Income Under Head Salaries – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Income Under Head Salaries – CMA Inter Direct Tax Study Material

Descriptive Question

Question 1.

What are the conditions to be fulfilled by an employee to get his accommodation in a hotel that will not be a taxable perquisite? (June 2013, 2 marks)

Answer:

Accommodation provided in a hotel will not be a taxable perquisite if the following two conditions are fulfilled.

- The period of such accommodation does not exceed 15 days.

- Such accommodation has been provided on the transfer of the employees from one place to another.

Question 2.

“Accommodation provided in a hotel will not be a taxable perquisite” in the hands of employees it correct? Briefly explain. (Dec 2013, 2 marks)

Answer:

Accommodation provided in a hotel will not be a taxable perquisite if the following two conditions are fulfilled.

- The period of such accommodation does not exceed 15 days.

- Such accommodation has been provided on the transfer of the employees from one place to another.

![]()

Question 3.

What are “profits in lieu of salary” as per Section 17(3) of the Income Tax Act, 1961? (Dec 2014, 3 marks)

Answer:

As per Section 17(3), “profits in lieu of salary” includes –

(i) The amount of any compensation due to or reàèlved by the assessee from his employer or former employer at or in connection with the termination of his employment or the modification of the terms and conditions, relating thereto;

(ii) Any payment (other than gratuity, commuted pension, compensation received under the Industrial Disputes Act or any other Act, etc., any payment from a provident fund to which the Provident Funds Act, 1925 applies, accumulated balance in recognized provident fund, payment from approved superannuation fund or house rent allowance) to the extent to which ¡t does not consist of contributions by the assessee or interest thereon or any sum received under a Keyman insurance policy including bonus allocated under such policy.

Practical Questions

Question 4.

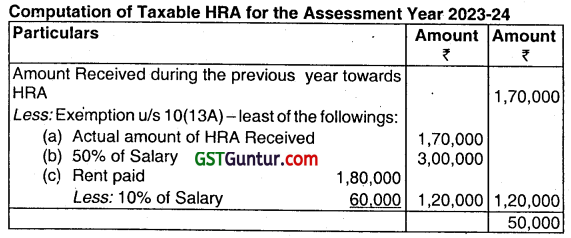

’R’ who resides at Delhi, gets ₹ 6,00,000 as basic salary. He receives ₹ 1,70,000 as house rent allowance. Rent paid by him is

₹,80,000. Find out the amount of taxable HRA for the assessment year 2023-24. (Dec 2012, 4 marks)

Answer:

Salary for HRA = Basic Salary + DA (forming part of retirement benefits) +

Commission (based on fixed percentage of turnover) = ₹ 6,00,000.

Question 5.

Excel Ltd. allotted 1000 (sweat) equity shares of ₹ 10 each to Mr. Rao, General Manager. The fair market value of the shares computed in accordance with the method prescribed under the Income-tax Act/Rules was ₹ 500 per share, whereas ¡t was allotted at ₹ 300 per share. What is the perquisite value of sweat equity shares allotted to Mr. Rao? In case these shares are sold subsequently, what would be their cost of acquisition in the hands of Mr. Rao? (Dec 2012, 6 marks)

Answer:

As per Section 17(2)(vi), the fair market value of sweat equity shares on the date on which the option is exercised by the assessee is considered as value of perquisite as reduced by the amount actually paid or recovered from him in respect of such shares.

Fair market value of 1,000 equity shares @ ₹ 500 each 5,00,000

Less: Amount recovered from Mr. Rao 1,000 x 300 each 3,00,000

Value of perquisite of sweat equity shares allotted to Mr. Rao 2,00,000

If these shares are sold subsequently, as per Section 49(2AA). Where the capital gain arises from the transfer of specified security or sweat equity shares which was treated as perquisite in the hands the employee, the cost of acquisition of such security or shares shall be the fair market value which has been taken into account for the purposes of valuation of perquisite. Hence, cost of acquisition for Mr. Rao shall be ₹ 5,00,000.

![]()

Question 6.

‘X’ a resident of Bengaluru receives ₹ 20,00,000 as basic salary. In addition, he gets ₹ 6 lakhs as dearness allowance (forming part of basic salary), 3.5% commission on sales made by him (sale made by X during the previous year in ₹ 80,00,000); ₹ 2,40,000 is paid to him as house rent allowance. He however pays ₹ 2,80,000 as house rent. Determine the quantum of HRA exempt from tax. (June 2013, 4 marks)

Answer:

Out of the H.A. received i.e., ₹ 2,40,000/-, the least of the following would be exempt

- ₹ 11,52,000/- being 40% of salary, i.e., basic salary, dearness pay, and commission: ₹ 28.80,000/-

- ₹ 2,40,000 being the house rent allowance.

- NIL, being the excess of rent paid (i.e., ₹ 2,80,000/- over 10% of salary, i.e., ₹ 2,88,000/-. As least of the three is NIL, the entire house rent allowance is taxable.

Question 7.

