Mutual Funds – CA Final SFM Study Material is designed strictly as per the latest syllabus and exam pattern.

Mutual Funds – CA Final SFM Study Material

Part – I (Theory)

Question 1.

Discuss briefly the advantages of investing through Mutual Funds. [May 2003, 2007, 2009] [4 Marks]

Answer:

The following are the benefits of investing through mutual fund schemes:

1. Professional Management: The funds are managed by highly skilled and professionally experienced managers with a backup of a research team.

2. Diversification : A small investor cannot hold diversified investment portfolio wdth low level of investible funds. But, he may take advantage of a well-diversified portfolio of securities with the help of mutual fund. It reduces the risk also.

3. Convenient Administration :Now-a-days most of the mutual funds offer services in a demat form which saves the time and also avoids delay in execution of transaction. So, there are no administrative risks of share transfer, etc.

4. High Returns : If we compare mutual fund with other avenues of the investment, then the investor always get higher return in mutual fund.

5. Liquidity : The investment in any mutual fund can be liquidated at any time. In case of open ended funds, the liquidity is provided by direct sales/ repurchase to the mutual fund. On the other hand, the stock exchange, at which the mutual fund is listed, provides liquidity in case of close ended funds.

6. Low Cost of Management: The mutual fund is not allowed to incur the cost beyond prescribed limit of 2.5%. Any cost in excess of this maximum limit is borne by the AMC.

7. Safety : The mutual funds are required to be registered with SEBI and are subject to strict mutual fund regulations. It provides protection to investor.

8. Transparency : The investor gets updated information about the funds. Many mutual funds disclose their portfolio on quarterly or monthly basis to their investors. Even, in case of open ended funds, the NAV is calculated on a daily basis and now published through AMFI in the newspapers.

9. Low transaction cost : The mutual funds uses pooled money from a number of investors due to which, they have advantage of economies of scale. That is why; it is beneficial for the investor as compared to direct investment in capital market which involves higher charges.

10. Flexibility : The investors can easily transfer their holdings from one scheme to another scheme within the same mutual fund. The wide range of schemes launched by different mutual funds provides flexibility to the investor to plan his portfolio.

Question 2.

What are the drawbacks of investments in Mutual Funds? [Nov. 2008] [4 Marks]

Answer:

The following are the disadvantages associated with mutual fund schemes:

1. Difficulty in selection : A common investor faces difficulty in selection of mutual fund out of large number of various schemes of mutual funds. The past performance may not prove to be reliable criterion in all situations.

2. Cost Factor: The entry load (payable at the time of investment) and exit load (payable at the time of leaving) reduce the return of investor. Moreover, the fee paid to Asset Management Company is not related with performance.

3. Different Objectives : The individual objectives of the investor may be different from the objectives of mutual fund. The skilled or professional investors or high net worth individuals may achieve their objectives through direct investment mode.

4. No Guarantee of Return : There is no guarantee of return in case of mutual fund as it depends upon performance of fund only. If it under performs, there are chances of depreciation in value of investment even with depletion of principal amount.

5. Unethical Practices /The investment in mutual funds is subject to risk from unethical practices like selling of holding to sister concern for substantive notional gains so that higher NAY may be disclosed.

Question 3.

Distinguish between Open-ended and close ended schemes. [Nov. 2010, May 2015] [4 Marks]

Answer:

The Mutual funds may be classified as open ended and close ended, on functional basis.

1. Open ended funds : These are the schemes floated by the mutual fund, where the investor can make entry and may exit at any time. The redemption period is indefinite and the capital of the fund is unlimited. These schemes are available for subscription and repurchase on a continuous basis. These funds are most liquid.

2. Closed ended Funds : Under these schemes, the investor can enter into the scheme during Initial Public Offering or from the stock market after the units have been listed. The life of these schemes is limited as after the specified period, the corpus of the closed ended schemes is liquidated. If the investor wants to exit in between, he can do so by selling units in the secondary market, or during repurchase period at his option.

| Basis |

Open ended fund |

Close ended fund |

| Size of the fund |

Unlimited and Flexible |

Limited and Fixed |

| Redemption period |

At the option of Investor |

Stipulated Maturity Period |

| Intra-day Trading |

Not possible |

Possible but expensive |

| Exit Route |

Through fund itself |

Through stock exchange, Where listed |

| Selling Rate |

At NAV plus load, if any |

Significant Premium/Discount to NAV. |

Question 4.

What is Exchange Traded Funds? What are its key features and benefits? [May 2010, Nov. 2013, Nov. 2016] [4 Marks]

Answer:

The exchange traded funds were introduced in US in 1993 and came to India around 2002. ETF is a hybrid product that combines the features of an index mutual fund and stock. It is a portfolio or basket of securities that replicates the composition of indices like Nifty, Sensex etc. It is not a stock or security by itself, but is traded as stock. ETF are listed on the stock exchange and their prices are linked to the underlying index.

The ETF can be bought or sold anytime during the market hours at prices that are expected to be closer to the NAV at the end of the day. The NAV of an ETF is the value of the underlying component of the benchmark index held by the ETF plus all accrued dividends less accrued management expenses.

The following are the benefits of ETF:

(a) Convenient to Trade : The ETF can be purchased/sold on the stock ex-change at any time when the market is open.

(b) Diversification / These funds offer diversification and also the flexibility at the same time.

(c) Short Selling/ One can short sell an ETF, which is not possible with index funds.

(d) Role of Fund Manager: The performance of ETF does not depend on the ability of fund manager.

(e) Convenient to Trade / When the trading starts in market, the investor can easily buy or sell ETF like equity shares at prices which are deemed real time.

Question 5.

Write short note on Money Market Mutual Fund. [Nov. 2011, 2015] [4 Marks]

Answer:

They are majorly debt-oriented schemes, where the main objective is to preserve the capital, easy liquidity and moderate income. The investments are made in short-term instruments which have high safety like, T-Bills, Govern-ment securities, certificate of deposit etc. These are suitable for institutional investors and individuals who have short term surplus funds. As they are for short period, they have lesser risk and are not affected by interest rate fluctuations.

The following are the salient features:

- Money market is that part of financial market which is for short term money.

- These schemes are safe and highly liquid instruments.

- These schemes generally provide high returns and highest safety to the ordinary investors.

- The short term/emergency requirements of various funds are met by such mutual funds.

Question 6.

What are the signals that indicate that it is the time for an investor to exit a mutual fund schemes? [Nov. 2014] [4 Marks]

Answer:

The following are the signals/indicators that investors use as exit criteria from the mutual fund scheme:

1. Under performance of mutual fund : The under performance criterion has two parameters:

(a) FROM INDEX : When the mutual fund consistently under performs its peer group, then it would be better to get out of the scheme. The amount may be invested in the winning schemes of peer group.

(b) FROM PEER GROUP : When the mutual fund consistently under per-forms the broad based index, then it is the high time for the investor to get out of the scheme.

2. Change in objectives : The mutual funds have various schemes with varying objectives. The investor chooses a particular scheme that suits his purpose. As regards indicators to exit, there are two aspects:

(a) OF MUTUAL FUND : Every investor works with his own risk prefer-ences and selects that scheme of the mutual fund which suits his goals. It may be regular income or growth fund. When the mutual fund changes its objective (Like from income to growth fund), then the investor may exit that mutual fund scheme.

(b) OF INVESTOR : When the investor changes his objective of investing in a mutual fund which is no longer beneficial to him, then it is also one of the indicators to exit a scheme.

3. Change in Fund Management /When there is change in the fund manager who handles the scheme and the image or reputation of new entrant is not known, then the investor may exit the mutual fund scheme.

Question 7.

Distinguish between Off-Shore Funds and Asset Management Mutual Funds. [Nov. 2017] [4 Marks]

Answer:

The following are the differences:

| Basis |

Off-shore Funds |

Mutual Funds |

| Raising of Money |

Internationally and investing money domestically (in India). |

Domestically as well as investing money domestically (in India). |

| Number of Investors |

Very few. |

Very large. |

| Per Capita investment |

It is very high as investors are High Net worth Individuals (HNI). |

It is very low as it is meant for retail/ small investors. |

| Basis of Management |

Investment Agreement is basis of management of the fund. |

Offer Document is the basis of management of the fund. |

Question 8.

Explain the different methods for evaluating the performance of a mutual fund. [Nov. 2019 Old Syllabus] [4 Marks]

Answer:

Methods for evaluating the performance of a mutual fund.

1. Sharpe Ratio

The excess return earned over the risk free return on portfolio to the portfolio’s total risk measured by the standard deviation. This formula uses the volatility of portfolio return. The Sharpe ratio is often used to rank the risk-adjusted performance of various portfolios over the same time. The higher a Sharpe ratio, the better a portfolio’s returns have been relative to the amount of investment risk the investor has taken.

S = \(\frac{\text { Return of portfolio }- \text { Retrun of risk free investment }}{\text { Standard Deviation of Portfolio }}\)

2. Treynor Ratio

This ratio is similar to the Sharpe Ratio except it uses Beta of portfolio instead of standard deviation. Treynor ratio evaluates the performance of a portfolio based on the systematic risk of a fund. Treynor ratio is based on the premise that unsystematic or specific risk can be diversified and hence, only incorporates the systematic risk (beta) to gauge the portfolio’s performance.

T = \(\frac{\text { Return of portfolio }- \text { Retrun of risk free investment }}{\text { Beta of Portfolio }}\)

3. Jensen’s Alpha

The comparison of actual return of the fund with the benchmark portfolio of the same risk. Normally, for the comparison of portfolios of mutual

funds this ratio is applied and compared with market return. It shows the comparative risk and reward from the said portfolio. Alpha is the excess of actual return compared with expected return.

Part – 2 (Numerical Problems: Topic Wise In Chronological Order)

Question 1.

Cinderella Mutual Fund has the following assets in Scheme Rudolf at the close of business on 31st March, 2014.

| Company |

No. of Shares |

Market Price Per Share (Rs.) |

| Nairobi Ltd. |

25,000 |

20 |

| Dakar Ltd. |

35,000 |

300 |

| Senegal Ltd. |

29,000 |

380 |

| Cairo Ltd. |

40,000 |

500 |

The total number of units of Scheme ‘Rudolf’ is 10 lacs. The Scheme Rudolf has accrued expenses of Rs. 2,50,000 and other liabilities of Rs. 2,00,000. Calculate the NAV per unit of the Scheme Rudolf. [Nov. 2014] [4 Marks]

Answer:

Calculation of Closing Net Assets

|

Rs. in crores |

| Market Value of Portfolio[Working Note-1] |

82.954 |

| (+) Closing cash in hand |

2.760 |

| (+) Dividend Accrued |

1.950 |

| Total Closing Assets |

87.664 |

| (-) Payable on shares |

(13.54) |

| (-) Expenditure incurred . |

(1.76) |

| Closing Net Assets |

72.364 |

NAV per unit = \(\frac{\text { Closing Net Assets }}{\text { Number of Units }}=\frac{\text { Rs. } 4,15,70,000}{10,00,000}\) = Rs. 41.57 per unit

Working Note-1 Computation of Market Value of Investments

| Company |

No. of Shares |

Market Price per share |

Total Market Value |

| Nairobi Ltd. |

25,000 |

20 |

5,00,000 |

| Dakar Ltd. |

35,000 |

300 |

1,05,00,000 |

| Senegal Ltd. |

29,000 |

380 |

1,10,20,000 |

| Cairo Ltd. |

40,000 |

500 |

2,00,00,000 |

|

|

|

4,20,20,000 |

Question 2.

Calculate the NAV of a regular income scheme on per unit basis of Red Bull mutual fund from the following information:

| Particulars |

Rs. in crores |

| Listed shares at cost (ex-dividend) |

30 |

| Cash in hand |

0.75 |

| Bonds & Debentures at cost (ex-interest) |

2.30 |

| Of these, bonds not listed & not quoted |

1.0 |

| Other fixed interest securities at cost |

2.50 |

| Dividend accrued |

0.8 |

| Amount payable on shares |

8.32 |

| Expenditure accrued |

1.00 |

| Value of listed bonds & debentures at NAV date |

10 |

Additional Information:

(1) Number of units ( Rs. 10 face value) = 30 lakhs

(2) Current realizable value of fixed income securities of face value of Rs. 100 is 106.50.

(3) The listed shares were purchased when index was the Present index is 7100 and 9000.

(4) Unlisted bonds and debentures are at cost. Other fixed interest securities are also at cost. [May 2016] [6 Marks]

Answer:

Calculation of Closing Net Assets

|

Rs. in crores |

Market Value of Portfolio [Working Note-1]

(+) Closing cash in hand

(+) Dividend Accrued |

51.53

0.75

0.80 |

Total Closing Assets

(-) Payable on shares

(-) Expenditure incurred |

53.08

(8.32)

(1.00) |

| Closing Net Assets |

43.76 |

NAV per unit = \(\frac{\text { Closing Net Assets }}{\text { Number of Units }}=\frac{\text { Rs. } 43.76 \text { crores }}{30 \text { Lakh Units }}\)

= \(\frac{\text { Rs. } 4376 \text { Lakhs }}{\text { 30 Lakh Units }}\) = Rs. 145.87 per unit

Working Note-1 Calculation of Market Value of Portfolio

| Particulars |

Workings |

Rs. in crores |

| Listed Shares |

(30 × 9000)/7100 |

38.03 |

| Unlisted Bonds (Unquoted) |

(at cost) |

1.00 |

| Listed Bonds & Debentures |

(value is given) |

10.00 |

| Other Fixed Interest Securities |

Tutorial Note |

2.50 |

|

|

51.53 |

Tutorial Note:

The current realizable value of fixed income securities has no relevance in the given problem as it is to be valued at cost, as per the instruction given in the question. Had this instruction not been given, then the value would have been calculated as follows:

Value = \(\frac{2.50}{100}\) × 106.5 = Rs. 2.66

The above calculation is based on the assumption that these securities have been purchased at face value.

Question 3.

Based on the following information; determine the NAV of a regular income scheme on per unit basis:

|

Rs. in Crores |

Listed shares at Cost (ex-dividend)

Cash in handBonds and debentures at cost

Of these, bonds not listed and quoted

Other fixed interest securities at cost |

20

1.23

4.3

1

4.5 0 8 |

Amount payable on shares

Expenditure accrued

Number of units (Rs. 10 face value) |

6.32

0.75

20 lacs |

| Current realizable value of fixed income |

|

Securities or race value ot Rs. 100

The listed shares were purchased when Index was |

106.5

1,000 |

| Present index is |

2,300 |

| Value of listed bonds and debentures at NAV date |

8 |

There has been a diminution of 20% in unlisted bonds and debentures other fixed interest securities are at cost. [May 2010] [6 Marks]

Answer:

|

Rs. in crores |

| Market Value of Portfolio [Working Note-1] |

59.30 |

| (+) Closing cash in hand |

1.23 |

| (+) Dividend Accrued |

0.80 |

| Total Closing Assets |

61.33 |

| (-) Payable on shares |

(6.32) |

| (-) Expenditure incurred |

(0.75) |

| Closing Net Assets |

54.26 |

NAV per unit = \(\frac{\text { Closing Net Assets }}{\text { Number of Units }}=\frac{\text { Rs. } 54.26 \text { crores }}{20 \text { Lakh Units }}\)

= \(\frac{\text { Rs. } 5426 \text { Lakhs }}{20 \text { Lakh Units }}\) = Rs. 271.30 per unit

Working Note-1 Calculation of Market Value of Portfolio

| Particulars |

Workings |

Rs. in crores |

| 1. Listed Shares |

(20 × 2300)/1000 |

46.00 |

| 2. Unlisted Bonds (Unquoted) |

(1 – 20%) |

0.80 |

| 3. Listed Bonds & Debentures |

(Given value) |

8.00 |

| 4. Other Fixed Interest Securities |

(At cost) |

4.50 |

|

|

59.30 |

Question 4.

A mutual fund made an issue of 10,00,000 units of Rs. 10 each on January 01, 2008. No entry load was charged. It made the following investments:

| 50,000 Equity shares of Rs. 100 each @ Rs. 160 |

Rs.

