Accounts of Companies – CA Inter Law Notes is designed strictly as per the latest syllabus and exam pattern.

Accounts of Companies – CA Inter Law Notes

Books Of Account – Sections 2(13), 128

Definition – Books of Account – Sec-tion 2(13)

‘Books of Account’ includes records maintained in respect of:

- all sums of money received and expended by the company and the matters in respect of which receipts and expenditure take place

- all sales and purchases of goods and services by the company

- the assets and liabilities of the company

- the items of costs as may be prescribed under section 148

![]()

Which Books of Account Should be Kept?

- Company should maintain at its registered office proper books of account, other relevant books and papers and financial statement for every financial year with respect to:

- all sums of money received and expended by the company and the matters in respect of which receipts and expenditure take place

- all sales and purchases of goods and services by the company

- the assets and liabilities of the company

- In the case of company which belongs to any class of companies specified under section 148 of Companies Act, 2013 required to maintain cost records.

Place of Maintaining Books

Books of account shall be maintained and kept at registered office.

Procedure to keep Books at any other place other than Registered office

- All or any books of account may be kept at other place in India, if Board of directors pass resolution and gives notice to Registrar within 7 days.

- Notice to Registrar shall specify name of books to be kept at other place and complete address.

Procedure to keep Separate set of Books at Branch

- If company wants to maintain a separate set of books at branch, the Board has to pass a resolution and within 7 days of such decision intimate the ROC, location of such declared branch office.

- If separate books of account are maintained at branch in India or outside India, it would be deemed to be compliance of section 128, if summarized returns are sent at regular intervals to the registered office or to a place where accounts are maintained as per decision of the Board.

- If books of account are maintained outside India, summarized returns shall be sent to the registered office at quarterly Intervals – Rule 4 of Companies (Accounts) Rules, 2014.

- Notice of address at which books of account are to be maintained is given in Form AOC-5.

Proper Books of Account – Section 128

- Company shall maintain proper books of account. Proper books of account means books of account which:

- Exhibit true and fair view of state of affair of company.

- Should explain the transaction entered into by company.

- Is maintained on accrual basis.

- Is kept according to double entry system.

- Books of account should be maintained in indelible ink if it is maintained in physical form.

Books of Account in Electronic Form – Rule 3 of Companies (Ac-counts) Rules, 2014

Books of account may be kept in electronic form.

Following conditions shall be satisfied to maintain books of account and other books in electronic form:

- It should remain accessible in India for subsequent reference.

- It should be retained completely in the format in which they were originally generated, sent or received.

- Information in electronic record (document) should be capable of being displayed in legible form.

- Proper system for storage, retrieval, display or printout of electronic records should be maintained by company as per audit committee or by Board where audit committee is not constituted.

- Information received from branch should not be altered. It should be kept in original form in which it was received from branch.

- Back up of books of account and other books should be maintained in electronic mode at any place but it should be kept in server physically located in India on periodic basis.

- Company is required to intimate Registrar on annul basis at the time of filing financial statement:

- Name of service provider.

- IP address of service provider.

- Location of service provider.

- Address or location where books are maintained on cloud.

![]()

Responsibility for Keeping Proper Books of Account

Who are responsible?

The following persons shall be held responsible for maintaining proper books of account:

- Managing Director; or

- Whole time Director in charge of finance function; or

- Chief Financial Officer; or

- If any other person (if authorised by Board in this regard).

Default

Person who is made responsible for maintaining books of account fails, he is punishable with:

- imprisonment for a term upto 1 year; or

- with fine from ₹ 50,000 to ₹ 5,00,000; or

- with both

Inspection of Books of Account & Financial Information – Section 128

- Section 128 provides that books of account and other books and papers maintained by the company within India shall be open for inspection at Registered Office of company or other place in India by any director during business hours.

- Summarised returns of the books of account of the company kept and maintained outside India shall be sent to registered office at quarterly intervals. It should be kept at registered office and kept open to directors for inspection.

Financial Statement – Section 129

- As per section 2(40), financial statement includes:

- Balance sheet

- Profit and loss account or in the case of company not for profit, income and expenditure statement

- Cash flow statement

- Statement of changes in equity, if applicable

- Any explanatory note annexed to above documents

- However, for One Person Company, small company and dormant company financial statement do not include cash flow statement.

Provisions Relating to Financial Statement or Legal Requirements for Financial Statement

Section 129 along with Schedule III to the Companies Act, 2013 deals with the preparation and presentation of financial statement.

Form or Format of Financial Statement

- The Balance Sheet should be in the form set out in Part I of Schedule III, and Profit and Loss Account shall be as per Part II of Schedule III of Companies Act, 2013.

- As per Schedule III, vertical form of Balance Sheet & Profit-Loss Account is compulsory.

Important Note:

An insurance company, banking company, an electric company and any other company for which Special Act governing it, if specified form of balance sheet, such companies are not required to disclose information as per Companies Act, 2013.

To comply with Accounting Standards

- Financial statement should comply with accounting standards.

- If it does not comply with the accounting standards, following disclosure should be made:

- the deviation from the accounting standards

- the reasons for such deviation

- the financial effect, if any, arising due to such deviation

CG may exempt class of Companies

Central Government may exempt any class of companies by notification from the provisions of this section or rules on following conditions:

- Exemption may be given in public interest.

- Exemption may be granted with or without condition.

- Exemption may be granted on its own or on application by class of companies.

![]()

Example:

Government Company engaged in defence production is granted exemption from relevant Accounting Standard on segment reporting.

Consolidated Financial Statement

- Consolidation of financial statements is made mandatory for all companies where a company has one or more subsidiaries whether Indian or foreign.

- The mandatory consolidation applies to all companies whether such company is:

- Listed or unlisted

- Private or public

- Company is not required to prepare its consolidated financial statements if:

- It is wholly owned subsidiary company or partially owned subsidiary of another company AND all its other members, have been intimated in writing and the proof of delivery of such intimation is available with company, do not object to company for not preparing consolidated financial statements

- Company’s securities are not listed on any stock exchange, either in India or outside India

- Its ultimate or intermediate holding company prepares and files consolidated financial statements with ROC, which are according to applicable accounting standards.

- For the purposes of consolidation of financial statements, the expression subsidiary includes associate company and joint venture.

Important Note:

The provisions of this Act are applicable to the preparation, adoption and audit of financial statements of holding company shall similarly apply to consolidated financial statements also.

Place of Financial Statement at AGM

At every Annual General Meeting, the Board shall place following documents:

- Financial statement of company; and

- Consolidated financial statement of company and of all subsidiaries; if any.

4. Extension Or Modification of Financial Year

Meaning of Financial Year – Section 2(41)

‘Financial year’, in relation to any company or body corporate, means the period ending on the 31st day of March every year. Now every company is required to follow uniform financial year.

Applicability

- Existing company and body corporate on the commencement of 2013 Act, is required to align its financial year as per provision of section 2(41) within a period of 2 years from commencement of 2013 Act. (Section 2(41) is made effective w.e.f. 1st April, 2014)

- Where a company or body corporate has been incorporated on or after 1st January of 2014, the period ending on the 31st day of March of the following year, in respect whereof financial statement of the company or body corporate is made up.

Examples:

- If company is incorporated on 31-12-2014, its first financial year shall be the period from 31-12-2014 to 31-3-2015.

- If company is incorporated on 1-1-2015, its first financial year will be 1-1-2015 to 31-3-2016.

Extension of Financial Year

Which company?

