Set Off & Carry Forward of Losses – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Set Off & Carry Forward of Losses – CMA Inter Direct Tax Study Material

Short Notes

Question 1.

Write short note on the following:

Losses which cannot be carried forward for set 6ff when the return of income Is not filed within the ‘due dEW specified under section 139(1). (June 2019, 5 marks)

Answer: .

Losses which cannot be carried forward where ROI is flied belatedly: Section 8.0 says that certain losses cannot be carried forward when the return is not filed within the “due date” specified under section 139(1) of the Act.

They are as under

- Business Loss

- Speculation Business Loss

- Loss from Business specified Ii section 35AD

- Loss assessable under the head “Capital gain”.

- Loss from owning and maintaining race horses.

Descriptive Question

Question 2.

Explain the provisions for carry forward and set off of business losses under Section 72. Explain the order of priority amongst

business loss, current depreciation and brought forward unabsorbed depreciation. (Dec 2012, 6 marks)

Answer:

The right of carry forward and set off of loss arising in a business or profession is subject to the following restrictions:

1. Loss can be set off only against Business Income: A loss to the assessee under the head “Profits and gains of business or profession”, and such loss cannot be or is not wholly set off against income under any head of income and he has no income under any other head, the whole loss shall be carried forward to the following assessment year, and:

- It shall be set off against the profits and gains, if any, of any business or profession carried on by him;

- if the loss cannot be wholly so set off, the amount of loss not so set off shall be carried forward to the following assessment year and so on:

2. Loss can be carried forward for 8 Years: No lõss shall be carried forward under this Section for more than eight assessment years immediately succeeding the assessment year for which the loss was first computed.

3. Return of Loss should be submitted in Time: A Loss cannot be carried forward unless it is determined in pursuance of a Return Filed within the time allowed:

- Current year depreciation u/s 32

- Brought forward business toss

- Brought forward unabsorbed depreciation

- Priority of set off.

![]()

Question 3.

What is reverse merger? Explain the reasons for resorting to the same by the assessees. (June 2014, 3 marks)

Answer:

A reverse merger refers to an arrangement where private company acquires a public company, usually a shell company, in order to acquire the status of a public company. Also known as a reverse takeover, it is an alternative to the traditional initial public offering (IPO) method of floating a public company. It is an easier way that allows private companies to change their

type while avoiding the complex regulations and formalities associated with an IPO. Also, the degree of ownership and control of the private stakeholders increases in the public company. It also leads to combining of resources thereby giving greater liquidity to the private company.

Question 4.

Explain the provisions relating to carrying forward and set off losses by closely held companies. (June 2015, 3 marks)

Answer:

Carry forward and set off of Iošses in case of certain companies [Section 79]

Section 79(1) where a change in shareholding has taken place during the previous year in the case of a company, not being a company in which the public are substantially interested, no loss incurred in any year prior to the previous year shall be carried forward and set off against the income of the previous year unless on the last day of the previous year, the shares of the company carrying not less than fifty-one percent of the voting power were beneficially held by persons who beneficially held shares of the company carrying not less than fifty-one percent of the voting power on the last day of the year or years in which the loss was incurred:

Provided that even if the said condition is not satisfied in case of an eligible start-up as referred to in section 80-lAC, the loss incurred in any year prior to the previous year shall be allowed to be carried forward and set off against the income of the previous year if all the shareholders of such company who held shares carrying voting power on the last day of the year or years in which the loss was incurred, continue to hold those shares on the last day of such previous year and such loss has been incurred during the period of seven years beginning from the year in which such company is incorporated.