80,00,000 |

| 7% Government Securities |

8,00,000 |

| 9% Debentures (Unlisted) |

5,00,000 |

| 10% Debentures (Listed) |

5,00,000 |

|

98,00,000 |

During the year, dividends of Rs. 12,00,000 were received on equity shares, Interest on all types of debt securities was received as and when due. At the end of the year equity shares and 10% debentures are quoted at 175% and 90% respectively. Other investments are at par.

Find out the Net Asset Value (NAV) per unit given that operating expenses paid during the year amounted to Rs. 5,00,000. Also find out the NAV, if the Mutual fund had distributed a dividend of Rs. 0.80 per unit during the year to the unit holders. [Nov. 2009] [8 Marks]

Answer:

(a) Computation of NAV, when dividend is not paid:

|

Rs. |

Market Value of Portfolio [Working Note-1]

(+) Closing cash in hand [Working Note-2]

(+) Accrued Income

Total Closing Assets

(-) Accrued Expenses

(-) Other Liabilities |

105,00,000

10,51,000

Nil

115,51,000

Nil

Nil |

| Closing Net Assets |

115,51,000 |

NAV per unit = \(\frac{\text { Closing Net Assets }}{\text { Number of Units }}=\frac{\text { Rs. } 115,51,000}{10,00,000 \text { Units }}\)

= Rs. 11.55 per unit

(b) NAV, when dividend is paid:

NAV per unit = \(\frac{\text { Rs. } 115,51,000 \text { minus }(10,00,000 \times 0.80)}{10,00,000 \text { Units }}\) = Rs. 10.75 per unit

Working Note – 1 Calculation of Market Value of Investments

| Particulars |

Workings |

Rs. |

| 1. Equity Shares (Quoted at 175% i.e. Rs. 175) |

50,000 @ Rs. 175 |

87,50,000 |

| 2. 10% Debentures (Quoted at 90%) |

5,00,000 @ 90% |

4,50,000 |

| 3. 7% Government Securities |

|

8,00,000 |

| 4. 9% Unlisted Debentures |

|

5,00,000 |

| Market Value of Investments |

1,05,00,000 |

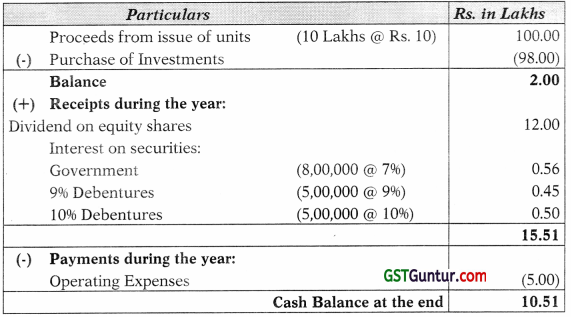

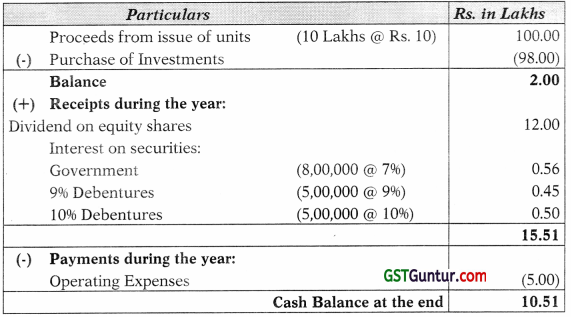

Working Note – 2 Calculation of cash balance at the end of year

Question 5.

Based on the following data, estimate the Net Asset Value (NAV) on per unit basis of a Regular Income Scheme of a Mutual Fund:

|

Rs. (in lakhs) |

| Listed Equity shares at cost (ex-dividend) |

40.00 |

| Cash in hand |

2.76 |

| Bonds & Debentures at cost |

8.96 |

| Of these, Bonds not listed & not quoted |

2.50 |

| Other fixed interest securities at cost |

9.75 |

| Dividend accrued |

1.95 |

| Amount payable on shares |

13.54 |

| Expenditure accrued |

1.76 |

Additional Information:

(1) Current realizable value of fixed income securities of face value of Rs. 100 is Rs. 96.50.

(2) Number of Units (Rs. 10 face value each): 2,75,000

(3) All the listed equity shares were purchased at a time when market portfolio index was 12,500. On NAV date, the market portfolio index is at 19,975.

(4) There has been a diminution of 15% in unlisted bonds and debentures valuation.

(5) Listed bonds and debentures carry a market value of Rs. 7.5 lakhs, on NAV date.

(6) Operating expenses paid during the year amounted to Rs. 2.24 lakhs. Take decimal up to three digits (when expressed in lakhs). [May 2014] [8 Marks]

Answer:

Calculation of Closing Net Assets

|

Rs. in crores |

| Market Value of Portfolio[Working Note-1] |

82.954 |

| (+) Closing cash in hand |

2.760 |

| (+) Dividend Accrued |

1.950 |

| Total Closing Assets |

87.664 |

| (-) Payable on shares |

(13.54) |

| (-) Expenditure incurred |

(1.76) |

| Closing Net Assets |

72.364 |

NAV per unit = \(\frac{\text { Closing Net Assets }}{\text { Number of Units }}=\frac{\text { Rs. } 72.364 \text { crores }}{2,75,000 \text { Units }}\)

= \(\frac{\text { Rs. } 72.364 \text { Lakhs }}{2.75 \text { Lakh Units }}\) = Rs. 26.3142 per unit

Working Note-1 Calculation of Market Value of Portfolio:

| Particulars |

Workings |

Rs. in crores |

| Listed Shares |

(40 × 19975)/12500 |

63.920 |

| Unlisted Bonds (Unquoted) |

(2.5 – 15%) |

2.125 |

| Listed Bonds & Debentures |

(Given value) |

7.500 |

| Other Fixed Interest Securities |

(9.75 × 96.50)/100 |

9.409 |

|

|

82.954 |

Tutorial Note:

(1) The information regarding operating expenses paid has no use since closing cash as well as closing accrued expenses are given.

(2) It has been assumed that the other fixed interest securities have been acquired at their face value.

Question 6.

A Mutual Fund Co. has the following assets under it on the close of business as on :

| Company |

No. of Shares |

1st February 2012 Market price per share (Rs.) |

2nd February 2012 Market price per share (Rs.) |

| L Ltd. |

20,000 |

20.00 |

20.50 |

| M Ltd. |

30,000 |

312.40 |

360.00 |

| N Ltd. |

20,000 |

361.20 |

383.10 |

| P Ltd. |

60,000 |

505.10 |

503.90 |

Total No. of Units 6,00,000

(i) Calculating Net Assets Value (NAV) of the Fund as on 1st February, 2012.

(ii) Following information is given:

Assuming one Mr. A, submits a Cheque of Rs. 30,00,000 to the Mutual Fund and the Fund manager of this company purchases 8,000 shares of M Ltd; and the balance amount is held in Bank. In such a case, what would be the position of the Fund?

(iii) Find new NAV of the Fund as on 2nd February 2012. [May 2012] [8 Marks]

Answer:

(i) NAV of the Fund as on 1st February, 2012

| Company |

No. of Shares |

Market Price |

Amount (Rs.) |

| L Ltd. |

20,000 |

20.00 |

4,00,000 |

| M Ltd. |

30,000 |

312.40 |

93,72,000 |

| N Ltd. |

20,000 |

361.20 |

72,24,000 |

| P Ltd. |

60,000 |

505.10 |

3,03,06,000 |

|

|

|

4,73,02,000 |

NAV = \(\frac{\text { Rs. } 4,73,02,000}{6,00,000}\) = Rs. 78. 84 (rounded Off)

(ii) The revised position of fund after receipt of Cheque from Mr. A:

| Company |

No. of Shares |

Market Price |

Amount (Rs.) |

| L Ltd. |

20,000 |

20.00 |

4,00,000 |

| M Ltd. |

38,000 |

312.40 |

1,18,71,200 |

| N Ltd. |

20,000 |

361.20 |

72,24,000 |

| P Ltd. |

60,000 |

505.10 |

3,03,06,000 |

| Cash |

|

|

5,00,800 |

|

|

|

5,03,02,000 |

Cash Balance = 30 Lakhs – (8,000 × 312.40) = Rs. 5,00,800

No. of units of fund = 6,00,000 + \(\frac{R s .30,00,000}{78.84}\) = 6,38,053

(iii) On 2nd February 2012, the NAV of fund will be as follows:

| Shares |

No. of Shares |

Price (2nd Feb.) |

Amount (Rs.) |

| L Ltd. |

20,000 |

20.50 |

4,10,000 |

| M Ltd. |

38,000 |

360.00 |

1,36,80,000 |

| N Ltd. |

20,000 |

383.10 |

76,62,000 |

| P Ltd. |

60,000 |

503.90 |

3,02,34,000 |

| Cash |

|

|

5,00,800 |

|

|

|

5,24,86,800 |

NAV as on 2nd February 2012 = \(\frac{R s .5,24,86,800}{6,38,053}\) = Rs. 82.26 per unit

Assumption: It has been assumed that the cheque of Rs. 30 lakhs has been realised on 1st February itself and the fund manager has purchased the units on the same day.

Question 7.

The following information is extracted from Steady Mutual Fund’s Scheme:

| Asset Value at the beginning of the month |

Rs. 65.78 |

| Annualized return |

15% |

| Distributions made in the nature of Income (per unit) |

Re. 0.50 |

| Distributions made in the nature of Capital gain (per unit) |

Re. 0.32 |

You are required to:

1. Calculate the month end net asset value of the mutual fund scheme (limit ^our answers to two decimals).

2. Provide a brief comment on the month end NAV. [Nov. 2012] [5 Marks]

Answer:

1. Calculation of NAV at the end of month:

r = \(\frac{\left(\mathrm{NAV}_{\mathrm{t}}-\mathrm{NAV}_{\mathrm{t-1}}\right)+\mathrm{I}_{\mathrm{t}}+\mathrm{CG}_{\mathrm{t}}}{\mathrm{NAV}}\)

NAVt = Net Asset Value at time period t

NAVt-1 = Net Asset Value at time period t-1

It = Income at time period t

CGt = Capital Gain distribution at time prd. t

Given Annual Return = 15%

Monthly Return (r) = 1.25%

Income (I t) = Re. 0.50

Capital Gain (CG t) = Re. 0.32

NAVt-1 = Rs. 65.78

0 0125 = \(\frac{\left(\mathrm{NAV}_{\mathrm{t}}-\text { Rs. } 65.78\right)+\text { Re. } 0.50+\text { Re. } 0.32}{\text { Rs. } 65.78}\)

0. 82 = NAVt – Rs. 64.96

NAVt = Rs. 65.78 2.

2. There is no change in NAV.

Question 8.

A mutual fund that had a net asset value of Rs. 20 at the beginning of the month made income and capital gain distribution of Re. 0.0375 and Re. 0.03 per share respectively during the month, and then ended the month with a net asset value of Rs. 20.06. Calculate monthly return. [May 2010] [5 Marks]

Answer:

|

Rs. Unit |

| Increase in NAV: [NAVt – NAVt-1] i.e. (Rs. 20.06 – Rs. 20.00) |

0.0600 |

| Dividend received [It] |

0.0375 |

| Capital gain distribution [CGt] |

0.0300 |

| Total Return during Holding period |

0.1275 |

Monthly Return on investment = \(\frac{0.1275}{20}\) x 100 = 0.6375%

Alternative Solution:

r = \(=\left[\frac{\left(N A V_t-N A V_{t-1}\right)+I_t+C G_t}{N A V_{t-1}}\right]\)

Where

R= Return on the mutual fund

NAVt = Net Assets Value at time period t

NAVt-1 = Net Assets Value at time period t-1

It= income at time period t

CGt = Capital Gain distribution at time period t

r = \(\left[\frac{(20.06-20)+0.0375+0.03}{20}\right]\) = 0.006375 or 0.6375%

Question 9.

A mutual fund that had a net asset value of Rs. 16 at the beginning of the month made income and capital gain distribution of Re. 0.04 and Re. 0.03 per share respectively during the month, and then ended the month with a net asset value of Rs. 16.08. Calculate monthly and annual rate of return. [June 2009] [4 Marks]

Answer:

|

Rs. Unit |

| Increase in NPV: [NAVt – NAVt-1] ie. (Rs. 16.08 – Rs. 16) |

0.08 |

| Dividend received [It] |

0.04 |

| Capital gain distribution [CGt] |

0.03 |

| Total Return during Holding period (Month) |

0.15 |

Monthly Return on investment = \(\frac{0.15}{16}\) × 100 = 0.9375%

Annual Rate of Return = \(\frac{0.9375}{1}\) × 12 = 11.25%

Alternative Solution:

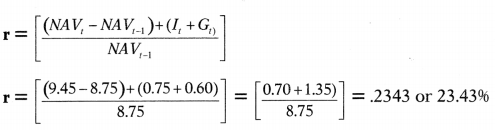

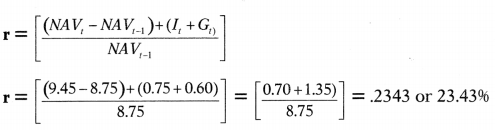

r = \(\left[\frac{\left(N A V_t-N A V_{t-1}\right)+I_t+G_t}{N A V_{t-1}}\right]\)

Monthly Return (r) = \(\left[\frac{(16.08-16)+0.04+0.03}{16}\right]\) = 0.009375 or 0.9375%

Annual Rate of Return = \(\frac{0.9375}{1}\) × 12 = 11.25%

Question 10.

An investor purchased 300 units of Mutual Fund at Rs. 12.25 per unit on 31st December, 2009. As on 31st December, 2010 he has received Rs. 1.25 as dividend and Re. 1.00 as capital gains distribution per unit.

Required:

(i) The return on the investment if the NAV as on 31st December, 2010 is Rs. 13.00.

(ii) The return on the investment as on 31st December, 2010 if all dividends

and capital gains distributions are reinvested into additional units of the fund at Rs. 12.50 per unit. [May 2011] [8 Marks]

Answer:

(i) Calculation of Holding Period Return

|

Rs./Unit |

| Increase in NPV: [NAVt – NAVt-1] i.e. (Rs. 13.00 – Rs. 12.25) |

0.75 |

| Dividend received[It] |

1.25 |

| Capital gain distribution[CGt] |

1.00 |

| Total Return during Holding period |

3.00 |

Return on investment = \(\frac{3.00}{12.25}\) × 100

= 24.49% p.a. [Since the holding period is 1 year]

(ii) When all dividends and capital gains distributions are reinvested into additional units of the Fund:

| Particulars |

Calculations |

Result |

| Dividends and Capital Gains per unit |

1.25 + 1.00 |

Rs. 2.25 per unit |

| Total amount reinvested from 300 units |

Rs. 2.25 × 300 |

Rs. 675 |

| Reinvestment unit Price |

|

Rs. 12.50 |

| Additional units added |

Rs. 675/12.50 |

54 Units |

| Value of 354 units at the end of the year |

354 × 13 |

Rs. 4,602 |

| Initial Investment |

300 × 12.25 |

Rs. 3,675 |

Holding Period Return = \(\frac{\text { Value of closing units }- \text { Initial Investment }}{\text { Initial Investment }}\)

\(\frac{R s .4,602-3,675}{3,675}=\frac{R s .927}{3,675}\) = 25.22%

Question 11.

Orange purchased 200 units of Oxygen Mutual Fund at Rs. 45 per unit on 31st December, 2009. In 2010, he received Re.1.00 as dividend per unit and a capital gains distribution of Rs. 2 per unit.

Required:

(i) Calculate the return for the period of one year assuming that the NAV as on 31st December 2010 was Rs. 48 per unit.

