Agricultural Income – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Agricultural Income – CMA Inter Direct Tax Study Material

Descriptive Question

Question 1.

State whether the following are agricultural income or non-agricultural income:

Where owner himself performs slaughter tapping and them sells the rubber.

Conversion of sugar cane into Gur. (June 2013, 2 marks)

Answer:

(i) Where owner himself performs slaughter tapping and then sells the rubber, it is Agricultural income.

(ii) Conversion of sugar cane into Gur – Non Agricultural income as it involves manufacturing activity which is of business nature.

Practical Questions

Question 2.

Manmohan owns a tea estate in Assam. He also owns a nursery wherein he grows plants and sells them. He furnishes the following particulars:

| ₹ | |

| (i) Profit from sale of green tea leaves | 1,75,000 |

| (ii) Profit from manufacturing of tea grown in the garden owned by him | 7,00,000 |

| (iii) Profit from sale of plants from nursery | 1,00,000 |

Compute tax payable by Manmohan for the Assessment Year 2023-24.

(Dec 2013, 6 marks)

Answer:

In the case of nursery plants, question is silent about whether sapling or seedling process activity has been undertaken or not. So, it is required as per the question that answer should be in both alternatives. Because if sapling or seedling process has been undertaken then it is agricultural Income otherwise not.

![]()

Alternative – 1

Computation of Taxable Income for the Assessment Year 2023-24

| Nature of Business | Agi. Inc. | Non- Agi. Inc. |

| Profit from sale of green leaves grown in own garden being agricultural Income is exempted under Section 10(1) | 1,75,000 | – |

| Profit from growing and manufacturing of tea (60% agricultural income and 40% non-agricultural income) | 4,20,000 | 2,80,000

|

| Profit from sale of plants from nursery (agricultural income) | 1,00,000 | – |

| Total Income | 6,95,000 | 2,80,000 |

Alternative – 2

Computation of Taxable Income for the Assessment Year 2023-24

| Nature of Business | Agi. Inc. | Non-Agi. Inc. |

| Profit from sale of green leaves grown in own garden being agricultural Income is exempted under Section 10(i) | 1,75,000 | – |

| Profit from growing and manufacturing of tea (60 % agricultural income and 40% non-agricultural income) | 4,20,000 | 2,80,000 |

| Profit from sale of plants from nursery (non-agricultural income) | – | 1,00,000 |

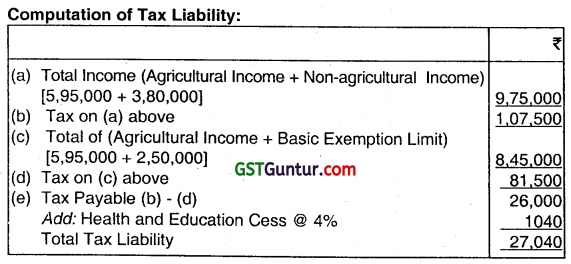

| Total Income | 5,95,000 | 3,80,000 |

Note -It is assumed that sapling & seedling process has not been undertaken for nursery plants.

Question 3.

Answer the following question with brief reasons/working:

(i) Rajesh has earned an income of ₹ 45,000 from letting out his rural agricultural lands for a movie shooting. Will this income be regarded as agricultural income and hence exempt? (June 2016, 2 marks)

Answer:

Rent earned from letting out the agricultural land is not rent or revenue derived from the agricultural land. As per Section 2(1A), any income derived from any building owned and occupied by the receiver of the rent or revenue of any such land, or occupied by the cultivator or the receiver of rent-in-kind, of any land with respect to which, or the produce of which, any process mentioned in the section alone, is re9arded as rent for the purpose of this section. Rent from letting out to a movie company will not fall in this category. The land was not used for agricultural purposes but for movie shooting. The impugned income is not agricultural income and hence is not exempt.

Question 4.

