CMA Inter Direct Tax Study Material MCQs

CMA Inter Direct Tax Study Material MCQs – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

CMA Inter Direct Tax Study Material MCQs

Question 1.

Choose the most appropriate alternative:

(i) The basic exemption limit for a non-resident super senior citizen above the age of 80 years for the assessment year 2023-24 is

A. ₹ 2,00,000

B. ₹ 2,50,000

C. ₹ 5,00,000

D. ₹ 1,60,000

Answer:

B. ₹ 2,50,000

₹ 2,50,000. Basic exemption limit for all non resident assessee is ₹ 2,50,000.

Question 2.

(ii) When patent is transferred, the amount received is

A. Not chargeable to tax

B. Chargeable under the head ‘Profits and gains of business or profession’

C. Taxable under the head ‘Income from other sources’

D. Adjusted towards the patent value in the block of assets

Answer:

D. Adjusted towards the patent value in the block of assets

Patent is an intangible asset. As per Section 2(11) of the Income Tax Act, there is a block for intangible assets, and it the

asset is transferred, the amount should be adjusted in the same block of assets.

Question 3.

(iii) Rent derived from land located outside India, used exclusively for agricultural purpose is

A. Agricultural income

B. Exempt income

C. Taxable as business income

D. Taxable under the head ‘Income from other sources’.

Answer:

D. Taxable under the head ‘Income from other sources’.

Taxable under the head ‘Income from Other Sources’. As per Section 10(1) of the Income Tax Act, agricultural income in India is fully exempt from tax. Foreign agricultural income will not fall under Section 10(1), hence taxable under the head ‘Income from Other Sources’.

Question 4.

(iv) Ram introduced his building costing ₹ 10,00,000 acquired in April, 2015 into the business newly commenced by him from 01.04.2022. The actual cost of building for the purpose of depreciation for the assessment year 2023-24 would be ₹

A. 10,00,000

B. 5,90,490

C. 6,56,100

D. None of these.

Answer:

C. 6,56,100

(10,00,000 – 10% of 10,00,000 = 9,00,000

9,00,000 – 10% of 9,00,000 = 8,10,000

8,10,000 – 10% of 8,10,000 = 7,29,000

7,29,000 – 10% of 7,29,000 = 6,56,100)

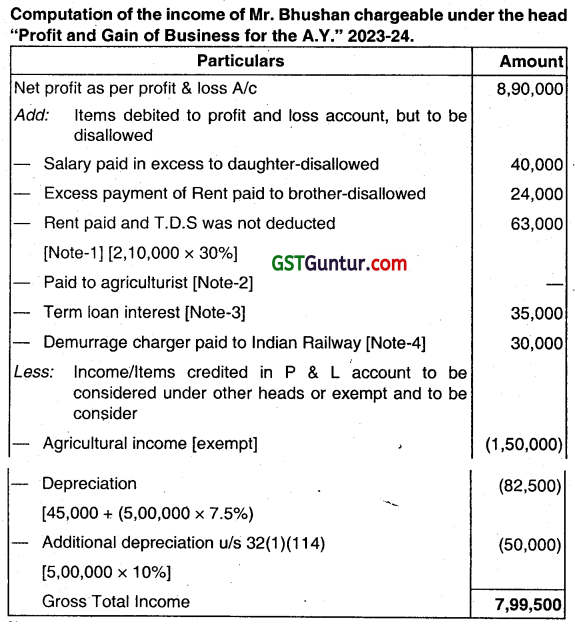

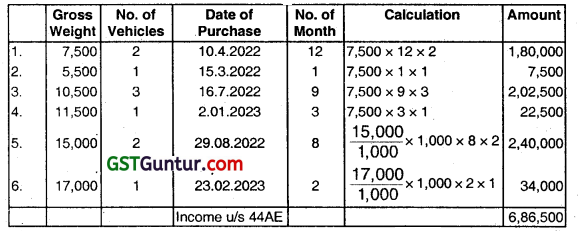

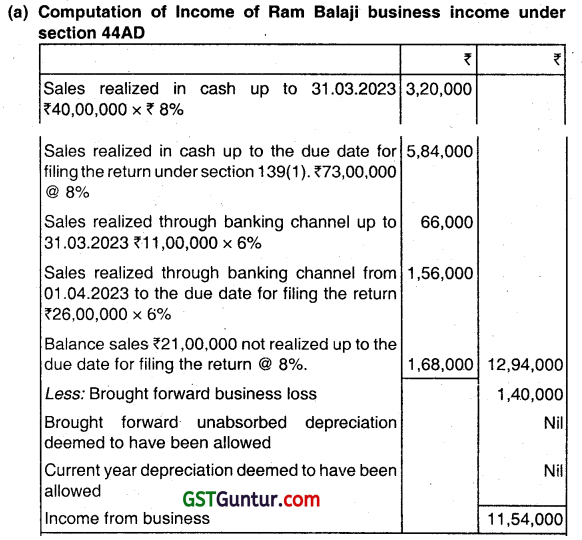

![]()

Question 5.

(v) Motor car with more than 1.6 litres cubic capacity is given to the employee both for official and personal use with expenditure on running and maintenance met by the employer. The car was self driven by the employee. The perquisite value shall be

A. ₹ 1,200 p.m.

B. ₹ 1,800 p.m.

C. ₹ 2,400 p.m.

D. Nil

Answer:

C. ₹ 2,400 p.m.

₹ 2,400 pm. As per Rule 3(2)(a) of the Income Tax Act, if employer is providing car with more than 1600 cc capacity to his employee and running and maintenance is borne by employer, the taxable value of perquisite is ₹ 2,400 pm

Question 6.

(vi) The liability for payment of advance tax would arise only when the tax liability of the taxpayer after reducing tax deductible at source exceeds

A. ₹ 10,000

B. ₹ 5,000

C. ₹ 20,000

D. None of these

Answer:

A. ₹ 10,000

As per Section 208 of Income Tax Act, 1961, liability of advance tax arises when estimated tax liability of tax payer exceeds ₹ 10,000.

Question 7.

(vii) Amount is received under the notified reverse mortgage scheme, is

A. Taxable as ‘Income from other sources’

B. Exempt from tax

C. 50% taxable

D. Taxable as capital gain

Answer:

(B) Exempt from tax.

Question 8.

(viii) Azhar, being an employee in a transport company, received ₹ 10,000 per month by way of allowance to meet his personal expenses in the course of running such transport system from one place to another. The amount chargeable to tax is

A. Nil

B. 3,000 p.m.

C. Fully-taxable

D. Fully exempt

Answer:

(B) 3,000 pm.

As per Section 10(14), allowance given to transport employees are exempt to the extent of least of following

i. 70% of allowance or

ii. ₹ 10,000. p.m.

Question 9.

(ix) Rajiv received scholarship of ₹ 20,000 to meet the cost of education. The amount of scholarship chargeable to tax is ₹.

A. Nil

B. ₹ 20,000

C. ₹ 10,000

D. ₹ 5,000

Answer:

(A) Nil, The scholarship granted to meet the cost of education is exempt from tax u/s 10 (16).

Question 10.

(x) Sita received family pension of ₹ 10,000 per month in the capacity of widow of the deceased spouse who died in the course of operational duties in Indian army. The amount c family pension chargeable to tax is

A. ₹ 1,20,000

B. ₹ 1,05,000

C. Nil

D. ₹ 30,000.

Answer:

(C) Nil, the family pension received by the family members of armed forces is exempted from tax u/s 10(19).

Question 11.

(xi) A religious trust received ₹ 2,00,000 by way of anonymous donation. The total amount of donation received during the year was ₹ 15,00,000. The amount of anonymous donation chargeable to tax is

A. ₹ 2,00,000

B. ₹ 1,00,000

C. ₹ 75,000

D. Nil. Not taxable

Answer:

(D) Nil. Not Chargeable. The anonymous donation received for religious purposes is excluded from the ambit of taxable

donation.

![]()

Question 12.

(xii) Fees paid to Registrar of Companies for increasing the authorized capital of a company is

A. Capital expenditure

B. Fully deductible

C. 50% deductible

D. 75% deductible (Dec 2012, 1 x 12 = 12 marks)

Answer:

(A) Capital Expenditure. A fee paid to ROC is non-recurring expenses. Hence it is capital expenditure.

(b) Fill up the blanks:

(i) Interest received on delayed payment of enhanced compensation shall be deemed to be ……………………………. (income/not an

income/interest relating to the concerned year alone is income) of the year in which it is received.

Answer:

Income

(ii) Gift received from a trust is ……………………………. (included/not included) in the taxable income of an individual.

Answer:

Included

(iii) Dividend received from a company having only agricultural income is ………………………. (agricultural income/non-agricultural income/50% taxable) in the hands of its shareholder.

Answer:

Nonagricultural income

(iv) There are two schools of Hindu Law, one in Mitakshara and the other is ……………….. .

Answer:

Dayabhaga

(v) The depreciation allowable in respect of an asset used for the purpose of business for less than 180 days shall be restricted

to …………………. (50%/25%/75%) of the normal rate of depreciation.

Answer:

50%

(vi) The rate of TDS will be ………………………….. in all cases, if PAN is not furnished by the deductee.

Answer:

20%

(vii) The minimum alternate tax u/s 115JB for the AX. 2023-24 shall be …………………………………… % of book profit [Basic rate excluding surcharge, educationcess, etc.].

Answer:

15%

(viii) The minimum penalty levied u/s 271A for not maintaining books of account, documents as required u/s 44AA is ……………….. .

Answer:

₹ 25,000

(ix) Prima facie, revision of any order can be made by the Commissioner of Income-tax within ………………………. years.