(ii) Calculate the return for the period of one year assuming that the NAV as on 31st December 2010 was Rs. 48 per unit and all dividends and capital gains distributions have been reinvested at an average price of Rs. 46.00 per unit. Ignore taxation. [Nov. 2011] [5 Marks]

Answer:

(i) Calculation of Holding Period Return

|

Rs./Unit |

| Increase in NPV: [NAVt NAVt-1] ie. (Rs. 48 – 45) |

3.00 |

| Dividend received [It] |

1.00 |

| Capital gain distribution [CGt] |

2.00 |

| Total Return during Holding period |

6.00 |

Return on investment = \(\frac{6.00}{45}\) × 100

= 13.3396 p.a. [Since the holding period is 1 year]

(ii) When all dividends and capital gains distributions are reinvested into additional units of the Fund:

| Particulars |

Calculations |

Result |

| Dividends and Capital Gains per unit |

1.00 + 2.00 |

Rs. 3.00 per unit |

| Total amount reinvested from 200 units |

Rs. 3.00 × 200 |

Rs. 600 |

| Reinvestment unit Price |

|

Rs. 46 |

| Additional units added |

Rs. 600/46 |

13.04 Units |

| Value of 213.04 units at the year end |

213.04 × 48 |

Rs. 10,225.92 |

| Initial Investment |

200 × 45 |

Rs. 9,000 |

Holding Period Return = \(=\frac{\text { Value of closing units – Initial Investment }}{\text { Initial Investment }}\)

= \(\frac{R s \cdot 10,225.92-9,000}{9,000}=\frac{R s \cdot 1,225 \cdot 92}{R s .9,000}\) × 100 = 13.62%

Question 12.

SBI mutual fund has a NAV of Rs. 8.50 at the beginning of the year. At the end of the year NAV increases to Rs. 9.10. Meanwhile fund distributes Re, 0.90 as dividend and Re. 0.75 as capital gains.

(i) What is the fund’s return during the year?

(ii) Had these distributions been reinvested at an average NAV of Rs. 8.75 assuming 200 units was purchased originally, what is the return? [Nov. 2017] [5 Marks]

Answer:

(i) Calculation of Holding Period Return

|

Rs. Unit |

| Increase in NPV: [NAVt NAVt-1] ie. (Rs. 9.10-8.50) |

0.60 |

| Dividend received [It] |

0.90 |

| Capital gain distribution [CGt] |

0.75 |

| Total Return during Holding period |

2.25 |

Return on investment = \(\frac{2.25}{8.50}\) × 100

= 26.47% p.a. [Since the holding period is 1 year]

(ii) When all dividends and capital gains distributions are reinvested into additional units of the Fund:

| Particulars |

Calculations |

Result |

| Dividends and Capital Gains per unit |

0.90 + 0.75 |

Rs. 1.65 per unit |

| Totai amount reinvested from 200 units |

Rs. 1.65 × 200 |

Rs. 330 |

| Reinvestment unit Price |

|

Rs. 8.75 |

| Additional units added |

Rs. 330/8.75 |

37.71 Units |

| Value of 237.71 units at the year end |

237.71 × 9.10 |

Rs. 2,163.16 |

| Initial Investment |

200 × 8.50 |

Rs. 1,700 |

Holding Period Return = \(\frac{\text { Value of closing units – Initial Investment }}{\text { Initial Investment }}\)

= \(\frac{R s \cdot 2,163.16-1,700}{1,700}\) × 100 = \(\frac{R s .463 .16}{R s .1,700}\) × 100 = 27.25%

Question 13.

A mutual fund having 300 units has shown its NAV of Rs. 8.75 and Rs. 9.45 at the beginning and at the end of the year respectively. The Mutual fund has given two Options to the Investors:

(i) Get dividend of Re. 0.75 per unit and capital gain of Re. 0.60 per unit, or

(ii) These distributions are to be reinvested at an average NAV of Rs. 8.65 per unit.

What difference would it make in term of returns available and which option is preferable by the investors? [Nov. 2018] [8 Marks]

Answer:

Option 1: When Dividend and Capital Gain are paid Returns for the year (on per Unit Basis)

| Change in Price (9.45 – 8.75) |

0.70 |

| Dividend Received |

0.75 |

| Capital Gain |

0.60 |

| Total Returns in holding period (one year) |

₹ 2.05 |

Holding Period Reward = \(\frac{2.05}{8.75}\) × 100 = 23.43%

Alternatively:

Option 2: When Dividend and Capital Gain are reinvested

| Dividend per unit |

0.75 |

| Capital Gain per unit |

0.60 |

|

1.35 |

Total Received for 300 units = 1.35 × 300 = t 405

Additional Units Acquired = \(\frac{405}{8.65}\) = 46.82 units

Total units = 300 + 46.82 = 346.82 units

|

Beginning of Year |

End of Year |

| Units held |

300 |

346.82 |

| NAV Per Unit |

₹ 8.75 |

₹ 9.45 |

| Total value |

₹ 2,625 |

₹ 3277.45 |

Holding Period Reward = \(\frac{3,277.45-2,625}{2,625}\) × 100 = 24.85%

Conclusion: Since the Holding Period Reward is more in terms of percentage in option-II (Reinvestment of distributions), the option II is preferable.

Question 14.

The following information is extracted from Steady Mutual Fund Scheme:

| Asset value at the beginning of the month |

Rs. 65.78 |

| Annualised Return |

15% |

| Distribution made in the nature of the income (Per Unit) |

0.50 |

| Distribution made in the nature of the Capital Gain (Per Unit) |

0.32 |

(i) Calculate the month end Net Assets Value of the mutual fund scheme (Limit your answer to two decimal).

(ii) Provide a brief comment on the month end NAV. [Nov. 2012] [5 Marks]

Answer:

(i) Calculation of NAV at the end of the month

r = \(\left[\frac{\left(N A V_t-N A V_{t-1}\right)+I_t+G_{\mathrm{I}}}{N A V_{t-1}}\right]\)

Where

R= 15% p.a. = 1.25% per month

NAVt =?

NAVt-1 = Rs. 65.78

I = Rs. 0.50

Gt = Rs. 0.32

0.00125 = \(\left[\frac{\left(\mathrm{NAV}_{\mathrm{t}}-65.78\right)+0.50+0.32}{65.78}\right]\)

On solving the above equation, we get NAVt = Rs. 65.78

(ii) Comment on month end NAV

There is no change in the value of NAV, as the entire income and gain has been distributed.

Question 15.

A Mutual Fund having 300 units has shown its NAV of Rs. 8.75 and Rs. 9.45 at the beginning and at the end of the year respectively. The Mutual Fund has given two options:

(i) Pay Re. 0.75 per unit as dividend and Re. 0.60 per unit as a capital gain, or

(ii) These distributions are to be reinvested at an average NAV of Rs. 8.65 per unit.

What difference it would make in terms of return available and which option is preferable? [May 2006] [6 Marks]

Answer:

Calculation of Holding Period Return under OPTION I [Income Plan]

|

Rs. Unit |

| Increase in NPV: [NAVt NAVt-1] ie. (Rs. 9.45 – 8.75) |

0.70 |

| Dividend received [It] |

0.75 |

| Capital gain distribution [CGt] |

0.60 |

| Total Return during Holding period |

2.05 |

Return on investment = \(\frac{2.05}{8.75}\) × 100

= 23.43% p.a. [Since the holding period is 1 year]

Under option II, all dividends and capital gains distributions are reinvested into additional units of the Fund @ Rs. 8.65 per unit.

| Particulars |

Calculations |

Result |

| Dividends and Capital Gains per unit |

0.75 + 0.60 |

Rs. 1.35 per unit |

| Total amount reinvested from 300 units |

Rs. 1.35 × 300 |

Rs. 405.00 |

| Reinvestment unit Price |

|

Rs. 8.65 |

| Additional units added |

Rs. 405/8.65 |

46.82 Units |

| Total units at the end after reinvestment |

300 + 46.82 |

346.82 |

| Value of 346.82 units at the year end |

346.82 × 9.45 |

Rs. 3,277.45 |

| Initial Investment |

300 × 8.75 |

Rs. 2,625.00 |

Holding Period Return = \(\frac{\text { Value of closing units }- \text { Initial Investment }}{\text { Initial Investment }}\)

= \(\frac{R s .3,277.45-2,625.00}{2,625.00}\) × 100 = \(\frac{R s .652 .45}{R s .2,625.00}\) × 10 = 24.85%

Comment: Since, the Holding Period Reward (in terms of percentage) is more under reinvestment plan, the option II is preferable.

Question 16.

A has invested in three Mutual Fund Schemes as per details below:

|

MF-A |

MF-B |

MFC |

| Date of Investment |

1-12-2009 |

1-1-2010 |

1-3-2010 |

| Amount of Investment (Rs.) |

50,000 |

1,00,000 |

50,000 |

| Net Assets value at entry date |

Rs. 10.50 |

Rs. 10.00 |

Rs. 10.00 |

| Dividend received up to 31-3-2010 |

Rs. 950 |

Rs. 1,500 |

Nil |

| Net Asset value as at March 31, 2010 |

Rs. 10.40 |

Rs. 10.10 |

Rs. 9.80 |

Required:

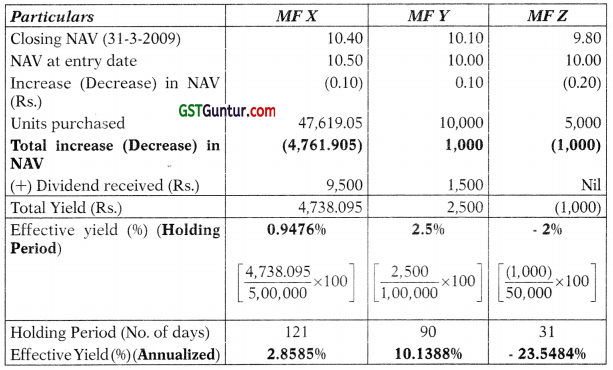

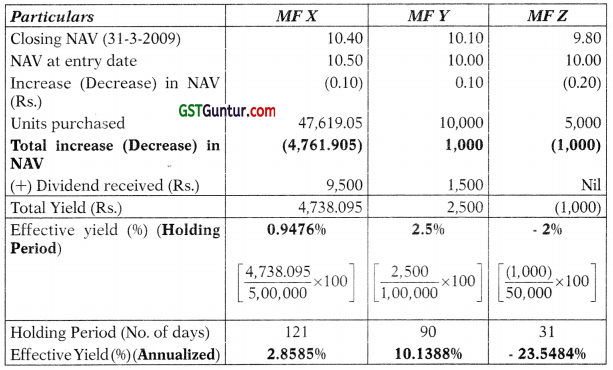

What is the effective yield on per annum basis in respect of each of the above three schemes to Mr. A up to 31-3-2010? [Nov. 2004] [6 Marks]

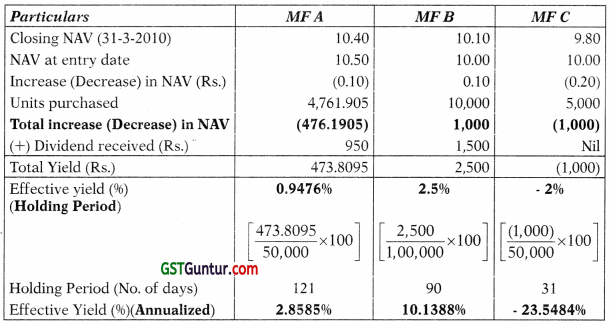

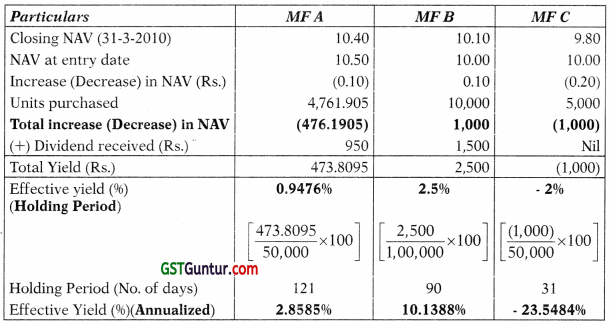

Answer:

Calculation of units purchased

| Particulars |

MFA |

MFB |

MFC |

| Amount of Investment (Rs.) (A) |

50,000 |

1,00,000 |

50,000 |

| NAV at entry date (B) |

10.50 |

10 |

10 |

| No. of units (A)/(B) |

4,761.905 |

10,000 |

5.000 |

Calculation of effective yield

Tutorial Note: While calculating number of days, the date of investment is taken into account.

Question 17.

Mr. Sinha has invested in three Mutual Fund Schemes as per details below: [Nov. 2009] [6 Marks]

|

MF-A |

MF-B |

MFC |

| Date of Investment |

1-12-2008 |

1-1-2009 |

1-3-2009 |

| Amount of Investment (Rs.) |

5,00,000 |

1,00,000 |

50,000 |

| Net Assets value at entry date |

Rs. 10.50 |

Rs. 10.00 |

Rs. 10.00 |

| Dividend received up to 31-3-2009 |

Rs. 9,500 |

Rs. 1,500 |

Nil |

| Net Asset value as at March 31, 2009 |

Rs. 10.40 |

Rs. 10.10 |

Rs. 9.80 |

You are required to calculate the effective yield on per annum basis in respect of each of the three schemes to Mr. Sinha up to 31-3-2009?

Answer:

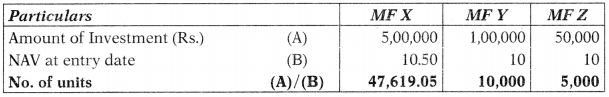

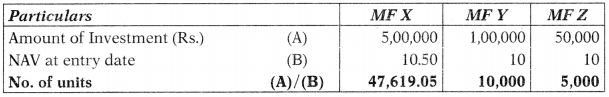

Calculation of units purchased

Calculation of effective yield

Tutorial Note: While calculating number of days, the date of investment is taken into account.

Question 18.

TUV Ltd. has invested in three Mutual Fund schemes as per the details given below:

|

Scheme X |

Scheme Y |

Scheme Z |

| Date of Investment |

1-10-2014 |

1-1-2015 |

1-3-2015 |

| Amount of Investment (Rs.) |

15,00,000 |

7,50,000 |

2,50,000 |

| Net Assets value at entry date |

Rs. 12.50 |

Rs. 36.25 |

Rs. 27.75 |

| Dividend received up to 31-3-2015 |

Rs. 45,000 |

Rs. 12,500 |

Nil |

| Net Asset value as at March 31, 2015 |

Rs. 12.25 |

Rs. 36.45 |

Rs. 27.55 |

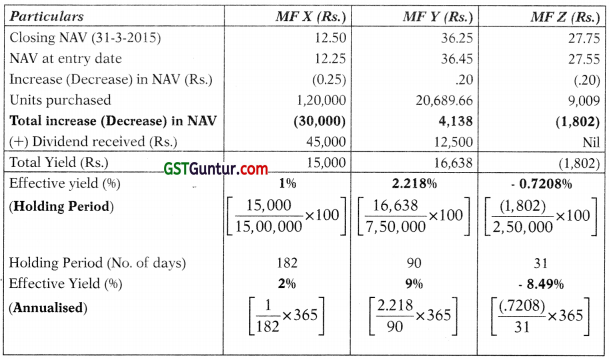

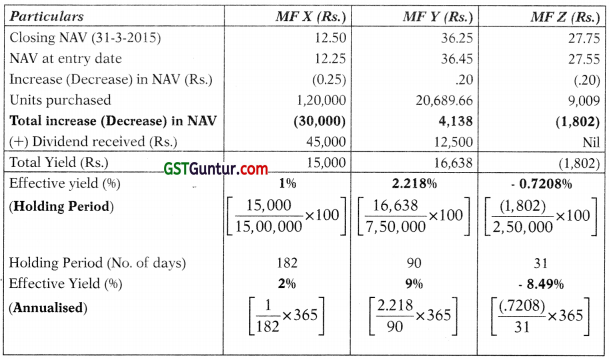

What will be the effective yield (per annum basis) for each of the above three schemes upto 31st March 2015?

Answer:

Calculation of units purchased

| Particulars |

MFX(Rs.) |

MF Y (Rs. ) |

MFZ (Rs.) |

| Amount of Investment (A) |

15,00,000 |

7,50,000 |

2,50,000 |

| NAV at entry date (B) |

12.50 |

36.25 |

27.75 |

| No. of units (A)/(B) |

1,20,000 |

20,689.66 |

9,009 |

Calculation of effective yield

Tutorial Note: While calculating number of days, the date of investment is taken into account.

Question 19.