State with brief reasons whether the following are agricultural income either in whole or in part:

(i) Purchase of standing sugarcane crop by Mr. Amin for ₹ 2 lakhs and after cutting the canes, selling them for ₹ 2,50,000.

(ii) Income from milk dairy run by Mr. Raj in his agricultural lands ₹ 50,000.

(iii) Income from sale of plants ₹ 1,00,000 earned by Mr. Jam who maintains a nursery by name Soundarya Nursery.

(iv) Income from sale of rubber ₹ 3,20,000 realised by Mr. Ram Nair who owns rubber estate and cultivates rubber.

(v) Income from gracing of cattles allowed in the land owned by Mr. Richard ₹ 60,000. (June 2018, 1 x 5 = 5 mark)

Answer:

(i) Purchase of standing sugarcane crop by Mr. Amin for ₹ 2 lakhs and after cutting the canes, selling them for ₹ 2,50,000 is not an Agricultural Income because he has not done the basic agricultural activities.

(ii) Income from milk dairy run by Mr. Raj in his agricultural land ₹ 50,000 is not an agricultural Income, it is an Income from Business.

(iii) Income from sale of plants ₹ 1,00,000 earned by Mr. Jam who Maintains nursery by name Soundarya Nursery is an Agricultural Income because it is derived by performing basic agricultural Activities.

(iv) Income from sale of rubber 3,20000 realized by Mr. Ram Nair who owns rubber Estate and Cultivates rubber is partly agricultural Income, 65% of such Income will be treated as agricultural income and 35% of such income shall be income liable to tax as business income.

(v) Income from gracing of calls allowed in the land owned by Mr. Richard ₹ 60,000 is not an agricultural Income.

![]()

Question 5.

Mr. Manish, a resident in India, has the following incomes for the year ended 31st March, 2023:

Income from sale of tea grown and manufactured in India ₹ 4,00,000

Income from growing and manufacturing rubber in India ₹ 5,00,000

Income from agricultural operations in Sri Lanka (cultivated paddy) ₹ 1,00,000

Income derived from sale of coffee grown, cured, roasted, and ground in India ₹ 2,00,000

Determine the quantum of income which is regarded as agricultural income and non-agricultural income in the hands of Mr. Manish for the assessment year 2023-24. (Dcc 2018, 6 marks)

Answer:

Computation of the quantum of income which is regarded as agricultural income and non-agricultural income in the hand of

Mr. Manish for the AY. 2023-24.

| Particulars | Agricultural Income | Non-Agricultural Income |

| Income of sale of tea | (60%) 2,40,000 | (40%) 1,60,000 |

| Income from growing and manufacturing rubber in India | (65%) 3,25,000 | (35%) 1,75,000 |

| Income from agricultural operations in Sri Lanka, | – | (100%) 1 ,00,000 |

| Income derived from sale of coffee grown, cured, roasted and ground in India | (60%) 1,20,000 | (40%) 80,000 |

| Aggregate Income | 6,85,000 | 5,15,000 |

Question 6.

Ashok, Surat furnishes you the following information for the previous year 2022-23:

| ₹ | |

| (i) Income from coffee grown and cured in Coorg, Karnataka | 3,00,000 |

| (ii) Income from tea grown and manufactured in Jorhat, Assam | 2,50,000 |

| (iii) income from Rubber estates in Kerala by sale of field latex obtained from rubber plants grown there. | 4,00,000 |

| (iv) Income from nursery by name ‘Soundarya Nursery’, Chennai | 2,00,000 |

| (v) Rent from a dwelling house in agricultural land in Coorg, Karnataka (It is occupied by the coffee estate labourers). | 90,000 |

Compute the agricultural income of Ashok. (June 2019, 5 marks)

Answer:

Computation of agricultural Income of Ashok for the Asst. Year 2023- 24:

| Particulars | Agricultural Income | Non-Agricultural Income |

| Coffee grown and cured in Coorg, Karnataka [75% agri income and 25% of non-agri income] | 2,25,000 | 75,000 |

| Income from tea grown and manufactured in Jorhat, Assam [60% agri income and 40% non-agri income] | 1,50,000 | 1,00,000 |

| Income from Rubber estates in Kerala [65% agri income and 35% non-agri income] | 2,60,000 | 1,40,000 |

| Income from nursery at Chennai is fully agricultural income | 2,00,000 | Nil |

| Rent from dwelling house in agricultural land in Coorg, Karnataka | 90,000 | Nil |

| Total | 9,25,000 | 3,15,000 |

Question 7.

