Return and PAN – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Return and PAN – CMA Inter Direct Tax Study Material

Short Notes

Question 1.

Revised return of income: Meaning and interplay of Section 139(5). (June 2017, 5 marks)

Answer:

Revised Return: Section 139 (5)

Law effective from Assessment year 2021 -22 [Finance Act, 2021]:

If any person having furnished a return under section 139(1) or under section 139(4), discovers any omission or wrong statement therein, then he may furnish a revised return up to 31st December of the relevant Assessment year or before the completion of assessment, whichever is earlier.

Law up to Assessment Year 2016-17:

Upto Assessment Year 2016-17, the return filed under section 139(4) could not have been revised under section 139(5).

As per Finance Act, 2016 w.e.f. Assessment Year 2017-18, the return filed under section 139(4) can be revised under section 139(5).

Notes:

- The revised return substitutes the original return from the date the original return was filed. Once a revised return is filed, the original return is deemed to have been withdrawn and the revised return is deemed to have been filed on the date the original return was filed.

- As assessee can revise a return any number of times provided that the revised return is filed within the time prescribed under section 139(5).

Question 2.

Write short notes on the following:

Who must sign the return of income in the following cases:

(i) Hindu undivided family when karta is bedridden.

(ii) Local authority.

(iii) Political party.

(iv) Limited Liability Partnership.

(v) Association of persons (Dec 2017, 5 marks)

(c) Revised return. (Dec 2017, 5 marks)

Answer:

(b)

(i) If the karta is absent from India or is mentally incapacitated, then by any adult member of the family.

(ii) In case of a Local Authority, by the Principal Officer thereof.

(iii) In case of Political Party, by the Chief Executive Officer of the Party.

(iv) In case of a Limited Liability Partnership:

- By the Designated partner thereof, or

- Where there is no designated partner as such, or where for any unavoidable reason such designated partner is not able to verify the return, by any partner thereof.

(v) In case of Association of Person by, any member or the Principal Officer thereof.

(c) Revised Return: Law Effective from Assessment year 2021-22 [Finance Act, 2021]

If any person having furnished a return under section 139(1) or under section 139 (4), discovers any omission or wrong statement therein, then he may furnish a revised return at any time up to 31 December of the relevant Assessment year or before the completion of the assessment, whichever is earlier.

Last Date for Filing of Belated or Revised Returns of Income Reduced by Three Months:

Currently, belated and revised ITRs can be fed voluntarily after the normal deadline, up to March 31st of the assessment year.

From FY 2021-22 onwards, belated returns are to be filed three months before the end of the relevant assessment year (up to December 31) or before the completion of the assessment, whichever is earlier.

![]()

Question 3.

Write short notes on the following:

(a) Fee for delay in furnishing the return of income;

(d) Adjustments during the course of processing of return of income u/s 139(1). (June 2018, 5 marks each)

Answer:

(a) Fee for Default in Furnishing Return of Income (Introduced by Finance Act, 2021)

1. Without prejudice to the provisions of this Act, where a person required to furnish a return of income under section 139 fails to do so within the time prescribed in sub-section (1) of the said Section, he shall pay, by way of fee, a sum of:

(a) ₹ 5,000, if the return is furnished after the due date of the assessment year; provided that if the total income of the person does not exceed ₹ 5 lakhs, the fee payable under this section shall not exceed ₹ 1,000.

2. The provision of this section shall apply in respect of return of income required to be furnished for the assessment year 2021-22 and future Assessment years.

(d) Scheme of processing of Returns:

(1) Where a return has been made under section 139, or response to a notice under section 142(1), such return shall be processed in the following manner, namely:

(a) the total income or loss shall be computed after making the following adjustments namely:

- any arithmetical error in the return; or

- an incorrect claims, if such incorrect claim is apparent from any information in the return;

- disallowance of loss claimed, if return of the previous year for which set off of loss is claimed was furnished beyond due date specified, under section 139(1);

- disallowance of expenditure or increase in income indicated in the audit report but not taken into account in computing the total income in the return;

- disallowance of deduction claimed [Under Section 10AA or under any of provisions of Chapter VI-A under the heading “C-Deductions in respect of certain incomes” if] the return is furnished beyond the due date specified under section – 139(1).

- addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total income in the return;

Provided further that the response received from the assessee, if any, shall be considered before making any adjustment, and in a case where no response is received within thirty days of the issue of such intimation, such adjustments shall be made.

(b) the tax and interest and fee under section 234F, if any shall be computed on the basis of the total income computed under clause (a);

(c) the sum payable by, or the amount of refund due to, the assessee shall be determined after adjustment of the tax and

interest and fee under section 234F, if any, computed under clause (b) by any tax deducted at source, any tax collected at

source, any advance tax paid any relief allowable under section 89/90/90/91, any tax paid on self-assessment, and any amount paid otherwise by way of tax or interest and fee under section 234F;

(d) an intimation shall be prepared or generated and sent to the assessee specifying the sum determined to be payable by, or the amount of refund due to, the assessee under clause (c); and

(e) the amount of refund due to the assessee in pursuance of the determination under clause (c) shall be granted to the assessee. With effect from 1.4.2020 (A.Y. 2020-21): Enlarging the Tax Base:

To enhance the scope of this provision a proviso inserted in the subsection (1) so as to provide for furnishing of return by a person referred to in clause (b) of the sub-section (1), who is not required to furnish a return under the said sub-section, if such person during the previous year:

- has deposited an amount or aggregate of the amounts exceeding one crore rupees in one or more current account

maintained with a banking company or a cooperative bank; or - has incurred expenditure of an amount or aggregate of the amounts exceeding two lakh rupees for himself or any other person for travel to a foreign country; or

- has incurred expenditure of an amount or aggregate of the amounts exceeding one lakh rupees towards consumption of electricity; or

- fulfills such other conditions as may be prescribed. 6th proviso of the said sub-section amended so as to provide for the furnishing of return by a person who is claiming rollover benefit of capital gains, for investment in a house or a bond or any other asset under sections 54,54B, 54D, 54EC, 54F, 54G, 54GA and 54GB.

Question 4.

Write short notes on the following:

(a) Verification of return of income in the case of an individual, HUF, and political party (Dec 2018, 5 marks)

(b) Any five transactions where quoting PAN is mandatory (Dec 2018, 5 marks)

Answer:

(a) Verification of Return of income in the case of:

Individual:

By the individual himself, in case he ¡s absent from India, by the individual himself or by some person duly authorised by him in this behalf.

HUF:

By the Karta and where the Karta ¡s absent from India or is mentally incapacitated from attending to his affair, by any other adult member of such family

Political Party:

By the chief executive officer of such party.

(b) Following are the five transactions where quoting PAN Is mandatory:

- Cash exceeding ₹ 50,000 during any one day

- Opening a Bank A/c with bank

- Making application for issue of a credit or debit card

- Sale or purchase of goods or service of any nature other than those specified above for an amount exceeding ₹ 2 lakh/transaction

- A contract for sale or purchase of security (other than share) for amount exceeding ₹ 1 lakh/transaction.

![]()

Question 5.

Write short note on the following:

Verification of return of income for company assessee under section 140. (June 2019, 5 marks)

Answer:

Verification of ROI for corporate assessee:

| In general | Managing Director |

| If due to any reason, it is not possible for MD to verify or where there is no MD | Any director |

| Where an application for corporate insolvency resolution process has been admitted by the Adjudicating Authority under Insolvency and Bankruptcy Code, 2016 | Insolvency professional appointed by such Adjudicating Authority |

| Non-resident company | A person holding a valid power of attorney. Copy of such power of attorney must be attached with the return. |

| Company in the process of winding up Where the management of the company has been taken over by the Central or State Government. | Liquidator of the company Principal officer |

Question 6.

