Income From House Property – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Income From House Property – CMA Inter Direct Tax Study Material

Short Notes

Question 1.

Write short note on Difference between unrealized rent and arrears of rent, realised in a subsequent year. (Dec 2021,3 marks)

Answer:

Difference between Subsequent collection of unrealized rent and arrears of rent

| Unrealized Rent | Arrears of rent |

| Rent which could not be realized from the tenant, if subsequently from the tenant, realized, gets taxed in the PY of receipt. | If the assesses has increased the rent payable by the tenant retrospectively’& there is dispute over such increase and later on, the assesses receives the increased rent as arrears, is called arrears of rent. It is taxable in the PY of Receipt. |

| However, deduction shall be allowed @ 30% of such unrealized rent. | Deduction of 30% is allowed on such arrears. |

| Taxable @ 70% of amount received | Taxable at 70% of amount received. |

Question 2.

Write short note on the following:

Deemed owner under House Property (Dec 2022, 5 marks)

Descriptive Question

Question 3.

How is the unrealized rent dealt with in annual value determination of a house property under the Income-tax Act, 1961? What are the conditions to be satisfied in this regard? (June 2015, 3 marks)

Answer:

Treatment of Unrealized Rent [explanation to Section 23(1)]:

Rule 4

The amount of unrealized rent is not to be includible while determining the annual value of a property. However, the following conditions are to be satisfied for excluding the unrealized rent.

- The tenancy must be bona tide.

- The defaulting tenant has vacated or steps have been taken to compelte him to vacate the property.

- The defaulting tenant is not in the occupation of any other property of the assessee; and

- The assessee has taken all steps to institute legal proceedings for the recovery of unpaid rent or satisfies the Assessing Officer that the legal proceedings would be useless.

Practical Questions

Question 4.

Mr. Nitin completed construction of a residential house on 01.04.2022. Interest paid on loans borrowed for the purpose of construction during the 30 months prior to completion was ₹ 60,000.

The house was let out on a monthly rent of ₹ 18,000.

Annual corporation tax paid is ₹ 35,000.

Interest paid during the year is ₹ 25,000.

Amount spent on repairs is ₹ 6,000.

Fire insurance premium paid ₹ 3,000 p.a.

The property was vacant for 4 months.

Annual letting value as per corporation records is ₹ 1,50,000.

He had also received arrears of rent of ₹ 36,000 during the year, which had not been not charged to tax in the earlier year.

Compute the income under the head “Income from House Property” for the assessment year 2023-24. (Dec 2012, 8 marks)

Answer:

Note (1):

| Computation of Gross Annual Value | |

| Municipal value | 1,50,000 |

| Actual rent (18,000 x 12) | 2,16,000 |

| Higher of the two | 2,16,000 |

| Less: Vacancy allowance as property was vacant for four months (2,16,000/12) x 4 | 76,000 |

| Gross Annual Value | 1,44,000 |

![]()

Question 5.

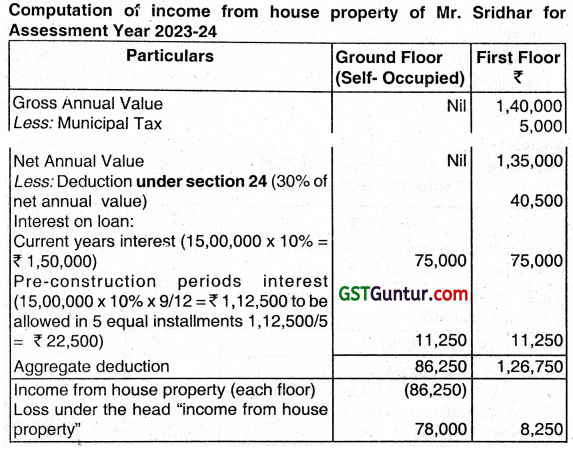

Mr. Sridhar constructed his house on a plot of land acquired by him in Kolkata. The house has two floors of equal size. He

started construction of the house on 1st April 2021 and completed construction on 30th June, 2022. He occupied the ground floor on 1 July 2022 and let out the first floor at a rent of ₹ 20,000 per month on the same date. However, the tenant vacated the first floor on 31st January 2023 and Mr. Sridhar occupied the entire house from 1st February 2023 to 31st March 2023.

