Assessment Procedures – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Assessment Procedures – CA Final DT Question Bank

Assessment Procedures

Question 1.

The A.O. has the power to make an assessment to the best of his judgment, in certain situations. What are they?[CA Final May 2010] [3 marks]

Answer:

As per Sec. 144, if any person:

(a) fails to furnish a return of income u/s 139(1) and has not furnished the return u/s 139(4), or

(b) fails to comply with all the terms of a notice issued u/s 142(1), or

(c) fails to comply with a direction issued u/s 142(2A), or

(d) fails to comply with all the terms of a notice issued u/s 143(2),

then the A.O., after taking into account all relevant material which he has gathered, shall make an assessment to the best of his judgment and determine the tax payable by the assessee.

Further, section 145(3) permits A.O. to make an assessment in the manner provided in section 144:

- where the A.O. is not satisfied about the correctness or completeness of the accounts of the assessee; or

- where the method of accounting u/s 145(1) has not been regularly followed by the assessee;

- where the ICDS notified u/s 145(2) have not been regularly followed by the assessee.

![]()

Question 2.

State whether the following assessees have to file return of income and if so, the due date for the A.Y. 2021-22:

(i) A registered trade union having income from let out property of ₹ 1,00,000.

(ii) A public trust hospital having an aggregate annual receipt of ₹ 200 lakhs and availing exemption u/s 10(23C)(via) with total income of₹ 1,10,000. [CA Final May 2011] [5 Marks]

Answer:

(i) A registered trade union is having income from property, which is exempt u/s 10(24). Sec. 139(4C) mandates filing of return only when the total income exceeds the maximum amount which is not chargeable to tax without giving effect to the provisions of sec. 10. Even without giving effect to sec. 10(24), the total income is below basic exemption limit and therefore, there is no mandatory requirement to file the

return of income.

(ii) The quantum of exemption u/s 10(23 C)(via) is not given in the question. If the total income of the public trust hospital, without giving effect to the exemption u/s 10(23C)(via), is less than the basic exemption limit of ₹ 2,50,000, the trust need not file its ROI. However, if the total in come without giving effect to the exemption u/s 10(23C)( via) exceeds ₹ 2,50,000, the trust has to file its ROI by 31st October, 2021.

![]()

Question 3.

The Assessing Officer issued a notice u/s 142( 1) on the assessee on 24th December, 2021 calling upon him to file return of income for A.Y. 202122. In response to the said notice, the assessee furnished a return of loss and claimed carry forward of business loss and unabsorbed depreciation.

State whether the assessee would be entitled to carry forward the losses as claimed in the return. [CA Final Nov. 2011] [4 Marks]

Answer:

Carry forward of business loss under sections 72(1), 73(2) (i.e. Speculation Loss) or 73A (i.e. specified business loss) cannot be made vide the return furnished in pursuance of notice u/s 142(1). Such losses can be carried forward only if the return is filed within the time limit u/s 139(1). However, the assessee can carry forward unabsorbed depreciation as it is covered u/s 32(2) through return furnished in pursuance of notice u/s 142(1).

![]()

Question 4.

State with reasons whether return of income is to be filed in the following cases for the Assessment Year 2021-22:

(i) Mr. X, an individual, aged 80 years, has a gross total income of ₹ 4,90,000 and he is eligible for deduction of ₹ 1,60,000 under Chapter VIA.

(ii) ABC, a partnership firm, has a loss of ₹ 10,000 during the previous year 2020-21.

(iii) A registered association, eligible for exemption u/s 10(23B), has income from house property of ₹ 2,80,000.

(iv) Mr. Y, an employee of ABC (P) Ltd., draws a salary of ₹ 4,90,000 and has income from fixed deposits with bank of ₹ 10,000. [CA Final May 2012] [4 Marks]

Answer:

(i) As per Sec. 139(1), every person other than a company or a firm, if his total income before claiming exemptions u/s 54, 54B, 54D, 54EC, 54F, 54G, 54GA or 54GB or deductions under Chapter-VIA, exceeds the maximum amount not chargeable to tax, is required to furnish the return of income for the relevant assessment year on or before the due date. In this case, the total income of Mr. X before claiming deduction under Chapter VI-A is ₹ 4,90,000, which does not exceeds the basic exemption limit of ₹ 5,00,000 as applicable to an individual aged 80 years or more and therefore, Mr. X is not required to furnish his return of income for the A.Y. 2021-22.

(ii) As per section 139(1), it is mandatory for a firm to furnish its return of income or loss on or before the specified due date. Therefore, M/s ABC has to furnish its return of loss for the A.Y. 2021-22 on or before the due date.

(iii) As per section 139(4C), every institution referred to, inter alia, in section 10(23B), whose total income without giving effect to the provisions of section 10 exceeds the maximum amount not chargeable to tax, is required to furnish the return of income for the relevant assessment year on or before the due date.

In this case, the registered association has income from house property of ₹ 2,80,000 before exemption u/s 10, which exceeds the basic exemption limit of ₹ 2,50,000. Therefore, it is under an obligation to furnish its return of income for the A.Y. 2021-22.

(iv) As per section 139(1), every person, whose gross total income exceeds the maximum amount not chargeable to tax, is required to furnish the return of income for the relevant assessment year on or before the due date. In this case, the gross total income of Mr. Y is ₹ 5,00,000 (₹ 4,90,000 + ₹ 10,000) which exceeds the basic exemption limit of ₹ 2,50,000 and therefore, Mr. Y has to furnish his return of income for A.Y. 2021-22.

![]()

Question 5.

