Share Capital and Debentures – CA Inter Law Study Material is designed strictly as per the latest syllabus and exam pattern.

Share Capital and Debentures – CA Inter Law Study Material

Kinds of Share Capital (Sec. 43)

Question 1.

Can equity share with Differential Voting rights be issued? if yes, state the Conditions under which such shares may be issued. [May 18 (6 Marks)]

Answer:

Conditions for the issue of equity shares with differential rights:

As per Sec. 43 of Companies Act, 2013, equity share capital of a company limited by shares may be (a) with voting rights; or (b) with differential voting rights as to dividend, voting or otherwise in accordance with such rules as may be prescribed.

As per Rule 4 of the Companies (Share Capital and Debenture) Rules, 2014, no company limited by shares shall issue equity shares with differential rights as to dividend, voting or otherwise, unless it complies with the following conditions, namely:

- the articles of association of the company authorizes the issue of shares with differential rights;

- the issue of shares is authorized by an ordinary resolution passed at a general meeting of the shareholders. However, where the equity shares of a company are listed on a recognized stock exchange, the issue of such shares shall be approved by the shareholders through postal ballot;

- the shares with differential rights shall not exceed 74% of the total post-issue paid up equity share capital including equity shares with differential rights issued at any point of time;

- the company has not defaulted in filing financial statements and annual returns for 3 financial years immediately preceding the financial year in which it is decided to issue such shares;

- the company has no subsisting default in the payment of a declared dividend to its shareholders or repayment of its matured deposits or redemption of its preference shares or debentures that have become due for redemption or payment of interest on such deposits or debentures or payment of dividend;

- the company has not defaulted in payment of the dividend on preference shares or repayment of any term loan from a public financial institution or State level financial institution or Scheduled Bank that has become repayable or interest payable thereon or dues with respect to statutory payments relating to its employees to any authority or default in crediting the amount in Investor Education and Protection Fund to the Central Government;

However, a company may issue equity shares with differential rights upon expiry of 5 years from the end of the financial Year in which such default was made good. - the company has not been penalized by Court or Tribunal during the last 3 years of any offence under the RBI Act, 1934, the SEBI Act, 1992, the SCRA, 1956, the FEMA, 1999 or any other special Act, under which such companies being regulated by sectoral regulators.

![]()

Variation of Shareholder’s Rights (Sec. 48)

Question 2.

Growmore Ltd.’s share capital is divided into different classes. Now, Growmore Ltd. intends to vary the rights attached to a particular class of shares. Explain the provisions of the Companies Act, 2013 to Growmore Ltd. as to obtaining consent from the shareholders in relation to variation of rights. [RTP-Nov. 18]

Answer:

Variation of Shareholder’s Rights:

Sec. 48 of Companies Act, 2013 deals with the provisions relating to variation of shareholder’s rights.

(1) Conditions for Variation in Rights:

(a) The holders of not less than 3/4th of the issued shares of that class whose rights are to be varied must give consent in writing or a special resolution passed at a separate meeting of the holders of the issued shares of that class.

(b) The MOA/AOA of the company must contain a provision with respect of such variation.

(c) In the absence of any such provision in the MOA/AOA, such variation must not be prohibited by the terms of issue of the shares of that class.

(d) If variation by one class of shareholders affects the rights of any other class of shareholders, the consent of 3/4th of such other class of shareholders shall also be obtained and the provision of this Section shall apply to such variation.

(2) No consent for variation:

(a) The holders of not less than 10% of the issued shares of a class, who did not consent to or vote in favour of the resolution for the variation, may apply to the Tribunal to have the variation cancelled, and where any such application is made, the variation shall not have effect unless & it is confirmed by the Tribunal.

(b) Application shall be made within 21 days after the date on which the consent was given or the resolution was passed.

(c) The decision of NCLT on application shall be binding on the shareholders.

(d) The Company shall file copy of NCLT order to ROC within 30 days from date of order of NCLT.

![]()

Calls on Shares (Secs. 49, 50 and 51)

Question 3.

Moon Star Machineries Limited is authorised by its articles to accept the whole or any part of the amount of remaining unpaid calls from any member even if no part of that amount has been called up by it. Anand, a shareholder, deposits in advance the remaining amount due on his partly paid-up shares without any calls being made by company. Whether Company is permitted to accept the advance amount received on unpaid calls from Anand?

Answer:

Acceptance of Calls in advance:

Sec. 50 of Companies Act. 2013 provides that a company may, if so authorised by its articles, accept from any member, the whole or a part of the amount remaining unpaid on any shares held by him, even if no part of that amount has been called up. However, such members shall not be entitled to any voting rights in respect of the amount so paid by him until that amount has been called up.

In the given case, company is authorised by its articles to accept the whole or any part of the amount of remaining unpaid calls from any member even if no part of that amount has been called up by it. Anand, a shareholder, deposits in advance the remaining amount due on his partly paid-up shares without any calls being made by company.

Conclusion: In view of the authorisation given by the Articles, Moon Star Machineries Limited is permitted to accept the advance amount received on unpaid calls from Anand. In other words, this is a valid transaction.

Question 4.

Coriander Masale Limited has issued 10,00,000 equity shares of ₹ 10 each on which ₹ 6 per share has been called till allotment and the first and final call of ₹ 4 is yet to be made. Reena holds 10,000 shares on which she had paid whole of ₹ 10 per share. In the upcoming extraordinary general meeting of the company, she wants to exercise her voting right as owner of fully paid-up shares. Whether Company can permit?

Answer:

Acceptance of Calls in advance:

Sec. 50 of Companies Act. 2013 provides that a company may, if so authorised by its articles, accept from any member, the whole or a part of the amount remaining unpaid on any shares held by him, even if no part of that amount has been called up. However, such members shall not be entitled to any voting rights in respect of the amount so paid by him until that amount has been called up.

In the given case, company has issued 10,00,000 equity shares of ₹ 10 each on which ₹ 6 per share has been called till allotment and the first and final call of ₹ 4 is yet to be made. Reena holds 10,000 shares on which she had paid whole of ₹ 10 per share. In the upcoming EGM of the company, she wants to exercise her voting right as owner of fully paid-up shares.

Conclusion: Company cannot permit Reena as she does not have voting right in respect of the ‘advance amount’ paid by her in respect of first and final call. The restriction will continue till the amount is duly called up by the company.

![]()

Issue of Securities at a Premium (Sec 52)

Question 5.

Walnut Foods Limited has an authorized share capital of 2,00,000 equity shares of ₹ 100 per share and an amount of ₹ 2 crores in its Securities Premium Account as on 31.03.2022, The Board of Directors seeks your advice about the application of Securities Premium Account for its business purposes. Please give your advice. [RTP-May 19]

Answer:

Utilisation of amount lying to the credit of Securities Premium Account:

As per Sec. 52 of the Companies Act, 2013, where a company issues shares at a premium, whether for cash or otherwise, a sum equal to the aggregate amount of the premium received on those shares shall be transferred to a “securities premium account”. The securities premium account may be applied by the company:

(a) towards the issue of unissued shares of the company to the members of the company as fully paid bonus shares;

(b) in writing off the preliminary expenses of the company;

(c) in writing off the expenses of, or the commission paid or discount allowed on, any issue of shares or debentures of the company;

(d) in providing for the premium payable on the redemption of any redeemable preference shares or of any debentures of the company; or

(e) for the purchase of its own shares or other securities under section 68.

Issue of Shares at a Discount (Sec. 53)

Question 6.

ABC Limited is a public company incorporated in New Delhi. The Board of Directors of the company wants to bring a public issue of 1,00,000 equity shares of ₹ 10 each. The BOD has appointed an underwriter for this issue for ensuring the minimum subscription of the issue. The underwriter advised the BOD that due to current economic situation of the country it would be better if the company offers these shares at a discount of ₹ 1 per share to ensure full subscription of this public issue. The Board of directors agreed to the suggestion of underwriter and offered the shares at a discount of ₹ 1 per share. The issue was fully subscribed and die shares were allotted to the applicants in due course.

