Residential Status – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Residential Status – CMA Inter Direct Tax Study Material

Distinguish Between

Question 1.

State the difference between residential status of a company and that of others. (Dec 2012, 2 marks)

Answer:

Rules to determine residential status of Companies [Sec. 6(3)]

A person being a company shall be said to be resident in India in any previous year if:

- It is an Indian Company, or

- Its place of effective management at any time in that year, is in India.

Note:

1. A company cannot be “ordinarily” or “not ordinarily resident”

2. Place of Effective management to mean the place where key management and commercial decisions that are necessary for the conduct of the entity’s business as a whole, are, in substance made.

Note: 1

For the purpose of this clause Place of effective management” means a place where key management and commercial decisions that are necessary for the conduct of business of an entity as a whole are, in substance made.

Note: 2

1. The guidelines for determining POEM as given in circular issued by CBDT shall apply to a company having turnovor or gross receipts exceeding ₹ 50 crores in the financial year.

2. A company is said to be engaged in “Active Business Outside India” and hence its POEM ¡s outside India. If it satisfies all the following conditions.

Passive income is 50% or less of its Total Income, (Income to be computed as per tax laws of the country where such company ¡s incorporated. Otherwise as per books of account if tax laws of that country does not require computation.]

Less than 50% of total assets situated in India.

The value of assets shall be:

(a) Depreciable assets. Average of its value for tax purposes at the beginning and end of Previous Year.

(b) Value as per books of account.

Less than 50% of total employees situated in India or are residents in India. (Number of Employees shall be average of number of employees at the beginning and end of the previous year. Employee shall include persons who are not directly employed but perform functions similar to employees e.g. contractual persons.] a Payroll expenses of employees situated in India or resident in India is less than 50% of total payroll expenditure.

[“Payroll” includes cost of salaries, wages, bonus plus employee‘s compensation including pension and social costs borne by

employer.] Majority meetings of Board of Directors are held outside India.

3. However, if it is established that Board of Directors are standing aside and not exercising their Powers of management and such powers of management are exercised by holding company or any other person resident in India, then POEM shall be considered in India.

![]()

Descriptive Question

Question 2.

Mr. Bharat, an engineering graduate, born and brought up in India, got employment in USA in August, 2022. By what date he should leave India, in order to become a non-resident? By that, what tax advantage he will get? (June 2015, 3 marks)

Answer:

Planning for residential status:

A person who leaves India for employment if remains for less than 182 days during the financial year of leaving, he will be a non-resident. Mr. Bharat must leave India before 29th September 2022 to be non-resident for the financial year 2022-23.

When he plans his departure in such a way that he becomes non-resident, his income accruing or arising outside India will not be subjected to tax in India. His income accruing or arising in India alone will be liable to tax in India.

Practical Questions

Question 3.

Mr. A furnishes the following particulars of his income during the previous year 2021-22:

(i) Income from agriculture in Bangladesh, received there of ₹ 2,00,000 and subsequently remitted to India.

(ii) Gift of ₹ 52,000 received in foreign currency from a relative in India.

(iii) Arrears of salary ₹ 70,000 received in India from a former employer in England.

(iv) Income from property received abroad but later on remitted to India ₹ 3,20,000. (₹ 1 lakh used in Bahrain for educational expenses and ₹ 2 lakhs remitted in India later).

(v) Profit from business outside India managed from India ₹ 90,000 and received outside India.

Find out the gross total income of Mr. A for the assessment year 2023-24 if A is

(i) Resident and ordinarily resident

(ii) Resident but not ordinarily resident and

(iii) Non-resident. (Dec 2012, 7 marks)

Answer:

| Particulars | Res. & ord. resident (ROR) | Res, but not ord. resident (NOR) | Nonresident (NR) |

| Income from agriculture in Bangladesh received there but later on remitted to India | 2,00000 | – | – |

| Gift received from a relative in India [exempt u/s 56(2)( VII)] | – | – | – |

| Arrears of salary received in India from a former employer in England | 70,000 | 70,000 | 70,000 |

| Income from property received outside India but later on remitted to India | 3,20,000 | – | – |

| Profit from business outside India managed from India. | 90,000 | 90,000 | – |

| Gross Total income | 6,80,000 | 1,60,000 | 70,000 |

Question 4.