| Other information | |

| (i) Fare Rent of each floor | ₹ 1,20,000 per annum |

| (ii) Municipal value of each floor | ₹ 80,000 per annum |

| (iii) Municipal tax paid | ₹ 10,000 |

| (iv) Repair expenses | ₹ 5,000 |

Mr. Sridhar obtained a housing loan of ₹ 15 lacs at interest of 10% per annum on 1st July, 2021. He did not repay any part of the loan till 31st March, 2023. Compute income from house property in the hands of Mr. Sridhar for the Assessment year 2023-24. (June 2013, 8 marks)

Answer:

Notes: Annual letting value is the higher of fair rent and municipal value. However, as the construction of the house was completed on 30th June, 2022, annual letting value should be considered for 9 months.

Fair Rent = ₹ 1,20,000 x 9/12 = ₹ 90,000

Municipal Value = ₹ 80,000 x 9/12 = ₹ 60,000

Annual letting value = ₹ 90,000

Actual Rent = ₹ 20,000 x 7 = ₹ 1,40,000

Gross Annual Value = Higher of annual letting value or actual rent = ₹ 1,40,000.

Question 6.

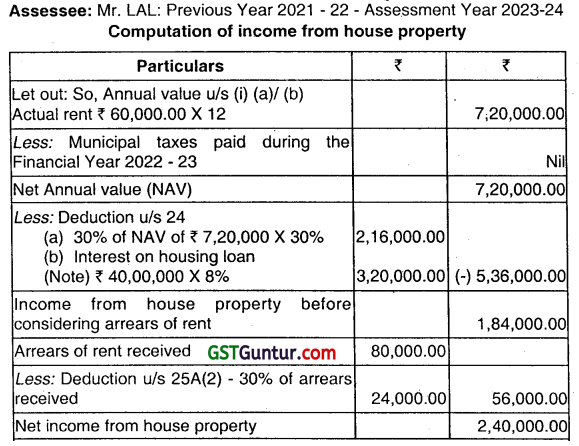

Mr. Lai is the owner of a commercial property let out at ₹ 60,000.00 per month. The Corporation tax on the property is ₹ 30,000.00 annually, 60% of which ¡s payable by the tenant. This tax was actually paid on 15.04.2022. He had borrowed a sum of ₹ 40.00 lakhs from his cousin, resident in Singapore (in dollars) for the construction of the property on which interest at 8% is payable. He has also received arrears of rent of ₹ 80,000.00 during the year, which was not charged to tax in the earlier years. What is the property income of Mr. Lai for the assessment year 2023-24? (Dec 2013, 5 marks)

Answer:

Question 7.

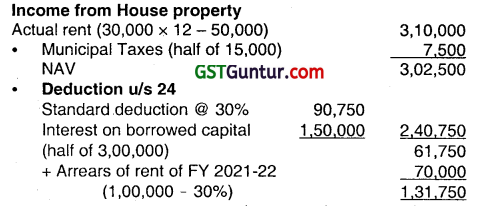

Ram and Shyam are members of a firm “R and S” and also joint owners (50% each) of a two-storied house property (of equal area), the details of which are as follows:

(i) Ground Floor – let out at a monthly rent of ₹ 30,000/-

(ii) First Floor-used for partnership business of Ram and Shyam.

(iii) Ram and Shyam received the following amounts in respect of another property which they had sold it on 31.03.2022:

Unrealized Rent of same property pertaining to FY 2022-23 – ₹ 50,000/-

Arrears of rent of sold-out property pertaining to FY 2021-22 – ₹ 1,00,000/-

(iv) Municipal taxes paid for the entire house property – ₹ 15,000/- p.a

(v) Interest on borrowings for the entire house property (Joint loan taken from HDFC)- ₹ 3,00,000/-

Compute the income from house property and also explain how such income will be assessed in the hands of R and S. (June 2014, 6 marks)

Answer:

AS R and S are joint owners (50% each) ₹ 65,875 (50% of 1,31,750) is taxable in R’s hand and ₹ 65,875 is taxable in S’s hand.

![]()

Question 8.

