Assessment of Various Persons – CMA Inter Direct Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Assessment of Various Persons – CMA Inter Direct Tax Study Material

Practical Questions

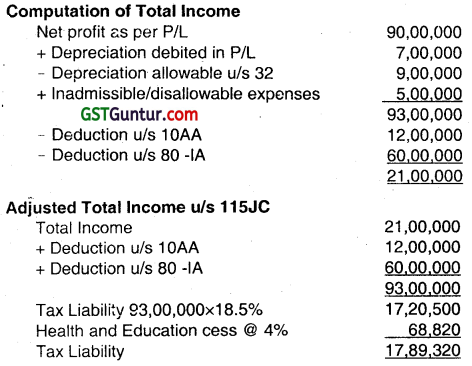

Question 1.

ABC LLP furnishes you the following details pertaining to the financial year 2022-23:

| ₹ | |

| Net Profit as per Profit and Loss Account | 90,00,000 |

| Depreciation debited in the Profit and Loss Account | 7,00,000 |

| Depreciation allowable under Section 32 | 9,00,000 |

| inadmissible/disallowable expenses | 5,00,000 |

| Deduction under Section 10 AA (computed) | 12,00,000 |

| Deduction under Section 80 IA (computed) | 60,00,000 |

Compute total income, adjusted total income under Section 11 5JC and tax liability of ABC LLP for the assessment year 2023-24. (June 2014, 6 marks)

Answer:

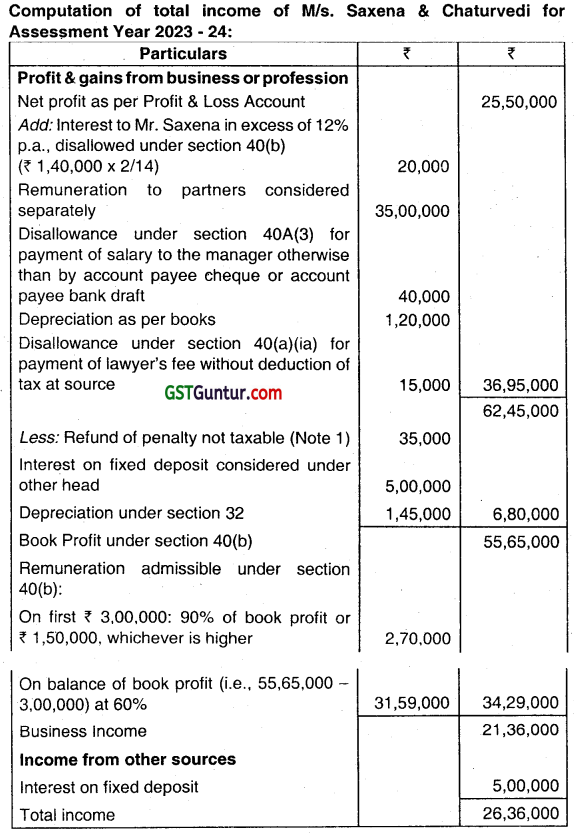

Question 2.

(a) The Profit & Loss Account of M/s. Saxena & Chaturvedi, Cost Accountants, shows a net profit of ₹ 25,50,000 after debiting/crediting the following items:

(i) Interest of ₹ 1,40,000 on capital of Mr. Saxena, partner calculated at 14% per annum.

(ii) Remuneration ₹ 35,00,000 to Mr. Saxena and Mr. Chaturvedi, who are working partners.

(iii) Salary of ₹ 40,000 to Mr. Chatterjee, Manager for February, 2023 was paid by bearer cheque on 1st March, 2023.

(iv) Depreciation ₹ 1,20,000.

(v) Professional fee of ₹ 45,000 was paid to a lawyer for obtaining a legal opinion. No tax was deducted at source.

(vi) A sum of ₹ 30,000 was paid to a trainee as a special award for ranking first in Final Examination of the Institute of Cost Accountants of India.

(vii) Refund of penalty ₹ 35,000 paid in the financial year 2020-21 relating to delayed payment of Goods & Service tax, after decision of the appellate authority in favour of the assessee.

(viii) Interest on fixed deposit ₹ 5,00,000.

The firm is entitled to depreciation of ₹ 1,45,000 under Section 32. Compute total income of the firm for the assessment year 2023-24. (Dec 2014, 9 marks)

Answer:

Notes:

1. Penalty for infractions of law is never allowed as deduction under section 37(1). Therefore, penalty for delayed payment of GST was disallowed in financial year 2020-21. As penalty was disallowed, refund of such penalty as a result of favourable appeal order does not attract deeming provision of Section 41(1). Hence, it is not taxable.

2. Special award was given to trainee for excelling in final examination of the institute to motivate him and in recognition of his caliber. Payment was made to boost his morale so that he could contribute more to the assessee firm. Thus, it has a nexus with the profession carried on by the firm and hence, the same is allowable is deduction under section 3 7(1). As it is debited to profit & loss account, no further adjustment is required.

![]()

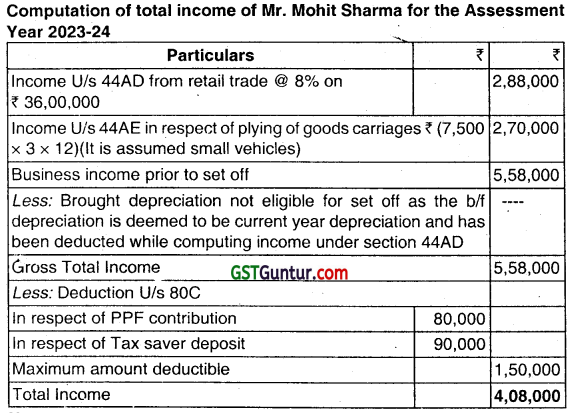

Question 3.

Mohit Sharma gives you the following information for the year ended 31.03.2023:

Owns 3 goods carriages throughout the financial year 2022-23

Retail trade turnover ₹ 36,00,000

Has eligible brought forward depreciation of the assessment year 2020-21 ₹ 60,000 relating to retail trade.

Deposited ₹ 80,000 in PPF account and ₹ 90,000 in tax saver deposit. Assume that he wants to offer income by opting for Sections 44AD and 44AE. Compute his total income for the assessment year 2023-24 (June 2015, 5 marks)

Answer:

Computation of total income of Mr. Mohit Sharma for the Assessment Year 2023-24

Note:

Amendment to [Section-44AE]

Section 44AE(2) has been substituted (with effect from the assessment year 2019-20) so as to provide that for a heavy goods vehicle, the profits and gains shall be an amount equal to ₹ 1,000 per ton of gross vehicle weight (or unladen weight) for every month (or part of a month) during which the heavy goods vehicle s owned by the assessee in the previous year or an amount claimed to have been actually earned from such vehicle, whichever is higher.

In the case of a goods carriage other than heavy vehicle, the profits an gains shall be an amount equal to ₹ 7,500 for every month (or part of a month) during which the goods carriage is owned by the assessee in the previous year or an amount claimed to have been actually earned from such goods carriage, whichever is higher. For this purpose, “heavy goods vehicle” means any goods carriage the gross vehicle weight of which exceeds 12,000 kilograms.

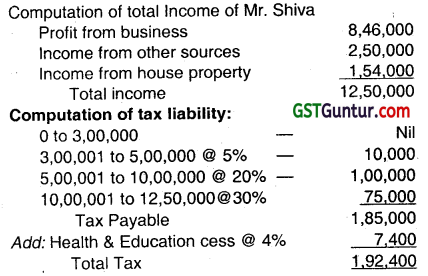

Question 4.

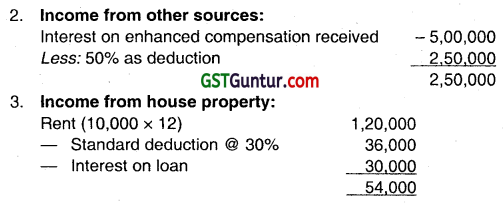

Mr. Shiva (age 62) having 4 heavy goods vehicles and 3 non-heavy goods vehicles wants to show the income chargeable to tax on presumptive basis. During the year 2022-23, he received interest on enhanced compensation of ₹ 5 lakhs relating to compulsory acquisition of land (made in the year 1991). He borrowed ₹ 3 lakhs for renovation of a let-out property from which he earned rental income of ₹ 10,000 per month. Interest on borrowed for house renovation for the year is ₹ 30,000. Compute his total income and income tax liability for the assessment year 2023-24. (Dec 2015, 5 marks)

Answer:

Working Notes:

1. Income from business:

Income = 7 truck 4 heavy & 3 Non heavy goods vehicles

= (3 × 7,500 × 12) + (4 × 12,000 × 12)

= 8,46,000

Note: Amendment to (Section-44AE1

Section 44AE (2) has been substituted (with effect from the assessment year 201 9-20) so as to provide that for a heavy goods vehicle, the profits and gains shall be an amount equal to ₹ 1,000 per ton of gross vehicle weight (or unladen weight) for every month (or part of a month) during which the heavy goods vehicle is owned by the assessee in the previous year or an amount claimed to have been actually earned from such vehicle, whichever is higher.

