CA Final SFM Study Material: ICAI Strategic Financial Management CA Final Study Material bridge the gap to your success. You can make use of the CA Final SFM Chapter Wise Important Questions and Answers via quick links available and score the best in exams. Don’t bother about your test preparation, as you can easily prepare with the CA Final SFM Practice Manual New Syllabus. You can identify your strengths and weaknesses using the CA Final Study Notes and ace up the preparation.

- CA Final SFM Study Material Notes New Syllabus

- CA Final SFM Chapter Wise Weightage New Syllabus

- CA Final SFM Practice Manual

- SFM CA Final New Syllabus

- How to Prepare for CA Final Exam?

- FAQs on CA Final SFM Study Material

CA Final SFM Study Material Notes New Syllabus – Strategic Financial Management CA Final Study Material Notes

Exam-registered candidates who are seeking the ICAI CA Final Strategic Financial Management SFM Study Material Question Bank Notes Pdf can check this page. Use the quick links of each concept and start preparing theory topics. CA Final SFM Study Material Practice Manual covers the important questions, all topics according to the latest syllabus, and the practice manual.

Tap on the topics links to get the important questions of CA Final Strategic Financial Management SFM.

CA Final Strategic Financial Management Study Material – CA Final SFM Practice Manual

- Financial Policy and Corporate Strategy

- Risk Management

- Security Analysis

- Security Valuation

- Portfolio Management

- Securitization

- Mutual Funds

- Derivatives Analysis and Valuation

- Foreign Exchange Exposure and Risk Management

- International Financial Management

- Interest Rate Risk Management

- Corporate Valuation

- Mergers, Acquisitions and Corporate Restructuring

- Startup Finance

- CA Final SFM Paper Nov 2020

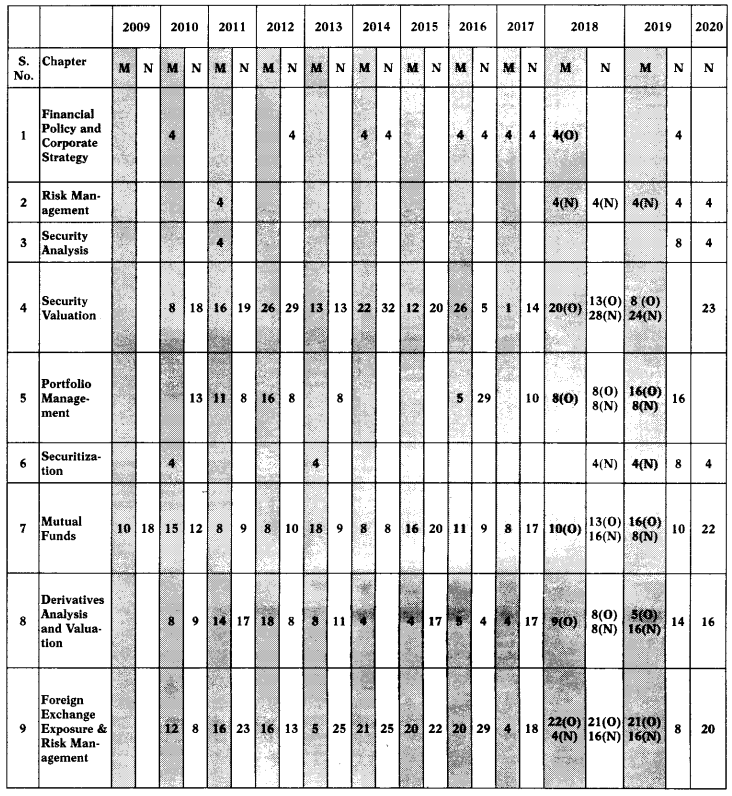

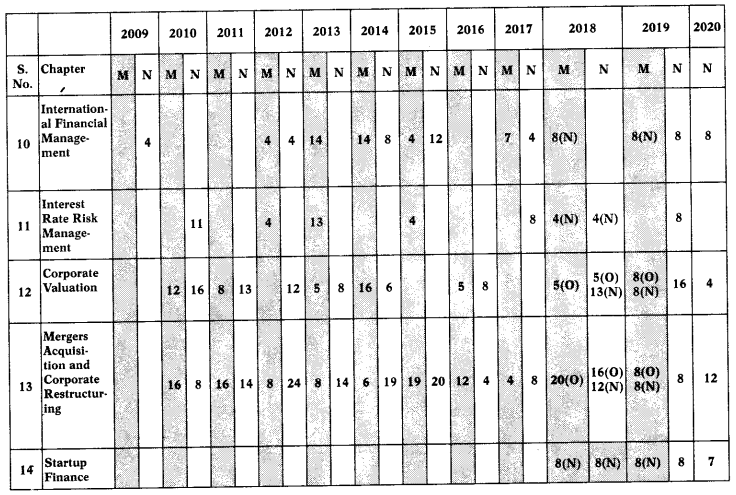

CA Final SFM Chapter Wise Weightage New Syllabus

Chapter Wise CA Final Strategic Financial Management SFM Weightage New Syllabus contains a list of high-weightage concepts. It also has the number of marks from each chapter. Get the important topics and prepare them with 100% confidence.

CA Final SFM Marks Distribution

Note: O = Old Syllabus, N = New Syllabus

CA Final SFM Practice Manual