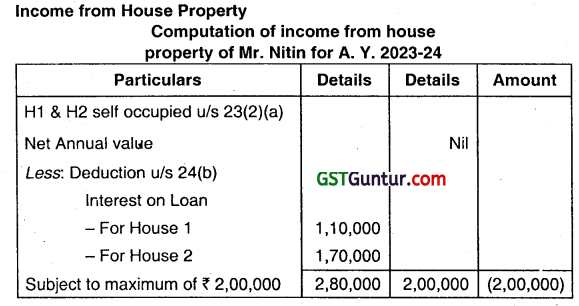

Mr. Nitin owns two houses, both of which are occupied by him for residential purposes. The details are given below:

| House-I | House-II | |

| Fair rent | 7,20,000 | 6,30,000 |

| Municipal value | 5,00.000 | 5,00,000 |

| Standard rent | 6,00,000 | 6,00,000 |

| Date of completion | 01.01.2005 | 01.07.2011 |

| Municipal tax paid | 10% | 12% |

| Date of loan | 01 .07.2002 | 01.05.2009 |

| Interest on loan for the financial year 2022-23 | 1,10,000 | 1,70,000 |

Compute his income from house property and advise which house should be opted by him as self-occupied. (June 2014, 6 marks)

Answer:

Loss from house property = ₹ 2,00,000

Note 1: If an assessee occupies two house property as self-occupied, he is allowed to treat two house as self-occupied.

Note 2: Interest paid or payable for one or two self-occupied properties subject to a maximum of ₹ 2,00,000.

Question 9.

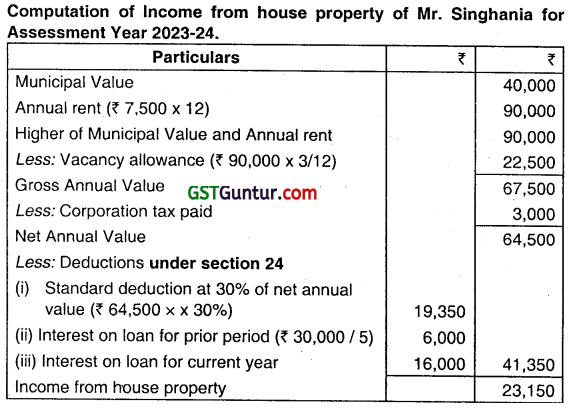

Mr. Singhania constructed a residential house property in Kanpur. Construction was completed on 1st April, 2022. The house was vacant from 1st April, 2022 to 30th June, 2022. The house was let out at rent of ₹ 7,500 per month from 1st August, 2022. Mr Singhania obtained loan for the purpose of construction, Interest paid on such loan during two years prior to completion of construction amounted to ₹ 30,000. Interest paid during the year 2022-23 is ₹ 16,000. The Fire Insurance premium paid is ₹ 2,000. Municipal value of the property has been assessed at ₹ 40,000. Annual corporation tax paid ₹ 3,000. Compute income under the head 1ncome from House Property” for Assessment year 2023-24. (Dec 2014, 6 marks)

Answer:

Question 10.

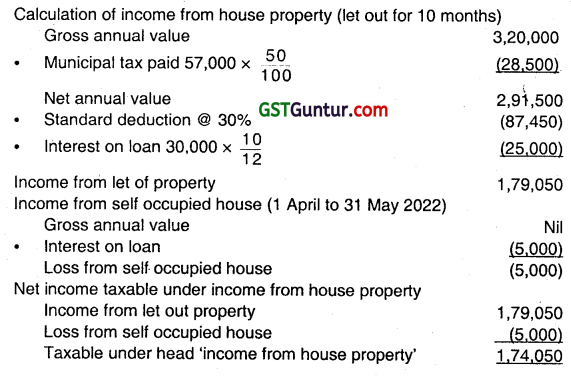

Raja is the owner of a residential house property having two independent floors of equal size in Chennai. The ground floor of the property has been let out to a tenant at rent of ₹ 15,000 per month from 1st June, 2022. The first floor of the property is occupied by Raja for his residential purposes.

