Clubbing of Income – CA Inter Tax Study Material is designed strictly as per the latest syllabus and exam pattern.

Clubbing of Income – CA Inter Taxation Study Material

Question 1.

Mr. Ramesh gifted a sum of ₹ 5 lakhs to his brother’s Minor Son on 16.04.2020. On 18.04.2020, his brother gifted Debentures worth ₹ 6 Lakhs to Mrs. Ramesh. Son of Mr. Ramesh Brother invested the amount in FD with Bank of India @ 9% p.a. Interest and Mrs. Ramesh received Interest of ₹ 45,000 on Debentures received by her. Discuss the implications under the provisions of the Income-tax Act, 1961. [May 2015, 4 Marks]

Answer:

| Issue | Treatment |

| 1. Taxability of Gift | both the Gifts are not taxable under the head “Income from Other Sources”, since the parties are covered by the term “Relative”, and is hence exempt |

| 2. Clubbing Provision – Principal | Income from assets transferred in a cross-transfer would be assessed in the hands of the Transferor, if –

a. Transfers are so intimately connected to form part of a single transaction, and b. Each transfer constitutes consideration for the other by being mutual or otherwise. |

| 3. Analysis and Conclusion | a. Income from Fixed Deposit received by Minor Son of Mr. Ramesh’s Brother will be clubbed in the hands of Mr. Ramesh’s Brother or his Spouse, whose Total Income is greater before such inclusion. Exemption u/s 10(32) of ₹ 1,500 per child can be claimed.

b. Interest on Debentures received by Ramesh’s wife will be clubbed in the hands of Mr. Ramesh |

![]()

Question 2.

Mr. Vaibhav started a Proprietary Business on 01.04.2018 with a Capital of ₹ 5,00,000. He incurred a loss of ₹ 2,00,000 during the year 2018-19. To overcome the financial position, his wife Mrs. Vaishaly, a Software Engineer, gave a gift of ₹ 5,00,000 on 01.04.2019, which was immediately invested in the business by Mr. Vaibhav. He earned a profit of ₹ 4,00,000 during the year 2020-2021. Compute the amount to be clubbed in the hands of Mrs. Vaishalv for the Assessment Year 2021-2022. If Mrs. Vaishalv gave the said amount as Loan, what would be the amount to be clubbed? [Nov. 2011, Modified]

Answer:

- The amount of profit to the extent of Gifted Amount to the Total Capital on the first day of the Previous Year must be clubbed in the hand of the Assessee. [Mohini Thapar vs. CIT and R.Ganesan vs. CIT]

- Income accruing or arising from transferred assets will alone be clubbed.

| Particulars | Previous Year 2020-2021 |

| (a) Capital as on 01.04.2018 (before Gift ? 5,00,000) | = Opening Capital as on 01.04.2018 – Loss for the FY 2018-2019.

= ₹ 5,00,000 – ₹ 2,00,000 = ₹ 3,00,000 |

| (b) Total Capital after Gift | As above ₹ 3,00,000 + ₹ 5,00,000 = ₹ 8,00,000 |

| (c) Profit/(Loss) | ₹ 4,00,000 |

| (d) Amount to be Clubbed | Profit Earned × Gifted Amount = 4,00,000 × 5,00,000 = ₹ 2,50,000

Total Capital 8,00,000 |

Note:

- Gift received from Spouse, ie. Relative, is not taxable.

- If the amount is received as Loan, than clubbing provision would not be attracted.

![]()

Question 3.

Mr. John commenced a proprietary business in the year 2008. His capital as on 01.04.2008 was ₹ 6,00,000. On 01.04.2018, his wife gifted ₹ 2,00,000 which he invested in the business on the same date. John earned profit from his proprietary business as given below:

Previous Year 2019-2020 = Profit ₹ 3,00,000.

Previous Year 2020-2021 = Profit ₹ 4,40,000.

During the Financial Year 2020-2021, he sold a vacant site which resulted in chargeable Long Term Capital Gain of ₹ 5,00,000 (computed). The vacant site was sold on 20.12.2020. Compute the Total Income of the Mr. John for the Assessment Year 2021-2022. [May 2011, Modified]

Answer:

- Based on Mohini Thapar Vs CIT and R. Ganesan Vs CIT case decisions, the amount of profit to the extent to gifted amount to total capital on the first day of the previous year must be clubbed in the hands of Mr. John’s wife.