Mr. Jeff, a citizen of USA came to India for 80 days, 90 days, 110 days and 130 days in the financial years 2019-20,2020-21,2021- 22 and 2022-23 respectively. Determine his residential status for the Assessment Year 2023-24. (June 2013, 3 marks)

Compute the total income of Mr. Taylor. UK citizen and a non-resident for the Assessment Year 2023-24 from the foIIoing details furnished by nim.

| ₹ | |

| (i) Income from business carried out in Mumbai (60% received in USA) | 5,00,000 |

| (ii) Capital gain from sale of shares of Zenith Private Limited, an Indian company. Sale proceeds were received in UK | 3,50,000 |

| (iii) Rent from a house property in New Jersey collected there, but later remitted to india through normal banking channel | 12,00,000 |

| (iv) Dividend received from MNO Limited, an Indian Company | 2,50,000 |

| (v) Royalty received in UK from PQR Limited, an Indian company for use of trade mark for its business operation in India | 6,00,000 |

| (vi) Interest on loan received in UK from S&T Limited, an Indian company. The loan was used by S&T Limited for its business carried on in Dubai. | 3,00,000 |

(June 2013, 7 marks)

Answer:

(a) As per Section 6 an individual is a resident in India in any previous year, if he fulfills any of the following two conditions:

(i) He is present in India in that previous year for 182 days or more.

(ii) He was present in India within 4 years preceding that previous year for 365 days or more and for 60 days or more in that previous year. In this case, Jeff was physically present in India for less than 182 days in previous year 2022-23.

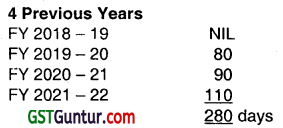

AY 2023 -24- FY 2022 – 23 = 130 days

Hence, non-resident. He was present in India for 130 days (more than 60 days in the previous year and he was physically present in India for 280 days (80 + 90 + 110) Le. less than 365 days in 4 previous years preceding the previous year 2022-23. Hence, he does not fulfill the second condition and Jeff is non-resident in India for the Assessment Year 2023-24.

Answer:

| Particulars | ₹ |

| Income from business carried out in India is income from business connection in India and deemed to accrue or arise in India. | 5,00,000 |

| Capital gain is deemed to accrue or arise in India as shares of Indian company are capital assets situated in India. Place of receipt of consideration is immaterial. | 3,50,000

|

| Rent from house property situated in New Jersey being an income from source outside India is not taxable. Subsequent remittance of rent to India does not alter the position. Dividend from Indian company is Taxable (Note – 1). | — |

| Royalty received from the Indian company is deemed to accrue or arise in India, as the patent was used by the Indian company for its business in India. | 10,00,000 |

| Interest on loan received from the Indian company is not deemed to accrue or arise in India as the amount of loan was | 6,00,000 |

| used by the Indian company for its business carried out outside India | — |

| Total Income | 24,50,000 |

Note – 1: There is a change in the dividend taxation regime with the abolishment of dividend distribution tax in case of dividend paid/distributed by domestic companies after 1 April 2020, hence, Section 10(34) which provided exemption from dividend received (after payment of Dividend Distribution Tax) is provided with a sunset clause i.e., the exemption would

not be applicable on income received by way of dividend on or after 1st April 2020.

![]()

Question 5.

Mr. Rajput, aged 82 years gives you the following information for the previous year 2022-23:

| ₹ | |

| (i) Interest on fixed deposits with banks | 4,80,000 |

| (ii) Long-term capital gain on sale of land | 50,000 |

| (iii) Short-term capital gain on sale of shares (securities transactions tax paid) | 20,000 |

Compute tax payable by Mr. Rajput for the Assessment year 2023-24 in cases (i) he is resident; (ii) he is non-resident. (June 2013, 4 marks)

Answer:

As per the proviso to Section 112(1)(a) if the following conditions are satisfied :

(i) The taxpayer is a resident individual or a resident HUF. He or it may be ordinarily resident or not ordinarily resident.