Other particulars relating to the property are as follows:

Compute income from house property of Raja for the 2023-24.

| Particulars | ₹ |

| Standard Rent | 3,20,000 p.a. |

| Municipal valuation | 3,80,000 p.a. |

| Fair rent | 3,70,000 p.a. |

| Annual municipal tax (50% paid) | 57,000 |

| interest on loan taken for construction of property for the year 2022-23 | 30,000 |

| Annual insurance premium | 5,000 |

Compute income from house property of Raja for the Assessment Year 2023-24. (Dec 2015, 7 marks)

Answer:

Working Notes:

Calculation of gross annual value:

(a) Municipal value or fair rent (whichever is higher) 3,80,000

(b) Standard Rent 3,20,000

(c) Expected rent whichever ¡s lower in (a) and (b) 3,20,000

(d) Actual rent received 15.000 x 10 (June 22 to March 23) 1,50,000

Gross annual value [whichever is higher in (c) and (d)] = 3,20,000

![]()

Question 11.

Mr. Kamal Hasan has two independent residential flats in an apartment, both of them being of identical size. First flat is

self-occupied and the second flat is occupied by his daughter, from whom he does not receive any rent. For each flat, the relevant annual rent details are as under:

| Particulars | ₹ |

| Municipal Value | 6,00,000 |

| Fair Rent | 5,70,000 |

| Standard Rent | 5,16,000 |

| Municipal Tax (fully paid) | 11 % of municipal valuation |

| Pre-construction period interest (third year) | 1,50,000 |

| Interest on housing loan for current year (25% unpaid) | 1,65,000 |

| Fire Insurance Premium | 2,500 |

| Ceiling amount | 2,00,000 |

Compute income of Mr. Kamal Hasan under the head “income from house property for assessment year 2023 – 24. (June 2016, 8 marks)

Answer:

Loss from house property = ₹ 2,00,000

Note 1: If an assessee occupies two house property as self-occupied, he is allowed to treat two house as self-occupied

Note 2: Interest paid or payable for one or two self-occupied properties subject to maximum of ₹ 2,00,000.

Question 12.

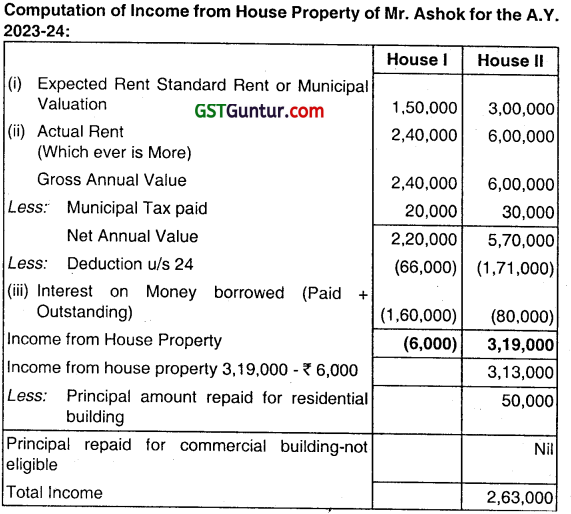

Mr. Ashok owns two buildings which are let out during the financial year 2022-23. The relevant details are as under:

| Particulars | House-I Residential ₹ | House-II Commercial ₹ |

| Municipal valuation | 1,80,000 | 3,60,000 |

| Standard rent | 1,50,000 | 3,00,000 |

| Actual rent | 2,40,000 | 6,00,000 |

| Municipal taxes – paid | 20,000 | 30,000 |

| Municipal taxes – outstanding | 10,000 | 15,000 |

| Interest on moneys borrowed – paid | 60,000 | 20,000 |

| Interest on moneys borrowed – outstanding | 1,00,000 | 60,000 |

| Housing loan principal repaid to bank | 50,000 | 30,000 |

You are requested to compute income of Mr. Ashok under the head “Income from House property” for the assessment year 2023-24. (Dec 2016, 9 marks)

Answer:

Question 13.

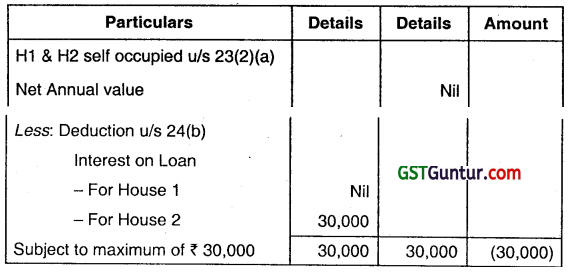

Surbhi has two houses, both of which are self-occupied. You are required to compute Surbhi’s income form house property for the Assessment Year 2023-24 and suggest which house should be opted by Surbhi to be assessed as self-occupied so that her tax liability is minimum. The particulars of these are given below:

| (Value in ₹) | ||

| Particulars | House – I | House – II |

| Municipal Valuation per annum | 1,30,000 | 1,15,000 |

| Fair Rent per annum | 1,10,000 | 1,70,000 |

| Standard rent per annum | 1,00,000 | 1,65,000 |

| Date of completion | 31-03-1999 | 31 -03-2001 |

| Municipal taxes payable during the year (paid for House II only) | 12% | 8% |

| Interest on money borrowed for repair of property during current year | – | 55,000 |

