Clubbing of Income – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Clubbing of Income – CMA Inter Direct Tax Study Material

Short Question

Question 1.

Write short note on the following:

(a) Clubbing of Minor Child (Dec 2022, 5 marks)

Descriptive Question

Question 2.

Explain the tax incidence in the case of a transfer of a let-out property, which is not revocable during the lifetime of the transferee. (Dec 2015, 3 marks)

Answer:

Section 62 of Income Tax Act, 1961 states that any asset transfer to the transferee:

- By way of trust which is not revocable during the lifetime of the beneficiary and in the case of any other transfer, which is not revocable during the lifetime of the transferee; or

- Made before the day of April 1961 WhiCh is not revocable for a period exceeding 6 years; Any income from such transfer shall be chargeable to tax as the income of the transferor as and when the power to revoke the transfer arises, and shall then be included in his total income.

Practical Questions

Question 3.

On 01.05.2022, Mr. Rama transferred the right to receive rental income arising from a factory godown owned by him, to his major son Mr. Lava, for a period of 10 years. The rental income derived is ₹ 10,000 per month. On 12.03.2018, he gifted 2000 shares of face value of ₹ 100 each, in Janak Granites Ltd., a listed company, to his wife Mrs. Seetha. Mr. Rama had purchased them on 19.02.2016 at ₹ 110 each.

Janak Granites Ltd. allotted bonus shares in the ratio of 1:1 on 12.04.2019. Mrs. Seetha sold all shares of the above company on 15.01.2023 in the National Stock Exchange for a net consideration of ₹ 180 per share, paying the applicable STT thereon.

Discuss how the above items will be treated in the hands of Mr. Rama and Mrs. Seetha for the assessment year 2023-24 (Computation of income is not required). (Dec 2012, 5 marks)

Answer:

As per Section 60, in case of transfer of income, whether recoverable or not, without transfer of assets from the income arises, such transferred income shall be included in total income of the transferor, not the transferee. Hence, in this case the rental income from the godown will be assessed in the hands of Mr. Rama.

As per Sec. 64(1)Qv), any income arising from assets transferred without adequate consideration to the spouse shall be included in the total income of the transferor-individual. Where such transferred asset is subsequently sold by the spouse, the resultant tax will have to be considered in the hands of the transferor only i.e., Mr. Rama.

Thus, capital gains on transfer of the original 2000 shares will have to be considered in the hands of Mr. Rama. Since the shares are long-term in nature and are listed shares sold in recognized stock exchange, STT also being paid, the ensuing capital gain is taxable under Section 112A.

However, accretion from the transferred asset is not clubbed in the hands of Mrs. Rama. Bonus shares are accretions and hence capital gains arising on transfer of the bonus shares will be assessed in the hands of Mrs. Seetha. Thus, capital gain on transfer of bonus shares will be taxed in the hands of M Seetha. The bonus shares have been held for less than 12 months and hence is a short-term capital asset. The cost of acquisition of bonus share is taken as nil. The profit from sale of the bonus shares being the net sale proceeds will be assessed as short-term capital gains and may be chargeable to tax at 15%.

![]()

Question 4.

Mr. Ashwin started a proprietary business on 20.04.2022 with a capital of ₹ 5,50,000. His wife Smt. Padma gifted ₹ 2,00,000 on the occasion of his birthday on 28.07.2021, out of which he introduced ₹ 1,00,000 into his proprietary business.

Details of his income from business are given below:

Financial year (Loss) Income

2021-22 ₹ (1,50,000)

2022-23 ₹ 4,00,000

He did not withdraw any amount from the business for his personal use. Determine the amount chargeable to tax in the hands of Ashwin and the amount liable for clubbing in the hands of his wife Smt. Padma. (Dec 2012, 5 marks)

Answer:

Computation of Income from business chargeable in the hands of Mr. Ashwin and clubbing in the hands of Smt. Padma for the Previous Year 2021-22. A.Y. 2022-23

| ₹ | |

| Profit/ loss | (1,50,000) |

| Gifted amount considering the investing part in the business | 1,00,000 |

| Capital | 5,50,000 |

| Clubbed amount | Nil |

| Income chargeable in the hands of Ashwin | Nil |

Computation of Income from business chargeable in the hands of Mr. Ashwin and clubbing in the hands of Smt. Padma for the Previous Year 2022-23. A.Y. 2023-24

| ₹ | |

| Profit/loss | 4,00,000 |

| Gifted amount considering the investing part in the business | — |

| Capital | 5,00,000 |

| Clubbed amount | 80,000 |

| (Previous year capital + Gifted amount – loss of business) (i.e. 4,00,000 x 1.00,000 ÷ 5,00,000) |

