Hire Purchase and Installment Sale Transactions – CMA Inter Financial Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Hire Purchase and Installment Sale Transactions – CMA Inter Financial Accounting Study Material

Distinguish Between

Question 1.

Distinction between Hire Purchase Agreement and Instalment Purchase Agreement (Dec 2018, 5 marks)

Answer:

Hire Purchase Agreement differs from Installment Purchase Agreement in the following respects:

| Basis of Distinction | Hire Purchase Agreement | Installment Purchase Agreement |

| 1. Act governing | It is governed by Hire Purchase Act 1972. | It is governed by the Sale of Goods Act 1930. |

| 2. Nature of Contract | It is an agreement of hiring. | It is an agreement of sale. |

| 3. Passing of Title (ownership) | The title to goods passes on last payment. | The title to goods passes immediately as in the case of usual sale. |

| 4. Right to Return goods | The hirer may return Unless seller defaults, goods without further goods are not returnable. | payment, except for accrued installment. |

| 5. Seller’s right to repossess | The seller may take possession of the goods it hirer is in default. | The seller can sue for price it the buyer is in default, He cannot take possession of the goods. |

| 6. Right to Dispose off | Hirer cannot hire out, sell, pledge or assign entitling transferee to retain possession as against the hire vendor. | The buyer may dispose of the goods and give good title to the bonafide purchaser. |

| 7. Responsibility for Risk of Loss | The hirer is not responsible for risk of loss of goods if he has taken reasonable precautions because the ownership has not yet transferred. | The buyer is responsible for risk of loss of goods because of the ownership has transferred. |

| 8. Name of Parties involved | The parties involved are called Hirer and Hire vendor. | The parties involved are called buyer and seller. |

| 9. Relationship between parties Involved | The relationship between hirer and hire vendor is that of Bailee and Bailor. | The relationship between the buyer and seller is that of a debtor and creditor till last installment is paid. |

| 10. Component other than Cash Price | Component other than Cash Price included in Installment is called Hire charges | Component other than Cash price included in Installment is called Interest. |

| 11. Method of Accounting | 1. Sales Method for goods of substantial sales values 2. Stock Methods for Goods of small sales values |

Interest Suspense Method. |

Question 2.

Distinguish between Hire-Purchase and Instalment Purchase. (Dec 2022, 5 marks)

Descriptive Questions

Question 3.

State when the title of goods are transferred to the hirer. (Dec 2021, 1 mark)

Answer:

Title of goods are transferred only when the agreed sum (Higher purchase price) is paid by the hirer)

Practical Questions

Question 4.

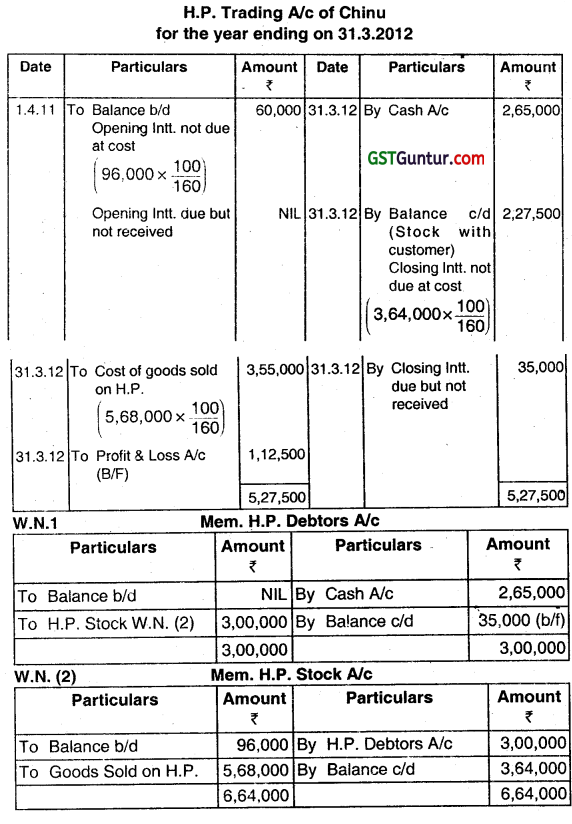

China sells goods on hire purchase at cost plus 60 percent. Prepare Hire Purchase Trading Account from the following information for the year ending 31st March, 2012:

| ₹ | |

| 1.4.2011 Stock with customers at hire purchase price | 96,000 |

| 31.3.2012 Sale of hire purchase goods during the year at hire purchase price | 5,68,000 |

| 31.3.2012 Cash received from hire purchase customers | 2,65,000 |

| 31.3.2012 Stock with customers’ at-hire purchase price | 3,64,000 |

(Dec 2012, 4 marks)

Answer:

![]()

Question 5.

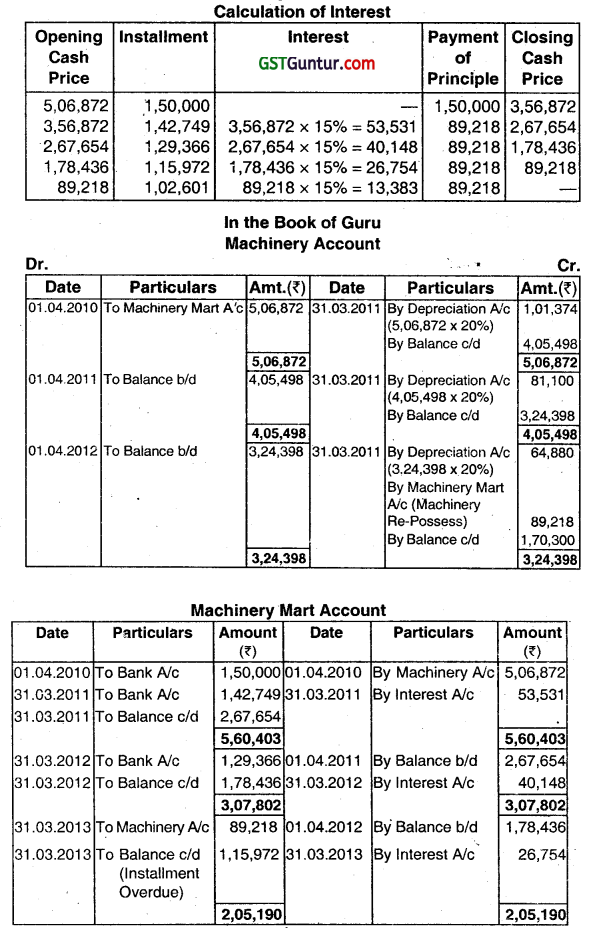

On 1st April, 2010 Guru purchased a machinery for cash price of 5,06,872 on hire purchase system from Machinery Mart. Payment to be made ₹ 1,50,000 down and the balance by four equal annual installments. Interest is charged @ 15% per annum. Guru depreciates machinery at 20% per annum on written down value method. Guru paid down payment and first two installments but could not pay the remaining installments. On 31st March, 2013 the Machinery Mart took possession of machinery. You are required to prepare Machinery Account and Machinery Mart Account in the books of Guru. (June 2013, 7 marks)

Answer:

Since the problem is silent regarding the amount of equal installment, it is assumed that the balance of cash price will be paid equally along with the interest on the amount outstanding.

Question 6.

Answer the following question (give workings):

₹ 30,000 is the annual installment to be paid for three years (given present value of an annuity of 1 p.a. @ 5% interest is ₹ 2.7232). Ascertain the cash price in cash of Hire Purchase. (June 2014, 2 marks)

Answer:

Cost price = 30,000 × PVAF (5%, 3 years)

= 30,000 × 2.7232

= 81,696

Question 7.

Answer the following question (Give workings):

Madhu purchased a machinery on hire purchase basis on 1st April 2014. ₹ 75,000 was paid immediately and the remaining amount was to be paid in three annual installments of ₹ 1,00,000 each. Interest rate is 15% per annum. Calculate the cash price. (Dec 2014, 2 marks)

Answer:

Calculation of cash price of Machine

Balance of cash price at the time of lO installment

= 1,00,000 – [1,00,000 × (15/115)] = 1 ,00,000- 13,043 = 86,957

Balance of cash price at the time of Il installment

= (1,00,000 + 86,957)- [1,86,957 × (15/115)]

= 1,86,957-24,386= 1,62,571

Balance of cash price at the time of I installment

= (1,00,000 + 1,62,571) – [2,62,571 × (15/115)]

= 2,62,571 – 34,248 = 2,28,323

Hence, Total cash price = 2,28,323 + down payment 75,000 = ₹ 3,03,323

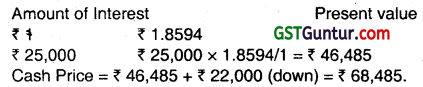

Question 8.

Answer the question:

GOPI purchased a plant-on-hire purchase system from GOPAL on 01.04.2015. The hire purchase rate was settled at ₹ 72,000, payable at ₹ 22,000 on 01.04.2015 and ₹ 25,000 at the end of two successive years. Interest was charqed @ 5% P.A. [Given PVI FA (at 5%, 2 years) = 1.8594] Ascertain the cash price of the plant. (June 2015, 2 marks)

Answer:

Question 9.

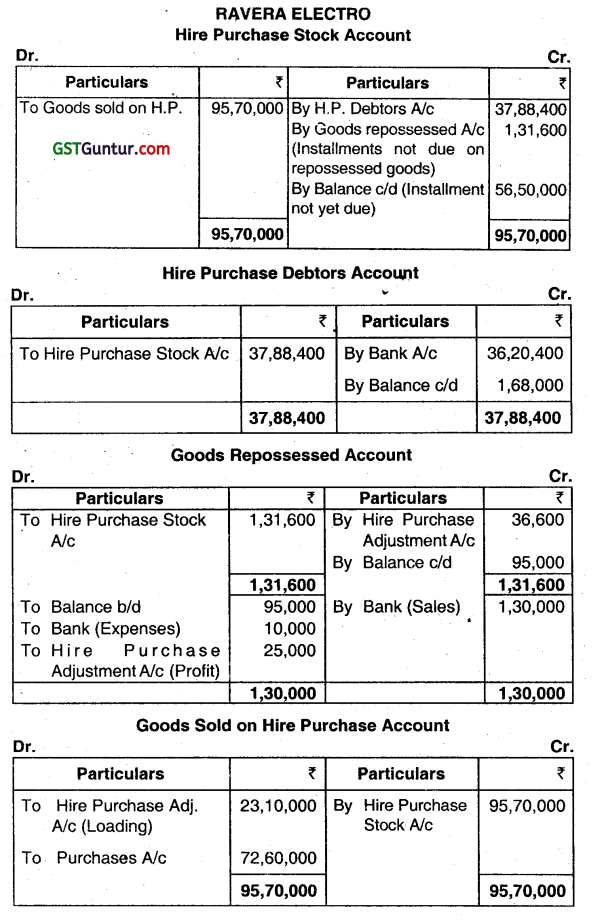

The hire purchase department of RAVERA ELECTRO sells LCD TV Sets and Refrigerators. This department was newly started on 1st April, 2014. The relevant information is as follows:

| (Amount in ₹ ) | ||

| Particulars | LCD TV | Refrigerator |

| Cost | 48,600 | 20,000 |

| Cash Price | 56,700 | 24,000 |

| Cash down payment | 8,100 | 4,000 |

| Monthly Instalments | 5,400 | 2,000 |

| Number of Instalments | 10 | 12 |

During the year ended March 31, 2015, 100 LCD TV Sets and 120 Refrigerators were sold on hire purchase (HP) basis. Two LCD TV Sets on which 3 installments only could be collected and 4 Refrigerators on which 5 installments had been collected were repossessed. These were valued at 95,000 and after reconditioning at a cost of 10,000 were sold outright for 1,30,000. Other installments collected and those due (Customer still paying) were respectively as follows:

LCD TV Sets 270 and 20

Refrigerators 400 and 30

Required:

Prepare necessary Ledger Accounts on ‘Stocks and Debtors System’ to record the above transactions and to reveal the profit of RAVERA ELECTRO. (Dec 2015, 2+1+2+1+2+4=12 marks)

Answer:

Working Note: .

(i) Hire Purchase price is 62,100 for each LCD TV set and ₹ 28,000 for each refrigerator:

Total cost and sales on this basis are as follows:

| H.P. Price (₹) | Cost (₹) | |

| LCD TV Sets (100) | 62,10,000 | 48,60,000 |

| Refrigerators (120) | 33,60,000 | 24,00,000 |

| 95,70,000 | 72,60,000 |

(ii) Total Collection:

| Particulars | LCD TV Sets (₹) | Refrigerators (₹) |

| Cash collected on down payment | (8100 x 100) 8,10,000 | (4,000 x 120) 4,80,000 |

| Installments collected | (5,400 × 270) 14,58,000 | (2,000 × 400) 8,00,000 |

| Amount collected on repossessed goods | (3 × 2 × 5,400) 32,400 | (2,000 × 5 × 4) 40,000 |

| Total collection | 23,00,400 | 13,20,000 |

| Installments dues not collected | (20 x 5,400) 1,08,000 | (30 x 2,000) 60,000 |

| H.P. DebtorsA/c | 24,08,400 | 13,80,000 |

| Total (24,08,400 + 13,80,000) | 37,88,400 |

(iii) Installments not yet due:

| LCD TV sets: Total installments on 98 sets (98 × 10) | 980 |

| Installments collected and due (270+ 20) | (290) |

| 690 |

(A) Amount of 690 installments @ ₹ 5,400 each 37,26,000 Refrigerators:

| Total installments on 116 refrigerators [116 × 12] | 1,392 |

| Less: Installments collected and due (400 + 30) | 430 |

| 962 |

(B)

| Particulars | ₹ |

| Amount of 962 installments @ 2,000 each | 19,24,000 |

Total amount (A+B) 56,50,000

Stock Reserve:

Stock Reserve = \(\frac{\text { H.P. Frice-Cost Price }}{\text { H.P.Price }} \) × Amount of Installment not yet due

LCD TV sets = \(\frac{13,500}{62,100} \) × 37 26,000=8,10,000

Refrigerators = \(\frac{8,000}{28,000} \) × ₹19 24,000 = ₹ 5,49,714

Total = 13,59,714

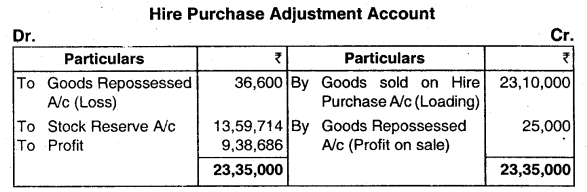

![]()

(v) Installment not due on repossessed goods:

| Particulars | ₹ |

| 2 LCD TV sets 7 installments on each @ ₹ 5,400 | 75,600 |

| 4 Refrigerators 7 installments on each @ ₹ 2,000 | 56,000 |

| 1,31,600 |

(vi) Installments due but not collected:

| Particulars | ₹ |

| LCD TV sets (20 × ₹ 5,400) | 1,08,000 |

| Refrigerators (30 × ₹ 2,000) | 60,000 |

| 1,68,000 |

Question 10.

Answer the following question.

MS SOHALI purchased a LCD TV on hire purchase system from MENZ ENTERPRISE on 01 .03.2016. The hire purchase rate was settled at ₹ 1,20,000, payable at ₹ 45,000 on 01.03.201 6 and ₹ 25,000 at the end of three successive years. Interest was charged @ 6% RA. [Given PVIFA(at 6%, 3 years) = 2.6730.] Compute the Cash Price of LCD-TV. (June 2016, 2 marks)

Answer:

Cash Price = ₹ 45,000 (down payment) + ( ₹ 25,000 × 2.6730)

= ₹ 45,000 + ₹ 66,825 = ₹ 1,11,825

Question 11.

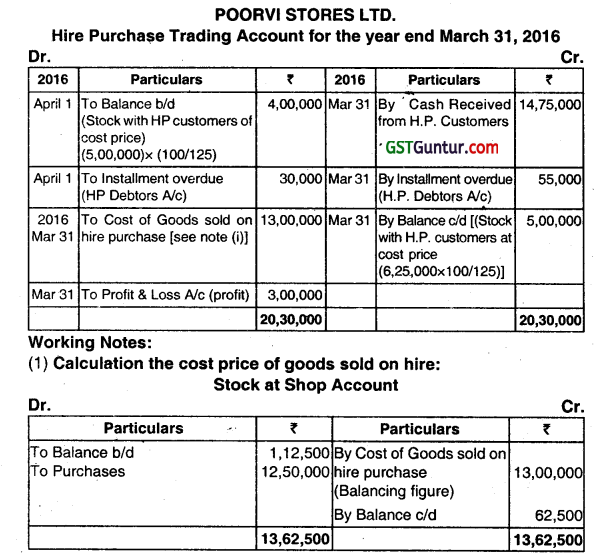

POOR VI STORES LTD. sells goods on hire purchase at Cost plus 25%. The following information is provided for the year ended March 31, 2016.

| ₹ | |

| April 1st 2015 Stock with hire purchase customers at hire purchase price | 5,00,000 |

| April 1st Stock at shop | 1,12,500 |

| April 1st 2016 Instalments overdue | 30,000 |

| March 31st Cash received from HP customers during the year | 14,75,000 |

| March 31st Purchases for the year | 12,50,000 |

| March 31st Instalments overdue | 55,000 |

| March 31st Stock at shop | 62,500 |

| March 31st Stock with hire purchase customers at hire purchase price | 6,25,000 |

You are required to prepare Hire Purchase Trading Account for the year ended March 31, 2016. (Dec 2016, 5+1=6 marks)

Answer:

Question 12.

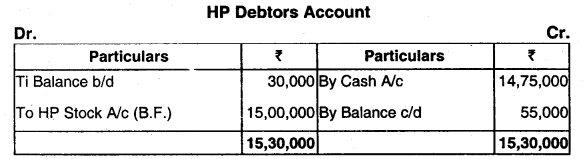

Moon purchased a machine on Hire Purchase System. The total cost price of the machine was ₹ 15,00,000 payable 20% down and four annual installments of ₹ 4,20,000, ₹ 3,90,000, ₹ 3,60,000 and ₹ 3,30,000 at the end of the 1 year, 2’ year, 3 year and 4 year respectively. Calculate the interest included in each year’s installment assuming that the sales were made at the beginning of the year. (June 2017, 8 marks)

Answer:

Cash Price = 15,00,000

Hire Purchase Price = (15,00,000 x 20%) + 4,20,000 + 3,90,000 + 3,60,000 + 3,30,000 = 18,00,000

Total Interest = 18,00,000 – 15,00,000 = 3,00,000

Ratio of(a): (b): (C): (d) = 1500:1080: 690:330 = 50: 36 : 23: 11

Interest included in installment of:

1. 1st year = 3,00,000 × \(\frac{50}{120}\) = 1,25,000

2. 2nd year=3,00,000 × \(\frac{36}{120} \) =90,000

3. 3rd year 3,00,000 × \(\frac{23}{120} \) = 57,500

4. 4th year = 3,00,000 × \(\frac{11}{120}\) = 27,500

Question 13.