Decide whether the issue of shares as mentioned above is valid or not as per Sec. 53 of Companies Act, 2013. What would be your answer in the above case if the shares are issued to employees as sweat equity shares? [Nov. 20 (3 Marks)]

Answer:

Issue of Shares at a discount:

Sec. 53 of the Companies Act, 2013 provides that a company shall not issue shares at a discount, except in the case of an issue of sweat equity shares given u/s 54 of the Companies Act, 2013. Any share issued by a company at a discount shall be void.

Conclusion: In accordance with the above provisions, issue of shares by ABC Limited at a discount of ₹ 1 per share is not valid.

In case the shares have been issued to employees as sweat equity shares, then the issue of shares at discount is valid considering the provisions of Sec. 54 of the Companies Act, 2013.

![]()

Question 7.

State the reasons for issue of shares at premium or discount. Also write In brief the purposes for which the securities premium account can be utilized? [Jan.21 (5 Marks)]

Answer:

Reasons for issue of shares at premium or discount:

When a company issues shares at a price higher than their lace value, the shares are said to be issued at premium and the differential amount is termed as premium. On the other hand, when a company issues shares at a price lower than their face value, the shares are said to be issued at discount and the differential amount is termed as discount. However, as per the provisions of section 53 of the Companies Act, 2013, a company is prohibited to issue shares at a discount except in the case of an issue of sweat equity shares given under section 54 of the Companies Act, 2013.

Utilisation of amount lying to the credit of Securities Premium Account:

As per Sec. 52 of the Companies Act, 2013, where a company issues shares at a premium, whether for cash or otherwise, a sum equal to the aggregate amount of the premium received on those shares shall be transferred to a “securities premium account”. The securities premium account may be applied by the company:

(a) towards the issue of unissued shares of the company to the members of the company as fully paid bonus shares;

(b) in writing off the preliminary expenses of the company;

(c) in writing off the expenses of, or the commission paid or discount allowed on, any issue of shares or debentures of the company;

(d) in providing for the premium payable on the redemption of any redeemable preference shares or of any debentures of the company; or

(e) for the purchase of its own shares or other securities under section 68.

![]()

Issue of Sweat Equity Shares (Sec. 54)

Question 8.

Trisha Data Security Limited was incorporated on 1st August, 2022 with a paid-up share capital of ₹ 200 crores. Within a small period of about 4 months in operation, it has earned sizeable profits and has topped the charts for its high employee friendly environment The company wants to issue sweat equity to its employees. A close friend of the CEO of the Company has told him that the Company cannot issue sweat equity shares as minimum 2 years have not elapsed since the time company commended its business. The CEO of the company has approached you to advice about the essential conditions to be fulfilled before the issue of sweat equity shares especially since their company is just a few months old. [RTP-May 19; MTP-March 19, May 20)

Answer:

Conditions to be fulfilled for issue of sweat equity shares:

As per Sec. 54 of the Companies Act, 2013, a company may issue sweat equity shares of a class of

shares already issued, if the following conditions are fulfilled, namely:

- the issue is authorised by a special resolution passed by the company;

- the resolution specifies the number of shares, the current market price, consideration, if any, and the class or classes of directors or employees to whom such equity shares are to be issued;

- where the equity shares of the company are listed on a recognised stock exchange, the sweat equity shares are issued in accordance with the regulations made by the Securities and Exchange Board in this behalf and if they are not so listed, the sweat equity shares are issued in accordance with such rules as prescribed under Rule 8 of the Companies (Share and Debentures) Rules, 2014,

The rights, limitations, restrictions and provisions as are for the time being applicable to equity shares shall be applicable to the sweat equity shares issued u/s 54 and the holders of such shares shall rank pari passu with other equity shareholders.

Conclusion: Trisha Data Security Limited can issue sweat equity shares by following the conditions as mentioned above. It does not make a difference that the company is just about 4 months old because no such minimum time limit of 2 years in operations is specified u/s 54.

![]()

Question 9.

Yellow Pvt Ltd. is an unlisted company incorporated in the year 2012. The company have share capital of ₹ 50 crores. The company has decided to issue sweat equity shares to its directors and employees. The company decided to issue 10% sweat equity shares (which in total will add up to 30% of its paid up equity shares), with a locking period of 5 years, as it is a start-up company. How would you justify these facts in relation to the provision for issue of sweat equity shares by a startup company, with reference to the provision of the Companies Act, 2013. Explain? [RTP-Nov. 21; MTP-Nov. 21]

Answer:

Issue of Sweat Equity shares by a start up company:

- As per Sec. 54 of the Companies Act, 2013, a company can issue sweat equity shares to its director and permanent employees of the company.

- Rule 8 of the Companies (Share Capital and debentures) Rules, 2014 provides that a start up company, may issue sweat equity share not exceeding 50% of its paid up share capital up to 10 years from the date of its in incorporation or registration.

- Further, the sweat equity shares issued to directors or employees shall be locked in/non- transferable for a period of 3 years from the date of allotment.

- In the given case, a start up company is willing to issue 10% sweat equity shares (which in total will add up to 30% of its paid up equity shares), with a locking period of 5 years.

Conclusion: Company can issue sweat equity shares by passing special resolution at its general meeting. The company as a startup company is right in issue of 10% sweat equity share as it is overall within the limit of 50% of its paid up share capital. But the lock in period of the shares is limited to maximum 3 years period from the date of allotment.

Issue and Redemption of Preference Share (Sec. 55)

Question 10.

During the Current Financial Year, the Board of Directors of Vititee Lifestyles Garments Limited is to undertake redemption of 20,000 Preference Shares of ₹ 100 each at a premium of ₹ 20 per share, it is made out by the Account Department that the profits are sufficient to meet the ensuring liability arising out of redemption of preference shares at premium. Whether Company need to create Capital Redemption Reserve?

Answer:

Redemption of preference shares:

- Sec. 55 of the Companies Act, 2019 provides that where preference shares are proposed to be redeemed out of the profits of the company, there shall, out of such profits, be transferred, a sum equal to the nominal amount of the shares to be redeemed, to a reserve, to be called the Capital Redemption Reserve Account.

- In the given case, company is to undertake redemption of 20,000 Preference Shares of ₹ 100 each at a premium of ₹ 20 per share.

Conclusion: The amount that needs to be transferred to Capital Redemption Reserve (CRR) account, if preference shares are redeemed at a premium out of profits which are otherwise available for dividend, is ₹ 20,00,000 being the sum equal to the nominal amount of the preference shares to be redeemed. There is no need to transfer to CRR account any amount paid towards premium.

![]()

Question 11.

Due to insufficient profits. Silver Robotics Limited is unable to redeem its existing preference shares amounting to ₹ 10,00,000 (10,000 preference shares of f 100 each) though as per the terms of issue they need to be redeemed within next 2 months. It did not, however, default in payment of dividend as and when it became due. What is remedy available to the company in respect of outstanding preference shares as per the Companies Act, 2013?

Answer:

Redemption of Preference Shares:

- As per Sec. 55 of the Companies Act, 2013, where a company is not in a position to redeem any preference shares or to pay dividend, if any, on such shares in accordance with the terms of issue (such shares hereinafter referred to as unredeemed preference shares), it may:

- with the consent of the holders of 3/4th in value of such preference shares, and with the approval of the Tribunal on a petition made by it in this behalf, issue further redeemable preference shares equal to the amount due, including the dividend thereon, in respect of the unredeemed preference shares, and on the issue of such further redeemable preference shares, the unredeemed preference shares shall be deemed to have been redeemed.

- The Tribunal shall, while giving approval, order the redemption forthwith of preference shares held by such persons who have not consented to the issue of further redeemable preference shares.

In accordance with the provisions of Sec. 55(3), Silver Robotics Limited can initiate steps for the issue of further redeemable preference shares equal to the amount due i.e. ₹ 10,00,000. For this purpose, it shall obtain the consent of the holders of 3/4th in value of such preference shares and also seek approval of the Tribunal by making a petition. In case, there are certain preference shareholders who have not accorded their consent for the proposal of issuing further redeemable preference shares, the Tribunal may order the company to redeem forthwith such preference shares.

Accordingly, Silver Robotics Limited must be ready with sufficient funds for the redemption of preference shares held by those who have not consented. On the issue of such further redeemable preference shares by the company, the unredeemed preference shares shall be deemed to have been redeemed.