Income chargeable in the hands of Ashwin 3,20,000

(Profit earned — clubbed amount = 4,00,000- 80,000)

Hence, the Clubbed amount in the hands of Padma = ₹ 80,000 and

Income chargeable in the hands of Ashwin = ₹ 3,20,000

Note:

Based on cases-R. Ganesan vs. CIT (1965) 58 ITR 411 (Mad.). Asset acquired by transferee out of gift from spouse ¡s also covered. Smt Mohini Thapar vs. CIT (1972)83 ITR 208 (SC) Indirect transfers are also covered.

i. The amount of profit to the extent of gifted to total capital on the first day of the previous year must be clubbed in the hands of Smt. Padma.

ii. The gift was made on 28.07.2021 therefore, the clubbing provisions shall not apply as the gift was made after the 1st day of the previous year.

iii. As per question, Ashwin has not withdrawn any amount for his personal use. So, closing capital of 2021-22 plus profit for that year is taken as the capital for Financial Year 2022-23.

Question 5.

A, a mentally retarded minor has a total income of ₹ 2,40,000 for the assessment year 2023-24. The total income of his father

B and of his mother C for the relevant assessment year is ₹ 4,00,000 and ₹ 3,00,000 respectively. Discuss the treatment to be accorded to the total income of A for the relevant assessment year. (June 2013, 3 marks)

Answer:

All income accruing or arising to a minor chord has to be included in the income of that parent whose total income is greater. However, the income of a minor child suffering from any disability of the nature specified in Section 80U shall not be included in the income of the parents but shall be assessed in the hands of the child. (Sec. 64). Thus the total income of A had to be assessed in his hands and cannot be included in the total income of either his father or his mother.

Question 6.

Manoj gifted ₹ 3,00,000 to his wife on 01.07.2022, which she invested in her beauty parlour business. The capital of Mrs. Manoj as on 01.04.2022 was ₹ 6,00,000. The profit for the year ended 31.03.2023 (computed) from business amounts to ₹ 2,40,000. The total income of Manoj (before clubbing) who is employed in a company amounts to ₹ 4,50,000 (computed).

Determine the income liable for clubbing in the hands of Mr. Manoj out of the incomes earned by Mrs. Manoj during the financial year 2022-23. (Dec 2013, 3 marks)

Answer:

The gift was given by Manoj to his wife on 01.07.2022. Reference to Explanation 3 to Section 64 must be made. As the opening capital as on 01.04.2022 belongs to Mrs. Manoj, Explanation 3 to Section 64 cannot be invoked for the financial year 2022-23.

The opening capital as on 01.04.2022 wholly belonged to Mrs. Manoj and therefore in spite of the gift and its investment in business, no portion of such income would be liable for clubbing. The total income of Mr. Manoj will not change in any manner by applying the clubbing provisions.

![]()

Question 7.

Mr. Vishal gifted a sum of ₹ 3 lacs to Miss Mrinal on 01.04.2022. Miss Mrinal got married to Mr. Vishal’s son on 01.06.2022.

MrinaI earned an interest of ₹ 22,000 from this gifted amount, for the year ended 31.03.2023. Can the interest income of ₹ 22,000 be clubbed in the hands of Mr. Vishal? (Dec 2014, 4 marks)

Answer:

Clubbing of Income u/s 64

In computing the total income of an individual, the income arising from assets transferred by an iridMdual, directly or indirectly, otherwise than for adequate consideration, to the son’s wife, will be clubbed u/s 64(1). As on the date of such transfer for inadequate consideration (i.e., gift), the relationship of father-in-law/daughter-in-law should exist.

In the instant case, Mr. Vishal gave the gift, will before the marriage of Mrinal with Mr. Vishal’s son. Hence, the interest income of ₹ 22,000 earned from such gifted amount cannot be clubbed in the hands of Mr. Vishal.

Question 8.