In the case of a goods carriage other than heavy vehicle, the profits and gains shall be an amount equal to 7.500 for every month (or part of a month) during which the carriage of the goods is owned by the assessee in the previous year or an amount claimed to have been actually earned from such goods carriage, whichever is higher. For this purpose, heavy goods vehicle” means any goods carriage the gross vehicle weight of which exceeds 12,000 kilograms.

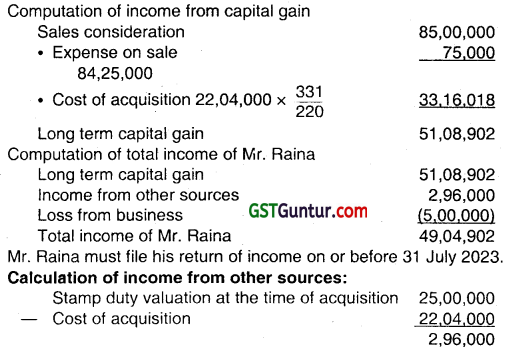

Question 5.

Mr. Suresh Raina sold a residential building for ₹ 75,00,000 on 1st July, 2022. It was acquired for ₹ 22,04,000 on 1st June,

2013. The stamp duty valuation of the property at the time of acquisition was ₹ 25,00,000 and at the time of transfer was ₹ 85,00,000. He paid brokerage at 1 % at the time of transfer. He deposited ₹ 40,00,000 in bonds of Rural Electrification Corporation Ltd. In March, 2023 and deployed the balance in a business commenced by him. He has business loss of ₹ 5,00,000 for the year ended 31st March, 2023. Compute total income of Mr. Suresh Raina and advise by what date he must file his return of income. Cost inflation index – F. Y. 201 3-1 4: 220; F. Y. 2022-23: 331 (Dec 2015, 5 marks)

Answer:

As per Sec. 56 (2)(x) the difference of stamp duty valuation and cost of acquisition is more than ₹ 50,000 (positive) the excess of stamp duty valuation over such cost of acquisition shall be taxed under head “income from other sources”.

Question 6.

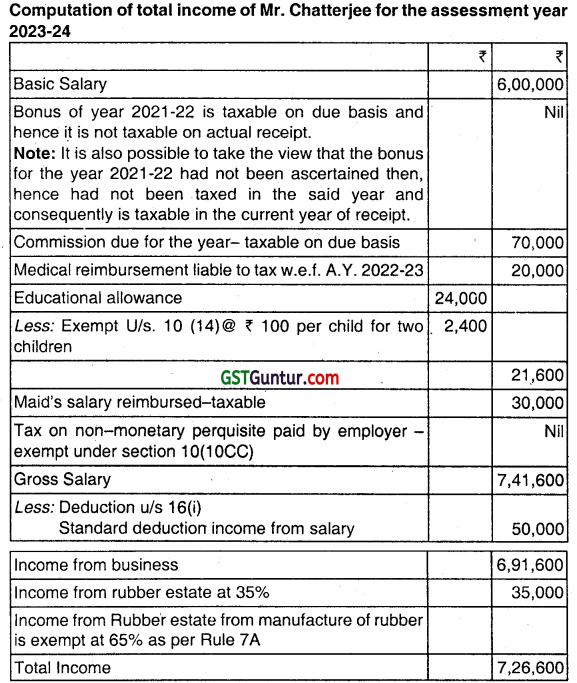

From the following particulars compute total income of Mr. Chatterjee for the assessment year 2023 – 24:

(i) Basic salary ₹ 50,000 per month.

(ii) Bonus for the year 2021-22 received in October 2020 ₹ 30,000.

(iii) Commission for the year 2022-23 but not received till 31.03.2023 ₹ 70,000.

(iv) Reimbursement of medical expenses on production of bills ₹ 20,000.

(y) Education allowance for 2 children paid by the employer ₹ 24,000.

(vi) Maid servant’s salary reimbursed by the employer ₹ 30000.

(vii) Income from cultivation and manufacture of rubber in the rubber estate owned in Kerala ₹ 1,00,000.

(viii) Tax on non-monetary perquisites paid by the employer ₹ 35,000. (June 2016, 9 marks)

Answer:

![]()

Question 7.

Mr. Anjan, an individual, aged 40 years having gross total income of ₹ 5,00,000 (including long-term capital gain from sale of land amounting to ₹ 3,90,000) during previous year 2022-23. He is entitled to get deduction under Chapter Vi-A for ₹ 1,79,000 consisting of deductions permissible under sections 80C, 80D and 80DD for ₹ 95,000, ₹ 4,000 and ₹ 80,000 respectively. Compute income tax payable by Mr. Anjan for assessment year 2023-24. (June 2016, 5 marks)

Answer:

Computation of income tax payable by Mr. Anjan for assessment year 2023-24

| Particulars | ₹ |

| Gross Total Income | 5,00,000 |

| Less: Deduction under chapter VI-A Eligible deduction | ₹ 1,79,000 |

| Deduction under chapter VI-A cannot be claimed from long-term capital gain. Hence deduction is restricted to other income i.e. ₹ 5,00,000 – ₹ 3,90,000= ₹ 1,10,000 | 1,10,000 |

| Total Income (representative long-term capital gain only) | 3,90,000 |

| Tax on other income | Nil |

| On long-term capital gain @ 20% of (₹ 3,90,000 – ₹ 2,50,000) | 28,000 |

| Less: Rebate under section 87A | 12,500 |

| 15,500 | |

| Add: Health and Education Cess @ 4% | 620 |

| Total Tax Liability | 16,120. |

Question 8.

Mr. Manoj gives you the following particulars of his income for the year ended 31st March, 2023:

| Particulars | ₹ |

| 1. interest on loan given to a friend (non-relative) | 80,000 |

| 2. Interest on public provident fund | 21,500 |

| 3. Winning from crossword puzzle (net) | 70,000 |

| 4. Directors fee from a company | 25,000 |

| 5. Royalty on a book written by him | 1,50,000 |

| 6. Expenses for typing the manuscript of the book | 15,000 |

| 7. Cash gift from father-in-law | 2,00,000 |

Compute the income of Mr. Manoj for the assessment year 2023-24. (June 2016, 8 marks)

Answer:

Computation of Total Income of Mr. Manoj for the Assessment year 2023-24

| Particulars | ₹ | ₹ |

| Income from Other sources: | ||

| Interest on loan | 80,000 | |

| Interest on public provident fund | 21,500 | |

| Less: Exemption U/s.10(15) | 21,500 | |

| Nil | ||

| Winning from crossword puzzle ₹ 70,000 x 100/70 | 1,00,000 | |

| Directors fee from a company | 25,000 | |

| Royalty on book | 1,50,000 | |

| Less: Expenses allowable U/s. 57 | 15,000 | |

| 1,35,000 | ||

| Cash gift father-in-law – relative hence not taxable | Nil | |

| Total Income | 3,40,000 |

Question 9.

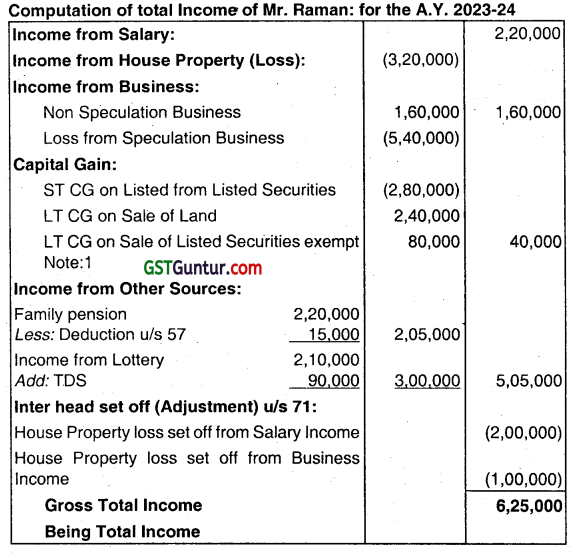

Determine the total income of Mr. Raman from the following details for the Assessment Year 2023-24:

| Particulars | ₹ In lakhs |

| Loss from house property | 3.20 |

| Income from salary | 2.20 |

| Income from non-speculation business | 1.60 |

| Loss from speculation business | 5.40 |

| Long-tern capital gain from sale of land | 2.40 |

| Long-term capital gain from sale of listed shares in recognised stock exchange | 1.80 |

| Short-term capital loss from sale of listed shares in recognised stock exchange | 2.80 |

| Family pension received | 2.20 |

| Lottery winnings (net of TDS) | 2.10 |

| Lottery tickets purchased | 0.30 |

Show clearly the items to be carried forward and those which cannot be carried forward. (Dec 2016, 6 marks)

Answer:

Losses to be carried forward

- Loss from Speculation Business 5,40,000

- ST CL on Sale of Listed Securities 40,000

- Loss from house property 1,20,000

Note: As per section 112A, Long-term capital gain on sale of listed equity shares, in excess of ₹ 1 lakh taxable @ 10%.