- Income accruing or arising from transferred assets only will be clubbed. Any income earned out of such income should not be clubbed, e.g. dividend from Bonus Shares. [MSS Rajan ITR 126 (Mad.)]

| Particulars | Financial Year 2018-2019 (₹) | Financial Year 2019-2020 (₹) |

| (a) Profit Earned | 3,00,000 | 4,40,000 |

| (b) Total Capital | Opening Capital 6,00,000 + Gift 2,00,000 = 8,00,000 | B/fw 8,00,000 + Last Year Profit 3,00,000 = 11,00,000 |

| (c) Amount of Clubbed income

(Taxable in the hands of Mrs. John) |

Profit Earned × Gifted Amount

Total Capital = 3,00,000 × 2,00,000 8,00,000 = ₹ 75,000 |

Profit Earned × Gifted Amount

Total Capital = 4,40,000 × 2,00,000 11,00,000 = ₹ 80,000 |

| ( cl) Amount Taxable in the hands of Mr. John = Total Profit – Clubbed Amount = (a-c) | = ₹ 2,25,000 | = ₹ 3,60,000 |

Note: Amount to be clubbed in the hands of Mr. John’s Wife for AY 2021 – 2022 is ₹ 80,000. (The Closing Capital of PY 2019-2020 Plus Profit for that year is taken as the Capital for PY 2020-2021 on the assumption that Mr. John did not withdraw any money from the business and that all Profits in the first year were reinvested into the business).

![]()

Computation of Total Income of Mr. John

| Particulars | Amount (₹) |

| Profits and Gains from Business or Profession | 3,60,000 |

| Long Term Capital Gains | 5,00,000 |

| Gross Total Income | 8,60,000 |

| Less: Deduction under Chapter VI-A | NIL |

| Total Income | 8,60,000 |

Question 4.

On 2 1.03.2020, Mr. Janak gifted to his wife Mrs. Thilagam 200 Listed Shares which had been bought by him on 19.04.20 18 at ₹ 2,000 per Share. On 01.06.2020, Bonus Shares were allotted in the ratio of 1:1. All these Shares were sold by Mrs. Thilagam as under:

| Date of Sale | Manner of Sale | No. of Shares | Net Sales Value (₹) |

| 21.05.2020 | Sold in Recognized Stock Exchange, STT paid | 100 | 2,20,000 |

| 21.07.2020 | Private Sale, to an Outsider | All Bonus Shares | 1,25,000 |

| 28.02.2021 | Private Sale, to her friend Mrs. Hema (Market Value on this date was ₹ 2,10,000) | 100 | 1,70,000 |

Briefly state the Income Tax consequences in respect of the sale of the shares by Mrs. Thilagam, showing clearly the person in whose hands the same is chargeable, the quantum and the Head of Income in respect of the above transactions. Detailed computation of Total Income in NOT required [May 2011, Modified]

Answer:

Net Sales Value represents the amount credited after all taxes, levies, brokerage, etc. and the same may be adopted for computing the Capital Gains.

- Principal: under sec. 64(1)( iv), in case of Income from assets transferred directly or indirectly to the Spouse, such Income shall be clubbed in the hands of the individual.

- Sale of 100 Shares on 21,05.2020 for ₹ 2,20,000 and another 100 Shares on 28.02.2021 for ₹ 1,70,000 shall be clubbed with the Total Income of Mr. Janak under the head Capital Gains. Capital gain exceeding ₹ 1,00,000 shall be taxed at a special rate of 10% u/s 112A.

- Short Term Capital Gain from Private Sale of 200 Bonus Shares (i.e. Bonus in the ratio 1:1) is taxable in the hands of Mrs. Thilagam under the head Capital Gains. It shall not be clubbed with the Total Income of Mr. Janak, since it is an income on income from transferred assets

![]()

Question 5.