Teachwell Education is a trust approved under section 10(23C)(vi) which runs various educational institutions. During the course of assessment under section 143(3), the Assessing Officer finds that the trust has carried out its activities in contravention of the section under which it was approved for exemption. Hence, the Assessing Officer wants to pass an order without giving exemption under section 10, which the assessee objects. You are required to examine the following with respect to the provisions of Income-tax Act, 1961.

(a) Whether the Assessing Officer can pass an order without giving exemption under section 10?

(b) Can the Assessing Officer get any additional time limit in completing this assessment? [CA Final May 2012] [4 Marks]

Answer:

(a) As per the first proviso to section 143(3), if the A.O. finds that the trust has carried out its activities in contravention of section 10(23C)(vi) under which it was approved for exemption, the Assessing Officer cannot himself disallow the said exemption while making an assessment u/s 143(3). He can do so only if:

- he has intimated the Central Government or the prescribed authority, which had earlier approved the concerned institution, about the contravention of the relevant provisions by the institution; and

- the approval granted to such institution has been withdrawn or notification in that respect has been rescinded.

Therefore, in the given case, since Teachwell Education is a trust approved under section 10(23C)(vzi), the Assessing Officer can pass an assessment order without giving exemption under section 10 only if he has intimated the contravention made by Teachwell Education to the Central Government or the prescribed authority, as the case may be, and its approval under section 10(23C)(vi) is.withdrawn.

(b) As per provisions of Explanation 1 to section 153 if the A.O. intimates the contravention of provisions of section 10(23C)(vi).to the Central Government or the prescribed authority then the period, commencing from the date of intimation of such contravention by the A.O. and ending on the date on which the copy of the order of withdrawing the approval u/s 10(23C)(vi) is received by the A.O., shall be excluded for computing the period of limitation for completing the assessment u/s 153.

Further, if in any case the time limit available to the A.O. for passing an assessment order, after such exclusion, is less than 60 days, such remaining period of assessment shall be deemed to have been extended to 60 days. Thus, the A.O. will get the above mentioned additional time for completing the assessment of Teachwell Education.

![]()

Question 6.

X and Y are partners of a partnership firm. The A.O. of X is of the opinion that the income returned by X is actually taxable in the hands of Y. The A.O., in order to safeguard the interest of the Revenue, assessed the income in the hands of both X and Y. The Assessing Officer recovered the tax due on the same from X and Y. He also imposed penalty under section 270A on Y for concealing the same. Comment on the actions of the A.O. [CA Final Nov. 2012] [5 Marks]

Answer:

When the ownership of the income is in dispute or is a matter of doubt, it is open to the A.O. to assess a particular income in the case of the person who is considered as liable to tax and include the same income in the case of another person also as a protective measure. Such an assessment is known as protective assessment.

It must, however, be noted that while protective assessment is permissible, a protective order for recovery is not permissible. In making a protective assessment, the authorities are merely making an assessment and leaving it as a paper assessment until the matter is decided one way or another, in further proceedings like appeal or revision.

Furthermore, a protective order of assessment can be passed but not a protective order of penalty.

Therefore, though the A.O.’s action in assessing the income in the hands of both X and Y is valid, the recovery of tax due on the same from X and Y and imposition of ‘penalty u/s 270A on Y for concealment of income is not valid.

![]()

Question 7.

Discuss, with reasons, whether the following statement is correct: Mahesh, a resident and ordinarily resident in India and having a house property and a bank account outside India, is not required to file ROI for A.Y. 2021-22, if his total income is below the maximum amount not liable to tax. [CA Final May 2013] [2 Marks]

Answer:

The statement is incorrect.

As per section 139(1), every resident and ordinarily resident having any asset located outside India or signing authority in any account located outside India is required to hie a return of income in the prescribed form 1 compulsorily, whether or not he has income chargeable to tax.

Therefore, Mahesh has to file a return of income in the prescribed form compulsorily for A.Y. 2021 -22, even if his total income is below the maximum amount not liable to tax, since he is a resident and ordinarily resident in India and has a house property and a bank account outside India.

Question 8.

The A.O. accepted the returned income filed by RL Ltd. for a particular A.Y. However, the A.O. initiated reassessment proceeding u/s 147 as he had reason to believe that the income had escaped assessment due to claim and allowance of club fees, gifts and presents and provision for leave encashment and accordingly, he issued notice u/s 148. However, after sufficient enquiries made by him, he came to the conclusion that no additions were required on account of these expenses.

But instead he made additions on account of disallowances u/s 14A and section 40(a)(ia) inrespect of other expenses which were not the original “reason to believe”and passed his reassessment order u/s 147. The A.O. is of the opinion thatExplanation 3 to section 147 permits him to assess the income which has escaped assessment and which comes to his notice subsequently in the course of proceeding u/s 147, even though the said issues were not part of the reasons recorded in the notice u/s 148. Is the action of the A.O. valid? [CA Final May 2013] [4 Marks]

Answer:

The issue under consideration is whether A.O. can make an assessment on the basis of an issue which came to his notice during the course of assessment, when the issues, which originally formed the basis of issue of notice u/s 148, were dropped in its entirety.

As per section 147, the A.O. may assess or reassess such income and also any other income chargeable to tax which has escaped assessment and which comes to his notice in the course of proceedings under that section.

The High Court, in Rg.nhaxy Laboratories Ltd. v. GIT(2011) (Delhi), observed that the words “and also” used in section 147 are of wide amplitude.