Question 10.

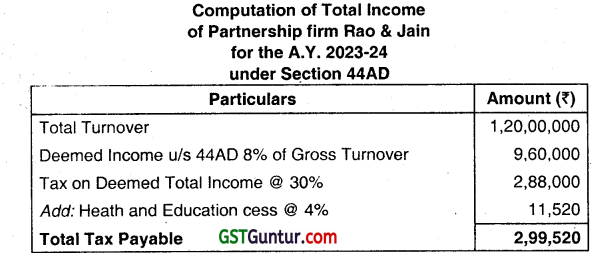

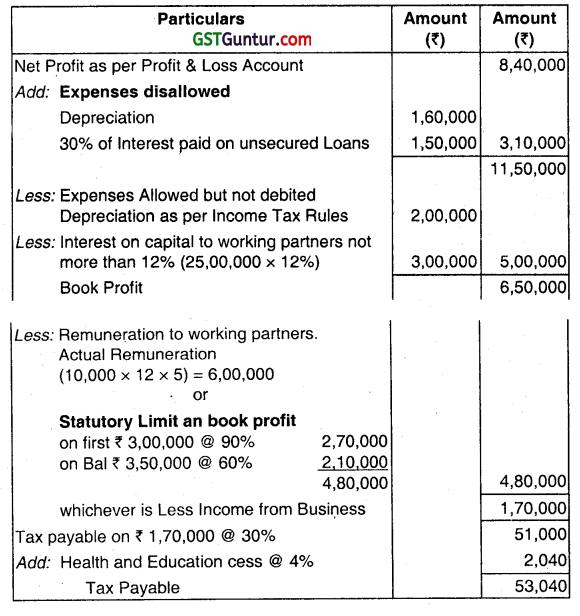

Rao and Jam is a partnership firm, consisting of 5 partners, with turnover of ₹ 1,20,00,000 for the year ended 31.03.2023. The

partnership deed provides for interest on capital at 14% per annum on the capital contribution of 5 lakhs each made by all the partners. All the partners are eligible for monthly working partner salary of ₹ 10,000 each. The firm provides you the following additional information:

| Depreciation eligible under Income-tax Rules, 1962 | ₹ 2,00,000 |

| Interest paid on unsecured loans for which no tax was deducted at source during the year or before the due date for filing return of income u/s 139(1) | ₹ 5,00,000 |

| Contract payments made during the year for which tax was deducted but remitted in financial year 2023-24 and before ‘due date’ for filing the return of income specified in Section 139(1). | ₹ 4,00,000 |

Rent paid to a partner Mr. Jam for premises occupied by the firm ₹ 1,20,000 on which no tax was deducted at source. The reasonable rent for similar premises was determined at ₹ 1,80,000.

The Net Profit of the firm before charging interest on capital and working partner salary as per books was ₹ 8,40,000. Depreciation notionally computed and provided in the books amounts to ₹ 1,60,000. The partners of the firm want you to compute income under section 44AD and also as per regular provisions, and suggest which option would be beneficial to them. (June 2017, 9 marks)

Answer:

Note: .

Deduction of Remuneration to partners and Interest on capital to partners will not allowed from Deemed Income u/s 44AD w.e.f. AY. 2023-24.

Computation of Total Income of partnership firm Rao & Jam for the A.Y. 2023-24 (under Normal Provisions of the Income Tax Act.)

Note: It is in the interest of the firm to maintains the Books of Accounts and get done tax Audit because the Tax liability in case of computation of Total Income and tax under regular provisions of Income Tax Act is less.

![]()

Question 11.

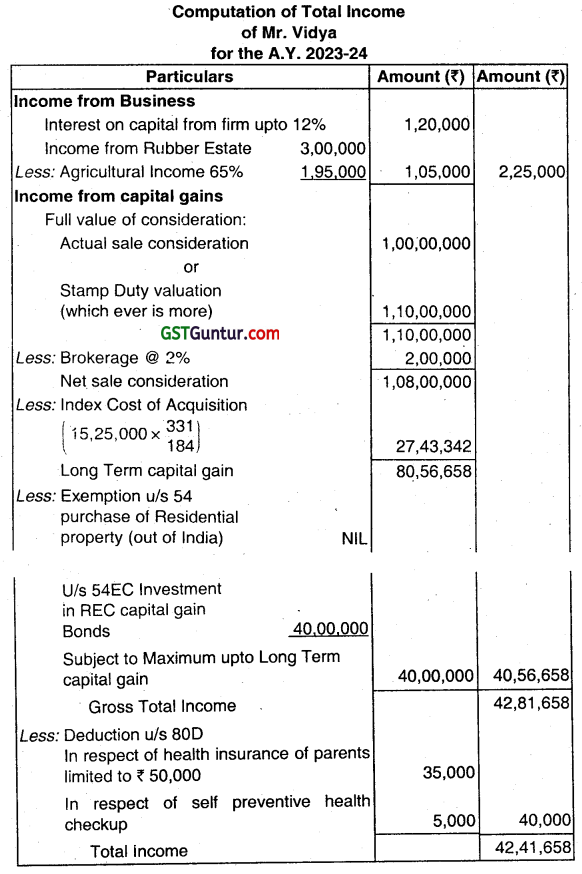

Ms. Vidya residing in Chennai acquired a residential house for ₹ 15,25000 on 28th May, 2011. It was sold for loo Iakhs in July

2022. The stamp duty valuation on the date of sale was ₹ 110 Iakhs. She paid brokerage @2% of sale consideration and on which no tax was deducted at source.

She deposited ₹ 40 lakhs in REG Capital Gain Bonds in September, 2022 and ₹ 20 lakhs in NHAI Capital Gain bonds in February 2023. She acquired a residential property in Colombo for ₹ 50 lakhs and left for Colombo in August 2022 and occupied the said property. She returned to India in September 2022 leaving the property vacant till the date of sale.

Her other incomes include (i) ₹ 1,50,000 by way of interest on capital @ 15% from a firm at Salem; and (ii) income from rubber estates and manufacture of rubber in Kerala amounting to ₹ 3 lakhs., where rubber is grown and processed by her.

She paid ₹ 35,000 towards health insurance of her parents who are senior citizens through credit card and paid in cash ₹ 8,000 towards master health checkup for herself.

Cost Inflation Index: F.Y. 2011-12 = 184; F.Y.2022-23:331

Compute the total income of Ms. Vidya for the Assessment Year 2022-23 under proper heads of income. Ignore DTAA provisions. (June 2017, 8 marks)

Answer:

Notes:

1. DeductIon under Section 80D: Maximum upto ₹ 30,000 including preventive health checkup for self.

2. Exemption U/s 54EC: Maximum up to ₹ 50 lakhs subject to investment made within 6 months from the date of transfer of Capital Asset.

Question 12.

Mr. Chirag has given the following details relating to financial year 2022-23:

(i) Received ₹ 56,000 by way of gift from his friends on the occasion of his marriage.

(ii) Purchased a land at Kanpur for ₹ 12,50,000 for construction of a residential house from a friend. The stamp duty value of the land on the date of purchase was ₹ 15,00,000.

(iii) Interest amounting to ₹ 1,80,000 relating to earlier years, on enhanced compensation received during the year. Legal expenses incurred ₹ 25,000.

(iv) Received loan of ₹ 3,50,000 from CNK Private Limited in which Mr. Chirag holds 12% voting power. The accumulated profit in the hands of the company at the time receipt of loan was ₹ 2,90,000.

Briefly narrate the tax consequences of the aforesaid items, sharing clearly the amount to be taxed in each case. (June 2017, 9 marks)

Answer:

(i) Gift Received from friends of ₹ 56,000 on the occasion of his marriage is not taxable U/s 56(2)(vii).

(ii) Since the Difference between stamp duty value and actual purchase price is more than ₹ 50,000 i.e. (15,00,000 -12,50,000=2,50,000) is liable to tax Under the head Income from other sources U/s 56(2)(vii).

