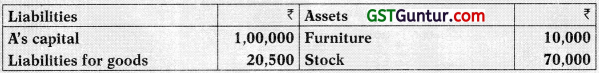

The following is the Balance Sheet of the retail business of Mr. A as at 31st December, 2015:

You are furnished with the following information:

(1) A sell’s his goods at a profit of 20% on sales.

(2) Goods are sold for cash and credit. Credit customers pay by cheques only.

(3) Payments for purchases are always made by cheques.

(4) It is the practice of A to send to the bank every weekend the collections of the week after paying every week, salary of ₹ 300 to the clerk, Sundry expenses of ₹ 50 and personal expenses ₹ 100.

Analysis of the Bank Pass-Book for the 13 weeks period ending 31st March, 2016 disclosed the following:

Payments to creditors ?

On the evening of 31st March, 2016, the Cashier absconded with the available cash in the cash box. There was no cash deposit in the week ended on that date. You are required to prepare a statement showing the amount of cash defalcated by the Cashier and also a Profit and Loss Account for the period ended 31st March, 2016 and a Balance Sheet as on that date.

Answer:

Statement showing computation of cash defalcated by the cashier

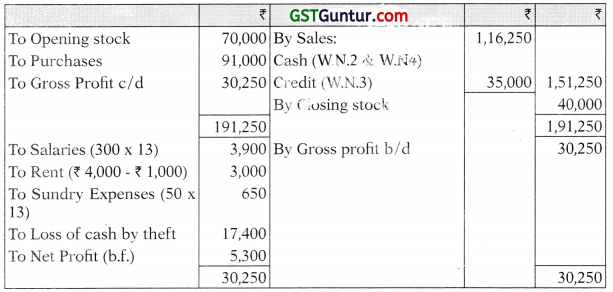

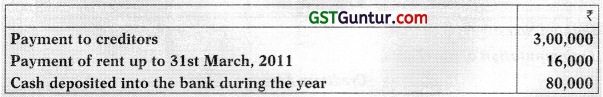

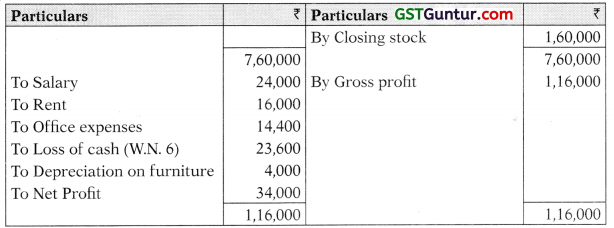

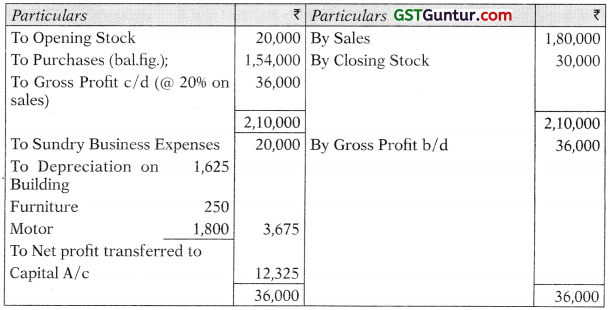

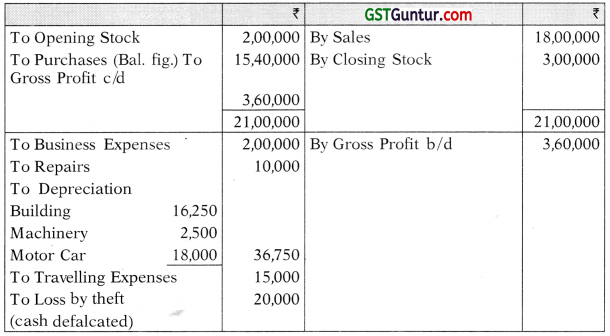

Trading and Profit and Loss Account for the 13-week period ended 31st March, 2016

Balance Sheet as on 31st March, 2016

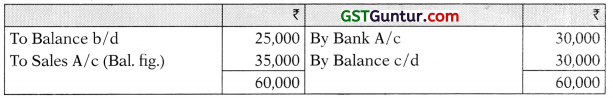

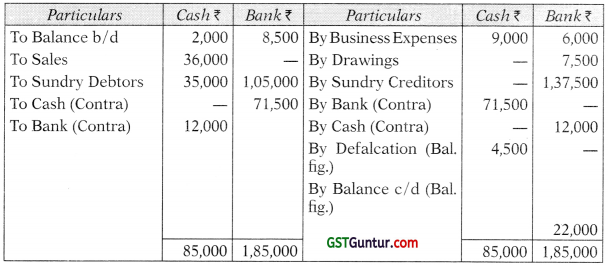

![]()

Working Notes

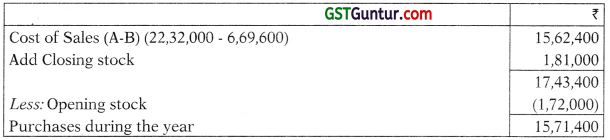

1. Computation of Purchases

Creditors Account

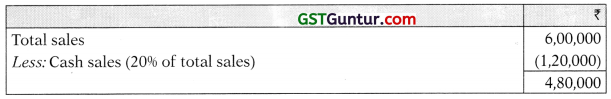

2. Computation of Total sales

3. Computation of Credit Sales

Debtors Account

4. Computation of Cash Sales

5. Bank balance as on 31.3.2016

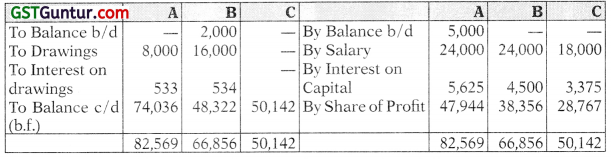

Question 5.

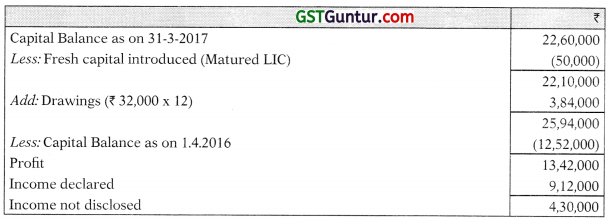

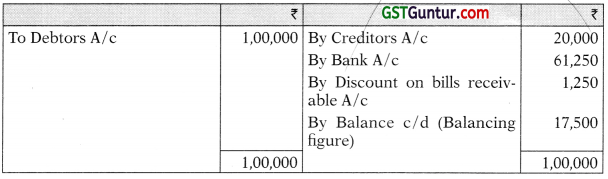

The books of account of Ruk Ruk Maan of Mumbai showed the following figures:

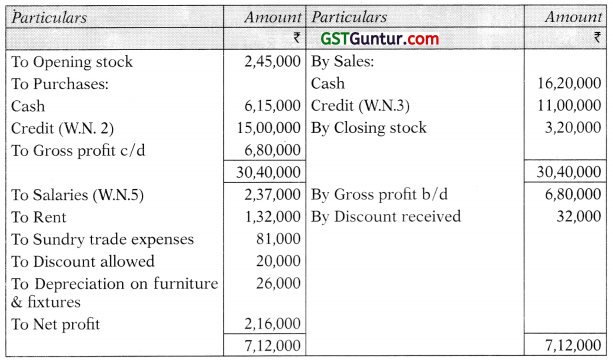

An analysis of the cash book revealed the following:

Depreciation is provided on furniture & fixtures @10% p.a. on diminishing balance method. Ruk Ruk Maan maintains a steady gross profit rate of 25% on sales.