(Dec 2017, 6 marks)

Answer:

In the book of Surbhi

Computation of Income from house property for the AY. 2023-24

It can assessee occupies two house property as self-occupied, he is allowed to treat two house as self-occupied

Loss from House Property = ₹ 30,000

Note: In case of loan for acquisition or construction taken prior to 01 -04-1999 or loan taken for repair, renovation or reconstruction at any point of time, interest paid or payable for one or two self-occupied properties subject to maximum of ₹ 30,000.

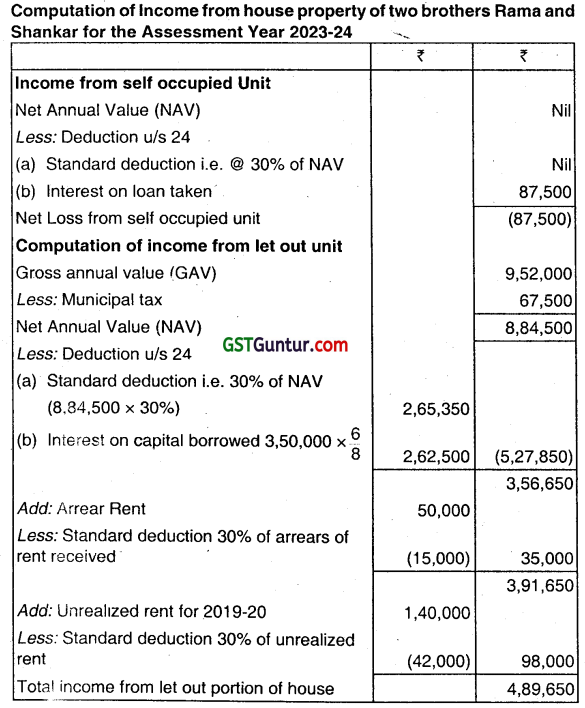

Question 14.

Two brothers Rama and Shankar are co-owners of a house property with equal shares. The property was constructed during the Financial year 2002-2003. The property consists of 8 identical units and is situated at Salem. During the Financial Year 2022-2023 each owner occupied 1 unit for residence and balance 6 units were let out at a rent of ₹ 14,000 per unit per month. The municipal value of property is ₹ 9,00,000 and municipal tax are 10% of municipal value, paid during the year. The

other expenses are as follows:

(i) Repairs ₹ 90,000

(ii) Insurance premium paid ₹ 15,000

(iii) Interest payable on loan taken ₹’ 3,50,000

One of the let out remained vacant for 4 months during the year. Rama could not occupy his unit for 6 months as he was transferred to Bangalore. He does not own any other house. The other income of Rama and Shankar are ₹ 3,50,000 and ₹ 1,80,000 respectively for the Financial Year 2022-2023.

The co-owners received during the year ₹ 1,40,000 as unrealized rent for 2019-2020 and ₹ 50,000 as arrears of rent.

Compute the income under the head “Income from House Property” and total income of the two brothers for the Assessment Year 2023-2024. (June 2018, 7 marks)

Answer:

| Income of both brothers from house property other source | Ram | Shankar |

| Income from house property | ||

| Let out portion | 2,44,825 | 2,44,825 |

| Less: Self-occupied portion (Restricted ₹ 30,000) | (30,000) | (30,000) |

| Net Income from house properly | 2,14,825 | 2,14,825 |

| Other income | 3,50,000 | 1,80,000 |

| Total income | 5,64,825 | 3,94,825 |

![]()

Question 15.