(iii) Interest on enhanced compensation received ₹ 1,80,000 is taxable under the head Income from other sources under section 56(2)(vill) and 50% of such interest is eligible for deduction u/s 57Qv).

(iv) Loan Received by Mr. Chirag from CNK Private Limited will be treated as dividend U/s 2(22)(e) upto the amount of Accumulated profit in the hands of the company on the date of loan given by the company if Mr. Chirag holds 10% or more voting power in the company. In the given case Amount of ₹ 2,90,000 out of ₹ 3,50,000 will be treated as dividend U/s 2(2)(e).

Question 13.

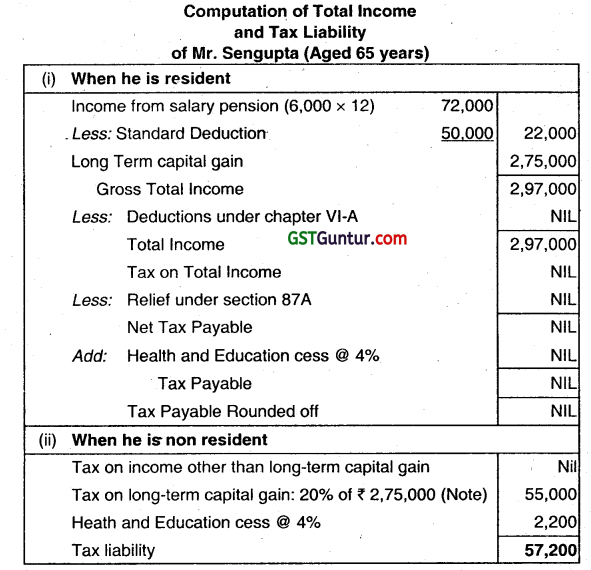

Mr. Sen G. Gupta (aged 65 years) is a retired person drawing a monthly pension of ₹ 6,000. His taxable long-term capital gain

from sale of paintings during the previous year 2022-23 is ₹ 2,75,000. He has no other income during the year. Compute his tax liability for Assessment Year 2023-24 (i) it he is resident and (ii) if he is non-resident. (June 2017, 8 marks)

Answer:

Note:

Where the individual assessee is non-resident, he is not entitled to deduct the excess of basic exemption limit over other income from long-term capital gain for computing tax liability (Section 112).

![]()

Question 14.

State the implications of the following transactions carried out by Kalai & Co. a partnership firm (Whose turnover always exceeded ₹ 500 lakhs) with reverence to the provisions applicable for the assessment year 2023-24:

(i) Audit fees of ₹ 35,000 paid by electronic transfer but no tax was deducted at source.

(ii) Arrear salary of 60,000 paid in cash to an employee who was posted in a ship for 10 days continuously. Tax was deducted at source on the total salary paid to the employee during the year.

(iii) Lorry freight paid by cash ₹ 30,000.

(iv) ₹ 3 lakhs freight paid to Indian Railways without deduction of tax at source.

(v) Salary paid to a son of a partner ₹ 20,000 per month. The market rate of such salary for similar qualifications is found to be ₹ 15,000 per month.

(vi) Income tax paid in cash ₹ 22,000.

(vii) Interest on term loan paid to Canara Bank ₹ 18,000 without deduction of tax at source.

(viii) interest on capital paid to partners at 15% in accordance with the condition contained in the partnership deed.

(ix) Keyman insurance policy premium paid ₹ 40,000. (Dec 2017, 9 marks)

Answer:

(i) 30% of Audit fees of ₹ 35.000. i.e. ₹ 10,500 will be disallowed.

(ii) Arrear of salary of ₹ 60,000 paid in cash will be disallowed, there is no need of adjustment.

(iii) Lorry freight paid by cash upto ₹ 35,000 allowed therefore no adjustment required.

(iv) TOS providers are not applicable to payment made in respect of Railway freight.

(v) Excess salary paid to a son of a partner disallowed i.e. ₹ 5,000 per month will be disallowed.

(vi) Income tax is a personal liability of partnership firm, not an expense. Therefore not allowed as expense.

(vii) Interest on term loan paid to Canara Bank of ₹ 18,000 is an allowed expense. There is no need of TDS.

(viii) Interest on capital paid to partners allowed at 12%, therefore 3% interest will be disallowed and added to profit.

(ix) Keyman insurance policy premium paid ₹ 40,000 is an allowed expense. There is no need of adjustment.

Question 15.

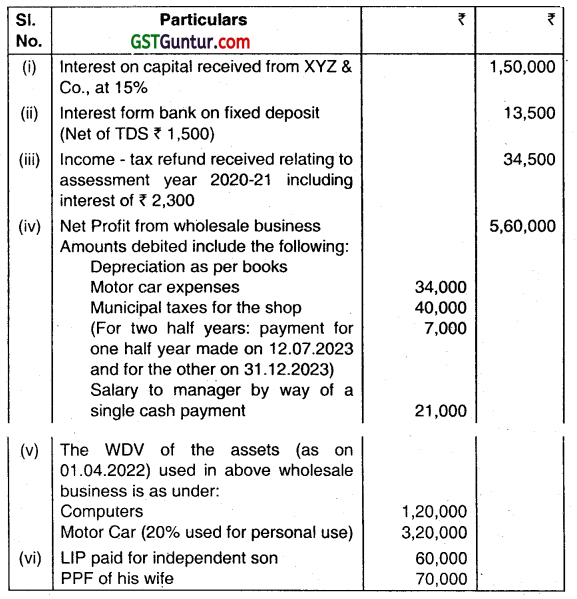

Mr. Rajiv. a resident individual, engaged in a wholesale business of health products. He is also a partner In XYZ & Co., a partnership firm. The following details are made available for the year ended 31.03.2023:

You are required to compute the total income of the Mr. Rajiv for the assessment year 2023-24 and the closing WDV of each block of assets. (Dec 2017, 9 marks)

Answer:

Question 16.

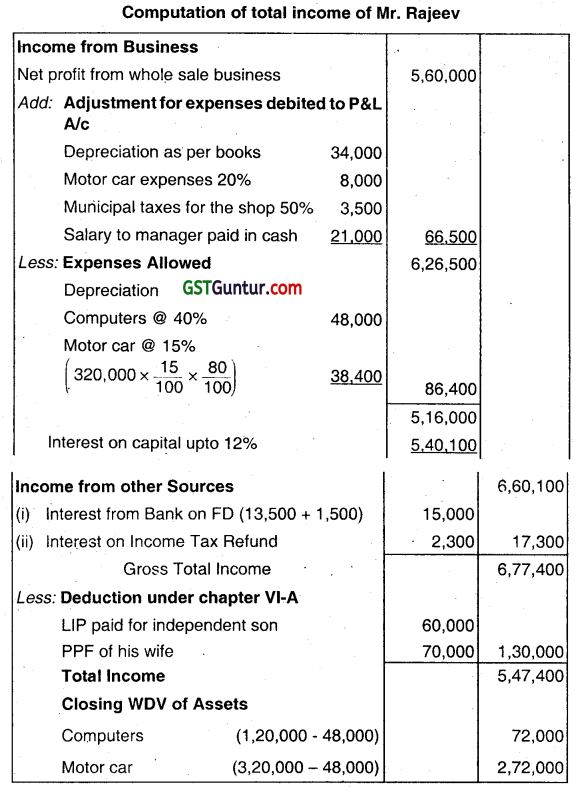

Following is the Profit and Loss Account of Mr. Abdul for the year ended 31.03.2023:

| Particulars | ₹ | Particulars | ₹ |

| To Staff Salary | 4,85,000 | By Gross Profit | 14,48,800 |

| To Shop rent | 1,20,000 | By Post office SB A/c interest | 14,200 |

| To Admin. Expenses | 2,96,000 | By Dividend from listed Indian Companies | 43,000 |

| To Drawings | 96,000 | ||

| To Depreciation | 2,22,000 | ||

| To Medical Expenses | 37,000 | By Bank SB interest | 12,000 |

| To Net Profit | 2,62,000 | ||

| 15,18,000 | 15,18,000 |

Additional information:

(i) Shop rent was paid to wife of Mr. Abdul and ₹ 60,000 is found to be excessive payment considering its size and location.

(ii) Depreciation allowable under the income-tax rules works out to ₹ 1,81.000.

(iii) Medical expenses include expenditure for family members of ₹ 16,000. Balance relates to staff medical expenses.

(iv) Drawings denote personal expenses of the proprietor.

(b) During the year he acquired a residential house for ₹ 20 lakhs which included stamp duty and registration fee of ₹ 1,60,000.