![]()

Question 12.

SKS Limited issued 8% 1,50,000 Redeemable Preference Shares of ₹ 100 each in the month of May, 2010, which are liable to be redeemed within a period of 10 years. Due to the Covid-19 pandemic, the Company is neither in a position to redeem the preference shares nor to pay dividend in accordance with the terms of issue. The Company with the consent of Redeemable Preference Shareholders of 70% in value, made a petition to the Tribunal [NCLT) to accord approval to issue further redeemable preference shares equal to the amount due. Will the petition be approved by the Tribunal in the light of the provisions of the Companies Act, 2013?

Can the company include the dividend unpaid in the above issue of redeemable preference shares? [May 22 (3 Marks)]

Answer:

Redemption of Preference Shares:

- As per Sec. 55 of the Companies Act, 2013, where a company is not in a position to redeem any preference shares or to pay dividend, if any, on such shares in accordance with the terms of issue (such shares hereinafter referred to as unredeemed preference shares), it may:

- with the consent of the holders of 3/4th in value of such preference shares, and => with the approval of the Tribunal on a petition made by it in this behalf,

issue further redeemable preference shares equal to the amount due, including the dividend thereon, in respect of the unredeemed preference shares, and on the issue of such further redeemable preference shares, the unredeemed preference shares shall be deemed to have been redeemed.

- with the consent of the holders of 3/4th in value of such preference shares, and => with the approval of the Tribunal on a petition made by it in this behalf,

- The Tribunal shall, while giving approval, order the redemption forthwith of preference shares held by such persons who have not consented to the issue of further redeemable preference shares.

- In the given case, company with the consent of Redeemable Preference Shareholders of 70% in value, made a petition to the Tribunal [NCLT) to accord approval to issue further redeemable preference shares equal to the amount due.

Conclusion: Petition will not be approved by the Tribunal as the consent of the holders of 3/4th in value of such preference shares is not taken.

Company can include the dividend unpaid in the above issue of redeemable preference shares, subject to consent of the holders of 3/4th in value of such preference shares.

![]()

Transfer and Transmission of Securities (Sec. 56)

Question 13.

Himanshu has received notice from Chaitanya Progressive Books Private Limited on 7th August, 2022 intimating that Shefali has submitted transfer deed duly signed by her for transfer of 500 partly paid-up shares (₹ 6 Paid up out of face value of ₹ 10 per share) in his name. Himanshu as transferee raise his objection to the proposed transfer of partly paid-up shares on 21st August, 2022. Whether Such objection is Valid?

Answer:

Transfer of Partly paid shares

As per Sec. 56(3) of Companies Act, 2013, where an application is made by the transferor alone and relates to partly paid shares, the transfer shall not be registered, unless the company gives the notice of the application in Form No. SH-5 to the transferee and the transferee gives no objection to the transfer within two weeks from the receipt of notice.

In the given case, Shefali has submitted transfer deed duly signed by her for transfer of 500 partly paid-up shares (₹ 6 Paid up out of face value of ₹ 10 per share) in the name of Himanshu. Himanshu as transferee raise his objection to the proposed transfer of partly paid-up shares on 21st August, 2022.

Conclusion: Objection is valid as objection was raised within the prescribed time.

Question 14.

Richa Daniel, after having obtained succession certificate, succeeded to 7,000 shares of ₹ 100 each allotted to her by late father Alexender Daniel by Speed Software Limited. To pay off the debt of her cousin Stesley, she wants to transfer whole of the 7,000 shares to her on the basis of a duly stamped instrument of transfer which has been signed by her as well as Stesley. Accordingly, she has delivered the required documents to the company for transfer of shares. Whether company can transfer the shares in favour of Stesley considering that Richa is not registered shareholder?

Answer:

Transfer by Legal representative:

As per Sec. 56(5) of Companies Act, 2013, the transfer of any security or other interest of a deceased person in a company made by his legal representative shall, even if the legal representative is not a holder thereof, be valid as if he had been the holder at the time of the execution of the instrument of transfer.

In the given case, Richa Daniel, successor of shares of her father, wants to transfer certain shares to her cousin on the basis of a duly stamped instrument of transfer which has been signed by her as well as her cousin. Accordingly, she has delivered the required documents to the company for transfer of shares.

Conclusion: Company, on receipt of duly stamped instrument of transfer along with requisite share certificates and succession certificate, shall transfer the shares in favour of Stesley.

Note: As an alternative, Richa Daniel may choose to get herself registered as holder of the shares in which case, she will make an application to the company. Application shall be accompanied with share certificates and succession certificate. On receipt of these documents, the company will scrutinize them and if found in order, it shall proceed to enter the name of Richa Daniel in the Register of Members.

![]()

Question 15.

Ratnesh, a resident of New Delhi, sent a transfer deed duly signed by him as transferee and his brother Suresh as transferor, for registration of transfer of shares to Ryan Entertainment Pvt. Ltd. at its registered office in Mumbai. He did not receive the transferred shares certificates even after the expiry of 4 months from the date of dispatch of transfer deed. He lodged a criminal complaint in Court at New Delhi. Decide, under the provisions of the Companies Act, 2013, whether the court at New Delhi is competent to act in said matter?

Answer:

Jurisdiction of Court, now Tribunal under the Companies Act, 2013:

- As per Sec. 56(4] of the Companies Act, 2013, every company, unless prohibited by any provision of law or of any order of court, Tribunal or other authority, shall deliver the certificates of all shares transferred within a period of 1 month from the date of receipt by the company of the instrument of transfer.

- Further, as per Sec. 56(6], where any default is made in complying with the provisions of Sec. 56, the company and every officer of the company who is in default shall be liable to a penalty of ₹ 50,000.

- In this case, the jurisdiction binding on the company is that of the State in which the registered office of the company is situated i.e. Mumbai.

Conclusion: Court at Delhi is not competent to act in the matter.

Question 16.

Mr. A was having 500 equity shares of Open Sky Aircrafts Limited. Mr. B acquired these shares of the company from Mr. A but the signature of Mr. A, the transferor on the transfer deed was forged. The company registered the shares in the name of Mr. B by issuing share certificate. Mr. B sold 100 equity shares to Mr. C on the basis of share certificate issued by Open Sky Aircrafts Limited. Mr. B and Mr. C are not having the knowledge of forgery. State the rights of Mr, A, Mr. B and Mr. C under the Companies Act, 2013. [MTP-May 20]

OR

500 equity shares of ABC Limited were acquired by Mr. Amit, but the signature of Mr. Manoj, the transferor, on the transfer deed was forged. Mr. Amit, after getting the shares registered by the company in his name, sold 250 equity shares to Mr. Abhi on the strength of the share certificate issued by ABC Limited. Mr. Amit and Mr. Abhi were not aware of the forgery. What are the liabilities/rights of Mr. Manoj, Amit and Abhi against the company with reference to the aforesaid shares? [RTP-Nov. 21]

Answer:

Forged Transfers:

As per Sec. 46(1) of the Companies Act, 2013, a share certificate once issued under the common seal, if any, of the company or signed by 2 directors or by a director and the Company Secretary, wherever the company has appointed a Company Secretary, specifying the shares held by any person, shall be prima facie evidence of the title of the person to such shares. Therefore, in the normal course the person named in the share certificate is for all practical purposes the legal owner of the shares therein and the company cannot deny his title to the shares.

However, a forged transfer is a nullity. It does not give the transferee (Mr. B] any title to the shares. Similarly any transfer made by Mr. B (to Mr. C] will also not give a good title to the shares as the title of the buyer is only as good as that of the seller.

Therefore, if the company acts on a forged transfer and removes the name of the real owner (Mr. A) from the Register of Members, then the company is bound to restore the name of Mr. A as the holder of the shares and to pay him any dividends which he ought to have received (Barton v. North Staffordshire Railway Co.).

In the above case, ‘therefore, Mr. A has the right against the company to get the shares recorded in his name. However, neither Mr. B nor Mr. C have any rights against the company even though they are bona fide purchasers.

![]()

Refusal to Register Transfer and Appeal Against Refusal – Sec. 58

Question 17.

