Performance Measurement and Evaluation – CA Final SCMPE Study Material is designed strictly as per the latest syllabus and exam pattern.

Performance Measurement and Evaluation – CA Final SCMPE Study Material

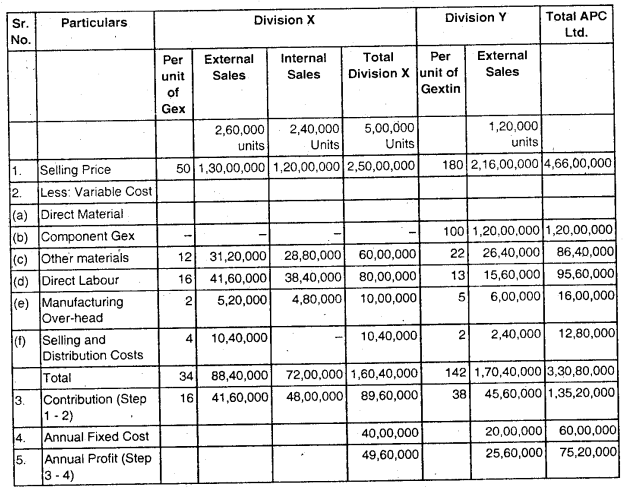

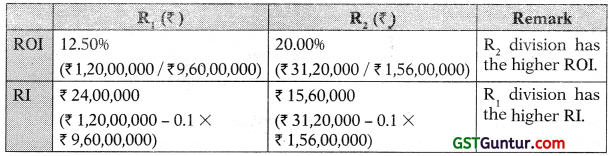

Question 1.

(RTP: ROI vs RI)

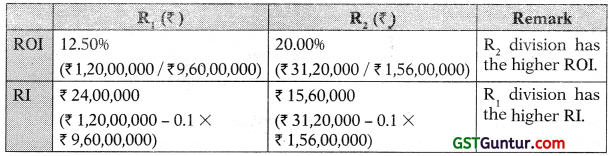

The following data pertain to two divisions. R1 and R2, of a large Shipping Company.

|

R1 (₹) |

R2 (₹) |

| Profit |

1,20,00,000 |

31,20,090 |

| Investment |

9,60.00,000 |

1,56,00,000 |

Required

INTERPRET the conflicting results based on financial performance measure and RI [May 2018 Exam]

Answer:

Residual Income is subject to a size effect but ROI is not. The larger size for the R1 Division (which is more than 6 times that of the R2 Division) overcomes its lower profitability, as measured by ROI. Thus, RI is not a good way to compare divisions that differ greatly on size.

Workings

Question 2.

(ROI Leading to Sub-Optimal Decision Making & Lack of Goal Congruence)

BYD Alloy Ltd. first opened its door in 1990 for business and now it is a major supplier of metals supporting over a dozen different industries and employs experts to support each industry. These include Wood & Panel Products Manufacturing, Hearth Products, Site Furnishings, Commercial and Residential Construction etc. It has grown through devotion to its customers, dedication to customer service and commitment to quality products. The company has two divisions: Division ‘Y’ and Division ‘D’. Each division work as an investment center separately, Salary of each divisional manager is ₹ 7,20,000 per annum with the addition of an annual performance related bonus based on divisional return on investment (ROI). A minimum ROI of 12% p.a. is expected to be achieved by each divisional manager. If a manager only achieves the 12% target, he will not be rewarded a bonus. However, for every whole 1% point above 12% which the division achieves for the year, a bonus equal to 3% of annual salary will be paid subject to a maximum bonus of 20% of annual salary. The figures belonging to the year ended 31 March 2018 are given below:

| Division‘Y’(₹ 000) |

|

Division ‘D’ (₹ 000) |

| Revenue |

29,000 |

17,400 |

Profit

Less: Head Office Cost |

5,290

(2,530) |

3,940

(1,368) |

| Net Profit |

2,760 |

2,572 |

Non-Current Assets

Cash, Inventory, and Trade Receivable

Trade Payable |

19,520

4,960

5,920 |

29,960

6,520

2,800 |

| Manager Responsible |

HAI |

FAI |

During the financial year 2017-18, FAI manager of Division ‘D’ invested ? 13.6 million in new equipment including an advanced cutting machine, which will increase productivity by 10% per annum. HAI, manager of Division ‘Y’, has made no Investment during the year, even its computer system needs updation. Division ‘Y’s manager has already delayed payments of its suppliers due limited cash & bank balance although the cash balance at Division ‘Y’ is still better than that of Division ‘D’.

Required

(i) For each division, COMPUTE, ROI for the year ending 31 March 2018, Justify the figures used in your calculation. (6 Marks)

(ii) COMPUTE bonus of each manager for the year ended 31 March 2018. (4 Marks)

(iii) DISCUSS whether ROI provides justifiable basis for computing the bonuses of managers and the problems arising from its use at BYD for the year ended 31 March 2018. (10 Marks) [Nov. 2018 RTP/Aug 2018 MTP]

Answer:

(i) ROI Division ‘Y’

Controllable Profit = ₹ 5,290K

Net Assets = ₹ 19,520k + ₹ 4,960K – ₹ 5,920K = ₹ 18,560K ROI = 28.5%

Division ‘D’

Controllable profit = ₹ 3,940K

Net Assets = ₹ 29,960K + ₹ 6,520K – ₹ 2,800K = ₹ 33,680K ROI = 11.7%

In computation of ROI of both division, controllable profit has been taken into consideration. The reason behind this is that the Head Office costs are not controllable and responsibility accounting considers that managers should only be held responsible for costs over which they have control. The assets figures being used also depend on the same principal. Figures of current assets and the current liabilities have been y taken into consideration as they are such items over which managers have complete control.

(ii) Bonus

Bonus to be paid for each percentagepoint= ₹ 7,20,000 × 396 = ₹ 21,600

Maximum Bonus = ₹ 7,20,000 × 20% = ₹ 1,44,000

Division ‘Y’

ROI = 28.5% (16 whole percentage points above minimum ROI) 16 × ₹ 21,600 = ₹ 3,45,600

Therefore, manager will be paid the bonus of ₹ 1,44,000 (max.)

Division ‘D’

ROI = 11.796 (Zero, percentage point above minimum)

Therefore Bonus = NIL

(iii) Discussion

FAI will not receive any bonus since he has not earned any point above minimum percentage. This is due to the large asset base on which the ROI figure has been computed. Total assets of Division ‘D’ are almost double the total assets of Division ‘Y’. The major reason behind this is that Division ‘D’ invested ₹ 13.6 million in new equipment during the year. If this investment were not made, net assets would have

been only ₹ 20.08 million and the ROI for Division ‘D’ would have been 19.62% resulting in payment of a bonus ₹ 1,44,000 (7 × ₹ 21,600 = ₹ 1,51,200; subject to maximum of ₹ 1,44,000) rather than the nothing. FAI is being penalized for making decisions which are in the best interests of his division. It is very surprising that he decided to invest where he knew that he would receive lesser bonus subsequently. He acted in the best interests of the BYD altogether. On the other hand, HAI has taken benefit from the fact that he has not invested anything even though it was needed for computer system updation. This is an example of sub-optimal decision making.

Further, Division ‘Y”s trade payables are over double those of Division ‘D’. In part, one would expect this due to higher sales (almost 66% more than Division ‘D’) and low cash levels at Division ‘Y’. Higher trade payable leads to reduce. The manager of division G would be most eager to accept the additional fund of Rs. 8,00,000 because of ROI of the protion in net assets figures. The fact that BYD is rewarding HAI with bonus, even though relationships with suppliers may be badly affected, is again a case of sub-optimal decision making.

If the profit margin (excluding head office cost) as percentage of sales is calculated, it comes to 18.24% for Division ‘Y’ and 22.64% for Division ‘D’. Therefore it can be seen that Division ‘D’ is performing better if < capital employed is ignored. ROI is simply making the division ‘D”s S performance worse.

FAI might feel extremely disappointed by getting nothing and in the future, he may opt to postpone the investment to increase the bonus. Non- investing in new technology and equipment will mean that the BYD will not be kept updated with industry changes and its overall future competitiveness will be affected.

Briefly, the use of ROI is resulting in sub-optimal decision making and a lack of goal congruence ie. what is good for the managers is not good for the company and vice versa. Fortunately, Division ‘D”s manager still seems to be acting for the benefit of the BYD but the other manager is not. The fact that one manager is receiving a much bigger bonus than the other is not justifiable here and may result in conflict in long run. This is disappointing for the company especially in the situation when the divisions need to work in unison.

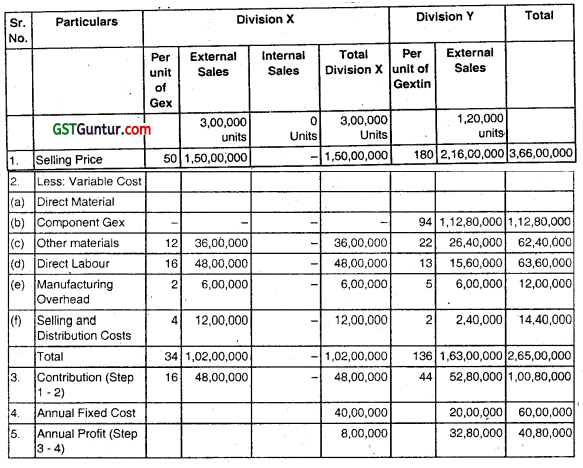

Question 3.