You are requested to compute the total income of Mr. Abdul for the assessment year 2023-24. (Dec 2017, 7 marks)

Answer:

Note-1: There is a change in the dividend taxation regime with the abolishment of dividend distribution tax in case of dividends paid/distributed by domestic companies after 1st April 2020, hence, Section 10(34) which provided exemption from dividend received (after payment of Dividend Distribution Tax) is provided with a sunset clause i.e., the exemption would not be applicable on income received by way of dividend on or after 1st April 2020. Hence, such deemed dividend will be taxable in the hands of recipient.

Question 17.

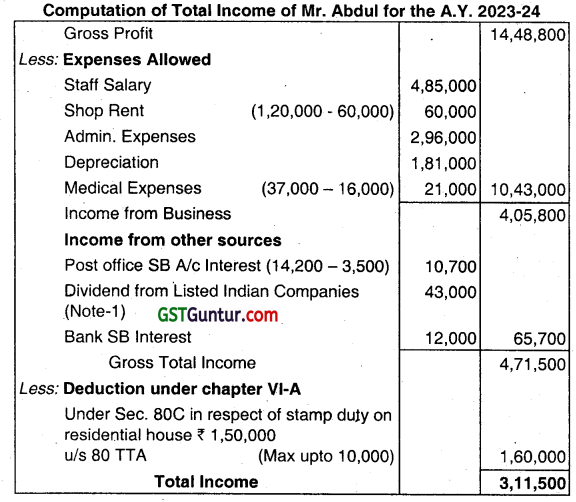

Compute the tax liability of Sri A. Hari Chandra Prakash whose total income is

(a) 49,62,500

(b) 51,00,000

Note : (Source of income is Salary only) (June 2018, 5 marks)

Answer:

Note: In case of individual and HUF, where total income exceeds ₹ 50 lakhs but does not exceed ₹ 1 crore, the aggregate of income tax and surcharge shall be restricted to: Tax on 50 lakhs + (Total income – 50 lakhs)

Question 18.

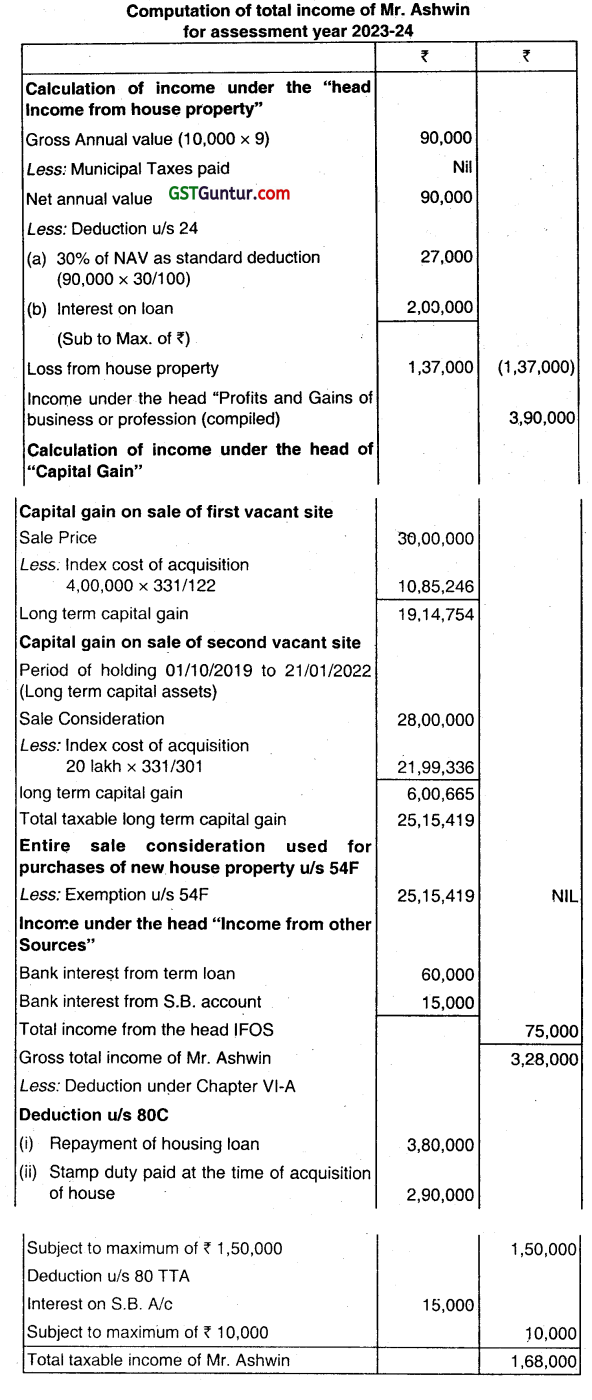

Mr. Ashwin of Chennai sold a vacant site for ₹ 30 lakhs to Mr. Raina on 01.05.2022. The value of land for stamp duty purposes was ₹ 25 lakhs. The vacant site was acquired in April, 2006 for ₹ 3 lakhs. The fair market value of the vacant site on 01.04.2006 was ₹ 4 lakhs. The entire sale consideration plus a housing loan of ₹ 38 lakhs from a nationalized bank was availed for acquiring a residential building for ₹ 68 lakhs in Pune on 01.07.2022. The stamp duty paid for the purpose of acquisition was ₹ 2,90,000. The property was let out for a monthly rent of ₹ 10,000 from 01.07.2022. Interest on housing loan during the year till its closure amounted to ₹ 2,80,000.

Mr. Ashwin sold yet another vacant site for ₹ 28 lakhs on 21.01.2023. This vacant site was acquired in October, 2020 for ₹ 20 lakhs. He utilized the entire sale proceeds realized in January 2023 for repaying the housing loan. His other incomes are (i) Income from business (computed) ₹ 3,90,000 and (ii) Bank interest of ₹ 60,000 from term deposits and ₹ 15,000 from SB account. Compute the total income of Mr. Ashwin for the assessment year 2022-23. Cost inflation index: F.Y. 2006-07 = 122; F.Y. 2020-21 = 301; E.V. 2022-23 = 331. (June 2018, 7 marks)

Answer:

Note No 1:

a. As per Section 50C where the consideration received or accruing as a result of the transfer by an assessee of a capital assets, being land or building or both, is less than the value adopted or assessed or assessable by any authority of a State Government (hereafter in this section referred to as the “Stamp valuation authority”) for the purpose of payment of stamp duty in respect of such transfer, the value so adopted or assessed or assessable shall, for the purpose of Section 48, be

deemed to be the full value of the consideration received or accruing as a result of such transfer.

b. As amended by Finance Act, 2020, that where the value adopted or assessed or assessable by the stamp valuation authority does not exceed 110% of the consideration received or accruing as a result of the transfer, the consideration so received or accruing as a result of the transfer shall, for the purpose of section 48 be deemed to be the full value of the consideration.

And where the value adopted or assessed or assessable by the stamp valuation authority is exceed 110% of the consideration received or accruing as a result of the transfer then Stamp Duty Value shall, for the purpose of section 48. be deemed to be the full value of the consideration.

Note No: 2

According to Section 54F subject to sub-section (4), where in the case of an assessee being an individual or HUF, the capital gain arises from the transfer of any long-term capital assets, not being a residential house (hereinafter in this section referred to as the original assets) and the assessee has, within a period of one year before or two years after the date on which the transfer took place purchased, or has within a period of three year after that date constructed, one residential house in India and cost of new asset is more than the net consideration in respect of the original asset, the whole of such capital gain shall not be charged under Section 45.

With effect from Assessment Year 2020-21 corresponding to FY 2019-20, a capital gain exemption is available for purchase of two residential houses in India. However, the exemption is subject to the capital gain not exceeding ₹ 2 crore. Also, the exemption is available only once in the lifetime of the seller.

![]()

Question 19.

