Branch Accounting – CMA Inter Financial Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Branch Accounting – CMA Inter Financial Accounting Study Material

Short Notes

Question 1.

Write short note on:

Classification of Branches for Branch accounting purpose. (Dec 2012, 5 marks)

Answer: .

Branches are classified as two-way,

(i) Inland Branch,

(ii) Foreign Branch

(i) Inland Branches:

(a) Dependent Branches: Branches in respect of which the whole of the accounting records are kept at head office.

(b) Independent Branches: As the name indicates such branches maintain independent accounting records.

(ii) Foreign Branches: Branches which are located in a foreign country other then ¡n which the company is incorporated they maintain independent and complete record of business.

Methods of accounting are:

- Final Accounts method

- At wholesale price

- At Cost Price/At Invoice Price

- Debtors method;

- Stock and Debtors method; and

- Cash Basis System.

Descriptive Questions

Question 2.

Define branch as per section 2(14) of the Companies Act, 2013. (Dec 2021, 1 mark)

Answer:

Any establishment described as a branch by the company.

Practical Questions

Question 3.

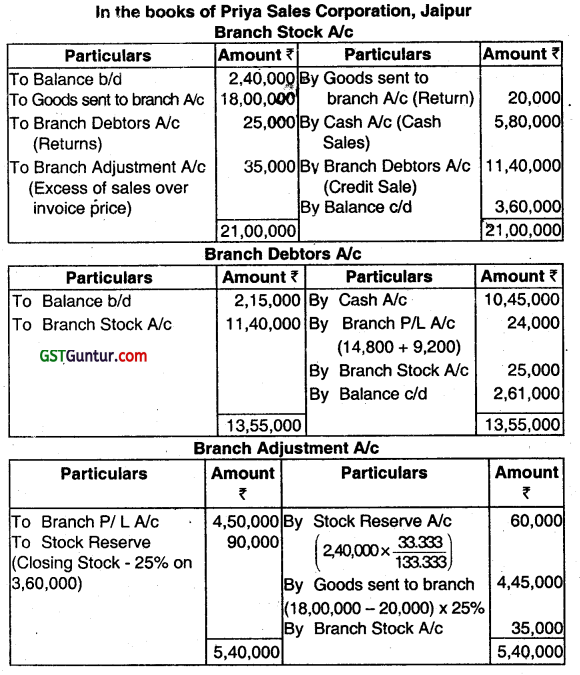

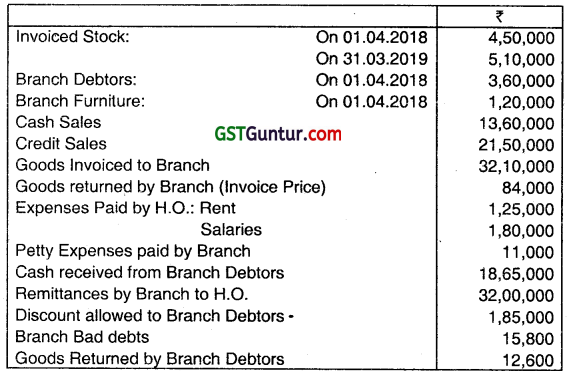

Priya Sales Corporation of Jaipur has a Branch at Kota to which goods are sent @ 33% above cost. The Branch makes sales both for cash and on credit. Branch expenses are paid directly from Head Office and the Branch has to remit all cash received into the Head Office Bank Account at Kota.

Following further details are given for the year ended 31st March, 2012:

| (₹) | |

| Goods sent to Branch at invoice price | 18,00,000 |

| Goods returned by Branch at invoice price | 20,000 |

| Stock at Branch on 1.4.2011 (at invoice price) | 2,40,000 |

| Branch Debtors on 1.4.2011 | 2,15,000 |

| Sales during the year: Cash | 5,80,000 |

| Credit | 11,40,000 |

| Cash received from Branch debtors | 10,45,000 |

| Discount allowed to by Branch to debtors | 14,800 |

| Bad debts | 9,200 |

| Sales return at Kota Branch | 25,000 |

| Salaries and wages at Branch | 1,80,000 |

| Rent, Rates and Taxes at Branch | 42,000 |

| Sundry expenses at Branch | 15,000 |

Stock at Branch on 31 .3.2012 at invoice price 3,60,000

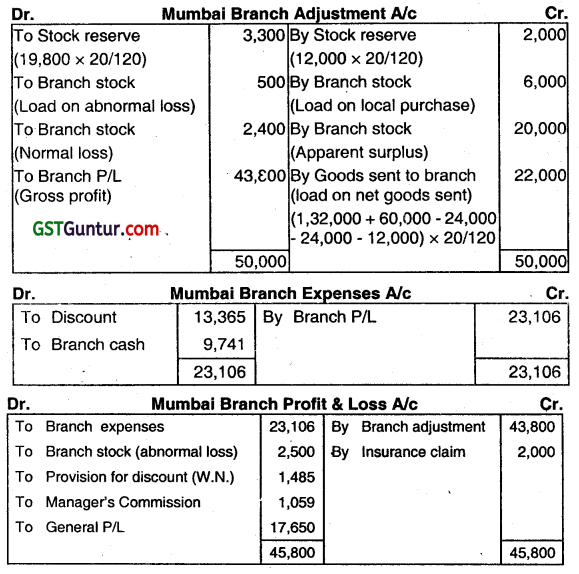

You are required to show Branch Stock Account, Branch Adjustment Account, Branch Expenses Account, Branch Debtors Account, Branch Goods sent to Branch Account and Branch Profit & Loss Account in the books of the Head Office. (Dec 2012, 8 marks)

Answer:

![]()

Question 4.

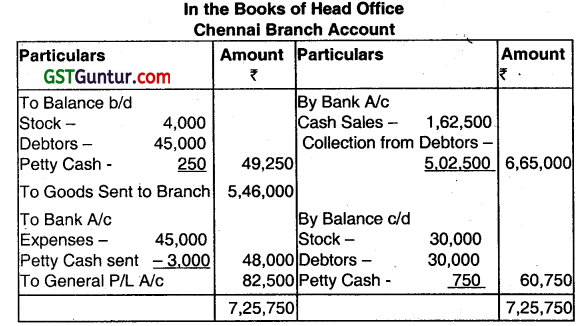

A Company with its Head Office at Kolkata has a Branch at Chennai. The Branch receives all goods from Head Office who remits cash for all expenses. Total Sales by Branch for year ended 31.03.2012 amounted to 6,50,000 out of which 75% on Credit. Other details for Chennai Branch were as under:

| 01.04.2011 | 31.03.2012 | |

| Stock | 4,000 | 30,000 |

| Debtor | 45,000 | 30,000 |

| Petty Cash | 250 | – |

Petty Cash sent by Head Office ₹ 3,000 but ₹ 2,500 is spent for Petty Expenses. The Expenses of 45,000 are actually spent by Branch. All sales are made by the Branch at Cost plus 25%. You are required to prepare the Chennai Branch A/c in the Books of Head Office for the year ended 31.03.2012. (June 2013, 5 marks)

Answer:

Working Notes:

1. Petty Cash Account

| To Balance b/d | 250 | By Petty Expenses | 2,500 |

| To Bank – Cash sent by H.O. | 3,000 | By Balance c/d | 750 |

| 3,250 | 3,250 |

2. Memorandum Debtors Account

| To Balance b/d | 45,000 | By Bank A/c (Collection) | 5,02,500 |

| To Credit Sales (6,50,000) x 75% | 4,87,500 | By Balance c/d | 30,000 |

| 5,32,500 | 5,32,500 |

3. Calculation of Cost of Goods Sent:

(a) Cost of Goods Sold 6,50,000 x 100/1 25 = 5,20,000

(b) Cost of Goods Sold = Opening Stock + Cost of Goods Sent – Closing Stock

5,20,000 = 4,000 + Cost of Goods sent – 30,000

Hence, Cost of Goods sent = 5,46,000

Question 5.