Answer:

4

(x) Unabsorbed loss under the head ‘Capital gains’ shall be carried forward for a period of ……………………… , assessment years immediately following the assessment year in which such loss was incurred.

Answer:

8

(xi) Loss from gambling ……………………………. (can/cannot) be carried forward and set off in subsequent years under profits from gambling. (Dec 2012, 1 x 12 =12 marks)

Answer:

Cannot

Question 13.

Choose the most appropriate alternative:

(i) The basic Exemption limit for a female below the age of 60 years for the assessment year 2023-24 is

(a) ₹ 1,80,000

(b) ₹ 1,90,000

(c) ₹ 2,00,000

(d) ₹ 2,50,000

Answer:

(d) ₹ 2,50,000

Question 14.

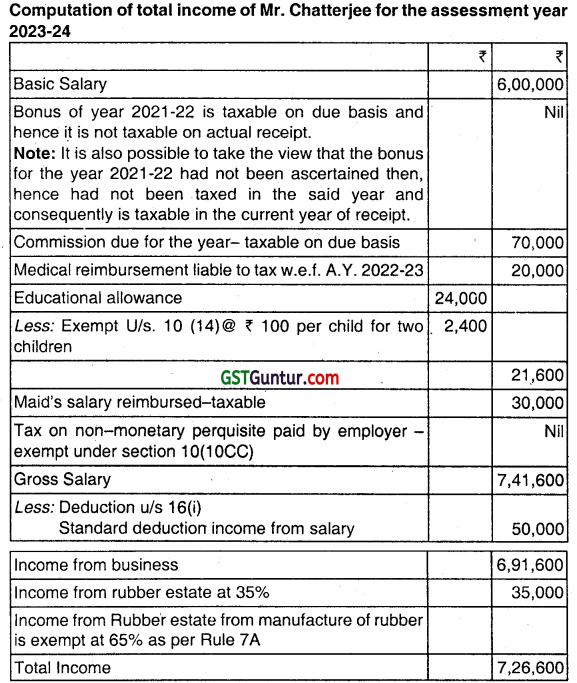

(ii) Under Rule 7A of the Income Tax.Rules, the following %age of income from manufacture of Rubber shall be deemed to be business income and liable to tax

(a) 15%

(b) 25%

(c) 35%

(d) 50%

Answer:

(c) 35%

Question 15.

(iii) Interest is payable to assessee on Refund under the Income Tax Act, 1961 at the rate of

(a) 5%

(b) 6%

(c) 9%

(d) 12%

Answer:

(b) 6%

![]()

Question 16.

(iv) The maximum penalty leviable for failure to keep or maintain books of account or document as required u/s. 44AA of the Income Tax Act, 1961 is

(a) ₹ 25,000

(b) ₹ 75,000

(c) ₹ 1,00,000

(d) ₹ 1,50,000

Answer:

(a) ₹ 25,000

The correct answer is ₹ 25,000 u/s. 271A.

Question 17.

(v) Tax on non-monetary benefit paid by the employer is

(a) Fully-taxable

(b) Taxable to the extent of 50%

(c) Taxable to the extent of 60%

(d) Fully exempted from Tax.

Answer:

(d) Fully exempted from Tax.

Question 18.

(vi) The maximum amount of deduction from Gross Total Income available to an individual for interest on savings bank deposit is

(a) ₹ 5,000

(b) ₹ 7,500,

(c) ₹ 10,000

(d) ₹ 12,000

Answer:

(c) ₹ 10,000

Question 19.

(vii) Loss from activity of owning and maintaining race horses can be carried forward for: (Assessment years)

(a) 4

(b) 6

(c) 8

(d) 5

Answer:

(a) 4

4 Assessment years

Question 20.

(viii) Annual value of house property it is not let out s taken as ……………………. .

Answer:

Nil

Question 21.

(ix) No tax is deductible if the amount of rent credited or paid during the financial year does not exceed rupees …………………… u/s 194 I of the Income Tax Act, 1961.

Answer:

₹ 2,40,000

Question 22.

(x) When entire net consideration has been invested by an individual towards subscription of shares of an eligible company the exemption, u/s. 54GB of the Income Tax Act,1961 would be

(a) NIL

(b) 10% of capital gain

(c) 50% of capital gain

(d) 100% of capital gain

Answer:

(d) 100% of capital gain

Question 23.

(xi) Amount received towards share application money when not properly explained it is ……………………. .

(a) taxable u/s. 68

(b) exempt u/s. 10

(c) fully taxable but deduction at 50% u/s. 57 (iii) is allowable

(d) None of the above

Answer:

(a) taxable u/s. 68

Question 24.

(xii) Book profit u/s. 115JB of a domestic company was ₹ 52 lakhs. The tax liability of the company for the assessment year 2023-24 would be

(a) 18.54% including cess

(b) 15.60% including cess

(c) 20% including cess surcharge at 5%

(d) 19.431 % including cess and surcharge at 2% (June 2013, 1 x 12 = 12 marks)

Answer:

(b) 15.60% including cess

(b) Fill up the blanks:

(i) Any sum paid to an approved university, college or other institutions u/s. 35(1) (iii) of the Income Tax Act, 1961 the allowable deduction is ……………………….. (100%/125%)

Answer:

100%

(ii) Interest payable to a partner by a firm shall not exceed …………………………. (18%/12%) per annum.

Answer:

12%

(iii) An assessee ………………………….. (can/cannot) spread over the arrears of rent over the past several years.

Answer:

Cannot

(iv) Chapter VI-A deduction …………………………. (shall/shall not) be allowed in respect of income from short term capital gain.

Answer:

Chapter VIA deduction shall be allowed in respect of short-term capital gain, generally. However, in case it is short-term capital gaiñ in respect of transaction in equity shares in a company chargeable to STT (u/s 111 A) deduction under Chapter VIA shall not be allowed. The question does not mention the type of transaction. Hence, both answers would be possible.

(v) Dividend receives by an Indian Company on shares of a Foreign Company is ……………………. (taxable/exempted)

Answer:

Taxable

(vi) Salary received by Mr. P a foreign national and a non-resident out-side India for services rendered in India for 150 days is …………………….. (chargeable/not chargeable) to tax in India.

Answer:

Chargeable

(vii) Deduction for provision for bad and doubtful debts made by a public financial institution is allowed up to …………………………… % of total income before allowing such deduction and deduction under chapter VIA.

Answer:

5

(viii) Z. Ltd. awarded three contracts for repair work of ₹ 22,000, ₹ 23,000 and ₹ 30,000 respectively to L. Ltd. in the year 2022-23. Z. Ltd. is …………………………. (required/not required) to deduct tax at source under Section 194C of the Income Tax Act 1961.

Answer:

Not Required

(ix) In case of slum sale of any undertaking indexation benefit is ……………………………….. (allowed/not allowed) for the purpose of computation of capital gain.

Answer:

Not allowed

(x) Annual value of any one palace in the occupation of a former ruler is ………………… .

Answer:

Exempt

(xi) A charitable trust must apply at least ……………………….. percent of its income towards its objects.

Answer:

85

(xii) The time limit for issue of notice to assess the income in relation to assets located outside India for reassessment purposes is …………………………… years from the end of the relevant assessment year. (June 2013, 1 x 12 = 12 marks)

Answer:

16

Question 25.

(b) Choose the most appropriate alternative:

(i) Travel expenditure of the patient and the attender for medical treatment abroad is fully exempted, ¡f gross total income before including reimbursement of toreign travel expenditure is

(A) ₹ 2,00,000

(B) ₹ 2,50,000

(C) ₹’ 3,00,000

(D) ₹ 5,00,000

Answer:

(A) ₹ 2,00,000

Question 26.

(ii) Audit of accounts u/s 44AB of the Income-tax Act, 1961 is mandatory for a person carrying on profession where his gross receipts exceed

(A) ₹ 40,00,000

(B) ₹ 60,00,000

(C) ₹ 20,00,000

(D) ₹ 50,00,000

Answer:

(D) ₹ 50,00,000

![]()

Question 27.

(iii) Long-term capital gain arising from sale of listed shares in a recognized stock exchange (SU paid) is exempt under Section

……………………….. of the Income-tax Act, 1961:

(A) 10(35)

(B) 10(37)

(C) 112A

(D) 10(36)

Answer:

(C) 112A

Question 28.

(iv) Deduction in respect of interest on deposits in savings account is allowed under Section 80 TTA of the Income-tax Act, 1961 to the maximum extent of

(A) ₹ 5,000

(B) ₹ 10,000

(C) ₹ 15,000

(D) ₹ 20,000

Answer:

(B) ₹ 10,000

Question 29.

(v) An assessee who has no income from business or profession will not be required to pay any advance tax ¡f the said assessee is alan

(A) Firm

(B) AOP

(C) Senior citizen

(D) Indian Company (Dec 2013,1 x 5 = 5 marks)

Answer:

(C) Senior citizen

(a) Fill up the blanks:

(i) Mr. A, a senior citizen, has total income of 8 lacs, earned by way of interest from secured debentures. The advance tax payable by him is ₹ ………………….. .

Answer:

Zero

(ii) A partnership firm will be treated as nonresident, only if the ………………………… of the control and management of its affairs is situate outside India.

Answer:

Whole

(iii) An employee of a partnership firm is treated as “specified employee” if the income under the head “Salaries”, excluding non-monetary perquisites exceeds ₹ ……………………… .

Answer:

50,000

(iv) The maximum amount of retrenchment compensation exempt u/s 10 (10B) in the hands of a person, when received from a private scheme not approved by the Board, is ₹ …………………………. .

Answer:

5,00,000

(v) Where any unrealized rent, earlier allowed as deduction is realized subsequently, the deduction available therefor is ₹ ………………………. .

