Investment Accounts – CA Inter Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Investment Accounts – CA Inter Accounts Study Material

Fixed Return Securities — Simple Questions

Question 1.

In 2015, R Ltd. issued 12% fully paid debentures of ₹ 100 each, interest being payable half yearly on 30th September and 31st March of every accounting year.

On 1st December, 2016, M/s. K purchased 10,000 of these debentures at ₹ 101 cum-interest price, also paying brokerage @ 1% of cum-interest amount of the purchase. On 1st March, 2017 the firm sold all of these debentures at ₹ 106 cum-interest price, again paying brokerage @ 1 % of cum-interest amount. Prepare Investment Account in the books of M/s. K for the period 1st December, 2016 to 1st March, 2017.

Answer:

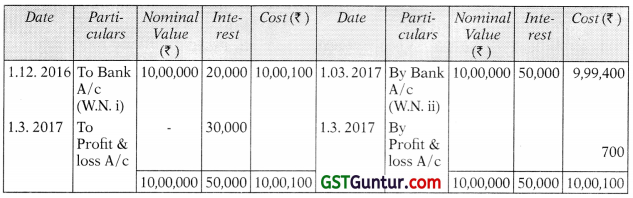

Investment Account for the period from 1st December, 2016 to 1st March, 2017

(Scrip: 12% Debentures of R Ltd.)

Working Notes:

(i)

(ii)

![]()

Question 2.

G holds 2,000, 15% Debentures of ₹ 100 each in R Ltd. as on April 1, 2015 at a cost of ₹ 2,10,000. Interest is payable on June, 30 and December, 31 each year. On May 1, 2015, 1,000 debentures are purchased cum-interest at ₹ 1,07,000. On November 1, 2015, 1,200 debentures are sold ex-interest at ₹ 1,14,600. On November 30, 2015, 800 debentures are purchased ex-interest at ₹ 76,800. On December 31, 2015, 800 debentures are sold cum- interest for ₹ 1,10,000. You are required to prepare the Investment Account showing value of holdings on March 31, 2016 at cost, using FIFO Method.

Answer:

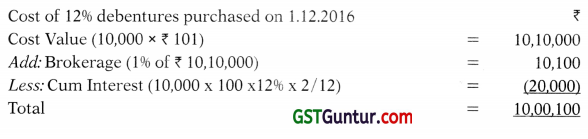

Investment Account of G

For the year ended 31.3.2016

(Script: 15% Debentures in R Ltd.)

(Interest payable on 30th June and 31st December)

Working Notes:

- Accrued Interest as on 1st April, 2015 = ₹ 2,00,000 × \(\frac{15}{100}\) × \(\frac{3}{12}\) = ₹ 7,500

- Accrued Interest as on 1.5.2015 = ₹ 1,00,000 × \(\frac{15}{100}\) × \(\frac{4}{12}\) = ₹ 5,000

- Cost of Investment for purchase on 1st May = ₹ 1,07,000 – ₹ 5,000 = ₹ 1,02,000

- Interest received as on 30.6.2015 = ₹ 3,00,000 × \(\frac{15}{100}\) × \(\frac{6}{12}\) = ₹ 22,500

- Accruedlnterestondebenturessoldon 1.11.2015 = ₹ 1,20,000 × \(\frac{15}{100}\) × \(\frac{4}{12}\) = ₹ 6,000

- Accrued Interest = ₹ 80,000 × \(\frac{15}{100}\) × \(\frac{5}{12}\) = ₹ 5,000

- Accrued Interest on sold debentures 31.12.2015 =

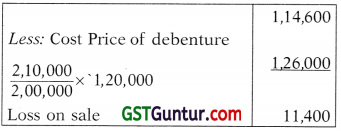

₹ 80,000 × \(\frac{15}{100}\) × \(\frac{6}{12}\) = ₹ 6,000 - Loss on Sale of Debenture on 1.1.2015

- Accrued interest as on 31.12.2015 = ₹ 1,80,000 × \(\frac{15}{100}\) × \(\frac{6}{12}\) = ₹ 13,500

- Accrued Interest = ₹ 1,80,000 × \(\frac{15}{100}\) × \(\frac{3}{12}\) = ₹ 6,750

- Cost of investment as on 31st March = ₹ 1,02,000 + ₹ 76,800 = ₹ 1,78,800

- Profit on debentures sold on 31st December = ₹ 1,04,000 – (₹ 2,10,000 × 800/2,000) = ₹ 20,000

![]()

Fixed Return Securities — Advanced Questions

Question 3.

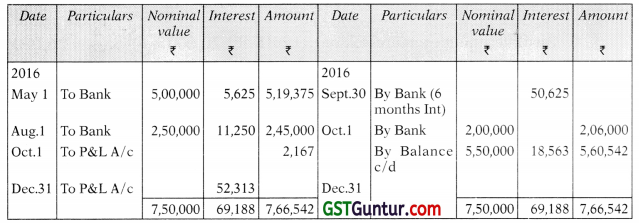

M purchased 5,000, 13.5% Debentures of Face Value of ₹ 100 each of S Ltd. on 1st May, 2016 @ ₹ 105 on cum interest basis. The interest on these debentures is payable on 31st & 30th of March & September respectively. On August 1st 2016 she again purchased 2,500 of such debentures @ ₹ 102.50 each on cum interest basis. On October 1st, 2016 she sold 2,000 Debentures @ ₹ 103 each. The market value of the debentures as at the close of the year was ₹ 106. Prepare the Debenture Investment Account in the books of M for the year ended 31st Dec. 2016 on Average Cost Basis. (RTP)

Answer:

Books of M Ltd.