Write short notes on the following:

Belated return under section 139(4)

Quoting of Aadhar number under section 139AA (Dec 2019, 5 marks each)

Answer:

Belated Return under Section 139 (4)

If Assessee fails to file return within due date then he can file belated return within following time limit

(a) 31st December of the Relevant Assessment year

or

(b) Before Completion of Assessment whichever is earlier.

Belated return filed u/s 139 (4) can be revised u/s 139(5) w.e.f A.Y. 2017-18

Last Date for Filing of Belated or Revised Returns of income Reduced by Three Months:

Currently, belated and revised lTRs can be filed voluntarily after the normal deadline, up to March 31 of the assessment year.

From FY 2021-22 onwards, belated return are to be filed three months before the end of the relevant assessment year (up to

December 31) or before the completion of the assessment, whichever is earlier.

(c) Quoting of Aadhaar number under Section 139 AA

Every person who is eligible to obtain Aadhaar number shall on or after the 15th July 2017, quote Aadhaar number:

- In the application form for allotment of permanent account Number.

- In the return of income if Aadhaar Number not available then that person should quote application – ID of Aadhaar.

As per Central Govt. Notification, provision of Section 139 AA not apply to an individual who does not possess the Aadhaar Number is:

- Resident in the states of J&K, Meghalaya and Assam;

- A non-resident as per Income Tax Act;

- Of the age of 80 years or more at any time during the P.Y;

- Not a Citizen of India.

Descriptive Question

Question 7.

State ten instances/transactions where Permanent Account Number (PAN) has to be compulsorily quoted. (Dec 2012, 5 marks)

Answer:

The following are the transactions for which quoting of PAN is mandatory.

1. Amount exceeding ₹ 10 lakh or valued by stamp valuation authority referred to in section 50C at an amount exceeding ₹ 10 lahks;

2. Sale or purchase of a motor vehicle or vehicle, which requires registration by a registering authority;

Note: The sale or purchase of a motor vehicle or vehicle does not include two-wheeled vehicles, inclusive of any detachable side car having an extra wheel attached to the motor vehicle.

3. A time deposit, exceeding ₹ 50,000 (fifty thousand rupees), with a bank;

4. A time deposit with post office, exceeding ₹ 50,000 (fifty thousand rupees) or aggregating to more than 5 Lakh during the financial year;

5. A contract of a value exceeding ₹ 1,00,000 (one Lakh rupees) for sale or purchase of securities;

6. Opening an account (other than basic saving A/c or time deposit not exceeding ₹ 50,000/-) with a banking company;

7. Payment to hotels and restaurants against their bills for an amount exceeding ₹ 50,000 (Fifty thousand rupees) at any one time;

8. Payment in cash for purchase of bank drafts or pay orders or banker’s cheques from a bank for an amount aggregating ₹ 50,000 (fifty thousand rupees) or more during any one day;

9. Deposit in cash aggregating ₹ 50,000 (fifty thousand rupees) or more, with a bank during any one day;

10. Payment in cash in connection with travel to any foreign country of an amount exceeding ₹ 50,000 (Fifty thousand rupees) at any one time.

Note:

- “payment in cash in connection with travel” includes payment in cash towards fare, or to a travel agent or for the purchase of foreign currency;

- “travel to any foreign country” does not include travel to the neighboring countries or to such places of pilgrimage

11. Making an application to any bank orto any other company or institution, for issue of a credit or debit card;

12. Payment of an amount of ₹ 50,000 (fifty thousand rupees) or more to a mutual fund for purchase of its units;

13. Payment of an amount of ₹ 50,000 (fifty thousand rupees) or more to a company for acquiring shares issued by it;

14. Payment of an amount of ₹ 50,000 (fifty thousand rupees) or more to a company or an Institution for acquiring debentures, or bonds issued by it;

15. Payment of an amount of ₹ 50,000 (fifty thousand rupees) or more to the Reserve Bank of India (RBI), for acquiring bonds issued by it;

16. payment of an amount aggregating ₹ 50,000 (fifty thousand rupees) or more in a year as life insurance premium to an insurer;

17. Sale or purchase, by any person, of goods or services of any nature any amount exceeding ₹ 2,00,000.

18. A time deposit with a Nidhi referred in section 406 of the Companies Act 2013, exceeding ₹ 50,000 (Fifty thousand rupees) or aggregating to more than ₹ 5 Lakh during the financial year.