Mr. Nilesh has transferred 1,000 equity shares of Perfect Vision Private Limited to his sister Ms. Mukta. The Company did not register the transfer of shares and also did not send notice of refusal to Mr. Nilesh or Ms. Mukta within the prescribed period. Discuss as per the provisions of the Companies Act, 2013, whether aggrieved party has any right against the company? [RTP-May 18; MTP-March 19, Oct. 19, Nov. 21]

Answer:

Rights of parties against company refusal to register transfer of shares:

As per Sec. 58(1) of the Companies Act, 2013, if a private company limited by shares refuses to register the transfer of or the transmission by operation of law of the right to any securities or interest of a member in the company, then the company shall send notice of refusal to the transferor and the transferee or to the person giving intimation of such transmission, within a period of 30 days from the date on which the instrument of transfer, or the intimation of such transmission, was delivered to the company.

As per Sec. 58(3] of the Companies Act, 2013, the transferee may appeal to the Tribunal against the refusal within a period of 30 days from the date of receipt of the notice or in case no notice has been sent by the company, within a period of 60 days from the date on which the instrument of transfer or the intimation of transmission, was delivered to the company.

In the present case, the company has committed the wrongful act of not sending the notice of refusal to register the transfer of shares.

Conclusion: Ms. Mukta being transferee can file an appeal before the Tribunal within a period of 60 days from the date on which the instrument of transfer was delivered to the company.

Question 18.

Harsh purchased 1,000 shares of Singhania Ltd. from pratik and sent those shares to the Company for transfer in his name. The Company neither transferred the shares nor sent any notice of refusal of transfer to any party within the period stipulated in the Companies Act, 2013. What is the time frame in which the company is supposed to reply to transferee? Does Harsh, the transferee have any remedies against the company for not sending any intimation in relation to transferred shares to him? [May 18 (4 Marks)]

Answer:

Refusal for Registration of transferred/transmitted securities:

As per Sec. 58(4] of the Companies Act, 2013, if a public company without sufficient cause refuses to register the transfer of securities within a period of 30 days from the date on which the instrument of transfer is delivered to the company, the transferee may, within a period of 60 days of such refusal or where no intimation has been received from the company within 90 days of the delivery of the instrument of transfer, appeal to the Tribunal.

Remedies available to the Transferee against the company:

As per Sec. 58(5] of the Companies Act, 2013, the Tribunal, while dealing with an appeal may, after hearing the parties, either dismiss the appeal, or by order:

(a) direct that the transfer or transmission shall be registered by the company and the company shall comply with such order within a period of ten days of the receipt of the order; or

(b) direct rectification of the register and also direct the company to pay damages, if any, sustained by any party aggrieved.

Conclusion: Harsh, can make an appeal before the tribunal for remedies that the company shall be ordered to register transfer /transmission of securities within 10 days of the receipt of order, or rectify register and pay damages.

![]()

Further Issue of Share Capital (Sec. 62)

Question 19.

A company, listed at Bombay Stock Exchanges, intends to offer its new shares to the non-members. The Existing members of the Company consider such shares as invalid in view of the provisions of Sec 62(1)(a). Whether Company can offer new shares without giving offer to existing shareholders?

Answer:

Further issue of Share Capital:

Sec. 62(1) of the Companies Act, 2013 provides that if at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares should be offered to:

(a) the existing equity shareholders of the company as at the date of the offer, in proportion to the capital paid up on those shares.

(b) employees under a scheme of employees’ stock option subject to a special resolution passed by the company and subject to such conditions as may be prescribed.

(c) to any persons, if it is authorised by a special resolution, whether or not those persons include the persons referred to in clause (a) or clause (b), either for cash or for a consideration other than cash, if the price of such shares is determined by the valuation report of a registered valuer subject to such conditions as may be prescribed.

Question 20.

VRS Company Limited Is holding 45% of total equity shares in SV Company Limited. The Board of Directors of SV Company Ltd, (incorporated on January 1, 2022) decided to raise the share capital by issuing further shares. The Board of Directors resolved not to offer any shares to VRS Company Limited, on the ground that it was already holding a high percentage of the total number of shares issued by SV Company Limited. The Articles of Association of SV Company Limited provides that new shares should first be offered to the existing shareholders of the company. On March 1, 2022, SV Company Ltd. offered new equity shares to all the shareholders except VRS Company Limited. Referring to the provisions of the Companies Act, 2013 examine the validity of the decision of the Board of SV Company Limited of not offering any further shares to VRS Company Limited.

Answer:

Further Issue of Share Capital:

As per Sec. 62(1) of the Companies Act, 2013, if, at any time, a company having a share capital proposes to increase its subscribed capital by issue of further shares, such shares should first be offered to the existing equity shareholders of the company as at the date of the offer, in proportion to the paid-up capital on those shares.

In the given case, the Articles of SV Company Limited provide that the new shares should first offered to the existing shareholders. However, the company offered new shares to all shareholders excepting VRS Company Limited, which held a major portion of its equity shares. Company cannot ignore a section of the existing shareholders and must offer the shares to the existing equity shareholders in proportion of their holdings.

Conclusion: Decision of the Board of Directors of SV Company Limited not to offer any further equity shares to VRS Company Limited on the ground that VRS Company Limited already held a high percentage of shareholding in SV Company Limited is not valid as it violates the provisions of Sec. 62(1) as well as Articles of the issuing company.

![]()

Question 21.

Dhyan Dairy Ltd., a dairy product manufacturing company wants to set up a new processing unit at Udaipur. Due to paucity of funds, the existing shareholders are not willing to fund for expansion. Hence, the company approached Shyam Ltd. for subscribing to the shares of the company for expansion purposes. Can Dhyan Dairy Ltd. issues shares only to Shyam Ltd. under the provision of Companies Act, 2013? If so, state the conditions. [MTP-March 18]

Answer:

Issue of Further Shares:

As per Sec. 62(1) of the Companies Act, 2013 if at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares should be offered to:

(a) the existing equity shareholders of the company as at the date of the offer, in proportion to the capital paid up on those shares.

(b) employees under a scheme of employees’ stock option subject to a special resolution passed by the company and subject to such conditions as may be prescribed.

(c) to any persons, if it is authorised by a special resolution, whether or not those persons include the persons referred to in clause (a) or clause (b), either for cash or for a consideration other than cash, if the price of such shares is determined by the valuation report of a registered valuer subject to such conditions as may be prescribed.

In the given case Dhyan Dairy Ltd. approached Shayam Ltd. for subscribing to the shares of the company for its expansion and Shyam Ltd. is neither an existing equity shareholder of the company nor an employee.

Conclusion: Dhyan Dairy Ltd., if it is authorised by a special resolution, may issues shares to Shayam Ltd. either for cash or for a consideration other than cash, subject to the condition that the price of such shares is determined by the valuation report of a registered valuer.

Question 22.

Shilpi Developers India Ltd. owned to Sunil ₹ 10,000. On becoming this debt payable, the company offered Sunil 100 shares of 1100 each in lull settlement of the debt. The said shares were allotted to Sunil as fully paid-up in lieu of bis debt. Examine the validity of this allotment in the light of the provisions of Companies Act, 2013. [MTP-Aug. 18]

Answer:

Issue of Shares in settlement of debt:

As per Sec. 62(l)(c) of the Companies Act, 2013 where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, either for cash or for a consideration other than cash, such shares may be offered to any persons, if it is authorised by a special resolution and if the price of such shares is determined by a valuation report of a registered valuer, subject to the compliance of such conditions as may be prescribed.

In the present case, Shilpi Developers India Ltd. allotment, to be classified as shares issued for consideration other than cash, must be approved by the members by a special resolution. Further, the valuation of the shares must be done by a registered valuer, subject to the compliance with the applicable provisions of Chapter III and any other conditions as may be prescribed.

![]()

Question 23.

Earth Ltd., a public company offer the new shares (further issue of shares) to persons other than the existing shareholders of the company. Explain the conditions when shares can be issued to persons other than existing shareholders. Discuss whether these shares can be offered to the Preference shareholders? [RTP-Nov. 18]

Answer:

Issue of Further Shares:

Sec. 62(1) of the Companies Act, 2013 provides that if, at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares should be offered to the existing equity shareholders of the company as at the date of the offer, in proportion to the capital paid up on those shares.