The language of the section is indicative of the position that the assessment or reassessment must be of the income, in respect of which the A.O. has formed a ‘reason to believe’ for the issue ofcnotice u/s 148 and also in respect of any other income which comes to his notice subsequently during the course of the proceedings as having escaped assessment. The correct interpretation, therefore, would be to regard the words ‘and also’ as being “conjunctive and cumulative with” and not “in alternative to” the first part of the sentence, namely, “the Assessing Officerrtiay assess and reassess such income”.

If the income, the escapement of which was the basis of the formation of the “reason to believe”, is not assessed or reassessed, it would not be open to the A.O. to independently assess only that income which comes to his notice subsequently in the course of the proceedings under the section as having escaped assessment. If he intends to do so, a fresh notice u/s 148 would be necessary.

Applying the rationale of the above court ruling, the action of the A.O. in passing a reassessment order u/s 147 by making additions on account of disallowances u/s 14A and section 40(a)(ia) in respect of other expenses, when the original “reasons to believe” ceased to exist, is not valid.

However, the Courts have given a contradictory judgments in the case of CIT v. Mehak Finvest P. Ltd. (2014) (P&H) and N. Govindaraju v. ITO (2015) (Kar).

![]()

Question 9.

The regular assessment of MNO Ltd. for the A.Y. 2018-19 was completed u/s 143(3) on 13th March, 2020. There was an audit objection by the Revenue Audit team that interest on loan should be disallowed partly as there was diversion of borrowed fund to sister concern without charge of interest.

(i) State, with reasons, whether the Assessing Officer can issue notice under section 148 on the basis of audit objection of the Revenue Audit team.

(ii) If the action stated in (i) above is not permitted, what is the option open to the Revenue Department to deal with the said audit objection? [CA Final May 2014, Nov. 2011] [8 Marks]

Answer:

(i) Section 147 states that if the Assessing Officer has reason to believe that any income chargeable to tax has escaped assessment for any assessment year, he may, assess or reassess such income and also any y other income chargeable to tax which has escaped assessment and y which comes to his notice subsequently in the course of the proceedings under this section.

Thus, the A.O. should have reason to believe that’ income chargeable to tax has escaped assessment. Supreme Court in the case of Indian & I Eastern Newspaper Society v. CIT(1979) held that audit party cannot ‘ express opinion on legal issues. Such opinion cannot be the basis upon ; which the Assessing Officer can initiate reassessment proceedings. The opinion should be of the A.O. and not of the audit party.

Moreover, it is well established that the Assessing Officer cannot make reassessment u/s 147 on the basis of change of opinion. So, assuming that the A.O. had already considered this issue earlier during the course of scrutiny assessment and had come to a conclusion that no disallowance of interest paid by the assessee is required, even though loans had been given to sister concern without any interest, if the s proceedings are commenced u/s 147 then it will be a clear case of change of opinion and the same issue cannot be the basis of reassessment, merely because the Revenue Audit team takes a different view.Therefore, the Assessing Officer cannot issue notice under section 148 on the basis of audit objection of the Revenue Audit team.

(ii) The option open to the Revenue is initiation of proceedings u/s 263, by the Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner. He has the power to call for and examine the records, if he is of the opinion that the order passed by the A.O. u/s 143(3) is erroneous in so far as it is prejudicial to the interests of the Revenue.

However, where the A.O. has considered the issue in the original assessment and come to a conclusion that no disallowance of interest is called for, the PCCIT or CCIT or PCIT or CIT cannot initiate revisionary proceedings, merely because he holds a different view. Only where the view taken by the Assessing Officer is unsustainable in law, the PCCIT or CCIT or PCIT or CIT will be justified in initiating the revisionary proceedings u/s 263.

In CIT v. Sohana Woollen Mills (2008), it has been held that mere audit objection and merely because a different view can be taken, it cannot be said that the order of the Assessing Officer is erroneous or prejudicial to the interest of revenue.

![]()

Question 10.

An assessment completed by the Assessing Officer was set aside by the ITAT on 30-01*2021 with a specific direction to re-examine certain disallowances. Before the fresh assessment is made, the Assessing Officer S discovers that some other income has escaped assessment. How should he proceed to make fresh assessment? [CA Final Nov. 2014, Nov. 2006j [4 Marks]

Answer:

If an assessment is set aside by ITAT and a direction to make a fresh assessment is given to the A.O., then, he shall make the fresh assessment under the same section in which the original assessment is made (i.e., under section 143(3)/144/147) and without any issue of fresh notice. It is not open to him to introduce new sources of income so as to enhance the assessment.

Punjab & Haryana High Court, in the case of Kartar Singh vs. CIT (1978), held that A.O.’s power to modify is confined only to the specific disallowances which were the subject matter of appeal to the ITAT.

In the given case, the assessment has been set aside with a specific direction to re-examine certain disallowances. Hence, the Assessing Officer has to proceed to make the fresh assessment on the basis of the directions given without considering any new source of income which has escaped assessment. Further, A.O. shall complete such assessment within the time limit prescribed under section 153(3).

However, after completing such assessment as per the direction of the Tribunal, the Assessing Officer can proceed under section 147 in respect of the escaped income.

![]()

Question 11.

Is it valid in law to rectify an assessment order u/s 154 due to subsequent change of law on retrospective basis? Also state, whether a Supreme Court judgment would warrant a rectification u/s 154 in respect of an order passed earlier by the A.O. [CA Final Nov. 2014, May 2013, May 2011] [4 Marks]

Answer:

In the case of CIT v. E. Sefton & Co. (R) Ltd. (1989), the Calcutta High Court held that if the assessment order is plainly and obviously inconsistent with the specific and clear provision as amended retrospectively, then it is clearly a mistake apparent from record. Therefore, the A.O. can rectify an assessment order u/s 154 due to subsequent change of law on retrospective basis.