(ii) Taxable income – Long-term Capital Gain ¡s less than the amount of basic exemption limit

The following shall be deducted from long-term capital gain:

Exemption Iimt- (Net Income or taxable income including Long-term Capital Gain – Long-term Capital Gain)

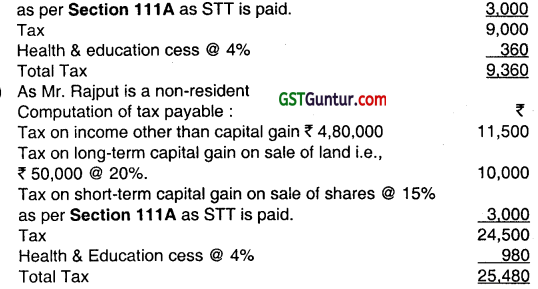

(i) As Mr. Rajput is a resident, the relief u/s 112 is available

| ₹ | |

| Basic Exemption Limit | 5,00,000 |

| Taxable income including Long-term Capital Gain | 5,30,000 |

| Long-term Capital Gain | 50,000 |

| Relief u/s 112 | 20,000 |

Computation of tax payable: ₹

Tax on income other than capital gain ₹ 4,80,000 Nil

Tax on long-term capital gain on sale of land i.e.,

₹ 50,000 – 20,000 i.e., ₹ 30,000 @ 20%. 6,000

Tax on short-term capital gain on sale of shares @ 15%

Question 6.

Answer the following questions with brief reasons/workings:

(c) Mr. David, a citizen of Spain came to India for the first time in previous year 2018-19, and stayed for 1oo days in that year. During the previous years 2019-20. 2020-21, 2021 -22, and 2022-23 he stayed in India for 120 days, 110 days, 80 days and 90 days respectively. What is the residential status of Mr. David for the assessment year 2023-24? (Dec 2015, 2 marks)

(f) X. Limited is an Indian company. However, ¡t carries on business in USA. All the shareholders are residents of USA. The Board Meetings and Annual General Meetings are held outside India. What ¡s the residential status of X. Limited? (Dec 2015, 2 marks)

Answer:

(c) As per Section 6 an individual is a resident in India in any previous year if he fulfills any of the following two conditions:

(i) He is present in India in that previous year for 182 days or more.

(ii) He was present in India within 4 year preceding that previous year for 365 days or more and for 60 days or more in that previous year.

(iii) In case of an Indian citizen or a person of Indian origin comes on a visit to India during the previous year; modified condition (ii) of sec. 6(1) is applicable

| Case | Modified condition (ii) of sec. 6(1) |

| His total income, other than the income from foreign sources! exceeds ₹ 15 lakhs during the previous year | He is in India for a period of 120 days or more (but less than 182 days) during the previous year and for 365 or more days during 4 previous years immediately preceding the relevant previous year |

| His total income, other than the income from foreign sources, does not exceed ₹ 15 lakhs during the previous year | He is in India for a period of 182 days or more during the previous year and for 365 or more days during 4 previous years immediately preceding the relevant previous year |

In case of Mr. David, he was physically present in India for less than 182 days in previous year 2022-23 but, he is physically present in India for 410 days in 4 year preceding that previous year and he also present for more than 60 days (i.e. 90 days) in previous year. Hence, Mr. David is resident in India in AY. 2023-24.

(f) As per Section 6(3)

A company is said to be a resident in India in any previous year if:

(i) It is an Indian Company as defined under section 2(26) of the Act; or

(ii) during the relevant previous year, its place of effective management, in that year, is in India.

X Limited is an Indian Company. Therefore, X Limited is a resident in India even if the business is carried on outside India and the meetings of the board and shareholders are held outside India.

Note: For the purpose of this clause “Place of effective management” means a place where key management and commercial decisions that are necessary for the conduct of business of an entity as a whole are, in substance made.

Question 7.