Section 79(2) Nothing contained in sub-section (1) shall apply,-

(a) to a case where a change in the said voting power and shareholding takes place in a previous year consequent upon the death of a shareholder or on account of transfer of shares by way of gift to any relative of the shareholder making such gift:

(b) to any change in the shareholding of an Indian company which is a subsidiary of a foreign company as a result of amalgamation or demerger of a foreign company subject to the condition that fifty-one percent shareholders of amalgamating or demerged foreign company continue to be the shareholders of the amalgamated or the resulting

foreign company;

(c) to a company where a change in the shareholding takes place in a previous year pursuant to a resolution plan approved under the Insolvency and Bankruptcy Code, 2016 (31 of 2016), after affording a reasonable opportunity of being heard to the jurisdictional Principal Commissioner or Commissioner;

(d) to a company, and its subsidiary and the subsidiary of such subsidiary, where,-

(i) The Tribunal, on an application moved by the Central Government under section 241 of the Companies Act, 2013 (18 of 2013), has suspended the Board of Directors of such company and has appointed new directors nominated by the Central Government, under section 242 of the said Act; and

(ii) a change in shareholding of such company, and its subsidiary and the subsidiary of such subsidiary, has taken place in a previous year pursuant to a resolution plan approved by the Tribunal under section 242 of the Companies Act, 2013 (18 of 2013) after affording a reasonable opportunity of being heard to the jurisdictional Principal Commissioner or Commissioner;

(e) to a company to the extent that a change in the shareholding has taken place during the previous year on account of relocation referred to in the Explanation to clauses (viiiac) and (viiiad) of section 47;

(f) to an erstwhile public sector company subject to the condition that the ultimate holding company of such company, immediately after the completion of strategic disinvestment, continues to hold, directly or through its subsidiary or subsidiaries, at least fifty-one percent of the voting power of such company in aggregate.

Section 79(3) Notwithstanding anything contained in sub-section (2), if the condition specified in clause (f) of the said sub-section is not complied with in any previous year after the completion of strategic disinvestment, the provisions of sub-section (1) shall apply for such previous year and subsequent previous years.

![]()

Practical Questions

Question 5.

A meet furnishes the following particulars of income/loss pertaining to previous year 2022-23:

| (₹ in lacs) | |

| (i) Profit from trading business | 6 |

| (ii) Loss from manufacturing business | 1.50 |

| (iii) Loss from profession | 2.50 |

| (iv) Profit from speculation in shares | 2.50 |

| (v) Loss from speculation in commodities. | 3 |

He has no other income during the year. Determine total income of Ameet for the Assessment Year 2023-24. Also state the loss to be carried forward. The manner of set off must be clearly shown in your answer. (Dec 2013, 5 marks)

Answer:

Computation of Total Income of Ameet for Assessment Year 2023-24

| Particulars | ₹ In lacs |

| Profit from trading business | 6 |

| Less: Set-off of loss from manufacturing business and loss from profession under Section 70 | 4 |

| 2 | |

| Profit from speculation in shares | 2.5 |

| Less: Setoff of loss from speculation ¡n commodities to the extent possible under Section 73 | 2.5 |

| Nil | |

| Total Income | 2 |

Unabsorbed loss of ₹ 0.50 lacs from speculation in commodities can be carried forward by Ameet for four assessment years.

Question 6.

(ii) X Co. Ltd. filed its return for the assessment year 2023- 24 on 10.12.2023, declaring a business loss of ₹ 12,00,000 and unabsorbed depreciation of ₹ 6,00,000. How much of loss and/or depreciation is eligible for carry forward? (Dec 2014, 3 marks)

Answer:

The assessee, in order to carry forward business loss, has to file the return of income before the ‘due date’ prescribed in Section 139(1). Section 80 debars carry forward of business loss to subsequent assessment years unless the return of income in which it has loss, is filed within due date specified in Section 139(1).

However, the embargo contained in Section 80 will not apply to carry forward of depreciation, both current year and that brought forward of preceding years. In view of the above, X Co. Ltd. cannot carry forward business loss of ₹ 12,00,000 but it can carry forward unabsorbed depreciation to future years for set-off.

Question 7.

Mr. Anurag, an individual engaged in the business, having turnover of ₹ 1.50 crores and no international transaction or specified domestic transaction incurred loss from business during the previous year 2021-22. Such business loss could not be set off against any other income during the year. He filed return of loss for Assessment Year 2022-23 on 31st March,2023.