Mr. A has invested in three Mutual Fund (MF) schemes as per the details given below:

| Particulars |

MF ‘A’ |

MFB’ |

MF‘C’ |

| Date of Investment |

01-11-2015 |

01-02-2016 |

01-03-2016 |

| Amount of Investment (Rs.) |

1,00,000 |

2,00,000 |

2,00,000 |

| Net Asset Value at entry date (Rs.) |

10.30 |

10.00 |

10.10 |

| Dividend Received up to 31-3-2016 (Rs.) |

2,850 |

4,500 |

Nil |

| NAV as on 31-3-2016 (Rs.) |

10.25 |

10.15 |

10.00 |

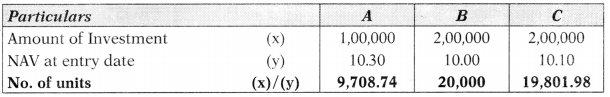

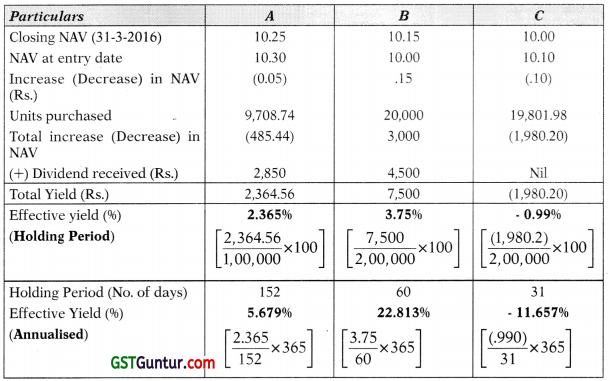

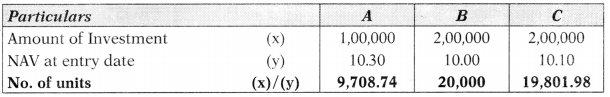

Assume 1 year = 365 days. Show the amount of rupees up to two decimal points.

You are required to find out the effective yield (up to three decimal points) on per annum basis in respect of each of the above three Mutual Fund (MF) schemes up to 31-3-2016. [Nov. 2016] [5 Marks]

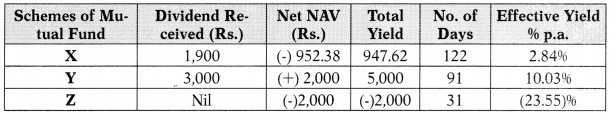

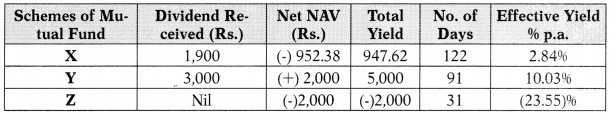

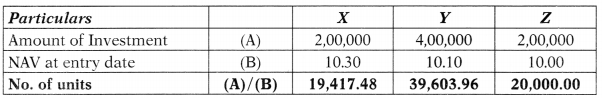

Answer:

Calculation of units purchased

Calculation of effective yield

Tutorial Note: While calculating number of days, the date of investment is taken into account.

Question 20.

Mr. Suhail has invested in three Mutual Fund Schemes as given below:

| Particulars |

Scheme A Rs. |

Scheme B Rs. |

Scheme C Rs. |

| Date of investment |

1-4-2011 |

1-5-2011 |

1-7-2011 |

| Amount of investment |

12,00,000 |

4,00,000 |

2,50,000 |

| Net Asset Value at entry date |

10.25 |

10.15 |

10.00 |

| Dividend received up to 31-7-2011 |

23,000 |

6,000 |

Nil |

| NAV as at 31-7-2011 |

10.20 |

10.25 |

9.90 |

You are required to calculate the effective yield on per annum basis in respect of each of the three Schemes to Mr. Suhail up to 31-7-2011.

Take one year = 365 days.

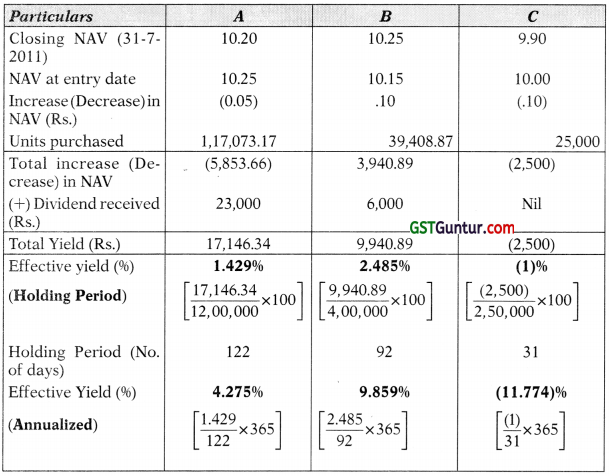

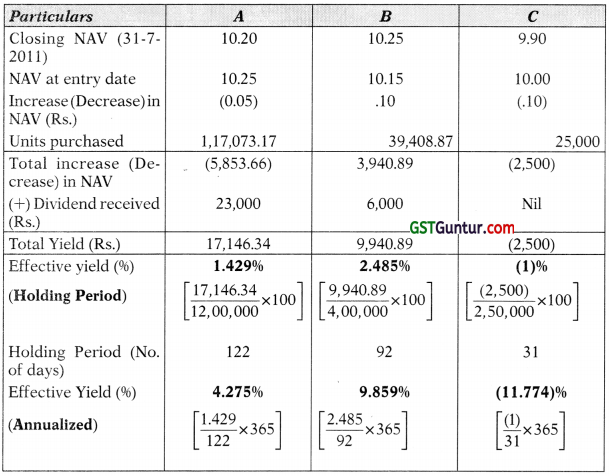

Show calculations up to two decimal points. [May 2013] [10 Marks]

Answer:

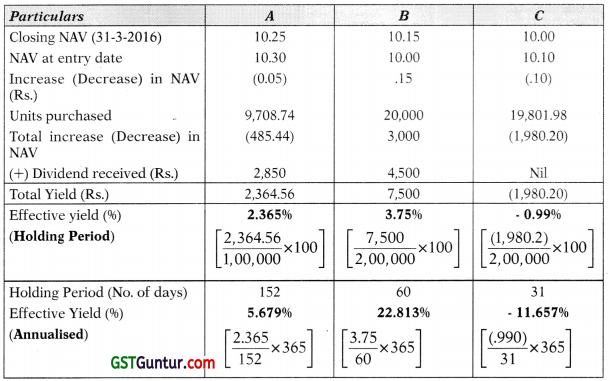

Calculation of units purchased

| Particulars |

A |

B |

C |

| Amount of Investment (x) |

12,00,000 |

4,00,000 |

2,50,000 |

| NAV at entry date (y) |

10.25 |

10.15 |

10.00 |

| No. of units (x)/(y) |

1,17,073.17 |

39,408.87 |

25,000 |

Calculation of effective yield

Tutorial Note: While calculating number of days, the date of investment is taken into account.

Question 21.

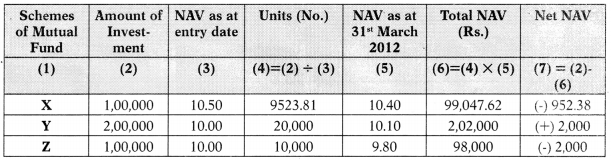

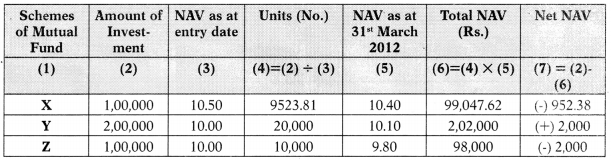

Ramesh Goyal has invested in three Mutual Funds. From the details given below, find out effective yield on per annum basis in respect of each of the schemes to Ramesh Goyal up to 31.03.2012.

| Mutual Fund |

X |

Y |

z |

| Date of investment |

01.12.2011 |

01.01.2012 |

01.03.2012 |

| Amount of investment (Rs.) |

1,00,000 |

2,00,000 |

1,00,000 |

| NAV at the date of investment (Rs.) |

10.50 |

10.00 |

10.00 |

| Dividend receipt upto 31.03.2012 (Rs.) |

1,900 |

3,000 |

Nil |

| NAV as on 31.03,2012 (Rs.) |

10.40 |

10.10 |

9.80 |

Answer:

Computation of Net Value Added during the year ended 31.03.2012

Effective yield in %

Question 22.

Mr. Y has invested in three Mutual Fund (MF) schemes as per the following details:

| Particulars |

MF‘X’ |

MF‘Y’ |

MF‘Z’ |

| Amount of Investment (Rs.) |

2,00,000 |

4,00,000 |

2,00,000 |

| Net Asset Value at the time of purchase (Rs.) |

10.30 |

10.10 |

10.00 |

| Dividend Received up to 31-3-2018 (Rs.) |

6,000 |

Nil |

5,000 |

| NAV as on 31-3-2018 (Rs.) |

10.25 |

10.00 |

10.20 |

| Effective Yield per annum as on 31-3-2018 (%) |

9.66 |

-11.66 |

24.15 |

Assume 1 year = 365 days.

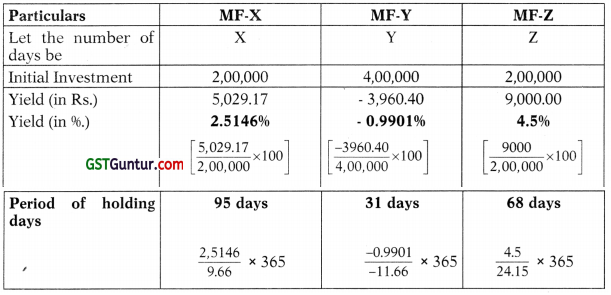

Mr. Y has misplaced the documents of his investment. Help him in finding the date of his original investment after ascertaining the following:

(i) Number of units in each scheme

(ii) Total NAV

(iii) Total Yield and

(iv) Number of days investment held [May 2018] [5 Marks]

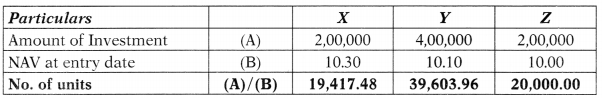

Answer:

(i) Calculation of Number of Units in each Scheme

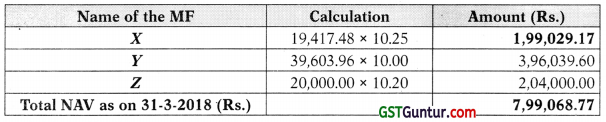

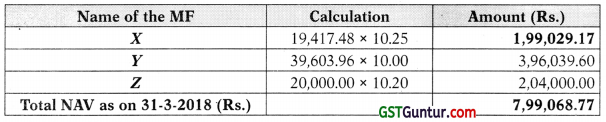

(ii) Calculation of Total NAV on 31.03.2018

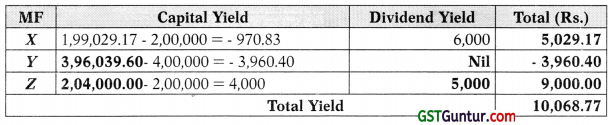

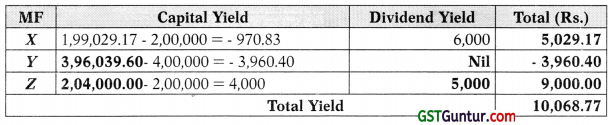

(iii) Total Yield

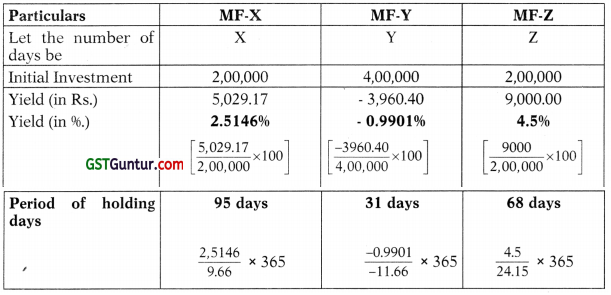

Total Yield = \(\frac{10,068.77}{8,00,000}\) × 100 = 1.2586%

(iv) Determination of Number of days the investment is held:

Tutorial Note: While calculating number of days, the date of investment is taken into account.

Question 23.

Mr. A can earn a return of 16% by investing in equity shares on his own. Now, he is considering a recently announced equity based mutual fund scheme in which initial expenses are 5.5% and annual recurring expenses are 1.5%. How much should the Mutual Fund earn to provide Mr. A return of 16%? [Nov. 2003] [4 Marks]

Answer:

r1 = Personal earnings of Mr. A = 16%

r2 = Mutual Funds earnings

r2 = \(\frac{r_1}{1-\text { initial } \exp \cdot(\%)}\) + recuring exp.(%)

The rate of return the mutual fund should earn (ie. r2);

r2 = \(\frac{16 \%}{1-0.055}\) + 1.5% = 16.93 + 1.5 = 18.43%

Question 24.

Mr. X earns 10% on his investments in equity shares. He is considering a recently floated scheme of a Mutual Fund where the initial expenses are 6% and annual recurring expenses are expected to be 2%. How much the Mutual Fund scheme should earn to provide a return of 10% to Mr. X? [June 2009] [2 Marks]

Answer:

r1 = Personal earnings of Mr. X

r2 = Mutual Funds earnings

r2 = \(\frac{r_1}{1-\text { initial } \exp (\%)}\) + recuring exp.(%)

The rate of return the mutual fund should earn (ie. r2);

r2 = \(\frac{10 \%}{1-0.06}\) + 2% = 10.64 + 2 = 12.64%

Question 25.

“Mr. Alex, a practicing Chartered Accountant, can earn a return of 15 per cent by investing in equity shares on his own. He is considering a recently announced equity based mutual fund scheme in which initial expenses are 6 per cent and annual recurring expenses are 2 per cent.

(i) How much should the mutual fund earn to provide Mr. Alex a return of 15 per cent per annum ?

(ii) Mr. Alex’s current Annual Professional Income is Rs. 40 Lakhs. His portfolio value is Rs. 50 Lakhs and now he is spending 10% of his time to manage his portfolio. If he spends this time on profession, his profes-sional income will go up in same proportion. He is thinking to invest his entire portfolio into a Multieap Fund, assuming the fund’s NAV will grow at 13% per annum (including dividend).

You are requested to advise Mr. Alex, whether he can invest the portfolio into Multicap Funds ? If so, what is the net financial benefit ? [Nov. 2019 Old Syllabus] [8 Marks]

Answer:

(i) r1 = Personal earnings of Mr. X

r2 = Mutual Funds earnings

r2 = \(\frac{r_1}{1-\text { initial } \exp (\%)}\) + recuring exp.(%)

The rate of return the mutual fund should earn (i.e. r2);

r2 = \(\frac{15 \%}{1-0.06}\) + 2.0% = 15.96 + 2 = 17.96%

(ii) Calculation of Return when 100% time is devoted to profession:

Current Income of Mr. Alex = Rs. 40 Lakh He spends 90% time in profession.

Increase in Income by investing 10% remaining time = \(\frac{40}{90}\) × 10

= Rs. 4.44 Lakhs

Total Income from profession (100% time) = Rs. 44.44 Lakhs

| Source |

90% time to Profession (Existing) |

100% time to Profession (Proposed) |

| Professional Income |

Rs. 40 Lakhs |

Rs. 44.44 Lakhs |

| Return from investment in Equity |

Rs. 50 Lakhs × 15% = Rs. 7.50 Lakhs |

Nil |

| Return from investment in Mutual Fund |

Nil |

Rs. 50 Lakhs × 13% = Rs. 6.50 Lakhs |

| Total |

47.5 Lakhs |

50.94 Lakhs |

∴ Increase in Income (50.94 – 47.5) = Rs. 3.44 Lacs

Therefore, Mr. Alex is advised to invest the portfolio into Multicap Funds and devotes 100% time to his profession.

Question 26.

The unit price of Equity Linked Savings Scheme (ELSS) of a mutual fund is Rs. 10. The public offer price (POP) of the unit is Rs. 10.204 and the redemption price is Rs. 9.80.