Investment in 13.5% Debentures in S Ltd. Account (Interest payable on 31st March & 30th September)

Note: Cost being lower than Market Value the debentures are carried forward at Cost.

Working Notes:

- Interest paid on ₹ 5,00,000 purchased on May 1st, 2016 For the month oF April 2016, as part of purchase price: 5,00,000 × 13.5% × 1/12 = 5,625

- interest reccivcd on 30th Sept. 2016

- Interest paid on ₹ 2,50,000 purchased on Aug. 1st 2016 for Apr11 2016 to Jul 2016 as part of purchase price:

2,50,000 × 13.5% × 4/12 = ₹ 11.250 - Loss on Sale of Debentures

- Cost of Balance Debentures

(₹ 5,19,375 + ₹ 2,45,000) × ₹ 5,50,000/₹ 7,50.000 = ₹ 5,60,542 - Interest on Closing Debentures for period Oct.- Dcc. 2016 carried

forward (accrued interest)

₹ 5,50,000 × 13.5% × 3/12 = ₹ 18,563

Question 4.

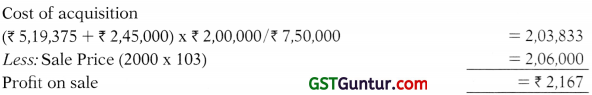

On 1st May, 2012, S purchased 5,000, 13.5% Convertible Debentures in X Ltd. of face value of ₹ 100 each @ 105 ex-interest. Interest on Debentures is payable each year on 31st March and 30th September. The accounting year is the calendar year. The following other transactions were entered into during 2012:

August 1

Purchased ₹ 2,50,000 Debentures @ 107 cum interest.

Oct. 1

Sale of ₹ 2,00,000 Debentures @ 103.

Dec. 31st

Receipt of 10,000 Equity shares in X Ltd. of ₹ 10 each on conversion of 20% of the Debentures held. Further, it also received interest on Debentures converted in cash at the time of conversion.

The market price of a Debenture and an Equity share in X Ltd. as on 31st Dec., 2012 was ₹ 106 and ₹ 15.

S held the Debentures as current assets. You are required to prepare Debenture Investment account In the books of S on Average cost basis. (RTP)

Answer:

Books of S

Debenture Investment Account for the year ending on 31-12-2012

(Scrip: 13.5% Convertible Debentures in X Limited)

(Interest payable on 31st March and 30th September)

Working Notes

- Cost of Debentures purchased on 1st August, 2012 = 107% of ₹ 2,50,000 – ₹ 11,250 (Interest) = ₹ 2,56,250

- Cost of Debentures sold on 1st October, 2012

= (₹ 5,25,000 + ₹ 2,56,250) × 2,00,000/7,50,000 = ₹ 2,08,333 - Loss on sale of Debentures = ₹ 2,08,333 – ₹ 2,06,000 = ₹ 2,333

- Cost of Debentures converted

= (₹ 5,25,000 + ₹ 2,56,250) × 1,10,000/7,50,000 = ₹ 1,14,583 - Cost of Debentures in hand on 31st December, 2012

= (₹ 5,25,000 + ₹ 2,56,250) × 4,40,000/7,50,000 = ₹ 4,58,334 (approx.) - Interest on Debentures converted = ₹ 1,10,000 × 13.5% × 3/12 = ₹ 3,713

- Closing balance of Debentures has been valued at cost (₹ 4,58,334) being lower than the market value ₹ 4,66,400 (₹ 4,400 × 106)

Question 5.

A Ltd. purchased on 1st April, 2018 8% convertible debenture in C Ltd. of face value of ₹ 2,00,000 @ ₹ 108. On 1st July, 2018 A Ltd. purchased another ₹ 1,00,000 debenture @ ₹ 112 cum interest.

On 1st October, 2018 ₹ 80,000 debenture was sold @ ₹ 108. On 1st December, 2018, C Ltd, give option for conversion of 8% convertible debentures into equity share of ₹ 10 each. A Ltd. receive 5,000 equity share in C Ltd. in conversion of 25% debenture held on that date. The market price of debenture and equity share in C Ltd. at the end of year 2018 is ₹ 110 and ₹ 15 respectively.

Interest on debenture is payable each year on 31 st March, and 30th September. The accounting year of A Ltd. is calendar year. Prepare investment account in the books of A Ltd. on average cost basis. Insurance Claim for loss of stock or profit (RTP)

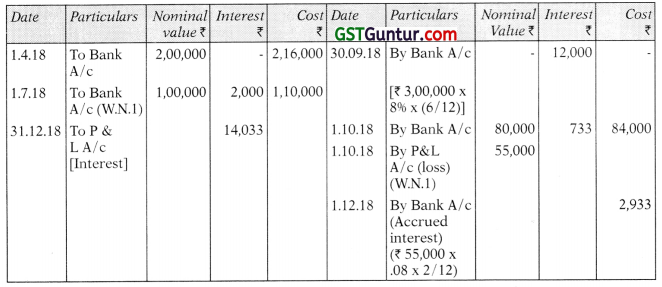

Answer:

Investment Account for the year ending on 31st December, 2018

Scrip: 8% Convertible Debentures in C Ltd.

[Interest Payable on 31st March and 30th September]

SCRIP: Equity Shares in C LTD.

