Preparation of Financial Statements of Not-for-Profit Organisations – CMA Inter Financial Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Preparation of Financial Statements of Not-for-Profit Organisations – CMA Inter Financial Accounting Study Material

Short Notes

Question 1.

Write short note on the following:

Features of Income and Expenditure Account (June 2019, 5 marks)

Answer:

Features of Income and Expenditure Account:

- It follows Nominal Account.

- All expenses of revenue nature for the particular period are debited to this Account on accrual basis.

- Similarly, all revenue incomes related to the particular prepaid are credited to this account on accrual basis.

- All Capital Incomes and Expenditures are excluded.

- Only current year’s incomes and expenses are recorded. Amounts related to other periods are deducted. Amounts outstanding for the current year are added.

- Profit on Sale of Assets is credited. Loss on Sale of Asset is debited. Annual Depreciation on Assets is also debited.

- If income is more than expenditure, it is called a Surplus and is added with Capital or General Fund etc. in the Balance Sheet.

- If expenditure is more than income, it is a deficit, and ¡s deducted from Capital or General Fund, etc. in the Balance Sheet.

Distinguish Between

Question 2.

Difference between Receipts & Payments Account and Income & Expenditure Account. (Dec 2016, 3 marks)

Answer:

Income and Expenditure Account and Receipts and Payments Account:

| Income and Expenditure Account | Receipts and Payments Account |

| 1. It is a Nominal Account. | It is a Real Account. |

| 2. It is a summary of the working of the organization. | It is a summary of cash and bank transactions of the organization. |

| 3. It is based on accrual system. | It is based on cash system. |

| 4. It records expenses and losses on debit side and incomes and gains on credit side. | It records inflow of cash on debit side and outflow of cash on credit side. |

| 5. It is a temporary account and has no opening and closing balance | It is a real account and starts with opening balance of cash and bank. |

| 6. It is closed at the end of the year and balance figure of the account is transferred to capital fund. | It is balanced at the end of the year and the balance carried forward shows the cash and bank balance at the end of the period. |

| 7. It records items of revenue nature only irrespective of their effect on flow of cash. | It records items both of capital and revenue nature provided they affect flow of cash. |

| 8. It records transactions of current year only. | It records transactions of previous years, current year and subsequent years provided flow of cash is affected. |

Practical Questions

Question 3.

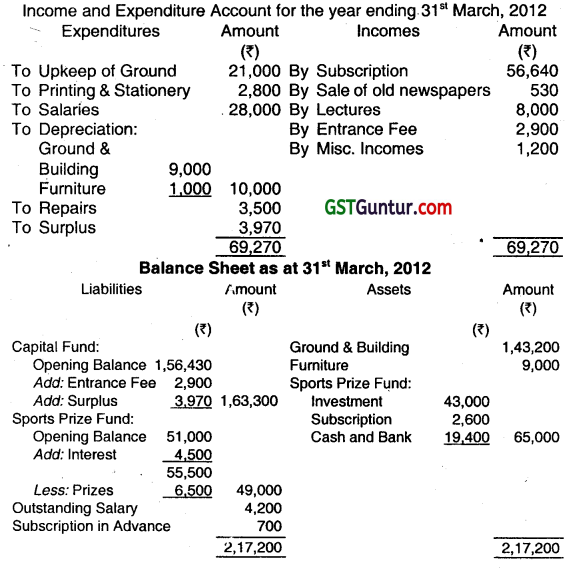

Income and Expenditure Account and the Balance Sheet of Nav Bharat Club are as under:

The following adjustments have been made in the above accounts:

(i) Upkeep of ground ₹ 1,500 and printing and stationery ₹ 510 relating to 2010-2011 were paid in 2011-12.

(ii) One-half of entrance fee has been capitalised.

(iii) Subscription outstanding in 2010-11 was ₹ 3,100 and for 2011-12 ₹ 2,600.

(iv) Subscription received in advance in 2010-11 was ₹ 1,100 and in 2011-12 for 201 2-13 ₹ 700.

(v) Outstanding salary on 31.3.2011 was ₹ 3,600.