You are required to prepare Trading and Profit and Loss account for the year ended 31st March, 2009 and Balance Sheet as on that date. (16 Marks) (May 2010)

Answer:

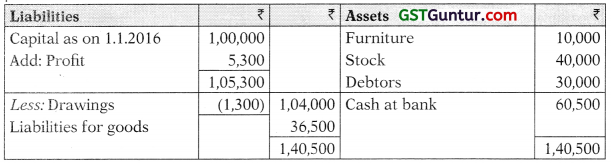

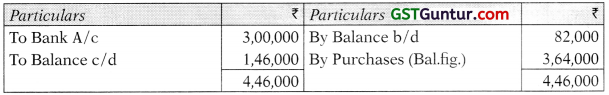

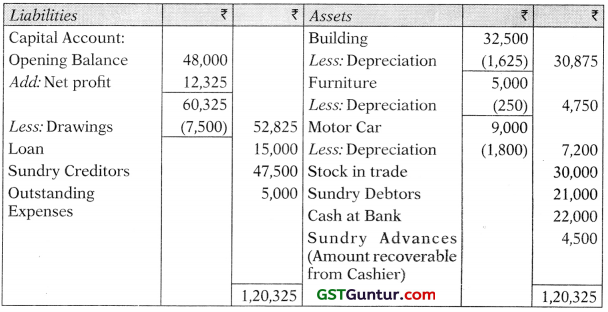

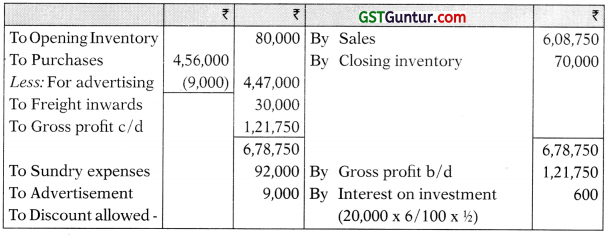

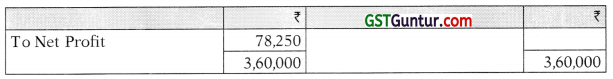

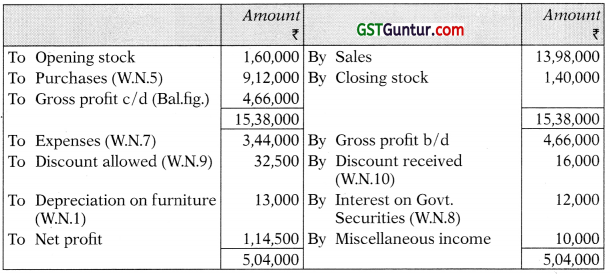

Trading & Profit & Loss Account for the year ended 31st March, 2009

Balance Sheet as at 31st March, 2009

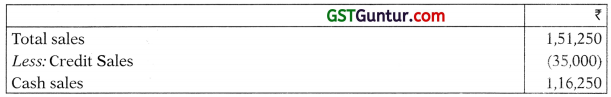

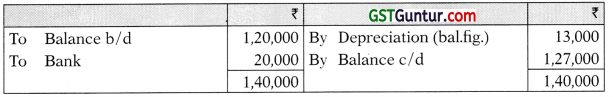

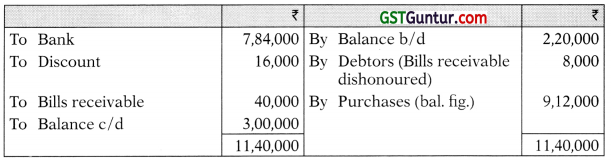

![]()

Working Notes:

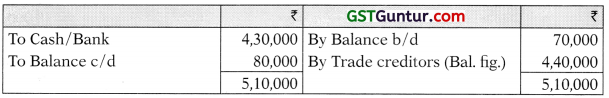

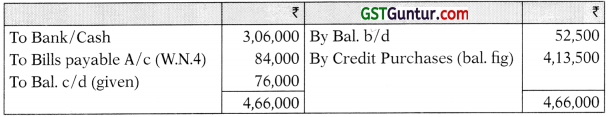

1. Bills Payable Account

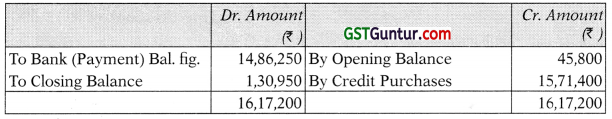

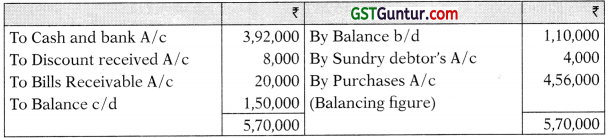

2. Creditors Account

3. Computation of credit sales

4. Debtors Account

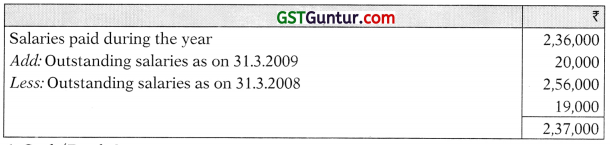

5. Salaries

6. Cash /Bank Account

7. Balance Sheet

Question 6.

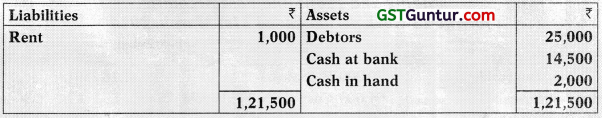

Mr. A runs a business of readymade garments. He closes the books of account on 31st March, 2010. The Balance Sheet as on 31st March, 2010 was as follows:

You are furnished with the following information:

- His sales, for the year ended 31st March, 2011 were 20% higher than the sales of previous year, out of which 20% sales was cash sales.

Total sales during the year 2009-10 were ₹ 5,00,000. - Payments for all the purchases were made by cheques only.

- Goods were sold for cash and credit both. Credit customers pay be cheques only.

- Deprecation on furniture is to be charged 10% p.a.

- Mr. A sent to the bank the collection of the month at the last date of each month after paying salary of ₹ 2,000 to the clerk, office expenses ₹ 1,200 and personal expenses ₹ 500.

Analysis of bank pass book for the year ending 31st March, 2011 disclosed the following:

The following are the balances on 31st March, 2011:

On the evening of 31st March, 2011, the cashier absconded with the available cash in the cash book.

You are required to prepare Trading and Profit and Loss A/c for the year ended 31st March, 2011 and Balance Sheet as on that date. All the workings should form part of the answer. (16 Marks) (May 2011)

Answer:

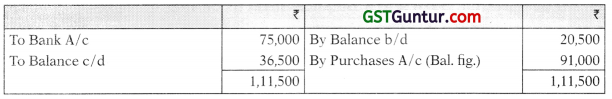

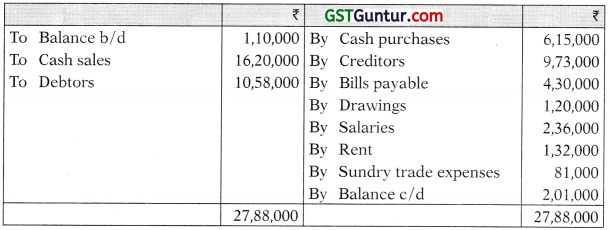

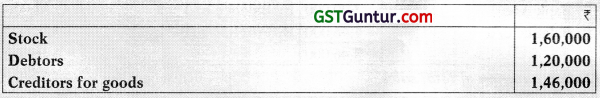

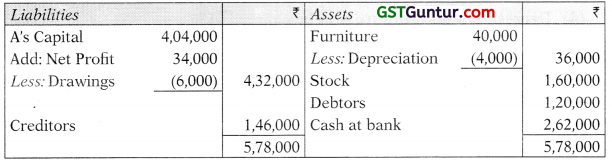

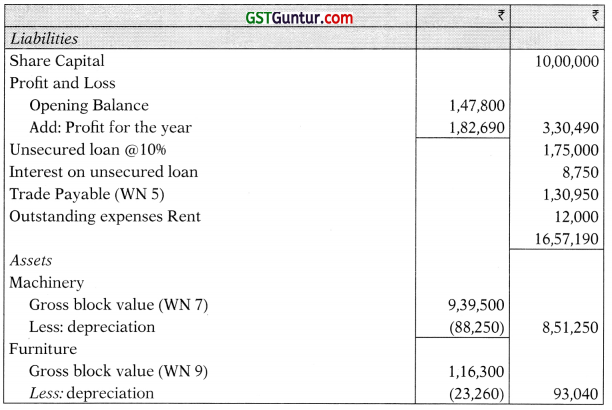

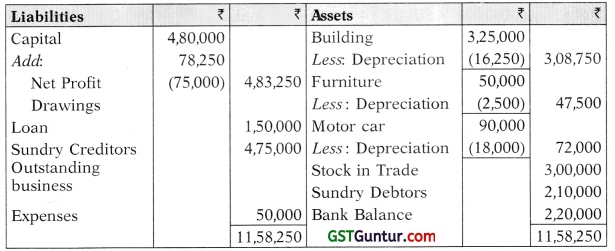

Trading and Profit and Loss Account for the year ending 31st March, 2011

Balance Sheet as on 31st March, 2011

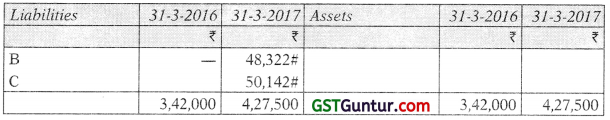

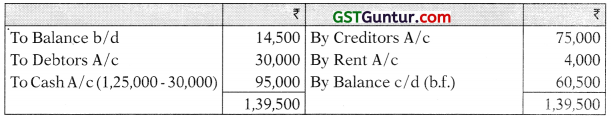

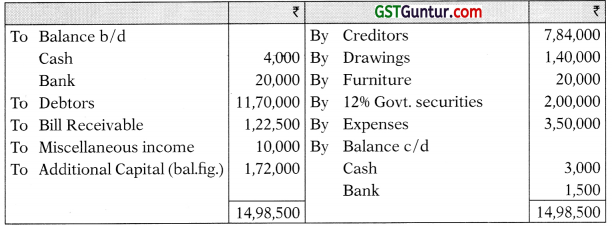

![]()

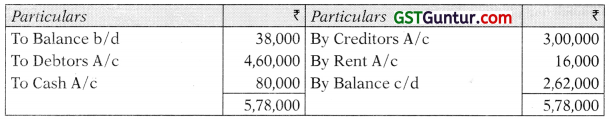

Working Notes:

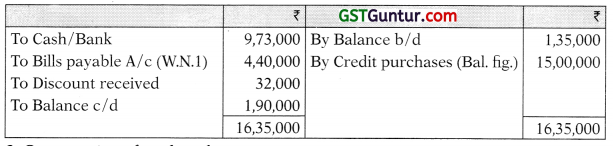

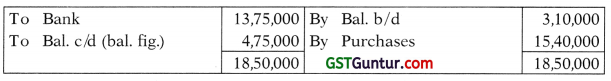

(1) Computation of purchases

Creditors Account

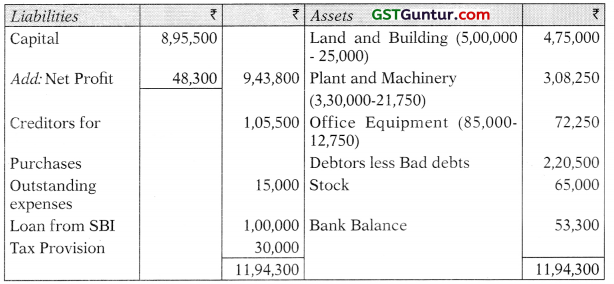

(2) Computation of total sales

(3) Computation of credit sales

(4) Computation of cash collections from debtors

Debtors Account

(5) Computation of closing balance of cash at bank

Bank Account

(6) Computation of cash defalcated by the cashier

![]()

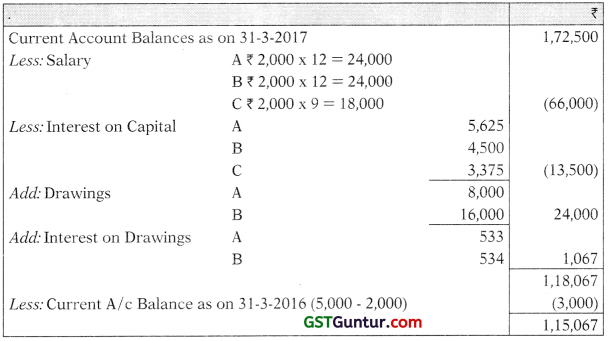

Question 7.

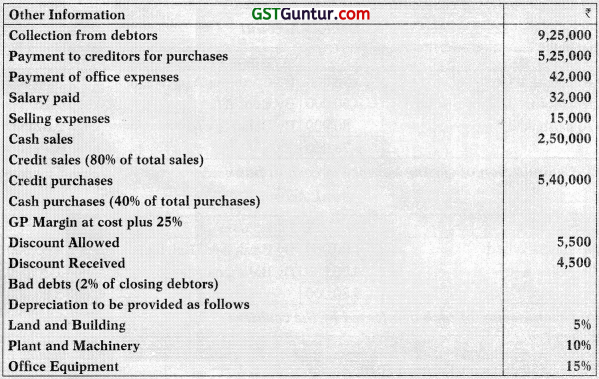

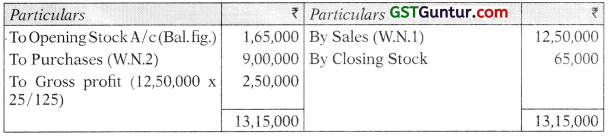

Following are the incomplete information of Moonlight Traders: The following balances are available as on 31.3.2013 and 31.3.2014.

Other adjustments:

- On 1.10.13 they sold machine having Book Value ₹ 40,000 (as on 31.3.2013) at a loss of ₹ 15,000. New machine was purchased on 1.1.2014.

- Office equipment was sold at its book value on 1.4.2013.

- Loan was partly repaid on 31.3.14 together with interest for the year. Prepare Trading P&LA/’c and Balance Sheet as on 31.3.2014. (16 Marks) (May 2014)

Answer:

Trading Account for the year ended 31.3.2014

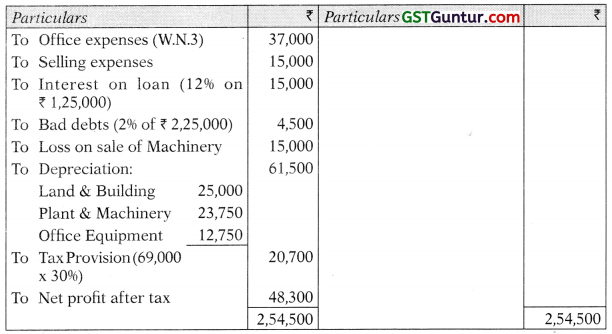

Profit and Loss Account for the year ended 31.3.2014

Balance sheet as on 31.3.2014

Working Notes:

1. Computation of Total Sales

2. Computation of Total Purchases

3. Office Expenses Account

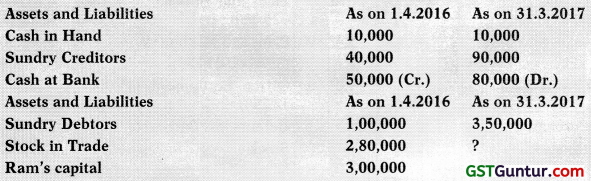

Question 8.

Ram carried on business as retail merchant. He has not maintained regular account books. However, he always maintained ₹ 10,000 in cash and deposited the balance into the bank account. He informs you that he has sold goods at profit of 25% on sales.

Following information is given to you:

Analysis of his bank pass book reveals the following information:

(a) Payment to creditors ₹ 7,00,000

(b) Payment for business expenses ₹ 1,20,000

(c) Receipts from debtors ₹ 7,50,000

(d) Loan from Laxman ₹ 1,00,000 taken on 1.10.2016 at 10% per annum

(e) Cash deposited in the bank ₹ 1,00,000

He informs you that he paid creditors for goods ₹ 20,000 in cash and salaries ₹ 40,000 in cash. He has drawn ₹ 80,000 in cash for personal expenses. During the year Ram had not introduced any additional capital. Surplus cash if any, to be taken as cash sales.

You are required to prepare:

- Trading and Profit and Loss Account for the year ended 31.3.2017.

- Balance Sheet as at 31st March, 2017.