(ROI & RI)

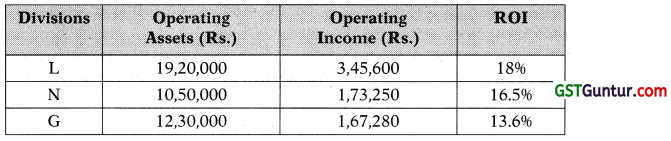

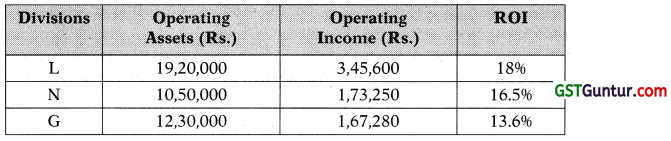

LMP Limited has three divisions. Its desired rate of return is 14%. The operating assets and income for each division are as follows:

| Divisions |

Operating Assets (Rs.) |

Operating Income (Rs.) |

| L |

19,20,000 |

3,45,600 |

| N |

10,50,000 |

1,73,250 |

| G |

12,30,000 |

1,67,280 |

| Total |

42,00,000 |

6,86,130 |

LMP limited has Rs. 8,00,000 of additional cash to invest in one of its divisions. The divisional managers have identified Investment opportunities that are expected to yield the following ROI is

| Divisions |

Expected ROIs for additional Investment |

| L |

16% |

| N |

12% |

| G |

15% |

Required

(i) CALCULATE ROIs at present for each division and STATE which division manager is currently providing the highest ROI. (3 Marks)

(ii) Based on ROI, IDENTIFY the division manager who would be the most eager to accept the additional Investment funds.

(1 Marks)

(iii) Based on ROI, IDENTIFY the division manager who would be least eager to accept the additional investment funds. (1 Marks)

(iv) STATE the division that offers the best investment opportunity for LMP limited. (1 Mark)

(v) DISCUSS the conflict between requirements (ii) and (iv) above, s (2 Marks)

(vi) ADVISE how the residual income performance measure could be used to motivate the managers to act in the best interest of the company. (2 Marks) [Oct. 2019 MTP]

Answer:

1. Present ROI of each division

The division manager of L division is currently providing the highest ROI of 18% among the three divisions.

posed investment of Rs. 15% is more than the present ROI of 13.6% and the acceptance of the proposal would increase the division’s ROI.

3. The managers of division L and N, both would be reluctant to invest the additional fund of Rs. 8,00,000 because their return on the proposed project that is 16% and 12% respectively for division L and N are lower than their existing ROI of 18% and 16.5%. However, the manager of division N would be least likely to accept the additional investment because the gap of the present ROI and proposed ROI of the project is 4.5% than that of division L of 2%.

4. Division L offers the best investment opportunity of 16% for LMP limited.

5. The managers are forced to choose between their personal best interests and the best interests of the company as a whole. When faced with decisions such as these, many managers choose to benefit themselves at the expense of their company, a condition described as sub optimisation.

6. To avoid sub-optimisation, the divisional performance measure be based on Residual Income (RI). If RI is used to measure the performance, there is greater probability that managers will be encouraged, when acting in their own best interests, also to act in the best interests of the company. Since, the use of RI does not penalise investment in projects with lower returns than current project returns.

In general, when RI is used as a performance measure, managers are willing to invest in any projects with returns equal to or greater than the required rate of return. However, RI suffers from the disadvantages of being an absolute measure, which means that it is difficult to compare the performance of a division with that of other divisions of a different size.

Question 4.

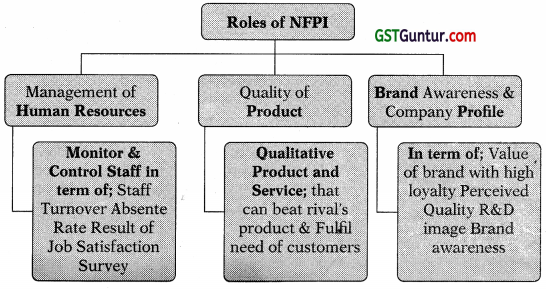

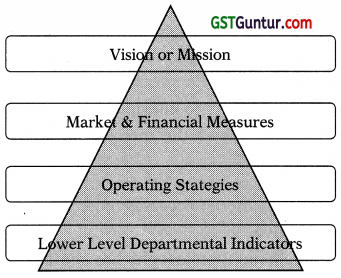

Non- Financial Performance Measures (NOV 2020 RTP)

Welfare LLP sells wide range of household products. The firm has recently received few negative feedbacks about the product and customer services. CEO is not happy with this. As per the opinion of CEO –

“Nowadays when social media play such an important role in making decisions, itscrucial to keep an eye on the quality of customer service you provide. If you don’t care about customers1 satisfaction, don’t expect them to care about your services or products. When customer share their story, they’re not just sharing their problems. They are actually teaching you how to make your product, service, and business better.”

There has been considerable discussion at the corporate level as to improve ‘Customer Satisfaction’. Convinced with this logic, firm has invested heavily in customer satisfaction and adopted the following plan of action- providing helpline 24/7 in order to develop persona! relationship with customer;

- redesign its online platform in order to make it more customer friendly;

- rewarding loyal customers by giving them experience, they would not forget for life; and

- ease the return and refund policy, offering no questions- asked guarantee is a smart move over competitors.

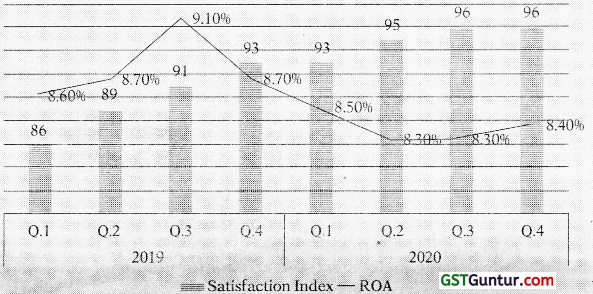

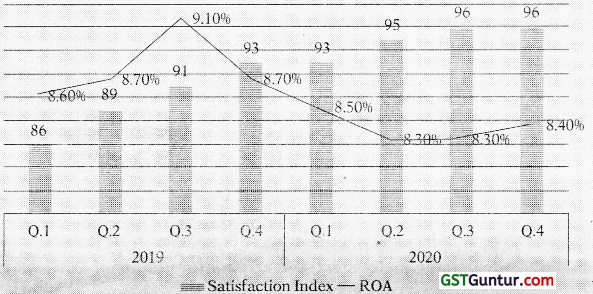

The CEO was initially delighted to see that their efforts pay off in the form of higher customer satisfaction score index, however he is anxious to see the corresponding financial results.

Required

Does the seeming lack of improvement in financial performance with customer satisfaction, Welfare LLP should stop investing a superior customer experience? DISCUSS. [Nov. 2020 RTF]

Answer:

In this case we can see that there are two considerable sides of the question one is customer satisfaction and another one is profitability. By adopting the proposed plans firm manage to get higher customer satisfaction score card and it is expected that with high customer satisfaction, the firm’s financial result will improve ie. increase ROA. However, increasing the customer satisfaction is costly. Plans which are used to increase customer satisfaction will increase the cost of the firm. This additional cost will weaken the firm’s ROA by lowing profit and increasing the asset base. The optimum level of customer satisfaction is where the incremental benefits are equal to incremental costs of increasing satisfaction.

While observing the pattern of data, the customer satisfaction has increased from 86 points to 91 points in first three quarters of 2019. At this level, the additional benefits seem to more significant than the additional cost. However, in subsequent quarters, additional cost has increased more rapidly than the additional benefits. Therefore, there is decrease in ROA as we move forward on the index. However, toward the end of 2020, we see a marginal increase in ROA. This is due to the lead-lag relation between satisfaction and ROA. Increased satisfaction might take some more time, some more quarters to result in higher ROA and the relation might not be linear. However, toward the end of 2020, the customer satisfaction score stabilizes at current levels (93-96 points).

Overall, Kristin should not stop investing in superior customer experience, the lack of apparent pattern in customer satisfaction and profitability could stem from several causes as discussed above. Instead, firm should take decision considering current satisfaction levels, the cost to increased satisfaction, and perception of the increased benefit. Moreover, the firm should also consider the current sales, otherwise it might lose its share to competitor if they do nothing.

Question 5.

(Return on Investment; Residual Income)

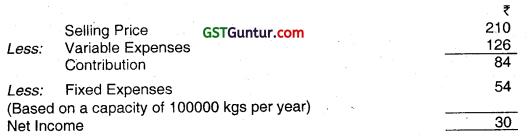

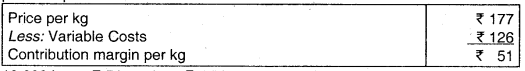

AKG Limited has three autonomous divisions. The divisions are evaluated on the basis of ROl, with year end bonuses given to divisional managers who have the highest ROL Operating results of Division II for the last year are given below:

|

₹ |

| Sales |

2,10.00,000 |

| Less: Variable Expenses |

1,26,00,000 |

| Contribution margin |

84,00,000 |

| Less: Fixed Expenses |

67,20,000 |

| Net Operating Income |

16,80,000 |

| Divisional Operating Assets |

52,50,000 |

The company’s overall ROI for the last year was 18% (considering all divisions). Division II has an opportunity to add a new product line that would require an investment of ₹ 30,00,000. Other details of the new product line are as follows:

| Sales |

₹ 90,00,000 per annum |

| Variable Expenses |

65% of sales |

| Fixed Expenses |

₹ 25,20,000per annum |

| Life cycle of the product line |

5 years |

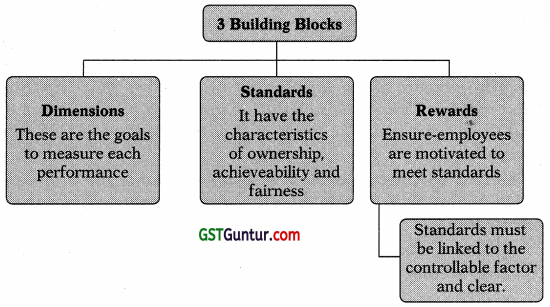

In addition to financial performance measures, the company wishes to introduce a variety of non-financial performance measures.

The company has set aggressive targets in both sales growth and ROI for the coming year. The company’s strategy for achieving these goals includes a campaign aimed at building brand recognition, customer retention, improvement in product quality, on time delivery to customers, expansion of eco-friendly product line and introduction of limited edition items.

Required:

(a) (i) CALCULATE last year’s ROI of Division II.