- A company or body corporate, which is a holding company or a subsidiary or associate company of a company incorporated outside India and is required to follow a different financial year for consolidation of its accounts outside India, the National Company Law Tribunal (NCLT) may allow any period as its financial year, whether or not that period is a year.

- A subsidiary company, associate company and joint venture company of a foreign company may, with approval of NCLT follow different period as its FY.

![]()

Procedure for Exemption

- Board meeting should be conveyed and resolution to extend the financial year of the subsidiary company should be passed.

- For specified IFSC public and private company, if it is subsidiary of foreign company, the financial year of subsidiary company may be same as financial year of its holding company and approval of Tribunal is not required for change in financial year.

- Application is made to the Tribunal in Form NCLT 1.

Approval And Signing (Authentication) of Financial Statements – Section 134

Approval by Board

The financial statements including consolidated financial statement if any, shall be approved by the Board of directors before they are signed on behalf of the Board and before they are submitted to the auditors for their report thereon.

Important Note:

Approval of financial statements cannot be by circular resolution of Board or by Board meeting held through video conferencing. It has to be at Board meeting as per section 179(3)

Signature

As per section 134(1), financial statement is required to be signed by:

- the Chairperson of the company where he is authorised by the Board or by two directors out of which one shall be Managing Director;

- the Chief Executive Officer, if he is a director in the company,

- the Chief Financial Officer; and

- the company secretary of the company, wherever they are appointed

In case of OPC

In case of OPC, financial statement shall be signed by one director.

In case of Banking Company

For banking company, financial statements (accounts) are authenticated as per Banking Regulation Act, 1949.

FS Submitted to Auditor

The financial statements duly considered, approved and signed should be handed over to the company’s auditors for their report thereon.

Auditor’s Report

The auditor’s report shall be attached to every financial statement.

Circulation of FS

Signed copy of financial statement including consolidated financial statement shall be issued, circulated to members. (Explained in details in next table)

Right of member to get copies of Audited Financial Statements Or Circulation Of Financial Statements And Other Documents – Section 136

Who are Entitle to get copy of FS & other Documents?

- Every member has right to get copy of audited financial statement.

- Member includes equity and preference shareholders. Preference shareholders are also entitle to get copy of financial statement.

- Apart from members, debenture trustee and all persons entitled to get notice of Annual General Meeting are entitled to get copy of financial statements.

![]()

Which Documents are Circulated?

Members are required to be sent following documents:

- Audited financial statement,

- Notes annexed to or forming part of financial statement,

- Consolidated financial statement, if any

- Auditors’ report,

- Board’s report.

Time limit for Dispatched

- The aforesaid documents shall be sent at least 21 days before the date of the meeting in which financial statements are placed.

- Aforesaid documents can be given less than 21 clear days before date of General Meeting, with consent of majority in number entitled to vote and who represent not less than 95% of paid up share capital. If company does not have share capital, consent of members having 95% of voting power exercisable at the meeting is required. Consent may be in writing or by electronic means.

Important Note:

- Nidhi Company, which satisfies following conditions is not required to send individual notice to members who do not individually or jointly hold shares not more than ? 1,000 of face value or not more than 1% of total paid up capital, whichever is less. Here, intimation shall be sent by public notice in regional language newspaper about date, time and venue of AGM and financial statement with its enclosure can be inspected at registered office of company and financial statement with enclosures are affixed in the notice board of Company.

- In case of section 8 Company, documents can be sent 14 days in advance instead of 21 days.

Circulation of Financial Statement & Other Documents in case of Listed Company

Listed company has option to send abridged accounts to members. Listed company is not required to send all above documents if it comply with following conditions:

- Copies of documents are made available for inspection to any members at registered office.

- It should be made available during working hours for period of 21 days before date of meeting.

- It has forwarded statement containing salient features of such documents in Form AOC-3 or AOC-3A (ie., abridged financial statements). Company which is required to comply with Companies (Indian Accounting Standards) Rules, 2015 shall forward their statement in Form AOC-3A.

- Listed company is compulsorily required to place its financial statements including consolidated financial statements and all other documents required to be attached or annexed thereto, on its website, which is maintained by company.

In the case of listed companies and other public companies which have a net worth of more than ? 1 crore and turnover more than ₹ 10 crore may send financial statement:

- By electronic mode to members, whose shareholding is in dematerialised form and whose email ids are registered with company.

- By electronic mode to members who are holding shares in physical form and who have positively consented in writing to receive financial statement by electronic mode.

- By dispatch of physical copies by registered post or speed post or courier service.

Important Note:

Member may request company to deliver copy of financial statement through particular mode other than above methods specified. But he has to pay fees for same.

Circulation and Placing of Separate Audited Accounts of Subsidiary

Every listed company having a subsidiary company should:

- Place separate audited accounts in respect of each subsidiary on its website.

- Provide copy of separate audited financial statements in respect of each of its subsidiary to any shareholders on demand.

![]()

Important Note:

- If foreign subsidiary company is statutorily required to prepare consolidated financial statement that can be placed on company’s website, instead of standalone statement of foreign subsidiary.

- If foreign subsidiary company is not required to get its account audited as place of that country where it is incorporate, unaudited financial statement may be placed on company’s website and may file unaudited financial statement.

- If financial statement of foreign subsidiary is in language other than English, then English translation should be uploaded on website of company.

Inspection of Financial Statement

- A member can inspect financial statement, consolidated financial statement, its attachment, auditors’ report thereon and directors’ report at registered office of company during business hours.

- Copies of separate audited or unaudited financial statements of subsidiary (where audit is not required of foreign subsidiary) should be sent to members who ask for such copy.

Filing of Financial Statements With Roc – Section 137

File with ROC

- Every company is required to file the financial statement with Registrar together with Form AOC-4.

- Consolidated financial statement is filed with Form AOC-4 CFS.

- Form AOC-4 shall be certified by CA, or CS or CWA in practice.

If AGM is Held and Financial Statements Adopted

- Every company is required to file with the Registrar following documents which are adopted at Annual General Meeting within 30 days from date of Annual General Meeting:

- Financial statement

- Consolidated financial statement (if applicable)

- All documents attached with financial statement

- If it is not filed within 30 days, filing may be done within 300 days with additional filing fees.

Financial Statements are not Adopted at AGM or Adopted at Adjourned AGM

- If financial statement is not adopted at Annual General Meeting, unadopted financial statements should be filed with all above specified documents with Registrar within 30 days of Annual General Meeting.

- Registrar should take note of unadopted financial statements on records as provisional till the financial statements are filed with him after their adoption in adjourned Annual General Meeting.

- The financial statements adopted in the adjourned Annual General Meeting should be filed with ROC within 30 days of such adjourned Annual General Meeting.

- If not filed within 30 days, filing may be done within 300 days with additional filing fees.

AGM for any year is not held

- The financial statement along with documents duly signed along with statement of facts and reason for not holding the Annual General Meeting should be filed within 30 days from the latest date on or before which that meeting should have been held.

- If not filed within 30 days, filing may be done within 300 days with additional filing fees.

- If company fails to file even within 300 days with additional fees, penal consequences follows.

Financial Statement in XBRL form – Rule 12 of Companies (Ac-counts) Rules, 2014

Applicability

- Following companies are required to file financial statement with ROC in extensible Business Reporting Language (XBRL) form:

- All listed companies and their Indian subsidiary.

- All companies having paid up capital of 5 crore or more or turnover of 100 crore or more.

- All companies which are required to prepare their financial statements in accordance with Companies (Indian Accounting Standards) Rules, 2015.

- Company which has filed its financial statement in XBRL at any time due to applicability of any of above points shall continue to file financial statements in XBRL though it may not fall under the class of companies specified therein in succeeding years.