Answer:

Trading and Profit and Loss Account for the year ended 31st March, 2017

Balance Sheet as at 31st March, 2017

Working Notes:

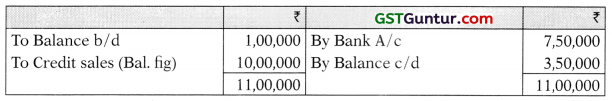

1. Sundry Debtors Account

2. Sundry Creditors Account

3. Cash and Bank Account

Question 9.

The following is the Balance Sheet of Chirag as on 31st March, 2015:

A riot occurred on the night of 31 st March, 2016 in which all books and records were lost. The cashier had absconded with the available cash. He gives you the following information:

(a) His sales for the year ended 31st March, 2016 were 20% higher than the previous year’s. He always sells his goods at cost plus 25%; 20% of the total sales for the year ended 31st March, 2016 were for cash. There were no cash purchases

(b) On 1st April, 2015 the stock level was raised to ₹ 30,000 and stock was maintained at this new level all throughout the year.

(c) Collection from debtors amounted to ₹ 1,40,000 of which ₹ 35,000 was received in cash, Business expenses amounted to ₹ 20,000 of which ₹ 5,000 was outstanding on 31st March, 2016 and ₹ 6,000 was paid by cheques.

(d) Analysis of the Pass Book revealed the Payment to Creditors ₹ 1,37,500, Personal Drawing ₹ 7,500, Cash deposited in Bank ₹ 71,500, and Cash withdrawn from Bank ₹ 12,000.

(e) Gross profit as per last year’s audited accounts was ₹ 30,000.

(f) Provide depreciation on Building and Furniture at 5% and Motor Car at 20%.

(g) The amount defalcated by the cashier may be treated as recoverable from him.

You are required to prepare the Trading and Profit and Loss Account for the year ended 31st March, 2016 and Balance Sheet as on that date.

Answer:

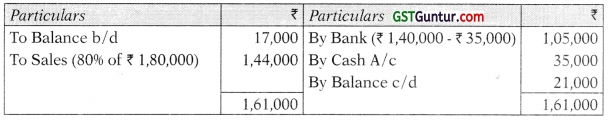

Trading and Profit and Loss Account

For the year ending on 31st March, 2016

Balance Sheet as at 31st March, 2016

Working Notes:

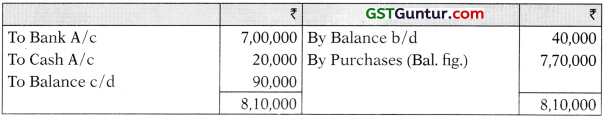

(i) Debtors Account

(ii) Creditors Account

(iii) Cash Book

(iv) Last year’s Total Sales = Gross Profit × 100/20 = ₹ 30,000 × 100/20 = ₹ 1,50,000

(v) Current year’s Total Sales = ₹ 1,50,000 + 20% of ₹ 1,50,000 = ₹ 1,80,000

(vi) Current year’s Credit Sales = ₹ 1,80,000 × 80% = ₹ 1,44,000

(vii) Cost of Goods Sold = Sales – G.P. = ₹ 1,80,000 – ₹ 36,000 = ₹ 1,44,000

(viii) Purchases = Cost of Goods Sold + Closing Stock – Opening Stock = ₹ 1,44,000 + ₹ 30,000 – ₹ 20,000 = ₹ 1,54,000

Final Accounts Method/Conversion Method — Advanced Problems

Question 10.

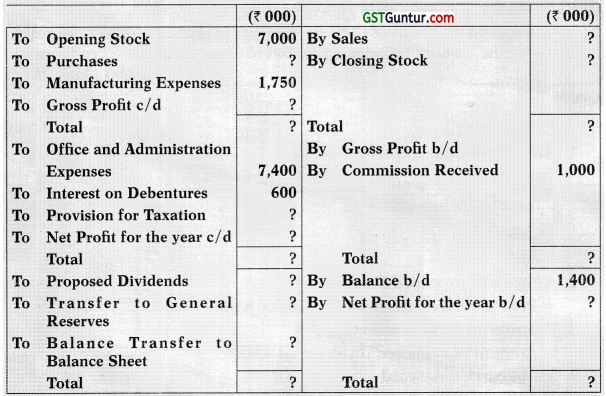

Following information of the Final Accounts of Kumaran Ltd. are missing as shown below:

Trading and Profit & Loss A/c for the year ended 31-3-2012

Balance Sheet as on 31-3-2012

You are required to provide the missing figures with the help of following information:

- Current ratio 2:1.

- Closing stock is 25% of sales.

- Proposed dividends are 40% of the paid-up capital.

- Gross profit ratio is 60%.

- Ratio of Current Liabilities to Debentures is 2 : 1.

- Transfer to General Reserves is equal to proposed dividends.

- Profit carried forward are 10% of the proposed dividends.

- Provision for taxation is 50% of profits.

- Balance to the credit of General Reserves at the beginning of the year is twice the amount transferred to that account from the current profits. (16 Marks) Nov. 2012)

Answer:

1. Amount of debentures

2. Amount of proposed dividend

= Paid up share capital × 40% = 10,000 × 40% = 4,000

3. Transfer to general reserves

= Amount of proposed dividend i.e. 4,000

4. Profit carried forward

= 10% of proposed dividend = 10% of 4,000 = 400

5. Net profit for the year

= Proposed dividend + Transfer to general reserve + Profit carried forward – Net profit carried forward

= (4,000 + 4,000 + 400) – 1,400 = 7,000

6. Provision for taxation

Provision for taxation = 50% of profit (i.e. before net profit)

It means that net profit is 50% and provision for tax is 50%.

Therefore, if net profit is 7,000 then, Provision for taxation is also 7,000

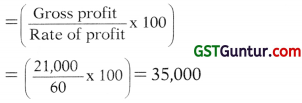

7. Gross profit

= Net profit + All expenses – Commission received

= (7,000 + 7,000 + 600 + 7,400) – 1,000 = 21,000

8. Sales

9. Closing stock

= 25% of sàles

= 25% × 35,000 = 8,750

10. Purchases

= (Sales + Closing stock) – (Opening stock + Manufacturing expenses + Gross profit)

= (35,000 + 8,750) – (7,000 + 1,750 + 21,000)

43,750 – 29,750 = 14,000

11. Balance of General Reserve as on 1.4.20 1 1

= Twice the amount transferred to general reserve during the year

= 2 × 4,000 = 8,000

12. Current Liabilities

= Current liabilities are twice of amount of debentures

= 2 × 6,000 = 12,000

13. Current Assets

Current Assets = Current ratio × Current liabilities

= 2 × 12,000 = 24,000

14. Sundry Debtors

Sundry Debtors = Current assets – Stock in trade – Bank balance

24,000 – 8,750 – 1,250 = 14,000

15. Total of Liabilities part of the balance sheet

= Shareholders’ capital + Non-current liabilities + Current liabilities

= (10,000 + 12,000 + 400) + 6,000 + 12,000 = 40,400

16. Other Fixed Assets

= Total of Liabilities part of the balance sheet – (Current assets + Plant and Machinery)

= 40,400 – (24,000 + 14,000) = 2,400.

![]()

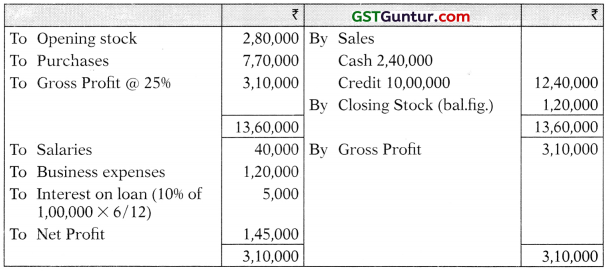

Question 11.