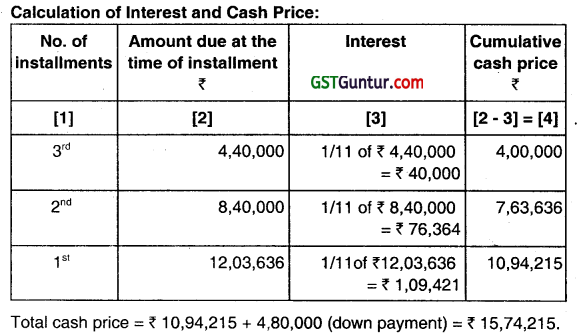

On 1 April, 2012, X Ltd. sells a Truck on hire purchase basis to X Transporters & Co. for a total purchase price of ₹ 18,00,000 payable as to ₹ 4,80,000 as down payment and the balance in three equal annual installments of ₹ 4,40,000 each payable on 31 March, 13, 2014 and 2015. The hire vendor charges interest @ 10% per annum. You are.required to ascertain the cash price of the truck for X Transporters & Co. Calculations may be made to the nearest rupee. (Dec 2017,8 marks)

Answer:

Ratio of interest and amount due = \(\frac{\text { Rate of Interest }}{100+\text { Rate of Interest }}=\frac{10}{100}=\frac{1}{11}\)

There is no interest element in the down payment as it is paid on the date of the transaction. Installments paid after certain period includes interest portion also. Therefore, to ascertain cash price, interest will be calculated from last installment to first installment as follows:

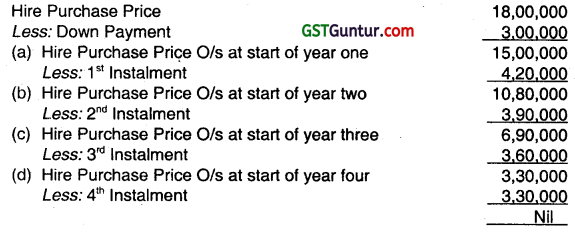

Question 14.

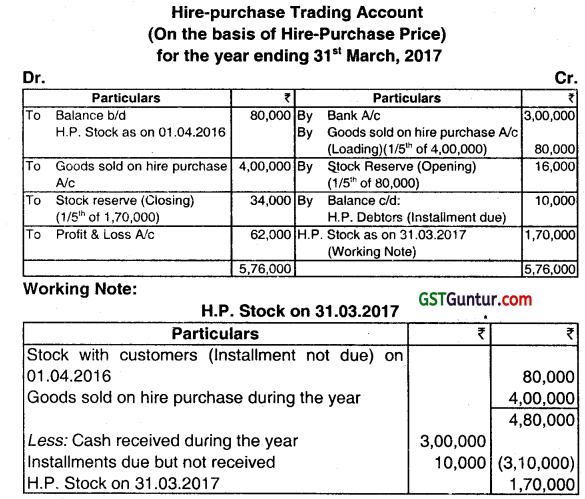

M/s. Zed Laptop Co. has a hire-purchase department and goods are sold on hire-purchase adding 25% to cost. From the following information (all figures are at hire-purchase price), Prepare Hire-Purchase Trading Account for the year ending, March 31, 2017:

| ₹ | |

| April 01, 2016 goods with customers (installments not yet due) | 80,000 |

| Goods sold on Hire-purchase during the year | 4,00,000 |

| Cash received during the year from customers | 3,00,000 |

| Installments due but not yet received at the end of the year, customers paying | 10,000 |

(June 2018, 5 marks)

Answer:

![]()

Question 15.

The following particulars relate to hire purchase transactions:

(i) X purchased three cars from Y on hire purchase basis, the cash price of each car being ₹ 2,00,000.