Calculate:

(i) Front-end Load

(ii) Back-end Load [May 2018 Old Course] [5 Marks]

Answer:

(i) Calculation of Front-end Load:

Public Offer Price = \(\frac{\text { Net Asset Value }}{1-\text { Front-end load }}\)

10.204 = \(\frac{10}{1-\text { Front-end load }}\)

Therefore,

1 – Front end load = \(\frac{10}{10.204}\) = .9

Front end load = 1 – 0.98 = .02 = 2%

(ii) Calculation of Back-end Load:

Redemption Price = Net Asset Value × (1- Back-end Load)

9.8 = 10 × (1- Back-end Load)

Therefore,

1 – Back end load = \(\frac{9.8}{10}\) = 0.98 10

Back end load = 1- 0.98 = .02 = 2%

Alternative Solution suggested by ICAI

Front End Load = \(\frac{10.204-10.00}{10.00}\) = 0.0204 or 2.04%

Exit Load = \(\frac{10.00-9.80}{10.00}\) = 0.020 or 2.00%

Question 27.

During the year 2017 an investor invested in a mutual fund. The capitai gain and dividend for the year was Rs. 3.00 per unit, which were reinvested at the year-end NAV of Rs. 23.75. The investor had total units of 26,750 as at the end of the year. The NAV had appreciated by 18.75% during the year and there was an entry load of Re. 0.05 at the time when the investment was made.

The investor lost his records and wants to find out the amount of investment made and the entry load in the mutual fund. [Nov. 2018 Old Course] [5 Marks]

Answer:

Calculation of Opening NAV

Closing NAV is Rs. 23.75 and Increase in NAV is 18.75%.

Therefore, if the opening NAV is x, then

x + 0.1875 x = 23.75

x = Rs. 20 Therefore, opening NAV was Rs. 20.

Calculation of Units purchased initially

Let number of units purchased initially = Y

Capital Gain and Dividends distributed = Rs. 3 per unit

Therefore, total Capital Gains = 3Y

Number of new units purchased by re-investment is calculated as follows:

= \(\frac{\text { Capital Gains + Dividends }}{\text { Closing NAV }}=\frac{3 Y}{R s .23 .75}\)

Therefore, total number of units = Y + \(\frac{3 Y}{R s .23 .75}\)

Given total units = 26,750

Y + \(\frac{3 Y}{R s .23 .75}\) = Rs. 23.75

Y = 23,750 units

Original units purchased = 23,750 units

Calculation of Investment made and Entry Load paid

Entry Load = 0.05

Cost Price of each unit at the time of investment = NAV + Entry Load = Rs. 20.00 + 0.05 = 20.05

Total investment = 23,750 Units x Rs. 20.05 = Rs. 4,76,187.50

Entry Load = 23,750 Units × Re. 0.05 = Rs. 1,187.50

Question 28.

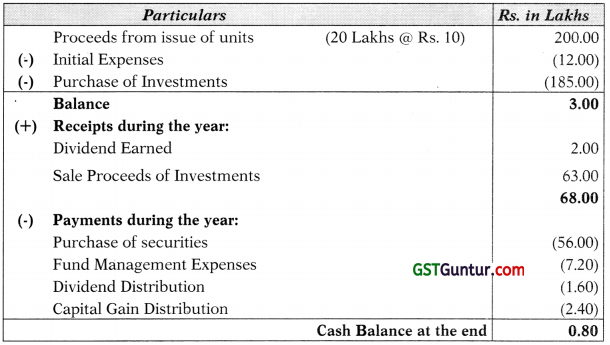

On 1-4-2012 ABC Mutual Fund issued 20 lakh units at Rs. 10 per unit. Relevant initial expenses involved were Rs. 12 lakhs. It invested the fund so raised in capital market instruments to build a portfolio of Rs. 185 lakhs. During the month of April 2012 it disposed off some of the instruments costing Rs. 60 lakhs for Rs. 63 lakhs and used the proceeds in purchasing securities for Rs. 56 lakhs. Fund management expenses for the month of April 2012 were Rs. 8 lakhs of which 10% was in arrears. In April 2012 the fund earned dividends amounting to Rs. 2 lakhs and it distributed 80% of the realized earnings. On 30-4-2012 the market value of the portfolio was Rs. 198 lakhs.

Mr. Akash, an investor, subscribed to 100 units on 1-4-2012 and disposed off the same at closing NAV on 30-4-2012. What was his annual rate of earning? [May 2013] [8 Marks]

Answer:

Calculation of Closing Net Assets

|

Rs. in Lakhs |

| Market Value of Portfolio |

198.00 |

| (+) Closing cash in hand [Working Note- 1] |

0.80 |

| (+) Accrued Income |

Nil |

| Total Closing Assets |

198.80 |

| (-) Accrued Expenses |

(Nil) |

| (-) Other Liabilities (Management Expenses) |

(0.80) |

| Closing Net Assets |

198.00 |

NAV per unit = \(\frac{\text { Closing Net Assets }}{\text { Number of Units }}=\frac{\text { Rs. } 198.00 \text { Lakhs }}{20 \text { Lakhs Units }}\) = Rs. 9.90 per unit

Calculation of Holding Period Return (Per Unit)

|

Rs.Unit |

| Increase in NPV: [NAVt – NAVt-1] i.e. (Rs. 10.00 – Rs. 9.90) |

(0.10) |

| Dividend received [It Per Unit [1.60 ÷ 20] |

0.08 |

| Capital gain distribution [CGt] |

0.12 |

| Total Return during Holding period |

0.10 |

Return on investment (Monthly) = \(\frac{0.10}{10}\) × 100

= 1%

Return on investment (Annualized) = \(\frac{1}{1}\) × 12 = 12% p.a.

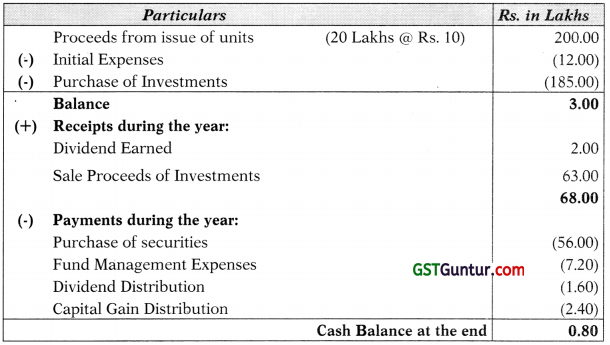

Working Note-1

Calculation of cash balance at the end of year

Question 29.

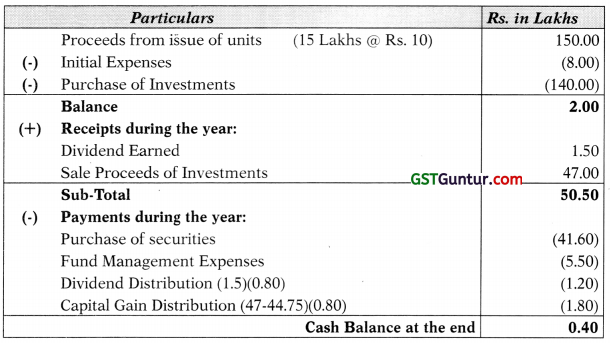

A mutual fund raised Rs. 150 lakhs on April 1, 2018 by issue of 15 lakhs units at Rs. 10 per unit. The fund invested in several capital market instruments to build a portfolio of Rs.140 lakhs. Initial expenses amounted to Rs. 8 lakhs. During the month of April, the funds sold certain instruments costing Rs. 44.75 lakhs for Rs. 47 lakhs and used the proceeds to purchase certain other securities for Rs. 41.6 lakhs. The fund management expenses for the month amounted to Rs. 6 lakh of which Rs. 50,000 was in arrears. The fund earned dividends amounting to Rs. 1.5 lakhs and it distributed 80% of the realized earning. The market value of the portfolio on 30th April, 2018 was Rs. 147.85 lakhs.

An investor subscribed to 1000 units on April 1 and disposed it off at closing NAV on 30th April. Determine his annual rate of earnings. [Nov. 2018] [8 Marks]

Answer:

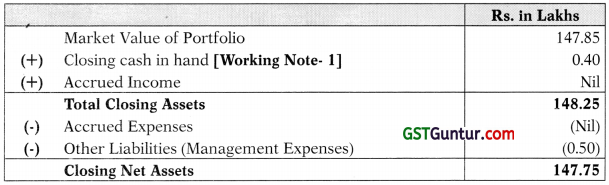

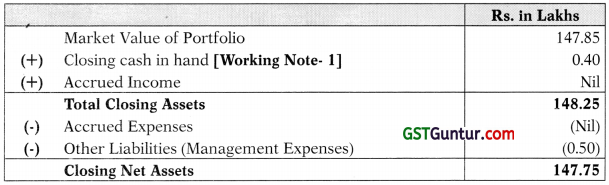

Calculation of Closing Net Assets

NAV per unit = \(\frac{\text { Closing Net Assets }}{\text { Number of Units }}=\frac{\text { Rs. } 147.75 \text { Lakhs }}{15 \text { Lakhs Units }}\) = Rs. 9.85 per unit

Calculation of Holding Period Return (Per Unit)

|

Rs. Unit |

| Increase in NPV: [NAVt – NAVt-1] i.e. (Rs. 10.00 – Rs. 9.85) |

(0.15) |

| Dividend received [It] |

0.08 |

| Capital gain distribution [CGt] |

0.12 |

| Total Return during Holding period |

0.05 |

Return on investment (Monthly) = \(\frac{0.05}{10}\) × 100 = 0.5%

Return on investment (Annualized) = 0.5 × 12 = 6.0% p.a.

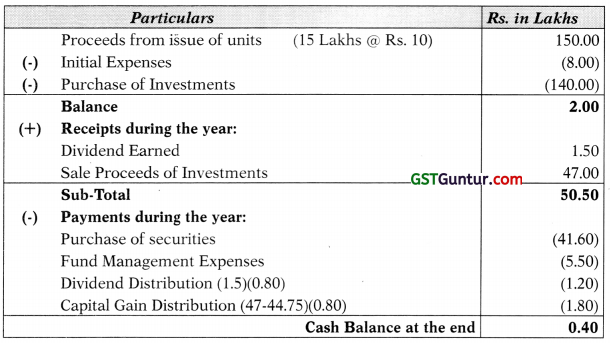

Working Note-1

Calculation of cash balance at the end of year

Question 30.

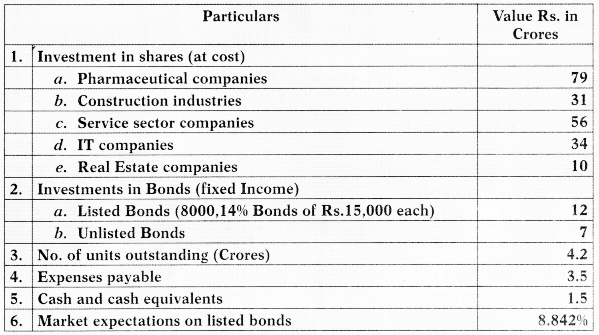

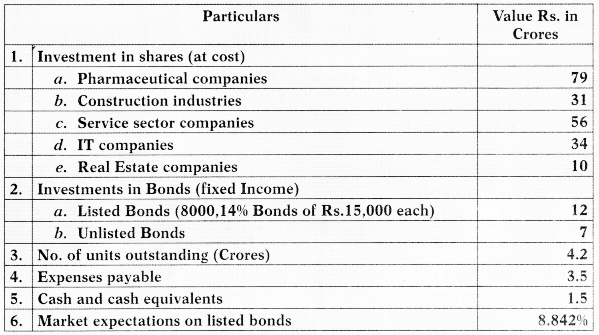

The following particulars relating to Vishnu Fund scheme:

Particulars relating to each sector are as follows:

| Sector |

Index on date of |

| Purchase |

Valuation |

| Pharmaceutical companies |

260 |

465 |

| Construction industries |

210 |

450 |

| Service sector companies |

275 |

480 |

| IT companies |

240 |

495 |

| Real Estate companies |

255 |

410 |

The fund has incurred the following expenses:

| Consultancy and Management fees |

Rs. 480 Lakhs |

| Office Expenses |

Rs. 150 Lakhs |

| Advertisement Expenses |

Rs. 38 Lakhs |

You are required to calculate the following:

i. Net Asset Value of the fund

ii. Net asset value per unit

iii. If the period of consideration is 2 years, and the fund has distributed Rs. 3 per unit per year as cash dividend, ascertain the Net return (Annualized).

iv. Ascertain the Expenses ratio. [May 2019][5 Marks]

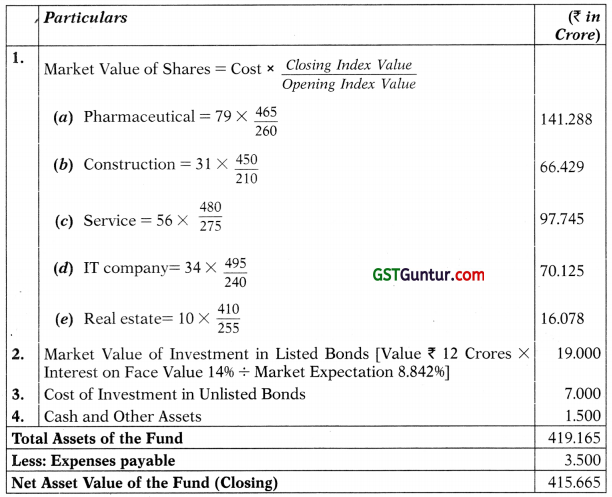

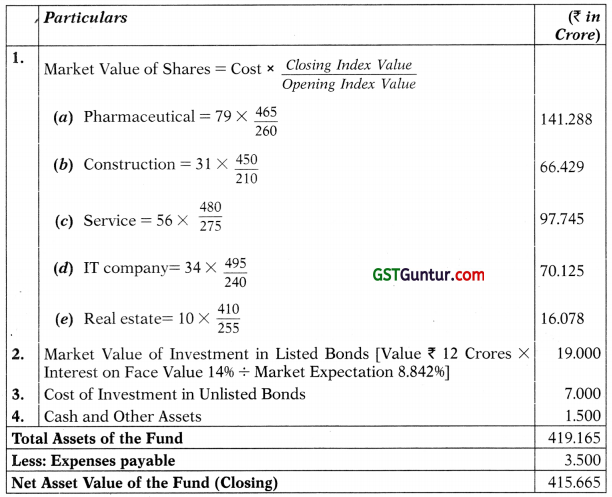

Answer:

(i) Net Asset Value of the Fund

(ii) Net Asset Value per Unit

NAV per Unit = Net Asset Value of the Fund × No. of Units Outstanding

= ₹ 415.665 Crores × 4.2 Crore Units= ₹ 98.97

(iii) Annualized Return on Fund

(a) Computation of Opening NAV

|

Particulars |

(₹ in Crore) |

| 1. |

Investment in shares (at cost) |

|

|

(a) Pharmaceutical companies |

79 |

|

(b) Construction industries |

31 |

|

(c) Service sector companies |

56 |

|

(d) IT companies |

34 |

|

(e) Real Estate companies |

10 |

|

Particulars |

(₹ in Crore) |

| 2. |

Investments in Bonds (fixed Income) |

|

|

(a) Listed Bonds (8000,14% Bonds of Rs. 15,000 each) |

12 |

|

(b) Unlisted Bonds |

7 |

| Net Asset Value of the Fund (Opening) |

229 |

Note: Cash and Other Assets are not included because they arise out of investments made in the beginning.

(b) Computation of Opening NAVper Unit

NAV per Unit = Net Asset Value of the Fund No. of Units Outstand-ing

= ₹ 229.00 Crores ÷ 4.20 Crore Units

= ₹ 54.52

(c) Computation of Returns per Unit

| Capital Appreciation = Closing NAV per Unit – Opening NAV per |

44.45 |

| Unit = ₹ 98.97 – 54.52 |

|

| Cash Dividend = ₹ 3 × 2 Year |

6.00 |

| Total Returns |

50.45 |

(d) Computation of Returns in percentage

NAV per Unit = \(\frac{\text { Return }}{\text { Opening NAV }}\) × 100 = \(\frac{50.45}{54.52}\) × 100 = 92.53%

Return p.a. = Total Return/Period = 92.53% ÷ 2 Years = 46.26%

4. Expense Ratio

(a) Total Expense = Management Advisory Fees ₹ 480 Lakhs + Administration Exp. ₹ 38 Lakhs + Office Expenses ₹ 150 Lakhs = ₹ 668 Lakhs

(b) Average Value of Portfolio

= (Opening Net Asset Value + Closing Net Asset Value) ÷ 2

= (₹ 415.665 Crores + ₹ 229 Crores) ÷ 2

= ₹ 644.665 Crores ÷ 2

= ₹ 322.33 Crores

(c) Expense Ratio = Total Expenses ÷ Average Value of Portfolio

= (₹ 6.68 Crores ÷ ₹ 322.33 Crores) × 100

= 2.07%

(d) Expense Per Unit = Total Expenses ÷ No. of Units = ₹ 6.68 Crores ÷ 4.20 Crores = ₹ 1.59 per unit

Question 31.