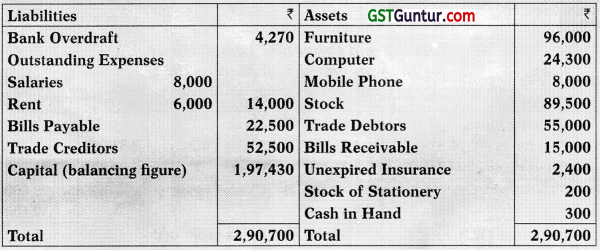

A sole trader requests you to prepare his Trading and Profit & Loss Account ended 31st March, 2013 and Balance Sheet as at that date. He provides you information:

Statement of Affairs as at 31st March, 2012

He informs you that there has been no addition to or sale of Furniture, Computer and Mobile Phone during the accounting year 2012-13. The other assets and liabilities on 31st March, 2013 are as follows:

He also provides you the following summary of his cash transactions:

It is found prudent to depreciate Furniture @ 5%, Computer @ 10% and Mobile Phone @ 25%. A provision for bad debts @ 5% on Trade Debtors is also considered desirable. (16 Marks) (May 2013)

Answer:

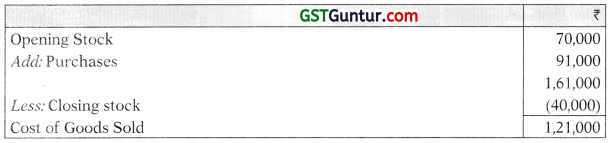

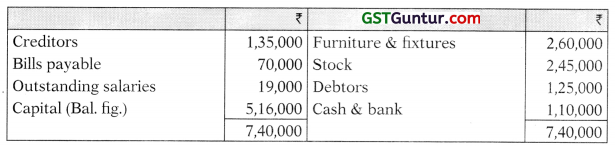

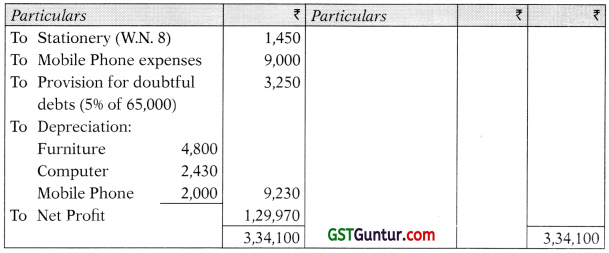

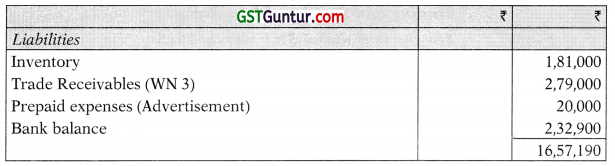

Trading and Profit and Loss Account for the year ended 31st March, 2013

Balance Sheet as on 31st March, 2013

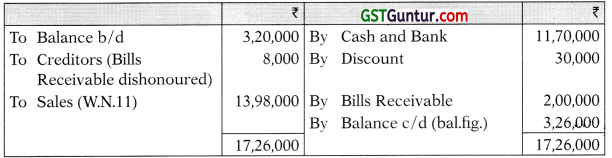

Working Notes:

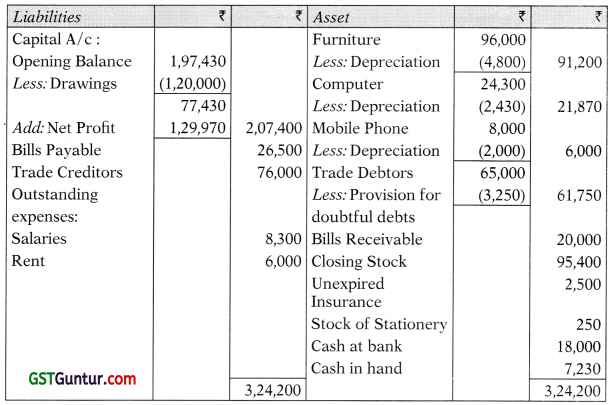

1. Debtors Account

2. Bills Receivable Account

3. Creditors Account

4. Bills Payable Account

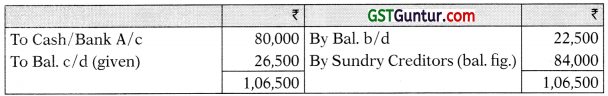

5. Insurance expenses for P&L

6. Salaries for P&L

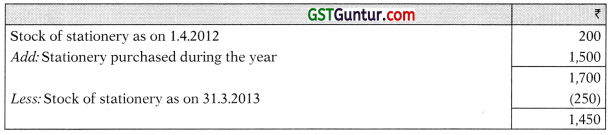

7. Rent expenses for P&L

8. Stationery expenses for P&L

![]()

Question 12.

The following is the Balance Sheet of M/s. Care Traders as on 1-4-2014:

A fire broke out in the premises on 31-3-2015 and destroyed the books of account. The accountant could however provide the following information:

- Sales for the year ended 31-3-2014 was ₹ 18,60,000. Sales for the current year was 20% higher than the last year.

- 25% sales were made in cash and the balance was on credit.

- Gross profit on sales is 30%.

- Terms of Credit

Debtor: 2 months

Creditors: 1 month

All creditor is paid by cheque and all credit sales are collected in cheque. - The Bank Pass Book has the following details (other than payment to creditors and collection from debtors)

- Machinery was purchased on 1-10-2014.

- Rent was paid for 11 months only and 25% of the advertisement expenses relates to the next year.

- Travelling expenses of ₹ 7,800 for which cheques were issued but not presented in bank.

- Furniture was sold on 1-4-2014 at a loss of ₹ 2,900 on book value.

- Physical verification as on 31-3-2015 ascertained the stock position at ₹ 1,81,000 and petty cash balance at nil.

- There was no change in unsecured loan during the year.

- Depreciation is to be provided at 10% on machinery and 20% on furniture.

Prepare Bank Account, Trading and Profit and Loss Account for the year ended 31-3-2015 in the books of M/s. Care Traders and a Balance Sheet as on that date. Make necessary assumptions wherever necessary. (16 Marks) (May 2015)

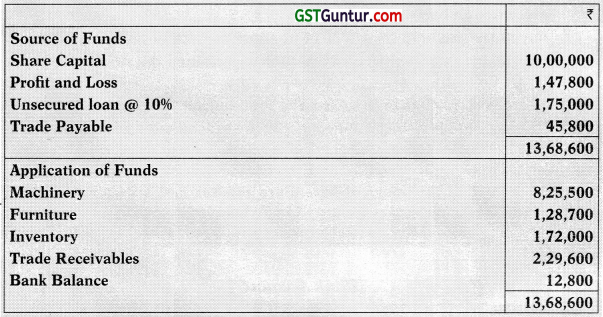

Answer:

Bank Account

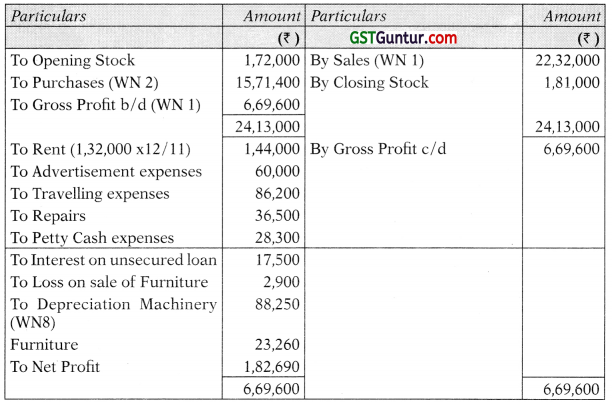

Trading and Profit and Loss Account For the year ended 31st March, 2015

Balance Sheet as on 1.4.2015

Working Notes:

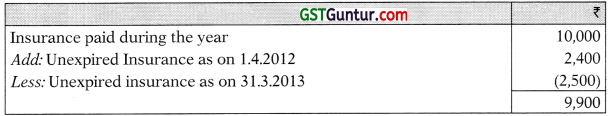

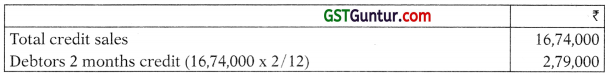

2. Purchases for the year ended 31.3.2015

3. Debtors as on 31.3.2015

4. Debtors account

5. Creditors as on 31.3.2015

6. Creditors account

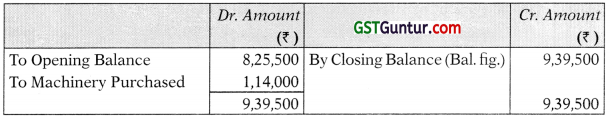

7. Machinery Account

8. Depreciation on Machinery f

9. Furniture Account

![]()

Question 13.

