CMA Inter Direct Tax & Indirect Tax Study Material 2023-2024, Direct Indirect Taxation CMA Inter Notes Syllabus, CMA Inter Direct Indirect Tax Notes MCQ Syllabus, CMA Inter DT IDT Study Material.

Direct Tax & Indirect Tax CMA Inter Study Material Notes Pdf

CMA Inter Direct Tax Study Material

1. Basics of Income Tax Act

- Basic Concepts of Income Tax Act

- Residential Status

- Agricultural Income

- Income, Which Do Not Form Part of Total Income

2. Heads of Income

- Income Under Head Salaries

- Income from House Property

- Profits and Gains of Business or Profession

- Capital Gains

- Income from other Sources

3. Total Income and Tax Liability of Individuals & HUF

- Clubbing of Income

- Set Off & Carry Forward of Losses

- Deductions, Rebate and Reliefs

- Assessment of Various Persons

- Tax Deducted & Collected at Source

- Advance Tax

- Return and PAN

- Self-Assessment & Intimation

CMA Inter Indirect Tax Study Material

4. Concept of Indirect Taxes

- 4.1 Concept and Features of Indirect Taxes

- 4.2 Difference between Direct and Indirect Taxes

- 4.3 Background of erstwhile Indirect Taxes (Central Excise, VAT etc.)

- 4.4 Constitutional Validity of GST

5. Goods and Services Tax (GST) Laws

- 5.1 Introduction to GST Law

- 5.2 Levy and Collection of CGST and IGST

- 5.3 Basic concepts of Time and Value of Supply

- 5.4 Input Tax Credit

- 5.5 Computation of GST Liability

- 5.6 Registration

- 5.7 Tax Invoice – Electronic Way Bill

- 5.8 Returns and Payment of Taxes

6. Customs Act & Rules

- 6.1 Customs Act-Basic Concepts and Definitions

- 6.2 Types of Duties

- 6.3 Valuation Rules

- 6.4 Computation of Assessable Value and Duties

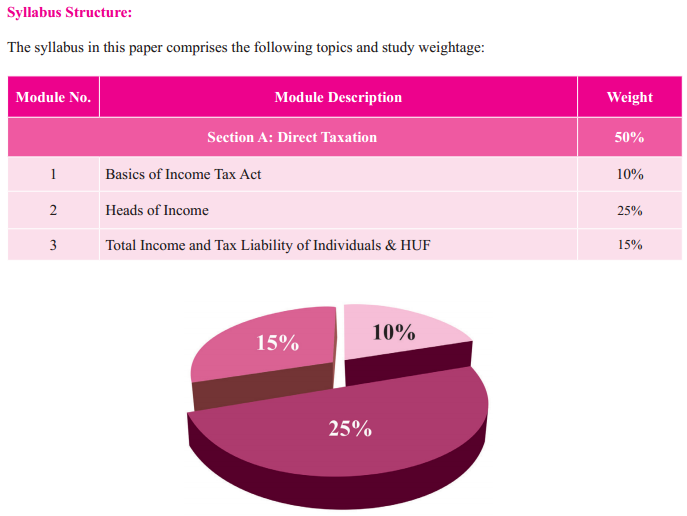

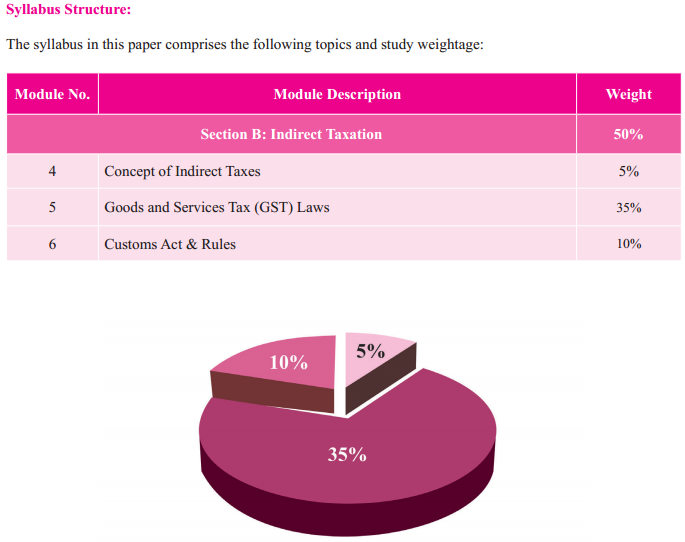

CMA Inter Direct and Indirect Taxation Syllabus

Direct and Indirect Taxation CMA Inter Syllabus

Total: 100 Marks

| Module Description | Weight |

| Section A: Direct Taxation | 50% |

| 1. Basics of Income Tax Act | 10% |

| 2. Heads of Income | 25% |

| 3. Total Income and Tax Liability of Individuals & HUF | 15% |

| Section B: Indirect Taxation | 50% |

| 4. Concept of Indirect Taxes | 5% |

| 5. Goods and Services Tax (GST) Laws | 35% |

| 6. Customs Act & Rules | 10% |

Section A: Direct Taxation

1. Basics of Income Tax Act

Basic Concepts, Basis of Charge and Capital and revenue Receipts, Residential Status and Scope of Total Income, Agricultural Income, Income which do not form part of Total Income.

2. Heads of Income

Salaries, Income from House Property, Profits and Gains of Business or Profession including Tax Audit u/s 44AB; and Provisions u/s 43A, 43B, 43AA, 4AD, 44ADA and 44AE (excluding Sections 42 to 44DB), Capital Gains, Income from Other Sources.

3. Total Income and Tax Liability of Individuals & HUF

Income of Other Person included in Assesses Total Income (Clubbing of Income), Set off and Carry Forward of Losses, Deductions, Rebate and Relief, Taxation of Individual (including AMT but excluding Non-resident) & HUF, Advance Tax, Tax Deducted at Source & Tax Collected at Source (excluding Non-resident), Filing of Return of Income, PAN, Self-Assessment & Intimation.

Section B: Indirect Taxation

4. Concept of Indirect Taxes

Concept and Features of Indirect Taxes, Difference between Direct and Indirect Taxes, Background of erstwhile Indirect Taxes (Central Excise, VAT, etc.), Constitutional Validity of GST

5. Goods and Services Tax (GST) Laws

Introduction to GST Law, Levy, and Collection of CGST and IGST – Application of CGST/IGST law, Concept of Supply including Composite and Mixed Supplies, Charge of Tax including Reverse Charge, Exemption from Tax, Composition Levy; Basic concepts of Time and Value of Supply, Input Tax Credit, Computation of GST Liability, Registration, Tax Invoice – Electronic Way Bill, Returns and Payment of Taxes

6. Customs Act & Rules

Customs Act-Basic Concepts and Definitions, Types of Duties, Valuation Rules, Computation of Assessable Value and Duties

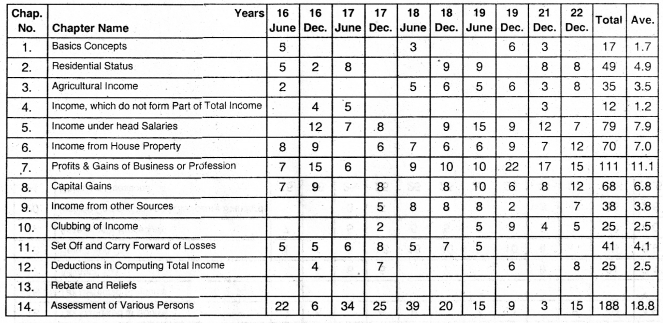

CMA Inter Direct and Indirect Taxation Chapter Wise Weightage