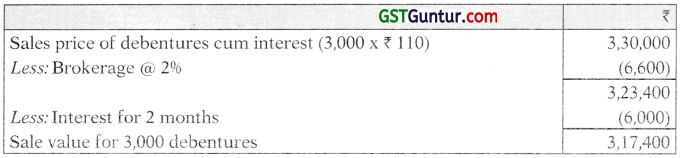

Working Notes:

- Cost of Debenture purchased on 1st July = ₹ 1,12,000 – ₹ 2,000 (Interest) = ₹ 1,10,000

- Cost of Debentures sold on 1st Oct.

= (₹ 2,16,000 + ₹ 1,10,000) × 80,000/3,00,000 = ₹ 86,933 - Loss on sale of Debentures = ₹ 86,933 – ₹ 84,000 = ₹ 2,933

Nominal value of debentures converted into equity shares = ₹ 55,000 [(₹ 3,00,000 – 80,000) × 2.5]

Interest received before the conversion of debentures Interest on 25% of total debentures = 55,000 × 8% × 2/12 = 733 - Cost of Debentures converted = (₹ 2,16,000 + ₹ 1,10,000) × 55,000/3,00,000 = ₹ 59,767

- Cost of closing balance of Debentures = (₹ 2,16,000 + ₹ 1,10,000) × 1,65,000/3,00,000 = ₹ 1,79,300

- Closing balance of Debentures has been valued at cost being lower than the market value i.e. ₹ 1,81,500 (₹ 1,65,000 @ ₹ 110)

- 5,000 equity Shares in C Ltd. will be valued at cost of ₹ 59,767 being lower than the market value ₹ 75,000 (₹ 15 × 5,000)

Note:

It has been assumed that interest on debentures, which were converted into cash, had been received at the time of conversion.

![]()

Question 6.

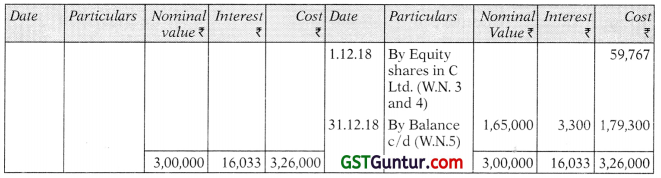

Gaama Investment Company holds 1,000, 15% debentures of ₹ 100 each in Beta Industries Ltd. as on April 1, 2009 at a cost of ₹ 1,05,000. Interest is payable on June, 30 and December, 31 each year.

On May 1, 2009, 500 debentures are purchased cum-interest at ₹ 53,500. On November 1, 2009, 600 debentures are sold ex-interest at ₹ 57,300. On November 30, 2009, 400 debentures are purchased ex-interest at ₹ 38,400. On December 31, 2009, 400 debentures are sold cum-interest for ₹ 55,000.

Prepare the investment account showing value of holdings on March 31,2010 at cost, using FIFO method. (6 Marks) (May 2010)

Answer:

In the books of Gaama Investments Ltd. Investment Account (15% Debentures in Beta Industries Ltd.)

Working Notes:

- Accrued interest as on 1.4.09 = ₹ 1,00,000 × \(\frac{15}{100}\) × \(\frac{3}{12}\) = ₹ 3,750

- Accrued interest = ₹ 50,000 × \(\frac{15}{100}\) × \(\frac{4}{12}\) = ₹ 2,500

Cost of investment for purchase on 1.5.09 = ₹ 53,500 – ₹ 2,500 = ₹ 51,000 - Interest received = ₹ 1,50,000 × \(\frac{15}{100}\) × \(\frac{4}{12}\) = ₹ 11,250

- Accrued interest = ₹ 60,000 × \(\frac{15}{100}\) × \(\frac{4}{12}\) = ₹ 3,000

- Accrued interest = ₹ 40,000 × \(\frac{15}{100}\) × \(\frac{5}{12}\) = ₹ 2,500

- Accrued interest = ₹ 40,000 × \(\frac{15}{100}\) × \(\frac{6}{12}\) = ₹ 3,000

- Sale price of investment on 31.12.09 = ₹ 55,000 – ₹ 3,000 = ₹ 52,000

- Accrued interest = ₹ 90,000 × \(\frac{15}{100}\) × \(\frac{6}{12}\) = ₹ 6,750

- Accrued interest = ₹ 90,000 × \(\frac{15}{100}\) × \(\frac{3}{12}\) = ₹ 3,375

- Cost of investment as on 31.3.10 = ₹ 51,000 + ₹ 38,400 = ₹ 89,400

- Loss on debentures sold on 1.11.2009:

Sales price of debentures ₹ 57,300

Less: Cost or investment sold = \(=\frac{\text { Rs. } 1,05,000}{1,000}\) × 600 = ₹ 63,000

Loss on sale = ₹ 5,700 - Profit on debentures sold on 31.12.2009:

Sales price of debentures ₹ 52,000

Less: Cost ot investment sold = \(=\frac{\text { Rs. } 1,05,000}{1,000}\) × 400 = ₹ 42,000

Profit on sale ₹ 10.000

Question 7.

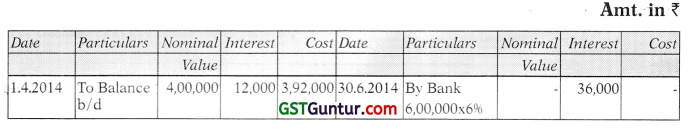

Mr. Chatur had 12% Debentures of Face Value ₹ 100 of M/s. Unnati Ltd. as current investments.

He provides the following details relating to the investments.