The following information relates to the business of ABC Enterprises, who requests you to prepare a Trading and Profit & Loss A/c for the year ended 31st March, 2017 and a Balance Sheet as on that date.

(a) Assets and Liabilities as on:

(b) Cash transaction during the year:

- Collection from Debtors, after allowing discount of ₹ 15,000 amounted to ₹ 5,85,000.

- Collection on discounting of Bills of Exchange, after deduction of discount of ₹ 1,250 by bank, totalled to ₹ 61,250.

- Creditors of ₹ 4,00,000 were paid ₹ 3,92,000 in full settlement of their dues.

- Payment of Freight inward of ₹ 30,000.

- Amount withdrawn for personal use ₹ 70,000.

- Payment for office furniture ₹ 10,000.

- Investment carrying annual interest of 6% were purchased at ₹ 95 (200 shares, face Value ₹ 100 each) on 1st October 2016 and payment made thereof.

- Expenses including salaries paid ₹ 95,000.

- Miscellaneous receipt of ₹ 5,000.

(c) Bills of exchange drawn on and accepted by customers during the year amounted to ₹ 1,00,000. Of these, bills of exchange of ₹ 20,000 were endorsed in favour of creditors. An endorsed bill of exchange of ₹ 4,000 was dishonoured,

(d) Goods costing ₹ 9,000 were used as advertising material.

(e) Goods are invariably sold to show a gross profit of 20% on sales.

(₹) Difference in cash book, if any, is to be treated as further drawing or introduction of capital by proprietor of ABC enterprises.

(f) Provide at 2% for doubtful debts on closing debtor. (16 Marks) (May 2017)

Answer:

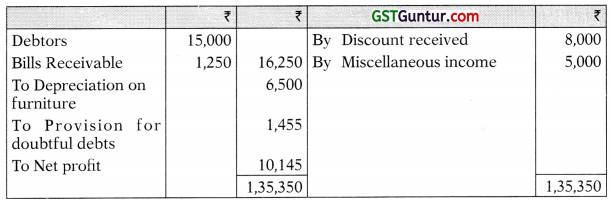

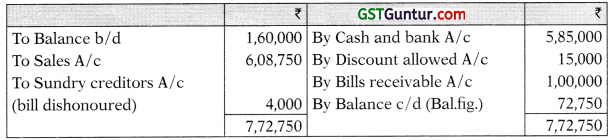

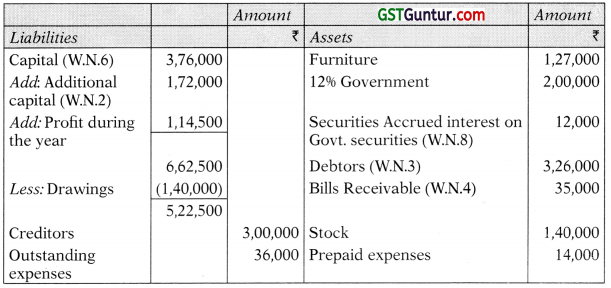

Trading and Profit and Loss A/c for the year ended 31st March, 2017

Balance Sheet as on 31st March, 2017

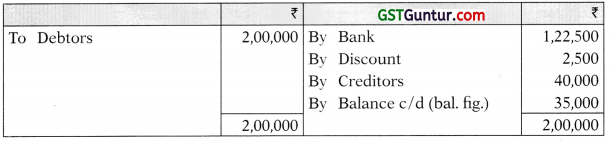

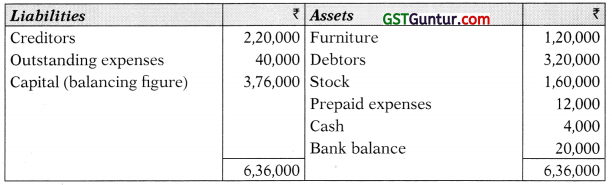

Working Notes:

(1) Capital (Opening)

Balance Sheet as on 1st April, 2016

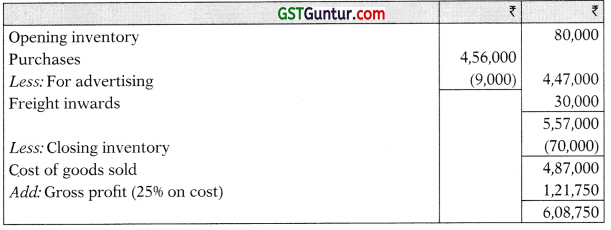

(2) Purchases made during the year

Creditors Account

(3) Sales made during the year

(4) Debtors (Closing)

Sundry Debtors Account

(5) Additional drawings

Cash and Bank Account

(6) Expenses for Profit and Loss A/c

Sundry Expenses Account

(7) Bills Receivable (Closing)

Bills Receivable Account

![]()

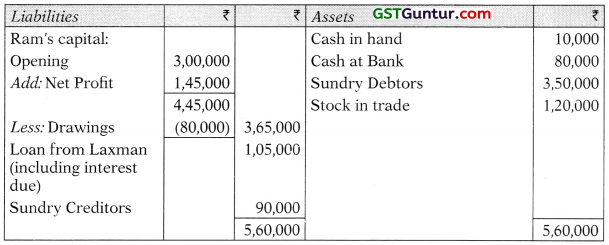

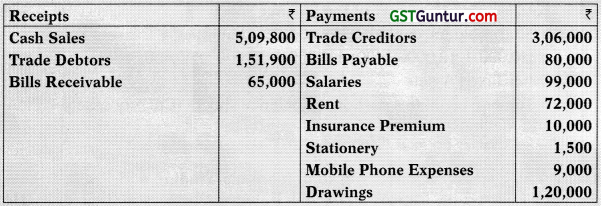

Question 14.

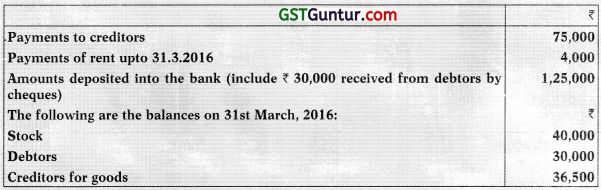

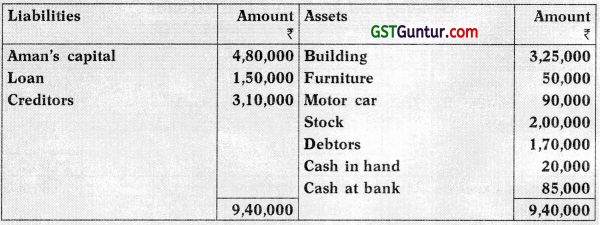

Aman, a readymade garment trader, keeps his books of account under single entry system. On the closing date, i.e. on 31st March, 2017 his statement of affairs stood as follows:

Riots occurred and a fire broke out on the evening of 31st March, 2018, destroying the books of account. On that day, the cashier had absconded with the available cash. You are furnished with the following information:

- Sales for the year ended 31st March, 2018 were 20% higher than the previous year’s sales, out of which, 20% sales were for cash. He always sells his goods at cost plus 25%. There were no cash purchases.

- Collection from debtors amounted to ₹ 14,00,000, out of which ₹ 3,50,000 was received in cash.

- Business expenses amounted to ₹ 2,00,000, of which ₹ 50,000 were outstanding on 31st March, 2018 and ₹ 60,000 paid by cheques.

- Gross profit as per last year’s audited accounts was ₹ 3,00,000.

- Provide depreciation on building and furniture at 5% each and motor car at 20%.

- His private records and the Bank Pass Book disclosed the following transactions for the year 2017-18:

- Stock level was maintained at ₹ 3,00,000 all throughout the year.

- The amount defalcated by the cashier is to be written off to the Profit and Loss Account.