(ii) DISCUSS whether the manager of Division II would accept or reject the new product line, if he takes his decision based solely on divisional ROI. (2 Marks)

(iii) AD VISE how residual income approach can he used as an alternative financial measure for evaluation of managerial performance in the best interest of the company.

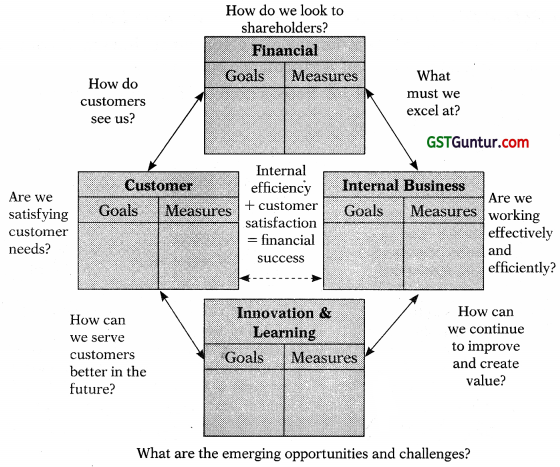

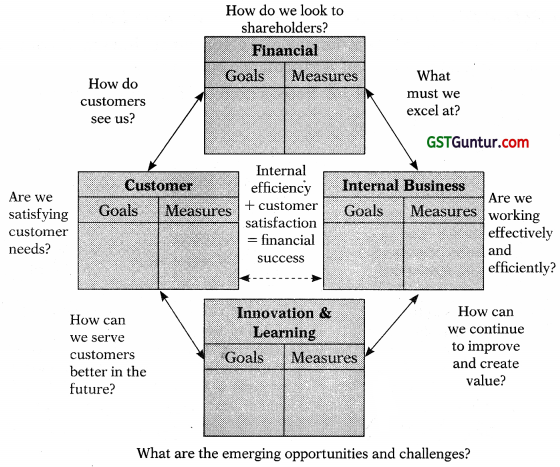

(b) Based on the above information and using a Strategy Map TABULATE two objectives and two measures for each perspective across the four dimensions of a balanced scorecard in the following format:

| Perspective |

Strategic Objective |

Measure |

|

|

|

[Nov. 2019]

Answer:

(a) (i) Calculation of last year ROI of Division II

= Controllable Profit/ Controllable Net Asset

= ₹ 16,80,000/1 52,50,000

= 32%

(ii) Calculation of ROI of New Product Line

| Particulars Amount |

(₹) |

| Sales |

90,00,000 |

| Less: Variable Cost |

58,50,000 |

| Controllable Contribution |

31,50,000 |

| Less: Fixed Cost |

25,20,000 |

| Controllable Profit |

6,30,000 |

| Investment Available |

30,00,000 |

| Return on the Proposed Line (ROI) |

21% |

The manager of Division II would be unwilling to invest the additional ₹ 30 lacs because this would decrease the Division II’s ROI of 32% to 28%.

[₹ 16,80,000 + ₹ 6,30,000/ (₹ 52,50,000 + ₹ 30,00,000)]

(iii) Generally, a manager who is evaluated based on ROI will reject any project whose rate of return is below the Division’s current ROI even if the rate of return of the project is above the company’s minimum reqidred rate of return. In contrast, managers who are evaluated using residual income will pursue any project whose rate of return is above the minimum required rate of return, because it will increase their residual income. So, in the best interest of the company as a whole, residual income approach can be used for evaluation of managerial performance.

Alternative

To overcome some of the dysfunctional consequences of ROI, the residual income approach can be used. For the investment decision for Division II, the residual income calculations are as follows:

| Proposed Investment |

₹ 30,00,000 |

| Controllable Profit |

₹ 6,30,000 |

| Cost of Capital (18%) |

₹ 5,40,000 |

| Residual Income (RI) |

90,000 |

Advise

This calculation indicates that the residual income of Division II will increase if manager accept the project. However, it is important to note that Residual Income does not always point to the right decision, because notional interest on accounting capital employed is not the same as IRR on cash investment. This Project has 1.65% IRR.

Overall, Residual Income is more likely than ROI to improve when managers make correct investment decisions, and so is probably a ‘safer’ basis than ROI on which to measure performance.

(b)

| Perspective |

Strategic Objective |

Measure |

| Financial |

- Improve ROI

- Increase Sales

|

- % increase in ROI

- % increase in sales

|

| Customer

Perspective |

- Improve brand recognition

- Customer retention

|

- % of target audience who recognize brand

- % of suggestions/ complaints responded

- % increase in repeat customers/Number of repeat customers

|

| Internal

Perspective |

- Improve in product quality

- Improve on time delivery to customers

- Reduction in time spent in non-value added activities

|

- % reduction in defect rate

- % of orders on time

- % increase in MCE

|

| Learning & Innovation |

- Expansion of ecofriendly product line

- Introduction of limited edition items

|

- No. of eco-friendly products developed.

- No. of limited editions introduced.

|

Other measures are also possible.

Question 6.

(Economic Value Added)

The following information is available for the division X of Xuz Ltd:

| Net operating profit before interest and taxes |

7,500 |

| Depreciation expenses |

2,500 |

| Change in net working capital |

1,250 |

| Capital expenditure |

1,000 |

| Invested capital |

12,500 |

| WACC |

8% |

| Tax Rate |

30% |

Answer:

EVA can be calculated as NOPAT minus the capital charge on invested capital. In this case, NOPAT is equal to net operating profit before interest and taxes ₹ 7,500 minus taxes ₹ 2,250 (₹ 7,500 × 30%), which is equal to ₹ 5,250. EVA is then equal to ₹ 4,250 (₹ 5,250 – ₹ 12,500 × 8%)

Question 7.

(Economic Value Added)

Boat Ltd. provides you with the following financial information as at 31st March 2018.

|

(₹ in lakhs) |

| Share Capital |

981.46 |

| Reserves and Surplus |

1,313.62 |

| Long Term Debt |

144.44 |

| Trade Payables |

20.38 |

Additional information provided is as follows:

(i) Profit before interest and tax is ₹ 2,202.84 lakhs

(ii) interest paid is ₹ 13.48 lakhs.

(iii) Tax rate is 30%

(iv) Cost of equity = 12.42% and cost of debt = 6.53%.

Required

CALCULATE Economic Value Added of Boat Ltd.

Answer:

EVA = NOPAT – WACC × Capital Employed Capital Employed

= ₹ 981.46 L + ₹ 1313.62 L + ₹ 144.44 L

= ₹ 2,439.52 L

WACC = \(\frac{(981.46+1,313.62)}{2,439.52}\) × 12.42% + \(\frac{(144.44)}{2,439.5}\) × 6.53%

= 11.68%+ 0.39%

= 12.07%

NOPAT = [PBIT- Interest – Tax] + Interest (net of tax)

|

₹ in lakhs |

| PBIT |

2,202.84 |

| Less: Interest |

(13.48) |

| PBT |

2,189.36 |

| Less: Tax @ 30% |

(656.81) |

| PAT |

1,532.55 |

| Interest (net of tax) [13.48 × (1- 0.30)] |

9.44 |

| NO PAT |

1,541.99 |

EVA = NOPAT – WACC × Capital Employed

= ₹ 1,541.99 L – 12.07% × ₹ 2,439.52 L

= ₹ 1,247.54 L

Question 8.

(Economic Value Added)

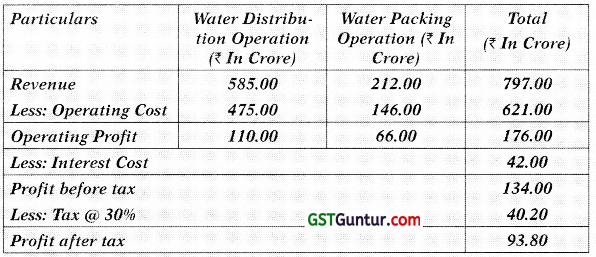

Jal Cleaning and Distribution Services Ltd. (JCDSL) was established with an aim for supply and distribution of water in Nagpur and as well as supply of water to the various local authorities for distribution to villages and other small cities adjacent to Nagpur under “MISSION PAANI”. This involved planning, operating, treating, maintaining, and distributing w ater resources in the country’s urban centres and other areas mandated by State Government. The mission statement is to provide clean and economical water for healthy life to the public”:

There are two operational divisions of JCDSL viz Water Distribution Operation (WDO) for distribution of water through pipes and Water Packaging Operation (WPO) for supplying water in packaged drinking winter bottles. The state government ensures that JCDSL does not take advantage of its monopoly position in the regional area by increasing prices. The government controls majority of services through its w ater regulatory body which determines an acceptable margin level (ROCE) and ensures that the pricing of JCDSL within these areas does not break this level. The other operation Le. Water Packing Operation (WPO) is not regulated by government and JCDSL is free to charge a market rate for water supply in bottles. The company is free to use water for Water Packaging Operation but the total use of water for Water Packing Operation (WPO) cannot exceed 35% of the total supply of water by the company. The company is presently using 20% of total water supply for packaging operation.

The brand name of packaged drinking water is “Swachh-Jal” which is packed in transparent plastic bottles. The water regulator calculates Return on Capital Employed (ROCE) of JCDSL based on its own valuation and assessment of the capital assets which are used in operation and profit from these services. Acceptable level of ROCE set by the regulator is 6.50%. If JCDSL breach this level, then the company would be heavily penalized. JCDSC board is making sincere efforts to improve the performance of the company for the benefit of the shareholders. The board of directors have decided to consider economic value added (EVA) as the key performance indicator, in order to meet the objective of maximizing shareholders’ wealth.