Answer the following sub-divisions briefly in the light of the provisions of the Income-tax Act, 1961:

A Government employee received gratuity of ₹ 16 lakhs upon retirement, ¡n September 2022. How much is taxable? (Dec 2013, 1 mark)

Answer:

As per Section 10 (10) gratuity of a person being a government employee is exempt without any monetary limit.

Question 8.

Raja joined TCI Limited on 1st June. 2021. Emoluments paid and benefits allowed by the company to Raja are as follows:

| ₹ | |

| Basic Salary | 40,000 p.m. |

| Dearness Allowance | 15,000 p.m. |

| Incentive | 30,000 p.m. |

A furnished accommodation at Mumbai belonging to the company is provided free. Cost of furniture there in ₹ 3,00,000

Motor car (with engine cc less than 1.6 liters) owned by the company along with a chauffeur for official and personal

purposes Salary of sweeper paid by the company 1,000 p.m.

Education provided for Raj’s son without any fees.

Cost of providing education by the school is 750 p.m.

Admission fee for corporate membership of a club paid 1,20,000

by the company. Bills for club facilities were paid by Raja.

House building loan of ₹ 10,00,000 was given by the company to Raja on 1st December, 2022 at interest rate of 5% p.a.

No repayment was made during the year. Compute the income of Raja chargeable under the head “Salaries”. (Dec 2013, 7 marks)

Answer:

Note 1: Salary for the purpose of computing taxable value furnished accommodation:

| Particulars | Amount (₹) |

| Basic Salary | 4,00,000 |

| Dearness Allowance | 1,50,000 |

| Bonus | 3,00,000 |

| 8,50,000 |

Assuming, Mr. Raja stays in a city where population is more than 25,00,000 as per 2001 census, value of unfurnished accommodation = 15% of salary

= 15% of ₹ 8,50,000

= 1,27,500

Value of furniture provided = 10% p.a. of actual cost

=10% of’ ₹ 3,00,000 x 10/12

= ₹ 25,000

(Assuming, the value of furniture given in the problem represents actual cost.)

![]()

Note 2: Computation of taxable value of perquisite – related to educational facility.

Since tuition fee per month is less than ₹ 1,000.

Amount of perquisite = Nil

Note 3: Computation of taxable value of perquisite – related to interest-free housing loan.

Value of Perquisite = Interest @ 10.75% p.a. less Actual interest charged = (10.75% – 5%) × ₹ 10,00,000 × 4/12 = ₹ 19,167

Note 4: Corporate membership fees of a club are for the business of the employer of the assessee, will not be treated as perquisite in the hand of employee.

Question 9.

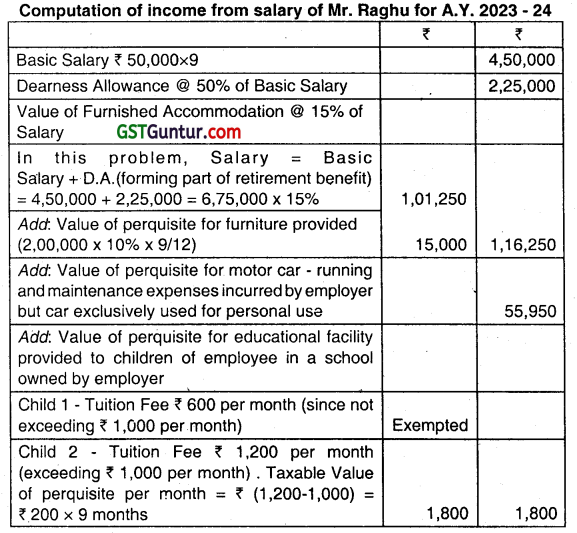

Mr. Raghu joined a company at Chennai on 01.07.2022 and was paid the following emoluments:

(i) Basic salary ₹ 50,000 per month.

(ii) Dearness allowance 50% of basic salary (eligible for retirement benefits).

(iii) Furnished accommodation owned by company was provided at Chennai.

(iv) Value of furniture in the accommodation ₹ 2,00,000 (cost).

(v) Motor car owned by the employer (with engine capacity less than 1.6 litres) given for exclusive personal use. Self-driven by Raghu. Expenses incurred by employer on its running and maintenance ₹ 55,950.

(vi) Educational facility for two children provided tree of cost. The school is owned by the company. Tuition fee per month ₹ 600 and ₹ 1200 respectively.

(vii) Annual membership fee for Gymkhana Club paid by the employer ₹ 20,000.

Compute the income from salary of Mr. Raghu for the assessment year 2023-24. (June 2014, 7 marks)

Answer:

| Add Club Membership tee paid by employer | 20,000 | |

| Gross Income from Salary | 8,69,000 | |

| Less: Standard deduction | 50,000 | |

| 8,19,000 |

Question 10.

Mr. Rahim. Director in a MNC Ltd. is entitled to a motor car (1.8 liters.) to be used for both official and private purposes.

Discuss the taxability of perquisite, it

(i) The car is owned by the employee, expenses paid by employer and it is a Chauffeur-driven car.