1-4-2014 Opening balance 4000 debentures costing ₹ 98 each

1-6-2014 Purchased 2000 debentures @ ₹ 120 cum interest

1-9-2014 Sold 3000 debentures @ ₹ 110 cum interest

1-12-2014 Sold 2000 debentures @ ₹ 105 ex-interest

31-1-2015 Purchased 3000 debentures @ ₹ 100 ex-interest 31-3-2015 Market value of the investments ₹ 105 each Interest due dates are 30th June and 31st December.

Mr. Chatur closes his books on 31-3-2015. He incurred 2% brokerage for all his transactions.

Show investment account in the books of Mr. Chatur assuming FIFO method is followed. (8 Marks) (May 2015)

Answer:

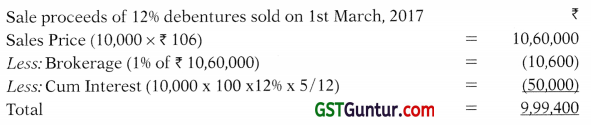

Investment A/c of Mr. Chatur for the year ending on 31-3-2015

(Scrip: 12% Debentures of Unnati Limited)

(Interest Payable on 30th June and 31st December)

Working Notes:

1. Valuation of closing balance as on 31.3.2015:

Value at the end = ₹ 4,20,000 ie. whichever is less

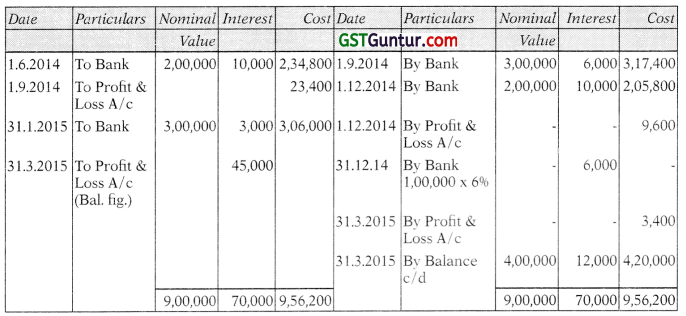

2. Profit on sale of debentures as on 1.9.2014

3. Loss on sale of debentures as on 1.12.2014

![]()

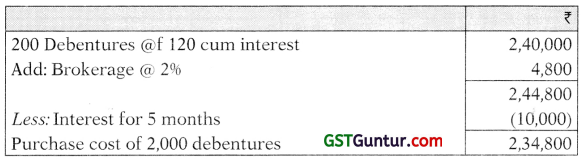

4. Purchase cost of 2,000 debentures on 1.6.2014

5. Sale value for 3,000 debentures on 1.9.2014

Question 8.

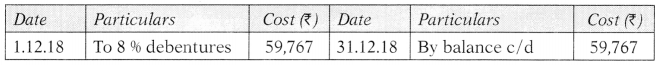

A Ltd. purchased on 1st April, 2015 8% convertible debenture in C Ltd. of face value of ₹ 2,00,000 @ ₹ 108. On 1st July, 2015 A Ltd. purchased another ₹ 1,00,000 debenture @ ₹ 112 cum interest.

On 1st October, 2015 ₹ 80,000 debenture was sold @ ₹ 105. On 1st December, 2015, C Ltd. give option for conversion of 8% convertible debentures into equity share of ₹ 10 each. A Ltd. receive 5,000 equity share in C Ltd. in conversion of 25% debenture held on that date. The market price of debenture and equity share in C Ltd. at the end of year 2015 is ₹ 110 and ₹ 15 respectively.

Interest on debenture is payable each year on 31 st March, and 30th September. The accounting year of A Ltd. is calendar year.

Prepare investment account in the books of A Ltd. on average cost basis. (8 Marks) (May 2016)

Answer:

Investment Account for the year ending on 31st December, 2015

Scrip: 8% Convertible Debentures in C Ltd.

[Interest Payable on 31st March and 30th September]

Scrip : Equity Shares in C LTD.

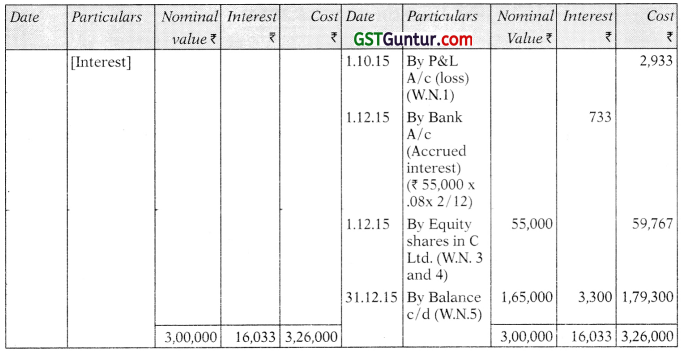

Working Notes:

- Cost of Debenture purchased OR 1st July = ₹ 1,12,000 – ₹ 2,000 = ₹ 1,10,000 (Interest)

- Cost of Debentures sold on 1st Oct.