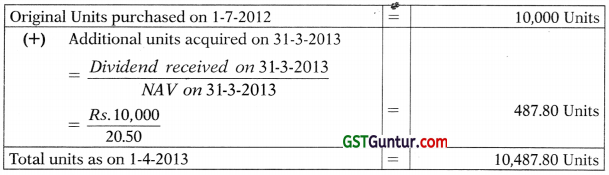

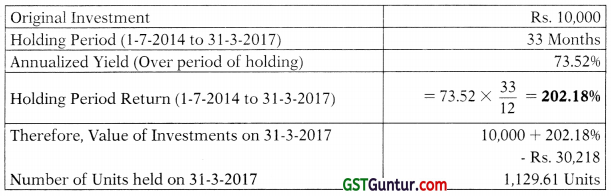

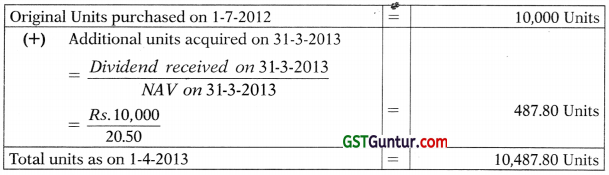

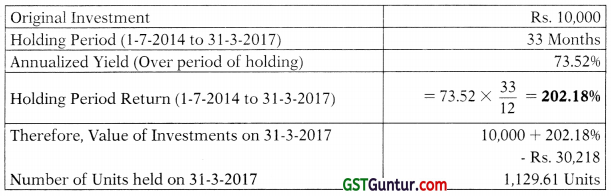

Mr. X on 1.7.2012, during the initial public offer of a Mutual Fund (MF) invested Rs. 1,00,000 at Face Value of Rs. 10. On 31.3.2013, the MF declared a dividend of 10% when Mr. X calculated that his holding period return was 115%. On 31.3.2014, MF again declared a dividend of 20%. On 31.3.2015, Mr. X redeemed all his investment which had accumulated to 11,296.11 units when his holding period return was 202.17%.

Calculate the NAV as on 31.03.2013, 31.03.2014 and 31.03.2015. [Nov. 2015] [8 Marks]

Answer:

Calculation of NAV as on 31-3-2013

| Original Investment |

= |

Rs. 1,00,000 |

| Yield for 9 months |

= |

115% |

| Market Value of Investments (on 31-3-2013) |

= |

1,00,000+ 115% 2,15,000 |

| Dividend Paid |

= |

10% of 1,00,000 Rs. 10,000 |

NAV would stand reduced to the extent of Dividend Payout.

Therefore, NAV (31-3-2013) = \(\frac{\text { Rs. } 2,15,000-\text { Rs. } 10,000}{10,000 \text { Units }}\) = Rs 20 50

Calculation of NAV as on 31-3-2014

Dividend as on 31.3.2014 = 10,487.80 Units × 10 × 0.2 = Rs. 20,975.60

Units after reinvestment of above dividend = 11,296.11 Units

Increase in units due to reinvestment = 11,296.11 – 10,487.80 = 808.31 Units

Additional units purchased on 31-3-2017 = \(\frac{\text { Dividend Received on 31-3-2014 }}{\text { NAV on 31-3-2014 }}\)

808.31 = \(=\frac{\text { Rs. } 20,975.60}{\text { NAV on } 31-3-2014}\)

Therefore, NAV on 31-3-2014 = \(\frac{\text { Rs. } 20,975.60}{808.31}\) = Rs 25.95

Calculation of NAV as on 31-3-2015

| Original Investment |

= |

Rs. 1,00,000 |

| Holding Period Return (1-7-2012 to 31-3-2015) |

= |

202.17% |

| Therefore, Value of Investments on 31-3-2015 |

= |

1,00,000 + 202.17% |

|

= |

Rs. 3,02,170 |

| Number of Units held on 31-3-2015 |

= |

11,296.11 Units |

Therefore, NAV on 31-3-2015 = \(\frac{\text { Rs. } 3,02,170}{11,296.11 \text { Units }}\) = Rs. 26.75

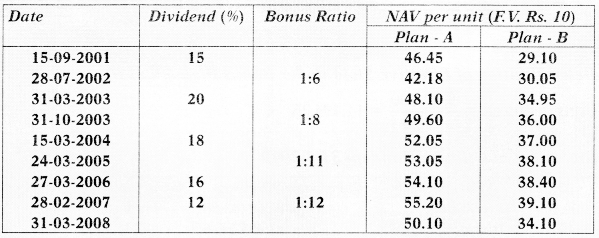

Question 32.

Mr. X on 1.7.2000, during the initial offer of some Mutual Fund invested in 10,000 units having face value of Rs. 10 for each unit. On 31.3.2001, the dividend operated by the M.F. was 10% and Mr. X found that his annualized yield was 153.33%. On 31.12.2002, 20% dividend was given. On 31.3.2003, Mr. X redeemed all his balance of 11,296.11 units when his annualized yield was 73.52%. What are the NAVs as on 31.3.2001, 31.12.2002 and 31.3.2003? [Nov. 2006] [6 Marks]

Answer:

This question is similar to Q. 30 (came in Nov. 2015) with the only dif-ference that in this question the annualized yield is given, which needs to be converted into holding period yield, in the following manner:

Yield for 9 months = 153.33 × \(\frac{9}{12}\) = 115%.

The rest of the solution is exactly similar to Q. 30 given before this question.

Question 33.

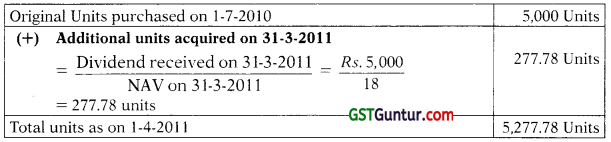

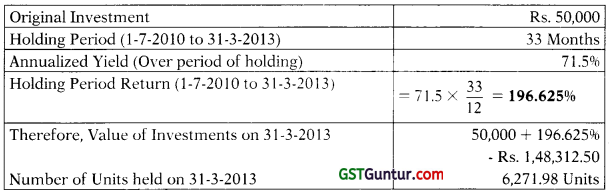

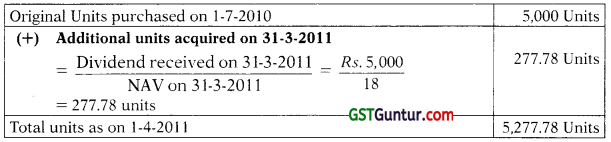

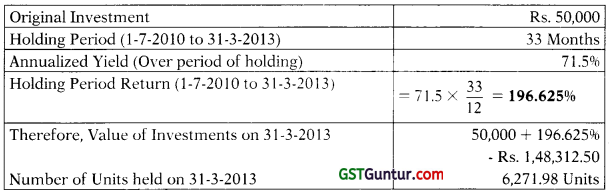

On 01 -07-2010, Mr. X invested Rs. 50,000 at initial offer in Mutual Funds at a face value of Rs. 10 each per unit. On 31-03-2011, a dividend was paid @ 10% and annualized yield was 120%. On 31-3-2012, 20% dividend and capital gain of Re. 0.60 per unit was given. Mr. X redeemed all his 6271.98 units when his annualized yield was 71.50% over the period of holding.

Calculate NAV as on 31-03-2011, 31-03-2012 and 31-03-2013.

For calculations consider a year of 12 months. [Nov. 2013] [5 Marks]

Answer:

Calculation of NAV as on 31-3-2011

| Original Investment |

= |

Rs. 50,000 |

| Annualized Yield |

= |

120% |

| Holding Period (1-7-2010 to 31-3-2011) |

= |

9 Months |

| Yield for 9 months 120 X 9/12 |

= |

90% |

| Market Value of Investments (on 31-3-2011) |

= |

50,000 + 90% = 95,000 |

| Dividend Paid |

= |

10% of 50,000 = Rs. 5,000 |

NAV would stand reduced to the extent of Dividend Payout.

Therefore, NAV (31-3-2011) = \(\frac{\text { Rs. } 95,000-\text { Rs. } 5,000}{5,000 \text { Units }}\) = Rs. 18.00

Calculation of NAV as on 31-3-2013

Dividend as on 31.3.2012 = 5,277.78 Units × 10 × 0.2 = Rs. 10,555.56

Units after reinvestment of above dividend 6,271.98 Units

Increase in units dueto reinvestment = 6,271.98 – 5,277.78 = 994.20 Units

Additional units purchased on 3 1-3-2012 = \(\frac{\text { Dividend Received on 31-3-2012 }}{\text { NAV on } 31-3-2012}\)

994.20 = \(\frac{\text { Rs. } 10,555.56}{\mathrm{NAV} \text { on } 31-3-2012}\)

Therefore, NAV on 3 1-3-2012 = \(\frac{\mathrm{Rs} .10,555.56}{994.20}\) = Rs. 10.62

Calculation of NAV as on 31-3-2013

Therefore, NAV on 31-3-2013 = \(\frac{\mathrm{Rs} \cdot 1,48,312.50}{6271.98 \text { Units }}\) = Rs. 23.65

Question 34.

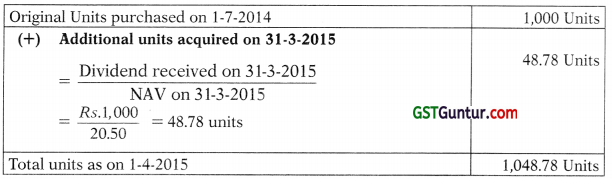

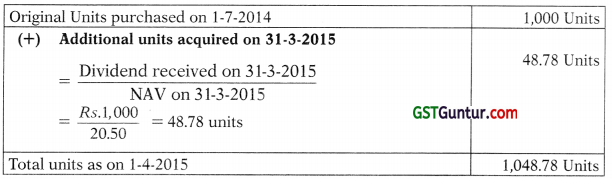

A reputed financial institution of the country floated a mutual fund having a corpus of Rs. 10 crores consisting of 1 crore units of Rs. 10 each. Mr. Vijay invested Rs. 10,000 for 1,000 units of Rs. 10 each on 1st July 2014. For the financial year ended 31st March 2015, the fund declared a dividend of 10% and Mr. Vijay found that his annualized yield from the fund was 153.33%. The mutual fund during the financial year ended 31st March 2016, declared a dividend of 20%. Mr. Vijay has reinvested the entire dividend in acquiring units of this mutual fund at its appropriate NAV. On 31st March 2017 Mr. Vijay redeemed all his balances of 1129.61 units when his annualized yield was 73.52%.

You are required to find out NAV as on 31st March 2015, 31st March 2016 and 31st March 2017. [Nov. 2017] [8 Marks]

Answer:

Calculation of NAV as on 31-3-2015

| Original Investment |

Rs. 10,000 |

| Annualized Yield |

153.33% |

| Holding Period (1-7-2014 to 31-3-2015) |

9 Months |

| Yield for 9 months 153.33 × 9/12 |

115% |

| Market Value of Investments (on 31-3-2015) |

10,000 + 115% – Rs. 21,500 |

| Dividend Paid |

10% of 10,000 – Rs. 1,000 |

NAV would stand reduced to the extent of Dividend Payout.

Therefore, NAV (31-3-2015) = \(\frac{\text { Rs. } 21,500-\text { Rs. } 1,000}{1,000 \text { Units }}\) = Rs. 20.50

Calculation of NAV as on 31-3-2016

Dividend as on 31.3.2016 = 1,048.78 Units × 10 × 0.2 = Rs. 2,097.56

Units after reinvestment of above dividend = 1,129.56

Units Increase in units due to reinvestment = 1,129.61 – 1,048.78 = 80.83 Units

Additional units purchased on 31-3-2016 = \(\frac{\text { Dividend Received on 31-3-2016 }}{\text { NAV on 31-3-2016 }}\)

80.83 = \(\frac{\text { Rs. } 2,097.56}{\text { NAV on } 31-3-2016}\)

Therefore, NAV on 31-3-2016 = \(\frac{\text { Rs. 2,097.5 }}{80.83}\) = Rs. 25.95

Calculation of NAV as on 31-3-2017

Therefore, NAV on 31-3-2017 = \(\frac{{Rs} .30,218}{1129.61 \text { Units }}\) = Rs. 26.75

Question 35.

The following are the data on five mutual funds:

| Mutual Fund |

Return |

Standard Deviation |

Beta |

| A |

15 |

7 |

1.25 |

| B |

18 |

10 |

0.75 |

| C |

14 |

5 |

1.40 |

| D |

12 |

6 |

0.98 |

| E |

16 |

9 |

1.50 |

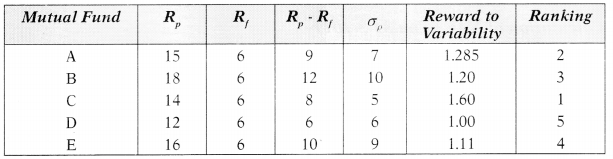

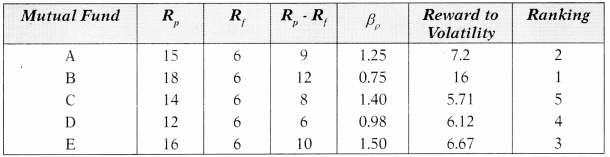

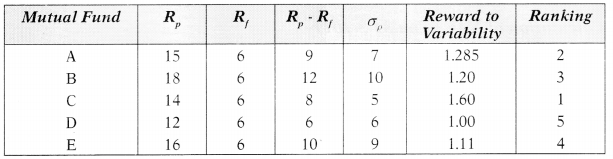

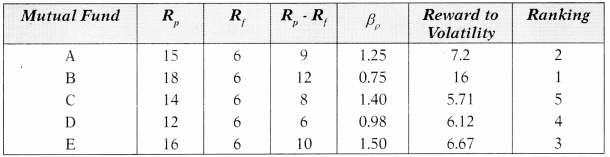

You are required to compute Reward to Volatility Ratio and rank these port-folios using:

(a) Sharpe Method and

(b) Treynor method

Assuming the risk free rate is 6%. [May 2016] [5 Marks]

Answer:

Sharpe Ratio (S) = \(\frac{\mathrm{R}_{\mathrm{p}}-\mathrm{R}_{\mathrm{f}}}{\alpha_{\mathrm{p}}}\)

Where

Rp = Return on Fund

Rf = Risk-free rate

Treynor Ratio (T) = \(\frac{\mathrm{R}_{\mathrm{p}}-\mathrm{R}_{\mathrm{f}}}{\beta_p}\)

σ = Standard deviation of Fund

βr = Beta of Fund

The Sharpe ratio indicates the excess return per unit of total risk. It implies that a higher ratio indicates more returns. Therefore, the mutual fund having highest ratio should be ranked first and so on.

Calculation of Sharpe Ratio (Reward to Variability)

The Treynor ratio indicates the excess return per unit of systematic risk. The higher should be preferred and rank should be given accordingly.

Calculation of Treynor Ratio (Reward to Volatility)

Question 36.