However, certain exceptions have been provided in the Companies Act, 2013 when such further shares of a company may-be offered to other persons as well. These are as under:

(a) Shares may be offered to employees under a scheme of employees stock option subject to a special resolution passed by the company and subject to such conditions as may be prescribed.

(b) Shares may be offered to any persons, if it is authorised by a special resolution, either for cash or for a consideration other than cash, if the price of such shares is determined by the valuation report of a registered valuer, subject to the compliance with the applicable provisions of Chapter HI and any other conditions as may be prescribed.

(c) if any equity shareholder to whom the shares are offered in terms of Sec. 62(1), declines such offer, the Board of Directors may dispose of the shares in such manner as it is not disadvantageous to the shareholders or to the company.

Issue of further shares to Preference Shareholders:

From the wordings of Sec. 62(1), it is quite clear that these shares can be issued to any persons who may be preference shareholders as well provided such issue is authorized by a special resolution of the company and are issued on such conditions as may be prescribed.

![]()

Question 24.

X Limited issued a notice on 1st February, 2022 to its existing shareholders offering to purchase one extra share for every 5 shares held by them. The last date to accept the offer was 15th February only. Mr. Kavi has given an application to renounce the shares offered to him in favour of Mr. Ravi, who is not a shareholder of the company. Examine the validity of application of Mr. Kavi under the provision of Companies Act, 2013. Would your answer differ if Ravi is a shareholder of X Ltd,? [Nov. 19 (5 Marks)]

Answer:

Renouncement of Rights attached to Right Shares:

As per Sec. 62 of the Companies Act, 2013, where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares shall be offered to persons who, at the date of the offer, are holders of equity shares of the company in proportion, as nearly as circumstances admit, to the paid-up share capital on those shares by sending a letter of offer subject to the following conditions, namely:

- the offer shall be made by notice specifying the number of shares offered and limiting a time not being less than fifteen days and not exceeding thirty days from the date of the offer within which the offer, if not accepted, shall be deemed to have been declined;

- unless the articles otherwise provide, the offer aforesaid shall be deemed to include a right exercisable by the person concerned to renounce the shares offered to him or any of them in favour of any other person; and the notice referred to in clause (i) shall contain a statement of this right;

- after the expiry of the time specified in the notice aforesaid, or on receipt of earlier intimation from the person to whom such notice is given that he declines to accept the shares offered, the Board of Directors may dispose of them in such manner which is not disadvantageous to the shareholders and the company.

In the instant case, X Ltd. issued a notice on 1st Feb, 2022 to its existing sharesholders offering to purchase one extra share for every five shares held by them. The last date to accept the offer was 15th Feb, 2022 only. Mr. Kavi has given an application to renounce the shares offered to him in favour of Mr. Ravi, who is not a shareholder of the company.

Conclusion: As nothing is specified related to the Articles of the company, it is assumed that offer shall be deemed to include a right of renunciation. Hence, Mr. Kavi can renounce the shares offered to him in favour of Mr. Ravi, who is not a shareholder of the company.

In the second part of the question, even if Mr. Ravi is a shareholder of X Ltd. then also it does not affect the right of renunciation of shares of Mr. Kavi to Mr. Ravi.

![]()

Alteration of Share Capital (Secs. 61 & 64)

Question 25.

The Directors of Mars Motors India Ltd. desire to alter Capital Clause of the Memorandum of Association of their company. Advise them about the ways in which the said clause may be altered under the provisions of the Companies Act, 2013. [MTP-Oct. 19]

Answer:

Alteration of Capital:

As per Sec. 61(1) of Companies Act, 2013, a limited company having a share capital may, if authorised by its Articles, alter its Memorandum in its general meeting to:

- increase its authorized share capital by such amount as it thinks expedient;

- consolidate and divide all or any of its share capital into shares of a larger amount than its existing shares;

However, no consolidation and division which results in changes in the voting percentage of shareholders shall take effect unless it is approved by the Tribunal on an application made in the prescribed manner. - convert all or any of its paid-up shares into stock and reconvert that stock into fully paid shares of any denomination.

- sub-divide its shares, or any of them, into shares of smaller amount than is fixed by the Memorandum;

- cancel shares which, at the date of the passing of the resolution in that behalf, have not been taken or agreed to be taken by any person, and diminish the amount of its share capital by the amount of the shares so cancelled.

Further, as per Sec. 64 of Companies Act, 2013, where a company alters its share capital in any of the above-mentioned ways, the company shall file a notice in the prescribed form with the Registrar within a period of 30 days of such alteration, along with an altered memorandum. The capital clause of memorandum, if authorised by the articles, shall be altered by passing an ordinary resolution as per Section 61 (1) of the Companies Act, 2013.

Question 26.

As per the financial statement as at 31.03.2021 the Authorized and Issued share capital of Manorama Travels Private Limited (the Company) is of ₹ 100 Lakh divided into 10 Lakh equity shares of ₹ 10 each. The subscribed and paid-up share capital on that date is ₹ 80 Lakh divided into 8 Lakh equity shares of ₹ 10 each. The Company has reduced its share capital by cancelling 2 Lakh issued but unsubscribed equity shares during the financial year 2021-22, without obtaining the confirmation from the National Company Law Tribunal (the Tribunal). It is noted that the Company has amended its Memorandum of Association by passing the requisite resolution at the duly convened meeting for the above purpose. While filing the relevant e-form the Practicing Company Secretary refused to certify the Form for the reason that the action of the Company reducing the share capital without confirmation of the Tribunal is invalid.

In light of the above facts and in accordance with the provisions of the Companies Act, 2013, you are requested to (i) examine, the validity of the decision of the Company and contention of the practicing company secretary and (ii) state, the type of resolution required to be passed for amending the capital clause of the Memorandum of Association. [May 22 (5 Marks)]

Answer:

Alteration of Share Capital:

As per Sec. 61 of the Companies Act, 2013, a limited company having a share capital is empowered to alter its capital clause of the Memorandum of Association. In accordance with Sec. 61(l)(e), a limited company having a share capital may, if so, authorised by its articles, alter its memorandum in its general meeting by cancelling shares which, at the date of the passing of the resolution in that behalf, have not been taken or agreed to be taken by any person, and diminish the amount of its share capital by the amount of the shares so cancelled. The cancellation of shares shall not be deemed to be a reduction of share capital.

In the given case, company has reduced its share capital by cancelling 2 Lakh issued but unsubscribed equity shares during the financial year 2021-22, without obtaining the confirmation from the National Company Law Tribunal (the Tribunal).

Conclusion: Based on the above discussion, following conclusions may be drawn:

- Decision of the Company to alter the capital clause without obtaining confirmation of NCLT is valid and contention of the practicing company secretary is not tenable.

- Ordinary resolution will be required to be passed for amending the capital clause of the Memorandum of Association.

![]()

Reduction of the Share Capital (Sec. 66)

Question 27.

The Authorized share capital of SSP Limited is ₹ 5 crore divided into 50 lakhs equity shares of ₹ 10 each. The company issued 30 lakh equity shares for subscription which was fully subscribed. The company called so far ₹ 8 per share and it was paid up. Later on, the company proposed to reduce the nominal value of equity share for f 10 each to f 8 each and to carry out the following proposals:

(i) Reduction in Authorized capital from ₹ 5 crore divided into 50 lakh equity shares of ₹ 10 each to ₹ 4 crore divided into 50 lakh equity shares of ₹ 8 each.

(ii) Conversion of 30 lakhs partly paid up equity shares of ₹ 8 each to fully paid up equity shares of ₹ 8 each there by relieving the shareholders from making further payment of ₹ 2 per share.

State the procedure to be followed by the company to carry out the above proposals under the provisions of Companies Act, 2013 [Nov. 20 (5 Marks)]

Answer:

(i) Procedure for reduction of share capital:

In order to carry out proposals by SSP Limited to reduce the nominal value of the equity share, the company has to comply with the procedure given u/s 66 of the Companies Act, 2013 which deals with the reduction of share capital.