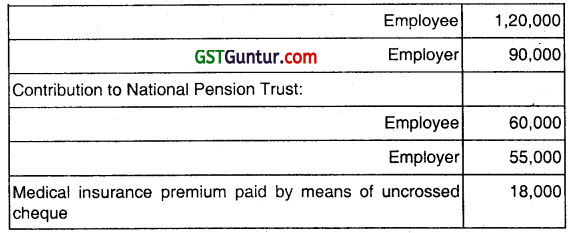

Mr. Kamal is employed in Rajini Mfg. Co. Ltd. Mumbai as General Manager furnishes the following information for the year ended 31.03.2023:

| Particulars | Amount (₹) |

| Basic salary (per month) | 50,000 |

| Dearness Allowance (eligible for retirement benefits) | 80% of basic salary |

| House Rent Allowance (per month) | 10,000 |

| Rent paid by him ₹ 15,000 per month for 6 months and ₹ 20,000 per month for balance 6 months (at Mumbai) | |

| City Compensatory Allowance (per month) | 2,500 |

| Medical reimbursements (annual) | 13,000 |

| Gymkhana club annual membership fee reimbursed by employer | 20,000 |

| Mobile phone bill reimbursed by the employer (Used for both official and personal use) | 37,500 |

| Motor car (cubic capacity of engine 2.2 liters) owned by the employee but the maintenance expenses fully met by the employer (Motor car was used both for personal and official use) | 85,800 |

| Cash gift paid by the employer in appreciation of performance on 01.01.2023 | 30,000 |

Contribution to recognized provident fund:

You are requested compute the total income of Mr. Kamal for the assessment year 2023-24. (June 2018, 10 marks)

Answer:

Computation of total income of Mr. Kamal for the Assessment Year 2023-24

| ₹ | |

| Basic Salary (50,000 x 12) | 6,00,000 |

| Dearness allowance (80% of 6,00,000) | 4,80,000 |

| House rent allowance (Note 1) | 18,000 |

| City compensatory allowance | 30,000 |

| Medical reimbursement (Annual) | 13,000 |

| Annual membership fee | 20,000 |

Working Note: 1

House rent allowance received 1,20,000

Less. Exemption u/s 10(13A)

(a) Actual house rent allowance received 1,20,000

(b) Rent paid over 10% of salary 2,10,000 – 1,08,000 = 1,02,000

(c) 50% of salary = 5,40,000

Least of the above exempt i.e. = 1,02,000

Taxable H.A. = Actual – Exempt = 1,20,000 – 1,02,000 = 18,000

Working Note: 2

Any amount contributed to recognized provident fund by employee shall be allowed as deduction u/s 80C from gross total income subject to the limit specified therein and contribution of employer shall be exempted up to 12% of salary.

Working Note : 3

Any contribution by an individual to any pension fund set up by any mutual Fund referred U/S 10(230) shall be allowed as deduction U/S 80C.

Question 20.

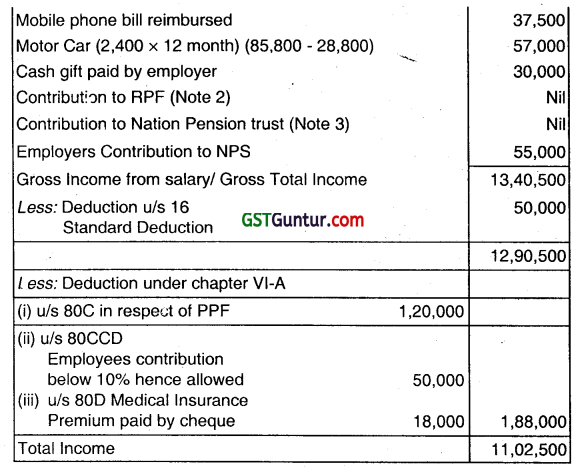

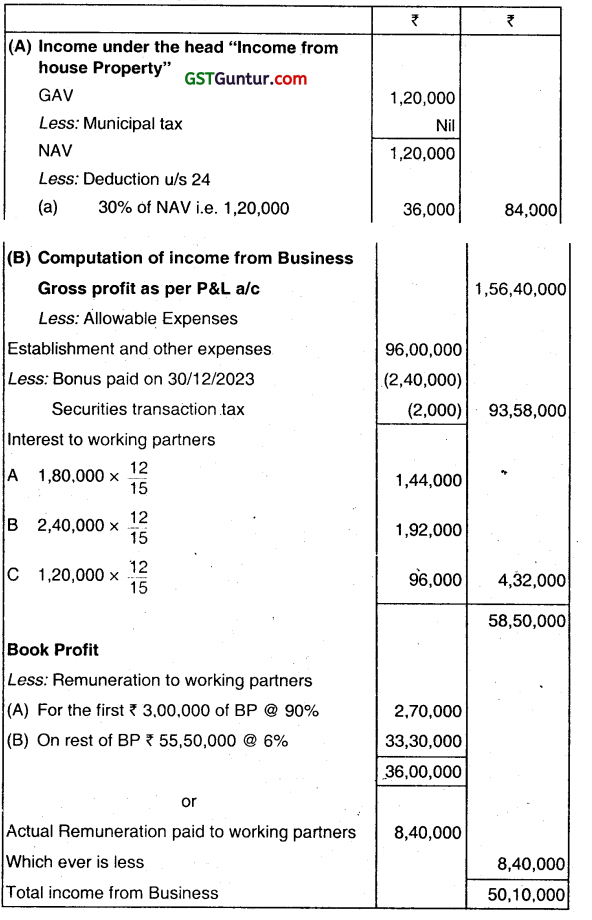

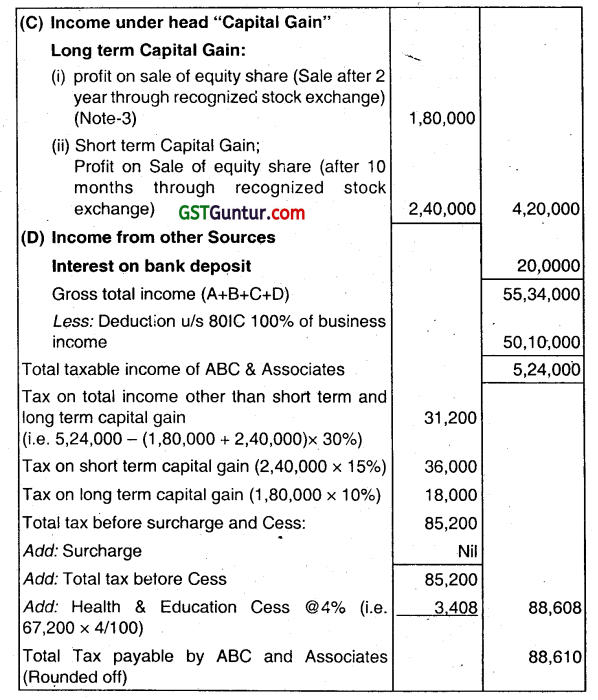

The Profit & Loss Account of ABC & Associates, a partnership firm for the previous year 2022-23 is given below:

Additional information:

(i) Establishment expenses include bonus ₹ 2,40,000 which was paid on 30-12-2023.

(ii) The firm is eligible for deduction under section 80-IC.

(iii) Establishment expenses also included securities transaction tax of ₹ 2,000.

Compute the tax liability of the firm for the assessment year 2023-24.

Assume that no extension of time has been granted u/s 139 (1) for filing the return of Income. (June 2018, 10 marks)

Answer:

Computation to total income and tax liability of the firm for the assessment year 2023-24

Note: 1

Interest and remuneration paid to the partners by a firm are not deductible. However, the interest and remuneration paid to partners by a firm are deductible if all the following conditions are satisfied:

(i) Payment of salary, bonus, commission or remuneration, by whatever name called (hereinafter referred as remuneration) is to a working partner. If it is paid to a non-working partner, the same shall be disallowed.

Note: 2

The payment of interest to a partner should not exceed the amount calculated at the rate of 12% per annum simple interest (any amount in excess will be disallowed).

Note : 3

As per section 11 2A, long-term capital gain on an equity share of a company taxable @ 10% in excess of 1 lakh without providing indexation.

Note: 4

Bonus received by an employee is charged to tax in the year of receipt relief under Section 89 can be claimed in respect of arrears of bonus received during the year.

![]()

Question 21.

Discuss the taxability or otherwise in the hand of the recipient:

Nilay, a member of his father’s HUF, gifted a house property to the HUF. The stamp duty value of the house is ₹ 8 lakhs. (2 marks)

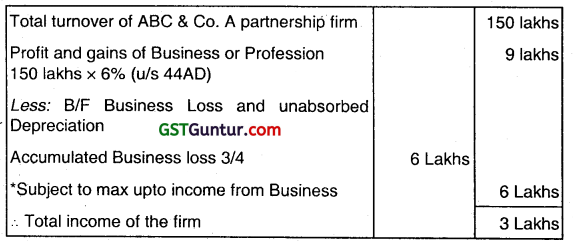

ABC & Co., a partnership firm, consisted of 4 equal partners up to 31.03.2022. It had accumulated business losses of ₹ 8 lakhs and unabsorbed depreciation of ₹ 6 lakhs relating to assessment year 2021-22. On 01.04.2022 one partner retired. The firm, for the previous year ended 31st March, 2023, made a turnover of ₹ 150 lakhs. The firm wishes to opt for presumptive taxation. The entire sale proceeds were realized through banking channel. Compute the total income of the firm for the assessment year 2023-24. (June 2018, 5 marks)

Answer:

(a) Since the HUF is covered under the definition of relative, therefore, gift of house property tÕ the HUF by its member is exempt from Tax.

