Capital Gains – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Capital Gains – CMA Inter Direct Tax Study Material

Short Question

Question 1.

Write short note on the following:

Capital gain on transfer of depreciable assets (Dec 2022, 5 marks)

Descriptive Question

Question 2.

Explain the provisions in regard to a reference to Valuation Officer for valuation of a capital asset under the provision of the Income-tax Act, 1961. (Dec 2012, 3 marks)

Answer:

Reference to Valuation Officer [Section 55A]

Under the following circumstances the Assessing Officer may refer the valuation of the capital asset to the Valuation Officer and his valuation report shall be binding on the Assessing Officer –

1. Where the value of the asset is estimated by the registered valuer but the Assessing Officer is of the opinion that the value so determined is at variance from its fair market value.

2. In any other case, the Assessing Officer is of the opinion that

- The fair market value of the asset exceeds the value of the assets declared by the assessee either by more than 15% or by ₹ 25,000. (Rule 111 AA); or

- The nature of the asset and other relevant circumstances are such that, it is necessary to do so.

Question 3.

Write a note on how interest received by an assessee on delayed compensation or enhanced compensation is taxed. (June 2013, 5 marks)

Answer:

- As per Section 145A (b) irrespective of method of accounting followed by the assessee interest received on compensation or on enhanced compensation shall be deemed to be the income of the year in which it is received.

- As per Section 56(2) (viD) income by way of interest on compensation or enhanced compensation shall be chargeable to income tax under the head “income from other sources”.

- Under Section 57 (iv) in computation of above Income of the assessee, a deduction for a sum equal to 50% ot such income shall be allowed to the assessee.

![]()

Question 4.

State the provisions relating to claiming of exemption in order to reduce tax liability on short-term capital gains. (June 2014, 5 marks)

Answer:

Provisions relating to claiming of exemption in order to reduce tax liability on short-term capital gains Applicable for Exemption U/s

- Transfer of Agricultural land 54B

- Transfer by way of compulsory acquisition by Government 54D

- Shifting of Industrial undertaking from Urban to Rural area 54G

- Compulsory acquisition of Agricultural land by Central Government / RBI 10(37)

- Transfer by companies engaged in power decorousness 10(41)

Question 5.

State the provisions of the Income Tax Act, 1961 relating to interest on compensation or enhanced compensation on compulsory acquisition of property. (Dec 2014, 4 marks)

Answer:

As per Section 1 45A (b), interest received by an assessee on compensation or enhanced compensation, as the case may be, shall be deemed to be the income of the year in which it is received irrespective of the method of Accounting followed by the assessee. Such interest is taxable under the head ‘Income f rorr. other sources as per the provision of Section 56.

In respect of such interest, the assessee shall be entitled under section 57 to claim deduction of a sum equal to 50% of such interest. No other deduction shall be allowed under any other provision of the Income-tax Act.

Key Points:

- Regardless of the method of accounting;

- Interest on compensation enhanced compensation is taxed in the year of receipt;

- It is taxed as income from other sources;

- 50% of such interest is allowable as expenditure.

Question 6.

Can Mr. Ajit who has long-term capital gain from sale of vacant site in India buy a residential house outside India to claim exemption under section 54F? Assume that he has no residential property in India. (June 2015, 3 marks)

Answer:

Exemption u/s 54F:

When the assessee has no residential house property or has not more than one residential house property, he ¡s eligible to claim exemption under section 54F. When a long-term capital asset other than a residential house is transferred, the exemption by way of investment in residential house could be obtained by deploying the net consideration.

The exemption is subject to the condition that the assessee has within a period of one year before or two years after the date of transfer of long-term capital asset acquires a residential house or three years after transfer constructs a new residential house in India for the purpose of availing the exemption under section 54F.

A person transferring a long-term capital asset in India cannot acquire a residential house outside India and be eligible for exemption under section 54F. Thus the person cannot claim exemption in respect of long-term capital gain on sale of vacant site in India by acquiring a residential house outside India.

![]()

Question 7.

When does advance money received for transfer of capital asset become chargeable to tax? Under what head of income is it

chargeable? (June 2015, 3 marks)

Answer:

As per Section 56(2)(ix) any sum of money received as advance in the course of transfer of capital asset is chargeable.

- If such sum is forfeited; and

- The negotiations did not result in transfer of such capital asset.

- Thus, the advance amount forfeited will be taxed as income from other sources.

Question 8.

State the conditions to be satisfied when a sole proprietary concern is succeeded by a company, to avail tax exemption in

respect of capital gains. (June 2015, 4 marks)

Answer:

Conversion of sole proprietary concern into a company:

Where a sole proprietary concern is succeeded by the company the capital gain on transfer of any capital asset or intangible asset will be tax-free.