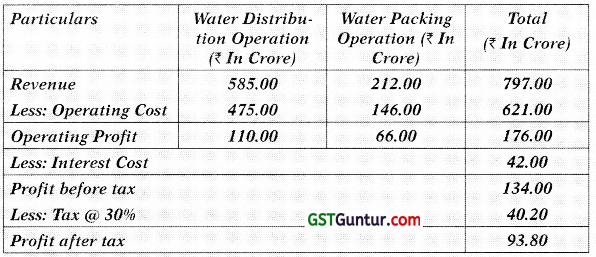

Key Financial data for the year ending 31st March, 2020 is given below :

Capital Employed for the last two years

| Particulars |

2019-20 (₹ In Crore) |

2018-19 (₹ In Crore) |

| As per Audited Accounts |

2,040.00 |

1,940.00 |

| As calculated by Water Regulator (for WDO operations only) |

1,812.00 |

1,760.00 |

The following notes are to be taken into consideration in the analysis:

1. Operating Costs include:

| Particulars |

2019-20

(₹ In Crore) |

2018-19

(₹ In Crore) |

| Depreciation |

124.00 |

118.00 |

| Provision for bad and doubtful debts |

6.00 |

2.00 |

| R&D Cost |

20.00 |

… |

| Other Non-Cash items |

22.00 |

11.00 |

2. Economic depreciation is ₹ 156.00 Crore in 2019-20. In the FY 2018-1 9, economic and accounting depreciation were assumed t0 be the same.

3. Current year’s tax paid is ₹ 23.00 Crore and deferred tax provisions of ₹ 2.00 Crore have been adjusted. There was no deferred tax balance before 2019-20.

4. The provision for doubtful debts was ₹ 12.00 Crore in the 2019-20 Balance Sheet.

5. Research and development has been non-capitalized. It belongs to a new project that will be developed over six years and is expected to be of long-term benefit to the company. 2019-20 is the first year of this project.

6. Cost of Capital:

| Equity |

15% |

| Debt (Post Tax) |

5% |

7. Gearing of JCDSL Equity:

| Equity |

30% |

| Debt (Post Tax) |

70% |

Required

(i) CALCULATE EVA of JCDSL for the year ending 31 March, 2020 based on the above information. (6 Marks)

(ii) EVALUATE the financial performance of JCDSL using EVA. (4 Marks)

(iii) ASSESS whether JCDSL comply with its acceptable ROCE level. (3 Marks)

(iv) ADVISE how JCDSL can improve its performance in terms of profitability and EVA in future. (7 Marks) [Nov 2020 Exam]

Answer:

(i) EVA of JCDSL for the year ending 31st March 2020 is negative ₹ 0.16 Crores.

Calculation of EVA

NOPAT – (WACC × Capital Employed)

= ₹ 156.40 crores – (8% × ₹ 1,957 crores)

= ₹ 156,40 crores – ₹ 156.56 crores

= – ₹ 0.16 Crores

Working Note 1 – Computation of NOPAT (Net operating profit after tax)

| Particulars |

₹ in Crore |

| Operating Profit |

176.00 |

| Add: |

| Accounting Depreciation |

124.00 |

| Provision for Bad and Doubtful Debts |

6.00 |

| Research and Development |

20.00 |

| Other Non-Cash Items |

22.00 |

| Less: |

| Economic Depreciation |

156.00 |

| Tax Paid |

23.00 |

| Tax Saving on Interest (₹ 42 crores × 30%) |

12.60 |

| NOPAT |

156.40 |

Working Note 2 – Computation of Capital Employed

| Particulars |

₹ in Crore |

| Capital Employed as on 31.03.2019 |

1,940.00 |

| Add: |

|

| Provision for Bad and Doubtful Debts as on 31.03.2019 (i.e. ₹ 12 – ₹ 6 crore) |

6.00 |

| Other Non-Cash Items (incurred in 2018-19) |

11.00 |

| Adjusted Opening Capital Employed |

1,957.00 |

Working Note 3 – Calculation of WACC

[(Ke × Ve) + (Kd × Vd)]/(Ve + Vd)]

= 1596 × 0.30 + 596 × 0.70

= 8%

(ii) Evaluation of Financial Performance

Presently, JCDSL is distorting value (negative EVA of 16 lacs) as it is not able to meet the economic cost of its own capital, hence detrimental to shareholder’s interest. The negative EVA raise the question on sustainability of business, hence perpetual succession become doubtful.

The prominent reason of negative EVA may be a higher cost of equity for JSDSL ie. 1596. Here it is worth noting that despite around 73.40% (585/797) of the revenue to JCDSL is from WDO which is regulated one and wherein demand is guaranteed in future. Hence, investing risk shall be low.

Another major reason of negative EVA may be cap on ROCE in case of WDO hence NOPAT can’t be raised beyond a level. JCDSL can focus

on WPO to increase its NOPAT (to make it enough for break-even) or it can slash its capital employed by selling unutilized or under-utilized assets.

(iii) ROCE of WDO is 6.25% (see working note below), hence JCDSL is complying with the acceptable cap limit of 6.50%.

Working Note – Computation of ROCE from WDO

ROCE = \(\left(\frac{\text { Operating Profit }}{\text { Capital Employed }}\right)\)

= (₹ 110 crores / ₹ 1,760 crores ) × 100

= 6.25%

In order to improve performance in term of EVA or profitability CDSL may apply any of the initiative either individually or in any combination operating profits can be made to grow without employing more capital in both operations, but especially in WDO i.e. greater efficiency; additional capital shall be invested in WPO where the return is more than the cost of obtaining the capital, i.e. profitable growth; capital shall be divested from those projects that do not cover the cost of capital, i.e. liquidate unproductive capital.

(iv) Advise

Operating margin from WPO is 31.13% (66.00/212.00) compared to 18.80% (110.00/585.00) of WDO. JCDSL may use the WDO activities ) as a trusted source of cash profit to reinvest in expansion of the WPO. There is scope of expansion in WPO, because the JCDSL currently using 20% of total water supply for packing operation against the upper cap of 35%. Hence, JCDSL shall expand the WPO (non-regulated businesses) to extent of 175% [(35%/20%) × 100] of current level using the cash generated by the regulated operation i.e. WDO.

Further, JCDSL may improve profitability by controlling costs within WDO activities through performance measurement. The regulatory body cannot argue that the company is overcharging its customers to increase profit margin. This is possible through strict observance of expenses and using cost savings techniques through efficiency improvements. In order to control cost within WDO, targets should be based on minimal variances and adopting cost reduction methods. It is important here to note that there is only a limited scope for increase in the operating profit of WDO due to ROCE cap. The maximum allowed operating profit can be only ₹ 114.4 crore i.e. 6.50% of ₹ 1,760 crore of capital employed.

Thus, JCDSL should go to expand its WPO as this is producing higher operating profit margins.

Question 9.

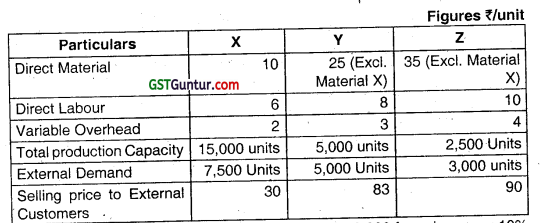

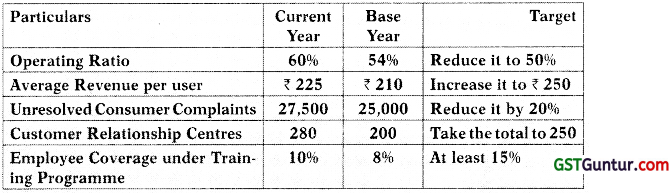

Alpha Control (AC) is a global leader in manufacturing of commercial building control systems with over 250 distributors and many thousands of installations in more than 50 countries. Control systems involve air conditioning systems, facility management, energy and water management, access control and security controls etc. At AC, manufacturing is done at a number of factory sites where some products are easy and largely produced and have a long life while other products are intricated and have a short life due to changing technologies. AC’s mission statement is to keep you ahead through control systems that improve productivity j and save energy’.

A Newly appointed chief executive officer (CEO) is anxious about declining share price of AC in the last two years. She identified that the business has grown through acquisition and senior management have focused on making corporate deals but not on making control systems. She announced that the AC’s focus must be on optimization and upgradation of its value generation rather than just getting bigger through acquisitions.