(ii) The car is owned by Mr. Rahim, expenses incurred ₹ 30,000 and chauffeur is paid a salary of ₹ 90,000 provided by the employer. (June 2014, 3 marks)

Answer:

Tutorial Note:

Had the car been owned by the employer in case of the above, case (i), the calculations would have been as follows:

Expenditure incurred + salary of chauffeur (as per income-tax guidelines)

= ₹ 2,400 pm + ₹ 900 pm = ₹ 3,300 pm

=₹ 39,600 per year.

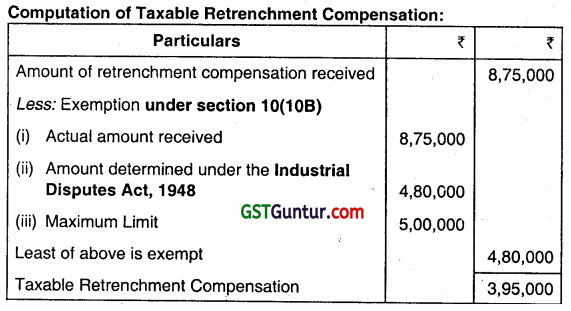

Question 11.

Mr. Mahim was retrenched from service of ABC Limited. He received retrenchment compensation amounting to ₹ 8,75,000. Amount of compensation determined under the Industrial Disputes Act, 1948 is ₹ 4,80,000. The scheme of retrenchment is not approved by the Central Government. Compute the taxable retrenchment compensation. (Dec 2014, 4 marks)

Answer:

Question 12.

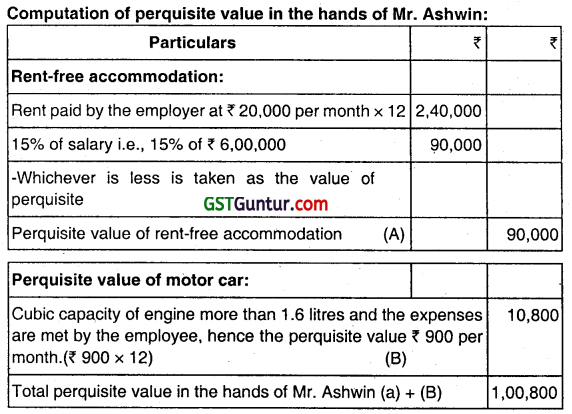

Mr. Ashwin finance manager in Beta Ltd. gives you the following information:

(i) A rent-free accommodation is provided by the employer at Bangalore by taking the accommodation on lease basis whose rent was ₹ 20,000 per month.

(ii) He is provided with a motor car (cubic capacity of engine more than 1.6 liters) both for official and personal use. The expenses on running and maintenance are met by the employee. Assume annual salary for the purpose of perquisite valuation as ₹ 6,00,000. You are requested to compute the perquisite value in the hands of Mr. Ashwin. (June 2015, 4 marks)

Answer:

![]()

Question 13.

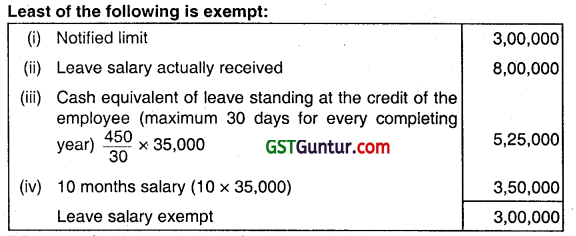

Mr. Sridhar an employee of XV Ltd. received ₹ 8 lakhs as leave salary on his retirement on 28.02.2023. Average salary drawn during last 10 months ₹ 35,000. Last drawn salary is ₹ 40,000. He rendered service of 24 years and 7 months. Leave taken while in service 9 months. Leave entitlement as per employer’s rules is 1\(\frac{1}{2}\) months for each completed year of service. Calculate the taxable leave salary for the assessment year 2023- 24. (Dec 2015, 4 marks)

Answer:

Taxable leave salary of non government employee received at his retirement will be as under:

₹ 5,00,000 (8,00,000 – 3,00,000) will be taxable leave salary in hands of Mr.Sridhar.

Question 14.

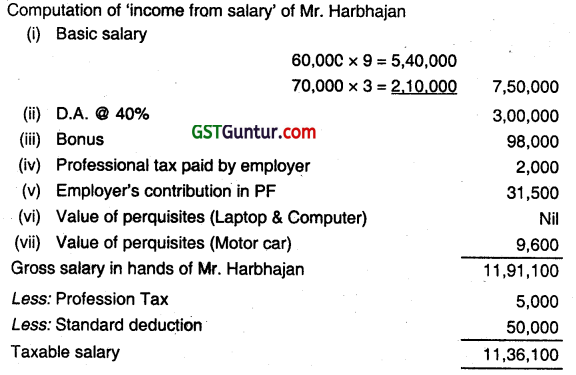

Mr. Harbhajan employed in Gama Ltd. furnishes you the following information for the year ended 31.032023:

(i) Basic salary up to 31.12.2022 ₹ 60,000 per month.

(ii) Basic salary from 01.01.2023 ₹ 70,000 per month.