The following conditions are to be satisfied in this regard:

- Alt the assets and liabilities of the sole proprietary concern relating to the business immediately before the success become the assets and liabilities of the company;

- The shareholding of the sole proprietor in the company is not less than 50% of the total voting power in the company and

- This continues to remain so for a period of 5 years from the date of succession; and

- The sole proprietor does not receive any consideration or benefit, directly or indirectly, in any form or manner, otherwise than by way of allotment of shares in the company.

Question 9.

State the circumstances under which the Assessing Officer may refer the valuation of capital asset to the Valuation Officer.

(Dec 2015, 4 marks)

Answer:

Reference to Valuation Officer [Section 55A]

Under the following circumstances the Assessing Officer may refer the valuation of the capital asset to the Valuation Officer and his valuation report shall be binding on the Assessing Officer –

1. Where the value of the asset is estimated by the registered valuer but the Assessing Officer is of the opinion that the value so determined is at variance from its fair market value.

2. In any other case, the Assessing Officer is of the opinion that

- The fair market value of the asset exceeds the value of the assets declared by the assessee either by more than 15% or by ₹ 25,000. (Rule 111 AA); or

- The nature of the asset and other relevant circumstances are such that, it is necessary to do so.

![]()

Practical Questions

Question 10.

(a) Answer the following sub-divisions briefly in the light of the provisions of the Income-tax Act, 1961:

(iv) Is the right of management in an Indian company a capital asset? On relinquishment directly or indirectly, is it liable to tax? (Dec 2013, 1 mark)

Answer:

Yes, it is a capital asset in view of the Explanation in Section 2(14). It is a transfer in view of Explanation 2 to Section 2(47). Hence the relinquishment is liable to capital gains tax.

Question 11.

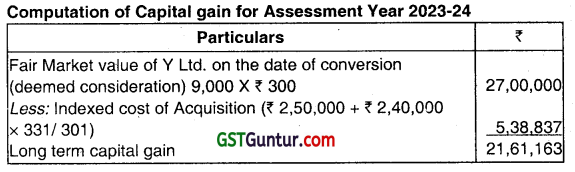

Chirag, an individual, purchased 5,000 shares of X. Limited at ₹ 50 per share and 4,000 shares of Y. Limited at ₹ 60 per share

in the previous year 2015-16 and held them as capital assets. In the previous year 2020-21, he converted the shares into his stock-in-trade. The fair market value of the shares of both the companies on the date of conversion was ₹ 300 per share.

In the previous year 2022-23, he sold the shares of the two companies at ₹ 380 per share. Shares were sold by way of private sale and hence securities transactions tax was not payable.

Ascertain chargeable capital gain and business income from the above-noted transactions in the hands of Chirag.

Cost Inflation Index:

Financial Year 2015-16: 254

Financial Year 2020-21: 301

Financial Year 2022-23: 331 (Dec 2013, 5 marks)

Answer:

Computation of Business Income for Assessment Year 2023 – 2024

| Particulars | ₹ |

| Sale proceeds of Shares (9,000 X ₹ 380) | 34,20,000 |

| Less: Fair market value of Shares on the date of conversion | 27,00,000 |

| Business Income | 7,20,000 |

Note: As securities transaction tax was not paid, exemption under section 112A in respect of long-term capital gain is not available.

![]()

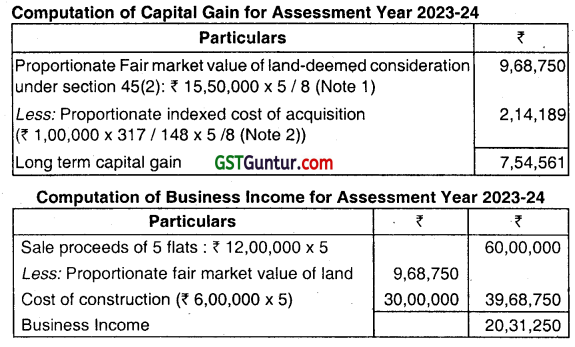

Question 12.

Mr. Ahuja purchased one plot of land in 2009-10 at a cost of ₹ 1,00,000 in Delhi. The land was held by him as capital asset. He converted the plot into his stock in trade on 1 April, 2021, on which date the fair market value of the plot was ₹15,50,000. He started constructing a building consisting of eight flats of equal size and dimension on the plot on 1st April, 2021. Cost of construction of each flat is ₹ 6,00,000. Construction was completed in June 2022. He sold five flats at ₹ 12,00000 per flat from June, 2022 to March, 2023. The remaining three flats were held as stock on 31 March, 2023. Compute Capital Gain and Business Income arising from above transactions for Assessment year 2023-24.