In the case of CIT v. Subodhchandra S Patel (2004), the Gujarat High Court held that non-consideration of a judgment of the jurisdictional High Court or the Apex Court would always constitute a mistake apparent from the record, regardless of the judgment being rendered prior to or subsequent to the order proposed to be rectified.

However, the Calcutta High Court, expressed a contrary view in Geo Miller & Co. v. DCIT [2003] holding that a subsequent exposition of law by Supreme Court does not render assessment order as made on mistake.

![]()

Question 12.

Discuss the correctness of the following statements in the context of the provisions of Income-tax Act, 1961:

(i) “The Joint Commissioner of Income-tax is empowered to issue direction to the Assessing Officer as he thinks fit for the guidance of the Assessing Officer during the assessment proceedings to complete the assessment in a specific manner.” [3 Marks]

(ii) “Assessing Officer may direct for the audit of the accounts under section 142(2A) of the Act, during the assessment proceeding on the basis of certain grounds”. [3 Marks]

(iii) “If assessee does not pay the self-assessment tax before furnishing the return of income, the return furnished shall be deemed to be a defective return”. [CA Final Nov. 2014] [2 Marks]

Answer:

(i) The statement is correct.

As per section 144A, a Joint Commissioner may, on his own motion or on a reference being made to him by the A.O. or on the application of an assessee, call for and examine the record of any proceeding in which an assessment is pending. Having regard to the nature of case or the amount involved or for any other reason, if he considers it necessary or expedient, he may issue such directions as he thinks fit for the guidance of the Assessing Officer during the assessment proceedings to complete the assessment in a specific manner.

Such directions shall be binding on the Assessing Officer.

However, no directions which are prejudicial to the assessee shall be issued before an opportunity is given to the assessee to be heard. A direction as to the lines on which an investigation connected with the assessment should be made shall not be deemed to be a direction prejudicial to the assessee.

(ii) The statement Is correct. Section 142(2A) expressly includes within its scope, the following reasons, on the basis of which the A.O. may direct special audit of accounts of an assessee with the previous approval of the CIT or CCIT:

- nature and complexity of accounts,

- volume of the accounts,

- doubts aboutffie correctness of the accounts,

- multiplicity of transactions in the accounts,

- specialized nature of business activity of the assessee; and

- the interests of the revenue.

(iii) The statement is incorrect.

The return shall not be deemed to be defective if the assessee does not pay the self-assessment tax before furnishing the return of income.

![]()

Question 13.

RKJ Private Limited’s assessment for A.Y. 2016-17 was completed u/s 143(3) on 15th November, 2017. The company received a notice u/s 148 dated 15th July, 2020 requiring the company to submit a return of income for A.Y. 2016-17 on the ground of escapement of certain income from assessment.

The company has approached you for advice on the principles to be followed by it before notice u/s 143(2) for the purpose of reassessment is issued by the Assessing Officer.

State the principles to be followed by the company and the Assessing Officer. [CA Final Nov. 2015] [4 Marks]

Answer:

As per Sec. 149(1), notice u/s 148 can be issued by the A.O. at any time within 4 years from the end of the assessment year of which income chargeable to tax has escaped assessment.

In the given question, notice has been issued by the A.O. within the time limit u/s 149(1) and hence the notice is not barred by limitation.

Now, the principles laid down by the Supreme Court in GKN Driveshafts (India) Ltd. v. ITO (2003), which would serve as rules of guidance and act as a binding precedent in cases where notice of reassessment is issued, are given hereunder:

- Where a notice u/s 148 is received, the proper course for the company is to file a return of income in response to the same.

- Thereafter, if the company desires, it can seek reasons recorded by the A.O. for issue of notice.

- If the reasons are asked for by the assessee, the A.O. is bound to supply such reasons, within a reasonable time.

- On receipt of the reasons, the company can file its objections against the issuance of notice, and if so done, the A.O. is bound to dispose of the same by passing a speaking order even before proceeding with the assessment.

Only after the same, the A.O. can issue a notice u/s 143(2).

If A.O. rejects the objections of the company and the company is not satisfied with such rejection order, it may prefer a writ petition against such rejection by the A.O. If the petition is not accepted by the High Court, it may prefer a Special Leave Petition to the Supreme Court.

If the Court accepts the Company’s petition, then A.O. has to prove that he had sufficient reasons to believe for issue of notice u/s 148.

![]()

Question 14.

After completion of regular assessment on February 22, 2018, Mr. Anshul received a notice on October 12, 2019 ti/s 148 for A.Y. 2017-18 on the ground that excess depreciation was allowed on certain assets. The A.O. recorded the reason for re-opening. In the course of reassessment proceedings the A.O. also disallowed certain expenses incurred in relation to dividend and tax-free interest, without recording the reasons for applying Section 147 on disallowance of such expenses. The A.O. passed the order disallowing the excess depreciation and certain expenses u/s 14A. Mr. Anshul seeks your opinion on the correctness of action of the Assessing Officer. Advise him. [CA Final Nov 2016, Nov 2010] [3 Marks]

Answer:

As per Explanation 3 to section 147, for the purpose of assessment or re-assessment u/s 147, the A.O. may assess or reassess the income in respect of any issue, which has escaped assessment, and such issue comes to his notice subsequently in the course of proceedings under this section, not-withstanding that the reasons for such issue have not been included in the reasons recorded u/s 148(2).

Therefore, though the reasons for the issue, which comes to the notice of A.O. during the reassessment proceedings, has not been recorded at the time reopening the assessment, the A.O. may deal with such issue or issues.