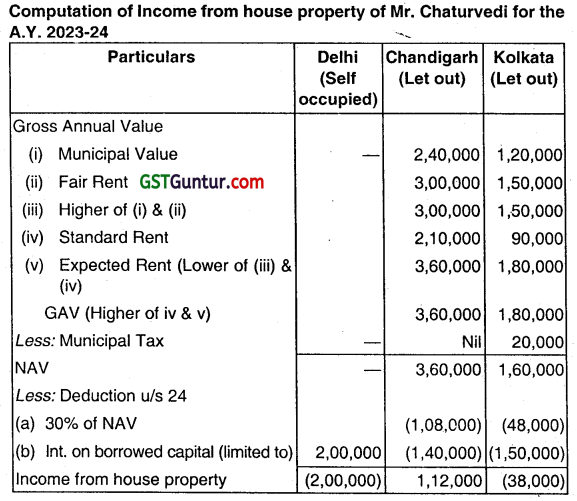

Mr. Chaturvedi, Delhi has 3 house properties in various parts of India. The details are given below:

| Location of Property | Delhi | Chandigarh | Kolkata |

| Usage | Self-occupied | Let out | Let out |

| Amount ₹ | Amount ₹ | Amount ₹ | |

| Rent received | NIL | 3,60,000 | 1,80,000 |

| Fair rent | 2,40,000 | 3,00,000 | 1,50,000 |

| Municipal value | 2,10,000 | 2,40,000 | 1,20,000 |

| Standard rent | 1,80,000 | 2,10,000 | 90,000 |

| Municipal tax – Due | 20,000 | 40,000 | 30,000 |

| Municipal tax – paid by the assessee | NIL | NIL | 20,000 |

| Interest on moneys borrowed | 2,80,000 | 1,40,000 | 1,50,000 |

Note: All the properties were acquired/constructed after 01.04.2013. You are required to compute the income of Mr. Chaturvedi chargeable under the head “Income from house property” for the assessment year 2023-24. (Dec 2018, 5 Marks)

Answer:

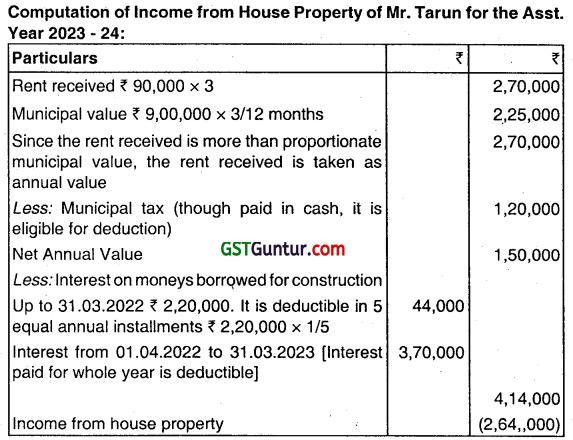

Question 16.

Tarun, employed in a private company, commenced construction of a commercial complex in July, 2021. He borrowed ₹ 50 lakhs from a bank @ 9% per annum. Interest up to 31.03.2022 was ₹ 2,20,000 and for the period from 01.04.2022 to 31.12.2022 ₹ 2,30,000. ₹ 1,40,000 towards interest for the balance three months remained unpaid. The construction of the building was completed on 31st December 2022. The building was let out w.e.t. 01.01.2023 for a monthly rent ₹ 90,000. Municipal tax of ₹ 1,20,000 was paid by cash on 10.01.2023. He repaid ₹ 1,90.000 towards principal during the previous year 2022-23, of which he paid ₹ 1,20,000 up to 31.12.2022. The municipal value of the property is ₹ 9,00,000. Compute the income from house property of Tarun for the assessment year 2023-24. (June 2019, 6 marks)

Answer:

Question 17.

Mr. Arun furnishes the following details relating to three house properties at Erode, Tamil Nadu, let out by him during the previous year 2022-23:

| Particulars | House – 1 | House – 2 | House – 3 |

| Gross municipal value | 2,10,000 | 3,30,000 | 2,40,000 |

| Fair rent (₹) | 2,40,000 | 3,60,000 | 3,00,000 |

| Standard rent (₹) | 2,20,000 | — | — |

| Let out period (months) | 9 | 12 | 11 |

| Vacant during the year for (Months) | 3 | — | 1 |

| Actual rent received (₹) | 1,60,000 | 2,40,000 | 3,30,000 |

| Interest on money borrowed (₹) | 1,05,000 | — | 2,10,000 |

| Land lease rent (₹) | — | — | 24,000 |

| Municipal tax paid being 2 months municipal value |

Compute the chargeable income from house property for the assessment year 2023-24. (Dec 2019, 9 marks)

