Penalties and Prosecutions – CA Final DT Question Bank is designed strictly as per the latest syllabus and exam pattern.

Penalties and Prosecutions – CA Final DT Question Bank

Question 1.

The A.O. completed the assessment of X Ltd. u/s 143(3) for the A.Y. 2018-19 on 30.12.2020. The A.O. has initiated the proceedings for penalty u/s 270A on 30.12.2020. What is the time limit for imposition of such penalty in the following cases?

(i) X Limited did not contest the assessment order.

(ii) X Limited contested the assessment order by filing appeal to the Commissioner (Appeals). The appeal was dismissed on 30th December, 2021, on which date the Commissioner received the appeal order.

(iii) The jurisdictional High Court stayed the penalty proceeding on 25th 4 June, 2021 and the Supreme Court vacated the stay on 25th November, 2021. [CA Final Nov. 2012] [5 Marks]

Answer:

Section 275(1) provides for the time limit for imposing penalty. According to this section, the time limit for imposition of penalty u/s 270A in the following cases would be:

![]()

(i) If X. Limited did not contest the assessment order:

Where the relevant assessment order is not the subject matter of either appeal or revision, an order imposing penalty shall not be passed

- after the expiry of the financial year in which the proceedings, in the course of which action for the imposition of penalty has been initiated, are completed, i.e. 31st March, 2021, or

- six months from the end of the month in which action for imposition of penalty is initiated, i.e. 30th June, 2021 whichever is later.

Therefore, the time limit for imposing penalty in this case would be 30th June, 2021.

(ii) If X. Limited made an appeal to the CIT(A) against the assessment order and the appeal was dismissed on 30th December, 2021 on which date the CIT received the appeal order:

Where the assessment order or other order is the subject matter of an appeal to the CIT(A) u/s 246A, and the CIT(A) passes the order disposing of such appeal, an order imposing penalty shall be passed:

- before the expiry of the financial year in which the proceedings, in the course of which action for imposition of penalty has been initiated, are completed i.e. 31st March, 2021 or

- within one year from the end of the financial year in which the order of the CIT(A) is received by the CCIT or CIT i.e. 31st March, 2023, whichever is later.

Therefore, the time limit for imposing penalty in this case would be 31st March, 2023.

(iii) If the penalty proceeding is stayed by the High Court on 25th June, 2021 and the stay is vacated by the Supreme Court on 25th November, 2021.

The period of stay is to be excluded from the time limit for imposition of penalty. Therefore, the time limit for imposing penalty in this case would be 30th November, 2021 (Normal Time Limit i.e. 30.06.2021 + 5 Months).

![]()

Question 2.

Examine the correctness of the following statements in the context of the provisions of the Income-tax Act, 1961.

The assessee, who is required to furnish a statement «f financial transaction or reportable account, fails to furnish the same. He is- liable for penalty u/s 271FA of the Income-tax Act, 1961. [CA Final Nov. 2014] [2 Marks]

Answer:

The statement is correct. In case of failure to furnish a.statement of financial transaction or reportable account within the time prescribed i.e., on or before 31st May immediately following the financial year in which the transaction is registered or recorded, a penalty of ₹ 500 per day is payable.

A penalty of ₹1,000 per day is payable on failure to furnish a statement of Financial transaction or reportable account in compliance of notice issued u/s 285BA(5).

![]()

Quarter 3.

(i) Explain Sec. 278C applicable in respect of offences committed by Hindu Undivided Families.

(ii) Fox limited failed to furnish information and documents sought by the Transfer Pricing Officer (TPO). Can TPO levy penalty for such failure? How much would be the quantum of penalty imposable for the said failure? [CA Final Nov. 2015] [6 Marks]

Answer:

(i) As per section 278C(1), where an offence been committed by a Hindu undivided family (HUF), the karta shall be deemed to be guilty of the offence and shall be liable to be proceeded against and punished accordingly. However, the karta shall not be liable to any punishment if he proves that the offence was committed without his knowledge or that he had exercised all due diligence to prevent the commission of such offence.