![]()

Re-Opening of Accounts And Financial Statements- Sections 130-131

- Company can:

- Re-open its books of account and recast its financial statements on order of NCLT or competent Court; or

- Voluntary revise financial statements or Board’s report

- The Tribunal or Court shall order to re-open books of account and recast financial statement of company when:

- Relevant earlier accounts were prepared in a fraudulent manner; or

Disclosure In Board’s Report – Section 134

Board report shall contain following matters:

- Extract of annual return – Section 92 (extract of annual return is in Form MGT-9)

- Number of Board Meetings held.

- Details in respect of frauds reported by auditors (other than those which are reportable to the Central Government)

- Statement on declaration given by independent directors (Applicable if company need to appoint independent directors as per Section 149)

- Company’s policy on directors’ appointment and remuneration including criteria for determining qualifications, positive attributes, independence of director and other matters in case of listed company. (Applicable only, if company is required to comply with Section 178 i.e., constitute Nomination and Remuneration Committee. This clause is not applicable to Government Company)

- Explanations or comments by the Board on every qualification, reservation or adverse remark made by :

- Auditor in audit report; and

- Company Secretary in his secretarial audit report

- Particulars of loan, guarantees or investment by company – Section 186

- Particulars of contracts or arrangements with related parties – Section 188 (i.e., Form AOC-2)

- State of the company’s affairs

- Amounts it proposes to carry to any reserves, if any

- Dividend recommended, if any

- Material changes and commitments, if any, affecting the financial position of the company which have occurred between the end of the financial year of the company to which the balance sheet relates and the date of the report

- Conservation of energy, technology absorption, foreign exchange earnings and outgo (Foreign exchange earnings and outgo details are not required to be given by Government Company engaged in defence equipment)

- Statement on risk management policy

- Details about the policy developed and implemented by the company on corporate social responsibility initiatives taken during the year.

- A statement in which formal evaluation has been made by Board of its own performance and that of its committees and individual directors in case of listed and other public specified company (This clause is not applicable in case the directors are evaluated by Ministry or Department of the Central Government or State Government, which is administratively in charge of company)

- Statement showing names of the top 10 employees in terms of remuneration drawn and the name of every employee, who:

- if employed throughout the financial year, was in receipt of remuneration for that year which, in the aggregate, was not less than ₹ 1,02,00,000

- if employed for a part of the financial year, was in receipt of remuneration for any part of that year, at a rate which, in the aggregate, was not less than ₹ 8,50,000 per month

![]()

Disclosure as per Rule 8 of Companies (Accounts) Rules, 2014

Following details are required in Board’s Report as per Rule 8 of Companies (Accounts) Rules, 2014:

- Financial summary or highlights

- Change in nature of business, if any

- Details of directors or KMP who were appointed or have resigned during the year

- Names of companies which have become or ceased to be its subsidiaries, joint ventures or associate companies during the year

- Details relating to deposits

- Details of significant and material orders passed by the regulators or Courts or Tribunal and its impact on the going concern status and company’s operations in future

- Details in respect of adequacy of internal financial controls with reference to financial statements

Directors’ Responsibility Statement – Section 134(5)

Directors’ Responsibility Statement, indicating therein:

- That in the preparation of the annual accounts, the applicable accounting standards had been followed along with proper explanation relating to material departures.

- That the directors had selected such accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the company at the end of the financial year and of the profit or loss of the company for that period.

Signing And Other Requirements – Board’s Report

The Board’s Report and any annexures thereto shall be signed by its Chairman, if he is authorised in that behalf by the Board.

If Chairman is not Authorized

- If Chairman is not so authorised, the report shall be signed by at least two directors, one of whom shall be Managing Director.

- In case of OPC, the report shall be signed by one director, where there is one director.

Attached

The report of Board of Directors shall be attached to financial statements laid before a company in General Meeting.

Filing with ROC

The Board resolution approving financial statement and Board Report shall be filed with ROC in Form MGT 14.

National Financial Reporting Authority (NFRA) – Section 132

Constitution

- The Central Government may by notification, constitute a National Financial Reporting Authority to provide for matters relating to accounting and auditing standards under this Act.

- It shall consist Chairperson and such other members (parttime or full time) not more than 15 appointed by Central Government.

- Chairperson shall be a person of eminence and having expertise in accountancy, auditing, finance or law.

- Chairperson and every member shall give declaration that he is not having any conflict of interest or lack of independence in respect of his appointment.

- Chairperson and members in full-time employment with NFRA shall not be associated with any audit firm (including related consultancy firms) during the course of their appointment and 2 years after ceasing to hold such appointment.

Powers

- The NFRA shall have power to investigate into matters of professional or other misconduct committed by any member or firm of Chartered Accountants.

- Such investigation can be either suo motu or on reference made to it by the Central Government.

- The NFRA has same powers as are vested in a civil court under the Code of Civil Procedure, 1908.

Other Body not Authorised to Investigate

Where a NFRA has initiated an investigation, no other institute or body shall initiate or continue any proceedings in such mattes of misconduct.

Appeal

Appeal against order of NFRA shall be filed before NCLAT.

![]()

Applicability Of Corporate Social Responsibility (CSR) Provisions – Section 135

Applicability:

- With effect from April 1, 2014, every company, private limited or public limited, which either has :

- a net worth of ₹ 500 crore or more,

- a turnover of ₹ 1,000 crore or more,

- net profit of ₹ 5 crore or more, need to spend at least 2% of its average net profit for the immediately preceding three financial years on corporate social responsibility activities.

- The CSR provisions are applicable to holding and subsidiary companies as well as foreign companies whose branches or project offices in India fulfil the specified criteria.

- The CSR provisions are applicable to section 8 company, if it attract any one of the above threshold limit.

- This section is not applicable to specified IFSC public and IFSC private company for period of 5 years from commencement of business.

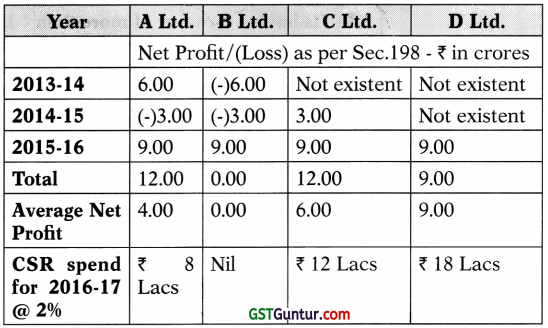

Example:

How to Calculate the ‘Average Net Profit’

How Net-worth or Profit or Turn-over is Calculated?

The net worth, turnover and net profits are computed as per section 198 of the 2013 Act.

As per section 2(57) net worth means an aggregate value of:

- The paid up share capital,

- All reserves created out of profits, and

- Securities premium account and debit or credit balance in profit and loss account.

After deducting the aggregate value of:

- Accumulated losses,

- Deferred expenditure, and

- Miscellaneous expenditure not written off

Profits from any overseas branch of the company, including those branches that are operated as a separate company would not be included in the computation of net profits of a company.

Besides, dividends received from other companies in India which need to comply with the CSR obligations would not be included in the computation of net profits of a company.

What if Turnover or Net-worth of Company is Reduced Subsequently?

The company which does not satisfy the specified criteria for a consecutive period of three financial years is not required to comply with the CSR obligations, implying that a company not satisfying any of the specified criteria in a subsequent financial year would still need to undertake CSR activities unless it ceases to satisfy the specified criteria for a continuous period of three years.