You are required to prepare Trading and Profit and Loss A/c for the year ended 31st March, 2018 and Balance Sheet as on that date of Aman. All the workings should form part of the answer. (15 Marks) (November 2018)

Answer:

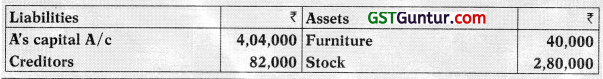

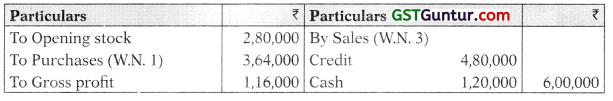

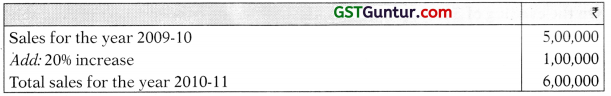

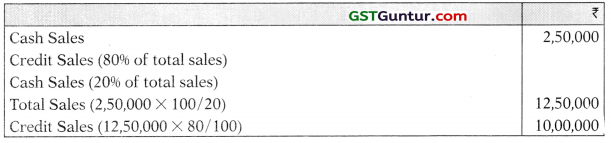

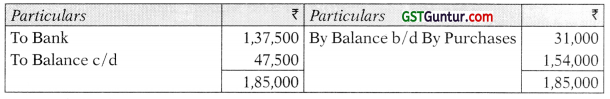

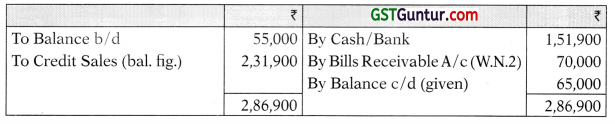

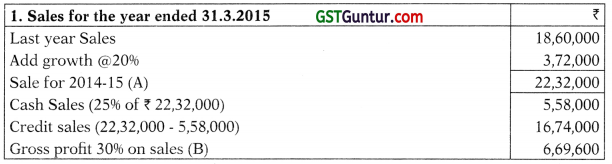

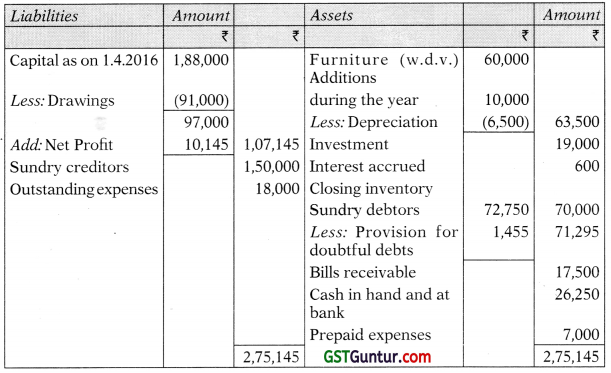

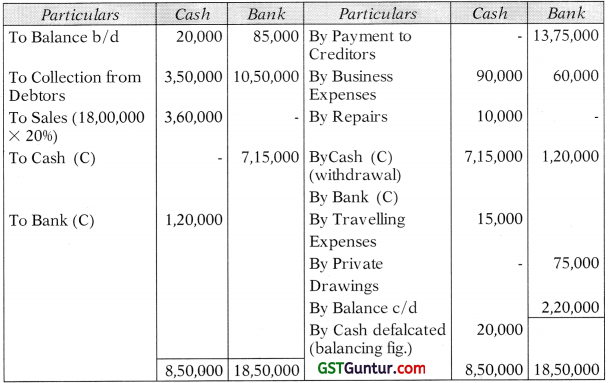

Trading and Profit and Loss Account for the year ended 31st March, 2018

Balance Sheet as on 31st March, 2018

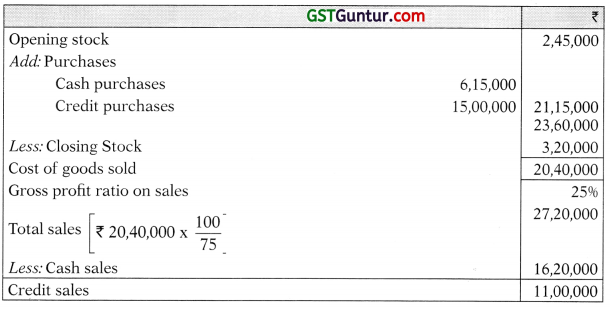

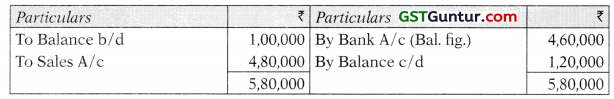

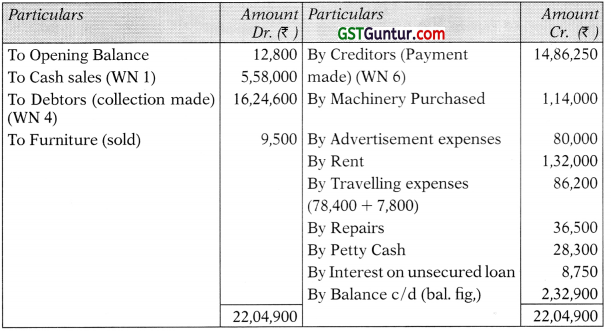

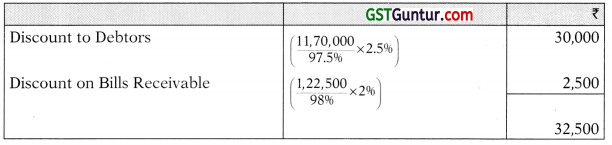

Working Notes:

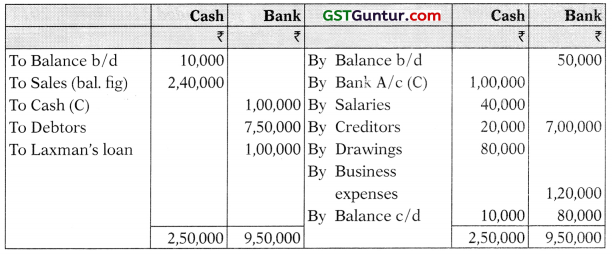

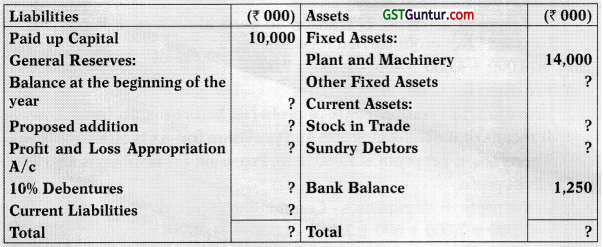

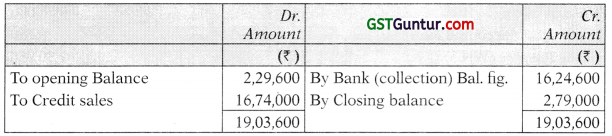

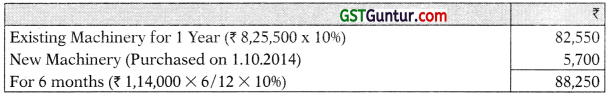

1. Cash and Bank Account

![]()

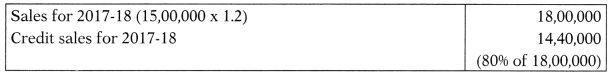

2. Computation of sales during 2017-2018

3. Debtors Account

4. Creditors Account

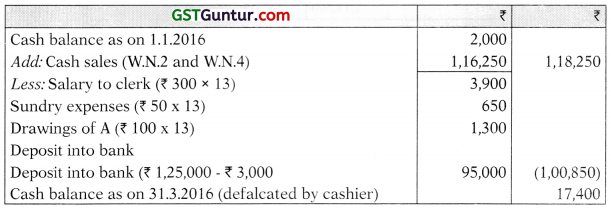

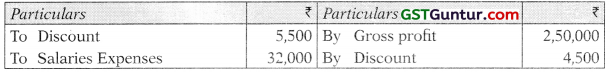

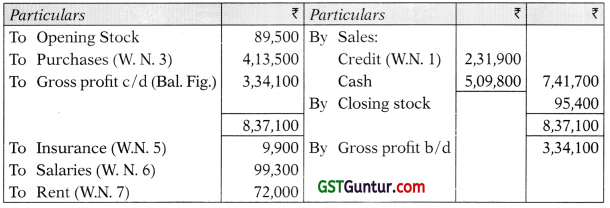

Question 15.