(i) Can Mr. Anurag carry forward such loss for set off against income from

business of the assessment year 2023-24?

(ii) Is there any difference if Mr. Anurag has unabsorbed depreciation instead of loss from business in the previous year 2021 -22 for carry forward to assessment year 2023-24 for set off? (June 2016, 5 marks)

Answer:

(i) As per Section 80 read with Section 139(3), business loss cannot be carried forward unless such loss is determined in pursuance of return filed within the time allowed under section 139(1). It is essential such return is filed within the due date laid down in Section 139(1).

In other words, if the assessee fails to file his return of loss on or before the due date of furnishing of return as prescribed by

Section 139(1) i.e. 31 October, 2022, then the business loss of the assessment year 2022-23 cannot be carried forward for set off in the subsequent eligible assessment years.

(ii) The answer will be different as regards unabsorbed depreciation. The above provision ¡s not applicable in case of carry forward of unabsorbed depreciation and set off in the next years. Carry forward of unabsorbed depreciation and set off in the next assessment year is governed by Section 32(2). Section 80 does not restrict the carry forward of unabsorbed depreciation in case of delayed submission of return of income.

Question 8.

For the assessment year 2023-24, an individual assessee filed return of income on 30.11.2023. He has unabsorbed depreciation of ₹ 2 lakhs and business loss of ₹ 3 lakhs. Can these items be carried forward to subsequent assessment year? Can this return be revised upon discovery of any error? (Dec 2018, 5 marks)

Answer:

It is clear that return of income has been filled on 30.11.2023 the same is not a return of income filled within the due date specified in Section 139(1) i.e. 31.07.2023 it is a belated return.

As per Section 139(3) read with Section 80, certain losses which include business loss, can be carried forward only whose the return has been filed with in due date. Here the return of income was filed belatedly. Therefore, business loss of ₹ 3 lakh cannot be carried forward. However, unabsorbed depreciation is not covered by the same. Hence, the same can be carried forward. According to Section 139(5), belated return can be revised in case of discovery of any error.

![]()

Question 9.

The following details have been furnished by Parikshit relating to previous year 2022-23.

| Particulars | ₹ |

| (i) Income from business (non-speculation) | 6,00,000 |

| (ii) Interest on fixed deposit (net of TDS) | 63,000 |

| (iii) Long-term capital gain on sale of a residential house | 1,00,000 |

| (iv) Unabsorbed short-term capital loss carried forward from Assessment Year 2022-23 | 1,10,000 |

| (v) Loss in non-speculative business carried on by his wife, Prerana. The business was started with the amount gifted by Parikshit during the year | 45,000 |

You are required to compute the total income of Parikshit for Assessment Year 2023-24. (June 2017, 6 marks)

Answer:

Question 10.