(b) Computation of total income of the firm ABC & Company for the Assessment Year 2023-24

Note: An individual HUE or partnership firm, who is a resident, whose total turnover or gross receipt in the previous year does not exceed on amount of two crore rupees are eligible for opting pres-emptive taxation scheme.

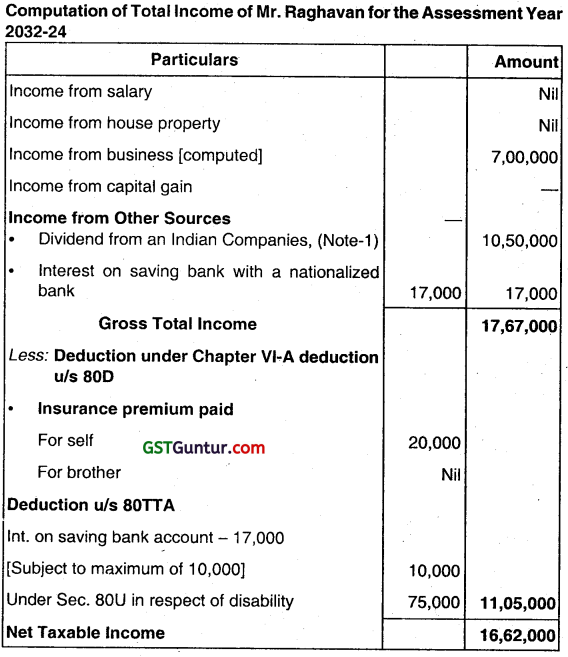

Question 22.

Mr. Raghavan, aged 57, is a person with disability. He furnishes you the following information for the year ended 31.03.2023.

(i) Income from business (computed) ₹ 7,00,000

(ii) Dividend from an Indian company ₹ 10,50,000

(iii) Interest on Saving bank account with a nationalized bank ₹ 17,000

(iv) Medical insurance premium paid by account payee cheque For self ₹20,000

For brother, wholly dependent on him ₹ 15,000

Compute his total income for the Assessment Year 2023-24. (Dec 2018, 5 marks)

Answer:

Note-1: There is a change in the dividend taxation regime with the abolishment of dividend distribution tax in case of dividends paid/distributed by domestic companies after 1st April 2020, hence, Section 10(34) which provided exemption from dividend received (after payment of Dividend Distribution Tax) is provided with a sunset clause i.e., the exemption would not be applicable on income received by way of dividend on or after 1st April 2020. Hence, such dividends will be taxable.

Question 23.

CMA Anup Banerjee is in practice as Cost Accountant. He follows mercantile basis of accounting. His income & expenditure account for the year ended 31st March, 2023 is given below:

| Expenditure | ₹ | Receipts | ₹ |

| Salary and stipends | 10,50,000 | Professional fees | 45,00,000 |

| Bonus to staff | 1,00,000 | Share of profit from a partnership firm | 2,00,000 |

| Meeting Conference and seminars | 2,50,000 | Interest on fixed deposit in a bank (Net of TDS) | 27,000 |

| Fees to consultants | 1,50,000 | Honorarium for valuation of answer papers of various institutes (Net of TDS) | 54,000 |

| Travelling and conveyance | 4,60,000 | ||

| Rent for office premises | 6,00,000 | ||

| Provision for bad debts | 40,000 | ||

| Depreciation | 1,45,000 | ||

| Provision for income tax | 7,02,000 | ||

| Excess of income over expenditure | 12,84,000 | ||

| 47,79,000 | 47,79,000 |

Other information:

(i) Depreciation as per the Income-tax Act ₹ 2,00,000.

(ii) Salary and stipends include ₹ 40,000 paid to one trainee for passing CMA final examination with rank.

(iii) Bonus to staff was paid in November 2023.

(iv) In the financial year 2021-22, a sum of ₹ 15,000 was due to a consultant, which was allowed. The said amount was paid on 14th May, 2022 in cash.

Compute the total income of CMA Anup Banerjee for the assessment Year 2023 -24. He has not opted for presumptive taxation scheme under section 44ADA. The due date for furnishing the return of income under section 139(1) may be taken as 31st Oct, 2023. (Dec 2018, 15 marks)

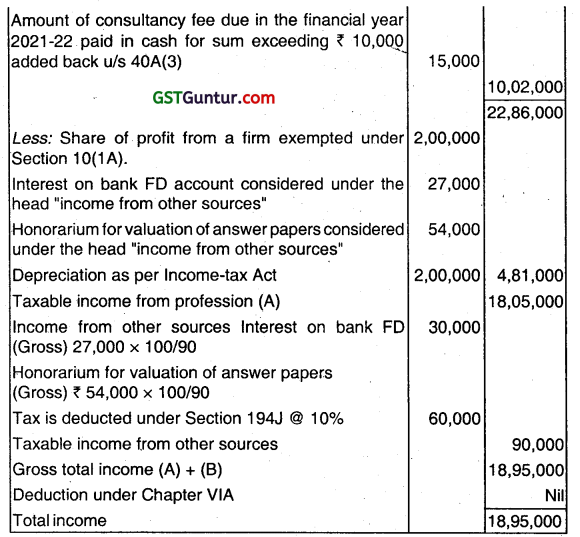

Answer:

| Particulars | ₹ | ₹ |

| Profits & gains of business or profession Net surplus as per Income & Expenditure A/c Add: Payment to a trainee for passing CMA Final examination with rank is in the nature of incentive to boost the morale of the staff. The expenditure is wholly and exclusively for the purpose of profession of the assessee and allowable u/s 37(1). As the amount has already been debited to income & expenditure account, no adjustment is necessary |

12,84,000 | |

| Bonus to staff not paid before the due date of filing return of income disallowed u/s 43B | 1,00,000 | |

| Under Section 36(1)(vii), bad debt does not include provision for bad debts. Hence, provision for bad debts is disallowed | 40,000 | |

| Depreciation debited to profit & loss account | 1,45,000 | |

| Provision for income-tax disallowed u/s 40(a) | 7,02,000 |

Question 24.

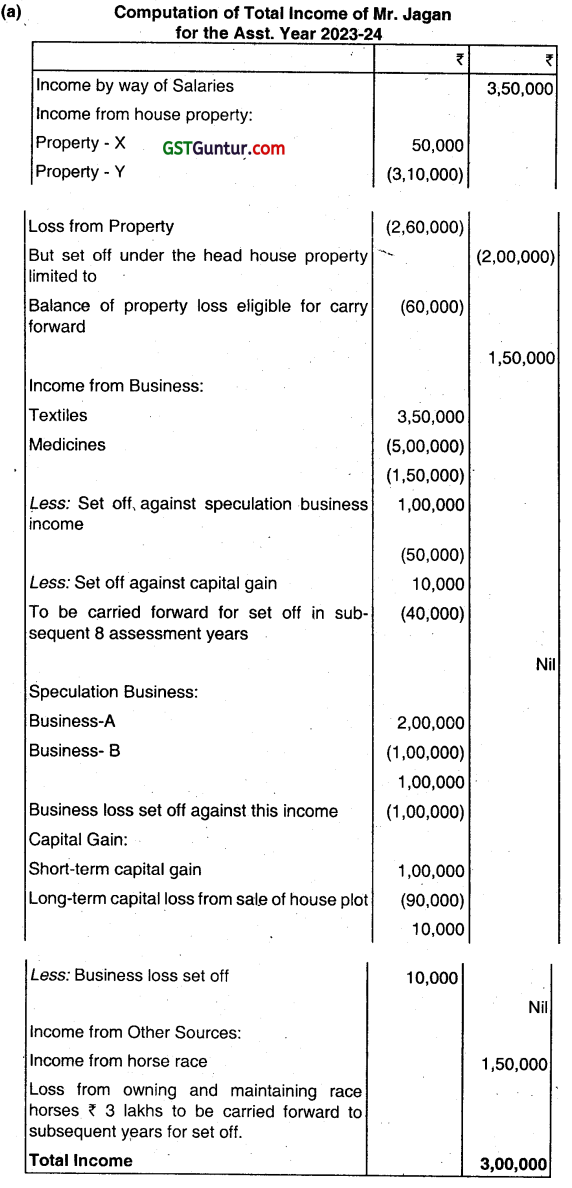

Compute the total income of Mr. Jagari, a resident, from the following details:

| Particulars | Amount (₹) |

| (i) Income under head Salaries’ | 3,50,000 |

| (ii) Income from owning and maintaining race horses | (3,00,000) |

| (iii) Long-term capital gain from sale of house plot | (90,000) |

| (iv) Income from house property-X | 50,000 |

| (v) Business Income-Medicines | (5,00,000) |

| (vi) Speculative business – A | 2,00,000 |

| (vii) Business Income-Textile | 3,50,000 |

| (viii) Speculative business-B | (1,00,000) |

| (ix) Income from horse races | 1,50,000 |

| (x) Income from house property – Y | (3,10,000) |

| (xi) Short-term capital gain from sale of immovable property | 1,00,000 |

(June 2019, 9 marks)