(a) Following are the transactions related to Mr. Kiran Kumar, a resident but not ordinarily resident ¡n India during the previous year 2022-23. Compute Gross Total Income of Mr. Kiran Kumar for the assessment year 2023-24.

| Particulars | ₹ |

| Income from agriculture in Sri Lanka (received in Sri Lanka and subsequently remitted to India) | 4,00,000 |

| Arrears of salary received in India from a former employer in USA | 2,50,000 |

| Rent from house property located outside India and received outside India (₹ 2,00,000 is used in Bahrain for the educational expenses of his son studying there and the balance ₹ 30,00,000 subsequently remitted of India) | 5,00,000 |

| Income from business in Japan which is managed and controlled from India (₹ 90,000 received in India and balance ₹ 3,10,000 received outside India) | 4,00,000 |

(June 2016, 5 marks)

Answer:

Computation of Gross Total Income of Mr. Kiran Kumar, a resident but not ordinarily resident for the assessment year 2023-24.

| Particulars | ₹ |

| Income from agriculture in Sri Lanka managed and controlled in Sri Lanka is not liable to tax in view of provision of Section 5(1) Subsequent remittance of income to India does not alter the position. | – |

| Arrear of salary received in India from a former employer in USA. | 2,50,000 |

| Income from house property located outside India is not an income accruing or arising in India or deemed to accrue or arise in India. Hence rent is not liable to tax in India. | – |

| Income from business in Japan which is managed and controlled from India is taxable in India in view of provision of Section 5(1) Place of receipt is not material | 4,00,000 |

| Gross Total Income | 6,50,000 |

Question 8.

(a) Discuss, with brief reason. the taxability or otherwise of the following under the Income-tax Act:

(ii) Mr. Ram Kumar, a citizen of India employed by the Government of India, left India for the first time on 10.02.2021 to USA for foreign assignment. He did not visit India during previous year 2022-23. He has been paid ₹ 5,00,000 towards allowances in USA. (Dec 2016, 2 marks)

Answer:

Allowances and perquisites paid or allowed as such outside India by the Government to a citizen of India for rendering service outside India is exempt under section 10(7). Accordingly, allowance of ₹ 5,00,000 paid outside for rendering services there would not be liable to tax.

![]()

Question 9.

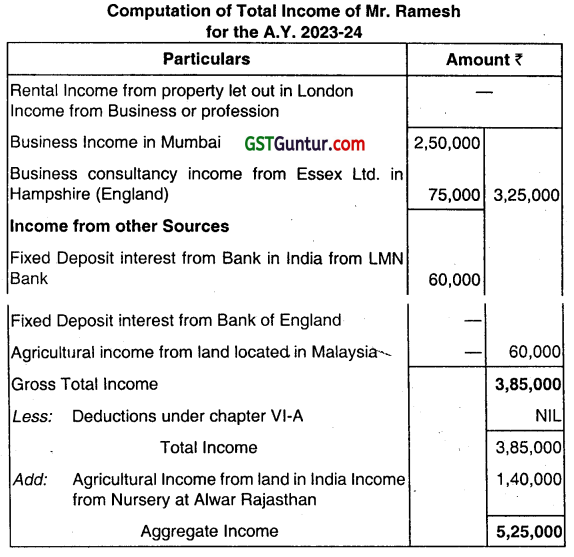

(a) Mr. Ramesh, an Indian citizen, gives you the following information for the year ended 31.03.2023.

| ₹ | |

| Business income in Mumbai | 2,50,000 |

| Rental income from property let out in London (Converted in Indian rupees) | 5,40,000 |

| Fixed deposit interest in India from LMN Bank | 60,000 |

| Fixed deposit interest from Bank of England (Converted in Indian rupees) | 40,000 |

| Business consultancy income from Essex Ltd. in Hampshire (England), being a company incorporated in Delhi having branch office in England. The business is managed from Delhi. (Converted in Indian rupees) | 75,000 |

| Agricultural income from land located in Malaysia (Converted in Indian rupees) | 90,000 |

| Income from nursery at Alwar, Rajasthan | 1,40,000 |

Mr. Ramesh returned to India on 15.06.2022 after remaining in England for 10 years. During the last 4 years, he was in India for 100 days only. Determine the residential status of Mr. Ramesh for the assessment year 2023-24 and compute his total income chargeable to tax in India by giving reason for treatment of each item. Note: Ignore Double Taxation Avoidance Agreement (DTAA). (June 2017, 8 marks)

Answer:

Notes:

1. Residential status of Mr. Ramesh for Assessment Year 2023-24 the Residential Status of Mr. Ramesh will be not ordinary resident because he has not satisfied both the additional conditions of Section 6(1).