Mr. Mittal has Minor Children consisting of three daughters and one son. The Annual Income all the Children for the Assessment Year 2021- 2022 were as follow –

| Particulars | Amount (₹) |

| First Daughter (Including Scholarship received ₹ 5,000) | 10,000 |

| Second Daughter | 8,500 |

| Third Daughter (suffering from Disability specified u/s 80U) | 4,500 |

| Son | 40,000 |

Mr. Mittal gifted 2,00,000 to his Minor Son who invested the same in the business and derived Income of ₹ 20,000 which is included above.

Compute the amount of Income earned by Minor Children to be clubbed in the hands of Mr. Mittal. [May 2014, 4 Marks]

Answer:

Computation of Total Income

| Particulars | Amount (₹) | Amount (₹) |

| Annual Income earned by 1st Daughter | 10,000 | |

| Less: Scholarship [Exception to Sec. 64( 1 A)] (assumed that Scholarship is received from a Trust registered u/s 10(23)/ 12A) ‘ | 5,000 | 5,000 |

| Annual Income Earned by 2nd daughter | 8,500 | |

| Annual Income earned by 3rd daughter [Exception u/s 64(1 A)] Disability u/s 80U

[Note: Income of Child suffering from disability u/s 80U shall be taxed only in that Child’s hands, and shall not be clubbed in the Parent’s hands] |

Nil | |

| Annual Income earned by Son (Income derived from Gift already included) | 40,000 | |

| Total of above | 53,500 | |

| Less: Exemption u/s 10(32) 1,500 per Child (1,500 × 3) [3rd Daughter not includible] | (4,500) | |

| Income to be clubbed in the hands of Mr. Mittal | 49,000 |

![]()

Question 6.

Mr. Sharma has children consisting 2 daughters and 2 sons. The Annual Income of 2 daughters were ₹ 9,000 and ₹ 4,500 and of sons were ₹ 6,200 and ₹ 4,300 respectively. The daughter who has Income of ₹ 4,500 was suffering from a disability specified u/s 80U. Compute the amount of Income earned by minor children to be clubbed in hands of Mr. Sharma. [May 2012, 4 Marks]

Answer:

| Particulars | Son 1 | Son 2 | Daughter 1 | Total |

| Annual Income | 6,200 | 4,300 | 9,000 | 19,500 |

| Less: Exempt u/s 10(32) | (1,500) | (1,500) | (1,500) | (4,500) |

| 4,700 | 2,800 | 7,500 | 15,000 |

Note: Income of Daughter whose income is ₹ 4,500 and suffering from disability specified u/s 80U shall not be clubbed in the hands of Mr. Sharma.

![]()

Question 7.

Mr. Dhaval and his wife Mrs. Hetal furnish the following information:

| Particulars | Amount (₹) |

| (a) Salary Income (computed) of Mrs. Hetal | 4,60,000 |

| (b) Income of Minor Son “B” who suffers from disability specified in Sec. 80U | 1,08,000 |

| (c) Income of Minor Daughter “C” from singing | 86,000 |

| (d) Income from profession of Mr. Dhaval | 7,50,000 |

| (e) Cash Gift received by “C” on 02.10.2020 from friend of Mrs. Hetal, on winning of Singing Competition | 48,000 |

| (f) Income of Minor Married Daughter “A” from Company Deposit | 30,000 |

Compute the Total Income of Mr. Dhaval and Mrs. Hetal for Assessment Year 2021-2022. [May, 2008, 8 Marks]

Answer:

Computation of Total Income

| Particulars | Mr. Dhaval(₹) | Mr. Dhaval (₹) |

| Income from Salaries | 4,60,000 | |

| Income from Profession | 7,50,000 | |

| Add: Income of Minor Married Daughter ‘A’ from Company Deposits | 30,000 | |

| Less: Exempt u/s 10(32) | (1,500) | |

| Gross Total Income | 7,78,500 | 4,60,000 |

| Less: Deduction under Chapter VIA | NIL | NIL |

| Total Income | 7,78,500 | 4,60,000 |

Notes:

- Income of the Minor Child shall be clubbed in the hands of the Parent whose Total Income is greater. The Parent in whose hands the Minor’s Income is clubbed is entitled to an exemption u/s 10(32), ₹ 1,500 per child.