In this case, the A.O. has issued notice u/s 148 to Mr. Anshul for reopening the assessment on the ground that excess depreciation was allowed on certain assets to Mr. Anshul. During the course of reassessment proceedings, the A.O. also disallowed certain expenses incurred in relation to dividend and tax-free interest, for which reasons were not recorded at the time of reopening the assessment and passed the order disallowing the excess depreciation and certain expenses u/s 14A. The action taken by the A.O. is therefore, correct as per Explanation 3 to section 147.

![]()

Question 15.

ABC Ltd., a listed company filed its return of income in which a claim for deduction under Chapter VI-A was made. The case was subjected to scrutiny assessment and order under section 143(3) was passed reducing the claim for deduction under Chapter VI-A. After 4 years from the end of assessment year a notice under section 148 was issued giving reasons such as subsequent tribunal and other court decisions which show that the deduction was excessively allowed in this case.

Is the action of the Assessing Officer valid? [CA Final Nov 2017] [4 Marks]

Answer:

Issue involved: The issue under consideration is whether initiation of reassessment beyond a period of 4 years on the basis of subsequent Tribunal and High Court ruling is valid, if there is no failure on the part of the assessee to disclose fully and truly all materials facts.

Provisions applicable: As per section 147, where the A.O. has reasons to believe that any income chargeable to tax for any assessment year has escaped assessment, then he may assess or reassess such income and also any other income which has escaped assessment and which comes to his notice subsequently during the course of proceedings under this section.

Further as per 1st proviso to Sec. 147, if an assessment has been completed u/s 143(3) or u/s 147, then no notice shall be issued after the expiry of 4 years from the end of the relevant A.Y. unless income has escaped assessment for such A.Y. by reason of failure on the part of the assessee to disclose fully and truly all material facts necessary for that assessment.

Analysis: The facts of the case are similar to the facts in Allanasons Ltd v. Dy. CIT (2014) wherein the above issue came up before the Bombay High Court. The High Court observed that it is well settled in terms of the proviso to section 147, that where any assessment is sought to be opened beyond a period of four years from the end of the relevant assessment year, two conditions have to be fulfilled cumulatively.

The first condition is that there must be reason to believe that income chargeable to tax has escaped assessment. The second condition is that such escapement of in-come should have arisen due to failure on the assessee’s part to fully and truly disclose all material facts required for the assessment.

The High Court, accordingly, held that a subsequent decision of Tribunalor High Court by itself is not adequate for reopening the assessment completed earlier u/s 143(3) unless there is a failure on the part of the assessee to disclose complete facts.

Conclusion: Applying the rationale of the High Court ruling to the present case, reassessment u/s 147 is not possible beyond the period of 4 years unless it is due to the failure of ABC Ltd. to disclose fully and truly all material facts necessary for assessment. Therefore, in the given case if it is assumed that there was no failure of ABC Ltd. to disclose fully and truly all material facts necessary for assessment, the action taken by the A.O. is not valid in law.

![]()

Question 16.

Dravid (P) Ltd. is engaged in manufacture of electrical items. It received deposit from the distributors and supplied goods in the market through the distributors. It could not locate some distributors with whom there was no transaction for the past 5 years or so. The income-tax assessment was completed u/s 143(3) but the issue of unclaimed deposits of distributors was never discussed.

The A.O. issued a notice u/s 148 after 4 years from the end of the relevant assessment year but without quantifying the amount of income which had escaped assessment. The assessee challenged the matter in appeal by contending that the A.O. without being definite of the quantum of income escaping assessment could not have initiated reassessment proceedings. Decide the validity of the contention of the assessee. [CA Final May 2018 (Old Syllabus)] [4 Marks]

Answer:

Issue Involved: The issue under consideration is that whether the reassessment proceedings initiated on the basis of notice issued u/s 148 after 4 years from the end of the relevant assessment year without quantifying the amount of income which had escaped assessment can be valid or whether they can be challenged by the assessee.

Provisions applicable: As per Sec. 149(1), no notice shall be issued for the relevant assessment year, if 4 years, but not more than 6 years, have elapsed from the end of relevant assessment year unless the income chargeable to tax which has escaped assessment amounts to or is likely to amount to ₹ 1,00,000 or more for that year.

Also, as per 1st proviso to Sec. 147, if an assessment has been completed u/s 143(3) or 147, then no notice shall be issued after the expiry of 4 years from the end of the relevant assessment year unless the income has escaped assessment for such assessment year by reason of failure on the part of the assessee to disclose fully and truly all material facts necessary for that assessment year.

Analysis: The facts of the case are similar to the facts of the case of Amarnath Agarwal v. CIT (2015), where the Allahabad High Court observed that the two distinct conditions must be satisfied for assuming jurisdiction to issue notice u/s 148 after a period of 4 years i.e. (i) escapement of income; and (ii) omission or failure on the part of the assessee to disclose fully and truly all material facts necessary for that assessment.

![]()

Further, as per sec. 149(1 )(b), it is mandatory for the A.O., in his reasons, to state that the escaped income is likely to be ₹ 1 lakh or more. This is an essential ingredient for seeking approval and the basis on which satisfaction is to be recorded by the competent authority u/s 151.

If this condition which is a precedent to substantiate the satisfaction of escapement of income is not complied with, the issuance of notice will be invalid. Accordingly, the High Court held that, in this case, the issue of notice u/s 148 after the four years time period was hot valid.

Conclusion: By applying the above rationale, the contention of the assessee to challenge the notice issued without quantifying the amount of income which had escaped assessment is valid.

![]()

Question 17.