= (₹ 2,16,000 + ₹ 1,10,000) × 80,000/3,00,000 = ₹ 86,933 - Loss on sale of Debentures = ₹ 86,933 – ₹ 84,000 = ₹ 2,933

Nominal value of debentures converted into equity shares = ₹ 55,000

[₹ 3,00,000 – 80,000) × .25]

Interest received before the conversion of debentures

Interest on 25% of total debentures = 55,000 × 8% × 2/12 = 733 - Cost of Debentures converted = (₹ 2,16,000 + ₹ 1,10,000) x = ₹ 59,767

55,000/3,00,000 - Cost of closing balance of Debentures = (₹ 2,16,000 + ₹ 1,10,000) = ₹ 1,79,300

x 1,65,000/3,00,000 - Closing balance of Debentures has been valued at cost being lower than the market value ie. ₹ 1,81,500 ft (₹ 1,65,000 @ ₹ 110)

- 5,000 equity Shares in C Ltd. will be valued at cost of ₹ 59,767 being lower than the market value ₹ 75,000 ft 15 × 5,000)

Note:

It has been assumed that interest on debentures, which were converted into cash, had been received at the time of conversion.

![]()

Variable Return Securities — Simple Questions

Question 9.

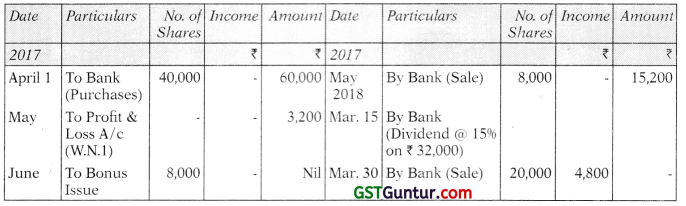

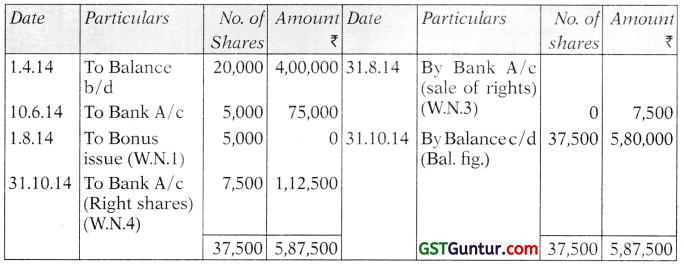

M carried out the following transactions in the shares of K Ltd.:

(1) On 1st April, 2017 she purchased 40,000 equity shares of ₹ 1 each fully paid up for ₹ 60,000.

(2) On 15th May 2017, Meera sold 8,000 shares for ₹ 15,200.

(3) At a meeting on 15th June, 2017, the company decided:

(i) To make a bonus issue of one fully paid up share for every four shares held on 1st June, 2017, and

(ii) To give its members the right to apply for one share for every five shares held on 1st June, 2017 at a price of ₹ 1.50 per share of which 75 paise is payable on or before 15th July, 2017 and the balance, 75 paise per share, on or before 15th September, 2017.

The shares issued under (i) and (ii) were not to rank for dividend for the year ending 31st December, 2017.

(a) M received her bonus shares and took up 4000 shares under the right issue, paying the sum thereon when due and selling the rights of the remaining shares at 40 paise per share; the proceeds were received on 30th September 2017.

(b) On 15th March, 2018, she received a dividend from K Ltd. of 15 per cent in respect of the year ended 31st Dec., 2017.

(c) On 30th March, 2018 she received ₹ 28,000 from the sale of 20,000 shares.

You are required to record these transactions in the Investment Account in M’s books for the year ended 31st March, 2018 transferring any profits or losses on these transactions to Profit and Loss account. Apply average cost basis.

Expenses and tax to be ignored.

Answer:

Books of M

Investment Account

(Shares in K Limited)

Working Notes:

Variable Return Securities — Advanced Questions

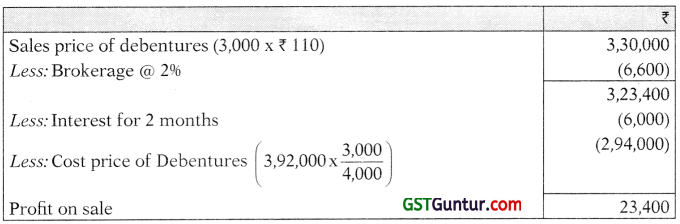

Question 10.

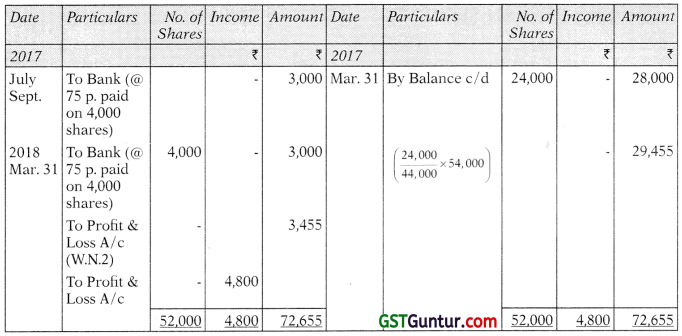

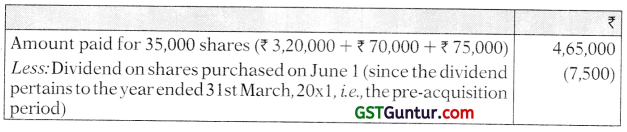

On 1 st January, 20X1, Singh had 20,000 equity shares in X Ltd. Nominal value of the shares was ₹ 10 each but their book value was ₹ 16 per share. On 1st June 20X1, Singh purchased 5,000 more equity shares in the company at a premium of ₹ 4 per share.

On 30th June, 20X1, the directors of X Ltd. announced a bonus and rights issue. Bonus was declared at the rate of one equity share for every five shares held and these shares were received on 2nd August, 20X1.

The terms of the rights Issue were:

(a) Rights shares to be issued to the existing holders on 10th August, 20X1.