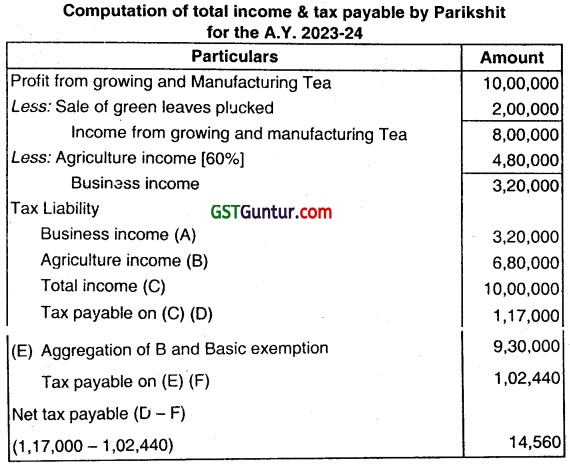

Parikshit (aged 25 years) is engaged in growing and manufacturing tea in India. His profit for the previous year 2021-22 amount to ₹ 10,00,000 which includes profit of ₹ 2,00,000 from sale green leaves plucked in his own garden. He has no other income during the year. Compute the total income and total tax payable by Parikshit. (Dec 2019, 6 marks)

Answer:

![]()

Question 8.

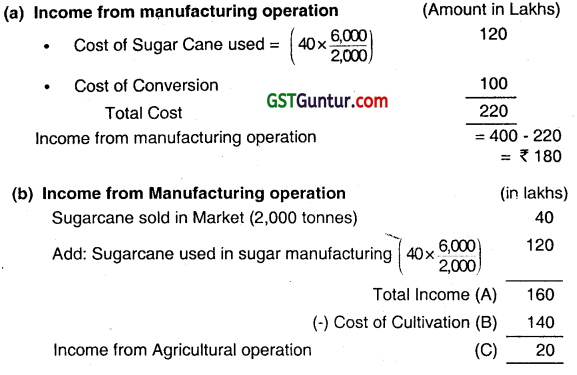

X Ltd. Grows sugarcane to manufacture sugar. Details for the previous year 2022-23 are as follows:

| Particulars | ₹ in lakhs |

| Cost of cultivation of sugarcane (8,000 tonnes) | 140 |

| Sugarcane sold in market (2,000 tones) | 40 |

| Sugarcane used to sugar manufacturing (6,000 tonnes) | – |

| Cost of conversion | 100 |

| Super produced & sold in market | 400 |

Compute Income of X Ltd. for the Assessment Year 2023-24. (Dec 2021, 3 marks)

Answer:

Question 9.

State which of the following would be agricultural income or otherwise:

(i) Salary of plantation worker from Duncan Co. Ltd. engaged in rubber plantation.

(ii) Royalty income from Orissa Coal Mines Ltd.

(iii) Interest on loan given to Ram Poultry Farming Ltd.

(iv) Rent received for use of land for grazing of cattle by God Dairy Ltd.

(v) Income from saplings and seedlings grown by Soundarya Nursery.

(vi) Rent from farmhouse in the midst of agricultural land received by Banerjee.

(vii) Compensation from insurance company for damage caused to standing crops due to cyclone received by Atul.

(viii) Profit on sale of crops after harvest where the standing crops were purchased by Agro Farms (P) Ltd. (Dec 2022, 8 marks)