CMA Inter Financial Accounting Study Material Important Questions, CMA Inter Financial Accounting Notes Pdf, CMA Inter Financial Accounting Syllabus Previous Year Question Papers MCQ Pdf, Financial Accounting CMA Inter Pdf, CMA Inter Financial Accounting Book Pdf.

Financial Accounting CMA Inter Study Material – CMA Intermediate Financial Accounting Notes

CMA Inter Financial Accounting Study Material Notes Pdf

- Accounting Fundamentals

- Bills of Exchange, Consignment, Joint Venture

- Preparation of Final Accounts of Commercial Organisations, Not-for-Profit Organisations and Incomplete Records

- Partnership Accounting

- Lease Accounting

- Branch (including Foreign Branch) and Departmental Accounts

- Insurance Claim for Loss of Stock and Loss of Profit

- Hire Purchase and Installment Sale Transactions

- Accounting Standards

- CMA Inter Financial Accounting MCQs

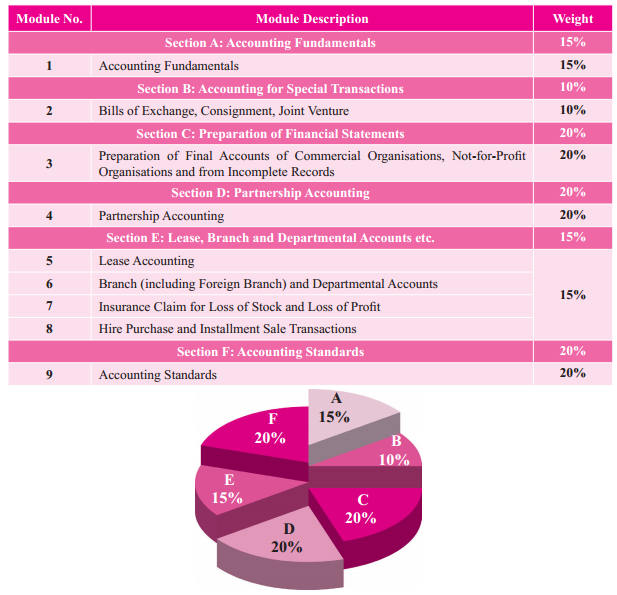

CMA Inter Financial Accounting Syllabus

Financial Accounting CMA Inter Syllabus

Total: 100 Marks

| Module Description | Weight |

| Section A: Accounting Fundamentals | 15% |

| 1. Accounting Fundamentals | 15% |

| Section B: Accounting for Special Transactions | 10% |

| 2. Bills of Exchange, Consignment, Joint Venture | 10% |

| Section C: Preparation of Financial Statements | 20% |

| 3. Preparation of Final Accounts of Commercial Organisations, Not-for-Profit Organisations and Incomplete Records | 20% |

| Section D: Partnership Accounting | 20% |

| 4. Partnership Accounting | 20% |

| Section E: Lease, Branch and Departmental Accounts etc. | 15% |

| 5. Lease Accounting | 15% |

| 6. Branch (including Foreign Branch) and Departmental Accounts | |

| 7. Insurance Claim for Loss of Stock and Loss of Profit | |

| 8. Hire Purchase and Installment Sale Transactions | |

| Section F: Accounting Standards | 20% |

| 9. Accounting Standards | 20% |

Section A: Accounting Fundamentals

1. Accounting Fundamentals

Four Frameworks of Accounting (Conceptual, Legal, Institutional, and Regulatory), Accounting Principles, Concepts and Conventions, Capital and Revenue Transactions – Capital and Revenue Expenditures, Capital and Revenue Receipts

Accounting Cycle – Charts ofAccounts and Codification Structure, Analysis of Transaction – Accounting Equation, Double Entry System, Books of Original Entry, Subsidiary Books and Finalisation of Accounts, Journal (Day Books and Journal Proper – Opening Entries, Transfer Entries, Closing Entries, Adjustment entries, Rectification entries), Ledger, Cash Book, Bank Book, Bank Reconciliation Statement, TriaI Balance (Preparation and Scrutiny), Adjustments and Rectifications, Depreciation and Amortisation, Adjustment Entries and Rectification of Errors, Accounting Treatment of Bad Debts and Provision for Doubtful Debts, Provision for Discount on Debtors and Provision for Discount on Creditors

Section B: Accounting for Special Transactions

2. BilIs of Exchange. Consignment, Joint Venture

Section C: Preparation of Financial Statements

3. Preparation of Final Accounts of Commercial Organisations. Not-for-profit organizations and from Incomplete Records

Preparation of Financial Statements of Commercial Organisations (other than Corporate Form of Organisation) – Income Statement, Balance Sheet; Preparation of Financial Statements of Not-for-Profit Organisation – Preparation of Receipts and Payments Account, Preparation of Income and Expenditure Account, Preparation of Balance Sheet; Preparation of Financial Statements from Incomplete Records

Section D: Partnership Accounting

4. Partnership Accounting

Admission of Partner, Retirement of Partner, Death of Partner, Treatment of Joint Life Policy, Dissolution of Partnership Firms including Piecemeal Distribution, Amalgamation of Partnership Firms, Conversion of Partnership Firm into a Company and Sale of Partnership Firm to a Company, Accounting of Limited Liability Partnership

Section E: Lease. Branch and Departmental Accounts Etc

5. Lease Accounting

6. Branch (including Foreign Branch) and Departmental Accounts

7. Insurance Claim for Loss of Stock and Loss of Profit

8. Hire Purchase and Installment Sale Transactions

Section F: Accounting Standards

9. Accounting Standards

Introduction to Accounting Standards – GAAP, AS, Convergence to Ind AS – Applicability and Scope; Specified Accounting Standards with Comparative Provisions under Ind AS; Disclosure of Accounting Policies (AS 1); Property Plant and Equipment (AS 10); The Effects of Changes in Foreign Exchange Rate (AS 11); Accounting for Government Grants (AS 12); Borrowing Costs (AS 16); Accounting for Taxes on Income (AS 22).

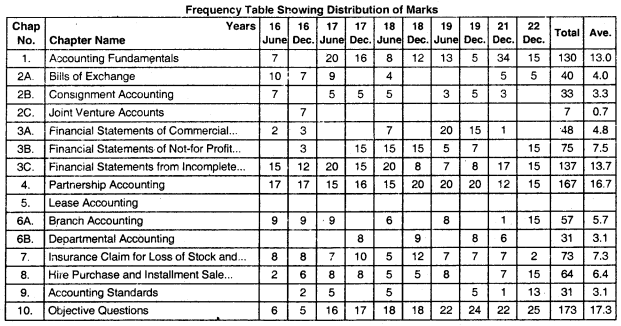

CMA Inter Financial Accounting Chapter Wise Weightage