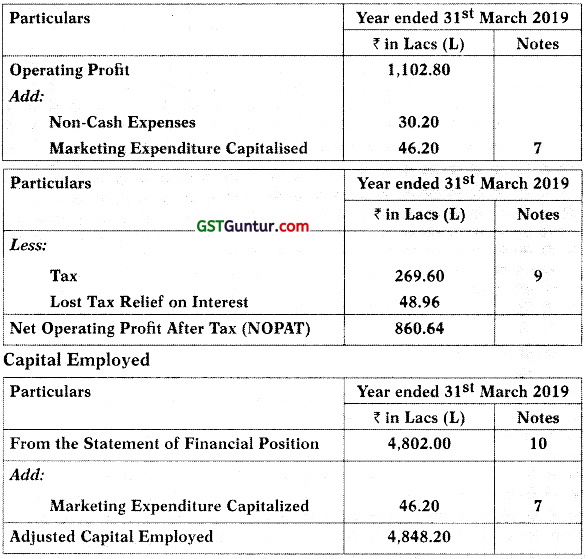

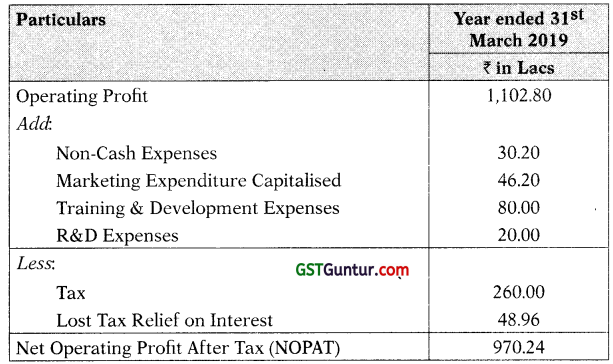

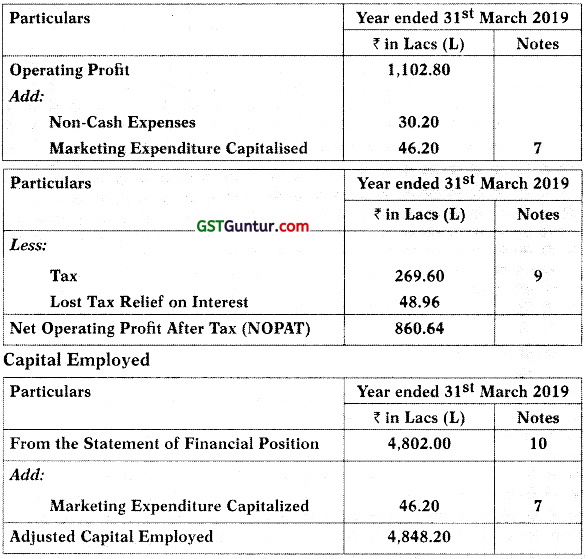

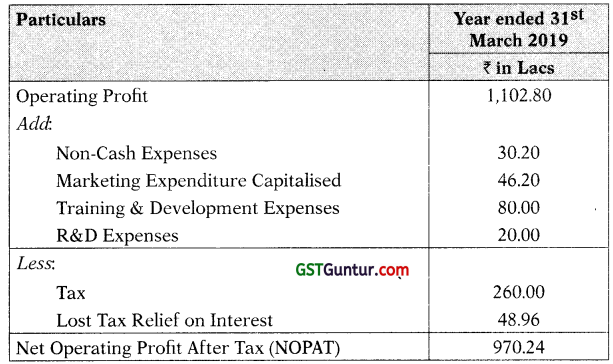

Assuming yourself as a performance management expert of AC, the CEO S? has asked you to aid her in her improvement programme. Firstly, she wants your views on the use of EVA as the key performance metric at AC. You are given the current EVA computation (Annexure 1) but there is some suspicion about whether the assistant who has done this work is sufficiently well trained about this method. So, she requires you to examine his accuracy and the assumptions forming part of the calculation.

Required

Write a report to the chief executive officer to EVALUATE the accuracy of the EVA calculation and the assumptions.

Annexure 1

NOPAT

WACC = (1/2 × 15%) + (1/2 × 7.8%) .

= 11.40%

EVA = NOPAT – (WACC × Capital Employed)

= ₹ 860.64 L – ₹ 4,848.20 L × 11.40%

= ₹ 860.64 L – ₹ 552.69 L

= ₹ 307.95 L

Assumptions and Notes

- Debt/Equity 1:1

- Cost of Equity is 15.00%

- Cost of Debt (pre-tax) is 7.80%

- Tax Rate is 30.00%

- Interest charged in the period was ₹ 163.20 L.

- In current fiscal year, AC spend ₹ 80.00 L in Training and Development by leveraging the latest digital technologies including virtual classrooms to deliver highly relevant training to staff at the point of need.

- Marketing Expenditure has been ₹ 46.20 L each year for the last two years to build the long- term brand.

- The total R&D spending was ₹ 20 L during this year for in-depth study of the TCP/IP protocols. The TCP/IP based products have not been launched yet.

- AC has paid Tax of ₹ 260 L while the tax charged per the accounts was ₹ 269.60 L.

- Capital employed during the Period (from the statement of financial position):

| Opening |

4,564.00 L |

| Closing |

4,802.00 L |

[March 2019 MTP] (20 Marks)

Answer:

Report

To: CEO, Alpha Control

From: Performance Management Expert

Date: 31st May 2019

Subject: Evaluation of EVA at Alpha Control

EVA provides a link between decisions, performance measures and rewards, which focuses managers on performing better. Incentive schemes based on EVA provide better quality information and motivation in making decision which in turn maximise shareholder’s wealth. In other words, EVA links the l operating returns to the assets that were used to generate those returns. The learning which flows from EVA analyses can be perceptive and can allow the manager not only to identify areas of weakness in performance but also to easily find solutions. AC is a multiproduct company having number of factory sites. EVA can help to appraise divisional contributors to, or detractors from, overall profitability. Thus, managers may be educated through EVA and pursue such objectives that improve operating profits investing more capital.

In addition, this report deals with evaluation of the accuracy and assumptions used in the calculation of AC’s EVA. There are many errors in the present calculation of EVA. These have been discussed below and revised calculations are enclosed.

- Non-Cash Expenses have been correctly added back to the profit as these are expenses which do not affect the cash flow of a given period.

- Addition back of Marketing Expenditure is also correct as spending contributes to future value-creation. For the same reason, the prior year spending is also added in to capital employed.

- Training and Development Expenses should be capitalised. Training and Development Expenses have been treated as an expense in the income statement, they should be added back to profit, and added to capital employed (at the end of the year).

- Research and Development (R&D) Expenses should be treated as marketing expenditure for long period.

- The tax expenses in the EVA calculation should be the tax paid with adjustment for lost tax relief on interest and not the adjusted amount of tax charged in the accounts.

- The WACC is incorrect because it should be based on post-tax cost of debt.

- Generally, a company takes, at least, a year’s time to earn a return on investment. Thus, the capital employed figure should be based on the beginning numbers.

NOPAT

Capital Employed

| Particulars |

₹ in Lacs |

| From the Statement of Financial Position (Starting) |

4,564.00 |

| Marketing Expenditure Capitalized |

46.20 |

| Adjusted Capital Employed |

4,610.20 |

WACC = (1/2 × 15%) + (1/2 × 7.8% × 70%)

= 10.2396

EVA = NOPAT – (WACC × Capital Employed)

= ₹ 970.24 L – ₹ 4,610.20 L × 10.23%

= ₹ 498.62 L

The recomputed EVA has increased from ₹ 307.95 Lacs to ₹ 498.62 Lacs | which shows a positive position for AC as it adds up the shareholder’s wealth.

For calculating NOPAT, following most common adjustments to accounting I profit as remarked by the Stern Stewart has been considered.

For Advertising, Research and Development Items expensed, Staff Training

- Impact on Profit: Increase CY’s profit, deduct economic depreciation on PY’s EVA adjustment.

- Impact on Capital Employed: Increase capital employed at the end of the year, increase capital employed in respect of similar add backs of PY’s investments not treated as such in financial statements (net of economic depreciation),

For Depreciation

- Impact on Profit: Add accounting depreciation and subtract economic depreciation.

- Impact on Capital Employed: Alter value of non-current assets (and capital employed) to reflect economic depreciation not accounting depreciation.

For Non- Cash Expenses

- Impact on Profit: Add back to profit.

- Impact on Capital Employed: Add to retained profits at the end of the year.

For tax charge, this will be based on ‘cash taxes’ rather than the accruals based methods used in financial reporting.

Further, the revised calculation of EVA is largely based on the following assumptions:

There is an implicit assumption that accounting depreciation (included in operating profit) is equivalent to economic depreciation (which should be used for EVA calculations). This assumption is doubtful, although there is no information for more accurate calculation.

For Additional Marketing Expenditure, no estimation of economic life (expected period during which an asset remains useful) in building the brand and corresponding economic depreciation has been considered in the above calculation.

No amortisation on the R&D Costs is required to be recognised as the product has not been introduced yet. This is in line with the accounting treatment of such items. There was no Research & Development expenditure in the previous year.

Question 10.

(Economic Value Added)

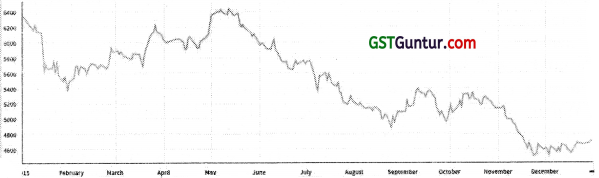

X Greetings is a Korean company based in Seoul committed to supplying the highest quality stationery, greeting cards, gifts, and children’s products, which are sourced from all over the world. Company also distributes Sunday Paper – Korean made eco-friendly stationery designed and manufactured in Seoul. X’s home currency is the KRW. It is also listed on the KRX for last 20 years and its current share price is KRW 23.25. You are a Management Accountant of the X Greetings and directors have asked you to study X on value-based management which is a different approach to the performance management. The directors have heard about this method considering it a way of focusing on shareholder’s interests and in the present economic scenario, they think it to be useful for the growth of X.

Conventionally earnings per share (EPS) and share price were being used to assess performance. The proposed changes are important and the directors require you to have the implications of the new analysis and also want to convince the major investors for the future benefits.

Financial data for X Greetings

| Particular |

2018-19 |

2017-18 |

|

KRW in million |

KRW in million |

| Profit after interest and tax |

55.55 |

65.38 |

| Interest |

15.60 |

8.00 |

| Opening capital employed |

273.58 |

198.40 |

| Closing capital employed |

329.13 |

273.58 |

|

Debt to Equity |

Debt to Equity |

| Capital structure |

40:60 |

40:60 |

|

% |

% |

| Costs of capital |

|

|

| Equity |

14.20 |

|

| Debt (pre-tax rate) |

8.00 |

6.00 |

| Tax rate |

30 |

30 |

| Stock market information: |

|

|

| Average number of shares in issue |

3.2 million |

3.2 million |

| Particular |

2018-19 |

2017-18 |

| Stock market all-share index |

1,985 |

2,561 |

| Retailing sector index |

1,155 |

1,408 |

| X Greetings (share price) |

KRW 22.50 |

KRW 24.40 |

Required

ASSESS the performance of X Greetings using Economic Value Added and ANALYSE the result relative to those of earnings per share (EPS) and share price. Assumptions, if any, should be clearly stated.

Answer:

The performance of X Greetings has gone down since earnings per share is down by 15.03% (W2) from last year. This indicates the company being not in the favour of investors. However, the share price seems up with a decline of only 7.79% relative to fall in retailing sector of 17.97% and the stock market down by 22.49% (W3). The sector comparison is more material for the performance of X as stock market all-share index (KOSPI) is composed of data from financial, manufacturing and other industries whereas retailing sector comparison is specific. This implies that the market views X as one % of the better prospects within the retailing sector that will encourage the shareholders to continue to hold their shares in the company.