(b) Rights issue would entitle the holders to subscribe to additional equity shares in the Company at the rate of one share per every three held at ₹ 15 per share the whole sum being payable by 30th September, 20X1.

(e) Existing shareholders were entitled to transfer their rights to outsiders, either wholly or in part

(d) Singh exercised his option under the issue for 50% of his entitlements and the balance of rights he sold to Ananth for a consideration of ₹ 1.50 per share.

(e) Dividends for the year ended 31st March, 20X1, at the rate of 15% were declared by the Company and received by Singh on 20th October, 20X1.

(f) On 1st November, 20X1, Singh sold 20,000 equity shares at a premium of ₹ 3 per share.

The market price of share on 31-12-20X1 was ₹ 14. Show the Investment Account as it would appear in Singh’s books on 31- 12-20X1 and the value of shares held on that date.

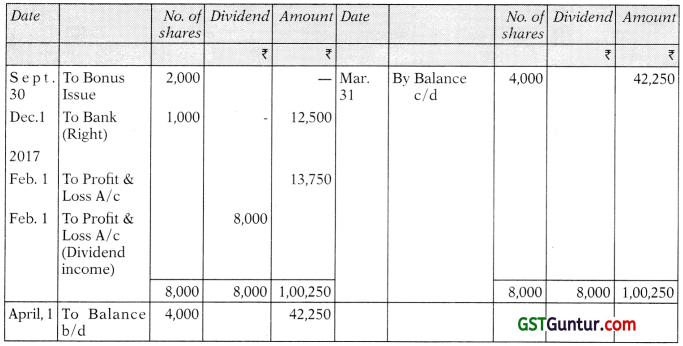

Answer:

Investment Account-Equity Shares in X Ltd.

* Dividend = [20,000 × 10 × 15%] [5,000 × 10 × 15%]

Working Notes:

1. Right shares

No. of right shares issued = (20,000 + 5,000 + 5,000)/3 = 10,000 shares

No. of right shares subscribed = 10,000 × 50% = 5,000

shares Amount of right shares issued = 5,000 × 15 = ₹ 75,000

No. of right shares sold = 10,000 – 5,000 = 5,000 shares

Sale of right shares = 5,000 × 1.5 = ₹ 7,500 to be credited to statement of profit and loss

![]()

2. Cost of shares sold

3. Value of investment at the end of the year

Assuming investment as current investment, closing balance will be valued based on lower of cost or net realisable value.

Here, Net realisable value is ₹ 14 per share Le. 15,000 shares x ₹ 14 = ₹ 2,10,000 and cost = 4,57,500/35,000 × 15,000 = ₹ 1,96,071. Therefore, value pf investment at the end of the year will be ₹ 1,96,071.

Question 11.

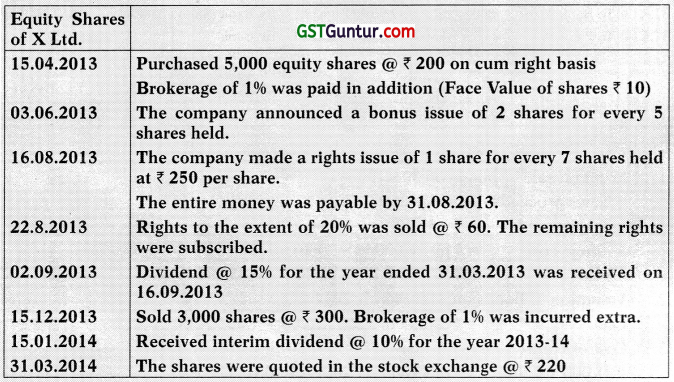

On 1st April, 2014, Hasan has 20,000 equity shares of Vayu Ltd., at a book value of ₹ 20 per share (face value of 10 each). He provides the following information:

(i) On 10th June, 2014, he purchased another 5,000 shares in Vayu Ltd., @ ₹ 15 per share.

(ii) On 1st August, 2014 Vayu Ltd., issued one bonus share for every five shares held by the shareholders.

(iii) On 31st August 2014, the directors of Vayu Ltd, announced a rights issue which entitle the shareholders to subscribe two shares for every six shares held @ of 15 per share. The shareholders can transfer their rights in full or in part.

Hasan sold 1 /4th of his right shares holding to Harsh for a consideration of 3 per share and subscribed the rest on 31st of October, 2014.

Prepare Investment A/c in the books of Hasan as on 31st October, 2014. (8 Marks) (Nov. 2014)

Answer:

Investment Account in the books of Hasan

(Equity shares in Vayu Ltd.)

Working Notes:

- Bonus shares = 25,000/5 = 5,000 shares

- Right shares = \(\frac{25,000+5,000}{6}\) × 2 = 10,000 shares

- Sale of rights = 10,000 shares × 1/4 × ₹ 3 = ₹ 7,500

- Rights subscribed = 10,000 × \(\frac{3}{4}\) × ₹ 15 = ₹ 1,12,500

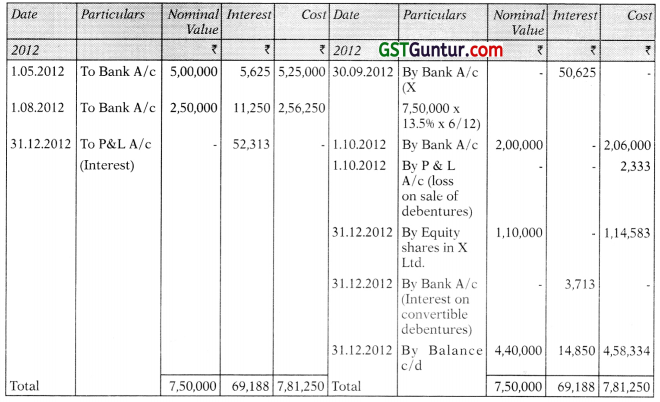

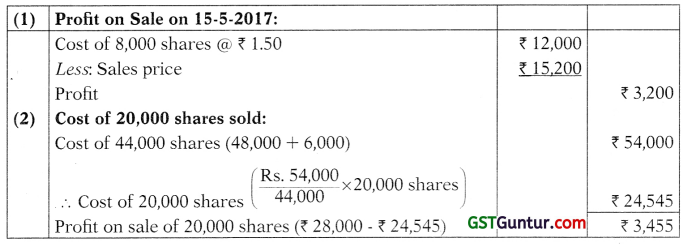

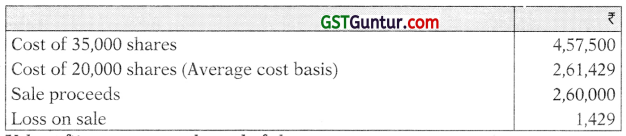

Question 12.

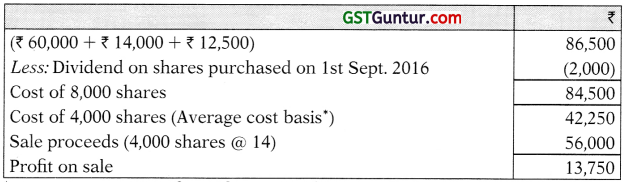

Akash Ltd. had 4,000 equity share of X Limited, at a book value of ₹ 15 per share (face value of ₹ 10 each) on 1st April, 2016. On 1st September, 2016, Akash Ltd. acquired 1,000 equity shares of X Limited at a premium of ₹ 4 per share. X Limited announced a bonus and right issue for existing shareholders.

The terms of bonus and right issue were—

- Bonus was declared, at the rate of two equity shares for every five equity shares held on 30th September, 2016.

- Right shares are to be issued to the existing shareholders on 1st Decem-ber, 2016. The company issued two right shares for every seven shares held at 25% premium. No dividend. Was payable on these shares. The whole sum being payable by 31st December, 2016.

- Existing shareholders were entitled to transfer their rights to outsiders, either wholly or in part.

- Akash Ltd. exercised its option under the issue for 50% of its entitlements and sold the remaining rights for ₹ 8 per share.

- Dividend for the year ended 31st March, 2016, at the rate of 20% was declared by the company and received by Akash Ltd., on 20th January, 2017.

- On 1st February, 2017, Akash Ltd., sold half of its shareholdings at a premium of ₹ 4 per share.

- The market price of share on 31.03.2017 was ₹ 13 per share.

You are required to prepare the Investment Account of Akash Ltd. for the year ended 31st March, 2017 and determine the value of share held on that date assuming the investment as current investment. (8 Marks) (May 2017)

Answer:

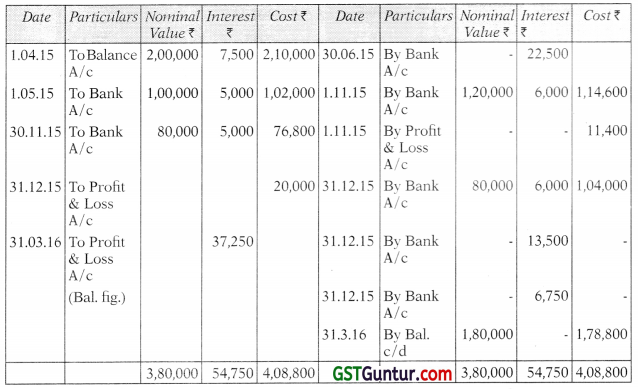

Investment Account Equity Shares in X Ltd.

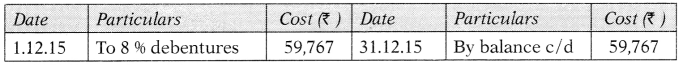

Working Notes:

1. Cost of shares sold — Amount paid for 8,000 shares

* For ascertainment of cost for equity shares sold, average cost basis has been applied.

![]()

2. Value of investment at the end of the year

Closing balance will be valued based on lower of cost (₹ 42,250) or net realizable value (₹ 13 × 4,000). Thus, investment will be valued at ₹ 42,250.

3. Calculation of sale of right

1,000 shares × ₹ 8 per share = ₹ 8,000

Amount received from sale of rights will be credited to P & L A/c as per AS 13

‘Accounting for Investments’.

4. Dividend received on investment held as on 1st April, 2016

= 4,000 shares × ₹ 10 × 20%

= ₹ 8,000 will be transferred to Profit and Loss A/c

Dividend received on shares purchased on 1st Sep. 2016

= 1,000 shares × ₹ 10 × 20% = ₹ 2,000 will be adjusted to Investment A/c

Note:

It has been assumed that no dividend is received on bonus shares as bonus shares are declared on 30th Sept., 2016 and dividend pertains to the year ended 31.3.2016.