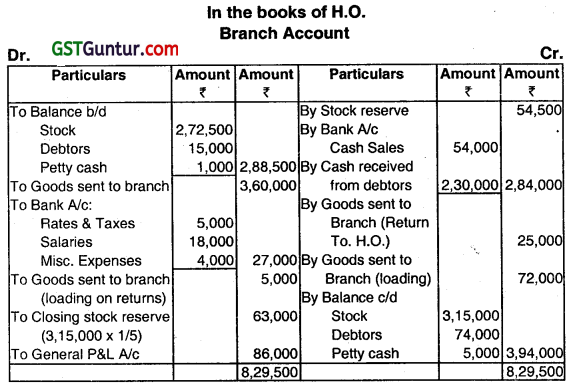

Prepare a Branch Account in the books of Head Office from the following particulars for the year ended 31 March 2013, assuming that H.O. sold goods at cost plus 25%.

| Particulars | ₹ | Particulars | ₹ |

| Stock on 01.04.2012 | 2,72,500 | Bad debts | 2,000 |

| Debtors on 01.04.2012 | 15,000 | Allowances to customers | 1,000 |

| Petty cash on 01.04.2012 | 1,000 | Return inward | 1,000 |

| Goods sent to Branch | 3,60,000 | Rates & Taxes | 5,000 |

| Goods returned to H.O. | 25,000 | Salaries | 18,000 |

| Cash sales | 54,000 | Misc. Expenses | 4,000 |

| Cash received from debtors | 2,30,000 | Stock on 31.03.2013* | 3,15,000 |

| Debtors on 31.03.2013 | 74,000 | ||

| Petty cash (31.03.2013) | 5,000 |

Both opening and closing stock at invoice price. (Dec 2013, 6 marks)

Answer:

Question 6.

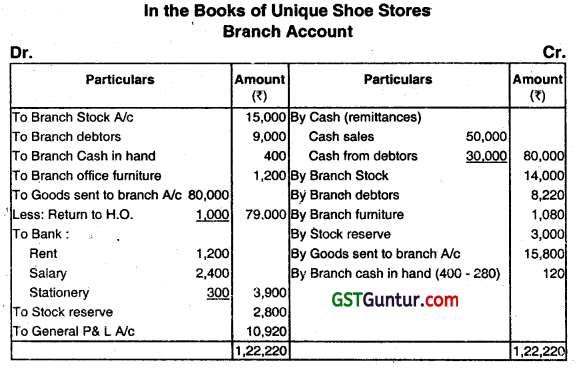

Prepare Branch account in the books of the Head Office and also debtors account from the following information given below: for the year 2013 The Unique Shoe Stores has an old branch at Kanpur. Goods are invoiced at the branch at 25% profit on cost price. The branch has been instructed to send all cash daily to the Head Office. All expenses are paid by the Head Office except petty expenses which are met by the Branch Manager.

| ₹ | |

| Stock on 01.01.2013 (invoice price) | 15,000 |

| Sundry debtors on 01.01.2013 | 9,000 |

| Cash in hand on 01.01.2013 | 400 |

| Office furniture on 01.01.2013 | 1,200 |

| Goods supplied by the Head Office (invoice price) for year | 80,000 |

| Goods returned to Head Office for year | 1,000 |

| Goods returned by debtors at the end of year | 480 |

| Debtors at the end of year | 8,220 |

| Cash sales for year | 50,000 |

| Credit sales for year | 30,000 |

| Discount allowed for year | 300 |

Petty expenses paid by Branch Manager during year 280

Stock on 31.12.2013 14,000

Provide depreciation on furniture at 10% per year (June 2014, 4+2=6 marks)

Answer:

Question 7.

Answer the question:

TUSHAR Ltd. with its Head Office ¡n Delhi invoices goods to its Branches at Mumbai and Kolkata at 20% less than the catalogue price which is cost plus 50% with instructions that cash sales are to be made at invoice price and credit sales at catalogue price less discount at 15% on prompt payments. Provision is to be made for discount to be allowed to debtors, at year-end on the basis of year’s trend of prompt payments.

All branch expenses are paid by the Head Office and all branch collections are remitted daily to Head Office.