In addition, X Greetings has generated positive EVA for 2018-19 KRW 37.03 m (Wl). EVA of FY 2018-19 has fallen from 2017-18 but still it is remained positive and so the company continues to create value for its shareholders even in the bearish market. It is therefore a good investment option even I in a falling market.

Working Note-1

EVA calculations for the periods given are:

| Particulars |

2018-19 |

2017-18 |

|

KRW in million |

KRW in million |

| Profit after interest and tax |

55.55 |

65.38 |

| Add Back: Interest (net of tax at 30%) |

10.92 |

5.60 |

| Net operating profit after tax (NOPAT) |

66.47 |

70.98 |

| Opening Capital employed |

273.58 |

198.40 |

Assumptions:

There are no non-cash expenses to adjust the profit.

Economic depreciation and Accounting depreciation are equal,

No lease exists for capitalization.

Cost of Capital

WACC2018-19 = 0.60 × 14.20% + 0.40 × 5.6096

= 10.7696

WACC2017-18 = 0.60 × 11.5096 + 0.40 × 4.20%

= 8.5896

EVA = NOPAT – Capital Employed × WACC

EVA2018-19 = 66.47 m – 273.58 m × 10.7696

= KRW 37.03 m

EVA2017-18 = 70.98 m – 198.40 m × 8.5896

= KRW 53.96 m

Working Note- 2

| Particulars |

2018-19 |

2017-18 |

Change |

| EPS |

KRW 17.36 |

KRW 20.43 |

-15.0396 |

Working Note- 3

| Particulars |

2018-19 |

2017-18 |

|

| KOSPI (capitalization-weighted index of all common shares) |

1,985 |

2,561 |

-22.4996 |

| Retailing sector index |

1,155 |

1,408 |

-17.9796 |

| X share price |

KRW 22.50 |

KRW 24.40 |

-7.7996 |

Question 11.

(EVA)

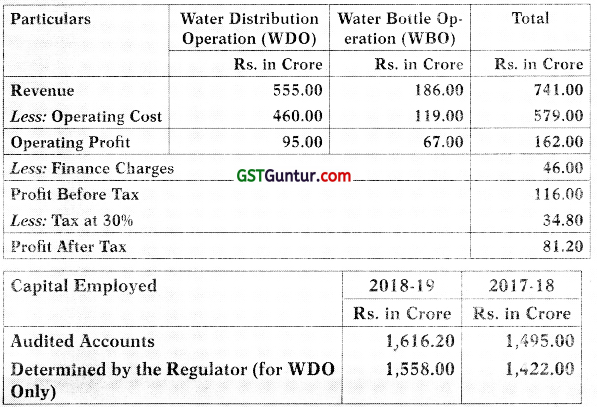

Water Benefit Services (WBS) is a parastatal company established with j an aim for supply and distribution of water in Mumbai as well as supply of water to the various local authorities for distribution to villages and j other small cities adjacent to Mumbai. This involved planning, operating, treating, maintaining, and distributing water resources in the country’s urban centers and other areas mandated by Maharashtra Government. Its mission is “To provide sustainable water in a cost effective and environmentally friendly manner to the economy”.

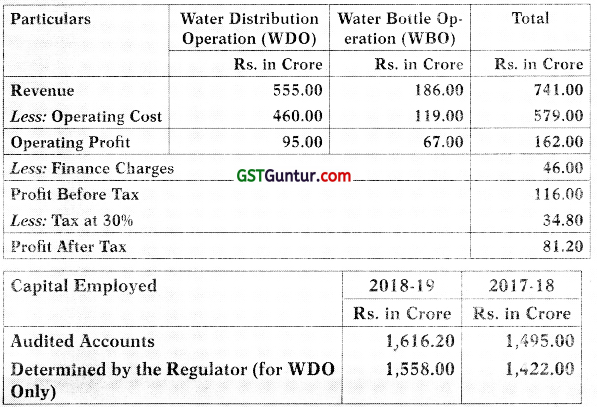

The government ensures that WBS does not take advantage of its monopoly position in the regional area by increasing prices. The government controls majority of services through its water regulatory body which determines an acceptable margin level (ROCE) and ensures that the pricing of WBS within these areas does not break this level. The remaining work i.e. a water bottle operation (WBO) is not regulated by government and WBS charges a market rate for water supply in bottle. The regulator compute return on capital employed (RGCE) of WBS based on its own valuation of the capita! assets which are used in operation and the profit from those services.

Acceptable level of ROCE set by the regulator is 7.00%. If WBS breach this level, then the company would be penalized. WBS board is trying to improve the performance for the benefit of the shareholders, in order to communicate the objective of maximizing shareholders’ wealth, the directors have decided to consider economic value added (EVA) as the key performance indicator.

Compute EVA of WBS based on the following information for the year ending 31 March 2019:

Notes

1. Operating Costs includes:

| Particular |

2018-19 |

2017-18 |

| Rs. in Crore |

Rs. in Crore |

| Depreciation |

118 |

114 |

| Provision for Doubtful Debts |

4 |

1 |

| Research and Development |

24 |

– |

| Other Non-Cash Items |

14 |

12 |

2. Economic depreciation is Rs.166 Crore in 2018-19. In FY 2017-18, economic and accounting depreciation were assumed to be the same.

3. Current year tax paid is (Rs.I8 crore) and deferred tax provisions of Rs.1.50 crore has been adjusted. There was no deferred tax balance before 2018-19. The provision for doubtful debts was Rs. 9 crore in the 2018-19 balance sheet.

4. Research and development has been non-capitalized. It belongs to a new project that will be developed over five years and is expected to be of long-term benefit to the company. 2018-19 is the first year of this project.

5. Cost of Capital

| Equity |

14% |

| Debt (Pre-Tax) |

6% |

6. Gearing of WBS

Required

(i) EVALUATE the financial performance of WBS using EVA. (10 Marks)

(ii) ASSESS whether WBS comply with its acceptable ROCE level (4 Marks)

(iii) ADVISE on how to improve profitability. (6 Marks) [MAY 2019 RTP]

Answer:

(i) Computation of NOPAT

| Particulars |

Rs. in Crore |

| Operating Profit |

162.00 |

| Add: |

|

| Non-Cash Items |

14.00 |

| Accounting Depreciation |

118.00 |

| Doubtful Debts |

4.00 |

| Research and Development |

24.00 |

| Less: |

|

| Economic Depreciation |

166.00 |

| Tax Paid |

18.00 |

| Tax Saving on Interest (Rs. 46 × 30%) |

13.8 |

| NOPAT |

124.20 |

Computation of Capital Employed

|

Rs. in Crore |

| Capital Employed as on 31.03.2018 |

1,495.00 |

| Add: |

|

| Provision for Doubtful Debt as on 31.03.2018 |

5.00 |

| Other Non-Cash Items (incurred in 2017-18) |

12.00 |

| Adjusted Opening Capital Employed |

1,512.00 |

WACC = 0.45 × 1496 + 0.55 × 6% × (1 – 30%) = 8.61%

EVA = NOPAT – (WACC × Capital Employed) = – 5.98 Crores

Evaluation

Presently, WBS is distorting value as it is not able to meet the economic cost of its own capital. This put the company into the question of perpetual succession and lead the company against shareholder’s interest. The reason could be a higher cost of equity for WBS. The investing risk should be low since 75% of the services that the company renders are important for the economy and demand is guaranteed in future. Optionally, WBS needs to either increase its NOPAT enough for break even on economic value added or slash its capital employed by selling unutilized or under-utilized assets.

(ii) Regulatory ROCE: Target 7.00%

ROCE = (Operating Profit/ Capital Employed) × 100%

= (95/1,422) × 100%

= 6.68 %

The ROCE is within the acceptable ROCE of 7.00%.

(iii) Operating Margins

Water Distribution Operation = 17.12% Water Bottle Operation = 36.02%

Advise

Operating margin from WBO is 36.02% compared to 17.12% (WDO). WBS may use the WDO activities as a trusted source of cash profit to reinvest in expansion of the WBO. Expansion through acquisition of appropriate non-regulated businesses using the cash generated by the regulated activities might be a good decision.

Further, WBS may improve profitability by controlling costs within WDO activities through performance measurement. The regulatory body cannot argue that the company is overcharging its customers to increase profit margin. This is possible through strict observance of expenses and using cost savings techniques through efficiency improvements. In order to control cost within WDO, targets should be based on minimal variances and adopting cost cutting methods.

Overall, in WDO, there is only a limited scope for increase in the operating profit since the maximum operating profit allowed, is Rs. 99.54 crore i.e. 7.00% of Rs. 1,422 crore of capital employed. Thus, WBS should go to expand its WBO as this is producing higher operating profit margins.

Question 12.

TRIPLE BOTTOM LINE (TBL)

HEALTH PROVIDER LTD. is a multi-specialty hospital in a mid-sized town. A 300+ bedded facility offers treatment across all medical disciplines of Cardiac, Oncology (Medical. Surgical and Radiotherapy), Neurosciences. Urology, Nephrology, Kidney Transplant, Aesthetics and Reconstructive Surgery, and other ancillary services. Most of the community members have their livelihood linked with the hospital. Marty of them are directly employed at the hospital as doctors, nursing staff, lab technicians or as oilier support staff. While, others arc indirectly related as suppliers of medical devices or drugs to the hospital, catering or housekeeping contractors etc. for the hospital. Hence, existence of the hospital is vital to the community. Growing aw areness about sustainable business prompted the management to identify areas that can help the hospital operate in a sustainable manner that would be mutually beneficial to the organization as well as the town that depends on it. Therefore, it has identified the initiatives that have been put in place to create a sustainable business. Information captured from various departments are being considered to prepare the Triple Bottom Line (TBL) report that is for the consumption both to internal and external stakeholders.

Required

IDENTIFY, which of the following aspects need to be reported in the TBL report and under which of the three categories. Provide reasons for classifying the aspect under a specific category, if applicable.

(i) Medical staff conduct charity camps every month. Open to all members of the community, who are provided with consultation free of charge.

(ii) Prompt and accurate tax payments based on records maintained without errors or fraud.