- The following income of the Minor Child shall not be clubbed u/s 64(1 A) –

a. Income of a minor child suffering from any disability specified u/s 80U.

b. Income on account of any activity involving application of skills, talent or specialized knowledge and experience. - In the given case, income of “B” suffering from disability and income of ‘C’ earned through application of her singing skills, talent or specialized knowledge and experience are not clubbed in the hands of the parents.

- In case of gift received by Minor Child ‘C’, since the amount of gift does not exceed ₹ 50,000, the same is not includible in the Total Income of the parents.

![]()

Question 8.

Mr. A is an Employee of Larsen Limited and has substantial interest in the Company. His Salary is ₹ 25,000 p.m. Mrs. A also is working in that company at a Salary of ₹ 10,000 p.m. without any professional qualification. (Ignore Standard Deduction)

Mr. A also receives ₹ 30,000 as Income from Securities, Mrs. A owns a House Property which she has let out. Rent Received from such House Property is ₹ 12,000 p.m.

Mr. & Mrs. A have three minor children – two twin daughters and one son, Income of the twin daughters is ₹ 2,000 p.a. and that of his son is ₹ 1,200 p.a. Compute the Income of Mr. and Mrs. A. [May 2013, 8 Marks]

Answer

Computation of Total Income

| Particulars | Mr. A (₹) | Mrs. A (₹) |

| Income from Salaries (25,000 × 12) | 3,00,000 | |

| Add: Salary paid to Mrs. A clubbed in the hands of Mr. A [since Mr. A has Substantial Interest in the Company, and Mrs. A does not have professional qualification. (10,000 × 12)] | 1,20,000 | |

| Income from House Property (W.N.) | 1,00,800 | |

| Income from Other Sources: Income from Securities | 30,000 | |

| Total Income (before including Minor’s Income) | 4,50,000 | 1,00,800 |

| Add: Income of twin daughters 2,000 | ||

| Income of son 1,200 | ||

| Less: Exempt u/s 10(32), ₹ 1,500 per Child (1,500 × 3 = 4,500) [restricted to Income clubbed] 3,200 | Nil | |

| Total Income | 4,50,000 | 1,00,800 |

Note: Income of a Minor Child shall be clubbed in the hands of Parent whose Total Income is greater before such clubbing and hence is clubbed in the hands of Mr. A.

Computation of Income from House Property

| Particulars | Amount (₹) |

| Gross Annual Value (12,000 × 12) | 1,44,000 |

| Less: Municipal Taxes | NIL |

| Net Annual Value | 1,44,000 |

| Less: Deduction u/s 24

3096 of Net Annual Value (1,44,000 × 3096) |

(43,200) |

| Income from House Property | 1,00,800 |

![]()

Question 9.

Mr. Dhaval has an income from Salary of ₹ 3,20,000 and his Minor Children’s income are under :

| Particulars | Amount (₹) |

| (a) Minor Daughter had earned the following income: | |

| From TV show | 50,000 |

| From Interest of FD with a Bank (deposited by Mr. Dhaval from his Income) | 5,000 |

| (b) Minor Son has earned the following income: | |

| From the sale of a own painting | 10,000 |

| From Interest of FD with a Bank (deposited by Mr. Dhaval from his Income) | 1,000 |

Compute the Taxable Income and tax liability in the hands of Mr. Dhaval. [Nov. 2009, 11 Marks]

Answer:

Computation of Total Income

| Particulars | Amount (₹) | Amount (₹) |

| (A) Income from Salary (given) | 3,20,000 | |

| (B) Income from Other Sources | ||

| Income of Minor Children [clubbed u/s 64(1 A)] | ||

| (a) Income of Mr. Dhaval’s Minor Daughter | ||

| Interest of FD with Bank | 5,000 | |

| Less : Exemption u/s 10(32) | (1,500) | 3,500 |

| (b) Income of Mr. Dhaval’s Minor [clubbed u/s 64(1 A)] | ||

| Interest of FD with Bank | 1,000 | |

| Less: Exemption u/s 10 (32) [restricted to Income clubbed] | (1,000) | Nil |

| Total Income (A + B) | 3,23,500 | |

| Tax on Total Income | 3,675 | |

| Less: Rebate u/s 87A (See Note) | (3,675) | Nil |

| Add: HEC @ 4% | Nil | |

| Total Tax Payable (Rounded Off) | Nil |

Note:

- Income on account of any activity involving application of skill or specialized knowledge and experience or the income of a minor child suffering from disability u/s 80U shall not be clubbed.