(Cost Inflation Index:

2009-10: 148

2021-22: 317

2022-23: 331) (Dec 2014, 9 marks)

Answer:

Notes:

1. Capital gain arising on conversion of capital asset into stock-in-trade is faxed in the year in which the converted asset is transferred. Therefore, capital gain in respect of proportionate land for 5 fIats is chargeable to tax in assessment year 2023-24.

2. Although tax liability for capital gain is taxed in the year of actual transfer, cost inflation index of the year in which capital asset is converted is fo be used for determining capital gain, as transfer under section 2(4 7) is recognized in the year of conversion.

Question 13.

Ajay purchased a house for ₹ 6 lacs from Anup Properties, a property dealer on 1st June, 2022, for his residential purpose. He paid stamp duty on value of ₹ 10 lacs assessed by Stamp Valuation Authority. Examine the tax implications in the hands of Ajay and Anup Properties. (Dec 2014, 4 marks)

Answer:

In the hands of Ajay:

As per Section 56(2)(x), where an individual receives any immovable property, being his capital asset for a consideration, which is less than the stamp duty value of the property by an amount exceeding ₹ 50,000, then the excess of stamp duty value over such consideration shall be taxed in the hands of the individual under the head “income from other sources”.

Therefore, the sum of 4 lacs (i.e., ₹ 10 lacs – ₹ 6 lacs) shall be taxed in the hands of Ajay under the head “income from other sources”.

In the hands of Anup Properties:

Anup Properties is a property dealer. So the property sold constituted his stock-in-trade. As per Section 43CA, where the consideration on transfer by assessee of an asset (other than capital asset), being land or building is less than the stamp duty value assessed or assessable, such stamp duty value shall be deemed to be the full value of consideration for the purpose, of

computing profits and gains from transfer of such asset.

Note:

The stamp duty value can be up to 120% (Earlier 110%) of the consideration if the transfer of “residential unit”, which means an Independent housing unit is made between 12th November 2020 and 30th June 2021. Therefore, sum of ₹ 10 lacs shall be taken to be the consideration on state of the building to Ajay and the said sum shall be considered for determination of business income of Anup Properties.

Question 14.

(a) From the following information, compute the income taxable under the head ‘Capital gains’ and ‘Income from other sources’ in the hands of Sachin:

(i) Sehwag gifted a vacant site to his friend Sachin on 23.05.2022 on the occasion of latter’s birthday.

(ii) Sehwag had acquired the said vacant site in May, 2016 for ₹ 30,00,000.

(iii) The fair market value of the site for stamp duty purposes on the date of gift i.e. on 23.05.2022 was ₹ 60,00,000.

(iv) Sachin sold the vacant site on 15.03.2023 for a consideration of ₹ 70 lakhs when its stamp duty value on the date of sale was ₹ 90 lakhs. For capital gains, state with reason, whether it is short-term or long-term. Also, compute the capital gains chargeable to tax in the hands of Sehwag. (Dec 2014, 4 marks)

Answer:

Computation of total income In the hands of Sachin A.Y. 2023-24

| Particulars | ₹ |

| Capital gains:

Sale consideration – Stamp duty valuation, as per Section 50C (i.e. more than 110% of sale consideration) |

90,00,000 |

| Less: Cost of acquisition | 60,00,000 |

| Short-term capital gain | 30,00,000 |

| Income from other sources:

Stamp duty value of the property on the date of receipt of gift i.e., 23.05.22 |

60,00,000 |

| Total income | 90,00,000 |

Note:

Where a property is received without consideration, the FMV i.e., stamp duty valuation ¡s the value taxable under the head Income from other sources in the hands of Sachin. The holding period in the hands of Sachin shall be from the date of receipt of property arid not from the date of acquisition by the previous owner. Since it was received on 23.05.2022 and sold on 15.03.2023 it is a short-term capital asset and the resultant gain ¡s short-term capital gain. The donor Sehwag is not subject to capital gains as the property was no transferred but was gifted which is not regarded as transfer under Section 47.

Question 15.

Mr. Dhoni sold a residential building at Cochin for ₹ 65 lakhs in December, 2022. The stamp valuation authority determined the value at ₹ 80 lakhs which was not contested by Mr. Dhoni. The property was acquired in April, 2010 for ₹ 6 lakhs. He acquired a residential flat at Ranchi for ₹ 55 lakhs and another residential house at Cuttack for ₹ 25 lakhs before March, 2023. Compute the capital gain of Mr. Dhoni for the assessment year 2023-24.