1. Opening Stock at Branch at its cost ₹ 12,000.

2. Opening Branch Debtors ₹ 10,000.

3. Goods Sent to branch (at cost to H.O.) ₹ 1,10,000.

4. Goods received by Branch till close of the year ₹ 1,27,000.

5. Transfer from Kolkata branch to Mumbai branch at catalogue price ₹ 75,000.

6. Transfer to Kolkata branch from Mumbai branch at catalogue price ₹ 30,000.

7. Goods purchased by Mumbai branch from local suppliers (cost) ₹ 30,000

Closing stock in hand at branch out of ‘local purchases (cost) ₹ 6,000.

8. Cash Sales ₹ 74,800.

9. Credit Sales ₹ 1,45,000.

10. Goods returned by Credit Customers to branch ₹ 30,000.

11. Goods returned by Credit Customers directly to RO. ₹ 15,000.

12. Goods returned by Branch to H.O. ₹ 24,000.

13. Cash remitted by Credit Customers directly to Branch ₹ 45,635.

14. Cash remitted by Credit Customers directly to H.O. ₹ 40,000.

15. Discount Allowed to Debtors ₹ 13,365.

16. Loss of Goods by fire (at invoice price) 3,000 against which 80% of cost was recovered from the insurance Company.

17. Loss of goods at Branch through normas pilferage (at catalogue price) ₹ 3,000.

18. Branch Expenses: Paid ₹ 9,000, Outstanding ₹ 741.

19. Branch Manager is entitled to a commission @ 6% of net profits after charging such commission.

Required:

Prepare Mumbai Branch Stock Account, Mumbai Branch adjustment A/c Mumbai Branch Expenses AIc and Mumbai Branch Profit & Loss A/c and Mumbai Branch Debtors Nc under Stock & Debtors Method. (Dec 2014, 12 marks)

Answer:

Calculation of provision for discount

Prompt paying debtors during year = \(\frac{13,365}{15 \%}\) =‘ 89,100

Total debtors who made payment during the year = 45,635 + 40,000 + 13,365 = 99,000

Proportion of prompt payers = \(\frac{89,100}{99,000}\) x 100 = 90%

Likely prompt paying debtors ¡n dosing debtors = 11000 x 90% = 9,900

Provision for discount = 9,900 x 15% = 1,485

![]()

Question 8.

Answer the question:

From the information of AMBA LTD. received from its branch – AB, calculate the invoice price of goods sent to branch and Profit included thereon.

Goods received from H.O. (AMBA LTD.) – ₹ 1,00,000

Goods in transit from HO. – ₹ 50,000

Goods are invoiced to branch at cost plus 25%. (June 2015, 2 marks)

Answer:

Branch Accounts

Goods “received” from H.O. 1,00,000

+ Goods in transit 50,000

Invoice Price of Goods Sent to Branch 1,50,000

Profit=Cost+25%

∴ 1/5 on Invoice Price

Profit = \(\frac{1,50,000}{5}\) = 30,000

Question 9.

Answer the following question (Give workings):

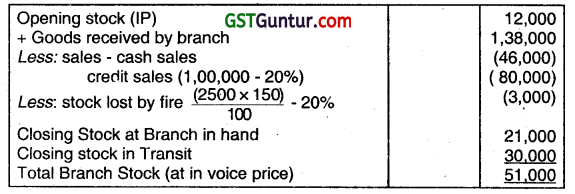

TULSIAN LTD. with its Head Office in Delhi invoices goods to its Branch at Mumbai at 20% less than the catalogue price which is cost plus 50% with instructions that cash sales are to be made at invoice price and credit sales at catalogue price.

| Opening Stock at Branch at its cost | ₹ 12,000 |

| Goods sent to Branch (at cost to H.O.) | ₹ 1,40,000 |

| Goods received by Branch till close of the year | ₹ 1,38,000 |

| Cash Sales | ₹ 46,000 |

| Credit Sales | ₹ 1,00,000 |

| Stock lost by fire (at cost) | ₹ 2,500 |

Required:

Calculate the amount of Closing Stock at Branch-Mumbai. (Dec 2015, 2 marks)

Answer:

Question 10.