Answer:

30% deductIon u/s 25A is available

(vi) In the case of a payee not having PAN for whom tax ¡s to be deducted at source u/s 1 94A, the rate applicable is ……………………………… . (June 2014, 6 marks)

Answer:

20%

(b) Choose the most appropriate alternative:

Question 30.

(i) For an employee in receipt of fixed medicál allowance, the maximum amount which is exempt is ₹

(A) 12,000

(B) 15000

(C) 18,000

(D) Nil

Answer:

(D) Nil

Question 31.

(ii) Disallowance for ependìture incurred in relation to exempt income is made under Section

(A) 14A

(B) 14

(C) 80A

(D) 10(33)

Answer:

(A) 14A

Question 32.

(iii) Where any land is located within aerial distance of 7 kms. from municipal limits, to be regarded as capital asset u/s 2(14), the population of the municipality as per last census done before 1.3.2013 should be more than

(A) 9 lacs

(B) 8 lacs

(C) 10 lacs

(D) None of these

Answer:

(C) 10 lacs

Question 33.

(iv) To avail exemption u/s 54, an individual should purchase a new residential house within …………………………. years from the date of sale

(A) 2

(B) 3

(C) 1

(D) 4

Answer:

(A) 2

Question 34.

(v) For an assessee engaged ¡n manufacturing activity, additional depreciation u/s 32(1 )(iv) for second-hand machinery costing ₹ 3 lacs, installed on 12.05.2015 is ₹

(A) 30,000

(B) 45,000

(C) 60,000

(D) Nil (June 2014, 5 marks)

Answer:

(D) Nil.

(a) Fill up the blanks:

(i) Deduction under Section 80G for donation to National Children’s Fund is ……………………… percent.

Answer:

100

(ii) Life Insurance premium paid in excess of ……………. percent of the actual capital sum assured LS not deductible under Section 80C, in respect of policies issued on or after 01.04.2013.

Answer:

10

(iii) Commodities transaction tax is ………………….. even if it is incurred in the course of business.

Answer:

Deductible

(iv) Buyback of unlisted shares by a company is ………………. in the hands of the shareholder.

Answer:

Exempt

(v) Rebate under Section 87 is to be calculated ………………………. the levy of education cess.

Answer:

Before

(vi) Rate of income-tax applicable for foreign institutional investors in respect of income from notified bonds and government securities is ………………………… .

Answer:

20%

(vii) The due date for furnishing Annual Information Return is …………………… .

Answer:

31st August

(viii) Sale of gold coin in excess of ………………………… is liable for tax collection at source. (Dec 2014, 1 x 8= 8 marks)

Answer:

₹ 2 lakhs

(b) Choose the most appropriate alternative:

Question 35.

(i) Deduction for investment in new plant or machinery under Section 32AC is applicable for

(A) all assessees

(B) companies

(C) partnership firms

(D) individuals

Answer:

(B) companies

Question 36.

(ii) Income of securitization trust from the activity of securitization is

(A) exempt [Section 10(23 DA)]

(B) taxable at 20%

(C) taxable at 5%

(D) taxable at the regular rates

Answer:

(A) exempt [Section 10(23 DA)]

![]()

Question 37.

(iii) Royalty paid by State Government undertaking to the State Government is

(a) deductible

(B) inadmissible

(C) 50% deductible

(D) 20% deductible

Answer:

(B) inadmissible

Question 38.

(iv) Time limit for setting up undertaking for generation of power to avail deduction under Section 80-IA is available upto

(A) 31.03.2019

(B) 31.03.2018

(C) 31.03.2017

(D) 31.03.2016

Answer:

(C) 31.03.2017

Question 39.

(v) The maximum deduction under Rajiv Gandhi Equity Savings Scheme is

(A) ₹ 10,000

(B) ₹ 50,000

(C) ₹ 1,00,000

(D) ₹ 25,000 (Dec 2014, 1 x 5 = 5 marks)

Answer:

(D) ₹ 25,000

(a) Fill up the blanks:

(i) A company incorporated outside India is said to be resident in India if control and management is …………………. situated in India.

Answer:

Wholly

(ii) A foreign company is liable to surcharge at 5%, if the total income exceeds ……………………. .

Answer:

₹ 10 crores

(iii) A Zero coupon bond is a long-term capital asset, it it is held for more than …………………………… months before transfer.

Answer:

12 months

(iv) If statement of deduction of tax at source is not filed within due date, the deductor is liable to a fee of …………….. per day of default or the amount of tax deductible, whichever is less.

Answer:

200

(v) Maximum amount of exemption under section 10(10C) of the Income-tax Act in respect of compensation received for voluntary retirement is ₹ ……………………. .

Answer:

₹ 5 lacs

(vi) A manufacturing company investing more than ₹ …………………. in new plant and machinery in the previous year 2022-23 is entitled to investment allowance @ 15%.

Answer:

₹ 25 crores

(vii) An assessee can contest an order of the Income-tax Appellate Tribunal on any substantial question of law of filing appeal to the jurisdictional High Court within ……………………. days from the date of receipt of the said order.

Answer:

120

(viii) Royalty payable by Government to a non-resident is liable to be taxed at …………………. % on gross amount of royalty. ( June 2015, 1 x 8 = 8 marks)

Answer:

25

(b) Choose the most appropriate alternative:

Question 40.

(i) Subject to fulfilment of other conditions, remuneration received by a foreign national as an employee of a foreign enterprise for services rendered by him during his stay in India is exempted from income tax, if his stay in India does not exceed a period of

(A) 30 days

(B) 60 days

(C) 90 days

(D) 120 days

Answer:

(B) 60 days

Question 41.

(ii) Long-term capital gain on off-market sale of shares of a listed company without availing of indexation benefit is taxed at

(A) 5%

(B) 10%

(C) 15%

(D) 20%

Answer:

(B) 10%

Question 42.

(iv) Deduction under section 80 JJAA ¡n respect of employment of new workmen can be claimed by a company for an amount equal to

(A) 15% of additional wages to new workmen

(B) 20% of additional wages to new workmen

(C) 25% of additional wages to new workmen

(D) 30% of additional wages to new workmen

Answer:

(D) 30% of additional wages to new workmen

Question 43.

(v) A return of income for Assessment Year 2023-24 filed within the due date specified ¡n Section 139(1) can be revised by the assessee at any time before expiry of

(A) 31 March, 2023

(B) 318t March, 2024

(C) 31st December, 2022

(D) 31st December, 2023 (June 2015, 1 x 4 = 4 marks)

Answer:

(D) 31st December, 2023

(a) Fill up the blanks:

(i) Assessee’s own contribution to the National Pension Scheme is eligible for a maximum deduction of ………………….. .

Answer:

₹ 50,000

(ii) Any payment received from an account opened under Sukanya Samriddhi Açcount Rules, 2014 is ……………………….. .

Answer:

Exempt (Sec. 10(IIA)]

(iii) A charitable trust in order to be eligible for exemption under section 11 must not have more than …………………….. % of aggregate receipts from any activity in the nature of trade, commerce or business.

Answer:

20

(iv) The amount of deduction towards health insurance premium paid by an individual (not being a senior citizen) is limited to ₹ ……………………. .

Answer:

25,000

(v) Fee under section 234E for delay in filing of quarterly TDS/TCS return is ₹ ……………………. per day. . (June 2016, 1 x 5 = 5 marks)

Answer:

200

(b) Choose the most appropriate alternative:

Question 44.

(i) A senior citizen having total income consisting of pension and let out property income aggregating to ₹ 6 lakhs must have paid advance tax during the financial year 2022-23 of

(a) NIL

(b) 90% of ₹ 28,840

(c) 90% of ₹ 44,290

(d) 90% of ₹ 39,140

Answer:

(a) NIL

Question 45.

(ii) Mr. Ramji is employed in ABC Ltd who maintained a hospital for treatment of employees. During the financial year 2022-23, the value of medical benefits availed by Ramji’s family from the hospital was ₹ 2,10,000. The amount of medical perquisite chargeable to income tax would be

(a) ₹ 2,10,000

(b) ₹ 1,05,000

(c) ₹ 21,000

(d) NIL

Answer:

(d) NIL

Question 46.

(iii) Mr. Laxman occupied his apartment till December 2022 and thereafter occupied the quarters provided by the employer. The apartment of Mr. Laxman was let out at ₹ 20,000 per month from 1st January, 2023. The annual value of the property would be

(a) ₹ 60,000

(b) ₹ 2,40,000

(c) ₹ 1,80,000

(d) Nil

Answer:

(a) ₹ 60,000

Question 47.

(iv) When a company paid ₹ 5 lakhs to Indian Institute of Technology to carry on research in a field unrelated to the activity of the company, the amount eligible for deduction paid by way of donation would be

(a) ₹ 5,00,000(100%)

(b) ₹ 6,25,000 (125%)

(c) ₹ 7,50,000 (150%)

(d) ₹ 7,50,000 (150%)

Answer:

(a) ₹ 5,00,000(100%)

Question 48.

(v) Mr. A has loss from regular business of ₹ 8 lakhs and income from speculation business of? 11 lakhs. His total income chargeable to tax would be

(a) ₹ 3,00,000

(b) ₹ 11,00,000

(c) ₹ 7,00,000

(d) ₹ 2,50,000 (June 2016, 1 x 5 = 5 marks)

Answer:

(a) ₹ 3,00,000

![]()

(c) State without indicating reason whether the following statements are true or false:

(i) Share of a private limited company held for 15 months before its sale is,a long-term capital asset.

Answer:

False

(ii) A return of income filed without payment of self-assessment tax is a defective return.

Answer:

True

(iii) Profit from growing and manufacturing tea in India is fully exempted from income tax under section 10(1) of the Income-tax Act.