Note: Salary is due and paid on the last day of every month.

(iii) Dearness Allowance @ 40% of basic salary.

(iv) Bonus equal to one month’s salary paid in February 2023 on basic salary and DA applicable for that month.

(v) Employer’s contribution to Provident Fund account of the employee at 15% of basic salary.

(vi) Profession tax paid ₹ 5,000 of which ₹ 2,000 was paid by employer.

(vii) Facility of laptop and computer was provided to Harbhajan both for official and personal use. Cost of laptop ₹ 35,000 and computer ₹ 25,000 acquired by the company on 01.01.2023.

(viii) A motor, car owned by the employer is provided to the employee meant for both official and personal use from 01.12.2022. Running expenses fully met by the employer which amounts to ₹ 35,000. The motor car (cubic capacity of engine exceeds 1.6 liters) was self-driven by Mr. Harbhajan. Compute the salary income chargeable to tax in the hands of

Mr. Harbhajan for the assessment year 2023-24. (Dec 2015, 7 marks)

Answer:

Working Notes:

- In case professional tax is paid by employer on behalf of employee, the amount paid shall be included in taxable gross salary of employee, then deduction can be claimed.

- Employer’s contribution in PF in exempted up to 12%. excess of 12% shall be taxable in hands of employee. Hence, 3% (15% – 12%) will be taxable in hands of Mr. Harbhajan.

- As per section 17(2)(viii) taxable value of perquisite for use of Laptop and computer shall be Nil.

- As per Rule 3(2), if the motor car (whose engine cubic capacity is 1.6 liters) is owned by employer and is used for both official and personal purposes by the employee, the value of perquisites would be ₹ 2,400 per months.

Question 15.

Answer the following question with brief reason/working:

(ii) Mr. Ajit is employed with XY Co. Ltd. at Mumbai from 01.04.2021. The company took accommodation on lease basis which cost ₹ 3 lakhs per annum. Mr. Ajit is eligible for salary plus DA of ₹ 1 lakh per month. The employer’s annual contribution to the recognized provident fund account of Mr. Ajit ¡s ₹ 1,20,000. What is the perquisite value of accommodation liable to tax in the hands of Mr. Ajit? (Dec 2016, 2 marks)

Answer:

Value of Perquisite will be: (Rent free Accommodation)

(a) 15% of Salary (12,00,000 x 15%) ₹ 1,80,000

Or

(b) Actual Lease Rent paid by employer ₹ 3,00,000

Whichever is lower i.e. ₹ 1,80,000.

Question 16.

An employee has been given a laptop purchased on 01.04.2022 for ₹ 40,000, which he is allowed to take home and use. What is the value to be treated as perquisite while computing Income under the head ‘salaries’? (Dec 2016, 2 marks)

Answer:

Laptop given by employer to the employee is exempt prerequisite. Therefore, value of perquisite will be NIL.

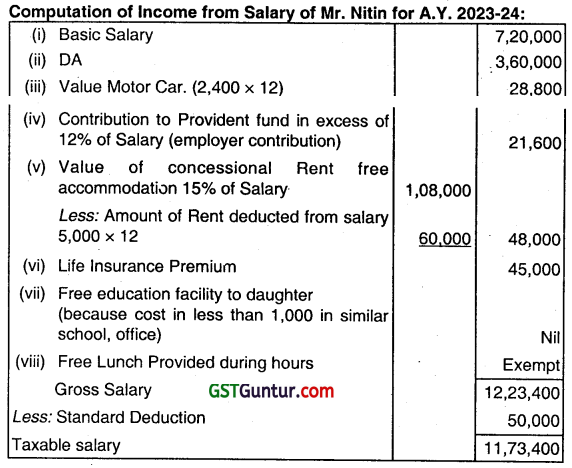

Question 17.

Mr. Nitin is the marketing manager of M&M Ltd., Mumbai. From the following details compute the salary income of Mr. Nitin for the assessment year 2023-24:

(i) Basic salary (per month) ₹ 60,000

(ii) Dearness allowance = 50% of basic salary

(iii) Motor car owned by employer given to employee. Entire running expenses are met by the employer and the car is used for both official and personal purposes by the employee. The engine cubic capacity is above 1.6 litres.

(iv) Provident fund contribution of both employer and employee at 15% of basic salary.

(v) Accommodation owned by the employer is given to the employee. A sum of ₹ 5,000 per month is deducted towards accommodation from the salary of employee.

(vi) Life insurance premium on policy taken by employee paid by the employer during the year ₹ 45,000.

(vii) The employer provides free education facility for Mr. Nitin’s daughter in a school maintained by the employer. Cost of education in similar school is ₹ 800 per month.