State with brief reason, whether the following statements are true or false: (No mark will be awarded for answers without reason)

(i) Where a notice u/s 143(2) is issued to the assessee, it is not required to process u/s 143(1), the return of income filed by the assessee.

(ii) Even without rejecting the books of account, if any, maintained by the assessee, the Assessing Officer can make a reference to the Valuation Officer u/s 142A for estimating the cost of construction of an immovable property.

(iii) Expenses of special audit conducted under section 142 shall be paid by the Central Government.

(iv) Only an individual can be regarded as a Tax Return Preparer u/s 139B. [CA Final Nov. 2018 (New Syllabus)] [6 Marks]

Answer:

(i) False: As per Sec. 143(1D), notwithstanding anything contained in Sec. 143(1), the processing of return shall not be necessary, where a notice has been issued to the assessee u/s 143(2). However, sec. 143(1D) shall not apply to any return furnished on or after A.Y. 2017-18. Therefore, ROI may be processed u/s 143(1) even if a notice u/s 143(2) has been issued.

(ii) True: As per Sec. 142A, the A.O. may make a reference to Valuation Officer (V.O.) whether or not he is satisfied about the correctness or completeness of the accounts of the assessee. Therefore to identify correct value of construction of immovable property, the A.O. can make a reference to V.O. u/s 142A for estimating the cost of construction of an immovable property, without rejecting the books of account, if any, maintained by the assessee.

(iii) True: The expenses of special audit conducted u/s 142A shall be determined by PCCIT/CCIT and shall be paid by the C.G.

(iv) True: Tax Return Preparer means any individual, who has been authorized to act as a Tax Return Preparer under aforesaid scheme but shall not include the following:

- any officer of Scheduled Bank;

- any legal practitioner;

- a Chartered Accountant;

- employee of the assessee who is getting the return furnished under this section.

Therefore, it is necessary that Tax Return Preparer is only an individual

![]()

Question 18.

For the Assessment Year 2021-22, Mr. John, was directed to carry out a special audit of his accounts u/s 142(2A) on 1.8.2021, without giving him an opportunity of being heard. ”

Answer the following questions in this regard:

(i) Can the assessee contend that since reasonable opportunity of being heard is not provided to him by the Assessing Officer, such notice requiring the special audit of accounts is not valid?

(ii) If the assessee decides to get his books of account audited u/s 142(2A), what will be the due date by which he has to submit the audit report (including the extended time, if any, allowed to him)?

(iii) If the assessee intentionally does not comply with the directions. How much penalty can be levied on him?

(iv) For failure to get the books of account audited u/s 142(2A), can prosecution proceedings be launched against the assessee? If yes, what will be the quantum of punishment for such default?

(v) Can the assessee approach the Settlement Commission to grant immunity from penalty and prosecution proceedings initiated against him? If yes, discuss the power of Settlement Commission to grant immunity in this regard. [CA Final May 2019 (Old Syllabus)] [6 Marks]

Answer:

(i) As per the proviso to section 142(2A), the Assessing Officer shall not direct the assessee to get the accounts audited unless the assessee has been given a reasonable opportunity of being heard.

Accordingly, the contention of the assessee that notice requiring special audit is not valid since reasonable opportunity of being heard has not been provided to him by the Assessing Officer is correct.

(ii) The maximum period (including extended time, if any, allowed) within which the assessee has to submit his audit report is 180 days from 1.8.2021, being the date on which direction to carry out a special audit of accounts u/s 142(2A) is received by the assessee. Accordingly, in this case, the assessee has to submit his audit report by 27.1.2022.

(iii) Penalty of ₹ 10,000 is leviable u/s 272A(1 )(d) for failure to comply with a direction issued u/s 142(2A).

![]()

(iv) If the assessee wilfully fails to comply with a direction issued to him u/s 142(2A), he shall be punishable with rigorous imprisonment for a term which may extend to one year and with fine u/s 276D.

(v) The assessee can approach the Settlement Commission to grant immunity from penalty and prosecution, if the additional amount of income-tax payable on income disclosed in the settlement application exceeds ₹ 50 lakh, where the assessee is the subject matter of search and ₹ 10 lakh, in other cases.

If the Settlement Commission is satisfied that the assessee has co-operated with it in the conduct of proceedings before it and has made a true disclosure of income, and the manner in which such income has been derived, it may grant to such person immunity from penalty and prosecution for failure to comply with direction u/s 142(2A).

However, the Settlement Commission cannot grant immunity from prosecution where prosecution proceedings have been initiated before the date of receipt of application u/s 245C.

![]()

Question 19.

Mr. Harish, a resident of India, for the financial year ended on 31.3.2021, owned

- a land in Canada purchased in September, 2005

- a flat in New Jersey (USA) purchased in April 2006 and

- a shop in a commercial complex in Finland purchased in June 2006.

He also has authority to operate a bank account (maintained with Citi- i bank, London) of a company in which his son and daughter are 100% shareholders since April 2019.

He has been served with notices u/s 148 for the Assessment Year 200607 to Assessment Year 2020-21 based on the information that he has not disclosed source of income for those asset acquisitions in his income tax returns in India.

Are the notices issued u/s 148 tenable in law? [CA Final May 2019 (New Syllabus), Nov 2013] [6 Marks]

Answer:

As per Sec. 147, where the A.O. has reasons to believe that any income chargeable to tax for any assessment year has escaped assessment, then he may subject to the provisions of sec. 148 to sec. 153, assess or reassess such income and also any other income which has escaped assessment and which comes to his notice subsequently during the course of proceedings under this section.

As per Sec. 148, before making an assessment or reassessment u/s 147, the A.O. shall serve on the assessee a notice requiring him to furnish the ROI within the time specified in the notice and the provisions of this Act shall apply as if such ROI were a ROI required to be furnished u/s 139.