(ii) The hire purchaser charged depreciation @ 20% on diminishing balance method.

(iii) Two cars were seized by on hire vendor when second instalment was not paid at the end of the second year. The hire vendor valued the two cars at cash price less 30% depreciation charged under it diminishing balance method.

(iv) The hire vendor spent ₹ 10,000 on repairs of the cars and then sold them for a total amount of ₹ 1 ,70,000.

You are required to compute:

(i) Agreed value of two cars taken back by the hire vendor.

(ii) Book value of car left with the hire purchaser.

(iii) Profit or loss to hire purchaser on two cars taken back by their hire vendor.

(iv) Profit or loss of cars repossessed when sold by the hire vendor. (June 2019, 8 marks)

Answer:

| Particulars | ₹ |

| (i) Price of two cars = ₹ 2,00,000 x 2 | 4,00,000 |

| Less: Depreciation for the first year @ 30% | 1,20,000 |

| 2,80,000 | |

| Less: Depreciation for the second year = ₹ 2, 80,000 x (30/100) | 84,000 |

| Agreed value of two cars taken back by the hire vendor | 1,96,000 |

| (ii) Cash purchase price of one car | 2,00,000 |

| Less: Depreciation on ₹ 2,00,000 @ 20% for the first year | 40,000 |

| Written drown value at the end of first year | 1,60,000 |

| Less: Depreciation on ₹ 1,60,000 @ 20% for the second year | 32,000 |

| (iii) Book value of car left with the hire purchaser | 1,28,000 |

| Book value of one car as calculated in working note (ii) above | 1,28,000 |

| Book value of Two cars = ₹ 1,28,000 x 2 | 2,56,000 |

| Value at which the two cars were taken back, calculated in working note (i) above | 1,96,000 |

| Hence, loss on cars taken back ₹ 2,56,000 – ₹ 1,96,000 = | ₹ 60,000 |

| (iv) Sale proceeds of cars repossessed | 1,70,000 |

| Less: Value at which cars were taken back ₹ 1,96,000 | |

| Repair ₹ 10,000 | 2,06,000 |

| Loss on resale | 36,000 |

Question 16.

A acquired on 1st January, 2020 a machine under hire purchase agreement, which provides for 5 haIl yearly installments of ₹ 6,000 each. The first instalment is due on 1st July, 2020. Assuming that the applicable rate of interest is 10% per annum, Calculate the cash price of the machine. All working should form part of the answer. (Dec 2021, 6 marks)

Answer:

Cash Purchase price of Machine – ₹ 25,977.

Question 17.

A acquired on 1st January, 2021 a machine under a Hire-Purchase agreement which provides for 5 halt-yearly instalments of ₹ 6,000 each, the first instalment being due on 1st July, 2021. Assuming that the applicable rate of interest is 10 per cent per annum, calculate the cash value of the machine. All working should form part of the answer.

(Dec 2022, 10 marks)

Hire Purchase and Installment Sale Transactions CMA Inter Financial Accounting Notes

Hire-purchase System

Under this system the purchaser (Hirer) pays the entire amount in staggered way viz, monthly, quarterly or yearly with some interest. Possession of goods is delivered to a hirerbut the title to the goods (Ownership) are transferred only when the agreed sum (Hire Purchase price) is paid by the hirer. Such hirer has a right to terminate the agreement at any time before the property so passes.

Default and Repossession

If a hire purchaser fails to pay any instalment on the stipulated date, the hire purchaser is said to be at default. In case of default by the hire purchaser, the hire vendor may. repossess the goods. Repossession means taking back the possession of goods by the hire vendor. Subject to agreement, the repossession may be either complete or partial.

Meaning of Complete or Full Repossession

In case of complete or full repossession, the hire vendor takes back the possession of all the goods.

![]()

Partial Repossession

In case of partial repossession, the hire vendor takes back the possession of a part of the goods.