Note:

Financial year Cost inflation index

2010-11 167

2022-23 331

You are required to plan in such a way that the incidence of tax is the least. (June 2015, 5 marks)

Answer:

Computation of capital gain of Mr. Dhoni for the assessment year 2023-24

| Particulars | ₹ |

| Sale consideration of residential building at Cochin | 65,00,000 |

| Stamp valuation authority has determined the value at ₹ 80 lakhs. | |

| The higher of the two is to be adopted as deemed sale consideration U/s 50C (See Note – 1) | 80,00,000 |

| Less: Indexed cost of acquisition | |

| ₹ 6,00,000 x 331 ÷ 167 | 11,89,222 |

| Capital Gains Before Exemption | 68,10,778 |

| Less: Exemption U/s 54 | |

| In respect of residential property acquired at Ranchi & Cuttack | 68,10,778 |

| Taxable long-term Capital Gain | NIL |

Note:

1. As per amendment made by Finance Act, 2020 w. e. f. 1st April, 2020 where the value adopted or assessed or assessable by the stamp valuation authority does not exceed 110% of the consideration receivec or accruing as a result of the transfer, the consideration so received or accruing as a result of the transfer shall, for the purpose of section 48, be deemed to be the full value of the consideration.

And where the value adopted or assessed or assessable by the stamp valuation authority is exceeds 110% of the consideration received or accruing as a result or the transfer then Stamp Duty Value shall, for the purpose of section 48, be deemed to be the full value of the consideration.

2. With effect from Assessment Year 2020-21 corresponding to FY 2019- 20, a capital gain exemption is available for the purchase of two residential houses in India. However, the exemption is subject to the capital gain not exceeding ₹ 2 crore. Also, the exemption is available only once in the lifetime of the seller.

![]()

Question 16.

Answer the following questions with brief’ reasons workings:

Mr. Vishnu received ₹ 2,00,000 on 10th April, 2022 as advance from Mr. Ram in pursuance of an agreement to transfer a vacant land held as capital asset. The agreement was cancelled later. Mr. Vishnu retained 50% of the advance and refunded the balance to Mr. Ram. What is the tax implication in the hands of Mr. Vishnu? (Dec 2015, 2 marks)

Mr. G gifted a house property to his son, Mr. H (age 20 years) on 5th June, 2022. The property was acquired by Mr. G on 10th October, 2018. Mr. H held the property as capital asset and transferred the property on 20th October, 2022 for ₹ 20 lakhs. Is the capital gain short-term or long-term? (Dec 2015, 2 marks)

Answer:

(a) As per Section 56(2)(ix) any sum of money received as advance in the course of transfer of capital asset is chargeable:

- If such sum is forfeited; and

- The negotiations did not result in transfer of such capital asset. Thus the amount of ₹ 1,00,000 (50% of 2,00,000) will be taxable under the head “Income from other sources” in hands of Mr. Vishnu.

(d) Where the capital asset became the property of the assessee under gift or will, the cost of acquisition of the asset shall be deemed to be the cost which the previous owner of the property acquired it; as increase by the cost of improvement incurred by the previous owner/assessee. (Section 49) and Where an asset received by the way of gift has been sold, the period of holding of the previous owner should be considered.

Therefore capital gain rising on sale of house property by Mr. H. will be long-term capital gain because the period of holding is more than 24 months.

Question 17.

ABC Private Limited allotted 10,000 shares of ₹ 10 each to Mr. A at 20 per share. The fair market value of the shares on the date of allotment was determined at ₹ 15 per share. Will such allotment have any tax implications in the hands of ABC (P) Ltd? What would be your answer in case the company is a listed company in Bombay Stock Exchange? If Mr. A is a non-resident, state the implication. (Dec 2015, 4 marks)

Answer:

Amendment to Section 56(2) of Income Tax Act, 1961. When a company (public unlisted or private company) issues its share to an Indian resident at a value more than fair market value of those shares, will be subjected to tax in hands of the company under head “Income from other sources”.

Thus share premium of ₹ 50,000 (i.e. 1,000 share at premium of ₹ 5 each) is taxable in hands of ABC Private Limited under head “Income from other sources”. and part of question/Answer: This clause is applicable to companies in which public are not substantially interested. The clause is not applicable to companies listed in any recognised stock exchange. This clause would not be applicable if ABC Private Limited is listed in BSE.