Example:

A Ltd is having turnover of more than ₹ 1000 crores or more but has incurred loss in any of the preceding three financial years then whether such company is required to comply with the provisions of section 135 of the Companies Act, 2013?

As per the provisions of section 135 of the Act, one of the three criteria has to be satisfied to attract section 135. Therefore, if a company satisfies the criteria of turnover although it does not satisfy the criteria of net profit, it will have to comply with the provisions of section 135 and the Companies (CSR Policy) Rules, 2014.

Which Activities Are Considered As Csr Activity – Section 135

Provisions

- The CSR activities should be undertaken by company as per its CSR policy.

- The CSR activities should not be undertaken in the normal course of business and must be with respect to any of the activities mentioned in Schedule VII of the Companies Act, 2013.

Activities Under-taken for CSR – Schedule VII

The activities that can be undertaken by a company to fulfil its CSR obligations include:

- eradicating hunger,

- poverty and malnutrition,

- promoting preventive healthcare,

- promoting education and promoting gender equality,

- setting up homes for women, orphans and senior citizens,

- measures for reducing inequalities faced by socially and economically backward groups,

- ensuring environmental sustainability and ecological balance,

- animal welfare,

- protection of national heritage and art and culture,

- measures for the benefit of armed forces veterans, war widows and their dependents,

- training to promote rural, nationally recognized, Paralympic or Olympic sports,

- contribution to the prime minister’s national relief fund or any other fund set up by the Central Government for socio-economic development and relief and welfare of SC, ST, OBCs, minorities and women,

- contributions or funds provided to technology incubators located within academic institutions approved by the Central Government and rural development projects,

- contribution to clean Ganga fund or Swachh Bharat Kosh

![]()

Which Expenditures are not Treated as CSR Expenditure?

- Expenditure on CSR activities undertaken outside India shall not be CSR expenditure. In determining CSR activities to be undertaken, preference would need to be given to local areas and the areas around where the company operates.

- CSR activities should be undertaken by the companies in project or program mode. One off event such as marathon or award or sponsorship of TV program, etc., would not be qualified as CSR expenditure.

- CSR project or program or activities that benefit only employees of company is not considered as CSR activities for section 135.

- Expenses incurred for the fulfilment of any act or regulation (example: Labour laws) would not count as CSR expendi¬ture.

- Contribution to any political party is not considered to be a CSR activity and only activities in India would be considered for computing CSR expenditure.

Important Note:

- If the hospitals and educational institutions were part of the business activity of the company, they would not be considered as CSR activity. However, if some charity is done by these hospitals or educational institutions, without any statutory obligation to do so, then it can be considered as CSR activity.

- Expenditure incurred by foreign holding company for CSR activities in India will qualify as CSR spend of the Indian subsidiary if, the CSR expenditures are routed through Indian subsidiaries and if the Indian subsidiary is required to do so as per section 135 of the Act.

CSR committee And Othercsr Provisions – Section 135

CSR Committee

To formulate and monitor the CSR policy of a company, a CSR Committee needs to be constituted.

Listed company

It should consist of at least three directors, including an independent director.

Other companies

Unlisted public companies and private companies that are not required to appoint an independent director shall constitute their CSR Committee with minimum two directors.

How to Under take CSR Activities?

Board of company may decide to undertake CSR activities approved by CSR Committee.

- A company can undertake its CSR activities through a registered trust or society or section 8 company established by its holding, subsidiary or associate company or otherwise, provided that the company has specified the activities to be undertaken, the modalities for utilization of funds as well as the reporting and monitoring mechanism.

- If the entity through which the CSR activities are being undertaken is not established by the company or its holding, subsidiary or associate company, such entity would need to have an established track record of three years undertaking similar activities.

- Companies can also collaborate with each other for jointly undertaking CSR activities, provided that each of the companies are able to individually report on such projects.

- A company can build CSR capabilities of its personnel or implementation agencies through institutions with established track records of at least three years, provided that the expenditure (including expenditure or administrative overheads) for such activities does not exceed 5% of the total CSR expenditure of the company in a single financial year.

Important Note:

MCA has vide General Circular No. 21/2014 dated 18th June, 2014 clarifies that salaries paid by the companies to regular CSR staff as well as to volunteers of the companies (in proportion to company’s time/hours spent specifically on CSR) can be factored into CSR project cost as part of the CSR expenditure.

Reporting of CSR Activities

- The report of the Board of Directors attached to the financial statements of the company would also need to include an annual report on the CSR activities of the company in the format prescribed in the CSR Rules setting out inter alia a brief outline of the CSR policy, the composition of the CSR Committee, the average net profit for the last three financial years and the prescribed CSR expenditure.

- If the company has been unable to spend the minimum required on its CSR initiatives, the reasons for not doing so are to be specified in the Board Report.

- Where a company has a website, the CSR policy of the company would need to be disclosed on company’s website.

![]()

Non-compliance of C SR Provisions

- The concept of CSR is based on the principle ‘comply or explain’.

- If the company has been unable to spend the minimum required on its CSR initiatives, the reasons for not doing so are to be specified in the Board Report.

- In case the company does not disclose the reasons in the Board’s report, the company shall be punishable with fine which shall not be less than 150,000 but which may extend to ₹ 25 lakh and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to three years or with fine which shall not be less than ? 50,000 but which may extend to ₹ 5 lakh, or with both.

Practice Questions

Question 1.

State the procedure for approval of directors’ report containing replies to the auditors’ comments and qualifications and authorising the Chairman ‘ to sign the report on behalf of the Board.

Answer:

Board’s report and annexure thereto shall be signed by Chairperson, if he is authorized in this behalf by Board. If he is not authorized, it shall be signed by at least two directors, one of whom shall be Managing Director or by one director where there is one director.

Company should pass Board resolution to authorize Chairperson to sign it. If director’s report contains reply to auditor’s qualifications or remarks, resolution should cover that aspect too.

Question 2.

Chairperson of an Annual General Meeting must make a speech or give a statement at the meeting. Explain the validity of this statement pursuant to the provisions of the Companies Act, 2013.

Answer:

Companies Act, 2013 or any other act does not provide that Chairman of AGM should make a speech or statement at meeting. Generally, AGM starts with Chairman’s speech where he explains company’s progress and working of company for period under review.

Question 3.

In relation to filling of financial statements of a company in XBRL mode and by using the XBRL taxonomy, decide whether the following companies are required to file the financial statements in the said mode:

(i) Grand Ltd., the subsidiary company of Tiny Ltd., which is listed at Kolkata Stock Exchange.

(ii) Prime Ltd., a company which has paid-up share capital of ? 100 crore.

(iii) Crafty Ltd., a company which has a turnover of ? 400 crore.

(iv) Comfort Ltd., a non-banking financial company.

Answer:

i. Yes. Listed company is required to file financial statements in XBRL mode.

ii. Yes. Company has paid up capital more than ₹ 5 Crores. (Threshold for paid up capital is ₹ 5 Crore or more)

iii. Yes. Company has turnover of ₹ 400 Crores (Threshold for turnover is ₹ 100 Crores or more)

iv. No. NBFC is not required to file financial statements in XBRL mode.

Question 4.

Where a company has a branch office, whether in India or abroad, the original books of account, records, etc. of the branch office will have to be maintained in the registered office of the company. Comment.

Answer:

Statement is false. The books of account relating to transaction effected at the branch office may be kept at that office. – Section 128

Question 5.