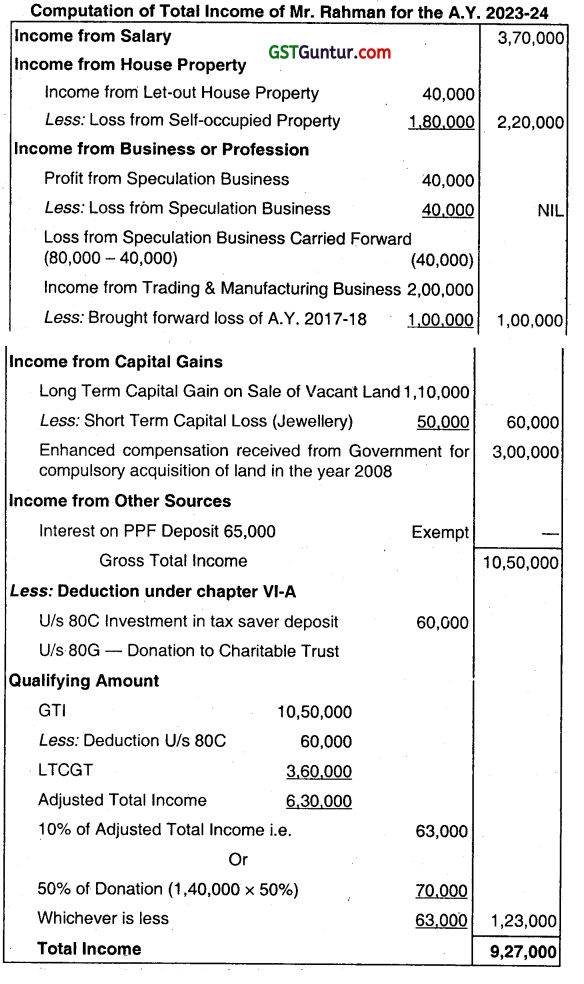

Mr. Rahman furnishes you the following information for the financial year 2022-23:

| Particulars | ₹ |

| Loss from speculation business – A | 80,000 |

| Profit from speculation business – B | 40,000 |

| Loss from self-occupied house property | 1,80,000 |

| Income from let out house property | 4,00,000 |

| Income from trading and manufacturing business @ 8% | 2,00,000 |

| Salary income | 3,70,000 |

| Interest on PPF deposit | 65,000 |

| Long-term capital gain on sale of vacant site | 1,10,000 |

| Short-term capital loss on sale of Jewellery | 50,000 |

| Investment in tax saver deposit on 31.03.2023 | 60,000 |

| Brought forward loss of business of assessment year 2017-18 | 1,00,000 |

| Donation to a charitable trust approved under section 80G | 1,40,000 |

| Enhancement compensation received from Government for compulsory acquisition of lands in the year 2009. | 3,00,000 |

You are requested to compute the total income of Mr. Rahman for the financial year 2022-23 and any loss e’igible for carry forward. (Dec 2017, 8 marks)

Answer:

Question 11.

Aswini’s accounts are not required to be audited under section 44AB. He furnished his return of income for Assessment Year 2023- 24 on 1st August, 2023. He has the following losses during the previous year 2022 – 23:

Loss from house property let out: ₹ 12,000

I oss from business: ₹ 60,000

Unabsorbed depreciation: ₹ 15,000

Short-term capital loss from sale of shares: ₹ 8,000

State, with reason, whether Aswini is entitled to carry forward above losses and unabsorbed depreciation. (June 2018, 5 marks)

Answer:

Where for any assessment year the net result of computation under the head “Income from house property”, “Profit and gains of business or profession”, income from the head “Capital Gains” is a loss to the assessee, and such loss is not wholly set off then the loss, which has not been set off wholly, shall be carried froward to the following assessment year, not being more than eight assessment year immediately succeeding the assessment year for which the loss was first computed.

Unabsorbed depreciation can be set off and carried forward to the following assessment year not being more then eight assessment years immediately succeeding the assessment year for which the loss was first computed. However, loss from house property can be set off only against the income from house property, and short-term capital loss can be set off only against the income from LTCG or STCG. On the basis of above discussion, we can say that Aswani is entitled to carry forward all these losses.

![]()

Question 12.

Ms. Pinky submits the following particulars for the year ended 31st March, 2023:

| Particulars | ₹ |

| (i) Loss from let out residential building-computed | 3,00,000 |

| (ii) Arrear rent from a commercial building received during the year (commercial property had been sold in June, 2020) | 10,000 |

| (iii) Textile business discontinued from 31st October 2021- Brought forward business loss of Assessment Year 2019-20 | 60,000 |

| (iv) Profit from chemical business of current year (computed) | 5,50,000 |

| (v) Bad debt written off in the Assessment Year 2018-19 relating to textile business recovered during the year consequent to Court decree | 1,00,000 |

| (vi) Long-term capital gain on sale of shares (STT paid) in recognized stock exchange on 23.05.2022 | 90,000 |

| (vii) Speculation business in oil seeds profit | 3,00,000 |

| (viii) Winning from lottery (Gross) | 11,00,000 |

| (ix) Loss from the activity of lowering and maintaining race horses | 2,10,000 |

You are required to compute the total income of Ms. Pinky and also ascertain the amount of losses that can be carried forward. (Dec 2018, 7 marks)

Answer: