Income from other Sources – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Income from other Sources – CMA Inter Direct Tax Study Material

Descriptive Question

Question 1.

Attempt the question below:

At what rate of interest on debentures of an Indian public limited company subscribed in foreign exchange by a non-resident Indian taxed? (June 2015, 1 mark)

Answer:

20%

Practical Questions

Question 2.

Discuss whether the following receipts are chargeable to tax in the hands of the recipients;

(i) Prize money of ₹ 10,000 awarded to Arjun for participating in a motor car rally.

(ii) Madhu received ₹ 10000 each from six friends on his 50th birthday.

(iii) Ramesh received a plot of land from his father-in-law as gift on his marriage anniversary. The value assessed by the Stamp Valuation Officer for the purpose of stamp duty was ₹ 5 lacs.

(iv) Pramod purchased shares of Z. Limited at ₹ 1 lac from his friend. The fair market value of the shares on the date of purchase was ₹ 1.70 lacs. (Dec 2013, 4 marks)

(b) Sanjay holds 16% shares in XYZ Private Limited. The company has given him a loan of ₹ 2 lacs on 1 February, 2022. The accumulated profit of the company on that date was ₹ 1.75 lacs. Sanjay’ repaid the loan on 31st’ March, 2022. Examine the tax implication, if any, of the above transactions in the hands of Sanjay. (Dec 2013, 4 marks)

Answer:

(a) (i) Prize money is an income under Section 2(24). It was received by Arjun as a result of application of his skill and experience.

(ii) Any amount received without consideration from any person or persons other than specified relatives, is not an income assessable under the head “income from other sources” under Section 56(2)(vii), if such amount does not exceeds ₹ 50,000. As the aggregate amount received as gift from six friends exceeds ₹ 50,000, the amount ₹ 60,000 is taxable under Section 56(2)(x).

(iii) As per Section 56(2)(x) any immovable property received form relative as gift not taxable in the hands recipient, irrespective of amount of property gifted.

(iv) As per Section 56(2)(x) even it asset is received (or inadequate consideration it is taxable in the hands of the recipient, if the difference between fair market value and the amount of consideration exceeds ₹ 50,000. Hence ₹ 70,000 is taxable in the hands of Pramod under the head “income from other sources”.

Answer:

(b) As per Section 2(22)(e) where a shareholder of a closely held company having 10% or more voting rights in the company, obtains loan or advance from such company, the amount of loan or advance to the extent of accumulated profit of the company shall be deemed to be dividend. Therefore, the amount of loan to the extent of ₹ 1.75 lacs shall be deemed to be dividend in the hands of Sanjay.

Note: There is a change in the dividend taxation regime with the abolishment of dividend distribution tax in case of dividend

paid/distributed by domestic companies after 1st April 2020, hence, Section 10(34) which provided exemption from dividend received (after payment of Dividend Distribution Tax) is provided with a sunset clause i.e., the exemption would not be applicable on income received by way of dividend on or after 1st April 2020. Such deemed dividend will be taxable in the hands of Sanjay.

![]()

Question 3.

Mr. Somu placed a deposit of ₹ 20,00,000 in LMN Bank on which he is eligible for interest of 1,90,000 for the year. He also

borrowed ₹ 7,00,000 from the bank on the security of the deposit. The amount borrowed was used for his medical expenses and daughter’s education. Interest on the amount borrowed was ₹ 63,000. He offered net interest income of ₹ 1,27,000 under the head ‘income from other sources’. Is he correct? (June 2014, 3 marks)

Answer:

Mr. Somu is not correct as the amount borrowed was not used for making deposit with LMN Bank. Interest income under the head ‘Income from other Sources’ would be ₹ 1,90,000.

Question 4.

Discuss the taxability or otherwise of the following gifts received by Awn, an individual during the financial year 2022-23:

(i) ₹ 50,000 each from his four friends on the occasion of his birthday.

(ii) Wristwatch valued at ₹ 20,000 from his friend. (June 2014, 2 marks)

Answer:

(i) Gift in cash exceeding ₹ 50,000 in aggregate in a financial year is taxable. Therefore, gift of ₹ 2,00000 received from friends is taxable under head income from other sources

(ii) Wrist Watch is not covered under the definition of gift. Therefore, wrist watch valued at ₹ 20,000 from his friend is not taxable.

Question 5.

Ms. Priya has kept a fixed deposit of ₹ 10 lakhs with State Bank of India on which she received interest of 80,000. Subsequently, she borrowed ₹ 5 lakhs from the same bank on the security of the fixed deposit. Interest paid on such loan is ₹ 50,000. She offered interest income of ₹ 30,000 (after adjustment of interest paid ₹ 50,000). Is she correct?

(Dec 2015, 2 marks)

Answer:

Ms. Priya is not correct, there is no provision in the act to allow the interest paid against the interest received by the assessee. Interest liability can not be claimed as deduction u/s 57(111). Hence, ₹ 80,000 will be taxed under head “Income from other sources”.

Question 6.

State the taxability of the following transactions for the assessment year 2023-24:

Ms. Janaki received family pension of ₹ 84,000. (Dec 2017, 2 marks)

Answer:

Family pension will be treated as income from other sources but a deduction of ₹ 15,000 will be allowed from family pension. Therefore, income from other sources in the hands of Ms. Janaki will be ₹ 84,000 less ₹ 15,000 = ₹ 69,000.

![]()

Question 7.

Mr. Vidyasagar received following gifts during the financial year 2022-23:

(i) Gift on the occasion of marriage from friends ₹ 70,000.

(ii) Gift on the occasion of birthday from friends ₹ 55,000.

(iii) Gift from maternal uncle on birthday ₹ 35,000.

(iv) Gift of motor car by grandfather’s younger brother. Fair market value of the car on the date of gift ₹ 3,50,000.

Compute the amount of gifts includible ¡n the total income of Mr. Vidyasagar for the financial year 2022-23. (Dec 2017, 3 marks)

Answer:

(i) Gift on the occasion of marriage from friends of ₹ 70,000 is exempt from tax.

(ii) Gift on the occasion of birthday from friends of ₹ 55,000 is treated as income from other sources u/s 56(2)(x) because the amount of gift is more than ₹ 50,000.

(iii) Gift from Material Uncle on birthday of ₹ 35,000 is exempt because the amount of gift ¡s less than ₹ 50,000.

(iv) Grandfather’s younger brother is not covered by the definition of “relative”. However, motor car is not covered by in the definition of the term “property in Explanation to Section 56(2)(vii).

Question 8.

Discuss the taxability or otherwise in the hands of the recipients:

(i) PQR Private Limited issued 15000 shares at ₹ 150 per share (face value ₹ 100 per share).The far market value of the share is ₹ 130 per share.

(ii) Mr. Sakshitha received a sum of ₹ 92,000 being proceeds at the time of maturity of a life insurance policy (taken 5 years back) and ₹ 1,10,000 being proceeds of maturity value of a Key-man insurance pocy.

(iv) Rashmi received a cell phone worth ₹ 60,000 as gift from her friend on the occasion of her birthday.

(v) On the occasion of her marriage Tripti received cash gifts of ₹ 1,30,000, which includes ₹ 60,000 from her friends.

(June 2018, 2 marks each)

Answer:

(i) Section 56 (2) (viib) provides that the following shall be taxable under the head Income from other sources:

Where a company, not being a company in which the public are substantially interested, receives in any previous year, from any person being a resident, any consideration for issue of shares that exceeds the face value of such shares, the aggregate consideration received for such shares as exceeds the fair market value of the shares.

Question 9.

Discuss the taxability or otherwise in the hands of the recipients:

(i) POR Private Limited issued 15,000 shares at ₹ 150 per share (face value ₹ 100 per share). The fair market value of the share is ₹ 130 per share.

(ii) Mr. Sakshitha received a sum of ₹ 92,000 being proceeds at the time of maturity of a life insurance policy (taken 5 years back) and ₹ 1,10,000 being proceeds of maturity valuo of a Key-man insurnœ policy.

(iv) Rashmi received a cell phone worth ₹ 60,000 as gift from her friend on the occasion of her birthday.

(v) On the occasion of her marriage Tnpti received cash gifts of ₹ 1,30,000, which includes ₹ 60,000 from her friends.

(June 2018, 2 marks each)

Answer:

(i) Section 56 (2) (viib) provides that the following shall be taxable under the head Income from other sources:

Where a company, not being a company ¡n which the public are substantially interested, receives in any previous year, from any person being a resident, any consideration for issue of shares that exceeds the tace value of such shares, the agreegate consideration received for such shares as exceeds the fair market value of the shares.

Therefore, income from other sources ¡n the hands of PQR Pvt. Ltd. will be:

15,000 shares x (₹ 150 – ₹ 130)

= ₹ 3,00,000

(ii) proceeds of maturity of a life insurance policy ₹ 92,000 is exempt in the hands of Mr. Sakshitha and proceeds of Maturity value of a key-man insurance policy is also exempt in the hands of Mr. Sakshitha.

(iv) Sec. 56(2)(x)(c): Gift Received by any person any property other than immovable property without consideration, the Agreegate fair market value of which exceeds ₹ 50,000. the whole of the agreegate fair market value of such property is taxable under the head Income from other sources. But cell phone is not included in the definition of property.

Therefore, Rashmi Received a cell phone worth ₹ 60,000 as gift from her friend on the occasion of her birthday is not taxable under the head Income from other sources.

(v) Gift Received on the occasion of the marriage of the individual is not taxable under the head Income from other sources. Therefore, on the occasion of her marriage Tripti received cash gifts of ₹ 1,30,000 is exempt from tax.

Question 10.

Explain with reasons, the taxability of the following transactions under the head “Income from other sources”:

(i) Veena received interest of ₹ 5,00,000 on additional compensation on account of compulsory acquisition of land acquired few years back.

Year-wise break up of interest received:

₹ 1,20,000 for the Financial Year 2020-21, ₹ 2,40,000 for the Financial Year 2021-22 and ₹ 1,40,000 for the financial Year 2022-23. (Dec 2018, 3 marks)

(ii) Gopal has shareholding (with voting rights) of 12% in Krishna Pvt. Ltd., a closely held company. He received loan of ₹ 2,50,000 from the company on 1 May, 2021, for which he furnished adequate security to the company. The accumulated profit of the company at that time was ₹ 1,75,000. Gopal repaid the loan on 30th Sept 2022. (Dec 2018, 3 marks)

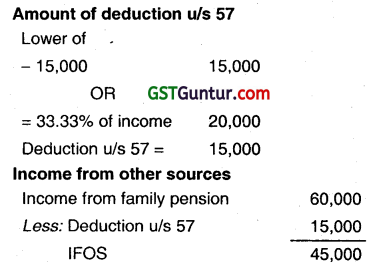

(iii) Family pension of ₹ 60,000 received by Sreelekha, window of Late Vikram. (Dec 2018, 1 mark)

(iv) Vasant, whose salary income is ₹ 4,00,000 has received a cash gift of ₹ 60,000 from a charitable trust for meeting his medical expenses. (Dec 2018, 1 mark)

Answer:

(i) Addition compensation taxable on Receipt Basis, and deduction of amount of 50% of compensation received u/s 57 allow.

Additional compensation taxable under the head – Income from other sources

Total Compensation Received

[1,20,000 + 2,40,000 + 1,40,000] 5,00,000

Less: Deduction u/s 57 2.50.000

Taxable under the head income from other sources 2,50,000

(ii) According to Section 2(22)(e), any payment by a company not being a company in which public are substantially interested of any sum by way of loan or advance to a shareholder being the beneficial owner of shareholding not less than 10% of voting power to the extent to which the company possesses accumulated profit deemed as dividend in the hand of the shareholder.