(viii) Cost of lunch provided by the employer during office hours ₹ 18,000. (Dec 2016, 8 marks)

Answer:

![]()

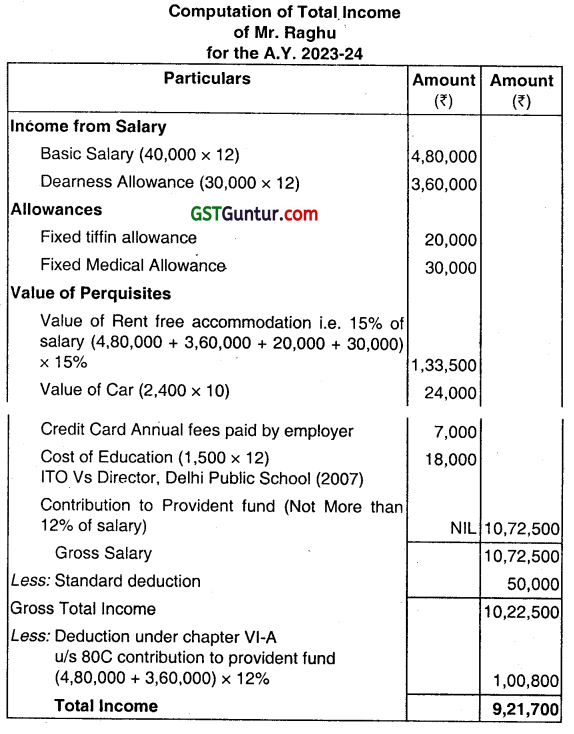

Question 18.

Mr. Raghu is employed with Yes Power Co. Ltd. as General Manager (Finance) at Kolkata. He furnishes you the following

information for the year ended 31.03.2023.

| ₹ | |

| Basic salary (per month) | 40,000 |

| Dearness allowance (per month) eligible for retirement benefits | 30,000 |

| Rent-free accommodation is provided. | |

| A car was provided to him from 01.06.2022 (engine cubic capacity more than 1.6 liters). It is used both for official and personal purposes. Running expenses are fully met by employer. Mr. Raghu drives the car himself. | |

| Provident fund contribution of both employer and employee 12% of basic pay and dearness allowance. | |

| Fixed tiffin allowance (per annum) | 20,000 |

| Fixed medical allowance (per annum) | 30,000 |

| Credit card annual fee paid by employer (used for personal purposes) | 7,000 |

| Only son of Mr. Raghu is given free education in the school run by the employer. Cost of education is ₹ 1,500 per month. | |

| Loan taken by Mr. Raghu from provident fund during the year | ₹ 50,000 |

Compute the total income of Mr. Raghu for the assessment year 2023-24. (June 2017, 7 marks)

Answer:

Question 19.

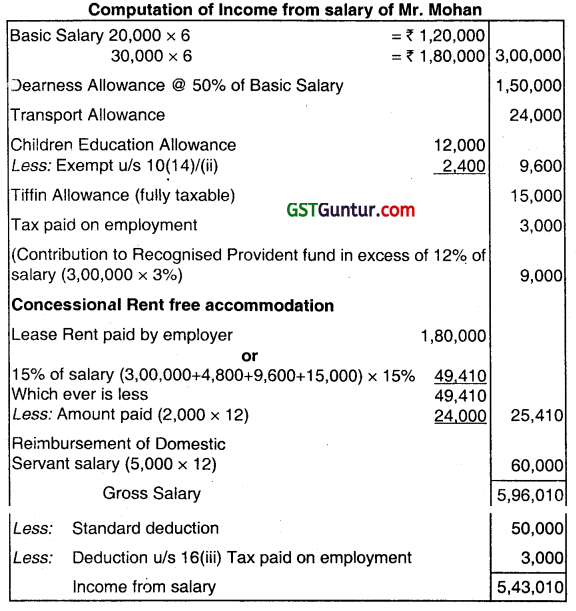

Mr. Mohan is sales manager in Steel King (P) Ltd. at Chennai. During the financial year 2022-23, he gets the following

emoluments from his employer:

| Particulars | ₹ |

| Basic salary up to 30.09.2022 | 20,000 p.m. |

| From 01.10.2022 | 30,000 p.m. |

| Dearness allowance @ 50% basic salary [it is not eligible retirement benefits] | |

| Transport allowance | 2,000 p.m. |

| Children’s education allowance (for 2 children) | 1,000 p.m. |

| Tiffin allowance (actual expenses ₹ 9,000) | 15,000 |

| Tax paid on employment | 3,000 |

| Contribution to recognition provident fund by the employer @ 15% of basic salary. | |

| An unfurnished accommodation taken on lease by the employer was given to the employee for the whole year. Lease rent paid by the employer ₹ 1,80,000. Amount recovered from the employee ₹ 2,000 per month. Domestic servant salary reimbursed by the employer as per employment agreement. Compute the salary income of Mr. Mohan for the assessment year 2023 24. | 5,000 p.m. |

(Dec 2017, 8 marks)

Answer:

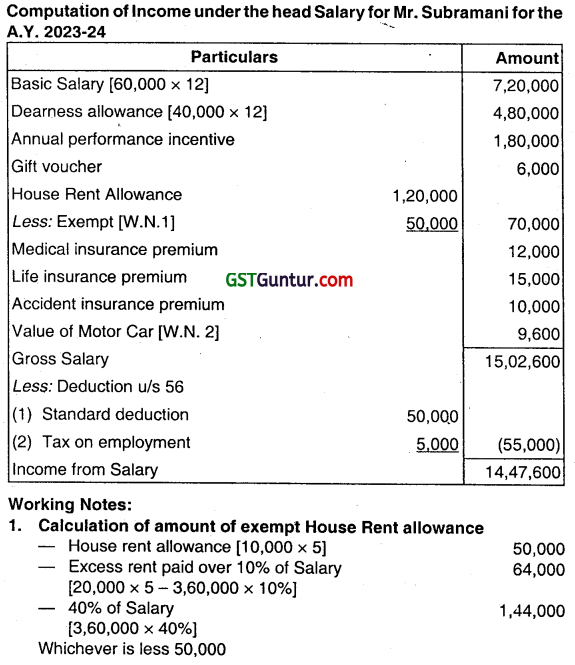

Question 20.

Mr. Subramani is Senior Manager (Finance) of VKS Steel Ltd. The particulars of his emoluments for the year ended 31.03.2023 are given below:

| Basic Salary | ₹ 60000 per month |

| Dearness Allowance | ₹ 40,000 per month (30% is for retirement benefit) |

| Annual performance Incentive | ₹ 1,80,000 |

| House Rent Allowance | ₹ 10,000 per month |

Mr. Subramani pays rent of ₹ 20,000 per month for a flat occupied from 1st November, 2021 at Erode, Tamil Nadu. He received gift voucher of ₹ 6,000 from the employer on the occasion of his marriage anniversary. The employer provided him a motor car (cubic capacity of the engine exceeds 1.6 litres) without chauffeur with effect from 1 December 2022. Running and maintenance expenses of ₹ 30,000 were fully borne by the employer. The car is used by Mr. Subramani both for official and private purposes.

The employer paid the following premiums for Mr. Subramani.

(i) Medical insurance premium ₹ 12,000

(ii) Life insurance premium ₹ 15,000

(iii) Accident insurance premium ₹ 10,000

Tax on employment paid to Erode Municipal Corporation by Mr. Subramani ₹ 5,000. Compute the income chargeable to tax under the head “Salaries” in the hands of Mr. Subramani for Assessment Year 2023-24. (Dec 2018, 9 marks)

Answer:

Calculation of amount of Salary for the purpose of House Rent allowance Salary means Basic Salary + D.A. if provided under the term of Retirement Benefit

(60,000 x 5) + (40,000 x 30% x 5) = 3,60,000

2. Where the motor car is owned or hired by the employer and is used party in the performance of duties and partly for private or personal purposes, the expenses on maintenance and running are met or reimbursed by the employer, then perquisite value 2,400 month [where cubic capacity of engine exceed 1.6 litres.

![]()

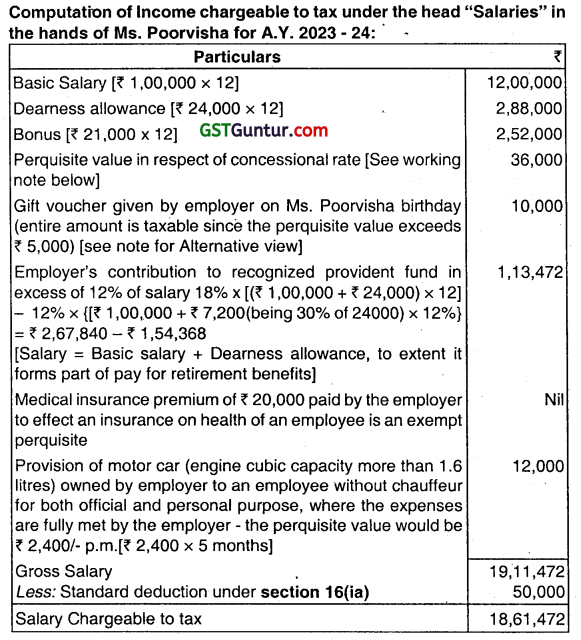

Question 21.

Ms. Poorvisha is the HR Manager in Poorni Textiles Ltd. She gives you the following particulars for the year ended 31 -03-2023:

Basic Salary ₹ 1,00.000 p.m.

Dearness Allowance ₹ 24,000 p.m. (30% of which forms part of retirement benefits).

Bonus ₹ 21,000 p.m.

Her employer-company has provided her with an accommodation on 1 April, 2022 at a concessional rent. The house was taken on lease by the company for ₹ 12,000 p.m. Ms. Poorvisha occupied the house from 1st November 2022, ₹ 4,800 p.m. is recovered from the salary of Ms. Poorvisha.

The employer gave her a gift voucher of ₹ 10,000 on her birthday.

She contributes 18% of her salary (Basic Pay plus DA) towards recognised provident fund and the company contributes the same amount.

Uniform allowance ₹ 24,000.