- Hence, Income of Minor Daughter from TV show (assumed to arise due to her talent and skill) and Income of Minor Son by way of sale of own painting is not clubbed in the hands of Mr. Dhaval. They shall be taxed in their hands separately.

- When Total Income of Resident Individual does not exceed ₹ 5.00 Lakhs, Rebate u/s 87A = 100% of Tax Payable or 12,500 whichever is less.

![]()

Question 10.

Mr. B is the Karta of HUF, whose Members derive Income as given below –

| Particulars | Amount (₹) |

| (i) Income from B’s Profession | 45 000 |

| (ii) Mrs. B’s Salary as Fashion Designer | 76,000 |

| (iii) Minor son D (Interest on Fixed Deposits with a Bank which were gifted to him by his Uncle | 10,000 |

| (iv) Minor Daughter P’s earnings from sports | 95,000 |

| (v) D’s winnings from Lottery (Gross) | 1,95,000 |

Discuss the tax implications in the hands of Mr. B and Mrs. B. [Nov. 2012, 8 Marks]

Answer:

| Particulars | Mr. B (₹) | Mrs. B (₹) | |

| Income From Salaries : (given) | NIL | 76,000 | |

| Profit and Gains of Business or Profession: | 45,000 | NIL | |

| Total Income before Clubbing of Minor Son’s income | 45,000 | 76,000 | |

| Add: Income of Minor Son D (Note 1) | |||

| (a) Interest of Fixed Deposit | 10,000 | ||

| (b) Lottery Winnings | 1,95,000 | ||

| 2,05,000 | |||

| Less: Exemption u/s 10(32) for Minor’s Income | NIL | (1,500) | 2,03,500 |

| Total Income | 45,000 | 2,79,500 | |

Notes :

- U/s 64(1 A), Income of a Minor Child shall be clubbed in the hands of the Parent whose Total Income is greater before such clubbing. Exemption of ₹ 1,500 per child shall be allowed in respect of such income.

- If the Minor receives income by exercise of labour, hard work, skill, knowledge or experience, then such income shall not be clubbed. In the given case, the Income of the Minor Daughter shall not be clubbed in the hands of her Parents.

![]()

Question 11.

During the Previous Year 2020-2021 the following transactions occurred in respect of Mr. A:

(a) Mr. A had a Fixed Deposit of ₹ 5,00,000 in Bank of India. He instructed the Bank to credit the Interest on Deposit at 9% from 01.04.2019 to 31.03.2020 to the Savings Bank Account of Mr. B, son of his brother, to help him in his Education.

(b) Mr. A holds 75% share in a Partnership firm. Mrs. A received a Commission of ₹ 25,000 from the Firm for promoting the sales of the Firm. Mrs. A possesses no technical or professional qualification.

(c) Mr. A gifted a Flat to Mrs. A on April 1st 2019. During the PY the Flat generated a Net Income of ₹ 52,000 to Mrs. A.

(d) Mr. A gifted ₹ 2,00,000 to his minor son who invested the same in a Business & he got a share Income of ? 20,000 from the Investment.

(e) Mr. A’s minor son derived an Income of ₹ 20,000 through a Business Activity involving Application of his Skill & Talent.

(f) During the year Mr. A got a Monthly Pension of ₹ 10,000. He had no other Income. Mrs. A received salary of ₹ 20,000 per month from a Part Time Job. (Ignore Standard Deduction)