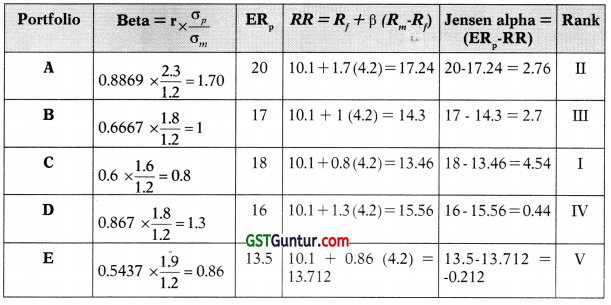

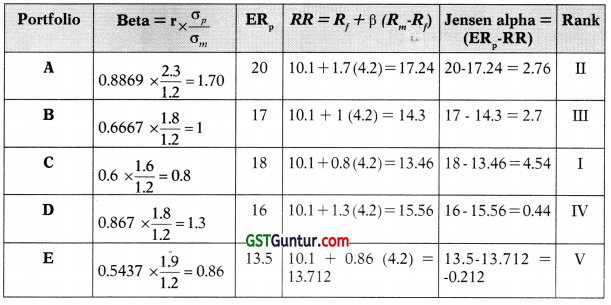

The five portfolios of a mutual fund experienced following result during last 10 years periods:

| Portfolio |

Average annual return % |

Standard deviation |

Correlation with the market return |

| A |

20.0 |

2.3 |

0.8869 |

| B |

17.0 |

1.8 |

0.6667 |

| C |

18.0 |

1.6 |

0.600 |

| D |

16.0 |

1.8 |

0.867 |

| E |

13.5 |

1.9 |

0.5437 |

Market risk (σm) : 1.2

Market rate of return : 14.3%

Risk free rate : 10.1%

Beta may be calculated only upto two decimal. Rank the portfolio using JENSEN’S ALPHA method. [May 2017] [8 Marks]

Answer:

The Jensen’s Alpha measures the difference between expected return of the portfolio and the required return as per CAPM model. This difference is called as’alpha. If alpha (α) is positive, it indicates that the portfolio is generating good returns.

Alpha (α) = Expected Return – Required return as per CAPM Required return as per CAPM = Rf + p (Rm – Rf)

Since, in this question, Beta (β) is not given; first Beta has to be calculated. The following formula can be used for calculation of Beta (β)

= Co-efficient of correlation between

Standard Deviation of Portfolio Standard Deviation of the market

Rm . Rf = 14.3 – 10.1 = 4.2

Statement of Beta and Jensen Alpha of Portfolio

Question 37.

Five portfolios of a mutual fund experienced following result during last 7 years periods:

| Portfolio |

Average annual return % [Rp] |

Standard deviation [Sp] |

Correlation with the market return [r] |

| A |

19.0 |

2.5 |

0.840 |

| B |

15.0 |

2.0 |

0.540 |

| C |

15.0 |

0.8 |

0.975 |

| D |

17.5 |

2.0 |

0.750 |

| E |

17.1 |

1.8 |

0.600 |

Market risk (σm) :1.2

Market rate of return (Rm) : 14.0

Risk free rate (Rf) 9.0

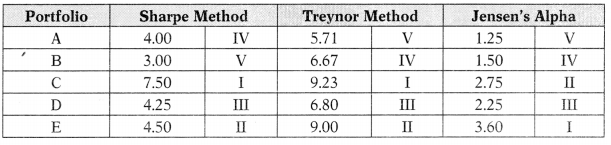

Rank the portfolio using

(a) Sharpe’s Method

(b) Treynor’s Method

(c) Jensen’s Alpha [Practice Question]

Answer:

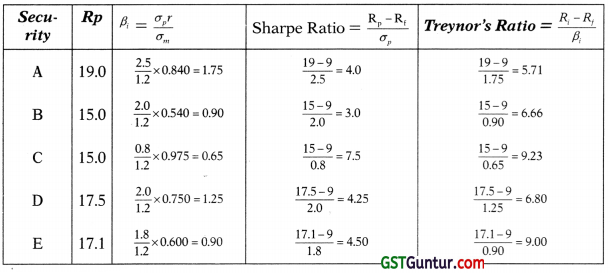

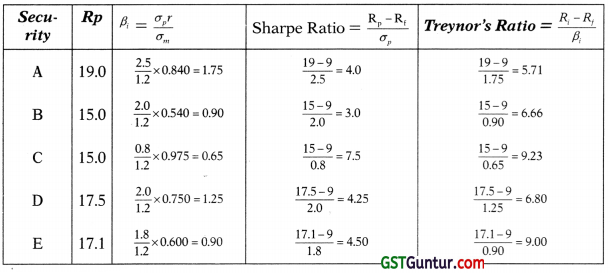

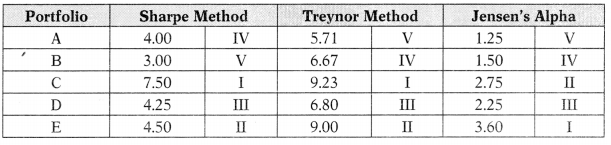

Let portfolio standard deviation be = σp

Market standard deviation = σm

Coefficient of correlation = r

Portfolio beta (βp) = \(\frac{\sigma_p r}{\sigma_m}\)

Required portfolio return (Rp) = Rf + βp (Rm – Rf)

(a) & (b)

(c) Jensen’s Alpha

| Portfolio |

Beta |

Return as per CAPM (Rp) |

Rp – (CAPM) |

| A |

1.75 |

9.0 + 1.75(14.0 – 9.0) = 17.75 |

1.25 |

| B |

0.90 |

9.0 + 0.90 (14.0 – 9.0 ) = 13.50 |

1.5 |

| C |

0.65 |

9.0 + 0.65 (14.0 – 9.0) = 12.25 |

2.75 |

| D |

1.25 |

9.0 + 1.25(14.0 – 9.0) = 15.25 |

2.25 |

| E |

0.90 |

9.0 + 0.90(14.0 – 9.0) = 13.50 |

3.6 |

Required portfolio return (R ) = Rf + Pp(Rm – Rf)

Question 38.

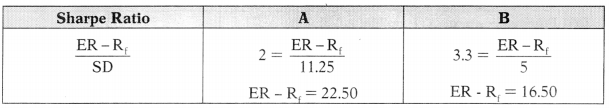

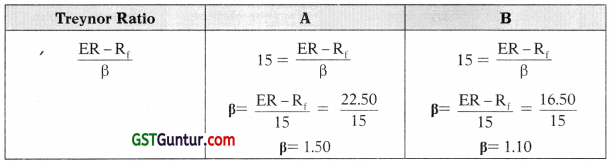

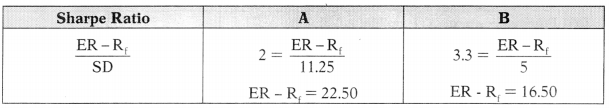

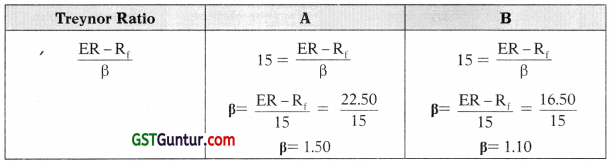

There are two Mutual Funds viz. D Mutual Fund Limited and K Mutual Fund Limited, each having close ended equity schemes.

NAV as on 31-12-2014 of equity schemes of D Mutual Fund Ltd. is Rs. 70.71 (consisting 99% equity and remaining cash balance) and that of K Mutual Fund Ltd. is Rs. 62.50 (consisting 96% equity and balance in cash).

Following is the other information:

|

Equity schemes |

| D Mutual Fund Ltd. |

K Mutual Fund Ltd. |

| Sharpe Ratio |

2 |

3.3 |

| Treynor Ratio |

15 |

15 |

| Standard deviation |

11.25 |

5 |

There is no change in portfolios during the next month and annual average cost is Rs. 3 per unit for the schemes of both the Mutual Funds.

If Share Market goes down by 5% within a month, calculate expected NAV after a month for the schemes of both the Mutual Funds.

For calculation, consider 12 months in a year and ignore number of days for particular month. [May 2015] [8 Marks]

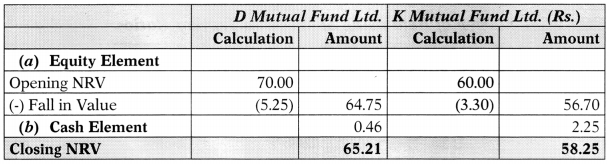

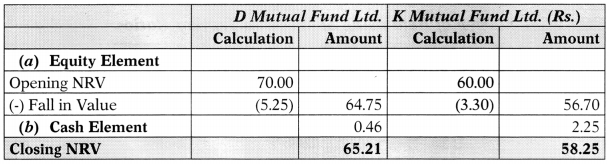

Answer:

The two mutual funds have different proportion invested in equity and balance is held as cash. The equity proportion will fluctuate with fluctuations in share market prices, depending upon the value of Beta (β).

The following steps are to be taken for calculation of final NAV.

Step I Calculation of Beta using Sharpe and Treynor Ratios.

Let us find out the Beta on the basis of value of ER – using Treynor ratio.

Therefore, the β for the two mutual funds are 1.5 and 1.10 respectively.

Step II Determination of Equity proportion in NRV

|

D Mutual Fund Ltd. (Rs.) |

K Mutual Fund Ltd. (Rs.) |

| NAV on 31.12.14 |

70.71 |

62.50 |

| % of Equity |

99% |

96% |

| Equity element in NAV |

70 |

60 |

| Cash element in NAV |

0.71 |

2.50 |

Step III Calculation of fall in value of Equity

The beta (β) indicates the sensitivity of equity component of the fund with change in share market. As the market has fallen by 5%, the equity element of both the funds will also fall.

Decrease in Value = (β × % fall in Sec. Market) × NAV (Equity Element)

DMF = (1.5 × 5%) × Rs. 70 = Rs. 5.25

KMF = (1.1 × 5%) × Rs. 60 = Rs. 3.30

Step IV Calculation of balance of Cash after 1 month

|

D Mutual Fund Ltd. (Rs.) |

K Mutual Fund Ltd. (Rs.) |

| Annual Expenses |

3.00 |

3.00 |

| Monthly Expenses (Annual Exp./12) |

0.25 |

0.25 |

| Opening Cash |

0.71 |

2.50 |

| Less: Expenses during the month |

(0.25) |

(0.25) |

| Cash balance after 1 month |

0.46 |

2.25 |

Step V Calculation of NAV after one month

Question 39.