Steps involved in the procedures are:

(1) Special Resolution: Subject to confirmation by the Tribunal on an application by the company, a company limited by shares or limited by guarantee and having a share capital may, by a special resolution, reduce the share capital in any manner and in particular, may:

(a) extinguish or reduce the liability on any of its shares in respect of the share capital not paid-up; or

(b) either with or without extinguishing or reducing liability on any of its shares,

(i) cancel any paid-up share capital which is lost or is unrepresented by available assets; or

(ii) pay off any paid-up share capital which is in excess of the wants of the company.

(2) Issue of Notice from the Tribunal: The Tribunal shall give notice of every application made to it to the C.G., Registrar and the creditors of the company and shall take into consideration the representations, if any, made to it by them within a period of 3 months from the date of receipt of the notice.

(3) Order of tribunal: The Tribunal may, if it is satisfied that the debt or claim of every creditor of the company has been discharged or determined or has been secured or his consent is obtained, make an order confirming the reduction of share capital on such terms and conditions as it deems fit.

(4) Publishing of order of confirmation of tribunal: The order of confirmation of the reduction of share capital by the Tribunal shall be published by the company in such manner as the Tribunal may direct.

(5) Delivery of certified copy of order to the registrar: The company shall deliver a certified copy of the order of the Tribunal and of a minute approved by the Tribunal to the Registrar within thirty days of the receipt of the copy of the order, who shall register the same and issue a certificate to that effect.

![]()

(ii) Alteration of Share Capital:

SSP Limited proposes to alter its share capital. The Present authorized share capital ₹ 5 crore will be altered to ₹ 4 crore. According to Section 61 of the Companies Act, 2013, a limited company having a share capital may alter its capital part of the memorandum. A limited company having a share capital may, if so authorized by its articles, alter its memorandum in its general meeting to:

- Cancel shares which, at the date of the passing of the resolution in that behalf, have not been taken or agreed to be taken by any person, and diminish the amount of its share capital by the amount of the shares so cancelled. The cancellation of shares shall not be deemed to be reduction of share capital.

- A company shall within 30 days of the shares having been consolidated, converted, sub-divided, redeemed, or cancelled or the stock having been reconverted, shall give a notice to the Registrar in the prescribed form along with an altered memorandum [Sec. 64 of the Companies Act, 2013],

The Company has to follow the above procedures to alter its authorized share capital.

Issue of Bonus Shares (Sec. 63)

Question 28.

Shankar Portland Cement Limited is engaged in the manufacture of different types of cements and has got a good brand value. Over the years, it has built a good reputation and its balance sheet as at 31.03.2021 showed the following position:

Authorized Share Capital (25,00,000 equity shares of face value of ₹ 10 each) ₹ 2,50,00,000

Issued, subscribed and paid-up capital (10,00,000 equity shares of face value of ₹ 10 each, fully paid-up) ₹ 1,00,00,000

Free Reserves – ₹ 3,00,00,000

The Board of Directors are proposing to declare a bonus issue of 1 share for every 2 shares held by the existing shareholders. The board wants to know the conditions and manner of issuing bonus shares under the provisions of Companies Act, 2013. [MTP-March 18; RTP-Nov 20, May 21]

Answer:

Issue of Bonus Shares:

As per Sec. 63 of the Companies Act, 2013, a company may issue fully paid-up bonus shares to its members, in any manner whatsoever, out of –

- its free reserves;

- the securities premium account; or

- the capital redemption reserve account.

Provided that no issue of bonus shares shall be made by capitalising reserves created by the revaluation of assets.

Conditions for issue of Bonus Shares:

No company shall capitalise its profits or reserves for the purpose of issuing fully paid-up bonus

shares, unless:

- it is authorised by its Articles;

- it has, on the recommendation of the Board, been authorised in the general meeting of the company;

- it has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it;

- it has not defaulted in respect of payment of statutory dues of the employees, such as, contribution to provident fund, gratuity and bonus;

- the partly paid-up shares, if any, outstanding on the date of allotment, are made fully paid-up;

- it complies with such conditions as are prescribed by Rule 14 of the Companies (Share Capital and Debentures) Rules, 2014 which states that the company which has once announced the decision of its Board recommending a bonus issue, shall not subsequently withdraw the same.

Further, the company has to ensure that the bonus shares shall not be issued in lieu of dividend.

For the issue of bonus shares Shankar Portland Cement Limited will require reserves of ₹ 50,00,000 (i.e. half of ₹ 1,00,00,000 being the paid-up share capital), which is readily available with the company. Hence, after following the above conditions relating to the issue of bonus shares, the company may proceed for a bonus issue of 1 share for every 2 shares held by the existing shareholders.

![]()

Question 29.

ABC Ltd. has following balances in their balance sheet as on 31st March, 2021:

| Equity Share Capital (3 Lakhs equity shares of ₹ 10 each) | 30,00,000 |

| Free Reserves | 5,00,000 |

| Securities Premium account | 3,00,000 |

| Capital Redemption Reserve account | 4,00,000 |

| Revaluation Reserve | 3,00,000 |

Directors of the company seeks your advice in the following cases:

(i) Whether company can give bonus shares in the ratio of 1:3?

(ii) What if company decides to give bonus shares in ratio of 1:2? [Nov,18 (2 Marks), MTP-Oct. 21]

Answer:

Issue of bonus shares:

As per Section 63 of the Companies Act, 2013, a company may issue fully paid-up bonus shares to its members, in any manner whatsoever, out of—

- its free reserves;

- the securities premium account; or

- the capital redemption reserve account:

Provided that no issue of bonus shares shall be made by capitalising reserves created by the revaluation of assets.

As per the given facts, ABC Ltd. has total eligible amount of ₹ 12 lakhs (i.e. 5.00 + 3.00 + 4.00) out of which bonus shares can be issued and the total share capital is ₹ 30.00 lakhs.

Conclusions: Based on the above discussions, following conclusions may be drawn:

(i) For issue of 1:3 bonus shares, there will be a requirement of ₹ 10 lakhs (i.e., 1/3 × 30.00 lakh) which is well within the limit of available amount of ₹ 12 lakhs. So, ABC Ltd. can go ahead with the bonus issue in the ratio of 1 : 3.

(ii) In case ABC Ltd. intends to issue bonus shares in the ratio of 1 : 2, there will be a requirement of ₹ 15 lakhs (i.e., 1/2 × 30.00 lakh). Here in this case, the company cannot go ahead with the issue of bonus shares in the ratio of 1:2, since the requirement of ₹ 15 lakhs is exceeding the available eligible amount of ₹ 112 lakhs.

![]()

Question 30.

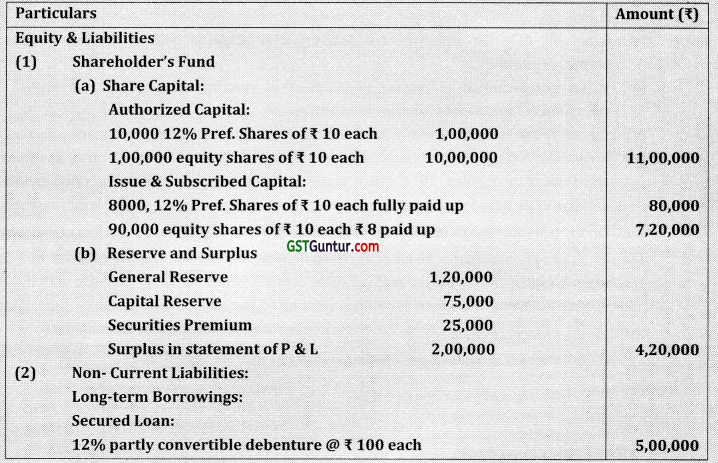

Following is the extract of the Balance sheet of Beltex Ltd. as on 31st March, 2022:

On 1st April, 2022 the company has made final call at ₹ 2 each on 90,000 Equity Shares. The Call Money was received by 25th April, 2022. Thereafter the company decided to capitalize its reserves by way of bonus @ 1 share for every 4 shares to existing shareholders.

Answer the following questions according to the Companies Act, 2013, in above case:

(A) Which of the above-mentioned sources can be used by company to issue bonus shares?

(B) Calculate the amount to be capitalized from free reserves to issue bonus shares.