LINKEN LTD., with a Head Office in Kolkata, sends goods to its /Madras branch at cost plus 25 per cent. The following particulars are available in respect of the Branch for the year ended 31st March, 2016.

| ₹ | |

| Opening Stock at Branch at cost to Branch | 4,00,000 |

| Goods sent to Branch at invoice price | 60,00,000 |

| Loss-in-transit at invoice price | 75,000 |

| Pilferage at invoice price | 30,000 |

| Sales | 60,95,000 |

| Expenses | 3,00,000 |

| Closing Stock at Branch at cost to Branch | 2,00,000 |

| Recovered from Insurance company against lost-in-transit | 50,000 |

You are required to prepare:

(i) Branch Stock Account

(ii) Branch Adjustment Account a

Branch Profit & Loss Account in the book of Linken Ltd. (June 2016, 5 + 2 + 2 = 9 marks)

Answer:

Question 11.

M/S YAVATI LTD. having its principal place of business at BENGALURU has a branch at New Delhi. The company sends goods to its branch at cost plus which is the selling price. The following information is given in respect of the branch for the year ended 31st March, 2016.

| ₹ | |

| Goods sent to Branch (invoice value) | 24,00,000 |

| Stock at Branch (01.04.2015)at selling price | 1,20,000 |

| Cash Sales | 9,00,000 |

| Returns from Customers | 30,000 |

| Branch Expenses paid for cash | 2,67,500 |

| Branch Debtors’ Balance (01.04.2015) | 1,50,000 |

| Discounts allowed | 5,000 |

| Bad Debts | 7,500 |

| Stock at Branch (31.03.2016) at selling price | 2,40,000 |

| Branch Debtor’s Balance (31.03.2016) | 1,82,500 |

| Collections from Debtors | 13,50,000 |

| Branch Debtors’ Cheques returned dishonoured | 25,000 |

You are required to prepare:

(i) Branch Stock Account

(ii) Branch Debtors Account and

(iii) Branch Adjustment Account to reveal the profit of the Branch for the year ended March 31, 2016. (Dec 2016, 3+2+4 = 9 marks)

Answer:

Question 12.

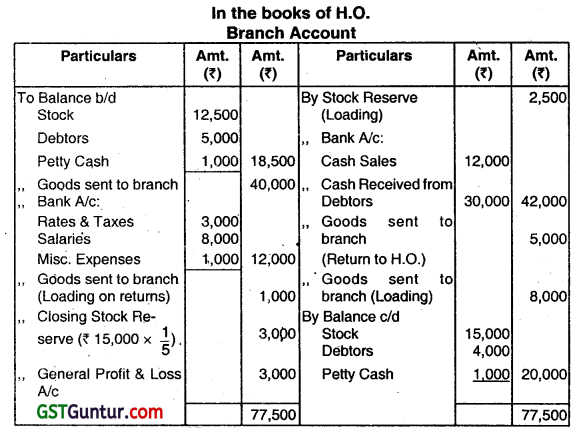

Prepare a Branch account in the books of Head Office from the following particulars for the year ended 31st March, 2017 assuming that H.O. supplied goods at cost plus 25%.

| Particulars | Amount (₹) | Particulars | Amount (₹) |

| Stock on 1.4.2016 (I.P.) | 12,500 | Bad Debts | 2,000 |

| Debtors | 5,000 | Allowances to customers | 1,000 |

| Petty Cash | 1,000 | Returns Inwards | 1,000 |

| Goods sent to branch (l.P.) Goods return to H.O. (I. P.) |

40,000

5,000 |

Cheques sent to Branch for expenses: | |

| Cash Sales | 12,000 | Rates & Taxes | 3,000 |

| Cash received from debtors | 30,000 | Salaries | 8,000 |

| Misc. Exps. | 1,000 | ||

| Stock on 31.03.2017 (I.P.) | 15,000 | ||

| Debtors | 4,000 | ||

| Petty Cash | 1,000 |

(June 2017, 9 marks)

Answer:

Note: Here loading is \(\frac{25}{125}=\frac{1}{5}\) of invoice price. Hence, loading on opening stock will be 15,000 × \(\frac{1}{5}\) = ₹ 2,500 and so on.

![]()

Question 13.