As per section 278(2), where an offence has been committed by a HUF and it is proved that the offence has been committed with the consent or connivance of, or is attributable to any neglect on the part of any member of the HUF, such member shall also be deemed to be guilty of that offence and shall be liable to be proceeded against and punished accordingly.

(ii) As per Sec. 271G; if any person who has entered into an international transaction or specified domestic transaction fails to furnish any such information or document as required by section 92D(3) sought for by the Transfer Pricing Officer, then, such person shall be liable to a penalty which may be levied by the A.O. or the Transfer Pricing Officer or the Commissioner (Appeals). Penalty would be a sum equal to 2% of the value of international transaction or specified domestic transaction for each such failure.

![]()

Question 4.

Mr. Madhusudan is regular in deducting tax at source and depositing the same. In respect of the quarter ended 31st December, 2020 a sum of ₹ 75,000 was deducted at source from the contractors. The statement of tax deducted at source u/s 200 was filed on 23rd March, 2021 for the quarter ended 31.12.2020.

(i) Is there any delay on the part of Mr. Madhusudan in filing the statement of TDS?

(ii) If the answer to (i) above is in the affirmative, how much amount can be levied on Mr. Madhusudan for such default u/s 234E?

(iii) Is there any remedy available to him for reduction/waiver of the levy? [CA Final Nov. 2015] [6 Marks]

Answer:

As per Sec. 200(3), every person, after paying TDS to the credit of Central Government, shall file a TDS Return quarterly. The due date of filing the return for the quarter ending on 31st December, 2020 is 31th January, 2021.

(i) Yes, there is a delay on the part of Mr. Madhusudan since he has filed return of TDS on 23rd March, 2021 instead of 31 st January, 2021. The delay is of 51 days.

(ii) As per Sec. 234E, if a person fails to deliver or cause to be delivered a TDS/TCS return within the prescribed time, he shall be liable to pay a fee of ₹ 200 for every day during which the failure continues. However, the amount of fee shall not exceed the amount of tax deductible or collectible, as the case may be. This fee has to be paid before delivering the TDS/TCS return.

Since, Mr. Madhusudan has made a delay of 51 days, a fee of ₹ 10,200 (i.e. 51 days x ? 200) shall be levied u/s 234E. The amount of TDS is ₹ 75,000 and hence the amount of fee is not exceeding the same.

(iii) The CBDT is empowered to issue general or special orders in respect of any class of incomes or class of cases, whether by way of relaxation of any of the provisions of sections 139,143, 144,147 etc. or otherwise. The CBDT may issue such order/s) from time to time, for the purpose of proper and efficient management of the work of assessment and collection of revenue. Section 234E is included in the list of sections in respect of which the CBDT is empowered to issue order for relaxation of the provisions of the Act.

Hence, the remedy available to Mr. Madhusudan is that he can file an application to the CBDT under section 119 and seek waiver/reduction of the penalty levied/leviable under section 234E.

![]()

Question 5.

An assessee deducted the tax at the time of making the payment of salaries. However, it delayed depositing the amounts of tax deducted with the revenue. The quantum of tax deducted was deposited with the revenue along with the interest by the assessee on its own before any notice determining the amount or declaring the assessee to be in default was made by the Revenue. The Assessing Officer levied penalty under section 221 of the Income-tax Act, 1961, for failure to pay tax deducted at source within the prescribed time. Is the action of Assessing Officer justified? [CA Final May 2016] [4 Marks]

Answer:

The issue under consideration in this case is whether the A.O. was justified in levying penalty u/s 221 when the assessee had voluntarily remitted the tax deducted at source, though belatedly.

In the case of Reliance Industries Ltd. v. CIT (2015), the Bombay High Court observed that as per section 201, a person is deemed to be an assessee-in- default for failure to deduct tax or after deduction, pay the tax to the credit of the Government within the prescribed time.