The company pays medical insurance premium to effect insurance on the health of Ms. Poorvisha ₹ 20,000. Motor car owned by the employer (Cubic capacity of engine exceeds 1.6 liters) provided to Ms. Poorvisha from 1 November 2022 which is used for both official and personal purposes. Repair and running expenses of ₹ 70,000 were fully met by the company. The motor car was self-driven by the employee. Compute the income chargeable to tax under the head “Salaries” in the hands of Ms. Poorvisha. Brief note on treatment of each item is required. (June 2019, 10 marks)

Answer:

Working Note:

1. Where the accommodation is taken on lease or rent by the employer, the actual amount of lease rent paid or payable by the employer of 15% of salary whichever is lower, in respect of the period during which the house is occupied by the employee, as reduced by the rent recoverable from the employee, is the value of perquisite. Actual rent paid by the employer from 01.11.2022 to 31.03.2023 = ₹ 60,000 [ ₹ 12,000 x 5 months]

15% of salary = ₹ 96,150 [15% x (₹ 1,00,000 +₹ 7,200 + ₹ 21,000) x 5 months]

Salary = Basic salary + Dearness allowance, to extent it forms part of pay for retirement benefits + Bonus Lower of the above is ₹ 60,000 which is to be reduced by the rent recovered from the employee.

Hence, the perquisite value of concessional rent = ₹ 60,000 – ₹ 24,000 [₹ 4,800 x 5 months] = ₹ 36,000

2. As per Rule 3(7) (iv), the value of any gift or voucher received by the employee or by member of his household on ceremonial occasion or otherwise from the employer shall be determined as the sum equal to the amount of such gift. However, the value of any gift or voucher received by the employee or by member of his household below ₹ 5,000 in aggregate during the previous year would be exempt as per the proviso to Rule 3(7)(iv).

In this case, the gift voucher of ₹ 10,000 was received by Ms. Poorvisha from her employer on the occasion of her birthday. Since the value of the gift voucher exceeds the limit of ₹ 5,000, the entire amount of ₹ 10,000 is liable to tax as perquisites.

3. In case of uniform allowance, it is assumed here that total amount of allowance is incurred for that purpose and hence it is fully exempted from tax.

Question 22.

Krishna is employed in XYZ Limited. He gets a basic salary of ₹ 80,000 per month and dearness allowance. equal to 40% of basic salary. 50% of dearness allowance forms part of pay for retirement benefits. Both Krishna and XYZ Limited contribute 12% of basic salary to new pension scheme referred to in section 80CCD. Examine the tax treatment of employer’s contribution and own contribution in the hands of Krishna (June 2019, 5 marks)

Answer:

Tax treatment of employer’s contribution in the hands of Krishna. Employer’s contribution to pension scheme referred to in section 80CCD would be treated as salary because it is specifically included in the definition of salary” under section 17(1)(viii). Accordingly, ₹ 1,1 5,200, being 12% of basic salary of ₹ 9,60,000 is to be included in the salary of Krishna. Tax treatment of Krishna’s own contribution In the hands of Krishna:

(i) Krishna’s contribution to pension scheme is allowable as deduction under section 80CCD(1). However, deduction is restricted to 10% of salary. Salary for this purpose – basic salary plus DA, if it forms part of pay for retirement benefit.

So, salary for this purpose = ₹ 9,60,000 + (50% of 40% of ₹ 9,60,000) = ₹ 11,52,000. Deduction under section 8OCCD(1) restricted to 10% of salary= ₹ 1,15,200

(ii) As per section 80CCD(!B), no deduction is permissible as the whole amount of contribution (i.e. ₹ 1,15.200) is exhausted under section 80CCD(1) Above deduction of ₹ 1,15,200 will be taken into consideration and be subject to the overall limit of ₹ 1,50,000 under section 80CCE.

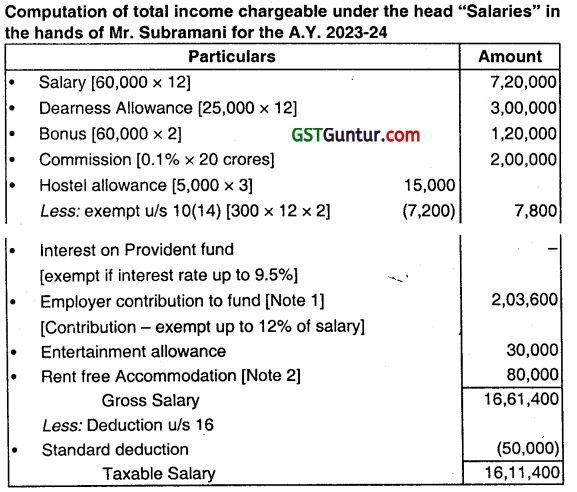

Question 23.

Mr. Subramani is the Chief Finance Manager of M/S LHW Ltd. based at Chennai. He has given the following particulars relating to salary:

(i) Basic Salary (60,000 x 12) = 7,20,000

(ii) D.A (₹ 25,000, x 12) = ₹ 3,00,000 (forms part of pay for retirement benefits)

(iii) Bonus – 2 months of basic pay.

(iv) Commission – 0.1% of the turnover of the company. The turnover of the company for previous year 2022-23 is ₹20 crores.