Answer:

False

(iv) Tax is required to be deducted at source from salary at the time of payment and not at the time of crediting salary to the account of the employee.

Answer:

True

(v) Capital gain arising from compulsory acquisition of a property under law is taxab’e in the year of receipt of compensation or part thereof. (June 2016, 1 x 5 = 5 marks)

Answer:

True.

(a) Fill up the blanks:

(i) The maximum amount deductible under section 88 TTA in respect of interest on savings bank account is ₹ ………………. .

Answer:

₹ 10,000

(ii) Monetary limit for exemption in the case of encashment of earned leave on superannuation received by private sector employees is ₹ …………………… .

Answer:

₹ 3,00,000

(iii) When unrealized rent of 50,000 in respect of a let-out property is realized subsequently, the amount liable to tax would be ₹ ………………….. .

Answer:

₹ 35,000

(iv) Interest on enhanced compensation received by Mr. A, a resident individual is ₹ 4,00,000 of which 75% pertains to earlier financial years. The amount of such interest to be included in the total income under the head ‘income from other sources’ is ₹ ……………………… .

Answer:

₹ 2,00,000

(v) Medical expenditure of ₹ 40,000 was incurred by Mr. A on his mother (being a senior citizen). The amount eligible for deduction under section 80D would be …………………….. . (Dec 2016, 1 x 5 = 5 marks)

Answer:

₹ 40,000.

Question 49.

(b) Choose the most appropriate alternative:

(i) When a person having agricultural lands sells the seeds taken from such lands in a nursery, which is pert of the said lands, the income from such sale is treated as

(A) Business income

(B) Agricultural income

(C) Income from other sources

(D) None of the above

Answer:

(B) Agricultural income.

![]()

Question 50.

(ii) An employer has paid medical insurance premium of ₹ 12,000 in respect of a salaried employee drawing annual salary of ₹ 6 lakhs. The amount of perquisite charged in the hands of emploiee is

(A) Nil

(B) ₹ 6,000

(C) ₹ 12,000

(D) None of the above

Answer:

(A) Nil

Question 51.

(iii) The rate of depreciation for a block of assets consisting of buildings used as factory is

(A) 2.5%

(B) 5%

(C) 10%

(D) None of the above

Answer:

(C) 10%

Question 52.

(iv) In case of a Hindu Undivided Family, where the return of income cannot be signed by the Karta, the same can be signed by

(A) the next senior-most male member.

(B) Karta’s wife.

(C) any male member of the family.

(D) any adult member of the family.

Answer:

(D) any adult member of the family.

Question 53.

(v) In case of an individual or HUF, to determine whether certain TDS provisions are attracted, what has to be seen is whether the person is subject to tax audit under section 44AB in

(A) the immediately preceding financial year.

(B) current year.

(C) last two continuous financial years.

(D) None of the above. (Dec 2016, 1 x 5 = 5 marks)

Answer:

(A) the immediately preceding financial year.

Question 54.

(c) Match the following:

| (i) Securities Transaction Tax | (a) Maximum limit ₹ 50 lakhs |

| (ii) Contribution of Employer to Pension Fund of Central Government | (b) Includible as Salary income of employee |

| (iii) Donation in kind | (c) Not deductible while computing income from property |

| (iv) Ground rent | (d) Deductible as business expenditure |

| (v) Bonds specified in Section 54EC | (e) Not eligible for deduction under section 80G |

(Dec 2016, 1 x 5 = 5 marks)

Answer:

| (i) Securities Transaction Tax | (d) Deductible as business expenditure |

| (ii) Contribution of Employer to Pension Fund of Central Government | (b) Includible as Salary income of employee |

| (iii) Donation in kind | (e) Not eligible for deduction under section 80G |

| (iv) Ground rent | (c) Not deductible while computing income from property |

| (v) Bonds specified in Section 54EC | (a) Maximum limit ₹ 50 lakhs |

Question 55.

(a) Find the most suitable alternative for the following:

(i) The number of identities included in the definition of persons is

(a) five

(b) six

(c) seven

(d) eight

Answer:

(c) seven

Question 56.

(ii) A trust shall not be considered as charitable trust for according the benefits of Section II when the commercial activities in the previous year exceed ₹ ………………… .

(a) 1o lakhs

(b) 25 lakhs

(c) 15 lakhs

(d) 30 lakhs

Answer:

(ii) There is no option in respect of correct answer as it should be 20% of gross receipt.

![]()

Question 57.

(iii) Deduction available under section 24(a) is of NAy.

(a) 30%

(b) 50%

(c) 15%

(d) 70%

Answer:

(a) 30%

Question 58.

(iv) Expenditure incurred by a businessman for ready-to-use software is entitled to benefit of

(a) 15% as depreciation

(b) 30% as depreciation

(c) 60% as depreciation

(d) 100% as revenue expenditure

Answer:

(d) 100% as revenue expenditure

Question 59.

(v) The basic exemption limit for a resident super senior citizen above the age of 80 is

(a) ₹ 2,00,000

(b) ₹ 2,50,000

(c) ₹ 5,00,000

(d) None of the above

Answer:

(c) ₹ 5,00,000

Question 60.

(vi) The provisions relating to interest on delay in payment of refund are given in section

(a) 234A

(b) 234B

(c) 244A

(d) 244B

Answer:

(c) 244A

Question 61.

(vii) Which of the following can be corrected while processing the return of income under section 143(1)?

(a) Any arithmetical error in the return

(b) Any mistake in the return of income

(c) Any error of principle in the return of income

(d) Any claim by the taxpayer which is against law

Answer:

(a) Any arithmetical error in the return

Question 62.

(viii) Notice under section 156 is given for

(a) failure to submit return

(b) tax demand

(c) deferment of tax

(d) None of the above

Answer:

(b) tax demand

Question 63.

(ix) As per Section 271 H, where a person fails to file the statement of tax deducted/collected at source i.e. TDS/TCS return on or before the due dates prescribed in this regard, then he shall be liable to pay penalty under section 271 H. Maximum penalty that can be levied is ₹ ………………… .

(a) 1,00,000, but not exceeding the amount of TDS/TCS.

(b) 2,00,000

(c) 3,00,000

(d) 3,00,000

Answer:

(a) 1,00,000 but not exceeding the amount of TDS/TCS

![]()

Question 64.

(x) The threshold exemption limit for Equalization levy is

(a) ₹ 5 lakh

(b) ₹ 3 lakh

(c) ₹ 2 lakh

(d) ₹ 1 lakh (June 2017, 1 x 10 = 10 marks)

Answer:

(d) ₹ 1 Lakh

(b) Match the following:

| (i) Section 87A | (A) ₹ 5,000 |

| (ii) Section 80GG | (B) ₹12,500 (or) Actual Tax (w.e.l.) |

| (iii) Sukanya Samrudhi Scheme | (C) ₹ 1,500 |

| (iv) Minor child exemption | (D) 30% deduction |

| (V) Arrears of rent | (E) Section 80 C |

(June 2017, 1 x 5 = 5 marks)

Answer:

| (i) Section 87A | (B) ₹12,500 (or) Actual Tax (w.e.l.) |

| (ii) Section 80GG | (A) ₹ 5,000 |

| (iii) Sukanya Samrudhi Scheme | (E) Section 80C |

| (iv) Minor child exemption | (C) ₹ 1,500 |

| (v) Arrears of rent | (D) 30% deduction |

(c) State whether true or false:

(i) An Indian company is always resident in India.

Answer:

True

(ii) Salary received by a member of Parliament is exempt.

Answer:

False

(iii) Income of a self-occupied property cannot be negative.

Answer:

False

(iv) Preliminary expenditures are allowed deduction in 10 equal instalments.

Answer:

False

(v) Capital gain arises from the transfer of any capital asset. (June 2017, 1 x 5 = 5 marks)

Answer:

True

(d) Fill in the blanks:

(i) In case of an Indian citizen who leaves India during the previous year for employment outside India, the period f 60 days shall be substituted by ………………………. days.

Answer:

182 days

(ii) Scholarship received by a student was ₹ 2,000 p.m. He spends ₹ 16,000 for meeting the cost of education. The Balance ₹ 8,000 is ……………………. .

Answer:

Exempt

![]()

(iii) Generally, income is taxable under the head, house property only when the assesse is the ……………………… of such house property.

Answer:

Owner

(iv) Salary, bonus, commission or remuneration due to or received by a working partner from the firm is taxable under the head …………………….. .

Answer:

Profits and gains of Business or profession

(v) Period for holding bonus shares or any other financial asset without any payment shall be reckoned from the date of …………………………. . (June 2017, 1 x 5 = 5 marks)

Answer:

Allotment

(a) Choose the most appropnate alternative:

Question 65.

(i) When Mr. Balu paid royalty to Dr. Peter of Sweden for use of know-how in India, such payment is

(a) exempt from tax.

(b) accruing in India.

(c) accrues in Sweden.

(d) received in India.

Answer:

(b) accruing in India.

Question 66.

(ii) In the case of foreign company with total income of more than ₹ 1 crore but less than 10 crores the surcharge liveable is at

(a) 5%

(b) 12%

(c) 2%

(d) 1%

Answer:

(c) 2%

Question 67.

(iii) Mr. Han resident in India received ₹ 11 lakhs by way of dividend from Indian companies. Such dividend is

(a) exempt from tax.

(b) taxable at regular rates.

(c) taxable at maximum marginal rate.

(d) taxable at 10%.

Answer:

(d) taxable at 10%.

Question 68.

(iv) When an employee receives money on closure of national pension System trust it is

(a) chargeable to tax.

(b) exempt from tax.

(c) 40% is exempt from tax.

(d) 60% is exempt from tax.

Answer:

(c) 40% is exempt from tax.

Question 69.