Deemed dividend taxable under the head income from other sources.

Deemed dividend = ₹ 1,75,000, taxáble in the hand of Gopal, as income from other sources.

(iii) As per Sec. 56, family pension taxable under the head income from other sources, and deduction u/s 57 allowed while computing income chargeable to tax under the head.

(iv) As per Section 56(2)(x), where any sum of money is received by any person from any person exceeding ₹ 50,000 in aggregate value of such sum will be liable to tax. Hence, Vasant received ₹ 60,000 from a charitable trust, are taxable under the head “Income from other sources.

![]()

Question 11.

Ms. Renu has received the following gifts during the previous year 2022-23:

(i) On the occasion of her marriage on 17th January 2023 she has received ₹ 1,00,000 as gift, out of which ₹ 50,000 are from relatives and balance from friends.

(ii) On 31st January, 2023, she has received gift of ₹ 55,000 from cousin of her mother.

(iii) She has received a mobile phone worth ₹ 22,000 from her friend on 16th August, 2022.

(iv) On 1st December 2022, she acquired a vacant land from her friend for ₹ 1,50,000. Stamp duty value on that date ₹ 2,10,000. Compute the taxable income from the aforesaid gifts. (June 2019, 8 marks)

Answer:

| Taxable Amount | Reasons |

| (i) Nil | Gifts received on the on the occasion of marriage are not taxable, whether they are received from relatives or friends |

| (ii) 55,000 | Cousin of Ms. Renu’s mother is not a relative. Hence, the gift is taxable. |

| (iii) Nil | Mobile phone is not included in the definition of property” as per Explanation to section 56(2)(x) |

| (iv) 60,000 | Purchase of land for inadequate consideration on December 2022 would attract the provision of section 56(2)(x). Where any immovable property is received for a consideration which is less than the stamp duty value of the property by an amount exceeding ₹ 50,000, the difference between the stamp duty value and consideration is chargeable to tax in the hands of individual. Hence, ₹ 60,000 is taxable in the hands of Ms. Renu. |

Question 12.

State with brief reason, the taxability or otherwise of the following in the hands of the recipients [except for (i), for which issue may be seen from the hands of the company], as per the provisions of the 1Income-tax Act, 1961:

Mr. Shankar gifted a LED 4” Generation TV to his sister’s daughter Manasa on 12.3.2023. The fair market value of the LED 4”’ generation TV on this date is ₹ 1,08,000. (Dec 2019, 2 marks)

Answer:

As per Section 56(2)(x), property includes Share and securities, Jewellery Drawings paintings, Archaeological Collections, Sculptures any other work of art, Bullion, Immovable property.

Any property received as gift or acquired for low consideration other than above. Section 56(2)(x) not applicable hence LED TV is not a property. It is not taxable in the hands of Manasa.

![]()

Question 13.

Rupesh furnishes you the following details for the financial year 2022-23:

| ₹ | |

| Director sitting fees from Sky (P) Ltd | 50,000 |

| Dividends from Indian companies | 1,20,000 |

| Interest on moneys borrowed for purchase of shares from which dividend income was earned. | 60,000 |

| Interest on Public Provident Fund A/c | 80,000 |

| Rent received for sub-letting a leasehold house property | 1,00,000 |

| Lease rent for the sublet leasehold property | 36,000 |

| Gift received from relatives on the occasion of marriage | 55,000 |

| Gift received from non-relatives on the occasion of marriage | 80,000 |

| Gift received from friends on the occasion of 25th birthday | 60,000 |

| Fixed deposit interest from PSU banks | 16,000 |

| Savings bank account interest | 12,000 |

| Net Agricultural income from land in Malaysia | 1,60,000 |

Compute total income of Rupesh for the assessment year 2023-24. (Dec 2022, 7 marks)