(C) If the company did not ask for the final call on April 1st, 2022, can it still issue bonus shares to

its members? [Dec. 21 (3 Marks)]

Answer:

Issue of Bonus Shares:

(A) Sources to be used to issue bonus shares:

As per Sec. 63 of the Companies Act, 2013, a company may issue fully paid-up bonus shares to its members, in any manner whatsoever, out of:

- its free reserves;

- the securities premium account; or

- the capital redemption reserve account:

Provided that no issue of bonus shares shall be made by capitalising reserves created by the valuation of assets.

In the given case, bonus shares may be issued out of:

General Reserve – 1,20,000

Securities Premium – 25,000

Surplus in statement of P & L – 2,00,000

(B) Amount to be capitalised;

As the company has decided to capitalize its reserves by way of bonus @ 1 share for every 4 shares to existing shareholders, therefore the amount to be capitalised will be 1 /4 of existing fully paid up capital.

Fully Paid up Equity capital – 9,00,000

Amount to be capitalised (1 /4 of 9,00,000] – 2,25,000

(C) Bonus Shares on partly paid up shares:

Bonus shares can be issued only on Fully paid up shares. Hence, If the company did not ask for the final call, it cannot issue bonus shares to its members.

Note: Company may capitalise its reserves for converting partly paid up capital into fully paid up capital through bonus call.

![]()

Restrictions on Purchase by Company or Giving of Loans by it for Purchase of its Shares (Sec. 67)

Question 31.

Heavy Metals Ltd. wants to provide financial assistance to its employees, to enable them to subscribe for certain number of fully paid shares. Considering the provision of the Companies Act, 2013, what advice would you give to the company in this regard. [RTP-Nov. 18]

Answer:

Financial Assistance to employees:

- Sec. 67(2) of the Companies Act, 2013 provides that no public company is allowed to give, directly or indirectly and whether by means of a loan, guarantee, or security, any financial assistance for the purpose of, or in connection with, a purchase or subscription, by any person of any shares in it or in its holding company.

- However, Sec. 67(3) makes an exception by allowing companies to give loans to their employees other than its directors or KMP, for an amount not exceeding their salary or wages for a period of 6 months with a view to enabling them to purchase or subscribe for fully paid-up shares in the company or its holding company to be held by them by way of beneficial ownership.

- It is further provided that disclosures in respect of voting rights not exercised directly by the employees in respect of shares to which the scheme relates shall be made in the Board’s report in such manner as may be prescribed.

Conclusion: Heavy Metals Ltd. can provide financial assistance upto the specified limit to its employees to enable them to subscribe for the shares in the company provided the shares are purchased by the employees to be held for beneficial ownership by them.

However, the directors or key managerial personnel will not be eligible for such assistance.

![]()

Question 32.

OLAF Limited, a subsidiary of PQR Ltd. decides to give a loan of ₹ 4,00,000 to its Human Resource Manager Mr. Surya Nayan, who does not fall in the category of Key Managerial personnel and draws a salary of ₹ 40,000 per month, to buy 500 partly paid-up equity shares of ₹ 1,000 each in OLAF Limited. Examine the validity of Company’s decision under the provisions of the Companies Act, 2013. [MTP-Aug. 18, Oct. 20; RTP-May 20]

Or

The Board of Directors of Rajesh Exports Ltd., a subsidiary of Manish Ltd., decides to grant a loan of ₹ 3,00,000 to Bhaskar, the finance manager of Manish Ltd., getting salary of ₹ 40,000 per month, to buy 500 partly paid up equity shares of ₹ 1,000 each of Rajesh Exports Ltd. Examine the validity of Board’s decision with reference to the provisions of the Companies Act, 2013. [Jan 21 (2 Marks)]

Answer:

Restrictions on purchase by company or giving of loans by it for purchase of its share

As per Sec. 67(3) of the Companies Act, 2013 a company is allowed to give a loan to its employees subject to the following limitations:

(a) The employee must not be a director or KMP;

(b) The amount of such loan shall not exceed an amount equal to 6 months’ salary of the employee.

(c) The loan must be extended for subscribing fully paid-up shares.

In the given instance, Human Resource Manager Mr. Surya Nayan is not a KMP of the OLAF Limited. Further, he is drawing a salary of ₹ 40,000 per month and wants to avail loan for purchasing 500 partly paid-up equity shares of ₹ 1,000 each of OLAF Limited in which he is employed.

Conclusion: Decision of OLAF Limited in granting a loan of ₹ 4,00,000 for purchase of its partly paid- up shares to Human Resource Manager is invalid due to the following reasons:

- The amount of loan is more than 6 months’ salary of Mr. Surya Nayan, the HR Manager. It should have been restricted to ₹ 2,40,000 only.

- The loan to be given by OLAF Limited to its HR Manager Mr. Surya Nayan is meant for purchase of partly paid shares.

Power of Company to Purchase its own Securities (Secs. 68, 69 and 70)

Question 33.

State the legal provision in respect of ‘Declaration of Solvency’, which an unlisted public company needs to adhere to while taking steps to buy-back its own shares.

Answer:

Declaration of Solvency:

- Sec. 68(6) of the Companies Act, 2013 provides that where an unlisted public company proposes to buy-back its own shares or other specified securities, it shall, before making such buy-back, file with the Registrar, a declaration of solvency in Form No. SH 9.

- The declaration shall be verified by an affidavit to the effect that the Board has made a full inquiry into the affairs of the company as a result of which they have formed an opinion that it is capable of meeting its liabilities and will not be rendered insolvent within a period of one year from the date of declaration of solvency adopted by the Board.

- The declaration shall be signed by at least 2 directors of the company, one of whom shall be the managing director, if any.

![]()

Question 34.

Ravish Ltd., desirous of buying back of all the equity shares from the existing shareholders of the company, seek your advice. Examine the provisions of the Companies Act, 2013, Discuss whether the above buy-back of equity shares by the company is possible. Also, state the sources out of which buy-back of shares can be financed? [RTP-May 18]

Answer:

Buy-back of Securities:

As per Sec. 68(2)(c) of the Companies Act, 2013, a company is allowed to buy back a maximum of 25% of the aggregate of its paid-up capital and free reserves.

Conclusion: Company in the given case is not allowed to buy-back its entire equity shares.

Sources out of which buy-back of shares can be financed .

Sec. 68 (1) of the Companies Act, 2013 specifies the sources of funding buy-back of its shares and other specified securities as under:

(a) Free reserves or

(b) Security Premium account or

(c) Proceeds of the issue of any shares or other specified securities.

However, no buy-back of shares or any specified securities can be made out of the proceeds of an earlier issue of the same kind of shares or same kind of specified securities.

Question 35.

Xgen Limited has a paid-up equity capital and free Reserves to the extent of ^ 50,00,000. The Company is planning to buy-back shares to the extent of ? 4,50,000. The company approaches you for advice with regard to the following:

(i) Is special resolution required to be passed?

(ii) What is the time limit for completion of buy-back?

(iii) What should be ratio of aggregate debts to the paid up capital and free reserve after buy-back? [May 18 (3 Marks)]

Answer:

Buy back of Securities:

As per Sec. 68(2) of Companies Act, 2013, the company shall not purchase its own shares or other specified securities unless:

(a) The buy-back is authorized by its articles;

(b) A special resolution has been passed at a general meeting of the company authorizing the buy-back except where:

(i) the buy-back is 10% or less of the total paid-up equity capital and free reserves of the company; and

(ii) such buy-back has been authorised by the Board by means of a resolution passed at its meeting;

- As per Sec. 68(4) of the Companies Act, 2013, every buy-back shall be completed within a period of 1 year from the date of passing of the special resolution, or as the case may be, the resolution passed by the Board u/s 68(2).

- As per Sec. 68(2) of Companies Act, 2013, ratio of the aggregate debts (secured and unsecured) owed by the company after buy-back is not more than twice the paid up capital and its free reserves. However, C.G. may prescribe higher ratio of the debt for a class or classes of companies.

- In the given case, Xgen Limited has a paid up equity capital and free reserves to the extent of ₹ 50,00,000. The company planned to buy back shares to the extent of ₹ 4,50,000.