Answer the following question with brief reason/working:

Interest of ₹ 15,000 on bank fixed deposits is received by the minor son of Ms. Santi. These fixed deposits were made by Ms. Santi out of her son’s earnings from stage acting. What is the tax treatment of interest? (Dec 2015, 2 marks)

Answer:

The interest received ₹ 15,000 will be taxed in hands of Mrs. Shanti. The income of minor son of Mrs. Shanti is chargeable under her individual hands. The clubbing provision do not apply to minor child’s income which is earned by his specialized skills but interest received is not the income earned by his manual work or activity involving application of specialized

knowledge, talent, skill or experience.

Question 9.

Mr. Vignesh and his wife Smt. Buddhi furnishes the following information for the year ended 31.03.2023:

| Particulars | ₹ |

| (i) Salary income (computed) of Smt. Buddhi | 5,50,000 |

| (ii) Income of minor son Brijesh who suffers from disability specified in Section 80U | 1,50,000 |

| (iii) Income of minor daughter Chitra from singing | 85,000 |

| (iv) Income from business (computed) of Mr. Vignesh | 4,00,000 |

| (v) Rental income from property earned by Smt. Buddhi during the year ₹ 4,80,000. The property was gifted by Vignesh 3 years ago out of love and affection. | |

| (vi) Income of minor daughter Chitra from company deposit. | 20,000 |

Compute the total income of Mr. Vignesh and Smt. Buddhi for the Assessment Year 2023-24. (Dec 2015, 5 marks)

Answer:

Notes:

(i) All income occurring or arising to a minor child has to be included in the income of that parent whose total income ¡s greater. However, the income of a minor child suffering from any disability of the nature specified in Sec. 80U shall not be included in the income of the parents but shall be taxed in the hands of the child. Thus income of Bnjesh (who is suffering from disability specified in Section 80U) will be taxable in his own hands.

(ii) Income of Chitra (minor child of Mr. Vignesh and Smf. Buddhi) will be assessed in her own hands because ¡t is income earned by minor child by her specialized skill and talent.

(iii) Income from business of Mr. Vignesh will be taxable in Mr. Vignesh hand under head Profit and gain from business”.

(iv) As per Sec. 64(1)(iv) any income arising from asset transferred with out adequate consideration to the spouse shall be included in the total income of the transferor. Thus the income from house property will be clubbed in Mr. Vignesh‘s

income.

(v) Income of minor daughter Chit ra from company deposit will be clubbed in total income of Mr. Vigriesh.

Question 10.

State the taxability of the following transactions for the assessment year 2023-24:

Ms. Jency got gift of 500 listed equity shares of a company from her husband when the market value of the share was 150 per share. After a month, the company issued bonus shares in 1:1 ratio. The original shares were acquired by her husband 4 months before the date of gift for ₹ 50,000. All the 1000 shares were sold for ₹ 1,50,000 through off-market transaction. How much is taxable and In whose hands it is taxable as income? (Dec 2017, 2 marks)

Answer:

Short-term capital gain arising from sale of original shares gifted i.e., ₹ 25,000 ( ₹ 75,000 – ₹ 50,000) shall be taxed in the hands of husband of Ms. Jency under section 64.

Capital gain attributable to bonus shares will not be liable for clubbing under section 64 since it is an accretion to the original shares. Therefore, ₹ 75,000 being the sale consideration from sale of bonus shares whose cost of acquisition is Nil ¡s taxable in the hands of Ms. Jency as short-term capital gain.

Question 11.

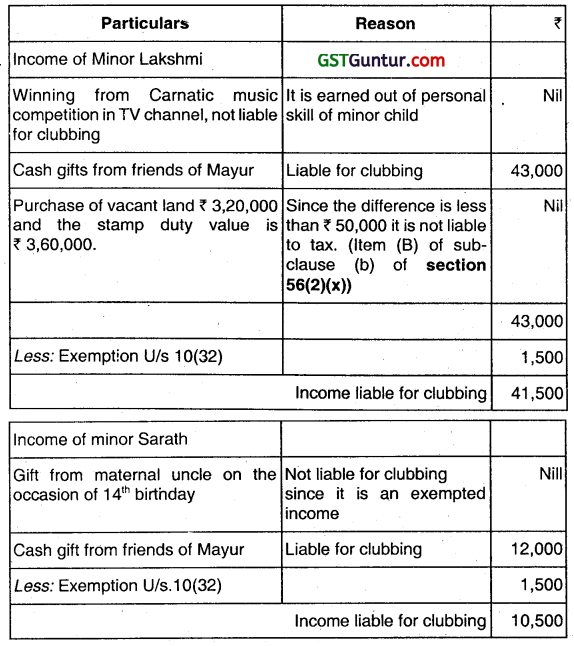

Shri Mayur has two minor children named Lakshmi (age 10) and Sarath (age 14). Following details pertain to the minor children for the year ended 31.03.2023:

(i) Minor Lakshmi won Camatic music competition in TV channel and was awarded cash prize of ₹ 2,00000.

