Insurance Claim for Loss of Stock and Loss of Profit – CMA Inter Financial Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Insurance Claim for Loss of Stock and Loss of Profit – CMA Inter Financial Accounting Study Material

Short Notes

Question 1.

Write short note on the following:

Consequential Loss Policy. (Dec 2018, 5 marks)

Answer:

Business enterprises get insured against the loss of stock on the happening of certain events such as fire, flood, theft, earthquake, etc. Insurance being a contract of indemnity, the claim for loss is restricted to the actual loss of assets. Sometimes an enterprise also gets itself insured against consequential loss of profit due to decreased turnover, increased expenses, etc.

If loss of profits consequent to the event or mis-happening (Fire, flood, theft, etc.) is also insured, the policy is known as loss of profit or consequential loss policy. The Loss of Profit Policy normally covers the following items:

- Loss of net profit ‘

- Standing charges.

- Any increased cost of working e.g., renting of temporary premises.

Descriptive Questions

Question 2.

Under loss of profit insurance, what is meant by gross profit? (Dec 2021, 1 mark)

Answer:

Gross profit means net profit plus insured standing charges.

![]()

Practical Questions

Question 3.

Answer the following question (give workings wherever required):

A fire damaged the premises of a trader resulting in loss of stock of ₹ 1,10,000. The goods salvaged from fire was ₹ 40,000. The policy was for ₹ 50,000 eligible for average clause. Decide the quantum of claim to be lodged with the insurance company. (Dec 2013, 2 marks)

Answer:

Loss of Stock = ₹ 1,10,000

Less: Stock salvage = ₹ 40,000

Net Loss = ₹ 70.000

Applying average clause,

Amount of claim = Amount of policy x Net loss / Actual loss ‘of stock = ₹ 50,000 × 70,000/1,10,000

= ₹ 31,818

Question 4.

Due to flood, business of Mr. Singh was dislocated from 01.04.2013 to 31.08.2013 (5 months). From the following details, calculate the amount of claim to be lodged ¡n respect of loss of profit policy.

| Particulars | ₹ |

| Policy amount | 1,25,000 |

| Turnover from 01.04.2013 to 31.08.2013 | 2,40,000 |

| Standing charges from 01.04.2013 to 31.08.2013 | 60,000 |

| Turnover during 01.04.2012 to 31.03.2013 | 12,00,000 |

| Gross profit ratio | 10% on sales |

| Standing charges for the year 2012-13 | 84,000 |

The turnover for the year 2013-14 was anticipated to increase y 10% over the turnover of the preceding year. (Dec 2013, 6 marks)

Answer:

| Particulars | ₹ |

| Standard turnover per month (2012-13) | 1,00,000 |

| Add: Increase anticipated pIus 10% | 10,000 |

| Expected turnover per month | 1,10,000 |

| Standard turnover for the period of dislocation [1,10,000 x 5] | 5,50,000 |

| Less: Actual turnover for the period of dislocation | 2,40,000 |

| Short sales | 3,10,000 |

| Gross profit on short sales @ 10% | 31,000 |

| Add: Increased cost of working actual | |

| Standard charges for the period of dislocation (7,000 x 5 = 35,000) | |

| Actual standing charges incurred during the period of dislocation ₹ 60,000 | |

| Increase in cost of working during period of dislocation ₹ 60,000 – ₹ 35,000 | 25,000 |

| Claim to be lodged | 56,000 |

Note:

- In absence of any information regarding Insured standing charges, Uninsured standing charges. Net profit etc. increase in cost of working during the period of dislocation is determined in this manner.

- Since the Annual Tumover is not mentioned the A ve rage Clause is not applied.

Question 5.

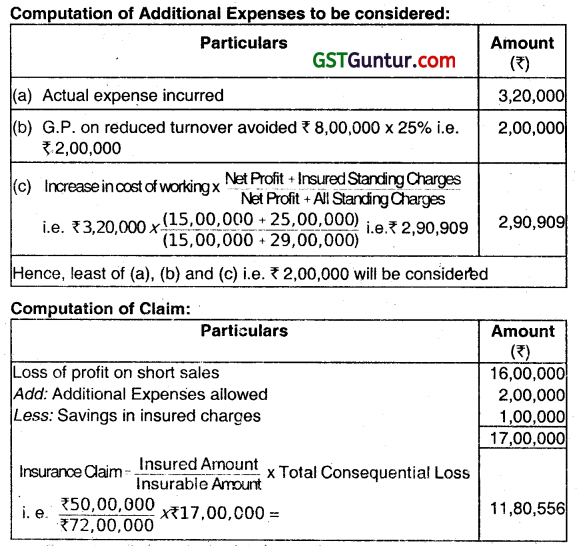

From the following information, calculate a consequential loss claim:

(i) Financial year ends on 31st March.

(ii) Fire occurs on December 1 following.

(iii) Period of disruption: December 1 to March 31.

(iv) Period of indemnity: 6 months.

(v) Net profit for previous financial year ₹ 15,00,000

(vi) Insured standing charges ₹ 25,00,000

(vii) Uninsured standing charges ₹ 4,00,000

(viii) Increase in the cost of working ₹ 3,20,000

(ix) Saving in insured standing charges ₹ 1,00,000

(x) Reduced turnover avoided through increased cost of workings: ₹ 8,00,000

(xi) ‘Special circumstances clause’ stipulated:

(a) Increase in turnover (standard and annual): 20%

(b) Increase in rate of gross profit: 5%

(xii) Turnover for the four months 31st July 30th Nov. 31st March ending

| I Year (₹) | 40,00,000 | 90,00,000 | 70,00,000 |

| II Year (₹) | 60,00,000 | 1,10,00,000 | 20,00,000 |

(xiii) Sum insured: ₹ 50,00,000. (June 2014, 8 marks)

Answer:

Computation of Short Sales:

| Particulars | Amount (₹) |

| Sales during the same period in last year | 70,00,000 |

| Add: 20% increase stipulated | 14,00,000 |

| Adjusted Sales | 84,00,000 |

| Less: Actual sales during disruption period | 20,00,000 |

| Amount of Short Sale | 64,00,000 |

Computation of G.P.(Agreed):

Rate of Gross Profit (G.P.) for Proceeding accounting year:

![]()

= \(\frac{40,00,000}{2,00,00,000} \times 100-20 \%\)

∵ Agreed Rate of G.P. = 20% + 5% = 25%

Loss of profit on Short Sales = 25% of ₹ 64,00,000 i.e. 16,00,000.

| Particulars | Amount (₹) |

| Annual Turnover [12 months immediately preceding the date of fire] | 2,40,00,000 |

| Add:20% Increase | 48,00,000 |

| Adjusted Annual Sales | 2,88,00,000 |

| GP on Adjusted Annual Sales or Insurable Amount ₹ 2,88,00,000 x 25% | 72,00,000 |

Question 6.

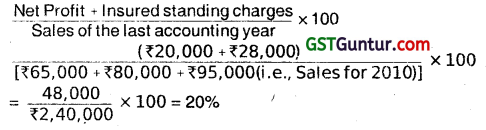

There was a serious fire in the premises of M/s Fortunate on 1st September 2011. Their business activities were interrupted until 31st December 2011, when normal trading conditions were re-established. M/s Fortunate are insured under the loss of profit policy for ₹ 42,000 the period of indemnity being six months. You are able to ascertain the following information:

(i) The net profit for the year ended 31 December 2010 was ₹ 20,000

(ii) The annual insurable standing charges amounted to ₹ 30,000 of which ₹ 2,000 were not included in the definition of insured standing charge under the policy.

(iii) The additional cost of working in order to mitigate the damage caused by the fire amounted to ₹ 600, and, but for this expenditure, the business would have had to shut down. ‘

(iv) The savings in insured charges in consequence of the fire amounted to ₹ 1,500.

(v) The turnover for the period of four months ended April 30, August 31st, and December 31, for each of the years 2010 and 2011 was as under:

| ₹ | ₹ | ₹ | |

| 2010 | 65,000 | 80,000 | 95,000 |

| 2011 | 70,000 | 80,000 | 15,000 |

You are required to compute the relevant claim under the terms of the loss of profits policy. (Dec 2014, 8 marks)

Answer:

Calculation of short sales:

Standard turnover: Sales from September 1,201 to Dec. 31, 2010, ₹ 95,000

Less: Sales during disruption period (1-9-2011 to 31-12-2011) 15,000

Short Sales 80,000

![]()

Calculation of Rate of Gross Profit:

Gross Claim

Application of Average Clause:

Sum Insured /Gross Profit on 12 months (Sales preceding the date of fire) x Gross claim

= ₹ 42,000/20% of ₹ 2,45,000 (1) x 15,076 = ₹ 12922

Therefore, claim for loss of profit to be lodged is ₹ 12,922.

Question 7.

Answer the question:

On 15th December 2014 the premises of NAGAR LTD. were destroyed by fire, but sufficient records were saved from which the following particulars were ascertained:

| ₹ | |

| Stock at cost on 1st April, 2013 | 2,20,500 |

| Stock at cost on 31st March, 2014 | 2,38,800 |

| Purchases less returns, year ended 31st March, 2014 | 11,94,000 |

| Sales less returns, year ended 31st March, 2014 | 14,61000 |

| Purchases less returns, 1st April, 2014 to 15th December, 2014 | 10,15,000 |

| Sales less returns, 1st April, 2014 to 15th December, 2014 | 11,62,000 |

In valuing stock for Balance Sheet as at 31 March, 2014 ₹ 6,900 had been written oft for certain stock which was a poor selling line, having cost of ₹ 20,700. A portion of these goods were sold in June, 2014 at a loss of ₹ 750 on the original cost of ₹ 10,350. The remainder of this stock was now estimated to be worth the original cost. Subject to the above exception, gross profit had remained at a uniform rate throughout. The stock salvaged was ₹ 17,500. The stock was insured for ₹ 2,50,000.

Required:

Calculate the amount of claim to be lodged with the Insurance company for Loss of Stock. (June 2015, 8 marks)

Answer:

Application of Average Clause:

Claim = \( \text { Loss of stock } \times \frac{\text { Policy value }}{\text { stock on day of fire }}\)

= \(3,10,930 \times \frac{2,50,000}{3,28,430}\)

= 2,36,679

Question 8.

Answer the following question (Give workings):

The godown of KODIAC LTD. was engulfed in fire on 31st May 2015 as a result of which a part of stock burnt to ashes. The stock was covered by Fire Policy for ₹ 2,00,000 subject to Average Clause. The records of

the company revealed the following particulars.

Actual Value of Stock as on 31.05.2015: ₹ 4,00,000

The Value of Salvaged Stock: ₹ 90,000

You are required to ascertain the amount of claim to be lodged with the Insurance Company. (Dec 2015, 2 marks)

Answer:

Claim to be lodged = \(\text { loss of stock } \times \frac{\text { Policy amount }}{\text { Average stock }} \)

= 4,00,000 – 90,000 × \(\frac{2,00,000}{4,00,000} \)

= 1,55,000

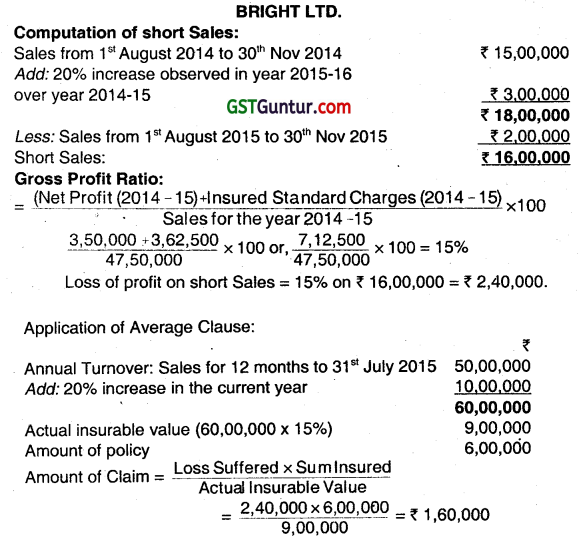

Question 9.

A fire occurred in the premises of BRIGHT LTD. on 1st August 2015. The company had a loss of profit policy for ₹ 6.00 lakhs which was subject to average clause. Sale from 1st August 2014 to 31st July 2015 were ₹ 50 lakhs and from 1st August 2014 to 30th Nov. 2014 being ₹ 15 lakh. During the indemnity period which lasted four months sales amounted to only ₹ 2,00,000. The company made up its accounts on 31st March. The Profit and Loss Account for the year ended 31st March 2015 is given below:

| Profit & Loss Account for the year ended 31st March, 2015 | |||

| Particulars | Particulars | ||

| Opening Stock | 5,00,000 | Sales | 47,50,000 |

| Purchases | 30,00,000 | Closing Stock | 2,50,000 |

| Manufacturing Expenses | 3,35,000 | ||

| Variable Selling Expenses | 4,52,500 | ||

| fixed Expenses | 3,62,500 | ||

| Net Profit | 3,50,000 | ||

| 50,00,000 | 50,00,000 | ||

Comparing the sales of first four months of year 2015-16 those of year 2014-15, it was found that sales were 20% higher in the year 2015-16. You are required to compute the amount of claim to be lodged with the Insurance Company under the Loss of Profit Policy. (June 2016, 4 + 2 + 2 = 8 marks)

Answer:

Question 10.

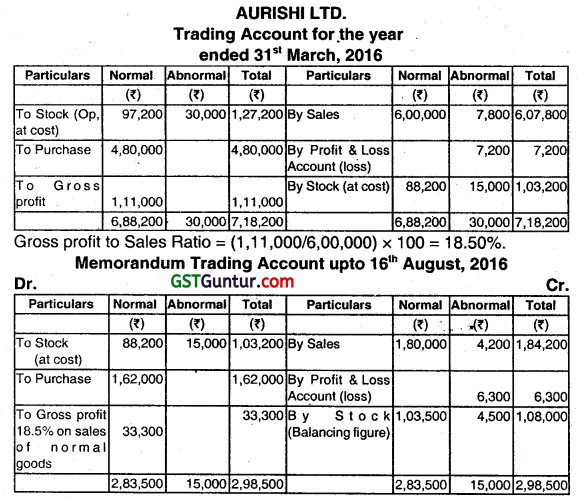

The factory premises of AURISHI LTD. were engulfed in the fire on August 16, 2016, as a result of which a major part of stock burnt to ashes. The stock was covered by policy for ₹ 90,000, subject to Average Clause. The records at the office of the company revealed the following information:

| ₹ | |

| Stock on 1st April 2015 | 1,1 5,200 |

| Purchases during the year ended 31 March, 2016 | 4,80,000 |

| Sales during the year ended 31st’ March, 2016 | 6,07,800 |

| Closing stock on 31st March, 2016 | 95,400 |

| Purchases from 1st April, 2016 to August 16, 2016 | 1,62,000 |

| Sales from 1st April, 2016 to August 16, 2016 | 1,84,200 |

An item of stock purchased in 2014 at a cost of ₹ 30,000 was valued at ₹ 18,000 on 31st March 2015, due to obsolescence. Half of this stock was sold in July, 2015 for ₹ 7,800; th remaining was valued at ₹ 7,200 on 31st March, 2016. One-fourth of the original stock was sold in June, 2016, for ₹ 4,200.

Salvaged stock was valued at ₹ 36,000.

You are required to compute the amount of claim to be lodged with Insurance Company for Loss of Stock. (Dec 2016, 3 + 3 + 2 = 8 marks)

Answer:

Since there is an average clause in the policy, the claim will be:

(Amount of the policy/stock on the date of fire) × stock destroyed by fire = ₹ 72,000 × (90,000/1,08,000) = ₹ 60,000.

Note: As an item of stock as on 31st March, 2015 was valued below cost, it was an abnormal item. It is shown under abnormal stock column at its original cost i.e., ₹ 30,000. The normal items have been separated to arrive at the normal rate of gross profit.

Assume: Ratio of G.P. was uniform throughout.

![]()

Question 11.

Ram trader’s godown caught tire on 29th August, 2016, and a large part of the stock of goods was destroyed. However, goods costing ₹ 54,000 could be salvaged incurring firefighting expenses amounting to ₹ 2,350.

The trade provides you the following additional information:

| ₹ | |

| Cost of stock on 1st April, 2015 | 3,55,250 |

| Cost of stock on 31st March, 2016 | 3,95,050 |

| Purchases during the year ended 31st March, 2016 | 28,39,800 |

| Purchases from 1st April 2016 to the date of fire | 16,55,350 |

| Cost of goods distributed as samples for advertising from 1st April, 2016 to the date of fire | 20,500 |

| Cost of goods withdrawn by trader for personal use from 1st April, 2016 to the date of fire | 1,000 |

| Sales for the year ended 31st March, 2016 | 40,00,000 |

| Sales from 1st April, 2016 to the date of fire | 22,68,000 |

The insurance company also admitted fire fighting expenses. The trader had taken the tire insurance policy for ₹ 4,50,000 with an average clause. Calculate the amount of the claim that will be admitted by the insurance company. (June 2017, 7 marks)

Answer:

Statement of Insurance Claim

| Particulars | ₹ |

| Value of stock destroyed by fire | 44,1300 |

| Less: Salvaged Stock | 54,000 |

| Add: Fire Fighting Expenses | 2,350 |

| Insurance Claim | 3,89,650 |

Note: Since policy amount is more than claim amount, average clause will not apply. Therefore, claim amount of ₹ 3,89,650 will be admitted by the Insurance Company.

Question 12.

The premises of X Ltd. caught fire on 22 January, 2015 and the stock was damaged. The value of goods salvaged was negligible. The firm made up accounts to 31st March each year. On 31st March, 2014 the stock at cost was ₹ 13,27,200 as against ₹ 9,62,200 on 31st March, 2013. Purchases from 1st April, 2014 to the date of fire were ₹ 34,82,700 as against ₹ 45,25,000 for the full year 2013-2014 and the corresponding sales figures were ₹ 49,17,000 and ₹ 52,00,000 respectively.

You are given the following further information:

(i) In July 2014, goods costing ₹ 1,00,000 were given away for advertising purposes, no entries being made in the books.

(ii) The rate of gross profit is constant.

X Ltd. had taken an insurance policy of ₹ 5,50,000 which was subject to the average clause. From the above information, you are required to make an estimate of the stock in hand on the date of fire and compute the amount of the claim to be lodged to the insurance company. (Dec 2017, 10 marks)

Answer:

Computation of claim for loss of stock

| Particulars | Amount (₹) |

| Stock on the date of fire i.e. on 22nd January, 2015 As the value of goods salvaged was negligible, therefore Loss of stock |

7,76,300 7,76,300 |

As policy amount is less than claim amount, claim will be restricted to policy amount only. Therefore, claim of ₹ 5,50,000 should be lodged by X Ltd. to the insurance company.

Working Note:

Trading Account for the year ended on 31 March, 2014

| Particulars | ₹ | Particulars | ₹ |

| To Opening Stock | 9,62,200 | By Sales | 52,00,000 |

| To Purchases | 45,25,000 | By Closing Stock | 13,27,200 |

| To Gross Profit | 10,40,000 | ||

| 65,27,200 | 65,27,200 |

Rate of gross profit to sales = 10,40,000/52,00,000 × 100 = 20%.

Question 13.

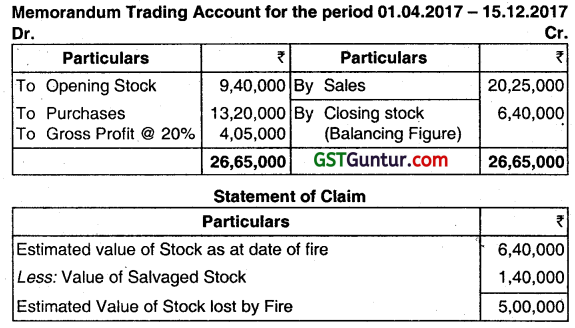

On 15th December 2017, a fire occurred in the premises of M/s. O/M Exports. Most of the stocks were destroyed. Cost of Stock salvaged being ₹ 1,40,000. From the books of account, the following particulars were available:

(i) Stock at the close of account on 31st March, 2017 was valued at ₹ 9,40,000.

(ii) Purchases from 01.04.201710 15-12-2017 amounted to ₹ 13,20,000 and the sales during that period amounted to ₹ 20,25,000.

On the basis of his accounts for the past three years, it appears that average gross profit ratio is 20% on sales.

Compute the amount of the claim, if the stock were insured for ₹ 4,00,000. (June 2018, 5 marks)

Answer:

As the value of stock is more than insured value, amount of claim would be subject to average clause.

Amount of Claim = \(\frac{\text { Amount of policy }}{\text { Value of Stock }} \times \text { Actual Loss of Stock } \)

Amount of Claim = \(\frac{4,00,000}{6,40,000} \times 5,00,000 \) = ₹ 3,12,500.

Question 14.

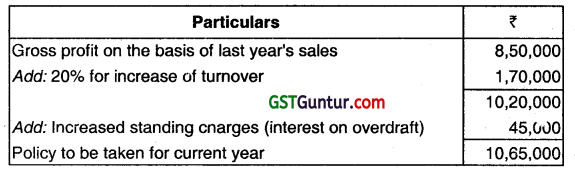

CCL wants to take up a loss of profit policy. Turnover during the current year is expected to increase by 20%. The company will avail overdraft facilities from its bank @ 15% interest to boost up the sales. The average daily overdraft balance will be around ₹ 3 Lakh. All other fixed expenses will remain same. The following further details are also available from the previous year’s account:

| ₹ | |

| Total variable expenses | 24,00,000 |

| Fixed expenses: | |

| Salaries | 3,30,000 |

| Rent, Rates, and Taxes | 30,000 |

| Traveling expenses | 50,000 |

| Postage, Telegram, Telephone | 60,000 |

| Directors fees | 10,000 |

| Audit fees | 20,000 |

| Miscellaneous income | 70,000 |

| Net Profit | 4,20,000 |

Determine the amount of policy to be taken for the current year. (Dec 2018, 7 marks)

Answer:

Working Notes:

1. Profit and Loss Account for the previous year

| Particulars | Amount (₹) | Particulars | Amount (₹) |

| To variable expenses | 24,00,000 | By Sales | 32,50,000 |

| To Fixed expenses | 5,00,000 | By Misc. income | 70,000 |

| To Net profit’ | 4,20,000 | ||

| 33,20,000 | 33,20,000 |

2. Gross profit of the previous year

| Particulars | (₹) |

| Sales | 32,50,000 |

| Less: Variable Expenses | 24,00,000 |

| 8,50,000 |

![]()

Question 15.

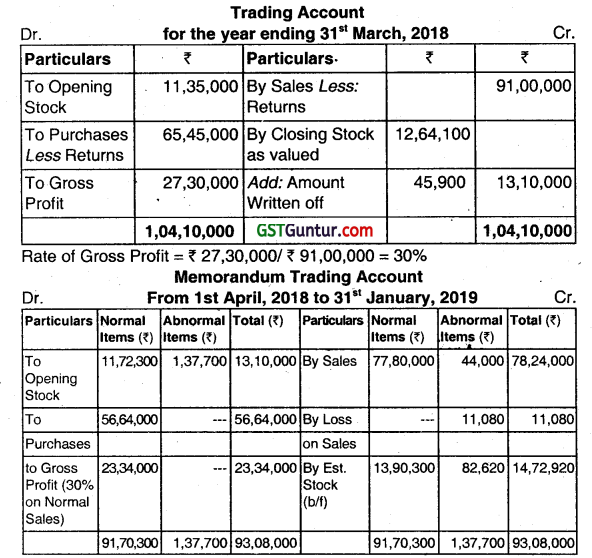

On 31st January, 2019 the premises of Toli Textiles Limited were destroyed by tire. The records of the company revealed the following particulars:

| ₹ | |

| Stock on 01.04.2017 | 11,35,000 |

| Stock on 31.03.2018 | 12,64,100 |

| Purchase Less returns, during the year ended 31st March, 2018 | 65,45,000 |

| Sales Less returns, during the year ended 31st March, 2018 | 91,00,000 |

| Purchase Less return, from 01.04.2018 to 31.01.2019 | 56,64,000 |

| Sales Less returns, from 01.04.2018 to 31.01.2019 | 78,24,000 |

In valuing stock on 31 March, 2018 45,900 had been written off out of certain stock which was of a poor selling line, having cost ₹ 1,37,700. A portion of these goods were sold in October, 2018 at a loss ₹ 11,080 on the original cost of ₹ 55,080. The remaining stock of this goods on the date of fire was to be valued at 80% of its original cost. Subject to the above exception, gross profit had remained at a uniform rate throughout. The stock salvaged from fire was ₹ 1,23,800. You are required to compute the amount of claim to be lodged for loss of stock. The stock was insured for ₹ 12,50,000. (June 2019, 7 marks)

Answer:

Working Notes:

(i) Stock on 1.4.18. Abnormal Items ₹ 1,37,700; and Normal Items = ₹ 13,10,000 – ₹ 1,37,700 = ₹ 11,72,300

(ii) Sale of Abnormal Items = ₹ 55,080 – ₹ 11,080 = ₹ 44,000

(iii) Sale of Normal Items = ₹ 78,24,000 – ₹ 44,000 = ₹ 77,80,000.

Loss of Stock

| ₹ | |

| Stock on the date of tire: Normal Items | 13,90,300 |

| Value of Abnormal Items (82,620 x 80%) | 66,096 |

| Value of Stock | 14,56,396 |

| Less: Stock Salvaged | 1,23,800 |

| Loss of Stock | 13,32,596 |

Amount of Claim applying Average Clause:

Amount of Claim = (Insured Amount! Value of Stock at the date of Fire) ×

Loss of Stock = (₹ 12,50,000/₹ 14,56,396) × ₹ 13,32,596 = ₹ 11,43,745

Question 16.

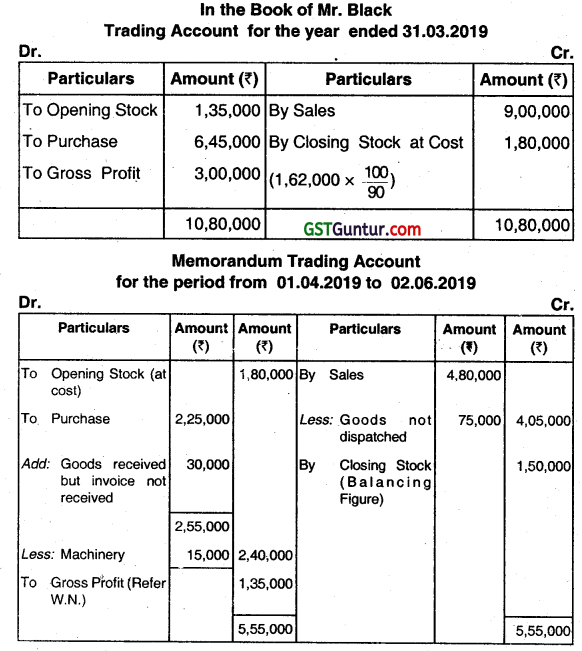

On 02.06.2019 the stock of Mr. Black was destroyed by fire. However, following particulars were furnished from the record saved:

| ₹ | |

| Stock at cost on 01.04.2018 | 1,35,000 |

| Stock at 90% of cost on 31.03.2019 | 1,62,000 |

| Purchases for the year ended 31.03.2019 | 6,45,000 |

| Sales for the year ended 31.03.2019 | 9,00,000 |

| Purchases from 01.04.2019 to 02.06.2019 | 2,25,000 |

| Sales from 01.04.2019 to 02.06.2019 | 4,80,000 |

Sales up to 02.06.2019 includes ‘75,000 (invoice price) being the goods not dispatched to the customers.

Purchases up to 02.06.2019 includes machinery acquired for ₹ 15,000.

Purchases up to 02.06.2019 does not include goods worth ₹ 30,000 received from suppliers, as invoice not received up to the date of fire. These goods have remained in the godown at the time of fire. The insurance policy is for ₹ 1,20,000 and it is subject to average clause. Ascertain the amount of claim for loss of stock. (Dec 2019,7 marks)

Answer:

Calculation of Insurance Claim:

Claim subject to average

clause = \(\frac{\text { Actual Loss of Stock }}{(\text { Value of Stock on the date of fire } \times \text { Amount of policy })} \)

= 1,20,000 × \(\left(\frac{1,50,000}{1,50,000}\right)\) = ₹ 1,20,000

Working Notes:

G.P. Ratio = \frac{3,00,000}{9,00,000} \times 100=33 \frac{1}{3} \%\(\)

Amount of Gross Profit = ₹ 4,05,000 × 33\(\frac{1}{3}\) % = ₹ 1,35,000.