(v) When employer contributes to approved superannuation fund it is chargeable to tax as perquisite when the contribution exceeds

(a) ₹ 1,50,000

(b) ₹ 1,00,000

(c) ₹ 50,000

(d) ₹ 20,000

Answer:

(a) ₹ 1,50,000

Question 70.

(vi) When the shares are held in unlisted company, it is treated as long-term capital asset when the holding period exceeds

(a) 36 months.

(b) 24 months.

(c) 12 months.

(d) 6 months.

Answer:

(b) 24 months.

![]()

Question 71.

(vii) Long-term capital gain arising from transfer of unlisted securities in the hands of non-resident/foreign company is chargeable to tax at

(a) 10%

(b) 20%

(c) 30%

(d) 40%

Answer:

(a) 10%

Question 72.

(viii) Interest on housing loan taken by individual being his first residential house is eligible for deduction under section 80EE up to a maximum of

(a) ₹ 30,000

(b) ₹ 50,000

(c) ₹ 1,50,000

(d) ₹ 72,00,000

Answer:

(b) ₹ 50,000

Question 73.

(ix) A start-up can claim deduction under section 80 – IAC for ……………………. consecutive years beginning from the year in which the eligible start-up was incorporated.

(a) 1

(b) 2

(c) 3

(d) 5

Answer:

(c) 3

Question 74.

(x) When the return of income for the assessment year 2023-24 is filed under section 139(4), the assessee can revise the return on or before

(a) 31.03.2024

(b) 31.12.2023

(c) 31.03.2025

(d) 31.12.2024 (Dec 2017, 1 x 10 = 10 marks)

Answer:

(b) 31.12.2023

(b) Match the following:

| (i) Additional depreciation for plant used for more than 180 days | (a) 40% |

| (ii) Basic exemption limit of income for resident individual being senior citizen | (b) ₹ 40,000 |

| (iii) Rate of tax for LLP | (c) ₹ 3,00,000 |

| (iv) Depreciation for computers | (d) 30% |

| (v) Exemption in respect of Post office SB interest | (e) 20% |

(Dec 2017, 1 x 5 = 5 marks)

Answer:

| (i) Additional depreciation for plant used for more than 180 days | (e) 20% |

| (ii) Basic exemption limit of income for resident individual being senior citizen | (c) ₹ 3,00,000 |

| (iii) Rate of tax for LLP | (d) 30% |

| (iv) Depreciation for computers | (a) 40% |

| (v) Exemption in respect of Post office SB interest | (b) ₹ 40,000 |

(c) State whether the following are True or False:

(i) Interest on deposit certificates issued under Gold Monetization Scheme. 2015 is exempt from tax.

Answer:

The Statement is true: Interest on deposit certificates issued under Gold Monetization scheme 2015 is exempt from tax u/s 10(15)(vi).

(ii) The monetary limit of ₹ 5 lakhs in respect of gratuity received by an employee covered by Payment of Gratuity Act, 1972 is exempt from tax.

Answer:

The Statement is false: The Monetary limit is ₹ 20 lakhs.

(iii) Medical insurance premium paid by son for parents who are senior citizens is deductible up to a maximum of ₹ 35,000.

Answer:

The Statement is false: Medical insurance premium paid by son for parents who are senior citizen is deductible upto a maximum of ₹ 50,000. (iii) (ci) Rate of tax for LLP is 30%.

(iv) In order to avail carry forward loss from house property, the return of income must be filed before the due date specified in Section 139(1).

Answer:

The Statement Is false: In order to avail carry forward loss from house property, ¡t Return of income is furnished after the due date.

(v) 30% of the additional employee cost incurred by the employer is deductible under section 80JJAA. (Dec 2017, 1 x 5 = 5 marks)

Answer:

Statement is true: 30% of the additional employee cost incurred by the employer is deductible u/s 80JJAA.

![]()

(d) Fill up the blanks:

(i) When a director of a company received ₹ 30 lakhs by way of non-complete fee, it is taxable under the head ……………….. .

Answer:

Profit and Gains of Business or Professional.

(ii) When unrealized rent is received based on court decree but at the time of receipt the property was not owned by the assessee, it is taxable under the head …………………….. .

Answer:

Income from House Property

(iii) When Mr. Ashwin received ₹ 20,000 as scholarship for meeting the cost of education it is ………………….. .

Answer:

Exempt

(iv) The Income Computation Disclosure Standards (ICDS) will apply only when the assesse adopts ……………………… method of accounting.

Answer:

Mercantile

(v) Speculation loss can be carried forward for a maximum period of (number of) years after the year of such loss.

(Dec 2017, 1 x 5 = 5 marks)

Answer:

Four

(a) Choose the most appropriate alternative:

Question 75.

(i) Which of the following ¡s not a case of deemed ownership of house property?

(a) Transfer to spouse for inadequate consideration

(b) Transfer to minor child for inadequate consideration

(c) Co-owner of a Property

(d) None of the above.

Answer:

(c) Co-owner of a Property

Question 76.

(ii) Where assessment has not been completed, belated income tax return for the A.Y. 2023-24 can be filed up to:

(a) 31.03.2024

(b) 31.12.2023

(c) 31.03.2025

(d) Cannot be filed belatedly.

Answer:

(b) 31.12.2023

![]()

Question 77.

(iii) An individual estimates that he is required to pay ₹ 1,00,000 as advance tax. By 15th of December, how much amount must be paid by the individual? .

(a) ₹ 30,000

(b) ₹ 75,000

(c) ₹ 1,00,000

(d) Nil.

Answer:

(b) ₹ 75,000

Question 78.

(iv) Section 80 RRB the Income-tax Act, 1961 deals with deduction from gross total income in respect of income by way of

(a) Interest on debentures of a government company

(b) Royalty income on authors

(c) Royalty on patents

(d) Royalty from textbooks.

Answer:

(c) Royalty on patents

Question 79.

(v) Preliminary expenses that can be amortized under the Income-tax Act 1961 has to be restricted to ……………………… of the cost of the Project.

(a) 5%

(b) 15%

(c) 20%

(d) None of the above.

Answer:

(a) 5%

Question 80.

(vi) Maximum Marginal Rate for the AY. 2023-24 is

(a) 34.5%

(b) 33.99%

(c) 42.74%

(d) None of the above.

Answer:

(c) 42.74%

Question 81.

(vii) Rebate u/s 87A can be claimed by

(a) Any resident

(b) Resident Individual

(c) Any person

(d) Any person other than non resident

Answer:

(b) Resident lndividual

Question 82.

(viii) As per Section 115 BBDA dividend from lndian companies is taxable in the hands of certain recipients at ………………….. when the aggregate dividend exceeds ……………………. .

(a) 10%, 1 lakh

(b) 15%, 10 lakhs

(c) 10%, 10 lakhs

(d) 5%, 5 lakhs

Answer:

(c) 10%, 10 lakhs

Question 83.

(ix) ICDS VIII deals with …………………….. .

(a) Government Grants

(b) Securities

(c) Revenue recognition

(d) Construction Contract

Answer:

(b) Securities

Question 84.

(x) Income escaping assessment is covered under section

(a) 144

(b) 156

(c) 143 (3)

(d) 147 (June 2018, 1 x 10 = 10 marks)

Answer:

(d) 147

(b) Match the following:

| (i) ALTERNATE MINIMUM TAX | (A) SECTION 44AD |

| (ii) RETURN BY WHOM TO BE VERIFIED | (B) SECTION 263 |

| (iii) REVISION BY COMMISSIONER | (C) SECTION 140 |

| (iv) PRESUMPTIVE TAX | (D) SECTION 80EE |

| (v) ₹ 50,000 | (E) SECTION 115JC |

(June 2018, 1 x 5 = 5 marks)

Answer:

| (i) Alternate Minimum Tax | (E) Section 115JC |

| (ii) Return by Whom to be Verified | (C) Section 140 |

| (iii) Revision by Commissioner | (B) Section 263 |

| (iv) Presumptive Tax | (A) Section 44AD |

| (v) ₹ 50,000 | (D) Section 88EE |

(c) State whether True or False:

(i) All incomes that accrue to a minor child will be included ¡n the total income of that parent whose total income is greater.

Answer:

False

(ii) Caution money forfeited by the assessee is taxable in the year of forfeiture under the head capital gains.

Answer:

False

(iii) Paintings are not considered as rersonal effects in the context of “capital asset” definition.

Answer:

True

(iv) In the hands of a manufacturer, factory building newly constructed is not eligible for additional depreciation.

Answer:

True

(v) Income from assets acquired by spouse out of pin money or household savings ¡s not subject to clubbing. (June 2018, 1 x 5 = 5 marks)

Answer:

True.

![]()

(d) Fill in the blanks:

(i) Deduction under section 80GGB in respect of house rent paid is applicable to ………………………. .

Answer:

Individual (Note: Deduction for house rent paid is under Section 80GG, not under Section 80GGB.)

(ii) Unabsorbed depreciation shall be allowed to be carried forward for any number of years and such carried forward unabsorbed depreciation may be set off against any income, other than …………………….. .

Answer:

Income from salary, winning from lotteries, crossword puzzles, etc.

(iii) Income referred to in Sec. 68 to Sec. 69D shall be taxable @ …………………………. (Excluding SC and Cess)

Answer:

60%.

(iv) ……………………………… received by an electoral trust shall be exempted.

Answer:

Any voluntary contributions.

(v) Income from sub-letting of a house property by a salaried employee is taxable under the head …………………… .

(June 2018, 1 x 5 = 5 marks)

Answer:

Income from other sources.

(a) Choose the most appropriate alternative:

Question 85.

(i) Short-term capital gain on sale of listed shares (STT paid) in a recognized stock exchange is chargeable to income-tax @ …………………………….. %.