(iii) Health provider, with the help of traffic police, has implemented a “green corridor” for ambulances that cany donor organs for trans-plantation. Organs harvested from the donor at one hospital can reach another hospital with the recipient patient at the earliest.

(iv) Medical waste is discarded at a landfill in a nearby dumpsite. Some of the waste are not bio-degradable.

(v) During review of the supplier for housekeeping service, it was observed that the service provider resorted to child labour to keep cost of operations lower.

(vi) Training and professional development programs doctors and nurses.

(vii) Lab reports are being made available online within the hospital computer system. This would reduce printing costs and storage space needed to maintain older records.

(viii) Health piovider has a good track record of having no medical negligence litigation cases filed against it.

(ix) The hospital is planning to market medical check-up packages so that facilities in its out- patient department can be utilized better.

(x) The number of inpatient hospital deaths decreased 8%, from 776 in 2016 to 715 in 2017. Assume all aspects are material enough to be reported in the TBL report.

Answer:

Aspects that need to be reported in the TBL report:

| Aspect |

Category on the TBL Report |

| (i) Medical staff conduct charity camps every month. Open to all members of the community, who are provided with consultation free of charge. |

Social bottom line, as it benefits the local community. |

| (ii) Prompt and accurate tax payments based on records maintained without errors or fraud. |

Economic bottom line, since tax payments impact an organization’s bottom line and money flow. |

| (iii) Health provider, with the help of traffic police, has impiemented a “green corridor” for ambulances that carry donor organs for transplantation. Organs harvested from the donor at one hospital can reach another hospital with the recipient patient at the earliest. |

Social bottom line, since green corridor would unable the ambulance to transport harvested organs between the hospitals at the earliest this would be beneficial for patients in need of critical care. |

| (iv) Medical waste is discarded at a landfill in a nearby dumpsite. Some of the waste are not bio-degradable. |

Environmental bottom line, as it

affects the ecological surroundings of the town. |

| (v) During review of the supplier for housekeeping service, it was observed that the service provider resorted to child labour to keep cost of operations lower. |

Social bottom line, since employing child labour leads to exploitation of children within the community. |

| (v) Training and professional development programs doctors and nurses. |

Social bottom line, since it contributes towards employee development. |

| (vi) Lab reports are being made available online within the hospital computer system. This would reduce printing costs and storage space needed to maintain older records. |

Environmental bottom line, since paper, cartridge and storage requirement would be lower. This preserves environmental resources. |

| (viii) Health provider has a good track record of having no medical negligence litigation cases filed against it. |

Social bottom line, since this is an indicator of the quality of services provided to patients. |

| (ix) The hospital is planning to market ‘medical check-up packages’ so that facilities in its outpatient department can be utilized better. |

Not relevant to TBL report. This is a marketing strategy to improve profitability. |

| (x) The number of inpatient hospital deaths decreased 8%, from 776 in 2016 to 715 in 2017. |

Social bottom line, since hospital mortality rate measures the clinical quality. |

Question 13.

(Case Study : Triple Bottom Line)

TEK Ltd. is a paper mill producing excellent quality writing and printing paper. It is located in a small town where eucalyptus, acacia and casuarina trees grow in plenty, which are required in the paper production process. It sources its raw material from pulp-wood plantations that grow the abovementioned trees. These plantations are located in degraded agrarian Sand surrounding the factory site, which was previously waste-land. Their owners are subsistence farmers, who have been encouraged to grow these trees to source raw’ material for the paper mill. The mill’s local procurement policy has thus provided a source of livelihood for this community. Moreover, almost 40% of the staff working at the mill are from the local community. Most of the mill’s labour force lives in residential areas near the factory site. Catering to the mill employees’ livelihood needs like food, clothing, education etc. has given the town alternate sources of income and thus has benefited the town. The plant managers at the mill have been working on various projects in order to build a sustainable business. This includes, reducing waste during the manufacturing process, imparting knowledge to local farmers at the pulp-wood plantations to improve the quality of wood through breeding and seed improvement techniques. Operations at the mill have yielded substantial profits over the last 15 years since inception.

You are the chief accounting officer of TEK taking care of all the reporting (internal and external) needs of the company. Recently, you read about the Triple Bottom Line (TBL) reporting that many other companies are following. You feel the need to introduce TBL reporting because:

The vital role played by the mill towards the development of the town. This can be highlighted in the TBL report. This will enhance the company’s goodwill. At the same time, you feel the need for transparency of operations and balancing the need of various stakeholders involved. All this can be addressed by publishing the TBL report periodically.

The mill’s operations are driven by the resources available in the environmeet. What the mill takes should be returned in equal if not in a higher measure. TBL reporting can help identify opportunities of giving back to the environment.

You have an appointment with the Chief Executive Officer to discuss this reporting framework. During a preliminary discussion, the CEO was sceptical of the need for additional reporting. “We are here to do business, profit should be the sole parameter for measuring our success. Shareholders are our only stakeholders. Annual reports would provide sufficient information to others who are interested in our operations. ”

Required

To convince the CEO, you need bring out the differences traditional accounting framework and the triple bottom line framework. Draft an e-mail on this subject that you need to send to the CEO for discussion at the meeting.

[April 2019 MTP] (20 Marks)

Answer:

To: CEO

From: Chief Accounting Officer

Date: 02/03/20XX

Subject: Traditional Accounting Framework vs. Triple Bottom Line

Framework Please find below comprehensive study on both frameworks in context of the TEK.

Best Regards,

Chief Accounting Officer

………………………………………. Attachment ………………………………………

Difference between traditional accounting framework and triple bottom line framework.

(i) Traditional accounting framework has a “single bottom line” that focuses on the profit that our company has made during the financial year. This is calculated by reducing costs, including the cost of capital, from revenues earned during the period, to arrive at the net profit that is available to the shareholders. This reporting framework has its focus on meeting the informational needs of mainly one category of stakeholder within the company, namely its shareholders. It satisfies the information needs of those interested in the financial aspects of business. It does not provide much insight on the social, environmental and economic implications of its operations.

Albeit, some information about its operations is available in various parts of its annual report, like the management discussion and analysis section or the chairman’s letter to shareholders. However, this is generally not sufficient to satisfy the information needs of other stakeholders, some of whom can be our company’s employees, customers, suppliers, communities living near our factory site or even the government. Transactions that do not directly impact our company are ignored. Recognition of an expense partly depends on utilization of assets. For example, costs incurred to operate machines used in the pulping process would include labour expense, repairs, depreciation, utility etc. These get captured as part of cost of goods manufactured in our financial reports. Therefore, assets and their related expense, that are owned and within the control of the company will be reported in the financial reports.

However, certain assets are neither owned nor controlled by the organization, yet it utilizes these resources in its operations. For example, the waste water from our company is discharged in the river nearby.

The waste water contains solids, chemicals and metal compounds that were used during production. This pollutes the river water, which is the primary source of water for our town. This poses both an environmental and health risk to the citizens. Although we have taken sustainability initiatives to reduce this waste, we do not pay to clean up the river water. It is the government that undertakes the onerous task of cleaning up the river water and also bears the clean-up cost. This aspect of our company’s operations and the associated cost will not get captured in our financial reports. Hence, the true cost of operations of our company is greater than the costs reported in the financial reports. Moreover, the market price that we charge our customer for our paper product does not factor this cost. Consequently, both our company and our customers who use our product end up under-pricing the cost to the environment and society.

It can be concluded that under traditional financial reporting, sustainability and our company’s performance are mutually exclusive. At the same time, information about sustainability is extremely important to other stakeholders like the community living next to the factory site since it affects their lifestyle, the local government that may be incurring substantial expense to nurture back the environment or environmentalists that seek to protect the habitat of other species. It might be critical for our company. Healthy environment and society are key drivers to sustain our operations. “Can we do business in a world fraught with sickness due to pollution?”

On the other hand, triple bottom line reporting framework focuses on a more broader view of the company addressing the interests of various other stakeholders. These stakeholders could our company’s employees, creditors, customers, communities near the factory site, government etc. The objective is to force ourselves to identify areas within our operations to create sustainable initiatives that would, in the long run, be beneficial to its current and future stakeholders as well as to our company itself. It focuses on the impact of the decisions and operations of our company on the society, environment, and economy. Known as 3Ps, people, planet and profit, hence the name “triple bottom line”. Triple bottom line goes beyond the financial aspects of an organization’s performance. This helps stakeholders make more informed assessments of the opportunities and risks that the company faces.

(ii) Traditional accounting framework uses the reporting currency as the unit of measurement. It follows the accounting and reporting principles generally accepted in the country it operates.

Materiality under this framework, is measured in monetary terms, that could impact the decisions of a rational investor. On the other hand, there is no uniform standard or measure for the TBL framework. Measurement of an aspect, therefore its materiality, could either be financial or non-financial. Organizations could follow the metrics suggested in the Global Reporting Initiative (GRI) framework. In India, efforts are underway to align the GRI with the Business Responsibility Report (BRR) mandated by SEBI for some of the public companies, The TBL report focuses on both the positive and negative impact of the organization’s performance on the society, environment and economy. TBL reporting may be (i) core reporting, report selective metrics or (ii) comprehensive reporting, a detailed report based on the GRI standards.

In summary, while financial reports provide information about the profitability of our company, TBL enhances the information available to various stakeholders who may hold different perspectives of the company’s business operations. TBL will work well to supplement | information in the financial statements.

Overall business strategy should be linked to the TBL reporting to work towards a sustainable future. Our company has already been working sustainability initiatives. Waste generation is being tackled by our plant managers. Metrics for this report has to come from various departments. Awareness about sustainability and its impact may open up opportunities that are currently being overlooked. Our company has been a lifeline for this town for the past 15 years. Why not use the TBL to highlight these positive aspects and garner goodwill for our company? TBL reporting need not remain another administrative task requiring just data gathering. It might vitalize our company to achieve greater heights of success.

Question 14.