2. In case of an Indian citizen or a person of Indian origin# comes on a visit to India during the previous year; modified condition (ii) of sec. 6(1) is applicable:

| Case | Modified condition (ii) of sec. 6(1) |

| His total income, other than the income from foreign sources! exceeds ₹ 15 lakhs during the previous year | He is in India for a period of 120 days or more (but less than 182 days) during the previous year and for 365 or more days during 4 previous years immediately preceding the relevant previous year |

| His total income, other than the income from foreign sources, does not exceed ₹ 15 lakhs during the previous year | He is in India for a period of 182 days or more during the previous year and for 365 or more days during 4 previous years immediately preceding the relevant previous year |

3. Rental Income from property let out in London will not be taxable in India because his residential status is not ordinary resident in India.

4. Fixed deposit interest from Bank of England will not be taxable India because his residential status is not ordinary resident in India.

5. Business Consultancy Income from Essex Ltd. in Hampshire (England) is taxable in India because the business is managed from Delhi India.

6. Agricultural Income from land located in Malaysia ¡s not taxable in India because his residential status is not ordinary resident in India.

7. Income from nursery at Alwar, Rajasthan will be treated as Agricultural Income on the assumption that the land is owned by Mr. Ramesh and Agricultural activities are carried out by himself. (which is exempt)

Question 10.

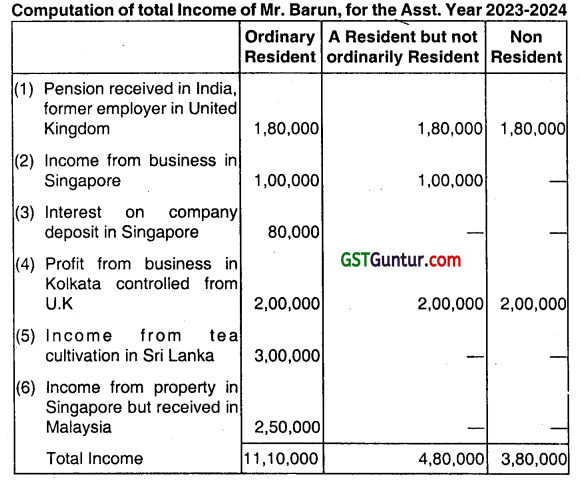

Mr. Barun furnishes you the following information for the year ended 31st March 2023:

Particulars

| ₹ | |

| (i) Pension received in India from a former employer in United Kingdom (UK) | 1,80,000 |

| (ii) Income from business in Singapore (Controlled from India) | 1,00,000 |

| (iii) Interest on company deposit in Singapore (credited in bank account held there) | 80,000 |

| (iv) Profit from business in Kolkata controlled from UK | 2,00,000 |

| (v) Income from tea cultivation in Sri Lanka | 3,00,000 |

| (vi) Income from property in Singapore but received in Malaysia | 2,50,000 |

Compute the total income of Mr. Barun, where he is

(i) an ordinarily resident in India;

(ii) a resident but not ordinarily resident in India, and

(iii) a non resident. (Dec 2018, 9 marks)

Answer:

Question 11.

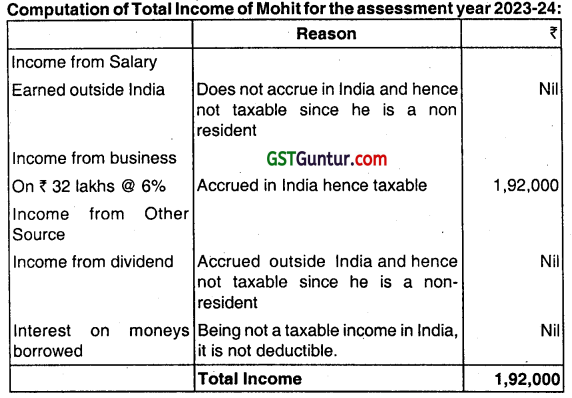

Mohit left India on 07.04.2022 to United Kingdom for employment. He returned to India on 07.11.2022, after resigning his job. He commenced a business on 01.12.2022 and his turnover was ₹ 32 lakhs up to 31.03.2023. All payments for the sales were received through crossed-account payee cheques. He wants to declare income under section 44AD. His salary income in the United Kingdom was ₹ 6,56,000. When he remained outside India, he invested in equity shares of Vodafone UK Inc. He earned dividend from Vodafone UK Inc. (foreign company) ₹ 60,000 during the previous year 2022-23. He borrowed ₹ 2,00,000 from Mr. Narain of Chennai to invest in the shares of the foreign company and paid interest of ₹ 20,000 for the year ended 31.03.2023. Determine his residential status for the assessment year 2023-24 and compute his total income. (June 2019, 9 marks)