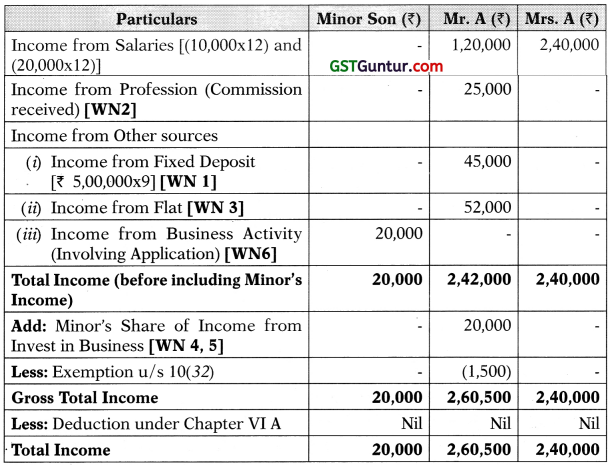

Discuss the Tax Implications & compute the Total Income of Mr. A, Mrs. A and their Minor Child [Nov. 2012, 8 Marks]

Answer:

Computation of Total Income

Notes:

- In case of Transfer of income without transfer of assets, the Income is taxable in the hands of the transferor.

- Remuneration of spouse from a concern in which the individual has substantial interest other than for exercising professional knowledge is clubbed in the hands of the individual.

- Income from Assets transferred to the Spouse, for inadequate con¬sideration is clubbed in the hands of the Individual.

- Income of the Minor Child shall be clubbed in the hands of the Parent whose total Income is greater. The Parent in whose hands the Minor’s Income is clubbed is entitled to an exemption u/s 10(32), ₹ 1,500 per child.

- Gift received from a Relative is not taxable. Hence, ₹ 2,00,000 received by Minor Son from his father Mr. A is not taxable in the hands of minor son.

- Income of the Minor Child on account of any activity involving application of skills, talent or specialized knowledge and experience shall not be clubbed.

![]()

Question 12.

Mr. Mahadev, a noted bhajan singer of Rajasthan and his wife Mrs. Dariya furnish the following information relating to the Assessment Year 2021-2022.

| S. No. | Particular | Amount (₹) |

| Income of Mr. Mahadev-professional bhajan singer (computed) | 5,65,000 | |

| 2 | Salary income of Mrs. Dariya (computed) | 3,80,000 |

| 3 | Loan received by Mrs. Dariya from Ramu & Jay (Pvt) Ltd. (Mrs. Dariya Holds 35% shares of the Co. The Co. has incurred losses since its inception 2 year back) | 2,50,000 |

| 4 | Income of their minor son Golu from winning singing reality show on T.V. | 2,50,000 |

| 5 | Cash gift received by Goiu from friend of Mr. Mahadev on winning the show | 21,000 |

| 6 | Interest income received by minor married daughter Gudia from deposit with Ramu & Jay Pvt. Ltd. | 40,000 |

Compute total taxable income of Mr. Mahadev & Mrs. Dariya for the Assessment Year 2021-2022. [Nov. 2013, 5 Marks]

Answer:

Computation of Total Income

| Particulars | Mr. Mahadev Amount (₹) | Mrs. Dariya Amount (₹) |

| Income from Salaries | 3,80,000 | |

| Income from Profession | 5,65,000 | |

| Loan from Ramu & Jay (P) Ltd. | Nil | Nil |

| Income of Minor son Golu from Reality show | Nil | Nil |

| Cash Gift received by Golu from his friend (Not taxable since amount is not exceeding ₹ 50,000) | Nil | Nil |

| Add: Income of Minor Married Daughter Gudia, from Company deposits (Since Mr. Mahadev’s Income is higher) | 40,000 | |

| Less : Exempt u/s 10(32) | (1,500) | |

| Gross Total Income | 6,03,500 | 3,80,000 |

| Less: Deduction under Chapter VIA | NIL | NIL |

| Total Income | 6,03,500 | 3,80,000 |

![]()

Notes:

- Income of the Minor Child shall be clubbed in the hands of the Parent whose Total Income is greater. The Parent in whose hands the Minor’s Income is clubbed is entitled to an exemption u/s 10(32), ₹ 1,500 per child.

- The following income of the Minor Child shall not be clubbed u/s

64(1 A) –

a. Income of a minor child suffering from any disability specified u/s 80U

b. Income of account of any activity involving application of skills, talent or specialized knowledge and experience.

In case of gift received by Minor Child ‘C’, since the amount of gift does not exceed ₹ 50,000, the same is not includible in the Total Income of the parents.