CA Final Study Material and CA Final Strategic Financial Management Practice Manual is also important book that everyone should refer to. It has the topics and explanations for every topic in detail. You can even get the answers for the CA Final SFM Important questions at this practice manual notes.

- Initial Pages

- Chapter 1: Financial Policy and Corporate Strategy

- Chapter 2: Risk Management

- Chapter 3: Security Analysis

- Chapter 4: Security Valuation

- Chapter 5: Portfolio Management

- Chapter 6: Securitization

- Chapter 7: Mutual Funds

- Chapter 8: Derivatives Analysis and Valuation

- Chapter 9: Foreign Exchange Exposure and Risk Management

- Chapter 10: International Financial Management

- Chapter 11: Interest Rate Risk Management

- Chapter 12: Corporate Valuation

- Chapter 13: Mergers, Acquisitions and Corporate Restructuring

- Chapter 14: Startup Finance

- Study Material

- Revision Test Papers

- Suggested Answers

- Mock Test Papers

- Question Papers

- Referencer for Quick Revision

- Hindi Medium – Study Material relevant for November, 2019 examination

SFM CA Final New Syllabus

ICAI has updated the new syllabus for CA Final exam. Here we are providing the chapter-wise concepts as per the CA Final SFM New Syllabus.

CA Final SFM Syllabus – CA Final Strategic Financial Management Syllabus

Paper 2: Strategic Financial Management

(One Paper – Three hours – 100 marks)

Objective:

To acquire the ability to apply financial management theories and techniques in strategic decision-making.

Contents:

1. Financial Policy and Corporate Strategy

(i) Strategic decision-making framework (ii) Interface of Financial Policy and strategic management (iii) Balancing financial goals vis-a-vis sustainable growth.

2. Risk Management

(i) Identification of types of Risk faced by an organisation (ii) Evaluation of Financial Risks (iii) Value at Risk (VAR) (iv) Evaluation of appropriate methods for the identification and management of financial risk.

3. Security Analysis

(i) Fundamental Analysis (ii) Technical Analysis- Meaning, Assumptions, Theories and Principles, Charting Techniques, Efficient Market Hypothesis (EMH) Analysis.

4. Security Valuation

(i) Theory of Valuation (ii) Return Concepts (iii) Equity Risk Premium (iv) Required Return on Equity (v) Discount Rate Selection in Relation to Cash Flows (vi) Approaches to Valuation of Equity Shares (vii) Valuation of Preference Shares

(viii) Valuation of Debentures/Bonds.

5. Portfolio Management

(i) Portfolio Analysis (ii) Portfolio Selection (iii) Capital Market Theory (iv) Portfolio Revision (v) Portfolio Evaluation (vi) Asset Allocation (vii) Fixed Income Portfolio (viii) Risk Analysis of Investment in Distressed Securities (ix) Alternative Investment Strategies in the context of Portfolio Management.

6. Securitization

(i) Introduction (ii) Concept and Definition (iii) Benefits of Securitization (iv) Participants in Securitization (v) Mechanism of Securitization (vi) Problems in Securitization (vii) Securitization Instruments (viii) Pricing of Securitization Instruments (ix) Securitization in India.

7. Mutual Fund

(i) Meaning (ii) Evolution (iii) Types (iv) Advantages and Disadvantages of Mutual Funds.

8. Derivatives Analysis and Valuation

(i) Forward/Future Contract (ii) Options (iii) Swaps (iv) Commodity Derivatives.

9. Foreign Exchange Exposure and Risk Management

(i) Exchange rate determination (ii) Foreign currency market (iii) Management of transaction, translation, and economic exposures (iv) Hedging currency risk (v) Foreign exchange derivatives – Forward, futures, options, and swaps.

10. International Financial Management

(i) International Capital Budgeting (ii) International Working Capital Management- Multinational Cash Management, Objectives of Effective Cash Management, Optimization of Cash Flows/Needs, Investment of Surplus Cash, Multinational, Receivable Management, Multinational Inventory Management.

11. Interest Rate Risk Management

(i) Interest Rate Risk (ii) Hedging Interest Rate Risk- Traditional Methods, Modern Methods including Interest Rate Derivatives.

12. Corporate Valuation

(i) Conceptual Framework of Valuation (ii) Approaches/Methods of Valuation- Assets-Based Valuation Model, Earning-Based Models, Cash Flow-Based Models, Measuring Cost of Equity, Capital Asset Pricing Model (CAPM), Arbitrage Pricing Theory, Estimating the Beta of an unlisted company, Relative Valuation, Steps involved in Relative Valuation, Equity Valuation Multiples, Enterprise Valuation Multiple, Other Approaches to Value Measurement, Economic Value Added (EVA), Market Value Added (MVA), Shareholder Value Analysis (SVA), Arriving at Fair Value.

13. Mergers, Acquisitions and Corporate Restructuring

(i) Conceptual Framework, (ii) Rationale, (iii) Forms, (iv) Mergers and Acquisitions- Financial Framework, Takeover Defensive Tactics, Reverse Merger (v) Divestitures- Partial Sell off, Demerger, Equity Carveouts (vi) Ownership Restructuring- Going Private, Management/Leveraged Buyouts (vii) Cross-Border Mergers.

14. Startup Finance

(i) Introduction including Pitch Presentation (ii) Sources of Funding (iii) Start-up India Initiative.

How to Prepare for CA Final Exam?

Many of the qualified candidates have followed this CA Final SFM Study Plan along with the preparation tips.

- To begin the preparation strategy, it is better to collect the CA Final SFM New Syllabus.

- Analyse the important concepts through CA Final Strategic Financial Management Question Papers.

- Concentrate more on the high-weightage concepts during the preparation.

- Everything can’t be studied in less time, so prepare repetitively asked questions and attend the mock tests.

- Coaching materials help with quick preparation.

- Make a proper time table and study all the subjects.

- Do revision before the exam.

FAQs on CA Final SFM Study Material

1. How to get study material for CA final?

Go through the new CA Final Syllabus and identify the important questions from all subjects. Strat preparing all the theory topics and do a quick revision.

2. Which is the toughest subject in CA final?

Advanced management accounting is the toughest subject in the CA Final Syllabus.

3. Is study material enough for CA final SFM?

Yes, CA Final SFM Study Material is enough for clearing the exam.

Key Takeaways

We hope that the details given here regarding CA Final SFM Study Material Notes PDF Download are useful for you. Along with the Strategic Financial Management practice manual, you can also find the study material. If you want to include any other data, let us know via the comment section. Get in touch with the site to know more related articles.