Prepare Receipts and Payments Account for the year ended on 31st March, 2012. (Dec 2012, 8 marks)

Answer:

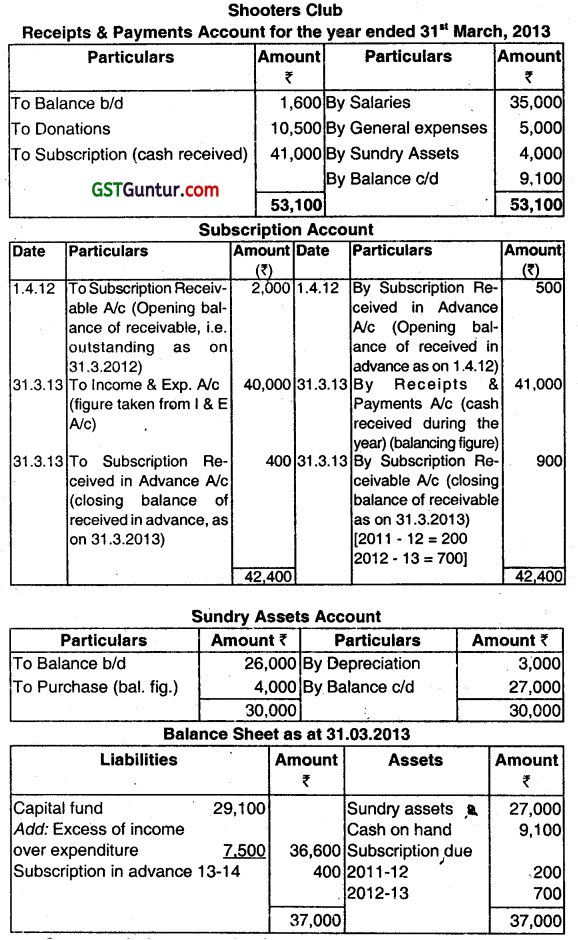

![]()

Question 4.

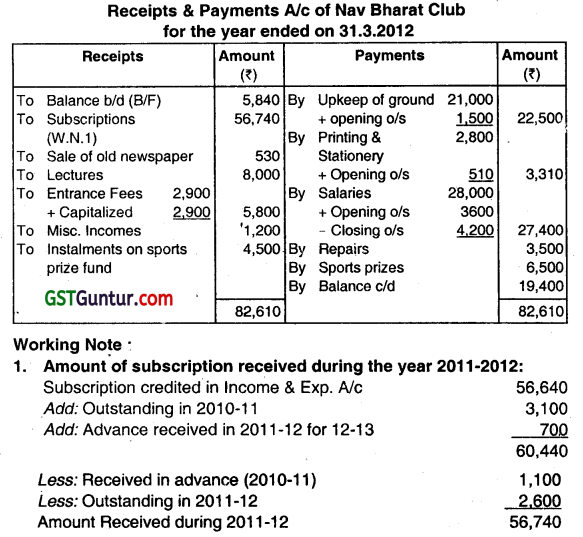

Jodhpur Club furnishes you the Receipts and Payments Account for the year ended 31.03.2013:

| Receipts | ₹ | Payments | ₹ |

| Cash in hand (1.4.2012) | 40,000 | Salary | 20,000 |

| Cash at Bank (1.4.2012) | 1,00,000 | Repair expenses | 5,000 |

| Donations | 50,000 | Furnitures | 60,000 |

| Subscriptions | 1,20,000 | Investments | 60,000 |

| Entrance fee | 10,000 | Misc. expenses | 5,000 |

| Interest on investments | 1,000 | Insurance premium | 2,000 |

| Interest from banks | 4,000 | Billiards table and other sports items | 80,000 |

| Sale of old newspaper | 1,500 | Stationery expenses | 1,500 |

| Sale of drama tickets | 10,500 | Drama expenses | 5,000 |

| Cash in hand (31.03.2013) | 26,500 | ||

| Cash at Bank (31.03.2013) | 72,000 | ||

| 3,37,000 | 3,37,000 |

Additional information:

(i) Subscriptions in arrears for 2012 – 13 ₹ 9,000 and subscription in advance for the year 2013-14 ₹ 3,500.

(ii) 400 was the insurance premium outstanding as on 31.03.2013.

(iii) Miscellaneous expenses prepaid ₹ 900.

(iv) 50% of donation is to be capitalized.

(v) Entrance fees to be treated as revenue income.

(vi) 8% interest has accrued on investments to five months.

(vii) Billiards table and other sports equipments costing ₹ 3,00,000 were purchased in the financial year 2011.12 and of which ₹ 80,000 was not paid 31.03.2012. There is no charge for Depreciation to be

considered. You are required to prepare Income and Expenditure Account for the year ended 31.03.2013 and Balance sheet of the Club as at 31.03.2013. (June 2013, 10 marks)

Answer:

Question 5.