(a) 10

(b) 15

(c) 20

(d) 30

Answer:

(b) 15

Question 86.

(ii) When the total income of an individual exceeds ₹ 50 lakhs, the surcharge is payable @

(a) 5%

(b) 7%

(c) 10%

(d) 12%

Answer:

(c) 10%

Question 87.

(iii) When the amount is withdrawn from National Pension System Trust, it is chargeable to tax to the extent the withdrawal exceeds ……………………. % of the contribution of the assessee.

(a) 10

(b) 25

(c) 15

(d)20

Answer:

(b) 25

Question 88.

(iv) Ms. Jothi (aged 23) got married and left India to join her husband in the United Kingdom on 10.06.2022. She had never left India earlier. Her residential status for the assessment year 2023-24 is:

(a) Resident and ordinarily resident

(b) Resident but not ordinarily resident

(c) Non-resident

(d) None of the above.

Answer:

(a) Resident and Ordinary Resident

Question 89.

(v) While computing TDS on salary paid to employees, the losses given below to the applicable extent would be considered by the employer:

(a) Loss from business

(b) Loss from house property

(c) Long-term capital loss

(d) Short-term capital loss

Answer:

(b) Loss from house property

Question 90.

(vi) When tax is not deducted at source on annual rent of ₹ 2 lakhs paid to landlord by a company, the amount liable for dis allowance under section 40(a) (ia) is

(a) Nil

(b) ₹ 2,00,000

(c) ₹ 20,000

(d) ₹ 60,000

Answer:

(d) ₹ 60,000

Question 91.

(vii) When the assessee has loss, from house property, the maximum amount of such loss eligible for set of against other permissible incomes would be

(a) ₹’ 30,000

(b) ₹ 1,50,000

(c) ₹’ 2,00,000

(d) No Limit

Answer:

Question 92.

(viii) When a capital asset was acquired on 01.04.2001 and sold in June, 2022, the cost of acquisition or the fair market value of the asset as on at the option of the assessee is to be adopted for indexation purpose:

(a) 01.04.2012

(b) 01.04.2001

(c) 01.04.1992

(d) 01.04.1982

Answer:

Question 93.

(ix) When a motor car is sold for ₹’ 12 lakhs by a dealer to a buyer holding PAN the amount of tax collectible as source shall be ……………………… .

(a) ₹’ 12,000 (1%)

(b) ₹’ 24,000 (2%)

(c) ₹’ 1,20,000 (10%)

(d) Nil

Answer:

Question 94.

(x) Cash donation given to a charitable trust (approved under section 80G) is eligible for deduction under that section, when the amount of donation does not exceed ₹’ …………………………. .

(a) 2,000

(b) 5,000

(c) 7,000

(d) 10,000 (Dec 2018, 1 x 10 = 10 marks)

Answer:

(a) 2,000

(b) Match the following (Sufficient to give the corresponding item in column 3 for column 1; reproducing columns 2 and 4

are not required):

| (i) Depreciation on patents | (A) 40% |

| (ii) Amount received by an individual as a loan in a reverse mortgage | (B) Valuation of inventories |

| (iii) Interest partner on capital | (C) 25% |

| (iv) Depreciation on solar power generating system | (D) Exempted since there is no transfer |

| (v) ICDS II | (E) Allowed up to 12% p.a. |

(Dec 2018, 1 x 5 = 5 marks)

Answer:

| (i) Depreciation on patents | (c) 25% |

| (ii) Amount received by an individual as a loan in a reverse mortgage | (d) Exempted, since there is no transfer |

| (iii) Interest partner on capital | (e) Allowed up to 12% p.a. |

| (iv) Depreciation on solar power generating system | (a) 40% |

| (v) ICDS II | (b) Valuation of inventories |

![]()

(c) State whether following statements are True or False.

(i) Cost of self-generated goodwill of business is deemed to be Nil.

Answer:

True

(ii) Reimbursement of ordinary medical expenses’by the employer is fully exempted.

Answer:

False

(iii) Where capital gain arises to an individual from the transfer of a capital asset, being immovable property under a joint developmen agreement, the capital gain ¡s chargeable to tax in the previous year in which the certificate of completion for whole or part of the project is issued by the competent authority.

Answer:

True

(iv) In order to avail carry forward of unabsorbed depreciation, the assessee must lurnish the return of income within the due date specified in section 139(1).

Answer:

False

(v) In order to claim exemption under section 54B, the agricultural land, which is transferred, must have been used by the assessee or his parents for at least 3 years prior to the date of transfer. (Dec 2018, 1 x 5 = 5 marks)

Answer:

False

(d) Fill in the blanks.

(i) The total income computed will have to be rounded off to the nearest multiple of …………………….. .

Answer:

10

(ii) Domestic company means alan …………………………. company.

Answer:

Indian

(iii) Additional depreciation on factory building for ₹ 30 lakhs, acquired by a manufacturer on 1 Dec., 2022 is …………………….. .

Answer:

Nil

(iv) Unabsorbed depreciation can be carried forward for ………………………. years.

Answer:

any number of

(v) An assessee, who receives leave encashment during continuation of his service, can also claim . (Dec 2018, 1 x 5 = 5 marks)

Answer:

Relief under Section 89

(a) Choose the most appropriate alternative for the following (option to be given only in capital letter A, B, C or D; entire

answer need not be reproduced):

Question 95.

(i) In the case of a domestic company (turnover/gross receipts ₹ 70 crores), the basic rate of income-tax applicable for computing as per normal provisions would be ……………………….., when the turnover of the company has been ₹ 45 crores in the previous year relevant to the assessment year 2020-21. (Note: ignore surcharge, education cess, etc.)

(a) 30%

(b) 29%

(c) 25%

(d) 35%

Answer:

(c) 25%

Question 96.

(ii) The maximum marginal rate of tax applicable for individual taxpayer having total income of ₹ 1.5 crore (including surcharge and health & education cess) is ………………………. .

(a) 34.32%

(b) 35.88%

(c) 34.944%

(d) 29.12%

Answer:

(b) 35.88%

Question 97.

(iii) When a charitable trust pays ₹ 50,000 per month towards rent to a resident for the premises occupied by it without deduction of tax at source for the entire previous year 2022-23, the amount of rental expenditure liable for disallowance would be ……………………. .

(a) Nil

(b) ₹ 6,00,000

(c) ₹ 4,20,000

(d) ₹ 180,000

Answer:

(d) ₹ 18,00,00

![]()

Question 98.

(iv) The lock-in-period for capital gain bonds issued by National Highway Authority of India for the purpose of deduction under section 54EC is ……………….. .

(a) 5 years

(b) 3 years

(c) 7 years

(d) 1 year

Answer:

(a) 5 years

Question 99.

(v) The TDS rate for payments made to a non-resident sportsman is …………………………….. %.

(a) 20

(b) 20.8

(c) 30

(d) Nil

Answer:

(b) 20.8

Question 100.

(vi) Where a partner of a firm transfers any capital asset to the firm by way of capital contribution, for the purpose of computing capital gain in the hands of the partner, the amount of deemed consideration is

(a) cost to the partner.

(b) fair market value of the asset on the date of transfer.

(c) the amount recorded in the books of the firm.

(d) value as determined by the Stamp Valuation Authority.

Answer:

(c) the amount recorded in the books of the firm.

Question 101.

(vii) When the gross receipts from profession exceed …………………………. lakhs, it is liable for audit under section 44AB and the provisions of section 44ADA will not apply.

(a) 50

(b) 25

(c) 100

(d) 20

Answer:

(a) 50

Question 102.

(viii) Medical insurance premium incurred for senior citizen is eligible for deduion up to ₹ ………………………. under section 80D.

(a) 30,000

(b) 50,000

(c) 1,00,000

(d) 60,000

Answer:

(b) 50,000

Question 103.

(ix) When a resident senior citizen having gross total income of ₹ 5,56,000, has derived interest from savings account in a nationalized bank of ₹ 8,200 and fixed deposit interest of ₹ 47,000 from such bank, he is eligible for deduction of ………………………….. from the gross total income.

(a) 55,200

(b) 8,200

(c) 47,000

(d) 50,000

Answer:

(d) 50,000

Question 104.

(x) Seshan, a retired civil servant received monthly pension of ₹ 60,000 during the previous year 2022-23. The amount of pension liable to tax after standard deduction would be ₹ ………………………….. .

(a) 7,10,000

(b) 7,00,000

(c) 6,70,000

(d) 6,30,000 (June 2019, 1 × 10 = 10 marks)

Answer:

(c) 6,70,000

(b) Match the following (sufficient to give the corresponding item in column 3 for column 1; reproducing columns 2 and 4

are not required):

| (i) ICDS IX | A. Quoting of A adhaar number |

| (ii) Section 139AA | B. ₹1500 per child u/s 10(32) |

| (iii) Minor son/daughter clubbing | C. Borrowing cost |

| (iv) Sec 45(2) | D. Exempted from tax u/s 10(17) |

| (v) Any allowance received by MP/MLA | E. Conversion of Capital asset into Stock in trade |

(June 2019, 1 x 5 = 5 marks)

Answer:

| (i) ICDS IX | (C) Borrowing Cost |

| (ii) Section 139 AA | (A) Quoting of Aaclhar number |

| (iii) Minor son/daughter clubbing | (B) ₹ 1500 per child u/s 10(32) |

| (iv) Sec 45(2) | (E) Conversion of Capital asset into stock in trade |

| (v) Any allowance received by MP/MLA | (D) Exempted from tax u/s 10(17) |

(c) State whether the following are True or False:

(i) In applicable situations of TDS, such TDS is to be deducted on amount including GST component.

Answer:

False

(ii) Contribution made to political party by way of cash to the extent of ₹ 10,000 is allowed as business expenditure.