Answer:

Determination of residential status:

| An individual is said to be resident in India in any previous year if he is in India for a period or periods amounting in all to 182 days or more; or |

| Was in India for 60 days or more during the previous year and has remained in India in 4 previous years preceding the previous years in aggregate for 365 days or more. |

| Extended time in the case of citizens of India, who leaves India for the purpose of employment outside India, the time limit is 182 days instead of 60 days given above. |

| In case of an Indian citizen or a person of Indian origin# comes on a visit to India during the previous year; modified condition (ii) of sec. 6(1) is applicable: |

| Case | Modified condition (ii) of sec. 6(1) |

| His total income, other than the income from foreign sources! exceeds ₹ 15 lakhs during the previous year | He is in India for a period of 120 days or more (but less than 182 days) during the previous year and for 365 or more days during 4 previous years immediately preceding the relevant previous year |

| His total income, other than the income from foreign sources, does not exceed ₹ 15 lakhs during the previous year | He is in India for a period of 182 days or more during the previous year and for 365 or more days during 4 previous years immediately preceding the relevant previous year |

When a person satisfies both the conditions, he is a resident. If he does not satisfy any of the conditions given above, he is non-resident.

In this case, Mohit remained in India for 151 days (6+24+31+31+28+31)

He has not stayed in India for 182 days or more and hence does not satisfy both the basic conditions.

His status is non-resident.

![]()

Question 12.

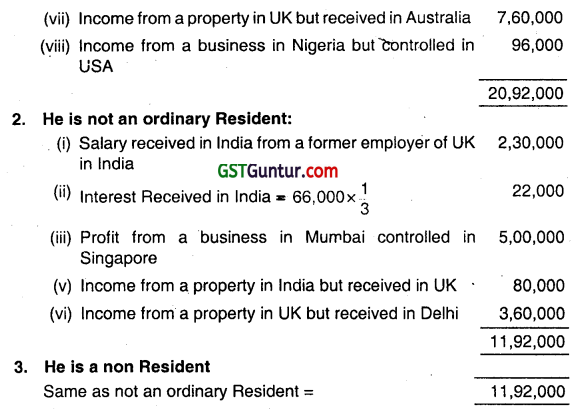

Rahman provides following details of income:

| Particulars | Amount |

| (i) Salary received in India from a former employer of UK | 2,30,000 |

| (ii) Interest on company deposit in Canada: Total amount of interest 1/3rd” received in India and the balance were credited to his bank account held outside India. | 66,000. |

| (iii) Profit from a business in Mumbai controlled from Singapore | 5,00,000 |

| (iv) Profit for the year 2020-21 from a business in Australia (income tax paid in Australia in that year itself) remitted to India | 6,00,000 |

| (v) Income from a property in India but received in UK | 80,000 |

| (vi) Income from a property in Malaysia but received in Delhi | 3,60,000 |

| (vii) Income from a property in UK but received in Australia | 7,60,000 |

| (viii) Income from a business in Nigeria but controlled from USA | 96,000 |

Calculate the total income for the A.Y. 2023-24 assuming that:

(1) He is an ordinary resident;

(2) He is not any ordinary resident:

(3) He is a non-resident. (Dec 2021, 8 marks)

Answer:

Computation of Total Income of Rahman for A.Y. 2023-24

1. When he is an ordinary Resident:

- Salary received in India from a former employer of UK 2,30,000

- Interest on company deposit in Canada: 66,000

- Profit from a business in Mumbai controlled in Singapore 5,00,000

- Income from a property in India but received in Australia 80,000

- Income from a property in Malaysia but received in Delhi 3,60,000

Question 13

Determine the residential status in the following independent cases:

(i) Albert born and brought up in India left India on 05.11.2022 for the purpose of employment to Malaysia. He did not visit India up to 31.03.2023.