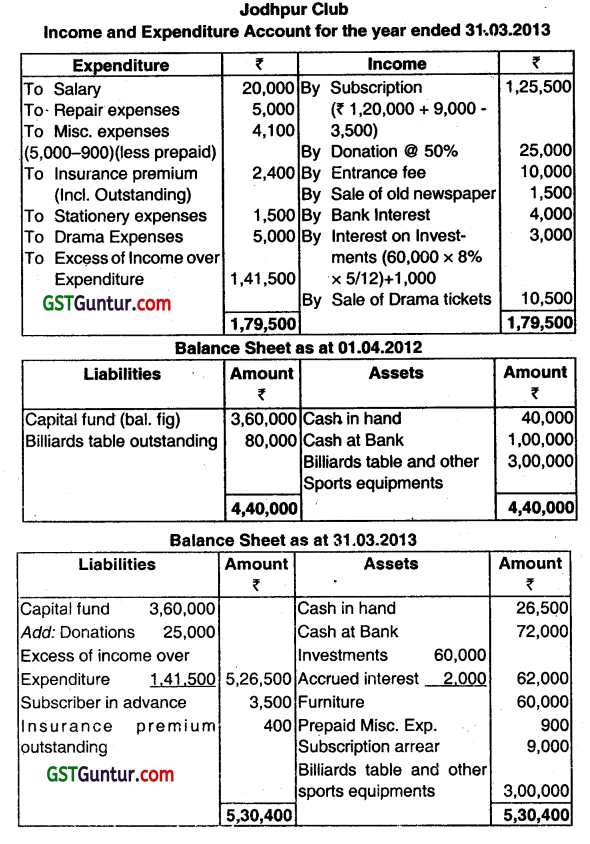

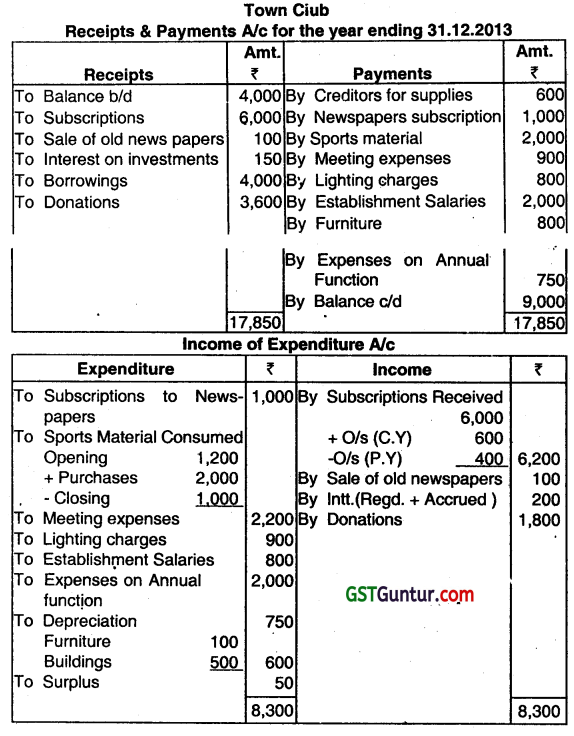

The Income and Expenditure Account of Shooters Club for the year ended 31st March, 2013 is given below:

Adjustments are made in respect of the following:

(i) Subscription for 2012 unpaid at 31.03.2012 ₹ 2,000 of which ₹ 1,800 was received in December 2012.

(ii) Subscription received in advance as on 01.04.2012 was ₹ 500.

(iii) Subscription received in advance as on 31.03.2013 is ₹ 400.

(iv) Subscription for 2012-13 unpaid as on 31.03.2013 is ₹ 700.

(v) Sundry asset as on 01.04.2012 ₹ 26,000. Sundry asset as on 31.03.2013 after depreciation ₹ 27,000.

(vi) Cash balance as on 01.04.2012 ₹ 1,600.

(vii) Capital fund as on 01.04.2012 ₹ 29,100.

Prepare:

(i) Receipts and Payments A/c for the year 2012-13.

(ii) Balance sheet as at 31.03.2013. (Dec 2013, 10 marks)

Answer:

Question 6.

Answer the following questions (give workings):

(iii) The following informations are obtained from the books of a club:

(a) Subscription received during the year ending 31 March, 2014 ₹ 2,56,000. out of which ₹ 8,000 was for the year 2014-15 and ₹ 11,000 for the year 2012-13.

(b) Subscription was outstanding on 01.04.2013 ₹ 18,000 and on 31.03.2014 for 2013-14 ₹ 21,000. Calculate the amount of subscription to be credited to Income and Expenditure Account for the year ending 31.03.2014. (June 2014, 2 marks)

Answer:

Computation of the amount creditable to Income & Expenditure Account:

| ₹ | |

| Subscription received during the year | 2,56,000 |

| Less Subscription received in advance for 2014-15 | 8,000 |

| Less: Subscription for 2012-13 | 11,000 |

| Add: O/s Subscription for 2013-14 | 21,000 |

| Subscription to be credited to Income & exp. A/c | 2,58,000 |

![]()

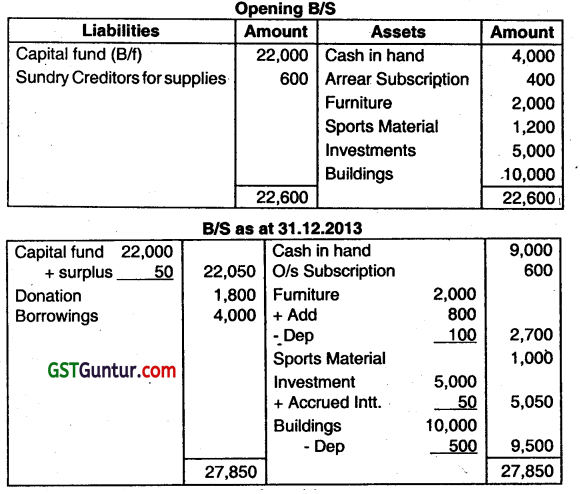

Question 7.

A Town Club provides you information relating to assets and liabilities as on 01.01.14.

Calculate

(i) Receipts and Payment Account,

(ii) income and Expenditure Account for the year ended 31 .12.2013 and

(iii) a Balance Sheet as on date.

Cash in hand ₹ 4,000, subscription receivable ₹ 400, furniture ₹ 2,000, sports material ₹ 1200, investments ₹ 5,000, buildings ₹ 10,000, and outstanding creditors for supplies ₹ 600. During the year 2013, the dub did the following business,

(i) Subscription received including the arrears ₹ 6,000,

(ii) subscription due ₹ 600,

(iii) paid the outstanding creditors for supplies ₹ 600,

(iv) subscriptions to newspapers ₹ 1,000,

(v) sports materials purchased ₹ 2,000,

(vi) sale of old newspapers ₹ 100,

(vii) meeting expenses ₹ 900,

(viii) lighting charges ₹ 800,

(ix) Establishment salaries ₹ 2,000,

(x) stock of sport materials at the end ₹ 1,000,

(xi) Interest received on investments ₹ 150 (outstanding ₹ 50),

(xii) borrowings ₹ 4,000,

(xiii) purchased furniture (31-12-2013) ₹ 800,

(xiv) expenditure on annual function ₹ 750 and

(xv) donations received ₹ 3,600 (half to be capitalised).

Provide depreciation at 5% on furniture and buildings. (June 2014, 4+4+2= 10 marks)

Answer:

Question 8.

Answer the question:

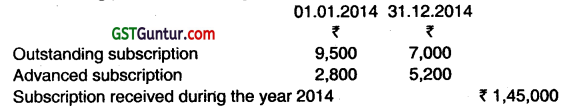

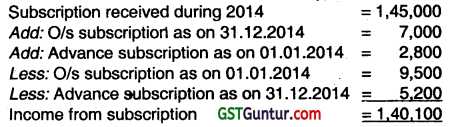

Compute the income from subscription for the year 2014 from the following particulars relating to TARUN CLUB:

(June 2015, 2 marks)

Answer:

Question 9.

Answer the question.

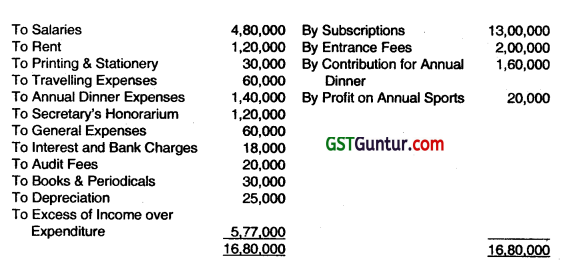

The following is the Income and Expenditure Account of GREEN CITY CLUB for the year ended March 31, 2015. (Amount in ₹)

The Income and Expenditure Account has been prepared after the following adjustments:

| ₹ | |

| Subscription Outstanding on 31.03.2014. | 1,20,000 |

| Subscription received in Advance on 31.03.2014. | 90,000 |

| Subscription Outstanding on 31.03.2015. | 80,000 |

| Subscription received in Advance on 31.03.2015. | 1,40,000 |

Salaries Outstanding at the beginning of the year and at the end of the year were ₹ 40,000 and ₹ 30,000 respectively.

Audit fees for the year (2014-15) has not been paid. Previous year’s audit fee ₹ 15,000 was paid during the year.

The club’s Assets on 31 March 2014 were as follows:

| ₹ | |

| Freehold Land | 10,00,000 |

| Sport Equipments | 2,60,000 |

At the end of the year, after depreciation, the equipments amounted to ₹ 2,70,000. Bank Loan of ₹ 1,00,000 as on 31st March, 2014 was still due at the end of the current year. On 31st March, 2015, Cash at Bank amounted to ₹ 6,97,000.