Prudent General Insurance Company Ltd. is engaged in the general insurance business. The company is not listed in any stock exchange in India but is a subsidiary of Reliable General Insurance Company Ltd., , listed at Bombay Stock Exchange. The turnover of Prudent General Insurance Company Ltd. is ₹ 330 crore. Examining the provisions of the Companies Act, 2013, state whether the company is required to file XBRL enabled balance sheet.

Answer:

Company is not required to file XBRL enabled balance sheet.

![]()

Question 6.

Pioneer Fisheries Ltd. has borrowed an amount of ₹ 50 crore from a financial institution. The Annual General Meeting of the company was held on 1 st September 2015. Examining the pro visions of the Companies Act, 2013, state as to who will sign and certify the annual return while filing the same with the Registrar of Companies after the Annual General Meeting.

Answer:

A director and company secretary of company shall sign the Annual Return of all companies except One Person Company. In case, if company has no company secretary, it should be signed by practicing company secretary. – Section 92

The annual return of following companies is required to be certified bv practicing company secretary:

- All listed company; or

- Companies having paid-up capital of ₹ 10 Crores or more; or

- Companies having turnover of ₹ 25 Crores or more

Accordingly, annual return of Pioneer Fisheries Ltd. shall be signed by its director and company secretary.

Question 7.

Bengaluru Limited is a listed company with a net worth of ₹ 95 lakhs and turnover of ₹ 11.6 crore as on 31st March 2016. The company wants to circulate the financial statements in electronic mode. Referring to the provisions of the Companies Act, 2013, advise the company whether it can do so.

Answer:

In the case of listed company and other public company which has a net worth of more than ₹ 1 Crore and turnover more than ₹ 10 Crore may sent financial statement by electronic mode to the:

- Members whose shareholding is in dematerialized form and whole email ids are registered with company

- Members who are holding shares in physical form and who have given positive consent in waiting to receive financial statement in electronic mode

Question 8.

Vir is a director in D JA Ltd. (the company). The company holds 75% shares of MRN Ltd. Vir wants to inspect the books of MRN Ltd. Examining the provisions of the Companies Act, 2013 advise whether Vir, the director , of DJA Ltd. can be allowed to inspect the books of MRN Ltd.

Answer:

Inspection in respect of any subsidiary of company should be done only by any person authorized in this behalf by resolution of Board of directors. In the given case, MRN Ltd. is subsidiary company of DJA Ltd. Accordingly, Vir, director of DJA Ltd. can be allowed to inspect the books of account of MRN Ltd. if he has been authorised in this regard by way of Board resolution.

Question 9.

The power of directors to approve the financial statements can be delegated to a committee of directors or some of the directors.

Or

The Board of directors of Grow More Ltd., a public company, has duly delegated its power to approve the financial statements of the company for the year 2014-15 to a committee of directors. The said committee considered the annual accounts and approved the same before the accounts were handed over to the statutory auditor of the company. Will you accept such approval of annual accounts?

Answer:

Power of Board to approve the annual accounts cannot be delegated to a committee or any director. Board must themselves consider and approve of annual accounts before it is handed over to statutory auditor.

Question 10.

Chatur is a director of Hopes Ltd., a public limited company, registered under the Companies Act, 2013. He wants to inspect the books of account and other books and papers of the company. Can he do so? Will your answer be different, if the director wants to inspect the books of account through an agent?

Answer:

Books of account and other books and papers of company maintained by the company within India can be inspected by director during business hours. Director is entitled to ask for inspect books of account and other books either personally or through an agent.

![]()

Past Examination Questions

Question 1.

DJA Company Limited held its Annual General Meeting for the financial year ended 31st March 2014, on 30th September 2014. The meeting was adjourned without placing the financial statement for financial year ending on 31st March 2014 before the meeting. The financial statement for financial year of 2014 was placed at the adjourned Annual General Meeting and the same was filed with the ROC on 20th December 2014. Examine with reference to the relevant provisions of the Companies Act, 2013, whether placing of the financial statement at the adjourned Annual

General Meeting and filing of the same with the ROC by the company on 20th December 2014 are in order? (CA May 1998)

Answer:

As per section 96 of Companies Act, 2013, Annual General Meeting of 7 company should be held within 6 months from end of financial year. Every company is required to have uniform financial year (i.e. 1st April to 31st March). It means company should have held meeting on or before 30th September. In the given case, company has conveyed Annual General Meeting on 30th September 2014 for financial year of 2014.

Adjourn Annual General Meeting should be held well within stipulated time (i.e. within 6 months from end of financial year). Here, financial statement was not placed before Annual General Meeting and it is adjourned. Facts of question do not clarify whether financial statement was approved or not. Assuming that it was approved at adjourned Annual General Meeting.

In view of the above facts and assumption, it can be suggested that if financial statement is not adopted at Annual General Meeting, unadopted financial statements should be filed with all specified documents with Registrar within 30 days of Annual General Meeting. Registrar should take note of unadopted financial statements on records as provisional till the financial statements are filed with him after their adoption in adjourned Annual General Meeting. The financial statements adopted in the adjourned Annual General Meeting should be filed with Registrar within 30 days of such adjourned Annual General Meeting. If not filed within 30 days, filing may be done within 300 days with additional filing fees. In the given case, financial statement should be filed on 20th December 2014 is valid if adjourned meeting was held on or before 21st November 2014.

Question 2.

X Ltd. has a subsidiary company called Y Ltd. The financial year of the holding company is 31st March, whereas that of the subsidiary company ends on 30th June every year. The management of the holding company decides that the financial year of the subsidiary Company for the year 1. 7.2013 to 30.6.2014 should be extended upto 31.3.2015, so that the financial years of the holding and subsidiary companies end on 31 st March every year. Advise the management about the steps to be taken under the Companies Act, 2013 to achieve the purpose. (CA May 2001 Modified)

Or

S Ltd. is a subsidiary company of H Ltd. The financial year of H Ltd. is from 1st April to 31st March, whereas the financial year of S Ltd. is 1st July to 30th June every year. This is now causing difficulties particularly in view of the requirement of reporting and circulating the consolidated annual accounts as required by Accounting Standard AS-21. The Board of Directors of H Ltd. decides that the accounting year of S Ltd. for the year 1st July, 2013 to 30th June, 2014 be extended from present 12 months to 21 months, i.e. 1 st July, 2013 to 31 st March, 2015, so that the financial years of the holding company and the subsidiary company end on the same date. State the provisions of the Companies Act, 2013 in this respect and mention the steps to be taken in this regard. (CA November 2003, 2005 Modified)

Or

Sunrise Limited is a subsidiary company of Hotline Ltd. The financial year of Sunrise Limited is 1st July to 30th June, whereas the financial year of Hotline Limited is from 1st April to 31st March every year. To maintain uniformity and consolidation of annual accounts the board of directors of Hotline Limited decided that the accounting year of Sunrise Limited for the year 1st July, 2013 to 30th June, 2014 be extended from present 12 months to 21 months i.e. 1st July 2013 to 31st March 2014. Mention in the light of the provisions of the Companies Act, 2013, the steps to be taken by the Hotline Limited in this regard. (CA June 2009 Modified)

Or

Ambitions Engineering Consultants Ltd., whose financial year ends on 31st March, has acquired Struggling Techies Ltd. making it a subsidiary company. The financial year of the subsidiary company ends on 30th June. The management of the holding company wants to change the financial year of the subsidiary company, if possible, so as to coincide with the financial year of the holding company. State the relevant provisions of the Companies Act, 2013 regarding the financial year and the maximum period upto which the accounts can be prepared in a financial year and the approvals, if any, required to be taken to accomplish this task (CA May 2010 Modified)

Answer:

The definition of financial year under Companies Act, 2013 has been aligned with the Tax laws. ‘Financial year’, in relation to any company or body corporate, means the period ending on the 31 st day of March every year. Now, every company is required to follow uniform financial year. Financial year for every company start from 1 st day of April.