Mix Questions

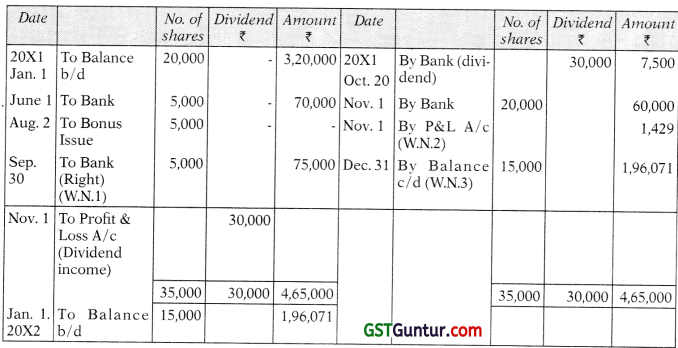

Question 13.

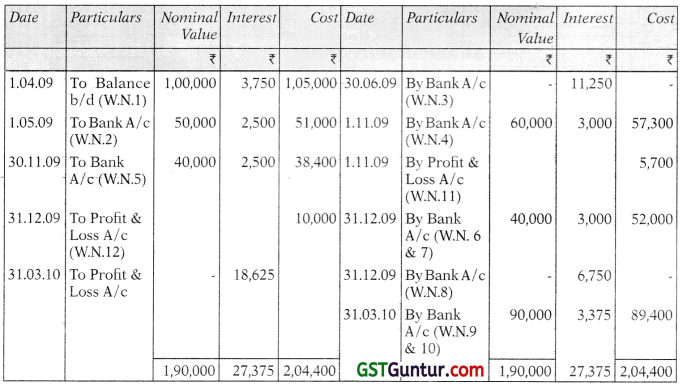

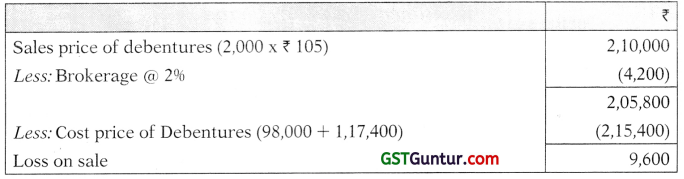

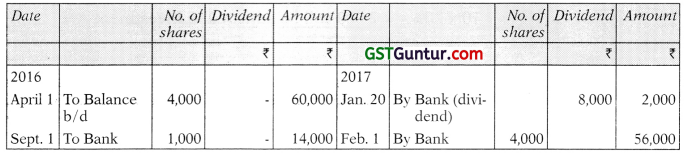

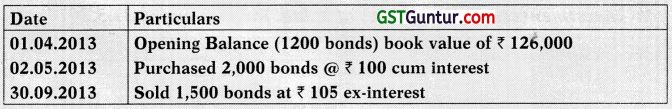

Smart Investments made the following investments in the year 2013-14:

12% State Government Bonds having face value ₹ 100

Interest on the bonds is received on 30th June and 31st Dec. each year.

Prepare Investment Accounts in the books of Smart Investments. Assume that the average cost method is followed. (8 Marks) (May 2014)

Answer:

In the books of Smart Investments

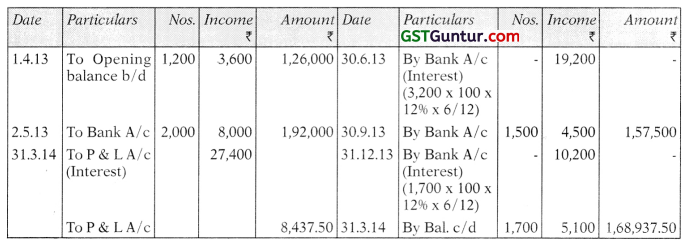

12% Govt. Bonds for the year ended 31st March, 2014

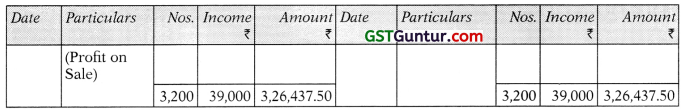

Investments in Equity shares of X Ltd. for year ended 31.3.2014

![]()

Working Notes:

1. Profit on sale of bonds on 30.9.13

= Sales proceeds – Average cost

Sales proceeds = ₹ 1,57,500

Average cost = ₹ [(1,26,000+1,92,000) × 1,500/3,200] = 1,49,062.50

Profit = 1,57,500 – ₹ 1,49,062.50 = ₹ 8,437.50

2. Valuation of bonds on 31st March, 2014

Cost = ₹ 3,18,000/3,200 × 1,700 = 1,68,937.50

3. Cost of equity shares purchased on 15-4-2013 = Cost + Brokerage = (5,000 × ₹ 200) + 1% of (5,000 × ₹ 200) = ₹ 10,10,000

4. Sale proceeds of equity shares on 15-12-2013 = Sale price – Brokerage

= (3,000 × ₹ 300) – 1% of (3,000 × ₹ 300) = ₹ 8,91,000.

5. Profit on sale of shares on 15-12-2013 = Sales proceeds – Average cost Sales proceeds = ₹ 8,91,000

Average cost = ₹ [(10,10,000 + 2,00,000 – 12,000 – 7,500) × 3,000/7,800]

= ₹ [11,90,500 × 3,000/7,800] – 4,57,885

Profit = ₹ 8,91,000 – ₹ 4,57,885 = ₹ 4,33,115.

6. Valuation of equity shares on 31st March, 2014

Cost = ₹ [11,90,500 × 4,800/7,800] = ₹ 7,32,615

Market Value = 4,800 shares × ₹ 220 = ₹ 10,56,000

Closing stock of equity shares has been valued at ₹ 7,32,615 i.e. cost being lower than the market value.

Note:

It has been assumed that no dividend is received on bonus shares as bonus shares are declared on 3-6-2013 and dividend pertains to the year ended 31-3-2013.