IIIrd part of question/Answer:

Any consideration paid by a non-resident to a closely held company for the share in it, the amount of share premium exceeds the fair market value of the share, company may not be liable to tax. If Mr. A is a non-resident, company would not be liable to tax for share premium (value in excess of fair market value of share) by Mr. A.

Question 18.

Ms. Sanvitha sold a residential house at Salem for a consideration of ₹ 9.5 crores on 10-01-2023. The buyer is an unrelated

person. The stamp duty valuation of the house is ₹ 10.20 crores. Brokerage on sale paid at 2%. In April, 2008 she had bought land for ₹ 1.20 crores. Registration and other expenses incurred were 10% of the same. The construction of the house was completed in March, 2011 for ₹ 1 crore.

She purchased the following two residential houses in March, 2023:

(i) House at Chennai for ₹ 1.1 crores

(ii) House at Mumbai for ₹ 3 crores.

She also purchased bonds of National Highway Authority of India on the following dates:

23-02-2023 ₹ 40 lakhs

12-04-2023 ₹ 50 lakhs

Compute income of Ms. Sanvitha under the head “capital gains’ for Assessment Year 2023-24. Cost inflation indices are:

FY 2009 – 10 148;

FY 2010 -11 167;

FY 2021 – 22 317;

FY 2022 – 23 331; (June 2016, 7 marks)

Answer:

Notes:

1. As per Section 50C, where the stamp duty value ¡s more than actual sale consideration, the former is to be adopted for computing capital gains. As per amendment made by Finance Act, 2020 w.e.f. 1st April, 2020 where the value adopted or assessed or assessable by the stamp valuation authority does not exceed 110% of the consideration received or accruing as a result of the transfer, the consideration so received or coming as a result of the transfer shall, for the purpose of section 48, be deemed to be the full value of the consideration.

And where the value adopted or assessed or assessable by the stamp valuation authority is exceeds 110% of the consideration received or accruing as a result of the transfer then Stamp Duty Value shall, for the purpose of section 48, be deemed to be the full value of the consideration.

2. U/s 54, exemption ¡s available only in respect of only one residential house acquired within the eligible period. Here it will be beneficial to claim for the house property bought at Mumbai. With effect from Assessment Year 2020-21 corresponding to FY 2019-20, a capital gain exemption is available for purchase of two residential houses in India. However, the exemption is subject to the capital gain not exceeding ₹ 2 crore. Also, the exemption is available only once in the lifetime of the seller.

3. U/s 54EC, maximum permissible deduction is ₹ 50 lacs.

![]()

Question 19.

Answer the following question with a brief reason/working:

(i) Mr. Rao sold a vacant site to Mr. Jam in August, 2020 for ₹ 5 lakhs.

The stamp duty valuation of the site at the time of sale was ₹ 8 lakhs.

The difference of ₹ 3 lakhs was taxed as income in the hands of Mr. Jam under the head ‘other sources’. Now in March, 2023, Mr. Jam sold the vacant site for ₹ 12 lakhs. What is the cost of acquisition of site to be adopted by Mr. Jam? ‘ (Dec 2016, 2 marks)

Answer:

Cost of acquisition of site to be adopted by Mr. Jam will be ₹ 8 lakhs as per Section 49 (4).

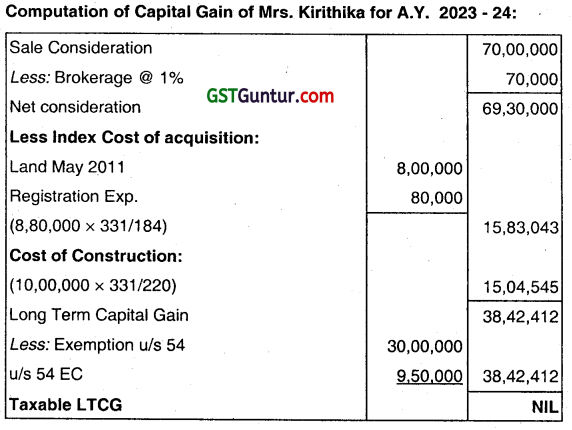

Question 20.