Answer:

False

(iii) Unabsorbed depreciation can be carried forward for any number of years.

Answer:

True

(iv) Interest on normal compensation/enhanced compensation is fully chargeable to tax in the year of receipt.

Answer:

False

(v) Long-term capital gain arising from sale of Usted shares (STT paid) is not fufly exempted from tax. (June 2019, 1 x 5 = 5 marks)

Answer:

True

(d) Fill up the blanks:

(i) Payment of royalty to a person resident in India requires deduction of tax at source at the rate of ………………………. .

Answer:

10%

(ii) The amount of wages paid to eligible new workmen by an assessee engaged in non-seasonal manufacturing activity is deductible u/s 80JJAA @ ……………………………… % of the wages so paid.

Answer:

30

(iii) An expenditure, for which cash payment is made for a sum exceeding …………………… on a single day is disallowed.

Answer:

10,000

(iv) If a return of income is not furnished within the due date prescribed in Section 139(1), such return can be filed on or before …………………… provided the assessment is not completed.

Answer:

31st December 2022

(v) Maximum amount of exemption under section 10(10C) in respect of compensation received for voluntary retirement is ₹ ………………………… . (June 2019, 1 x 5 = 5 marks)

Answer:

₹ 5,00,000.

(a) Choose the most appropriate alternative for the following (Option to be given only ¡n capital letter A,B,C or D; entire

answer need not be reproduced):

Question 105.

(i) Mr. Atul (aged 63), a resident Indian, paid for himself through account payee cheque, health insurance premium of ₹ 2,10,000 for 5 years in one lump sum on 28.03.2023. The eligible amount of deduction under section 80-D for the Assessment Year 2023-24 would be ₹ …………………….. .

(a) 50,000

(b) 30,000

(c) Nil

(d) 42,000

Answer:

(d) 42,000

Question 106.

(ii) Ramesh Tea Ltd., acquired a motor car for ₹ 6,20,000 on 30.08.2022. The company is engaged in manufacture of tea in India. The amount of depreciation allowable on such motor car would be.

(a) 93,000

(b) 37,200

(c) 46,500

(d) Nil

Answer:

(a) 93,000

Question 107.

(iii) When an individual non-resident has total income exceeding ₹ 50 lakhs, the amount of surcharge payable on income tax would be

(a)17%

(b) 15%

(c) 12%

(d) 10%

Answer:

(d) 10%

![]()

Question 108.

(iv) When a charitable trust paid rent of ₹50,000 per month throughout the previous year 2022-23 and no tax was deducted at source, the amount of expenditure to be considered for computing the application of income by the trust would be ……………………….. .

(a) 6,00,000

(b) 1,80,000

(c) 3,00,000

(d) 4,20,000

Answer:

(d) 4,20,000

Question 109.

(v) Manoj a resident employee in ABC Ltd., an Indian Company, has gross annual salary income of ₹ 20,60,000. Tue standard deduction available under section 16(1) would be ₹ …………………… .

(a) Nil

(b) 30,000

(c) 40,000

(d) 50,000

Answer:

(d) 50,000

Question 110.

(vi) Shares in unlisted companies, in order to be treated as long-term capital asset, should be held for a minimum period of …………………… immediately prior to the date of transfer.

(a) 365 days

(b) 12 months

(c) 24 months

(d) None of the above

Answer:

(c) 24 months

Question 111.

(vii) Padmaja Power Co. (P) Ltd. is engaged in generation and distribution of electrical power. It avails deduction under section 80-IA. The gross receipts of the company is ₹ 89 lakhs. The last date for filling the return of income in order to be eligible to avail deduction under section 80-IA is …………………… . (Note: Assume there is no extension of time for filing the return of income)

(a) 31.10.2023

(b) 31.07.2023

(c) 30.11.2023

(d) 31.03.2024

Answer:

(a) 31.10.2023

Question 112.

(viii) Mr. Harivallabh incurred medical expenditure of ₹ 1,20,000 in respect of the disease specified in rule 11 DD for his father (aged 66) who is wholly dependent on him. The amount eligible for deduction from his gross total income would be ………………………. .

(a) 40,000

(b) 60,000

(c) 80,000

(d) 1,00,000

Answer:

(d) 1,00,000

Question 113.

(ix) When Mr. Avinash earned long-term capital gain of ₹ 1,80,000 on sale of listed shares, his total income being ₹ 10 lakhs, the amount of income-tax (including cess) on the said long-term capital gain would be ……………………. .

(a)Nil

(b) 18,720

(c) 8,320

(d) 10,400

Answer:

(c) 8,320

Question 114.

(x) Mr. Seshan received a loan of ₹ 2 Lakhs from Seshan Trading (P) Ltd. in which he has 35% equity shareholding (with voting power). The accumulated profits of the company on the date of loan was ₹ 10 lakhs. The amount of tax (ignore cess) payable on such loan would be ₹ ……………………….. .

(a) @ 10% by Mr. Seshan

(b) @ 20% by the company

(c) @ 30% by the company

(d) depended upon other income earned by Mr. Seshan. (Dec 2019, 1 x 10=10 marks)

Answer:

(c) @ 30% by the company

(b) Match the following (Sufficient to give the corresponding item in column 3 for column 1; reproducing columns 2 and 4 are not required):

| (i) Threshold limit for TDS deduction on commission/brokerage under section 194H | (A) 18,000 |

| (ii) Rate of tax on royalty from registered patent in india. | (B) 2,000 |

| (iii) Rate of tax deduction at source for participating in a Television channel game show in case of residents. | (C) 10% |

| (iv) Cash donation exceeding this amount is not admissible under section 80G. | (D) 30% |

| (v) Taxable amount where enhanced compensation of ₹ 36,000 has been received. | (E) ₹ 15,000 |

(Dec 2019, 1 x 5 = 5 marks)

Answer:

| (i) Threshold limit for T.D.S deduction on commission/brokerage under Section 194-H | (E) ₹ 15,000 |

| (ii) Rate of tax on Royalty from registered patent in India | (C) 10% |

| (iii) Rate of tax deduction at Source for participating in a Television Channel game show in case of residents | (D) 30% |

| (iv) Cash donation exceeding this amount is not admissible under Section 80-G | (B) 2,000 |

| (v) Taxable amount where enhanced compensation of ₹ 36,000 has been received | (A) 18,000 |

(c) State whether the following statements are True or False:

(i) Income from sale of seeds derived from a nursery adjacent to agricultural lands is an agricultural income.

Answer:

Income from sale of seeds derived from a nursery adjacent to agricultural lands is an agricultural income – True

(ii) Unabsorbed depreciation can be carried forward for a maximum period of eight assessment years.

Answer:

Unabsorbed depreciation can be carried forward for a maximum period of eight assessment year – False

(iii) Cash gifts of ₹ 1,00,000 received from uncle’s son by a resident individual is taxable as income from other sources.

Answer:

Cash gift of ₹ 1,00,000 received from uncle’s son by a resident individual is taxable as income from other sources – True

(iv) A firm, resident in India, having total income of ₹ 1,46,000 is eligible to claim deduction u/s 80D.

Answer:

A firm, resident in India, having total income of ₹ 1,46,000 is eligible to claim deduction u/s 80-D – False

(v) For adjusting brought forward business loss with current year business income, one of the conditions is that such business must be continued during the current year. (Dec 2019, 1 x 5 = 5 marks)

Answer:

For adjusting brought forward business loss with current year business income, one of the conditions is that such business must be continued during the current year – False.

![]()

(d) Fill in the blanks:

(i) A resident Indian aged 62, who has received interest of ₹ 12,000 from savings bank account and ₹ 43,000 as interest on bank fixed deposits, is eligible to a deduction of ………………………. from his gross total income.

Answer:

A resident Indian aged 62, who has received interest of ₹ 12,000, from saving bank account and ₹ 43,000 as interest on bank deposits, is eligible to a deduction of ₹ 50,000 from his gross total income.

(ii) Daily allowance received by a member of parliament is ………………………….. .

Answer:

Daily allowance received by a member of parliament is exempt.

(iii) An expenditure, for which cash payment is made for a sum exceeding ₹……………………. on a single day is disallowed u/s 40A(3).

Answer:

An expenditure for which cash payment is made for a sum exceeding ₹ 10,000 on a single day is disallowed u/s 40A(3).

(iv) If a return of income for the AY 2023-24 is not filed within the due date prescribed in section 139(1), such return can be filed on or before ………………………….. provided assessment is not completed.

Answer:

If a return of income for the A.Y. 2023-24 is, not filed within the due date prescribed in Section 139(1), such return can be filed on or before 31.12.2023, provided assessment is not completed.

(v) Maximum amount of exemption under section 10(10C) in respect of compensation received for voluntary retirement is ₹ ……………………….. . (Dec 2019, 1 x 5 = 5 marks)

Answer:

Maximum amount of exemption under Section 10(10C) in respect of compensation received for voluntary Retirement is ₹ 5,00,000.

Question 115.

When ₹ 4 lakh is paid by resident Mr. X (having PAN) towards overseas tour program, how much must be collected by the tour operator by way of TCS?

(1) @20% ₹ 80,000

(2) @ 10% ₹ 40,000

(3) @ 0.50% ₹ 2,000

(4) @ 5% ₹ 20,000

Answer:

(3)@ 0.50% ₹ 2,000

Question 116.

When a member of AOP receives share income it is exempt from tax when

(1) When shares of members in the AOP is determinate.

(2) AOP paid tax at the maximum marginal rate .

(3) When AOP does not pay tax.

(4) AOP paid tax at the regular rates

Answer:

(2) AOP paid tax at the maximum marginal rate.

Question 117.