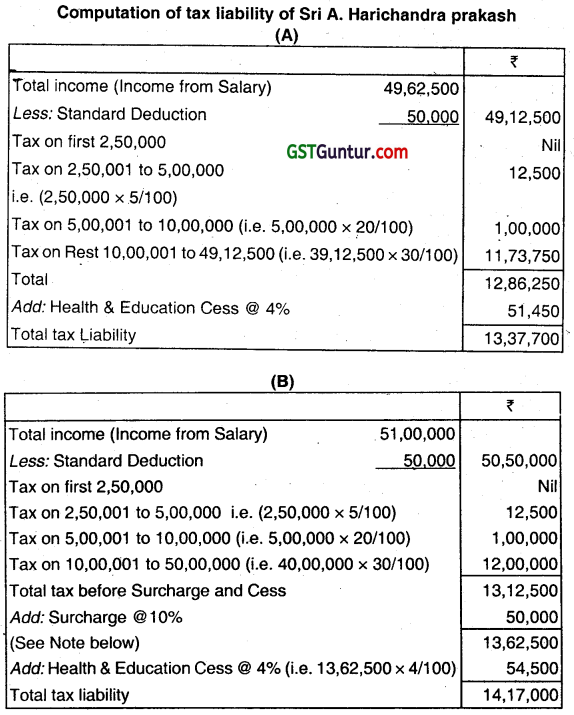

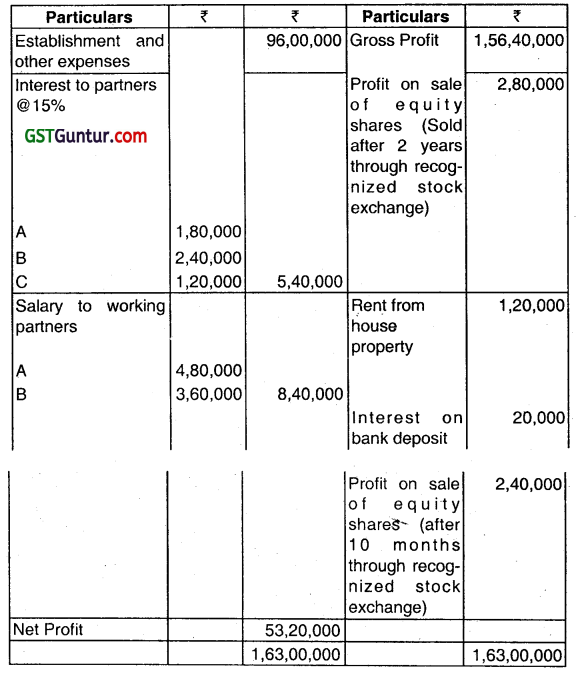

(b) Brindavan & Co. is a partnership firm consisting of 4 partners viz., Ram, Rahim, Robert and Rakesh. The firm made turnover exceeding ₹ 100 lakhs and the net profit of firm was ₹ 9,50,000 before considering the following items:

Answer:

![]()

Question 25.

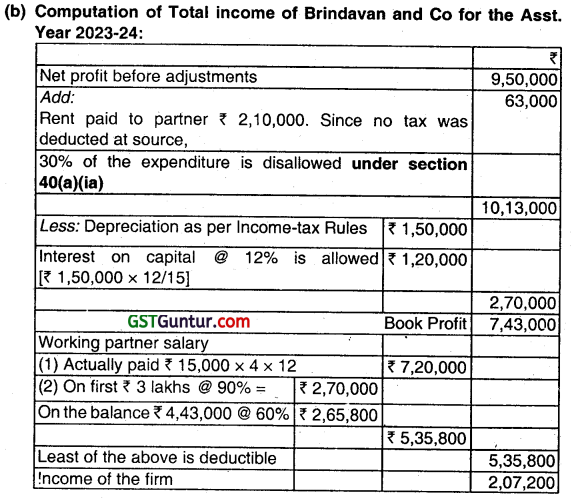

Madhav is a sole proprietor of Han Silks. He reports turnover of ₹ 240 lakhs for the previous year 2022-23 and a net profit of

₹ 8,10,000 as per books of account. The following items are debited and credited to Profit and Loss Account.

(i) Bonus to employees ₹‘60,000 Provision made on 31.03.2023 and was paid on 30.11.2023 after the due date for filing the return.

(ii) Interest on private loan ₹ 12,000 was paid by account payee crossed cheque on 10.08.2022. No tax was deducted at source. Turnover of Raghav for the previous year 2021-22 also exceeded ₹ 200 lakhs.

(iii) Dividend train Indian Companies (listed in recognized stock exchange) received during the year ₹ 21,000.

(iv) PPE interest credited 27,000 and savings bank interest ₹ 13,500 from UCO Bank.

(v) One Generator was purchased for ₹ 90,000 on 10.01.2023. Subsidy received from Government @ 20%. The subsidy is credited to P&L Account. No depreciation is charged in the books for generator.

(vi) Rent received from let out property ₹ 1,65,000 credited to profit and toss account. Municipal tax to the said property 1 ₹ 5,000 was paid on 10.03.2023 which is debited to profit and loss account.

(vii) Salary paid to wife 30,000 per month during the year 2022-23. (Reasonable monthly salary considering her qualifications and experience is ₹ 20,000 per month.)

You are requested to compute the income from business of Madhav taking note to the above adjustments. Brief reason is to be given for treatment of each item given above. (Dec 2019, 9 marks)

Answer:

Question 26.

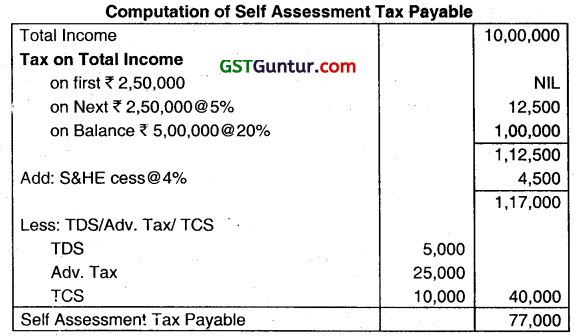

The total income of Mr. M is ₹ 10 lakhs. In this income, ₹ 50000 was earned by way of Interest on which the payer of Interest

deducted tax at source @ 10% (₹ 5,000). He paid advance Tax of ₹ 25,000 in different installments. TCS collected at source was ₹ 10,000. Calculate the self-assessment tax to be paid under section 140A at the time of filing the Return of income.

[Note: Compute the tax as per old regime.] (Dec 2021, 3 marks)

Answer:

Question 27.

Following is the profit arid loss account of Ashok (age 56) a resident for the year ended 31.03.2023:

| To Rent | 2,70,000 | By Gross Profit | 10,50,000 |

| To Car repair & running expenses | 10,000 | By Cash Gift from friend | 35,000 |

| To Income tax | 15,000 | By Profit on sale of car | 20,000 |

| To Medical expenses | 20,000 | By Interest on income tax refund | 1,300 |

| To Administration expenses | 1,30,000 | ||

| To Salary | 90,000 | ||

| To Net Profit | 5,71,300 | ||

| 11,06,300 | 11,06,300 |

Other information:

(i) He bought a motor car on 1st March, 2023 for ₹ 2 lakhs by paying cash.

(ii) He sold his old motor car on 8th September, 2022 whose WDV as on 01.04.2022 was ₹ 60,000 and book value ₹ 80,000 for ₹ 97,000.

(iii) Medical expenses given above includes medical expenses for wife ₹ 7,000.

(iv) Let out a residential property for a monthly rent of ₹ 25,000 to Amin through out the financial year 2022-23. Municipal tax of ₹ 30000 was paid in cash in December, 2022

(v) Incurred ₹ 50,000 towards medial expenditure for employees due to fire accident in business premises. This amount is included in administrative expenses given above.

(vi) Paid health insurance premium for himself and wife ₹ 20,000 by crossed cheque. Also paid health insurance premium for his two children by net banking ₹ 12,000.

(vii) Repaid housing loan principal by cash ₹ 1,05,000 and life insurance premium of his brother ₹ 22,00,000 and of himself ₹ 25,000.

Compute the total income of Ashok for the assessment year 2023-24. (Dec 2022, 15 marks)