Mrs. Kiruthika sold a residential house at Mumbai for a consideration of ₹ 70,00,000 on 14.02.2023. She had bought land in May, 2011 for ₹ 8,00,000. Registration and other expenses incurred were 10% of the same. The construction of the house was completed in November, 2012 at a cost of ₹ 10,00,000. The sale was made to a stranger. She had taken an advance of ₹ 2,00,000

In cash on 10.04.2022, for which clear evidence is available. At that time stamp duty valuation was ₹ 70,00,000. At the time of registration in February, 2023, there was 10% increase in stamp duty valuation. She received the balance consideration of ₹ 68,00,000 in February, 2023 by cheque. Brokerage paid for sale was 1% on sale consideration received. She purchased the following residential houses in March, 2023:

(i) House at Delhi for ₹ 11,00,000

(ii) House at London for ₹ 19,00,000

He also purchased bonds of National Highway Authority of India approved for the purpose of Section 54EC on the following dates:

29/03/2022 ₹ 4,50,000

22/05/2022 ₹ 5,00,000 .

Compute income chargeable under the head ‘Capital Gains’ in the hands of Mrs. Kiruthika for Assessment Year 2023-24.

Cost Inflation Indices (CII) are as under:

| Financial Year | CII |

| 2011-12 | 184 |

| 2013-14 | 220 |

| 2021 -22 | 317 |

| 2022-23 | 331 |

(Dec 2016, 7 marks)

Answer:

Note 1: With effect from Assessment Year 2020-21 corresponding to 2019-20, a capital gain exemption is available for the purchase of two residential houses in India. However, the exemption is subject to the capital gain nol exceeding ₹ 2 crore. Also, the exemption is available only once in the lifetime of the seller.

Question 21.

State the taxability of the following transactions for the assessment year 2023-24:

(i) Mr. Ashok acquired a vacant site from Mr. Bnjesh (non-relative) for ₹ 6 lakhs when the stamp duty valuation of the vacant site on the date of registration of document was ₹ 10 lakhs.

(ii) Rosy & Co. a partnership firm engaged in trading of vacant lands. It sold vacant land for ₹ 40 lakhs when the stamp duty valuation of the lands was ₹ 55 lakhs.

(v) Mr, Jayaram retired from a nationalized bank on 30.11.2022, sold his motor car for ₹ 5 lakhs. The Car was used by him for the last 5 years and was received as gift from his brother who acquired the car for ₹ 10 lakhs on 10.01 .2015.

(vi) Mr. Vasu acquired an agricultural land situated in a village (rural area) for ₹ 10 lakhs from Mr. Sundar (non-relative) when the stamp duty valuation on the date of registration of document was ₹ 12 lakhs. (Dec 2017, 2 x 4 = 8 marks)

Answer:

(i) Under section 56(2)(x): Income from other sources: Where an Individual or HUF receives, in any previous year from any person or persons an immovable property being land or building with consideration (it stamp duty value exceeds the purchase price by more than ₹ 50,000) then value of gift stamp duty value – purchase price i.e.₹ 10 lakhs – ₹ 6 lakhs = ? 4 lakhs being taken as income from other sources and liable to tax.

(ii) Section 43CA: Special provisions for full value of consideration for transfer of assets other than capital assets in certain cases.

As per provisions of Section 43CA of the Income Tax Act, 1961 full value of consideration for sale of vacant land by Rosy & Co. will be ₹ 55 lakhs and difference between full value of consideration and cost of acquisition will be treated as income from business.

Note:

The stamp duty value can be up to 120% (Earlier 110%) of the consideration if the transfer of presidential unit, which means an independent housing unit is made between 12th November 2020 and 30th June 2021.

(v) Difference between sale consideration i.e. ₹ 5,00,000 and WDV of Car as on 01/04/2022 will Not be treated as short-term capital gain in the hands of Mr. Jayaram.

(vi) Rural agricultural land will not be treated as capital asset and difference between stamp duty value and cost of acquisition will not be treated a. income from other sources, hence not liable to tax.

![]()

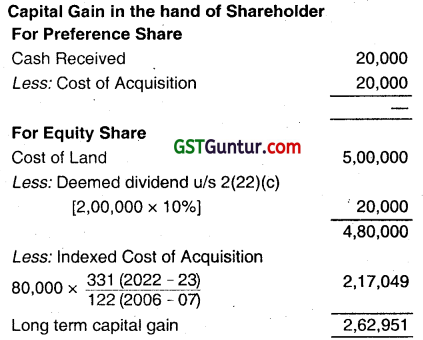

Question 22.

The summarized financial position of Purva India (P) Ltd. as on 31/12/2022 is as under:

| Liabilities | Amount ₹ | Assets | Amount ₹ |

| Equity share capital of ₹ 10 each | 8,00,000 | Land | 6,00,000 |

| Preference share capital | 1,00,000 | Building (WDV as per Income tax Act) | 3,00,000 |

| Reserves | 2,00,000 | Machinery (WDV as per Income tax Act) | 4,00,000 |

| Loan Creditors | 6,00,000 | Current Assets | 10,40,715 |

| Creditors | 6,00,000 | ||

| Provision of Dividend Distribution Tax | 40,715 | ||

| 23,40,715 | 23,40,715 |

Additional Information:

The Company went into liquidation on the balance sheet date; all current assets and buildings realized at book value. The realized money was applied towards payment of outside liabilities including Dividend Distribution Tax, and therefore after the preference shareholders.