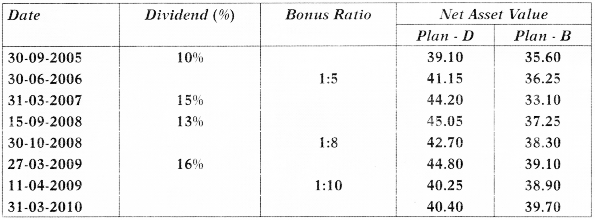

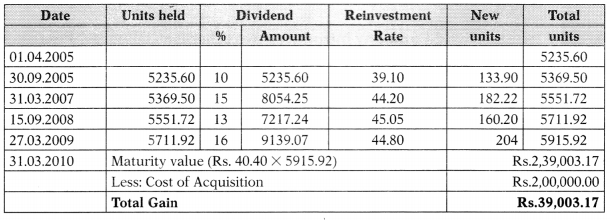

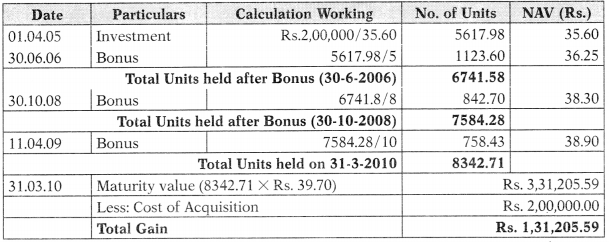

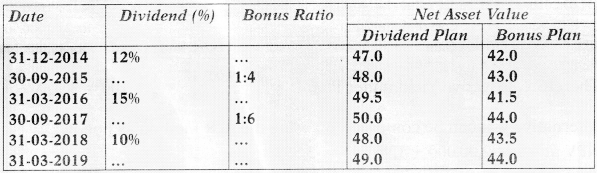

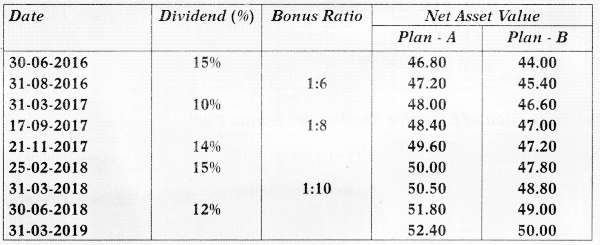

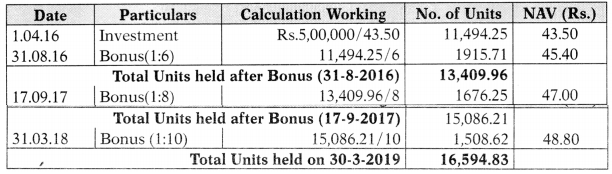

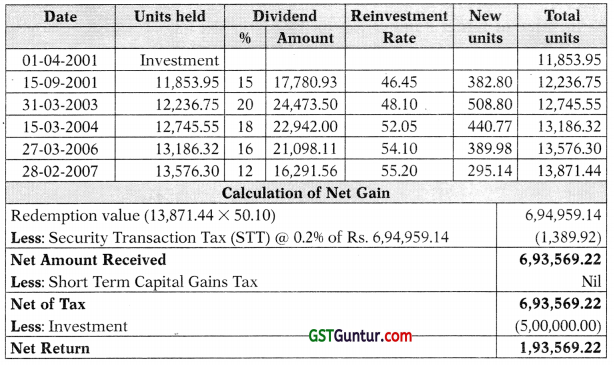

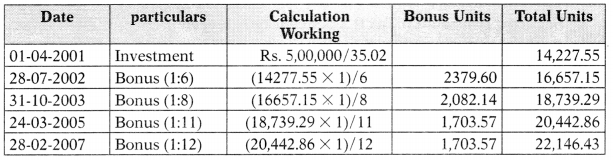

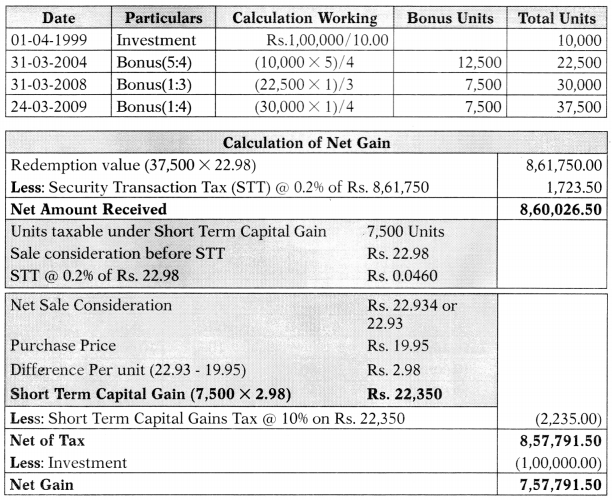

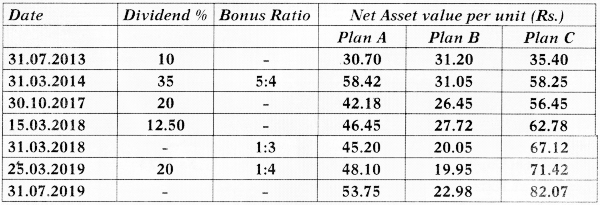

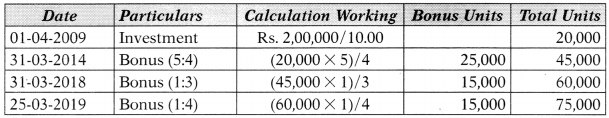

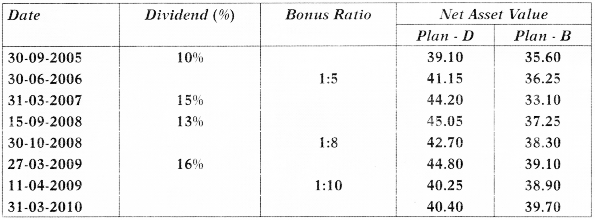

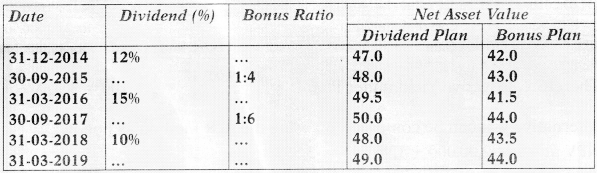

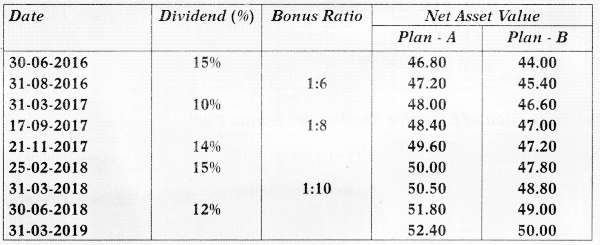

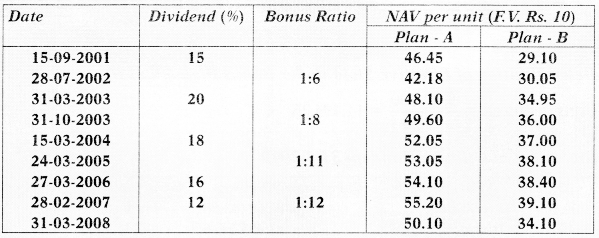

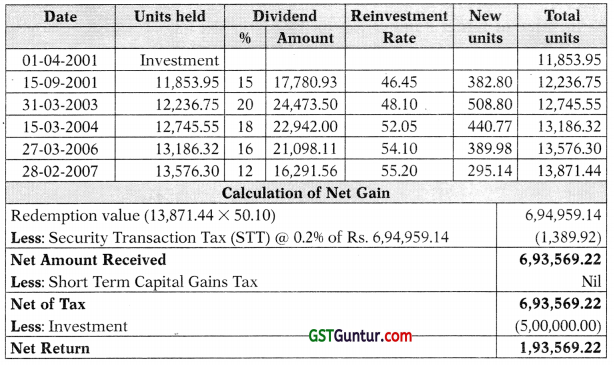

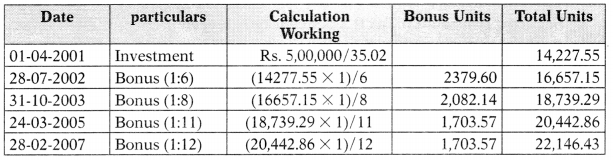

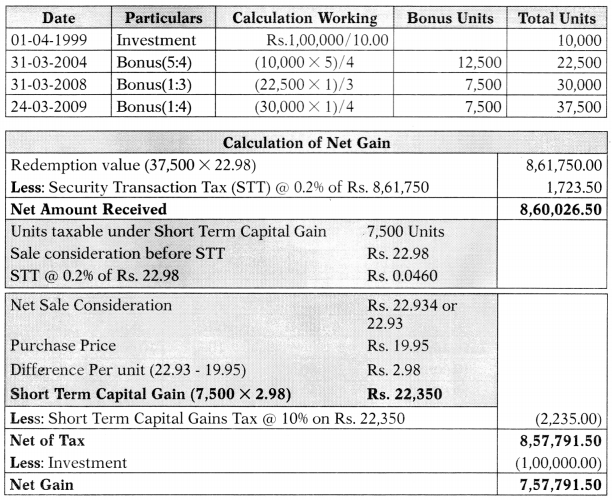

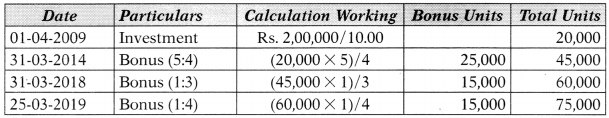

A mutual fund Company introduces two schemes i.e. Dividend plan (Plan D) and Bonus plan (Plan B). The face value of the unit is Rs. 10. On 01-04-2005, Mr. K invested Rs. 2,00,000 each in Plan – D and Plan – B when the NAV was Rs. 38.20 and Rs. 35.60 respectively. Both the plans matured on 31-03-2010. Particulars of dividend and bonus declared over the period are as follows:

What is the effective yield per annum in respect of the above two plans? [Nov. 2010][8 Marks]

Answer:

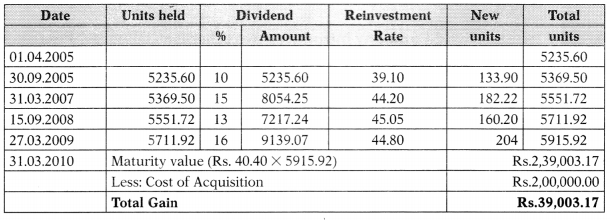

Determination of Effective Yield under Dividend Plan (Plan – D)

Units acquired = \(\frac{2,00,000}{38.20}\) = 5235.60

Statement of Units in Hand on 31-3-2010

Therefore, Effective Yield under Plan D = \(\frac{R s .39,003.17}{R s .2,00,000} \times \frac{1}{5}\) × 100 = 3.90%

Alternatively, it can be computed by using the IRR method as Follow:

NPV at 4% = -2,00,000 + 1,96,443 = -3,557

NPV at 2% = -2,00,000 + 2,16,473 = 16,473

IRR = LR + \(\frac{N P V \text { at } L R}{N P V \text { at } L R-N P V \text { at } H R}\) (HR – LR) = 2% + \(\frac{16473}{16473-(-3557)}\)(4% – 2%) = 3.645%

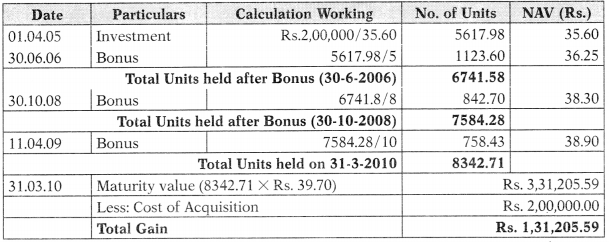

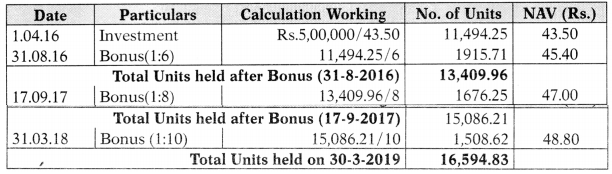

Determination of Effective Yield under Bonus Plan (Plan – B)

Statement of Units in Hand on 31-3-2010

Therefore, Effective Yield under Plan B = ^ 00*066″‘ X I X = 13.12%

Alternatively, it can be computed by using the IRR method as Follow:

NPV at 13% = -2,00,000 + 1,79,765 = -20,235

NPV at 8% = -2,00,000 + 2,25,413 = 25,413

IRP = LP + \(\frac{N P V \text { at } L R}{N P V \text { at } L R-N P V \text { at } H R}\) (HR – LR)

= 8% + \(\frac{25413}{25413-(-20235)}\)(13% – 8%)

= 10.78%

Question 40.

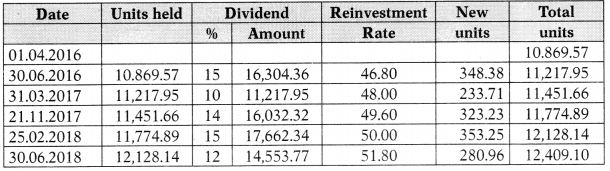

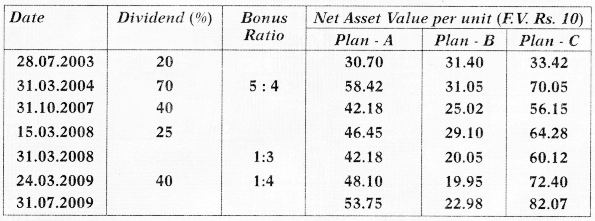

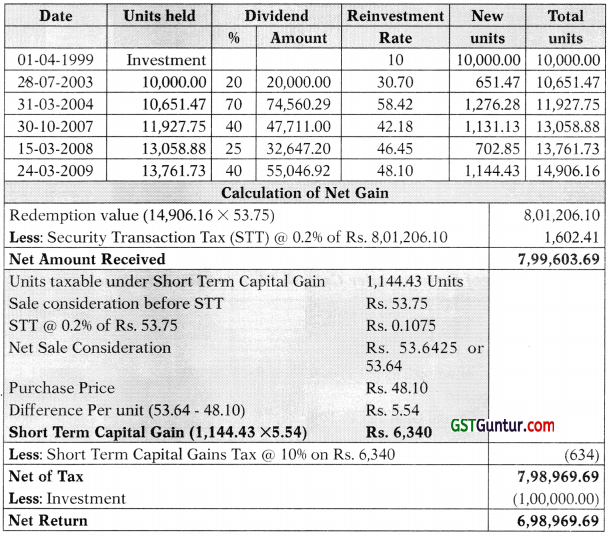

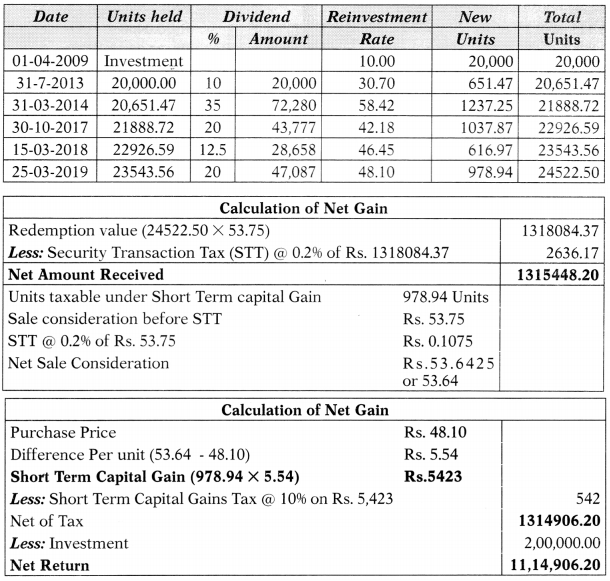

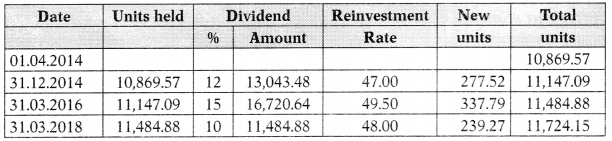

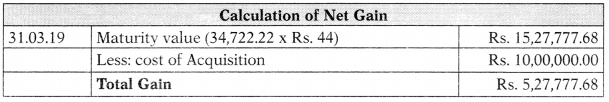

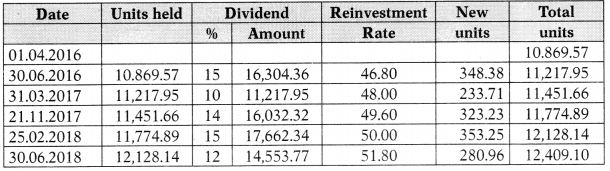

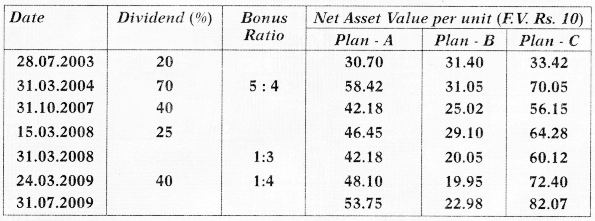

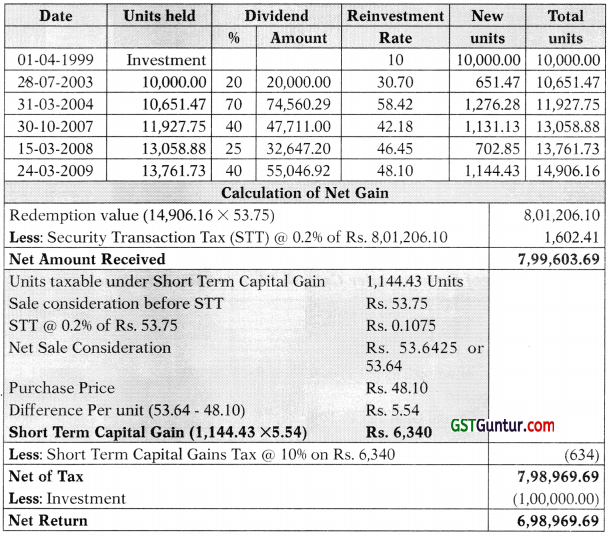

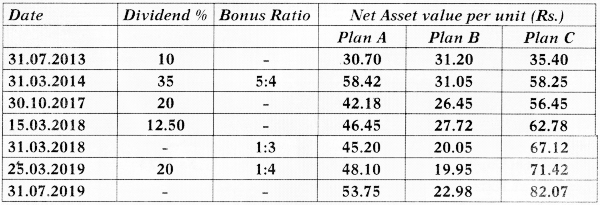

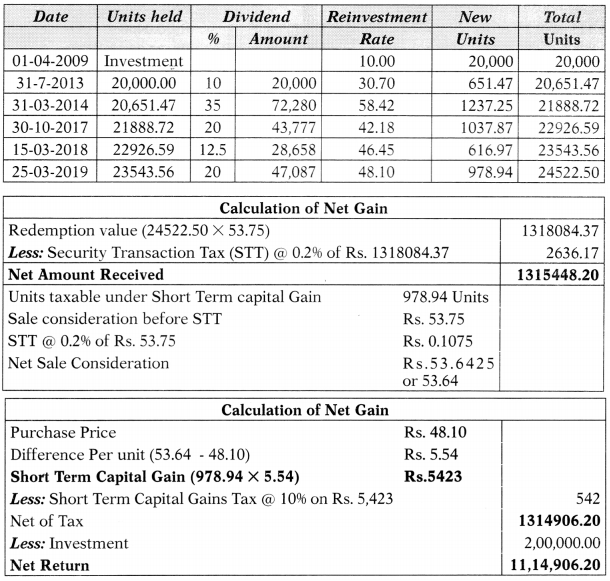

A Mutual Fund Company introduces two schemes – Dividend Plan and Bonus Plan. The face value of the Units is Rs.10 on 1-4-2014. Mr. R invested Rs. 5 Lakh in Dividend plan and Rs.10 lakh in Bonus Plan. The NAV of Dividend Plan is Rs. 46 and NAV of Bonus Plan is Rs. 42. Both the plans matured on 31 -03-2019. The particulars of Dividend and Bonus declared over the period are as follows:

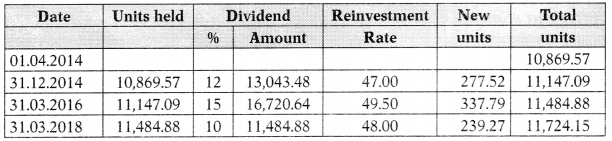

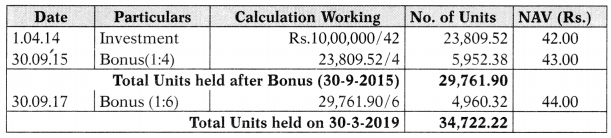

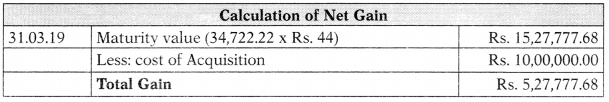

You are required to calculate the effective yield per annum in respect of the above two plans. [May 2019] [8 Marks]

Answer:

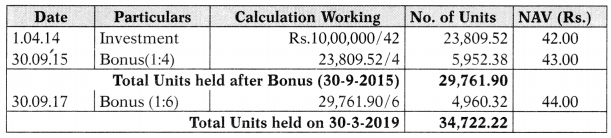

Determination of Effective Yield under Dividend Plan

Units acquired = \(\frac{5,00,000}{46}\) = 10,869.57

Statement of Units in Hand on 31-3-2010

Statement showing calculation of gain

| 31.03.2019 |

Maturity value (Rs. 49 × 11,724.15) |

Rs. 5,74,483.35 |

|

Less: Cost of Acquisition |

Rs. 5,00,000.00 |

|

Total Gain |

Rs. 74,483.35 |

Therefore, Effective Yield under Dividend Plan = \(\frac{\text { Rs. } 74,483.35}{\text { Rs. } 5,00,000} \times \frac{1}{5}\) × 100

= 2.98%

Alternatively, it can be computed by using the IRR method as Follow:

NPV at 3% = -5,00,000 + (5,74,483.35 × 0.8626)

= -5,00,000 + 4,95,549.34 = -4,450.66