(Triple Bottom Line)

The triple bottom line recognizes that a company’s performance should not only be viewed in terms of its ability to generate economic profits for its owners, but also by its impact on people and the planet for its long term economic and social viability. LMN Limited has recently undertaken initiatives towards sustainability as below :

(i) Reduced the amount of plastic usage in the peanut butter jars.

(ii) Provided financial support to hospital run by local authority in the vicinity of the factory.

(iii) Constructed solar powered warehouse.

(iv) Generate profit for the company’s shareholders.

(v) Started child care unit for the benefit of women employees as well as for the neighbourhood community.

Required

IDENTIFY whether this initiative would primarily impact people, planet or profit [Nov 2019 Exam] (5 Marks)

Answer:

Triple Bottom Line

Identification of initiatives undertaken by LMN Ltd. into categories it would impact based on the Triple Bottom Line Model – People, Planet or Profit.

| Reduced the amount of plastic usage in peanut butter jars. |

Planet |

| Provided financial support to hospital run by local authority in the vicinity of the factory |

People |

| Constructed solar powered warehouse |

Planet |

| Generated profit for the company’s shareholders |

Profit |

| Started child care unit for the benefit of women employees as well as for the neighbouring community |

People |

Examiner Comment: This question was related to triple bottom line. Most of the examinees scored full marks.

Question 15.

Case Scenario (Triple Bottom Line Approach)

Fashion industry prospered more than any other industry and it kepi blooming with new trends being brought weekly and almost all being sold in no time. The NextGen clothing (NGC) into the fashion industry, situated in the outskirts of Deshipur, had several textile plants, nurturing the needs of the community. NGC had a good base of labourers and farmers, few of them aged under 14, from nearby locations enrolled into the program. They had no source of employment past the cloting plants. It gave boost to their living avenues with receptivity to all modern facilities of living. They worked overtime to get NGC to where it wanted to be.

The raw materials did not cost much toNGC, given the local availability and the cheap quality. The low financial cost and the low sale price it offered to its customers allowed it to churn out cotton and viscose fabricated clothes in humungous quantities. The citizens loved the articrafts brought out by the designers and the cotton material pleased them.

NGC had no history of reporting sustainable efforts to build up a strong environment to work in. It reported phenomenally huge profits in past three years, paid out impressive dividends to its shareholders, bonuses and lucrative overtime pays to its labourers. All were happy and no one complained about the sustainability aspect, the duty it owes to its surroundings and the greater environment.

The community focused on the form rather than the substance of it. It ‘ kept overlooking the brutal effects of producing cotton and viscose in local farms which was the primary source of raw material for NGC. s One day NGC learnt that a scholar born and brought up in Deshipur, studied in Northern America, returned to his hometown. He presented brain storming sessions to the civilized people which made them rethink on their clothing habits. His sessions were summarized below:

Cotton

First of all, the production of cotton involves enormous water usage, which is already a scarce resource globally. Just to manufacture cotton enough to make a t-shirt, involves using liters of water. Above that fertilizers and pesticides employed takes a toll on farmers health. They become ill often than not. Not just the cotton producing process is environmentally non tenable, it involved tons of water for spinning the cotton and dying the fabric to make the cloth. The chemical composed @ water then flows to the nearby rivers and hampers the life of water beings and people around.

Viscose

This is a semi synthetic matter derived directly from wood pulp and converted into cloth by application of chemicals and water. Most of the deforestation can be ascribed to the paper production and rayon production. The greedy merchants overlook even the protected areas to get the required pulp. The sprouting air pollution and water pollution has left community residents forsaken to cry over their fate. The use I of harmful chemicals leads to diseases like cancer and heart strokes.

We, the Customers

The ridiculously low prices of the clothes with the advent of the internet have created a desperate demand of clothes and have led to surge in its buying frequency. Hardly few of us contemplate on how a t-shirt or jeans ; we are wearing was made, what processes they had to undergo before it took that shape and the extent of loss and injury it caused persistently, ;

In a nutshell, his sessions were about the ideas hinting at the destructive impacts on environment thatNGC is bringing to their plate. They gave a patient listening to all his talks, welt fabricated in their native language, free from any fictions.

The training sessions of the scholar, Raghupicked up many ears, it was all over the country and NGC started to perceive this as the verge of its downfall. NGC had to give a rethinking on the way clothes were made.

Required

RECOMMEND ways to bring a turnaround in the reporting framework and go extra miles to do something “sustainable” for the environment

Answer:

Sustainability is a wider phenomenon in itself and cannot be narrowed to just the environment and its people. Ensuring sustainability in a profound context means not just to make the present secure but also considering the needs of the future for the resources. This can be done when there is well blend of demand and supply of such resources.

As per the triple bottom line approach, in the context of fashion, sustainability is interpreted as using environmentally ethical means of producing wearables like clothes, footwears, and other apparels. This approach considers the challenges that a production process brings to the people and the planet even if of less intensity to the firm itself, in the short run. The triple bottom line counts in the advantage of the greater stakeholders rather than the traditional shareholders as noted down from a traditional reporting policy.

Therefore, a sustainable fashion is an undertaking to consider the implications of triple bottom line pillars i.e., environment or planet, the people, and the profitability of the firm) when producing consumables. This holistic approach looks beyond just the term fashion and does what is to be done to put in place an ecological balance.

Once we understand the term sustainability, we now catalog some of the sustainable efforts that are recommended in the situation of NGC and they are:

Producing quality materials

Now a days firms are resorting to producing cheap materials that cost them less to produce and sell. Bearing the come and go fashion in mind, their produces have less longevity and are more representative of use and throw stuffs. Given the environmental boost, NGC should use materials that guarantee longer lasting textiles, thoughtfully designed and priced. This will plunge the need to buy the clothes so often and will enhance the clothing experience of the masses. The highly priced material will lower the demand and keep at bay its accessibility to all. From a short-term perspective, this may sound a financial hit which in the long term will prove a reputational boost to the firm, given the drastic change in quality it adapts to.

Spreading awareness among the customers

Though many expectations are just around the firms engaged in textile production and sale thereof, the customers are no less responsible in turning down the clothes and discarding them in less environmentally amicable manner. They do not discard the clothes in the right time and at right place, rendering the clothes unsuitable for reuse. The thrift stores and donation center are propelled to throw such unfit clothes. As per reports, only established donation centers or processing centers are able to sell overwhelming quantities of secondhand clothing and footwears. So, there is a strong relation between the conscious buying choice of the customers and the sustainability in the fashion industry. With less numbers of purchases of good quality pieces, they can support sustainability.

Using organic materials and addressing safety issues

Triple bottom line suggests that reducing financial expense at the cost of health of its people can cost unimaginative money to the firm in the long run. A firm cannot be seen in isolation to its people who work for its interest and the local residents that live around. As indicated from the facts above, we are aware that producing cotton and viscose involved usage of enormous pesticides and fertilizers that ultimately impaired the health of the farmers and other people involved. They end up having life threatening diseases like cancer and heart strokes. Organic material does not necessarily eliminate the application of pesticides and other toxic materials; however, it will reduce its usage to an acceptably low level. Though restoring to organic materials would not lead to reversal of harmful effects that occur once the cotton is harvested, it will present considerable relief to the health of its people. The adversity occurring by way of colossal use of water to produce organic cotton as compared to the ordinary cotton has to be kept in mind though. This aspect will risk the sustainability of the water for the future generation, an already scarce resource for the present as well.

Moreover, selling the produce for cheap prices, will mean an adjustment to the wages of the labourers and farmers they receive for their hard work. Historically we have seen that firms with an attempt to practice price competition, try to cut down their production cost by compromising the quality of machines they use, providing below standard working environment to their workers, undue firing of skilled people. All of these presents an ongoing challenge to the wellbeing of those people such that they are forced to eke out their living.

Channelizing efforts towards recycling

NGC can introduce in novative recycling channels to ensure that customers are enticed to turn over the used clothes rather than throwing them away, Having a recycling collector at its store with a catchy slogan like 20% discount on fresh stocks for the used clothes, can help. This effort directs people to resort to reusing their old stuffs so that the landfill pressure reduces thereby reducing the emission of carbon gases in the environment. Few firms collect their own products, and after working on them, are sold below normal prices.

Alternatively, NGC can seek the services of third party that can help them buying secondhand clothes and sorting those based on their quality and resale the ones suitable for use and get others to the recycling process, Such unsold clothes left over can be used as raw materials by carpet manufacturers or other textile manufacturers.

Compliance to local labour laws

The true cost of any firm is not just the perceivable financial cost that is reported in its annual publications, it also comprises of the non-financial costuot counted in the context of financial reports. As mentioned above, the low quality of machines can cause myriad accidents at NGC’s plant thereby putting it into legal liabilities which is although a financial cost for the firm but will prove to be reputational risk in the long run, a non-financial cost.

Ethical manufacturing also means complying by the local laws of the country pertaining to usage of labour. We see that NGC are pulling in children of age below 14 years to get their job done. Rather than defending the rights of its workers, it puts an imminent risk to the local kids. It is against the local labour laws to hire child labour and provoke them to work when it is their right to receive educational and nutritional support at this age.

Producing Poly clothes

We see the most expensive sportswear made out of recycled polyester materials, which comes as no surprise. Thanks to the ethically aware multinational firms. It is suggested that NGC should direct its effort in reducing the negativity of plastic remnants brought into the cycle. The plastic materials like ketchup bottles, pickle and oil containers are processed to a liquid consistency which is then turned into reusable fabrics. The demand for cotton clothes is surging globally and polyester made clothes appears to bring a switch over. Poly clothes have less ecological impacts compared to cotton and are easily recyclable; and consume less water.

Reducing the usage of water consumption

As evidenced from the facts, each cloth made to wear consumes liters of water. This usage of water can be controlled by manufacturing as per the just in time approach rather than churning out humungous quantities. This will allow controlled production of raw material on need basis and in turn the limited manufacture of the clothes. NGC can adapt the policy of taking customized order made to manufacture what is ordered for. This will also ensure limited flow of hazardous chemically composed water to the nearby rivers, thus managing the risk of commoners’ lives.