Mr. Utkarsh is a holder of 10% equity shares and 20% preference shares of the company. Equity shares were originally acquired by him 16.08.2006 at face value. However, he had subscribed to preference shares on 01.04.2022, which were issued at par. He received a part of land (MV ₹ 5,00,000) and cash (for preference share) ₹ 20,000. Compute the capital gain in hands of the company and Mr. Utkarsh. (Dec 2018, 8 marks)

Answer:

As per Section 46(1), no capital gain shall arise in the hands of the company on distribution of assets to the shareholder on liquidation. Dividend includes any distribution made to the shareholder of the company on its liquidation, to the extent to which such distribution is attributable to the accumulated profit of the company immediately before its liquidation.

Question 23.

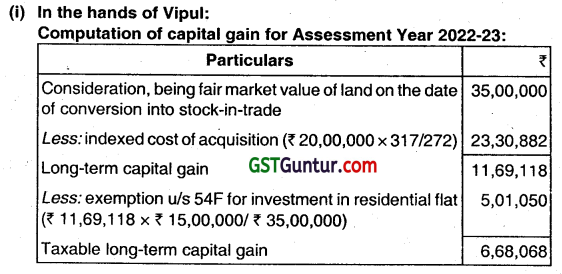

Vipul held a plot of land in Haryana as capital asset till 31st March, 2021. The land was acquired by him in the previous year 2017- 18 for ₹ 20,00,000. It was converted into stock-in-trade on 1st April, 2021 of real estate business carried on by him. The fair market value of the land on the said date was ₹ 35,00,000. Vipul sold the land to Vinod for, ₹ 45,00,000 on 31 January, 2023. The stamp duty assessed on the said date in respect of the land amounted to ₹ 50,00,000. Vipul purchased a flat for ₹ 15,00,000 on 31st March, 2023 for his residential purpose. He has no other residential property.

(i) Compute the income arising from the above transactions under appropriate heads of income ¡n the hands of Vipul.

(ii) What is the effect on assessment of Vinod, if Vinod had bought the land for constructing a residential property?

Additional Information:

Financial year Cost Inflation Index

2017-18 272

2022-22 317

2022-23 331

(June 2019, 10 marks)

Answer:

Computation of business income for Assessment Year 2023-24:

| Particulars | ₹ |

| Consideration, being stamp duty value on the date of sale [under section 43C, actual consideration or stamp duty value, whichever is more is to be taken as consideration] | 50,00,000 |

| Less: Cost of acquisition, being fair market value on the date of conversion | 35,00,000 |

| Business income | 15,00,000 |

(il) Effect on assessment of Vinod for Assessment Year 2023-24:

As per section 56(2)(x), where immovable property in the nature of capital asset is received for a consideration less than the stamp duty value, the difference between the stamp duty value and actual consideration shall be taxed as income from other sources, if such difference exceeds ₹ 50,000.

Note: .

The stamp duty value can be upto 120% (Earlier 110%) of the consideration it the transfer of “residential unit”, which means an independent housing unit is made between 12th November 2020 and 30th June 2021. In the instant case, Vinod purchased the land for constructing residential property meaning thereby that the land is his capital asset. So, the difference between the stamp duty value and actual purchase price i.e. ₹ 5,00,000 is taxable in his hands under the head ‘Income from other sources”.

Question 24.

State with brief reason, the taxability or otherwise of the following in the hands of the recipients [except for (i), for which issue may be seen from the hands of the company], as per the provisions of the Income-tax Act, 1961:

(i) Unicorn Capital Private Limited, a closely held company, issued ₹ 14,000 shares at ₹ 135 per share. (The face value of the share is ₹ 10 per share and the fair market value of the share is ₹ 120 per share).

(ii) Mr. Srinivsan received an advance of ₹ 96,000 on 1 9.09.2022 against the sale of his, house. However, due to non-payment of balance amount in time, the contract was cancelled and the amount of ₹ 96,000 was forfeited.