19. A time deposit With a NBFC which holds a certificate of registration under section 45-IA of the RBI Act, 1934 to hold or accept deposit from public, exceeding ₹ 50,000 (Fifty thousand rupees) or aggregating to more than ₹ 5 Lakh during the financial year.

![]()

Question 8.

What are the consequences if a person fails to comply with the provisions of Section 139A of the Income Tax Act, 1961?

(June 2013, 2 marks)

Answer:

As per Sec. 272 B (2) if a person fails to comply with the provisions of Sec. 139A, the assessing officer may direct such person to pay by way of penalty a sum of ₹ 10,000/-

Question 9.

Answer the following question with brief reasons/working:

Every return of income filed by the assessee cannot be revised is the statement correct? (June 2016, 1 mark)

Answer:

Effective from: AY. 2021 -22

If any person, having furnished a return under section 139(1) or belated return under section 139(4), discovers any omission or any wrong statement therein he may furnish a revised return at any time up to 31st December of the relevant assessment year or before the completion of the assessment whichever is earlier.

Therefore Answer Should be True:

Return furnished in pursuance of a notice issued under section 142(1) cannot be revised.

Question 10.

Track the importance of furnishing the Return of Loss with special reference to the provisions of section 80 read with section 139(3). (Dec 2021, 4 marks)

Answer:

Importance of Return of income as per section 139(3)

1. ROI is required to be furnished if a person wants to carry forward his losses.

2. If any person has sustained any loss in PY & he wants to carry forward following losses:

- Normal business loss u/s 72(1);

- Speculation business loss u/s 73(2);

- Loss from specified business u/s 73A(2);

- Loss u/h “Capital Gains” u/s 74(1);

- Loss from the activity of owning & maintaining race horses u/s 74A(3); he shall mandatorily furnish a ROL within the time prescribed u/s 139(1) to carry forward loss.

3. Section 139(3) nw sec. 80 require the assessee to file ROL in same manner as that of ROI within the time a’owed u/s 139(1) & all the provisions of this Act shall apply to ROL as if it is a ROI u/s 139(1).

Note: It is not mandatory to file ROI (Except in case of Company/Firm) as there is No Income.

Practical Questions

Question 11.

Powell Ltd. filed its return of loss beyond the ‘due date’ prescribed in Section 139(1) read with Section 80 of the Act. It has business loss of ₹ 20,50,000. It approaches you for advice regarding the course of action to be taken to secure the benefit of carry forward of business loss for set off against future profits. Advise suitably. (June 2014, 3 marks)

Answer:

Generally, return filed beyond the due date specified in Section 139 (1) would deprive the taxpayer the benefit of carry forward of business loss. However, in extraordinary circumstances, the CBDT has the powers to condone the delay in filing return having carry forward of business loss to the future years.

[Associated Electro Ceramics vs. CBDT 201 ITR 501 (Kar)].

As per Circular No. 8 of 2001 monetary limits have been prescribed for condonation of delay in filling loss returns. In cases where the refund is less than ₹ 10,000, the Assessing Officer can condone the delay with the approval of CIT. for refunds from ₹ 10,001 to ₹ 1,00,000 the Assessing Officer can condone the delay with the approval of CCIT/DGIT. Where the refund

claim exceeds ₹ 100,000 only the CBDT has the power to condone the delay.

Therefore, the loss return of Powell Ltd. could be condoned by CBDT. However, Powell Ltd. has to file a condonation petition to the CBDT to carry forward the business loss.

Question 12.