Existing companies on the commencement of 2013 Act, is required to align its financial year as per provision of section 2(41) within a period of 2 years from commencement of 2013 Act. (Section 2(41) is made effective w.e.f. 1st April 2014)

A company or body corporate, which is a holding company or a subsidiary of a company incorporated outside India and is required to follow a different financial year for consolidation of its accounts outside India, the National Company Law Tribunal (NCLT) may allow any period as its financial year, whether or not that period is a year.

In view of above provision, X Ltd cannot apply to NCLT for extension or modification of financial year of its subsidiary because its subsidiary is Indian company. The financial year of holding company start on 1 st April but its subsidiary company on July. Subsidiary company should take necessary steps to align its financial year with holding company within period of 2 years from date of commencement of 2013 Act.

![]()

Question 3.

The financial statement of AS Limited have been signed by two directors A and B. The board comprises of a third director C, who is also the Managing Director. The company has also employed a full time secretary. ‘ Examine whether the authentication of the financial statements is in accordance with law. (CA May 2000 Modified)

Or

Examine the validity of the following with reference to the provisions of the Companies Act, 2013:

The financial statement of TXN Ltd. for the year ended 31st March, 2014 was signed by one of its Directors and the Secretary. (CA June 2009 Modified)

Or

The Board of Directors of Vishwakarma Electronics Limited consists of Mr. Ghanshyam, Mr. Hyder (Directors) and Mr. Indersen (Managing Director). The company has also employed a full time Secretary.

The financial statement of the company were signed by Mr. Ghanshyam and Mr. Hyder. Examine whether the authentication of financial statements of the company was in accordance with the provisions of the Companies Act, 2013? (CA November 2011 Modified)

Answer:

The financial statement (i.e. balance sheet, profit and loss account and cash flow statement) must be signed on behalf of the Board of directors by Chairperson of company, if he is authorized in this behalf. If Chairperson is not authorized, it should be signed bv :

- two directors including MD when there is one, and

- chief executive officer (CEO) if he is director,

- chief financial officer and company secretary where they are appointed. – Section 134 of Companies Act, 2013.

In the instant case, the profit and loss account and balance sheet have been signed by Mr. A and Mr. B, the directors. In view of section 134 of the Companies Act, 2013, Mr. C, Managing Director should be one of the two signing directors. Since the company has also employed a secretary, he should also sign the profit and loss account and balance sheet in addition to the Managing Director C, and one of the directors, either A or B.

Question 4.

The financial statement of a listed company have not been prepared in accordance with some of the applicable accounting standards. Examine the responsibility of the directors and auditors in this regard under the Companies Act, 2013. (CA May 2003 Modified)

Or

XYZ Limited did not prepare its financial statement for financial year in conformity with some of the mandatory Accounting Standards.

You are required to state with reference to the provisions of the Companies Act, 2013, the responsibilities of directors and statutory auditor of the company in this regard. (CA May 2007)

Or

XYZ Ltd. while preparing the financial statement for the financial year ended 31st March, 2014 did not comply with the Accounting Standards. State the consequences that follow in case of non-compliance. (CA November 2011 Modified)

Answer:

As per section 129(5) of Companies Act, 2013, if the financial statements are not prepared as per accounting standards, the company shall disclose in financial statements the following:

- the deviation from the accounting standards

- the reasons for such deviation

- the financial effect, if any, of such deviation

As per section 129 of Companies Act, 2013 Managing Director, Whole time Director in charge of finance, Chief Financial Officer or any other person charged by Board is duty bound to comply requirement of AS. In absence of these persons, all directors are liable for non-comply with AS.

Every auditor should comply with applicable accounting standards. Further, the Board’s report shall include a Directors’ Responsibility Statement, indicating therein that on the preparation of the annual accounts, the applicable accounting standards had been followed along with proper explanation relating to material departures.

The auditor shall state in his report that the annual accounts comply with accounting standards referred to in section 133 of Companies Act, 2013.

Question 5.

The Board of Directors of a company propose to charge the Chief Accountant of the company with the duty of ensuring compliance with the provisions of the Companies Act, 2013 relating to maintenance of proper books of account and financial statements in accordance with the law. (CA November 2003 Modified)

Even if the company is managed by Managing Director, it is possible for the Board of Directors to make any other person (here-Chief Accountant) responsible to ensure compliance with sections 128and 129. When Board has made any other person responsible for complying sections 128 and 129, he is liable to be punished:

- with sentenced to imprisonment upto 1 year or

- with fine which is not less than ₹ 50,000 but not more than ₹ 5 Lakh or

- with both

If company has Managing Director, Whole time Director in charge of financial function or Chief Financial Officer and board has not specified any other person to comply with provisions of sections 128 & 129, they are liable.

![]()

Question 6.

The Annual General Meeting of M/s Robertson Ltd., for laying the financial statements thereat for the year ended 31st March 2014 was not held. In this context:

(i) Advise the company regarding compliance of the provisions of section 137 of the Companies Act, 2013 for filing of copies of financial statement with the Registrar of Companies.

(ii) Will it make any difference in case the financial statements were duly laid before the AGM held on 27th September 2014 but the same were not adopted by the shareholders? (CA May 2005)

Answer:

I. If annual General Meeting is not held, the financial statement along with documents duly signed along with statement of facts and reason for not holding the Annual General Meeting should be filed within 30 days from the latest date on or before which that meeting should have been held. – Section 137

If not filed within 30 days, filing may be done within 300 days with additional filing fees. If company fails to file even within 300 days with additional fees, penal consequences follows.

II. If financial statements are placed before Annual General Meeting but not adopted at Annual General Meeting, it should be filed with all specified documents with Registrar within 30 days of Annual General Meeting.

Registrar should take note of unadopted financial statements on records as provisional till the financial statements are hied with him after their adoption in adjourned Annual General Meeting. If Annual General Meeting is held on 27th September, 2014, the financial statements along with attachments specified for financial year of 2014 should be filed with the Registrar of Companies by 26th October, 2014. If not filed within 30 days, filing may be done within 300 days with additional filing fees. If it is not filed within 300 days, it attract penalty.

Question 7.

With reference of the provisions of the Companies Act, 2013, explain the legal position where XYZ Limited, having one Indian subsidiary company and an overseas subsidiary company, attached to its financial statements and other documents in respect of its Indian subsidiary company only. (CA November 2006)

Answer:

Consolidation of financial statements is made mandatory for all companies where a company has one or more subsidiaries whether Indian or foreign. The mandatory consolidation applies to all companies whether such company is:

- Listed or unlisted

- Private or public

For the purposes of consolidation of financial statements, the expression, subsidiary includes associate company and joint venture. Financial Statement includes:

- Balance sheet

- Profit and loss account or in the case of company not for profit, income and expenditure statement

- Cash flow statement

- Statement of changes in equity, if applicable

- Any explanatory note annexed to above documents

XYZ Ltd. has committed default by not attaching documents relating to foreign subsidiary.

Question 8.