(ii) Chander born and brought up in India was employed in Singapore since 01.04.2018. He stayed in India in every financial year for 70 to 80 days.

(iii) Dilip a foreign citizen came to India for the purpose of employment in X Co. Ltd. and stayed in India from 05.06.2022 and remained in India up to 31.03.2023. (Dec 2022, 2 + 2 + 4 = 8 marks)

Basic Concepts of Income Tax Act – CMA Inter Direct Tax Notes

Resident in India

An individual is said to be a resident in India if he satisfies any one of the following conditions:

- He is in India in the previous year for a period of 182 days or more [Sec. 6(1)(a)];

or - He is in India for a period of 60 days or more during the previous year and for 365 or more days during 4 Previous years immediately preceding the relevant previous year [Sec. 6(1 )(c)]

Non-Resident in India

An assessee who is not satisfying sec. 6(1) shall be treated as a non-resident in India for the relevant previous year.

Exceptions to the above rule

A. In the following cases, condition (ii) of sec. 6(1) [i.e. sec. 6(1)(c)j is irrelevant:

- An Indian citizen, who leaves India during the previous year for employment purpose.

- An Indian citizen, who leaves India during the previous year as a member of crew of an Indian ship.

Tax point: Above assessee shall be treated as resident in India only if he resides in India for 182 days or more in the relevant previous year.

B. In case of an Indian citizen or a person of Indian origin comes on a visit to India during the previous year; modified condition (ii) of sec. 6(1) is applicable:

| Case | Modified condition (ii) of sec. 6(1) |

| His total income, other than the income from foreign sources, exceeds ₹ 15 lakhs during the previous year | He is in India for a period of 120 days or more (but less than 182 days) during the previous year and for 365 or more days during 4 previous years immediately preceding the relevant previous year |

| His total income, other than the income from foreign sources, does not exceed ₹ 15 lakhs during the previous year | He is in India for a period of 182 days or more during the previous year and for 365 or more days during 4 previous years immediately preceding the relevant previous year |

| Person of Indian origin | A person is deemed to be of Indian origin if he or either of his parents or grandparents were born in undivided India. Here, grandparents may be paternal or maternal. “Income from foreign sources” means income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India) and which is not deemed to accrue or arise in India. |

C. An individual shall be deemed to be resident in India if following conditions are satisfied:

- He is a citizen of India

- His total income, other than the income from foreign sources, exceeds ₹ 15 lakhs during the previous year;

- He is not satisfying any of the basic conditions given u/s 6(1) [i.e., 182 days or 60 days + 365 days]; and

- He is not liable to tax in any other country or territory by reason of his domicile or residence or any other Criteria of similar nature. [Sec. 6(1A)]

Tax point

However, if such individual has satisfied either of the basic conditions, then he shall be treated as resident in India u/s 6(1).

Further note that the exception is not applicable in case of foreign citizens even if he is a persons of Indian origin. If these conditions are satisfied, then such individual shall be deemed as resident irrespective of number of days of his stay in India.

In case of NRIs and foreign nationals who were stranded in India due to Covid 19, the Government has assured that their stay in the country during the period will not be counted for the purpose of determining their residency status for taxation purpose.

![]()

In case of an individual, being a citizen of India and member of the crew of a ship, the period or periods of stay in India shall, in respect of an eligible voyage, not include the period beginning on the date entered into the Continuous Discharge Certificate in respect of joining the ship by the said individual for the eligible voyage and ending on the date entered into the Continuous Discharge Certificate in respect of signing off by that individual from the ship in respect of such voyage. In simple words, in the Continuous Discharge Certificate, the date of joining is recorded as 1st January 2021 and the date of ending the voyage is recorded as 31st January 2021, then the entire period of 31 days shall be excluded from his stay in India.

“Eligible voyage” shall mean a voyage undertaken by a ship engaged in the carriage of passengers or freight in international traffic where

- for the voyage having originated from any port in India, has as its destination any port outside India; and

- for the voyage having originated from any port outside India, has as its destination any port in India.