Answer:

Computation of income from house property

| Particulars | House -1 | House – 2 | House – 3 |

| Gross municipal value or fair rent whichever is higher but limited to standard rent (A) | 2,20,000 | 3,60,000 | 3,00,000 |

| Figure after adjustment of above for vacant period | 1,65,000 | 3,60,000 | 2,75,000 |

| Actual rent received (B) | 1,60,000 | 2,40,000 | 3,30,000 |

| Annual value whichever is more | 1,65,000 | 3,60,000 | 3,30,000 |

| Less: Municipal tax paid | 35,000 | 55,000 | 40,000 |

| 1,30,000 | 3,05,000 | 2,90,000 | |

| Less: Deduction U/s 24@ 30% | 39,000 | 91,500 | 87,000 |

| 91,000 | 2,13,500 | 2,03,000 | |

| Less: Interest on moneys borrowed | 1,05,000 | – | 2,10,000 |

| Land lease rent (Not deductible) | – | – | Nil |

| Chargeable Income from house property | (14,000) | 2,13,500 | (7,000) |

| Chargeable income from house property (Total) | 1,92,500 |

Question 18.

Mr. Santhosh sold his residential house property at Vadodara in Dec, 2021. In June, 2022, he recovered rent of 25,000 from Mr. Ramesh, to whom he had let out his house for two years from May 2016 to April 2018. He could not realise two months rent of ₹ 50,000 from him and to that extent his actual rent was reduced while computing income from house property for A.Y.2017-18.

Further, he had let out his property from June 2018 to Oct 2021, 2022 to Mr. Satish. In April, 2019, he had increased the rent from ₹ 12,000 to ₹ 15,000 per month, and the same was a subject matter of dispute. In November 2022, the matter was finally settled and Mr. Santhosh received ₹ 99,000 as arrears of rent for the period June 17 to October 2021. Would the recovery of unrealized rent and arrears of rent be taxable in the hands of Mr. Santhosh, and if so, an which year? He spent ₹ 19,000 towards lawyer fees for collecting the arrears of rent. (Dec 2021, 4 marks)

Answer:

Taxability of un realised rent recovered and arrears of rent Since the unrealised rent was recovered in the P.Y. 2022-23, the same would be taxable in the A.Y. 2023-24 under section 25A, irrespective of the fact that Mr. Santhosh was not the owner of the house in that year. Further, the arrears of rent was also received in the P.Y. 2022-23, and hence the same would be taxable as income from house property in the A.Y. 2023-24 under section 25A, even though Mr.Santhosh was not the owner of the house in that year. A deduction of 30% of unrealised rent recovered and arrears of rent would be allowed while computing income from house property of Mr.Santhosh for A.Y. 2023-24.

Computation of income from house property of Mr. Santhosh for A.Y. 2023-24.

| Particulars | ₹ |

| (i) Unrealised rent recovered | 25,000 |

| (ii) Arrears of rent received | 99,000 |

| 1,24,000 | |

| Less: Deduction @ 30% | 37,200 |

| Income from house property | 86,800 |

Note: Any other charge other than standard deduction is not allowed as deduction. Lawyer fees paid is hence not deductible.

![]()

Question 19.

Amar (age 50) a resident has the following properties which are let out during the financial year 2022-23.

| Particulars | House 1 | House 2 | House 3 |

| Actual Rent (House 3 vacant for 2 months) | ₹ 3,00,000 | ₹ 3,00,000 | ₹ 3,00,000 |

| Gross municipal value | ₹ 2,40,000 | ₹ 3,00,000 | ₹ 3,30,000 |

| Fair rent | ₹ 2,70,000 | ₹ 3,30,000 | ₹’3,00,000 |

| Standard rent | ₹ 2,10,000 | ₹ 2,70,000 | ₹ 4,20,000 |

| Municipal tax | 10% | 10% | 10% |

| Sewerage tax | ₹ 14,000 | ₹ 10,000 | ₹ 15,500 |

| Water tax | 5% | 5% | 5% |

| Interest on moneys borrowed | ₹ 1,05,000 | ₹ 1,32,500 | ₹ 1,65,500 |

Compute income from house property for the assessment year 2023-24. (Dec 2022, 7 marks)