![]()

Question 17.

A fire engulfed the premises of a business of M/s Pritam on the morning of 1st July, 2020. The building equipment and stock were destroyed and the salvage recorded the following:

Building: ₹ 4,000

Equipment: ₹ 2500

Stock: ₹ 20,000

The following other information was obtained from the records saved from the period from 1st January, to 30th June, 2020.

Sales ₹ 11,50,000

Sales returns ₹ 40,000

Purchases ₹ 9,50,0O0

Purchases returns ₹ 12,500

Cartage inward ₹ 17,500

Wages ₹ 7,500 .

Stock in hand on 31st December, 2019 ₹ 1,50,000

Building valued on 31st December, 2019 ₹ 3,75,000

Equipment valued on 31st December, 2019 ₹ 75,000

Depreciation provided till 31 December, 2019 on:

– Building ₹ 1,25,000

– Equipment ₹ 22,500

No depreciation has been provided after December 31st, 2019. The latest rate of depreciation is 5% P.a. on building and 15% P.a. on equipment by straight-line method. Normally business makes a profit of 25% on net sales.

You are required to computed as on 30-06-2020

(i) Amount of gross profit.

(ii) Amount of closing stock.

(iii) Amount of stock destroyed by fire.

(iv) Statement of claim

(a) Stock

(b) Building

(c) Equipment. (Dec 2021, 6 marks)

Answer:

Gross Profit – ₹ 2,77,500

Closing Stock – ₹ 2,80,000

Stock destroyed by Fire – ₹ 2,80,000

Statement of claim

Stock – ₹ 2,60,000

Building – ₹ 2,36,625

Equipments – ₹ 44,375

Total ₹ 5,41,000

Net Sales = 11,50,000 – 40,000 = 11,10,000

GP =11,10,000 × 25% = 2,77,500

COGS = 11,10,000 – 2,77,500 = 8,32,500

op st + Purchase + Direct expenses – CL Stock = COGS

1.50,000 + 9,50,000 – 12,500 + 17,500 + 7,500 Cl Stock = 8,32,500

Cl Stock = 2,80,000

Claim of stock =2,80,000 – 20,000 = 2,60,000

Depreciation on

(a) Building \(\frac{3,75,000 \times 5 \%}{2}=\frac{18,750}{2} \) = 9,375

Claim = 3,75,000 – 1,25,000 – 9,375 – 4,000 = 2,36,625

(b) Depreciation on Equipment \(\frac{75,000 \times 15 \%}{2}\) = 5,625

Claim = 7,500 – 22,500 – 5,625 – 2,500 = 44,375

Question 18.

Entity A carried plant and machinery its books at ₹2,00,000 which were destroyed n a fire. These machines were insured ‘New for Old’ and were replaced by the insurance company with new machines of fair value ₹ 20,00,000. The old destroyed machines were acquired by the insurance company and the company did not receive any cash compensation. State, how Entity A should account for the same. (Dec 2022, 2 marks)

Insurance Claim for Loss of Stock and Loss of Profit CMA Inter Financial Accounting Notes

Insurance Claims

The business pays insurance premium yearly or quarterly or as per agreement. If any accidental loss occurs, the business has to compute the amount of loss and file a claim for compensation to the Insurance Company.

Loss of Stock

As stocks constitute a considerable portion of the working capital of any business and specially for trading concerns, any loss of stock directly affects the solvency of the business. A business has to cover this risk

adequately. If stock records and stock are destroyed, it becomes difficult to ascertain the amount of stock lost. When the loss suddenly occurs, up-to-date value of stock does not become available.

Average Clause

It is a clause contained in a fire insurance policy, it encourages full insurance and discourages under-insurance. The insured person also has to bear a portion of loss himself in case the value of stock lost is more than the value of the policy.

Elimination of Abnormal! Defective Items

Goods which cannot fetch the usual rate of gross profit are considered as unusual or abnormal items.

![]()

Loss of Profit

A fire may create a consequential loss to a business over and above the instantaneous damage of stock. It disrupts normal activities for some time during which the business has to go on paying standing charges like rent, salaries, etc. without any effective return. It also causes a loss of profits which the business could have earned if normality was not disturbed by the accident.