![]()

As per Sec. 149(1), no notice u/s 148 shall be issued for the relevant assessment year if 4 years have elapsed from the end of relevant assessment year. However, if the escaped income is related to any asset (including financial interest in any entity) located outside India, the A.O. may issue notice upto 16 assessment years from the end of relevant assessment year.

In this case Mr. Harish, a resident of India, owned a land in Canada purchased in Sept., 2005, Flat in New Jersey purchased in April, 2006 and a shop in commercial complex Finland purchased in June, 2006. He also has ‘ authority to operate bank account in Citibank, London.

Since, the assets are located outside India, the A.O. can issue notice upto 16 assessment years from the end of relevant assessment year. Therefore, the action of A.O. to issue notice for A.Y. 2006-07 to A.Y. 2020-21 based on the information that Mr. Harish has not disclosed source of income for assets acquired outside India is valid.

Interest

Question 1.

MNO Limited paid a sum of ₹ 15 Lakhs as salary to Mr. X for which no tax was deducted at source by the company. Mr. X filed his return of income and paid the tax due by way of self assessment. The A.O. issued notice to Mr. X demanding interest u/s 234B as no advance tax was paid by him. Your opinion is sought on the following aspects,

(a) Is the action of A.O. valid?

(b) If not, is there any other means available to A.O. to recover the interest? [CA Final May 2012] [4 Marks]

Answer:

Section 209 provides that in case the payer has failed to deduct tax at source, then the amount of tax so deductible shall not be reduced from the income-tax liability of the resident payee for determining his liability to pay advance tax.

Therefore, the resident payee shall be liable to pay advance tax and in such case section 234B for default in {f&yment of advance tax would be attracted. Further, interest @1% per month or part of month would be leviable u/s 201(1A) on the payer from the month in which tax was deductible till the date of furnishing of return by the resident payee.

![]()

Question 2.

Bhola & Co., a firm, failed to pay the advance tax as required by the provisions of Income-tax Act, 1961. The assessment was done u/s 143(3) i and the assessment order issued by the A.O. stated that interest is payable i u/s 234B. The order did not contain any direction for the payment of interest, it merely stated that interest is payable. The assessee’s contention is that since the direction for payment of interest is absent in the assessment order, it could not be fastened with liability to interest u/s 234B. Examine the validity of assessee’s contention. [CA Final May 2016] [4 Marks]

Answer:

The issue under consideration is whether interest liability u/s 234B would arise in the absence of specific direction for payment of interest in the assessment order.

As per Sec. 234B, the moment an assessee who is liable to pay advance tax has failed to pay such tax or where the advance tax paid by the assessee isless than 90% of the assessed tax, the assessee becomes liable to pay simple interest @ 1% per month or part of the month.

Levy of interest u/s 234B is automatic w hen the conditions of section 234B are met. It was so held by the Gauhati High Court in the case of CIT v. Assam Mineral Development Corporation Ltd. (2010)

The contention of the firm, Bhola & Co., that it could not be fastened with the liability to interest under section 234B in the absence of the direction for payment of such interest in the assessment order is, therefore, not valid, assuming that interest u/s 234B has been computed for determining the tax liability as per the income-tax computation sheet annexed to the assessment order. Interest liability u/s 234B would arise, even in the absence of specific direction for payment of interest in the assessment order.

![]()

Question 3.

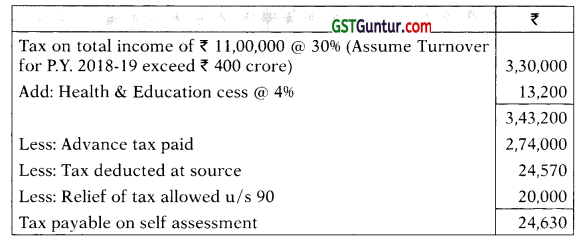

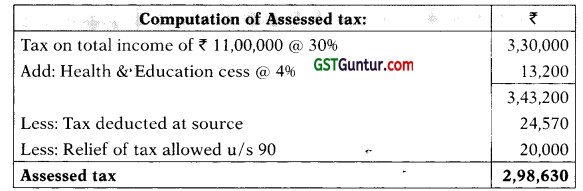

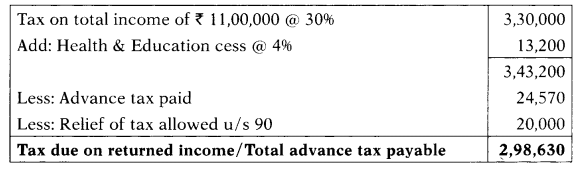

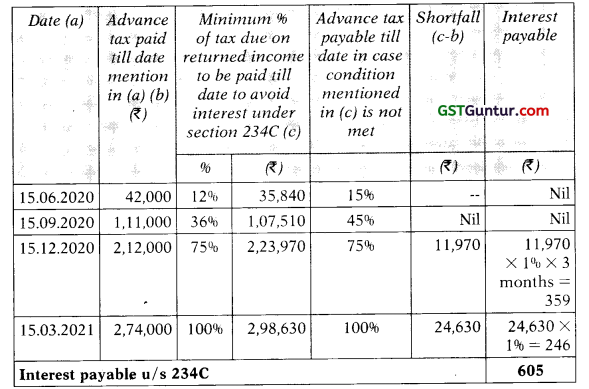

PA Consulting Ltd’s has total turnover of ₹ 1,55,00,000 and total income of ₹ 11,00,000 during the previous year ended 31.3.2021. Tax deducted at source by different payers amounted to ₹ 24,570 and tax paid in foreign country on a doubly taxed income amounted to ₹ 20,000 for which the company is entitled to relief u/s 90 as per the double tax avoidance agreement. During the year the company paid advance tax as under:

| Date of Payment | Advance tax paid (₹) |

| 15-06-2020 | 42,000 |

| 12-09-2020 | 69,000 |

| 15-12-2020 | 1,01,000 |

| 15-03-2021 | 62,000 |

The company filed its return of income for the Assessment Year 2021-22 on 15.11.2021.