You are required to prepare:

(i) The Receipts and Payments Account tor the year ended 31st March, 2015 and

(ii) Balance Sheet as on 31.03.2015 (Dec 2015, 5+4+1+2 = 12 marks)

Answer:

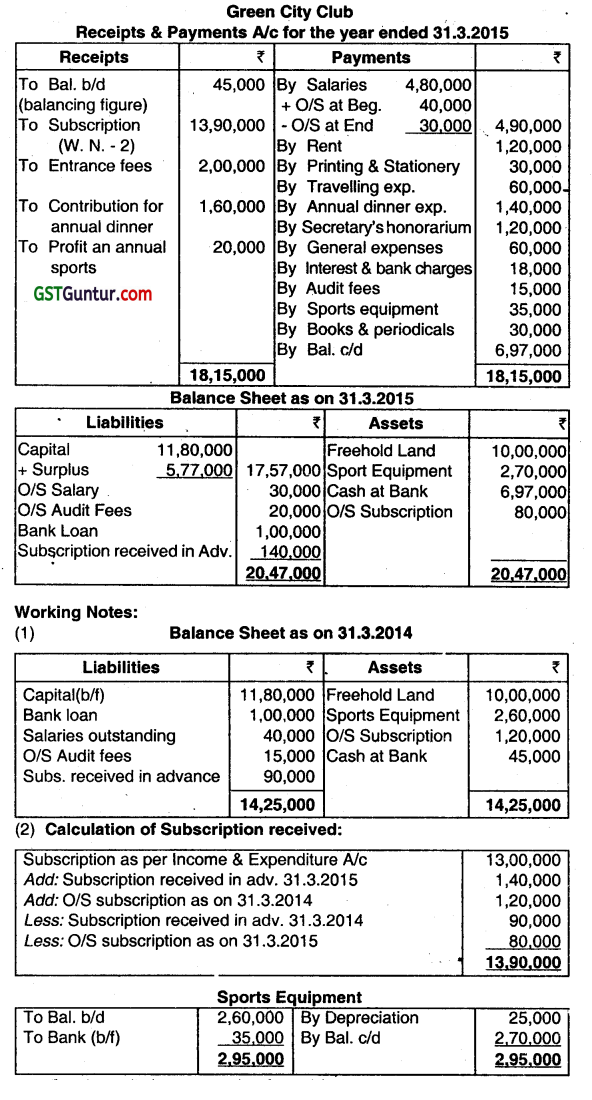

Question 10.

The following is the income and Expenditure Account of Gama Club for the year ended 31 March. 2017:

Income and Expenditure Account for the year ended 31st March, 2017

| Expenditure | ₹ | Income | ₹ |

| To Salaries | 19,500 | By Subscription | 68,000 |

| To Rent | 4,500 | By Donation | 5,000 |

| To Printing | 750 | ||

| To insurance | 500 | ||

| To Audit Fees | 750 | ||

| To Games & Sports | 3,500 | ||

| To Subscriptions written off | 350 | ||

| To Miscellaneous Expenses | 14500 | ||

| To Loss on sale of Furniture | 2,500 | ||

| To Depreciation: Sports Equipment | 6,000 | ||

| Furniture | 3,100 | ||

| To Excess of income over expenditure | 17,050 | ||

| 73,000 | 73,000 |

Additional information:

| 31-03-2016 | 31-03-2017 | |

| ₹ | ₹ | |

| Subscription in arrears | 2,600 | 3,700 |

| Advance Subscriptions | 1,000 | 1,500 |

| Outstanding expenses: Rent |

500 | 800 |

| Salaries | 1,200 | 350 |

| Audit Fee | 500 | 750 |

| Sports Equipment less depreciation | 25,000 | 24,000 |

| Furniture less depreciation | 30,000 | 27,900 |

| Prepaid Insurance | – | 150 |

Book value of furniture sold is ₹ 7,000. Entrance fees capitalized ₹ 4,000. On 1st April, 201v there was no cash in hand but Bank Overdraft was for ₹ 15,000. On 31st March, 2017 cash in hand amounted to ₹ 850 and the rest was Bank balance. Prepare the Receipts and Payments Account of the Club for the year ended 31st March, 2017. (Dec 2017, 15 marks)

Answer:

![]()

Question 11.

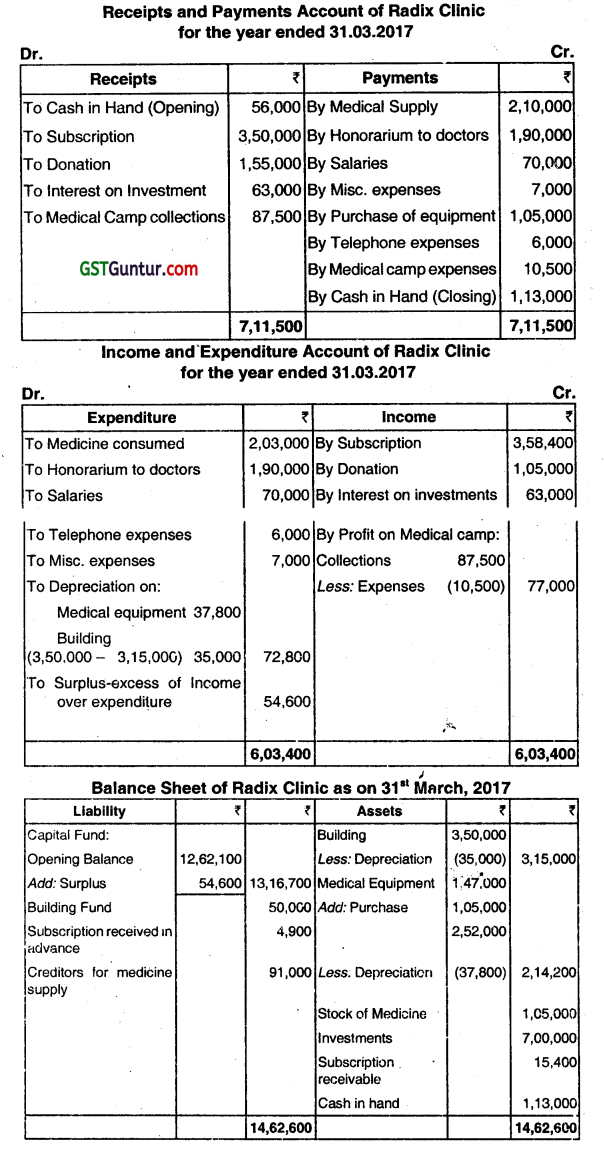

Following is the summary of Receipts and Payments of

Radix Clinic for the year ended 31 March, 2017:

| ₹ | |

| Opening Cash Balance | 56,000 |

| Donations received (including 50,000 for Building Fund.) | 1,55,000 |

| Payment to creditors for Medicines Supply | 2,10,000 |

| Salaries | 70,000 |

| Purchase of Medical Equipments | 1,05,000 |

| Medical Camp Collections | 87,500 |

| Subscription Received | 3,50,000 |

| Interest on Investments @ 9’p.a. | 63,000 |

| Honorarium to Doctors | 1,90,000 |

| Telephone Expenses | 6,000 |

| Medical Camp Expenses | 10,500 |

| Miscellaneous Expenses | 7,000 |

Additional Information:

| 01.04.2016 ₹ | 31.03.2017 ₹ | |

| 1. Subscription Due | 10,500 | 15,400 |

| 2. Subscription Received In Advance | 8,400 | 4,900 |

| 3. Stock of Medicine | 70,000 | 1,05,000 |

| 4. Medical Equipments | 1,47,000 | 2,14,200 |

| 5. Building | 3,50,000 | 3,15,000 |

| 6. Creditor for Medicine Supply | 63,000 | 91,000 |

| 7. Investments. | 7,00,000 | 7,00,000 |

You are required to prepare Receipts and Payments Account and Incomes and Expenditure Account for the year ended 31st March, 2017 and the Balance Sheet as on 31st March, 2017. (June 2018, 15 marks)

Answer:

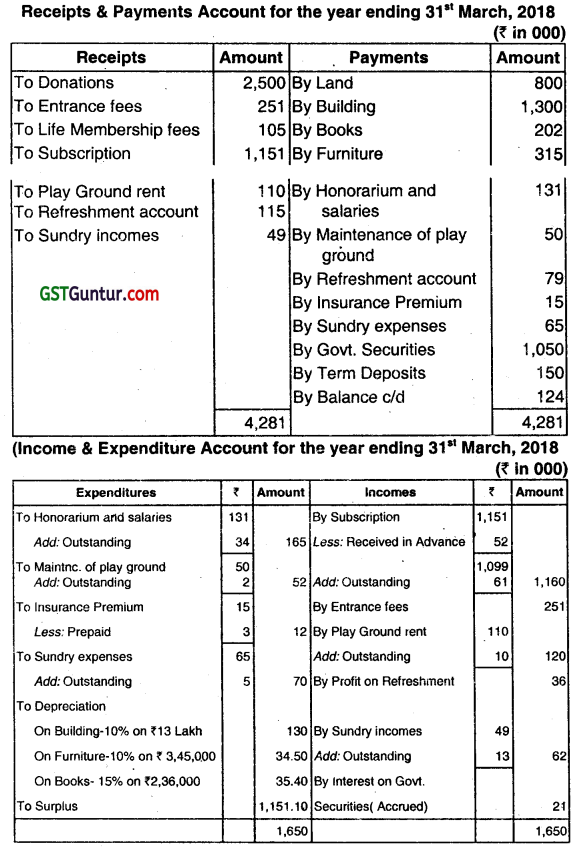

Question 12.