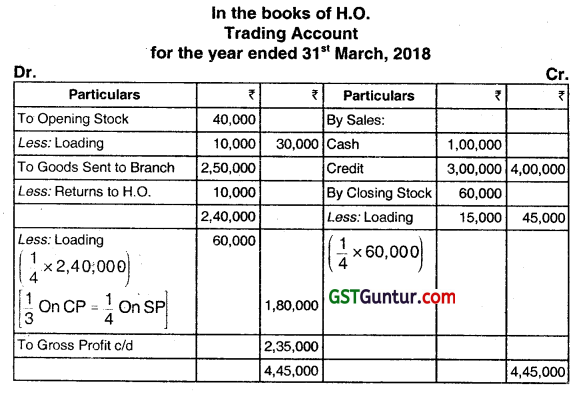

X Ltd. has its H.O. in Delhi and a branch in Mumbai. H.O. supplied goods to its branch at cost plus 33%. From the particulars given below prepare a Branch Trading Account for the year ended 31st March 2018

in the books of RO.:

| Particulars | Amount (₹) | Particulars | Amount (₹) |

| Opening Stock (l.P) | 40,000 | Sales: | |

| Goods sent to Branch (I.P.) | 2,50,000 | Cash | 1,00,000 |

| Return to H.O.(l.P.) | 10,000 | Credit | 3,00,000 |

| Discounts allowed to customers | 10,000 | ||

| Closing Stock (l.P.) | 60,000 |

It is estimated that 2% of the goods received are lost through natural wastage. (June 2018, 6 marks)

Answer:

Note:

1. Discount allowed to customer will appear in Branch Profit & Loss Account.

2. Loss through natural wastage is a normal loss and as such, the same should be charged against branch’s gross profit. So, no adjustment is required.

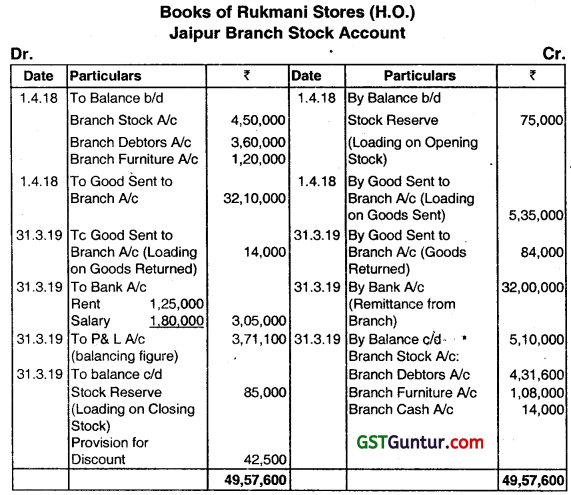

Question 14.

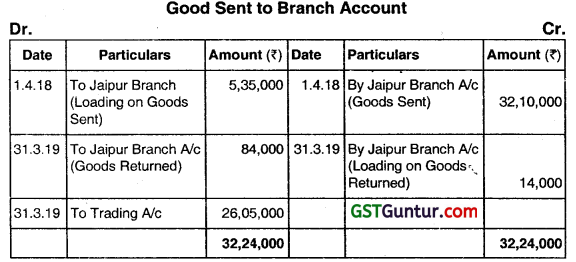

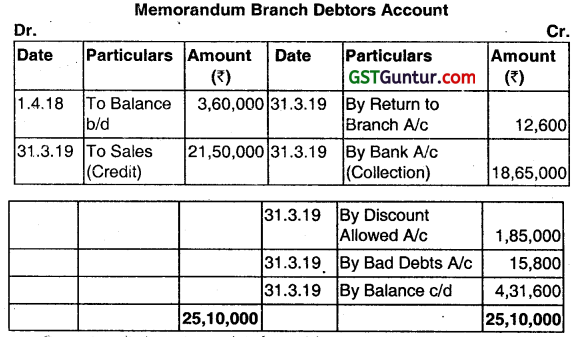

Rukmani Stores, Delhi invoiced goods to its Jaipur Branch @ 20% less than the Catalogue price which is cost plus 50% with instructions that cash sales were to be made at invoice price and credit sales at catalogue price and allow discount on prompt payment. The following details related to branch are provided by Rukmani Stores for the year ended 31st March 2019:

It was decided to make provision for discount of ₹ 42,500 on closing debtors for prompt payment. Depreciate the furniture @ 10% per annum. You are required to prepare Jaipur Branch Account and Goods Sent to Branch Account in the books of Rukmani Stores. (June 2019, 8 marks)

Answer:

Notes on Jaipur Branch A/c:

1. Since in Question, Invoice Price is given therefore, Jaipur Branch Stock A/c should be prepared at Invoice Price.

2. In this case Debtor method of Branch Accounting is used therefore, petty expenses of ₹ 11,000 incurred by Branch itself would not be shown at the debit of Jaipur Branch A/c. These petty expenses are already adjusted in closing balance of Branch cash of ₹ 14,000.

3. On similar logic we have correctly not shown Bad Debts and Discount relating to Jaipur Branch A/c to the debit of Jaipur Branch A/c since these Bad Debts and Discount are already adjusted in closing balance of Branch Debtors.

Note on Good Sent to Branch AIc: Since in Question, Invoice Price is given therefore, Good Sent to Branch A/c should be prepared at Invoice Price.

Notes:

- Furniture at on 31.03.2019 = ₹ 1,20,000 x 90% = ₹ 1,08,000.

- Cash Balance at Branch on 31.03.2019 = ₹ 13,60,000 (Cash Sales) + 18,65,000 (Collection from Debtors) – ₹ 32,00,000 (Remittances from Branch) – ₹ 11,000 (Petty Exp. Paid by Branch) = ₹ 14,000.

- Closing Branch Debtors:

Question 15.

From the following particulars relating to Pune Branch for the year ending December 31, 2018, prepare Branch Account in the books of Head Office:

| ₹ | ||

| Stock at Branch on January 1, 2018 | 10,000 | |

| Branch Debtors on January 1, 2018 | 4,000 | |

| Branch Debtors on December 31, 2018 | 4,900 | |

| Petty cash at branch on January 1, 2018 | 500 | |

| Furniture at branch on January 1, 2018 | 2,000 | |

| Prepaid fire insurance premium on January 1, 2018 | 150 | |

| Salaries outstanding at branch on January 1, 2018 | 100 | |

| Goods sent to Branch during the year | 80,000 | |

| Cash Sales during the year | 1,30,000 | |

| Credit Sales during the year | 40,000 | |

| Cash received from debtors | 35,000 | |

| Cash paid by the Branch debtors directly to the Head Office | 2,000 | |

| Discounts allowed to debtors | 100 | |

| Cash sent to Branch for Expenses: | ||

| Rent | 2,000 | |

| Salaries | 2,400 | |

| Petty Cash | 1,000 | |

| Annual Insurance up to March 31, 2019 | 600 | 6,000 |

| Goods returned by the Branch | 1,000 | |

| Goods returned by the debtors | 2,000 | |

| Stock on December 31, 2018 | 5,000 | |

| Petty Cash spent by Branch | 850 | |

| Provide depreciation on furniture 10% p.a. |

Goods costing ₹ 1,200 were destroyed due to fire and a sum of ₹ 1,000 was received from the Insurance Company. (Dec 2022, 15 marks)

Branch Accounting CMA Inter Financial Accounting Notes

Branch

A Branch is a subordinate division of an office.

Section 2(14) of the Companies Act, 2013 defines a Branch Office as- Any establishment described as a Branch by the Company.

Dependent Branches

Dependent branches are branches in respect of which the whore of the accounting records are kept at Head Office only.

Independent Branches

Independent branches are branches which maintain independent accounting records.

Foreign Branches

Foreign branches are located in a foreign country (i.e. in a country other than in which the company ¡s incorporated and registered).

![]()

Debtors Method

This method is usually adopted when the branch is of small size. Under this method, the head office maintains separate Branch Account for each branch. Its purpose is to ascertain profit or loss made by each branch.

Stock and Debtors Method

When there are large number of transactions, this method is particularly adopted by the H.O. to make efficient control over the branches.