When the resident individual has total income of ₹ 60 lakhs, the rate of surcharge applicable is

(1) 10%

(2) 15%

(3) 37%

(4) 25%

Answer:

(1) 10%

Question 118.

When a company opts for section 115BAB for the assessment year 2023-24, the maximum rate of depreciation allowable for

the eligible assets owned by it is

(1) NIL

(2) 40%

(3) 30%

(4) 15%

Answer:

(2) 40%

Question 119.

R gifted his house property to his married minor daughter. The income from such house properly shall be included in the hands of:

(1) it will be first computed as minor daughter’s income and clubbed in the income of the R or Mrs R depending upon whose total income is higher.

(2) income of married minor daughter

(3) R as deemed owner

(4) R. However, ¡t will be first computed as minor daughter’s income and then clubbed in the income of R

Answer;

(1) it will be first computed as minor daughter’s income and clubbed in the income of the R or Mrs R depending upon whose total income is higher.

Question 120.

When an employee receives ₹ 18,700 from the employer by way of reimbursement of medical expenditure incurred by him for his family, the amount liable for inclusion by way of perquisite is:

(1) ₹ 18,700

(2) ₹ 15,000

(3) ₹ 3,700

(4) NIL

Answer:

(4) NIL

![]()

Question 121.

Gift of money amounting to ₹ 2,00,000 given in India by a resident on 16.08.2022 to a non-resident (non-relative) shall be:

(1) taxable to the extent of ₹ 1,50,000

(2) exempt

(3) be fully taxable in the hands of the resident

(4) fuLly taxable in the hands of non-resident

Answer:

(4) fully taxable ¡n the hands of non-resident

Question 122.

In the case of charitable trust registered under section 12AA when the amount of anonymous donation received is Z20 Iakhs, the quantum of anonymous donation liable to tax would be:

(1) ₹ 1 lakh

(2) ₹ 19 lakhs

(3) ₹ 20 lakhs

(4) Nil

Answer:

(2) ₹ 19 lakhs

Question 123.

Where a part of the block of asset is sold for a price less than the opening W.D.V. plus cost of assets, if any, acquired during the year, the balance amount shall be treated as:

(1) Terminal/balancing depreciation

(2) None of the given options

(3) W.D.V for the purpose of charging current year deprecation

(4) short-term capital loss

Answer:

(3) W.D.V for the purpose of charging current year deprecation

Question 124.

The following income shan be exempt under Section 10(23FC) of Income-tax Act, 1961:

1. Interest received from special purpose vehicle

2. Dividend received or receivable from a special purpose vehicle

(1) Both 1 and 2

(2) 2 only

(3) Neither 1 nor 2

(4) 1 only

Answer:

(1) Both 1 and 2

Question 125.

What is the monetary limit for transactions between eligible holding company and subsidiary company to trigger the provisions of

specified domestic transactions?

(1) ₹ 200 lakhs

(2) ₹ 500 lakhs

(3) ₹ 2000 Iakhs

(4) ₹ 100 lakhs

Answer:

(3) ₹ 2000 lakhs

Question 126.

A business loss can be curried forward and set off in the subsequent assessment year when the business on account of which this

loss has arisen:

(1) None of the given options

(2) is continued for any part of the previous year

(3) is continued or not

(4) is continued in the assessment year in hick the such loss is set off

Answer:

(3) is continued or not

![]()

Question 127.

Alternate Minimum Tax is applicable in case of

(1) individual or HUF

(2) Firm and individual

(3) any person other than a company

(4) firm and a company

Answer:

(3) any person other than a company’

Question 128.

Suresh incurred ₹’ 90,000 by way of salary paid to employees which has not been accounted for in th business. The amount

of income-tax payable on such salary (Ignore HEC but consider surcharge)

(1) NIL

(2) None of the given options

(3) ₹’ 67,500

(4) ₹ 54,000

Answer:

(3) ₹’ 67,500

Question 129.

While computing the capital gains, an eligible assessee is allowed to opt for market value as on 1.4.2022 in case of:

(1) all capital assets other than depreciable assets, goodwill of a business, trademark or brand name, right to manufacture, right to carry on any business or profession tenancy rights, loom hours, and route permits.

(2) all capital assets other than depreciable asset

(3) None of the given options

(4) all capital assets

Answer:

(1) all capital assets other than depreciable assets, goodwill of a business, trademark, or brand name, right to manufacture, right to carry on any business or profession tenancy rights, loom hours, and route permits.

Question 130.

An undertaking was owned and operated for 28 months before it was sold on slump sale basis. Land and buildings form part of its assets. The resultant gain would be

(1) Short-term capital gain

(2) Exempted income

(3) Long-term capital gain

(4) Business income

Answer:

(1) Short-term capital gain

Question 131.

An award of ₹ 1,00,000 was announced for tracing a missing person. R traced the person and received the award amount. In the hands of R, such receipt shall be:

(1) exempt up to ₹ 50,000

(2) casual income

(3) fully taxable

(4) fully exempt

Answer:

(3) fully taxable

Question 132.

Which of the following propositions are correct for availing deduction under section 80-IAC:

(1) 80-IAC provides for a deduction of an amount equal to 100% of the profits or gains derived from an eligible startup for 3 consecutive assessment years out of 10 years beginning from the year of incorporation.

(2) The deduction shall be available to an eligible start-up if the total turnover of its business does not exceed ₹ 25 crores in any of the previous years beginning from the year of incorporation

(1) 1 only

(2) Neither 1 nor 2

(3) 2 only

(4) Both 1 and 2

Answer:

1 only

Question 133.

Ram commenced construction of residential building on 01.04.2016. Interest on housing loan up to 31.03.2022 was ₹ 4,40,003. Interest for the period from 01.04.2022 to 30.09.2022 (being the date of completion of construction of the residential house) was ₹ 60,000. Interest for the period from 01.10.2022 to 31.03.2023 amounts to ₹ 50,000. How much is the interest eligible for deduction under section 24 for the assessment year 2023-24 for this let-out property?

(1) ₹ 1,50,000

(2) ₹ 1,98,000

(3) ₹ 5,00,000

(4) ₹ 1,00,000

Answer:

(2) ₹ 1,98,000

Question 134.

A company makes regular payments of brokerage to a person for purchase of raw materials. When does the company become liable to deduct tax at source on such brokerage?

(1) When the aggregate brokerage paid or payable exceeds ₹ 50,000

(2) When the aggregate brokerage paid or payable exceeds ₹ 15,000

(3) When the brokerage payable exceeds ₹ 10,000

(4) When the aggregate brokerage paid exceeds ₹ 30,000 (Dec 2021, 1 x 20 =20 marks)

Answer:

(2) When the aggregate brokerage paid or payable exceeds ₹ 15,000

Question 135.

Maintenance of specified books of accounts compulsory if gross receipts in all three preceding PY exceeds ………………….. in case of

persons carrying on the profession of technical consultancy.

Answer:

₹ 1,50,000.

Question 136.

Compensation received under Voluntary Retirement Scheme by an individual shall be regarded as …………………. while computing the income under the head USalariesI

Answer:

Profit in lieu of salary

Question 137.

The rate (excluding surcharge and Cess) of tax applicable on the total income of local authority is …………………….. .

Answer:

30%

Question 138.

A surgeon (doctor) has aggregate annual receipt of ₹ 48 lakhs (₹ 20 lakhs through cash and rest through bank) for the year ended 31.03.2023. His presumptive income under section 44ADA is ₹ …………………………. .

Answer:

₹ 24 lakhs

![]()

Question 139.

When a partnership firm pays salary to working partners of ₹ 6 lakhs when the partnership deed permits payment of 5,40,000. The Book profit of the firm is ₹ 6,00,000. The quantum of remuneration allowable in the hands of firm will be …………………… .

Answer:

₹ 4,50,000

Question 140.

An agricultural land situated beyond ………………….. from the limits of municipality is not regarded as a capital asset, even though the population of municipality as per the last preceding census exceeds ₹ 1 lakh but less than ₹ 10 lakhs.

Answer:

6Kms

Question 141.

When the assessment under section 143(3) is made on 10th December, 2022 by the National Faceless Assessment Centre (NFAC), the time limit for filing petition for rectification of mistake under section 154 would expire by (date).

Answer:

31 .3.2027

Question 142.

When a senior resident individual incurs medical expenditure of ₹ 60,000 towards cataract surgery to his mother (super senior citizen) the amount eligible for deduction under section 80-D is ……………………. if there is no health insurance policy coverage for her.

Answer:

₹ 50,000.

Question 143.

In case of a capital asset, being land or building or both, the fair market vafue of such asset on 1-04-2023 shall not exceed the ……………………… of such asset as on 1- 04-2023 where such stamp duty value is available.

Answer:

Stamp duty value

Question 144.

Royalty of ₹ 1oo lakhs was paid outside India to Andrew, a non-resident for sale of his cinematographic films; -iL such films are to be telecasted in Indian TV channels then the said amount shall be …………………….. (taxable/exempt! partially taxable) ¡n the hands of Andrew

Answer:

Taxable

Question 145.

Mr. Veer, a salaried employee made own contribution to the National Pension Scheme of 50,000 when his basic salary and DA in the previous year is ₹ 480,000. Where the employer contribution is Nil, then he is eligible for a maximum deduction of …………………. under section 80CC D (1).

Answer:

₹ 48,000

Question 146.

Loss from speculation business is eligible for carry forward and set off for subsequent …………………. assessment years

Answer:

4

Question 147.

When an Indian company earns ₹ 20 lakhs by way of income from transfer of carbon credits, the rate of tax applicable on such

income would be ……………………… % (ignore surcharge and cess)

Answer:

10

Question 148.

Person authorized to verity the Return of Income [Section 140] for Political party is ………………… of such party

Answer:

The chief executive officer