The following information provided by the Nay Yuvak Mandai, Delhi for the first year ended 31 March, 2018:

(i) Donations received for building ₹ 25 Lakh.

(ii) Other incomes and receipts were: (₹ in ‘000)

| Particulars | Capital Income (₹) | Revenue Income (₹) | Actual Receipt (₹) |

| Entrance fees | – | 251 | 251 |

| Life Membership fees | 105 | – | 105 |

| Subscription | – | 1,160 | 1,151 |

| Play Ground rent | – | 120 | 110 |

| Refreshment account | – | 115 | 115 |

| Sundry incomes | – | 62 | 49 |

(iii) Expenditures and actual payments were: (₹ in ‘000)

| Particulars | Capital Expenditure (₹) | Revenue Expenditure (₹) | Actual Payment (₹) |

| Land | 800 | – | 800 |

| Books | 236 | – | 202 |

| Furniture | 345 | – | 315 |

| Honorarium and salaries | – | 165 | 131 |

| Maintenance of playground | – | 52 | 50 |

| Refreshment account | – | 79 | 79 |

| Insurance Premium | – | 12 | 15 |

| Sundry expenses | – | 70 | 65 |

Others:

Donation were utilized to the extent of ₹ 13 Lakh in construction of building, balance were unutilized. In order to keep in safe, 8% Government Securities were purchased on 31st December, 2017 for ₹ 10.50 Lakh. Remaining amount was put ¡n bank as term deposit on 31st March, 2018. During the year 2017-18, Subscription received in advance ₹ 52,000 for the year 2018-19. Depreciation to be charged on Building and Furniture @ 10% and on Books @ 15%. You are required to prepare the Receipts & Payments Account, Income & Expenditure Account and Balance Sheet as on 31st March, 2018. (Dec 2018, 15 marks)

Answer:

Working Notes:

- Donation received for building has been treated as capital item.

- Amount of Term Deposit = Donations Received-(Cost of Building + 8% Govt. Securities)

₹ 25 Lakh – (13 Lakh + 10.50 Lakh) = ₹ 1,50,000 - Profit on Refreshment = ₹ 1,15,000 – 79,000 = ₹ 36,000

- Outstanding Subscription = ₹ 11,60,000- (11,51,000-52,000) = ₹ 61,000

- Accrued Interest on Govt. Securities: ₹ 10,50,000 × 8% × 3112 = ₹ 21,000

![]()

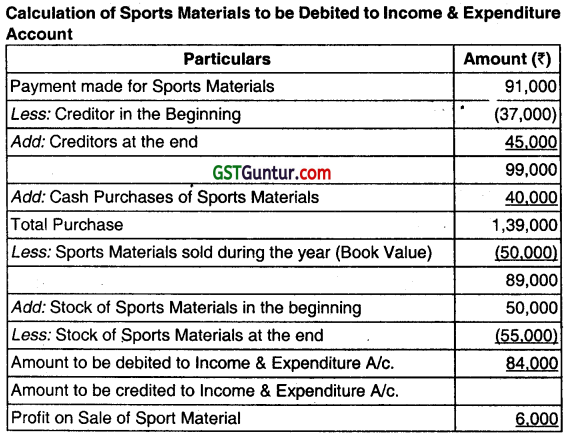

Question 13.

Calculate the amount of sports material to be transferred to income and Expenditure Account of Kanan Bala Sports Club, Ludhiana, for the year ended 31st March, 2018:

| Particulars | (₹) |

| (i) Sports Material sold during the year (Book value ₹ 50,000) | 56,000 |

| (ii) Amount paid to creditors for sports material | 91,000 |

| (iii) Cash purchase of sports material | 40,000 |

| (iv) Stock of sports material as on 31.03.2017 | 50,000 |

| (v) Stock of sports material as on 31.03.2018 | 55,000 |

| (vi) Creditors for sports material’ as on 31.03.2017 | 37,000 |

| (vii) Creditors for sports material as on 31.03.2018 | 45,000 |

(Dec 2019, 7 marks)

Answer:

Question 14.