(v) Contribution of the employer and employee to the recognized provident fund ₹ 3,50,000 each.

(vi) Interest credited to Recognized Provident Fund Account at 9.5% ₹ 65,000.

(vii) Rent-free unfurnished accommodation provided by the company for which the company has paid annuàl rent of ₹ 80,000.

(viii) Entertainment Allowance ₹ 30,000.

(ix) Hostel allowance for three children ₹ 5,000 each.

Compute the income chargeable under the head “Salaries” in the hands of Mr. Subramani for the Asssessment Year 2023-24. (Dec 2019, 9 marks)

Answer:

Note:

1. Calculation of exempt amount of Employer’s Contribution to RPF,

= Salary for the purpose of employer contribution

= Basic + D.A. + Commission

= 7,20,000 + 3,00,000 + 2,00,000

= 12,20,000

Exempt Contribution = 12% x 12,20,000 = 1,46,400

Taxable Amount = 3,50,000 – 1,46,400 = 2,03,600

2. Computation of taxable amount of Rent free Unfurnished accommodation lower of following amount taxable

- 15% of salary [1 3,77,800 x 15%] 2,06,670

- Higher charged paid by employer Taxable amount = 80,000 80,000

Salary for the purpose of Rent free accommodation

Salary = Basic + D.A + Bonus + Commission + All taxable allowance = 7,20,000 + 3,00,000 + 1,20,000 + 20,00,000 + 7,800 + 30,000 = 13,77,800

![]()

Question 24.

Shri Varun is employed in ABC & Co at Kolkata during the previous year 2022-23. His basic salary per month is ₹ 50,000 and dearness allowance which forms part of salary for retirement benefits is 40% of basic salary. ABC & Co also provided an education allowance of ₹ 3,000 per month for the updation of knowledge by employees.

An accommodation was provided by the ABC & Co. at Kolkata for which rent is paid by the ABC & Co. The rent paid by the ABC & Co. is ₹ 10,000 per month. Along with the accommodation at Kolkata he was also provided with furniture items which was taken on hire and the hire charges was paid by ABC & Co. A television set was hired per annum for ₹ 6000 and furniture were hired for ₹ 12,000 per annum. He was provided Refrigerator and washing machine for which the original cost borne by ABC & Co. was ₹ 1,00,000.

Shri. Varun was given a fixed medical allowance of ₹ 5,000 per month and fixed tiffin allowance of 2,000 per month. The telephone bill including mobile bill paid by the ABC & Co. which costed them ₹ 15,000 per month. Further, a laptop costing ‘ ₹ 70,000 was provided to him to perform his job from home by ABC & Co on 1.01 2023.

The contribution in Recognised provident fund by ABC & Co was @ 15% of basic salary; along with this the contribution of Shri. Varun also contributed ₹ 7,500 per month to Recognised provident fund. Shri. Varun paid medical insurance premium by bearer cheque for ₹ 20,000. He received an interest of ₹ 24,000 from the bank account with UCO Bank for his savings account. He also paid interest on educational loan taken for his son’s education in an Indian college for ₹ 1,00,000 a year.

Shri. Varun wants your advice in computing the following for tax planning purposes:

State taxable allowances paid by ABC & Co to Shri Varun.

Compute perquisite value of rent-free accommodation provided by ABC & Co.

Calculate the tax-free and taxable perquisites provided by the employer ABC & Co. and compute the gross total income of Shri. Varun Compute the quantum of deduction under Chapter VI-A and the total income of Shri. Varun. You are required to make the computations and assist him. (Dec 2021, 12 marks)

Answer:

| ₹ | |

| Perquisite value of rent-tree accommodation | 1,48,000 |

| Tax-free perquisites: Telephone bill reimbursed Laptop |

Nil Nil |

| Taxable perquisite | 1,48,000 |

| Gross total income | 11,50,000 |

| Deduction under Chapter VI A | 2,20,000 |

| Total Income | 9,30,000 |

Question 25.

Shri Manas, Finance Manager of Lighting Co. Ltd. furnishes you the following information:

| ₹ | |

| Basic Salary (per month) | 50,000 |

| Dearness allowance 50% on basic salary Note: Not forming part of retirement benefit | |

| Transport allowance – per month | 2,500 |

| Bonus (per annum) | 50,000 |

| Commission – for the year | 2,00,000 |

| Refreshments during office hours – cost to employer | 27,000 |

| Rent-free accommodation provided by the employer at Kolkata | |

| Furniture fittings in the rent-free accommodation. Original cost ₹ 4,80,000 acquired in financial year 2019-20. | |

| Medical facility in clinic maintained by the employer – estimated cost in case it is incurred in outside clinic | 65,000 |

| Gardener provided for maintaining the garden – salary of gardener | 36,000 |

The motor car of the employer was sold to Manas for ₹ 5 lakhs in August 2022. The car was acquired by the company on 01.06.2019 for ₹ 11,50,000. Compute income from salary of Shri Manas for the assessment year 2023-24. (Dec 2022, 7 marks)