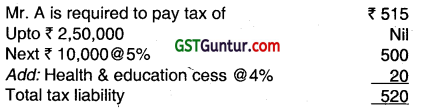

Mr. A (non-resident) aged 66 has total income (computed) ₹ 2,60,000 comprising income from house property and income

from other sources. Is he required to file his return of income for the assessment year 2023-24? Also compute the total amount of tax payable by him. (Dec 2014, 3 marks)

Answer:

Mr. A is a senior citizen but non-resident. The basic exemption limit applicable to him is ₹ 2,50,000. As the total income exceeded the basic exemption limit, he is liable to file his return of income.

He is not eligible for rebate under section 87A because it is applicable to resident assessee (ordinary or not ordinary) only.

Question 13.

You are requested to state whether the following will attract penalty provisions for the financial year 2022-23.

(i) Mr. Jayant whose turnover was ₹ 150 lakhs for the financial year 2021- 22 admitted income as per books of account as ₹ 6,50,000. The return was filed without getting the books of account audited under section 44AB.

(ii) Mr. Maheswari received ₹ 5 lakhs by cash on 01.10.2022 for sale of an a partment at Thane to Mr. Mahesh. As the agreement between the parties got cancelled, Mr. Maheswari refunded the advance by account payee cheque on 01.02.2023. (Dec 2017, 4×2 = 8 marks)

Answer:

(i) Yes, u/s 271 B failure to get accounts audited or furnish a report of audit as required under section 44 AB:

½% of Total sales, turnover, or gross receipts, etc, or ₹ 1,50,000 whichever is less. In the present case, Total penalty will be ₹ 75,000.

(ii) Yes, u/s 271D – Taking or accepting certain Loans and deposits or specified sum in contravention of the provisions of Section 269SS:

Amount equal to loan or deposit or specified sum is taken or accepted. In the present case, Maximum penalty u/s 271 D will be ₹ 5,00,000.

![]()

Question 14.

State with one line reason, the due date for tiling the return of income in the throwing cases:

(i) Mr. Solkar, engaged in trade, has total turnover of ₹ 220 lakhs for the year ended 31.03.2023.

(ii) Krish Srikanth, an advocate, has aggregate professional receipts of ₹ 12,40,000 opting to admit income under section 44ADA.

(iii) Mr. Abid Ah, having 5 heavy goods transport vehicles which are run on hire, opting to admit income under section 44AE.

(iv) M/s Jayantilal & Mankaci, a firm engaged in hotel business with annual turnover of ₹ 130 lakhs preferring to offer income based on applicable presumptive provisions.

(v) Vaman Kumar Charitable Trust having total income of ₹ 12 lakhs. (before giving effect to the provisions of Section 11 and 12, and before seeking accumulation of income for application in the future years.) (June 2018, 6 marks)

Answer:

Every person:

(a) being a company or a firm, or

(b) being a person other then a company or a firm, if his total income or the total income of any other person in respect of which he is assessable under this Act during the previous year exceeded the maximum amount which is not chargeable to tax.

All those taxpayers, who have opted for the presumptive income scheme as per Section 44AD, Section 44ADA, and Section 44AE of the Income-Tax Act bile his return before;

- A person (other than a company) where accounts are required to be audited under the Income-tax Act or under any other low; The due date for filing the return is 31st October of the assessment year.

- Mr. Krish Sri Kanth, an advocate, who opting presumptive income scheme u/s 44ADA shall file before 31 October, if Audit are applicable and 31st July if Audit are not applicable.

- Mr. Abid All, having goods transport vehicles opting presumptive income scheme u/s 44AE shall file before 31 St October, if Audit are applicable and 31st July if Audit are not applicable.

- M/s Jayantilal and Mankad, a partnership firm engaged in hotel business with annual turnover of 130 lakhs, opting presumptive income scheme U/S 44AD shall file before 31st October if Audit are applicable and 31st July if Audit are not applicable.

- Vaman Kumar Charitable Trust having total income of ₹ 12 Lakhs. (Before giving effect to the provision of sections 11 and 12) shall file return of income u/s 139(4A) before 31st October of the assessment year.