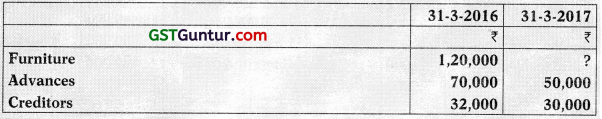

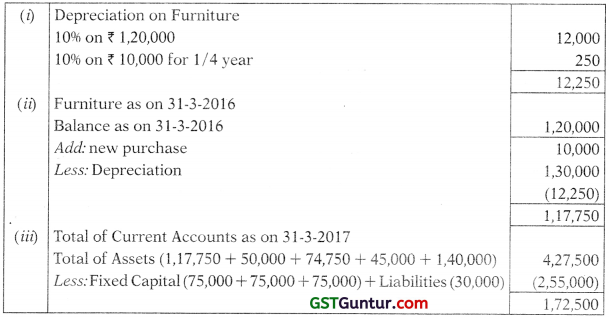

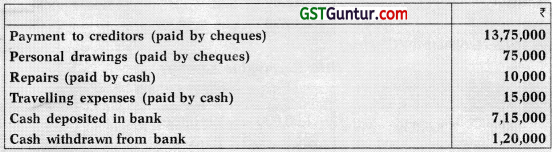

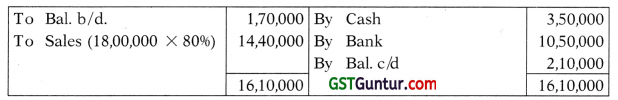

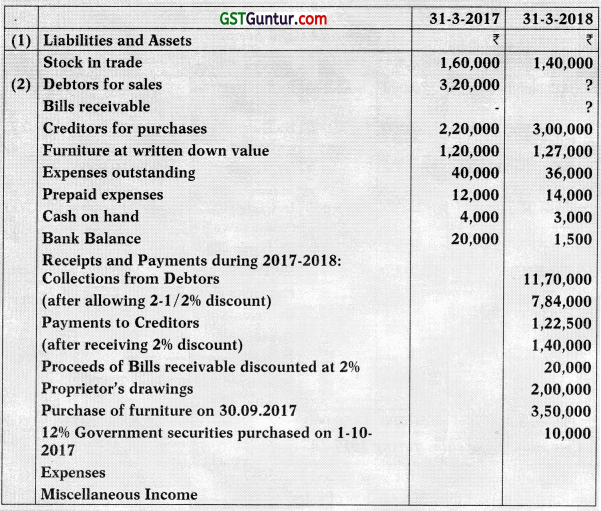

From the following information in respect of Mr. P, prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and a Balance Sheet as at that date:

Answer:

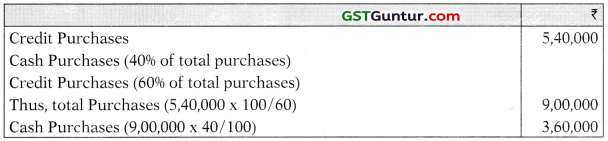

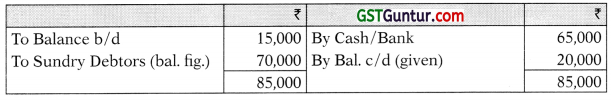

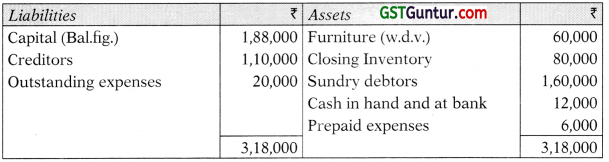

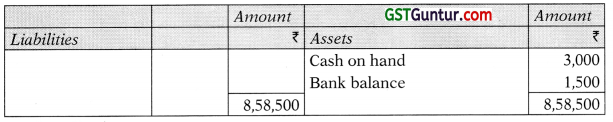

Trading and Profit and Loss Account for the year ended 31st March, 2018

Balance Sheet as on 31st March, 2018

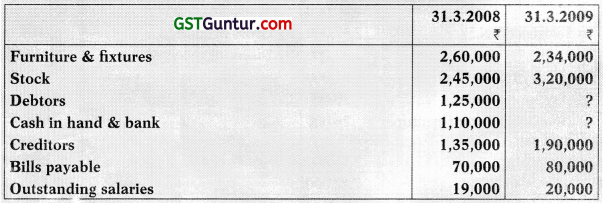

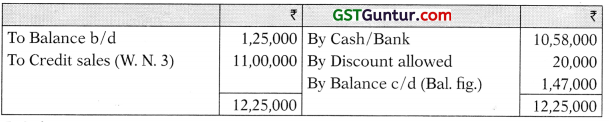

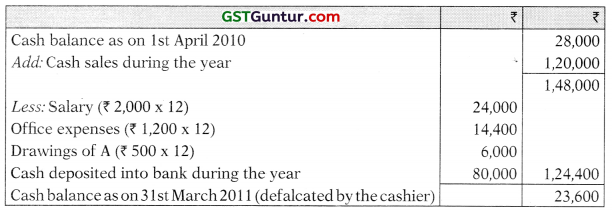

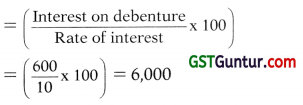

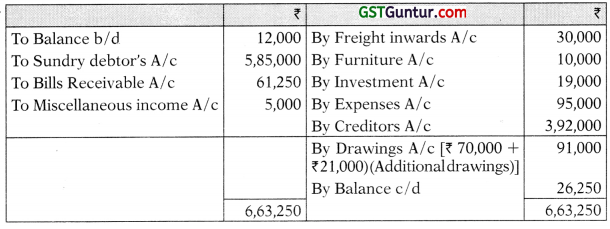

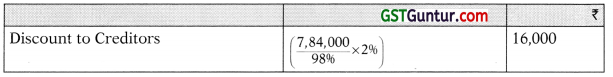

Working Notes:

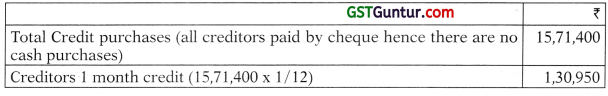

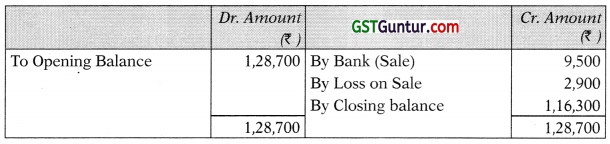

1. Furniture account

2. Cash and Bank account

3. Debtors account

4. Bills Receivable account

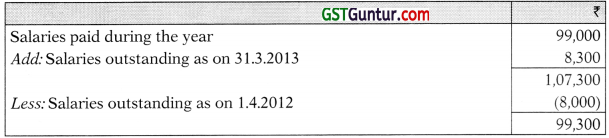

5. Creditors account

![]()

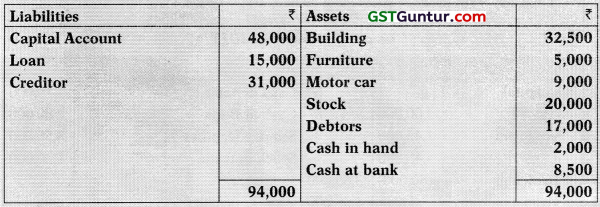

6. Balance Sheet as on 1st April, 2017

7. Expenses for P&L

8. Interest on Government securities

2,00,000 × 12% × 6/12 = ₹ 12,000

Interest on Government securities receivables for 6 months = ₹ 12,000

9. Discount allowed

10. Discount received

11. Credit sales

Cost of Goods sold = Opening stock + Net purchases – Closing stock

= ₹ 1,60,000 + ₹ 9,12,000 – ₹ 1,40,000

= ₹ 9,32,000

Sale price = ₹ 9,32,000 + 50% of 9,32,000 = ₹ 13,98,000