An allegation was levelled against PQR Ltd. that the funds of the company are misused. Mr. Z, one of the Directors of the company wants to inspect the books of account of the company in order to ascertain whether the allegation was true. But since Mr. Z does not have the knowledge of accounting, he appoints Mr. A, his friend and a practicing Chartered Accountant to go through the books of account of the company on his behalf. The company seeks your advice as to whether Mr. A may be allowed to inspect the books of account of the company on behalf of Mr. Z. You are required to give your advice to the company on behalf of Mr. Z. You are required to give your advice to the company keeping in view the provisions of the Companies Act, 2013. What would be your advice if Mr. Z would have been a shareholder only and not a Director of the company? (CA May 2007 Modified)

Answer:

Summarised returns of the books of account of the company kept and maintained outside India shall be sent to registered office at quarterly intervals. It should be kept at registered office and kept open to directors for inspection.

If any other financial information is maintained outside the country, director can furnish request to company setting out full details of financial information sought and period for which such information is sought in writing. Company should provide financial information within 15 days.

Financial information should be demanded by director himself and not bv his power of attorney holder or agent or representative. In view of above provisions, Mr. Z, director who can be refused right of inspection through agent.

In case Mr. Z is a member of the company, he shall be able to inspect the books of account only if he is given such a right by ordinary resolution of the members or if authorized by the Board. Here, Mr. Z would have to exercise the right personally and not through a proxy ie. he can himself inspect the books but cannot ask Mr. A to inspect the books on his behalf.

Question 9.

Annual General Meeting of a company has been concluded on 30th April, 2014. Now the company is required to submit or file its Annual Return and financial statement with Registrar of companies. You are required ‘ to state the procedure for such filing. (CA May 2008 Modified)

Answer:

As per section 92 of Companies Act, 2013 annual return of a company has to be filed with Registrar of Companies within 60 days from the day on which the Annual General Meeting of a company is held. Annual return is required to be hied in Form MGT 7. In the case of listed company or company having paid up capital of 110 crore or more or turnover of X 50 crore or more, annual return shall be certified by Company secretary in practice and in Form MGT 8. It is filed within 30 days from the day on which the Annual General Meeting of a company is held.

![]()

Following procedure is to be followed for filing of above documents:

- To log on website of www.mca.gov.in and download the forms.

- To fill up the Company Identification Number (CIN) and other details in form.

- To attach the Annual Return and financial statements to the respective forms.

- To check the forms with the help of the ‘check form’ button provided in the forms.

- To digitally sign the forms and submit forms.

- To pay the filing fee either through credit card or challan.

- To check from the website of Ministry of Corporate Affairs, in due course, whether the forms Hied have been approved.

Question 10.

The Board of Directors of M/s PQR Ltd. have a practical problem. The registered office of the company is situated in a classified backward area of Maharashtra. The Board wants to keep the account books of the company at its corporate office in Mumbai which is conveniently located. The Board seeks your advice about the feasibility of maintaining the accounting records at a place other than the registered office of the company. Advice. (CA November 2008)

Answer:

The books of account can be kept at such other places in India, if Board of directors has passed resolution to this effect. The Board resolution so passed shall be hied within 7 days of passing Board resolution with the Registrar of Companies and notice giving full address of the other place to all other Government and concerned authority. Thus, in the present case, the company can follow the above procedure and keep its accounts book at Mumbai office. Alternatively, company can maintain books of account in electronic form. Books maintained in electronic form can be accessed from anywhere.

Question 11.

As required under the provisions of the Companies Act, 2013, a company incorporated under the Act has to include in the report of Board of Directors a ‘Directors Responsibility Statement’. Directors of the company seek ‘ your advise about the matters to be included in the statement. Advise. (CA November 2010 Modified)

Answer:

Question 12.

Adorable Ltd., incorporated under the Companies Act, 2013 has on its Board, 5 directors and a Managing Director. The company has also appointed a Company Secretary. The financial statements of the company, viz., balance sheet and statement of profit and loss for the yearended31st March, 2015, were authenticated under signatures of one director and the Company Secretary. Referring to the provisions of the Companies Act, 2013, examine the validity of authentication. What shall be your answer in case the company in question is a ‘one person company’?

Answer:

Chairperson of company must sign the financial statements (Le. balance sheet, profit and loss accounting and cash flow statement) on behalf of the Board of directors, if he is authorized in this behalf. If Chairperson is not authorized, it should be signed by :

- Two directors including MD when there is one, and

- Chief executive officer (CEO) if he is director,

- Chief Financial Officer and Company Secretary where they are appointed – Section 134

In the instant case, one director and the Company Secretary have signed financial statements. In view of section 134 of the Companies Act, 2013, Managing Director should be one of the two signing directors. In case of OPC, one director should sign financial statements.

Question 13.

The paid up capital of Western Zone Insurance Limited is ? 7 crore. Point out whether the said company is required to hie Balance Sheets and Profit and Loss Account along with Director’s and Auditor’s Report for the year 2013-14 by using the XBRL taxonomy under the Companies Act, 2013? (CA November 2012 Modified)

Answer:

Following companies are required to file its financial statement in the XBRL taxonomy:

- Indian listed company and its Indian subsidiary company

- Company having paid up capital of ₹ 5 crore or more

- Company having turnover of ₹ 100 crore or more.

But the above rule is not applicable to Banking company, Insurance company, Power company, Non-banking finance company (NBFC) and Housing Finance Company. In the above given case, Western Zone Insurance Ltd. is Insurance company and hence it is not required to hie financial statement in XBRL for the vear 2013-14.

Question 14.

ABC Private Limited was incorporated on 15-9-2013 in the State of Maharashtra by a group of professional engineers without any knowledge about the maintenance of the books of account. The company has appointed you as the chief accounts officer at New Delhi where the books of account will be maintained. Keeping the provisions of section 128 of Companies Act, 2013, advise the management on:

I. The nature of books to be maintained

II. The period for which the accounts have to be preserved, and

III. The steps to be taken if the books of account are to be kept in New Delhi. (CA May 2014 Modified)

Answer:

I. As per section 128 of Companies Act, 2013, company should maintain at its registered office proper books of account, other relevant books and papers and financial statement for every financial year with respect to:

- all sums of money received and expended by the company and the matters in respect of which receipts and expenditure take place

- all sales and purchases of goods and services by the company.

- the assets and liabilities of the company

The prescribed particulars relating to cost incurred on material and labour for company specified under section 148 of Companies Act, 2013.

II. As per section 128 of Companies Act, 2013, books of account relating to the period of not less than 8 financial years shall be preserved in good condition along with the relevant v ouchers. Where a company has not been in existence for 8 years, the books of account and related vouchers should be preserved in good order right from the first accounting year of the company. This period of 8 years can be longer, if the company is under investigation and Central Government direct company to maintain its books of account for period more than 8 years.

III. Books of account shall be maintained and kept at registered office. All or any books of account may be kept at other place in India if Board of directors passes resolution and gives notice to ROC within 7 days.

Notice to ROC shall specify name of books to be kept at other place and complete address. If books of account are maintained outside India, summarized returns shall be sent to the registered office at quarterly intervals. – Rule 4 – Companies (Accounts) Rules, 2014.

![]()

Question 15.

Mr. Bhagvath, recently acquired 76% of the equity shares of M/s. Renowned Company Ltd., in the hope of earning good dividend income.

Unfortunately the existing Board of directors have been avoiding declaration of dividend due to alleged inadequacy of profits. Unconvinced, Mr. Bhagvath seeks permission of company to allow to him to examine / the books of account, which is summarily rejected by the company. Examine and advise the provisions relation to inspection of books of account and remedy available. (CA November 2014)

Answer:

The members or shareholders of company are not vested any right to inspect books of account of company under Companies Act, ‘2013. However, member or shareholders of company may be permitted to inspect books of account if Articles of association of company authorise inspection to members. As per section 128, director has right to inspect books of account during business hours.