(ii) Minor Lakshmi received cash gifts from friends of Mayur ₹ 43,000. No single gift exceeded ₹ 10,000.

(iii) Minor Sarath received gift of gold chain whose fair market value was ₹ 80,000 from his maternal uncle on the occasion of his 14th birthday. He also received cash gift of ₹ 12,000 from friends of Mayur on his birthday.

(iv) Out of accumulated savings of daughter Lakshmi, one vacant land was acquired. The stamp duty value of the land ₹ 3,60,000. The documented value of the land ₹ 3,20,000. Compute the income of minor children of Mayur which ¡s liable for clubbing. (June 2019, 1 x 5 = 5 marks)

Answer:

Question 12.

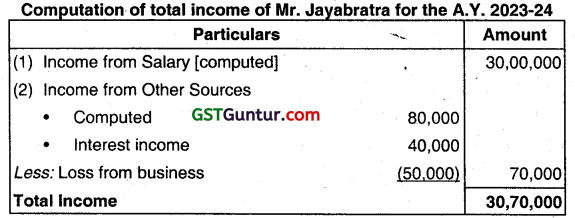

Mr. Jayabrata gifted ₹ 10,00,000 to his wife, Mrs. Sangeeta on 1st January, 2021. Out of the same, Sangeeta lent 4,00,000 for 6 months . to her friend, Bedabati on 1st April, 2022 bearing interest @ 20% p.a. Sangeeta received half-yearly interest of ₹ 40,000 on such loan on 1st October, 2022.

The aforesaid interest was immediately invested in debentures of a company. These debentures were sold by Sangeeta for ₹ 70,000 on 31st January, 2023. The balance amount of gift received from Mr. Jayabrata was invested as her capital in a sole proprietary business, which resulted in a loss of ₹ 50,000 for the previous year 2022-23. Mr. Jayabratas’s own income (computed) consisted of salary of ₹ 30,00,000 and income from other sources of ₹ 80,000. The return of income is being filed on 21.12.2023. Compute the total income of Mr. Jayabrata under suitable heads of income, indicating brief reason for the treatment of all the important items. (Dec 2019, 9 marks)

Answer:

Note:

1. As per Section 64(1)(IV) if any individual transfer any assets to his or her spouse without consideration or for inadequate consideration then income from such assets is received by spouse but tax on such income paid by transferor. Hence in this case interest income taxable in the hand of Mr. Jayabratra.

2. Income includes loss, therefore if there is loss then also clubbing provisions are applicable

3. All the clubbing provisions are not applicable to second-generation income.

![]()

Question 13.

Mr. X gifts ₹ 1 Lakh to his wife Mrs. X on 1st April, 2022 which she lends to a firm at Interest rate of 14% p.a. On 1st Jan 2023, Mrs. X withdraws the money and gifts it to her son’s wife D. She claims that interest which has accrued to D, her daughter-in-law, from January 1st, 2023 to March 31, 2023 on investment made by D is not assessable ¡n her hands but in the

hands of Mr. X. is this correct? What would be the position, if Mrs. X has gifted the money to minor grandson, instead of the daughter-in- law? (Dec 2021, 4 marks)

Answer:

Applicability of clubbing provisions

- Yes, the statement of Mrs. X is correct. Section 64(1) provides that in computing the total income of any individual, there shall be clubbed all such income as arises directly or indirectly to the son’s wife, of such individual, from assets transferred directly or indirectly to the son’s wife by such individual otherwise than for adequate consideration.

- There is an indirect transfer by Mr. X to the daughter-in-law & therefore, the interest income shall be clubbed with the income of Mr. X.

- If Mrs. X had gifted the money to her minor grandson, then the interest income arising to the minor shall be clubbed u/s 64(1A) in the total income of that parent (son/daughter-in-law) whose total income (before including such income) is higher.