In this case, the assessee has deducted the tax but failed to pay the tax so deducted to the credit of the Government within the prescribed time. Hence, it would be deemed to be an assessee-in-default for failure to pay the tax after deduction. Consequently, penalty u/s 221 would be attracted.

Further, the assessee would not cease to be liable to penalty u/s 221 merely by reason of the fact that before the levy of penalty, he has paid the tax [Explanation to section 221(1)]. The action of the A.O. in this case is, therefore, justified.

![]()

Question 6.

What is the quantum of penalty that could be levied in each of the following cases:

- Failure to get books of account audited as required under section 44AB within the time prescribed under the Act.

- ailure to comply with a direction issued under section 142(2A)

- Failure to furnish report from an Accountant, as required under section 92E. [C4 Final May 2017] [3 Marks]

Answer:

- Penalty for failure to get accounts audited as required under section 44 AB:

Penalty leviable under section 271B is lower of 0.5% of total turnover or gross receipts OR ₹ 1,50,000. - Penalty for failure to comply with a direction issued under section 142(2A):

Penalty leviable under section 272A( 1): ₹ 10,000 for each default or failure. - Penalty for failure to furnish report from an Accountant, as required under section 92E:

Penalty leviable under section 271 BA: ₹ 1,00,000.

Question 7.

The A.O. lodged a complaint against M/s. KLM, a firm, under section 276CC of the Income-tax Act, 1961 for failure to furnish its return of income for the A.Y. 2021-22 within the prescribed time. The tax payable on the assessed income, as reduced by the advance tax paid and tax deducted at source, was ₹ 60,000. The appeal filed by the firm against the order of assessment was allowed by the Commissioner (Appeals). The A.O. passed an order giving effect to the order of the Commissioner (Appeals). The tax payable by the firm as per the said order of the A.O. was ₹ 5,000. The Assessing Officer has accepted the order of the Commissioner (Appeals) and has not preferred an appeal against it to the Income Tax Appellate Tribunal. The firm desires to know of the maintainability of I the prosecution proceedings in the facts and circumstances of the case. [CA Final May 2017, May 2007] [3 Marks]

Answer:

Section 276CC provides for prosecution for wilful failure to furnish a return of income within the prescribed time, in a case where tax would have been evaded had the failure not been discovered.

Since the amount of tax which would have been evaded does not exceed ₹ 25 lakh, the imprisonment would be for a term of 3 months to 2 years. In addition, fine would also be attracted.

However, in a case where the return of income is not filed within the due date, prosecution proceedings will not be attracted if the tax payable by the assessee (not being a company) on the total income determined on regular assessment, as reduced by the advance tax or self assessment tax, if any, paid and any tax deducted or collected at source, does not exceed ₹ 10,000.

In this case, even though the tax liability of the firm as per the original order of assessment exceeded ₹ 10,000, however, as a result of the order of the Commissioner (Appeals), it got reduced to ₹ 5,000, which is less than ₹ 10,000.

Therefore, since the tax liability of the firm on final assessment was determined at ₹ 5,000, the prosecution proceedings are not maintainable.

![]()

Question 8.

What would be the penalty leviable u/s 270A in case of DEF Ltd. an Indian Company, if none of the additions or disallowances made in the assessment or reassessment qualify u/s 270A(6) and the under-reported income is not on account of misreporting?

| Particulars of total Income of A.Y. 2021-22 | Amount in ₹ | |

| (1) | As per the return of income furnished u/s 139(1) | (6,00,000) |

| (2) | Determined under section 143(1)(a) | (3,00,000) |

| (3) | Assessed under section 143(3) | (1,00,000) |

| (4) | Reassessed under section 147 | 4,00,000 |

Note: The total turnover of DEF Ltd. for the P.Y. 2018-19 was ₹ 300 crores. [CA Final Nov. 2017] [4 Marks]

Answer:

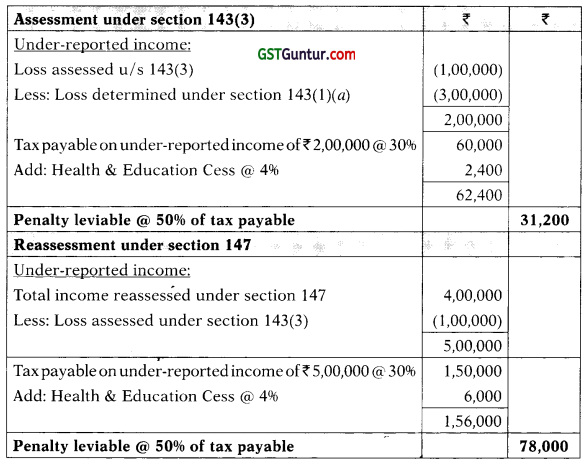

PQR Ltd. is deemed to have under-reported its income since:

(i) the assessment u/s 143(3) has the effect of reducing the loss determined in a return processed u/s 143(l)(a); and .

(ii) the reassessment u/s 147 has the effect of converting the loss assessed u/s 143(3) into income.

Therefore, penalty is leviable u/s 270A for under-reporting of income.

Computation of penalty leviable under section 270A

![]()

Question 9.

BNG Ltd., a domestic company has deducted TDS of ₹ 28,451 during the Qtr. 1 of F.Y. 2020-21. They had filed the TDS return for Qtr. 1 on 15.09.2020. The IT Department had sent a notice of demand to the company, wherein a fee was levied u/s 234E of the Income Tax Act, 1961 (Act) for ₹ 8,800. The Company paid the demand raised by the Department and also claimed such payment as business expenditure during the A.Y. 2021 -22. Discuss whether the demand raised by the Department is correct, as per the provisions of the Act. Also, explain whether fee paid u/s 234E can be claimed as deduction while computing the income under the head “Profits and gains of business or profession”. [CA Final May 2018 (Old Syllabus)] [6 Marks]

Answer:

Demand raised by the Department:

As per Sec. 234E, where a person fails to deliver a statement within the time prescribed u/s 200(3), he shall be liable pay the fee of ? 200 for every day during which the failure continues. As per Sec. 200(3), the time limit for furnishing the return of TDS for Quarter 1 is 31st July but BNG Ltd. has filed it on 15.09.20 and therefore, there is a delay of 46 days (i.e. from 01.08.2020 to 15.09.2020).

Therefore, the company shall be liable for paying the fees of ₹ 9,200 200 × 46 days). However, the demand raised by the Department in respect of fees u/s 234E is only ₹ 8,800 and therefore, the Department has raised ₹ 400, less in respect of fees u/s 234E, than what is payable by the BNG Ltd.

Fee paid u/s 234E claimed as deduction:

As per Sec. 37, any expenditure incurred wholly and exclusively for the purpose of business or profession is allowed as deduction. The fee paid u/s 234E is not in the nature of penalty or interest.

The Legislature has consciously used the word ‘penalty’ and ‘interest’ at other places in contradiction to the word ‘fee’. Also, there is no express provision in the Act which disallows such fee paid and therefore, fee paid u/s 234E is allowable as deduction while computing business income.

![]()

Question 10.

MCM is a firm, liable to tax at the rate of 30% and has filed its return of income. The following information is provided to you:

(i) Returned Total income – ₹ 1,00,00,000

(ii) Total income determined u/s 143(1 )(a) – ₹ 1,20,00,000

(iii) Total income assessed u/s 143(3) – ₹ 1,60,00,000

(iv) Total income reassessed u/s 147 – ₹ 1,90,00,000

Considering that none of the additions or disallowances made in the assessment or re-assessment as above qualifies u/s 270A(6), compute the amount of penalty to be levied u/s 270A of the Income-tax Act, 1961 at the time of assessment u/s 143(3) and at the time of reassessment u/s 147. (Assume under-reporting of income is not on account of misreporting) [CA Final May 2018 (Old Syllabus)] [6 Marks]

Answer:

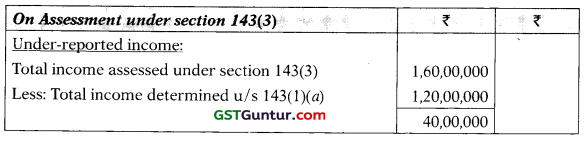

MCM is deemed to have under-reported its income since:

- its income assessed u/s 143(3) exceeds its income determined in a return processed u/s 143(1)(a); and

- the income reassessed u/s 147 exceeds the income assessed u/s 143(3).

Therefore, penalty is leviable u/s 270A for under-reporting of income.

Computation of penalty leviable under section 270A

![]()

Question 11.

Discuss the following in the context of provisions of Income Tax Act, 1961:

Penalty to be imposed on an assessee is to be based upon the law as it stood at the time that default was committed or upon the law as it stands in the financial year in which the assessment was made. Suppose, an assessee files return of income in response to a notice of reassessment, and any concealment was detected, and at that time the laws relating to imposition of penalty was different from the provisions at the time when the original return was filed. Which law should be applicable in this case? [CA Final May 2018 (Old Syllabus)] [4 Marks]

Answer:

The issue under consideration is whether the penalty for concealment of income is to be based upon the law in force at the time the original return was filed or the law in force at the time of assessment/reassessment.

The penalty imposable on account of the commission of a wrongful act is to be in accordance with the law operating on the date on which the wrongful act was committed. Since, the concealment in this case with reference to which the penalty could be imposed is the concealment of income in the return originally filed by the assessee, the law applicable on the date of such wrongful act alone could be applied.

The law applicable for imposition of penalty will be the law in force at the time of filing the original return, in which the income is not disclosed/ income is concealed, and not the law as it stands on the date on which return in response to the notice for reassessment.

Even in a case, where a return filed in response to a notice of reassessment involved an element of concealment, the law applicable would be the law as it stood at the time when the original return was filed and not the law as it stood on the date on which the return was filed in response to the notice for reassessment.

Accordingly, penalty would be imposable on the basis of the law at the time the original return was filed.

![]()

Question 12.

Pramod, a resident individual of age of 52 years, has not furnished his return of income for the A.Y. 2021-22, However, his total income for such year as assessed u/s 143(3) is ₹ 14 Lakhs.

Whether penalty u/s 270A attracted? If yes, what will be the quantum of penalty leviable? [Note: Assume that this is not a case of misreporting]. [CA Final May 2018 (New Syllabus)] [3 Marks]

Answer:

As per Sec. 270A(1), the A.O. or the CIT(A) or PCIT or CIT may, during the course of any proceedings under this Act, direct that any person who has under-reported his income shall be liable to pay a penalty in addition to tax, if any, on under reported income.

As per Sec. 270A(2), the person shall be considered to have under-reported his income, if the income assessed is greater than the maximum amount not chargeable to tax, where no return of income has been furnished.

In this case, the assessee-Pramod has not furnished his return of income for the A.Y. 2021 -22. However, his total income assessed for such year u/s c 143(3) is ₹ 14,00,000, which exceeds the maximum amount not chargeable to tax i.e. ₹ 2,50,000 and therefore, the Pramod has under reported his income. Since, the Pramod has under reported his income, he shall be liable for penalty u/s 270A @ 50% of the amount of tax payable on such under reported income.

The amount of tax payable on ₹ 14,00,000 shall be ₹ 2,41,800. Therefore, the quantum of penalty shall be 50% of ₹ 2,41,800 i.e. ₹ 1,20,900.

![]()

Question 13.

Can prosecution be launched for following defaults? Examine the relevant provisions with quantum of prescribed punishment, if any?

(i) The assessee deliberately has failed to comply with the requirement of section 142(f) and/or 142(2A).

(ii) The assessee has failed deliberately to make the payment of tax collected u/s 206C.

(iii) The assessee had restrained and not allowed the officer authorized as per section 132(1)(iib) of the Act to inspect the documents maintained in form of electronic record and the books of account. [CA Final May 2018 (New Syllabus)] [3 Marks]

Answer:

(i) As per Sec. 276D, if a person wilfully fails to produce books of account and documents as required u/s 142(1) or wilfully fails to comply with a direction to get-the accounts audited u/s 142(2A), he shall be punishable with rigorous imprisonment for a term which may extend to one year and with fine.

(ii) As per Sec. 276BB, if a person fails to pay to the credit of the Central Government, the tax collected u/s 206C, he shall be punishable with rigorous imprisonment for a term which shall not be less than three months but which may extend to seven years with fine.

(iii) As per Sec. 275B, if a person who is required to afford the authorised officer the necessary facility to inspect the books of account or other documents, as required u/s 132(1 )(iib), fails to afford such facility to the authorised officer, he shall be punishable with rigorous imprisonment for a term which may extend to two years and shall also be liable to fine.

![]()

Question 14.

Specify the quantum of Fee/Penalty, if any, to be levied in the following cases. Your answer must specify the relevant provisions of Income-tax Act, 1961.

(i) Mr. Abhiram, an individual, whose taxable income working out to ₹ 13.25 Lakhs, filed the ROI on 12.03.2022 for the assessment year 2021-22. The due date for furnishing return of income u/s 139(1) is 31.10.2021.

(ii) Mrs. Sirisha filed the return of income on 31.01.2022 for the assessment year 2021-22. The due date for furnishing return of income is 31.07.2021 u/s 139(1) and her taxable income is ₹ 4.98 lakhs.

(iii) Mr. Robert received a sum of ₹ 2.50 lakhs from Mr. Rajiv on 31.01.2021 in cash in contravention of provisions of section 269ST. [CA Final Nov. 2018 (Old Syllabus)] [3 Marks]

Answer:

(i) As per section 234F, late fee of ₹ 5,000 is leviable, if the return of income is furnished after the due date specified u/s 139(1) but furnished on or before 31st December of the assessment year. In other cases, late fee of ₹ 10,000 is leviable.

Since, Mr. Abhiram, an individual, having total income of ₹ 13.25 lakhs, furnished his return of income for A.Y. 2021-22 on 12.3.2022 i.e., after 31st December 2021, late fee of ₹ 10,000 is leviable.

(ii) Late fee of ₹ 5,000 or ₹ 10,000, as the case may be, leviable u/s 234F cannot exceed ₹ 1,000, if the total income does not exceed ₹ 5,00,000. Accordingly, late fee not exceeding ₹ 1,000 is leviable in this case, since Mrs. Sirisha’s total income of ₹4,98,000 does not exceed ₹ 5,00,000.

(iii) As per section 271 DA, penalty equivalent to the sum received in contravention of section 269ST (i.e., receipt of a sum of ₹ 2 lakh or more in aggregate from a person in a day otherwise than by an account payee cheque/bank draft or use of ECS through a bank A/c or through such other electronic mode as may be prescribed) is leviable. Accordingly, penalty of ₹ 2.50 lakhs is leviable on Mr. Robert for receiving a sum of ₹ 2.50 lakhs (being a sum in excess of ₹ 2 lakhs) by way of cash from Mr. Rajiv on 31.1.2021.

![]()

Question 15.

In the course of search operation u/s 132rof the Income-tax Act, 1961, in the month of July, 2020, Mr. Khemka has-made a declaration u/s 132(4) to the Income Tax authorities on the earning of his income not disclosed in respect of previous year 2019-20. Can that statement save Mr. I Khemka from a levy of penalty, if he is yet to file his return of income for assessment year 2020-21? [CA Final Nov. 2018 (New Syllabus)] [3 Marks]

Answer:

As per Sec. 271AAB, where search has been initiated u/s 132, the A.O. may direct the assessee to pay in addition to tax, if any, payable by him, penalty @ 30% of the undisclosed income of the specified previous year, if such assessee;

- in the course of the search, in a statement u/s 132(4), admits the undisclosed income; and

- on or before the specified date:

- pays the tax with interest in respect of undisclosed income; and

♦ furnish return of income for the specified previous year declaring such undisclosed income therein.

- pays the tax with interest in respect of undisclosed income; and

In all other cases i.e. if above conditions are not satisfied, then penalty @ 60% shall be attracted.

Therefore statement u/s 132(4) cannot save Mr. Khemka from a levy of penalty u/s 271AAB. If Mr. Khemka furnishes the ROI and pays the tax with interest on or before the specified date, then penalty will be attracted @ 30% of undisclosed income, otherwise the penalty shall be attracted @ 60%.

![]()

Question 16.

State with reasons the penalty leviable on each of the independent instances.

(1) The premises of A Ltd. were searched, and undisclosed income of ₹ 20 crores was determined. The Company did not admit the undisclosed income in a statement u/s 132(4) but declared the same in a return furnished, and paid the tax with interest thereon.

(2) M/s. ABC Trust an eligible investment fund has filed a statement of its activities for the year ended 31.3.2021 on 31.7.2021.

(3) Meena Caterers has received ₹ 1 lakh in cash and ₹ 9 lakh by account payee crossed cheque from Mr. Arvind for rendering catering services 1 on the occasion of his daughter’s wedding.

(4) Mrs. P is a trader who is subject to audit u/s 44AB. She has reported cash collections from various Sundry Debtors, but has discovered that she omitted to include 2 more debtors in the statement already filed. She has reported the omission to the authorities within 15 days. [CA Final Nov. 2019 (Old Syllabus)] [4 Marks]

Answer:

(1) As per section 271 AAB, where a search has been initiated u/s 132, the A.O. may direct the assessee to pay in addition to tax, if any, payable by him, penalty @ 60% of the undisclosed income of the specified previous year, if such assessee:

- in the course of the search, in a statement u/s 132(4), does not admit the undisclosed income; and

- on or before the specified date:

- declares such income in the return of income furnished for the specified previous year; and

- pays the tax, together with interest, if any, in respect of the undisclosed income.

Since, A Ltd. did not admit the undisclosed income in a statement u/s 132(4) but declared the same in a return furnished, and paid the tax with interest thereon, it shall be liable for a penalty (a) 60% of undisclosed income of ₹ 20 crores i.e. ₹ 12 crores.

(2) As per section 271 FAB, if any eligible investment fund which is required to furnish a statement or any information or document, as required u/s 9A(5), fails to furnish the same within the prescribed time limit i.e. within 90 days from the end of financial year, a penalty of ₹ 5,00,000 shall be levied.

In this case, M/s. ABC Trust filled statement of activities for the year ending 31.3.2021 on 31.7.2021 which is after 90 days from the end of financial year and therefore, a penalty of ₹ 5,00,000 shall be levied u/s 271 FAB.

![]()

(3) As per Sec. 269ST, no person shall receive ₹ 2,00,000 or more in respect of transaction relating to one event or occasion from a person otherwise than by an account payee cheque or an account payee bank draft or use of electronic clearing system or through such other electronic mode as may be prescribed.

The contravention of such section shall attract penalty u/s 271 DA. In this case, Meena Caterers has received ₹ 1 lakh in cash and ₹ 9 lakh by account payee crossed cheque from Mr. Arvind for rendering catering services on the occasion of his daughter’s wedding. Since, the cash receipt is less than ₹ 2,00,000, there is not contravention of Sec. 269ST and therefore, no penalty shall be levied u/s 271 DA.

(4) As per Sec. 285BA(6), any inaccuracy in the statement furnished shall be reported to the prescribed authorities within 10 days. If such inaccuracy is not reported within such time limit, penalty of ₹ 50,000 shall be levied on the assessee u/s 271FAA. In this case, Mr. P has, who is liable to audit u/s 44AB, has reported the omission after 10 days, he shall be liable for a penalty of ₹ 50,000 u/s 271FAA.