Conclusion: Referring to the above provisions, following conclusions may be drawn:

- Special resolution will not be required as the buy-back is less than 10% of the total paid-up equity capital and free reserves (50,00,000 × 10/100= 5,00,000) of the company, but such buy back must be authorized by the Board by means of a resolution passed at its meeting.

- Time limit for completion of buy-back will be a period of one year from the date of passing of the resolution by the Board.

- The ratio of the aggregate debts (secured and unsecured) owed by the company after buy-back should not be more than twice the paid up capital and its free reserves.

![]()

Question 36.

Which fund may be utilized by a Public Limited Company for purchasing (buy back) its own shares? Also explain the provision of Companies Act, 2013 regarding the circumstances in which a company is prohibited to buy back its own shares. [May 19 (5 Marks)]

Answer:

Funds utilized for purchase of its own securities:

Sec. 68 of the Companies Act, 2013 provides that a company may purchase its own securities out of:

- its free reserves; or

- the securities premium account; or

- the proceeds of the issue of any shares or other specified securities. However, buy back of any kind of shares or other specified securities cannot be made out of the proceeds of an earlier issue of the same kind of shares or same kind of other specified securities

Prohibition for buy back in certain circumstances (Sec. 70):

1. No company shall directly or indirectly purchase its own shares or other specified securities-

(a) through any subsidiary company including its own subsidiary companies; or

(b) through any investment company or group of investment companies; or

(c) if a default is made in repayment of deposits or interest payment thereon, redemption of debentures or preference shares or payment of dividend to any shareholder or repayment of any term loan or interest payable thereon, to any financial institutions or banking company; But where the default is remedied and a period of 3 years has lapsed after such default ceased to subsist, then such buy back is not prohibited.

2. No company shall directly or indirectly purchase its own shares or other specified securities in case such company has not complied with provisions of Sections 92 (Annual Report), 123 (Declaration of dividend), 127 (Punishment for failure to distribute dividends), and section 129 (Financial Statements).

![]()

Question 37.

XYZ unlisted company passed a special resolution in a general meeting on January 5, 2023 to buy back 30% of its own equity shares. The articles of association empower the company to buy back its own shares. Earlier the company has also passed a special resolution to buy back its own shares on January 15, 2022. The company further decided that the payment for buy-back to be made out of the proceeds of the company’s earlier issue of equity shares. In the light of the provisions of Companies Act, 2013,

(i) Decide, whether company’s proposal is in order?

(ii) What will be your answer if buy back offer date is revised from January 5,2022 to January 25th 2023 and percentage of buy back is reduced from 30% to 25% keeping the source of purchase as above? [Nov. 19 (5 Marks)]

Answer:

Buy back of Securities:

(i) Company’s proposal to buy back is not in order due to the following reasons:

- Company proposed to buy back 30% of its own equity shares. But as per section 68(2)(c) of the Companies Act, 2013, buy back of equity shares in any financial year shall not exceed 25% of its total paid up equity capital in that financial year.

- Company has also passed a special resolution to buy back its own shares on January 15th, 2022, now the company passed a special resolution on January 5th, 2023 to buy back its own shares. This is not valid as no offer of buy back, shall be made within a period of one year from the date of the closure of the preceding offer of buy back, if any.

- Company decision as to use of proceeds of the company’s earlier issue of equity share for the purpose of buy back is not in order as according to proviso to Sec. 68(1), buy back of any kind of shares or other specified securities cannot be made out of the proceeds of an earlier issue of the same kind of shares or same kind of other specified securities.

(ii) If buy back offer date is revised from 5th January 2023 to 25th January 2023 and percentage of buy back is reduced from 30% to 25% keeping the source of purchase as above, then also the company’s proposal is not in order as buy back of any kind of shares or other specified securities cannot be made out of the proceeds of an earlier issue of the same kind of shares or same kind of other specified securities.

![]()

Question 38.

London Ltd., at a general meeting of members of the company, passed an ordinary resolution to buy-back 30% of its equity share capital. The articles of company empower the company for buy back of shares. Explaining Die provisions of the Companies Act, 2013, examine:

(a) Whether company’s proposal is in order?

(b) Would your answer be still the same in case the company instead of 30%, decides to buy back only 20% of its equity share capital? [Jan. 21 (3 Marks)]

Answer:

Buy back of Securities:

As per Sec. 68(2) of the Companies Act, 2013, no company shall purchase its own shares or other specified securities under sub-section (1), unless:

(a) the buy back is authorised by its articles;

(b) a special resolution has been passed at a general meeting of the company authorising the buyback:

Provided that nothing contained in this clause shall apply to a case where:

- the buy-back is 10% or less of the total paid-up equity capital and free reserves of the company; and

- such buy-back has been authorised by the Board by means of a resolution passed at its meeting;

(c) the buy-back is 25% or less of the aggregate of paid-up capital and free reserves of the company: Provided that in respect of the buy-back of equity shares in any financial year, the reference to 25% in this clause shall be construed with respect to its total paid-up equity capital in that financial year.

In the instant case, London Ltd., at a general meeting of members of the company, passed an ordinary resolution to buy back 30% of its equity share capital. The articles of the company empower the company for buy back of shares.

Conclusion: Based on the provisions as stated above following conclusions may be drawn:

(a) Company’s proposal is not in order, since a special resolution as required has not been passed.

(b) If the company decides to buy back only 20% of its equity share capital, then also special resolution is required. Hence, answer will not change, company proposal is not in order.

Question 39.

Natraj Limited is engaged in the manufacturing of glass products. It wants to provide financial assistance to its employees to enable them to subscribe for fully paid shares of the company. Advise whether it amount to purchase of its own shares. If, in the instant case, the company itself purchasing to redeem its preference shares, does it amount to acquisition of its own shares? [MTP-April 21]

Answer:

Financial Assistance to employees and buy back of securities:

Financial assistance to its employees by the company to enable them to subscribe for the shares of the company will amount to the company purchasing its own shares. However, Sec. 67(3) of the Companies Act, 2013, permits a company to give loans to its employees other than its directors or KMP, for an amount not exceeding their salary or wages for a period of 6 months with a view to enabling them to purchase or subscribe for fully paid-up shares in the company or its holding company to be held by them by way of beneficial ownership.

Sec. 68 of the Companies Act, 2013 however, allows a company to buy back its own shares under certain circumstances and subject to fulfilment of prescribed conditions. Purchasing in order to redemption its preference shares, does amount to acquisition or purchase of its own shares. But this is allowed in terms of Sec. 68 of the Companies Act, 2013 subject to the fulfilment of prescribed conditions, and upto specified limits and only after following the prescribed procedure.

![]()

Question 40.

“The offer of buy-back of its own shares by a company shall not be made within a period of six months from the date of the closure of the preceding offer of buy-back, if any and cooling period to make further issue of same kind of shares including allotment of further shares shall be a period of one year from the completion of buy back subject to certain exceptions.” Examine the validity of this statement by explaining the provisions of the Companies Act, 2013 in this regard. [July 21 (3 Marks), MTP-March 22]

Answer:

Buy-back of Securities:

Provisions related to buy-back of securities are covered u/s 68 of Companies Act, 2013. Accordingly,

No offer of buy-back, shall be made within a period of 1 year from the date of the closure of the preceding offer of buy-back, if any.

Where a company completes a buy-back of its shares or other specified securities under this section, it shall not make further issue of same kind of shares including allotment o f further shares u/s 62(1)(a) or other specified securities within a period of 6 months except by way of bonus issue or in the discharge of subsisting obligations such as conversion of warrants, stock option schemes, sweat equity or conversion of preference shares or debentures into equity shares.

Keeping in view of the above provisions, the statement “the offer of buy-back of its own shares by a company shall not be made within a period of six months from the date of the closure of the preceding offer of buy back, if any and cooling period to make further issue of same kind of shares including allotment of further shares shall be a period of one year from the completion of buy back subject to certain exceptions” is not valid.

Debentures – Sec. 71

Question 41.

What are the provisions of the Companies Act, 2013 relating to the appointment of Debenture Trustee by a Company. Whether the following can be appointed as Debenture Trustee?

(i) A shareholder who has no beneficial interest

(ii) A creditor whom the company owes f 499 only.

(iii) A person who has given a guarantee for repayment of amount of debentures issued by the company?