(iii) Mr. Dhandapani, transferred a house property to his son Mr. Vignesh Karthik without consideration. The value of the house is ₹ 12 lakhs as per the stamp valuation authority. (Dec 2019, 6 marks)

Answer:

(i) As per Section 56(2) (x), if any closely held company issue share to any resident shareholder on premium then:

(issue price of share – FMV of such share) shall be taxable in the hands of company under IFOS. Income from other sources in the hands of Unicorn Capital Private Limited

= (135 – 120) x 14,000 = ₹ 2,10,000

(ii) As per Section 51, Any advance money forfeiture on or after 1/4/2014 shall be charged to tax in the year of forfeiture under the head “income from other sources u/s 56(2) (x) Income from other sources in the hands of Srinivasan for the AY. 2023-24 ₹ 96,000

(iii) As per Section 56(2) (x), property is not taxable if it is received from any Relative without consideration. Hence house property ¡s received by Mr. Vignesh Karthik from his father without consideration It is not taxable in the hand of Vignesh

Karthik because father is covered under definition of Relative.

![]()

Question 25.

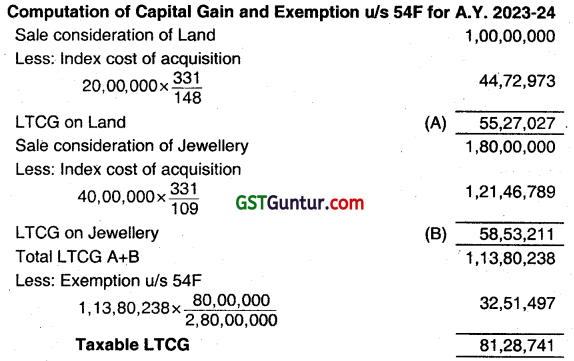

Shri. Charan, a resident, has sold some assets during the previous year 2022-23, and furnishes the following details:

| Items | Cost of acquisition | Sale consideration | Year of acquisition |

| Land | ₹ 20 lakhs | ₹ 100 lakhs | 2008-09 |

| Jewellery | ₹ 40 lakhs | ₹ 180 lakhs | 2002-03 |

Note: Cost Inflation Index FY 2003-04 = 109; FY: 2009-10 = 148; and FY 2022-23 = 331

In March, 2023, he purchased a residential house at Delhi for ₹ 80,00,000 for self-occupation, even though he already owned one residential house (self-occupied) since 1st April, 2014. Compute capital gain including exemption, if any. (Dec 2021, 5 marks)

Answer:

Question 26.

Compute capital gain in the individual cases:

(i) A listed equity share is acquired on 1st of March, 2018 for ₹ 150, its fair market value is ₹ 270 on 31 March, 2018 and it is sold on 31st of August, 2022 in a recognised stock exchange for ₹ 70.

(ii) A listed equity share is acquired on 1st of May, 2019 for ₹ 230, ¡ts fair market value is ₹ 450 on 31st of March, 2020 and it is sold on 1st’ of April, 2023 in a recognized stock exchange for ₹ 400. (Dec 2021, 3 marks)

Answer:

Computation of capital gains

(i) In this case, the actual cost of acquisition ¡s less than the fair market value as on 31st March, 2018. The sale value is less than the fair market value as on 31st of March, 2018, and also the actual cost of acquisition. Therefore, the actual cost of ₹ 150 will be taken as the cost of acquisition in this case. Hence, the loss under the head long-term capital gain will be ₹ 80 (₹ 70 – ₹ 150) per share in this case

(ii) In this case, the actual cost of acquisition is less than the fair market value as on 31st of March, 2018. However, the sale value is also less than the fair market value as on 31st of March, 2018. Accordingly, the sale value of ₹ 400 will be taken as the cost of acquisition and the long-term capital gain will be NIL (₹ 400 – ₹ 400).

Question 27.

Raghuram (age 44) inherited a vacant land from his father in April, 1999. The land was acquired by his father in January, 1991 for ₹ 5 lakhs. The fair market value of the land as on 01.04.2002 was ₹ 25 lakhs. Raghuram entered into an agreement for sale of land in January 2022 and received ₹ 5 lakhs as advance. This amount was forfeited since the party did not complete the transaction.

Again, Raghuram looked for a buyer and found one Sathish interested in the property. The sale consideration was fixed at ₹ 200 lakhs vide agreement made in December, 2022. It was sold and the document was registered in March, 2023. Brokerage @ 1% of the sale consideration was paid. The stamp duty value of the land on the date of sale was ₹ 215 lakhs. Raghuram acquired a residential building at Chennai for ₹ 180 lakhs in May, 2023. Cost inflation index F.Y. 2001-02 100, F.Y. 2022-23 = 331 Compute the taxable capital gain in the hands of Raghuram for the assessment year 2023-24. (Dec 2022, 7 marks)