Question 16.

ABC Limited has on its Board, four Directors viz. W, X, Y and Z. In addition, the company has Mr. D as the Managing Director. The company also has a full time Company Secretary, Mr. Wise, on its rolls. The financial statements of the company-Balance Sheet and Statement of Profit & Loss and the Board’s Report for the year ended 31st March 2015 were authenticated by two of the directors, Mr. X and Y under their signatures. Referring to the provisions of the Companies Act, 2013:

(i) Examine the validity of the authentication of the Balance Sheet and Statement of Profit & Loss and the Board’s Report.

(ti) What would be your answer in case the company is a One Person Company (OPC) and has only one Director, who has authenticated the Balance Sheet and Statement of Profit & Loss and the Board’s Report? (CA November 2015)

Answer:

As per section 134 of Companies Act, 2013, Chairperson of company shall sign financial statement where he is authorized by the Board. If Chairperson is not authorized by Board, it shall be signed by two directors out of which one shall be Managing Director, if any, and Chief Financial Officer, if he is director of company and Company Secretary, if he is appointed. In case of OPC, one director shall sign it.

The Board’s report and any annexures thereto shall be signed by its Chairman if he is authorized in that behalf by the Board. If Chairman is not authorized, the report shall be signed by:

- At least two directors, one of whom shall be Managing Director; or

- By director where there is one director

(I) Accordingly, financial statement and Board’s report should be signed by Mr. D, Managing Director. Financial statement should be signed by Mr. Wise, Company Secretary of Company. In the given case, two directors, Mr. X and Mr. Y, signed it. Authentication is not as per provisions of Companies Act, 2013.

(II) Authentication of Financial Statement and Board’s Report by one director in case of OPC is valid.

Question 17.

D JA Company Limited, incorporated under the provisions of Companies Act, 2013, has two subsidiaries – AJD Limited and AMR Limited. All the three companies have prepared their financial statements for the year ‘ ended 31st March 2015. Examining the provisions of the Companies Act, 2013, answer the following:

(i) In what manner the subsidiaries – AJD Limited and AMR Limited shall prepare their Balance Sheet and Profit & Loss Account?

(ii) What would be your answer in case the DJA Limited – the holding company, is not required to prepare consolidated financial statements under the Indian Accounting Standards?

(iii) What shall be your answer in case one of the subsidiary company’s financial statements does not comply with the Accounting Standards?

(iv) To what extent is the Central Government empowered to exempt a company from preparing the financial statements in compliance with the Indian Accounting Standards? (CA November 2015)

Answer:

The provisions of Companies Act, 2013 are applicable to the preparation, adoption and audit of financial statements of holding company shall similarly apply to consolidated financial statement.

Question 18.

Explain the law laid down under the Companies Act, 2013 in respect of filing of annual financial statements with Registrar of companies in the following two situations who is liable for the default.

i. Where financial statements of the company are filed with the ROC after 10 months from its due date?

ii. Where financial statements are not at all filed by the company with the ROC? (CA May 2016)

Answer:

As per section 137 of Companies Act, 2013 every company is required to file financial statements with Registrar within 30 days from the date of Annual General Meeting. If financial statements are not filed within 30 days, filing may be done within 300 days with additional filing fees. If company fails to file even within 300 days with additional fees, following penal consequences take place:

- Company is punishable with fine of ₹ 1000 per day for every day during which the default continues, but shall not be more than ₹ 10 lakhs; and

- Managing Director or Chief Financial Officer is punishable with imprisonment, which may extend to 6 months or with fine of not less than ₹ 1 lakh but which extend to ₹ 5 lakhs.

If the company has neither Managing Director nor Chief Financial Officer, all directors are responsible.

![]()

Question 19.

Super Real Estate Limited, a listed company has made the following profits; the profits reflect eligible profits under the relevant section of the Companies Act, 2013.

| Financial year | Amount (₹ in crores) |

| 2011-12 | 20 |

| 2012-13 | 40 |

| 2013-14 | 30 |

| 2014-15 | 70 |

| 2015-16 | 50 |

(i) Calculate the amount that the company has to spend towards CSR.

(ii) Give the composition of the CSR committee of a listed and unlisted company.

(iii) Will the company suffer penalties if they fail to provide for or incur expenditure for CSR?

List only two activities that are expressly prohibited from being considered as CSR activities. (CA November 2016)

Anwer:

(i) ₹ 3 Cr. (2% of average net profits of last 3 years i.e., ₹ 30 + 70 + 50 Crores)

(ii), (iii) & (iv) Refer paragraph nos. 12 & 13

Question 20.

Bengaluru Limited is a listed company with a net worth of ₹ 95 lakhs and turnover of ₹ 11.6 crore as on 31st March 2016. The company wants to circulate the financial statements in electronic mode. Referring to the provisions of the Companies Act, 2013, advise the company whether it can do so. (CA November 2016)

Answer:

In the case of listed company and other public company which has a net worth of more than ₹ 1 Crore and turnover more than ₹ 10 Crore may sent financial statement bv electronic mode to the:

- Members whose shareholding is in dematerialized form and whole email ids are registered with company

- Members who are holding shares in physical form and who have given positive consent in writing to receive financial statement in electronic mode

Question 21.

Shoki Internal Ltd. has a network of six branches scattered all over the world out of which two are in India. The networth of the company is ₹ 650 crores. Since the net profits of the company were in downward trends, Mr. Nikung a retired general manager of the bank was appointed by the company to analyse the financial health of the company. Among the other points having been reported by Mr. Nikung the CEO of the company seeks your advice, particularly on the application of the provisions of CSR under the Companies Act, 2013 based on the following:

(i) The net profit of the company in the financial year 2012-13 was ₹ 18 crore which was contributed by the branches located in India and outside in the ratio of 35:65.

(ii) Since 2013-14 onwards all the branches located in India have not earned any profit.

(iii) The Financial Statement for the year 2015-16 revealed that there was a net profit of ₹ 7 crore to the company and the total expenses on travelling abroad were ₹ 2.5 crore.

(iv) The company had borrowed loan at a very high of interest which needs to be swapped with low financing cost.

(v) During the year 2016-17 the company has so far spent CSR expenses to the tune of 1.10 per cent of the average net profits of the company made during the three preceding immediately financial year which in his view need special attention. (CA May 2017)

Answer:

Following amounts or element of profits are not included while calculatingnet profit for CSR applicability:

- Any profit arising from overseas branch or separate company operated in India

- Any dividend received from other companies in India which are covered and complying provisions of section 135 of Companies Act, 2013 As per point No. ii, all branches in India have not contributed to profit. It means overseas branches contribute all profits. Net profits of overseas branches are not included and therefore CSR expenditure is not required to be incurred for financial year 2016-17. Company has not violated any provision.

Question 22.

The Board of Directors of M/s PQR Ltd. have a practical problem. The registered office of the company is situated in a classified backward area of Maharashtra. The Board wants to keep the account books of the company at its corporate office in Mumbai which is conveniently located. The Board seeks your advice about the feasibility of maintaining the accounting records at a place other than the registered office of the company. Advice. (CA November 2008)

Answer:

The books of account can be kept at such other places in India, if Board of directors has passed resolution to this effect. The Board resolution so passed shall be filed within 7 days of passing Board resolution with the Registrar of Companies and notice giving full address of the other place to all other government and concerned authority. Thus, in the present case, the company can follow the above procedure and keep its accounts book at Mumbai office. Alternatively, company can maintain books of account in electronic form. Books maintained in electronic form can be accessed from anywhere.