Compute interest, if any payable by the company u/ss 234A, 234B and 234C. Assume that transfer pricing provision is not applicable. [CA Final Nov. 2012, May 2017] [7 Marks]

Answer:

(i) Interest for defaults in furnishing return of Income u/s 234A

Since, PA Consulting Ltd. has furnished ROI on 15-11-2021 i.e. 15 days after the due date of filling Return, interest shall be payable @ 1% for a month on the amount of tax payable on total income, as reduced by tax and prepaid taxes.

Interest Payable = ₹ 24,630 × 1% = ₹ 246.

(ii) Interest for default in paying advance tax u/s 234B

Where the advance tax paid by the assessee is less than 90% of the assessed tax, the assessee would be liable to pay interest u/s 234B.

Advance tax to be paid 90% of assessed tax = ₹ 2,98,630 × 90% = ₹ 2,68,767

![]()

Since, the advance tax paid by PA Consulting Ltd. ₹ 74,000) is more than 90% of the assessed tax (₹ 2,68,767), it is not liable to pay interest u/s 234B.

(iii) Interest u/s 234C

Calculation of interest payable under section 234C:

Question 4.

Arjun’s total Income for AY. 2021 -22 is ₹ 10 lakhs consisting of salary, capital gain and income from other sources. After considering TDS and advance tax a sum of 50,000 towards tax is still payable. Because of various reasons he could not file his return of Income within the prescribed time limit. Arjun approaches you for advice on the following Issues:

(i) Whether he can file a return of income on P December, 2021?

(ii) Whether he will be able to revise his return of income, In case he discovers any omission or mistake in his return filed on 01.12.2021?

(iii) What amount of interest and penalty, he will be subjected to for the defaults, If any, for the relevant assessment year. [CA Final Nov. 201 7] [4 Marks]

Answer:

(i) As per section 139(4), any person who has not furnished a return within the time allowed u/s 139(1) may furnish a belated return for the P.Y. at any time before the end of the relevant AX. or before the completion of assessment, whichever is earlier. Therefore, assessee can file return for A.Y. 2021-22 till 31.03.2022 assuming assessment has not been completed before 31.03.2022. Hence, Arjun can file a return of income on December, 2021

(ii) As per section 139(5), if any person, having furnished return of income u/s 139(1) or belated return u/s 139(4), discovers any omission or misstatement therein, then he may furnish a revised return at any time before the end of the relevant A.Y., or before the completion of assessment, whichever is earlier.

![]()

The return filed by Arjun on 01.12.2021 is a belated return filed u/s 139(4) and as per Sec. 139(5) belated return can be revised. Thus, Arjun will be able to revise his return of income, in case he discovers any omission or mistake in his return filed on 01.12.2021. Further, he can revise his return till 31.03.2022 assuming assessment has not completed before 31.03.2022.

(iii) Mr. Arjun will be liable to pay interest u/s 234A for default in furnishing ROI. Interest is levied on self assessment tax @ 1% p.m. or part of the month for the period of delay. In the given case the due to file ROI would be 31.07.2021 and so the interest will be levied for 5 months, Thus, the amount of interest shall be ₹ 2,500 (i.e. ₹ 50,000 × 1% × 5 months).

Further, there is no provision for levy of penalty in case of delay in 5 filing the ROI. However, Mr. Arjun would be liable to pay late fee u/s 234F. As per section 234F, fees for failure to furnish Return of income u/s 139 within the time limit prescribed u/s 139(1) shall be:

(a) ₹ 5,000, if ROI is furnished on or before 31st day of December of the assessment year;

(b) ₹ 10,000 in any other case.

However, if the total income of the person does not exceed ₹ 5,00,000, fee payable shall not exceed ₹ 1,000.

So, Mr. Arjun would be liable to pay late fees of ₹ 5,000 as the ROI is filed before 31.12.2021 and his total income exceeds ₹ 5,00,000.

![]()

Question 5.

The assessment of Nargis Agro Ltd., for A.Y. 2021-22 was completed u/s 143(3). The order so passed does not contain any specific direction for payment of interest u/s 234B, but was being accompanied by form ITNS-150 containing and giving the calculation of interest payable u/s 234B on the Assessed Tax. The assessee being aggrieved of the levy of interest u/s 234B seeks your opinion. Kindly advice. [CA Final Nov. 2017] [4 Marks]

Answer:

The issue under consideration is whether interest liability u/s 234B would arise in the absence of specific direction for payment of interest in the assessment order.

The facts of the case are similar to the facts in CIT v. Bhagat Construction Co (P.) Ltd. (2016), where the Supreme Court observed that levy of interest u/s 234B is automatic when the conditions of section 234B are met and the income-tax computation sheet/form [Form ITNS-150] is part of the assessment order, even though the assessment order does not contain a specific direction for payment of interest.

Applying the above rationale, Nargis Agro Ltd. becomes liable to pay interest u/s 234B for A.Y. 2021-22 even if the assessment order passed under section 143(3) does not contain any specific direction for payment of such interest, since the order is accompanied by Form ITNS-150 containing and giving calculation of interest payable under section 234B.