CA Inter Taxation Study Material Free PDF Download: To clear one of the toughest exams in education life ie., CA, students have to be well prepared for the exams by referring to the best study resources like study notes, mock test papers, MCQs, question papers, exam pattern, etc.

If you are going to attend the CA Intermediate exams and wondering how to download CA Inter Tax Study Notes PDF? You have entered the right page. Here, we have provided direct download links of CA Intermediate Taxation Study material along with chapter-wise weightage, and syllabus of Taxation CA Inter.

- CA Inter Taxation Study Material

- CA Inter Taxation MCQs & Case Studies

- CA Inter Tax Chapter Wise Weightage

- CA Intermediate Taxation Syllabus

- FAQs on CA Inter Paper 4 Taxation Study Material Notes PDF, Weightage Syllabus, MCQs & Case Studies

CA Inter Taxation Study Material – CA Inter Tax Study Material Notes Syllabus

Aspirants can prepare for their taxation ca inter paper by taking help from the CA Intermediate Taxation Study Material Notes given by the ICAI. Want to know where and how to get them for free? Here is the right way to do it. Simply go to the official site of ICAI or else click on the available CA Inter Tax Part A and Part B pdf links. You can view or download these free pdf formatted Chartered accountancy Intermediate Taxation Handwritten Revision Notes and start preparing every chapter flexibly and score well in the exams.

CA Inter Income Tax Study Material

Our experts reached out to the ICAI official website and navigated to the CA Inter Taxation Study Materials to find the CA Inter ICAI Taxation Income Tax Study Materials. After researching them deeply, we have curated the important questions and answers, handwritten revision notes, and MCQs for all the chapters below.

- Basic Concepts

- Residence and Scope of Total Income

- Incomes Which Do Not Form Part of Total Income

- Income from Salaries

- Income from House Property

- Profits and Gains from Business or Profession

- Capital Gains

- Income from Other Sources

- Clubbing of Income

- Set-off and Carry Forward of Losses

- Deductions from Gross Total Income

- Agricultural Income

- Computation of Total Income and Tax Payable

- Advance Tax, TDS, and TCS

- Provision for Filing of Return of Income and Self-Assessment

CA Inter Indirect Tax Study Material

Here are some of the CA inter indirect tax chapters study material notes links to be used for learning and practicing the core concepts of paper 4 section B. All these study notes are prepared by the experts and taken with the reference of ICAI. So, students can avail of these CA Intermediate Indirect Tax Study Materials in pdf format and start their exam preparation immediately.

- GST in India

- Supply Under GST

- Charge of GST

- Exemptions from GST

- Time of Supply

- Value of Supply

- Input Tax Credit

- Registration

- Tax Invoice, Credit and Debit Notes

- Payment of Tax

- Returns

- CA Inter Taxation Question Paper Nov 2019

CA Inter Taxation MCQs & Case Studies

Do you guys want to become experts in answering the CA Inter Tax Paper? Simply click on the below links and start practicing the CA Inter Taxation Chapters by referring to the ultimate resource called CA Intermediate Taxation Income Tax & GST MCQs and Case Studies Pdf available below.

- CA Inter Taxation Income Tax Multiple Choice Questions (MCQs)

- CA Inter Taxation Income Tax Case Studies

- CA Inter Taxation GST Multiple Choice Questions (MCQs)

- CA Inter Taxation GST Case Studies

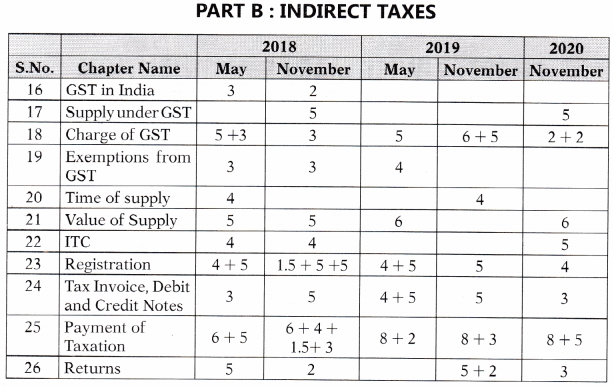

CA Inter Tax Chapter Wise Weightage

Knowing the details about chapter-wise CA Inter Taxation is very important to understand and plan the timetable. Here, we have tabulated the ICAI-provided Taxation CA Inter Part A & B Chapters Weightage for your reference. Check out them clearly and score great marks in part A-Income Tax and Part B-Indirect Tax.

CA Intermediate Taxation Syllabus

The latest CA Inter Paper 4 Tax Syllabus can be referred from this guide as we have listed the complete syllabus of CA Intermediate Taxation in Two sections. Checking the syllabus of any paper will guide you on how to divide the concepts for preparation and make you confident to attempt the toughest exams of CA.

Mentioned CA Inter Tax Part A&B Revised Syllabus is taken from the official site of the Institute of Chartered Accountants of India (ICAI) so students can trust to view the provided syllabus when they require.

CA Inter Taxation Syllabus – CA Inter Tax Syllabus

PAPER – 4: TAXATION

(One paper — Three hours — 100 Marks)

Objective:

To develop an understanding of the provisions of income-tax law and goods and services tax law and to acquire the ability to apply such knowledge to make computations and address application-oriented issues.

SECTION A: INCOME TAX LAW (60 MARKS)

Contents:

1. Basic Concepts

(i) Income-tax law: An introduction (ii) Important definitions in the Income-tax Act, 1961 (iii) Concept of previous year and assessment year (iv) Basis of Charge and Rates of Tax

2. Residential status and scope of total income

(i) Residential status (ii) Scope of total income

3. Incomes which do not form part of total income (other than charitable trusts and institutions, political parties and electoral trusts)

(i) Incomes not included in total income (ii) Tax holiday for newly established units in Special Economic Zones

4. Heads of income and the provisions governing computation of income under different heads

(i) Salaries (ii) Income from house property (iii) Profits and gains of business or profession (iv) Capital gains (v) Income from other sources

5. Income of other persons included in assessee’s total income

(i) Clubbing of income: An introduction (ii) Transfer of income without transfer of assets (iii) Income arising from revocable transfer of assets

(iv) Clubbing of income of income arising to spouse, minor child and son’s wife in certain cases (v) Conversion of self-acquired property into property of HUF

6. Aggregation of income; Set-off, or carry forward and set-off of losses

(i) Aggregation of income (ii) Concept of set-off and carry forward and set-off of losses (iii) Provisions governing set-off and carry forward and set-off of losses under different heads of income (iv) Order of set-off of losses

7. Deductions from gross total income

(i) General provisions (ii) Deductions in respect of certain payments (iii) Specific deductions in respect of certain income (iv) Deductions in respect of other income (v) Other deductions

8. Computation of total income and tax liability of individuals

(i) Income to be considered while computing total income of individuals (ii) Procedure for computation of total income and tax liability of

individuals

9. Advance tax, tax deduction at source and introduction to tax collection at source

(i) Introduction (ii) Direct Payment (iii) Provisions concerning deduction of tax at source (iv) Advance payment of tax (v) Interest for defaults in payment of advance tax and deferment of advance tax (vi) Tax collection at source — Basic concept (vii) Tax deduction and collection account number

10. Provisions for filing return of income and self-assessment

(i) Return of Income (ii) Compulsory filing of return of income (iii) Fee and Interest for default in furnishing return of income (iv) Return of loss (v) Provisions relating to belated return, revised return, etc (vi) Permanent account number (vii) Persons authorized to verify return of income (viii) Self-assessment.

SECTION B – INDIRECT TAXES (40 MARKS)

1. Concept of indirect taxes

(i) Concept and features of indirect taxes (ii) Principal indirect taxes

2. Goods and Services Tax (GST) Laws

(i) GST Laws: An introduction including Constitutional aspects (ii) Levy and collection of CGST and IGST a) Application of CGST/IGST law b) Concept of supply including composite and mixed supplies c) Charge of tax including reverse charge d) Exemption from tax e) Composition levy (iii) Basic concepts of time and value of supply (iv) Input tax credit (v) Computation of GST liability (vi) Registration (vii) Tax invoice; Credit and Debit Notes; Electronic way bill (viii) Returns (ix) Payment of tax

Note — If any new legislation(s) is enacted in place of existing legislation(s), the syllabus will accordingly include the corresponding provisions of such new legislation(s) in place of the existing legislation(s) with effect from the date to be notified by the Institute. Similarly, if any existing legislation ceases to have effect, the syllabus will accordingly exclude such legislation with effect from the date to be notified by the Institute. Students shall not be examined concerning any particular State GST Law.

Consequential/ corresponding amendments made in the provisions of the Income-tax law and Goods and Services Tax laws covered in the syllabus of this paper which arise out of the amendments made in the provisions not covered in the syllabus will not form part of the syllabus. Further, the specific inclusions/ exclusions in the various topics covered in the syllabus will be effected every year by way of Study Guidelines. Specific inclusions/ exclusions may also arise due to additions/ deletions every year by the annual Finance Act.

CA Inter Study Material

FAQs on CA Inter Paper 4 Taxation Study Material Notes PDF, Weightage Syllabus, MCQs & Case Studies

1. Is ICAI study material enough for CA Intermediate taxation?

Proper strategy and strict discipline towards preparation will help you in cracking the CA Inter exams. Along with this, ICAI study material, RTP, Questions Papers, and Mock Tests are sufficient for clearing the CA Inter Taxation paper.

2. How can I get Taxation CA Inter study material?

You can get the CA Inter Taxation Study material from icai.org or at our page @gstguntur.com.

3. How to prepare income tax for CA Intermediate?

- Initially, start learning from the basic concepts of direct taxes and in the advanced stage go with Head of Income topics.

- Take help from the ICAI study modules or coaching videos or test papers.

- Answer all the sample and previous questions papers and MCQs of CA Inter tax. Cover all your gaps and assess your performance from the result.

4. Which book is best for CA Inter Taxation?

Pointing to the one best CA Inter Taxation Book is difficult so here we have given you the three CA Inter Best books for Taxation:

- CA Intermediate Taxation Book by G Sekar

- T.N Manharan Taxation CA Inter Book

- Taxation CA Inter Book by Vinod K Singhania

Final Thoughts

Expecting that our experts and research team shared data on CA Inter Taxation Study Material May 2023 PDF helped you prepare all the concepts properly and quickly. Every question and answer along with provided other study notes was explained lucidly for better understanding to students to score good marks in their exams.

Do share this ultimate guide with friends and help them in their preparation too. Have your eye contact at our website @gstguntur.com for the latest and updated details about CA Exams 2023 from the official website.