The following is the Income and Expenditure Account of Gama Club for the year ended 31st March, 2021:

Income and Expenditure Account for the year ended 31st March, 2021

| ₹ | ₹ | ||

| To Salaries | 19,500 | By Subscription | 68,000 |

| To Rent | 4,500 | By Donation | 5,000 |

| To Printing | 750 | ||

| To Insurance | 500 | ||

| To Audit Fees | 750 | ||

| To Games & Sports | 3,500 | ||

| To Subscriptions written off | 350 | ||

| To Miscellaneous Expenses | 14,500 | ||

| To Loss on sale of furniture | 2,500 | ||

| To Depreciation: Sports Equipment |

6,000 | ||

| Furniture | 3,100 | ||

| To Excess of income over expenditure | 17,050 | ||

| 73000 | 73,000 |

Additional information: ‘

| 31-3-2020 | 31-3-2021 | |

| ₹ | ₹ | |

| Subscriptions in arrears | 2,600 | 3,700 |

| Advance Subscriptions | 1,000 | 1,500 |

| Outstanding Expenses: | ||

| Rent | 500 | 800 |

| Salaries | 1,200 | 350 |

| Audit Fee | 500 | 750 |

| Sport Equipment less depreciation | 25,000 | 24,000 |

| Furniture less depreciation | 30,000 | 27,900 |

| Prepaid Insurance | – | 150 |

Book value of furniture sold is ₹ 7,000. Entrance fees capitalized ₹ 4,000. On 1st April, 2020, there was no cash in hand but Bank Overdraft was for ₹ 15,000. On 31St March, 2021, Cash in hand amounted to ₹ 850 and the rest was Bank balance. Prepare the Receipts and Payments Account of the Club for the year ended 31st March, 2021. (Dec 2022, 15 marks)

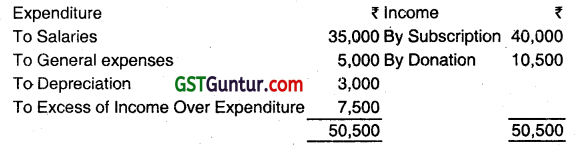

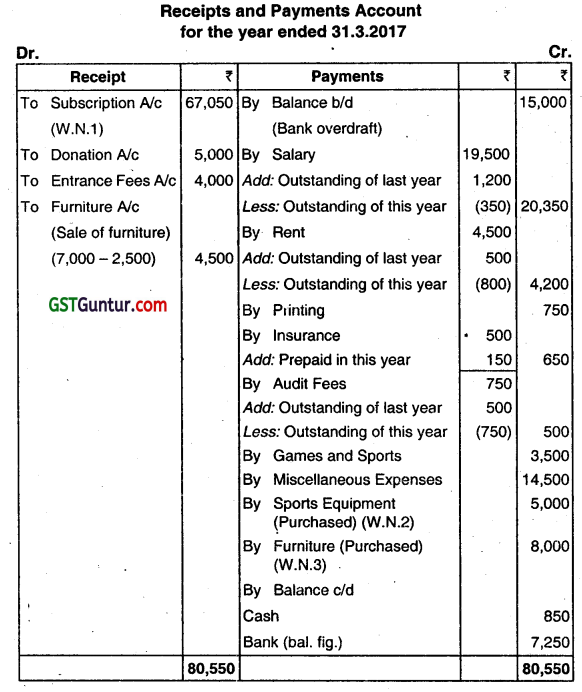

Preparation of Financial Statements of Not-for-Profit Organisations CMA Inter Financial Accounting Notes

Receipt and Payment Account

This is similar to cash book. Entries are made on cash basis and items pertaining to previous year or current year or subsequent years are also recorded. Receipts are shown on debit side and payments are shown on

credit side. Capital as well as revenue items are entered in the R & P A/c.

Income and Expenditure Account

This is similar to the Profit and loss AJc and is prepared exactly based on same principles. As the name suggests only revenue items are recorded here in. Incomes are recorded on the credit side while the expenses on the debit side. Both incomes and expenses must be taken on the basis of accrual concept.

Balance Sheet

It is prepared as on the last day of the accounting period. It also has assets and liabilities and prepared based on accounting equation. But, there’s no capital account. Instead, there is a capital fund. The surplus or deficit from Income & Expenditure A/c is adjusted against this capital fund at the end of the year.

Capital Fund

It is also called ‘General Fund” or accumulated Fund.” It is actually the Capital of a non-profit concern. it may be found out as the excess of assets over liabilities. Usually “Surplus” or Deficit” during a period is added with o deducted from it.

![]()

Special Fund

It may be created out of special donation or subscription or out of a portion of the ‘Surplus’.

Legacy received

It is to be directly added with Capital Fund after deduction of tax,(if any). It is a kind of donation received according to the will made by a deceased person.